International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 06 | Jun 2024 www.irjet.net p-ISSN:2395-0072

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 06 | Jun 2024 www.irjet.net p-ISSN:2395-0072

Sowmyanarayanan Soundararajan Guru

Birla

Institue of Technology & Science, Pilani, India

The rapid advancement of artificial intelligence (AI) and its integration with digital payment systems has catalyzed a transformative shift across industries like finance, travel and hospitality, and retail. This paper explores the symbiotic relationshipbetweenAIanddigitalpayments,examininghowkeytechnologiessuchasmachinelearning,naturallanguage processing, and predictive analytics drive unprecedented innovation in areas like personalized travel recommendations, dynamic pricing, fraud detection in e-commerce, inventory optimization, and customer experience enhancement. While unlocking new efficiencies and business growth opportunities, AI implementation in digital payments also presents significantdataprivacy,algorithmicbias,andcybersecuritychallengesaddressedthroughindustryusecases.Byanalyzing bestpractices,thepaperproposesstrategiesforharnessingAI'spotentialtoenhancesecurity,streamlineoperations,and deliver superior customer experiences across sectors, while navigating complexities through responsible innovation, ethical practices,andcross-stakeholdercollaboration - pavingthewayforAIanddigital paymentstoshapethe future of seamless,intelligenttransactions.

TheeffectivefusionofAIanddigitalpaymentswillbeessentialforboostingcompetitivenessandinfluencingthedirection offinanceastheindustrydevelopsfurther.Thisarticleoffersinsightfulanalysisandpracticalsuggestionsforcompanies, decision-makers, and scholars who want to comprehend and take advantage of artificial intelligence's revolutionary potentialinthedigitalpaymentecosystem.

Keywords: AI-powered digital payments, Predictive analytics, Fraud detection, Natural language processing (NLP), Data privacy and security

The integration of artificial intelligence (AI) technologies in digital payment systems has revolutionized the financial industry, enabling unprecedented levels of efficiency, security, and user experience [1]. This transformative convergence

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 06 | Jun 2024 www.irjet.net p-ISSN:2395-0072

of AI and digital payments is not limited to the financial sector alone; it is reshaping various industries, including Travel andHospitality,andRetail,bydrivingimprovedcustomerexperiencesandoperationalefficiencies[2].AIencompassesa widerangeoftechnologies,suchasmachinelearning,naturallanguageprocessing,andpredictiveanalytics,eachplayinga crucial role in driving innovation in digital payments and beyond. In the Travel and Hospitality industry, AI-powered chatbotsandvirtualassistantsareenhancingcustomersupport,providinginstantandpersonalizedassistanceforbooking inquiries, travel planning, and issue resolution [3]. Additionally, machine learning algorithms are enabling dynamic pricing, personalized recommendations, and fraud detection in online travel bookings, optimizing revenue and ensuring securetransactions[4].Similarly,intheRetailsector,AIistransformingdigitalpaymentsandrevolutionizinge-commerce experiences. Predictive analytics are being leveraged for demand forecasting, inventory management, and targeted marketing campaigns, ensuring seamless product availability and personalized recommendations [5]. Natural language processing (NLP) powers intelligent chatbots and conversational assistants, facilitating effortless shopping experiences andreal-timecustomersupport[6].Beyondenhancingcustomerexperiences,AIisdrivingoperationalefficienciesacross theseindustries.Machinelearningalgorithmsareoptimizingsupplychainmanagement,demandforecasting,andresource allocation, enabling businesses to streamline operations and reduce costs [7]. Predictive analytics are also being utilized for fraud detection and risk management, ensuring secure digital payment transactions and protecting customers' financial information [8]. While the integration of AI in digital payments presents numerous opportunities, it also introduceschallengesrelatedtodataprivacy,algorithmicbias,andcybersecurityrisks[9].Asthesetechnologiescontinue to advance, addressing these challenges through responsible innovation, ethical practices, and regulatory compliance becomes paramount to unlocking the full potential of AI in digital payments and fostering trust among customers and stakeholdersacrossvariousindustries[10].

ThetransformativepotentialofAIindigitalpaymentsextendsacrossvariousindustries,includingTravelandHospitality, andRetail.ThesesectorsareleveragingAItechnologiestoenhancecustomerexperiences,optimize operations,anddrive businessgrowth,asmentionedintheintroduction[2].

In the Travel and Hospitality industry, AI is revolutionizing digital payments and transforming the customer journey. Machine learning algorithms are enabling personalized recommendations and dynamic pricing for travel bookings, tailoring offerings based on individual preferences,travel patterns,and market demand[11]. This not only enhancesthe customerexperiencebutalsomaximizesrevenueopportunitiesfortravelcompanies.Moreover,machinelearningplaysa crucial role in fraud detection and prevention for online travel bookings. By analyzing transaction data and identifying anomalies or suspicious patterns, AI algorithms can detect and mitigate fraudulent activities, ensuring secure digital payment transactions and protecting customers' financial information [4]. Natural language processing (NLP) is another AI technology driving innovation in this industry. NLP-powered chatbots and virtual assistants are enhancing customer supportandengagementbyprovidinginstantandpersonalizedassistanceforbookinginquiries,travelplanning,andissue resolution [3]. These intelligent assistants can understand and respond to customer queries in natural language, improvingcustomersatisfactionandreducingtheworkloadonhumanagents.

