EDITOR’S NOTE

EDITOR’S NOTE

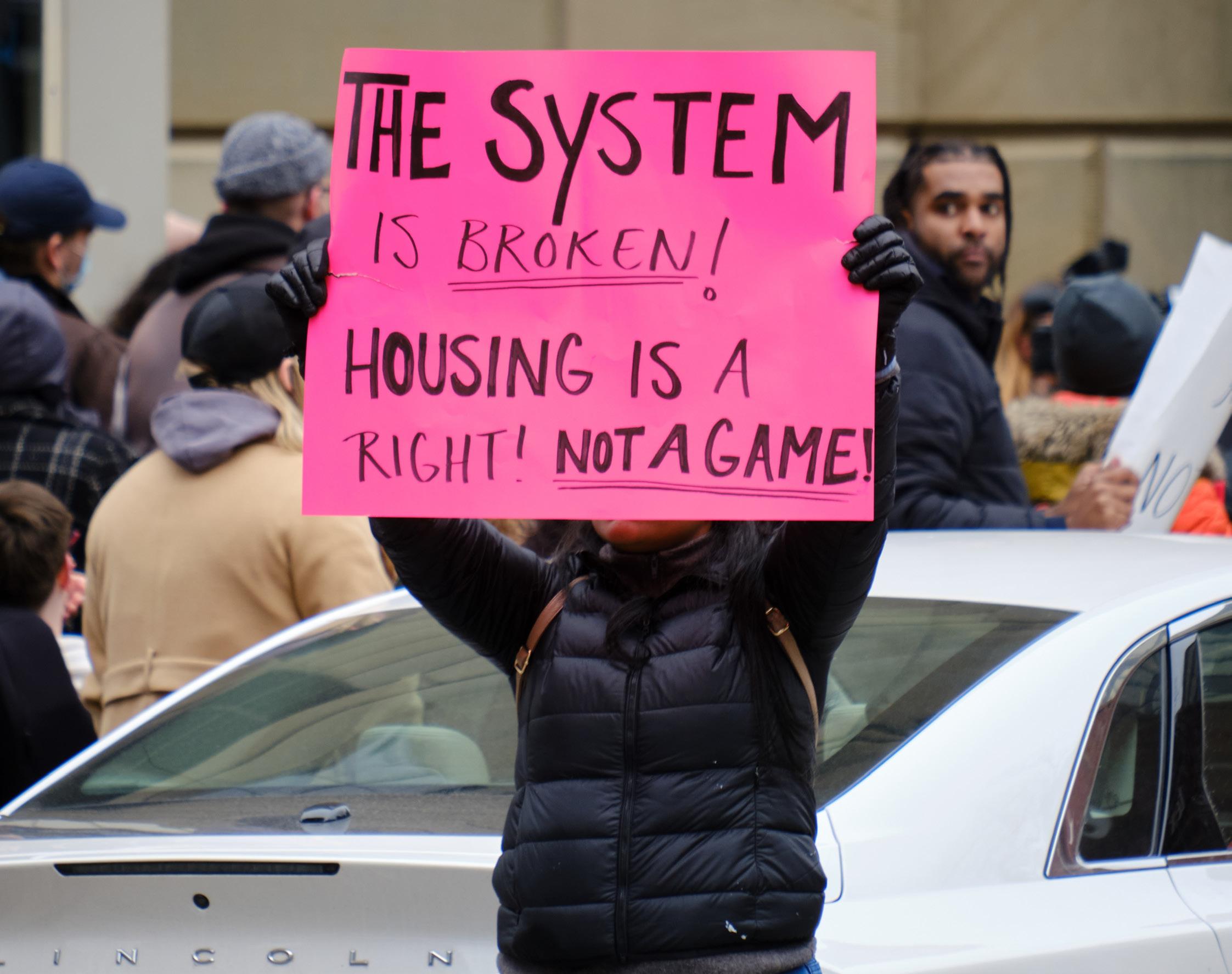

Canada’s official poverty rate is projected to have climbed to 10.2% in 2023, marking a structural breaking point. The surge follows a staggering 21.8% jump between 2021 and 2022, leaving one in six Canadian households grappling with food insecurity. Together, these figures expose a stark reality: the economic floor supporting low-income Canadians is fragile, inadequate, and increasingly dependent on government goodwill that appears to be receding. Is the nation failing its own citizens? The question looms large.

China, the world’s second-largest economy, faces a troubling imbalance in its auto industry. Generous subsidies and policy support have propelled it to global leadership, yet domestic automakers, despite meeting Xi Jinping’s production targets, are now building more cars than the market can absorb. The glut is squeezing profits and raising doubts about the sustainability of China’s industrial strategy.

Meanwhile, Russia, battered by Western sanctions, continues to flex its technological muscle in the Arctic. Moscow is determined to consolidate its dominance over the resource-rich region, highlighting how geopolitics and technology intersect in one of the world’s most strategically contested frontiers.

The cover story of the November 2025 edition of International Finance revolves around the world of cryptocurrency, a sector that has delivered headline-making milestones. Total market capitalisation surged past the $4 trillion threshold, the United States enacted the landmark GENIUS Act, and Bitcoin’s parabolic rally shattered all-time highs before a sharp correction reset the narrative. The year has been one of firsts, volatility, and transformation—signalling that crypto is no longer a fringe experiment but a central force in global finance.

NOVEMBER 2025

VOLUME 25

ISSUE 54

editor@ifinancemag.com www.internationalfinance.com

The European Union fully implemented its Markets in Crypto-Assets regulation in late 2024 and throughout 2025

CHINA'S AUTO INDUSTRY FACES SCRUTINY

China's drive to boost EV sales for job creation and growth comes at the cost of profitability

DREAM DEFERRED: THE AFCFTA STORY

The scale of trade under AfCFTA rules hasn't matched Africa’s ambitions

The

Without a unified, compliant customer profile, personalisation becomes difficult and risky

52 Neobanks aim to conquer America

70 The collapse of Canada’s promise 88 AI chatbots open door to scams

ANALYSIS

12 Gulf moves beyond oil reliance

60 Lebanon’s road to recovery begins now

78 Russia’s Arctic power play

32 INSIGHT

TRUMP’S TARIFFS SHAKE WORLD TRADE

US President Donald Trump has portrayed himself as a resetter of a system he says is rigged against the world’s largest economy

40 SUMOTH C

The success of fintech partnerships lies in approaching stakeholders through collaboration OPINION

BANKING’S FUTURE IS COLLABORATION

03 EDITOR'S NOTE

The year crypto grew up 0 6 TRENDING

GoPro Max 2 simplifies 360 cam 08 NEWS

Foxconn to invest $3 Billion in AI front

www.internationalfinance.com

Director & Publisher Sunil Bhat

Editorial

Prajwal Wele, Agnivesh Harshan, CL Ramakrishnan, Prabuddha Ghosh

Production Merlin Cruz

Design & Layout Vikas Kapoor

Technical Team

Prashanth V Acharya, Bharath Kumar

Business Analysts

Alice Parker, Indra Kala, Stallone Edward, Jessica Smith, Harry Wilson, Susan Lee, Mark Pinto, Richard Samuel, Merl John

Business Development Managers

Christy John, Alex Carter, Gwen Morgan, Janet George

Business Development Directors

Sid Jain, Sarah Jones, Sid Nathan

Head of Operations Ryan Cooper

Accounts Angela Mathews

Registered Office INTERNATIONAL FINANCE is the trading name of INTERNATIONAL FINANCE Publications Ltd 843 Finchley Road, London, NW11 8NA

Phone

+44 (0) 208 123 9436

Fax

+44 (0) 208 181 6550

Email info@ifinancemag.com

Press Contact editor@ifinancemag.com

Associate Office

Zredhi Solutions Pvt. Ltd. 5th Floor, Sai Complex, #114/1, M G Road, Bengaluru 560001

Ph: +91-80-409901144

Verizon is laying off more than 13,000 employees in mass job reductions that come as the American telecom giant says it must "reorient" the entire company, according to a memo from CEO Dan Schulman to staff. The memo stated that the current cost structure "limits" the company's ability to invest, particularly in customer experiences. He said the company needed to "simplify operations" to address the "complexity and friction" that slow it down and frustrate customers. Verizon had nearly 100,000 full-time employees at the end of 2024, according to securities filings. The venture also plans to convert 179 corporate-owned retail stores into franchised operations, apart from closing one outlet.

