Lake Norman | Q2 2025

Q2 Market Report | July 2025

OVERALL MARKET REPORT

Lake Norman’ s Luxury Market

Hiccups, Surges Forward

COMMUNITY UPDATES

Cornelius

Davidson

Mooresville

West Shore

North Shore

Concord & Cabarrus

Lake Hickory & Lake Rhodiss

MARKET FORECAST

It now seems that the second half of 2025 looks solid and competitive for sellers at a level more so than the previous two years

Lake Norman’s Luxury Market Hiccups, Surges Forward

Following the market disruptions during April and May, Lake Norman’s luxury real estate market has rebounded after a brief slowdown. Pending luxury contracts had dipped to 258, below the seasonal norm of 280+, but have since climbed to 287, signaling a strong recovery. This rebound represents 30 more pending deals than were closed in June, typically one of the busiest months for closings.

With the Dow recovering and luxury buyers regaining confidence, leading indicators are pointing toward a solid, potentially robust third quarter in 2025. Showing requests and website traffic have increased beyond typical seasonal patterns, further supporting the upward trend, though still sensitive to shifts in broader public sentiment.

Inventory has also grown as more homeowners who had held off due to low interest rates are listing their properties. Unit sales are up across nearly all price points compared to 2024, but increased inventory is helping to restore some balance to the market, marking the first signs of equilibrium seen since 2019.

