BDB elevates Bahrain’s SMEs & economic growth

BDB is emerging as a guiding force in Bahrain's SME revolution, led by Group CEO Dalal Al Qais

Green Banking: Promising future, yet challenging

Can Claudia Sheinbaum break AMLO’s shadow?

EDITOR’S NOTE

BDB is emerging as a guiding force in Bahrain's SME revolution, led by Group CEO Dalal Al Qais

Green Banking: Promising future, yet challenging

Can Claudia Sheinbaum break AMLO’s shadow?

EDITOR’S NOTE

United States President Donald Trump, in his second stint at the White House, has been quite vocal about the future direction of the American energy industry. He wants the sector's players to enter the "Drill, Baby, Drill" mode and set new records for oil and gas exploration and extraction. However, oil majors are concerned that increasing oil and gas output even further could create a glut and drive prices down, which is a development they want to avoid at any cost.

Meanwhile, the small Caucasian country of Georgia has become a new global tech hotspot. In 2020, only 1,971 IT companies were operating in the nation, with 79% of them being locally owned. But in 2024, the tally has risen to 24,117, with 84% now being international. The sector recorded a turnover of GEL 2.4 billion ($816 million) in 2023, marking a significant boost to Georgia’s economic landscape.

Let’s shift gears and focus on "Green Banks," mission-driven institutions designed to drive the transition to clean energy and combat climate change. Unlike traditional banks, their primary goal is not profit maximisation but rather the deployment of clean energy solutions. These institutions work to create a steady pipeline of sustainable projects and actively seek out opportunities within the market to make a meaningful impact.

Our cover story for the April 2025 edition of International Finance highlights the Bahrain Development Bank (BDB), which, since its inception in 1992, has been a cornerstone of the Kingdom’s financial ecosystem. Standing in 2025, BDB has evolved into Bahrain’s primary hub for SME development, and it is actively working to build a stronger entrepreneurial ecosystem in the Kingdom.

APRIL 2025

VOLUME 25

ISSUE 47

editor@ifinancemag.com www.internationalfinance.com

Bahrain Development Bank is emerging as a guiding force in the country's SME revolution, led by Group CEO Dalal Al Qais

ECONOMY BANKING & FINANCE

GREEN BANKING: PROMISING FUTURE, YET CHALLENGING

Green banking, has transformed itself from a niche concept to a central strategy for financial institutions

THE BIG TECH CRACKDOWN: A THREAT TO INNOVATION?

For the EU, competition is just as important as competitiveness when it comes to regulating big tech

CAN CLAUDIA SHEINBAUM BREAK AMLO’S SHADOW?

Claudia Sheinbaum’s presidency represents a significant step forward for women in leadership in Mexico

DOGE’S ‘REFORM PLANS’ FOR FAA: WHAT IS MUSK UP TO?

According to reports, Elon Musk’s DOGE project directed the firing of hundreds of Federal Aviation Administration employees

'ACQUISITIONS ACCELERATE GROWTH EFFECTIVELY'

Harbourfront Wealth has developed and grown a leadership team with deep operational knowledge

MIDDLE EAST INVESTORS BET BIG ON TURKEY

BUSINESS DOSSIER

48 BCEL Bank: Revolutionising banking for Laotians

Over the past 18 months, bond yields in Turkey have increased significantly 44 INSIGHT

60 finexis advisory shines in global financial rankings

70 Mohammed Alsolami: A financial entrepreneur’s success story

82 Petroleum Trading Lao revolutionises fuel access

92 ABK: Kuwait’s Best Investor Relationship Bank

104 SAFE: Leading Saudi security & economic growth IN CONVERSATION

of

Are African ports ready for global trade boom?

In corporate lending, the use of real-time financial analytics is

Director & Publisher Sunil Bhat

Editorial

Prajwal Wele, Agnivesh Harshan, CL Ramakrishnan, Prabuddha Ghosh

Production Merlin Cruz

Technical Team Prashanth V Acharya, Bharath Kumar

Business Analysts

Alice Parker, Indra Kala, Stallone Edward, Jessica Smith, Harry Wilson, Susan Lee, Mark Pinto, Richard Samuel, Merl John

Business Development Managers

Christy John, Alex Carter, Gwen Morgan, Janet George

Business Development Directors

Sid Jain, Sarah Jones, Sid Nathan

Head of Operations Ryan Cooper

Accounts Angela Mathews

Registered Office INTERNATIONAL FINANCE is the trading name of INTERNATIONAL FINANCE Publications Ltd 843 Finchley Road, London, NW11 8NA

Phone

+44 (0) 208 123 9436

Fax +44 (0) 208 181 6550

Email info@ifinancemag.com

Press Contact editor@ifinancemag.com

Associate Office

Zredhi Solutions Pvt. Ltd. 5th Floor, Sai Complex, #114/1, M G Road, Bengaluru 560001

Ph: +91-80-409901144

As it releases its results, Apple is likely to be questioned about the impact of the China-US tariff standoff on its business and the delayed roll-out of important AI features. Despite Apple profiting from a surge in sales of its cheaper iPhone 16e during the January-March period due to possible tariffs, Wall Street analysts still predict the company will report a slight sales decline. That would be the second consecutive quarter with declines. Electronics have not yet been subject to tariffs under the Trump administration, but Washington has hinted that some levies may be implemented. Improvements to Siri have been delayed to 2026, and Apple pulled a commercial that promoted unreleased AI functionalities.

OnePlus recently confirmed that the device will not be launching in the US or Europe, despite the fact that the more compact and somewhat alluring OnePlus 13T attracted attention when it was announced. In essence, the OnePlus 13T is merely a scaled-down version of the OnePlus 13, one of the greatest Android flagships in recent years. Its powerful specifications, larger battery, and more are all included in a more compact design with a 6.32inch display.

Gulf Bank has accelerated its efforts to inform clients about the value of utilising secure platforms, like the "Sahel" app, when making payments for services provided by government organisations as part of its ongoing support for the "Diraya" awareness campaign. Gulf Bank advised users to confirm the legitimacy of websites and digital platforms before making any payments or entering information, cautioning against relying too much on internet search engines, which can be deceptive and may direct users to fraudulent websites that look legitimate.

The Zimbabwean government has wrapped up public consultations on a new bill that aims to standardise fish production and handling practices in its aquaculture operations and streamline the regulation and management of the country's fisheries. The Ministry of Lands, Agriculture, Fisheries, Water, and Rural Development is pushing the Zimbabwean Fisheries and Aquaculture Bill, which would place all regulatory authority over fisheries and aquaculture under the ministry's Fisheries and Aquaculture Resources Production Department.

Source: Statista

In Doha, Saudi Foreign Minister Prince Faisal bin Farhan met with Sheikh Mohammed bin Abdulrahman bin Jassim Al Thani, the Prime Minister and Foreign Affairs Minister of Qatar. They talked about bilateral relations, aspects of cooperative efforts, and strategies for their development during the

meeting, apart from co-chairing the Saudi-Qatari Coordination Council's Executive Committee meeting. Within the framework of the Saudi-Qatari Coordination Council, the two parties reviewed the strong fraternal ties and talked about ways to develop them both bilaterally and multilaterally in the international arena.

HEIKKI MALINEN

CEO OF OUTOKUMPU Heikki Malinen addressed the limited direct impact of recent US tariffs on the company's operations but cautioned about ongoing challenges from renewable fuel oversupply and market volatility

THORSTEN MICHALIK

CEO OF HSBC Thorsten Michalik was appointed as the new CEO of HSBC's asset management business for the UK, Europe, and the Americas, having previously led HSBC’s asset management operations in Germany

JOCHEN ZEITZ

CEO OF HARLEY-DAVIDSON Jochen Zeitz announced his intention to retire after five years at the helm, having previously served as Chairman and CEO of Puma for 18 years and being instrumental in steering Harley-Davidson

The UAE provides a stable and business-friendly environment, with an emphasis on diversifying the economy

Egypt is predicted to contribute 5,891 hotel rooms in 2025, ranking fourth in the Middle East and Africa region

Aldar Properties' first-quarter 2025 profit before tax increased by 33% year over year to AED 2.2 billion ($599 million), while net profit after tax increased by 22% year over year to AED 1.9 billion. Chairman Mohamed Khalifa Al Mubarak stated that the company's early-year performance demonstrates the strength and diversification of its business sectors, as well as its capacity to function effectively and expand in accordance with a well-defined plan to generate long-term, sustainable value.

