An ‘agents first’ philosophy for growth with Pan-American Life’s José Suquet

PAGE 6

What Medicare beneficiaries really want in AEP

PAGE 26

Medicaid asset protection planning for 2025

PAGE 30

An ‘agents first’ philosophy for growth with Pan-American Life’s José Suquet

PAGE 6

What Medicare beneficiaries really want in AEP

PAGE 26

Medicaid asset protection planning for 2025

PAGE 30

If you’re ignoring life settlements, you’re not doing your job.

Advisors are overlooking one of their client’s most valuable assets without realizing it. Your duty doesn’t end with a surrender form, turn them into opportunities. Turn the page

It’s

Every year, over $100 billion in life insurance is lapsed or surrendered, often without clients ever hearing the words “life settlement.”

That’s not just a missed opportunity. That’s a fiduciary failure.

Life Settlements:

• Regulated in 45 states

• Offer 4–10x the cash surrender value

• Free, no obligation policy appraisals

• Backed by real-life outcomes, not hypotheticals

• Supported by licensed brokers who act as fiduciaries

If your client has a policy they no longer need, want, or can afford, there’s no excuse for ignoring this option.

Don’t be the advisor who says, “I didn’t know.” Be the one who says, “I’ve got a better solution.”

And there’s no better source than the Life Insurance Settlement Association (LISA)—the oldest and largest organization in the space, representing 30 years of leadership, education, and advocacy.

LISA is driving the movement to make life settlements a standard part of the financial planning conversation, and to support advisors in doing what’s right.

Think you’re fulfilling your fiduciary duty?

Turn to page 4 to rethink fiduciary responsibility and discover why life settlements are becoming the standard, not the exception. Don’t surrender, create client opportunities.

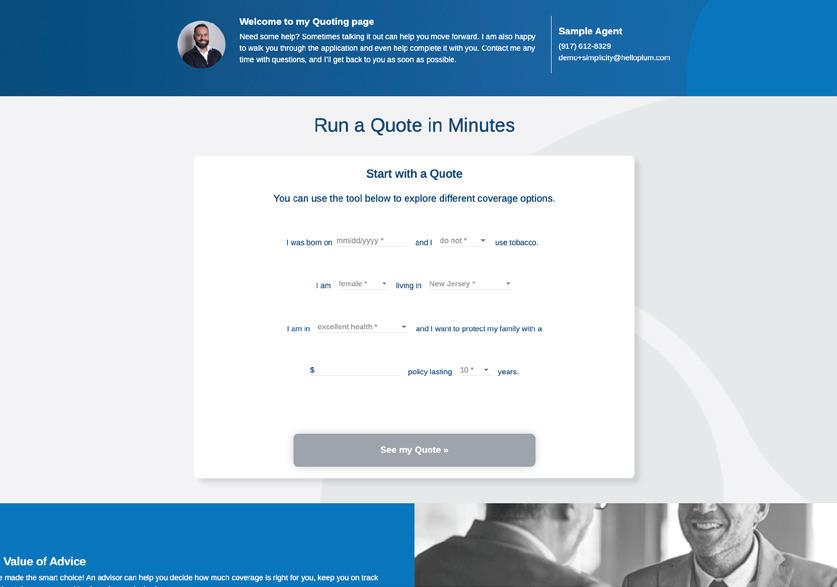

Simplicity LifeLinkTM Transforms The Way Life Insurance Is Purchased, From Quoting to Application to Issue

Save time and effort in placing cases

Impress clients with the ease and convenience of working in today’s digital world

Research and get product details all in one convenient spot

6 An ‘agent s first’ philosophy for growth José Suquet said that Pan-American Life’s success is based on keeping its focus on the agents who serve their clients.

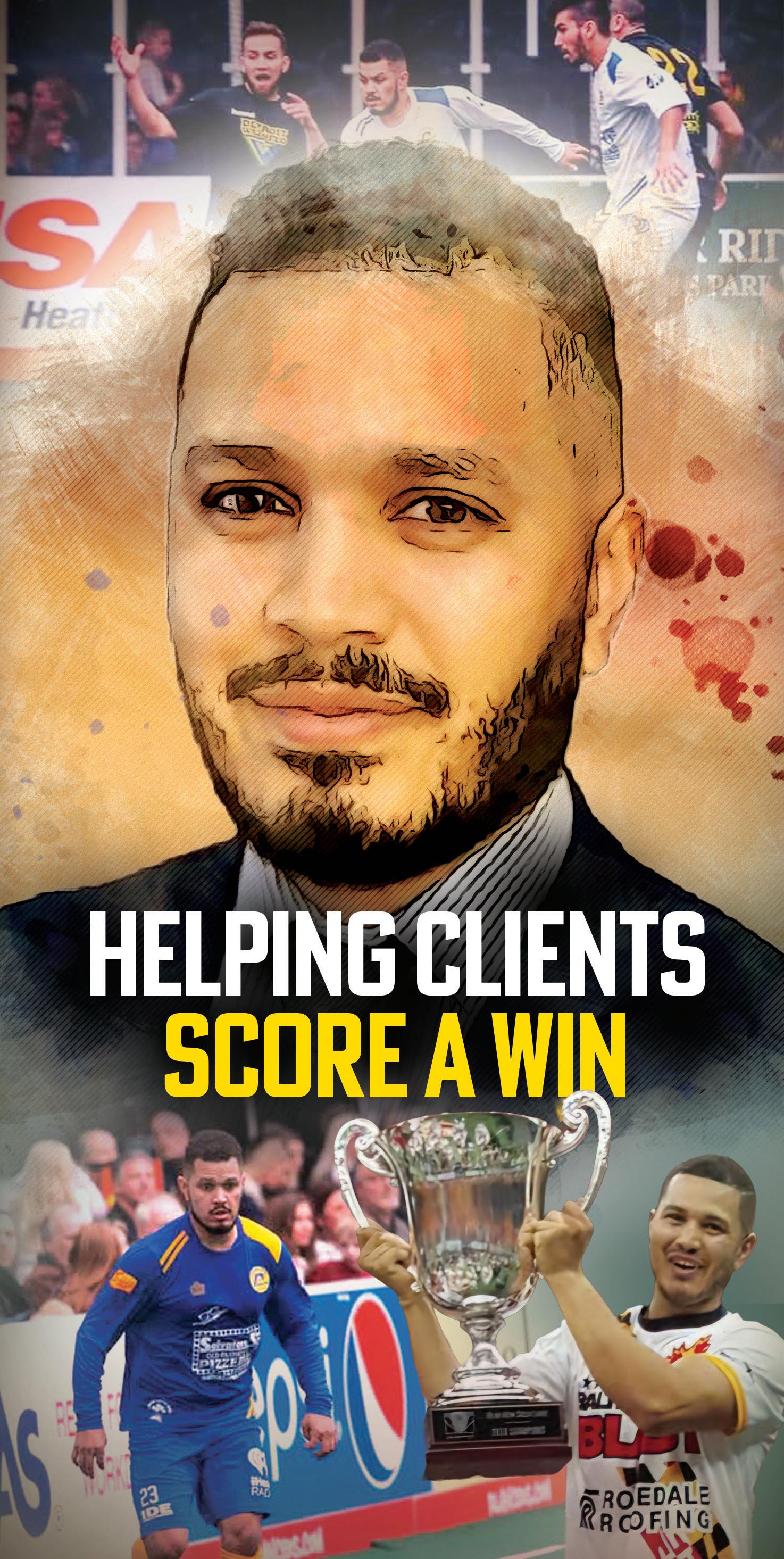

14 Helping clients score a win

By Susan Rupe

Jeremy Ortiz’s soccer career led him to a second act in the financial services field.

