EDITOR’S NOTE

EDITOR’S NOTE

Once viewed largely as an industrial base or a developing consumer market, the Asia-Pacific (APAC) region is now emerging as the driving force behind global economic growth over the next 15 years. Home to approximately 4.3 billion people and contributing over 60% of global output, APAC is undergoing a profound transformation powered by four major forces: rapid urbanisation, accelerating digital transformation, growing investments in green infrastructure, and shifting demographics.

This dynamic mix gives the region a unique advantage. With a combination of young, fast-growing labour markets, thriving technology centres, hyperconnected megacities, and cutting-edge innovation in digital finance, APAC is uniquely positioned to shape the next era of global economic development.

In 2025, the financial world witnessed a defining moment. Warren Buffett, the legendary "Oracle of Omaha," officially stepped down from his role at Berkshire Hathaway. Under his leadership, the conglomerate grew into a $1.18 trillion enterprise. It became famed for its disciplined long-term investment philosophy and consistent decision to reinvest earnings rather than distribute dividends. His retirement marks the end of an era and leaves a legacy that will continue to influence generations of investors.

Meanwhile, digital-only financial institutions such as neobanks and challenger banks are revolutionising the financial services sector. They are rebuilding the banking system from the ground up. By harnessing emerging technologies and placing user experience at the forefront, they are transforming the way individuals and businesses interact with money.

The cover story of the July 2025 edition of International Finance features the National Real Estate Registration Services Company (RER), a Saudi enterprise wholly owned by the Kingdom’s Public Investment Fund. Aligned with Vision 2030, RER helps drive economic diversification and sustainable growth in Saudi Arabia.

JULY 2025

VOLUME 25

ISSUE 50

editor@ifinancemag.com www.internationalfinance.com

RER LEADS SAUDI REAL ESTATE’S DIGITAL REVOLUTION

RER aims to build and update a database of all property units within the Kingdom

CHESKY’S 'FOUNDER MODE' IGNITES REVIVAL OF AIRBNB

Airbnb encourages users to plan their trips and discover memorable activities, all within the app

WARREN BUFFETT: THE GENIUS BEHIND MARKET MASTERY

Warren Buffett’s guidance helped Berkshire navigate many economic booms and recessions

CAN OPENAI’S IDEALISM SURVIVE CORPORATE CHANGE?

OpenAI’s leadership argues that staying ahead in AI requires access to far greater funding

'MONEX USA PRIORITISES SEAMLESS, FASTER PAYMENTS'

Monex USA's existing technology stack, built on years of investment, was wellprepared for RTP implementation

SAUDI VISION 2030 GOES TO SEA

Saudi Arabia’s maritime investments are poised to reshape global trade logistics, offering new trade routes and boosting economic growth

BUSINESS DOSSIER

Masah drives Riyadh's eco-friendly construction boom 68 SHWE Bank: Leading Myanmar's financial growth

Rakeez Capital powers Saudi business growth 100 The Clock Towers Complex facilitates pilgrim journey

Advisors

Director & Publisher Sunil Bhat

Editorial

Prajwal Wele, Agnivesh Harshan, CL Ramakrishnan, Prabuddha Ghosh

Production Merlin Cruz

Technical Team Prashanth V Acharya, Bharath Kumar

Business Analysts

Alice Parker, Indra Kala, Stallone Edward, Jessica Smith, Harry Wilson, Susan Lee, Mark Pinto, Richard Samuel, Merl John

Business Development Managers

Christy John, Alex Carter, Gwen Morgan, Janet George

Business Development Directors

Sid Jain, Sarah Jones, Sid Nathan

Head of Operations Ryan Cooper

Accounts Angela Mathews

Registered Office INTERNATIONAL FINANCE is the trading name of INTERNATIONAL FINANCE Publications Ltd 843 Finchley Road, London, NW11 8NA

Phone

+44 (0) 208 123 9436

Fax +44 (0) 208 181 6550

Email info@ifinancemag.com

Press Contact editor@ifinancemag.com

Associate Office

Zredhi Solutions Pvt. Ltd. 5th Floor, Sai Complex, #114/1, M G Road, Bengaluru 560001

Ph: +91-80-409901144

As operational and geopolitical developments put its margins to the test, low-cost airline Wizz Air will suspend all locally based flight operations out of Abu Dhabi. The Hungarian company will close its Abu Dhabi hub in September 2025 in order to concentrate on its core markets in Central and Eastern Europe. Wizz CEO Jozsef Varadi wants to compete with Europe's biggest airline, Ryanair, while pursuing better profits. The CEO said that the company had been underinvesting in the market over the past few years, but could now return to the full spirit of continuously exploiting it. Wizz has ordered 280 aircraft from Airbus, most of which will be deployed in Europe, which accounts for about two-thirds of the airline’s business.

Intel is reportedly preparing to launch its enthusiast-class Nova Lake-AX processor in 2026. Designed for highperformance laptops and desktops, this new SoC will feature up to 52 cores, advanced Foveros packaging, and a powerful Xe3 "Celestial" integrated GPU. Nova Lake-AX is anticipated to be a direct competitor to AMD's Strix Halo APUs. While AMD's offerings set a high bar, Intel aims to challenge that lead with its next-generation platform.

Top six leading startups and their market share (In Billion US Dollars)

PlayAI, a US-based voice AI startup started and run by Egyptian engineer Mahmoud Felfel, has been purchased by Meta. Mahmoud and Hammad Syed co-founded PlayAI in 2020 after Mahmoud graduated with a Bachelor of Engineering from Mansoura University in Egypt in 2012. Before launching the voice AI startup in the United States, the two had previously collaborated as software engineers at the classified website Dubizzle. PlayAI has created what it calls "the voice of intelligence," and its flagship product, Play Dialog, is a conversational AI first.

A surge in dealmaking boosted investment banking, and tumultuous markets drove record revenue in Goldman Sachs’ equities division, resulting in a record Q2 profit. The findings reflect a growing trend of Wall Street trading desks being boosted by market turbulence as investors realign holdings to mitigate tariff-related risks. LSEG estimates the investment bank’s equity revenue increased 36% to $4.3 billion, exceeding analysts’ expectations of $3.6 billion. Revenue from fixed income, currencies, and commodities came to $3.47 billion, 9% more than the previous year.

Source: StartupBlink

mordorintelligence.com

Activity in the United Kingdom's construction sector fell in July 2025 at the sharpest rate since the height of the COVID pandemic amid a collapse in housebuilding, underscoring the challenge facing the Labour government to meet its 1.5 million new homes target. The data provider said a sharp drop in residential

building pulled down its monthly PMI for the British construction sector, alongside a plunge in civil engineering and a downturn in commercial property. The survey will be carefully monitored by the Treasury and the BoE to determine the next step, as the pressure mounts on Chancellor Rachel Reeves.

ANDREW FORREST FORMER CEO OF FMG Andrew Forrest lashed out at the Australian Tax Office, accusing it of being aggressive, unreasonable in its tax guidance, and not legally robust in administering the law

FRANCIS DUFAY CEO OF JUMIA Francis Dufay's company, Jumia, is back in the spotlight as Pan-African telecommunications provider Axian Telecom announces its acquisition of an 8% stake in the company

SCOTT FARQUHAR

FORMER CEO OF ATLASSIAN According to a recent SEC Form 4 filing, businessman Scott Farquhar sold 7,665 shares of Class A Common Stock on July 14, 2025, under a pre-arranged Rule 10b5-1 trading plan

Bahrain is expected to engage with Oracle and Cisco, with plans to replace Chinese servers with Cisco products

Turkey is a significant market due to its sizable and technologically savvy populace

The Crown Prince of Bahrain met with President Donald Trump to discuss trade, Iran, and regional security issues, while announcing plans to invest over $17 billion in the United States. The plan also called for the Gulf nation to enter into an agreement valued at about $7 billion for its national airline, Gulf Air, to purchase 40 General Electric engines and 12 Boeing aircraft with an additional six-aircraft option.

Crown Prince Salman bin Hamad Al Khalifa said, "We're very happy to be announcing $17 billion worth of deals that are coming to the United States. And this is real. These aren't fake deals."

Prince Salman announced this during a visit to the Oval Office, following Trump's foreign investment agreements from a May 2025 trip to the Middle East. Trump agreed to sell the Saudis an arms package valued at almost $142 billion while in Riyadh, and he also got Saudi Arabia to commit $600 billion to invest in the world's largest economy.