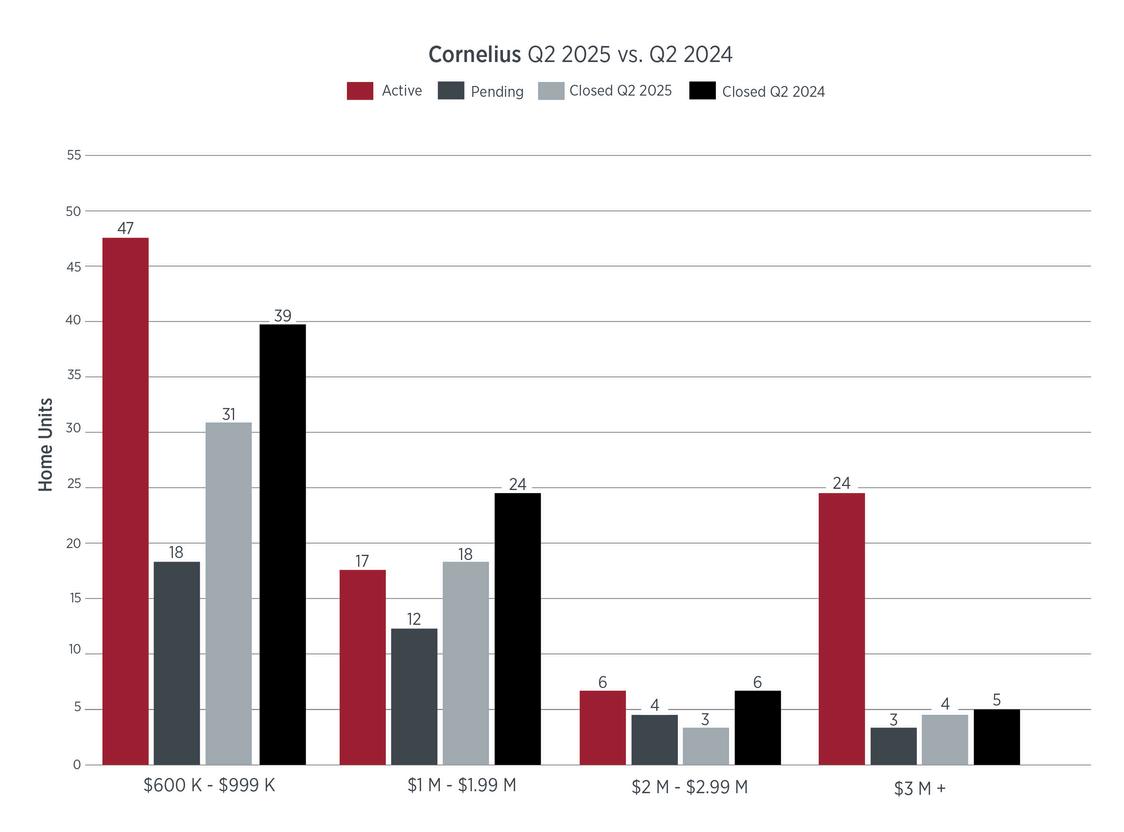

C o r n e l i u s

Cornelius saw a decline in closings from 74 to 58 units yet saw hot pursuit of properties under $3 million, with inventory positions in the $1-3 million range dropping to just 30 days. Meanwhile the ultra luxury range had 24 active listings over $3 million in list price with 4 closings for the quarter and 3 pending contracts. All that said, with 37 pending contracts, the trend line is ticking upward in all price ranges.

