ccc offers comprehensive solutions designed to modernize financial businesses as per the outlook of the Saudi regime

SANJAY KUMAR EDITOR-IN-CHIEF INTERNATIONAL FINANCE

SANJAY KUMAR EDITOR-IN-CHIEF INTERNATIONAL FINANCE

ccc offers comprehensive solutions designed to modernize financial businesses as per the outlook of the Saudi regime

SANJAY KUMAR EDITOR-IN-CHIEF INTERNATIONAL FINANCE

SANJAY KUMAR EDITOR-IN-CHIEF INTERNATIONAL FINANCE

Mortgage rates continued to decline in the United States, as the new house sales data suggest the entry of new buyers into the market. For the first time in almost 11 years, home sale prices decreased year over year in February 2023, and total home sales experienced their greatest monthly percentage gain since July 2020.

Is the US property market up for a growth trajectory in 2023?

Experts have mixed opinions as there is a shortage of homes in the country. Those who bought houses recently at historically low loan rates are continuing to live in them. The difficulty of affordability for many people, especially first-time homeowners, is perpetuated in part by tight inventory constraints that prevent prices from declining.

Shifting the focus away from the property market, let’s talk about the electric vehicle sector, where car sales are soaring like never before. Results for the first quarter indicate happy news for the electric vehicle makers, despite supply chain challenges and higher upfront prices. Ford declared a growth rate of 139% while Volkswagen witnessed a 65% increase, and Tesla registered a sales rise of 81%

Concerns among consumers over rising oil costs and tax incentives are thought to be the reason for the shift in the attitude of customers when it comes to buying electric vehicles. And this behavioural change is undoubtedly helping the automakers.

And last but not least, this edition of the International Finance Magazine is bringing another inspirational tale for its readers, from Saudi Arabia, where ccc by stc, a leading Customer Experience Management provider, is progressively pioneering the advancement of the Business Process Outsourcing (BPO) industry in the Kingdom through local, digitized services with international standards such as COPC OSP standards.

ccc also offers comprehensive solutions designed to modernize financial businesses as per the outlook of the Saudi regime

INDUSTRY

ECONOMY

16

ELECTRIC VEHICLES:

In 2021 Ramaphosa offered an action plan to develop additional power generation capacity in the short to medium term

TECHNOLOGY

46

IMF

BANKING AND FINANCE

66

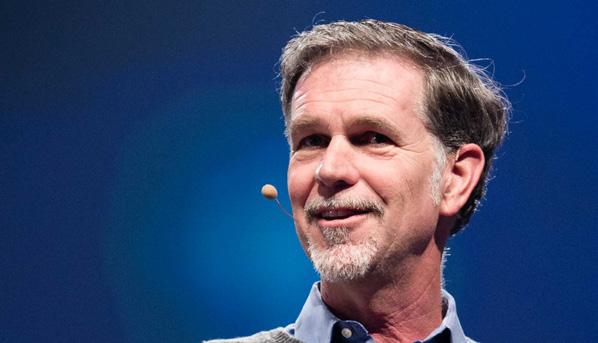

SWIMMING AGAINST THE STREAM: THE NETFLIX STORY

Netflix earned some 7.7 million new subscribers in the last three months of 2022

88

BLENDING AI & RULES-BASED APPROACH IN FINANCE

Most financial institutions want to ensure they are knowledgeable about Artificial Intelligence

100

Climate change affects a company's fundamentals, and thus markets overall

FEATURES

30 Technology & the future of real estate

58 Reopening of China to benefit Thai economy?

78 Agro-tech revolutionizing coffee production

BUSINESS DOSSIER

40 PNL: Leading Africa’s logistics sector from front

56 Meteoric rise of Quantum Metal

72 Landco: When luxury meets sustainability

82 Siang Tang Tan: Leader who transformed Muscat air cargo

92 Finexis Advisory Guiding HNWI clients to success

98 Tamweel Aloula Changing Saudi’s SME landscape

www.internationalfinance.com

Director & Publisher Sunil Bhat

Editor-in-Chief

Sanjay Kumar

Editorial

Prajwal Wele, Agnivesh Harshan, CL Ramakrishnan, Prabuddha Ghosh

Production Merlin Cruz

Design & Layout

Vikas Kapoor

Technical Team

Prashanth V Acharya, Sunil Suresh

Business Analysts

Alice Parker, Indra Kala, Stallone Edward, Jessica Smith, Harry Wilson, Susan Lee, Mark Pinto

Business Development Managers

Christy John, Alex Carter, Gwen Morgan, Janet George

Business Development Directors

Sid Jain, Sarah Jones, Sid Nathan

Head of Operations Ryan Cooper Accounts Angela Mathews

Registered Office INTERNATIONAL FINANCE is the trading name of INTERNATIONAL FINANCE Publications Ltd 843 Finchley Road, London, NW11 8NA

Phone +44 (0) 208 123 9436

Fax +44 (0) 208 181 6550 Email info@ifinancemag.com

Press Contact editor@ifinancemag.com

Associate Office Zredhi Solutions Pvt. Ltd. 5th Floor, Sai Complex, #114/1, M G Road, Bengaluru 560001 Ph: +91-80-409901144

A competitive market does not require a "magic number" of network operators, according to Britain, which set the goal of bringing next-generation 5G mobile service to inhabited areas by 2030. All four of the country's mobile networks—BT's EE, Telefonica's O2, Liberty Global's Virgin Media O2, and Vodafone are implementing 5G. Currently, at least one carrier can provide basic 5G coverage to 77% of the population. By the end of the decade, Britain said it intended standalone 5G, also known as 5G Plus, to be widely accessible, opening the door to new technologies like driverless cars, robotics, and drones.

A software upgrade that would allow investors access to more than $30 billion of the digital tokens is scheduled for the second-largest cryptocurrency, Ether. Investors will be able to redeem an offshoot of ether tokens that they have deposited in exchange for interest on the blockchain network during the previous three years thanks to Shapella, the most recent upgrade to the Ethereum blockchain. According to data company Dune Analytics, these so-called "staked ether" tokens currently make up around 15% of all ether tokens and are valued at about $31 billion. The changes will lead to heightened volatility for ether, investors predicted.

The private equity firm Blackstone Inc announced that it had raised $30.4 billion for its newest global real estate fund as it seeks to expand in the sector. Blackstone Real Estate Partners X is a 48% larger real estate fund than the company's last one, which closed in 2019. Blackstone has shifted away from assets like traditional offices and malls that are suffering from a post-pandemic adoption of flexible work and spike in e-commerce, concentrating its portfolio on logistics, rental housing, hotel, lab office, and data centres. Sector selection has never been more critical, Ken Caplan, CEO of Blackstone said.

HP announced in a security bulletin that it would take up to 90 days to patch a critical-severity vulnerability that impacts the firmware of certain business-grade printers. The security issue is tracked as CVE-20231707 and it affects about 50 HP Enterprise LaserJet and HP LaserJet Managed Printers models. The company calculated a severity score of 9.1 out of 10 using the CVSS v3.1 standard and notes that exploiting it could potentially lead to information disclosure.

MOHAMED BIN ZAYED

CROWN PRINCE OF ABU DHABI

According to State Finance Minister Shehan Semasinghe of Sri Lanka, the World Bank has promised to continue supporting the island nation's efforts to stabilise its economy and speed up its economic recovery. The World Bank Group extended its assistance to Sri Lanka, according to State Finance Minister Shehan Semasinghe, who made the statement while in Washington for the 2023 Spring Meetings of the World Bank Group and the International

Monetary Fund. In the meeting, Semasinghe met with the World Bank's Managing Director of Operations, Anna Bjerde, together with Central Bank Governor P. Nandalal Weerasinghe and Secretary to the Treasury K. M. Mahinda Siriwardana. According to the report, the Minister said the discussion focused on how Sri Lanka’s reform agenda will support its economic recovery. He also interacted with the World Bank team that specialised in interventions.

