International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 11 Issue: 05 | May 2024 www.irjet.net p-ISSN: 2395-0072

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 11 Issue: 05 | May 2024 www.irjet.net p-ISSN: 2395-0072

Subhan Shaik 1

,

Dr. N. Siva Surendra

2

1 Assistant Professor Department of Business Administration, Prasad V Potluri Siddhartha Institute of Technology, Vijayawada, Andhra Pradhesh,India, 2 Assistant Professor Department of Business Administration ,Prasad V Potluri Siddhartha Institute of Technology, Vijayawada, Andhra Pradhesh ,India

Abstract - This paper explores the role of fintech in promoting financial inclusion. It analyses how fintech has bridged the gap between the traditional banking system and underserved populations. By leveraging technology and innovativesolutions, fintech has enhancedaccess to financial services, particularly in developing regions. The paper discussesvariousapplicationsoffintechinexpandingfinancial inclusion, comparisons with traditional banking methods, challenges, and opportunities for future research.

Key Words: Financialinclusion,Fintech,Bankingservices, Microfinance, Digital payments, Remittances, Access to finance,Economicdevelopment.

Financialinclusion,theaccessandusageoffinancialservices by all individuals and businesses, is vital for economic growth and development. However, traditional banking systemsoftenfailtoreachtheunbankedandunderbanked populations, leading to exclusion from basic financial services.Fintech,theintegrationoftechnologyintofinancial services, has emerged as a solution to address these gaps andimprovefinancialinclusion.

In 2017, Badar Alam Iqbal and Shaista Sami evaluated the effect of financial inclusion on the expansion of the Indian economyovera periodofsevenyears.Multipleregression modelingwasusedtoanalyzesecondarydata,andthestudy's findings demonstrated that the bank branch and credit depositratiohadanoteworthyandfavorableimpactonthe GDPofthecountry.

Ms.DivyaniDatta(2023)concentratedongivingaconceptual explanation of how fintech aided in the post-pandemic financialinclusionofIndia.Thestudy'sdescriptiveapproach providedanimaginativepicture,anditalsomadementionof how fintech may assist put the economy back on track by addressingitsoveralleffectsonthepeopleasawhole.

Guild(2017)investigatedFinTechandtheFutureofFinance, the Impact of Technology on the Financial Sector, and the RelationshipbetweenTechnicalInnovationsinFinTechand Technological Advancement and Innovation. FinTech developmentsinclude,amongotherthings,digitalcurrency

transfer systems available in Kenya and India. His paper's main focus is on how FinTech has changed the way that millionsofpeopleinemergingnationslikeChinaandIndia accessfinance,withanemphasisontherolethatregulatory frameworks play in facilitating this process. He concluded that technological advancement might transform global financebyfosteringgreaterinclusivity,decentralization,and egalitarianisminFinTech.

Fintechhasrevolutionizedthefinancialsectorbyoffering digital payment solutions, mobile banking, peer-to-peer lending platforms, and microfinance services. These innovative technologies have enabled individuals without access to traditional banks to participate in the financial system.Fintechcompaniessuchasmobilemoneyproviders havealloweduserstoconducttransactions,savemoney,and access credit using their mobile phones, thus reducing the barrierstofinancialaccess.

In comparison to traditional banking methods, fintech offers lower costs, faster transactions, and greater convenience. Mobile banking apps and online payment platformshavesimplifiedfinancialprocesses,makingthem accessible to a wider audience. Furthermore, fintech companiesleveragedataanalyticsandartificialintelligence to assess creditworthiness and offer tailored financial productstounderservedpopulations.

Despite the benefits of fintech in promoting financial inclusion,challengesexist,suchascybersecurityrisks,data privacy concerns, and regulatory barriers. Additionally, digitalliteracyandinternetconnectivityissuescanhinderthe adoption of fintech services in certain regions. Addressing thesechallengeswillbecrucialtoensuringthatfintechcan trulyenhancefinancialinclusionforall.