GoPro Max 2 simplifies 360 cam

The GoPro Max 2 is a waterproof 360 action camera capable of 8K video. The Max 2’s greatest aspect is that it’s faster and easier to use than its main competitor, the Insta360 X5. The Max 2 uses the same general design as the original Max. Its square shape is shorter but wider than the Insta360 X5. On each side are two 1/2.3inch image sensors behind user-replaceable lenses. Those smaller sensors likely help to keep the camera size small, but are a liability in low light.

American banking giant JPMorgan has expanded in Dubai as part of a broader push to grow and do more business with medium-sized companies in the Middle East and beyond. The move will pose a direct challenge to competitors like Citigroup, and comes after JPMorgan recently devoted more resources to coverage of socalled midcaps in Austria and Poland. The bank is also now weighing increasing its presence in Turkey. Midcaps have opened up another revenue stream for JPMorgan beyond its traditional focus on the biggest blue-chip firms.

Saudi Arabia-based fintech Tabby announced a secondary share sale involving shares held by existing shareholders that valued the company at $4.5 billion before a potential public listing. Shares in the buy-now-pay-later (BNPL) firm were purchased from existing investors by HSG, Boyu Capital, and other parties. Tabby allows customers to make deferred payments on purchases and is backed by Abu Dhabi sovereign wealth fund Mubadala. Tabby, since its formation in 2019, has stitched up collaborations with over 40,000 businesses

The world’s 20 largest economies are projected to expand by only 2.9% in 2030, weighed down by protectionist pressures and policy uncertainty, marking their weakest medium-term outlook since the 2009 global financial crisis, according to the International Monetary Fund (IMF). The global lender highlighted a range of challenges confronting the international economy, including widening imbalances, strained public finances, and ageing populations across advanced nations. In

2025, the group's output was expected to expand by 3.2%, down from 2024's 3.3%. Within the G20, advanced economies such as the United States, Britain, Australia, Canada, France, Germany, Italy, Japan, and South Korea are expected to record growth of just 1.4% in 2030. In contrast, the bloc’s emerging economies: Argentina, Brazil, China, India, Indonesia, Mexico, Russia, Saudi Arabia, South Africa, and Turkey, are forecast to achieve a stronger pace of 3.9%

ABEY KGOTLE CEO-DESIGNATE, MERCEDESBENZ SOUTH AFRICA Abey Kgotle resigned as CEO-designate for personal reasons just before assuming the role, with the company announcing he will step down effective 30 November

SCOTT FARQUHAR CO-FOUNDER OF ATLASSIAN Scott Farquhar, one of Australia’s most influential tech founders, driving Atlassian’s global growth in collaboration software, was featured as a business leader at the Forbes Australia 2025 Business Summit in November

FUNDI SITHEBE FORMER CEO OF 4RACING Fundi Sithebe, a former CEO of 4Racing, noted for her role in South African racing, was in the spotlight for her significant participation in regulated industries and transformation

Foxconn, which has delayed its goal of taking 5% of the global EV market by 2025, is waiting for conditions to improve before scaling investments

Vietnam Airlines recorded a posttax profit of over VND2.92 trillion, up VND1.89 trillion from the same period in 2024

In a momentous shift in its capital allocation pattern, the world's largest electronics manufacturer, Foxconn, is planning to invest between $2 to $3 billion annually in AI infrastructure and technology.

While revealing the news, Foxconn Chairman Young Liu said that AI spending will make up more than half of the roughly $5 billion of the annual capital expenditures (capex) at Foxconn over the next three to five years, and that he expects China's crowded electric vehicle market to shake out soon.

Liu told the news agency that AI will make up the majority of Foxconn's investment in the near term and that the company is in talks with the Japanese government about potential investments in AI and EV-related projects.

But with too many companies chasing too little profit, the industry is "barrelling toward a shakeout," Liu warned, saying that limited government support cannot sustain every automaker in the world's largest EV market.

Foxconn, which has delayed its goal of taking 5% of the global EV market by 2025, is waiting for conditions to improve before scaling investments.

Liu said the electric vehicle sector could become like the early personal computer (PC) industry, where intense competition made in-house production unsustainable and drove a shift to outsourcing.

Foxconn pioneered that model with Compaq Computer in the 1990s the world's largest PC supplier. Liu said a similar dynamic is emerging for electric vehicles, with carmakers likely to outsource faster as competition intensifies.

"Once they start outsourcing with one successful example, the others will follow. That's exactly what we saw in the PC market," he said.

The cloud and networking division of Foxconn, which also includes its AI server business, has surpassed consumer electronics for the past two quarters. The division's revenue in the second quarter of 2025 rising 47% year-on-year to NT$731.8 billion ($24.32 billion) in August.

This has exceeded the Smart Consumer Electronics segment with NT$634.5 billion ($21.08 billion). In early November, the company announced a $1.37 billion investment in expanding its AI and supercomputing infrastructure.

Etihad Airways and Vietnam Airlines are deepening travel links between the UAE and Vietnam with the launch of a new codeshare partnership, building on the Gulf-based carrier's recently launched service between Abu Dhabi and Hanoi.

The move will give Etihad guests access to key Vietnamese and other Asian destinations, with the convenience of a single ticket for the entire journey, one check-in, and automatic baggage transfer throughout. Abu Dhabi is now the gateway connecting Vietnam to the Middle East, Europe, and Africa.

Arik De, Chief Revenue and Commercial Officer, Etihad Airways, said, "This partnership with Vietnam Airlines delivers significant value to our guests by unlocking access to some of Asia's most dynamic and popular destinations. Our new Abu Dhabi-Hanoi service has been warmly received, and this codeshare agreement transforms it into a gateway to Vietnam's most exciting cities."

“Combined with our frequent flyer partnership, which enables loyalty members of both airlines to earn and redeem miles across our combined global networks, this collaboration underscores our

commitment to providing our guests with greater flexibility, broader reach, and superior travel experiences," he added.

Nguyen Quang Trung, Director of Corporate Planning and Development, Vietnam Airlines, said, "Vietnam Airlines is pleased to advance our partnership with Etihad Airways through this new codeshare agreement, following the Memorandum of Understanding signed in 2024. The collaboration offers seamless access to Etihad’s network across the Middle East, Europe, and Africa, while allowing more travellers to experience Vietnam Airlines’ signature warmth and hospitality."

Etihad and Vietnam Airlines already have a frequent flyer partnership, allowing loyalty members to earn and redeem miles across the ventures' combined global reach. According to its latest consolidated financial statement for Q2 2025, Vietnam Airlines Corporation reported revenue of more than VND58.68 trillion ($2.24 billion), a 10% year-on-year increase, alongside a pre-tax profit of VND6.68 trillion ($255 million), up 19.3%. The corporation recorded a post-tax profit of over VND2.92 trillion ($111.45 million), an increase of VND1.89 trillion compared to the same period in 2024.

The PRA said the proposed new limit of £110,000 had been increased in light of consultation feedback and to reflect the latest inflation data

The RFI includes fare collection systems, depot management, utilisation and commercialisation of the PRASA fibre network

British savers will have up to 120,000 pounds ($158,000) of their money protected in the event of a bank failure, the Bank of England said after increasing the deposit guarantee limit by 40%. The new deposit protection limit, under the Financial Services Compensation Scheme (FSCS), is 41% higher than the current limit of £85,000 and will take effect from 1 December. The Bank of England's Prudential Regulation Authority (PRA), which had previously proposed an increase to 110,000 pounds, said it opted for a higher threshold to reflect persistently high inflation. The new cap exceeds the European Union’s harmonised 100,000 euro ($115,860) limit but remains below the limit in the United States,

Through its mortgage and real estate finance law, Kuwait now seeks practical and comprehensive solutions to the housing issue while also revitalising the broader real estate sector. Ibrahim Al-Awadhi, Head of the Real Estate Union, said that the recently circulated version is only a preliminary draft. Mortgage benefits will be limited to those eligible for housing assistance and individuals purchasing units from real estate developers’ projects. The primary objective of the law is to ease the growing pressure on the Kuwait Credit Bank in providing traditional government financing by creating alternative financing channels to support the Public Authority for Housing Welfare (PAHW) in meeting housing demands.

