SANJAY KUMAR EDITOR-IN-CHIEF INTERNATIONAL FINANCE

SANJAY KUMAR EDITOR-IN-CHIEF INTERNATIONAL FINANCE

SANJAY KUMAR EDITOR-IN-CHIEF INTERNATIONAL FINANCE

SANJAY KUMAR EDITOR-IN-CHIEF INTERNATIONAL FINANCE

As International Finance celebrates the 10th anniversary of the IF Awards, we cherish the journey which started in 2013, with the aim of recognising industry talents, leadership skills, industry net worth and capabilities on an international platform. Over the years, IF Awards became one of the most recognized awards in the business world.

Our milestone year also coincides with a time when the global economy is going through a tumultuous situation. Russia's invasion of Ukraine and the resultant sanction wars have pushed the world into a crisis situation.

While the energy sector is reeling under the weight of Vladimir Putin vs west economic warfare, policy rate hikes from the United States Federal Reserve and other central banks made food imports a costly affair. Severe inflation and global wealth inequality are adding more woes to the unstable situation.

While the richest 10% of the world population currently owns the majority of the wealth, the remaining are still fighting for their basic needs. Global economic inequalities are now as extreme as they were a few decades back. This has been further aggravated by the COVID pandemic as it wiped out years of progress in reducing poverty. While the world’s richest lot has doubled its fortunes since 2020, over 160 million people have been pushed into poverty. On top of that, many countries in the world like Nigeria, Mexico and even the United Kingdom are facing a growing food crisis.

Despite all the pessimism surrounding the global economy over the last couple of years, the banking sector seems to be on the bright side in 2023 and our cover story revolves around one such successful venture called Lao Development Bank.

IN CONVERSATION

KICKING OFF LAOS' BANKING REVOLUTION

BANKING AND FINANCE

34

DATA PRIVACY, SECURITY BIGGEST CHALLENGE OF DIGITIZATION

Decentralized finance will have long-term adoption in future

ANALYSIS

12 How to make money when the market is falling?

40 Gender diversity in fintech

RISK MANAGEMENT TECHNIQUES FOR FINANCIAL SERVICES

Modern project management techniques helps improve client financial service experiences

18 80

SOUTH AFRICA’S CRIPPLING ELECTRICITY PROBLEM

Ramaphosa offered an action plan to develop additional power generation capacity in 2021

TECHNOLOGY ECONOMY

44 Machine vs man: AI to replace humans?

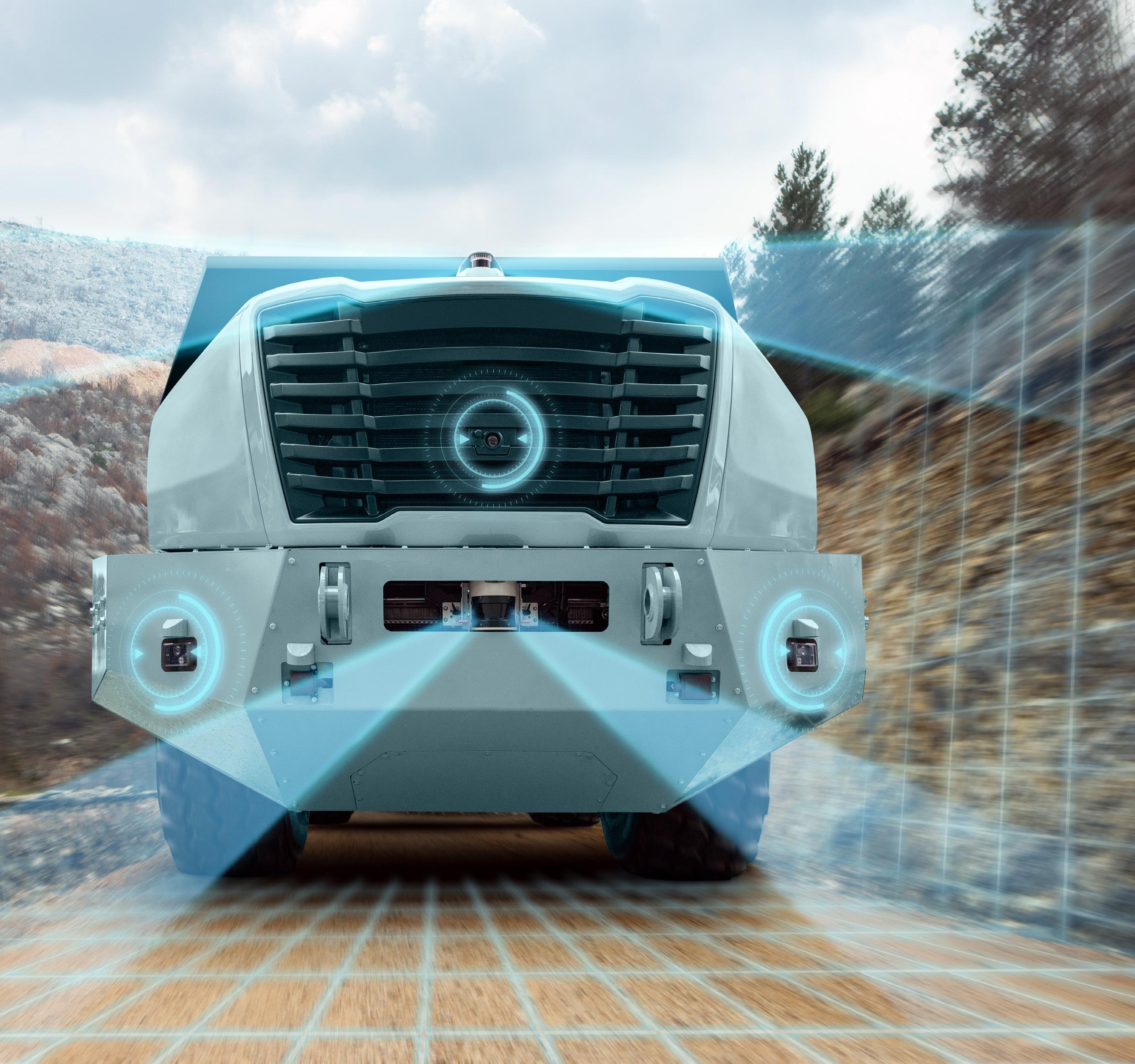

IMPLEMENTATION, NOT INNOVATION IS KEY TO WINNING AI RACE

The US, China, Japan, Russia, and the EU are all trying to capitalize

48 92

JOB CUTS: DO RECESSIONS HAVE A SILVER LINING?

Recessions are unavoidable stage of the economic cycle that bring hardship to businesses

52 Crypto 'Profit' Scam: Dark side of the web

BUSINESS DOSSIER

38 CBFS: Innovating a seamless banking experience

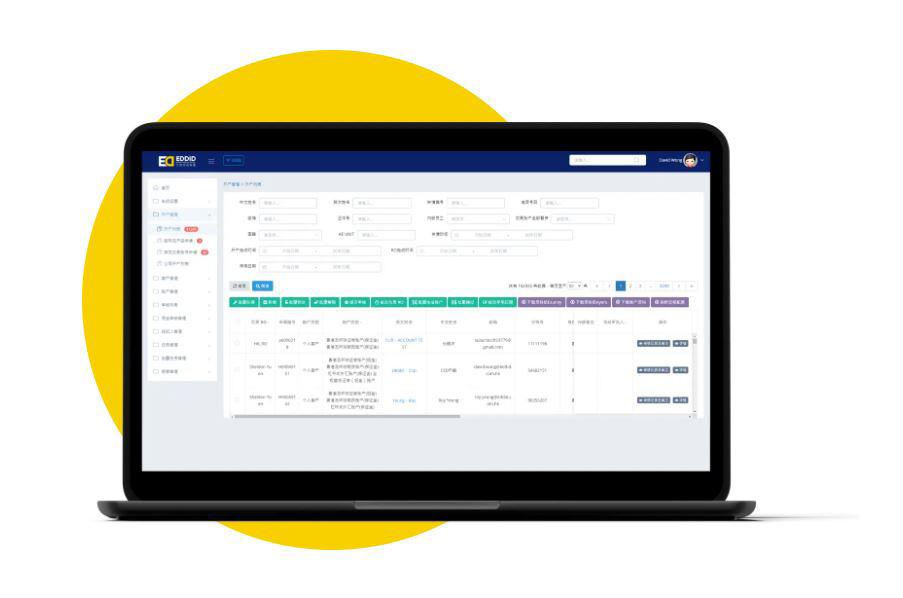

72 ‘Eddid ONE is backed by robust AI technologies’