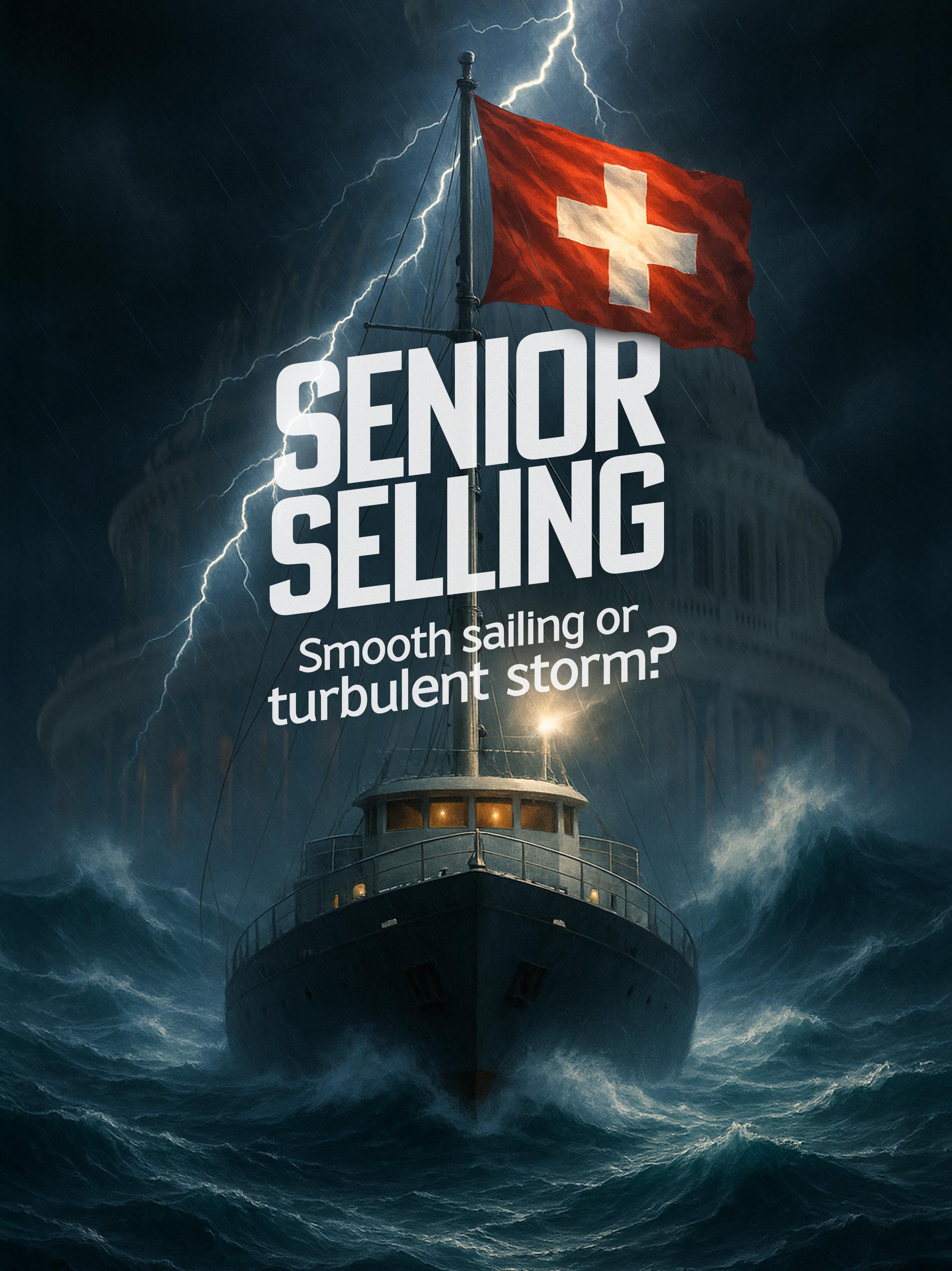

Senior selling: Smooth sailing or turbulent storm?

By Susan Rupe

Brokers brace themselves for another annual enrollment period.

18 Buy-sell agreements and life insurance

By Bracknell Baker and Caleb Baker

While many business owners aspire to a smooth exit, unforeseen events can disrupt business continuity.

22 Is the best rate always the best deal?

By Drew Gurley

Although a higher rate will most certainly catch a prospect’s eye, it’s not always the best long-term solution.

