Leading the way with term life insurance

Protective

a faster route

a

Confidently meet more client needs with a process that’s fast and effortless.

Protective® Classic Choice term is built to work as hard for your clients as you do.

Cases placed 57% faster* 35- and 40-year term periods

Our Velocity digital platform simplifies the sales process at every step.

A direct path to permanent coverage

Our conversion rider with optional chronic illness protection meets changing needs.

U.S. News 4.3-star rating and named best for term life. ** You get paid faster, too!

We’re one of only three carriers that offer longer coverage.

Backed by a strong, award-winning carrier

Explore Protective Classic Choice term

* Based on Protective operations cycle times over a trailing 12-month period, calculated by comparing non-Velocity process path to Velocity path, displayed as a percentage. Data current as of April 2025.

** As of June 1, 2025. www.usnews.com/insurance/life-insurance

Protective refers to Protective Life Insurance Company (PLICO) located in Omaha, NE, and its affiliates, including Protective Life and Annuity Insurance Company (PLAIC) located in Birmingham, AL. Product guarantees are backed by the financial strength and claims-paying ability of the issuing company.

Protective® is a registered trademark of PLICO. The Protective trademarks, logos and service marks are property of PLICO and are protected by copyright, trademark, and/or other proprietary rights and laws.

Protective Classic Choice (TL-21) is a term life insurance policy issued by Protective Life Insurance Company, located in Omaha, NE. Policy form numbers, product features, and availability may vary by state. Consult the policy benefits, riders, limitations, and exclusions. Subject to underwriting. Up to two-year contestable and suicide period. Benefits adjusted for misstatement of age and sex.

All payments and guarantees are subject to the claims-paying ability of Protective Life Insurance Company. Protective is a registered trademark and Classic Choice is a trademark of Protective Life Insurance Company.

Start Smart. Grow Strong.

Smart Start Accumulator and Smart Start Accumulator Plus are the next generation of Single Premium Fixed Indexed Annuities designed specifically for discerning clients seeking both growth and protection.

Smarter Market Entry

Give clients the advantage of a smart start, ensuring they begin from the lowest market point in 90 days for higher accumulation potential.

Effortless Portfolio Allocation

No more guesswork. Provide clients the ease of three pre-selected index combinations designed to align with their financial goals and comfort level.

IN THIS ISSUE

INTERVIEW

8 The best of both worlds Paul LaPiana, head of brand, product and affiliated distribution with MassMutual, understands both the career agency system and the independent distribution channel. He tells InsuranceNewsNet how both systems can coexist to bring protection and planning to more consumers.

FEATURE My best day in life insurance

By John Hilton

Agents reflect on the moments when life insurance mattered most for their clients and reinforced why they persist in the profession.

IN THE FIELD

26 Fiscal fitness

By Susan Rupe

Jeff Smith is an insurance and retirement advisor. Jennifer Scherer is a fitness coach. Together, they help clients obtain both physical wellness and financial security.

32 How life insurance funds executive benefit plans

By Milo Markovic

The executive benefits marketplace is a $42 billion market and one of the fastestgrowing segments in the industry.

ANNUITY

36 From ‘live on’ to ‘leave on’ By Paul Garfoli

How an annuity death benefit rider can strengthen legacy planning.

HEALTH/BENEFITS

40 The silent threat of disability to ultrasuccessful clients

By Sean McNiff

Protecting clients from the risk of a disability event can save their organizations.

ADVISORNEWS

44 Why financial professionals should enter the 403(b) K-12 educator market

By Jim Kais

Some advisors avoid this space due to misconceptions and criticisms.

BUSINESS

46 The Pied Piper Principle: Why the best leaders attract the best talent By Casey Cunningham

High standards and magnetic energy make you the kind of leader everyone wants to follow.

THE KNOW

What’s next for the Federal Insurance Office?

By Doug Bailey

The FIO’s critics see it as redundant, bureaucratic and an unwelcome intrusion into a state-dominated and decades-old regulatory framework.

Life insurance awareness gets an innovative makeover in 2025

There are a couple of givens when it comes to life insurance: nearly everybody needs it, and not nearly enough people have it.

Every year, insurers confront this problem with strategies and approaches to increase awareness of life insurance. This need is especially highlighted during Life Insurance Awareness Month in September. As consumer expectations evolve and digital transformation accelerates, the life insurance industry is responding with some creative strategies in 2025. From gamification to artificial intelligence, insurers are finding new ways to educate, engage and enroll people in coverage. Here are some of the most notable innovations reshaping life insurance awareness today.

1. AI-driven personalization and smart outreach

Artificial intelligence is transforming how insurers connect with potential policyholders. AI-driven platforms analyze consumer behavior, demographics, health data and even social media activity to deliver highly targeted messages about life insurance.

For example, instead of relying on generic email campaigns or ads, insurers are using AI to predict when someone might be most open to buying life insurance — such as after major life events like marriage or a home purchase. These tools can also recommend policy types tailored to a person’s risk profile and financial goals.

2. Digital-first and flexible policy options

Digital convenience is no longer optional — it’s expected. Modern consumers want to research, buy and manage life insurance online without ever talking to an agent if they prefer. To meet this demand, insurers are creating flexible, digital-first policies that can be easily adjusted as life circumstances change.

For example, consumers can increase coverage after having a child or reduce coverage as debts are paid off — all with a few clicks in a user-friendly dashboard. This self-service model appeals especially to millennials and Generation Z, who make up a growing share of the insurance market.

3. Gamification and financial literacy engagement

To make insurance education more appealing, companies are introducing gamified tools and mobile apps that teach users about life insurance through interactive challenges. John Hancock’s Vitality program, for example, which is available with its life insurance offerings, uses wearable integration and app-based gamification to incentivize healthy behaviors (e.g., steps walked, gym visits, nutrition tracking). Customers earn points and rewards — including premium discounts and gift cards — for meeting daily health goals.

4. Insurance embedded in everyday transactions

“Embedded insurance” refers to offering life insurance as an add-on within unrelated platforms, like mobile banking apps, payroll platforms or e-commerce sites. This approach reduces the need for a dedicated sales pitch and allows users to opt into affordable policies during transactions they’re already making — for example, someone booking a vacation and being offered travel life insurance within the app.

5. Wellness-linked insurance products

Today’s life insurance is often bundled with wellness features. These may include

mental health resources, wearable device integrations, gym discounts and access to holistic health coaching. The idea is to reframe life insurance not just as protection for when you die but also as a benefit that supports you while you live.

This trend appeals to new consumers who value self-care. This approach will help them see insurance as part of a broader lifestyle strategy — not just a grim necessity.

6. Bundled and cross-sold insurance solutions

Another growing strategy is bundling life insurance with other products — such as disability insurance or long-term care or critical illness coverage. These packages are positioned as full-circle protection, covering a person across their entire lifespan and health journey.

For agents and advisors, this bundling approach deepens client relationships and boosts retention while simplifying the conversation about comprehensive coverage needs.

7. Behavior-based discounts and dynamic pricing

Incentives tied to personal health behavior are becoming more common. Using data from fitness trackers, sleep monitors or nutrition apps, insurers are offering lower premiums or cash-back rewards to individuals who demonstrate healthy habits such as walking 10,000 steps a day or maintaining good sleep hygiene.

This model makes life insurance more interactive and gives consumers a sense of control over what they pay — increasing both awareness and appeal.

Only time will tell how successful these new strategies will be, but one thing is certain: The life insurance industry is working to become more agile, engaging and tech-forward than ever before.