84 SBM Bank: Staying relevant in an evolving environment

106 TEB Asset Management: Focus on new tech investments

www.internationalfinance.com

Director & Publisher

Sunil Bhat

Editor-in-Chief

Sanjay Kumar

Editorial

Prajwal Wele, Agnivesh Harshan, CL Ramakrishnan, Prabuddha Ghosh

Production Merlin Cruz

Design & Layout

Vikas Kapoor

Technical Team

Prashanth V Acharya, Sunil Suresh

Business Analysts

Alice Parker, Indra Kala, Ayesha Misba, Stallone Edward, Jessica Smith, Rohit Samuel, Harry Wilson, Susan Lee, Mark Pinto

Business Development Managers

Christy John, Alex Carter, Gwen Morgan, Janet George

Business Development Directors

Sid Jain, Sarah Jones, Sid Nathan

Head of Operations Ryan Cooper Accounts Angela Mathews

Registered Office INTERNATIONAL FINANCE

is the trading name of INTERNATIONAL FINANCE Publications Ltd 843 Finchley Road, London, NW11 8NA

Phone +44 (0) 208 123 9436

Fax +44 (0) 208 181 6550

Email info@ifinancemag.com

Press Contact editor@ifinancemag.com

Associate Office

Zredhi Solutions Pvt. Ltd. 5th Floor, Sai Complex, #114/1, M G Road, Bengaluru 560001 Ph: +91-80-409901144

The Swiss National Bank increased its benchmark interest rate yet again, taking it to 1%. The central bank said it was looking to counter “increased inflationary pressure and a further spread of inflation” with the move. The Swiss National Bank Chairman Thomas Jordan said, “All in all the inflationary pressure is higher than in September so further tightening was necessary. We are using a risk management approach and we are looking at what policy is appropriate in order to achieve our goal." Inflation in the country remains above the Swiss National Bank’s target of 0-2%.

Instagram is introducing and expanding many features to help users keep their accounts secure. The social network is launching a new “hacked” hub where users can report and resolve account access issues. If the user is unable to login then the user can enter Instagram.com/ hacked on a mobile phone or desktop browser to access the new hub. Next, users will be able to select if they think they have been hacked, forgot their password, lost access to two-factor authentication, or if their account has been disabled.

The EU has promised billions of dollars of investment in Southeast Asia, as leaders looked to bolster ties at a summit in the face of the Ukraine war and challenges from China. The EU hosted its first full summit with the Association of Southeast Asian Nations (ASEAN) in Brussels.

“There might be many, many miles that divide us, but there are much more values that unite us,” European Commission President told the gathered leaders.

The EU has been on a diplomatic push to galvanize a global front against Moscow.

A Taiwanese consumer electronics company, High Tech Computer Corporation (HTC) had introduced introduce a new lightweight flagship augmented reality (AR) headset. The headset has two hours of battery life, be fully self-contained, and support controllers with six degrees of freedom as well as hand tracking. The headset’s key feature is its outward-facing cameras that pass a color video feed to users’ screens, allowing for mixed reality experiences. The headset also have HTC headset have a depth sensor.

ROBIN HAYES

CEO, JETBLUE AIRWAYS CORP.

Robin Hayes disrupted the planned merger between deep discounters spirit Airlines and Frontier Group Holdings, wooing Spirit in a USD 3.8 billion cash deal.

The Middle East experienced economic growth for the second year in a row in a year marked by global economic uncertainty brought on by inflation, geopolitical crises, and supply chain instability. Countries in the region invested in innovative technologies and projects may indicate greater integration in the years to come.

According to an IMF prediction released in October, GDP growth in the

Middle East is expected to increase from 4.1% in 2022 to 5% in 2023, while global GDP growth is expected to drop from 6% in 2022 to 3.2% in 2023 as a result of persistently high oil prices. Even while regional economic growth is expected to slightly slow to 3.6% in 2023, it will still be higher than the estimated global rate of 2.7%. This year Kuwait's GDP grew by 8.7%, Saudi by 7.6%, and UAE by 5.1%.

LISA COOK

MEMBER, BOARD OF GOVERNORS OF THE FEDERAL RESERVE SYSTEM

Lisa Cook served as a member of the Federal Reserve Board of Governors. She is the first African American woman and the first woman of color to sit on the Board.

PHIL SPENCER

CEO, MICROSOFT GAMING

Phil Spencer is the head of the Xbox brand. He recently negotiated the biggest deal in company and video game history, the USD 69 billion takeover of Activision Blizzard.

Over 5.2 million lease agreement were registered with the Dubai Land Department Trust in Zimbabwe's currency is low as people saw their savings wiped out by hyperinflation in 2008

The rental dispute centre in Dubai is celebrating nine years of stability in the city's rental market. The Dubai Land Department (DLD) has received more than 100,000 cases since it established its judicial branch to provide economic stability for the city's landowners and tenants.

A total of 103,975 rental lawsuits have been filed in the centre, consisting of 92,732 original lawsuits and 11,243 appeal lawsuits. Of these, 100,000 lawsuits have been resolved, or 96% of the cases filed there.

Only 1.9% of the more than 5.2 million lease agreements with a total value of USD 179 billion that were registered with the Dubai Land Department during the same time period were the subject of this litigation (AED654bn). This helps to increase public trust in the emirate's legal system and legislative process.

Judge Abdulqader Mousa, Director of the RDC, said, “We are proud to have developed the world’s first smart judicial rental system and made it available to litigants, whether inside or outside the country. It is based on a sustainable

methodology, a pioneering real estate and rental model, an environment that incubates innovation and effective governance, and is part of Dubai Land Department’s strategic vision.”

RDC settled disputes by coming to reconciliation agreements, which resulted in 10,179 cases being settled peacefully for a total of AED282.8 million over an average of five days.

Mousa clarified, “One can infer the speed and accuracy of litigation through the index of the average duration of first-instance lawsuits, which is ten days, and the average duration of appeal lawsuits, which is 14 days. Concerning the execution of judgments, the average duration of execution of rental judgments and decisions in 2013 was 10 days.”

Dubai rental structures could be seeing significant changes with a new Rental Index to govern how much landlords and building owners will be able to hike prices for tenants. According to media reports, proposed changes currently under discussion are for Dubai’s rental index to be based on the quality of individual buildings rather than the neighbourhood they are in.

Zimbabwe has launched gold coins to be sold to the public in an effort to control the raging inflation that has devalued the nation's fragile currency. The Reserve Bank of Zimbabwe, the nation's central bank, made the historic announcement in an effort to increase public trust in the domestic currency.

According to the IMF, trust in Zimbabwe's currency is low as people saw their savings wiped out by hyperinflation in 2008 which reached 5 billion dollars. Zimbabweans today prefer to compete on the black market for limited US dollars to retain at home as savings or to use for everyday transactions due to their strong memories of that tragic time and also many shops do not accept Zimbabwe's currency. Recently, the central bank gave 2,000 coins to commercial banks.

Zimbabwean economist Prosper Chitambara said that the coins can be used for purchases in shops, depending on whether the shop has enough change.

"The government is trying to moderate the

very high demand for the US dollar because this high demand is not being matched by supply. The expectation is that ... there will also be moderation in terms of the depreciation of the local currency, which should have some kind of stabilizing effect in terms of pricing of goods," he added.

Any individual or company can buy the gold coins from authorized agents such as banks using the local currency or foreign currencies and purchasers can choose to keep the coins at a bank or take them home, according to an announcement by the country’s central bank. Foreigners can only buy the coins in foreign currency, the announcement followed.

"Called Mosi-oa-Tunya, which in the local Tonga language refers to Victoria Falls, the coins "will have liquid asset status, it will be capable of being easily converted to cash, and will be tradable locally and internationally. The coin may also be used for transactional purposes," the central bank added.

People holding the coins can only trade them for cash after 180 days from the date of buying, the bank said.

