APPLIED PROTECTS THE TITANS OF INDUSTRY.® ©2023 Applied Underwriters, Inc. Rated A- (Excellent) by AM Best. Insurance plans protected U.S. Patent No. 7,908,157. IT PAYS TO GET A QUOTE FROM APPLIED®

Accepting large workers’ compensation risks. Most classes. All states, all areas, including New York City, Boston, and Chicago. Few capacity and concentration restrictions. Simpli ed nancial structure covers all exposures. EXPECT THE WINNING DEAL ON LARGE WORKERS’ COMPENSATION. Call (877) 234-4450 or visit auw.com to get a quote.

4 | INSURANCE JOURNAL | APRIL 3, 2023 INSURANCEJOURNAL.COM Contents News & Markets 8 U.S. Commercial Rates Increased in Q4 – But at Slower Pace: WTW 12 P/C Carriers Losing Ground to MGAs in Talent War 14 Louisiana Supreme Ct. Reverses, Finds No Coverage Owed for COVID Shutdown 15 WCRI: Consolidation of Health Care Driving Up Prices in Work Comp 26 Heavier Vehicles, Distracted Drivers Impacting Claim Severity Departments 6 Opening Note 10 Figures 11 Declarations 16 Business Moves 18 People 27 My New Markets Idea Exchange 36 Opportunity Abundant in the Multifamily Affordable Housing Market 38 Winning the Referral Game with Real Estate Education 40 Workplace Shootings Are on The Rise – Here’s How the Insurance Industry Can Respond 42 When it Comes to Today’s Mega-Concerts, Insurance Takes the Spotlight 44 The Talent Crunch Is Poised to Get Much, Much Tougher: Here’s How to Win 46 Minding Your Business: Acquisitions and Agency Value 48 Ask the Insurance Recruiter: A Checklist to Successfully Hire Remote Account Managers 50 Closing Quote: Overcoming Barriers: Where Are the New MGAs? Special Report 20 Closer Look: Insurer Startup Trium Cyber Finds Path to Profits, With Large Business Focus 22 Spotlight: Experts Urge Empathy, Thoughtfulness for Insurers in Challenging Cyber Landscape 24 Spotlight: Exploring the Dos and Don’ts of Drones, Insurance-Wise 28 Special Report: Hard Commercial Property Market to Linger as Property Owners Take On More Risk 30 Special Report: Risk Management Considerations for Condo Association Boards 32 Special Report: Architects’ & Engineers’ Market Sees Rising Claims Severity Amid Wave of New Projects 34 Spotlight: EEOC Releases Annual Report for Fiscal Year 2022 April 3, 2023 • Vol. 101 No. 6

THE SPECIALIZED INSURANCE YOU DIDN’T DARE DREAM ABOUT. BUT WE DELIVERED IT ANYWAY.

To offer truly specialized industry insurance, innovation is the name of the game. It’s how we’re taking specialization to a whole new level. With extensive experience in underwriting, risk engineering services and claims, we go beyond the expected. And we deliver the innovative, customizable solutions and service mid- to large-size businesses demand across a range of industries.

The Hartford Financial Services Group, Inc., (NYSE: HIG) operates through its subsidiaries, including underwriting company Hartford Fire Insurance Company, under the brand name, The Hartford®, and is headquartered at One Hartford Plaza, Hartford, CT 06155. For additional details, please read The Hartford’s legal notice at www.TheHartford.com. 23-ML-1752450 © March 2023 The Hartford

TheHartford.com/specialization

Small Business Gap

There appears to be a large gap between small business owners’ biggest stressors in 2023 and what they’re prepared for when it comes to their insurance knowledge and coverage. That’s according to data released from NEXT Insurance which surveyed more than 500 small business owners across the United States.

Insurance is often a blind spot for small business owners, the survey revealed, as 90% of respondents noted they lack confidence that their businesses are adequately insured. Also, 96% of respondents did not achieve a grade of 70% or higher in a general insurance knowledge test. Yet, only a third reported seeking professional help for their insurance needs. None of the 500 respondents got a perfect “test” score, indicating that many still need the proper support to navigate the industry.

According to NEXT, small businesses are often a bellwether for the greater American and global economies. When small businesses begin to feel pressured by inflation, supply chain woes, staffing shortages and more, it signals broader challenges ahead.

Key survey findings include:

• More than half of the respondents (51%) listed making a professional mistake — anything from workplace accidents or HR issues to clerical errors — as a top potential risk with the power to negatively impact their business. Surveyed small business owners also indicated their top stressors for the coming year: 68% are most concerned about inflation, followed by reduced consumer spending, a potential recession and supply chain issues.

• Despite 90% of small businesses lacking confidence that they’re adequately insured against their most worrisome risks, more than a quarter of respondents (29%) don’t have any business insurance coverage at all. More than half of those surveyed (51%) say their business is less than “very prepared” to face potentialrisks, but 18% of all respondents are not taking or do not plan to take any steps in the next six months to better protect their business.

• More than half of survey respondents (53%) said their greatest barrier to obtaining insurance comes down to knowing what coverage and policies their business needs. Despite not knowing where to start, just one-third will seek professional help.

• Rural business owners are more concerned about inflation than their counterparts in the suburbs (71% versus 64%). Cyberattacks or data breaches keep small business owners over 45 years old up at night compared to those under 45 (41% versus 30%). Female small business owners are facing a more challenging insurance journey than their male counterparts: Women are more likely to see their knowledge of coverage and policy needs as a barrier to getting insurance compared to men (60% of women compared to 50% of men). Women are also more likely to not have insurance (35%) compared to men (25%).

NEXT conducted its survey in early 2023 to understand what challenges are top of mind for small business owners, how prepared they feel for challenges from an insurance perspective, and to test their knowledge of general liability insurance.

Andrea Wells Vice President, Content

Chairman of the Board Mark Wells | mwells@wellsmedia.com

Chief Executive Officer Joshua Carlson | jcarlson@insurancejournal.com

ADMINISTRATION / CIRCULATION

Chief Financial Officer Mark Wooster | mwooster@wellsmedia.com

Circulation Manager Elizabeth Duffy | eduffy@wellsmedia.com

Staff Accountant Sarah Kersbergen | skersbergen@wellsmedia.com

EDITORIAL

V.P. of Content Andrea Wells | awells@insurancejournal.com

Executive Editor Emeritus Andrew Simpson | asimpson@wellsmedia.com

National Editor Chad Hemenway | chemenway@insurancejournal.com

Southeast Editor William Rabb | wrabb@insurancejournal.com

South Central Editor/Midwest Editor Ezra Amacher | eamacher@insurancejournal.com

West Editor Don Jergler | djergler@insurancejournal.com

International Editor L.S. Howard | lhoward@insurancejournal.com

Content Editor Allen Laman | alaman@wellsmedia.com

Assistant Editor Jahna Jacobson | jjacobson@insurancejournal.com

Copy Editor Stephanie Jones | sjones@insurancejournal.com

Columnists & Contributors

Contributors: Elizabeth Blosfield, Lael Chappell, Joseph Dorr, Jim Sams, Susanne Sclafane, Christa Solfanelli, Megan Stevenson, Nathan Tripler, Frank Zuccarello

Columnists: Tony Caldwell, Catherine Oak, Mary Newgard

SALES / MARKETING

Chief Marketing Officer

Julie Tinney | jtinney@insurancejournal.com

West Sales

Dena Kaplan | dkaplan@insurancejournal.com

Romeo Valdez | rvaldez@insurancejournal.com

Kelly DeLaMora | kdelamora@wellsmedia.com

South Central Sales Mindy Trammell | mtrammell@insurancejournal.com

Southeast and East Sales (except for NY, PA, CT)

Howard Simkin | hsimkin@insurancejournal.com

Midwest Sales

Lisa Whalen | (800) 897-9965 x180

East Sales (NY, PA and CT only)

Dave Molchan | (800) 897-9965 x145

Advertising Coordinator Erin Burns | eburns@insurancejournal.com

Insurance Markets Manager

Kristine Honey | khoney@insurancejournal.com

Sr. Sales & Marketing Coordinator Laura Roy | lroy@insurancejournal.com

Marketing Administrator Alberto Vazquez | avazquez@insurancejournal.com

Marketing Director Derence Walk | dwalk@insurancejournal.com

DESIGN / WEB / VIDEO

V.P. of Design

Guy Boccia | gboccia@insurancejournal.com

Web Team Lead Josh Whitlow | jwhitlow@insurancejournal.com

Ad Ops Specialist

Jeff Cardrant | jcardrant@insurancejournal.com

Web Developer Terrance Woest | twoest@wellsmedia.com

Web Developer Jason Chipp | jchipp@wellsmedia.com

V.P. of New Media

Bobbie Dodge | bdodge@insurancejournal.com

Videographer/Editor

Ashley Waldrop | awaldrop@insurancejournal.com

ACADEMY OF INSURANCE

Director

Patrick Wraight | pwraight@ijacademy.com

Online Training Coordinator

George Jack | gjack@ijacademy.com

6 | INSURANCE JOURNAL | APRIL 3, 2023 Write the Editor: awells@insurancejournal.com Opening

SUBSCRIPTIONS: Call (855) 814-9547 or visit ijmag.com/subscribe Outside the US, call (847) 400-5951 Insurance Journal, The National Property/Casualty Magazine (ISSN: 00204714) is published 22 times annually by Wells Media Group, Inc., 3570 Camino del Rio North, Suite 100, San Diego, CA 92108-1747. Periodicals Postage Paid at San Diego, CA and at additional mailing offices. SUBSCRIPTION RATES: $7.95 per copy, $12.95 per special issue copy, $195 per year in the U.S., $295 per year all other countries. DISCLAIMER: While the information in this publication is derived from sources believed reliable and is subject to reasonable care in preparation and editing, it is not intended to be legal, accounting, tax, technical or other professional advice. Readers are advised to consult competent professionals for application to their particular situation. Copyright 202 Wells Media Group, Inc. All Rights Reserved. Content may not be photocopied, reproduced or redistributed without written permission. Insurance Journal is a publication of Wells Media Group, Inc. POSTMASTER: Send change of address form to Insurance Journal, Circulation Dept, PO Box 708, Northbrook, IL 60065-9967 ARTICLE REPRINTS: Contact (800) 897-9965 x125 or visit insurancejournal.com/reprints

Note

Despite 90% of small businesses lacking confidence that they’re adequately insured, more than a quarter of respondents don’t have any business insurance coverage at all.