John Forcucci Editor-in-chief

Discover why the best annuity rates aren’t always the most important thing, how AI won’t quickly replace humans, and why interest is rising for income for life in 401(k)s

Is the best rate always the best deal?

by Drew Gurley

When shopping for annuities, consumers often focus on one number: the rate. And it’s no wonder — interest rates are plastered across brochures and emphasized in ads promising growth and security.

But for agents working in the real world with real people, the truth is more nuanced. Although a higher rate will most certainly catch a prospect’s eye, it’s not always the best long-term solution when a product doesn’t match a customer’s true needs.

Annuities, like ducks, are simple on

the surface but complex underneath.

At their core, annuities are financial contracts issued by insurance companies and designed to provide guaranteed income. Annuities include a growth component, depending on the type of product. Depending on the type — fixed, indexed or variable — annuities can serve different goals:

» Guaranteed lifetime income

» Market-linked growth with downside protection

» Tax-deferred accumulation paired with guaranteed growth when an income rider is leveraged

On the surface, rates are an easy component to compare. Higher is better, right? And why not, since most clients have had an accumulation mindset their entire lives? Now we are talking about preservation. Fast-forward to a prospect’s golden years. We as agents should help direct the discussion to asset preservation. For some folks, that level of reframing doesn’t happen overnight.

One of the biggest concerns in retirement is living too long and running out of money. Clients want peace of mind. They want predictability, and annuities can be a great option.

But annuity rates aren’t always what they seem. Some are fixed and declared by the insurer. Others are tied to index performance with participation caps or spreads. Many come with bonuses, rollup rates or complex formulas that apply only to the income rider base, not the cash value.

The key for agents is to help clients understand what those rates actually do and whether they align with the client’s financial goals. What is your customer guaranteed to receive with any product they are considering?

Why AI still needs human advisors in insurance

by Rayne Morgan

Artificial intelligence, or ‘AI,’ has become a leading buzzword in the insurance industry, but not all insurance companies are feeling the pressure or buying into the hype.

According to Tanner Hackett, founder and CEO of Los Angeles-based MGU Counterpart, appetite for AI in insurance varies heavily, and actual adoption rates may lag behind reported interest.

“Appetite for AI tools within the industry varies. Forward-thinking brokers are seeking AI tools to differentiate themselves and deliver faster quotes and better risk assessments. That said, pressure to use AI is mounting. What started as a competitive advantage is quickly becoming a necessity,” Hackett said.

Many industry leaders would agree. Companies like Mylo and Embroker suggest AI is not just a trendy new fad but an innovative way to modernize and improve service.

But Michael Silverman, president and CEO of New York’s Silver Lining Insurance, holds a different view. He maintains that while AI has benefits, insurance is and always will be a people-centered industry first and foremost.

“Purchasing insurance is personal, whether it’s for your business or your family or anything else. It is personal, it is emotional, and I haven’t found an AI product or a robot or a system that really gets to that,” Silverman said.

A combination of competitive pressure, client expectation and operational necessity is increasing adoption of AI

among American insurers, Hackett suggests.

“SMBs expect the same digital experience they can get elsewhere. When we can deliver competitive pricing two to five times faster through agentic underwriting, it’s clear that AI is becoming essential to stay competitive,” he said.

He noted that while most insurers have incorporated some form of digital strategy, many still seem to be in an exploratory phase rather than embracing full implementation. In his view, this “lack of urgency and unwillingness to adapt” hurts both insurance businesses and the clients they protect. Read the

Rayne Morgan is a journalist, copywriter and editor with more than 10 years of combined experience in digital content and print media. Contact her at rayne.morgan@innfeedback.com.

Worker interest rises for employer lifetimeincome options in 401(k) plans

by Ayo Mseka

Almost all workers who are saving in 401(k) plans say it is important for their retirement plans to provide options for converting savings into guaranteed monthly retirement income that never runs out. And 87% think employers have a responsibility to help them achieve retirement income security.

This is according to a survey of over 2,000 401(k) participants by Nuveen, the investment manager of TIAA, and the TIAA Institute. These findings represent a dramatic increase in interest in guaranteed lifetime income, the survey said. When asked in 2021, fewer than six in 10 workers said that their employers had a responsibility to provide access to lifetime income in retirement.

In fact, the survey found that about 90% of 401(k) participants:

» Think it would be valuable for 401(k) plans to include a fixed annuity.

» Would be interested in saving with a fixed annuity if it were included in their plan.

» Would consider using a fixed annuity to provide steady monthly income throughout retirement.

» Agree it would be valuable for their target-date investments to include a fixed annuity component.

The survey added that today, the typical 401(k) plan does not offer a way to convert savings into a consistent monthly income that is guaranteed for a retiree’s lifetime, despite 401(k) plans being the dominant form of retirement savings in the private sector, with 79 million active participants and $6.8 trillion in assets.

In response, innovative 401(k) plan sponsors are exploring how to offer guaranteed retirement income by adding fixed annuities to a retirement plan, the survey said.

“Incorporating fixed annuities into 401(k) plans is a simple, effective and low-cost way to fill the retirement income design gap. With tools like target-date investments that include a fixed annuity component, sponsors can simplify savings and investing, as well as the ability to convert retirement savings into retirement income,” said Brendan McCarthy, head of Retirement Investing at Nuveen. “A well-designed decumulation strategy isn’t just a nice-to-have, it is essential to realizing the full value of a 401(k) plan — and workers agree.”

Read the full story online: https://bit.ly/401koptions25

Ayo Mseka has more than 30 years of experience reporting on the financial services industry. She formerly served as editor-in-chief of NAIFA’s Advisor Today magazine. Contact her at amseka@innfeedback.com.

Insurers want to know the cost of heat waves

When most people think about disasters, they think of fires or floods. But a more dangerous risk could be lurking in the form of heat waves, and insurers want to know how much damage a heat wave would unleash and at what cost.

As doctors and public officials tackle the rise in dangerous health effects, there are early efforts to assess heat’s financial toll. In California alone, the state found in a study published last year that seven extreme heat events over a 10-year period from 2013 to 2022 caused $7.7 billion in economic harm.

Climate risk models don’t typically make detailed projections for extreme heat. For one thing, heat is less of a threat to real estate than it is to health, energy infrastructure and the food supply. But cities, businesses and insurers need the financial risks to be outlined more clearly, and some believe a new market for heat insurance — driven in part by artificial intelligence and the need to cool data centers — is around the corner.

The property information firm Cotality, previously known as CoreLogic, recently started offering heat-hazard modeling on its widely used risk-analysis platform. And Mercer launched a climate health-cost forecaster tool evaluating how extreme heat and other risks could impact companies’ health insurance costs. It draws on historical incidence data, medical claim codes associated with climate events and published research.

WHEN 60 IS THE NEW 40

More Americans than ever are staying in the workforce longer, with more than half of retirement-age Americans saying they have no plans to leave. That’s the word from Asset Preservation Wealth & Tax, which showed a shift in how Americans view their later years.

Between 2015 and 2024, the number of Americans 65 and older still doing the 9-to-5 grew by more than 33%, CNBC reported. Meanwhile, the overall labor force grew by less than 9%. Nearly half of survey respondents (48%) admitted they’re working past the traditional retirement age out of financial necessity. Health care costs bear much of the blame.

Roughly two-thirds of older workers need the income to cover essential costs,

according to CNBC, but others pursue work for entirely different reasons, including mental stimulation, social connections or simply because they enjoy what they do.

FEW EXPECT TO RECEIVE AN INHERITANCE

When it comes to inheritance, a Northwestern Mutual study shows Americans have two opposing thoughts. More Americans say they plan to leave a legacy, while few expect to be on the receiving end of one.