South Korea is highly reliant on exports of everything from chips and cellphones to vehicles and ships

Elon Musk has asked Twitter users to vote on whether he should step down as head of the social media platform

South Korea extended sales tax reductions on some fuel oil goods and passenger cars by a few months amid warnings of a more severe economic recession than anticipated in 2023. “Our economy’s growth is expected to slow next year due to the effects of a global economic slump, and the difficulty will be focused on the first half,” Finance Minister Choo Kyung-ho said. The fourth-largest economy in Asia, South Korea, is highly reliant on exports of everything from chips and cellphones to vehicles and ships. It is generally predicted that growth will decline to below 2% in the following year from around 3% this year. The central bank reduced its forecast for economic growth in 2019 from 2.1% to 1.7%.

Philippine Governor Felipe Medalla said that the central bank isn't likely to pause interest-rate increases at least in the next two meetings as inflation remains far above target. "Inflation expectations are higher than our own forecast," he said in an interview with Bloomberg Television's David Ingle, a day after delivering a half-point interest-rate increase. The Philippines is home to Southeast Asia's fastest inflation and one of the two economies in the region that's yet to see price gains peak. At 8%, consumer price growth is double the ceiling of the central bank's 2-4% target, making its containment a top priority for the BSP. "Inflation will be back to 2-4% by the third or fourth quarter next year," Medalla said.

Following a backlash over the company’s latest controversial policy change, Elon Musk has asked Twitter users to vote on whether he should step down as head of the social media platform. Musk tweeted, "Should I step down as head of Twitter? I will abide by the results of this poll." "As the saying goes, be careful what you wish, as you might get it," the Twitter CEO added in a later tweet. The poll had nearly received 10.5 million votes, with users voting 56.343.7% for Musk to go. Musk’s poll came after Twitter’s announcement that it would no longer allow the “free promotion” of other social media platforms sparked a backlash among users.

Wage growth in the UK’s private sector accelerated in the three months to October as inflation rose into double digits, according to data that promises to fuel an increasingly bitter stand-off between ministers and unions. Annual growth of 6.9% in regular weekly earnings, excluding bonuses, was the highest outside the pandemic period in the private sector, the Office for National Statistics said. Workers in the UK have seen their pay fall sharply in real terms as consumer prices have risen even faster. Public sector workers have suffered a much bigger hit to living standards, with their earnings growing by just 2.7% over the same period, one of the biggest gaps recorded between the private and public sectors, the ONS said.

We can earn in the falling market by shorting futures, buying put options and selling call options

Investing and trading are the two ways to make money in the stock market. But if you are an investor, you will only make money when the market is trending upwards. What when the markets are falling? How will you generate returns when the market goes into a downtrend?

Many traders and investors are unaware of the alternative way of generating income in falling markets, as they tend to stay away from the market during such times. Before understanding how to generate returns in a falling market, let us know about the three phases of markets:

Bullish Market: A market trending upwards due to the rise in prices of the shares is called a bullish market. Sideways Market: The term sideways market means there are no clear trends found in the market.

Bearish Market: A market trending downwards due to the fall in shares prices is called a bearish market.

Financial markets around the globe include asset classes such as equities, derivatives, currencies, and commodities for trading. Equities are nothing but stocks that are traded in the Equity-Cash market.

options market is high risk and high reward activity.”

A derivative is an instrument whose value is derived from its underlying assets like stocks, currencies, and commodities. The three most common types of derivative instruments are Forwards, Futures and Options.

American investment manager James Chanos, said, “Derivatives in and of themselves are not evil. There’s nothing evil about how they are traded, how they are accounted for, and how they are financed, like any other financial instrument, if done properly.”

A forward market is a marketplace that sets the price of assets and financial instruments for future delivery and is used for trading. It allows contract parties to customize the time, amount, and rate at which the contract will be performed.

For example, consider the case of a farmer who harvests a particular crop but is uncertain about its pricing three months later. In this situation, the farmer can lock in the price at which he will sell his produce in the next three months, by entering into a forward contract with a third party.

In an interview with Forbes magazine, Berkshire Hathway CEO Warren Buffet said, "The future is never clear”, citing the uncertainty of the market.

A futures market is a central financial exchange where participants buy and sell futures contracts for delivery on a specified date.

said, “Trading in futures and

Dr. Kamakhya Narain Singh, IEPF Chair Professor at IICAFutures are exchange-traded derivative

Dr. Kamakhya Narain Singh, IEPF Chair Professor at IICA said, “Making money consistently requires a lot of knowledge and experience"

contracts that lock in the future delivery of a commodity or security at a price set today.

Futures contracts are made in an attempt by producers and suppliers of commodities to avoid market volatility. These producers and suppliers negotiate contracts with an investor who agrees to take on both the risk and reward of a volatile market.

Futures markets are where these financial products are bought and sold for delivery at some agreed-upon date in the future with a price fixed at the time of the deal. Futures markets are for more than simple agricultural contracts, and now involve the buying, selling, and hedging of financial products and future values of interest rates.

Futures contracts can be made or "created" as long as open interest is increased, unlike other securities that are issued.

Imagine an oil producer who plans to produce one million barrels of oil over the next year. It will be ready for delivery in 12 months. Assume the current price is $75 per barrel. The producer could produce the oil, and then sell it at the current market prices one year from today.

Given the volatility of oil prices, the market price at that time could be very different from the current price. If the oil producer thinks oil will

be higher in one year, they may opt not to lock in the price now. But, if they think $75 is a good price, they could lock in a guaranteed sale price by entering into a futures contract.

By entering into this contract, in one year the producer is obligated to deliver one million barrels of oil and is guaranteed to receive $75 million. The $75 price per barrel is received regardless of where spot market prices are at the time.

For example, one oil contract on the Chicago Mercantile Exchange (CME) is for 1,000 barrels of oil. Therefore, if someone wanted to lock in a price (selling or buying) on 100,000 barrels of oil, they would need to buy/sell 100 contracts. To lock in a price on one million barrels of oil/they would need to buy/sell 1,000 contracts.

Retail traders and portfolio managers are not interested in delivering or receiving the underlying asset. A retail trader has little need to receive 1,000 barrels of oil, but they may be interested in capturing a profit on the price moves of oil.

Futures contracts can be traded purely for profit, as long as the trade is closed before expiration. Many futures contracts expire on the third Friday of the month, but contracts do vary so check the specifications of contracts before trading them.

For example, it is January, and April contracts are trading at $55. If a trader believes that the price of oil will rise before the contract expires in April, they could buy the contract at $55. This gives them control of 1,000 barrels of oil. They are not required to pay $55,000 ($55 x 1,000 barrels) for this privilege, though. Rather, the broker only requires an initial margin payment, typically of a few thousand dollars for each contract.

The profit or loss of the position fluctuates in the account as the price of the futures contract moves. If the loss gets too big, the broker will ask the trader to deposit more money to cover the loss. This is called maintenance margin.

The final profit or loss of the trade is realized when the trade is closed. In this case, if the buyer sells the contract at $60, they make $5,000 [($60-$55) x 1,000]. Alternatively, if the price drops to $50 and they close out the position there, they lose $5,000.

The advantage is that you can also sell first and buy later in the futures market. This process is known as Shorting Futures.

Examples of futures markets are the New York Mercantile Exchange (NYMEX), the Chicago Mercantile Exchange (CME), the Chicago Board of Trade (CBoT), etc.

CA Rachana Ranade, a Chartered Accountant, on Twitter wrote, “If you trade in futures and options without proper knowledge, you will have no future, and you will be left with no options."

The term option refers to a financial instrument that is based on the value of underlying securities

such as stocks.

Options are versatile financial products. These contracts involve a buyer and seller, where the buyer pays a premium for the rights granted by the contract.

Traders and investors buy and sell options for several reasons. Options allow a trader to hold a position in an asset at a lower cost than buying them. Investors use options to reduce the risk exposure of their portfolios.

American options can be exercised any time before the expiration date of the option, while European options can only be exercised on the expiration date or the exercise date. Exercising means utilizing the right to buy or sell the underlying security.

Call options allow the holder to buy an underlying security at the stated price called the strike price, by the

expiration date called the expiry. The holder has no obligation to buy the asset if they do not want to purchase the asset. The risk to the buyer is limited to the premium paid. Fluctuations of the underlying stock have no impact.