The South African government has released a series of Requests for Information (RFI) in a bid to attract private sector ideas and investment to modernise and expand the rail system, as the country strives to achieve its goal of 600 million passenger trips a year by 2030. Minister of Transport Barbara Creecy said that participation in the RFI process will help the organisation gather information, innovative ideas, and solutions to inform future Requests for Proposals for private sector investment in the passenger rail sector. The RFI includes fare collection systems, depot management, utilisation and commercialisation of the Passenger Rail Agency of South Africa's (PRASA) fibre network to improve digital connectivity.

The Technology Innovation Institute (TII), the applied research arm of Abu Dhabi’s Advanced Technology Research Council (ATRC), is collaborating with Space42, the UAE-based AI-powered SpaceTech company with global reach, to co-develop and deploy the UAE’s first space-to-ground quantum communication network, integrating both satellite and ground-based systems powered by sovereign Quantum Key Distribution (QKD) technology. This represents a strategic step in the UAE’s quantum communication ambitions, laying the groundwork for ultra-secure data exchange, strengthening cyber resilience, and reinforcing national leadership in the future of secure digital infrastructure across both ground and space domains.

With risks now seen as lower, more investors are willing to compete for opportunities in the Gulf than ever before

Project finance in the Gulf Cooperation Council (GCC) region is undergoing a rapid transformation as markets mature and political risks recede, giving investors greater confidence to fund ambitious infrastructure projects. This confidence has fostered a robust pipeline of deals across the GCC.

Hugh Morris explains that as the market matures, perceptions of geopolitical risk in the region have improved

The region’s unique position is also a draw as the GCC offers a middle-ground risk and return profile standing between the low-risk, low-yield markets of the West and the higher-risk, high-yield opportunities in the East.

Industry experts observe that the GCC’s political and economic environment has stabilised significantly in recent years. Hugh Morris, Senior Research Partner at the consultancy Z/Yen, explains that as the market matures, perceptions of geopolitical risk in the region have improved. A more stable environment has, in turn, enabled a growing pipeline of infrastructure projects.

With risks now seen as lower, more investors are willing to compete for opportunities in the Gulf than ever before. In a global investment climate where low-risk assets with decent yields are

scarce, the GCC’s balanced risk-reward profile is especially compelling to international financiers.

This improved climate has paved the way for greater collaboration among lenders. International banks, armed with large pools of capital and expertise in complex project financing, are increasingly partnering with local GCC banks that have invaluable on-the-ground knowledge and relationships.

Together, these partnerships blend global financial power with local insight to ensure projects are funded and executed effectively. These synergies help major developments get off the ground, as each party brings complementary strengths to the table.

Even with these positive trends, project finance deals are not without challenges. Many projects span 20 years or more, with loan repayment schedules commonly stretching over 12 to 25 years. Critically, loans are usually repaid from the project’s own revenues once it is operational, as sponsors do not typically guarantee the debt.

This structure means lenders shoulder significant risk, since repayment hinges entirely on the project’s success. Naturally, banks expect to earn a premium interest rate in return for taking on this risk. However, competition in today’s market is pushing lenders to offer more attractive terms to win business, even as they must adhere to strict capital adequacy rules. Balancing risk-based pricing with competitive financing packages has become a key focus for Gulf banks.

Saudi Arabia and the United Arab Emirates (UAE) currently lead the region in large-scale project investments. A major driver behind this trend is the strategic push to diversify national economies away from oil and gas, building a sustainable postoil future.

Both countries benefit from centralised decision-making, as directives from top leadership are translated swiftly into infrastructure initiatives on the ground. For example, Saudi Arabia has embarked on pioneering projects in green hydrogen energy, and the UAE has made a bold entry into nuclear power. Saudi Arabia’s $50 billion Al Diriyah development near Riyadh aims to create a cultural and tourist hub, echoing Dubai’s success in drawing international visitors.

Despite this ambitious pipeline, not everything is rosy. A spokesperson for Bank ABC points out that there remains an estimated $5 trillion annual investment gap globally for clean energy, highlighting shortcomings in meeting climate targets after COP29.

The bank argues that financial institutions must play a greater leadership role in bridging this gap. This reality highlights why many Gulf-based banks and investors are focusing their efforts on funding renewable energy and other energy transition projects.

Another notable shift in the Gulf’s project finance landscape is the growth of social infrastructure projects such as hospitals, schools, and public amenities, which are often structured as public-private partnerships (PPPs). Ehab Nassar, a director at Fitch Ratings, observes that this trend is driven by the same strategy of reducing reliance on oil revenues.

Governments in the GCC have been ramping up PPP frameworks to tap private-sector capital and expertise for public projects. Until the late 2010s, true project finance deals outside the oil and gas sector were relatively limited. Since then, countries like Saudi Arabia and the UAE have introduced formal PPP programmes as part of their economic diversification agendas.

Not every major project in the region uses a PPP structure. For instance, Abu Dhabi’s Barakah nuclear

power plant, a cornerstone of the UAE’s clean energy strategy, was financed through a more traditional mix of government support and international investment rather than a typical PPP, combining both debt and equity in its funding.

It was backed by over $18 billion in loans from the Abu Dhabi government and international lenders (including KEXIM), plus an equity investment of $4.7 billion from a joint venture between Emirates Nuclear Energy Corporation (ENEC) and Korea Electric Power Corporation (KEPCO).

Because the plant will help decarbonise the UAE’s power grid, the authorities classified its financing as a green loan, emphasising its contribution to the country’s green economy goals. In July 2023, once the plant was operational, two major Emirati lenders, Abu Dhabi Commercial Bank and First Abu Dhabi Bank, stepped in to refinance a large portion of the project’s debt, taking over the loan facilities that KEXIM had initially provided.

Project financiers in the GCC are also experimenting with new deal structures to improve funding efficiency. One notable evolution, highlighted by Abbas Husain of Standard Chartered, is the use of “hard mini-perm” financing coupled with long-term off-take agreements.

In these arrangements, a project’s initial bank loan might have a shorter tenor, effectively requiring refinancing after a few years, while the project itself benefits from a long-term concession or purchase contract. This approach shifts much of

the refinancing risk to the off-taker and offers two key benefits. There are lower initial financing costs and greater liquidity from banks to kick-start construction. Such projects often plan to refinance later by issuing project bonds or securing longer-term commercial loans once the development is operational.

For infrastructure projects where the off-taker does not shoulder refinancing risk, developers typically secure long-term bank loans up front. Export credit agency (ECA) financing and other government-backed loans remain crucial in these cases, providing stability with low interest rates over long tenors and often coming with guarantees or insurance that enhance the project’s credit profile. By boosting the project’s credit quality in this way, such support makes it more attractive to a broader range of investors.

Once projects are up and running, many Gulf sponsors seek to refinance their debt on better terms. According to Mazen Singer, a partner in infrastructure finance at PwC Middle East, most project owners look to refinance about five to eight years after a project becomes operational. By that stage, construction is complete, operations have stabilised, and revenue streams are more predictable.

The project’s risk profile improves significantly. Refinancing at this point can lower the overall cost of capital and optimise the debt structure. In some cases, it even allows sponsors to free up capital for new developments. If one waits

Construction

Furniture & decor

Ship building & repair

Construction materials

Electronics

Source: gcc-turkiye.net

much longer, those advantages diminish, and once a loan’s remaining term becomes short, the potential savings from refinancing are far more limited.

The pool of financiers and investors has also widened as the GCC market matures. Singer notes that more export credit agencies are now involved in Gulf projects. In addition, specialised infrastructure funds are drawn to mature, cash-generating (brownfield) assets, and local capital markets are growing more open to project bond issuances.

Husain of Standard Chartered adds that improved regulatory and governance frameworks, clearer procurement processes, and high-calibre project sponsors have made banks much more comfortable with regional project risks. Strong sovereign support underpins many deals, and often the off-taker is a state-owned utility or

the obligation is backed by a government ministry. This backing substantially reduces perceived credit risk and has enabled banks to offer financing at more competitive rates than in the past.

Thanks to an expanding track record of completed projects, investors now see a pipeline of successful ventures in the GCC, which builds confidence that each new project is a sound investment. These successes, and the collaborative financing behind them, demonstrate the Gulf governments’ determination to construct a prosperous post-oil future.

However, industry veterans caution that financial discipline is still urgently needed. Hugh Morris warns that regulators must carefully prevent investors from over-leveraging projects and taking excessive returns, as such practices could ultimately end up undermining longterm infrastructure sustainability in the region.

