International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 11 Issue: 06 | Jun 2024 www.irjet.net p-ISSN: 2395-0072

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 11 Issue: 06 | Jun 2024 www.irjet.net p-ISSN: 2395-0072

Sudharson Gunasekaran

Senior Software Developer at a Leading Investment Management Firm ***

Abstract - Thebankingsectorisundergoingasignificant transformation with the advent of digital technologies. Transactionreconciliation,acrucialaspectofensuringthe authenticity of payment-related activities, is also being revolutionized. This article delves into the transformative power of AI in enhancing reconciliation and improving transactional facilities. AI, through its automation of the reconciliationprocess,providesorganizationswithreal-time reporting,identifiestransactionfailuresandopportunities, and significantly increases productivity through effective time management. Recent developments in machine learning,particularlyreinforcementlearning,areenabling businessestointegratethesetechnologiesseamlessly.The automationoftaskssuchasmanualcheckingandcomparing ledger transactions with balance sheets through AI is a game-changer,significantlyimprovingefficiency

Key Words: Reinforcement learning, reconciliation, transaction, transaction management, Artificial intelligence

1. INTRODUCTION

Transaction reconciliation is the process of verifying transaction data by comparing ledger entries to original entries to ensure document accuracy. AI has brought significant changes to the payment and settlement system (Izzo et al. 2022 [1]). In recent decades, information technologyhasoptimizedaccountingmethodsandincreased efficiencyincontinuousaccounting.Digital transformation enables organizations to measure performance more effectively.AI'sroleinenhancingtransactionreconciliationis crucial, impacting bank reconciliation, credit card reconciliation, intercompany reconciliation, and more (Petkov,2020[2]).

Theriseofonlinepaymentmethodsforregulartransactions betweenbanksande-commercebusinessesunderscoresthe importanceofaccuratetransactionreconciliation.AIplaysa pivotal role in this, helping organizations maintain daily records and match them with original transactions. More importantly, machine learning algorithms enhance reconciliation techniques and serve as a robust defense against fraudulent transactions. With the development of technologiessuchasdeeplearningandartificialintelligence, businesses have automated processes, which are not only helping organizations with time management and optimization but also ensuring the security of financial transactions(Ravi,2023[4]).

Deepreinforcementlearningaddressesutilitymaximization problems, further improving reconciliation methods. AIdriven reconciliation systems will eventually replace traditional methods, with neural networks automatically identifyingandrectifyingtransactionerrors(Perdanaetal., 2023[5]).Thereinforcementlearningmodelsalreadybeing developedandusedbyotherorganizationscanbefurther trainedandcustomizedtobecomemoreefficientinhandling transactions(Charpentieretal.,2021[6]).

ResearchmethodologyisessentialforanalyzingAI'srolein transactionreconciliation.Primaryandsecondaryresearch methodscollectbothnumericalandqualitativedata.Primary researchgathersfirst-handdata,whilesecondaryresearch usesexistingdata(Strijkeretal.2020[7]).Bothmethodscan be qualitative or quantitative. Qualitative methods collect non-numerical data like reports and case studies, while quantitativemethodscollectnumericaldataforpredictions andpatternidentification.

This research uses secondary qualitative methods to find insights and collect numerical data. The thematic analysis identifiespatternsandcategoriesfromthedata.Thestudy exploresvariousaspectsofAIintransactionreconciliation usingqualitativeanalysis.Secondaryqualitativeanalysisis definedascollectingnon-numericdata,suchascategorical datafrompublicopinions,surveys,interviews,anddatafrom paststudies.Extensiveanalysisofexistingliterature,various casestudies,andinterviewswiththepersonsengagedwith AI research have contributed to the depth of the research (Shah,2023[8]).

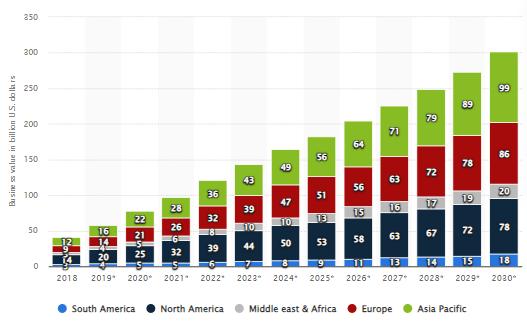

AI is crucial for technological revolutions, with its robust processingpowerallowingquickanalysisoflargedatasets. The fourth industrial revolution relies on AI branches like deeplearning,computervision,neuralnetworks,andpattern recognitiontosolvecomplexproblems(Liuetal.2020[9]). Businesses use AI to automate repetitive tasks, enhance customerrelationships,andmanagetransactions.AI'simpact on the banking industry is significant, with predictions of generating99billionUSDby2030throughAIadoption(Chen etal.2023[10]).