IntheRetailsector,AIistransformingdigitalpaymentsandrevolutionizinge-commerceexperiences.Predictiveanalytics, powered by machine learning algorithms, are being leveraged for demand forecasting, inventory management, and targeted marketing campaigns [5]. By analyzing historical data and customer behavior patterns, retailers can optimize their supply chain, ensure seamless product availability, and deliver personalized recommendations to customers. NLPpowered chatbots and conversational assistants are also playing a crucial role in enhancing customer support and engagement in the Retail industry. These intelligent assistants can facilitate effortless shopping experiences by guiding customersthroughproductselection,providingreal-timeassistance,andprocessingdigitalpaymentsseamlessly[6].

Furthermore, machine learning algorithms are being utilized for fraud detection and risk management in e-commerce transactions. By identifying suspicious patterns and anomalies in real-time, these algorithms can prevent fraudulent activities, protecting both customers and retailers from financial losses [8]. Across both the Travel and Hospitality, and Retail industries,the integrationofAIindigital paymentsisdrivingoperational efficiencies,optimizingrevenuestreams, and delivering superior customer experiences. As these technologies continue to evolve, businesses in these sectors will need to embrace AI-powered innovations to remain competitive and meet the ever-increasing demands of customers in thedigitalage[2].

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 06 | Jun 2024 www.irjet.net p-ISSN:2395-0072

AI Technique Application in Digital Payments

MachineLearning

NaturalLanguageProcessing

PredictiveAnalytics

Biometrics

AnomalyDetection

A. Machine Learning

Frauddetection,riskassessment,andcreditscoring

Chatbots,customersupport,andsentimentanalysis

Customerchurnprediction,cross-selling,upselling

Userauthentication,securetransactions

Identifyingsuspiciousactivities,preventingfraud

Table 1: AI techniques used in digital payments and their applications

Real-time fraud detection and prevention made possible by machine learning, a subset of artificial intelligence, is a key factor in the revolution of digital payment systems. Machine learning algorithms can detect patterns and anomalies that pointtopossiblefraudulentactivitybyevaluatingenormousvolumesoftransactiondata.Highlevelsofsecurityindigital paymentprocessesareensuredbythesealgorithms,whichareconstantlylearningandadaptingtonewfraudpatterns.

TheapplicationofmachinelearningbyPayPal,awell-knowndigitalpaymentcompany,isonenoteworthyexample.PayPal analyzes millions of transactions in real-time using machine learning algorithms, which allows for the highly accurate detectionandpreventionoffraudulentactivity.Inadditiontosavingthebusinessmillionsofdollarseveryyear,thisalso increasescustomerconfidenceintheirdigitalpaymentservices.

Furthermore, real-time creditworthiness assessments of borrowers can be made with the help of machine learningpowered risk assessment models. These models can accurately predict a borrower's likelihood of default by analyzing a varietyofdatapoints,includingcredithistory,income,andspendingpatterns.Thishelpsfinancialinstitutionsmakewellinformedlendingdecisionsandlowerstheriskofnon-performingloans.

Oneofthemostimportantusesofmachinelearningindigitalpaymentsystemsisthereal-timedetectionandprevention of fraud. Digital payment security and integrity are seriously threatened by fraudulent activities like credit card fraud, identity theft, and unauthorized transactions. By analyzing enormous volumes of transaction data in real-time, spotting patterns and anomalies that point to possible fraud, and initiating the proper steps to stop or lessen the effects of fraudulentactivity,machinelearningalgorithmsprovideapotentsolutiontothisissue.

Algorithmsaretrainedonhistoricaltransactiondata,whichincludesbothlegitimateandfraudulenttransactions,inorder toapplymachinelearningforfrauddetection.Thealgorithmsareabletorecognizepatternsandtraitsthatset fraudulent activity apart from legitimate activity by learning from this data. Unusual transaction amounts, high-risk locations, or suspicious transactiontimingarea fewexamplesof thesepatterns.Afterbeingtrained, themachinelearning modelsare able to assess the probability of fraud by instantly analyzing incoming transactions and comparing them to the patterns they have discovered. If a transaction is deemed suspicious, the system can take several actions, such as blocking the transaction,requestingmoreauthenticationfromtheuser,oralertingtherelevantauthorities[8].

Machinelearning'scapacitytoadjusttonewandchangingfraudpatternsisoneofitsmainbenefitswhenitcomestofraud detection. Machine learning algorithms can learn from new data and update their models accordingly, ensuring that the system remains effective in detecting and preventing fraud even as fraudsters constantly come up with new ways to get around conventional security measures [12]. Machine learning-based fraud detection systems have already been implementedwithremarkablesuccessbyanumberoffinancialinstitutionsanddigitalpaymentproviders.Leadingdigital payment company PayPal, for instance, has seen a considerable drop in fraud rates and false positives since integrating machinelearning algorithmsfor fraud detection. Similarto this, Visa,one of thelargest payment networksglobally,uses machine learning to analyze billions of transactions annually in order to identify and thwart fraud in real time. Additionally, machine learning-based Furthermore, machine learning-based fraud detection systems can be integrated withothersecuritymeasuresliketwo-factorauthenticationandbiometricauthenticationtoprovideacomprehensiveand multi-layered approach to protecting digital payments. This comprehensive approach ensures that fraudulent activities canbeidentifiedandpreventedeveninthecasethatOneofthemainconcernsisthepotentialforalgorithmicbias,where biases present in historical data are picked up and reinforced by machine learning models [13]. There are additional