Bahrain, home to the US Navy's Fifth Fleet, has emerged as a significant security ally. It forged relations with Israel in 2020

through the Abraham Accords, which were mediated by Washington and partly motivated by common concerns about Iran. Trump's trade policies impose a baseline 10% tariff on Bahrain's exports, but they are exempt from the higher levies applied to exports from other nations.

The new Bahrain deal will support 30,000 American jobs and was secured with help from Trump and Commerce Secretary Howard Lutnick. The Gulf country is expected to engage with Oracle and Cisco, with plans to replace Chinese servers with Cisco products.

Bahrain also seeks to increase its investments in American energy, tech, and manufacturing sectors. The Crown Prince intends to deploy capital to increase US domestic aluminium production, invest in LNG production to secure energy supplies, purchase cutting-edge AI chips, and partner with US hyperscalers.

The King of Bahrain will visit Washington to finalise these agreements and solidify the progress made in building the two nations' economic prosperity.

The Trendyol Group of Turkey, Baykar CEO Haluk Bayraktar, Abu Dhabi's sovereign fund ADQ, and Ant International announced that they have reached an agreement to investigate the possibility of a joint fintech venture that would provide digital financial services in Turkey.

An MoU was signed by the four parties to create a platform that would offer digital payments, loans, deposits, investments, and insurance, among other services. According to the companies, the platform will target small businesses and individuals, with a special emphasis on Trendyol's seller network.

As per Bayraktar, who is best known for leading Turkey’s top drone manufacturer, the project will rely on domestic infrastructure and strive for high security standards.

While Mansour AlMulla, the deputy CEO of ADQ, highlighted Turkey's growth potential in the digital economy, Alibaba Group President Michael Evans, speaking on behalf of Trendyol's primary investor, said the partnership demonstrated interest in the country's digital economy.

According to Ant International, Turkey is a significant market due to its sizable and technologically savvy populace, though the companies did not disclose a projected investment size. The development comes when the country's fintech sector is showing signs of rapid growth.

One major fintech success story has been Dgpays, a Turkish financial technology firm, that doubled its valuation following significant investment from the European Bank for Reconstruction and Development (EBRD) and Truffle Capital. This marked one of the largest international investments in Turkey’s fintech sector.

In February, Mundi, another fintech making capital market products and investment opportunities accessible to Turkish SMEs, raised a $2.5 million seed round led by Speedinvest and DeBa Ventures.

By collaborating with intermediary partners, Mundi is helping Turkish small and medium enterprises automatically manage their savings through overnight savings accounts, mutual funds, and repo products.

Volvo is among the automakers most vulnerable to rising tariffs

Citigroup has hinted that it might launch its own stablecoin

Volvo pauses US car sales amid tariff fallout

Volvo Cars has reduced its range of US models this year, becoming one of the first large automakers to stop its American shipments as President Donald Trump's auto tariffs have started taking their toll on the industry. Geely Holding, a Chinese company which owns the Swedish automaker, is now removing sedans and station wagons from its US lineup amid declining demand. Volvo is among the automakers most vulnerable to rising tariffs because the majority of its vehicles are made in China or Europe. Tariffs of 27.5% on European cars and over 100% on Chinese imports have forced automakers to rethink strategies, with Aston Martin limiting American exports and Nissan suspending US production of Canadian-bound cars.

Kuwait tightens hold on foreign property access

To organise Kuwait's real estate market and improve the investment environment, a draft decree has been submitted by the Ministry of Justice to the Fatwa and Legislation Department regarding controls on property ownership by foreigners through companies listed on the Boursa Kuwait and real estate funds. The Council of Ministers has yet to approve 7/2025, which governs real estate ownership. Striking a careful balance between luring organised real estate investment, preserving the demographic composition, and prohibiting the exploitation of residential properties for investment or commercial purposes alone is the goal. The decree maintains the real estate privileges accorded to their citizens.

Jane Fraser, the CEO of Citigroup, has hinted that the company might launch its own stablecoin to help with digital payments. She stated that they were considering issuing a Citi stablecoin, but of course, the tokenised deposit space was where they were most active. She added that this was a favourable chance for them. Fraser noted that the thirdlargest US lender is looking into stablecoin reserve management and crypto asset custody options. After Citigroup announced that it would repurchase at least $4 billion worth of stock and reported second-quarter results that exceeded Wall Street projections, the bank's shares monetarily reached their highest level since the 2008 financial crisis.

Microsoft has teamed up with the Idaho National Laboratory (INL) to investigate the application of AI in the US nuclear power plant permitting process. The project uses Microsoft's AI to create engineering and safety reports based on previous license applications. Users will be able to edit and improve the content produced by AI. INL's deputy division director for nuclear safety and regulatory research, Scott Ferrara, stated that the technology could also increase the amount of energy produced by current nuclear plants. The AI could help facilities prepare requests for license amendments to increase power generation. This effort is part of a broader push to speed up nuclear permitting using advanced technologies.

Wages in the hospitality sector rose sharply, with hotels and restaurants increasing staff pay by 8.5% in the year to April

The Bank of England (BoE) faces a challenge: managing inflation and guiding the economy, particularly after recent data indicated that starting salaries in the UK have increased at their fastest rate in nearly three years.

According to the latest figures from job search platform Adzuna, the average advertised salary hit £42,278 in April 2025, a rise of 8.9% year-onyear, marking the steepest annual increase since June 2022. Every month, salaries rose by 0.75%, further complicating the central bank’s efforts to justify additional interest rate cuts.

The BoE had been hoping for a clearer signal that inflationary pressures were easing before committing to a series of rate cuts in the second half of 2025

The Monetary Policy Committee (MPC) of the Bank of England is now witnessing its key members, including the Bank’s chief economist Huw Pill, expressing concern about elevated wage growth, warning that loosening monetary policy too quickly could reignite inflationary pressures.

According to Adzuna, vacancies rose slightly by 1% year-on-year to 862,876, but were down 0.95% compared to March, suggesting a mixed picture for hiring momentum.

What's going on?

Sectors seeing the strongest demand for workers included healthcare, which hit its highest vacancy

level since January 2023, as well as hospitality, logistics, teaching, and retail. The construction and trade sectors recorded a sharp 15.2% decline in vacancies, reflecting cooling activity in those industries.

The BoE had been hoping for a clearer signal that inflationary pressures were easing before committing to a series of rate cuts in the second half of 2025. However, April’s inflation surprise, which saw the consumer price index jump to 3.5%, up from 2.6% in March, has prompted fresh caution.

Although the ONS reported a slight slowdown in overall wage growth, down to 5.6% in Q1 from 5.9% in Q4, starting salary trends suggest that employer competition for skilled staff remains high, particularly in regions with labour shortages. The MPC has a dilemma: to stay with rate reductions to stimulate growth, or pause to prevent an inflationary rebound.

A Chartered Institute of Personnel and Development (CIPD) study paints a different yet painful picture.

The report, titled "Labour Market Outlook – Spring 2025," found employer confidence declining again this quarter, with the net employment balance falling to +8 — the lowest level recorded outside of the pandemic. Hiring intentions have softened, and one in four employers now plan redundancies, rising to 27% in the private sector.

Rising employment costs, including increases

in National Insurance and the National Living Wage, are forcing many organisations to scale back recruitment, limit training investment, and consider price increases. Uncertainty around the Employment Rights Bill and global events adds to employers’ caution.

"The further softening in employment in April suggests businesses continued to respond to the rise in business taxes and the minimum wage by reducing headcount," said Ruth Gregory, deputy chief UK economist at Capital Economics.

She also stated that despite a deceleration in wage growth, it remained relatively strong, meaning the Bank of England will remain cautious over future interest rate cuts.

For BoE, the key concern is that if earnings grow quickly, firms will seek to push up prices, thereby putting up the inflation rate.

As per Gregory, sticky wage growth (a situation where wages do not immediately adjust up or down in response to changes in labour market conditions) may mean the bank remains uneasy about inflationary pressures in the near term.

The Bank of England has noted that wages have

quietly continued to rise, raising concerns that this could indicate a seismic and more long-lasting shift in the relationship between workers and employers. In May, the European country announced its public sector pay awards, which were higher than ministers had previously said they could afford and outstripped higher-than-expected inflation.

Still, it failed to please the disgruntled doctors. In fact, the latter threatened to protest against the new pay structure. After teachers were awarded a 4% increase, teaching unions also responded angrily to the Keir Starmer government’s refusal to fully fund the deal and warned that it would damage the quality of education that pupils received. The largest union plans to take the first step towards possible industrial action.