Cornelius Home Sales

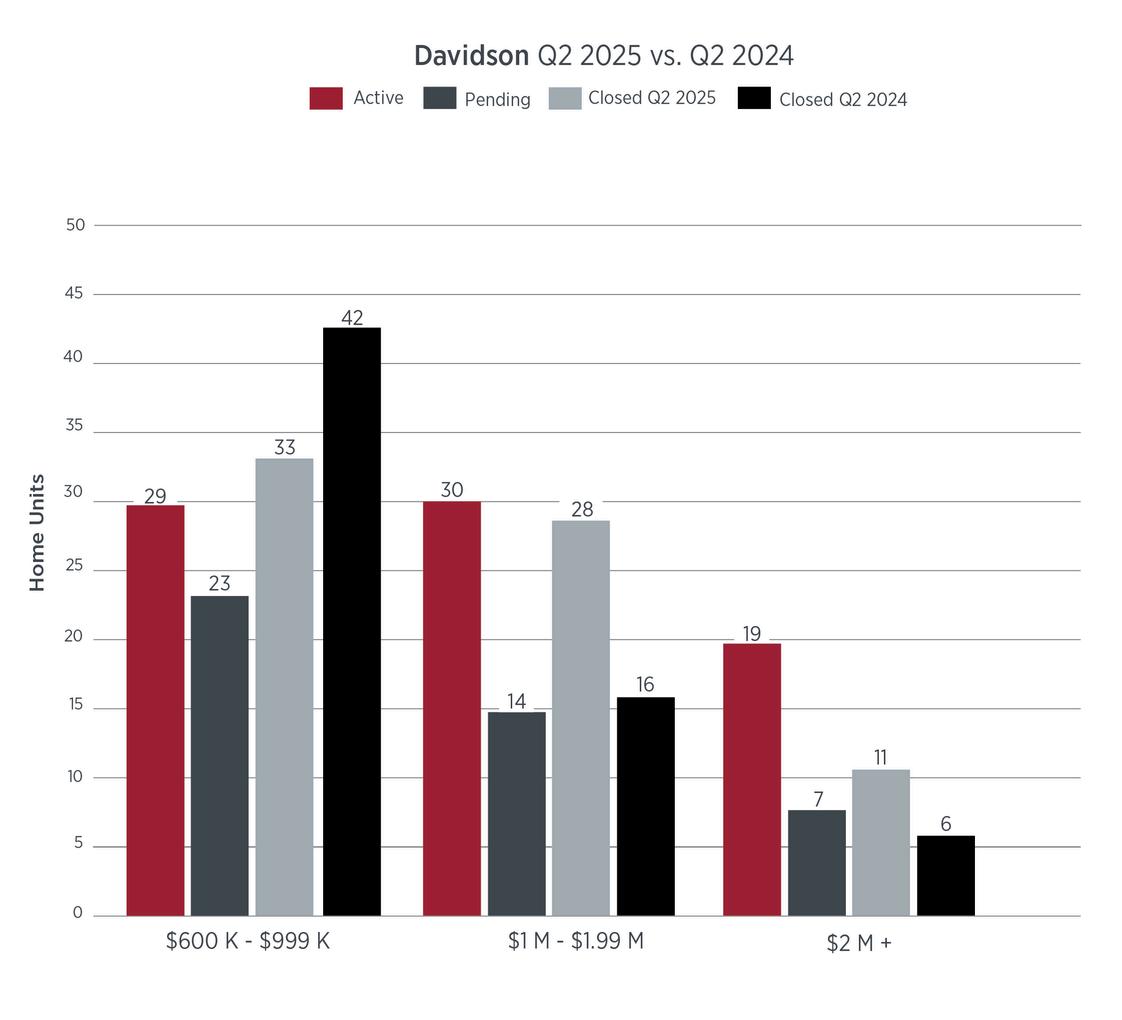

D a v i d s o n

The torrid luxury market in Davidson finally saw glimpses of a possible slower pace from what had proven to be completely bulletproof sell-through ramp up in the ultraluxury range over $2 million. The lower price points under $1 million remained fairly tight at around 40 days of inventory, while the ranges over $1 million expanded to 60 days or so. All that said, Davidson still saw a 10% increase in unit sell-through in the luxury segment with 72 homes closing vs 65 in last year ’ s second quarter including another near 80% increase at $2 million plus.

Davidson Home Sales

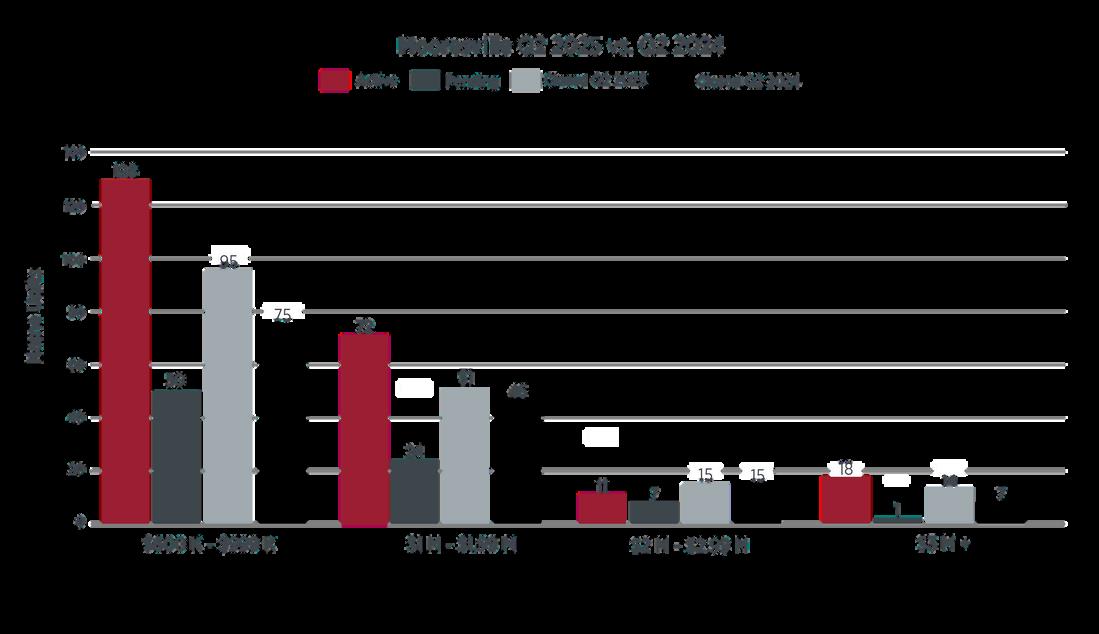

Mooresville

Less landlocked than other areas on the east side of Lake Norman, Mooresville saw a spike in the sub-$1 million range segment, with 95 homes closing compared to 75 during last year ’ s second quarter. The ultra-luxury range over $3 million in list price grabbed significant market share lake-wide, with 14 closings compared to just 4 last year. Renovation efforts are in full swing for older homes, and available land for new construction remains plentiful for ultra-luxury projects compared with the south end of the lake.