Financial inclusion as a driver of economic development Challenges faced by marginalized populations in accessing financialservicesTheemergenceoffintechasasolutionto enhancefinancialinclusion

3. Fintech and Access to Banking Services Mobilebanking anditsroleinexpandingaccesstobankingservicesDigital banking platforms and their impact on financial inclusion Case studies illustrating successful fintech initiatives in

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 11 Issue: 05 | May 2024 www.irjet.net p-ISSN: 2395-0072

improving banking accessibility Challenges in ensuring inclusivityindigitalbankingsolutions.

The evolution of microfinance and its impact on poverty alleviation The integration of fintech in microfinance institutions(MFIs)Peer-to-peer(P2P)lendingplatformsand their role in extending credit to underserved populations Case studies demonstrating the effectiveness of fintechenabledmicrofinance.

Fintech and Digital Payments Theriseofdigitalpayment solutionsandtheircontributiontofinancialinclusionMobile money platforms and their role in promoting cashless transactions Block chain technology and its potential to revolutionize digital payments Challenges in ensuring the securityandinteroperabilityofdigitalpaymentsystems.

Fintech and Remittances Thesignificanceofremittances in supporting household incomes in developing countries Theroleoffintechinreducingthecostandenhancingthe efficiencyofremittancetransfersCasestudiesshowcasing innovative fintech solutions in the remittance market Regulatorychallengesandopportunitiesinthecross-border remittancespace.

Opportunities and Challenges of Fintech Adoption Opportunitiesforfintechtobridgethefinancialinclusiongap Challengesrelatedtoregulatorycompliance,data privacy, and cyber security The importance of digital literacy and infrastructureinfosteringfintechadoptionFuturedirections forresearchandpolicyinitiativestomaximizetheimpactof fintechonfinancialinclusion.

3.2. Market analysis of fintech in India:

India's fintech market has been experiencing significant growth over the past few years, driven by various factors suchasincreasingsmartphonepenetration,risinginternet usage,governmentinitiativespromotingdigitalpayments, and a growing demand for convenient and accessible financialservices.

1. Digital Payments:Indiahaswitnessedarapidshift towardsdigitalpayments,fueledbyinitiativeslike Unified Payments Interface (UPI) which enables instantfundtransfersbetweenbankaccountsusing mobile phones. Fintech companies like Paytm, PhonePe,GooglePay,andothershavecapitalizedon this trend, offering digital wallets, payment gateways,andotherpaymentsolutions.

2. Lending: Fintech lending platforms have gained traction in India, especially among underserved segmentsofthepopulationwhohavelimitedaccess to traditional banking services. These platforms

leverage technology and data analytics to assess creditworthiness and provide quick loans to individualsandsmallbusinesses.Examplesinclude platforms like Lendingkart, Capital Float, and KreditBee.

3. Personal Finance Management: Fintech companiesareofferingsolutionstohelpindividuals manage their finances more efficiently. These includebudgetingapps,investmentplatforms,and robo-advisors that use algorithms to provide personalizedfinancialadvice.PlayerslikeScripbox, Groww,andETMoneyareprominentinthisspace.

4. Insurance Technology (Insurtech): Insurtech startupsareleveragingtechnologytosimplifythe insurance buying process, improve underwriting efficiency, and enhance customer experience. Companies like Policybazaar, Coverfox, and Acko aredisruptingthetraditionalinsuranceindustryby offeringcomparisonplatforms,digitalpolicies,and innovativeinsuranceproducts.

5. Blockchain and Cryptocurrency: While the regulatoryenvironmentaroundcryptocurrencyin India has been uncertain, fintech start-ups are exploring block chain technology for various applicationsbeyondcryptocurrency,suchassupply chainmanagement,identityverification,andsmart contracts.

6. Regulatory Environment: The regulatory landscapeinIndiaisevolvingtoaccommodatethe growth of fintech while ensuring consumer protectionandfinancialstability.TheReserveBank of India (RBI) and other regulatory bodies are introducing guidelinesandframeworksto govern different aspects of fintech, such as digital payments, peer-to-peer lending, and data protection.