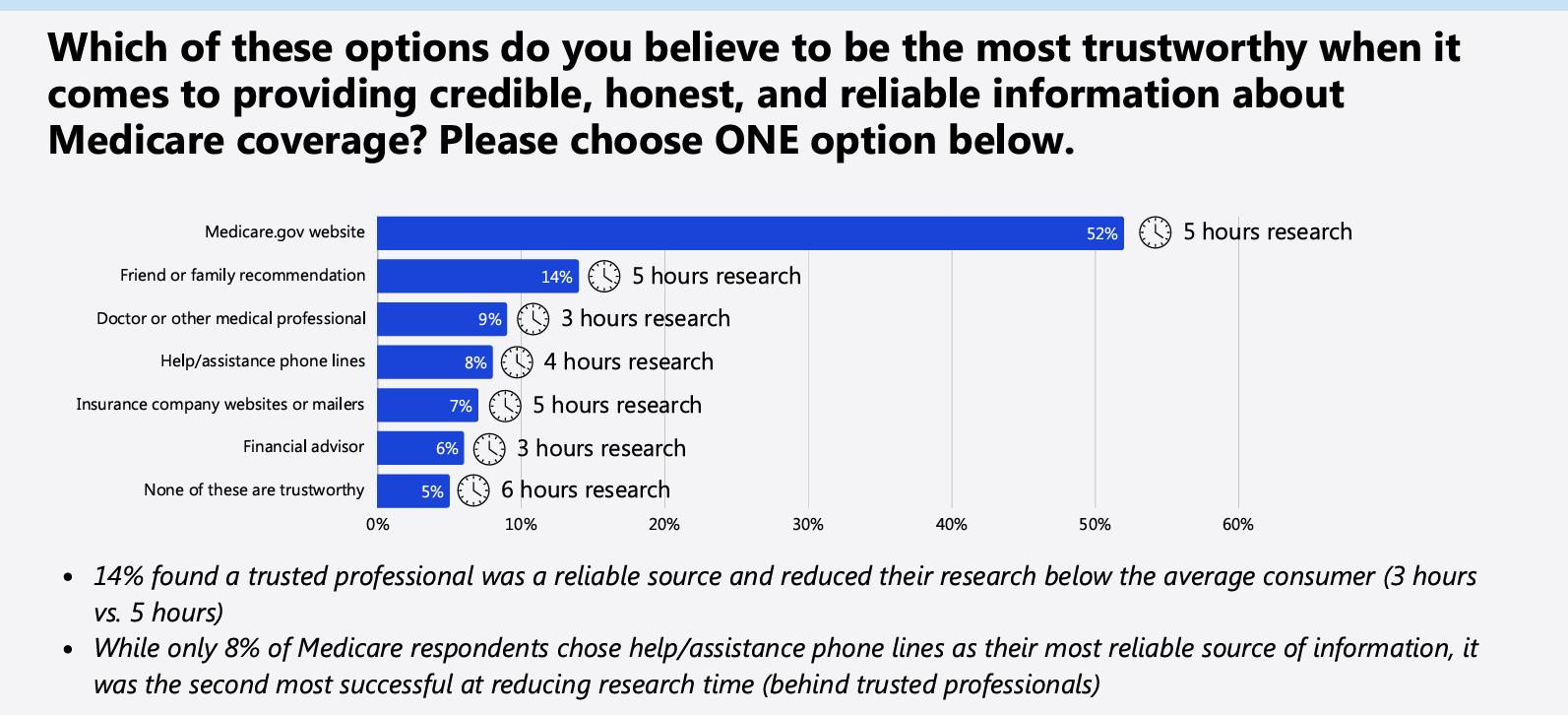

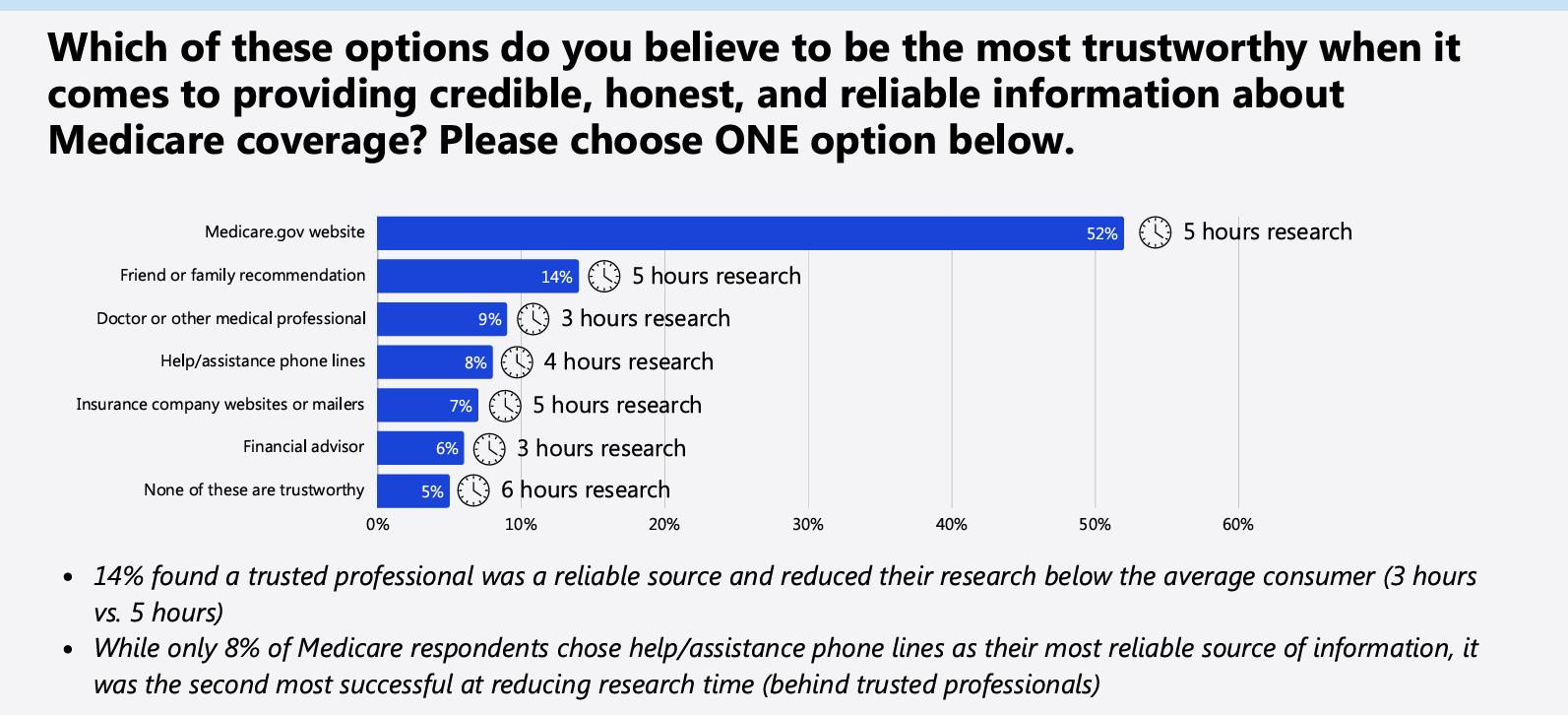

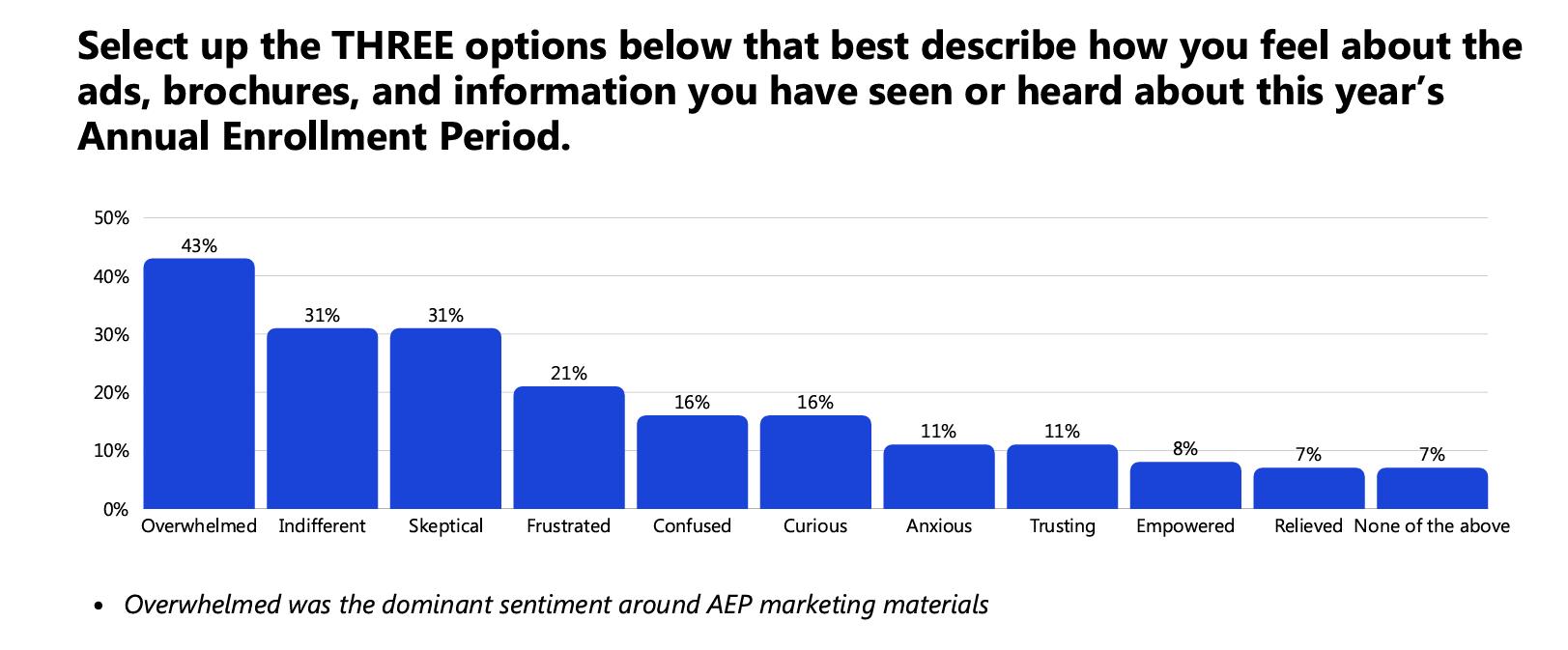

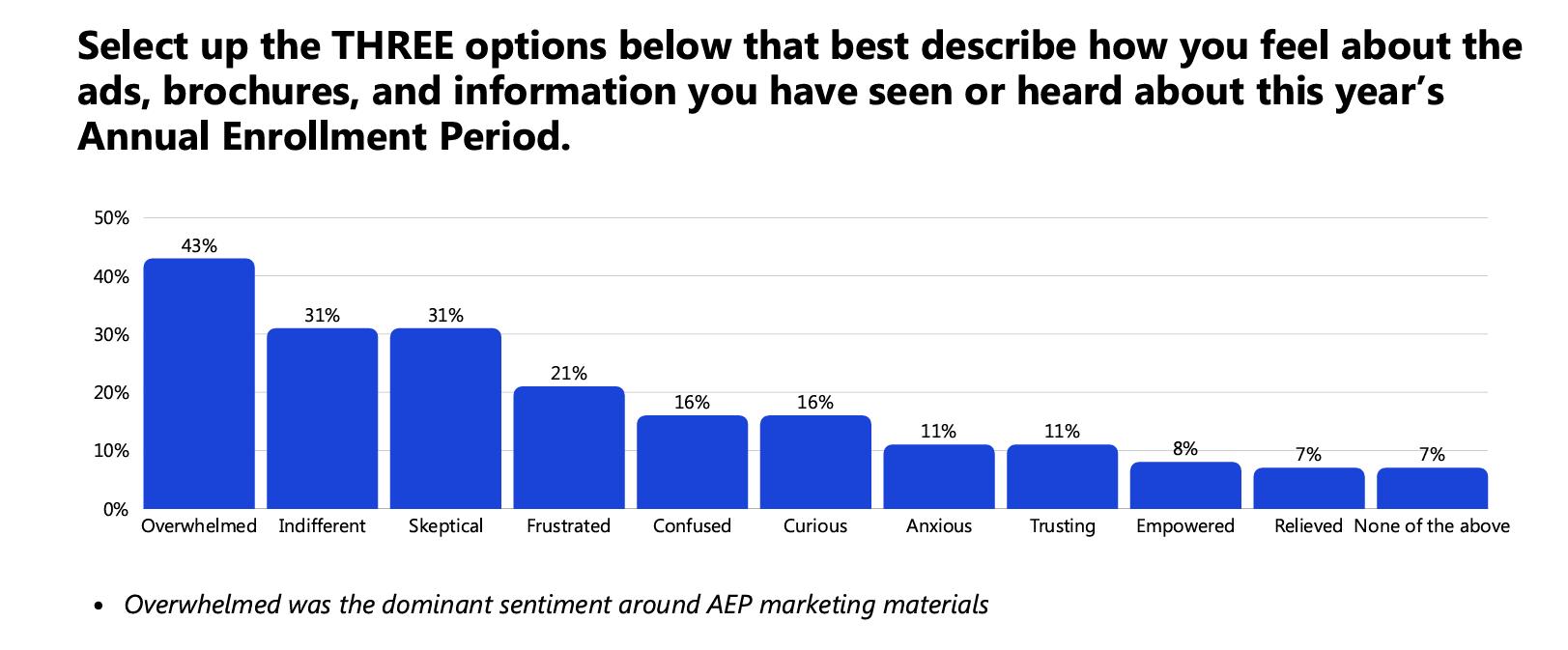

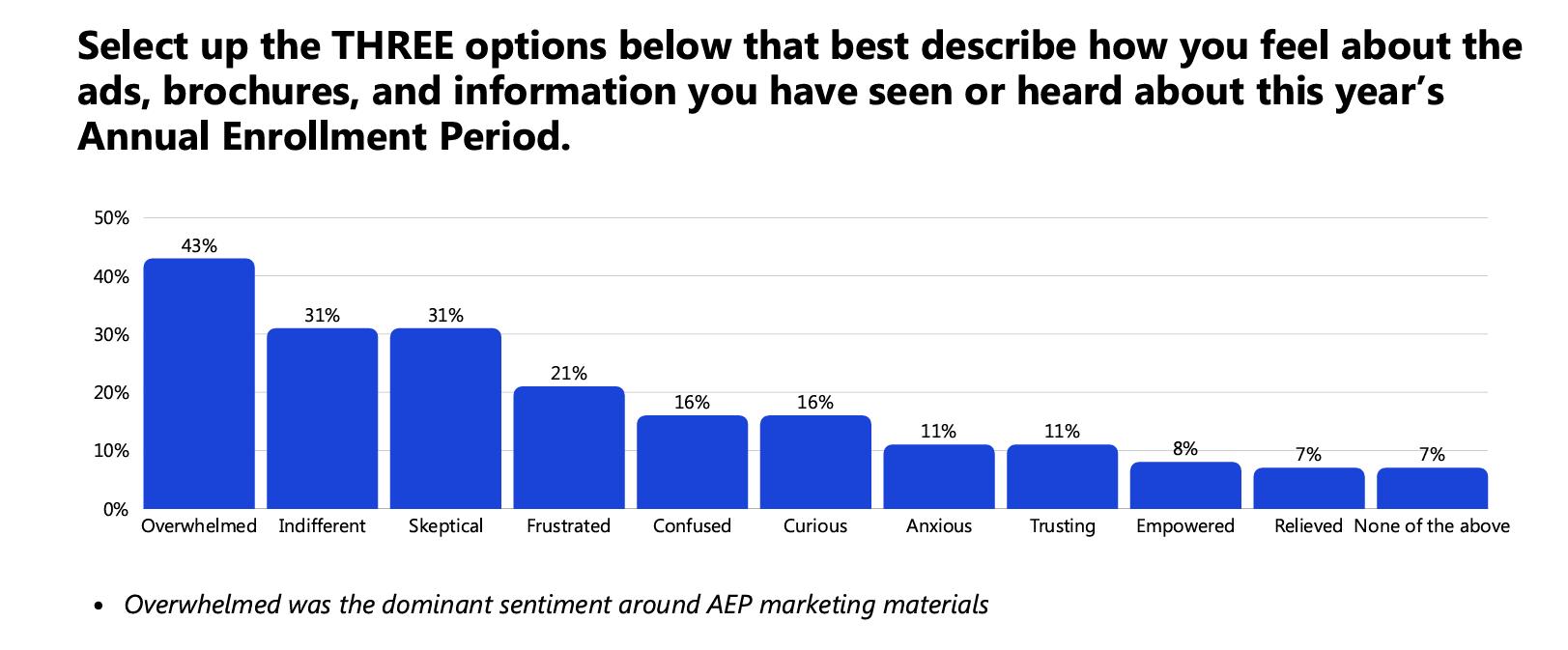

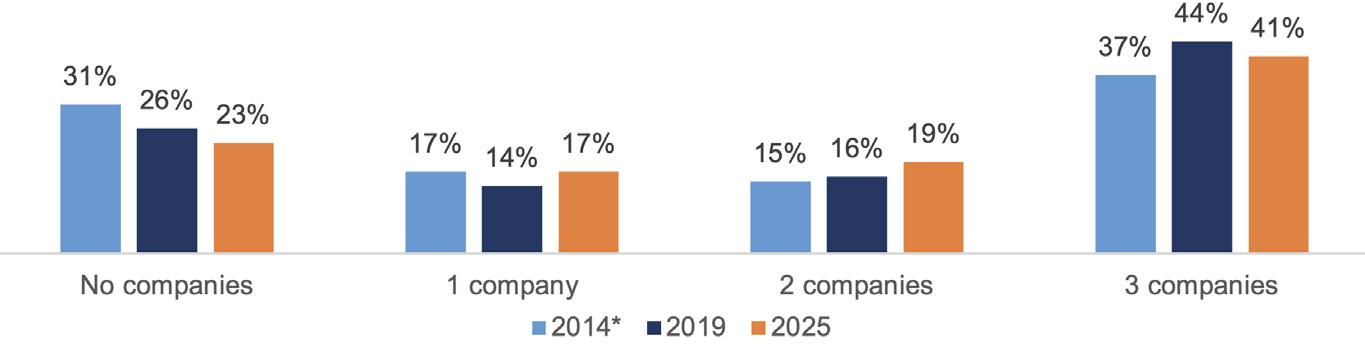

26 What Medicare beneficiaries really want in AEP

By Kris Schneider

Medicare beneficiaries find annual enrollment period to be confusing and overwhelming.

30 Medicaid asset protection planning: Crisis planning vs. preplanning

By Patrick Simasko and Kelsey Simasko Eligibility rules can devastate families financially if proper planning is not in place.

32 What high-performing advisors are doing differently in 2025 By Faheem Shakeel

They talk less about products and services and more about experiences, risks and relationships.

34 Treating financial wellness By John Hilton

How can advisors help clients feel better about their financial futures?

The landscape for selling health care to seniors, particularly Medicare Advantage plans, is experiencing substantial changes, forcing financial advisors and insurance agents to reconsider their strategies and approach during Medicare’s annual enrollment period.

Traditionally, Medicare Advantage has offered an opportunity for agents due to predictable commissions and the growing popularity of these plans among seniors. However, recent changes — most notably, the elimination or drastic reduction of commissions by certain carriers — have introduced a new layer of complexity to the sales process.

Medicare Advantage plans, designed as an all-in-one alternative to Medicare, typically include coverage for hospital stays, doctor visits, prescription drugs and additional benefits such as dental, vision and hearing. This coverage has driven their popularity. Enrollment in Medicare Advantage has steadily climbed, and, today, nearly half of all Medicare beneficiaries own such policies, a trend projected to continue as the senior population expands.

For advisors and agents, however, the drive to sell Medicare Advantage plans has hinged not only on the benefits but also on consistent compensation. Recent developments, though, including major carriers reducing or completely removing commissions, have shaken this industry. Agents who counted on the stable annual renewals and upfront commissions now face

uncertainty. As one agent who contacted InsuranceNewsNet said: “While the companies may feel that they no longer need agents to write their coverage, Medicare beneficiaries would tell a different story if asked their opinion. … How can we serve the public if we are not getting paid?”

Why are carriers reducing or removing commissions? Among other things, insurers are contending with increased regulatory oversight and tighter profit margins. Regulators are also paying closer attention to sales practices to ensure seniors make well-informed decisions. The enhanced oversight, combined with rising health care costs, has driven the cost-cutting measures that are impacting agent commissions.

Despite these shifts, Medicare Advantage continues to be highly attractive for seniors. Financial advisors and insurance agents must determine how to adjust sales strategies for the new realities — if they still want to participate in the market.

While some carriers are eliminating commissions, others continue to provide compensation and support for agents. According to medicaresupp.org, initial year Medicare Advantage commissions are $705/member/year (2025). This is a 2.3% increase from $689/member/year (2024). Renewal commissions are $353/member/year (2025).

Advisors will be evaluating carrier partnerships not only on commission structures but also on stability, quality of customer service, and support.

Advisors and agents may consider

diversifying their portfolios to make up for the commission losses. Ancillary products such as supplemental health insurance, prescription drug plans and long-term care solutions can enhance value to clients while helping agents maintain revenue streams. This holistic approach may also help strengthen client relationships.