According to him, the UAE provides a stable and business-friendly environment, with an emphasis on diversifying the economy, luring in foreign investment, and investing in key industries. He pointed out that the development revenue backlog has hit a record AED 55.7 billion and stated that Aldar is in a strong position to deliver sustainable performance, deploy capital effectively, and reinforce its role as a longterm partner in guiding the UAE's economic developmental trajectory.

According to Aldar Group CEO Talal Al Dhiyebi, the company's first-quarter

financial results were impressive, fuelled by sustained growth in its core business areas. Development sales climbed 42% to AED 8 billion, showing continued strength.

Aldar has taken proactive measures to improve liquidity and fortify its financial position by obtaining a syndicated loan and issuing capital markets securities. Key financial highlights include Aldar's AED 46.7 billion UAE revenue backlog, which shows good revenue visibility for the ensuing two to three years.

Aldar obtained AED 9 billion in syndicated revolving credit facilities and an AED 1.8 billion hybrid capital solution from Apollo, and it issued AED 3.7 billion in hybrid capital notes and AED 1.8 billion in green sukuk to further improve its capital structure and financial flexibility.

Strong government investment in housing and infrastructure is reflected in the AED 49.5 billion in construction currently underway, out of the AED 88.7 billion project management services backlog.

According to Sherif Fathy, Egypt's Minister of Tourism and Antiquities, the country is extending its options for lodging tourists with new rules for vacation rentals in an effort to alleviate the current hotel room shortage caused by an increase in tourists.

The minister said Egypt's tourism industry saw 15.78 million visitors in 2024, a recordbreaking 21% increase over pre-pandemic levels and a 6% year-over-year increase. He further noted that international visitor arrivals increased by a staggering 25% in the first quarter alone, compared to the previous year, despite the initial forecast for 2025 calling for a 6% increase.

“We are happy with the developments, but we are extremely challenged by the lack of rooms to accommodate the demand… that's why we're encouraging all types of investments in rooms and hotels,” he said.

As per Fathy, the Airbnb business model serves as the basis for the recently approved set of minimum requirements for vacation rentals. It is anticipated that the action will help areas like the New Valley and Aswan,

where a large number of establishments have historically operated unofficially without a Tourism Ministry license.

The ministry also offered an incentive for investment in both vacation homes and hotels by waiving all fees associated with changing a property's license from any business to a touristic business.

Fathy noted that Egypt's tourism vision for 2031 calls for 30 million tourists annually, and reaching this target will necessitate doubling the number of hotel rooms.

“If the supply of rooms grows ahead of schedule, the tourism target could be met earlier,” he said.

A February 2025 report by Zawya Projects revealed that Egypt is predicted to contribute 5,891 hotel rooms in 2025, ranking fourth in the Middle East and Africa region after Saudi Arabia, the United Arab Emirates, and Qatar, respectively.

Tourism marketing expert and CEO of Digital Experts, Alaa Khalifa, predicts that vacation rentals will fill 75% of Egypt's current 200,000 hotel room deficit.

DXB reached its highest monthly traffic ever in January alone, welcoming 8.5 million visitors

Economies that rely on imports and oil exports have been severely impacted this year

Senator lauds Tinubu's tax reforms

According to Senator Olamilekan Adeola, who represents Ogun West in the National Assembly, President Bola Tinubu's administration's tax reform programme will save the country's economy from the "cabal's" influence. He explained that the "cabal" no longer controls the nation's affairs. Adeola made this declaration during the second Mega Empowerment/Town Hall Meeting and Thank You Tour of Ogun West in Ipokia. He pointed out that Tinubu had virtually eliminated the cabal's ability to govern the nation. According to the lawmaker, the country is headed toward stable growth and economic recovery. Adeola also said he would continue to facilitate developmental projects for Ogun West.

DXB receives 23.4 million guests in Q1

In Q1 2025, Dubai International (DXB) welcomed 23.4 million visitors, sustaining its momentum and solidifying its position as the world's top international airport. Both Dubai's increasing popularity as a global travel destination and DXB's status as the preferred entry point for millions of tourists were reflected in the performance. Even though the first quarter of this year broke all previous records, traffic was up 1.5% from the same period in 2024. DXB reached its highest monthly traffic ever in January alone, welcoming 8.5 million visitors. However, there was a bump. Cargo volumes registered a minor contraction of 3.6% year-on-year during the first quarter, with Dubai Airport handling 517,000 tonnes of cargo.

Source: Statista

African and Caribbean consumers will be seamlessly able to source gasoline, diesel, jet fuel, and other products from refineries on the continent thanks to the $3 billion revolving credit line that the African Export-Import Bank has launched. For the facility's first three years, the bank anticipates that it will provide $10-14 billion in trade finance and help reduce the region's yearly fuel import bill, which is approximately $30 billion. Economies that rely on energy trade have been impacted by a decline in crude prices and an increase in freight expenses. Brent crude is down over 20% since January on supply dynamics and fears that a global trade war will sap demand.

The internationally recognised interior architecture and design firm Two | 88 by Rina Rankova has teamed up with Swiss real estate developer DHG Properties on their most recent residential project in Meydan Bukadra, Dubai. This partnership combines Two | 88's expertise in world-class design and upscale interiors with DHG's dedication to real estate excellence and Swiss-quality construction, setting new standards for upscale living in Dubai. Two | 88 has studios in Dubai, London, and Marbella, and possesses vast experience designing ultra-prime homes and businesses. The partnership comes at a time when Dubai is experiencing a surge in record-breaking luxury property transactions.

Bretton Woods had a crucial role in saving a globe ravaged by conflicts, poor leadership, and geopolitical uncertainty

Russia's invasion of Ukraine in the winter of 2022 brought to light once more the shortcomings of the World Bank and the International Monetary Fund (IMF), two international organisations tasked with coordinating strategies to address the ensuing economic crisis.

Following the attack, US Treasury Secretary Janet Yellen, a former chair of the US Federal Reserve, issued a warning.

When representatives from 44 countries, led by the United States and the United Kingdom, convened in New Hampshire for the so-called United Nations Monetary and Financial Conference in July 1944, Bretton Woods was established

Janet Yellen said, "We will need to modernise our existing institutions—the IMF and the multilateral development banks— so that they are fit for the 21st century, where challenges and risks are increasingly global."

She added that the defeat of Russia calls for actions that the World Bank and IMF might not be able to implement.

Yellen, a pivotal figure in the previous Joe Biden administration, was referring to a wide range of issues, including trade disputes that are getting worse, sanctions against Russia, big-power rivalry that is causing geopolitical tensions, and— perhaps most worrying of all—the deterioration of the 80-year-old Bretton Woods institutions that were initially created for this very reason.

Bretton Woods had a crucial role in saving a globe ravaged by conflicts, poor leadership, and geopolitical uncertainty.

"The IMF was formed in 1944 from the wreckage of two world wars. The old-world order was in ruins, and populism had taken over most of the world in the decades before we were born. The IMF was crucial to the world's remarkable advances in global integration and wellbeing following Bretton Woods," IMF Managing Director Kristalina Georgieva said, earlier this year.

When representatives from 44 countries, led by the United States and the United Kingdom, convened in New Hampshire for the so-called United Nations Monetary and Financial Conference in July 1944, Bretton Woods was established. From the wreckage, they established a new, globally coordinated economic system aimed at growth and restoration. Thus, they established the World Bank and IMF.

“Eighty years later, the global economy is once again in a moment of significant turmoil as countries recover from the pandemic and conflict has flared across Europe, the Middle East, and Africa,” Georgieva continued, “but here we are again. The question that remains in the midst of all of this is whether the Bretton Woods Institutions (BWIs) can handle the demands of a much larger and more intricate global economy. If not, what other options are there?”

Georgieva summarised, "We still face many of the same challenges as when we first started. A

military force has once again invaded a neighbour in Europe, and regional conflicts are escalating, increasing the risks to the entire world. Once more, protectionism and populism are growing. In addition, we are battling disruptive technologies like artificial intelligence (AI) and virtual currencies, as well as global megatrends like climate change and the demographic shift.”