Mooresville Home Sales

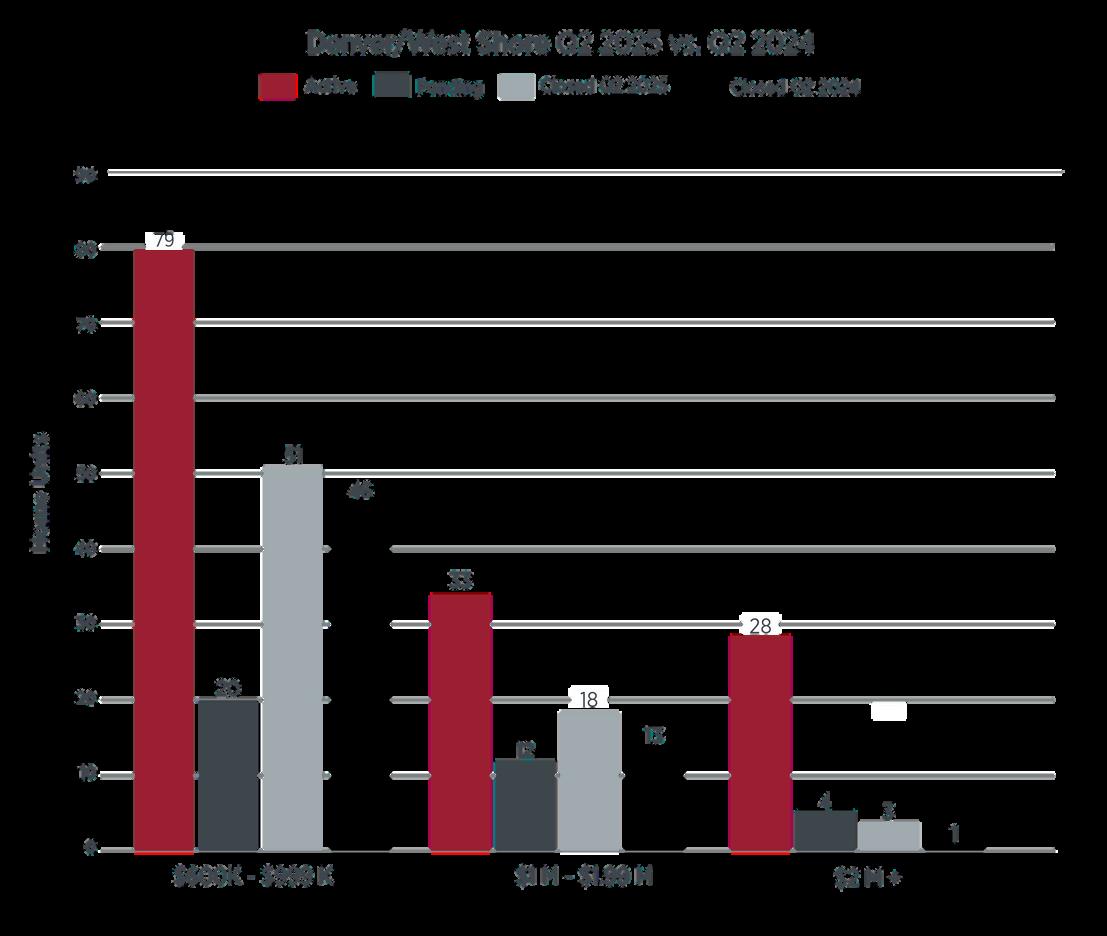

Denver | West Shore

Similar to Davidson, one of the first quarter’ s star areas saw the pace of sell-through slow just a bit, yet still manage to blow away last year ’ s second quarter, 72 luxe units to 60. Each segment, under $1 million, $1-2 million, and $2 million-plus all saw quarterly increases compared to last year ’ s second quarter, just not quite as robust as the first quarter’ s spike. That said, the West Shore is well-positioned for strong performance and is poised for a promising run over the next few years.