Buyers are bullish on a stock and believe the share price will rise above the strike price before the option expires.

Their profit on this trade is the market share price less the strike share price plus the expense of the option — the premium paid and any brokerage commission to place the orders. The result is multiplied by the number of option contracts purchased, then multiplied by 100 — assuming each contract represents 100 shares.

If the underlying stock price does not move above the strike price by the expiration date, the option expires worthlessly. The holder is not required to buy the shares but will lose the premium paid for the call.

For example, suppose Microsoft

(MFST) shares trade at $100 per share and you believe they will increase in value. You decide to buy a call option to benefit from an increase in the stock's price.

You purchase one call option with a strike price of $115 for one month in the future for 37 cents per share, called your premium. Your total cash outlay is $37 for the position plus fees and commissions (0.37 x 100 = $37).

If the stock rises to $116, your option will be worth $1. The profit on the option position would be 170.3% since you paid 37 cents and earned $1—that's much higher than the 16% increase in the underlying stock price from $100 to $116 at the time of expiry.

In other words, the profit in dollar terms would be a net of 63 cents or $63 since one option contract represents 100 shares [($1 - 0.37) x 100 = $63].

If the stock falls to $100, your option would expire worthlessly, and you would be out a $37 premium.

The upside is that you didn't buy 100 shares at $100, which would have resulted in a $15 per share, or $1500, total loss.

As you can see, buying call options can help limit your downside risk and earn an exponential profit.

To quote the famous Warren Buffet — "Don't invest in something you don't understand".

Selling call options is known as writing a contract. The writer receives the premium fee. In other words, a buyer pays the premium

to the writer (or seller) of an option. The maximum profit is the premium received when selling the option.

An investor who sells a call option is bearish and believes the underlying stock's price will fall or remain relatively close to the option's strike price during the life of the option.

If the prevailing market share price is at or below the strike price by expiry, the option expires worthlessly for the call buyer. The call option seller pockets the premium as their profit.

However, if the market share price is more than the strike price at expiry, the seller must either sell shares from their portfolio holdings or buy the stock at the prevailing market price to sell to the call option buyer.

The contract writer incurs a loss. How large of a loss depends on the cost basis of the shares they must use to cover the option order, plus any brokerage order expenses, but less any premium they received.

Let us consider the following example. Assume that Microsoft shares trade at $100 per share, and you feel that the value will not go beyond $115.

You decide to sell a call option at a strike price of $115 for 37 cents per contract. The net premium received by you is $37(0.37*100) considering 100 shares in a contract. Your profit is limited to your premium collected i.e $37.

If the shares rise to $116 and the premium becomes $1, you will be at a loss of $63 ($1 - 37 cents*100). If the shares rise further to $120, your

editor@ifinancemag.com

option premium will increase by $4. Now you will be at a loss of $463 ($5 - 37 cents*100). This loss excludes the brokerage and order expenses.

As you can see, the risk to the call writers is far greater than the risk exposure of call buyers. The call buyer only loses the premium. The writer faces infinite risk because the stock price could continue to rise, increasing losses significantly.

Another Warren Buffet quote will be the aptest to describe the above. “Derivatives are financial weapons of mass destruction”.

Put options are investments where the buyer believes the underlying stock's market price will fall below the strike price on or before the expiry date.

Since buyers of put options want the stock price to decrease, the put option is profitable when the underlying stock's price is below the strike price.

Their profit on this trade is the strike price less the current market price, plus expenses—the premium paid and any brokerage commission to place the orders. The result would be multiplied by the number of option contracts purchased, then multiplied by 100—assuming each contract represents 100 shares.

The value of holding a put option will increase as the underlying stock price decreases. Conversely, the value of the put option declines as the stock price increases. The risk of buying put options is limited to the loss of the premium if the option expires worthlessly.

Consider that Microsoft shares trade at $110 per share, and

you believe that the value will decrease. You decide to buy a put option to benefit from a decrease in stock’s price.

You buy a put option of $100 strike price for the current month expiry, trading at a premium of 37 cents per share. In case the stock price moves against you, your loss is limited to the premium you have paid i.e $37 (37cents*100)

If the stock price falls to $99 and the premium turns to $1, you are in profit of $63 ($1 - 37 cents*100). If it further falls to $89 then your premium rises to $10 and you will be in a profit of $1063. A profit of 2873%.

As you can see, buying put options will help you earn an exponential income during the falling markets with limited risk.

Selling put options is also known as writing a contract. A put option writer believes the underlying stock's price will stay the same or

increase over the life of the option, making them bullish on the shares.

If the underlying stock's price closes above the strike price by the expiry, the put option expires worthlessly. The writer's maximum profit is the premium.

The risk for the put option writer happens when the market's price falls below the strike price.

The seller is forced to purchase shares at the strike price at expiry. The writer's loss can be significant depending on how much the shares depreciate.

The writer (or seller) can either hold on to the shares or hope the stock price to rise back above the purchase price or sell the shares and take the loss. Any loss is offset by the premium received.

An investor may write put options at a strike price where they see the shares being a good value and would be willing to buy at that price. When the price falls, they get the stock at the price they want with the added benefit of receiving the

option premium.

For example, Microsoft is trading at $110 per share, and you sell a put option of a strike price of $100 with a premium of 37 cents. Your profit is limited to your premium i.e $37.

If the price falls to $99, you will be at a loss of $63.

If the price falls to $89, you will either have an option to take a loss of $1063 or you can buy the shares at the strike price of $100 hoping the stock price to rise above your purchase price.

Charlie Munger, vice chairman of Berkshire Hathway, once said, “The world of derivatives is full of holes that very few people are aware of. It's like hydrogen and oxygen sitting on the corner waiting for a little flame."

One can earn in the falling market by shorting futures, buying put options, and selling call options.

“Making money consistently requires a lot of knowledge and experience. Beginners should be very cautious about taking trades

in the F&O market without fully learning about the mechanism of investment and related risks,” Dr.Kamakhya Singh said.

Derivative contracts such as futures and options are another great way to profit from a market that's falling. Even with derivatives, there are plenty of different ways to generate returns. For instance, you can sell a futures contract, sell a call option, or buy a put option. Derivatives are so popular that the majority of the daily trade volume in the Indian stock exchanges come from them.

One of the reasons why many investors turn towards derivatives is that it is versatile. With futures and options, you can not only make money during a falling market, but also generate significant returns even when the market is going up. Another advantage of dealing with derivatives is that you don't have to possess the underlying asset before you enter into a contract. That said, when selling derivative contracts, the amount of loss that you might have to bear if the price doesn't move according to your expectations is unlimited. This makes them one of the riskier investment options around in the market.

When the markets are in a tough phase, you could always look past the stock market for wealth creation. There are several other investment options out there that can provide you with reasonable returns even when the markets are not moving in your favour. Gold, for instance, is one of the most sought-after options

whenever investors find themselves in a pinch. This is primarily because the precious metal is considered to be a safe-haven asset since it tends to retain its value even amidst geopolitical and economic tensions. Another major advantage for gold is that it is negatively correlated with the stock market. What this means is that the price movement of gold and that of stocks are opposite to each other. For instance, when the prices of stocks fall down, the price of gold tends to go up and vice versa. Bonds that are issued by the government and the US Dollar are two of the other popular safe-haven assets that you could invest in.

If long-term wealth creation is really important to you, then you could look towards other alternative investment options as well. In India, there's absolutely no dearth of safe and moderate return generating investment options. For instance, you could invest in traditional schemes like shortterm fixed deposits and recurring deposits to generate some revenue till the markets get stabilized and start to go up. Savings plans are also good alternative options to consider, because they give you the dual advantage of a life cover combined with guaranteed payouts.

editor@ifinancemag.com

Modern project management techniques popular in the financial services sector lower risk, help develop new products and services, and improve client experiences

IF CORRESPONDENT

Banks and financial service providers are exposed to an expanding number of hazards due to increased digitalization. As a result, cybersecurity threats are rapidly growing. In addition, the breadth of legislation about specific industries is expanding as data privacy authorities step up enforcement.

As a result, many of these risks are amplified in the financial services sector, significantly complicating financial organizations' risk management and cybersecurity readiness.

Today, more than nearly any other industry, banks face challenges with risk management. However, emerging technologies have always influenced how financial institutions operate.