The majority of economists concur that, just when the world needs to avoid it, it is breaking apart into Global Economic Fragmentation (GEF).

GEF is seen as a policy-driven reversal of global economic integration that makes it less likely for countries to work together to solve global crises, stops new ideas from spreading in emerging markets, and risks sending money to countries with low incomes. In other words, by concentrating on ourselves, we are regressing.

The IMF, which is facing the possibility of becoming obsolete, explains that "in our increasingly fragmented world, nations have focused on reshoring essential goods and supply chains, including minerals crucial for green technologies, semiconductors, and military hardware due to concerns over national security and geopolitical motives."

Higher import prices, divided markets, limited access to labour and technology, decreased productivity, and a decline in living standards are the direct consequences, according to the IMF.

Bretton Woods had a crucial role in saving a globe ravaged by conflicts, poor leadership, and geopolitical uncertainty.

Tariffs, subsidies, currency wars, protectionism, industrial policies, and penalties are the causes of this fragmentation. Together, they are suppressing the international trade that may help turn things around. In summary, nations are choosing their own paths and taking opposing positions. This generally undermines Bretton Woods' primary goal of global financial stability.

Many nations are therefore at risk of experiencing a decline in their wealth. According to recent studies, developing markets and mature economies may suffer long-term losses of up to 4% of GDP. The repercussions? Food insecurity, social unrest, and debt problems, with the most vulnerable countries suffering the most.

A new IMF report estimates that the spread of GEF might result in a long-term drop in global economic production of up to 7%. That would come at a disastrous cost, estimated at over $7.4 trillion.

Although the phrase is frequently used, economists are certain that we are at a crossroads once again and are not even close to reaching a consensus on a Bretton Woods-style solution.

“We can choose to pursue a path of instability and conflict in the future. Or we can decide on the route of collaboration and mutual gain," Georgieva said.

However, is it feasible to reform the BWIs? The

BRETTON WOODS WORLD BANK

IMF and the World Bank are facing "existential challenges," according to macroeconomist Amin MohseniCheraghlou of American University in Washington, DC, who is also the head of the Atlantic Council's Bretton Woods 2.0 Project.

He provides a long list of examples to support his claims, including the rise of new competitors, revolutionary new technologies like artificial intelligence, and two decades of social and economic upheavals like the Great Financial Crisis, the destruction caused by COVID, and the severe issues brought on by climate change, especially in Sub-Saharan Africa. Furthermore, as non-Western economists frequently note, the GFC and climate change are two of these ills that originated in the West.

Mohseni-Cheraghlou asserts that a significant problem in BWIs is the concentration of power in the wrong hands. In other words, at a time when "economies that are not part of the high-income club are playing an increasingly large role in global trade and finance," the leadership is firmly rooted in the US, Group of Seven (G7), and European Union (EU).

The United States and the European Union hold almost 40% of the votes, even though "their relative prominence in the global economy has eroded." Chinese scholars concur, pointing out that Beijing has been denied a position in the BWIs that, in their opinion, is appropriate given its undeniable economic power.

Professor Qin Yaqing, a political scientist at Shandong University, is adamant that a global governance structure that is "multi-level, multi-

World Bank Group financing disbursements to partner countries from 2019 to 2023, by agency (In Million US Dollars)

Recipient-Executed Disbursing Account

Source: Statista

issue, and multi-organisational" must take the place of what he refers to as "US hegemony" over these institutions. In fact, he shares Beijing's belief that economic fragmentation is best for China.

It would enable China to "choose allies to achieve various objectives and operate nimbly across regions, issues, and organisations."

He contends that the disintegration of global governing organisations would ultimately contribute to the collapse of the former hegemonic system.

The majority of Western nations, along with several Asian ones, are undoubtedly concerned about China assuming a more aggressive leadership role in a post-Bretton world. They're halfway there already. China's Belt and Road Initiative (BRI) has drawn other nations into Beijing's web, as noted by American political scientists.

As could be predicted, two of the 24 United Nations members that voted not to denounce Russia's invasion of Ukraine were North Korea and Russia, while the other 22 are all Belt and Road beneficiaries.

The fact that 49 out of the 58 countries that did not cast ballots are also involved in the Belt and Road is maybe more indicative of China's own predominance among the more disgruntled countries. We have the option of going down the route of instability and conflict. Or we might decide to follow the route of mutual prosperity and cooperation.

Since their own coffers are far from deep enough, the IMF and World Bank now have to deal with a far more complicated world of international financing.

According to Yellen, "We have been working in billions so far, and experts put the funding needs in the trillions."

Positively, there are many new lenders available, including sovereign wealth funds, pension funds, regional multilateral development banks, and state-led development finance organisations. For example, there were more than 40 multilateral development banks and financial institutions at the time of the previous count, but there are now at least 50 solely national development banks. Additionally, a total of 130 sovereign

wealth funds are investing $12 trillion. While private pension funds have $42 trillion in assets in their treasuries, public pension funds have $24 trillion worldwide.

Furthermore, the number and financial clout of multinational firms has skyrocketed in the past eight decades.

They "command economic and technological might larger than many countries," according to Mohseni-Cheraghlou.

Multinational corporations account for a quarter of all jobs worldwide and nearly one-third of the global GDP, based on solid data. In fact, Walmart alone generated more income in 2023 than the GDP of over 170 countries.

To sum up, Bretton Woods was built for a different time period and urgently has to be updated to meet the demands of this new, far more complicated one. The Nixon

administration's 1971 removal of the gold standard, a significant disruption to the system, exemplifies how the institutions have adeptly navigated past challenges.

Despite the challenges posed by "intractable geopolitical tensions," the Bretton Woods table presents numerous benefits. Some of these, according to economists, include an unjust global tax system, a role in responding to crises like COVID (Yellen thinks the GFC response was "too timid and short-lived"), the quick mobilisation of capital to aid developing nations, and World Trade Organisation reform (China prefers regional trading blocs that allow it to get around WTO regulations). All things considered; this massive package is poised to challenge the foundations of Bretton Woods.

While the Bretton Woods institutions were pivotal in rebuilding

the global economy after WWII, their current structure and mechanisms appear outdated in addressing the complexities of today’s interconnected and fragmented world.

The rise of new economic powers, shifting geopolitical dynamics, and evolving global challenges require a radical overhaul of these institutions to ensure they remain effective. This is no small task, but the alternative—a more fragmented world without coordinated economic governance—could be far more destabilising. As the global landscape continues to evolve, the question remains whether the BWIs can adapt in time or if we will see the rise of new structures altogether.

While Eurozone banks have demonstrated resilience, doubts over their long-term profitability persist

IF CORRESPONDENT

Many of the largest banks in the Eurozone exceeded second-quarter earnings forecasts, despite worries about a more challenging outlook. Although their shares were limited, Reuters claims they profited from high interest rates and substantial investment banking activity.

According to Chris Burt, Director of the Risk Coalition Research Company, "where the market suspects the organisation is taking more risk than might be appropriate," shares may be lower than expected due to financial results and company performance.

"Imagine the Titanic moving at full speed across the Atlantic, making fantastic progress," he continues.

While European banking shares increased by 20% between January and July 2024, hitting nearly nine-year highs, "the STOXX Europe 600 Banks index was down 0.5% after a raft of bank earnings fed into analyst and investor concerns about the sustainability of the sector's profit growth. Eurozone banks see investment banking boost but outlook stalls shares," according to Mathieu Rosemain, Tom Sims, and Valentina Za's article.

A legal provision related to Deutsche Bank's failing Postbank unit contributed to the company's quarterly loss and 7% stock decline. The company also scrapped plans for a repurchase and increased bad loan loss charges. Although BNP Paribas anticipates exceeding its €11.2 billion net profit goal, an 11% decline in net interest income (NII) has raised worries in its retail division.

Additionally, Moody's Ratings thinks that UniCredit and Santander's NII have essentially peaked. As a result, risk charges will go up, even though growing profits have improved investor mood. Despite this, lenders have traded below their tangible book value, which raises questions about whether their profitability can last.

Despite this, the investment banking businesses of BNPP and Deutsche helped to diversify revenue streams in recent quarters by offsetting any shortfalls.

"At BNPP, revenue from equities trading and prime brokerage services jumped 58%," added Rosemain, Sims, and Za.