FOREMOST® Learn more at ForemostAgent.com We have insurance solutions for the entire household! We offer auto and home policies, but also have excellent coverage and multi-policy discounts for other products like marine, motorcycle, off-road vehicle, travel trailer and more. Help your customers get outdoors with A Better Insurance Experience!® REIMAGINE THE OUTDOORS by insuring recreational products with Foremost Insurance! Not all products, coverages and discounts are available in all areas. 9024448 04/23

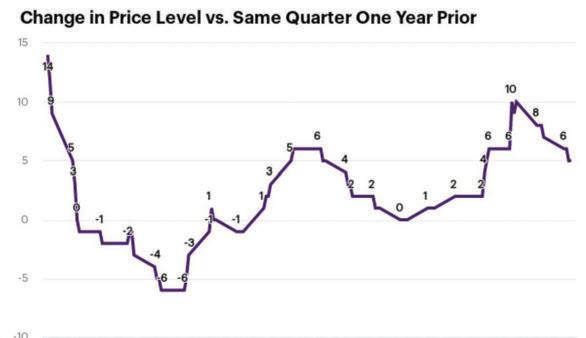

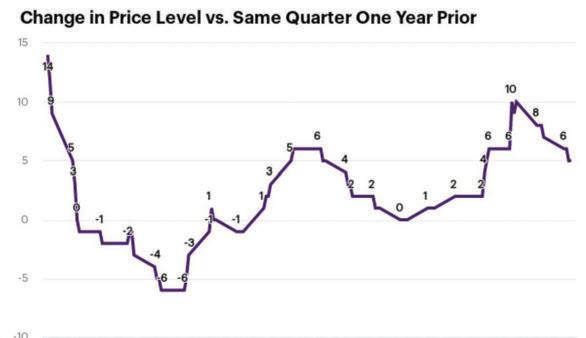

U.S. Commercial Rates Increased in Q4 — But at Slower Pace: WTW

U.S. commercial insurance prices grew in the fourth quarter of 2022 by an average of 4.8%, down from the rate of 5.2% in the previous quarter (Q3 2022), according to WTW’s most recent Commercial Lines Insurance Pricing Survey (CLIPS).

The aggregate commercial price change reported by carriers spiked to nearly and above 10% in the second through fourth quarters of 2020, and since then declined to just below 5% in the fourth quarter of 2022.

“Rates continued to harden across nearly all lines of coverage in the fourth quarter however at a slower pace. While the average change still showed an increase [of 4.8%], overall market tempering demonstrates a trend of sustained market stabilization,” commented Yi Jing, director, Insurance Consulting and Technology, WTW, in a statement.

Prices for Lines of Business

Data for nearly all lines indicate

moderate to significant price increases in Q4 2022 with the exception of workers’ compensation and directors and officers (D&O) liability.

CLIPS continues to indicate a slight price reduction for workers’ compensation, while D&O liability experienced another quarter price decrease, larger than the prior quarter.

Both commercial property and commercial auto liability saw a larger price increase than last quarter, in contrast to all other

survey lines, said WTW. Commercial auto saw reported price increases near or above double digits for the 21st consecutive quarter.

Cyber, which was first introduced into the survey in the fourth quarter of 2021 with the volume being much smaller than all other lines, slowed down its price increase to a single digit, said the WTW survey.

The third largest price increase came from excess/umbrella liability which saw significantly accelerating prices over the previous 14 quarters and experienced a slightly lower increase than the prior quarter, although still a close to a double-digit price increase.

Account Sizes

When comparing account sizes, WTW noted that reported price changes were all below double digits including specialty lines, which now has a small price decrease driven by directors and officers liability.

8 | INSURANCE JOURNAL | APRIL 3, 2023 INSURANCEJOURNAL.COM

News & Markets

IICF Inclusion in Insurance Global Conference

IICF Inclusion in Insurance Global Conference

June 13–15, 2023, New York City

New York Hilton Midtown

Proceeds benefit nonprofit and charitable organizations across the US and UK through the IICF Community Grants Program.

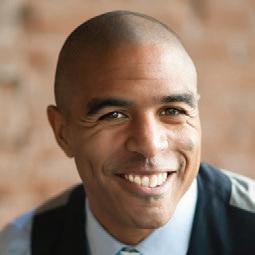

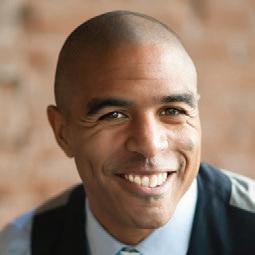

Eric M. Bailey

The bestselling author of “The Cure for Stupidity: Using Brain Science to Explain Irrational Behavior” and leading expert on human relationships and communication. Eric has a diverse set of experiences that includes helping NFL All-Pro Larry Fitzgerald pet a rhinoceros, doing barrel rolls in an F-16, and chatting with LL Cool J on the campus of Harvard University.

Claudia Brind-Woody

IBM Managing Director in the UK and Ireland. Recipient of numerous awards, Claudia was named to the Financial Times Global LGBT Role Models Hall of Fame in 2016 after having been in the top 10 on their list for the three previous years. Brind-Woody is the Global Co-Chair for the LGBT Executive Taskforce at IBM.

Register today: inclusion.iicf.org

For sponsorship please contact Betsy Myatt at emyatt@iicf.com or (917) 544-0895

Chris De Santis

An independent organizational behavior practitioner, speaker, podcast host of Cubicle Confidential, and author of “Why I Find You Irritating: Navigating Generational Friction at Work.” He has developed a framework for understanding generational perspectives, explaining when it makes sense to talk about these differences and when it doesn’t.

Jon Macaskill

A Navy SEAL Commander turned mindfulness and meditation teacher. Macaskill has served in Iraq, Afghanistan, off the coast of Somalia and in Panama. His consulting business brings mindfulness and mediation to high performing teams dealing with stress, anxiety, and depression while increasing focus, creativity, and productivity.

Join us for the in-person return of our industry-leading Global Conference, where hundreds of exceptional insurance professionals of all ages and stages will convene for an action-oriented program with a unique focus on leadership and an inclusive future for the industry. Learn more at: inclusion.iicf.org

Thank you to our earliest 2023 Sponsors

Diamond Sponsor Sponsors

Register today!

Figures

The number of employees, former employees and family members that have sued Springdale, Arkansas-based Tyson Foods, alleging it failed to take appropriate precautions at its meat-packing plants during the early days of the COVID pandemic. In the lawsuit filed in Pulaski County Circuit Court, the plaintiffs said Tyson’s negligence and disregard for its workers led to emotional distress, illness and death. Several of the plaintiffs are the spouses or children of Tyson workers who died after contracting COVID.

$23.8 Million

The amount vaping company Juul Labs will pay Chicago to settle a lawsuit alleging the company marketed products to underage users. The Chicago Department of Public Health will use the money for youth prevention and reduction programs, education and outreach, according to a city press release. The company agreed to pay $2.8 million within 30 days and the rest later this year, the statement said.

The number of gun companies ordered to stop selling or distributing unfinished or unserialized gun parts used to assemble untraceable “ghost guns” to consumers in New York. An injunction granted by U.S. District Judge Jesse Furman in Manhattan reflects a deal reached between the gun companies and N.Y. Attorney General Letitia James while the AG’s broader lawsuit against ghost gun sales under state law continues. The impacted gun distributors are Brownells Inc., Blackhawk Manufacturing Group (80 Percent Arms), Salvo Technologies Inc. (80 P Builder or 80P Freedom Co.), G.S. Performance LLC (Glockstore), Indie Guns LLC, Primary Arms LLC, Arm or Ally LLC, Rainier Arms LLC, KM Tactical LLC, and Rock Slide USA LLC.

$54 Million

The amount of an alleged workers’ compensation fraud scheme to which Wesley Owens, 54, and Beau Wilson, 38, both of Atlanta, Georgia, pleaded no contest in California. The two were charged with multiple felony counts of insurance fraud and conspiracy following a California Department of Insurance investigation. Owens owned and was the CEO of Bison Workforce Solutions, a professional employer organization based outside Atlanta, which provided outsourced workers’ comp insurance, human resources, payroll, tax and other services.

10 | INSURANCE JOURNAL | APRIL 3, 2023 INSURANCEJOURNAL.COM

10

34

Declarations

Opioid Fight

“The Justice Department is using every tool at our disposal to confront the opioid epidemic that is killing Americans and shattering communities across the country.”