For instance, according to the Deutsche Bundesbank, the German banking sector's personnel has consistently decreased over the past 20 years. Still, total assets have climbed by

nearly 50% during the same time. The constant use of technology has contributed significantly to this improvement in productivity.

However, because technology is increasingly influencing and altering banking business models and how people and businesses spend, save, borrow, and invest money, the effects of technological transformation have never been as dramatic as they are now. As a result, the banking sector is suddenly facing competition from businesses developing their financial systems, including media organizations, technological firms, and internet shops.

CB Insights reports that 27 fintech unicorns, or privately held businesses worth more than $1 billion, were formed by investors in 2020. In 2021,

there were 157 new "unicorns," and among the 500 unicorns with the highest market values were 70 financial businesses.

Most of these new competitors lack a banking license. Most of the time, they were experts in particular technical support or financial services, such as credit scoring, mobile payments, or cloud services. Since banks have started collaborating with startups and fintech companies, outsourcing has become an unstoppable trend in the banking industry. As with all other facets of digitization, their collaboration with fintech has presented banks with fresh, complicated concerns.

As the financial industry grows more digital, more data is handled, new technologies are used, risks increase, and institutions increasingly need to focus on cybersecurity and risk management. For example, according to information released by the European Commission at the end of 2020, the pandemic saw a 38% increase in cyberattacks against financial institutions.

Therefore, it is no longer sufficient to comply with the banking supervisory standards for IT and the minimum criteria for risk management (MaRisk) (BAIT). Banks cannot mitigate new risks by giving them equity and liquidity backing. Risks that are not financial must also be considered.

Banks must identify and consider threats such as terrorism, conflict, cybercrime, natural catastrophes, climate change, sanctions, and geopolitical upheavals while managing their risk. As a result, the risk and compliance operations will also require closer integration.

There are many issues with how banks implement risk management in this environment. Some critical questions to keep in mind are: How can

you avoid having a server outage that lasts several hours and has significant financial repercussions? What dangers are involved when working with outside service providers, especially when outsourcing particular processes? How can you guard against hardware and software malfunctions? How can technical mistakes be avoided when configuring IT systems? How can the IT structure's weak points be identified? How well-protected are the IT system's interfaces? How can you prevent unauthorized access to enormous amounts of data? How do you stop employee deception and manipulation? What administrative rights are required for which employees? What expertise do the bank's board and employees have in risk management? How should the risk from the changing climate be mitigated? How should we respond to conflict, raw resource shortages, and changes in global politics? What should one do in an emergency if an attacker renders the IT system useless?

The European Commission unveiled a proposed Digital Operational Resilience Act to assist banks in creating a robust security posture, including a solid risk management system that can resist attacks of all kinds (DORA). This proposal is a component of the Digital Banking Package, a collection of policies that utilize digital finance's innovation and competitive potential while reducing the associated risks.

The EU Commission claims that the Digital Finance Package includes a digital finance strategy for the EU financial industry, among other things, with the following goals: Bolster and further enhance the financial industry's

operational digital resilience. Always keep an eye on outside information and communication technology (ICT) service providers doing business with financial institutions. Financial institutions should carry out their responsibilities in this area in the future.

Germany passed the act to Strengthen Financial Market Integrity (FISG) in June 2021, and as a result, many financial regulations have been modified. The financial watchdog BaFin, among other things, has direct access to the businesses banks use to outsource crucial tasks and operations.

Turning individual screws in light

of the complex threat environment facing banks' IT systems is insufficient. Risk management aims to make the financial organization more resistant to attacks from inside and outside. Digital resilience needs to keep getting better. Risk management in banks must be viewed as a business necessity that affects every employee and every technology advancement, including big data, cloud solutions, artificial intelligence, and robotic process automation, in addition to the IT departments of financial institutions.

Digital solutions will be used appropriately in risk management as the financial sector becomes more digitalized. However, up until now, this has not been the case. According to the 2021 report "From Crisis to Opportunity: Redefining Risk Management" from the Financial Times subsidiary Longitude,

only 10% of banks have fully automated most of their risk management tasks. Only 6% of the risk modeling process has been entirely automated. Nevertheless, the research claims that the institutions driving this transition are already reaping strategic rewards. It includes, for instance, the capacity to produce data-driven insights more quickly and broadly in a market that is becoming more unpredictable.

The advantages of utilizing cuttingedge technologies for banking risk management are clear. Implementation, nevertheless, is not always straightforward. Therefore, investing in systems, tools, and improved analytics capabilities is vital. Big data, AI, and machine learning will be critical to enabling ability without considerable resources. Although such programs demand investment, they will pay off in improved data protection, reduced risk, and resilience against a constantly changing array of cyber threats.

The rate of change in the financial services sector is accelerating. Institutions must discover ways to promptly and affordably provide clients with new services and improved experiences to stay competitive. Many people have used Agile project management to achieve this. However, the requirement for effective risk management still exists despite the urgency. Institutions should guarantee that risk management and controls are an inherent part of the process while expediting the development of new goods and solutions, which can be challenging for Agile projects.

Institutions should alter how business units and the risk management function collaborate on projects and how the three lines of risk management defense interact with agile teams to expedite projects without raising the risk. They should ask these questions and find the following answers: How can risk management be integrated into an Agile project to mitigate risks and improve efficiency? Choice privileges. What decision-making authority should they grant to project participants, the three lines of defense for risk management, and particularly the business units? Talent. What organizational frameworks and risk management skill sets will we require for the three lines of defense risk governance model, and how should this model be implemented to integrate well with Agile projects? Tools and speedups.

LDB has grown in each area in terms of personnel, professionalism, and modernization by applying new technologies in the banking network

Over the past two decades, the bank has actively and progressively contributed to the implementation of the state’s policies and guidelines, based on its rights and roles, in order to stimulate Laos’ social-economic development. Owned by the Ministry of Finance (MOF) and operating under the Bank of Lao PDR, LDB also actively complies with both domestic and international regulations.

After 1999, the Bank of Laos issued a policy to restructure state-owned commercial financial institutions, as apart from being localized in nature, these banks also lacked financial capacities and were riddled with overlapping organizational structures, along with other issues such as high operational costs, low competition capacities, limited business operations, and less openness to international cooperation. Therefore, the government merged two local banks, Lane Xang Bank Limited and Lao Mai Bank limited, as one in 2003, which came to be known as Lao Development Bank (LDB). The purpose of this merger was to revitalize and rebuild strong stability, recreate trust in the society, turn the banking operations into a well-run business and facilitate the national socio-economic development with more qualified and competent personnel. The bank also strives to ensure its clients’ rights and interests, while effecting the implementation and expansion of the Lao government resolutions.

LDB has gone through a range of challenges, as the Laos economy kept on developing. Over the merging period, the policy was also changed and made flexible. With steady growth in terms of total assets, human

resources, and technology development, the bank used the former accounting system called “Bank 2000” before migrating to the new Core Banking System “T24” in 2010.

Since March 2010, all LDB branches were connected to the bank’s network, which became online across the country. The Bank has also introduced new products and services such as ATMs, and EFTPOS (Electronic Funds Transfer Point of Sale), apart from becoming a pioneer, in terms of introducing Mobile Banking in the form of “M-Commerce”. ATM-based financial transactions became the first group of banking operations to fully integrate mobile banking into its e-commerce fold, apart from modernizing many aspects of its services. LDB is also providing loan services to promote and develop small and medium enterprises (SMEs), with an aim to strengthen the national economic base, create jobs for local people, and improve their lives.

However, the challenges from the COVID pandemic and economic recession are unavoidable to LDB. So, the privatization policy

The Lao Development Bank Co., LTD (LDB) is not only one of the largest commercial banks in Laos but is also considered one of the most outstanding financial institutions to watch out for in 2023.

by the merger with Chaleun Sekong Energy Co., Ltd was applied to the bank in order to improve its performance. The vision behind the merger was also to implement the new policy and directions of the Lao government to transform and improve the structures of state-owned enterprises and commercial banks to become joint ventures. The government agreed to sign the joint venture MOU between Chaleun Sekong Energy Co., Ltd and the Ministry of Finance on 17/03/2021, thus commencing the joint study and discussion on issues such as the organizational structure and personnel and joint venture agreement. Through the study, research, and implementation in a strict and concise manner, LDB achieved outstanding results in the compliance, rules and regulations front. The government agreed to sign the joint venture agreement on 01/09/2021 between Chaleun Sekong Energy Co., Ltd holding 70% while 30% remaining held by the Ministry of Finance, of the shares.