The latest findings from Northwestern Mutual’s 2025 Planning & Progress Study reveal nearly one-third (31%) of U.S. adults anticipate leaving an inheritance or a financial gift or donation to a charitable organization — up from 26% in 2024. Meanwhile, only one-fifth

As we move into the year 2054, we’ll see a crucial demographic shift, as more people will be 100 and over than ever before.”

— Kristi Rodriguez, head of the Nationwide Retirement Institute

(20%) expect to receive an inheritance, a decrease from the 25% who said the same last year.

The study also finds that among those expecting to receive an inheritance, more than half (57%) say it is “critical” or “highly critical” to their long-term financial security. For Generation Z and millennials, it’s even higher — 63% and 69%, respectively.

Six in 10 (60%) Americans who expect to leave an inheritance say they have had a conversation with their family about their plans, according to the research. But 4 in 10 (39%) baby boomers and 6 in 10 (61%) of those in Generation X say they do not have a will.

MIDDLE CLASS CONTINUES TO SHOW FINANCIAL RESILIENCE

Middle-class households’ financial resilience is stabilizing at normal levels, according to the American Council of Life Insurers’ most recent Financial Resilience Index. But although the index showed stability, a few dark clouds are on the horizon.

More than half (55%) of middle-class households are at least somewhat concerned about the risk of a serious decline in their financial situation, and 1 in 5 (20%) are very concerned. These figures closely reflect sentiments captured in 2024.

Almost half (46%) of middle-class households also report they are not confident they will be able to build sufficient retirement savings. And 40% are not confident they will be financially protected in the event of a major medical expense, the need for long-term care or the unexpected death of an income earner.

THE WELLS ADVANTAGE IS BETTER… TAKE THE ADVANTAGE.

Wells Advantage Group isn’t offering gimmicks — WE GIVE YOU TERRITORY, a pipeline that never sleeps, and a comp package that turns heads. You get…

• Exclusive protected TERRITORIES (going fast)

• Turnkey AI PLATFORM delivers immediate leads

• COMPENSATION UPGRADES with most of your current carriers

• Free, HIGH-CONVERTING LEADS (like Uber, but for leads)

• IULs issued in minutes

• NEW IUL CARRIERS that beat your competition

• AI-POWERED PROSPECTING discovers money in motion near you

• Tools and master classes — no cost to you

THE BEST WORLDS

BOTH

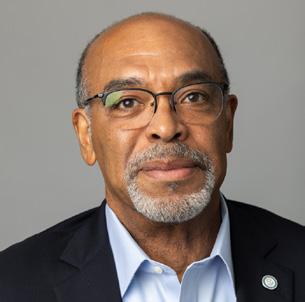

MassMutual’s Paul LaPiana on blending career and independent channels while staying true to core offerings.

An interview with Paul Feldman, publisher

In a world in which everyone is chasing the next shiny object, MassMutual continues to focus its efforts on whole life insurance, disability insurance and annuities while emphasizing holistic financial planning.

Paul LaPiana, head of brand, product and affiliated distribution with MassMutual, started in the industry by joining forces with his college roommate to cold-call on prospects. That was the beginning of a career that has spanned more than 30 years.

In this interview with publisher Paul Feldman, LaPiana describes how the career agency system and the independent channel can coexist and bring protection and planning to more consumers.

PAUL FELDMAN: How did you get into the industry?

PAUL LAPIANA: I was the first person in our family to graduate from college. I come from a blue-collar family — pipefitters and electricians. When I graduated from college in 1992, there wasn’t a robust job market. My college roommate’s father was a general agent or managing partner with Equitable, so my roommate Dave, who is still with Equitable 34 years later, was going to be a financial advisor.

I did not know anything about what being a financial advisor was, so I went in for an interview, and before I knew it, I was hired as a financial advisor with Equitable.

The reaction from my parents was very underwhelming. They were not excited about it. My dad’s first comment was “You’re not going to sell me anything.”

His second comment was “Anytime you want to get in the union, I can get you $6.95 an hour and full benefits.”

Dave and I ended up cold-calling our way into the business. At night, we coldcalled on people who had new babies, people who had just bought or refinanced homes. During the day, we knocked on doors of small to medium-sized businesses for any kind of 401(k), SEP plan or health insurance that owners tried to put into their companies, because all the top advisors at Equitable were focused on the corporate market.

I was an advisor for eight years before someone asked Dave and me to leave our practice and go to the corporate side, but that’s the journey.

FELDMAN: How long have you been with MassMutual?

LAPIANA: I’ve been with MassMutual for nine years. But if you looked at my years of service, it would actually be 23 — I was at Equitable as an advisor for eight years. Our mentor, who is our managing partner, tapped us to start third-party distribution for Equitable AXA in 1999, so we gave up our practice to do that.

I followed some of those folks a couple years later to start a third-party business at MetLife. I was at MetLife for 15 years, about 10 of that on wholesaling and distribution and third parties. Then I was asked to lead the career agency system at MetLife in 2012, and I did that for about 4-1/2 years.

as the solution, or they can go to one of our competitors, who also have great products on the shelf.

We did a brand relaunch in 2017. The foundation was mutuality, trust, protection, financial strength, premier products and solutions. But we’ve seen a transition since then, going down the funnel and talking more about protection, accumulation, retirement income solutions, and the need for advice and guidance. Clients can’t go it alone. They need an advisor or a team or advisors to help them navigate the complexity.

Now as we get into a new era of our brand, it’s still about protection, accumulation and retirement income. But the narrative around advice and guidance is shifting a little bit to more about holistic

Now as we get into a new era of our brand, it’s still about protection, accumulation and retirement income. But the narrative around advice and guidance is shifting a little bit to more about holistic financial planning and wealth management as part of the journey.

As you know, when MetLife made a decision to spin off the retail business, which is now Brighthouse, the first shoe that dropped was they sold the career agency system to MassMutual in 2016. I joined the company in 2016, so I carried my years of service, but I’ve actually been at MassMutual for nine years, and it has been great.

FELDMAN: One of MassMutual’s strengths is its brand. Tell me about the brand, what you are doing with it and how you make it better.

LAPIANA: There are two elements of our brand. One is consumer awareness and consideration for the actual company itself. The other is down the funnel a bit, which is advisor and distributor awareness and consideration, because they have choices. They can use our products

financial planning and wealth management as part of the journey. This is really to help our advisors because they are holistic in nature and it helps them tell their story.

A lot of people don’t know us for wealth management, so this helps us recruit new people to MassMutual’s career system. Finally, I would say this supports the journey for all of our independent advisors who also do holistic planning. It nests nicely into their value proposition that MassMutual is a manufacturer that helps them get there and helps get their clients to the finish line.

It is a complicated dance, though, because it’s not just about consumers, it’s also about the distributor. And guess what? We’re not only in career and third party. We’re multiple products in those channels, and then we also have worksite, and then we’re also institutional. So we’re

Paul

(pictured with his family) says he wants advisors to help families “get to the finish line” with their protection and investment goals.

speaking to different audiences, and that increases the complexity.

FELDMAN: Tell me a little bit about your perspective on career agents and independent agents.

LAPIANA: I spent a lot of time in both worlds. We have this philosophy that you can only get to so many consumers through your career agency system. If you have 6,000-ish advisors, you’re serving a lot of clients. But there are a lot more people in this country in need of protection, accumulation and retirement income. Third-party channels and the right third-party partners are a valuable way to reach those consumers who are doing business with those advisors.

I think both channels are needed. When I think about career advisors, ours are entrepreneurial, and we support their independence, but they represent the company’s brand. They are the individuals who drive the advance and guidance and then use the product to deliver solutions and recommendations.

What I love about career agents is there’s a loyalty; there’s an active feedback loop. They’re the ones who are delivering the advice — because it is about advice; it’s not about product.