According to Olivier Panis, Associate Managing Director of Financial Institutions Group at Moody's Ratings, the outlook for Eurozone bank earnings remained rather stable. In 2023, the banks in the zone increased their net interest margins (NIMs).

"We expected profitability to stabilise in countries where variable-rate lending predominates," he said.

In the first half of 2024, HSBC and other Italian and Nordic banks did better than their counterparts. In 2025, Moody's Ratings predicts that bank profitability in the Eurozone will "remain strong" notwithstanding a drop.

As per Panis, Moody's Ratings believes most profit margins have peaked as policy

rates began to decline this year. However, the move from current accounts to more costly term accounts will slow down.

After two years of low lending activity, Panis continues, "Stable economic growth and inflation near central bank targets will offer the opportunity for stronger lending volumes while also supporting asset quality and risk charges."

However, he believes that operating costs will continue to rise. Higher compensation costs and technology are to blame for this. As a result of higher interest rates in nations like Spain, Portugal, and Italy, Moody's Ratings believes that there may be some divergent profitability trends among banking systems with a larger percentage of assets at variable rates.

According to Fitch Ratings, the biggest banks in Europe are expected to be profitable in 2024, matching the high levels of 2023. Fitch's September 2024 "Large European Banks Quarterly Credit Tracker" indicates that most of the 20 major banks experienced strong results in the first half of the year.

Due to their "better than expected earnings," it raised its full-year projections for a few banks. For instance, according to a press release, HSBC and other Italian and Nordic banks did better than their counterparts in the first half of 2024.

They were expected to continue performing at a high level from July to December. French banks, on the other hand, are falling behind their counterparts and are only predicted to see modest increases in profitability.

According to Z/Yen Senior Research Partner Hugh Morris, the outlook is generally favourable. He claimed that the Eurozone's growth rate is likely between 3-4%, which should boost bank profits throughout the banking industry because mortgages account for half of bank lending in the Eurozone, and demand for

them has been generally weak over the past few years.

He clarifies that the European Central Bank (ECB) "believes the banks will be able to improve with a forecast of global GDP growth of 3.4% for the next two years."

ECB believes that the Eurozone is expected to closely align with this forecast. One of the driving factors behind this is the anticipated long-term increase in mortgages, in contrast to their previous period of stagnant growth in the region.

Morris finds the banks' net interest incomes (NIIs) among the most intriguing aspects. They are crucial to the mediumterm financial gains of banks. He claims that cost management has been a major driver of BNP Paribas and that it is one of the factors that drive short-term development.

He underscores that while other criteria may fluctuate, NII remains the benchmark. For instance, cost control helped BNP achieve record profits, Morris continues. During a 40-50-year cycle, banks manage costs when they have to and don't when they don't.

The market examines NII because it has doubts about BNP's ability to maintain rigorous cost control. That is the crux of the problem. For what reason does the market have doubts about BNP? A significant portion of the solution is NII.

"A full-scale conflict in the Middle East is another possibility. The entire world will get sick if someone sneezes in that region. More than Ukraine is to blame for the rise in the price of Brent crude oil. These kinds of price shocks will impact bank lending and investment decisions. Although no one can predict what will occur, these are the main contributing elements. Morris also believes that the Eurozone is

growing slowly and that banks' expansion would be constrained by the West's latent productivity," Morris added.

It is possible that certain banks were undervalued and are not receiving the full reflection of profitability, which is why

they have been held back. Morris thinks that worries about NII and the long-term viability of headline profits may be to blame.

He said, "A lot depends on how each bank is made up, and there is cyclical falling in love and out of love with investment banking as a way to kick start growth."

Deutsche Bank incurred significant losses as a result of this mistake. Twenty years ago, Deutsche Bank aimed to establish itself as a global investment bank to rival the American market, but within five to ten years, everything crumbled. Despite having fewer assets than Santander, it is the 22nd largest bank globally. In terms of assets, it is only somewhat larger than the Toronto Dominion Bank.

The NII is a significant measure of medium-term performance, and stock markets are attempting to price in the value of future performance. If they observe that the NII's performance deviates from short-term gains, they will pay closer attention to that.

Interest rate issues have hindered certain banks, according to Panis. The sustainability of banks' profit growth may be affected, he believes, as the advantages of higher rates to their net interest margins have begun to wane.

Despite rate reduction by central banks, he predicts that borrowing costs will continue to be higher than they were before 2022. This will have an impact on borrowers' capacity to refinance and repay debts.

The increased cost of living and the fact that asset values in Europe have not changed significantly since 2022 only make the situation worse.

"As a result of the monetary tightening, the cost of funding has materially increased, with the end of targeted longerterm refinance operations (TLTROs) and a material shift in the deposit mix toward more expensive term deposits," he continues, adding that he believes this could affect asset quality and moderate lending volumes.

Even while this change may have stabilised, the deposit mix hasn't changed since 2022, and central banks have started lowering interest rates once more.

The revenue and expenses from the stock market compound these difficulties.

According to him, capital markets income helps sustain revenue, but

inflation in salaries and one-time expenses are driving up costs, which may hurt the long-term viability of profit growth.

He agrees with Morris that "geoeconomic fragmentation, which could increase volatility, impact banks’ operating environments, their asset risk, and profitability," has several sources of uncertainty. The turmoil in the Middle East and the war in Ukraine are two prime examples of this.

However, Morris believes that NII is primarily responsible for the worries regarding the durability of profit increases.

Before adding that the market has witnessed the emphasis on cost management and the interest in erratic industries, like investment banking, come and go, he states, "It is the breadand-butter business, and it is not looking so rosy."

The biggest banks in Europe are probably going to be profitable in 2024, matching the high 2023 levels.

Despite the market's attempt to

incorporate its likely performance into the current stock price, NII remains a persistent presence. Since the share price ought to reflect the present value of anticipated medium-term profit streams, Morris views it as Economics 101.

He believes that this indicates that "the markets' perception of forward value will outweigh one set of half-year results."

He doesn't know Unicredit well, but he thinks it's an unusual strategy that the CEO, Andrea Orcel, decided to give back almost all of the company's profits to shareholders in the form of dividends and buybacks.

Morris further says it is unclear whether the choice to purchase a digital bank in Belgium resulted in a decline in quarterly revenues, especially with regard to the latter, and whether it caused a 3% decline in shares.

Even if purchasing a digital bank costs money up front, Unicredit may benefit in the long run. At the same time, it will not become distinctly apparent for a considerable amount of time.

"This uncertainty would cause its shares to decline, and although the markets appreciate innovation, they are leery of money pits and white elephants," Morris noted.

According to Panis, increased market volatility is driving activity for investment banking, and client transactions are increasing capital markets revenue. He claims that this will help revenue growth in 2024. This is especially true for banks that "may suffer from low lending activity in commercial banking, as is the case for French banks, for example."

Nevertheless, he notes that the growth of the capital markets division "drove a 6% rise in adjusted revenue to $65 billion for European global investment banks in Q2 2024, with a significant boost from equity and investment banking income."

Then there are the fees associated with underwriting and advising on debt issuances, equity, and M&A transactions.

According to him, each of them adds to the total earnings.

"When a deal is there to be done, the fees and margins are probably better than they have been," Morris adds, even though there are fewer opportunities available.

Leverage against the cost base is necessary, and he discovers that if three individuals are needed to complete a $50 million deal, it might take all of them to complete a $500 million contract. He asserts that while this approach is advantageous for finding deals, it may leave you with an uncovered cost base when market conditions change. This indicates that the cost base stays essentially fixed. Growing economies of scale tend to make profitability highly volume-dependent.

However, diversification of capital markets activities in Europe has benefited investment banking, in part because of the COVID-19 pandemic, which caused several banks to suffer considerable losses. Panis pointed out that certain banks also decided to lower their risk appetite restrictions for specific

equity derivatives with exotic structures. Banks have also developed more balanced worldwide market divisions with a more diverse product mix as a result of geopolitical crises, such as the Russia-Ukraine war, which generated price instability.

"This diversification is rather creditpositive when implemented successfully because it exposes less of the overall business model of those banks to market turbulence and makes capital market revenues relatively less volatile," he says, adding that not all European banks have equal access to the depth of the US capital market.

Nonetheless, Morris holds the belief that certain banks are concealing issues and should return to their fundamental role as a value store. He believes that banking should be a boring, mediummargin industry.