To deal with the challenges of the post-COVID period, Lao’s domestic population will contribute

to the government's policy to stimulate the economic recovery by creating a clean hydropower export industry, supporting Lao eco-tourism with a focus on potential entrepreneurs, promoting the agricultural sector to serve society within the country to meet the needs of local people throughout the country, providing trade-investment support, shops or distributors, and hospitals. LDB is actively working towards these goals to ensure that the businesses have access to finance sources at reasonable interest rates, apart from being able to perform management-related duties smoothly.

Through the joint ventures and management under Chaleun Sekong Energy Co., Ltd, LDB improved and reformed the organizational culture and working approach of its Board of Directors as well as the technical staff. Right now, it has more than 18 branches, 75 service units, 263 ATM machines, and eight currency exchange units across the country. LDB has been solving many issues, apart from determining and declaring the bank’s vision, missions, strategic plan, and business operation directions. Another obvious thing is the rapid business drive of the new standardized corporate governance and new Board of

Directors, which is full of knowledge with great ability, expertise, experience, and professionalism, combined with the inspirational leadership of its Chairman, Mr. Sitthisone Thepphasy, who has a broad vision, apart from possessing great leadership-direction on business operations, knowledgeable skills and insights, ethics, and self-discipline.

Following the joint venture restructuring, LDB held a general meeting with the shareholders to approve the organizational structure, which consists of the Board of Directors, the Board of Management, the committees to the Board of Directors, the independent disciplinary committee, division committees, branch committees, and unit committee. All these panels met the international standard on corporate governance, known as the three lines of defence.

Mr. Thepphasy said, "I shall manage and drive LDB's goals strongly. I would develop the LDB leadership staff so that they become stronger, more courageous, and responsible towards the target of fulfilling teamwork with professionalism and transparency, apart from having a cordial relationship with each other, and maintaining proper behaviours to achieve the target of making the organization stronger and profitable one. They must also ensure that our business operations comply with the regulations, as well as keeping the satisfaction of business partners in mind, so that the customers use our services more."

LDB has revised its key documents in line with the latest business structure (which changed from the old to the new one), with a goal to adhere to the slogan “Change for the Target to Success”, which envisions the financial institution to be more concise, standardized, complete, harmonious and consistent, apart from sticking to its strategic plan, vision, and business operation approach under the new management, in order to be stronger comprehensively and sustainably, in terms of profits.

In addition, the documents' improvement programme started with the revision of LDB's internal regulations. This regulation set is the financial institution's main document and it is based on the law on commercial bank management and related rules such as relevant regulations of the Bank of Lao PDR.

LDB has the vision of becoming the bank that customers can trust for getting the best services, the best technology, and the best staff responses. To realize this, the bank has taken measures towards reforming and building senior executives with ideas, imagination, teamwork models, and quality

management by prioritizing each strategic task to satisfy its customers and partners effectively and sustainably. Apart from that, LDB has goals of reforming the research/study method form, building a professional team or procuring professionals to train and help decision-making in a highly systematic, scientific, and unified manner, to ensure the general interest, along with maintaining the bank's status of being a profit-making institution with great responsibility and ethics.

Another priority area is to develop tools for analysing investment and cost-balancing approaches as scientific return indicators to facilitate accurate, clear and effective decision-making.

The Chairman of the LDB’s executive committee, Mr. Chanthanome Phommany, while talking about his organization’s highly successful transformation journey, remarked, “In the past 10 months, I would like to confirm that all parties, including the Lao government, the Bank of the Lao PDR, employees and customers have pleasantly welcomed the new board of directors with satisfaction and provided good support. We have goals and strategic plans defined in the 6-month plan before officially signing a joint venture with the government. I and the board of directors have led and managed the organization with a clear vision, have a complete systematic plan, focus on actual work, and transform the new mechanism of the Lao Development Bank to be able to run smoothly and effectively.”

As a result, LDB currently has a significant assets growth at 245% compared to 2021. In 2022, LDB was a profitable financial institution with positive cash flows. The earnings increased at significantly faster rates than Laos’ overall banking industry. ROE was 31% and NPL was only 0.02% at the 2022 end.

Giving his insights to International Finance about LDB’s transformation journey, Mr. Phommany added, “We can give you some examples to get an understanding of how we think now. One – we thoroughly analysed the bank financials and business before we devise our strategies. We knew exactly how many thousand dollars are un-utilized, we calculated the exact Cost of Funds, we knew what exactly affects our Cost of Funds, we could precisely tell which branch is overusing funds with fewer returns, we could precisely see which branch overspends (in

comparison to their business volumes) and so on.”

“We have defined a clear strategy, with the work of the board of directors in a systematic manner. All goals and action plans are defined in a standardized structure. Two – based on all our research & analysis, we had clear and focused strategies with the work of the board of directors in a systematic manner. Goals and action plans for all verticals & horizontals were well structured. Three – We have recruited employees with the knowledge and experience and we have improved the welfare policy for employees to stimulate and encourage the performance of employees,” he further added.

“

LDB has been improving in various areas including personnel, professionalism, and modernization by applying new technologies in the banking network more and more than ever before.

Mr. Phommany also shared examples like LDB creating modern technologies and training its employees to operate via those solutions, in order to transform the company’s image.

Technology was once a pain point for the financial sector in general, especially across small markets. While they require huge budgets to stay in touch with the breakthrough solutions, the investments on the technology front have to bring back monetary benefits too. Therefore, the bank put a lot of effort to upgrade and develop LDB’s digital and core banking systems.

“We have improved the technology continuously and firmly. This could produce a good result as we can see the number of customers who have used our Mobile App (LDB Trust) has significantly increased and so on etc…” Mr. Phommany remarked. LDB has grown in each

area in terms of personnel, professionalism, and modernization by applying new technologies in the banking network more and more than ever before.

“Although the technology budget is a huge amount and could be the major challenge for our development, we have some special reserves, which were related to profit generations and market demands. We have to ensure what you develop and offer to the market is suitable for customers’ behaviours. In addition, we also have many internationally recognized and renowned technology development partners. Therefore, all we did was to choose the right tech partners and motivate them to do better,” Mr. Phommany said, while talking about LDB’s successful journey on the technology front.

LAO DEVELOPMENT“As of now, we can only say keep watching. We are determined to change the banking segment and we would surely provide what is best for our customers and for our staff,” he remarked.

Over two decades, the Bank has been upgrading its system and introducing various products and services to meet the current and future lifestyles such as deposits, loans, fund transfers, ATMs, Credit and Debit Card (Union Pay, Visa), mobile banking (LDB TRUST), LDB BIZ (Payroll), online statements, and EDC, SWIFT, Western Union, E-border and so on. Both LDB Trust and LDB BIZ have been performing soundly via mobile phone and web-based platforms to provide 24/7 convenient customer services such as money transfers, top-ups, bill payments (electricity, water, loan), easy passes, etc.

LDB TRUST has emerged as a game-changing one, with its mobile banking and E-Wallet facilities, to serve customers in a more convenient, quick, and modern manner with different features in order to process financial banking transactions including paying bills, fund transfers, etc. The users can manage their own money and follow bank statements in real-time by themselves. Apart from financial transactions, LDB TRUST can also be used for gaining market information on the gold price, Bitcoin value, mining, FX rate, and interest rates. Customers and businesses can track their fund transfers; check bills and promote their products as well (for businesses only). Currently, over 50,000 merchants are using the platform.

LDB BIZ is an internet banking solution for corporate customers such as private companies and international organizations. These ventures can process

financial transactions by themselves without stepping inside LDB branches. It’s a safe and convenient method, as all the users need to do is log in on the web browser/ application via computer, tablet, or smartphone.