The third-party side allows you to grow because you reach more people. The positives of that, if you work with the right

partners, is that there is a value on the relationship, the brand, the financials, the value proposition you bring with your wholesaling team, your product portfolio, your underwriting. It provides you with growth and allows you, again, to reach more consumers.

What I like about having both channels is that it provides not only growth and an additional feedback loop, but it also allows you to keep your ear to the ground. If you can provide growth and you can still manage profitability and risk, it makes everything better.

FELDMAN: How do we get more people into this industry?

LAPIANA: One thing I am concerned about is that right now, the industry’s trading on experienced advisors, because not a lot of career agencies exist, and that has been fuel for new recruits into the industry. The industry has not been as focused on inexperienced recruiting. It is a very expensive investment, but it is an investment.

When you couple that with the need for advice and guidance going up and the number of people retiring from this industry — you’ve seen some of the research that says about one-third of current active advisors will be out in 10 years — there’s a mismatch between demand and supply.

We are fortunate to still be in the affiliated distribution game. We appreciate our partners at Northwestern Mutual, New York Life, Equitable, Guardian, because we’re doing both — we’re recruiting new people to the industry and we’re also recruiting experienced advisors to the business.

One thing we’ve changed in our model over the last couple of years is that we are focusing on fully licensed advisors. What we found is when we bring fully licensed folks in, you have a more committed new advisor. When you provide them with the proper training, you see productivity rates go up, you see retention rates go up. Retention in this industry is around 9%

What I love about career agents is there’s a loyalty; there’s an active feedback loop. They’re the ones who are delivering the advice — because it is about advice; it’s not about product.

LaPiana

after four years. If they’re fully licensed, we see a retention rate of 30% to 35%. The benefit of that is they’re also able to serve clients in a more proper way as opposed to only selling insurance and annuity products. They’re thinking about things more holistically.

The other thing we’re doing with inexperienced hires is strategically hiring new advisors to existing teams. When you think about our aging advisor population, the need for succession planning and the need to expand the scale of their practices, bringing in junior advisors is important. But it also works well for the junior advisor because they get coaching, they get mentorship, they get immediate access to clients in the book of business. It also helps the senior partners deliver on all the promises they made to those families and individuals along the way.

Now they have people serving them and providing the right solutions. With teambased advisors, we’ve seen productivity up and retention up, which is awesome.

FELDMAN: Let’s talk about your distribution. You have the independent side, and you have the career channel. What’s the mix for your organization?

LAPIANA: Our career channel has roughly 6,000 advisors and 55 firms across the country. They are independent contractors. Our goal for that channel is to put the right national and localized resources around them so that they can do what’s the most important part of their profession — serve clients and acquire new clients to grow their business.

Looking at their product mix, we do about $650 million to $700 million of life insurance through the doors of our career agency. That’s about 90% of our life insur-

FELDMAN: I think disability insurance is the most undersold product. MassMutual sells individual DI. Why aren’t more companies selling it?

LAPIANA: The disability industry has been a very slow growth industry. It has been kind of the same for years — around a $500 million to $600 million business.

Many manufacturers aren’t comfortable in that market. A small subset of carriers have dominated the market for years and we’ve been a No. 3 or No. 4 player in disability with a 10% to 12% market share.

It’s not only about the product. It’s also about getting people to understand the reason why you must put this in as a foundational part of financial planning.

If you say you’re doing financial planning and you have credentials after your name, you must do disability planning for your clients

We’re also working on lead generation. The most difficult thing about this business is getting in front of people on a favorable basis. We have a lot of leads coming through from our branding and marketing efforts as well as our in-force books of business. We’re layering on some technology and data analytics and getting those people in the hands of the right advisors so they can serve them.

The last thing we are doing is looking at different models of how we compensate new people coming into the industry. The old-school way is full commission. When you have a career-changer with kids and a mortgage, that way doesn’t work. So how do we take that investment and provide more salary-based options to help people transition into a new career?

I don’t think we have all the answers, but we’re looking to bring between 1,200 and 1,500 new advisors into the industry every year.

ance, and it’s huge. That organization does roughly $12 million a year in annuities. But we as a manufacturer get only about 40% to 45% of that, depending on the year. That organization does about 95% of our fully underwritten disability insurance. Wealth management does about $40 billion in new sales a year, and we have around $300 billion under management.

When you move to the independent channel, it’s a bit of the reverse. Our MassMutual Strategic Distributors channel is doing about 10% of our life insurance business and 5% of DI, and we want that to grow. On the annuity side, they’ve got scale. They’re doing 80% to 85% of our annuities through specialty distributors, independent marketing organizations and broker/dealers, and then mostly through MassMutual Ascend.

We have individually underwritten disability; we also have a multilife. Think of guaranteed standard issue for the executive space. We also have things like business overhead expense as well as buy/sell — we have a full suite. What you’ve seen over the years is that DI has been concentrated in special distributors that have focused a lot of their time in the medical and dental areas. We haven’t seen a broader base of sellers, meaning financial advisors selling it beyond the medical and dental space to white collar and even gray collar and blue collar. One of the issues we face is there’s a fear factor for advisors in selling disability because it crosses the threshold into a lot of health issues. A lot of times advisors know it’s one of the most important things you can do in a holistic plan, but they don’t want to mess up if something goes wrong because the client has a back issue or a shoulder issue. Then there’s an exclusion and the client is disgruntled. The advisor doesn’t want to lose the assets under management and they don’t want to lose the life insurance, so they put off addressing disability. It’s not only about the product. It’s also about getting people to understand the reason why you must put this in as a foundational part of financial planning. If you say you’re doing financial planning and you have credentials after your

name, you must do disability planning for your clients. If you don’t like the conversation, have someone on your team who does or partner with someone who knows how to do it.

FELDMAN: What products are hot, and what products do you see as the future for MassMutual?

LAPIANA: Being a mutual company, we are committed to and we love the value proposition of whole life. We want to continue to make sure that our advisors in our career system, affiliate advisors and folks that sell us as a third-party appreciate and understand the value that product brings to the end consumer or the business owner or the trust for the next generation. That is a product we are always keeping competitive and investing in because we believe in it.

Our affiliated advisors sell a fair amount of variable universal life; they sell a fair amount of universal life. So we are looking in the life insurance sleeve — to continue to appropriately support and grow whole life but also to bring out some adjacent products to give us a shot to earn some more business with our affiliated channel.

FELDMAN: Where do you see the biggest growth?

LAPIANA: We think there is opportunity in both VAs and RILAs, and we think we’ll be able to get really good, comfortable run rates in VAs as well as RILAs.

I am a fan of the traditional VA with living benefits. Those products play a good role and provide a lot of value to consumers looking to provide guaranteed retirement income to themselves and their families.

FELDMAN: MassMutual started a digital life insurance subsidiary, Haven Life, which has since discontinued its direct-to-consumer operation. What

it’s a viable channel for carriers, now and in the future. And it is a very small piece of insurance in today’s market — somewhere between 3% and 5%. At this point, we’re looking at the worksite as the opportunity to get to more consumers who may not be served by advisors.

It’s still somewhat true that these products are sold, not bought, so you need someone to get the consumer to sort through the confusion and take action. Even though you see more people going online to look for life insurance, the bad news is they’re not transacting.

We need to get people to take action, and that’s the key. The landscape is confusing and there’s more activity to search and learn, but there’s not more activity to buy.

I am a fan of the traditional VA with living benefits. Those products play a good role and provide a lot of value to consumers looking to provide guaranteed retirement income to themselves and their families.

We’re bullish on the annuity market because we have an aging population and people undersaved for retirement. A lot of people will have to go it alone for retirement because of the shift from defined benefit plans to defined contribution plans and questions about the future of government programs.