Denver/West Shore Home Sales

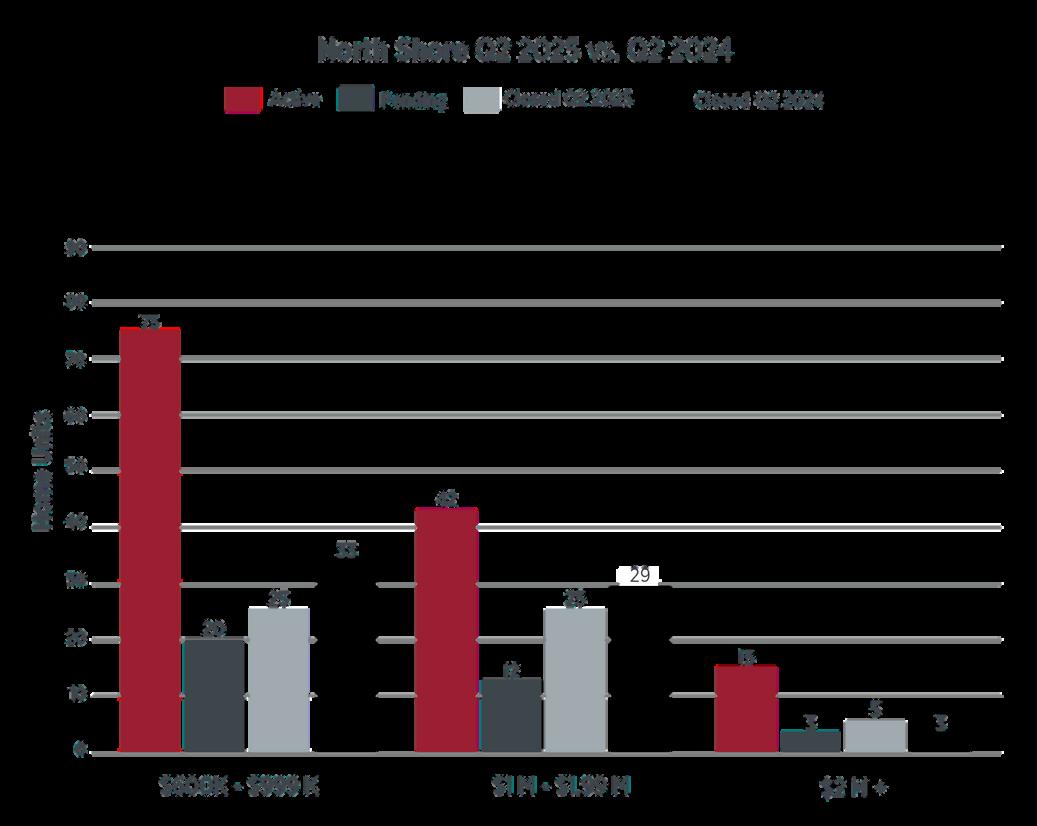

North Shore

Troutman / Sherrills Ford

The northern shores of Lake Norman continue to emerge. While unit sell-through dropped a bit from last year ’ s second quarter, 65 sales vs 55 this year, the ratios of inventory to pending contracts continues to indicate healthy conditions. With 132 luxury actives, yet 75 pending contracts, this area continues to display less than 90 days of inventory with two Ivester Jackson | Christie’ s sales leading the way in ultra-luxury price range over $2 million.