Apart from offering international bank transfers by SWIFT (Society for Worldwide Interbank Financial Telecommunications), API, Western Union, and E-Border, LDB puts a special focus on the importance of strengthening and implementing risk management on the compliance related to laws such as Anti-Money Laundering, Combating the Financing of Terrorist (AML/CFT) and Foreign Account Tax Compliance Act (FATCA). LDB not only has created policies and procedures related to AML/CFT and international standards including Know Your Customer (KYC) and Customer Due Diligence (CDD) implementation, but also has the standard automated AML Compliance system, qualified personnel who has knowledge and skills on the AML field and has an AML/CFT program that meets the international standard.

The first one is SWIFT Sanctions screening, which enables LDB to have the continuous assurance that no blacklists and sanction lists are transacted through LDB’s system.

The bank uses this to screen both incoming and outgoing transaction messages. If any of the messages match with the latest sanctions list, the financial institution gets real-time alerts and rejects transactions that are considered true hits.

Then comes the second mechanism in form of FICO Tonbeller compliance solutions or Siron AML, Siron AML Analysis and Siron KYC. The bank intends to use them to protect its products, services and its customers as well as the partners from financial crime. In the context of Siron AML and Siron AML Analysis, these two parts are used to prevent money laundering such as stopping criminals from becoming customers and monitoring suspicious activity. The bank uses Siron KYC to identify customer risk rating, and customer onboarding screening against sanctions and blacklists and is the tool for the bank to implement its customer acceptance policy.

The LDB recently bagged two awards, "Fastest Growing Commercial Bank in Laos” and “Best Employee Welfare Initiatives in Laos" at International Finance awards. This recognition comes as no surprise, given LDB's track record of being one of the most customer-friendly and reliable banks in Asia.

editor@ifinancemag.com

A study by N26, a German online bank, shows a steady decline in the number of open bank branches in the US by 7% since 2012

The digitalization of almost all modern consumer services is becoming increasingly necessary for industries across the globe to deliver relevant value to their users. This phenomenon has resulted in several emerging cross-industry trends that have led to a transformation in the expectations of how customers access goods and services.

These new expectations have forced companies of all sizes to adopt emerging technologies and modernize their businesses to remain relevant. Banking is one of the industries that has experienced these changes the most and has witnessed the whirlwind of digital initiatives that have completely disrupted the industry, especially since the COVID pandemic.

World Bank Group President David Malpass said, "The digital revolution has catalyzed increases in the access and use of financial services across the world, transforming ways in which people make and receive payments, borrow, and save.”

Banking users are now demanding digital solutions and are more aware of all they can now do using their computers and smartphones. Henceforth, it’s no surprise that traditional banks keep losing

their appeal, and online banks have become the new belle of the ball.

The pandemic may have accelerated the adoption of digital banking solutions, but mobile banking platforms and Fin-techs have been around for a while. What COVID did was bring mobile banking’s benefits to the surface and drive its accelerated adoption. As a result, traditional banking methods are slowly but surely getting outgunned, and digital banking – especially mobile-only banks – is becoming the norm. This way, online banking is reshaping the landscape of the world’s financial services industry, a future where in-person interactions are no longer the status quo.

As many experts think that online banking is the future and has the potential to take over traditional banking, Professor Vincenzo Capizzi, SDA Professor of Banking and Insurance told International Finance that mobile banking cannot take over traditional banking as it fails to build customer relationships.

Professor Vincenzo Capizzi said, "Mobile banking is certainly an important value driver in terms

of competitive strategy, particularly in demand by the younger generations. But worldwide evidence indicates that the physical banker-customer relationship is essential. On the contrary, mobile banking helps to give added value to the physical relationship, which can thus be focused on a greater advisory content.”

However, vital questions remain: How are mobile banks impacting traditional physical banks? Will users drop their existing traditional banks altogether and switch to all-digital banking services? What are the benefits of mobile banks? What makes them superior to conventional banking solutions?

The banks that don’t have a physical branch are referred to as mobile or online banks. These are fullfledged financial institutions without a physical branch, meaning they operate exclusively online. To access their services, one needs an internet connection and a smartphone, tablet, or computer.

Mobile banks typically offer the same services you would find at a traditional bank without hav-

ing to physically go to a branch, stand in line, and deal with tellers, other clients, parking, traffic, etc. With mobile banks, an individual can easily open an account, make payments, transfer funds, and withdraw cash, all of these by using an app or website on the device.

Additionally, most online banks offer debit and credit cards with no monthly fees, easy cash withdrawals from various ATMs worldwide, and simple currency conversions. These features, and many more, are the reasons why mobile banking keeps gaining traction and surpassing traditional banks, which are struggling to keep up with the new normal.

Thanks to technologies such as mobile internet networks, cloud computing, artificial intelligence, Big Data, and blockchain, the banking industry has taken the plunge into becoming a predominantly digital industry. This has forced traditional banks to transform and upgrade or perish. Also, due to these technologies evolving at unbelievable

speeds, mobile-only banks are popping up left and right with new features and more services added continuously, broadening the scope of what we can accomplish through digital banking. This phenomenon has skyrocketed the popularity of digital banks, and their usage has increased significantly in the past decade.

In the UK alone, the number of mobile banking users rose from 30% in 2007 to 76% in 2020. This rise in the adoption of digital banking means that most customers are either no longer visiting physical branch locations or have dropped their traditional banks altogether to switch to a mobile-only bank. Consequently, traditional banks are starting to see digital banks as a genuine threat.

Aside from the evident benefits of digital banks, one of the root causes for online banking becoming a disruptive force and changing the face of modern banking is the millennial population. Millennials are very tech-savvy and grew up during the boom of the digital world, so they are more demanding, less loyal, and usually expect their products and services to be digitized, accessible, personalized, and efficient. Henceforth, for millennials, traditional bank-

ing is useless and obsolete. Actually, a survey from The Millennial Disruption Index found that 71% of millennials would prefer to go to the dentist than physically talk to their traditional banks.

Furthermore, 73% would be more excited about online financial offerings from Google, Amazon, Apple, PayPal, or Square than from their traditional bank. And, if we consider that millennials are the largest generation group on the planet, we can easily conclude that adoption rates for mobile banking are only going to keep climbing. For traditional banks, this means updating their archaic banking models or being doomed to slowly but surely disappear.

A recent study conducted by N26, a German online bank, shows a steady decline in the number of open bank branches in the US of 7% since 2012. This figure is expected to fall to 16,000 by 2030, and the decreasing trend suggests that all branches will close by 2034. Furthermore, the study also shows that 46% of Americans believe that the current banking system needs to change, and 16% say they don’t trust banks.

Less than $25,000 12.8%

19%

27.5%

12.9%

or greater 27.9%

Source: Fedreserve.gov

From these figures, we can easily conclude that traditional banking is on its way to oblivion. The current banking system is flawed, and most conventional financial institutions aren’t keeping up with shifting consumer habits. In addition to the pandemic, which was a fantastic driver of this shift in habits, younger generations aren’t exactly branch-friendly. They are digital natives, which mean that mobile banking wasn’t a pandemic-driven transition for them; it was the norm. These larger generational groups drive online bank adoption through the roof and bring to the surface evident flaws in the current banking system.

Added to this is that many traditional banks are taking too long to abandon their obsolete legacy systems and aren’t leveraging new emerging technologies to effectively challenge their digital counterparts and meet the needs of younger customers. FinTechs and online banks have taken advantage of these unmet needs. They have created a mobile ecosystem with a broader scope of features that gives their users power over their financial lives and redefines what they can do with just a swipe of their finger.

Nonetheless, however pervasive mobile tech-

nologies have become in our lives, the truth is the basic need for banking services remains unchanged. People will always need to make deposits, open new accounts, get new debit and credit cards, apply for loans, and purchase goods. And even though you can perform all of these tasks using online banks, there will always be customers who value human-to-human connections when it comes to something as personal as money.