We’ve done things to enhance our fixed annuity portfolio. We’ve made some enhancements to our income annuities so that we can compete more favorably. We added a variable annuity and we’re looking at things with our registered index linked annuity product that Ascend has today to make that product more competitive.

are your thoughts about insurance carriers going direct to consumers?

LAPIANA: We as an industry need to reach more people because people are underinsured. You and I also discussed that the advisor population is shrinking right now. That also means more advisors will go up market, not down market, and that means fewer people will be able to have the advice and guidance they need.

So how do you get to the middle-market, lower mass affluent consumer? There are a couple of ways. You can get to them through the group market, through their worksite, and we actively participate in that market. And you get to them through a direct-to-consumer model.

We learned a lot of things by launching Haven — both good and bad. We do think

FELDMAN: Do you have any closing thoughts?

LAPIANA: I would say the need for advice and guidance in this country is maybe at an all-time high. But the industry, in my mind, isn’t at scale, delivering on holistic advice. They’re using financial planning tools to gather assets, put people in a 60/40 portfolio and think they stuck the landing.

There has been some research done that basically says that advisors and teams who use permanent life insurance adjacent to annuities, adjacent to the 60/40 portfolio, deliver the best outcomes for clients in the form of the highest income, longest duration of income, most optimal and efficient wealth transfer and efficiency of accumulation. That is not happening in the industry.

What we think is a differentiator for our advisors is the understanding of wealth but staying true to our protection DNA and understanding how life insurance, disability insurance and annuities bring value to people’s portfolio and help them get to the finish line that’s right for them and their family or their business.

Break out of the crowd

Sell Foresters.

Grow faster. Win big.

Let’s transform your life insurance experience

It’s all about empowering you to succeed. With Foresters Financial™, you can tap into state-of-the-art products, tailored technology, ongoing sales support and more opportunities to make a meaningful di erence for your clients.

Right now, 41% of adults are reporting that they don’t have enough life insurance coverage. That is a huge market of nearly 106 million potential customers.1 When you’re with Foresters, you can cater to these customers with accessible coverage and unique living benefits that will keep clients engaged.

All that’s left is you. This is your opportunity to expand your reach and stand out in ways you won’t find with other carriers.

Trust in a secure future

When people buy life insurance, they want an insurer that is strong and well-positioned for the future. With Foresters, you can give them that—and more.

Foresters origins date back to 1874 when The Independent Order of Foresters (IOF) was founded as a fraternal benefit society—a member-based insurance provider for everyday families. Since then, we’ve grown into an international financial services provider with over two million members in the US, Canada and the UK. We are financially strong with assets of $12.9 billion, liabilities of $11.4 billion and a surplus of $1.5 billion.2,3 For 24 consecutive years, the independent rating agency A.M. Best has given us an “A” (Excellent) rating for excellent balance sheet strength and operating performance.4 In 2024, Foresters paid $672 million in insurance claims and benefits.2 In addition, Foresters total dividend payout to eligible participating certificate holders in the US was $25.8 million in 2024. The average Foresters dividend rate over the past 20 years is above 6%.5 The dividend interest rate in 2024 was 5.9%.6 As a fraternal benefit society, we manage our own financial reserves. Our Risk-Based Capital (RBC) ratio exceeds the National Association of Insurance Commissioners’ (NAIC) guidelines. Our purpose—enriching family and community well-being—means we are continually redefining our model to help you bring financial security and overall well-being to everyday families.

Risk-based capital ratio of 541%

Discover all our member benefits now!

{QR CODE}

In 2024, Foresters paid $672 million 2 in insurance claims and benefits paid

Surplus of

$1.5 billion 2,3

Over the past 20 years, the average Foresters dividend rate has remained above 6%

Explore our di erent underwriting options

From streamlined to more detailed processes, there’s an underwriting option to suit each client’s needs.

The traditional underwriting option involves your clients potentially undergoing medical exams and health questionnaires to qualify for coverage.

A streamlined underwriting process for healthier clients to receive decisions in seven days or less without medical exams and health interviews.

O ers no medical exams and fewer medical questions—perfect for your clients who want a more convenient underwriting option.7

With instant decision, clients are informed immediately of their eligibility and can potentially receive coverage promptly through a digital process.7

Unique o erings for unique clients

Foresters o ers inclusive programs and flexible underwriting to help more families access life insurance—especially those who may not qualify through traditional channels:

ITIN Program

Designed for US residents who have an Individual Taxpayer Identification Number (ITIN) and at least three years of residency. This program helps more families—particularly those without a Social Security Number—gain access to life insurance protection.

Coverage for people with diabetes

Foresters is transforming the life insurance experience for people living with diabetes—an often-underserved group in the insurance market. With over 38.4 million Americans living with diabetes, many go uninsured due to limited eligibility or high costs.8

This inclusive approach reflects Foresters broader commitment to meeting clients where they are. By o ering accessible life insurance o erings—like the ITIN program and coverage for people with diabetes—alongside meaningful member benefits, Foresters empowers clients to protect their families, support their well-being and live more confidently.

Beyond life insurance

Real complimentary benefits for real lives

Life insurance contracts typically go from purchased to stored away until the worst happens. It’s di erent with Foresters. Your insured clients 9 become members of a community where people get more out of their coverage with a suite of complimentary member benefits9 they can use right away.

As Foresters members, your clients can give back to their communities through helpful grants and live their best lives with their loved ones. These are real benefits, with no catch! Your clients will love them.

For producers like you, our member benefits can be great tools for referrals. They can help you connect with more

people, expand your reach and grow your business in ways you might not get with other carriers.

Let your clients know that they can go beyond life insurance with benefits that make a real di erence in their lives and communities.

“ Thank you for being part of our purpose. Your work doesn’t just help protect families, it strengthens neighborhoods, fuels generosity and helps shape a brighter future. I’m proud to have you representing Foresters and the values we stand for. Let’s keep building something meaningful, together.”

MARK RUSH , Chief Distribution O cer, U.S. Sales

Community Volunteer and Foresters Care™

Organize volunteer activities in local communities with two yearly grants of up to $1,500 with Community Volunteer, or help support immediate needs with two yearly grants of up to $200 with Foresters Care.

LawAssure 10

An online document preparation service helps members create customizable wills, powers of attorney and healthcare directives.

Competitive Scholarships 11

Hundreds of tuition scholarships, up to $2,000 each, are awarded yearly to member families.

Foresters Member Discounts™ 12

Save on products from top brands and exciting experiences through one easy-to-use online site.

Foresters Go ™ 13

A wellness app where members can earn rewards for big and little healthy choices and giving back.

Orphan Benefit and Scholarships 14

Income support up to $900 per month, per child under 18 years old who lose their parent(s). Up to $6,000 in scholarships per year, per child (up to four years) for post-secondary schooling for orphaned children.

1 Source: https://www.forbes.com/advisor/life-insurance/life-insurance-statistics/ (April 8, 2025)

2 All figures are presented in USD. The figures are based on consolidated financial results prepared in Canadian dollars as at December 31, 2024 and converted into USD using the Bloomberg spot exchange rate of 1.4384.

3 Consolidated financial results as at December 31, 2024. The surplus comprising assets of 12.9 billion and liabilities of $11.4 billion represents excess funds above the amount required as legal reserves for insurance and annuity certificates in force and provides additional assurances to our members for our long term financial strength. Financial strength refers to the overall health of The Independent Order of Foresters. It does not refer to nor represent the performance of any particular investment or insurance product. All investing involves risk, including the risk that you can lose money.