— Attorney General Merrick Garland said after the U.S. government sued Rite Aid Corp., accusing the pharmacy chain of missing “red flags” as it illegally filled hundreds of thousands of prescriptions for controlled substances, including opioids. In a complaint filed in federal court, the Department of Justice said Rite Aid repeatedly filled prescriptions from May 2014 to June 2019 that were medically unnecessary, for off-label use, or not issued in the usual course of professional practice.

Confidential Confessions

“A priest faces excommunication if he discloses the communication made to him during confession. … And the sacramental seal of confession is the worldwide law of the Catholic Church, not just the diocese of Burlington, Vermont.”

— Bishop Christopher Coyne told the Vermont Senate Judiciary Committee that the church is opposed to a bill that would remove an exemption from Vermont’s child abuse and neglect reporting laws. Clergy are currently not required to report potential evidence of such crimes if they learn of it in confidence while acting as a spiritual advisor.

Ohio Train Terror

“I kind of kept myself under control, told my kids, ‘OK, guys, we have to leave.’ … The only thing I knew was I had to get my kids to safety. Take just the necessary things and get out of there.”

— Heather Bable said, recalling the terror of the night when a train loaded with hazardous chemicals derailed less than a half-mile from her home in East Palestine, Ohio. She heard an earthshaking boom and, from her bathroom window, “all you saw was the flames.”

Louisiana Commissioner Retiring

“I’ve

made that decision for two reasons:

The first is to remove politics from the vitally important upcoming legislative session where many significant issues are affecting our state and the future of our state’s property insurance market will be debated and hopefully decided to improve that market. … The second reason is that I am obviously 78 years old and have spent almost 50 years serving the public of Louisiana. While very healthy and continuing to exercise, I want to enjoy the remaining years of my life with my family and hopefully some new hobbies.”

— Louisiana Insurance Commissioner Jim Donelon announced that he will not run for reelection this fall, marking an end to 17 years as the state’s chief insurance regulator.

Forest Service Distrust

“The U.S. Forest Service admitted fault, but we have a long way to go before they regain the trust of New Mexicans. … This letter requests that the (Forest Service) clearly explain what they plan to change to prevent another grave error like this. Our lands, forests, waters and communities cannot afford anything less, and our people deserve it.”

— U.S. Rep. Teresa Leger Fernández of New Mexico said in a statement after members of New Mexico’s congressional delegation sent a letter to Forest Chief Randy Moore looking for assurances from the U.S. Forest Service that it is taking preventative measures to ensure that future prescribed fires don’t turn into disasters. The largest wildfire in state history, sparked last year by a Forest Service prescribed burn, charred more than 530 square miles of Rocky Mountain foothills, destroying homes and livelihoods.

Florida Windshield AOB Bill

“Any attempt by a policyowner to enter into such assignment agreement is void and unenforceable.”

— Reads Florida’s House Bill 541, which was approved by the House Banking and Insurance Committee. The bill would ban assignment-of-benefits agreements for windshield repairs, a measure that proponents hope will stem a flood of litigation aimed at insurers.

APRIL 3, 2023 INSURANCE JOURNAL | 11 INSURANCEJOURNAL.COM

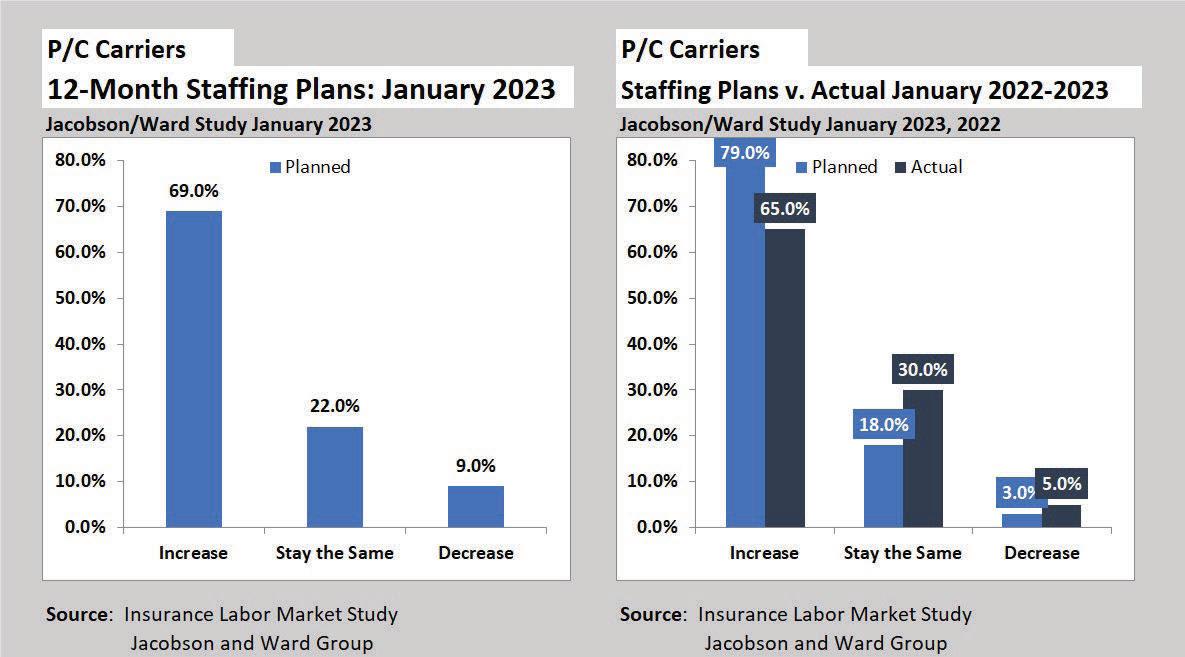

P/C Carriers Losing Ground to MGAs in Talent War

By Susanne Sclafane

During a webinar about an insurance industry labor market survey, an industry recruiter said insurance carriers are losing ground to managing general agents in the war for talent.

“On the property and casualty side, primarily in the commercial space, it’s been MGAs [that] are really growing very very quickly and very substantially, and they’re taking a share of the employee market as they continue to grow [and] become a bigger factor in the commercial business,” said Greg Jacobson, chief executive officer of The Jacobson Group, as he and Jeff Rieder, partner at Aon and head of Ward Benchmarking, reported the results of the Semi-Annual U.S. Insurance Labor Market Study published by the two firms.

Jacobson made the observation as he explained why insurance carrier employment figures from the U.S. Bureau of Labor Statistics, while rising, have not quite made it back to a record level achieved in 2020.

“There are two primary reasons why we haven’t reached the highest levels — and they don’t really have anything to do with planned reductions in staff,” Jacobson said. Instead, carriers are having difficulty keeping up with turnover “primarily as it relates to retirements.” In addition, “we’re

also seeing more and more employees go to alternative employers,” he said, referring to MGAs.

Later in the webinar, Jacobson reviewed results of the survey, including a question which asked insurance carrier respondents (85% of which were from P/C carriers) to assess the difficulty they are having in filling 11 types of positions, ranging from technology to claims to operations to executives. As in recent prior surveys, every category remains difficult to fill, the survey found. In other words, respondents assessing their hiring struggles on a 10-point scale, assigned scores of 5 or above, on average, for every type of insurance job.

But even the hardest-to-fill jobs — in technology and actuarial areas — had lower scores than last year. “It is absolutely getting easier [to fill jobs] within the context of still being really difficult,” said Jacobson.

There’s one exception, however. Underwriting positions are getting slightly tougher to fill, according to survey respondents, Aon Ward’s Rieder noted. “We’ve seen, particularly for the commercial line segment, a notable challenge for companies to fill positions, and that tends to be an area where companies have also seen more poaching of talent,” he said. In addition, he said, other surveys — surveys about compensations — reveal greater increases in pay for underwriters, particularly in entry and intermediate roles “as

companies are again poaching talent from other organizations.” Therefore, it was hardly surprising that underwriting bucked the overall trend of declining placement difficulty.

“And there are alternative employers of choice for individuals to work for, especially in the commercial lines underwriting space,” Rieder said, again offering MGAs, as well as startups and traditional regional and super regional carriers getting into specialty markets as examples.

Reviewing the responses to a related question — which asked what functions carriers are most likely to try to fill this year — Rieder noted sharp (full-point or more) year-over-year reductions in scores for technology, analytical, actuarial and operations. There were no similar drops for the front office roles for underwriting and claims. “The core activities for insurance around claims and underwriting still remain very very much in high demand,” Rieder said.

Explaining the declines for back office functions, he said that for many clients his firm works with “there has been an emphasis on overall expense reduction, particularly as there’s been some economies of scale ... being achieved during the virtual work environment.”

While the industry’s greatest need across all types of insurers still remains technology staffing, P/C personal lines

12 | INSURANCE JOURNAL | APRIL 3, 2023 INSURANCEJOURNAL.COM News & Markets

carriers rank their hiring aspirations for claims professionals ahead of technology professionals. Rieder pointed to the loss frequency and severity challenges in personal lines to explain the results, also noting that personal lines carriers took some reductions in force in their claim staff when the pandemic brought those claims metrics down — either through a reduction of force or a pause in hiring.

“That appears to have come full circle. We also see generally higher levels of turnover, particularly into those entry level claims activities,” he said.