North Shore Home Sales

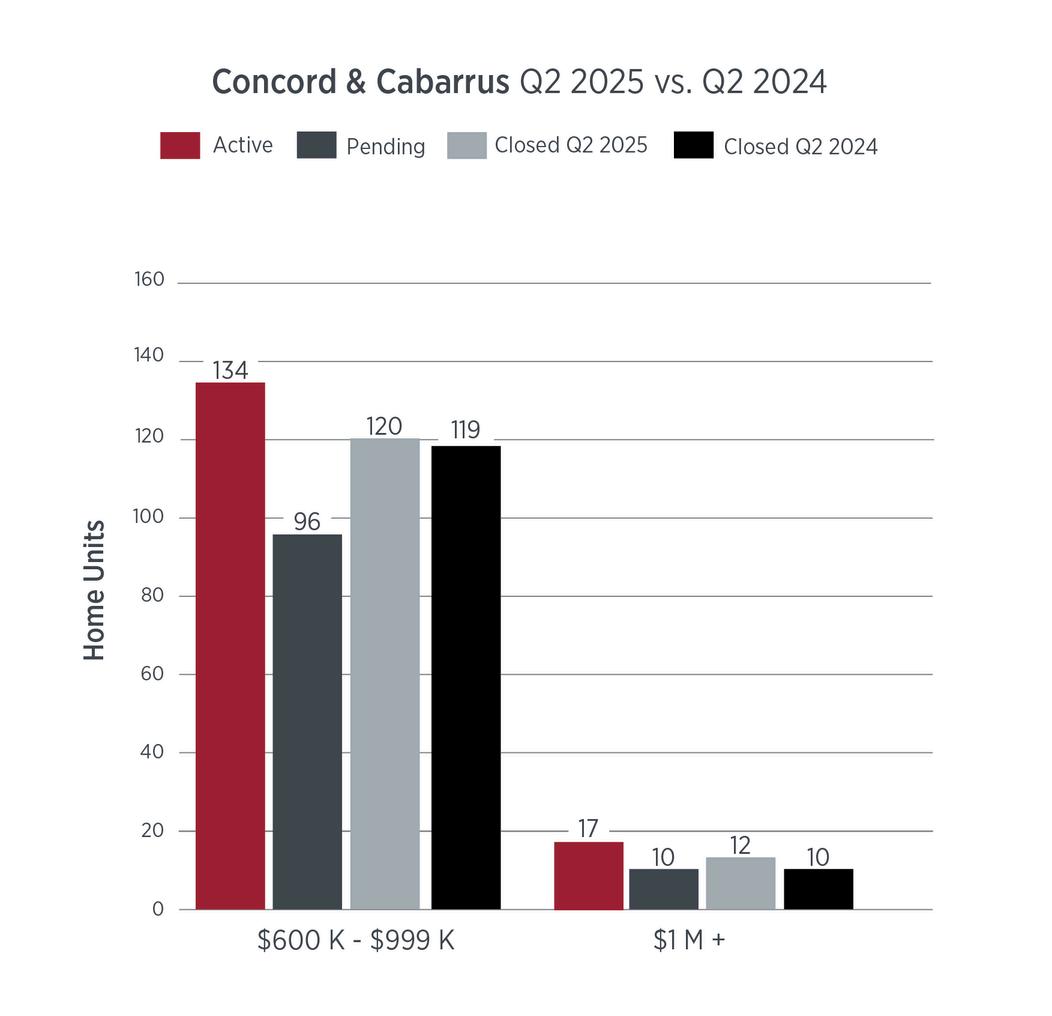

C o n c o r d & C a b a r r u s

Continuing to benefit from lower land costs and tax rates, the communities of Cabarrus County continue to emerge with a growing luxury market. Total sell-through rose from 129 units to 132, while luxury units over $1 million saw a spike of 10 units in pending contracts after only seeing 12 closings in the second quarter. This momentum points to a possible record-breaking third quarter.