4 The A.M. Best rating assigned on September 6, 2024, reflects the overall strength and claims-paying ability of The Independent Order of Foresters (IOF) but does not apply to the performance of any non-IOF issued products. An “A” (Excellent) rating is assigned to companies that have a strong ability to meet their ongoing obligations to policyholders and have, on balance, excellent balance sheet strength, operating performance and business profile when compared to the standards established by A.M. Best Company. A.M. Best assigns ratings from A++ to F, A++ and A+ being superior ratings and A and A- being excellent ratings. See ambest.com for our latest rating.

5 Past performance is not a prediction, estimate, or guarantee of future performance.

6 Dividends are not guaranteed. Past dividends are not an indicator of future performance.

7 Insurability depends on answers to medical and other application questions and underwriting searches and review.

8 Source: https://www.cdc.gov/diabetes/php/data-research/ (May 15, 2024)

9 Description of member benefits that your clients may receive assumes they are a Foresters Financial member. Foresters Financial members are insureds under a life or health insurance certificate issued by The Independent Order of Foresters or Foresters Life Insurance Company. Foresters Financial member benefits are non-contractual, subject to benefit specific eligibility requirements, definitions and limitations and may be changed or cancelled without notice or are no longer available.

10 LawAssure is provided by Epoq, Inc. Epoq is an independent service provider and is not a liated with Foresters. Some features may not be available based on your jurisdiction. LawAssure is not a legal service or legal advice and is not a substitute for legal advice or services of a lawyer.

11 This program is administered by International Scholarship and Tuition Services, Inc. Eligible members, their spouse, dependent children, and grandchildren may apply subject to the eligibility criteria. Please visit https://www.foresters.com/en/member-benefits/scholarships for further details.

12 Discounts are administered by BenefitHub Technology Canada Limited.

13 Foresters Go is provided by The Independent Order of Foresters and is operated by dacadoo AG.

14 Orphan Scholarships and Orphan Benefits are available to eligible members with an in force certificate having either a minimum face value of $10,000 or if an annuity, a minimum cash value of $10,000 or a minimum contribution of $1,000 paid in the previous twelve months.

Foresters products and riders may not be available or approved in all states and are subject to eligibility requirements, underwriting approval, limitations, contract terms and conditions and state variations. Refer to the applicable Foresters contract for your state for these terms and conditions and ezbiz for product availability. Underwritten by The Independent Order of Foresters.

Foresters Financial, Foresters, Foresters Care, Foresters Moments, Foresters Renew, Foresters Member Discounts, Foresters Go, the Foresters Go logo and Helping Is Who We Are are trade names and trademarks of The Independent Order of Foresters (a fraternal benefit society, 789 Don Mills Rd, Toronto, Ontario, Canada M3C 1T9) and its subsidiaries.

For producer use only. Not for use with the public.

506680 US 07/25

Don’t blend in. Break through and stand out like never before.

State-of-the-art products

One-on-one sales support

A selection of underwriting options

Individual Taxpayer Identification Number Program

Coverage for people with diabetes

Complimentary benefits1 to help members give back to their communities

Scan to learn more

1 Foresters member benefits are non-contractual, subject to benefit specific eligibility requirements, definitions and limitations and may be changed or cancelled without notice or are no longer available. Foresters Financial and Foresters are trade names and trademarks of The Independent Order of Foresters (a fraternal benefit society, 789 Don Mills Rd, Toronto, Ontario, Canada M3C 1T9) and its subsidiaries. For producer use only. Not for use with the public. 424862 US 07/25

Behind every policy is a story.

Agents reflect on the life-changing moments that define why they do what they do — and why life insurance matters more than ever.

BY JOHN HILTON

Selling life insurance includes a lot of dry and technical things, like getting licensed and learning about the do’s and don’ts of compliance.

And then there are the products, which can veer into arcane territory. Agents have to learn the details about so many aspects of sales and products, including popular features like riders and index returns.

And, finally, there are the book-building things. The painstaking process of getting leads, making contacts and building a book of business to underpin a career.

Are you fired up to be an agent yet?

We cover all of those issues and many others in InsuranceNewsNet Magazine because they fall under “information our readers need to know.”

But there’s another side to selling life insurance: the private and personal reward — the feeling of helping individuals, couples and families with life insurance products that provide security — and, sometimes, a lifeline.

There are those moments that make all the hours and all the legwork worthwhile. Maybe it doesn’t happen every day, but agents have the unique opportunity to make a tangible difference in people’s lives.

It might be helping a family protect their financial future, guiding a business owner through risk management or ensuring someone’s loved ones are secure no matter what happens. The job isn’t just about selling policies; it’s about building trust, offering reassurance in uncertain times and providing peace of mind.

Agents often develop long-term relationships with clients, becoming trusted advisors over decades. Frequently, that tight bond either starts with or includes a crucial moment when the agent and the life insurance policy rescued a family from a difficult situation.

We asked our readers to share some of those moments so we can celebrate Life Insurance Awareness Month in style. The strong response we received is further evidence that the human-to-human aspect makes selling life insurance worthwhile.

Bob Chitrathorn: Benefits rider to the rescue

One experience that stands out is with a client I’ll call Cheryl. She was retiring from the school district and came to me

for help with her retirement planning.

As we worked together, she mentioned that she was planning to let her term life policy lapse. Her children were grown, and she didn’t think she needed it anymore.

That’s when I introduced her to a life insurance policy that included living benefits. She saw the value and decided to move forward, getting approved for a $150,000 policy. Her premium was around $1,800 a year.

Roughly a year later, Cheryl experienced a significant health issue. She could still enjoy life, but she wasn’t able to afford full-time care — either in a facility or at home. I reminded her about the accelerated benefit rider included in her policy and helped her file a claim.

To her surprise and relief, the insurance company approved monthly benefit payments of about $2,300. She was overjoyed. That income allowed her to move in with her sister, contribute to the household financially and maintain her dignity and quality of life. It not only helped her — but gave her sister the support she needed as well.

That experience reinforced a simple truth: Life insurance isn’t just about death benefits, it’s about protecting quality of life while you’re still living.

— Bob Chitrathorn, CFO/vice president of wealth planning at Simplified Wealth Management and a Forbes Finance Council Member

Life insurance isn’t just about death benefits, it’s about protecting quality of life while you’re still living.

Noel Anderson: Responding to a 9/11 need

In the beginning days of my career in the life insurance industry in the early 2000s, I was struggling to find purpose in my career. I was considering leaving the industry altogether until I had a life-changing (and career-changing) experience by helping beneficiaries of life insurance policies in the aftermath of the 9/11 attacks.

My company at the time had a client in the World Trade Center, and we ran a life insurance split-dollar program for the client’s top key people. The individual would get a death benefit paid to their beneficiary, and the employer would also receive a death benefit if the person passed away while working.

I regularly visited their offices to explain the plan to new hires and help with onboarding, which involved lots of tedious form filling and back and forth. I built real relationships with these people.

Most of the employees accepted this special benefit, but not all of them saw immediate value in the plan.

When Sept. 11 happened, my company was as shocked as the rest of the world. Given that I had relationships with real people who worked in the World Trade Center, I felt intensely passionate about what the outcome would be and how I could play a role in helping some of the victims’ families.

After 9/11, I feared insurers like my own company might deny claims for World Trade Center employees, labeling

Chitrathorn

It was an extraordinary response, and I felt proud to be part of something so meaningful during such a tragic time. That really gave me purpose.

the attack as war or terrorism, grounds at the time for only refunding premiums. (That tragic event ultimately led to policy changes covering such acts.)

I called the CEO’s office to ask if benefits would be paid, and to my surprise, he called me back. Not only were claims being honored, but they were paid out by late October, far earlier than the industry norm. The company even set up sites near Manhattan where beneficiaries — both companies and individuals — could collect checks in person. It was an extraordinary response, and I felt proud to be part of something so meaningful during such a tragic time.