He was recently named the Crown Prince of Abu Dhabi, the oil-rich capital of the UAE. He is the eldest son of UAE President Sheikh Mohamed bin Zayed Al Nahyan.

AKBAR AL BAKER

CEO QATAR AIRWAYS GROUP

Al Baker has been at the helm of Qatar Airways. He oversees a team of more than 41,026 people. The group reported 78% increase in revenues of $14.4 billion.

CEO ENOC GROUP

The group has 30 subsidiaries and employs more than 9,000 people. ENOC has a total of 162 fully operational service stations around the UAE.

As the SNB deposited the cash with Credit Suisse, sight deposits increased from 515 billion in midMarch to a peak of 567 billion francs Ukraine stated in June 2022 that it hoped to earn 1.5 billion euros by the end of the year from electricity exports to the EU

According to data published by the central bank, Credit Suisse has already paid back some of the emergency liquidity offered by the Swiss National Bank (SNB), signalling an ebbing of the liquidity crisis which triggered the lender's fall. Sight deposits - cash held by commercial banks overnight with the SNB - fell by 31 billion Swiss francs ($34.3 billion), the data showed.

The drop was the second-largest decline ever, trailing only the time when the SNB began removing market liquidity after ending zero interest rates in September of 2022. Sight deposits have increased recently as a result of Credit Suisse receiving emergency liquidity injections to prevent a bank run as anxious customers withdrew their money. As a last-ditch effort to save itself, the lender said last month that it sought to borrow up to 50 billion francs from the SNB. The data said that confidence has been lost in the bank due to their number of mistakes. The SNB also provided an additional 200 billion francs in liquidity following a state-sponsored takeover by rival UBS.

As the SNB deposited the cash with Credit Suisse, sight deposits increased from 515 billion in mid-March to a peak of 567 billion francs. However, the rising trend reversed as sight deposits decreased to 532 billion francs. The SNB, UBS, and Credit Suisse all declined to speak publicly on the situation.

An economist at J.Safra Sarasin named Karsten Junius said the reduction may be linked to Credit Suisse repaying part of the emergency liquidity it had borrowed and no longer needing to rely on the support of the central bank, Reuters reported.

"Confidence in the bank has been restored by the UBS merger, and from this data, it would appear customer outflows have stopped. A bank run has been stopped by the SNB coming in and offering massive liquidity and customers are reassured by UBS being there too. Credit lines from other banks would also appear to have been re-established," Junius said.

Sight deposits would have decreased as a result of the SNB's possible involvement in the forex markets, Junius added.

Ukraine's energy minister announced that electricity shipments to Europe have restarted after being halted in October when Russia started mounting frequent missile and drone attacks targeting vital energy facilities. The strikes resulted in widespread power outages that affected both businesses and residents, prompting workers to put in extra hours trying to fix the grid.

Energy Minister German Galushchenko said, "We have resumed exports, adding that Russia did not succeed at all at destroying our energy system."

The primary market for energy exports from Ukraine is the European Union. Despite the resumption of exports, according to Galushchenko, the country's first priority remains the provision of electricity to its own citizens.

"We hope to reach the export volumes that we had last year. We plan and will conduct negotiations to increase them because today's reserves in the system allow us to do that," he said in televised comments.

Ukraine, which once exported electricity to Moldova, Hungary, Slovakia, and Poland, stated

in June 2022 that it hoped to earn 1.5 billion euros ($1.64 billion) by the end of the year from electricity exports to the EU.

"There are currently plans to increase cross-border traffic between Ukraine and Poland, which will increase exports," Galushchenko added.

In order to look into Russian airstrikes on the power grid, the chief prosecutor of the International Criminal Court travelled to Ukraine in February. According to Kyiv, the strikes were meant to scare regular residents. The military of the adversary had to be weakened, according to Moscow.

The airstrikes resulted in power outages in the eastern and central regions of Kharkiv and Poltava. The mayor of Kharkiv, Ihor Terekhov, described the damage in the city as “colossal” and they advised residents to be patient as water, electricity and heating were out back then.

In response to attacks, the US national security council spokesperson, John Kirby, said Russia was trying to "put fear into the hearts of the Ukrainian people and to make it that much harder on them as winter is now upon them."

Apple hopes to achieve carbon neutrality throughout its entire supply chain and product lifecycle

DOE intends to dramatically change how it determines the petroleum-equivalent fuel economy rating for EVs

Apple announced that it had increased its financial contribution to a fund it had set up two years prior to investing in initiatives that reduce atmospheric carbon. The Restore Fund, which the iPhone manufacturer established in 2021 with a $200 million commitment, will receive up to an extra $200 million in investment, according to the company. The additional funding is anticipated to help the fund launch new initiatives and double its prior target of removing approximately one million metric tonnes of carbon dioxide annually, the company said. Apple hopes to achieve carbon neutrality throughout its entire supply chain and product lifecycle, by 2030. The fund is established with NGO Conservation International and Goldman Sachs Group Inc.

The dollar dipped against most major currencies, with the exception of the yen, with investors anticipating US inflation data due for publishing would provide some insight into when US interest rates will peak. The US dollar index decreased 0.07% to 102.05 when measured against a basket of currencies. The euro moved up 0.12% to $1.0926, while the pound gained 0.02% to $1.2430. Both currencies are now trading above their anticipation. According to a Reuters poll of economists, the US inflation data for March is predicted to come in at 5.2% year-over-year, down from 6.0% earlier, while core inflation likely edged up to 5.6%. It could be the difference between a 25bp hike at the next Fed meeting.

In order to achieve government fuel economy standards, the US Energy Department (DOE) proposed lowering the mileage ratings for electric vehicles (EVs), a move that would compel automakers to offer additional low-emission vehicles or upgrade current ones. For use in the National Highway Traffic Safety Administration's (NHTSA) Corporate Average Fuel Economy (CAFE) program, DOE intends to dramatically change how it determines the petroleum-equivalent fuel economy rating for electric and plug-in hybrid vehicles. "Encouraging adoption of EVs can reduce petroleum consumption but giving too much credit for that adoption can lead to increased net petroleum use," DOE said in its proposed regulation.

Ahli Bank in Oman reported that its board had rejected a merger proposal from Bank Dhofar, Oman's second-largest institution. A non-binding merger offer from Bank Dhofar was rejected by Ahli Bank's board, which is partially owned by Bahrain's Ahli Bank. The smaller lender disclosed that it had received a proposal to merge with Bank Dhofar, which would have resulted in an organisation with assets worth more than $19 billion. According to financial statistics, Ahli Bank in Oman has around $7.9 billion in assets, compared to $11.2 billion for Bank Dhofar. A binding merger agreement between HSBC Bank Oman and regional rival Sohar International Bank was signed last year; the arrangement received central bank approval in February.

of people shifting from petrol vehicles to EVs

In a housing market crash, you would typically see a 20% to 30% drop in home prices and a decline in home sales—far more than what’s currently happening

According to the National Association of Realtors, mortgage rates continued to decline in the United States, the new house sales data show that more buyers are entering the market. For the first time in almost 11 years, home sale prices decreased year over year (y-o-y) in February, and total home sales experienced their greatest monthly percentage gain since July 2020. However, many experts have mixed opinions on how much further home values will fall this year.

The data shows that there is still a shortage of homes in the country. Those who bought homes recently at historically low loan rates are continuing to live in them. The difficulty of affordability for many people, especially first-time homeowners, is perpetuated in part by tight inventory constraints that prevent prices from declining.

As property prices continue to rise year over year, they are not as startling as they were at the beginning of 2022. Experts say, how much further home prices dip in 2023 will likely depend on where mortgage rates go.

Housing experts continue to keep a close eye on

the economy as the industry moves to the first half of 2023 after being pulled in many different directions by factors like high inflation, highinterest rates, persistent geopolitical uncertainty, and fear of recession.