7. Collaboration and Partnerships: Traditional financialinstitutionsareincreasinglycollaborating withfintechstart-upstoleveragetheirtechnology andinnovation.Banksandfinancialinstitutionsare partnering with fintech firms to enhance their product offerings, improve customer experience, andstreamlineoperations.

8. Challenges:Despitethegrowthopportunities,the Indian fintech market faces several challenges, including regulatory uncertainty, cyber security risks, infrastructure limitations, and the need for greater financial literacy among the population. Additionally, competition is intensifying as more players enter the market, leading to pressure on marginsandtheneedfordifferentiation

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 11 Issue: 05 | May 2024 www.irjet.net p-ISSN: 2395-0072

Fintech Funding & Valuation India'sFintechindustryhas receivedmoney,makingover14%ofglobalfunding.India comes in second for deal volume. By 2030, the Fintech Market Opportunity is projected to reach $2.1 trillion. In 2022,Indianfintechsrankedasthecountry'ssecondmost fundedstartupindustry.In 2022,fintechstartupsinIndia raised $5.65 billion. Between 2021 and 2022, the overall number of unique institutional investors in Indian fintech increasedfrom535to1019,nearlydoubling.

IndianFinTechcompanieshavethepotentialtoreshapethe financialserviceslandscapeinthreeways:

TheFinTechstart-upsarelikelytoreducecostsand improve quality of financial services. Not being burdened withlegacyoperations,ITsystems,and expensive physical networks, benefits of leaner operatingmodelscanbepassedontocustomers.

The FinTech industry will develop unique and innovativemodelsofassessingrisks.Leveragingbig data, machine learning, and alternative data to underwrite credit and develop credit scores for customerswithlimitedcredithistorywillimprove thepenetrationoffinancialservicesinIndia.

FinTech will create a more diverse, secured, and stable financial services landscape. FinTech companies are less homogenous than incumbent banks and offer great learning templates to improve,both,capabilitiesandculture.

4.1 Digital Payments:

UPI has surpassed the historic 10 billion transactions since 2016, when there were only 1 milliontransactions.

In March 2024, UPI recorded 13.4 billion transactions,thegreatestamountever.

By 2025, daily transactions on the UPI platform mightreach$1billion.

Thevalueandvolumeofdigitalpaymentsclimbed by91%and76%,respectively,by2022.

According to a 90,000-person pan-Indian digital paymentssurvey,42%ofparticipantshaveutilized digitalpayments.

There has been a 53% increase in the number of touch points (from 170 million to 260 million) acceptingdigitalpaymentinfrastructure.

4.2 Fintech's and financial inclusion's currentstate:

With an AUM of US$1,294.00m in 2024, Digital Investmentwillbethelargestmarket.

Inthedigitalinvestmentsector,theaverageannual maintenance unit (AUM) per user is expected to reachUS$9.38by2024.

In2025,themarketfordigitalassetsisprojectedto increaseatarateof11.81%inrevenue.

It is anticipated that there will be 837.20 million usersinthedigitalpaymentssectorby2028.

In 2024, the market for digital investments is expectedtohavetotalassetsundermanagementof US$1,294.00million.

TheuniqueattributesofKPIsintheFinTechdomain prohibit their amalgamation and exhibit as a solitaryfigureemblematicoftheFinTechindustry asawhole.