However, he believes that balance sheets are very challenging to correctly understand since "human ingenuity has added multiple layers of risk and complexity to that, to the point that banks’ report and account. This leads to a wobble and a misconception of share value.”

According to author and banking futurist Brett King, a conceptual shift is necessary to align investments with broader social initiatives and evolving value creation. This requires a re-evaluation of how performance is assessed.

He argues that, despite the profitability of investment banking, it is not appropriate for the modern world. He believes that investment banks, along with banks in general, must adopt a fundamentally new way of thinking to continue thriving. To achieve this, they need to develop more diverse revenue sources that align with contemporary value systems.

High interest rates and strong investment banking revenues have driven banks’ profitability, but market scepticism persists, reflected in restrained stock performances. Analysts attribute this hesitation to factors such as declining net interest income (NII), rising operational costs, and geopolitical uncertainties.

Geopolitical tensions, inflation, and fluctuating deposit mixes further complicate the outlook. While stable economic growth and improved lending volumes offer hope, rising operating costs and risk charges may offset these gains. The banking sector's ability to navigate these challenges will depend on strategic cost management and adaptability to evolving financial conditions.

Ultimately, while Eurozone banks have demonstrated resilience, doubts over their long-term profitability persist. The market remains cautious, weighing short-term earnings against the broader economic landscape. As interest rates shift and global uncertainties loom, the banking sector must strike a balance between growth and risk management to sustain investor confidence and maintain profitability in an increasingly complex financial environment. FEATURE BANKS

BANKING AND FINANCE

IF CORRESPONDENT

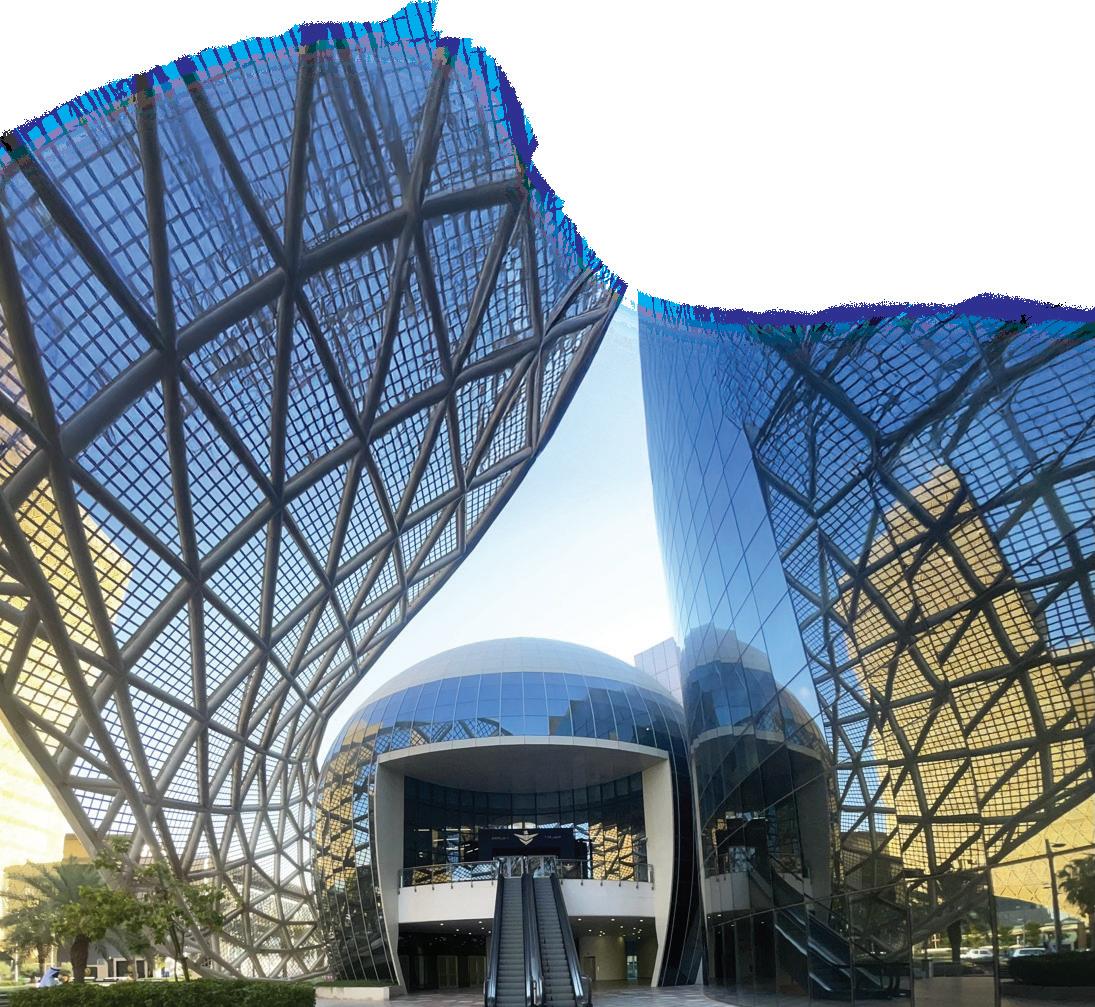

Established in 1992 to catalyse Bahrain’s economic advancement, the Bahrain Development Bank (BDB) has long served as a cornerstone of the Kingdom’s financial ecosystem. From the outset, BDB was established to advance sustainable development across Bahrain by offering critical financing support to the country’s Small and Medium-Sized Enterprises (SMEs).

Today, BDB’s role as a trusted partner in Bahrain’s financial sector is further accentuated by its commitment to innovation, strategic investments, and economic diversification.

BDB is emerging as a guiding force in Bahrain's SME revolution, led by Group CEO Dalal Al Qais

What began as a specialist institution in 1992 has evolved into Bahrain’s primary hub for SME development, one that is actively working to build a stronger entrepreneurial ecosystem in the Kingdom.

Aligned with "Bahrain Economic Vision 2030," BDB has adopted a dynamic strategy to stimulate business activity and support the sustained growth of the vital SME sector.

Bahrain's SME Development Board wants to establish the country as a leading hub for startups and emerging businesses by formulating promising developmental strategies that will increase the contribution of these enterprises to the national GDP, boost exports, and create quality employment opportunities for the national workforce.

This vision aligns with Bahrain's Economic Recovery Plan, which includes 43 initiatives focused on SME development. The plan is a collaborative effort involving the Economic Development Board (EDB), the Labour Fund (Tamkeen), the Bahrain

Development Bank (BDB), the Ministry of Youth Affairs, and the Tender Board. These stakeholders are working together to create a supportive infrastructure for SMEs, recognising their pivotal role in cultivating new industries.

Currently, SMEs constitute approximately 93% of Bahrain's commercial establishments. This significant presence underscores the importance of targeted initiatives to support and enhance the sector's contribution to the national economy. BDB plays an active role in fulfilling this strategy by providing SMEs with essential growth capital.

With the vision of becoming the regional leader in digital solutions and financial services for SMEs, BDB wants to enable businesses to grow locally and internationally by facilitating access to finance and export markets.

Over the years, BDB has transformed from being a traditional bank into an agile, innovationdriven institution deeply committed to supporting Bahrain’s growing economic landscape. Established during the early days of the Kingdom’s modern economic growth journey, the bank has provided

critical financial support to enterprises at key milestones, reinforcing its position as a longstanding contributor to national progress.

Leading BDB's emergence as a guiding force in Bahrain's SME revolution is Dalal Al Qais, the bank's Group Chief Executive Officer.

A banking veteran with professional experience spanning over 20 years in the banking and financial industry, Dalal Al Qais possesses deep-rooted knowledge in areas such as retail, SME, digitisation, as well as risk across conventional, Islamic, and international banks.

She earlier served as Chief Retail Banking Officer for the region at Standard Chartered Bank, apart from donning the role of Chief Retail Banking and Wealth Management Officer at the Bahrain Islamic Bank (BisB).

Since assuming charge at BDB, Dalal Al Qais has steered the bank towards a new era of growth marked by innovation and inclusivity. Her leadership at BDB and dedication to the growth of Bahrain’s SME sector have been a game-changer for the organisation.

BDB’s role in supporting SMEs

BDB offers business loans with flexible terms and competitive interest rates that accommodate the varied needs of emerging enterprises.