However, there are some promising trends developing. According to the National Association of Realtors (NAR), the median price of an existing home sold in February decreased by 0.2% to $363,000 dollars from the same month last year. This brings to an end a record-breaking run of 131 straight months of year-over-year gains, despite a 14.5% increase from January to February in total existing-home sales, which ended a 12-month streak of declining sales. According to NAR, these sales were down 22.6% from a year ago.

According to preliminary data from the US Census Bureau and the US Department of Housing and Urban Development (HUD), housing starts increased by 9.8% in February, contributing to the creation of much-needed inventory. According to Freddie Mac, mortgage rates decreased slightly in mid-January and were 6.42% for the week ending February.

Since the housing crash of 2008, when the construction of new homes plummeted, there has been a problem with low housing inventory. It has not entirely recovered—and won’t in 2023. In contrast to earlier downturns, the housing supply has remained

As property prices continue to rise year over year, they are not as startling as they were at the beginning of 2022

stuck at close to historic lows, supporting demand and maintaining higher home prices.

Inventory has a 2.6-month supply at the current sales pace, which is low by historical standards but up from 1.6 months a year ago, according to NAR. Industry analysts have a pessimistic assessment of when inventory will eventually stabilise based on this and other data.

"I believe that we are likely to see low inventory continue to vex the housing market throughout 2023," says Rick Sharga, executive vice president of market intelligence at ATTOM Data. And with 70% of homeowners sitting on a mortgage rate of 4% or less, Sharga says we are unlikely to see an inundation of homes soon, the Forbes Advisor reported.

On the other hand, there are some positive signs present in the field of home construction. According to the US Census Bureau and HUD, single-family construction which started in February jumped by 9.8% and building permit applications by 13.8% after five straight months of losses.

The most recent data from NAHB/Wells Fargo Housing Market Index (HMI) on builder outlooks also showed optimism. The HMI index, which measures builder confidence, increased by two points, from 42 to 44. After 12 straight months of declines, this is the third consecutive month-over-month improvement. Experts say, there will need to be more consecutive upticks before seeing a meaningful resurgence in new construction because builder confidence is still low. An index of 50 or above suggests more builders predict excellent conditions ahead.

Experts also stated that the Federal Reserve is making matters worse by consistently raising the federal funds rate. Federal Reserve Chair Jerome Powell answered inquiries regarding the Fed's strong monetary tightening strategies in its attempts to control inflation during a semi-annual hearing before the Senate Banking Committee.

During a conversation with Senator Raphael Warnock, Jerome Powell noted that boosting the central bank interest rate increases borrowing costs for businesses that build new houses and

makes financing and expanding manufacturing for suppliers more expensive. Additionally, he acknowledged that high fixed mortgage rates deter homeowners from selling their homes when they have a low fixed-rate mortgage. These conditions all put further pressure on the inventory, Jerome Powell explained.

"The bottom line is that there really isn’t a likely scenario that leads to inventory levels approaching historically normal numbers in 2023, which means that prospective homebuyers are still going to have to work hard to find something to buy," Sharga said.

Due to the continued inventory problem that is keeping home prices elevated, many analysts anticipate that the housing market is more likely to correct itself from the double-digit percentage rises which are seen in home prices over the past several years rather than crash.

"Home prices will be steady in most parts of the country with a minor change in the national median home price," Sharga said.

However, some experts who follow the housing market predict that some areas may experience an increase in home sales and prices, particularly in places where home values have remained reasonable over the past few years when compared to the median income.

"We are estimating about a 5% drop nationally. Some markets, believe it or not, will probably see prices continue to increase," Sharga added. Senator Raphael Warnock agrees, pointing out that there

would be increases or decreases in housing prices depending on the region, with cheaper places likely to witness price rises and more costly ones likely to see falls.

According to some analysts, a significant proportion of borrowers have positive equity in their houses, placing today's homeowners in a considerably stronger position than those who were recovering from the 2008 financial crisis. As a result, there is little chance of a home market crash.

"Homeowner equity is at the highest level it’s been in the past several decades, so homeowners have a lot of value in their home," Nicole Bachaud, an economist at Zillow, said.

In a housing market crash, you would typically see a 20% to 30% drop in home prices and a decline in home sales—far more than what’s currently happening. Another crash symptom that’s been missing is a jump in foreclosure activity.

"I think we’re more likely to see the market cool, rather than crash," Sharga said.

Even with the gradual increase in foreclosures that followed the COVID-19 foreclosure moratorium's expiration in September 2021, they are still below pre-pandemic levels.

The Year-End 2022 US Foreclosure Market Report from ATTOM Data shows that the number of foreclosures was 34% lower in 2022 than it was in 2019.

"It seems clear that government and mortgage industry efforts during the pandemic, coupled with

the United States

2013 - 302

2014 - 324

2015 - 363

2016 - 371

2017 - 378

2018 - 397

2019 - 395

2020 - 392

2021 - 389

2022 - 391

From 2015- 2022 (In Million Dollars)

Source: CensusHUD

a strong economy, have helped prevent millions of unnecessary foreclosures," Sharga said.

Foreclosures increased by 2% from December to January 2023, up 36% from the previous year. The fact that many homeowners, including those who are having trouble making payments, have seen a significant increase in their property values recently is a significant distinction between the current housing crisis and that of 2008. That means they still have equity in their homes and are not underwater—when they owe more than the house is worth.

Sharga noted that borrowers in foreclosure are leveraging the positive equity in their homes by refinancing their homes or selling for a profit. "It seems likely that this is a trend that will continue in 2023," Sharga said.

In any market, purchasing a home is a very personal choice. Homes are typically the biggest single investment that a person will make in their lifetime, therefore it's important to have a strong financial foundation before making a purchase. Based on your down payment and interest rate, use a mortgage calculator to determine your estimated monthly housing costs.

Neda Navab, president of the US region at Compass, a real estate tech company, said, "Trying to predict what might happen this year is not the best home-buying strategy. Buyers sitting on the sidelines today in anticipation of lower prices tomorrow may end up disappointed."

Neda Navab anticipates a slight reduction in home prices in the hotter markets of recent years, but she does not anticipate a widespread, nationwide price decline similar to that which followed the 2008 financial crisis. Experts advise buying a home based on your wants and budget rather than holding out for substantially lower pricing. It is possible that a house you like in a neighbourhood you like that also meets your budget is the one for you. But, if you make too many compromises to obtain a home, you can experience buyer's remorse and be forced to sell the property.

According to the CoreLogic Market Risk Indicator (MRI), which

provides a monthly assessment of the overall health of the nation's housing markets, Bellingham, Washington, is at extremely high risk (70%-plus chance) of experiencing a decrease in home values over the coming 12 months. Other areas with a very high probability of price drops include Crestview-Fort Walton BeachDestin, Salem, Merced, and Urban Honolulu in the United States.

A probability score (from 1 to 100) is provided by CoreLogic Market Risk Indicators, a multiphase regression model, for the likelihood of two scenarios for each metro: a price fall of more than 10% and one of less than 10%. The likelihood of a price cut increases with a score. CoreLogic is a leading global provider of property information, analytics, and dataenabled solutions.

To make homes more accessible, the housing market may require 'a correction.' Since the beginning of 2012, the national housing market in the United States has increased annually. All 50 states and the District of Columbia saw an increase in home prices during the second quarters of 2021 and 2022. Buyers continue to raise property prices in today's housing market, which causes homes to sell quickly. To win bidding wars in the fiercely competitive home market during this pandemic, the United States witnessed overzealous purchasers submit offers before visiting the property and waive contingencies.

editor@ifinancemag.com

Although electric vehicle sales appear to have a future, there are worrying shortages of essential materials, which may hinder automakers' ability to meet demand while maintaining low prices

Electric vehicle (EV) sales are soaring like never before. Results for the first quarter indicate nothing but happy news for the electric vehicle makers. The auto industry claims good performances in electric vehicles despite supply chain challenges and higher upfront prices.