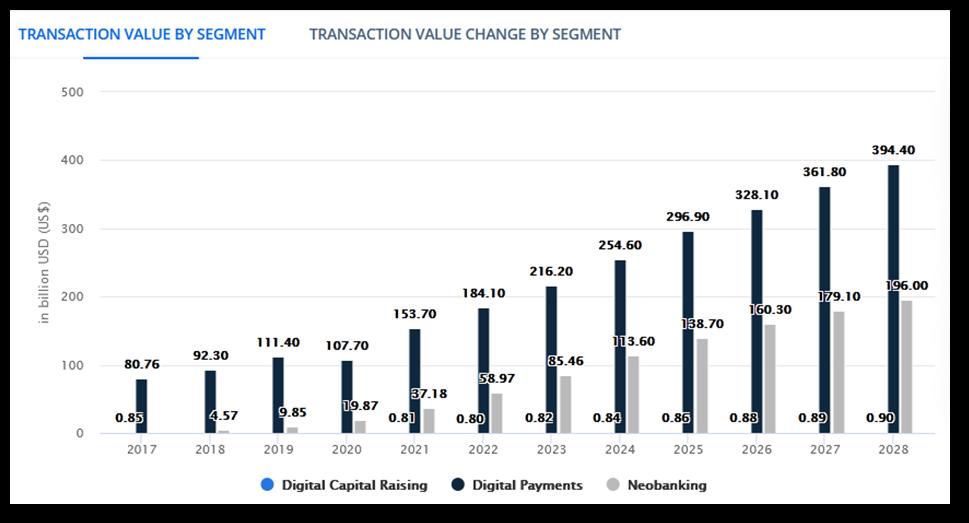

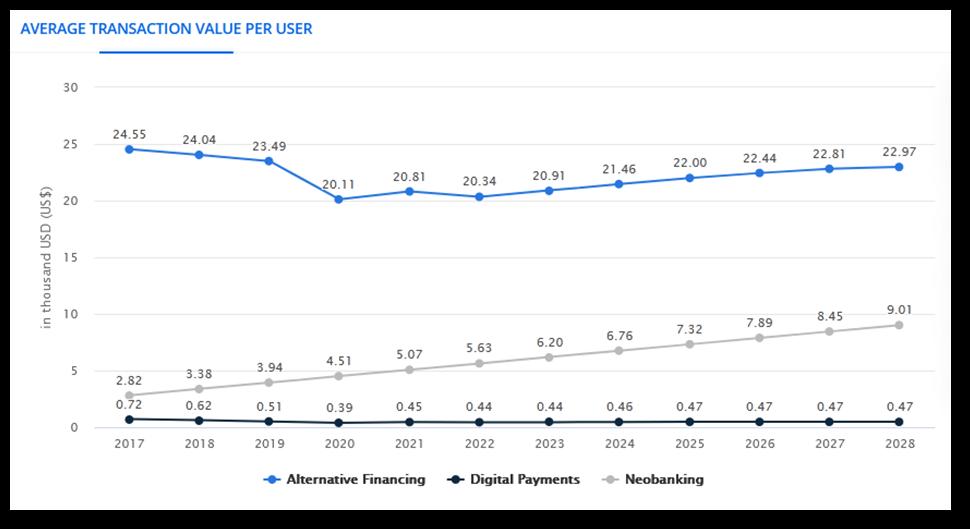

Source: StatistaMarketInsights

Figure2: Transaction Value by Users in Fintech

Source: StatistaMarketInsights

From the above two figures it is evident that by 2028 $394.90billionofdigitalpaymentsisboomingupwhereas $254.60 billion in the 2024 it shows the landscape of the

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 11 Issue: 05 | May 2024 www.irjet.net p-ISSN: 2395-0072

growthinthedigitalpayments.Sothatfutureofthefinancial markets is going in to new horizons. There is an huge revolutionarychangesaretakingplaceinthismarket.

Name of the Company Valuation of Company TypeofBusiness

$6.4billion

$1.1billion

$2.9billion

$1.9billion

$4billion

$3billion

$1.45billion

CRED is an Indian fintech company, iis a rewardbasedcreditcardpayments app.