Reductions Unplanned

More recent reductions in staffing for all types of P/C and life/health carriers have been unplanned, Jacobson reiterated at one point during the webinar in response to an audience member who asked why insurers are not hitting hiring targets. Is it “entirely driven by the inability to find suitable new employees?” they asked.

“That’s exactly right. That’s absolutely what’s happening,” Jacobson said. “The reason why the industry has less employees than it did two years ago is not because the industry intended to reduce jobs. It’s because there are more open jobs.”

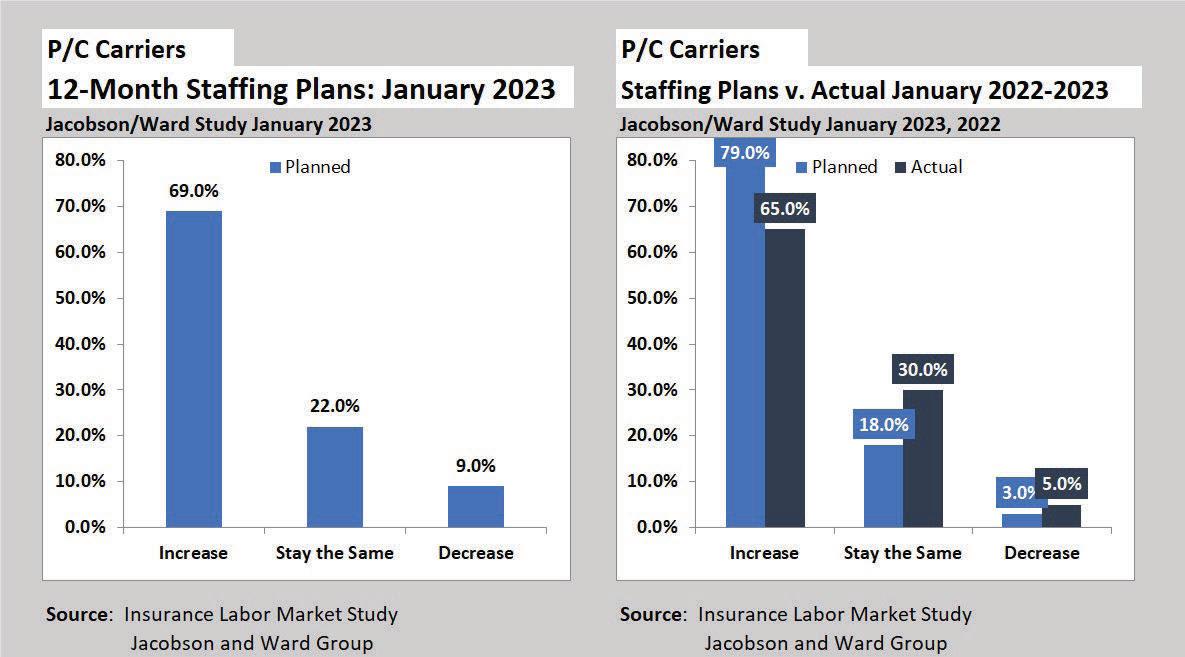

In fact, last January, 79% of P/C carriers surveyed had indicated that they intended to increase the size of their workforces in 2022. A year later, only 65% reported that they actually did.

In addition, while only 3% said they planned to decrease staff a year ago, that

figure is up to 9% for 2023. Across all types of insurers, the percentage intending to decrease staff jumped from 3% in 2022 to 10% in 2023. Rieder and Jacobson said that this change is probably indicative of concerns about economic volatility.

For the first time in the 14-year history of the survey, Aon and The Jacobson Group have tabulated figures on voluntary and involuntary turnover within the industry. Jacobson said that historically, insurance is one of the lowest turnover industries in the economy, but that has changed. In the last 12 months, the voluntary turnover (individuals choosing to leave on their own including retirements) was 11.1%, while involuntary turnover (people who are let go) was 3.6%, for a total turnover rate of 14.7%.

On a positive note, “that started to come back to close to pre-pandemic numbers over the last six months,” Jacobson said, reporting that the figures dropped to 8% for voluntary turnover, and 2.8% for involuntary turnover for the second half of the year. Still, “overall this is considerably higher turnover than the historical norm from the insurance industry, and most of that probably is related to just the way employees view their relationship with their employer over the course of their career,” Jacobson said.

Back to the Future

As carriers try to keep ahead of voluntary turnover, they are more willing to fill in entry level ranks, especially in

back office operations roles — and even in underwriting.

In total, carriers said that 27% of positions are expected to be filled with entry level staff, up from 22% reported from the prior survey in July 2022. While actuarial and operations functions remain the most likely to be filled with entry level personnel, right behind them in the latest survey is underwriting, with carriers surveyed in January 2023 saying that 38% of their underwriting positions are entry level — up from just 16% in July 2022.

“Companies are beginning to invest more in classes — hiring groups of underwriting and client entry level positions out of college. That might be a class of 8-10 individuals,” Rieder reported, noting that by doing this semiannually, carriers intend to keep this pool of talent growing while replenishing those lost through elevated levels of turnover.

“For many of the tenured insurance individuals that grew up in the 80s and 90s, it was very much commonplace to see large classes.” But that type of activity “was cut by many organizations or turned down” in 2009 and the early 2010s, after the recession. “Now, we’re seeing a reemergence,” he said.

Paying for Talent

Asked specifically about industry pay scales, Rieder said that going into 2022, merit increases were anticipated to come in around 3.5%, but materialized to be a little bit closer to 4%. And for some organizations, there were 4.5% jumps. Jacobson, noted that the Bureau of Labor Statistics actually shows year over year increases in compensation of about 6%.

“The difference between the 4% merit raises and the 6% total that we’re seeing from the BLS is for most part due to the higher end of people from outside of an organization. It’s more expensive to hire people from the outside than it is to retain your employees. So we were seeing some significant jumps in salaries as a result of people leaving and going from one organization to another,” Jacobson said.

APRIL 3, 2023 INSURANCE JOURNAL | 13 INSURANCEJOURNAL.COM

Sclafane is the executive editor of Carrier Management. Email: ssclafane@carriermanagement.com

News & Markets

Louisiana Supreme Court Reverses, Finds No Coverage Owed for COVID Shutdown

By Jim Sams

The Louisiana Supreme Court has joined state high courts across the nation in rejecting a policyholder’s business-interruption claim for income lost because of government restrictions imposed to slow the spread of COVID-19.

The high court on March 17 reversed the Louisiana Court of Appeals and reinstated a trial court decision that found the virus did not cause a direct physical loss to the Oceana Grille, a seafood restaurant in the heart of New Orleans’ French Quarter.

“Oceana never repaired, rebuilt or replaced any property that was allegedly lost or damaged,” the 5-2 opinion says. “While we are sympathetic to the immense economic challenges faced in responding to the pandemic, we cannot alter the terms of an insurance contract under the guise of contractual interpretation when the policy uses unambiguous terms.”

Cajun Conti, owner of the Oceana Grille, filed the first lawsuit in the country seeking insurance coverage for a COVID-19 shutdown. The company’s attorney, John Houghtalling III, had the ear of President Donald Trump, who said during a press conference that he thought claims by restaurants that purchased all-risk policies without virus exclusions should be paid.

But an Orleans Parish judge, like most courts that considered the question, ruled that the virus did not cause a direct physical loss that required coverage by an all-risk commercial property insurance policy.

The Louisiana Court of Appeals, however, reversed the decision in a 3-2 ruling. The Lloyd’s of London syndicate that issued Cajun Conti’s policy appealed to the Supreme Court.

The high court rejected arguments that prior decisions finding that coverage was owed for a property con-

taminated by lead dust and properties that required restoration after the installation of defective Chinese drywall set precedents that favored coverage.

“Oceana’s property was not physically lost in any tangible or corporeal sense,” as required for coverage under the policy, the majority said.

Justices Jefferson D. Hughes III and Piper D. Griffin dissented.

“Like smoke from a fire next door that did no physical damage to the premises, but caused the business to be closed until the odor could be removed and the business cleaned, a physical loss occurred,” Hughes said in a short dissenting opinion.

Only one state high court has ruled in favor of a policyholder seeking coverage for a COVID-19 shutdown.

The Vermont Supreme Court reversed a trial court decision to grant summary judgment against a dental practice and in favor of an insurer, but did not make a final decision on the merits of the case.

At least 19 state high courts have ruled in favor of insurers and rejected coverage, according to a litigation tracker managed by the University of Pennsylvania.

Sams is the editor of Claims Journal. Email: jsams@claimsjournal.com.

14 | INSURANCE JOURNAL | APRIL 3, 2023 INSURANCEJOURNAL.COM

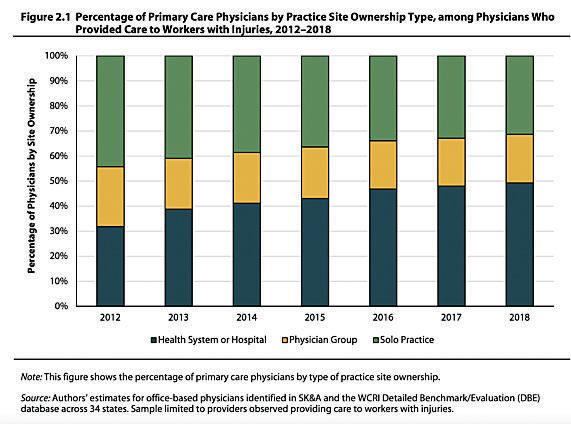

WCRI: Consolidation of Health Care Driving Up Prices in Work Comp

Consolidation of physician services into larger groups owned by hospitals and health care systems is driving up the cost of care in workers’ compensation, according to a new study by the Workers’ Compensation Research Institute (WCRI).