Major auto player Ford declared a growth rate of 139% while Volkswagen witnessed a 65% increase, and Tesla registered a rise of 81%

Concerns among consumers over rising oil costs and tax incentives are thought to be the reason for the recent amazing performance of electric vehicle sales.

Global oil prices have skyrocketed as a result of rising inflation following the COVID pandemic recovery and the Russian invasion of Ukraine. The average price per gallon in the US recently stood at $4.25,

up from $2.92 a year ago.

While increasing gas prices have prompted American consumers to think about purchasing electric cars, tax incentives, such as the federal tax credit of $7,500, have also played a huge role in inspiring many to switch to electric vehicles.

Although electric vehicle sales appear to have a future, there are worrying shortages of essential materials, which may hinder automakers' ability to meet demand while maintaining low prices.

The shortages are caused by a number of issues, including sanctions against Russian metals, COVID

lockdowns in China, embargoes against minerals from Xinjiang, and the backlog in US mining project approvals.

The most pressing scarcity is lithium, a vital component of batteries. Compared to last year, the cost of lithium battery cells has already risen from $105 to $160 per kilowatt-hour, and if supply constraints are not resolved, costs will keep increasing.

There have long been recommendations for producing more lithium batteries. It was foreseen by Tesla CEO Elon Musk in November

2021. He made light of the possibility that Tesla would have to enter the mining industry later in April on Twitter. But it's not just Tesla alone; due to a lack of batteries, Volkswagen has already sold its entire electric vehicle inventory in the US.

China currently dominates the lithium battery business. It refines 80% of the world's raw materials, owns 77% of the world's cell capacity, and produces 60% of the world's battery components. Lockdowns imposed by the government have had a catastrophic impact on world productivity. These slowdowns not only endanger American industry but also national security because these batteries are employed in electric vehicles and a variety of US defence technology.

The public and private sectors must collaborate to boost investments, advance mining and production in the United States and the Western Hemisphere quickly, and diversify supply chains to lessen our reliance on Chinese lithium in order to handle this threat.

Businesses have been stepping up to the plate and investing in electric vehicles and the essential components required for making these vehicles.

Tesla just purchased 10,000 acres in Nevada to start mining and established a Gigafactory in Texas to act as its primary manufacturing plant. SK, a South Korean firm, is getting ready to launch a sizable battery factory in Georgia where it will produce batteries for Ford and Volkswagen.

As part of its plan to obtain lithium from the Salton Sea in California's Imperial Valley, where the Berkshire Hathaway Power Plant is attempting to produce up to 600,000 tonnes of lithium carbonate annually, GMC announced that it will invest in Controlled Thermal Resources, a business that uses geothermal energy to extract lithium.

Despite these actions being praiseworthy, the problems cannot be resolved by the private sector on their own. The Joe Biden administration must promote divestment from key minerals made in China.

The White House has so far set aside more than $7 billion to improve the country's battery supply chain. As part of that investment, $3.1 billion, according to Joe Biden, will be given to businesses that produce and recycle lithium batteries. The Defense Output Act was also approved by the White House in March, which will significantly enhance battery production.

However, the Biden administration needs to go further. While exploring minerals that can replace lithium in batteries, the White House ought to offer incentives to firms willing to invest in battery plants in the US. China operates 93 large battery plants, compared to just 4 in the US.

New mining facilities must be approved quickly by the federal government. Eliminating regulatory barriers to mining will not only boost investment but also shorten the response time for urgent shortages, and solve a critical need in national security.

Finally, the US sector needs to diversify its supplies in order to completely lessen its reliance on lithium. Some firms have already identified viable solutions.

Iron-based grid batteries are being developed by ESS Inc. of Oregon, which will reduce the need for lithium and increase the supply of electric vehicles. Since the ocean is thought to contain up to 180 billion tonnes of lithium, a German Tech Institute assumes they can filter seawater to get additional lithium.

With everything said, the electric vehicle is the wave of the future for the auto industry, but for this revolution to truly succeed, the public and private

sectors must collaborate to reduce the regulatory burden on mining and production as well as to challenge China's dominance by promoting investment in domestic or "near-shore" lithium resources and expanding the range of practical battery options.

The problem does not lie only with the shortages of essential materials but also with the urge for people to shun fossil fuel-powered vehicles and opt for electric vehicles.

After persuading a reluctant Congress to invest heavily in electric vehicles, the White House must now convince tens of millions of hesitant drivers to buy them.

The administration aims to stop fossil fuel-powered transportation as electric cars struggle to shed their image as unreliable and difficult to charge. But unfortunately, GOP lawmakers are spreading these perceptions to harm the

administration’s plan.

Federal agencies are hurrying to improve electric vehicle driving and boost public confidence by providing 500,000 new chargers and forming a new office to coordinate the changeover.

Additionally, the climate measure Joe Biden signed recently combines incentives for car buyers with prizes for carmakers who increase electric vehicle production and shift manufacturing lines to the US, providing the firms with a new impetus to embrace the change and promote the vehicles.

Even electric vehicle loyalists are frustrated by wait lists and increased pricing, adding to the administration’s difficulties.

Gregory Pierce, co-director of UCLA’s Luskin Center for Innovation, predicts a rough few years. Even with subsidies, there aren’t enough

affordable electric vehicles.

Robert Fernatt, director of the state’s electric auto association, said it’s “very tough.” A vast region of West Virginia has no fast charging stations for anything but a Tesla, an expensive premium car. He advises out-of-state travellers to avoid West Virginia.

Even California, the country’s electrification pioneer, faces challenges in accelerating the change. Even with state and federal subsidies for low-income drivers that could soon add up to $17,500 for a used model, getting drivers into the cars is difficult.

At whatever price, selling most drivers on the autos will take time. According to an April survey by Consumer Reports, most drivers would not contemplate buying or leasing an electric vehicle today.

there has been expensive and resourceintensive, mainly focusing on a few states. As a result, only 5% of new automobiles sold are zero-emission, and nearly half of those sales are in California.

Joe Biden’s aim of selling half of all new automobiles as electric by 2030 will require many more states to adopt California’s and Massachusetts’ intensive outreach and regulatory measures.

However, not everyone is on board. The GOP is still working for the fossil fuel lobby, which wants to slow down the transition to green energy.

Meanwhile, Lucid Group, a Californiabased electric vehicle manufacturer, has announced that it would be opening its first overseas manufacturing plant in Saudi Arabia. Apart from this, the Kingdom of Saudi Arabia will give up to $3.4 billion in financing and incentives over the following 15 years.

According to a press release issued by the luxury automobile company recently, the manufacturing plant would be able to build 155,000 vehicles per year and will first serve the local market. The automobiles will thereafter be exported to other countries.

Currently, Lucid’s factory which is based in Arizona can produce 350,000 units a year. Furthermore, Saudi Arabia’s minister of funding, Khalid al-Falih has stated that the country needs electric vehicle battery manufacturers, suppliers, and others who will open stores in the country, potentially creating 30,000 jobs.

Khalid al-Falih concluded by stating that Saudi Arabia is dedicated to its transition away from traditional fuels and sustainable energy.

Many owners of the 2.5 million electric cars in the US love them. However, getting editor@ifinancemag.com

ccc offers comprehensive solutions designed to modernize financial businesses as per the outlook of the Saudi regime

is a Saudi Arabia-based leading Customer Experience Management provider, which is progressively pioneering the advancement of the Business Process Outsourcing (BPO) industry in the country through local, digitized services with international standards such as COPC OSP standards.