Concord & Cabarrus Home Sales

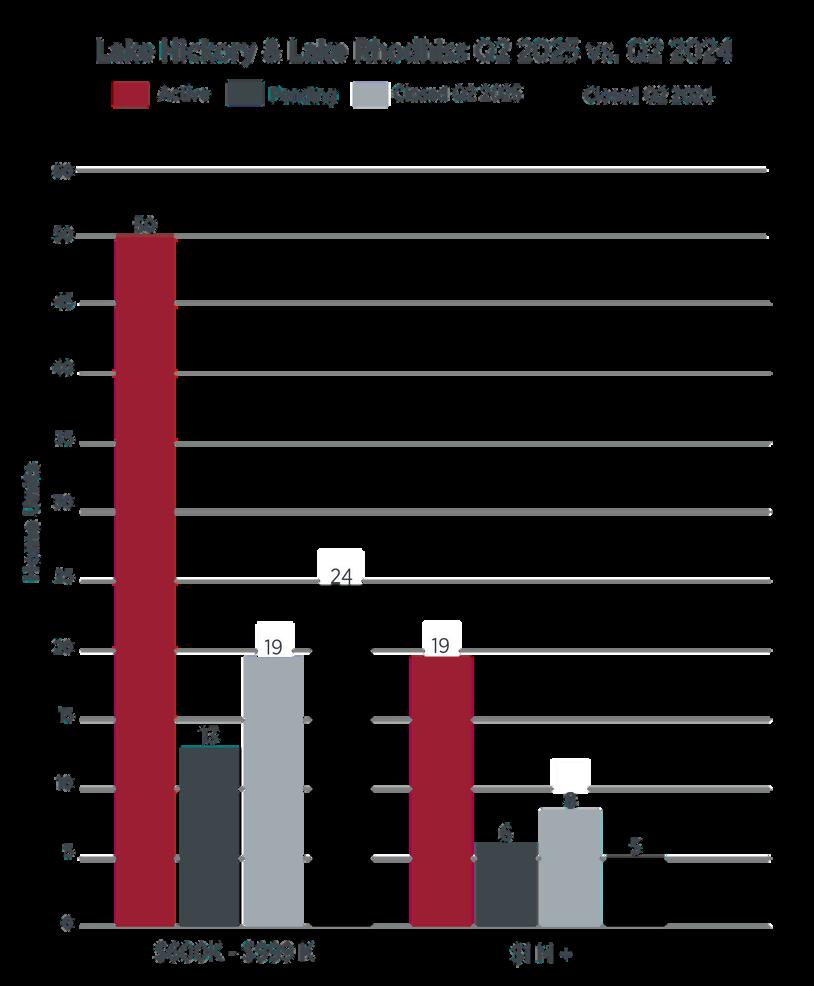

Lake Hickory & Lake Rhodhiss

The emerging luxury market in the upper Catawba River chain of lakes, Lake Hickory and Lake Rhodiss, saw continued progress in the mid and million-dollar plus categories. While activity was down slightly in the range just below $1 million, the range above $1 million saw an increase from 5 units in last year ' s second quarter, to 8 in this year ' s just ended quarter. Inventory, at 19 homes over $1 million in comparison to 6 pending contracts, points to an absorption rate of roughly three months, which is fairly balanced at this point of the summer. The highest waterfront sale this year has been a 10 acre $2.125 million waterfront property on 47th Avenue in Hickory.

Lake Hickory & Lake Rhodhiss

Home Sales

Forecast: The Market Has a Very Solid Second Half

Despite all the gyrations in the second quarter, the resilient American luxury consumer re-engaged in June with one of its favorite choices - North Carolina. This led to a solid end to the quarter and momentum in the way of pending contracts. Both Charlotte and Lake Norman are on pace to set record years in the range above $2 million in list price, remarkable considering the uncertainty of late April and early May. Lake Norman sported a 20% increase, and Charlotte showed increases in both the $2 million and $4 million-plus ranges for the year. With website search numbers trending upwards, it now seems that the second half of 2025 looks solid and competitive for sellers at a level more so than the previous two years, yet still sporting solid and qualified buyers, many who are continuing to deploy cash in this asset class.

Where

will you Where will you

Listen To Our Podcast And Visit Our Video Page For Market Forecasts, Interviews, and Marketing Ideas, Join the Team at Ivester Jackson | Christie's for the Latest in the Carolinas Luxury Real Estate Content.