The decision to award 1.4 million NHS staff, including nurses, midwives and ambulance workers, a smaller rise (3.6%) also met with anger. The Royal College of Nursing (RCN) said it was “grotesque” to hand doctors a bigger increase than nurses who earned less than them.

Wes Streeting, the health secretary, and Bridget Phillipson, the education secretary, sought to defend the rises by highlighting that they represented the second time public sector personnel had received

above inflation pay rises since Labour took power in 2024.

Are we seeing a 2022 scenario being played out all over again? Back then, inflation not only rocketed, it led to a situation where, in a desperate scramble to keep pace with rising prices to protect their incomes, British private and public sector workers took widescale industrial action in a way that brought back memories of the 1970s. What followed was a series of pay deals thrashed out between bosses and employees, with unions often arguing they had been due pay increases for years.

When considering the British private sector, relations between bosses and the rank and file have already been redefined by a shift towards remote working caused by the COVID-19 pandemic, and then companies’ increasing insistence on more regular attendance at work. Despite the volatile background, Threadneedle Street policymakers now ask whether the wage increases indicate that the power balance has moved back in the direction of workers, allowing them to protect their finances.

Data from the Office for National Statistics (ONS) has gone some way to justifying the BoE view.

According to payroll data from the ONS, wages in the hospitality sector rose sharply, with hotels and restaurants increasing staff pay by 8.5% in the year to April, well above the 3.5% inflation rate.

Retail workers also saw gains, with median pay rising by 6.9% over the same period. Across the economy, average wage growth reached 6.4%.

Recently, BoE chief economist

Huw Pill said the UK’s labour market was becoming less flexible, suggesting employers were no longer able to freely hire and fire as they once could. Businesses, charities and public sector organisations have been laying off staff and freezing job adverts, but those staff who stay behind are well rewarded.

Ben Caswell, an economist at the National Institute of Economic and Social Research (NIESR), said, "Wages adjusted for inflation have returned to where they were before the cost of living crisis began in 2021. And the share of overall national income that is secured by workers rather than firms has also recovered to 2021 levels. While the average pay figures disguise many

winners and losers, the aggregate figure showed most workers had benefited from inflation-busting pay rises to recover lost ground."

He also focused on a slightly less up-to-date measure of pay based on employees’ average regular earnings over a rolling three-month period. This showed a rise in Great Britain that was still well above inflation at 5.6% in January to March 2025, though not as much as the PAYE data shows.

Caswell sees a series of minimum wage increases, closing the gap with the average wage, which is likely to fuel further pay rises as companies attempt to maintain a significant difference between the salaries of those on the bottom rung and the semi-skilled workers and middle managers above them.

Average growth of weekly earnings in the United Kingdom compared with the CPI inflation rate from January 2025 to May 2025 (In Percentage)

James Smith, research director at the Resolution Foundation, said that the weakening economic outlook worked against a prolonged recovery in pay.

He noted, “If we believe that wages consistent with the Bank of England’s 2% target would be about 3.5%, then we are well above that level at the moment. And that would give the Bank good reason to be cautious about cutting interest rates. However, other pay surveys are showing earnings rising at a much slower rate, so the official figures might be a bit like Wile E Coyote and about to be brought down to earth.”

Emphasising the likely shortterm nature of the current bumper pay rises, the bank’s regional agents say employers are limiting pay rises to between 3% and 4% by the end of 2025. The Starmer government is not planning to pay more than 4% to public sector workers on average, and more departmental budget squeezes may be coming up.

Talking about other industries, take the hospitality sector, for example, which is known to

employ a high proportion of minimum wage workers, and the same applies to the retail industry, boosting pay in 2025.

Senior journalist Phillip Inman claimed that most likely not next year or the year after, the legal minimum salaries will start rising more slowly.

Seemanti Ghosh, principal economist at the Institute for Employment Studies, sees the significant return to office-related demands from the companies as direct evidence of worker power reaching its limits. There has also been a gold rush for digital skills, which will result in another paradigm shift in the labour market.

Employers had to pay higher wages this time around, as they needed to retain skilled staff and pay them more while they embarked on a search for workers who were more adaptable in an ever-changing work environment.

“If wage increases are not driven by negotiations with unions, then they are due to employers wanting to hang on to skilled staff. This matters for all companies that increasingly rely on soft skills for

things like project management and tech skills in other areas. We also see it in the green sector, where there is a shortage of people with the skills the industry needs,” Seemanti remarked.

How much of this dislocation is systemic and will keep wages higher for longer will be a subject of debate for the rest of the year. Pill advocated for keeping interest rates elevated while the trends become clearer, believing there is less damage from higher rates than letting inflation run away again.

Other MPC members disagree, arguing that businesses cannot invest in skills training while borrowing costs are prohibitively high.

It reflects a starkly different view of the labour market, one that emphasises the lasting damage caused by rising job losses and prolonged economic stagnation.

Swati Dhingra and Alan Taylor want rates to come down quickly. Who wins the argument inside the central bank could dictate whether workers or bosses have the whip hand in the great tussle over pay.

Chips have become the new oil, with control over them reshaping the global balance of power in the 21st century

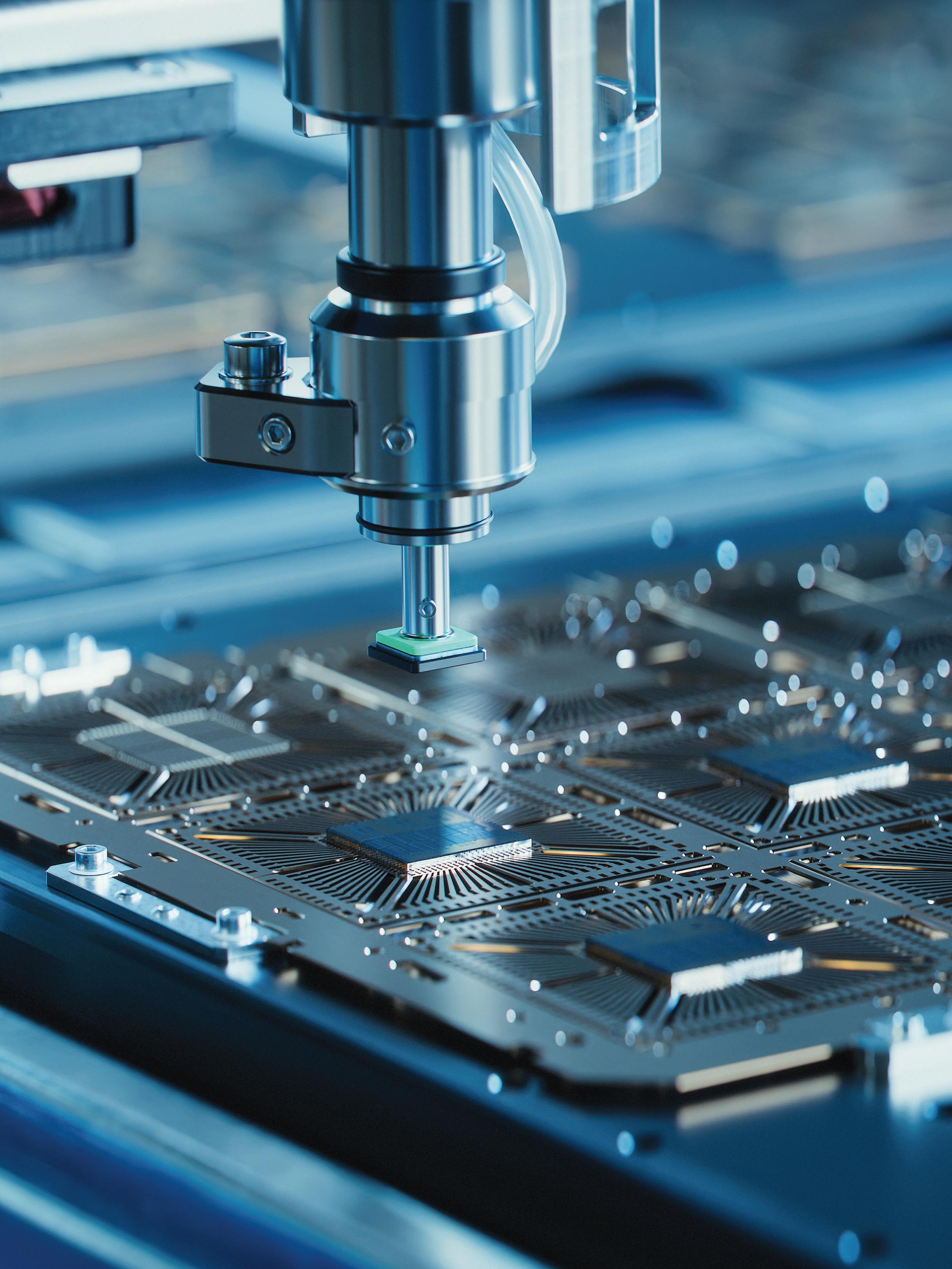

The fight for dominance in semiconductors, the “chips” powering everything from smartphones and cloud servers to military systems, has become the centrepiece of global economic and geopolitical competition. In what’s now called the chip war, the United States and China face off in a high-stakes rivalry, with Taiwan’s unlikely dominance making it the third pillar of this new era. Semiconductors, a half-trillion-dollar industry expected to double by 2030, are the linchpin of AI innovation, military power, and global economic clout.