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 11 Issue: 06 | Jun 2024 www.irjet.net p-ISSN: 2395-0072

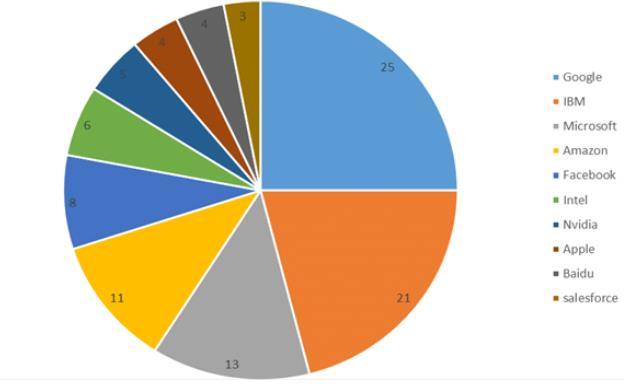

Figure 1: Percentage of the usage of AI technology in corporate businesses

(Source:Paliwal et al.,2021 [11])

Figure 2: business value in billions from the use of AI in the banking sector

(Source: Thormundsson,2022 [12])

Reinforcement learning, a subset of machine learning, is a type of AI that learns from its environment through continuous feedback. It is used in finance, manufacturing, stock markets, and corporate industries. Reinforcement learningframeworkssolveproblemsthathavepersistedfor forty years related to optimal control and behavioral economicsbymakingdecisionsbasedonthefeedbackthey receive (Charpentier et al. 2021 [13]. This technology can optimizetransactionreconciliationspeedandcostanddetect fraud by learning from past instances and adjusting its strategiesaccordingly(Singhetal.2022[14]).

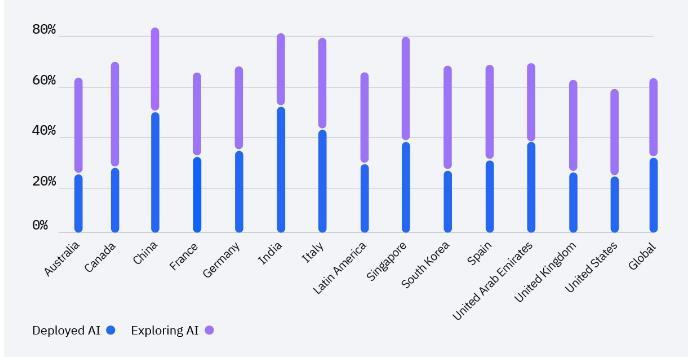

Figure 3: Global AI adoption index (Source:IBM,2022 [15])

AIholdsimmensepotentialinreducingcostsandtimespent managing data reconciliation processes. It serves as a vigilant watchdog, detecting fraudulent transactions by identifyingpatternsthatmightgounnoticedbyhumaneyes. Techniques like data mining and extraction help finance organizations detect threats and protect customers. Moreover, AI simplifies maintaining balance sheets and reduceslaborcostsbyautomatingreconciliationprocesses, creatingamoreefficientandsecurefinancialfuture(Penget al. 2023 [16]). Reinforcement learning algorithms include support vector machines, Monte Carlo methods, and temporal difference learning (Ramicic and Bonarini, 2020 [17]). First, these reinforcement algorithms check the environmentofthetransactiontoverifytheauthorizationof theusers,andthentheyperiodicallytransferandupdatethe user's information. Incomplete transactions are reported withinmomentsinordertorevoketheentireprocessand roll back the transaction datasets. Throughout the entire process,nohumaninterventionisrequired.

