IVESTER JACKSON | CHRISTIE'S

LUXURY MARKET REPORT & FORECAST

Charlotte | Q2 2025

Charlotte | Q2 2025

The Charlotte Luxury Market Shows Solid Results Despite Uptick in Inventory

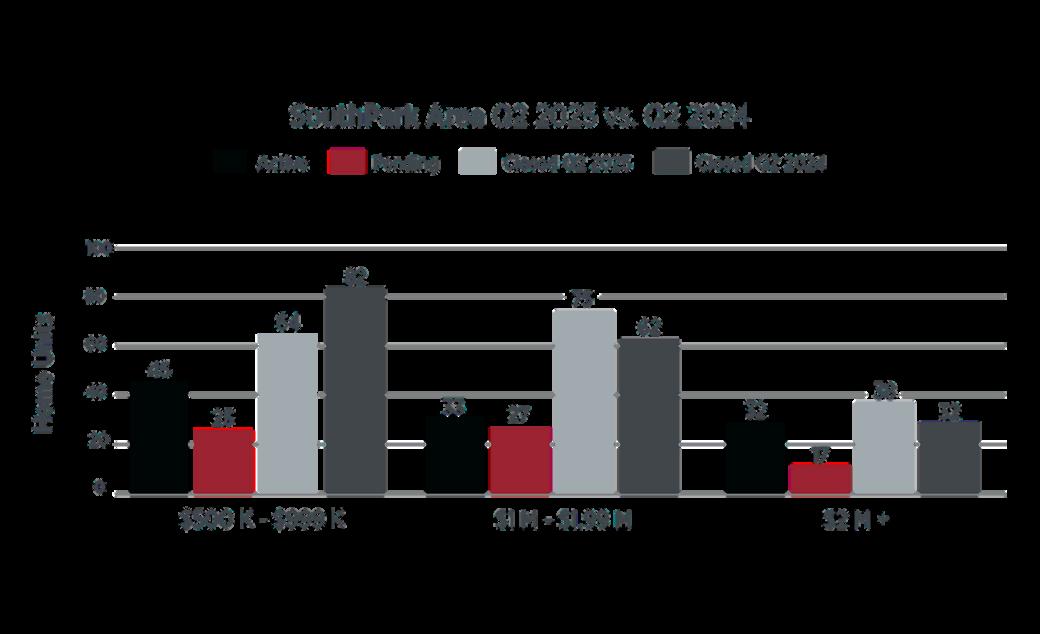

SouthPark

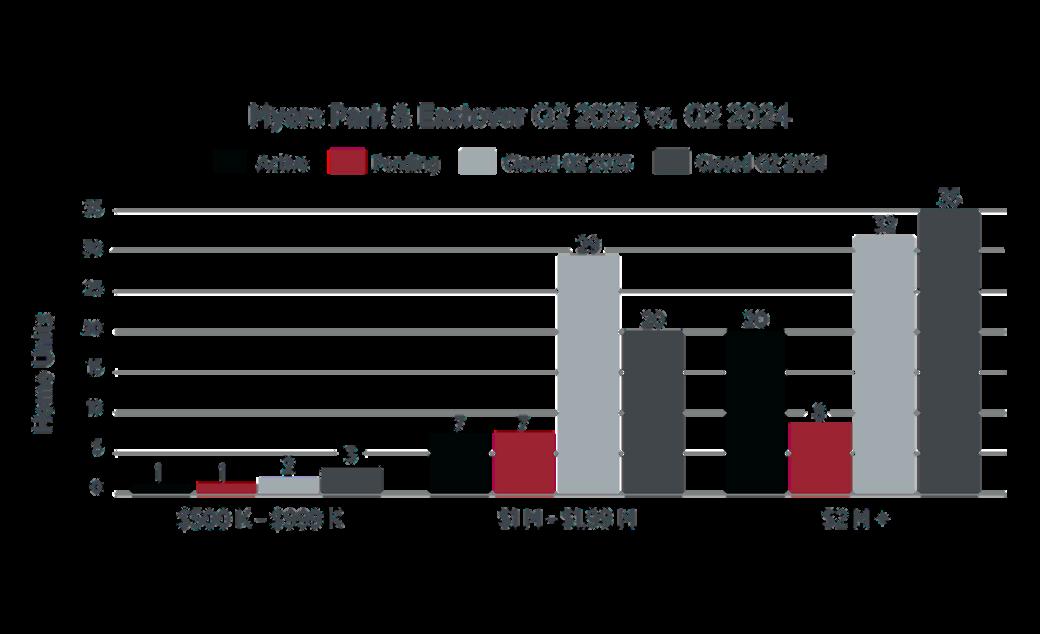

Myers Park & Eastover

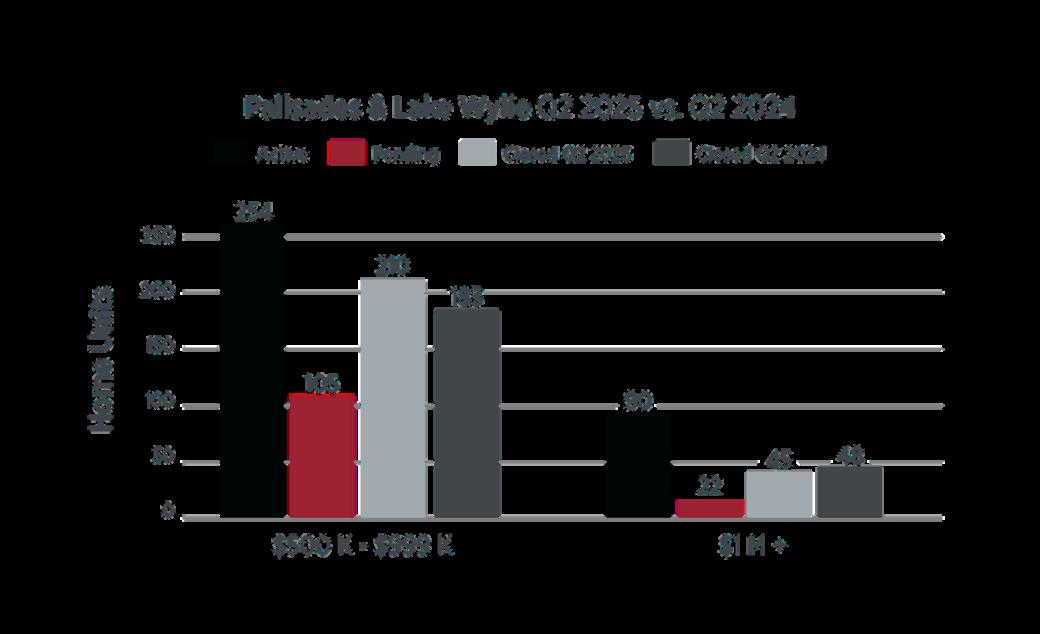

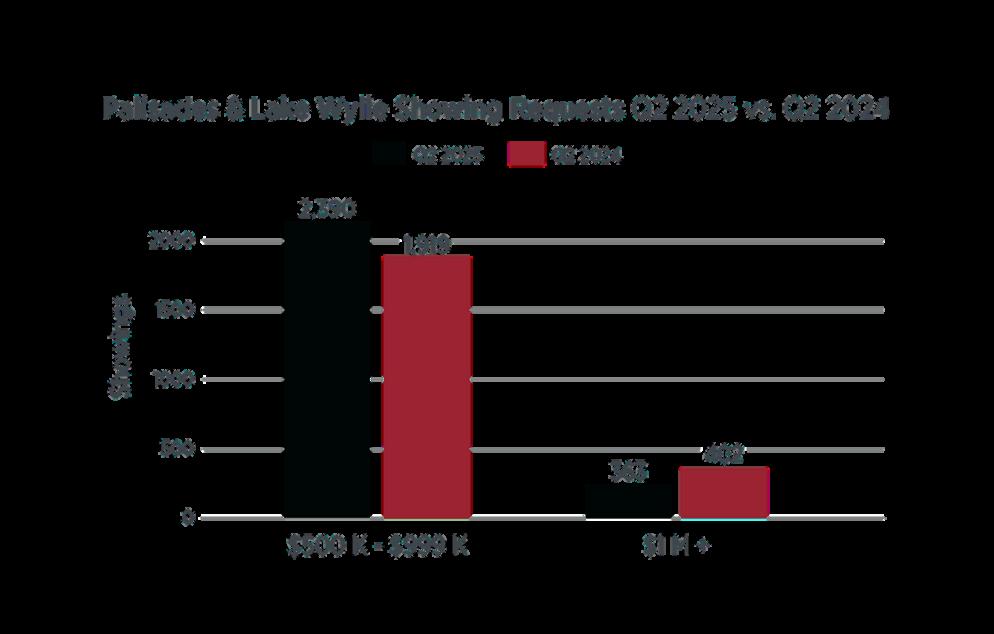

Lake Wylie & The Palisades

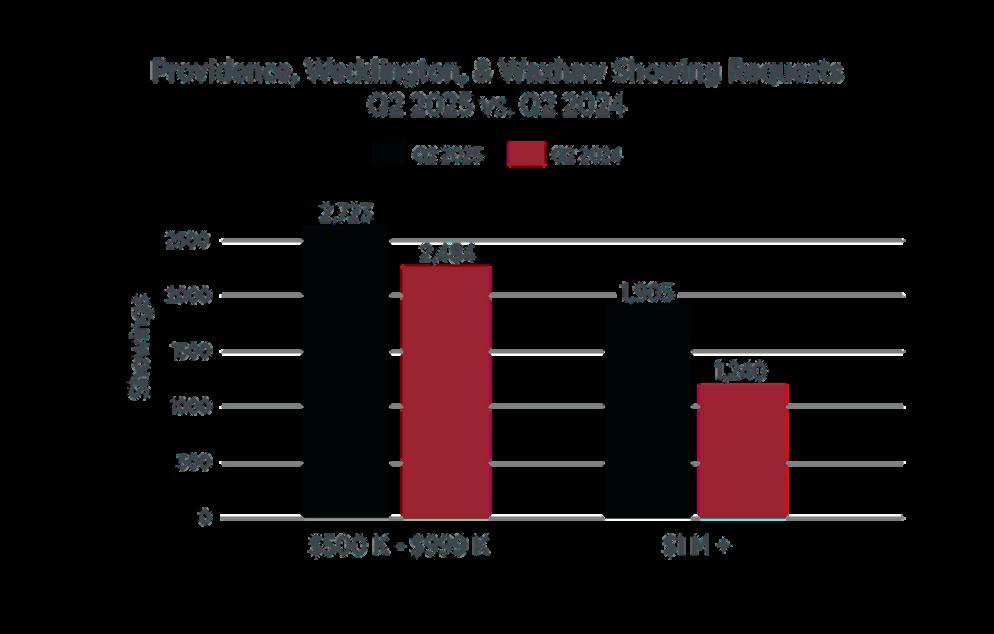