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 06 | Jun 2024 www.irjet.net p-ISSN:2395-0072

challengesassociatedwithDdetection.Thepossibilityofalgorithmicbias,inwhichmachinelearningmodelspickupand reinforcebiasesfoundinhistoricaldata,isoneofthekeyworries[13].Someusergroupsmaythenbetreatedunfairlyor discriminatorilyasaresult.Itisessentialtomakesurethatthetrainingdataisrepresentative,diverse,andfreeofbiases inordertoreducethisrisk,andthatthemodelsareroutinelycheckedforfairnessandtransparency.Therequirementfor substantial quantities of high-quality data for the efficient training and updating of machine learning models presents another difficulty. Strong data management and collection procedures are needed for this, as well as adherence to data privacy laws like the General Data Protection Regulation (GDPR). The advantages of utilizing machine learning for realtime fraud detection and prevention in digital payments are evident, even in spite of these difficulties. Machine learning will become more and more important in securing digital transactions and shielding users from financial losses and identitytheftasdigitalpaymentvolumescontinuetoriseandfraudstersbecomemoreskilled.

In the world of digital payments, NLP, another subfield of AI, is revolutionizing customer support and service. Chatbots andvirtualassistantswithnaturallanguageprocessing(NLP)capabilitiescancomprehendandreplyto clientinquiriesin natural language, offering prompt and tailored assistance. This lessens the workload for human customer service representativeswhilesimultaneouslyincreasingcustomersatisfaction.

"Erica," the virtual assistant at Bank of America, is a perfect illustration of NLP in action. With the help of sophisticated natural language processing algorithms, Erica can comprehend and react to customer inquiries in a natural language, helping with tasks like money transfers, bill payment, and account balance inquiries. Digital payments are now more accessible and convenient thanks to this round-the-clock virtual support that also improves customer experience and expeditesbankingprocedures.

Additionally, NLP makes it possible to analyze user sentiment and feedback on social media sites and online forums. Digital payment providers can learn important information about the preferences, problems, and expectations of their customers by mining textual data and detecting keywords and emotions. Developing targeted marketing campaigns, addressingcustomerconcerns,andenhancingproductofferingsareallpossiblewiththehelpofthisdata.

Thefieldofartificialintelligence'sNaturalLanguageProcessing(NLP)istransformingcustomersupportandservicein the digital payment space. More natural and intuitive interactions between users and digital payment systems are made possible by NLP, which gives computers the ability to comprehend, interpret, and produce human language [14]. Digital paymentproviderscanimprovecustomerexperience,automatecustomersupport,andobtaininsightfulinformationfrom userfeedbackbyutilizingnaturallanguageprocessing(NLP)techniqueslikesentimentanalysis,namedentityrecognition, andlanguagetranslation.

Thecreationofchatbotsandvirtualassistantsisoneofthemostwell-knownusesofnaturallanguageprocessingindigital payments. These AI-powered solutions provide real-time assistance and direction around-the-clock by comprehending and responding to consumer inquiries in natural language [3]. Chatbot accuracy and efficiency can be continuously improved over time by integrating natural language processing (NLP) with machine learning algorithms. This allows chatbotsto learn fromcustomerinteractions.Inadditiontolessening the workloadforhumancustomersupportagents, thisguaranteesthatclientsreceivedependableandconsistentassistancethroughallavailablechannels.

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 06 | Jun 2024 www.irjet.net p-ISSN:2395-0072

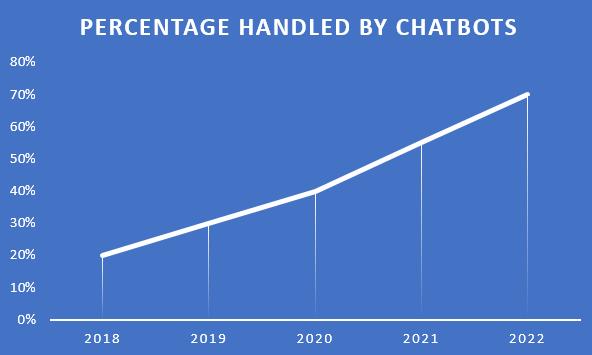

Graph 1: Percentage of customer service inquiries handled by NLP-powered chatbots