While progress in Gulf project finance has been impressive, experts note certain challenges remain. One issue is the lack of historical precedent in the region for some project finance scenarios, which breeds uncertainty for lenders. For example, there is still little proven case law on how readily lenders can enforce their security interests if a project runs into trouble.

Another concern is limited transparency and information sharing, which makes it harder for outside investors to gauge project risks. All of these gaps point to the need for stronger legal and regulatory frameworks across the GCC to reduce uncertainty and build long-term confidence. Notably, regulatory development is not uniform across the bloc. The UAE and Saudi Arabia boast the most advanced frameworks and capital markets, while smaller economies are still

catching up.

Industry analysts suggest several steps that could further strengthen the Gulf’s project finance ecosystem. One suggestion is the standardisation of PPP frameworks. Uniform PPP laws and contracts across the region would make projects more bankable and attract international lenders. Another idea is to develop secondary markets.

An active trading of infrastructure debt and equity would facilitate refinancing and let banks recycle capital into new projects. Finally, there is a shifting refinancing risk to off-takers. If utilities (project off-takers) bear future refinancing obligations, initial lenders can free up capacity, boosting liquidity for new projects.

With continued regulatory innovation and collaboration among stakeholders, the GCC is well-positioned to emerge as a leader in the next phase of global infrastructure finance. However, sustaining this momentum will require more than just money. It also calls for developing human capital.

Analysts like Mazen Singer emphasise the importance of cultivating local expertise and institutional capacity in project finance. By training professionals and nurturing national champions in the industry, Gulf countries can ensure that the ambitious projects of today lead to a lasting legacy of knowledge and prosperity.

editor@ifinancemag.com

IF CORRESPONDENT

China’s emphasis on boosting sales for job creation and growth comes at the cost of profitability and healthy competition

In September, crucial news emerged from the Chinese automobile sector. It was about the China Association of Automobile Manufacturers (CAAM) launching an anti-discrimination probe into the impact on the auto industry of US trade policy over chips. The investigation, which will witness heavy participation from Chinese automakers, comes just after Beijing initiated discrimination and dumping investigations into American chips.

Government policies and subsidies have effectively made China a leader in the global automotive industry and electric vehicles. Domestic automakers have met the production targets that the Communist government’s policy wanted to achieve, but a new headache has emerged.

The world’s second-largest economy’s auto industry is making more cars than the global market can absorb. The industry players are finding it increasingly difficult to make a profit.

Compared to the United States, Chinese electric vehicles start at less than $10,000, whereas the average price of an EV remains at $35,000.

Liuzhou, a Chinese city with a population of 21 million, has a showroom in a shopping mall offering special deals on new cars, including 50% off on locally made Audis and a seven-seater SUV for about $22,300, more than 60% below its sticker price. These cars are made by China's FAW (First Automobile Works).

With so many cars in one place, these deals are possible. A company called Zcar, which informed Reuters about its business practice of buying in bulk from automakers and dealerships, is now of-

Zcar, which pop up in fire sales on TikTok-style social media sites. These cars are rebranded as used (even though the odometer says otherwise) and exported overseas, or some wind up in weedy car graveyards. According to many industry figures and analysts, these practices are signs of a market that is vastly oversupplied and at risk of a shakeout, as is seen in the Chinese property market and the solar industry,” Reuters reported. China’s emphasis on boosting sales for job creation and growth comes at the cost of profitability and healthy competition. It makes local governments compete with each other for cheap land and INDUSTRY FEATURE

fering customers the option of choosing from among 5,000 vehicles.

An industry survey released in August 2025 revealed that many manufacturers were struggling with excess inventory. As a result, they have been unable to generate additional revenue, leading dealers to lower prices. Some retailers have registered and insured unsold cars in bulk, a strategy that enables automakers to count these vehicles as sold and allows dealers to qualify for factory rebates and bonuses from manufacturers.

“Unwanted vehicles end up in the hands of grey-market traders like

subsidies for automakers. They make production and tax-revenue commitments, which fuel overcapacity across the country.

During an interaction with Reuters, Rupert Mitchell, an Australia-based macroeconomics commentator who previously worked at a Chinese EV startup, said, "When there is a directive from Beijing that this is a strategic industry, every provincial governor wants the car factory. They want to be in good shape with the party. Ultimately, what happens is that it makes the existing auto sector double down on investment."

A review by Reuters of thousands of

car-sales listings, hundreds of government documents, state-media reports, court filings, and consumer-complaint records, as well as interviews with over 20 industry players, including dealers, buyers, analysts and manufacturing executives, shows how oversupply is enfeebling China's auto market even as the industry emerges as a world power.

Foreign rivals are lagging Chinese brands in delivering new models, but the same government policies that spurred explosive growth and innovation in automaking are causing lose-lose transactions throughout the domestic sales chain.

The industry and commerce ministries did not address these issues publicly, issues like pressures facing the sector, the potential for consolidation or the extent to which government policies promoted oversupply.

The experts state that these issues have wider implications for China’s economy. The country’s GDP accounts for around 10% of the auto industry and related services. Chinese policymakers have long waved off American and European concerns about overcapacity caused by cheap Chinese exports, but Chinese officials have pledged to cool price wars in electric vehicles and solar

panels in recent months.

According to consultancy Gasgoo Automotive Research Institute, Chinese automakers have the ability to make twice the 27.5 million cars they produced in 2024. The issue is particularly severe in gasoline cars, where demand collapsed as Beijing promoted EVs, while the number of EV factories mushroomed as companies and local authorities jumped in.

Another consultancy, AlixPartners, estimates that only 15 of the 129 electric vehicle and hybrid brands in China will be financially sustainable by 2030. This price war is now in its third year. Allowing that to happen would mean allowing many automakers to fail, an outcome that some analysts say would risk mass layoffs and falling consumer spending, an outcome many Chinese officials have resisted.

Yuhan Zhang, principal economist at The Conference Board’s China Centre, said, "That leaves automakers and local governments locked in a downward spiral. They feed and reinforce one another, trapping the market in a vicious cycle."

This is not only a problem for Chinese automakers. Foreign brands are losing market share, with Chinese car sales going to foreign brands in the first seven months of this year at 31%, down from 62% in 2020, according to the China Association of Automobile Manufacturers (CAAM).

European governments are concerned that affordable Chinese-made cars will undermine their domestic automotive industries. In contrast, the United States has effectively banned Chinese cars due to national security risks and allegations of unfair competition.

The origins of this market date back to

the 1990s in Beijing, when national policymakers aimed to position China at the forefront of significant technological changes, particularly in the auto industry. This shift occurred as people began transitioning from internal combustion engines to electric vehicles.

In 2009, it bought out a programme to promote automakers who are producing electric vehicles and consumers purchasing these cars, by bringing billions of dollars in subsidies. As a result, the EVs had not caught on by 2017.

That year, government officials drafted a car-making policy blueprint, a 13,000-character document known as the “Medium-and Long-Term Development Plan for the Automotive Industry,” which laid out a target of 35 million vehicles produced annually by 2025, twice the American annual sales record.

Chinese authorities, who had been trying to rein in an overheated property sector, started to discourage excess investment. The automaking blueprint became an expedient second economic pillar for local governments that had relied on land sales and real-estate tax revenue.

The 2017 plan also fanned a rush by local authorities to court electric vehicle makers. In 2024, China almost reached the goal, building over 31 million, according to the China Association of Automobile Manufacturers (CAAM).

The competition has set a playbook across China. The local governments offer incentives to automakers, and expect production and tax-revenue goals in return. Also, automakers have often prioritised meeting those goals over turning a profit, and over time, local governments have kept manufacturers that might have gone under in other markets afloat.

The right automaker can also be a massively profitable bet. The coun-

ty government in Changfeng, Anhui province, lured BYD in 2021 with inexpensive land, and in return, the county, which was once the main producer of traditional flatbread, received a mega-factory from the EV maker.

Experts say they have calculated from property-sales filings published by the Chinese government that over five years, BYD bought 8.3 square kilometres of land in Changfeng at an average price 40% below the average price paid by other buyers.

In 2023, the year after BYD began production in Changfeng, the county’s economic growth outpaced the national rate by 9.1 percentage points. It was 5.6 percentage points higher in 2024.

The Chinese smartphone maker Xiaomi started acquiring land in Bei-

jing's Yizhuang district for an electric vehicle factory in 2022, buying more than 206 soccer fields' worth at an average price 22% below what others paid for industrial land, land-sales filings show.