That really gave me purpose.

Life insurance is important, and we have to explain that. Both the company’s and the families’ paths would have changed had this plan not been put in place.

Like I said, I’d been thinking about leaving the industry prior to this. Of course, I never ended up leaving. Now, I work with planners to help their clients understand how life insurance helps their families, their companies and their key employees.

— Noel Anderson, vice president of executive benefits at Vanbridge

Matt

Schmidt:

A lifeline following a heart attack

In my 21-year career as an insurance agent, my favorite experience was letting a longtime client know that he could accelerate

part of his life insurance policy via living benefits.

Most clients tend to forget the specifics of a policy that we provide for them. In this case, the client initially opted for a policy that was $7 a month less expensive than the one I initially proposed.

After explaining that I felt having a policy with living benefit riders would provide better protection, he reluctantly agreed. Fast-forward seven years, this client contacts me about possibly canceling the policy.

After I asked if there was a specific reason for the request, he explained that he can’t afford it due to having a heart attack and being unable to work for an extended amount of time.

I then proceeded to explain that it might be possible to accelerate a “large”

amount of his policy, to help him out with his difficult situation. A few weeks later this client received over $200,000 from the carrier. This client has sent us several referrals and is probably our biggest advocate of what we do for families.

While I never want any client to experience an adverse health issue, this story had a very happy ending and reminds me to this day of how our recommendations impact families in the future.

— Matt Schmidt, CEO of Diabetes Life Solutions

Robert Cullen: A convincing argument saves the day

I’ve been in the insurance world since 2007, and there’s a saying that you never forget your first check that you deliver to a beneficiary. And my first one happened to be a big one.

I live in a rural area of California, a small town of about 13,000 people. And I had been talking to the wife of a man who was the primary breadwinner for the family. The couple had three young kids between the ages of about 3 and 9.

I learned from talking to the wife that they did a needs analysis and that they had a mortgage on their very, very nice home on a big ranch. The home was worth about $1.5 million, and they had a $1.2 million mortgage on it. The husband had plenty of money to pay for it, but I told the wife, “Man, if something happens to your husband, you don’t have the capacity to make as much money as he does. What are you going to do?”

So, we engaged with the husband, and he was resistant at first. It took almost

While I never want any client to experience an adverse health issue, this story had a very happy ending and reminds me to this day of how our recommendations impact families in the future.

Anderson

Schmidt

Introducing EclipseMark

The NEW FIA That Changes the Game

Say

GENEROUS LIQUIDITY: 15% annual penalty-free withdrawals— Because flexibility matters.

ACCUMULATION FOCUSED: 12% premium bonus option**— Boost the annuity value from day one and jump-start earnings. Available

Fixed Rate—Yes, you read that right.

S&P 500® IQ Index*—Guaranteed rates plus in-and-out transfers allowed!

EclipseMark is a product of Standard Insurance Company, Portland, OR. The Standard is a marketing name for StanCorp Financial Group, Inc. and subsidiaries. Insurance products are offered by Standard Insurance Company of Portland, Oregon in all states except New York. Product features and availability vary by state and distributor and are solely the responsibility of Standard Insurance Company. Products are designed and exclusively marketed by Legacy Marketing Group®, an independent agency. Legacy Marketing Group is not an affiliate of The Standard or its affiliates. EclipseMark is a service mark of Legacy Marketing Group. Contract: ICC17-SPDA-IA(01/17), SPDA-IA(01/17), SPDA-IA(01/17)FL. Riders: ICC24 R-VPB, ICC24 R-PTP-GPR, ICC24 R-PTP-TIR, ICC17-R-PTP, ICC17-R-GMAB-IA, ICC17-R-MVA-IA, ICC17R-TCB-IA, ICC17-R-NHB-IA, ICC17-R-ANN-IA, ICC17-R-DB-IA, ICC17-R-ANNDW, ICC17-R-POF-IA, ICC20-R-IRA, ICC20-R-Roth IRA, ICC20-R-QPP, R-VPB, R-PTP-GPR, R-PTP-TIR, R-PTP, R-GMAB-IA, R-MVA-IA, R-TCB-IA, R-NHB-IA, R-ANN-IA, R-DB-IA, R-ANNDW, R-POF-IA, R-IRA, R-Roth IRA, R-QPP, R-GMAB-FL, R-MVA-FL, R-ANN-FL, R-IRA-FL, R-Roth IRA-FL, R-QPP-FL, R-DB-IA-FL. Annuities are not guaranteed by any bank or credit union and is not insured by the FDIC or any other governmental agency. Some annuities may go down in value. Guarantees are based on the financial strength and claims-paying ability of Standard Insurance Company.

The “S&P 500®” and “S&P 500 IQ 0.5% Decrement Index” (“S&P 500 IQ Index” or the “Index”) are products of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”) and have been licensed for use by Standard Insurance Company (The Standard). S&P®, S&P 500®, US 500™, The 500™, iBoxx®, iTraxx® and CDX® are trademarks of S&P Global, Inc. or its affiliates (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). The Standard’s Fixed Indexed Annuities are not

S&P, their respective

and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have

or

a year for him to finally agree to life insurance. We ended up doing a $2 million life policy, and then he tragically ended up dying less than a year after the policy was written.

The carrier did pay and the widow received $2 million, and with that, there were several benefits involved. She paid off the mortgage, so now she had the home free and clear, plus had money to be able to put food on the table, and those kids were now able to stay in the home.

And being in a small town, I’m still in touch with the family, and it’s neat to see those kids are now having kids of their own. Just to see that family grow up, and to think that was a major fork in the road. Had the husband not gotten the life insurance, what would have happened to the wife and their home? Where would the kids have been raised? The life insurance money really set the family up for financial success, and it’s being passed to the next generation.

I think the key part of that was the first time that I talked to the husband about it. He said, “No.” The second time he said, “No.” It took several conversations, and that really was because I believe in life insurance.

I teach a lot of classes, and I talk at a lot of conferences, and I tell agents, “There’s going to be some point in your career when you’re going to have a customer die. And that customer is either going to have life insurance or is not going to have life insurance. And if that client doesn’t have life insurance, the last thing I want to be in your head is you thinking, “Oh, I never offered life insurance.”

Had the husband not gotten the life insurance, what would have happened to the wife and their home? Where would the kids have been raised? The life insurance money really set the family up for financial success, and it’s being passed to the next generation.

That is the most awful feeling you’ll ever have.

— Robert Cullen, advisor, Farmers Financial Solutions

Joe Mallee: Taking care of the family

As the oldest of four children in a middleclass family of police officers, firefighters and nurses, I learned early that protecting the ones you love requires more than good intentions.

Early in my career as a financial advisor, my parents asked me to serve as guardian for my three much younger siblings should anything happen to them. I agreed on the condition that they complete comprehensive financial planning together.

With professional help, they established wills, trusts, disability insurance, and life insurance coverage — a decision

Five years later, my mother had risen to executive level at a home health care company, managing approximately 30 offices. Despite battling rheumatoid arthritis, she maintained excellent health habits and had never smoked. When what seemed like a routine cough turned out to be stage 4 lung cancer, our family faced an unimaginable shock. At 55, with an average prognosis of just six months, she was fighting for her life.

The disability insurance they had established provided crucial financial stability during her treatment, allowing my family to focus on her care rather than worrying about bills and finances. When my mother passed away, I found myself processing the first death claim of my career — to my own father.

The death benefit paid off my father’s mortgage and funded my younger siblings’ college education, providing the financial foundation that allowed Dad to grieve while maintaining stability for our family. This experience crystallized my understanding of MassMutual’s purpose and my role in helping people secure their future and protect the ones they love.