While ccc empowers businesses in Saudi Arabia and beyond to strategically optimize operations for various service lines including Customer Lifecycle Management, HRO, F&A for multiple industry segments, it also boosts operational efficiency through an enriched experience to achieve more impactful and long-lasting business outcomes.

ccc is the subsidiary of Saudi Telecom (stc), the largest telecommunications provider in KSA and is headquartered in Riyadh. ccc operates from three strategic locations across the country, assisted by stateof-the-art facilities and technology that ensure the best quality, consistent services to its customers.

The company has employed more than 6,000 people, including 2,300 women, so far with a very high Saudization rate. With digital technology playing an increasingly important role within the large socioeconomic set-up, ccc’s approaches make it well-placed to take advantage of the opportunities it holds. The company has a wide range of solutions spanning the entire spectrum of customer care, technology services, digital businesses, consulting, back office, and all other specialized services focused on ccc’s primary aim to provide customers with an enhanced experience.

BPOs enable companies to streamline their operations by undertaking most of the monotonous duties from their core teams, thus allowing them to focus on important responsibilities which result in increased productivity and higher cost reductions.

The industry is currently on the evolution path

and here are some other key trends ccc thinks will happen in the Saudi’ outsourcing industry going forward:

Digitization will give BPO services a new lease of life

Digitization has broadened the range of services that the future of the BPO industry can provide. ‘Traditional’ outsourcing has declined as new technologies are offering newer alternatives.

Robotic Process Automation (RPA) is beginning to take over, supported by Artificial Intelligence (AI), which can lead to more agile outsourcing services offering customers higher quality experiences. Technological advancements and solutions will change the way businesses interact, engage with their customers and fulfil their service obligations.

BPO providers will be aiming at automating firstlevel customer interactions and work processes with tech-like chatbots instead of completely relying on manual tasks. This will help lower attrition in the long term. Automation will greatly impact the type of services provided by BPOs.

During and post the COVID pandemic, remote/ hybrid work culture has become the sort of the new normal. Going forward, BPOs will increasingly gain from utilizing part of the

ccc by stc

workforce as it can reduce a great number of physical overheads.

A combination of both onshore and offshore outsourcing models can optimize companies’ operational costs. Known as right shoring, the process involves outsourcing complex and higher-valued customer interactions onshore, while moving regular high-volume tasks to cheaper locations.

Traditional dialogue-based IVR (Interactive Voice Response) systems with complex menu trees don’t meet the needs of the tech-savvy consumers of the 21st century. IVR systems are getting augmented with AI technology, thus significantly improving the efficacy of self-service systems.

The BPO sector will adopt new trends like the Outsourcing of Knowledge Processes (KPO), Outsourcing Legal Services (LPO), Research Process Outsourcing (RPO), services aided by Information Technology Enabled Services (ITES).

The BOP industry will continue to be a customercentric one and the changes and new trends here will all be based on customer experiences. There is a growing demand for CX consulting services, thus providing new growth avenues of growth for contact centres.

While omnichannel service delivery and customer analytics solutions are the key trends shaping the future of CX, a few other important aspects for delivering top-notch customer experience and differentiating it from competitors are providing personalized services, having efficient addressing of issues, and gaining the customer trust through accuracy and follow-ups.

Enterprises are increasingly looking to partner with operators who are not only capable of embracing the customer-centric approach but also can proactively suggest innovative solutions for transforming their CX operations.

BPOS need to focus on three global trends that are improving customer experience: CX consulting: Several operators are expanding their portfolio to offer CX consulting services – from conceptualization to integration and implementation of comprehensive customer-centric solutions to enhance CX.

Omnichannel CX: Customers are now relying on multiple interactive platforms to connect with businesses and this approach focuses on having consistent communications and engagements across all channels.

CX analytics: This is the key in getting the context on-point for every customer interaction. It also captures the most updated customer insights, helping enterprises make strategic decisions on products and services.

Chief Financial Officers (CFOs) these days have to face immense pressures, given the economic environment and the changing global

landscapes. Apart from meeting the dual mandates of leading their financial functions with digital transformation, these professionals also need to ensure that their organizations accelerate on the progress path.

This factor is guiding businesses now to use outsourcing, in order to drive transformational changes, improve business results, and create profit-driving platforms. ‘Vision 2030’ is about building a strong, thriving, and stable Saudi Arabia that provides fair economic opportunity for all. Another pillar of this vision is the determination to become a global investment powerhouse based on the idea that the country holds strong capabilities and these can be harnessed to stimulate the economy and diversify revenues.

There’s an appetite for outsourcing customer care services and the key drivers behind this are improving effectiveness and saving cost. Saudi has a price-sensitive market and this factor makes many

BPO service providers enter a price-war mode to gain a larger market share. On the other hand, a large segment of the market is not quality-driven, especially retail, hospitality, and food.

Thus, clients will evaluate the BPO providers on the prices in higher weightage over the services’ quality. Industries like banking and finance (BFSI) and government services used to be the greatest consumers of BPO services. However, recently, the Council of Cooperative Health Insurance Council (CCHI) and National Cybersecurity Authority (NCA) put pressure on the BFSI sector to insource the BPO services and nationalize the expertise.

Having said that, manpower-based services will witness increased adoption by the government, like facility management, paid parking management, and revenue-sharing business. These types of activities will help further BPO services by some service providers.

That apart, some of the other high-growth verticals are:

E-commerce, which has a 41.0% CAGR (Compound Annual Growth Rate) currently, will continue to grow, but not at the same pace as online shopping becoming mainstream. The market would witness increased competition and the existing platforms will become more efficient in order to deliver better customer service.

Healthcare at 31.6% CAGR as the Ministry of Health deployed several applications and services, apart from increasing its contact centre capacity to respond to citizens' queries related to the COVID-19 medical consultation. The privatization of hospitals will drive the contact centre business both in voice and digital formats.

The government at 15.7% CAGR is looking to rebound from the fall in oil prices and the pandemic, and will invest in the contact centre to cater for the high demand for new services in tourism, culture, sports and investment.

The moderate growth verticals are:

Retail and wholesale at 9.4% CAGR were heavily impacted by COVID, as the pandemic and the resultant social distancing norms refrained consumers from visiting retail shops and diverted them towards e-commerce. Businesses in this field will be under continuous pressure, as they will be forced to opt for cost-cutting measures including renegotiation of outsourcing contracts.

Travel and transport at 7.4% CAGR will have to contend with the large contracts in aviation which will be subjected to heavy negotiation. The sector growth will be supported by the contracts for metro Riyadh and public transportation.

The energy sector at 7.0% CAGR is mainly manpower outsourcing driven. The falling oil prices will result in heavy negotiations with contact centres and BPO providers.

Others at 7.7% CAGR include automotive, pharmaceutical, real estate, manufacturing, agriculture, media, and entertainment. The drop in 2020 was majorly driven by sectors like entertainment and automotive, which will turn to

digital channels to serve their clients. Currently, utility, hospitality, BFSI and telecom are the slowest growing verticals, thus needing steady revival efforts.

Talking about outsourcing, CFOs are still the key decision-makers. Saudi Arabia is currently experiencing a growing demand for front-office process outsourcing. Over 77% of the spending can be attributed to front-office processes while around 23% can be attributed to back-office activities ’outsourcing. The front-office outsourcing market will grow at a five-year CAGR of 10.2% while the back-office market, although small, will grow at a CAGR of 9.5% in the same timeframe.

The aim is to improve the business environment, so that the economy grows and flourishes, driving healthier employment opportunities and long-term prosperity. This promise is built on cooperation and on mutual responsibility, and ccc has chosen to step in to help the country attain this vision. The ccc F&A spectrum of services can provide businesses with next-generation

capabilities, digital playbooks, and underlying systems that can help their clients to optimize their finance functions and create financial intelligence.

The company also leverages technology, automation, industry and domain expertise to digitally transform F&A (Finance and Accounting) into the value addition of its client enterprises so that these businesses can grow and attract global investments. ccc also offers comprehensive solutions designed to modernize financial businesses as per the outlook of the Saudi regime.