Beijing mandated that the plant have a minimum annual revenue of 47 billion yuan, or about $6.6 billion, at full production. Xiaomi followed an open bidding process and did not receive discounts or incentives for the land, and it was the only bidder, according to tender information posted by Beijing's municipal government.

In China, the Guangzhou officials published a policy document in June 2025. However, it stated that the city would aim to develop up to three makers of "new energy vehicles," including fully electric cars and hybrids, to each

produce 500,000 vehicles a year, while awarding up to 500 million yuan (about $70 million) a year to each automaker that built new production lines and made 100,000 vehicles in three years.

At least six other local governments between 2023 and 2025 issued policies to encourage automakers to expand output, policy documents show. Earlier this year, Chinese authorities began to raise the alarm about auto price wars, saying competition was unsustainable. In July, President Xi Jinping chided provincial officials, asking why every province was rushing to invest in a small number of technologies, including electric vehicles and artificial intelligence.

Automakers' impossible growth

Excess capacity driving aggressive sales

targets isn’t limited to China. General Motors, Ford and Chrysler had too many factories making too many cars in the early 2000s, and shut down more than a dozen plants in the United States. Pressure to meet sales targets and gain market share is higher in China, industry analysts and former executives say.

In recent years, the industry has started referring to this kind of competition as involution, a concept that describes self-destructive competition that rewards irregular practices.

Liang Linhe, the chairman of Sany Heavy Truck, one of China's largest truck makers, said vehicle manufacturers are compelled to keep selling and producing, even at a loss, because this generates cash flow, which is essential to survival.

“It’s like riding a bicycle: As long as you keep pedalling, you might feel exhausted, but the bike stays upright,” Linhe said.

As losses mount, many carmakers are pedalling faster, leading some analysts to talk about a shakeout. In early 2025, EV brand Neta shut down operations after its parent filed for bankruptcy.

In 2024, Chinese tech company Baidu and automaker Geely laid off workers and restructured their joint venture, Ji Yue Auto, which was facing fierce competition.

Still, some say that an abrupt shock is unlikely. Consolidation could take years, and local governments would likely support struggling automakers, limiting the impact.

Michael Pettis, senior fellow at Carnegie China, said, "The problem of excess capacity in China is a systemic problem."

The chief executive and co-founder of Chinese electric vehicle startup Xpeng, He Xiaopeng, said in 2023 that each automaker would have to sell three

million cars a year by 2030 to stay alive, and only eight would survive by then. Xpeng sold 190,000 cars in 2024. A handful of large players are reaching or close to those volumes, and are well placed to be the survivors in a cull.

Geely said it aims to achieve five million vehicle sales per year by 2027, more than double the 2.2 million it sold last year. It is still unknown whether that target still applies. BYD, the industry leader, has set aggressive targets for 2025, but has slowed its expansion.

Its quarterly profit fell for the first time in more than three years in August, and it has internally adjusted its original plan to sell 5.5 million vehicles to at least 4.6 million. Most industry players are selling a fraction of that.

Source: Autokunbo INDUSTRY FEATURE CHINA

In 2024, as state-owned automakers like Changan, Dongfeng and FAW lagged their private peers in the EV race, the national regulator of government-owned firms announced that it wanted the state companies to expand market share and production, rather than profitability.

The automakers and the regulator, the State-owned Assets Supervision and Administration Commission, have not made any official statement regarding this so far. Changan stated that it aimed to quadruple sales of new-energy vehicles by 2030.

Reuters reported that an influx of new cars has made it more challenging for dealers to turn a profit. This assessment comes from Chen Keyun, a retired dealer in Jiangsu province, and is supported by four other dealers.

Chen said the problems, such as dealers selling new cars at a loss and offloading them to traders who sell them on as zero-mileage "used" cars, are root-

ed in China's "production-oriented" industrial model.

“Automakers have ignored the true level of demand but kept expanding capacity and increasing sales targets, forcing dealers to take more inventory,” he said.

A survey by the China Automobile Dealers Association reported that only 30% of dealers are profitable in August. The dealer groups in Henan, Sichuan provinces and the Yangtze River Delta publicly raised these issues and problems in June.

“We urge automakers to formulate sales guidance policies that align with market realities. If the sales channels collapse, the market will die!” the Henan Automobile Industry Chamber of Commerce said in an open letter to unspecified automakers.

Chen also stated that larger deal-

erships overpurchase inventory to hit automakers’ sales targets and obtain factory rebates.

"If you have managed to sell 16 out of the 20 units targeted for the month, what will you do with the remaining four units on the very last day of the month?” said one dealer in Jiangsu.

He went on to say that selling those cars even at fire-sale prices would mean qualifying for a bonus of around 80,000 yuan, or $11,200, and put him close to break-even.

Lang Xuehong, a deputy secretary-general of the CADA industry group, said dealers were selling at up to 20% below their cost, a level never before seen. In July 2025, EV brands Neta and Zeekr inflated sales in recent years, with Neta doing so for more than 60,000 cars.

The automakers had cars insured

before they were sold so that the vehicles could be booked formally toward monthly sales targets. Neta's parent, Hozon, which is in bankruptcy administration, could not be reached for comment.

Zeekr told Reuters in July that the cars had been insured with mandatory traffic insurance to ensure their safety while on display, and that they were legally new when sold to buyers.

Neta and Zeekr represent a widespread padding of sales figures across the industry, much of it involving zero-mileage used cars that have been insured and booked as sold, according to dealers and analysts.

Dealers and traders then export those cars as used, often with the blessing of local governments, or market them domestically through grey markets, as four regional dealer groups ac-

cused car companies of doing in June.

In a rooftop parking lot at a mall in Chengdu, Wang Lihong rides a scooter with a selfie stick, shooting video for social media while livestreaming for Zcar, a grey-market trader that flips brandnew vehicles that dealers couldn't sell. Hosts like Wang stream on platforms like Douyin, China's TikTok.

Wang, who has 1.25 million followers, said recently that Zcar was Sichuan province's largest seller of zero-mileage ‘used’ cars, available in March, June, September and December, “when dealers rush to meet the quarter or annual sales targets set by the automakers for cash rebates.”

The marketing director for Zcar, Zhou Yan, said that because it sources some vehicles directly from automakers

in bulk, it can sell at deep discounts.

Zhou also said that Zcar had acquired more than 3,000 Malibus in China from SAIC-GM, the American automaker’s Chinese joint-venture entity, and was selling them for under $14,000 apiece, down from a sticker price of $24,000.

GM told Reuters that "authorised dealers are the only official channels for our vehicle sales", and that Zcar "isn't a dealer affiliated in any way" with SAIC-GM.

Zcar said its Cheshi subsidiary bought 3,428 Malibus for wholesale distribution to dealers. Zcar also said it sells "popular, attention-getting models to draw people into our stores" and often sells at a loss.

The Malibus have not been reported in any previous trade. Audi did not have an opinion on what Zcar is doing, but said it does not condone grey-market trade, which it considers detrimental to the long-term value of its vehicles.

China’s auto industry hit a record in 2024, producing over 31 million vehicles as NEV production surged past 12 million. But too much capacity and excess inventory are creating real risks. The rapid growth that was once praised now threatens long-term stability, as fierce competition and price cuts could undercut profits for many automakers. Without better coordination, China’s car boom could turn into a costly overhang for companies and the economy alike.

editor@ifinancemag.com

The European Union fully implemented its Markets in Crypto-Assets regulation in late 2024 and throughout 2025

IF CORRESPONDENT

The year 2025 has proven to be a watershed moment for the digital asset ecosystem, characterised by a complex interplay between unprecedented institutional integration and the enduring volatility inherent to nascent asset classes. International Finance will provide a detailed analysis of the sector’s performance, shaped by three key developments.

These include the total cryptocurrency market capitalisation surpassing the $4 trillion threshold, the enactment of the GENIUS Act, which established the first comprehensive federal regulatory framework for stablecoins in the United States, and a parabolic price trajectory for Bitcoin that saw it breach new all-time highs before succumbing to a macro-induced correction in November.

While the breach of the $4 trillion mark signalled a structural re-rating of the asset class and placed it on par with major global equity exchanges, market dynamics revealed a bifurcation between asset performance and infrastructure growth.