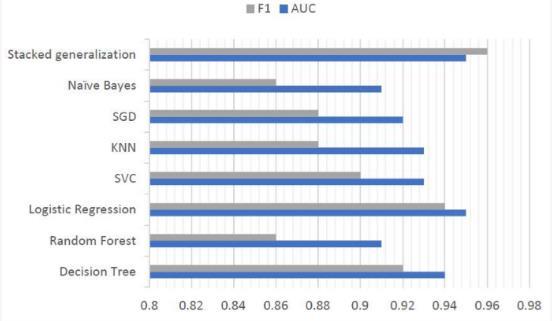

Figure 4: Effectiveness of different Machine learning algorithms to identify fraud in transaction (Source:IBM,2022 [15])

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 11 Issue: 06 | Jun 2024 www.irjet.net p-ISSN: 2395-0072

AItransformsoperationalprocesses,enablingbusinessesto respondtomarkettrends.CloudaccountingpoweredbyAI providesreal-timetransactionandbalancesheetreporting. AI algorithms and machine learning techniques, such as reinforcement learning, optimize reconciliation. AI-based systems can automate transaction recording, verification, andbalancesheetreconciliation,improvingefficiencyand decision-making(MihaiandDuţescu,2022[18]).

Potential Challenges, Risks, and Ethical Considerations

4.1 Data Privacy and Security

AIsystemsneedagreatdealofdatatofunctioneffectively, raisingprivacyconcerns.Unauthorizedaccesstosensitive financialdatacanleadtosignificantbreachesandeconomic losses.Inordertoprotectcustomerdata,organizationsneed toimplementrobustdataprotectionmeasuresandadhereto regulationssuchasGDPR

AIsystemscaninadvertentlyperpetuatebiasespresentin thedata theyaretrainedon.Intransaction reconciliation, biasedalgorithmsmayunfairlyflagcertaintransactionsas fraudulentbasedonbiasedpatterns.Itiscrucialtodevelop unbiased algorithms and regularly audit them to ensure fairnessandaccuracy.

AI decision-making processes can be opaque, making it challengingtounderstandhowcertaindecisionsaremade. Thislackoftransparencycanleadtoaccountabilityissues, mainly when errors occur. Organizations must strive for transparency in their AI systems, providing clear explanationsforautomateddecisions.

Theautomationoftransactionreconciliationprocessescan leadtojobdisplacementforrolestraditionallyperformedby humans. While AI can enhance efficiency, it is essential to consider the social impact on employees. Organizations should invest in retraining programs to help workers transitiontonewroles.

TheethicaluseofAIisacriticalconsideration.Organizations must ensure that AI technologies are used responsibly, avoiding misuse that could harm individuals or groups. Developing ethical guidelines and frameworks for AI

implementationcanhelpmitigatepotentialrisksandensure AIbenefitssocietyasawhole.

4. Discussion

AI drives a new technological revolution with intelligent robots,automation,dataanalysis,andcloudcomputing.The fourth industrial revolution is based on AI and machine learning.Data collectionhas become more accessible, and businesses can use AI to analyze structured and unstructureddataforinsights.AItechnologies,suchasdeep learning and reinforcement learning, automate repetitive processesandbuildself-learningsystems.

CorporateinvestmentinAIdevelopmentisincreasing,with companieslikeGoogle,IBM,andMicrosoftleadingtheway. AI transforms the banking and finance industry by automatingtransactionreconciliationandmanagingbalance sheets. The reconciliation process includes reviewing documents, managing balance sheets, and comparing transactiondata,whichistraditionallymanagedmanually. AI optimizes this process, detects fraudulent transactions, and provides an accurate understanding of transactions. Reinforcement learning techniques, like Monte Carlo methods,customizesolutionsfororganizations,preventing discrepanciesandfraud.

5. Conclusion

AI technologies are transforming business processes globally. Companies collaborate to optimize accounting, supplychain,andadvertisingthroughAI.Thereconciliation processiscrucialforupdatingbusinessreportsandensuring accuracy. Currently, reconciliation involves collecting, storing, comparing, and identifying discrepancies in data, often managed manually. AI automates this process, reducingcostsanderrors.

Reinforcement learning algorithms can be customized to manage transaction reconciliation. Machine learning algorithms detect fraud, manage transactions, and update reports.AI-drivensystemsenhancesecurityandefficiency. The development of advanced AI technologies is ongoing, and companies' active participation will accelerate their integrationandbenefits.