“Medical markets are increasingly concentrated,” said John Ruser, WCRI president and chief executive officer, in a statement. “This means that patients are more likely to be treated by physicians at sites owned by hospitals and health systems. This raises a policy concern that the increasing concentration of medical providers may lead to higher payments for medical care without corresponding improvements in patient outcomes.”

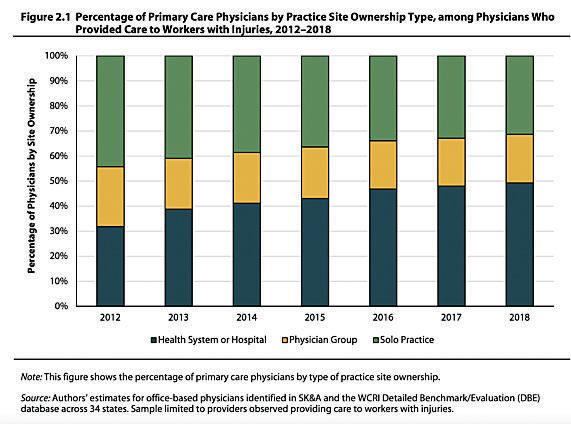

The study found that from 2012 to 2018 the percentage of physicians practicing at sites owned by hospitals or health systems increased to 49% from 32% for primary care physicians, and to 35% from 18% for orthopedic surgeons.

This “vertical integration” of the industry increased the average payment per procedure by 8% overall, or $29 per procedure. But costs increased more in states that don’t use fee schedules to regulate prices charged for treating injured workers. In those states, payments per procedure increased an average of $91 because of vertical integration, the study says.

WCRI said the study, conducted by researchers Bogdan Savych and Olesya Fomenko, is the first to study the cost of vertical integration in workers’ compensation.

The study said most of the increase in costs was driven by changes in the frequency and mix of services provided, known as utilization. Vertical integration increased the price of each procedure provided by only 2%.

The study says a substantial amount of research has found that fewer physicians are employed in sole practice and more are employees of health systems and hospitals. Advocates for consolidation say it leads to more frequent use of best practices and better coordination of care, but skeptics say that consolidation reduces competition and leads to higher prices for medical care.

WCRI, looking specifically at primary care physicians who treat injured workers, found that more than 44% were in sole practice in 2012 and only 31% were in sole practice in 2018. For orthopedic surgeons, the share in sole practice declined from 41% to 27% during that period.

In the meantime, the share of primary care physicians employed by hospitals and health systems climbed from 33% to

49%, and the share of orthopedic surgeons working for hospitals and health systems climbed from 18% to 35%.

The WCRI researchers found the cost of vertical integration varied largely by location and type of provider. The study found the impact of consolidation was greatest in states without fee schedules.

Vertical integration in those states led to 12% increases in payments per procedure, 14% in payments per service type and an 11% increase in payments per day of care. For states with fee schedules, vertical integration led to payment increases ranging from 7% to 9% in each category.

“We can expect that when a state has a fixed-amount fee schedule, there are fewer opportunities for vertically-integrated providers to affect prices,” the study says. “However, prices may be more responsive to changes in the market power of providers in states without fixed-amount fee schedules.”

The study did not include any information on whether the higher prices charged led to better outcomes for workers’ compensation patients, but suggested more research is needed in that area.

APRIL 3, 2023 INSURANCE JOURNAL | 15 INSURANCEJOURNAL.COM News

& Markets

Business Moves

Burns & Wilcox, McIntyre & Associates

Burns & Wilcox has signed a definitive agreement to acquire McIntyre & Associates, a Ruston, Louisiana based managing general agent.

The deal is expected to close early in Q2 2023.

Family owned for two generations, McIntyre is a wholesale business with significant commercial lines expertise, including contractors, lessors risk, restaurants, special events and commercial packages, among other areas.

Originally founded by Bill McIntyre in 1988, the company is now led by McIntyre’s son-in-law Bart Dugdale.

East

NSM

Pennsylvania-based insurance program specialist NSM Insurance Group has completed its acquisition of three businesses that specialize in the field of medical stop loss insurance and managed care insurance.

The firms are Sequoia Reinsurance Services in Minnesota, and IOA Re’s two divisions, Rockport Benefits in Massachusetts and Insurance Resources and Auditing Services in Pennsylvania. Rockport and IRAS are subsidiaries of ELMC Risk Solutions in New York, a portfolio company of private investment firm J.C. Flowers & Co.

Bill McKernan, president of NSM, called the firms “high-performing companies with a proven track record of profitability.”

Richard Fleder is CEO of ELMC; John Parker is president and CEO of IOA Re; and Dan Bolgar is president and CEO of Sequoia Reinsurance Services. Rockport Benefits is co-led by managing directors Amy Argeros and Heidi Herlihy.

Carlyle purchased NSM from White Mountains last August.

NSM has more than $1.5 billion in premium across more than 25 specialty insurance programs and brands in the U.S. and UK. Its programs focus on collector cars; pets; social services and behavioral health; addiction treatment; coastal condominiums; towing and garage; trucking; sports and fitness; professional liability for contractors, architects and engineers; habitational; staffing; and workers’ comp.

Midwest

Arthur J. Gallagher, SBP

Arthur J. Gallagher & Co. acquired Fort Wayne, Indiana-based Stewart, Brimner, Peters & Company Inc.

SBP is a retail insurance broker offering a variety of commercial and personal insurance products along with employee benefits consulting to clients in central and northern Indiana.

Jason Brimner, John Brimner, Jeff Peters, Mick Stewart and their team will remain in their current location under the direction of Sean Gallagher, head of Gallagher’s Great Lakes region retail property/casualty brokerage operations.

South Central

ALKEME, NAPA Insurance Center

ALKEME announced the acquisition of the NAPA Insurance Center, an Austin, Texas-based insurance agency that provides health and property/casualty insurance to NAPA’s independently owned auto part stores and auto care centers nationally.

Founded over 30 years ago, the NAPA Insurance Center has been serving the NAPA family through business insurance, flood insurance, group healthcare, individual healthcare, personal insurance and life insurance offerings.

Based in Ladera Ranch, California, and backed by GCP Capital Partners, ALKEME serves thousands of clients with a wide range of offerings including P/C, benefits, surety, risk and wealth management.

Dugdale will join Burns & Wilcox as associate managing director and report to Bonnie Steen, vice president and managing director for Burns & Wilcox Louisiana and Arkansas.

Southeast Keyes

Keyes Coverage, a rapidly growing Florida insurance brokerage, has acquired three firms: Bill and Sheila Gaylor Insurance, based in Melbourne, Florida; My Florida Insurance Broker, in Vero Beach; and Brian Laudanno Insurance in Coral Springs.

It’s part of a plan to continue growing the Keyes firm in 2023, the company said.

The Gaylor agency has been serving the Space Coast area for more than 30 years, offering personal and commercial lines products. My Florida Insurance has been in business for some 15 years in Martin County. Laudanno has offered health and property/casualty insurance in south Florida for two decades.

Principals and employees of those agencies will remain on board, Keyes said.

Keyes has been in business in south Florida since 1975, specializing in in corporate P/C coverage and in personal lines. It has more than 80 employees in its office building in Tamarac, Florida.

Keyes is part of the Keystone Agency Partners brokerage platform.

16 | INSURANCE JOURNAL | APRIL 3, 2023 INSURANCEJOURNAL.COM

AJG, Benson

Arthur J. Gallagher & Co., the global

insurance brokerage and consulting firm, acquired Nashville-based Anderson Benson, a retail insurance brokerage and risk management firm.

Anderson Benson, founded in 2012, has carved out a niche in the entertainment industry, along with hospitality, construction, transportation.

Principals George Anderson, Reno Benson, Brent Daughrity, Steve Buzzell, Will Wright and their team will remain in their current location under the direction of Bumpy Triche, head of Gallagher's MidSouth retail property/casualty brokerage operations.

Arther J. Gallagher, a publicly traded firm, is headquartered in Rolling Meadows, Illinois, and offers services in 130 countries.

Relationships Matter, Flowers

Less than eight months after two of Alabama’s oldest insurance agencies

merged to create the Where Relationships Matter Group, the group has taken on another agency with offices in the southeast part of the state.

WRM Group announced that it has inked a merger agreement with Flowers Insurance Agency, which has offices in Dothan, Eufala and Phenix City.

Flowers’ Managing Partner Shane Sinquefield joins Haig Wright II and Lin Moore as managers of the expanded WRM Group.

Flowers will operate under its own name and employees will continue at their respective offices.

Flowers provides commercial insurance, surety and bonding, employee benefits solutions, personal and life insurance.

WRM was formed last summer when Byars/Wright Insurance and PritchettMoore Insurance merged. Both firms were more than 75 years old and have offices around the state.

West Reliance, Truck Team Insurance

Reliance Partners acquired the assets of Truck Team Insurance in Salt Lake City, Utah.

Truck Team Insurance owner Brent Tate will join Reliance Partners’ team as vice president of sales. He has more than 20 years of commercial insurance experience, and founded Truck Team Insurance five years ago. Truck Team Insurance is an insurance brokerage providing commercial trucking insurance in 23 states.