Technology is another factor reshaping Medicare sales. Using advanced customer relationship management systems, automated enrollment tools and digital marketing strategies can help grow client reach. Advisors leveraging technology will be able to reach those tech-savvy seniors who may prefer digital interaction.

Seniors navigating Medicare options may find the task confusing and possibly overwhelming. Agents who offer clear, unbiased educational content — whether through seminars, webinars, blogs or personalized consultations — will build credibility and trust for seniors seeking these plans in a market that’s more competitive for the remaining commission dollars.

Advisors and agents who can adapt to these industry shifts, emphasizing service, education and additional product offerings, may be able to continue to find success in the Medicare Advantage market. But as the agent asked: “How can we serve the public if we are not getting paid?”

John Forcucci Editor-in-chief

A Washington law firm is interviewing health advisors who were unfairly targeted by the Centers for Medicare & Medicaid Services in preparation for a potential class action lawsuit against the federal agency for its use of algorithms to punish agents who enrolled consumers in Affordable Care Act coverage.

Diceros Law is interviewing agents who tried to enroll clients in the ACA marketplace in 2024, only to find out they were kicked out of the CMS online enrollment system and suspended from selling coverage because CMS algorithms erroneously flagged them as committing fraud

Agents told InsuranceNewsNet in November that they were suspended from using the ACA online platform and lost their books of business as a result. Although agents were eventually reinstated, they lost income.

Diceros is working with Health Agents for America to identify agents who were harmed and interview them for the possible lawsuit. In addition, Diceros has been asked to provide witness testimony on the issue to the House Committee on Oversight and Government Reform. The law firm is seeking testimony from agents who lost income as well as clients who were unable to enroll in health insurance because of CMS actions.

Fewer Americans believe they will be able to financially support all their goals in life, an Allianz Life survey found. In 2025, only 70% of Americans said they feel confident about their ability to financially support everything they want to do in life. This has decreased every year since 2020 when 83% said they felt confident. Fewer (61%) feel confident specifically about meeting their savings goal for retirement.

At the same time, Americans are increasingly worried about a recession affecting how much they can save for retirement (30%, up from 25% in 2024) and taxes taking a big chunk out of their retirement funds (26%, up from 18% in 2024).

This worry could be driven by ongoing concerns about a national or global financial crisis. Nearly 2 in 3 (62%) say they are concerned that another national or global financial crisis in the near future would derail their retirement strategy. Even so, just 46% say they have incorporated the potential implications of future national or global financial crises into their financial retirement plan.

The youngest generation in the workforce is saying “no thanks” to the corporate 9-to-5 and embarking on the path to entrepreneurship.

An increasing percentage of Generation Z is ditching the corporate ladder in favor of founding their own

Rest assured, tariffs are not going away.”

— U.S. Commerce Secretary Howard Lutnick

businesses. LinkedIn data found about 18% of business founders in 2024 were Gen Zers, compared with 14.5% in 2023.

About 59% of millennials and Gen Zers reported having a traditional job before starting their own company, according to a 2024 American Express survey. A survey by CNBC and SurveyMonkey found that some Gen Z workers report wanting more meaningful work and find their jobs uninspiring. Nearly half said they are just “coasting” on the job, which was higher than older generations.