"BDB plays a major role in driving Bahrain’s economic diversification. By channelling funding into innovative projects and supporting sectors beyond traditional industries, the bank contributes significantly to the nation’s Vision 2030 goals. Its proactive support for sectors such as technology, renewable energy, and modern manufacturing has enabled the Kingdom to reduce reliance on conventional industries while making way for a more dynamic and inclusive economy. Our strategic investments and forward-thinking initiatives have been integral to creating job opportunities, enhancing competitiveness, and ensuring long-term economic resilience," said Dalal Al Qais.

In April 2024, BDB entered into a ground-breaking partnership with Export Bahrain to introduce tailored export and supply chain financing solutions that offer competitive interest rates to support businesses in expanding into global markets. With a focus on facilitating international product and service exports, this initiative aligns seamlessly with the SME Development Board’s 2022-2026 Strategy, aiming to encourage a vibrant ecosystem of thriving businesses.

In November 2024, BDB, in partnership with a consortium of leading local and regional banks, launched the Kingdom’s first $265 million (BD100 million) Private Credit SME Growth Fund. The fund aims to accelerate economic development by providing critical financial support to SMEs.

The Central Bank of Bahrain (CBB) is offering incentives to participating banks, allowing their funded portions to count towards their share of SME lending with a risk-weighted average of 25%. The fund’s capital is pooled from key local and regional financial institutions, demonstrating a strong commitment to Bahrain’s SME sector. Managed by BDB with the support of Tamkeen, the fund was developed in collaboration with the Ministry of Industry and Commerce (MOIC), National Bank of Bahrain (NBB), Al Salam Bank, Bank of Bahrain and Kuwait (BBK), and Khaleeji Commercial Bank. It focuses on high-value sectors with significant export potential and job creation opportunities.

The fund has a 10-year structure, with a five-year

BDB offers a comprehensive range of financial products, services, and solutions, including business loans, advisory support, and diverse financing options tailored for entrepreneurs

deployment period dedicated to loan disbursements. Contributing to Bahrain’s sustainability goals, up to 10% of the fund will be allocated to support green economy initiatives.

Key products and services offered

BDB’s Investment Division supports its mission to accelerate the development of SMEs in the Kingdom. Targeting establishments that have the potential to grow locally and internationally, and have high commitment from both their owners and management, investments can be made at different levels of their business cycle.

Apart from heavily focusing on sectors like healthcare, manufacturing, food security, financial institutions, logistics, and technology, BDB has also shown keen interest in supporting companies that promote import substitution, export opportunities, job creation, value addition, and foreign investment.

"Our extensive experience across various industries stems from a deep understanding of the unique challenges and opportunities faced by SMEs in Bahrain. The Director nominated by the bank on the board of the investee companies supports and guides the firm to achieve its full potential and reach its goals. The Investment Division provides minority interest equity, which is typically up to 20% of the paid-up equity share capital, as a shareholder in private companies as a means of funding," BDB’s Group CEO added.

BDB offers a comprehensive range of financial products, services, and solutions, including business loans, advisory support, and diverse financing options tailored for entrepreneurs. Prominent among these offerings is Shariacompliant Finance, which offers business owners to secure a minimum amount of BHD 3,000 to finance specific assets like plant or machinery. The bank also provides working capital loans with comfortable repayment tenors and grace periods for sectors like manufacturing, ICT (information and communication technology), agribusiness,

private education, healthcare, tourism, trading, transportation, and other services.

BDB has also partnered with Labour Fund Tamkeen to introduce "BDB & Tamkeen Finance," a suite of soft financing programmes for MSMEs offered in accordance with Islamic Sharia principles. Through this collaboration, Tamkeen facilitates access to finance by subsidising a percentage of the loan profit for eligible applicants under applicable schemes.

Key offerings under this joint initiative include Start Your Business, which is designed to support new enterprises within their first three years of operation. This programme empowers earlystage businesses with financial solutions tailored to their growth requirements, aiming to foster entrepreneurship, productivity, and innovation. Go Digital is another initiative that encourages MSMEs to integrate relevant digital technologies into their operations, helping them advance their business models, increase efficiency, and improve agility. Business Growth is targeted at scaling existing enterprises by providing financial support for strategic objectives such as entering new markets, launching new products or services, franchising, expanding locally, or boosting exports. Lastly, Business Turnaround supports struggling enterprises by providing temporary access to financing, along with a structured recovery plan to help them stabilise operations and return to sustainable growth.

In addition to these programmes, BDB provides trade finance instruments to facilitate commercial activity. These include letters of credit (L/C), issued on behalf of importing clients to guarantee payments to exporters, and various types of Letters of Guarantee. These guarantees, such as Bid Bonds, Performance Bonds, and Advance Payment Guarantees, are commonly used in project-based transactions to support clients’ contractual obligations.

The bank also offers an overdraft facility for its client MSMEs, which essentially authorises them to overdraw their accounts up to an agreed limit. Such facilities are normally granted to meet working capital requirements arising from the customer’s operating cycle.

BDB’s role in financial inclusion

Financial inclusion is deeply embedded in BDB's mission to empower underserved and high-

potential business segments across the Kingdom. For over three decades, the bank has been a strategic enabler of business growth, a role it continues to play through its impactful initiatives and innovative financing solutions that directly address the sector’s evolving needs. BDB has become a transformative force for startups, women entrepreneurs, and rural businesses' access to finance.

In November 2023, BDB collaborated with The Supreme Council for Women, the BENEFIT Company (the Kingdom’s leading innovator in fintech and electronic financial transactions services) and Bahrain FinTech Bay to establish the Innovate for Bahrain Centre (I4B) at the Riyadat Centre in A'ali.

This pioneering initiative aims to drive comprehensive programmes that promote gender equality in the technology industry through multifaceted programmes that align with national strategies led by the Supreme Council for Women in partnership with the private sector. Operated by

Bahrain Fintech Bay and supported by Tamkeen, I4B is designed to equip women with the tools, resources, and networking needed to succeed in the digital economy.

As stated by Group CEO Dalal Al Qais: "We have launched purpose-driven initiatives such as the Riyadat scheme to empower female business owners, zero-interest loans to boost food security and sustainable development in the agriculture and fisheries sectors, and the SME fund to expand capital access for high-impact ventures. In collaboration with Tamkeen, we have also introduced co-financing programmes that extend tailored support to MSMEs across various sectors."

Believing in Bahraini women's ability to fuel the Kingdom’s economic growth and create a transformational impact, the Riyadat Scheme is helping these entrepreneurs scale their businesses with access to favourable Sharia-compliant financing and dedicated advisory services. The scheme supports both new and existing enterprises

BDB’s strategic goals for the future centre around expansion, new product introductions, and other priorities aligned with Bahrain’s broader economic vision

through two financing tracks, delivered in collaboration with Tamkeen’s “Start Your Business” and “Business Growth” programmes.

Innovation and technology in banking

BDB has continued to lead by example in digital transformation, consistently embracing innovative technologies to enhance operational efficiency, customer experience, and service accessibility.

Central to this transformation is tijara, BDB’s flagship digital banking platform. Built to meet the evolving needs of MSMEs, tijara provides real-time account information, transaction details, statement downloads, fund transfers within BDB and to external accounts, as well as international transfers via SWIFT, all in a secure and userfriendly environment.

BDB customers can use the Tijara platform to view account balances and account and transaction details, download statements, generate account reports, and transfer funds to their own accounts and other BDB (and non-BDB) accounts. Funds can

also be transferred to international bank accounts through SWIFT. With advanced security features such as two-factor authentication and password encryption, the platform offers peace of mind while delivering convenience at scale.

In October 2020, BDB took a major step forward by selecting the TCS BaNCS Global Banking Platform, developed by Tata Consultancy Services (TCS), a leading global IT services, consulting, and business solutions organisation, to modernise its core banking infrastructure. The decision was driven by a strategic goal to deliver personalised digital customer experiences and align with Bahrain’s national vision of cloud-based transformation.

Hosted on Amazon Web Services (AWS), the TCS BaNCS platform integrates cutting-edge technologies like APIs, artificial intelligence, and data analytics to support the rapid rollout of new products and services. This cloud-native solution not only enhances scalability, security and cost efficiency, but also enables BDB to tap into TCS’s fintech ecosystem to accelerate innovation and create contextual, value-driven interactions with customers.