Reliance Partners is a commercial insurance agency with locations in Chattanooga, Tennessee; Birmingham, Alabama; Chicago; Austin, Texas, Tempe, Arizona; Milwaukee, Wisconsin, Sacramento, California; and Tampa, Florida, with a national client base largely concentrated in the transportation and logistics space.

APRIL 3, 2023 INSURANCE JOURNAL | 17 INSURANCEJOURNAL.COM We’re the quickest. Standalone personal umbrellas issued the same day. Discover the unexpected at PersonalUmbrella.com Admitted carrier, rated A XV by A.M. Best For licensed insurance agents Available nationally. Underwriting criteria varies by state. Visit us online for guidelines. A.M. Best rating e ective 03/23. For the latest rating, visit ambest.com. California Insurance License 0D08438

People

National

Tracy Ryan will join the Allianz Global Corporate & Specialty SE board of management as chief regions and markets officer for North America.

Based in New York, succeeds William (Bill) Scaldaferri who has decided to leave Allianz after 23 years, 11 of which were as a member of the board of management.

Ryan previously was at Liberty Mutual Insurance Group where she was a board member and president, Global Risk Solutions North America, having served in a variety of technical and leadership roles over nearly 30 years.

AXA XL Insurance continues to build out its U.S. Mid-Market business with the addition of Bennett Turner as head of strategy and operations and Christopher Fallon, head of analytics.

Turner joins AXA XL from Liberty Mutual, where he most recently served as a senior director for casualty and specialty lines analytics. He has nearly 20 years of extensive experience in the property/ casualty and financial services industries.

Fallon also joins from Liberty Mutual, where he most recently served as a senior director for casualty and specialty lines analytics.

Turner and Fallon are based in Boston.

East

Wayne Gearhart has been promoted from vice president of claims to senior vice presi-

dent and chief operating officer of Hartford Mutual Insurance Group, headquartered in Hartford, Connecticut.

Gearhart brings nearly 30 years of insurance industry experience to the new position. He joined Harford Mutual in 2019 as assistant vice president of claims and was promoted to vice president of claims in 2021.

Additionally, Geneau Thames has been promoted from assistant vice president, general counsel, and corporate secretary to vice president, general counsel and corporate secretary. Thames has served as Harford Mutual’s in-house counsel since 2015.

The MEMIC Group, headquartered in Portland, Maine, hired Karen Kyer as a new senior production underwriter in the Mid-Atlantic region.

With more than 20 years of experience helping independent agents write monoline workers’ compensation policies in Virginia and Maryland, Kyler specializes in multiple product lines as an adviser to her agency partners.

Managing general agent GMI Insurance (GMI), headquartered in Phoenixville, Pennsylvania, appointed Shawn Hall Sr. as chief operating officer and chief revenue officer.

Before Hall’s appointment at GMI, he served as senior vice

president and managing director of workers’ compensation/ regional vice president at Breckenridge Insurance.

Also, Kelly Kelly joins GMI as administrative manager.

Midwest

Valley Insurance Agency Alliance (VIAA) hired Brett Weis as personal lines coach. He will work with VIAA’s development team and coach new and existing team members on best practices for all property/ casualty insurance issues.

Weis has worked in the insurance industry for nearly 10 years. Before joining VIAA, he served as a personal lines department manager at an independent insurance group serving doctors nationwide. VIAA is based in Clayton, Missouri.

Chicago-based Ryan Specialty promoted Michael VanAcker to executive vice president of RT Specialty, Ryan Specialty’s wholesale brokerage and binding authority specialty.

VanAcker has over 10 years of experience at Ryan as chief operating officer of Ryan Specialty and before that as RT Specialty’s chief operating officer and controller. He also served as director, FP&A, and manager in finance and accounting.

Frankenmuth Insurance

Senior Vice President Phil McCain will retire on June 2 after 37 years of service and leadership.

McCain started at the Frankenmuth, Michigan-based company as a programmer in 1986. He serves as Frankenmuth’s ethics officer, is a member of the corporate executive committee and is responsible for disaster recovery and corporate planning. During McCain’s tenure, Frankenmuth Insurance integrated Patriot Insurance Co., a subsidiary of Frankenmuth Insurance, into its business processes.

Upon McCain’s retirement, Curtis Williams, director of technical services, will be promoted and appointed vice president of information technology.

J.M. Wilson, based in Portage, Michigan, hired Jennifer MikosBenavides as assistant transportation underwriter in its Arlington Heights, Illinois, office.

Mikos-Benavides is responsible for assisting underwriters with new and renewal commercial transportation accounts, as well as maintaining relationships with carriers and independent insurance agents in Illinois, Iowa, and Wisconsin.

Prior to joining JM Wilson, Mikos-Benavides worked in banking and commercial loans for over 20 years.

Omaha National Group Inc appointed Dale Mackel chief

18 | INSURANCE JOURNAL | APRIL 3, 2023 INSURANCEJOURNAL.COM

Tracy Ryan

Wayne Gearhart

Geneau Thames

Shawn Hall Sr.

Brett Weis

Jennifer MikosBenavides

Phil McCain

financial officer.

Mackel joins Omaha National after two years as executive vice president and chief financial officer and treasurer with LHC Group, a publicly traded home health and hospice provider based in Lafayette, Louisiana.

Bryan Connolly, who previously served as chief financial officer, has been promoted to chief operating officer.

South Central

Marine Underwriters of America, a DOXA Insurance company and underwriter of ocean marine, inland marine and related properties, hired Dustin Goodwin as head of the new marine claims program.

Marine Underwriters is headquartered in Conroe, Texas.

Goodwin brings over 27 years of experience in complex claims management, having held leadership positions at top companies in the industry, including senior director at Fidelis Claims Service and senior claims adjustor at CNA Ocean Marine.

Goosehead Insurance Inc. made several leadership promotions, including the appointment of Matthew Hunt as vice president, agency operations.

Hunt began his career with Goosehead in 2010 and has played an instrumental role in opening new markets across the country.

Goosehead, headquartered in West Lake, Texas, also promoted four new managing directors across various departments.

Chelsea Donner has been promoted to managing director of the service department. Donner launched Goosehead’s

San Antonio, Texas, service center in August 2021 and will now lead the San Antonio office. She began her career with Goosehead in 2017.

Dericka Marshall-Dillon has been promoted to managing director of human resources. Marshall-Dillon oversees both the HR and payroll departments. She joined Goosehead in 2013.

Johnny Preston has been promoted to managing director, human capital development. Preston is responsible for improving agent productivity across the company’s franchise and corporate channels. He has been with Goosehead since 2008.

Silver Burney has been promoted to managing director of corporate sales in Fort Worth, Texas. Burney will oversee Goosehead’s Fort Worth and San Antonio markets and will continue his role in recruiting, training and growth in both the corporate and franchise channels. He joined Goosehead in 2016.

Southeast David Altmaier has moved from overseeing regulation of insurance companies to overseeing operations for one — the Bermuda-based reinsurer Aspen Insurance Holdings. Altmaier, who was Florida’s insurance commissioner for six years until he stepped down in December, has been named to the reinsurer’s board of directors.

Aspen Insurance Holdings Ltd. houses a number of reinsurance and insurance

subsidiaries with operations on four continents. These include Aspen Bermuda Ltd.; Peregrine Reinsurance Ltd.; Silverton Re; Aspen Re America; Aspen American Insurance Co., which offers medical malpractice, inland marine, and other property insurance; and Aspen Specialty Insurance Co.

McGriff, a subsidiary of Truist Insurance Holdings, hired Greg Draddy for its Carolinas specialty risk team.

The company said Charlotte is an emerging flagship operation and Draddy will help drive further growth in the region.

He has more than 20 years of experience in commercial insurance, including the last eight in Charlotte with global brokerage firms.

West Venbrook Group LLC, based in Woodland Hills, California, promoted Brenda Sherman to executive vice president of business development and strategic alliances.

A Venbrook executive since 2015, Sherman has more than 30 years of industry experience across both the carrier and program administration sides.

In the newly created role, she will ramp up business development initiatives and work with agency partners to source alternative distribution channels.

Before joining Venbrook,

Sherman held roles at AIG, Tokio Marine, Liberty Mutual, and others. She is based in Southern California.

PCF Insurance Services in Lehi, Utah, named Jenni Lee Crocker president.

Crocker was PCF’s senior vice president, growth and operations for the past year. She will remain on the board of directors at PCF after completing her two-year tenure as a board member.

Crocker has more than 27 years of experience. Before joining PCF in 2022, she spent more than 10 years at Marsh as managing director and corporate leader for the mid-Atlantic region and Virginia office head.

Leavitt Group in Cedar City, Utah named Kevin P. Grady as chief legal officer and Brooke L. MacNaughtan chief people and community officer, a newly created role.

Before joining Leavitt Group, Grady was vice president and deputy general counsel at Monat Global Corp.

MacNaughtan has been with Leavitt Group for 20 years, and she most recently served as VP of travel, meetings and incentives. Her new role encompasses employee experience and travel, meetings, incentive trips and recruiting client service staff.

APRIL 3, 2023 INSURANCE JOURNAL | 19 INSURANCEJOURNAL.COM

Greg Draddy

David Altmaier

Brenda Sherman

Kevin P. Grady

Jenni Lee Crocker

Brooke L. MacNaughtan

Closer Look: Cyber Insurer Startup Trium Cyber Finds Path to Profits, With Large Business Focus

level of contraction in terms of the loss caps available in reinsurance treaties.”