Providence, Weddington & Waxhaw

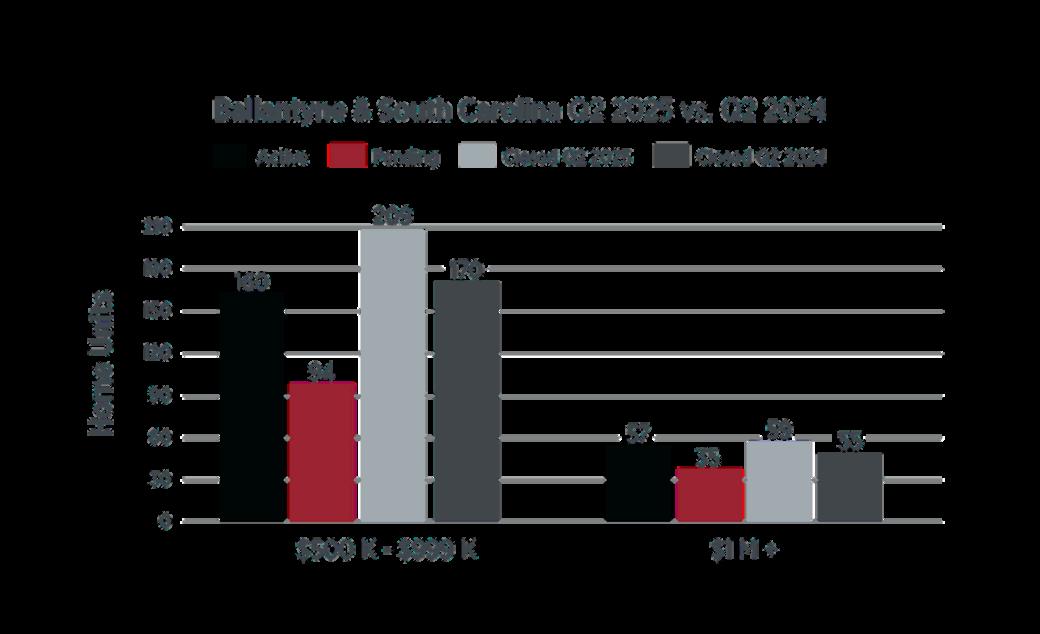

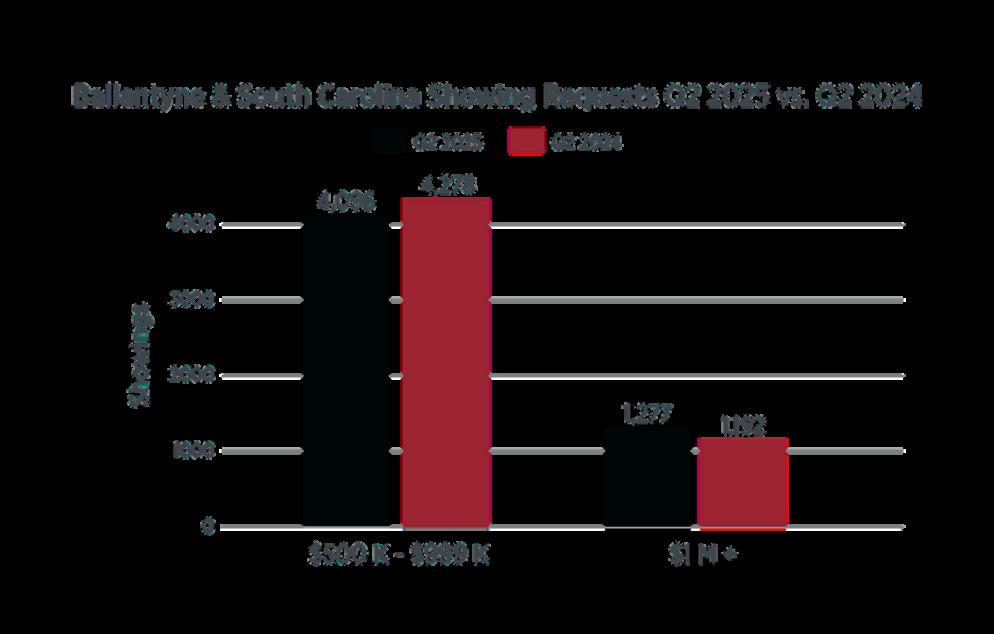

Ballantyne & South Carolina

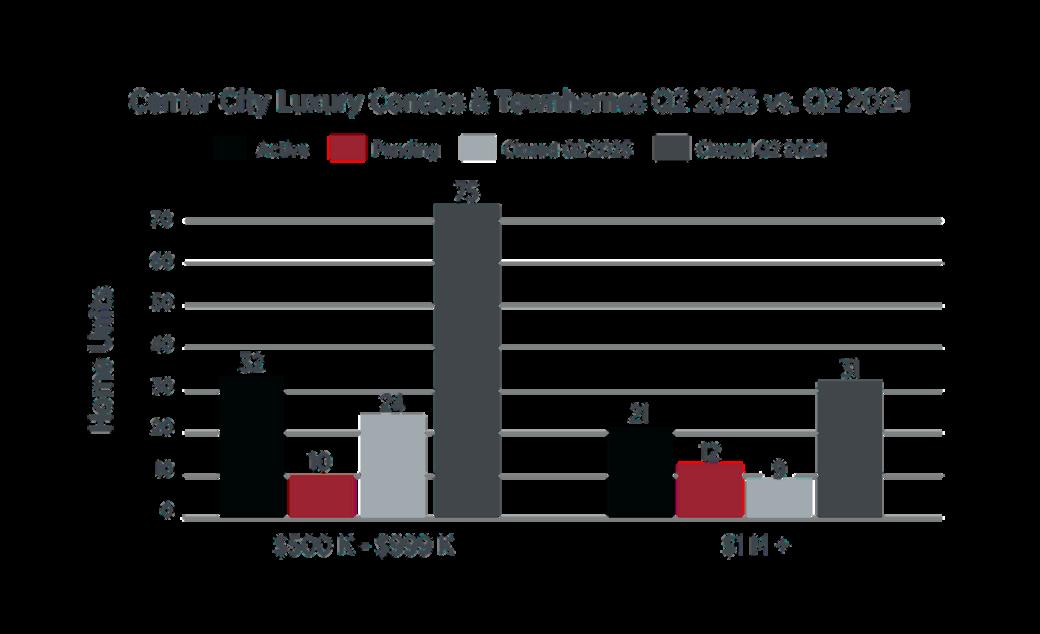

Center City Luxury Condos & Townhomes

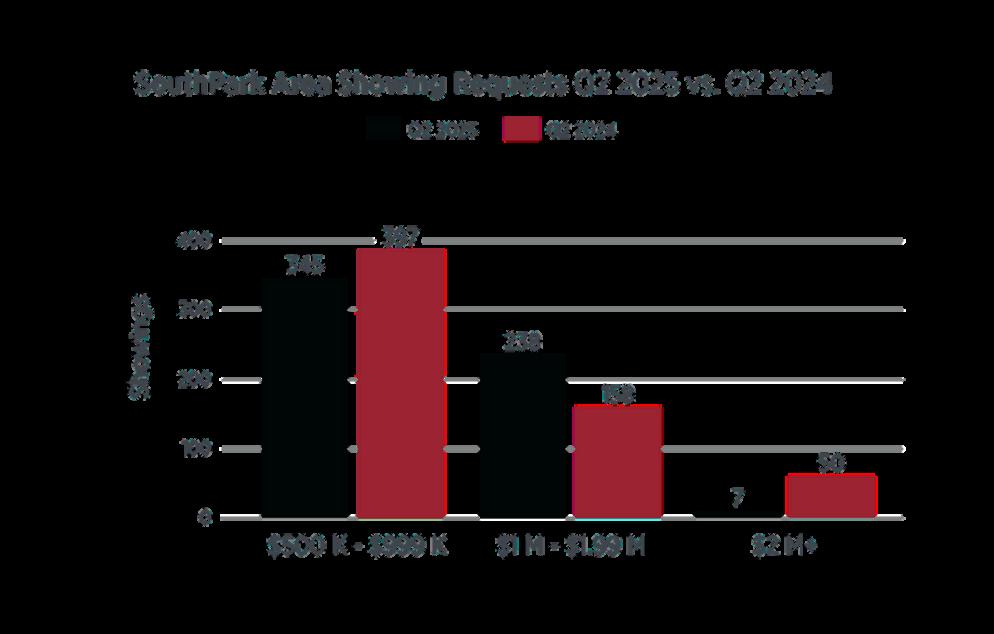

While down from 2024’s hot market, showing data remains solid enough to continue to push positive closing numbers in comparison

From market forecasts, interviews, and marketing ideas, join the team at Ivester Jackson I Christie's for the latest in the Carolinas luxury real estate content

While the Charlotte luxury market continued to generate positive gains in sold luxury housing units, an increase in inventory has provided more buyer choice and slowed the upward trajectory of pricing in the region This should not be confused with overall drops in pricing compared to prior year per square foot totals While price reductions on active listings have been fairly common over the recent quarter, much of this was the result of aggressive list pricing that has now responded to market conditions

Throw in the volatility of the financial markets at the April start of high buying season, and recent upticks in pending contracts seem to point to a pushing back of the traditional buying cycle into mid-summer vs late spring. While the ultra-luxury segment over $2 million in list price has seen a rise in inventory, actual sell-through has also outpaced 2024 by 5%, with a spike above $5 million in list price sell-through compared to last year. Unit sales in this range have thus far totaled 15 closings in Charlotte over $5 million in list price vs 6 last year, which is counterbalanced by 11 active listings, roughly four to six months of average selling time