Bank ofAmerica's"Erica" isa noteworthyillustrationof NLP-poweredvirtual assistancein thedigital payment industry. Introducedin2018,Ericaisavirtualfinancialassistantpoweredbyartificialintelligence(AI)thatcanhandleavariety of functions,includinggivingtransactiondetails,respondingtoinquiriesaboutaccounts,andprovidingcustomizedfinancial guidance. Erica can understand and reply to consumer inquiries in natural language by utilizing sophisticated NLP techniques,whichimprovestheusabilityandaccessibilityofbankingservices.Inordertoanalyzecustomersentimentand feedback from a variety of channels, including social media, online reviews, and customer support interactions, natural languageprocessing(NLP)isessential.Digitalpaymentprovidersareabletoautomaticallyrecognizeandextractopinions, emotions, and attitudes from large volumes of unstructured text data by using sentiment analysis algorithms [15]. Businessescanusethisusefuldatatoimprovetheirproductsandservicesbyidentifyingareasforimprovement,gauging customer satisfaction, and making data-driven decisions. Additionally, NLP makes it possible to create fraud detection tools that can examine communication patterns and user behavior to spot possible security risks. Digital payment providers can proactively prevent fraudulent activities and safeguard user accounts by keeping an eye on customer interactionsacrossmultiplechannelsandutilizingnaturallanguageprocessing(NLP)techniquesto identifyanomaliesor suspicious language patterns [16]. Nevertheless, there are certain difficulties involved in integrating NLP into digital payments.ThepossibilityofbiasinNLPmodels,whichcanreinforceormagnifysocietalbiasesfoundinthetrainingset,is one of the main causes for concern [17]. Ensuring that the data used to train NLP models is representative, diverse, and freeofdiscriminatorybiasesiscrucialtoreducingthisrisk.Regularauditsandfairnessassessmentsshouldalsobecarried out in order to find and correct any biases that might develop over time. To effectively train NLP models, a significant amount of high-quality, labeled data is required, which presents another difficulty. Particularly for languages with few digital resources, this can be expensive and time-consuming [18]. Digital payment providers can work with educational institutions,researchgroups,andbusinesspartnerstopoolresourcesandproduceshareddatasetsforNLPresearchand developmentinordertogetaroundthischallenge.

The potential advantages of NLP in digital payments are enormous, notwithstanding these difficulties. NLP will become more and more important as customer expectations for smooth, customized experiences rise. It will transform customer service, automate support procedures, and provide insightful data from user feedback. Digital payment providers can maintainacompetitiveedge,provideoutstandingcustomerexperiences,andstimulateinnovationinthequicklychanging fintechsectorbyutilizingnaturallanguageprocessing(NLP).

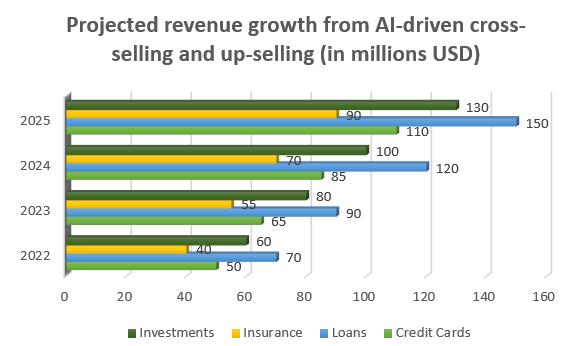

AI-powered predictive analytics is another important technology propelling innovation in digital payments. Predictive analytics is the ability to forecast customer behavior and preferences through the analysis of past transaction data and customer profiles. This allows for customized recommendations and targeted marketing. For example, by examining a customer'spastpurchasesandforecastingtheirpropensitytobuyrelatedgoodsorservices,predictiveanalyticscanassist in locating cross-selling and upselling opportunities. By providing tailored and pertinent recommendations, this boosts customer satisfaction while also increasing revenue for digital payment providers. Additionally essential to reducing

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 06 | Jun 2024 www.irjet.net p-ISSN:2395-0072

customer attrition is predictive analytics. Digital payment providers can proactively engage with customers and offer incentives or solutions to retain them by analyzing customer behavior patterns and spotting signs of potential attrition. Predictive analytics is used by well-known payment processing company Stripe to both identify and stop fraudulent activityandgivecustomers individualizedpayment experiences.Stripe'spredictivemodelscandetectsuspiciousactivity and take appropriate action, like blocking transactions or requesting additional authentication, by analyzing transaction datainreal-timeandcomparingitwithhistoricalpatterns.Unprecedentedinnovationindigitalpaymentsisbeingdriven by the integration of AI technologies like machine learning, natural language processing, and predictive analytics. These technologies facilitate data-driven decision-making, increase security, optimize workflows, and improve customer experience.WithAI'scontinueddevelopment,theworldofdigitalpaymentsshouldseemorerevolutionaryshiftsthatwill improve transaction security, efficiency, and personalization. But integrating AI into digital payments also brings with it some issues that need to be resolved. Algorithmic bias, cybersecurity risks, and data privacy and security concerns are a few of the major issues that call for careful thought and strong safeguards. Responsible innovation must be given top priorityaswenavigatethesedifficultiesandfullyutilizeAI.ThiswillguaranteethattheadvantagesofAI-powereddigital paymentsarerealizedwhilereducingrisksandfosteringjustice,accountability,andtransparency.

Customers

Merchants

Payment Providers

Financial Institutions

Enhanced security, personalized experiences, and 24/7 support

Reduced fraud losses, improved payment processing, and highersales

Increased efficiency, lower costs, and competitive differentiation

Better risk management, improved compliance, and customerretention

Table 2: Benefits of AI in digital payments for different stakeholders

Artificialintelligence(AI)integrationintodigitalpaymentshasmanyadvantages,includingincreasedsecurity, efficiency, and personalization, but there are also a number of issues that need to be resolved to ensure a responsible and longlastingrollout.Thesechallengesencompasstechnical,ethical,andregulatoryaspects,requiringacomprehensiveapproach tomitigaterisksandmaximizethepotentialofAIinthedigitalpaymentlandscape.