In a further demonstration of its digital-first strategy, BDB entered a strategic partnership in February 2025 with Mazad, a leading online auction

platform. This collaboration enables the bank to conduct asset sales through live bidding, creating a more transparent, efficient and competitive process. By leveraging Mazad’s advanced digital capabilities, BDB is building a more accessible, fairer, and reliable bidding ecosystem for investors.

In June 2024, BDB won the “Excellence in Sustainable Environmental Development” Award at the GCC International CSR Awards. This achievement reiterated the bank’s ongoing commitment to environmental sustainability, its efforts to promote green initiatives, and its continued support for agricultural projects, including the Farmers Market in Hoorat A’ali, which serves as a key platform for local farmers to showcase their products and boost sales.

As part of its efforts to support food security and agricultural production in the Kingdom, BDB offers zero-interest financing solutions to farmers and fishers in partnership with the Ministry of Finance and National Economy. The product enables farmers to expand their businesses and allows local fishermen to purchase equipment with ease.

The bank has also shown longstanding support for the National Initiative for Agricultural Development (NIAD)’s Forever Green campaign over the past four years by contributing to tree planting efforts across various areas within the Kingdom. BDB’s diverse initiatives highlight its active role in contributing to the United Nations’ Sustainable Development Goals (SDGs), promoting economic growth, gender equality, supporting MSMEs, and enhancing education in Bahrain.

BDB’s support for individuals in the fishery and agriculture sectors includes offering interestfree loans for production development. As of December 2023, 2,729 individuals had received loans amounting to BD 22.7 million, illustrating the bank’s commitment to promoting sustainable agriculture.

In addition, BDB’s provision of education loans aligns with SDG 4 (Quality Education). The bank also supported 1,160 individuals with loans totalling BD 20.4 million as of December 2023, reflecting its dedication to enhancing educational opportunities and human development.

Partnerships, collaborations, and a promising future

BDB has continued to build strong partnerships with financial institutions, government agencies, and international bodies to enhance its service offerings and contribute meaningfully to Bahrain’s long-term economic vision.

Among the most impactful of these is BDB’s collaboration with the Labour Fund Tamkeen, which subsidises over 50% of the interest on eligible loans, significantly improving access to capital for MSMEs. The bank has also played a leading role in empowering female entrepreneurs through its partnership with the Supreme Council for Women, offering tailored business loans for women-led ventures.

BDB’s partnership with the Bahrain Tender Board is easing SME access to government tenders. Meanwhile, its collaboration with Export Bahrain empowers Bahraini SMEs to scale internationally by providing export support and financing mechanisms.

In November 2024, BDB signed a strategic agreement with Lumofy, an AI-powered talent management platform, to enhance employee upskilling practices at the bank. This collaboration marks a significant step forward in BDB’s ongoing efforts to build internal capabilities that support longterm operational excellence and sustained success.

BDB’s strategic goals for the future centre around expansion, new product introductions, and other priorities aligned with Bahrain’s broader economic vision. Plans for the near to medium term include broadening the spectrum of financial products and developing innovative digital platforms to simplify banking services. The bank is also improving its advisory and funding programmes to strengthen Bahrain's entrepreneurial landscape. At the same time, it continues to invest in state-of-the-art fintech innovations to improve operational efficiency and extend its competitive edge in an evolving market landscape.

As it looks to the future, BDB will continually seek new alliances with both local and international stakeholders to drive collaborative efforts in innovation, sustainability, and inclusive economic progress across the Kingdom.

Green banking, has transformed itself from a niche concept to a central strategy for financial institutions

IF CORRESPONDENT

Green Banks are known as mission-driven institutions that use innovative financing to accelerate the transition to clean energy and fight climate change. These institutions are supposed to care more about deploying clean energy than maximising profit. It actively develops a pipeline of clean projects and seeks out opportunities in the market.

All Green Banks have the mission to address climate change, though many also have additional objectives, such as improving resiliency or addressing underserved markets.

With the mission of combating the impacts of climate change becoming the new normal in the 21st-century socio-economic setup, the financial sector has become a pivotal force in driving sustainability. Banks, too, are aligning their lending, investment strategies, and product offerings with environmental, social, and governance (ESG) objectives.

While ESG has become integral to achieving global net-zero carbon emissions, green banking, on the other hand, has transformed itself from a niche concept to a central strategy for financial institutions aiming to support the green transition and safeguard the planet.

Becoming "Green Banks" has become the policy imperative for 21st-century financial institutions. Take HSBC, for example, which has made a bold commitment to align its portfolio with the Paris Agreement’s goal of netzero financed emissions by 2050. The London-headquartered bank in 2024 made significant strides on the ESG front.

Prominent among them was the collaboration with Google Cloud, as part of which new initiatives were launched to support the burgeoning climate tech sector. This partnership, particularly through the Google Cloud ReadySustainability (GCRS) programme, will offer tailored financial products and services in the United States and the United Kingdom, designed to propel the growth of innovative startups.

In 2024, HSBC also partnered with Dun & Bradstreet (D&B), a global provider of business decision data and analytics, to support Hong Kong businesses in enhancing their resilience and competitive edge through environmental, social, and governance (ESG) reporting.

Last but not least, HSBC’s Hong Kong division partnered with Cathay Pacific and biofuels platform EcoCeres started a new initiative aimed at helping to decarbonise air travel by supporting the use of sustainable aviation fuel (SAF) in the Chinese administrative region.

Source: Wiley Online Library

HSBC will now purchase 3,400 tonnes of SAF produced by EcoCeres for use by Cathay Pacific on flights departing from Hong Kong International Airport. The transaction marks HSBC’s largest SAF purchase to date, and the initiative will support Cathay Pacific’s goal to scale the use of SAF to 10% of its fuel consumption by 2030.

In 2024, German giant Deutsche Bank announced a series of finance and due diligence commitments aimed at strengthening its ocean protection policies, including the implementation of a freeze on direct financing of deep-sea mining projects.

The new announcement forms were part of Deutsche Bank's commitment to the BackBlue initiative. Backed by the United Nations (UN) and led by the blue economy-focused organisation the Ocean Risk and Resilience Action Alliance (ORRAA), the Blue Finance Commitment

(BackBlue) initiative was launched in 2021 to incorporate ocean considerations in finance and insurance decisions.

In Asia, too, ESG is rapidly capturing the attention of financial institutions and governments. Across the continent, a number of new regulations were introduced recently, increasing scrutiny of corporate operations. China announced in 2024 that listed companies would be required to publish sustainability reports by 2026. A similar rule for reporting is already in place for companies on the Hong Kong Stock Exchange.

Singapore, too, took steps with the creation of the Green Finance Industry Taskforce (GFIT). The GFIT is divided into workstreams, with focuses on developing a taxonomy with clear sustainability objectives, improving environmental risk management, and supporting green financing solutions.

In response, banks operating in Asia are now becoming innovative in their way of supporting their clients in their environmental, social, and governance goals, tying the products and services they offer to environmental targets. Standard Chartered launched an ESGlinked cash account for their corporate banking clients, tying the interest rates and fee pricing to the company’s performance.

According to Elizabeth Girling, head of sustainable finance products and frameworks at Standard Chartered, the accounts will incentivise clients at the organisational level to work sustainability into their treasury management arrangements.

As companies began to focus on their Scope 3 emissions (which track the indirect carbon emissions throughout the length of a company’s value chain), banks are developing products to support their

decarbonisation goals.

Uzayr Jeenah, partner at McKinsey, noted that DBS has supported fashion retailer H&M in developing financing tools to assist with the decarbonisation of their supply chains. H&M’s suppliers are now able to access financing via DBS and technical support from sustainability consultant Guidehouse to reduce their climate impact through initiatives like upgrades to factories.

Jeenah termed these initiatives, which are focused on value creation, as ones that go beyond the trend of “green lending for the sake of green lending" and are driven by the corporate customer base, which has become increasingly demanding evidence of their net-zero progress.

The Banker reported that the "banks are being further assisted in gaining greater oversight of the companies across a value chain by the integration of datarich messaging systems, which increase transparency and accountability."