Having a CFO professional to handle the bookkeeping and accounting work is something which remains on top of any company’s priority list. The reason big businesses are choosing to outsource their F&A activities lies in the fact that this option gives them access to highly-skilled, well-trained and knowledgeable financial expertise, which in turn, helps these enterprises to ensure smooth operations,

faster growth and improved cash-flows.

Having an outsourced F&A activity also helps businesses to focus on their core functions and move up the value chain ladder. The choice is between an advanced outsourced accounting team and customized controller/CFO services, but the point here is that the particular activity will transform the concerned business’s finance functions and maintain foolproof accounting, which will help the enterprise to generate a solid brand name.

Having an outsourced F&A activity gives businesses better cost-saving options and a sound ability to solve capacity issues. Some of the other advantages are:

Access to F&A expertise: Outsourcing helps businesses to access the specialized knowledge of highly trained accountants/finance professionals. These individuals have the experience and expertise to produce the best results, irrespective of whatever businesses they are working in.

Higher time and cost savings: Outsourcing is cheaper, as you don't have to face the prospect of facing overhead expenses, which is faced by businesses in case they are hiring and maintaining a team of dedicated inhouse staff to handle the bookkeeping job. Also, the employees get spared from these mundane tasks and

they can use this extra time to give priority to solving other operational issues.

Increased scaling ability: Outsourcing F&A gives businesses the ability to scale up or down their operations based on the workloads. Businesses can increase or decrease the number of people working on projects and not be bound by time or cost constraints to deliver as per clients’ needs.

Better business intelligence & business

continuity: An outsourced accounting team gives businesses the element of proactivity as financial experts can spot red flags beforehand and offer appropriate solutions.

Some of the commonly outsourced services are payroll accounting, accounts payable, and accounts receivable. However, most businesses are now eyeing more strategic and high-level functions such as budgets, forecasts and internal audits. That’s where Digital Finance & Outsourcing comes into the picture.

This solution has the technological advantage, as it brings from Robotic Process Automation (RPA), automated bill payments, and enterprise

resource planning (ERP) solutions, apart from being adaptable towards global operating models that help companies save on time and resources of manual F&A.

Digital Finance & Outsourcing is, however, not supposed to replace the manual finance functions in the client companies. It’s more about the effective harmony between the man and the machine, which in turn, will help companies to work more on operations and sales while ensuring that their daily mundane and repetitive financial tasks are being taken care of consistently.

Digital finance depends on proven cloud technology solutions that provide comprehensive finance resolutions, starting from key performance indicators (KPIs), metrics, to financial reporting automation, in order to ensure timely and accurate outcomes. Digital Finance & Outsourcing simplifies and standardizes processes to enable companies to develop better benchmarks and meet regulatory requirements faster.

Digital finance advisors also leverage tech to advise clients about how to further their offerings and make them more convenient and accessible to make the digital transformations of businesses a solid one. Ideally, digital transformation through outsourcing should look at enhancing processes in three key areas: automation, analytics and collaboration. Finance companies should look towards SaaS (Software as a service) solutions, cloud migration, and other innovative technologies to assist in the

Some of the commonly outsourced services are payroll accounting, accounts payable, and accounts receivable. However, most businesses are now eyeing more strategic and high-level functions such as budgets, forecasts and internal audits. That’s where Digital Finance & Outsourcing comes into the picture

digitization of their finance functions.

A digital finance department of any company brings these advantages:

Reduced error margins: With digital F&A, teams get a 360-degree view of their data which makes human errors easier to identify. Also, the data gets updated into a centralized system which makes for better compliance.

Enhanced security: A digitalized system helps businesses to store sensitive data within secure cloudbased systems, and also offers SaaS solutions devised for finance functions that offer sophisticated security processes.

Advanced analytics: Digital finance can give businesses access to advanced analytics by leveraging AI, real-time data processing and innovative machine learning.

Improved employee performance: Digital tools replace the repetitive, tedious tasks that slowdown employee performance and helps to streamline processes such as vendor management, cash flow forecasting, accruals, and audit preparation.

Irrespective of their sizes, businesses have reached a point where they have realized that it pays to collaborate with trusted, proven BPOs that can help make these enterprises optimize operations and make workflows workable, so that these businesses can stay resilient and relevant.

editor@ifinancemag.com

In recent years, the real estate sector has seen disruption due to the advent of new technologies and changing demographics among homebuyers. These issues have impacted all facets of conventional real estate transactions, starting from how properties are listed to typical closing timelines. As a result, many investors are now still determining how the sector’s future will pan out and how they can adjust to these changes. Keep reading to find out how to get ready for the future of real estate, both personally and professionally.

New technology and an influx of finances are causing significant changes in the real

estate sector. This surge in the capital should be taken as a hint that the real estate sector is getting ready for rapid transformations due to the emergence of new digital resources. Most importantly, investors must be prepared for blockchain technology, virtual reality, smartphone apps, and online property listing platforms' influence on all facets of real estate transactions.

Investors will soon notice increased competition among websites that advertise properties, many designed to make it easier for prospective/current owners to acquire/ sell their properties. Although websites like Zillow and Trulia have dominated the market for some time, other websites of a similar nature will still be developed.

Buyers and renters will have clear notions of what they are looking for when shopping for houses, thanks to the popularity of internet listing systems. Investors who want to stay ahead of the curve must adjust to buyers (and sellers) who have instant access to hundreds of real estate listings. Joining the bright home trend and including appliances and other elements compatible with new apps is one approach to stand out. These elements' greater security and energy efficiency appeal to the techsavvy demographics.

Many facets of the real estate transaction process will continue to alter as more smartphone apps get developed. Real estate agents can already sign and share contracts and other papers on their phones thanks to programmes like Docusign and Dotloop. Tenants can pay rent or contact landlords online using other apps like Buildium and RentTrack. As investors look for ways to automate the deal acquisition, property administration, and communications, these apps are anticipated to gain popularity.

Apps that use blockchain technology to support the legal aspects of a transaction are also likely to be released, which will be of interest to investors. They will concentrate on several topics, including exchanging crucial papers and transferring deeds or titles. Blockchain networks boost trust and eliminate intermediaries when purchasing and selling real estate.

Another emerging technology that will have an impact on the real estate industry is virtual reality. Even though 3-D walkthroughs and 360-degree images may be familiar to investors, their use is anticipated to grow.

Investors may boost the number of property viewings without adding extra time or effort by offering prospective buyers a new method to experience properties. Buyers will be able to tour homes without ever going, thanks to recorded 3D property tours.

Investors will be thrilled to learn that virtual reality software will be used for property viewings and may assist renovators in planning their projects. For instance, several apps may enable investors to observe staged rooms and renovations from their mobile phones. In addition, property developers and investors interested in raw land investments may benefit from virtual reality in real estate. According to Forbes, property developers should prepare for virtual reality applications that let users experience finished properties before construction even begins.

According to investors, introducing new technology will generally benefit all parties involved in real estate deals. Investors should consider these impending changes as methods to make business more dependable and efficient rather than worrying about new resources.

India-based proptech firm Square Yards launched its 3D Metaverse platform in August 2022 to showcase the future of real estate search and discovery through a high-end 3D digital twin of the city of Dubai, the next property investment destination. The platform brings cutting-edge technologies such as 3D, AI, VR, AR, and interactive real estate visualisation into play through its Metaverse app.

"With this solution, users can search from over 2000+ potential real estate projects across Dubai through its interactive 3D interface, get complete details of the project, and enter into the

2023: 10.70

2024: 11.30

2025: 11.90

2026: 12.40

2027: 12.90

2028: 13.50

2029: 14.00

2030: 14.60

(In Million Dollars)

Source: statista.com

project metaverse as an Avatar," the company said.