Ensuring the security and privacy of sensitive customer data is one of the main obstacles to integrating AI in digital payments.ForAIalgorithmstolearnandgenerateprecisepredictions,enormousvolumesofdata,includingfinancialand personal data, are crucial [19]. The gathering, storing, and processing of this data, however, poses serious privacy issues sinceusersmightfindituncomfortablethattheirdataisbeingusedforAIdecision-makingandtraining.Digital payment providers need to take strong measures to protect consumer information from misuse or unauthorized access. Some of these measuresincludedata anonymization,accesscontrols,and encryption[20].Companiesshouldalsogivecustomers controlovertheirpersonalinformationandclearexplanationsofhowtheirdataisused.Theyshouldalsobetransparent abouthowtheycollectandusedata.ToguaranteethatAIimplementationsindigitalpaymentsfollowlegalrequirements andprotectcustomerrights,compliance withdata privacyregulationsis essential.Examplesoftheseregulationsarethe California Consumer Privacy Act (CCPA) in the United States and the General Data Protection Regulation (GDPR) in the EuropeanUnion.

Forinstance,intheTravelandHospitalityindustry,AI-poweredpersonalizationanddynamicpricingmodelsoftenrelyon customer data, such as travel preferences, booking history, and personal information. Ensuring the secure handling and protectionofthissensitivedataiscrucialtomaintainingcustomertrustandcomplyingwithdataprivacyregulations[27].

The possibility of algorithmic bias and unfairness presents a serious obstacle to the use of AI in digital payments. AI systems are trained on historical data, which may have discriminatory patterns or underlying biases [21]. AI algorithms

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 06 | Jun 2024 www.irjet.net p-ISSN:2395-0072

mayreinforceorevenmagnifythesebiasesiftheyarenotrecognizedandaddressedduringthedevelopmentandtraining process.Thiscouldresultinunfairordiscriminatoryoutcomesfor particularcustomergroups.Ifthetrainingdataforan AI-based credit scoring system reflects past disparities in credit access, for instance, the system may unintentionally discriminate against people from specific demographics or socioeconomic backgrounds [22]. Digital payment providers need to make sure that their AI models are trained on a variety of representative, unbiased, and diverse data sets. They also need to regularly audit and test the models to make sure they are fair and do not discriminate. Additionally, businessesoughttoemployexplainableAIstrategies,whichofferinsightintotheAIalgorithms'decision-makingprocess andfacilitatea bettercomprehensionanddetectionofpotentialbiases[23].Digital paymentcompaniescandemonstrate their commitment to moral and just AI practices and gain the trust of regulators and customers by promoting accountabilityandtransparency.

IntheRetailsector,AI-drivenproductrecommendationsandtargetedmarketingcampaignscouldpotentiallyperpetuate biasesbasedoncustomerdemographics,socioeconomicstatus,orpastpurchasebehavior,leadingtounfairtreatmentor exclusionofcertaincustomersegments[28].

C. Risks Associated with Cybersecurity

The use of AI in digital payments carries additional cybersecurity risks due to the possibility of new cyberattack vulnerabilities arising from the complexity and interconnectivity of AI systems [24]. Cybercriminals might try to take advantage of holes in AI algorithms or alter training data, which could result in compromised systems, fraudulent transactions, or data breaches. Digital payment providers need to make significant investments in strong cybersecurity measures, including multi-factor authentication, real-time monitoring, advanced encryption, and anomaly detection, in order to mitigate these risks [25]. It is recommended to perform routine security auditsandpenetrationtestsinordertodetectandaddressanypotentialvulnerabilitiespresentinAIsystems.Companies shouldalsoencouragea cultureofcybersecurityawarenessamongtheirstaffmembersbyofferingfrequenttrainingand instruction on the best practices for developing and implementing safe artificial intelligence. Digital payment providers can also benefit from working together with industry partners and cybersecurity experts to stay up to date on the latest threats and create risk-reduction plans that work. A multidisciplinary approach involving the expertise of data privacy specialists, cybersecurity experts, ethicists, and AI researchers is needed to address these challenges. Digital payment providersneedtoputahighpriorityonresponsibleAIdevelopment,makingsurethattheirapplicationscomplywiththe law, customer expectations, and ethical standards. Digital payment businesses can fully utilize AI while preserving consumer confidence, regulatory compliance, and the integrity of their systems by proactively tackling these issues and making significant investments in security measures. A dedication to responsible and secure implementation will be necessary for long-term success in this dynamic and transformative industry as artificial intelligence (AI) continues to advanceandshapethefutureofdigitalpayments.

For example, in the Travel and Hospitality industry, where digital payments are often integrated with online booking systemsandcustomerdatabases,asuccessfulcyberattackcouldcompromisesensitivepersonalandfinancialinformation, resultinginsignificantreputationalandfinancialdamage[29].

Artificialintelligence(AI)indigitalpaymentsoffersaplethoraofchancesforadvancementandexpansion.AItechnologies have the potential to completely transform the digital payment industry by achieving previously unheard-of levels of efficiency,security,andcustomersatisfactionastheydevelopandgrow.Digitalpaymentproviderscantakeadvantageof newopportunitiesfordifferentiationandvaluecreationbyutilizingAI,puttingthemattheforefrontofthemarket.