Ackofollowsanonline-led model and hence all operationsforthecompany are offered through the digitalplatform

BharatPe is an Indian fintechcompanythatsells digital payment and financial servicesto small merchants and Grocery stores

MobiKwik is an Indian payment service provider founded in 2009 that provides a mobile phonebasedpaymentsystem

Digit Insurance is one of the leading General Insurance companies in IndiaonamissiontoMake Insurance Simple for people

Groww is India's growing financialservicesplatform whereuserscanfindtheir investment solutions pertainingtomutualfunds

Zetaisanext-genbanking tech company The company provides credit and debit card issuer processing

1. Job Creation: Fintech unicorns often experience rapidgrowth,leadingtothecreationofnumerous jobopportunities.Thesecompanieshireadiverse rangeoftalent,includingengineers,datascientists, product managers, marketers, and customer support staff. By providing employment opportunities, fintech unicorns contribute to reducing unemployment and driving economic growth.

2. Innovation and Disruption:Fintechunicornsare at the forefront of innovation in the financial services industry. They develop disruptive technologies and business models that challenge traditional banking and financial institutions. By introducing new products and services, such as digital payments, peer-to-peer lending, roboadvisors, and blockchain-based solutions, fintech unicornsdriveefficiency,reducecosts,andenhance financialinclusion.

3. Financial Inclusion:Fintechunicornsplayacrucial role in expanding access to financial services, especially in regions with limited banking infrastructure. Through mobile banking, digital wallets, and other innovative platforms, these companies enable underserved populations to participate in the formal financial system, access credit, make payments, and save money. By promoting financial inclusion, fintech unicorns contributetopovertyreductionandsocioeconomic development.

4. Foreign Investment and Capital Inflows:Fintech unicorns attract significant investment from venturecapitalfirms,privateequityinvestors,and multinational corporations. This influx of capital stimulates economic activity, fosters entrepreneurship,andpromotesthegrowthofthe startupecosystem.Moreover,successfulexits,such as initial public offerings (IPOs) or acquisitions, generate returns for investors and further fuel investmentintheeconomy.

$5billion

Pine Labs is a leading merchant platform empowering any businesses to accept multiple modes of payments, get in-depth customerinsights

Fintech unicorns, which are startup companies valued at over $1 billion, play a significant role in India's economic developmentinseveralways:

5. Digital Infrastructure Development: Fintech unicorns invest in building digital infrastructure, including payment gateways, mobile apps, data analytics platforms, and cyber-security solutions. Theseinvestmentsstrengthenthecountry'sdigital ecosystem,improveconnectivity,andenhancethe overallefficiencyoffinancialtransactions.Arobust digitalinfrastructureisessentialforsupportingecommerce, online banking, and other digital services,drivingeconomicgrowthinthedigitalage.

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 11 Issue: 05 | May 2024 www.irjet.net p-ISSN: 2395-0072

Fintech applications in financial inclusion include digital wallets, crowdfunding platforms, insurtech services, and block chain-based solutions. These technologies have empowered individuals and small businesses to access capital,manage risks,and improve financial management. For example, block chain technology enables transparent andsecuretransactions,expandingfinancialopportunities formarginalizedcommunities.

Fintechplaysacrucialroleinpromotingfinancialinclusion by leveraging technology to provide accessible and affordablefinancialservicestounderservedpopulations.As fintechcontinuestoinnovateandexpandglobally,thereare opportunities for further research on optimizing these solutions, addressing challenges, and maximizing their impact on financial inclusion. Fintech has the potential to significantly enhance financial inclusion in India by providing convenient, affordable, and accessible financial servicestounderservedpopulations,ultimatelycontributing toeconomicgrowthandpovertyreduction.

[1] World Bank, "The Global Findex Database 2017: MeasuringFinancialInclusionAroundtheWorld"

[2] McKinsey&Company,"ThePowerofDigitalInclusion: Technology'sRoleinAdvancingFinancialInclusion"

[3] GatesFoundation,"FinancialServicesforthePoor:The RoleofFintech"

[4] https://www.researchgate.net/publication/331244922 _Fintech_and_the_Future_of_Financial_Services_What_Ar e_the_Research_Gaps

[5] https://ijcrt.org/papers/IJCRT2302233.pdf

[6] https://www.mdpi.com/1911-8074/16/2/122

[7] https://www2.deloitte.com/in/en/pages/financialservices/articles/fintech-india-ready-for-breakout.html