The typically in high demand SouthPark area and the region below Fairview once again showed solid sell-through in the luxury segment. The $1 million range showed a solid 17% increase in closed units, 75 vs 62 last year, while the ultraluxury range saw a similar increase as 38 properties closed over the $2 million dollar threshold vs 32 in last year ’ s second quarter Inventory remained fairly tight in the luxury segment, with 65 homes active over the $1 million threshold, yet there are a solid 44 pending contracts in the same price segment. The range between one and two million remains very popular, and should continue to show tight conditions with interest rates starting to show slight declines

Similar to the SouthPark area, the range just above $1 million in list remained in high demand in Myers Park, with 29 homes closing vs 20 in last year ’ s second quarter. The ultra-luxury segment over $2 million did show a rare, somewhat flat quarter Closings were down 10%, which is off slightly compared to last year, as inventory climbed slightly to 20 homes active and another 8 pending heading into the third quarter.

The waterfront market around Lake Wylie and the Palisades area showed solid sell-through in the segment just under $1 million in list price, recording a 13% increase over 2024’s second quarter

The $1 million luxury segment saw flat results, with inventory jumping to 90 homes on the active market over $1 million in list price and 22 listings pending. Buyers definitely have more options in this area and are pushing average days on market to four to five months on average

The highway 16 corridor moving out into Union County produced solid luxury results yet again; meanwhile, the midmarket range just below the $1 million threshold saw a slight decline in closings of roughly 15%. The segment above $1 million in list price saw a very solid 18% increase in closings, with 139 homes closed vs 119 in last year ’ s second quarter. The quarter also ended with a very solid inventory-to-pendingcontract ratio, with 81 active homes and 47 pending deals waiting to close, or roughly 60-70 days’ worth of inventory.

The border communities south of Charlotte saw solid results, with sell-through in the sub-$1 million price range increasing 15% over 2024’s second quarter, while the segment above $1 million in list price saw a solid 8% increase over the same period last year Inventory in the luxury range showed 57 active listings with a very healthy 35 pending contracts waiting to close, equating to about 60 days’ absorption.

The multi-family luxury segment in and around the beltway did see some softening when compared to 2024’s second quarter. The range below $1 million saw a significant drop in closings, 75 vs 24 this year, while the luxury range over $1 million also slowed, with 31 closings vs 9 this year Subsequently, inventory did increase, though it remains fairly balanced compared to pending contracts. In the luxury segment, 21 listings showed active with another 12 pending deals set to close in the third quarter, which should dictate stable pricing conditions.

Realtor showing request data, while down from 2024’s hot market, remains solid enough to continue to push positive closing numbers in comparison with last year As an example, while a certain price range may have been attracting ten showings a month last year, this year ’ s totals are more in the five to six buyer showing appointment range in the mid-level luxury ranges This is still more than enough to generate the occasional bidding war and solid sellthrough As is always the case, the hyperlocal conditions and pricing segment competition, or lack thereof in some cases, drive market conditions The $1-2 million dollar price range remains very active, even white hot in some high demand areas, while climbing the food chain up above $5 million results in more balanced conditions That said, the financial markets drive the upper ranges, and thus recent returns to near historic highs have buyers re-engaged North Carolina continues to enjoy solid economic and business conditions while attracting interest from other areas, so absent major upheaval, luxury consumers appear to be growing more conditioned to temporary ebbs and flows of volatility and should continue their pursuit of high end real estate

Where will you

center yourself next?

Charlotte

1515 Mockingbird Lane, Suite 900

Charlotte, NC 28209

Lake Norman

21025 Catawba Ave, Suite 101

Cornelius, NC 28031

North Shore

350 Morrison Plantation Parkway, Suite C1

Mooresville, NC 28117

Asheville

18 S Pack Square

Asheville, NC 28801

Wilmington 527 Causeway Drive

Wrightsville Beach, NC 28480

Highlands Cashiers

210 North Fifth Street

Highlands, NC 28741