— Joe Mallee, head of MassMutual Financial Advisors at MassMutual Financial Group

Ian Freeman: Bringing security to the family of a fallen 9/11 client

One of the most defining moments in my career was delivering a life insurance claim following the 9/11 attacks. I was in Dallas that day, watching the events unfold on television.

The disability insurance they had established provided crucial financial stability during her treatment, allowing my family to focus on her care rather than worrying about bills and finances.

Cullen

Mallee

Trade Center] buildings with multiple clients. Ironically, many of my meetings happened to fall on Tuesdays, and 9/11 was a Tuesday.

As soon as I realized what was happen ing, I started calling my clients. I was able to reach all of them except one.

By Friday, with flights still limited, I flew into Philadelphia and drove into New York. I’ll never forget the smoke rising from the rubble as I crossed the Verrazzano-Narrows Bridge. That Sunday, I picked up my dad, who happened to be best friends with the victim’s father, and we drove to their home. When we arrived, there were more than 100 people gathered, but I was the only one asked to go into a separate room with his widow. It was in their children’s bedroom, which seemed so poignant.

She asked only one question, and it was the correct question and the only one that mattered: Am I going to be okay?

In moments like that, you are acutely aware of what this profession is really about — protecting lives, families and communities. The rest is noise. And you better have the right answer.

Fortunately, we did. And today, those children are our clients, too.

— Ian Freeman, founder and financial advisor at The Freeman Group, Northwestern Mutual

Todd Weiss: Two generations of security

One of my clients recently passed away in his mid-50s, leaving behind a powerful financial legacy for his family. When I first started working with him in 2015, he had $2.5 million in term insurance.

This experience reinforces my belief in insuring children at an early age — a strategy I’ve implemented with my own kids. I’m always considering adding juvenile policies for all my clients’ kids.

Through strategic planning and foresight, I was able to add another $7 million in whole life insurance and provide his family with absolute financial security if they ever faced a difficult time without him.

What’s truly inspiring about this case is the intergenerational impact of our planning. I helped the client set up policies for his two children, now in their mid-20s. One is building a career and is single, while the other is working and living with a significant other.

Both young adults have continued to fund their whole life policies, fully appreciating the legacy their father began and illustrating the versatility of life insurance planning. Our recent conversations have focused on explaining the policies’ benefits, including their use for liquidity events, and the importance of coverage for their partners or future families.

It’s a powerful reminder of how insurance can create financial security and leave a meaningful impact for generations to come.

She asked only one question, and it was the correct question and the only one that mattered: Am I going to be okay? In moments like that, you are acutely aware of what this profession is really about — protecting lives, families and communities.

This case also highlights the importance of staying vigilant with policy management. When I discovered the client was ill, we quickly converted an expiring term policy to a permanent one in his final months, ensuring his family wouldn’t lose crucial coverage.

This proactive approach not only secured the family’s financial future but also laid the groundwork for continued relationships and future potential opportunities with the adult children. It’s a win-win situation, demonstrating the long-term value of comprehensive insurance planning.

This experience reinforces my belief in insuring children at an early age — a strategy I’ve implemented with my own kids. I’m always considering adding juvenile policies for all my clients’ kids.

The only thing I ever hear from people who own whole life policies is “I wish I had done more and started at a younger age.” By thinking generations ahead with thoughtful life insurance planning, we can create an impact of financial security that spans generations.

— Todd Weiss, wealth management advisor at Summit Financial

InsuranceNewsNet

Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at john.hilton@innfeedback.com. Follow him on X @INNJohnH.

Freeman

Weiss

Your Annual “Awareness” Booster

In this year’s Life Insurance Awareness Month Thought Leadership Series, leaders throughout the industry offer perspective on the trending sales, strategies and products dominating an ever-changing life insurance marketplace.

INSIDE

Getting Clients to Act on the Long-Term Care Conversation with Kansas City Life

Page 21

Protective’s Term Life Stands the Test of Time

with Aaron Seurkamp, Senior Vice President and President of the Protecion & Retirement Division at Protective Life

Page 22

Trust and Tech in Tandem with John Borgen and Jennifer Smith of Sapiens and Mike Attewell of Trusted Fraternal Life

Page 24

Getting Clients to Act on the Long-Term Care Conversation

An effective plan will educate clients as to what the three major planning behaviors are in response to long-term care costs. Just lay out honestly how people act. Then they can see where they fall on the list.

The first planning behavior is when people ignore the issue and hope for the best. Sometimes the magnitude of the conversation is just too worrisome to confront. The second planning behavior is that a person accepts the statistics that they will need care but then choose to self-insure.

The consequences are the same for people in each of those first two behavioral categories. The first thing that happens is they must start liquidating assets. They can do this while the assets last. They also must pay all the subsequent taxes. Recall those huge unknown variables of the stock market, interest rates, and inflation; this is the time when people are reminded that those are realities over which they possess absolutely no control.

Do you know how a person can make long-term care costs significantly more expensive than they otherwise would have been? They can get sick and need help during a down stock market or low-interest rate environment. Nobody gets to pick what’s going on in the world when health issues arise.

Then once the assets have been depleted far enough, they can then go sign up for the government plan which is called Medicaid. Looking at this path, when it comes to self-insuring, even if a person can self-insure, why would they want to?

Finally, there is a third planning behavior where people act by choosing to hedge the risk. What does hedging the risk look like? One way to hedge risk is through traditional long-term care insurance. The planning challenges to this approach are that policies often will be “use it or lose it.” The costs can go up, benefits are mediocre, and underwriting is vigorous. Remember that there are plenty of health issues which can make people more likely to need long-term care but that do not necessarily shorten life expectancy.

However, what has proven to be a more popular hedging solution is a hybrid approach using life insurance with an accelerated death benefit rider. This approach turns the previously unattractive value proposition on its head. Now at worst, the client’s beneficiaries are going to receive a tax-free death benefit. Kansas City Life Insurance Company’s applicable solution is the robust Enhanced Living Benefits (ELB) rider.

Can a person own a life insurance policy and be their own beneficiary without dying? Yes, and knowing that fact will significantly increase the chance that they purchase a policy!

Through the accelerated death benefit provided by the ELB rider, a person may be saved from being forced to liquidate retirement accounts. Easing the financial impact is a big deal. So is reducing the physical impact of family members providing care.

Independence can be preserved by staying in their own home. The money can pay for receiving in-home skilled nursing and making necessary home modifications such as widening doorways, installing ramps and rails, or updating their bathroom for easier use. This is why Tom Hegna calls it “anti-nursing home insurance.” The ELB rider may be able to provide the resources to keep clients in their own home.

Perhaps the most crucial benefit could be family harmony. No parent purposefully makes a decision that results in their children never speaking to one another again. When kids are little, they fight, then take a break or a timeout, and are best friends again an hour later. However, when adult siblings fight, they may become estranged. Failing to adequately plan for these expenses makes that outcome considerably more plausible.

In real life here’s how the conversation goes, “You make all the money with your big career, you should be paying for mom’s care, so she doesn’t have to go into a facility,” or perhaps someone yells, “You stay at home while your spouse works; you should be taking care of mom or let her move in with you,” or another could declare, “We had to move away for our jobs, but you still live in the same town as mom. You should be going over to help her every morning on your way to work and again on your way home from work.”

It does not need to be that way. Using a Kansas City Life IUL policy with the added Enhanced Living Benefits (ELB) rider may be the perfect tool for you to change someone’s family legacy.

To find out more about Kansas City Life’s IUL products with the Enhanced Living Benefits rider, visit www.KCLife.com.

Protective’s Term Life Stands the Test of Time