Cryptocurrency is becoming more accepted in the mainstream, but the numbers show there is a long way to go as far as Americans incorporating it into their lives.

Pew Research shows about 1 in 6 U.S. adults — 17% — have ever invested in or used cryptocurrency, while half that — 8% — have used it in the past year. Crypto use is highest among men 18 to 29 years old and lowest among women 50 and older. The Federal Reserve found that 7% of U.S. adults have used crypto in the past 12 months as of 2024, down from 12% in 2021.

Compare this with 26% of U.S. households owning stocks or mutual funds, and 60% having retirement accounts, according to the U.S. Census Bureau.

That's a cents- less idea ...

For decades, financial professionals have relied on a trusted set of tools to help clients manage risk, plan for retirement, and navigate life’s financial transitions. But what happens when one of the most valuable personal financial assets, a life insurance policy, stops serving its original purpose or is no longer needed?

That’s the moment when a lesserknown option, the life settlement, should come into play. Unfortunately, many advisors overlook or are not educated about it. And in doing so, they may be leaving their clients—and their fiduciary duty—behind.

Bryan Nicholson, Executive Director of the Life Insurance Settlement Association (LISA), and Brian Casey, a partner with Troutman Pepper specializing in insurance transactional and regulatory law, explain fiduciary responsibility, regulatory reality, and why life settlements are no longer a fringe concept, but a financial planning essential.

A life settlement allows a policyholder— typically a senior age 65+—to sell a life insurance policy they no longer want, need, or can afford to a licensed provider for a lump sum. That lump sum can be many times higher than the policy’s cash surrender value.

Despite being legally recognized for over 100 years and regulated in 45 states, life settlements are still often misunderstood or ignored.

“Many advisors don’t realize that this is an option—or that failing to present it could raise questions about their fiduciary responsibility,” said Casey. “The industry hasn’t yet seen widespread litigation on that point, but the winds are

shifting, especially with respect towards more consumer protection for senior populations.”

In fact, life settlement brokers are fiduciaries by statute. “That means they’re legally obligated to act in the best interest of the policyholder,” said Casey. “Advisors who partner with licensed life

to notify policyowners of the life settlement option when they inquire about surrendering or lapsing a policy

Nicholson pointed to LISA’s “Faces of Life Settlements” campaign to illustrate the real-world impact of these transactions.

“They find out too late that they could have received five or even ten times the policy’s cash value.”

settlement brokers can bring that level of fiduciary protection to their clients.”

According to the SEC’s Fiduciary Interpretation, “An investment adviser must, at all times, serve the best interest of its client and not subordinate its client’s interest to its own.” That makes overlooking a valuable opportunity like a life settlement more than just a missed chance—it’s a potential compliance concern.

What happens when a client surrenders a policy—or lets it lapse—without ever being told a life settlement might have been possible?

“We’ve seen cases where policyholders or their families come back after the fact, frustrated they weren’t made aware of the option,” said Nicholson. “They find out too late that they could have received five or even ten times the policy’s cash value.”

As more consumers become aware of life settlements, the legal and reputational risks for advisors who fail to present the option are growing. In several states, carriers are required

Some examples used include:

• David, 88, was paying $75,000 annually on a $2 million policy he no longer needed. He received $792,000 in a life settlement—far more than the $42,000 cash surrender value.

• Janice, 78, was struggling to cover longterm care costs. A life settlement turned her $750,000 policy with just an $11,000 surrender value into $90,000 in cash.

• John and Mary, in their 70s, were about to surrender a $500,000 survivorship policy when they learned about life settlements. Their policy delivered $85,000 in value they didn’t know they had.

“These are not rare-edge cases,” said Nicholson. “They’re the types of clients every advisor has in their book of business.”

If life settlements offer such clear value, why are they still so often ignored?

Casey said several factors contribute: “There’s lingering discomfort tied to

the early days of viatical settlements in the 1990s. There’s confusion about the process. And in some cases, there’s a fear of regulatory scrutiny or lost commissions.”

But those fears are largely unfounded. Today’s life settlement industry is tightly regulated, with licensing, disclosure, and escrow requirements that protect all parties. And agents who help facilitate a transaction are often eligible for referral fees or commissions— particularly when the alternative is a lapsed policy that would generate nothing.

Some signs that a client may be a good candidate for a life settlement include:

• Rising premium costs that are straining the client’s budget

• Changes in life circumstances (e.g., retirement, death of a spouse, sale of a business)

• No longer needing to replace lost income or support dependents

• A policy that’s about to lapse or be surrendered

dealers, and gathering industry-wide data to support transparency and trust.

“We want this to be a mainstream conversation,” said Nicholson. “And we’re committed to helping advisors get there.”

For advisors who want to explore whether a life settlement may be right for a client, LISA offers a range of resources—including its newly updated Guide to Common Life Settlement Questions

Every year, more than $100 billion in life insurance is lapsed or surrendered by seniors— often without exploring alternatives.

“In many cases, the policyholder reinvests the settlement into new insurance products, annuities, or longterm care coverage,” said Nicholson. “There are follow-on opportunities for the advisor that strengthen—not weaken—the client relationship.”

The Demographic Imperative Beyond fiduciary duty, demographics are creating increased demand for solutions like life settlements.

“We’re looking at a rapidly aging population, most of whom are underprepared for retirement and long-term care costs,” said Nicholson. “Meanwhile, many of them hold life insurance policies that no longer serve their original purpose.”

“This is often one of the largest assets on a client’s personal balance sheet,” said Casey. “Why wouldn’t you evaluate it the way you would any other financial asset?”

Nicholson emphasized that LISA doesn’t advocate for life settlements in every case. But he firmly believes they should be part of the broader financial planning conversation.

“This is not a fringe product. It’s a legitimate financial tool,” he said. “And our role at LISA is to make sure it’s understood, accessible, and handled with integrity.”

To that end, LISA is investing in expanded educational outreach, building partnerships with IMOs, RIAs, and broker-

While LISA does not provide financial advice, its members include licensed brokers, providers, legal experts, and underwriters who specialize in facilitating life settlement transactions.

“Life settlements aren’t for everyone,” said Nicholson, “but they are a powerful option when the time is right. And advisors who want to uphold their fiduciary duty need to know what’s possible.”

Life insurance settlements are no longer just an option; they’re essential in financial planning. Visit LISAtoolkit.com or scan the code to get your Guide to Common Life Settlement Questions.

President and CEO of Pan-American Life Insurance Group JOSÉ SUQUET said that starting his career as an agent with the company “was the best decision I could have ever made.”

An interview with publisher PAUL FELDMAN

Twenty years ago, PanAmerican Life Insurance Group’s president and CEO José Suquet was tasked with turning things around at the company, which was founded in 1911 by Crawford E. Ellis, a United Fruit Co. executive during the height of the banana trade between New Orleans and Honduras.

Suquet grew the business in core Latin American markets, overhauling the company’s financial structure and cutting business lines that were not central to the company’s strategy.

In the past two decades, he has grown company revenues from $284 million to nearly $1.5 billion. Pan-American Life, composed of more than 30 member companies, has a footprint in 49 states and more than 20 countries.

In this interview with InsuranceNewsNet publisher Paul Feldman, Suquet talks about the key to the company’s past, present and future success.

Paul Feldman: One of the things that impresses me is that you’ve gone from being an agent in the field to being CEO of an insurance company — and you have one of the longest tenures I know of: 20 years as CEO of Pan-American. Tell me how you got into the business, and tell me about your journey from agent to CEO.

José Suquet: I had just graduated from college at Fordham University in New York. I was already married — I got married at the young age of 20. We lived in Park Slope, Brooklyn. I went home — my mother was there and my wife was there, and I was all excited: I had received a job offer. They said, “Wow, what is it?” And I said, “Well, I’m going to become a life insurance agent.”

And they immediately sat back and were a little trepidatious — to say the least. My mother started clutching her heart a little bit and she said, “Well, what kind of salary are you going to have?” And I said, “Well, they had two different plans. One was a salary and a small commission, but then they had a higher commission and a bonus on top of that, but no salary. And I decided to forgo the salary and go with the commission and bonus.”

At that point, I thought I had lost my mother. And my wife was also a bit scared. But it was the best decision I could have ever made. That was July 1, 1979. I couldn’t have had a more dreamlike career. And I owe it all to my roots of being an agent first.

I kept selling, and I became a unit manager for Equitable. Six years later, in 1985, I was given an opportunity to move down to Miami to take over an agency. I took over a consolidated agency, and we had a great run there. We became one of the largest agencies in the industry in the span of about eight years. I ended up with about 300 agents.

became head of the agency system at AXA Equitable and then took over as head of distribution. I was responsible for all of the agency system, all of the third-party distribution, such as regular brokerage, as well as banks, wirehouses, broker-dealers. We were running a big shop at the time and took it from about $4 billion or $5 billion in sales to about $13 billion in sales in about a seven- or eight-year period.