By L.S. Howard

Trium Cyber is the industry’s first Lloyd’sapproved company to provide mono-line cyber coverage for U.S. risks. Launched in January 2023, the full stack surplus lines insurer has joined the ranks of new entrants to the cyber market and those existing carriers that have expanded their market share over the past year.

While it’s an attractive prospect as premiums have skyrocketed, rates more recently have begun to moderate. Indeed, cyber insurance pricing increases moderated to 28%

What’s in a Name?

The name Trium Cyber has Latin roots. Trium is the inflected form of trēs (or three), according to the company’s website.

The insurer said it provides three essential components to support its insureds, and more broadly, promote market stability and the effective management of cyber risk:

• Proprietary underwriting methodology

• Comprehensive risk management capabilities

• Real-time loss mitigation services

in the fourth quarter of 2022, compared to 48% in the third quarter as new entrants to the market increased capacity, according to Marsh’s Global Insurance Market Index.

Nevertheless, Josh Ladeau, CEO of Trium Cyber, isn’t worried that the new capacity will again drive prices down to unsustainable levels because cyber underwriters are very aware of the possible systemic exposures and need to keep rates above the cost of risk.

“The market has really shifted. I don’t think it’s just a temporary rate correction. There is an acknowledgement across carriers and reinsurers that the rate levels of a few years ago were not sustainable and would give us significant difficulty if there are major industry cyber events,” Ladeau said in an interview with Insurance Journal.

“There will be some price fluctuation over the year, but I think there is enough understanding of the aggregate nature of the exposure, as well as the frequency and severity of attritional claims.”

Even at the reinsurance level, there has been a significant pullback, as concerns over aggregate exposure grow, he said. “Reinsurers have looked to cap losses at a lower attachment level. So even as you see the direct insurance portfolios growing, there has been some

Ladeau noted that industry players are very aware that rampant growth and over-competition isn’t healthy, especially given the spike in cyber loss ratios in 2020, he emphasized.

“Despite top-line growth over the years, the cyber insurance market has experienced significant challenges at all points of the value-chain,” said Trium Cyber on its website.

According to Swiss Re, a main driver of cyber insurance market growth has been rising frequency and severity of cyberattacks, which have raised awareness of the risk. “In the U.S., the largest cyber market, premiums grew by 74% in 2021. Standalone policy premiums increased 92%, driven by rate increases after ransomware incidents led to a spike in loss ratios in 2020,” said Swiss Re in its report, titled “Cyber insurance: strengthening resilience for the digital transformation,” published in November 2022.

Swiss Re said the cyber market has immense growth potential because most losses are uninsured. “Given estimates of annual global cyber losses at US$945 billion [according to a report from McAfee], nearly all of the risk remains uninsured,” said Swiss Re, noting that one estimate from the Geneva Association puts the protection gap at 90%.

Focus on Larger Insureds

Unlike some of its competitors that prefer covering smalland-medium-sized enterprises (SMEs), Trium Cyber focuses on large businesses with more than $1 billion of revenue, with robust security postures.

“Historically speaking, that has served us very well in terms of performance relative to the industry,” Ladeau said.

In the large market segment, there is a greater emphasis and investment in security and their IT redundancies — or their ability to use secondary and tertiary solutions in the event they have a cyber incident, he said.

“Some businesses have the ability to run their systems offline, allowing them to maintain business operations even during an outage,” he said. And some organizations have multiple layers of redundancy, so if a major provider goes down, “they can fail over to an additional provider.”

On the other hand, small businesses — SMEs — are one of the more difficult areas in the market today, he cautioned. “I don’t know if there’s yet enough rate in the small business line. Obviously, time will determine whether that’s the case.”

Smaller businesses with homogenous networks, standard tools and systems, and much less investment in security technologies are more likely to be affected if there’s a systemic or aggregated event, he said.

20 | INSURANCE JOURNAL | APRIL 3, 2023 INSURANCEJOURNAL.COM

Many of these smaller companies do not employ a chief information security officer (CISO) and have outsourced their IT and IT security, he continued. Their knowledge and control over their cyber security is likely to be less than it is for the middle market, while the middle market, in turn, also has less rigorous controls than large market customers, he said.

In addition, there are a lot more SMEs than Fortune 1000 companies. As a result, if the limits are aggregated across all those smaller businesses — which in the U.S. number in the millions — the cost would be much higher than for the Fortune 1000 companies — even with the higher limits purchased by big companies, Ladeau added.

“As you move upstream and get into the large market on any individual risk, there is more loss potential on that account, on an individual account basis, because they buy higher limits.” That potential downside is more than offset by stronger controls and established redundancies, supporting segment profitability, he explained.

Swiss Re estimates that the total claim arising from a cyber-incident targeting an

SME is in relative terms three times more than for large corporations, with forensic costs typically ranging from $20,000 to $100,000 for a firm with turnover of less than $50 million.

Downstream Exposures

In the underwriting process, downstream technology dependencies are examined closely — because they can create exposure to systemic events. “We develop an understanding about who is reliant on what technologies and to what degree they’re reliant, and then we position our book around that.”

One notable example of downstream aggregated exposure can be found within the airline industry. Ladeau said about 40% of airlines use one type of booking technology, or at least have that technology as one of their core components for booking, which increases the aggregation potential.

“But shared dependencies like this can be found across various industries such as healthcare and financial institutions,” he said.

Individual risk selection involves assessment of a customer’s security posture, system redundancies, event

response and disaster recovery capabilities and downtime procedures, he explained.

“With our relatively narrow underwriting focus and stringent risk selection criteria, I do feel, from a loss perspective, we have some level of insulation.”

As a veteran cyber underwriter, Ladeau knows what he’s talking about. “The only line I’ve ever written is cyber,” he said. “I’ve always been focused on the profitability of my line of business, and I’ve been able to write sustainably profitable business over the last 15 years, including the last three or four challenging years.”

After joining the startup in September 2022, he helped Trium Cyber navigate the Lloyd’s approval process to become the industry’s first monoline cyber syndicate, Syndicate 1322.

Previously, he led the global cyber platform for Aspen, and prior to that role, he was practice lead for Allied World where he developed the company’s cyber risk platform.

About Trium Cyber

Writing on behalf of Lloyd’s Syndicate 1322, using Lloyd’s “A”-rated, surplus-lines paper, Trium Cyber has the support to write as much as $50 million in gross premiums in the cyber market for 2023.

An excess-only carrier that provides cyber and technology errors and omissions cover, the company can take up to a maximum line of $10 million,

and will regularly deploy a $5 million line, bringing approximately $1.5 billion of new capacity to the U.S. market.

Trium Cyber uses its own proprietary underwriting methodology, real-time claims platform and complimentary cyber risk management services.

Ladeau said the company differentiates itself by being able to make underwriting and claims decisions in the U.S., which is particularly important for cyber where real-time loss scenarios are common.

This is different than third party liability or professional liability claims where claims are resolved in weeks, months or even years, he said.

“In cyber, oftentimes you’re dealing with that claim within hours of an event happening. Being able to get involved immediately with the claim is an important factor. Being U.S.-based in a time zone closer to our distribution partners and clients is a really important differentiating factor of what we do,” Ladeau added.

“The syndicate only writes through the one binder for the U.S. operating company. There is no open market business written out of London.”

While Trium Cyber might eventually provide European coverage, Ladeau said, for 2023 and for the foreseeable future, it will remain focused solely on U.S.-domiciled risks.

The company is backed by Pelican Ventures and third-party capital providers.

This profile of Trium Cyber is the inaugural article in a regular series of Company Spotlights, published by Insurance Journal, which cover the insurance industry’s startups and innovators.

APRIL 3, 2023 INSURANCE JOURNAL | 21 INSURANCEJOURNAL.COM

Josh Ladeau

Spotlight: Insuring Cyber Experts Urge Empathy, Thoughtfulness for Insurers in Challenging Cyber Landscape

By Elizabeth Blosfield

While the continuously evolving cyber threat landscape is a growing problem for insurers, experts say it’s not an insurmountable one, and empathy and thoughtfulness will be key as insurers seek to tackle it.

“The part that sometimes is a little bit frustrating for me is seeing when insurance companies are sort of throwing up their hands and saying, because it’s a difficult problem, it’s an impossible problem,” said Madhu Tadikonda, CEO of Corvus Insurance. “I don’t think that really has much empathy for our commercial clients and policyholders.”

Tadikonda’s comments come after Zurich CEO Mario Greco said in a December 2022 interview in the Financial Times that he believes cyber threats are in danger of becoming uninsurable.

In a widely reported quote from the interview, he said

he believes the growing sophistication and scale of cyberattacks is putting them at risk of becoming uninsurable and questioned what the consequences would be if a cyber criminal takes control of vital parts of U.S. infrastructure.

In a recent episode of The Insuring Cyber Podcast, he said, “first off, there must be a perception that this is not just data … this is about civilization. These people can severely disrupt our lives.”

A representative from Zurich wasn’t available to comment at the time of this podcast, but Greco’s comments come amid growing concern about the cyber threat landscape and the pressure it’s putting on insurers.

The cyber insurance sector has been tested recently with growing ransomware attacks and rising premiums. However, a 2022 Cyber Insurance Market Trends report from Panaseer found that isn’t necessarily

scaring insurers away.