"Imagine searching for properties to buy, sell and rent across Dubai in high-quality 3D at true scale, visit the project building in VR, walk around the amenities and interiors, and interact with residents and salespeople virtually," said Tanuj Shori, the company's Co-founder and CEO, while interacting with the ET.

Rentd, a UK-based company is all set to launch an online property platform for Dubai, which will enable renters and landlords to conclude the entire rental journey online. Features on the platform include 3D virtual tours of villas and apartments to signing contracts digitally.

One of the significant developments in real estate investing is the growing gap between homeowners and real estate agents. As a result, many wonders if listing a home on their own or working with a professional agent are preferable.

Real estate brokers are still in need in the 21st century, and it isn't easy to see a time when they won't be required. Unfortunately, they provide the typical homeowner with far too much value.

To begin with, their bargaining abilities and knowledge of the local real estate market will always help sellers get the best price for their homes, homeowners who attempt to sell a home risk losing money with only one hiccup. The buyer's representative might

negotiate a lower price. Everything may go right with a qualified agent to represent the concerned parties’ interests in a transaction.

Agents have the potential to sell a home more quickly in addition to getting the most money for it. They already have a qualified buyers list in addition to marketing initiatives.

Before the house is formally listed for sale, the proper agent can already have a buyer in mind.

There is no denying that a competent real estate agent is priceless, particularly for those in the investing sector, but a few trends need your attention. For Sale by Owner (FSBO) platforms, in particular, are starting to carve out a niche among a small group of sellers.

In the last two years, almost 17% of homebuyers felt they didn't need to use a real estate agent, according to a poll done for Redfin. The survey, made possible by SurveyMonkey Audience, found that discounted commissions are becoming increasingly common. Onethird of the homeowners who did utilise an agent to buy a house claimed that their representative provided incentives in the form of a refund or savings of more than $500.

Realtors frequently charge 6% of the sales price in exchange for their services. As a result, commissions can exceed $14,000 on a single-family home with a median value of $230,000. At that point, the idea of doing without a Realtor becomes alluring.

Over half of all homeowners in America would consider selling their property without a Realtor's assistance, according to research from ForSaleByOwner. At the same time, 55% of Millennials admitted they planned to offer their house using the "for sale by owner" sales strategy.

With today's consumers, particularly millennials, exerting more control over the purchasing and selling process than ever, the real estate market is undergoing a "dramatic transformation," according to Lisa Edwards, director of the business strategy at ForSaleByOwner.

The peak of the 2015 selling season saw an astonishing 57% growth in listings on ForSaleByOwner, and nothing indicates that the trend won't continue. Yet it's vital to remember that most sellers are from the Northeast. Large cities with large populations, like New York, Boston, and Philadelphia, seem more interested in skipping the agency process. Even the National

Association of Realtors (NAR) agreed that FSBO transactions are more likely to occur in major urban regions.

Today, without the assistance of an agent, [sellers] may quickly comprehend market conditions by using free internet pricing tools, evaluating recently sold homes, and looking at homes currently for sale online, according to Edwards.

Sites like Redfin have proven to be very beneficial for sellers. While typical agents can get away with charging twice as much, Redfin only charges sellers 1.5% of the transaction price. The difference may result in a $3,750 savings for sellers of a $250,000 home.

There is no denying that the way individuals view selling has altered due to internet listing services. Particularly agents have been forced to respond to the development of technology.

A Redfin representative stated that "real estate agents are reacting to increasing competition in the market," adding that traditional brokers had to adapt their business practices to remain competitive.

Of course, there is no reason to think trends will force real estate agents out of business. FSBO and other websites have made it simpler for the typical seller to advertise a home, but real estate brokers still have a position in the industry.

Real estate property markets are anticipated to change when millennials, a new wave of homebuyers, enter the market. The Urban Land Institute report indicates that millennials are beginning to enter the real estate market with an emphasis on suburban locations.

Although suburban house developments are nothing new, the real estate market may see fascinating changes in these locations. It has

been discovered that millennial homebuyers are more interested in walkable neighbourhoods and close to community resources.

While suburban areas can represent fresh markets for mixed-use and retail spaces, this should be good news for investors looking to enter the commercial sector.

Real estate investors may run into renters of all ages looking for more facilities in metropolitan regions. Parking and trash collection may be regarded as conveniences in the current market, but more is needed in the future. In the end, new amenities like roof access, communal spaces, and even specific offices will receive more attention in real estate.

Although they will only develop further, investors who own multifamily buildings may see these changes as early as 2023. Those that want to stay in the lead should monitor similar properties and alternative neighbourhood options.

Luxury properties will become more prevalent in real estate in the future. This is because inventory (especially luxury houses) will grow as housing demand rises to accommodate homebuyers.

Investors will see the highest rises, per Realtor.com, in locations like San Jose, CA; Seattle, WA; Boston, MA; and Nashville, TN. Yet, these developments should still be anticipated by investors nationwide.

Finally, green building techniques and eco-friendly housing amenities will likely become more prevalent, which is good news for all real estate agents.

Investors should only partially discard the real estate industry's ecofriendly segment, even though tax policies may have reduced some motivation for eco-friendly home upgrades.

According to the National

Association of House Builders, 80% of homebuyers would be favourably influenced by energy efficiency. The survey covered Energy Star appliances, above-code insulation, and adequately insulated windows.

These qualities should be kept in mind by real estate investors who specialise in new construction and house flipping and should be incorporated as necessary.

The real estate housing market's future holds some intriguing adjustments overall. Accordingly, investors should monitor their individual needs to determine whether to capitalise on developing trends.

Finding information about the future of real estate from more seasoned investors

is one of the finest methods to do it. Individuals who have been investing for ten or more years have witnessed (and adjusted to) significant changes in how the real estate market operates. In many situations, these investors have improved their ability to predict where real estate may be headed.

Than Merrill, CEO of FortuneBuilders and a real estate investor, has invested for over 15 years. So when asked where he saw the real estate industry going, his primary responsibility was technology.

In an interview with Disruptor Daily, Merrill stated that the advent and rising popularity of cryptocurrencies and blockchain would significantly impact transaction times. With greater access to these networks, he continued, buyers and sellers will operate more quickly.

On a related point, some investors

have made assumptions about how technology will affect relationship dynamics and transaction timelines in the real estate sector. Buyers and sellers, landlords and tenants, and even investors and contractors are included.

For instance, Dominique Burgauer, CEO of Archilogic, stated that cuttingedge businesses are currently driving the adoption of new technology. For example, almost all phases of a building's existence will soon be managed online, according to Burgauer. Likewise, the real estate sector will be online, from development and furnishing through sales and upkeep.

According to this perspective, many investors might wait for rival companies to lead the way with innovative technologies. Investors should instead concentrate on finding the best ways to adopt these new technologies before

their rivals can.

Furthermore, according to Property Radar, “local investors need to concentrate more on off-market real estate purchases and value development. In general, Wall Street doesn't want any issues with either people or property. Deals that don't scale include heavy fixers, probate, liens, unclear titles, and hoarder homes. Also, they need to aggressively investigate upzoning, accessory housing units, or innovative financing options. To compete, our sector needs to keep becoming more professional.”

Investors should concentrate on research, education, and mentoring to adapt and evolve with industry titans. Although there is still much to learn about the real estate market's future, investors can develop their professional judgement and take action when necessary by continually experimenting with new ideas.

Emerging technologies, interactions between buyers and agents, and shifting homeowner demographics will influence future trends in real estate. To succeed, real estate investors must develop the ability to flourish in this environment.

The real estate market is changing significantly due to new technologies that will shorten closing times, online listing sites that will make purchasers more knowledgeable, and the entry of new age groups. Even professional forecasts point to future market shifts. As a result, investors have a lot to look forward to regarding the future of real estate.