That would have been 2000, 2001. We became a private United States subsidiary of AXA, and I decided that it was a good time to explore other opportunities. I left AXA, took some time, and then was

Pan-American Life Insurance Group sponsored the “Criaturas de la Noche” (Creatures of the Night) exhibit in the Jaguar Jungle at the Audubon Zoo in New Orleans. José Suquet, chairman of the board and CEO, leads the ribbon-cutting ceremony.

We were doing about $25 million of new life insurance premium every year. We sold annuities, of course, through the broker-dealer, and mutual funds and investment products. I had 13 unit managers. I had an estate planning attorney on staff, a pension attorney on staff, a securities products coordinator and a marketing director.

Feldman: That’s impressive infrastructure.

Suquet: At that time, Jim Benson, who’s a legendary figure in the insurance industry, had come to Equitable, and he asked me to come up to the home office at Equitable. And at that time, AXA had taken a minority stake at Equitable. We went public before I moved up there, and we had a tremendous run. So I

recruited by BISYS, the largest life broker at that time, to run three different businesses for them. I had experience there with brokerage and then decided that I wanted to go back into the carrier world and took some time there.

Feldman: Equitable has a multinational arm. Were you involved with that as well?

Suquet: Not really, no. It was all U.S. focused. We had a tremendous run there. At that time, we had some $60 billion in variable annuities assets under management. Equitable today is still a leader in the VA and indexed annuity business. We were also very big in variable life business. Equitable, during the late 1980s, early ’90s, was having some difficult times. It was very difficult to sell

general account products because of the issues that Equitable was dealing with. So we developed variable life products, and we became the leader in variable products at the time.

I took some time off, hung up a consulting shingle and did a couple of consulting projects for big-name firms that you would know. Then I was offered an opportunity by a couple of the major Northeastern insurers to run distribution or run a business or two. But I did not want to go back to the big carriers. I wanted to run my own show. So I just held out.

The Pan-American search firm called me, and I believed it was an ideal fit. Many people in the industry who knew me were surprised that I would go to such a small company. But it has been a ride that has far exceeded my personal and professional expectations. It was not an agent-centric company.

I remember changing that immediately. I’m very optimistic that even when I’m not here — and I plan to be here for quite some time — I’ve made it clear that nothing happens in an insurance company until an application comes in the door. Your assets that you manage don’t increase until apps start coming in the door. You don’t have underwriters. You don’t have anything. I had to instill that. You should be ringing celebratory bells when the business comes in the door. That’s a real shift in culture at many carriers.

Feldman: I haven’t heard another carrier say it like that.

Suquet: Some carriers must think, “This would be a really great place if it weren’t for these pesky agents.” I had carried a rate book under my arm, so I was the complete opposite of that. I think that has permeated and will continue to permeate for at least a generation or two after I’m gone.

Feldman: What kind of changes are you seeing around the industry?

Suquet: I’ve been in the industry for 46 years as of July 1. One of the biggest changes is the emergence of private equity in the business, at both the carrier level and the distribution level. I think that’s

healthy overall. I would tell you that at the carrier level, the private equity folks are in it for an asset play and to manage assets. I think that they’re experts at that. For the most part, a number of the carriers that have gone down this path have reduced their distribution or sold their distribution or closed it up, and that’s fine. That’s understandable.

On the distribution side, the private equity firms have been the beneficiaries of this phenomenon of carriers exiting distribution. So whether it’s the Simplicys, the Integritys, etc., we happen

The regulatory environment continues to increase in scope and severity. And this is from someone who is involved in 22 different countries, jurisdictions outside of the U.S., in addition to 49 states in the United States where we’re involved and we have a fairly large regulatory infrastructure. So we don’t fight the regulation; we try and stay ahead of it and try and make it as easy as possible to do business with our distributors.

I think some companies have tried to get into markets that they probably shouldn’t be in or they don’t have the

to be on the shelf space of just about most of the major distribution organizations in the industry, primarily in the life insurance space. We also, in the U.S., do a group of fixed indemnity products and stop-loss.

We’re on the shelf space on some of that as well. The product shift has gone from variable and fixed products, which we’re still in, in the whole life to indexed — lots of indexed — whether it’s variable annuities or indexed universal life. So that’s been a change over the last 20 years, all for the good of the industry.

I think another big 800-pound gorilla is the increased pace and associated cost of regulatory and technology changes and, in particular, information security and data breaches. That has taken hold, and you must build defenses around your data and around your systems. You must educate your employees, your executives. You must provide tools for education and protection to your distributors because everyone is at risk from a cybersecurity point of view.

necessary expertise for. We have stayed true to our values and purpose, which is life, health and accident. We are not going to go after the shiny new object on the product front. We have stayed focused on whole life, participating whole life, through our absorption of Mutual Trust Life Insurance Co., and that has gone well. We’ll be celebrating our 10th anniversary of that. We have numerous choices for our agents and brokers.

And then we have recently introduced an indexed universal life product family that focuses on the simplicity of the indexed UL. So I think that those are the major changes.

On the distribution front, we continue to realize that you have to earn distributors’ business through a competitive product set, but also through superior service and an understanding of what they do. I may be either a dying breed or a dinosaur, because I don’t think there are too many people like me who have carried a rate book and who are now running insurance companies.

My mission is to make sure that the understanding that “nothing happens until an app comes in the door” permeates for another couple of generations at least in our company.

Feldman: I think that is a strong philosophy: putting your agents first. They’re the ones writing your policies. And putting distributors first because they’re helping you get your products out there.

Suquet: And another nuance about us: We do not go direct to the consumer. Our primary customer is the distributor. Even in our stop-loss business, where carriers have direct sales forces to the groups, we do not. We have a network of managing general underwriters that do this for us. So we do not go direct. We believe that our primary customer is the agent, the broker, the independent marketing organization and that is our starting point. Our first focus is service through that intermediary.

Feldman: Pan-American Life serves some niche markets in the industry. Tell us a little bit about these niches.

Suquet: When I first came here, the chairman at that time who recruited me said, “All of the challenges you are facing and the heavy, heavy competition are out of New Orleans and the United States. All of your opportunities are international.”

For my first few years, I focused on Latin America. In hindsight, it was the absolute best move. We had a variable life product that I shut down. I shut down our disability business. I did not want to compete in independent distribution with the big boys, as I call them, such as National Life or Pacific Life. All their CEOs are good friends of mine, and needless to say, those carriers are big mutual companies. We didn’t want to start off competing with that. So we went where no man has dared to go. And it proved very good for us.

As things developed, we said, “Well, how do we expand in the United States?” And little by little we created niches, but we also said we need some scale. We converted the company to a mutual holding company, and we said, “What’s the

universe of potential merger partners out there?” And Mutual Trust came up, and we hit it off with them. They were looking for a potential merger partner, and that got us into the middle-market whole life business. We’ve done that successfully for 10 years. We have a terrific distribution head of our U.S. life business, Luke Cosme, who does a great job.

We also have a niche in our high net worth foreign national business. A lot of wealthy foreigners who have a connection to the United States are looking for a high-quality company that understands that market and is not afraid of the underwriting risk, the international travel. And we do that quite well. We are experts in that area.

I think that maybe it’s because of my upbringing. I was born in Cuba and have been here since I was 2 years old. Even though we do business in 22 different countries, I still think this is the greatest country on earth. I think there’s a lot of opportunity here.

I think we’re in a real sweet spot, as long as we understand the dynamics and the risks. We have a cadre of about five reinsurers that like our business quite a bit. We have a very good track record with our reinsurers. So that’s a real niche. And that’s what we do in the United States: middle-market whole life, now indexed universal life backed up by a number of selling systems and then the high net worth foreign national business, all on the life insurance front.

Feldman: What do you see as your company’s biggest opportunity in the next five years?

Suquet: In the next five years, we want to continue to explore the Hispanic market. We’re also unique in that, through our footprint in Latin America, we have Hispanics whose parents or grandparents came from one of the countries that we currently do business in. We’re not a fly-by-night in these countries. We have been in Panama 110 years.

We’ve been elsewhere in Central America more than 70 years. We’re looking for cross-border opportunities in trade. Even though there’s talk of the tariffs and all that, there’s still significant trade going on between Mexico and the United States. So we think that we’re uniquely positioned

in terms of the life, health, and accident and travel accident products to capture cross-border type opportunities. That’s where I see the niche.

We think that the emergence of other parts of the world and their interest in the United States will continue to feed this high net worth foreign national business. So we want to continue to do that. We had our best year ever in 2024. We’re off and running again in 2025.

Feldman: One of the products that you recently launched or are launching, your indexed UL, is exciting. Will that be available through normal distribution?

Suquet: Yes, that is available in the United States. We have it available in our high net worth foreign market as well. So it is available; it’s taking hold.

Feldman: Are annuities an area of growth that you see in the future?

Suquet: They really are not. I have found throughout my career that it’s almost as important to not do things as it is to focus and go in specific directions, and we just don’t have the scale. I’d rather devote the excess capital that we have on continuing to grow our life business, the stop-loss, the group business and then our international activities as well. So now, annuity is not in the cards and I doubt very much it will ever be.

Feldman: Is there anything that I didn’t ask that I should have?

Suquet: I believe leadership is not a position, but it’s an action and the actions that lead to a position. I’m blessed to have a leadership position, but it was built by the actions I’ve chosen throughout my career and continue to display.