[1] Izzo,M.F.,Fasan,M.,&Tiscini,R.(2022).“Therole of digital transformation in enabling continuous accounting and the effects on intellectual capital: the caseofOracle.”MeditariAccountancyResearch,30(4), 1007-1026.

[2] Petkov, R. (2020). “Artificial intelligence (AI) and the accounting function A revisit and a new perspective for developing framework.”Journal of emerging technologiesinaccounting,17(1),99-105.

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 11 Issue: 06 | Jun 2024 www.irjet.net p-ISSN: 2395-0072

[3] Satheesh, M., & Nagaraj, S. (2021). “Applications of artificial intelligence on customer experience and service quality of the banking sector. “ International ManagementReview,17(1),9-86.

[4] Ravi, H. (2023). “Blockchain: an EOM approach to reconciliation in banking.”Innovation & Management Review,20(1),17-27.

[5] Perdana,A.,Lee,W.E.,&Kim,C.M.(2023).“Prototyping and implementing Robotic Process Automation in accountingfirms:Benefits,challengesandopportunities to audit automation.”International Journal of AccountingInformationSystems,51,100641.

[6] Charpentier, A., Elie, R., & Remlinger, C. (2021). “Reinforcement learning in economics and finance.” ComputationalEconomics,1-38.

[7] Strijker,D.,Bosworth,G.,&Bouter,G.(2020).“Research methodsinruralstudies:Qualitative,quantitativeand mixedmethods.”JournalofRuralStudies,78,262-270.

[8] Shah, V. (2023). “Striking a Balance: Ethical ConsiderationsinAI-DrivenLawEnforcement. “Revista EspanoladeDocumentacionCientifica,17(2),110-136.

[9] Liu, P., Jiang, W., Wang, X., Li, H., & Sun, H. (2020). Researchandapplicationofartificialintelligenceservice platform for the power field.Global Energy Interconnection,3(2),175-185.

[10]Chen,B.,Wu,Z.,&Zhao,R.(2023). “Fromfictiontofact: the growing role of generative AI in business and finance.” Journal of Chinese Economic and Business Studies,21(4),471-496.

[11] Paliwal,M.,Patel,M.,Kandale,N.,&Anute,N.(2021). “Impactofartificialintelligenceandmachinelearning on business operations.” Journal of Management ResearchandAnalysis,8(2),70-75.

[12] Thormundsson, B. (2022). Statista, “Business value derived from artificial intelligence (AI) in banking industry worldwide from 2018 to 2030, by region.” [Retrieved on 5th March 2024] from: https://www.statista.com/statistics/994826/worldwid e-artificial-intelligence-in-banking-business-value-byregion/

[13] Charpentier, A., Elie, R., & Remlinger, C. (2021). “Reinforcement learning in economics and finance. “ ComputationalEconomics,1-38.

[14]Singh,V.,Chen,S.S.,Singhania,M.,Nanavati,B.,&Gupta, A.(2022). “How are reinforcement learningand deep learning algorithms used for big data based decision making in financial industries–A review and research

agenda. “ International Journal of Information ManagementDataInsights,2(2),100094.

[15]IBM, 2022. IBM Global AI Adoption Index 2022 [Retrieved on 5th March 2024] from: https://www.ibm.com/watson/resources/ai-adoption

[16] Peng,Y.,Ahmad,S.F.,Ahmad,A.Y.B.,AlShaikh,M.S., Daoud, M. K., & Alhamdi, F. M. H. (2023). Riding the wavesofartificialintelligenceinadvancingaccounting and its implications for sustainable development goals.Sustainability,15(19),14165.

[17]Ramicic, M., & Bonarini, A. (2020). “Correlation minimizing replay memory in temporal-difference reinforcementlearning.”Neurocomputing,393,91-100.

[18]Mihai, M. S., & Duţescu, A. (2022). “How cloud accounting and integrated services based on AI can impactaccountingcompanies?.” InProceedingsofthe International Conference on Business Excellence(Vol. 16,No.1,pp.849-858).

SudharsonGunasekaranisasenior software developer at an leading investmentmanagementfirmwith overeighteenyearsofexperience He specializes in architecting, designing, and developing highly performant, scalable, and highly available enterprise applications acrossthefinance,pharmaceutical, ande-commerceindustries.Hehas been a Senior Member of IEEE since2023.