A. Increasing Safety and Effectiveness Improving security and efficiency is one of the biggest areas for innovation and expansioninAI-powereddigitalpayments.LargevolumesoftransactiondatacanbeinstantlyanalyzedbyAIalgorithms, whichcanthenbeusedtospottrendsandabnormalitiesthatmightpointtofraud.Digitalpaymentproviderscanreduce financiallossesandsafeguardcustomerassetsbyproactivelydetectingandpreventingfraudbyutilizingmachinelearning andpredictive analytics.AI canalsoexpediteand automatea number of processes related todigital payments, including risk assessment, underwriting, payment processing, and reconciliation. Artificial intelligence (AI) can minimize human error,loweroperatingcosts,andspeedupprocessingbyautomatingtime-consumingandrepetitivetasks.Customersmay experience faster, more dependable payment experiences as a result of this increased efficiency, and digital payment providersmayexperiencecostsavingsandincreasedprofitability.

IntheRetailsector,AI-poweredfrauddetectionsystemscananalyzevastamountsoftransactiondata,identifysuspicious patterns, and prevent fraudulent activities in real-time, safeguarding both customers and retailers from financial losses [30].

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 06 | Jun 2024 www.irjet.net p-ISSN:2395-0072

B. Enhancing the Client Experience Enhancingcustomer experienceisa majoravenueforinnovationandexpansionin AI-powered digital payments. Artificial intelligence (AI) technologies, like machine learning and natural language processing (NLP), can make it possible for users to interact with digital payment systems in a personalized and simple way. AI algorithms are able to provide personalized offers, recommendations, and services that are catered to the needs andpreferencesofeachindividualbyevaluating customerdata,preferences,andbehavior.AI-drivenchatbotsandvirtual assistants,forinstance,canprovideround-the-clockcustomerservicebyrespondingtoquestions,resolvingproblems,and offeringadviceinnaturallanguage.Witheveryinteraction,theseintelligentassistantscanpickupnewskillsthatwillhelp them better understand and cater to the needs of their users. AI can improve customer satisfaction, establish trust, and promote enduring loyalty by providing quick, accurate, and individualized support. Additionally, by anticipating future requirements and providing pertinent goods or services at the appropriate moment, AI can facilitate proactive customer engagement. Artificial intelligence (AI) algorithms can detect cross-selling and up-selling opportunities by examining transactionhistory,spendingtrends,andlifeevents.Thisallowsthemtopresentcustomerswithtailoredoffers thatadd valueandincreaserevenuefordigitalpaymentproviders.

For instance, in the Travel and Hospitality industry, AI-powered virtual assistants can provide personalized travel recommendations, suggest itineraries based on individual preferences, and offer real-time support throughout the bookingandtravelexperience[31].

C. Increasing Market Share in the Digital Economy Theincorporationofartificialintelligence(AI)intodigitalpayments offers noteworthy prospects for enhancing competitiveness within the swiftly changing digital marketplace. AI can give digitalpaymentprovidersasignificantcompetitiveedgeasconsumerexpectationsforeasy,safe,andcustomizedpayment experiencesrise.

BusinessescandrawandkeepconsumersinanincreasinglycrowdedandcompetitivemarketbyutilizingAIto innovate and differentiate their offerings [26]. Artificial intelligence (AI) capabilities can differentiate digital payment providers from their competitors and offer a compelling value proposition to clients. Examples of these features include biometric authentication,intelligentfrauddetection,andpersonalizedfinancialmanagementtools.

AIcanalsohelpdigitalpaymentcompaniesgrowintonewmarketsandcustomersegmentsbyreducingentrybarriersand fosteringthedevelopmentofcreative,inclusivefinancialservicesandproducts.Forinstance,underprivilegedgroupswith little credit history or sporadic income sources may find it easier to obtain financing with the aid of AI-powered credit scoringandriskassessmentmodels.

In AI-powered digital payments, there are countless and revolutionary opportunities for growth and innovation. Digital payment providers can set themselves apart from the competition by embracing AI technologies, investing in their advancement, and creating new opportunities for value creation. This will put them at the forefront of the industry and boostefficiencyandcustomerexperiences.

To properly take advantage of these prospects, businesses must overcome the obstacles posed by AI, including concerns about cybersecurity, algorithmic bias, and data privacy. Digital payment providers can leverage AI to drive competitiveness and sustainable growth in the digital economy by collaborating with stakeholders throughout the ecosystem,fosteringacultureofcontinuouslearningandinnovation,andadoptingaresponsibleandethicalapproachto AIdevelopment.

IntheRetailsector,AI-drivendynamicpricingmodelscanhelpretailersstaycompetitivebyadjustingpricesinreal-time basedonmarketdemand,competitorpricing,andinventorylevels,optimizingrevenueandprofitability[32].