In fact, according to a recent study, 73% of surveyed customers still prefer in-person interactions when dealing with the financial aspects of their lives. The N26 research we touched on earlier also shows that 89.2% of Americans prefer to stick to a bank with physical branches. They rank access to cash (53.7%) and in-person advice (50.4%) as two of the top benefits of physical branches over online banks. Furthermore, they found that security was a considerable concern when switching to online-only banks, followed by the lack of human interaction. While witnessed a considerable rise in the adoption of online banking, we can’t confidently conclude that physical branches will disappear at any point soon.

editor@ifinancemag.com

Areas of banking that depend on economic activity may suffer – consumer banking, consumer/business loans growth, credit card usage, mortgage business etc

Vivek Sharma is a Senior Executive Vice President & Head of International Clients Group, Edelweiss Wealth. He is a finance professional with more than 17 years of experience in the Capital Markets, Investment Management, and Wealth Management industry. In his professional stints with Edelweiss, both in India and in Singapore, he has been instrumental in conceptualizing and building businesses from startup to growth phase. Vivek also brings with him diverse experience across Investment strategy, institutional sales, and business strategy along with managing diverse teams and P&L responsibility. Vivek has also been instrumental in building and managing some of the marquee group-level global partnerships at Edelweiss, in international markets.

In his current role, he has with Market Advocacy initiatives for the group. Vivek is an Economics Graduate and holds a Master’s degree in Business Administration from Symbiosis.

As a young veteran of 18 years, Vivek commenced his career graph with the consumer banking business at Citibank, followed by a product investment role at ING Investment Management which led to varied roles at Edelweiss. He is among the few Indian financial services business leaders to traverse roles across the value chain from wealth management, asset management and institutional securities in India and abroad.

Vivek has spent the last few years propagating the India growth story to global investors, a natural people’s person and compelling storyteller. Not one to let cynicism cloud his judgment, Vivek believes in looking at objectives with a realistic lens. He believes that the pandemic has been a blessing in disguise for India in a lot of ways.

“Our ability to fight the pandemic and emerge with a new wave of businesses and ideas, has made India look more attractive than at any time in the past. As the country approaches the $5 trillion mark in terms of GDP, the international community would only welcome the opportunity with open arms,” he avers.

According to Vivek, qualities such as clear communication, collaboration, accountability, and transparency are the key mantras to successfully grow and build business’s in the long term. In his interview with the International Finance Magazine, Vivek Sharma shared insights on topics like Digital Banking, Fin-tech, Asset-Management, Crypto, and much more. An excerpt from the interview:

IF: Tell us about the products/services/solutions your company provides and how they get value out of it?

Vivek Sharma: Edelweiss Asset Services, which was established in 2013 (a custodial arm of Edelweiss Wealth Management), is a SEBI (Securities and Exchange Board of India) registered DDP (Designated Depository Participant) and offers the regulated business of custody and clearing services to global

investors that invest in India’s capital markets. The firm has global offices in Singapore, Hong Kong, London, Dubai, and New York. We offer a plugand-play model and fully integrated services across Securities Custody & Safe Keeping, Derivatives Clearing, Setup Advisory, Research & Execution Services, and Compliance Support that meets every business requirement of Foreign Investors to invest in Indian markets.

Our clientele includes Foreign Portfolio Investors (FPIs), Mutual funds, Alternate Investment Funds, Portfolio Management Services, Domestic Brokers, Corporate Treasuries, and High Net-worth

76% of users believe companies must do more to protect their data online

58% of users said they would be willing to share data to avoid paying for online contentIN CONVERSATION VIVEK SHARMA SENIOR EXECUTIVE VP & HEAD OF INTERNATIONAL CLIENTS GROUP, EDELWEISS WEALTH

volatility and downside risks in the short term, especially with a tighter monetary policy regime globally, a stronger US dollar, high inflationary pressures from supply chain disruptions, geopolitical tensions, and robust postpandemic

Individuals (HNIs). Our focus within the FPI segment is across institutional formats such as Hedge Funds, HFT's Quant Funds, Proprietary Trading Firms, Long only & Family offices.

Edelweiss has been present in the Indian Financial Services space for about 25 years and has emerged as a choice of India Partner for global institutional clients, primarily because of the specialist role we play and for the support we provide throughout the investment life cycle right from set-up to advisory to transactions to closures. Today, Edelweiss Asset Services has grown exponentially to become the dominant clearing member of the country and commands a significant market share in the NSE (National Stock Exchange of India) F&O segment.

safeguarded. This is a big concern with rising cases of hacking, scams, and data leaks.

The structural factors behind the growth of the fintech industry remain intact despite volatility in the economic and business cycles. In many countries, there is a substantial portion of the population that is unbanked or underserved when it comes to basic financial services, with the incumbent banking players remaining unable or unwilling to fill the gap due to a variety of reasons – legacy systems, capital constraints, regulations, industry structure, etc. This is dovetailed with the fact that the younger generation in these countries is digital natives and thus comfortable with fintech services delivered through technological platforms that circumvent traditional routes of delivery.

Banking has

The compatibility between different systems is one of the biggest challenges. As a custody and clearing services provider to global clients, different clients will have different back-office systems depending on their legacy systems, choice of other service providers, degree of outsourcing etc. One of our biggest USPs is the ability to adapt our service to be compatible with the systems that our clients are using. Unlike many similar players in this space, we are able to do this because we have developed our digital systems in-house and thus, able to customize it to suit our client’s digital requirements.

Another challenge with increasing digitalization is data privacy and security. Clients are concerned with ensuring the data that they provide to us, which can include some very sensitive personal information of their directors, and UBOs for KYC purposes, are well

There will be short-term volatility and downside risks in the short term, especially with a tighter monetary policy regime globally, a stronger US dollar, high inflationary pressures from supply chain disruptions, geopolitical tensions, and robust post-pandemic demand. Beyond short-term market gyrations, the longterm demand for investment services and investors choosing to stay invested remain robust. We have seen a strong activity from our client base in terms of new FPI account openings, and continue to have a strong pipeline of global clients looking to set up their FPIs this year.

The technology underlying bitcoin and many other cryptocurrencies – blockchain, decentralized finance, distributed ledger technology – will have long-term adoption and use-cases. We are seeing new fin-tech players utilizing these technologies and pioneering new forms of financial services or new modes of delivering existing financial services from these technologies.

The highly speculative elements of cryptocurrencies make them hard to value and subject

"There will be short-term

demand"

to extreme volatility. This means they are not a useful asset class from a portfolio management perspective, besides their function as a speculative investment.

How will an unstable economy impact the banking sector?

Areas of banking that depend on economic activity may suffer – consumer banking, consumer/ business loan growth, credit card usage, mortgage business etc. Banks with robust asset and wealth management arms that can generate stable fee incomes, independent of margins and loan growth, would benefit as investors position their portfolios defensively to weather the uncertainty.

Capital market activity will tend to slow down as deal-making becomes tactical and opportunistic as companies adopt a wait-and-see approach before doing acquisitions. Trading activity will also tend to slow as financial market participants become defensive in the face of uncertainty.

What would be your advice to asset-management firms?

Have a clear strategy for establishing a strong

In May 2022, The Chimera ETFs traded a total of AED 62.7 million in the secondary market, the second-highest total this year and the third-highest since the launch of Chimera’s

competitive advantage, given that the asset management industry is becoming increasingly crowded. This can be in the form of scale or niche expertise in a particular asset class or geography. Improve processes and productivity through technological solutions or service providers who can offer superior technological offerings.

Since the economy is passing through bouts of instability, what kind of investment advice will you like to give to our readers?

Remain invested in the market through a welldiversified portfolio as time in the market is better than timing the market. EM countries like India offer good long-term growth prospects and should definitely be in a well-diversified portfolio.

editor@ifinancemag.com

Commercial Bank Finance Services (CBFS) is one of Qatar’s top three licensed brokerage houses, regulated by the Qatar Financial Markets Authority (QFMA). Established in 2011, CBFS is a wholly owned subsidiary of Commercial Bank with paid-up capital of QAR 700 million. Their business mission is to become a "Brokerage House of Choice" for domestic and international clients by offering them first-to-market and best-in-class products and services leveraging digital technology to help them meet their financial goals.

CBFS provides customers with secure platforms to trade on Qatar Stock Exchange listed stocks, bonds and Treasury bills. Customers can trade directly through numerous channels during trading hours, i.e. online and mobile trading applications from anywhere during market trading hours. Clients can also call their dealing room phone lines to place their trades. CBFS also provides periodic local and global market economy and company research for clients to help them make informed investment decisions.

The long-term strategy with which CBFS operates is by providing clients with the services and products that are important to their financial needs. Concrete steps have been taken to educate the public about the Qatari stock market and give these members the tools to facilitate their trade. This entails creating competitive market products that are up-to-date and attractive to create these long-life relationships.