You must walk the talk as a leader and have clear, articulated tactics and strategies that people know. People should not guess how you feel about things. They certainly don’t have to guess with me. I’m an open book. Good, bad or ugly, they know how I feel about issues; they know how I feel about current events. As a leader, in any dealings that you have with your clients, you must be transparent and you must be authentic.

Is the Medicare market settling down or stirring up?

Brokers await the annual enrollment period.

BY SUSAN RUPE

Amanda Brewton predicts rough seas ahead as the Medicare annual enrollment period approaches.

Brewton is president of Medicare Answers Now and is a frequent speaker and trainer at industry events.

“There will be market disruptions with plans no longer being available in some counties,” she said.

In addition, she predicted carriers will adjust their prescription formularies to account for changes brought about by the Inflation Reduction Act. Now that the IRA has been in effect for a year, carriers have a better understanding of what the act’s $2,100 annual out-of-pocket maximum for Medicare beneficiaries will mean.

Hospitals also will get into the game, she said. “There will be more hospitals playing ‘chicken’ in the media with carriers as they negotiate their network contracts, which will lead to fear that Medicare beneficiaries will possibly lose their doctors.”

Technology has its own role in stirring up disruption when it comes to people signing up for coverage. “Auto-dialers and AI bots sound cool but don’t necessarily give the best experience to the beneficiary,” she said.

As the U.S. population continues to age, Medicare enrollment increases every year. As of February, about 68.5 million Americans were enrolled in Medicare — an increase of more than 1.2 million over the previous year, the Centers for Medicare & Medicaid Services reports. About 1 in 5 Americans receives health care through Medicare.

Adding to the Medicare surge is the statistic that about 15% of Medicare beneficiaries change plans in a given year, the Commonwealth Fund reports.

All this adds up to a hectic season for Medicare advisors when the 7½ week annual enrollment period begins Oct. 15 and wraps up Dec. 7.

Will the upcoming enrollment period see stability in the Medicare market or will brokers need to navigate turbulent waters for their clients? It depends on who you ask.

Brewton told InsuranceNewsNet that concern over carriers is what’s keeping agents up at night. A growing list of carriers has stopped paying commission for Medicare Part D prescription drug plans and certain Medicare Advantage plans, meaning that agents do the work of enrolling clients in coverage but receive no payment from the carriers for their efforts.

“Many are worried about carriers and about the public seeing the value in the service and guidance that agents/brokers provide,” she said. “Many go above and way beyond just the initial sale of a plan, including help with obtaining services their plan covers, enrolling in Medicare, handling claims issues and so much more.”

Sam Melamed , CEO of NCD, a dental and health insurance company, and an expert in the Medicare space, also sees disruption ahead.

“I think the first thing brokers should expect for this annual enrollment period is continued meaningful disruption,” he told InsuranceNewsNet. “Last year, during open enrollment, we had carriers in midstream take their plans off of enrollment platforms or go commission-less to try to suppress some of the business that was coming in a surprising way, and it’s reasonable to expect more of that this year.

“Especially with some of the major carriers struggling, we’ll probably see a number of plans pulled out of a number of markets where they are unprofitable. So it’s important to get a sense of whether you’re in markets where the carriers are currently struggling or not, because if they are struggling in your market, you’ll see a lot of extra disruption.”

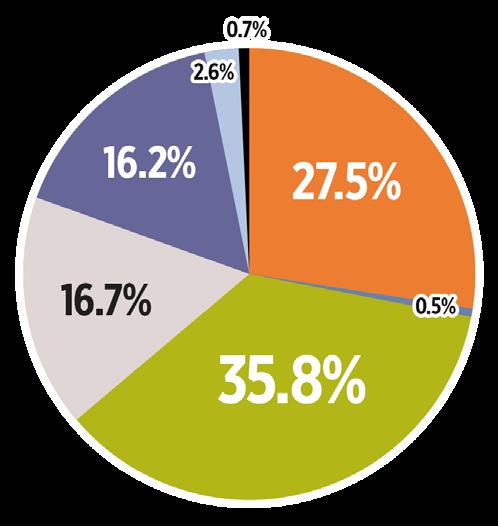

Enrollment in MA plans continues to increase, with 51.1% of Medicare beneficiaries choosing MA plans in 2025, up from 50.4% in 2024.

Melamed said he believes MA will hold on to its market share for next year but not expand as much as in prior years because of continued disruption in the MA space. One disruption he sees with MA is a pullback on dental, vision and

“There will be more hospitals playing ‘chicken’ in the media with carriers as they negotiate their network contracts, which will lead to fear that Medicare beneficiaries will possibly lose their doctors.”

— AMANDA BREWTON

As of February 2025

68.5M

Total Medicare enrollment 51.1%

Enrolled in MA & other health plans

90.1%

Age 65 and over

81.3%

With Medicare Part D coverage

In 2026, several key changes will impact Medicare beneficiaries, particularly regarding drug costs and plan features. The out-of-pocket maximum for prescription drugs in Part D will increase to $2,100. Additionally, Medicare Advantage plans will see a 5.06% increase in payments from 2025 to 2026, totaling over $25 billion.

Below is a more detailed breakdown.

Prescription Drug Costs:

The out-of-pocket maximum for Part D, which is the amount a beneficiary pays before the plan covers the full cost of their drugs, will increase to $2,100 in 2026. This is a $100 increase from the 2025 limit of $2,000.

Medicare Advantage Plan Payments:

CMS anticipates a 5.06% increase in MA plan payments for 2026, resulting in over $25 billion in additional funding for these plans.

Inflation Reduction Act Implementation:

The Inflation Reduction Act’s changes to Part D will continue to be implemented in 2026, including the elimination of cost-sharing for certain vaccines and the restriction of cost-sharing for a one-month supply of insulin.

Risk Adjustment Models:

CMS will update the risk adjustment models for both Part C (Medicare Advantage) and Part D to reflect changes in diagnosis codes and cost data from the latest years, ensuring accurate plan payments.

Other Changes:

Additional changes may include updaing the Medicare Plan Finder, enhancing the review of marketing and communication materials, and improving rules on MA plans’ use of internal coverage criteria.

over-the-counter drug benefits that make MA a popular choice with many enrollees. He also predicts a drop in the number of zero-premium MA plans.

“The utilization of these benefits has been very high these days, but at the same time, carriers are struggling,” he said. “So if you see continued pressure there, that will probably lead to even more market pullback. It’s possible we’ll start to see some shift away from $0 premium plans. It still may be too early for that, but carriers are talking about that as well.”

Brokers also are feeling the impact of instability and disruption in the Medicare market, Melamed said.

“The biggest concern I hear from brokers is that a complicated business gets more complicated every year. It sometimes feels like the walls are closing in on all sides. Every year, there are new regulations to comply with. Meanwhile, the carriers are skittish and pulling commissions from some plans. So it feels pretty unstable to be a broker in today’s market.”

Despite the negatives that Melamed described, he is optimistic about the role of a broker in helping people enroll in the right plan.

“I think it’s never been easier for retail brokers to demonstrate their expertise,” he said. “A lot of the larger national brokers are only able to work with a few carriers, but a local broker who really knows their local market can work with every carrier in their market. They know when you go to the doctor in your neighborhood, when you use the hospital system, and they have a fluency with the local health care landscape that really matters.

“Local retail brokers also understand the networks, the formularies and the intricacies of the benefits, so it’s easy for them to become that local trusted source of information and get a lot of referrals.”

Medicare plans. She also speaks at various industry events.

“In particular, the Biden administration had proposed broadening what they defined as marketing,” Fingold said. “Marketing has had kind of a two-part definition, where the item material — the marketing piece — would have to have the intent to promote and to attract the right enrollee. But it also needed to have a certain substantive component about benefits, premium and about the specifics of the plan to be considered marketing. The importance of this is, a marketing piece has a number of regulatory provisions that must be met, plus it must be submitted to CMS for approval.”

This process can be challenging for agents and brokers, she said.

“It’s a multistep process, and it can take an extended period of time,” she said. “This is significant because CMS doesn’t allow materials to be submitted for the following contract year before June 1, and then Oct. 1 is when marketing starts. So if you want to have something in place, you must have it processed in that time frame.”

The proposed rule would have broadened the types of materials that must go through the CMS approval process, she said.

“The two-part requirements were the intent and the content,” she said. “The Biden administration proposed limiting it to just the intent. So anything that intended to attract attention, to promote the plan, would have been included in this, and that was fairly broad.”

CMS also limited marketing of supplemental benefit amounts in MA plans, she said.

A proposed rule in the waning days of the Biden administration impacts the marketing of MA, said Helaine Fingold . She is an attorney with Epstein Baker Green in Baltimore. Fingold formerly worked at CMS and specializes in working with

“CMS seemed to be concerned that beneficiaries were making plan choices based on supplemental benefit offerings. Some plans have a bucketed proposal where you could get a certain dollar value toward a bucket of benefits. But the way it was, marketing was telling people they could get $500 on a benefit card and made it sound like it was about the money and not about the benefits. CMS was concerned that this was misleading.”

The Trump administration has not dismissed or moved forward on the Biden proposal, Fingold said.