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 06 | Jun 2024 www.irjet.net p-ISSN:2395-0072

The symbiosis of artificial intelligence (AI) and digital payments represents a transformative force across various industries,offeringunparalleledopportunitiesforinnovation,growth,andvaluecreation.TheTravelandHospitality,and Retail sectors have witnessed the disruptive potential of this convergence, as AI technologies revolutionize customer experiences, optimize operations, and drive business growth. In the Travel and Hospitality industry, AI-powered personalized recommendations, dynamic pricing, and intelligent virtual assistants have redefined the customer journey, delivering tailored experiences and efficient support throughout the booking and travel process. Additionally, machine learning algorithms have enhanced fraud detection and prevention, ensuring secure digital payment transactions and protectingcustomers'financialinformation.Similarly,intheRetailsector,predictiveanalyticsandsentimentanalysishave enabled demand forecasting, inventory management, and targeted marketing campaigns, optimizing supply chains and delivering personalized recommendations to customers. NLP-powered chatbots and conversational assistants have facilitated effortless shopping experiences, providing real-time assistance and seamlessly processing digital payments. Beyond these industry-specific applications, the integration of AI in digital payments offers numerous benefits, such as enhanced security, improved operational efficiency, and superior customer experiences. However, the successful implementation of these technologies is not without its challenges. Concerns surrounding data privacy, algorithmic bias, andcybersecurityrisksmustbeaddressedthroughrobustsafeguards,ethicalprinciples,andregulatorycompliance.Aswe navigate this transformative landscape, a commitment to responsible and ethical AI development is paramount. Collaboration among stakeholders, including digital payment providers, AI researchers, policymakers, and regulatory bodies,iscrucial tofosterinnovationwhile mitigating risksandpromoting fairness, transparency,andaccountability.By harnessing the power of AI responsibly and strategically, businesses across industries can unlock the full potential of digital payments, driving unprecedented levels of efficiency, security, and customer-centricity. As we shape the future of financeandcommerce,thesymbiosisofAIanddigitalpaymentsholdsthepromise ofcreatingamoreinclusive,resilient, andprosperousdigitaleconomyforgenerationstocome.

1) Dignum, V. (2020). Responsible artificial intelligence: Challenges and opportunities. In Responsible Artificial Intelligence(pp.1-18).Springer,Cham.https://doi.org/10.1007/978-3-030-39978-8_1

2) Reshma, P. S., Aithal, P. S., & Acharya, S. (2021). The future of artificial intelligence in the banking and financial industry-A review based analysis. International Journal of Management, Technology, and Social Sciences (IJMTS), 6(1),88-99.https://doi.org/10.47992/IJMTS.2581.6012.0131

3) Okuda,T.,&Shoda,S.(2018).AI-basedchatbotserviceforfinancialindustry.FujitsuScientific&TechnicalJournal, 54(2), 4-8. https://www.fujitsu.com/global/documents/about/resources/publications/fstj/archives/vol542/paper01.pdf

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 06 | Jun 2024 www.irjet.net p-ISSN:2395-0072

4) Awoyemi, J. O., Adetunmbi, A. O., & Oluwadare, S. A. (2017). Credit card fraud detection using machine learning techniques: A comparative analysis. 2017 International Conference on Computing Networking and Informatics (ICCNI),1-9.https://doi.org/10.1109/ICCNI.2017.8123782

5) Ravi,K.,&Ravi,V.(2017).Asurveyonopinionminingandsentimentanalysis:Tasks,approachesandapplications. Knowledge-BasedSystems,89,14-46.https://doi.org/10.1016/j.knosys.2015.06.015

6) Feldman,R.(2013).Techniquesandapplicationsforsentimentanalysis.CommunicationsoftheACM,56(4),82-89. https://doi.org/10.1145/2436256.2436274

7) Grover, P., Kar, A. K., & Dwivedi, Y. K. (2020). Understanding artificial intelligence adoption in operations management: Insights from the review of academic literature and social media discussions. Annals of Operations Research.https://doi.org/10.1007/s10479-020-03683-9

8) Dornadula, V. N., & Geetha, S. (2019). Credit card fraud detection using machine learning algorithms. Procedia ComputerScience,165,631-641.https://doi.org/10.1016/j.procs.2020.01.057

9) Dignum, V. (2020). Responsible artificial intelligence: Challenges and opportunities. In Responsible Artificial Intelligence(pp.1-18).Springer,Cham.https://doi.org/10.1007/978-3-030-39978-8_1

10) Baesens, B., Bapna, R., Marsden, J. R., Vanthienen, J., & Zhao, J. L. (2016). Transformational issues of big data and analyticsinnetworkedbusiness.MISQuarterly,40(4),807-818.https://doi.org/10.25300/MISQ/2016/40:4.03

11) Qiu,R.T.,Li,M.,&Zhang,W.(2021).Exploringthedynamicsofonlinehotelpricing:Amachinelearningapproach. International Journal of Contemporary Hospitality Management, 33(4), 1179-1201. https://doi.org/10.1108/IJCHM-10-2020-1150

12) Varmedja,D.,Karanovic,M.,Sladojevic,S.,Arsenovic,M.,&Anderla,A.(2019).Creditcardfrauddetection-machine learning methods. 2019 18th International Symposium INFOTEH-JAHORINA (INFOTEH), 1-5. https://doi.org/10.1109/INFOTEH.2019.8717766

13) Mehrabi,N.,Morstatter,F.,Saxena,N.,Lerman,K.,&Galstyan,A.(2021).Asurveyonbiasandfairnessinmachine learning.ACMComputingSurveys,54(6),1-35.https://doi.org/10.1145/3457607