International Finance unpacks how Taiwan emerged as a chipmaking powerhouse, the US bid to reclaim manufacturing, and how Washington’s export bans and China’s countermoves are reshaping the global economy. Along the way, we bring insights from industry leaders and policy experts on the economic fallout and the future of the silicon struggle.

Global semiconductor supply

Just 100 miles from China’s coast, Taiwan’s TSMC (Taiwan Semiconductor Manufacturing Co.) produces roughly 90% of the world’s most advanced semiconductors. These chips power everything from Apple iPhones and Nvidia AI accelerators to critical infrastructure and defence systems.

Taiwan’s dominance, especially at the smallest transistor sizes, makes it the linchpin of the global tech supply chain: a phenomenon sometimes called the “silicon shield.” The logic is simple. Taiwan’s role in chip supply makes military conflict an economic catastrophe for everyone involved, acting as a deterrent to aggression.

TSMC’s ascent was decades in the making. Founded in 1987 with state support, TSMC pioneered the “pure-play” foundry model, producing chips designed by others and steadily outpacing global rivals.

Today, its technical know-how lets it pack billions of transistors onto fingernailsized chips, years ahead of competitors. Until recently, nearly all these leading-edge chips were made in Taiwan, a concentration that inspires both awe and anxiety.

INDUSTRY

FEATURE

CHIPS SEMICONDUCTORS

On one hand, TSMC is an economic and strategic bulwark for Taiwan, seen as a “sacred mountain protecting the country.” On the other hand, it creates a single point of failure: a natural disaster or geopolitical event could disrupt the world’s chip supply, with devastating consequences.

Policymakers worry about what will happen to TSMC’s “fabs” if China ever attacks or blocks Taiwan. The stakes are enormous: advanced chips are critical for civilian technology and national defence.

Even within Taiwan, there’s anxiety over how much chip technology should be shared abroad. Morris Chang, TSMC’s 91-year-old founder, has called out the dilemma, “The US Commerce Secretary said repeatedly that Taiwan is a very dangerous place [and] America cannot rely on Taiwan for chips… that, of

course, is Taiwan’s dilemma.”

While TSMC is expanding overseas, Chang notes that “in the chip sector, globalisation is dead. Free trade is not quite that dead, but it’s in danger.” His warning is that higher costs and less ubiquity for advanced chips will result if the world splits into competing tech blocs.

Taiwan’s role as a global chip linchpin brings leverage and vulnerability, a reality now pushing others to develop their own advanced chipmaking muscle.

The United States once led the world in chip design and manufacturing. As production shifted to Asia, America’s share of global chip fabrication capacity fell from 37% in 1990 to just 12% by 2020.

Former Commerce Secretary Gina Raimondo summed up the American

predicament by saying that America had “dropped the ball,” allowing Asian rivals to surge ahead. Now, after pandemicdriven supply chain shocks, Washington is determined to “onshore” and “reshore” semiconductor production. But is it working?

A flurry of policies followed, from tariffs and trade pressure to hefty investment incentives. President Donald Trump threatened tariffs to push TSMC and others into building US plants. As a result, TSMC agreed to a $12 billion fab in Arizona, later expanding to a $40 billion project, which marked their first advanced facilities outside Taiwan. These fabs, when fully operational, will produce 4nm and 3nm chips, still trailing Taiwan’s 2nm technology but among the world’s most advanced.

President Joe Biden followed with the CHIPS and Science Act, a $52 billion

package of subsidies, grants, and tax credits designed to “supercharge” US semiconductor manufacturing. This resulted in big investments from both American and foreign firms.

TSMC secured $6.6 billion in US grants for its Arizona plants, Samsung got $6 billion for a new Texas plant, and Micron announced a $100 billion New York megafab. The irony? Onshoring incentives are also benefiting foreign giants, whose rise was built on decades of government support in Asia.

Building a robust domestic chip industry is proving complex. Chip fabs are among the world’s most sophisticated factories, requiring immense precision and years to build. TSMC and Samsung have faced delays, cost overruns, and skilled labour shortages in the US.

Arizona’s TSMC site even had to “import” technicians from Taiwan, causing friction with US labour unions. Making advanced chips takes armies of PhD-level engineers, yet US immigration policies restrict high-skilled talent.

Analyst Marc Einstein notes, “You can’t just magic PhDs out of nowhere.”

Many experts argue that expanding high-skilled visa programmes is essential for the US chip renaissance.

Chip manufacturing is a global ecosystem. An advanced chip may be designed in California and fabricated in Taiwan using equipment from the Netherlands and materials from Japan and Germany.

“No single country can do everything,” says TSMC Arizona president Rosemary Castanares.

Even US fabs rely on $150 million ASML lithography machines from Europe. For now, US-based fabs remain smaller and a technological step behind Asia’s mega-fabs.

Historian Chris Miller calls TSMC’s Arizona plants “a generation behind the

cutting edge in Taiwan,” and much lower in output.

TSMC itself is clear: its most advanced chips, and bleeding-edge R&D, will stay in Taiwan. Arizona’s fabs get slightly older, though still advanced tech.

The US officials might tout reshoring wins, but the centre of gravity remains in Asia. Restoring US chip leadership is a long-term effort, needing not just money and factories but also investment in education, workforce training, and immigration reform.

As Washington tried to onshore chipmaking, it also wielded trade weapons to slow China’s technological rise. The US-China trade war, which started with tariffs in 2018, has increasingly focused on semiconductors as a strategic chokepoint. The Trump and Biden administrations have sought to deny China advanced chips and manufacturing equipment to “protect national security.”

A pivotal moment occurred in October 2022 when Washington enacted stringent export controls. These regulations prevent global companies from selling high-performance chips or chip equipment that utilises US

technology to China without obtaining a difficult-to-secure license.

If a chip was made with US software or machinery, as almost all advanced chips are, exporting it to China is restricted. The rules even bar US citizens from working for certain Chinese firms, choking off a “key pipeline of American talent.”

American officials argue this is essential to prevent “sensitive technologies” from fuelling China’s military modernisation, since advanced chips are dual-use, meaning they power both civilian and military AI.

Beijing calls this “technology terrorism” and has filed complaints at the World Trade Organisation, accusing Washington of abusing export controls. Chinese officials warn that these moves destabilise global supply chains. The impact is very much real. Huawei’s handset business collapsed after US sanctions cut it off from advanced chips.

Other Chinese firms, like memory giant YMTC, have been blacklisted. Even the United Kingdom-based ARM won’t license its latest designs to Chinese customers. Washington’s allies in the Netherlands and Japan have joined in, restricting exports of crucial lithography and chip equipment to China.

China’s initial response was cautious, but it has since weaponised its own dominance in key minerals. In 2023, Beijing restricted exports of gallium and germanium, both vital for chipmaking, and later banned exports of more minerals to the US.

These tit-for-tat moves signal China’s willingness to hit back with strategic materials. China also imposed its own limited bans, such as restricting US firm Micron’s chips from critical Chinese infrastructure.

At home, China has doubled down on self-reliance, pouring tens of billions into its chip sector through national funds and the “Made in China 2025” campaign.

President Xi Jinping calls on China to excel in key core technologies to ensure domestic innovation, thus preventing the country from being hindered by foreign sanctions.

The trade war has forced Chinese firms to seek new markets and supply chain arrangements, but often with slimmer profits.