Bitcoin’s ascent to a peak of approximately $126,000 was fuelled by the "Trump trade" and massive ETF inflows, yet its subsequent 30% correction underscored the market's continued sensitivity to macroeconomic shocks, specifically stagflationary signals from the US labour market. Conversely, the stablecoin sector, now buttressed by federal law, decoupled from speculative volatility to process transaction volumes rivalling global payment networks like Visa, which confirms its utility as a settlement layer for the digital economy.

We dissect these trends through six core sections, including a detailed analysis of legislative reform. By synthesising data on regulatory shifts and on-chain metrics, we offer a nuanced perspective on how the industry has transitioned from a speculative fringe to a regulated, albeit volatile component of the global financial architecture.

In July 2025, the digital asset sector achieved a historic valuation milestone as the total market capitalisation surpassed $4 trillion for the first time. The event was not merely a psychological victory for early adopters but a quantitative signal of the asset class's integration into the broader financial system. To contextualise this growth, the market cap effectively doubled from its previous cycle highs, driven by a confluence of retail resurgence and institutional capital deployment.

The ascent to $4 trillion was underpinned by distinct structural factors that differentiate this cycle from the speculative manias of 2017 and 2021. Foremost among these was the deepening of liquidity pools facil-

itated by the approval of spot ETFs across multiple jurisdictions.

The "ETF wrapper" served as a critical conduit for wealth management platforms and pension funds to allocate capital without the operational burden of custody, effectively unlocking trillions in previously sidelined capital.

Data from the third quarter of 2025 indicates that the rally was supported by extensive institutional demand, which was further catalysed by legislative advancements in the United States. The market did not rise in a vacuum; rather, it was buoyed by a "pro-crypto" administration and a tangible shift in regulatory posture. The correlation between legislative clarity and capital inflows became undeniable, as evidenced by the sharp uptick in valuations following the passage of the GENIUS Act.

However, the composition of this market capitalisation reveals a significant evolution in capital allocation. While Bitcoin retained its dominance as the primary store of value and accounted for over $2.4 trillion of the total market cap at its peak, the 2025 cycle witnessed a broadening of the value spectrum. Capital rotated aggressively into programmable blockchains and stablecoins, reflecting a market that increasingly values utility and yield over pure speculation.

The psychological impact of crossing the $4 trillion mark forced a reassessment of risk models among global macro strategists. At this scale, the asset class becomes too large to ignore for sovereign wealth funds and endowment managers who must now consider digital assets as a necessary component of a diversified portfolio to hedge against debasement and capture technological alpha. Industry analysts noted that crossing this mark signals a "structural re-rating" of crypto, moving it from an asymmetric bet to a staple allocation.

The market demonstrated resilience by holding above the $3.88 trillion level during periods of consolidation, dipping only approximately 2% from peak levels during initial profit-taking phases. Such consolidations are characteristic

of maturing markets where rapid appreciation is digested through time rather than deep price corrections. The ability of the market to sustain valuations above the $4 trillion line for extended periods in mid-2025 suggested that the capital base had shifted from highly leveraged retail traders to "sticky" institutional holders with longer time horizons.

As liquidity deepened, it also fragmented across a growing number of venues and chains. Layer 1 has seen good growth, but introducing Layer 2 solutions on top of it means that execution and infrastructure have become as critical as asset selection. And experts reiterate that sustaining this growth would require resilient systems that are adept at handling high-frequency institutional flows and smart risk frameworks to manage the disparate liquidity pockets.

If the $4 trillion market cap was the quantitative highlight of 2025, the Guiding and Establishing National Innovation for US Stablecoins Act of 2025 (GENIUS Act) was its qualitative cornerstone. Signed into law by President Donald Trump on July 18, 2025, this bipartisan legislation ended years of regulatory purgatory for the digital asset industry. It established a comprehensive federal framework for payment stablecoins, effectively legitimising the sector's most practical application, which is dollar-denominated digital settlement.

The GENIUS Act is transformative primarily because of its definitional clarity and establishment of a dual-track regulatory system. It amends US federal securities laws and the Commodity Exchange Act (CEA) to explicitly state that a payment stablecoin is not a "security" or a "commodity". This jurisdictional

carve-out is the "holy grail" for issuers who have spent years navigating the aggressive enforcement actions of the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC).

Instead of shoehorning stablecoins into 1930s securities laws, the Act places them under the supervision of banking regulators through two distinct pathways. One through the Federal Track for Non-Banks. Federally licensed non-bank stablecoin issuers are now subject to oversight by the Office of the Comptroller of the Currency (OCC). This allows fintech companies to operate with a national charter without becoming full-fledged banks. Secondly, there are subsidiaries of insured depository institutions that fall under the supervision of their primary federal regulator, such as the Federal Reserve or the FDIC.

Crucially, the Act also preserves the state regulatory system. Issuers with less than $10 billion in outstanding stablecoins can opt for regulation under a state-level regime provided that the state's standards are deemed "substantially similar" to the federal framework. That provision was a major victory for state regulators like the NYDFS, ensuring that local innovation hubs are not crushed by federal preemption while still maintaining a high national standard.

A central pillar of the GENIUS Act is the imposition of strict prudential standards designed to prevent the "bank runs" that plagued the sector in previous cycles. As per the legislation, all stablecoin issuers must maintain 1:1 reserves backed by high-quality liquid assets (HQLA).

The prohibition on rehypothecation is particularly significant as it prevents the specific type of leverage-driven contagion that caused the collapse of algorithmic stablecoins and unregulated lending desks in 2022. By mandating that reserves be held in bankruptcy-remote accounts with priority claims for holders, the Act effectively creates a digital equivalent of cash that is safer than uninsured bank deposits.

One of the most debated aspects of the GENIUS Act was the prohibition on interest payments. Issuers are explicitly forbidden from passing the yield generated by their reserve assets (such as Treasury bills) on to the holders of the stablecoins. That provision was the subject of intense advocacy from the traditional banking lobby, including the American Bankers Association.

They argued that if stablecoins offered a risk-free

yield comparable to Treasuries, they would suck liquidity out of the traditional banking system and destabilise community banks that rely on low-cost deposits.

For the crypto industry, this creates a clear business model trade-off. While issuers cannot compete on yield, they are forced to compete on utility, speed, and integration. This has pushed issuers to focus on building payment rails and merchant networks rather than simply marketing their tokens as savings vehicles.

The GENIUS Act also integrates stablecoins into the national security apparatus. Issuers are explicitly subject to the Bank Secrecy Act (BSA), obligating them to implement rigorous Anti-Money Laundering (AML) and Know Your Customer (KYC) programmes.

The Act grants the Treasury Department enhanced powers to combat illicit finance, including requirements for issuers to possess the technical capability to "seize, freeze, or burn" tokens when legally ordered. That provision addresses the "sanctions evasion" narrative often used by critics, ensuring that compliant stablecoins cannot be used as a tool for rogue states or criminal enterprises.

Issuers are also forbidden from using "deceptive names" or marketing materials that imply their product is backed by the "full faith and credit of the United States" or covered by federal deposit insurance. Such rules prevent the dangerous misconception that a private stablecoin is a government-guaranteed instrument.

The year 2025 reinforced a fundamental truth about Bitcoin. It remains a highly sensitive liquidity gauge capable of delivering parabolic returns and devastating corrections in equal measure.

The narrative of "institutional maturation" did not dampen volatility; rather, it introduced new transmission mechanisms for macro shocks to cascade through the market.

Bitcoin's performance in the first three quarters of 2025 was nothing short of spectacular. Fuelled by the "Trump trade" following the election, fa-

vourable regulatory signals and the relentless bid from spot ETFs, Bitcoin embarked on a parabolic run. By October, the asset had breached the six-figure mark, setting a new all-time high of approximately $126,270. The rally was characterised by a palpable sense of euphoria dubbed "Uptober" as market participants anticipated a "super-cycle" driven by the convergence of sovereign adoption and corporate treasury accumulation.

The role of ETFs in this rally cannot be overstated. BlackRock’s iShares Bitcoin Trust (IBIT) alone amassed massive assets under management by 2025, with the fund becoming the most successful ETF launch in history. The "passive bid" from these products created a constant demand shock that stripped supply from exchanges, forcing prices upward in a classic liquidity squeeze.