14) Hirschberg, J., & Manning, C. D. (2015). Advances in natural language processing. Science, 349(6245), 261-266. https://doi.org/10.1126/science.aaa8685

15) Feldman,R.(2013).Techniquesandapplicationsforsentimentanalysis.CommunicationsoftheACM,56(4),82-89. https://doi.org/10.1145/2436256.2436274

16) Pandey, S., & Ratn, D. (2020). An intelligent system for credit card fraud detection using natural language processing. 2020 IEEE 9th International Conference on Communication Systems and Network Technologies (CSNT),122-125.https://doi.org/10.1109/CSNT48778.2020.9115743

17) Shah,D.,Schwartz,H.A.,&Hovy,D.(2020).Predictivebiasesinnaturallanguageprocessingmodels:Aconceptual frameworkandoverview.Proceedingsofthe58thAnnualMeetingoftheAssociationforComputationalLinguistics, 5248-5264.https://doi.org/10.18653/v1/2020.acl-main.468

18) Joshi, P., Santy, S., Budhiraja, A., Bali, K., & Choudhury, M. (2020). The state and fate of linguistic diversity and inclusion in the NLP world. Proceedings of the 58th Annual Meeting of the Association for Computational Linguistics,6282-6293.https://doi.org/10.18653/v1/2020.acl-main.560

19) Baesens, B., Bapna, R., Marsden, J. R., Vanthienen, J., & Zhao, J. L. (2016). Transformational issues of big data and analyticsinnetworkedbusiness.MISQuarterly,40(4),807-818.https://doi.org/10.25300/MISQ/2016/40:4.03

20) Shastri, S., Roy, S., & Basu, D. (2020). Reinforcing cybersecurity in digital payments using deep learning-based intrusion detection system. 2020 IEEE International Conference on Electronics, Computing and Communication Technologies(CONECCT),1-6.https://doi.org/10.1109/CONECCT50063.2020.9198441

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 06 | Jun 2024 www.irjet.net p-ISSN:2395-0072

21) Mehrabi,N.,Morstatter,F.,Saxena,N.,Lerman,K.,&Galstyan,A.(2021).Asurveyonbiasandfairnessinmachine learning.ACMComputingSurveys,54(6),1-35.https://doi.org/10.1145/3457607

22) Fuster,A.,Goldsmith-Pinkham,P.,Ramadorai,T.,&Walther,A.(2022).Predictablyunequal?Theeffectsofmachine learningoncreditmarkets.TheJournalofFinance,77(1),5-47.https://doi.org/10.1111/jofi.13090

23) Barredo Arrieta, A., Díaz-Rodríguez, N., Del Ser, J., Bennetot, A., Tabik, S., Barbado, A., ... & Herrera, F. (2020). ExplainableArtificialIntelligence(XAI):Concepts,taxonomies,opportunitiesandchallengestowardresponsibleAI. InformationFusion,58,82-115.https://doi.org/10.1016/j.inffus.2019.12.012

24) Truong, N., Sun, K., Lee, G. M., & Guo, Y. (2019). GDPR-compliant personal data management: A blockchain-based solution. IEEE Transactions on Information Forensics and Security, 15, 1746-1761. https://doi.org/10.1109/TIFS.2019.2948287

25) Modi, C., & Patel, D. (2018). A comprehensive survey on security in cloud computing. Cybersecurity, 1(1), 1-20. https://doi.org/10.1186/s42400-018-0002-y

26) Reshma, P. S., Aithal, P. S., & Acharya, S. (2021). The future of artificial intelligence in the banking and financial industry-A review based analysis. International Journal of Management, Technology, and Social Sciences (IJMTS), 6(1),88-99.https://doi.org/10.47992/IJMTS.2581.6012.0131

27) Pereira, J., & Romão, M. (2022). The growth of artificial intelligence in tourism: A systematic review. Tourism ManagementPerspectives,43,100980.https://doi.org/10.1016/j.tmp.2022.100980

28) Binns, R., Harati, P., Luck, M., Manzi, B., Vasconcelos, W., & Zhao, J. (2022). Understanding algorithmic bias: There aresomeissues.AIEthics,2(2),171-180.https://doi.org/10.1007/s43681-022-00139-6

29) Tavares, L. A., Krechler, T., & Fritz, S. M. (2022). The impact of cybersecurity on the tourism industry: a survey of hotels.TourismManagementPerspectives,41,100962.https://doi.org/10.1016/j.tmp.2022.100962

30) Datta,S.,&Singh,S.(2022). Artificial Intelligence:ABoontotheRetail Industry.In ChallengesandInnovations in Industry4.0Ecosystem(pp.71-86).CRCPress.https://doi.org/10.1201/9781003182658-4

31) Pantano, E., Priporas, C. V., & Stylos, N. (2022). Digital transformation of the tourism and hospitality industry: Identifying the challenges and opportunities. In Strategic Innovative Marketing in Tourism (pp. 41-58). Springer, Cham.https://doi.org/10.1007/978-3-030-98880-0_3

32) Lim,S.H.,&vanDerMeer,R.B.(2021).LeveragingAItotransformtheretailecosystem:astudyontheimpactsof dynamic pricing techniques on consumer purchase behavior. Journal of Marketing Analytics, 9(2), 101-115. https://doi.org/10.1057/s41270-021-00105-y