Meanwhile, allied equipment makers like ASML now face the loss of lucrative Chinese customers, which raises concerns about lost innovation and revenue.

Nvidia CEO Jensen Huang recently blasted US export controls as “backfiring.”

He notes that Nvidia’s share of China’s AI chip market fell from 95% to 50%, with Chinese firms ramping up in-house alternatives. The bans, he says, “have pushed Chinese companies toward home-grown alternatives, spurring Chinese investment.”

Bill Gates similarly says US pressure has forced China to “go full speed ahead” on its own chips.

While some US officials argue these bans buy the West a crucial lead time in military AI, critics warn the strategy may accelerate China’s self-sufficiency and ultimately weaken the American industry.

The Chinese playbook

China has responded to the chip war with a multipronged strategy. At the core: building a self-sufficient semiconductor ecosystem. State-backed funds and national strategies aim to reduce dependence on foreign tech, especially in critical areas like manufacturing equipment and chip design.

Chinese firms have aggressively recruited global talent, including Taiwanese and American engineers, and have sometimes resorted to industrial espionage. The urgency to innovate has only intensified after US sanctions nearly crippled companies like ZTE and Huawei.

One breakthrough occurred in 2023 when Chinese chipmaker SMIC produced a 7nm chip, used in Huawei’s Mate 60 Pro, despite lacking access to the world’s most advanced lithography equipment.

US experts suspect SMIC adapted older machines with multiple patterning to achieve the feat. The phone’s teardown revealed memory chips from South Korea’s SK Hynix, showing that China can still source key components through unofficial channels or stockpiles.

While 7nm lags behind Apple’s 3nm chips, the achievement signals that China can adapt around sanctions, even though it comes at a high cost. Chinese companies are also developing workarounds, like using opensource chip architectures (RISC-V) and clustering less advanced chips to achieve AI tasks. Diplomatic efforts target partnerships with countries like Russia and some in Southeast Asia.

In parallel, China is building its own software and tooling ecosystem to reduce reliance on US and allied IP.

Still, China faces several pitfalls, including corruption in its state funds, persistent dependence on imported materials, and the technological gap in ultra-advanced manufacturing.

Globally, the chip war is creating a bifurcated tech order. There is a US-led bloc with strict controls and the most advanced chips, while a China-centric sphere relies on indigenous innovation and sometimes older technology.

Countries such as those in Europe, India, and Japan are now pursuing domestic manufacturing as a strategic objective. The aim is to avoid dependency on a single foreign supplier.

The US-China semiconductor standoff has global ramifications. Allies, from Europe to Japan and India, are launching their own chip initiatives to bolster supply chain resilience. The European Union’s Chips Act aims to double Europe’s production share by 2030.

Japan is subsidising TSMC’s new Kumamoto plant; India, pitching its lowcost labour and market scale, is working to attract chipmakers despite obstacles like land acquisition and water supply. All these moves indicate a shift since countries want to reduce overreliance on any one supplier.

The balancing act is delicate for Asia’s chip powerhouses such as Taiwan, South Korea, and Japan. While they are US security partners, they rely heavily on China for a significant portion of their chip exports. With extensive operations in China, Korean giants Samsung and SK Hynix have even required waivers from US regulations.

TSMC, while benefiting from the US “friendshoring,” is careful not to sever links with Chinese customers. Diversification, by building plants in the United States and Japan, hedges bets against both geopolitics and American pressure.

A major unintended consequence is tech ecosystem fragmentation. If the world splits into separate tech stacks, innovation could slow (due to

duplication and lost scale), but could also spark alternative breakthroughs. If denied access to leading-edge chips, the Chinese firms might focus on alternative architectures or software innovations.

The US and its allies, wary of supply chain risk, are building redundancy at a higher cost. A Boston Consulting Group study estimates that a full USChina semiconductor split could cost US companies $80 billion in lost revenues and $20 billion less R&D annually. Despite these costs, there is hope that competition will spur next-generation innovation, including quantum chips, new materials, and more resilient supply chains.

Governments everywhere are pouring money into chip R&D, education, and mature-node production for critical industries like autos and defence. Recent chip shortages made clear that even older chips are vital.

AI is front and centre in this fight. US restrictions aim to hold back China’s AI progress by limiting access to the

most powerful GPUs. In the short term, it’s working, as Chinese companies are scrambling to adapt.

But software-side innovation and hardware workarounds are likely. If anything, scarcity may force efficiency and new approaches to AI development. In the long run, stifling hardware access may backfire by spurring domestic breakthroughs in China and elsewhere.

The chip war also raises fundamental questions about economic sovereignty. Governments now ask whether they can count on secure chip supplies in a crisis.

For many, the answer is “not yet,” driving a rush to build national capacity and regional redundancy, even if it means higher costs. Taiwan’s “silicon shield” still matters, but if TSMC globalises, no one country will wield absolute leverage for long.

Looking ahead, an “armed détente” is possible: both superpowers invest in reducing their vulnerabilities, and a new equilibrium emerges. North America might reach 20% of global chip output

by 2030; China could attain partial self-sufficiency in 7nm or 5nm nodes. The world could then operate dual tech systems, trade some chips while restricting others for security reasons.

A total rupture, such as war over Taiwan, remains a nightmare. Disruption to Taiwan’s fabs would cripple the global electronics industry.

So far, fear of mutual destruction has preserved the status quo. As the US and others reduce reliance on Taiwan, that deterrence may weaken over time.

The world is realising, sometimes painfully, how critical and fragile the semiconductor supply chain is. Chips have become the new oil, with control over them reshaping the global balance of power in the 21st century.

Silicon geopolitics is here to stay, and every country will feel its impact.

IF CORRESPONDENT

The National Real Estate Registration Services Company (RER), a Saudi enterprise wholly owned by the Kingdom’s Public Investment Fund (PIF), serves as a reliable entity granted by the government exclusivity for the implementation of real estate registration works. Aligned with PIF’s vision for economic advancement within the Kingdom, RER strategically pursues its mission in lockstep with the ambitious "Vision 2030" agenda, aimed at broadening economic horizons and promoting sustainable growth.

RER aims to build and update a database of all property units within the Kingdom

During his interaction with International Finance , Dr. Mohammad Al-Suliman, RER CEO, said, "RER has distinguished itself as an innovative leader in the real estate registration industry. With a strategic focus on digital transformation, customer service centricity, and sustainable development, RER has redefined the standards of property registration to be a trusted partner in the real estate ecosystem by creating sustainable value and transforming ecosystems through customercentric real estate services and digital solutions.”

“The Kingdom of Saudi Arabia is undergoing a significant transition in all sectors to support a diversified and progressive economy, driven by the objectives of a smart and sustainable future defined in Saudi Vision 2030. The real estate sector is making significant progress to align with this ambitious aim,” the CEO added.

Intending to make Saudi's real estate ownership information trustworthy, transparent, and easily accessible, RER aims to build and update a database of all property units within the Kingdom.

“As we construct the register, we will employ PropTech to handle the data in order to provide a range of services that aim to improve the investment and real estate market,” Dr. Mohammad Al-Suliman continued.

RER's operations are centred around a strategy called "EASE." Although the word has a different meaning than what is found in English dictionaries, it can be broken down into four operational pillars: E (Enhancing the Foundation), A (Accelerating Core Mandate), S (Sustainable Growth), and E (Ecosystem Partner).

RER sees “EASE” as a form of strategy, which will help it to meet its objectives of ensuring a

smart and sustainable future-defined real estate sector under the “Vision 2030.” Under the “EASE Strategy,” RER will align its organisational values and capabilities, along with building trust with the property sector stakeholders, from 2023 to 2025. It will be followed up by “Accelerating Core Mandate,” whether the venture will look to excel in the registry operations, apart from focusing on technology advancement and contributing towards environmental sustainability.

RER services in real estate transactions are based on three fundamental principles: efficiency, transparency, and legality. Transparent ownership is required for all units, including public, commercial, residential, and agricultural. The First Registration Service is responsible for establishing

this foundation. Presently, the Real Estate Registry diligently documents the present condition of each property on a dedicated page.

The Subsequent Transactions Service simplifies and clarifies the process of recording any modifications that occur following the initial registration, including ownership transfer, merging, subdivision and split, rights, restrictions, and responsibilities management (adding, removing, transferring, modifying).

Furthermore, there are several value-added services, including the Transaction API and Verification API, which offer convenient access to precise and comprehensive information regarding property transactions and ownership. Given the lack of dependable data, the real estate ecosystem will need to depend on RER's registry operations for real estate information.