Jeenah also pointed to the move from MT standards to ISO 20022 standards used in transaction messaging, saying it will “unlock use cases," such as decarbonising the supply chain. Through these messages, greater detail is given on the recipient of funds, allowing for further traceability along a supply chain and across borders.

As per June 2024 research titled “Sustainability Reporting for Banks: The Climb Starts Here,” The London Institute of Banking & Finance (LIBF) noted that sustainability is becoming a key focus area in the financial sector of the MENA (Middle East and North Africa) region, driven by regulatory frameworks, market demand, and technological advancements.

Initiatives like the "Unified ESG Metrics for GCC Listed Companies" and national sustainability agendas

in the UAE and Saudi Arabia are setting standards for transparency and comparability.

"Consumer and investor pressure for sustainable financial products is pushing banks to integrate ESG principles into their strategies. The rise of green bonds, sustainable loans, and FinTech solutions is further advancing the sector’s commitment to environmentally and socially beneficial projects. Moreover, partnerships with educational institutions like the London Institute of Banking & Finance (LIBF) are enhancing the knowledge and capacity of financial professionals in ESG practices," the study noted.

Financial institutions are strengthening corporate governance and ethical leadership to support sustainability goals. Leadership commitment and enhanced governance structures have become crucial for driving the sustainability agenda. Regional partnerships and

the adoption of global benchmarks are promoting best practices and improving local sustainability efforts.

Additionally, there is a growing emphasis on comprehensive and transparent ESG reporting, financial inclusion, and social impact investments. By diversifying investment portfolios towards sustainable assets and regularly assessing their environmental and social impacts, the financial sector in MENA aims to achieve long-term risk management and positive social outcomes.

ESG has become even more important in MENA, considering it is a region vulnerable to environmental challenges. According to a report by the World Economic Forum, temperatures here rise twice as fast as the global average.

This harsh reality calls for an urgent pivot to sustainable practices, which extend well into the finance space. In early 2023, PwC identified green financing as a key economic theme to watch. Green finance focuses on raising funds to tackle environmental problems, such as reducing emissions, climate change, and restoring biodiversity. It is part of sustainable finance, a broader approach that involves considering ESG factors in investment decisions.

In the MENA model of green finance, we have green bonds, which, issued by governments or private companies, are a kind of loan created to fund projects that help the environment. Green sukuk is similar to a green bond, while remaining compliant with Islamic law. According to OECD (The Organisation for Economic Co-operation and Development) data from 2020, the region has consistently received between $2 and $3 billion each year in climate finance since 2012.

"While the inflow of climate finance has been steady, it falls short of meeting the region’s demands, prompting several

MENA countries to innovate and expand their green finance mechanisms. After all, green finance offers vital opportunities for the region, especially those belonging to the Gulf Cooperation Council (GCC).

An analysis by Strategy& revealed that by 2030, green investments in six major GCC industries could significantly boost the economy. These investments could contribute up to $2 trillion to the cumulative GDP, generate over 1 million jobs, and attract foreign direct investment (FDI)," reported The Middle East Economy.

Closing the financial gap in MENA’s transition toward a more sustainable economy, governments in this part of the world have begun enacting laws and regulations driven by sustainability goals. Take the UAE, for example, where the Securities and Commodities Authority mandates that public joint-stock companies on the Abu Dhabi Exchange or Dubai Financial Markets issue an annual sustainability report. Such an initiative aims to boost investor confidence and

ensure companies disclose and manage important ESG factors effectively.

The year 2023 marked a significant surge in green social, sustainable, and sustainability-linked bonds (GSSB) issuances in the MENA region. Total sales reached a new high of $24 billion, equivalent to a 155% increase from the previous year. Leading the way were the UAE and Saudi Arabia. Together, these two powerhouses accounted for 77% of the total issuances in MENA. Egypt also made a mark with the Green Panda Bond, the first from the region to be issued in China. It raised RMB 3.5 billion to fund public transit projects and received a partial guarantee from the Asian Infrastructure Investment Bank (AIIB).

The same year also turned out to be an important one for green sukuk in the region, as Islamic issuances made up more than a quarter of the total regional output for the first time. MENA also dominated the global market in green sukuk, achieving sales of around $6.5 billion.

In 2024, MENA further solidified its position in the global green finance market. While Oman introduced a sustainable finance framework, this allowed for the issuance of various financial instruments, including green bonds and sukuk, to fund renewable energy projects.

The Saudi Ministry of Finance also unveiled its Green Financing Framework, a detailed plan supporting projects across clean transportation, renewable energy, and climate change adaptation. Fitch Ratings projected that ESG sukuk would exceed $50 billion globally within two years.

The end of Q1 2024 marked a significant milestone, with ESG sukuk reaching $40 billion, demonstrating a year-on-year growth of 60.3%. Saudi Arabia and the UAE further consolidated their positions at the forefront of this growth, holding the largest shares of Fitch-rated ESG sukuk — 45% and 33%, respectively.

Businesses are now realising that integrating sustainability into core operations is not just about fulfilling social responsibility, but is also critical to long-term business viability. However, these commitments come with significant risks, particularly for banks with substantial exposure to high-emission sectors like energy and mining.

financing green transitions opens new growth avenues and positions them as leaders in the future of green finance.”

For banks, the green transition requires a fundamental rethinking of traditional business models, where profitability and sustainability are no longer mutually exclusive. Instead, they are interdependent. As demand grows for sustainable products and investments, financial institutions that successfully integrate ESG factors into their business strategies will outperform their competitors, both in terms of market share and profitability.

This shift, however, comes with its challenges. Banks must address risks associated with greenwashing and navigate complex regulatory frameworks, which pose significant obstacles in balancing profitability with sustainability commitments. To tackle this multifaceted landscape, financial institutions are creating new financial products, utilising innovative technologies, and investing in transparency and data verification to achieve their financial and sustainability objectives.

When it comes to developing and deploying green financial products, banks are employing strategies like green bonds, sustainability-linked loans (SLLs), and ESG-focused instruments, which are at the forefront of this financial innovation. These products enable banks to fund projects that support sustainability objectives while maintaining strong financial performance.

The global green bond market, for example, has seen exponential growth in recent years, reaching hundreds of billions of dollars in annual issuances.

He said, “Sustainability-linked loans and green bonds are essential in meeting the growing demand for sustainable investments. They offer performancebased financing that encourages companies to meet their ESG targets while maintaining financial viability.”

However, despite green financial products holding some potential, challenges remain. Banks must manage the reputational risks associated with accusations of greenwashing (companies falsely claiming to meet ESG standards) and navigate an evolving regulatory environment. Frameworks like the "EU Green Taxonomy" and the UK’s "Sustainability Disclosure Requirements" (SDR) demand that banks provide detailed ESG data and ensure that their products align with sustainable finance principles.

Banks now require robust systems for collecting and verifying ESG data. Without transparent and measurable outcomes, these financial institutions also risk losing credibility and investor confidence.

"Reducing exposure to carbonintensive industries can weigh on shortterm profitability, but financing the shift to a low-carbon economy presents enormous long-term opportunities," said Peter Panayi, Head of Global GoTo-Market at BuildingMinds, while explaining, “Banks are finding that while reducing exposure to carbon-intensive sectors may affect short-term profits,

Rajul Sood, Managing Director and Head of Banking at Acuity Knowledge Partners, highlighted the importance of data in this process, as he said, “Banks monitor green loans through impact reports and key metrics, such as renewable energy projects financed, energy efficiency improvements, and carbon emissions reductions. This data is essential for ensuring that investments are both financially sound and aligned with sustainability goals.”

The issue of greenwashing has become a significant concern for banks and their stakeholders. Greenwashing is a phenomenon where companies/financial institutions exaggerate or falsely claim their environmental credentials to attract capital. Regulatory bodies are tightening the rules around sustainable finance BANKING AND

Richard Bartlett, co-founder and CEO of GreenHearth, a fintech focused on financing renewable energy projects, shared his thoughts about the increasing importance of these products.

to ensure transparency and prevent misleading claims. The EU’s Green Taxonomy, for instance, now provides a clear framework for what constitutes a ‘green’ investment, making it more difficult for institutions to claim green credentials without substantiating them.

In the United Kingdom, the Sustainability Disclosure Requirements (SDR) aim to increase transparency around ESG reporting.

However, Bartlett notes that the UK lags behind the European Union in implementing comprehensive regulatory frameworks.