The euphoria came to an abrupt halt in November. Bitcoin crashed approximately 30% from its peak, sliding to trade near $82,605 on November 21. The correction wiped out over $1.2 trillion in total digital asset value in just six weeks, a destruction of wealth equivalent to the GDP of a mid-sized G7 nation.

The catalyst for the crash was a "stagfla-

tionary" shock delivered by the US labour market. A long-delayed US jobs report released confusing data that showed job creation rebounding while the unemployment rate simultaneously climbed to 4.4%. The mixed signal clouded expectations for Federal Reserve rate cuts, triggering a "risk-off" event across all global markets.

The crash revealed the double-edged sword of institutionalisation. While ETFs provided inflows during the rally, they also provided a frictionless exit door during the panic. United States-listed Bitcoin ETFs recorded $903 million in outflows on a single Thursday as the "paper hands" of the new cohort folded at the first sign of trouble.

When code became cash

Bitcoin dominated the macro narrative of 2025 and has matured as an asset class with store-of-value propositions. But the focus is slowly shifting to high-throughput utility, and all eyes are on alt-coins. The "State of Crypto" report highlighted that Hyperliquid and Solana combined to account for 53% of revenue-generating economic activity, signalling a changing of the guard in where value is actually accrued.

Solana emerged as the undisputed leader of the

high-performance blockchain sector. In stark contrast to the broader market, Solana's ecosystem metrics exploded to the upside. Builder interest increased by 78% over the prior two years, making it the fastest-growing ecosystem for developers. That surge in developer activity translated directly into user adoption, with the network processing a significant plurality of the industry's transaction volume.

The market acknowledged this differentiation. Even during the November crash, Solana-based investment products showed remarkable resilience. While Bitcoin ETFs bled assets, Solana and XRP ETFs recorded consistent inflows, suggesting that investors were actively decoupling their views on "utility" tokens from the macro-driven Bitcoin trade.

If there was one undeniable success story in 2025, it was stablecoins. The total stablecoin supply reached a record high of over $300 billion. More impressively, stablecoins settled $46 trillion in total transaction volume over the year. Even after adjusting for artificial trading volume, the figure stood at $9 trillion, more than five times PayPal’s annual throughput and more than half of Visa’s.

The data proves that stablecoins have found product-market fit beyond crypto trading. They are being used for cross-border B2B payments and remittances in inflation-stricken nations, and as a dollarised savings instrument globally. The GENIUS Act further catalysed this usage by providing the legal certainty needed for banks and multinational corporations to integrate stablecoins into their treasury operations, effectively turning them into a new rail for global commerce.

While the GENIUS Act provided a unified path for the United States, the rest of the world navigated a fragmented and often contradictory regulatory landscape in 2025. The divergence created significant friction for cross-border projects and forced issuers to adopt regional containment strategies rather than global expansion plans.

The European Union (EU) fully implemented its Markets in Crypto-Assets (MiCA) regulation in late 2024 and throughout 2025. While initially hailed as a pioneering framework, MiCA has revealed the steep cost of compliance. Startups faced immense operation-

Largest cryptocurrency spot exchanges based on 24h trade volume in the world on October 1, 2025 (In Billion US Dollars)

Source: Statista

al burdens to meet prudential and conduct standards, which diverted resources away from innovation. The stablecoin market in Europe faced a specific crisis of relevance. US dollar-denominated tokens continued to hold a 99% market share globally, leaving Euro-denominated stablecoins on the fringes with a market capitalisation of less than EUR 350 million.

In response to this dominance, a consortium of nine major European banks, including ING and Deutsche Bank, formed a new venture in September 2025. Their goal is to launch a fully MiCA-compliant Euro stablecoin to compete with American giants. However, analysts warn that Europe may be "too late" as the network effects of USD stablecoins are already deeply entrenched in global DeFi and payment rails.

In Asia, the regulatory narrative is split between two primary hubs. Hong Kong moved aggressively to capture the digital asset market by enacting the Stablecoin Ordinance, which became effective on August 1, 2025. The law introduced a dedicated licensing regime for fiat-referenced stablecoins and required issuers to maintain full reserve backing with high-quality liquid assets. In parallel, regulators proposed new licensing regimes for OTC dealers and custodians to close remaining oversight gaps.

Singapore took a more restrictive approach to offshore risks. The Monetary Authority of Singapore (MAS) enforced a strict deadline of June 30, 2025, for Digital Token Service Providers (DTSPs). Any entity providing services from Sin-

gapore to customers outside the country was required to obtain a license or cease operations. The move was designed to prevent regulatory arbitrage where firms would set up in Singapore solely to project an image of legitimacy while serving high-risk jurisdictions without local oversight.

Emerging markets continued to drive grassroots adoption, often outpacing regulatory frameworks. Brazil emerged as a leader by establishing a Central Authority for Digital Assets (CADA) in January 2025 and implementing a comprehensive licensing framework that will be fully enforceable by February 2026. The clarity helped boost daily trading volumes in Brazil to $1.8 billion.

Nigeria also witnessed a surge in activity after lifting its banking ban on crypto firms. Monthly trading volumes on licensed exchanges rose by 47% in the first quarter of 2025 alone. India similarly saw a recovery in volumes after the initial shock of its tax regime wore off, with the government launching a "Regulatory Sandbox 2.0" to explore tokenised real estate and carbon credits. Together, these developments signal a decisive shift from the "ban and ignore" policies of the past to a "regulate and tax" approach.

The starkest challenge of 2025 remains the lack of global harmonisation. The GENIUS Act in the US and MiCA in the EU operate on fundamentally different principles regarding foreign issuers. The GENIUS Act encourages the US Treasury to pursue mutual recognition, but currently requires foreign issuers to meet US standards to access the American market.

Conversely, MiCA's strict localisation requirements have forced some global exchanges to delist non-compliant stablecoins for European users. Such a regulatory "spaghetti bowl" threatens to balkanise liquidity and complicate the dream of a seamless global value-transfer layer.

As we look toward 2026, the trajectory is clear. The infrastructure is ready for prime time, and the regulatory wars are largely over, yet the challenge now shifts from survival to scale in a high-stakes macroeconomic environment.

editor@ifinancemag.com

US President Donald Trump has portrayed himself as a resetter of a system he says is rigged against the world’s largest economy

The global trading system that has supported and promoted free trade and global prosperity for nearly 80 years is now facing an unprecedented level of uncertainty. This is mainly because of the upheaval caused by the tariff regime of United States President Donald Trump.

Experts believe that the American tariff is causing fundamental shifts in the economic and political relationships between nations.

Free trade movement

Free trade imagines that goods and services move freely across borders with few restrictions, as opposed to protectionist policies that may include tariffs or import quotas. Yet free trade has never been pure.

After the Second World War, a rules-based global trading system emerged from the ashes. These rules, implemented by various organisations, helped countries maintain their sovereignty and reduce trade barriers.

The first-ever rules-based global trading system started with the 1947 General Agreement on Tariffs and Trade. This was signed in Geneva, Switzerland, by 23 countries. All the countries,

through mutual talks and agreements, brought about significant tariff reductions on merchandise goods. These significant rounds of talking led the way for the creation of the World Trade Organisation (WTO) in 1995.

The World Trade Organisation incorporated binding mechanisms to resolve trade disputes between countries, extended rules-based trade to services, intellectual property and investment measures, and allowed global trade to expand dramatically: merchandise exports increased from $10.2 trillion (A$15.6 trillion) in 2005 to more than $25 trillion (A$38.3 trillion) in 2022.

Yet, despite decades of liberalisation, truly free trade has remained beyond reach, with protectionism continuing through traditional tariffs and non-tariff measures such as technical standards, and increasingly, national security restrictions.

One of the economists who has argued that this current trade disruption is based on a ‘grievance doctrine’ is Richard Baldwin, who wrote that the

Change

Trump administration does not see trade as a way to benefit from exchanging goods and services between two countries, but instead sees it as a zero-sum game in which one country is stealing from another.

Baldwin stated that, in the world of tariffs, other nations are ripping off the United States. Trade deficits occur when a country's imports exceed its exports. These deficits are often viewed not just as economic outcomes of the trade system, but rather as a form of theft. Similarly, international agreements are not treated as tools for mutual advantage, but as tools of disadvantage.

Trump has portrayed himself as a resetter of a system he says is rigged against the world’s largest economy. What used to be delivered by the United States in the form of defence, economic and political security, stable currency arrangements, and predictable market access now seems to be delivered more and more in the form of an economic bully demanding absolute advantage. This shift from global insurer to extractor of profit has generated uncertainty in relations with individual countries

(In Billion US Dollars) Source: Statista

that goes well beyond the relationship itself.