Due to the automation of processes like property assessment and land registration made possible by GIS, administrative overhead is reduced and human error is minimised, leading to increased efficiency

- Dr. Mohammad Al-Suliman, RER CEO

RER’s operational principle is crystal clear: increase trust in the Saudi real estate market, apart from improving transparency and ownership data accessibility, thereby supporting the goals of “Vision 2030” by enhancing the property sector’s efficiency and increasing its investment attractiveness across the markets.

The Real Estate Indicators Service offers an alternative solution where RER use generative AI to produce advanced insights tailored to different customers.

Talking about RER's value-added services and its emphasis on sustainability, the venture is working on building a roadmap to diversify sources of income by investing in the capabilities of the real estate registry.

Among the "Value-Added Services," we have "Real Estate Transaction," which is RER's management of all transactions that occur for the property after completing the first registration and reflecting them in the real estate registry. Followed by "Real Estate Transaction," we have "Data Monetisation," which is the optimal investment of real estate data to provide products and services based on accurate data to support decision-making, contributing to raising the transparency and reliability of the real estate sector, designed for all beneficiary groups.

Finally, RER invests in operational, technical and geospatial capabilities to develop innovative solutions and services that provide added value for sustainable growth.

“Incorporating Geographic Information System (GIS) technology is revolutionising the real estate industry in Saudi Arabia. GIS provides a spatial

component to the data, improving our capacity to establish and expand a comprehensive national real estate database that will ultimately support the development and structure of the real estate industry in the Kingdom,” Dr. Mohammad AlSuliman noted.

Since May 2023, RER has implemented GIS to improve the quality of its real estate services by assessing and tracking real estate assets through the registry process using geospatial survey technology and aerial images.

RER's geospatial approach has become a milestone in the accuracy and availability of real estate information for the organisation. Through the deployment of advanced aerial imaging technologies by RER, critical land ownership details and property boundaries have been captured, thereby improving the transparency and reliability of real estate data for all stakeholders.

RER's geospatial approach is special in many ways: it has been the first such national project, in terms of covering a vast stretch of land (both urban and non-urban areas). Also, through its "Geospatial Data Management," RER has established, stored and currently maintains a national cadastral map with an anticipated 8.2 million properties and 3-5 petabytes of data storage. The company has also set up a "National Real Estate Data Map Governance" to execute its "geospatial approach."

What makes the GIS route special is its ability to add clarity to managing and understanding the spatial aspects of Saudi Arabia’s real estate sector.

“It is a digital map-based platform that enables RER to overlay information such as property boundaries, land usage rights, and infrastructure. This allows individuals and investors to make more informed decisions and streamlines the process of buying even further. Ensure that all stakeholders have access to information about properties and their environs by making propertyrelated data available through interactive maps. Due to the automation of processes like property assessment and land registration made possible by GIS, administrative overhead is reduced and human error is minimised, leading to increased efficiency,” Dr. Mohammad Al-Suliman remarked.

To its credit, RER has embraced a transformative approach to disrupt the Kingdom's traditional real estate registration processes, achieved by implementing a user-centric digital model, which emphasises ease of use, efficiency, and accessibility.

By integrating advanced technological solutions, RER has streamlined operations, apart from significantly reducing turnaround times and enhancing overall user satisfaction. These efforts have improved the functionality of real estate registries and established new benchmarks for the real estate sector's excellence.

“The inception of RER marked the beginning of a new era in property registration, characterised by an unwavering commitment to technological innovation and user experience. By integrating sophisticated

digital tools, RER has successfully transformed outdated procedures into a streamlined, transparent, and efficient process. This digital prowess has not only optimised registry operations but also established RER as the new standard-bearer for the industry,” the CEO stated.

“RER's operations have fostered secure property rights, enhanced transparency, and enabled effective urban planning, thereby laying a foundation for economic growth and investment attractiveness. RER's active contribution to sustainable development is a testament to its dedication to societal advancement and industry innovation,” Dr. Mohammad AlSuliman commented.

In the upcoming decade, there will be a prominent shift from the traditional and time-consuming process of real estate registration to a modern and efficient digital system, which offers improved convenience and speed

- Dr. Mohammad Al-Suliman, RER CEO

RER has bridged the gap between technological innovation and personalised customer service by establishing a dedicated customer service centre, which offers stakeholders a direct line of communication and assistance, underscoring RER's holistic approach to customer satisfaction and engagement.

“In the upcoming decade, there will be a prominent shift from the traditional and time-consuming process of real estate registration to a modern and efficient digital system, which offers improved convenience and speed,” Dr. Mohammad AlSuliman predicted.

This change is crucial for determining the future of the Kingdom's real estate sector. The RER

portal, launched in 2023, plays a significant role in the digitalisation of the Gulf major’s property industry by simplifying the registration process, providing a wide range of property-related services that enhance access to real estate data.

“The primary objective of RER is to guarantee the safeguarding of property rights, streamline interactions, and empower property owners. The RER platform will streamline the process of researching properties and conducting transactions of any magnitude, requiring only a few clicks. This is just a superficial overview of RER's ambitions to transform the real estate registration process by enhancing user-friendliness, transparency, and efficiency. The objective of Saudi Vision 2030 is to position the real estate sector as a catalyst for economic diversification in Saudi Arabia. This goal is achievable due to the country's advanced technology capabilities, robust digital infrastructure, and favourable market regulations,” Dr. Mohammad Al-Suliman said.

In order to advance its mission, RER will focus on advancing geospatial mapping initiatives and expanding coverage across the Kingdom to improve the precision of property boundaries and identification.

“Our goal is to register approximately 80% of the properties in the Kingdom by 2025. A massive undertaking like this will strengthen safeguards for property rights, increase transparency, and create a solid foundation for future economic development and planning. And for this year, we will cover Riyadh and announce more than 4.2 million parcels across the kingdom,” Dr. Mohammad Al-Suliman informed International Finance

The "Vision 2030" initiative focuses on economic diversification and highlights the importance of digital transformation throughout the economy. In the real estate sector, some of the key objectives include increasing home ownership rates, enhancing service quality, and making investments more attractive. These goals are central to the roadmap's vision for the future.

“These pillars are undoubtedly consistent with

the RER's goals and efforts to digitise and automate all real estate activities. The ‘EASE Strategy’ is RER's five-year roadmap for digital transformation. The primary goal of this approach is to streamline operations and improve the real estate experience in the Kingdom through digitisation, automation, dependability, and transparency. In this regard, the RER aims to automate all real estate transactions using its e-platform,” Dr. Mohammad Al-Suliman remarked.

“RER's ongoing commitment to excellence has shaped the landscape of real estate registration services and demonstrated a profound understanding of its work's economic and social implications. By securing property rights and enhancing transparency, RER has laid a solid foundation for property ownership that supports economic expansion and boosts investment opportunities. This, in turn, has reinforced RER's role as a trusted and indispensable partner in the regional development narrative,” he continued.

The organisation's holistic approach to real estate registration has been pivotal in driving change and delivering value to all stakeholders involved. Through the facilitation of secure property rights, RER has not only empowered landowners but has also provided a stable environment for real estate investments, which is crucial for the region's socio-economic development.

“Moreover, RER's proactive stance in adopting the latest technologies and methodologies showcases its leadership in setting industry trends. The successful mapping of an extensive area through aerial surveys is a testament to RER's innovative spirit and its dedication to precision and quality. The customer service centre initiative stands as an example of RER's commitment to excellence, ensuring that every stakeholder receives personalised attention and support. This blend of technology and personal service underscores RER's understanding that while digital transformation is vital, human connections remain integral to its success,” Dr. Mohammad AlSuliman concluded.

Airbnb encourages users to plan their trips and discover memorable activities, all within the app

In late 2023, following a dramatic tech-world episode involving OpenAI’s leadership, Airbnb CEO Brian Chesky found himself at a personal and professional crossroads.

The energy he had poured into helping his friend Sam Altman reclaim the CEO seat at OpenAI left him energised but restless. Alone in his San Francisco home over Thanksgiving weekend, he began typing furiously, not about OpenAI but about Airbnb.

For years, Airbnb had been synonymous with short-term vacation rentals. It disrupted hotels, built a global community of hosts and guests, and weathered crises from regulatory hurdles to the COVID-19 pandemic. It was profitable, dominant, and for the first time in Chesky’s entrepreneurial life, dangerously close to stagnation.