“Despite the considerable pressures, our research shows it’s not enough to make insurers exit the market,” the report said, finding that even if the current rate of cyberattacks remains the same, 84% of respondents said they’d continue to offer cyber insurance over the next three years.

This sentiment was echoed by experts on this podcast episode, who added that helping customers navigate a challenging cyber landscape should be insurers’ first concern.

these are the ways insurance companies are trained and built to think about things.”

Tim Francis, enterprise cyber lead at Travelers, agreed, adding that the insurance industry is armed with a lot more data and knowledge about cyber now than it has had in the past.

To listen to the full podcast with Madhu Tadikonda and Tim Francis visit, https://www.insurancejournal.tv/videos/21355. Be sure to watch for new episodes of The Insuring Cyber Podcast publishing every other Wednesday along with the Insuring Cyber newsletter.

To subscribe, visit https://www.insurancejournal.com/subscribe.

“Whether we think it’s insurable or difficult or whatnot, it is a very real risk that our customers are worried about,” Tadikonda said. “They talk about cyberattacks in their boardrooms. The CEOs of companies get very tough questions about how they’re weighing investments in software and services and how their insurance works together in a risk management solution … I think that would be a real miss if we didn’t respond to something our customers really care about and are worried about, especially given that

“I think that over the last couple of years, we’ve actually learned a lot,” he said. “So, cyber certainly is a challenging space. It’s going to be a challenging space and if there was anyone that thought otherwise, that would be the wrong thought process to bring to this. But I think done with thought, done with care, certainly cyber is a space that that can be managed.”

He went on to say that he not only believes cyber is a risk that can be managed by insurers, but that it’s incumbent upon the insurance industry to do so as technology continues to advance.

“The reality is that we’ve got customers that use technology and use data and are going to continue to use technology and data in all sorts of new

22 | INSURANCE JOURNAL | APRIL 3, 2023 INSURANCEJOURNAL.COM

Madhu Tadikonda

Tim Francis

and innovative ways over the next several years and in the future,” he said. “I think it’s incumbent upon our industry to help them understand their risks, their exposures, and to create insurance products that can help transfer some of that risk. Not without concern, but thoughtfully. I think that there’s certainly a way that can be done.”

Tadikonda said one of the ways insurers can do this is by harnessing data and sharing that knowledge to educate policyholders about their cybersecurity.

“We’ve got a very rich database of incidents and claims and how that links back to what policyholders or customers looked like before an attack,” he said. “And we

have real valuable advice and information for policyholders about which of the investments they can make, which ones reduce frequency and severity, and which ones make them most resilient.”

The challenge, of course, is that the threats are changing all the time.

“Certainly in cyber, what happened in the past, while informative, helpful, useful for sure, is sometimes less predictive for cyber than maybe looking back at that data would be in other lines,” Francis said. However, Tadikonda said insurers will simply need to adapt to a faster paced environment, relying on not only data, but early predictions and a little bit of intuition, to stay ahead. “If you waited two

years for things to appear in the actuarial tables, it might be too late,” he said. “So sometimes, you have to base things on cybersecurity data, good intuition, early results of things, seeing what emerging attacks are, even if there aren’t necessarily insurance claims on the web.”

Francis said that as the cyber insurance industry evolves, he’s noticing a market shift as many carriers who stepped back from the risk initially are now more confident in the space since they have a better handle on it.

“I think this is actually a great time to be a buyer of cyber insurance,” he said. “I think when the ransomware trend was at its worst, a lot of carriers battened down the

hatches and said ‘We’re going to require a higher standard of cybersecurity with our customers.’”

This meant customers who didn’t have robust cybersecurity measures in place could have difficulty finding coverage or could be paying significant prices, he said. “That was just the nature of the risk,” he said. “I think carriers have kind of come out of that frenzy, and what we’re now seeing is not less underwriting standards, but the ability to have those customers that maybe don’t have ideal standards be able to connect with risk professionals that can help them.”

APRIL 3, 2023 INSURANCE JOURNAL | 23 INSURANCEJOURNAL.COM Thanks to Stephen for the kind words and thank YOU for reading. Our journalists take pride in serving the industry. If this publication is valuable to you, please consider upgrading your subscription at www.insurancejournal.com/pro

publication to keep me informed &

“Great

on top of my game.”

IJHOUSE16700 half.indd 1 6/2/20 4:14 PM

Stephen Peters - Producer at Hamrick Insurance Services & Satisfied Insurance Journal Subscriber

Blosfield is the deputy editor of Carrier Management. Email: eblosfield@ wellsmedia.com.

Spotlight: Drone Course

Exploring the Dos and Don’ts of Drones, Insurance-Wise

By Jahna Jacobson

Drones are an increasingly popular hobby for adults and kids.

And it’s all fun and games and cool videos until something glitches, and an out-of-control rack of spinning blades hits someone in the head. Or crashes into a house.

The potential for drones to cause injury and property damage raises questions about what types of activity are covered by existing insurance and whether drone hobbyists or professionals should have specific insurance that covers drones, and whoever or whatever gets in the way.

Kevin Amrhein, president of the Florida Insurance School of Continuing Education and the CE partnership, has answers for insurance professionals who can expect to see an increase in drone coverage conversations as the use of drones for fun and profit continues to grow. He outlined some need-to-know information for insurance professionals in his Insurance Journal Academy of Insurance course, Insuring Drones (Because Humans Do Dumb Things with Them).

What Not to Say About Drones

Insurance professionals need to know the limitations of what they should discuss with clients or advise clients when it comes to drones, Amrhein said.

“Lots of folks will ask you questions throughout your tenure as an insurance professional — ‘Hey, can I do this with my drone? Can I do that with my drone?’” Amrhein said. “And I think we as

insurance professionals need to be confident enough to be able to say, ‘There are rules. You are responsible for the rules.’”

Rather than presenting “yourself to your insureds as the end-all-be-all of drone regulations,” he said. “I think it’s probably more in your interest to present yourself to your insureds as the insurance expert.”

For example, what if a client wants to know whether they can charge a fee to take pictures of groups with their new drone?

“If you were asked that question, as an insurance agent how would you respond to that?” Amrhein said. “Do you feel like that’s a question that you are supposed to answer?”

Taking pictures may instinctively seem like a low-risk venture, but in this case, it’s the payment that will trip up coverage and change the rules, Amrhein said.

“If you are charging for the use of a drone, it’s no longer considered recreational use,” he said. “There are separate rules about commercial use, and this is now commercial use. Lots of separate rules, including what kind of certifications are required and what you have to do to get those things.”

Regardless of professional status or skill, drone operators need to follow regulations. The best place to start learning is at the federal level, said Amrhein. He recommends insurance professionals and drone operators study the rules on the Federal Aviation Administration site, www.faa.gov. Drones are aircraft and subject to the same regulatory authorities as

other aircraft on federal, state and local levels, he said. It’s up to operators to know and follow the regulations in their area, whether they are flying for personal enjoyment or professional pursuits.

“You better know what you’re talking about,” Amrhein said. “Or I would say steer the conversation back to, ‘That’s a great question. I’m only going to talk to you about insurance.’”

Personal Drone Use Coverage

When it comes to personal, recreational drone use, com-

mon concerns are bodily injury claims and property damage claims, Amrhein said.

“Liability is the insurance you cannot go without,” he said.

From a liability standpoint, all the ISO (Insurance Services Office Inc.) forms have the same language, and the definition of aircraft liability is very comprehensive, Amrhein said. “If you were to read this definition, your takeaway would be pretty much anything you do with a drone or somebody else does with your drone is going to be a problem for you. It’s

24 | INSURANCE JOURNAL | APRIL 3, 2023 INSURANCEJOURNAL.COM

going to trigger the definition of aircraft liability.

“Now, why does ISO define aircraft liability? Do you think it’s because they want to cover it? No,” he said.

“When we have specifically defined terms in policies like this, it’s generally because we want to limit or exclude coverage,” Amrhein said. “And if we’re going to limit or exclude coverage, we have to be very clear, unambiguous as to what it is we don’t want to pay for.”

However, in defining aircraft liability, ISO adds its own interpretation of what aircraft is, Amrhein said. It essentially says that aircraft means any

contrivance used or designed for flight, except model or hobby aircraft not used or designed to carry people or cargo.

“Well, what about most recreational drones?” Amrhein said. “Well, by definition, a drone doesn’t carry people. We know that. What about cargo? Can drones be manufactured to carry cargo? Sure. Are there drones that are built for that purpose? Yes.

“Is a typical recreational drone that you would buy on Amazon or buy at Best Buy for your son or for your daughter, or for yourself for recreational purposes, maybe to take some video? Is that thing designed to

carry cargo? No.”

Amrhein said it creates a give-back in the exclusion because the aircraft liability exclusion can’t be used to remove coverage if the drone isn’t aircraft.

“The exclusion is very clear in the policy. It says we don’t cover aircraft liability. But what did we tell you? In the definition of aircraft, liability doesn’t include drones.”

However, as drones have become more common, insurance is adapting. It’s important for those seeking and selling drone coverage to be specific in their requests, to read all the policy information and to double-check endorsements for exclusions that apply to model or hobby aircraft.

“If there’s an exclusionary endorsement added to the homeowner’s policy, some carriers for a premium will remove that,” Amrhein said. “So, it’s incumbent on us to determine if the policies that we have sold have been modified to remove liability coverage.”