Trump has also challenged the very basis of the World Trade Organisation: its principle of ‘most-favoured nation’ treatment, under which no country can make different rules for different trading partners, and “tariff bindings”, the limit on global tariff rates.

Even some analysts of American trade policy have argued that the United States might withdraw from the World Trade Organisation, an act that would formally repudiate the rules-based order of global trade.

The rise of China as the manufacturing superpower of the world has completely transformed the landscape of international trade.

China is expected to make up 45% of global industrial output by 2030, with its manufacturing surpluses currently around $1 trillion (A$1.5 trillion) annually. This is largely due to substantial subsidies and market protections. This situation poses a fundamental challenge to American market capitalism, particularly for the Trump administration, as it contrasts sharply with China's state capitalism.

Global annual GDP growth from 2018 to 2025

Source: Trading Economics

While the year 2025 saw the trade war between Washington and Beijing dominating the media headlines, with tariffs and counter-tariffs taking the shape of an aggressive boxing match, there is no positive headway as despite the ongoing truce, analysts caution that the detente remains fragile in a rivalry that also involves fierce geopolitical and strategic angles, with China now firmly challenging United States' established global hegemony.

Such was the ferocity of the trade war that it almost caused a near stoppage of the American manufacturing ecosystem, with China imposing strict controls over its rare earth exports. It took a meeting between Donald Trump and Xi Jinping last month in South Korea to cool things off to some extent. While the United States has halved fentanyl-linked tariffs on imports from China to 10% and extended for a year a truce that lowered the reciprocal tariff rate from 34% to 10%

In return, China’s Ministry of Commerce rolled back export restrictions on critical minerals and rare earth materials to Uncle Sam. Those curbs, first imposed on October 9, had targeted materials vital for military hardware, semiconductors, and other high-tech industries. Beijing also reversed retaliatory limits on exports of gallium, germanium,

antimony, and other so-called super-hard materials such as synthetic diamonds and boron nitrides. Those measures, introduced in December 2024, were widely seen as a response to Washington’s expanded semiconductor export restrictions on China.

However, Morgan Stanley economists said that Beijing has not completely relaxed the export-control framework it introduced in April and is likely to maintain a “calibrated choke-point” meant to preserve leverage in case the trade war resumes. China is also reportedly developing a so-called “validated end-user” system, or VEU, to block rare earth exports to companies with ties to the American military set-up.

According to the Wall Street Journal, if strictly implemented, the move could make it more difficult for automotive and aerospace companies with both civilian and defence clients to import certain Chinese materials.

This polarisation puts pressure on many countries to pick sides, and Australia illustrates these tensions, with defence and security ties to the United States as part of the AUKUS agreement (a security pact between Australia, the United Kingdom, and the Unit-

Global annual trade growth from 2018 to 2025

Annual change in merchandise trade volume in imports and exports worldwide

Source: World Trade Organisation

Source: Statista

ed States), but also strong economic ties with China, which has been the country's largest two-way trading partner even during recent disputes.

While this fragmentation offers opportunities for cooperation between "middle powers," particularly between European and Asian countries that are increasingly looking for alternative frameworks that do not always require American leadership, it cannot replace the scale and benefits of the United States-led system.

In a recent summit in China, other non-Western members of the Shanghai Cooperation Organisation (SCO) also expressed support for the multilateral trading system, issuing a joint statement reiterating World Trade Organisation principles and criticising unilateral trade measures. This is a bid to assert global leadership while the United States negotiates with individual countries.

This has been regularly opposed by the ‘BRICS+ bloc,’ a larger group of countries, along with the BRICS countries. They were always against the Western-dominated institutions and advocated for alternative governance structures. The countries that raised their voice include Brazil, Russia, India,

Average tariff rate on all imports in the United States from 2018 to 2025

Source: Statista

China, South Africa and Indonesia.

Experts stated that countries lack the institutional depth to serve as an alternative to the World Trade Organisation-centred trading system, absent enforceable trade rules, systematic monitoring mechanisms, or conflict resolution procedures.

Since 1990, more than one billion people have been lifted out of extreme poverty thanks to the global trading system. However, the era of United Statesled multilateralism is coming to an end, and it is unclear what will take its place.

One possible scenario is that global institutions, such as the World Trade Organisation, may weaken over time. In contrast, regional trade agreements could become more important, maintaining some degree of rules-based trade while also accommodating great power competition.

It is likely that other countries might be willing to join like-minded countries. The countries that set high policy standards in certain areas, such as freer trade, regulatory harmonisation, or security restrictions, allow them to set up a global trade system.

editor@ifinancemag.com

CONVERSATION HETARTH PATEL WEBENGAGE

Open banking is giving fintechs access to richer, consented transaction data, and that’s changing the nature of engagement

CL RAMAKRISHNAN

As the Middle East’s fintech and digital banking ecosystem accelerates its shift toward data-driven, regulation-first innovation, WebEngage has emerged as a key partner enabling institutions to deliver compliant, hyper-personalised customer experiences at scale. Leading this transformation is Hetarth Patel, Vice President, Growth Markets – MEA, Americas & Asia Pacific, whose 24-year career in Information Communication Technology (ICT) spans strategy, global expansion, and building high-impact organisations.

A strategic thinker with a track record of driving growth across global companies, including leadership roles at Oracle and Flytxt BV, Hetarth now spearheads WebEngage’s mission to cement its position as a customer retention pioneer across MEA, the Americas, and APAC.

In this exclusive conversation with International Finance, Hetarth shares deep insights on how fintechs in Saudi Arabia and the UAE are navigating data regulations, accelerating retention-led engagement, and preparing for an AI-powered future.

IF: How do fintechs in Saudi Arabia and the UAE balance hyper-personalisation with strict data regulations like SAMA and PDPL?

Hetarth Patel: Fintechs in Saudi Arabia and the UAE have realised that personalisation and regulation don’t conflict; they require better architecture. The smart ones begin with privacy-by-design: clear consent, strict access control, and strong separation between PII and behavioural signals. Once that foundation is in place, hyper-personalisation becomes a matter of using patterns, not identities.

In Saudi Arabia, especially, SAMA and PDPL push companies to keep

data within the Kingdom, so the intelligence layer has to operate locally. When you treat governance as part of the system, you can deliver real-time experiences without crossing any regulatory lines.

How is WebEngage’s regional data centre helping BFSI clients in Saudi Arabia and the UAE offer personalised experiences while staying compliant?

Our Saudi deployment was built specifically to give banks and insurers the confidence to scale personalisation without worrying about residency. Everything from raw events to backups stays in-country, which aligns with how SAMA and PDPL expect sensitive data to be handled.

We also separate identity data from behavioural streams and let teams control exactly which fields can be used for segmentation, modelling, and journey orchestration. UAE institutions, especially those operating across borders, benefit from a similar setup because they can build seamless journeys while honouring local rules. Things move seamlessly on customer engagement because the compliance guardrails are already baked into the architecture.

With WebEngage’s ZeroPII architecture, all personally identifiable data stays entirely within the

customer’s own environment, never touching the WebEngage Cloud. Our platform only processes behavioural and non-PII attributes, while personalisation happens securely on the customer’s premises via the WebEngage Agent.

With the focus shifting from customer acquisition to retention, what strategies are fintechs in this region adopting to stay competitive?

We are seeing more and more MENA fintech companies move from campaigns to journeys. Instead of running bursts of acquisition, they’re wiring always-on flows around onboarding, activation, credit usage, savings habits, and renewals. That shift alone has improved their unit economics.

We also see more behavioural engagement, such as responding to missed payments, salary credits, failed KYC attempts, or changes in spending patterns. These signals can be far more meaningful than demographics.

In today’s “milli-second economy,” how do WebEngage’s tools enable hyper-personalisation for fintechs and digital banks?

WebEngage ingests live events from banking cores, wallets, and apps, stitches them into real-time profiles,

When fintechs unify their data and design separate journeys for each cohort, they can support inclusion and deliver premium experiences without duplicating infrastructure

flows, residency, and consent. Fintechs operating region-wide need stacks that can adapt country by country without rewriting everything. And finally, skills. Teams are still learning how to blend legal, security, and marketing perspectives into one workflow.