Chesky's breakthrough was a realisation. Airbnb didn’t have to be just a travel company. Its strengths in trust-building between strangers, design thinking, and crisis response were transferable. Why couldn’t it become the infrastructure for booking all real-world services, just as it once did for homes?

In a burst of creative output, Chesky wrote a 10,000-word document reimagining Airbnb as a comprehensive service platform. He envisioned users opening the app not just to book a place to stay, but to hire a dog walker, book a massage, find a personal chef, or connect with a local photographer.

Like Amazon’s evolution from bookstore to everything store, Chesky believed Airbnb could evolve into a life concierge, where anything physical, experiential, or service-based could be booked with trust and ease. This wasn’t a pivot. It was a platform expansion. The goal was to transform Airbnb into the first app people think of, not just for travel, but for everyday services.

From one-off experiences to recurring needs, Chesky wants Airbnb to be the destination where your digital reputation meets your real-world needs. The company would leverage its massive user base and robust vetting infrastructure to match people with not only homes but also hairstylists, personal trainers, tutors, and more.

The 200 million dollar reinvention now underway is Airbnb’s largest strategic bet since its founding. For Chesky, it’s more than just growth. It’s a reclamation of creativity, a doubling down on mission, and a fight against the dreaded word that

haunts mature companies: stagnation.

In this reimagining, Airbnb isn’t settling into middle age. It’s breaking out of its pigeonhole and trying to redefine what it means to belong anywhere, not just for a night but in every facet of modern life.

Channelling Apple to build a super-app

Brian Chesky has always believed that great companies are built on great design, not just in aesthetics, but in philosophy as well. Airbnb’s reinvention isn’t simply a business move; it’s a design-led revolution. At the heart of this evolution is Chesky’s

lifelong admiration for Apple and its late founder, Steve Jobs.

Design has always been central to Airbnb’s DNA. Chesky and co-founder Joe Gebbia are alumni of the Rhode Island School of Design. But what Airbnb is attempting now is a fullscale transformation into a super-app for services and experiences, which requires a design discipline on par with the world’s most revered product companies. This is where Jony Ive comes in.

The legendary Apple designer and Chesky have been collaborating closely, bringing Ive’s team at LoveFrom into the fold. While the specifics of their contributions remain mostly under

wraps, their fingerprints are everywhere in Airbnb’s new visual language. It is minimalist, emotionally warm, and obsessively refined.

The app’s new interface revolves around three core icons: a house for traditional stays, a bell for services, and a hot-air balloon for experiences. Each icon was crafted with symbolic intent. The hot-air balloon, for example, was chosen after extensive internal debate. It needed to evoke exploration, joy, and a touch of nostalgia. Even the flame size beneath the balloon basket was scrutinised. That level of microdetail isn’t an indulgence; it is the strategy.

Chesky is deeply involved in these choices. In daily product reviews, he doesn’t just give broad direction; he adjusts shadows, rewords labels, and debates icon proportions. He refers to himself not only as a CEO, but also as a product designer who never lets go of the pencil. This hands-on approach mirrors Jobs' intense focus on the tiniest elements of Apple’s devices and interfaces.

This design-first philosophy extends beyond visuals. Airbnb is rethinking flow, friction, and feel. Services need to be instantly discoverable yet not overwhelming. Profiles must inspire trust without feeling transactional. Experiences should feel curated, not commodified. Every interaction is designed to express care.

For Chesky, this isn't just about making something functional. It’s about making something memorable, something that stirs emotion. Like Apple, Airbnb is chasing the kind of design that becomes invisible in its elegance and essential in its utility.

The result is a platform that feels less like an app and more like a beautifully organised world, where belonging doesn’t just mean staying the night but navigating life with beauty, ease, and trust. Airbnb isn’t simply copying Apple. It’s aiming to join the same cultural and emotional tier.

In a world increasingly dominated by anonymous online interactions, trust has become the ultimate currency, and Airbnb knows it. From its earliest days, the platform’s success hinged on strangers trusting strangers. That leap of faith involved sleeping in a stranger’s home, which only worked because of reviews, identity checks, and

Source: Statista

responsive support. Now that Airbnb aims to become a hub for booking realworld services, trust must be redefined and fortified.

At the centre of this transformation is identity. Brian Chesky doesn’t just want users to create profiles. He wants those profiles to become the gold standard of online authenticity. In his vision, an Airbnb profile could one day function as a digital credential, almost like a passport, that users could carry across platforms, services, and borders.

That may sound like a fantasy in today’s fragmented digital landscape, but Chesky is serious. He’s betting that a meticulously verified Airbnb identity will be more trustworthy than anything online.

This ambition requires going far beyond a photo and a phone number. Airbnb is now vetting service providers with rigorous background checks, license verification, resume screenings, and professional photography. The company is investing in biometric security features, holographic overlays, and reactive inks, similar to those used

to prevent counterfeiting on the government-issued IDs. It’s identity proofing on a whole new level, because it’s flashy and necessary.

Why the overkill? Because the stakes are higher. Booking a vacation rental is one thing. Inviting someone into your home for a haircut, massage, or tutoring session requires deeper psychological assurance. Airbnb is building a framework where trust isn’t implied; it is engineered.

There’s a broader ambition at play. If Airbnb succeeds, it could pioneer a new form of decentralised, userowned identity. In a future where people distrust large tech companies and governments are slow to adapt, a neutral, globally recognised digital credential could transform the landscape. Chesky knows this is a stretch goal and one worth reaching for.

The challenge? Airbnb is not alone. Facebook tried and failed to become a universal identity layer. Apple, Google, and Microsoft all have their own ambitions in this space. But Airbnb has one key advantage. It already has a strong track record of managing high-stakes interactions between strangers. It knows how to handle disputes, mediate claims, and prevent fraud.

Ultimately, trust is not just a feature for Airbnb. It is the product. And as the company expands its scope, this product will need to be rebuilt step by step, brick by digital brick, to meet a new and even more demanding standard. In Chesky’s mind, belonging isn’t possible without trust. And now, trust must be designed as deliberately as any interface or business model Airbnb has ever built.

Lessons from a flop turned flagship

Airbnb’s new wave of ambition includes something old with a fresh

BRIAN CHESKY

coat of strategy, namely, Experiences. Launched in 2016 with high hopes, Airbnb Experiences promised to let travellers do more than just stay in a location because it invited them to live like locals, guided by hosts offering activities ranging from dumplingmaking to architectural tours. But the programme flopped. Interest waned, inventory stagnated, and the excitement faded. Fast forward to 2025, Brian Chesky is betting big on the reinvention of that same concept.

Why bring back something that failed? According to Chesky, the original Experiences launch wasn’t flawed in vision but in timing and execution. The infrastructure wasn’t ready. The user base wasn’t large or engaged enough. Airbnb, still focused on scaling its core rental business, didn’t have the bandwidth to support it. The product quietly lingered in the background, underdeveloped and under-promoted.

This time, things are different. Airbnb has matured, and the ecosystem is ready. With a massive, engaged global user base and a richer tech backbone, Experiences is returning not as a side project, but as a core pillar of Airbnb’s identity. The numbers speak volumes, with more than 22,000 Experiences available across 650 cities, and a growing roster of high-end, curated offerings labelled “originals.” These are hosted by top-tier professionals such as star chefs, elite athletes, and even celebrities like Conan O’Brien.

Chesky has learnt from his past mistakes. Rather than a big bang rollout followed by silence, the relaunch features a steady cadence of promotional drops and exclusive events. The goal is to create a rhythm that keeps users curious and engaged, more like a content platform than a travel add-on. Airbnb encourages users to plan their

trips and discover memorable activities for the upcoming weekend, all within the app.

Experiences now benefit from deeper integration into the Airbnb app itself. The design team has made them easier to find, more visually compelling to browse, and quicker to book. The hot-air balloon icon representing Experiences on the app's home screen is not just decorative but serves as a gateway to a new kind of engagement that is spontaneous, local, and personal. Of course, the risks remain. Experiences must scale without losing their artisanal, one-of-a-kind charm.

Airbnb has to ensure safety, quality, and consistency across vastly different geographies and cultures. There is also the issue of regulation, since offering services like culinary classes or wellness treatments can bring local licensing complications.

If Airbnb can overcome those hurdles, Experiences could be more than a profitable side business. They could become the emotional core of the platform, the feature that connects users to real people, real stories, and real memories.