From 2020 to 2021, private flights nearly tripled and emissions more than quadrupled

A study from Dutch environmental consultancy CE Delft hit the hornet's nest as it found that over 572,000 private flights were recorded in Europe alone in 2022, thus producing over 3.3 million metric tons of carbon emissions.

As per the study, from 2020 to 2021, private flights nearly tripled and emissions more than quadrupled. By 2022 end, these flights increased by 1.5 times from the 2020-21 period and carbon footprints also more than doubled. This disturbing news comes amid the aviation sector increasing its investments in R&D-related activities for revolutionary concepts like Sustainable Aviation Fuel (SAF), and electric and hydrogen aircraft, in order to meet the ambitious goal of a 'Net Zero' footprint by 2050.

The above study’s data set included the 27 European Union nations as well as Norway, Switzerland, and the United Kingdom. Private flights from these regions produced some 5.3 million metric tons of carbon emissions in the last three years.

The countries emitting the most carbon from

private flights in 2022 were the UK, France, and Germany. The United Kingdom wore the crown of shame, as Guardian reported that the country recorded 90,256 private flights in 2022, equivalent to a private flight taking off every six minutes and emitting over 500,000 metric tons of CO2.

The most popular flight paths were recorded between London and Paris, Paris and Geneva, and London and Nice. These short-haul flight operations ranging from just 251 to 500 km reached their peak in 2022, as nearly one-quarter of all private flights were taken over short distances, routes which can be covered by alternatives like trains and bike rides.

In 2020, lockdowns were imposed to curb the COVID spread. While this resulted in civil aviation coming to a screeching halt and hurting the stakeholders financially, it also reduced global emissions.

However, this short-term gain was difficult to maintain and as the world came back into normalcy by 2022, the aviation sector's carbon footprint has gone up again, but the disturbing aspect here is the global elites’ preference to comfort over the environment, and it complicates the EU’s efforts to reduce emissions by 55% compared with 1990 levels by the next decade.

On March 30, Greenpeace published a press release, where it called for a ban on private jets and short-distance flights on routes which have

The countries emitting the most carbon from private flights in 2022 were the UK, France, and Germany

alternatives like trains, saying "It should be part of an equitable plan to address the climate crisis."

In 2022, France got the nod from the European Commission to abolish domestic flights shorter than 2.5 hours, as there were protests in front of business-jet maker Dassault’s Paris headquarters, while others reportedly participated in “sit-ins” in multiple countries that effectively shut down private airports, while calling for private jets to be banned.

Spain has plans of ending all short-haul flights by 2050, while Germany doubled its flight ticket tax in 2022 for passengers undertaking shorthaul air journeys. Belgium will levy new taxes on private jets as well as older, noisier commercial aircraft from April 2023 as part of a scheme to reduce noise and air pollution.

“The noise pollution experienced by residents near Brussels National Airport, whether they live in Flanders, Brussels or Wallonia, cannot remain as it is,” Georges Gilkinet, Deputy Prime Minister and Transport Minister, said in the statement announcing the new taxes.

Aircraft using Brussels Airport currently pay a

tax based on the noise levels it generates during takeoff and landing. The new tax will now factor in carbon emissions as well as flight length. Any flight shorter than 500 km (310 miles) will see increased duties.

However, the European Business Aviation Association (EBAA) has cautioned against an outright ban on private flights, while citing that the particular activity employs almost 400,000 people and contributes almost 90 billion euros ($95.5 billion) to Europe’s GDP annually.

In 2021, a report from the European campaign group Transport & Environment (T&E) showed that the CO2 emissions from the continent's private jet market had increased by 31% between 2005 and 2019, rising faster than those from commercial aviation.

The report titled ‘Private Jets: Can the Super-rich Supercharge Zero-Emission Aviation’ reveals that the impact of private jets in terms of carbon emissions was ten times bigger than the one caused by commercial aviation and 50 times more severe than trains.

T&E aviation director Andrew Murphy said, "Flying on a private jet is probably the worst thing you can do for the environment. And yet, super-rich super polluters are flying around like there’s no climate crisis."

According to T&E, the most common type of private jet in the European market is the Cessna Citation Excel, which can carry eight passengers and has a fully-loaded range of 2,700km and is perfectly suitable for short-haul flights.

The second most used is the Beechcraft King Air, a turboprop aircraft which can fit up to six flyers (including crew and passengers), with a ferry range of 1,900 km. As reported by Transport & Environment in 2021, leisure was said to be the primary reason for flying private, especially during the summer months.

In a past survey by private aviation buyer’s Guide Private Jet Card Comparisons (a survey which was reported by Airport Technology), 46% of respondents said they were using private aviation to transport family members, and 45% reportedly flew privately to a second home.

Talking about the European market, private jets are mostly used for intra-continental flights. As per the aviation website Airport Technology, some of the preferred routes for such flights are spread across Switzerland, Italy, the UK and France.

Currently, the UK and France are the biggest polluters, producing 19.2% and 16.5% of CO2 emissions respectively, and these two nations outmatch the 20 other European countries. France in particular is one of Europe’s main hubs for private jets. One-tenth of all flights that were departing from France in 2019 were private jets and 80% of those flights travelled within Europe. Flights produce

greenhouse gas carbon dioxide from burning fuel and this contributes to global warming.

While emissions from civil aviation are reportedly known as significantly worse than any other mode of transportation, in terms of per kilometre travelled, the ratio varies depending on size, occupancy levels and efficiency. Private jets have a track record of producing more emissions per passenger than commercial flights.

For example, Cessna Citation XLS burns 189 gallons (857 litres) of aviation fuel an hour on average. For a journey of two hours and 45 minutes, this private jetliner will be requiring 2,356 litres of aviation fuel, which is a lot, if seen from the pollution angle.

The United Kingdom Department for Business, Energy and Industrial Strategy (BEIS) in 2021 stated that 2.52kg of carbon dioxide was emitted for every litre of aviation turbine fuel burned. So mathematically, a two hours and 45 minutes journey by Cessna Citation XLS will produce 5.9 tonnes of CO2. BEIS also recommended that to "capture the maximum climate impact" of flights, CO2 emissions figures should be multiplied by 1.9 to reflect the effect of non-CO2 emissions released by planes at high altitudes, which, as per the scientists, increases the global warming effect.

Therefore, the total emissions for the particular Cessna flight would be 11.3 tonnes of CO2 equivalent, and since the private jet carries nine passengers, each of them would be responsible for 1.2 tonnes on their journey.

In 2021, during an interaction with BBC, Debbie Hopkins, an expert in decarbonising transport at University of Oxford, said, "A huge amount of fuel is used during takeoff and landing of a plane, no matter how many people you have on board. So an already polluting mode of transport (commercial aviation) becomes even worse (with private jets)."

The 21st-century aviation is standing at a crossroads. On the one hand, the stakeholders are going from biofuels to batterypowered aircraft. Then we have the opposition to private jets deservedly reaching a new level as environmental activists are lobbying for stricter regulations/ outright bans.

• The private jet aircraft industry was estimated at $27.54 billion in 2019

• In 2021, the market hit $23.6 billion - and is expected to reach $36.94 billion by 2028

• There are an estimated 21,979 business aircraft jets worldwide

• North America had 15,547 private jet aircraft, more than all the other regions combined

• Europe had the second highest with 2,760 private aircraft

• Australia and Oceania only had 230 active business aircraft

• Industry forecasts predict between 6,362 and 7,300 new jet deliveries, valued between $204.4 billion and $236 billion over the next 10 years

However, one also cannot overlook European Business Aviation Association's concerns against a drastic regulatory move, as the private jet sector employs a good number of professionals and contribute significantly to Europe's GDP.

One needs to find a middle path. SAF and battery-powered jets can be that option, as they can be deployed for short-haul flights on a pilot basis.

Kennedy Ricci, founder of 4Air, which advises companies on making their operations more sustainable, told Robb Report, “We’re less than 5% of where we need to be by 2050.”