As Chesky put it, the original Experiences was Airbnb’s “Newton,” meaning it was a too-early precursor to something that could eventually be game-changing.

Now, rebooted and reimagined, Experiences has the potential to become Airbnb’s iPhone moment, the product that changes everything.

There is a moment in every successful founder’s journey where they must choose between staying involved in the weeds or stepping back to let professional managers take over. For

Brian Chesky, that moment came during the COVID-19 pandemic. When Airbnb lost 80% of its business in a matter of weeks, survival required more than delegation. It required leadership grounded in obsession. And Chesky stepped in. That decision marked the beginning of what he now calls “Founder Mode,” a state of hands-on, deeply detailed, and often intense leadership that goes far beyond executive oversight. This is not micromanaging for the sake of control. It is about product-level immersion. For Chesky, this meant showing up to every design review, obsessing over

copywriting, layout, button shadows, iconography, and more. Every corner of the Airbnb experience had to be re-evaluated. If Airbnb was going to reinvent itself, the founder had to be back in the trenches.

Not everyone welcomed the shift at first. Some employees saw the reengagement as overbearing. The culture had drifted toward consensus and process, away from urgency and instinct.

As Chesky became unapologetically meticulous, something changed. Clarity returned. Momentum returned. The company stopped trying to please

committees and started building again.

Brian Chesky’s approach echoed the founder-driven ethos popularised by Paul Graham of Y Combinator, who later wrote an essay inspired by Airbnb titled “Founder Mode.” Graham argued that only founders truly know what a company should become. Listening too much to external managers, he warned, can dilute the vision. Chesky became the poster child for a new wave of founderled craftsmanship.

His team now expects and respects the intensity. Product reviews with Chesky can swing from philosophical

to painstakingly granular. Chesky might rewrite a headline mid-meeting, question the spacing on a profile card, or pull up screenshots of rival apps on the spot. While that can make team presentations nerve-wracking, the result is cohesion. The app, the brand, the company—it all begins to feel like it came from a single mind.

This kind of leadership is not scalable forever. Eventually, Airbnb will need other leaders who can operate with a similar vision and intensity. But for now, Founder Mode is fuelling a renaissance at the company. Chesky

is not just overseeing a transformation. He is architecting it one pixel at a time and one principle at a time.

It is a vivid reminder that great products often come not from efficient processes, but from unrelenting obsession. In Chesky’s case, his return to the product trenches may be the thing that turns Airbnb’s next chapter from just another evolution into something iconic.

Can Airbnb compete on so many fronts?

Brian Chesky’s vision for Airbnb is sweeping. He wants to turn a travel company into a services super-app, a trust platform, a credentialing authority, and a cultural hub. It is a bold move worthy of admiration. But it also raises a difficult question. Can Airbnb compete on all these fronts without losing its focus?

The market Airbnb is entering is not just enormous. It is fragmented, entrenched, and fiercely competitive. For every category Chesky wants to touch, there is already a dominant player. Instacart and DoorDash dominate local services. Yelp handles discovery. OpenTable manages dining. Eventbrite curates experiences. Craigslist covers almost everything else. Then there are the tech giants such as Apple, Google, Meta, and Microsoft, each with greater reach, deeper pockets, and in many cases, a head start.

Airbnb’s traditional moat has been its trust infrastructure in short-term rentals: user reviews, verified identities, and effective dispute resolution. But applying that same model to high-touch services such as massages, personal training, or hairstyling pre-

sents new challenges. There is no room for error. One bad experience, such as a bad haircut, a missed chef appointment, or an uncomfortable massage, can damage more than one night. It can erode trust across the entire platform.

Each new vertical brings different regulations, user expectations, and logistical issues. Booking a rental is transactional, while booking a service is relational and full of unpredictable variables.

Is Airbnb prepared to resolve disputes between a nail artist and a dissatisfied customer? What happens if a service provider forgets an appointment or performs poorly? These scenarios are not theoretical. They are inevitable at scale.

Internally, the challenge is equally steep. Expanding across many categories could stretch Airbnb’s culture, product roadmap, and engineering bandwidth too thin. The company is no longer refining one product. It is trying to build a platform that serves hundreds of micro-industries, each with unique behaviours and expectations. Few companies manage such complexity while maintaining a coherent user experience.

Chesky’s bet on identity is similarly bold. The idea of Airbnb becoming a universal digital credential is almost a moonshot. Governments are slow to recognise private-sector IDs. Facebook tried and failed. Apple, Google, and others have more institutional reach. While Airbnb has trust credibility, convincing the world to treat a vacation rental profile as a legitimate form of ID is a steep climb.

There is also the risk of user confusion. Including more features, icons,

and flows could bloat the platform. Airbnb’s simplicity has always been its secret weapon. Since it is an app you open a few times a year, it still feels intuitive. Turning it into a daily-use super-app may overwhelm casual users who want to book a place to stay.

Chesky is not naive about these risks. He knows that reinvention is a gamble. But he believes the greater risk is standing still. A profitable yet stagnant product is still vulnerable to disruption. In that sense, expansion is not just ambition but also self-preservation. Success will hinge on execution. If Airbnb can integrate new services while maintaining its design clarity, scale without losing trust, and build a cohesive experience that feels useful rather than crowded, it could redefine how people interact with the real world through technology. If it cannot, it may become a cautionary tale about a company that tried to do everything and ended up excelling at nothing.

Brian Chesky’s gamble is now in motion. The Airbnb CEO is betting that the future belongs to platforms that do not just fulfil one need but anticipate all of them. In his mind, to truly belong anywhere, you should be able to do anything.

Saudi Arabia's investment in its maritime sector may lead to a shift in global trade logistics, reducing reliance on conventional routes. The Kingdom is positioning itself as a global logistics hub, enhancing its maritime infrastructure and prioritising sustainability, all thanks to its strategic location at the crossroads of international trade.

This initiative is a major component of Saudi Arabia's "Vision 2030" economic diversification programme, which aims to reduce the Kingdom's dependency on oil revenues.

Omar Hariri, the president of the Saudi Ports Authority, announced in August 2024 that, thanks to fruitful partnerships between his organisation and the private sector, investments in the Kingdom's maritime industry have surpassed SR25 billion ($6.66 billion).

Hariri stated that partnerships with both domestic and foreign businesses have led to large investments over the last four years.

Pierroberto Folgiero, CEO of Fincantieri, one of the world's largest shipbuilding companies, discussed how Saudi Arabia's investment in maritime infrastructure is influencing the course of international trade routes.

“By expanding its shipbuilding capacity and enhancing its logistics infrastructure, the Kingdom can address global supply chain bottlenecks, strengthen its maritime influence, and foster resilience in international trade flows,” he said.

Saudi Arabia’s maritime investments are poised to reshape global trade logistics

Folgiero stated that his company views this as an opportunity to leverage its shipbuilding and maritime technology experience, adding that Saudi investments in cutting-edge maritime infrastructure could open up alternate trade routes and reduce dependency on chokepoints like the Suez Canal.

“Investments in shipbuilding, ports, logistics, and shipping services have allowed the Kingdom to capitalise on its geographic advantages. Notable projects include the development of the King Salman International Maritime Industries Complex in Ras Al-Khair, set to become one of the world’s largest shipyards, and the modernisation of key ports such as the Jeddah Islamic Port and King Abdulaziz Port,” he said.

According to the CEO, Saudi Arabia is advancing its shipbuilding and maritime technology by forming strategic alliances with leading companies across the globe.

“These collaborations focus on transferring expertise and technology, accelerating the Kingdom’s evolution into an influential player in the international maritime and shipping sectors,” Folgiero continued.

He highlighted that a key component of Saudi

Cargo quantities of Saudi Arabia's ports from 2014 to 2023

marine budget in Saudi Arabia from 2015 to 2019

Total number of passenger arrivals at ports in Saudi Arabia from 2018 to 2022

Arabia's maritime strategy is its focus on smart ports, which use automation, IoT, and AI. By streamlining trade, increasing transparency, cutting costs, and speeding up turnaround times, these technologies will make the Kingdom a desirable location for international shipping and logistics firms.

Fincantieri Arabia, a subsidiary specialised in shipbuilding, maritime systems and equipment, and naval logistics support services such as training and simulation, was established in May 2024.

According to Folgiero, this expansion will strengthen Saudi Arabia's maritime presence internationally, localise technology, and create jobs.

The expanding maritime industry in Saudi Arabia will benefit more than just well-known foreign corporations.