“We’re waiting and seeing what the impact will be,” she said. “But my message is, don’t let down your compliance guard.”

A more optimistic view of annual enrollment came from Jerry Adair, Medicare broker sales manager with Health Care Service Corp. in Atlanta.

“I do believe brokers will have a little breath of fresh air when it comes to this year’s enrollment; they’ll have a little bit more of a normal AEP than what they’re used to,” he said.

Adair said he believes the Medicare market has calmed down since last year, with carriers having a chance to adapt their pricing to changes brought about by the IRA’s lowering of prescription drug costs to Medicare enrollees.

“Last year, there were big changes and the plans didn’t know how to react to them. They didn’t know how other plans would react to them, and nobody knew how it would affect their bottom line,” he said. “Carriers didn’t know how to make sure their plans would be profitable, and they also didn’t know how they would compare with their competition.”

Carriers continue to announce that they are not paying commissions on certain plans, “So it’s still crazy,” Adair said. “Some have told me that they think the enrollment period for 2026 will be just as bad as 2025, but I don’t think that will be the case.”

Adair gave some reasons why he believes the upcoming enrollment period will be easier for brokers.

“I believe carriers have a better idea of what their plans and their competitors will look like. When carriers do their planning to figure out how much membership they expect and how much they want, they will have a better idea on what their competition will be able to do now that we have one year of new rules under our belt and there isn’t anything crazy changing this year,” he said.

CMS is increasing funding for MA plans in 2026, with a final rate increase of 5.06%. This is a significant increase compared to the 2.23% increase proposed by the previous administration. The higher rate is estimated to result in an additional $25 billion in payments to MA plans in 2026. The higher payments are expected to provide more financial

stability for MA plans, particularly after two years of cuts and plan closures.

Adair said he believes the increased federal payment will result in stronger plans and a more stable marketplace.

But brokers remain concerned about carriers not paying commission on certain plans, he said. “I believe that’s more to do with the fact that these plans aren’t as profitable for the carriers. Especially on the prescription drug plans, there’s not a huge profit there.”

Consumer demand for MA will continue to grow, Adair predicted, especially as consumers with health conditions will get priced out of the Medicare Supplement market.

“I’m seeing brokers offering Medicare Advantage plans and pairing them with a hospital indemnity plan so that people can have the coverage they need without the rates going up,” he said.

Adair said he has seen more brokers leave the business in the past six months than he did in the past five years.

“This is not a good sign, because I believe strongly that the best way for someone to get the best plan for their needs is to work with a knowledgeable local broker. For brokers seeing the uncertainty of the market and a lot of them wanting to leave over the past few months, that is not a good sign.

“But I’m hopeful that this annual enrollment period will see a little bit more certainty and have brokers a little less uneasy than I’ve seen them in the past few months.”

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents’ association and was an award-winning newspaper reporter and editor. Contact her at srupe@ insurancenewsnet.com.

The health care landscape is ever-changing ... Don’t forget to read up on the latest at insurancenewsnet.com.

“When carriers do their planning to figure out how much membership they expect and how much they want, they will have a better idea on what their competition will be able to do now that we have one year of new rules under our belt and there isn’t anything crazy changing this year.”

— JERRY ADAIR

Innovation designed to deliver.

Diversification designed to perform.

Strategies designed to lead.

Discover how Allianz is reshaping the IUL marketplace and how you can benefit.

Proudly sponsored by

Visit our new “one-stop shop” for important information you need (and need to know) to help business owners plan for an ownership transfer of their business – and how life insurance can play a role in a smooth transition. And watch for more turnkey programs coming soon.

→ Scan the QR code, or visit → www.allianzlife.com/turnkey-programs (Secure site login required)

Actionable insights, innovative strategies, and exclusive tools to help you serve clients better and grow your business.

The indexed universal life (IUL) space is rapidly evolving—and Allianz is proud to be helping lead the way. As client expectations shift, economic conditions fluctuate, and the regulatory environment grows more complex, one thing is clear: innovation is essential. That’s why we created this IUL guide: to give you relevant insights, real-world strategies, and powerful tools to help you grow your business and better serve your clients.

At Allianz, innovation is about solving real challenges your clients are facing and building long-term value. That means developing innovative product features, leveraging proprietary platforms like our in-house affiliate’s hedging desk1 to help influence product design, and ensuring that every advancement works as hard for your clients as you do. From lockable index allocations to an interactive illustration experience, we offer tools designed to create long-term value. The value of these innovative features are in addition to the traditional benefit of life insurance, the financial protection of the death benefit.

This guide brings that innovation to life. Inside, you’ll find articles that explore:

• Diversifying within an IUL policy to help create more resilient, credible strategies—without sacrificing accumulation potential

information. It’s a resource you can put into action. Our goal is simple: to equip you with tools, insights, and solutions that deepen client trust and deliver long-

“From lockable index allocations to an interactive illustration experience, we offer tools designed to create long-term value.”

• Putting clients in greater control with features like Index Lock, designed to offer added flexibility in uncertain markets

• Leveraging the Life Advanced Markets turnkey program to engage small business owners in meaningful, action-oriented succession planning conversations using IUL

• Elevating your sales process with Ensight, an interactive digital platform that transforms complex IUL illustrations into simple, compelling client conversations

Whether you’re new to Allianz or a long-time partner, this guide is designed with your success in mind. It’s more than

term value no matter how the market shifts.

Thank you for your continued partnership and for the work you do to help your clients secure their futures. We’re honored to support you, and we’re excited about what we can achieve together as the IUL landscape continues to grow. •

Sincerely,

Jason Wellmann

Senior Vice President, Life Distribution Allianz Life Insurance Company of North America

1 Allianz Investment Management U.S. LLC (AIM US), a wholly-owned subsidiary of Allianz Life Insurance Company of North America, provides investment management and hedging services to the broader Allianz Group.

Indexed universal life insurance (IUL) provides a death benefit that is generally paid income tax-free to beneficiaries, as well as accumulation potential that can be used for various financial needs.

Indexed universal life insurance policies require qualification through health and financial underwriting.

Diversifying within a policy does not ensure that it will be credited with interest in any given year.

Because the index value locks at the end of the day, the value used to determine the index credit may be higher or lower than at the time of the request. Exercising an Index Lock may result in a credit higher or lower than if the Index Lock had not been exercised. We will not provide advice or notification regarding whether to exercise an Index Lock or the optimal time for doing so.

Guarantees are backed solely by the financial strength and claims-paying ability of Allianz Life Insurance Company of North America.

Products are issued by Allianz Life Insurance Company of North America, 5701 Golden Hills Drive, Minneapolis, MN 55416-1297.

This content does not apply in the state of New York.

Product and feature availability may vary by state and broker/dealer.

For financial professional use only – not for use with the public.

In an increasingly unpredictable market, the old playbook of chasing past performance just doesn’t cut it anymore. Indexed universal life insurance (IUL) has long been a powerful tool for both protection and accumulation potential, but it’s time we rethink how we use it. Allianz believes the future of IUL lies in diversification —and they’ve built their strategy around making that future accessible, understandable, and effective for both financial professionals and clients.

Diversification Isn’t Just a Buzzword—It’s a Long-Term Strategy Diversification in the context of IUL doesn’t refer only to spreading assets across different types of financial vehicles within a portfolio. It’s about strategically allocating across multiple allocation options and bonus opportunities—so clients aren’t betting on a single choice. That can be important in any market environment, where economic shifts can throw even the most carefully crafted index off course. “Diversification in IUL is about more than just spreading allocations,” says Corey Luke, AVP, Head of Life Advanced Markets. “It’s about creating a policy strategy that’s built to weather different market environments—not just thrive in the perfect scenario.”

You don’t have to sacrifice competitiveness to diversify.

One of the key challenges in the industry has been that diversified strategies are a good talking point but they don’t always illustrate well. Many carriers struggle to promote diversified approaches if

Allianz also pioneered one of the most innovative product features in the IUL space: lockable indexes. Clients can manually lock in an index value (once during a policy year) or set automatic triggers that can potentially if an index value reaches a predefined threshold. It’s about giving clients more control without needing them to become market experts. “A client might see a 12% index

“Diversification can take the pressure off being ‘right’ about market direction. It’s about being prepared, not predictive. And that changes the whole conversation.”

Allianz IUL products offer up to 16 allocation options—built from five indexes, three bonus structures, non-bonus options, multiple crediting methods, and a fixed account—allowing financial professionals to tailor strategies to fit each client’s comfort level with risk and long-term goals. Luke explains, “Financial professionals have the flexibility to build truly customized strategies that align with each client’s goals and risk tolerance.” Whether someone leans aggressive or conservative, the tools are there to construct a thoughtful, balanced approach. And the best part?

they lead to less competitive illustrated scenarios. Illustrated rates are set by a complex set of regulations taking into account product design, historical lookback information, and bonus availability. Due to inefficient design or a lack of options, it’s not uncommon for competitor IULs to have only one index bonus combination that illustrates best.

Allianz takes a different approach “We focus on a combination of customer value and choice when designing our products,” says Luke. “We’ve been driving index innovation for years and have many options with established historical data. Our diversified strategies maintain competitiveness so financial professionals don’t have to choose between showing a strong illustration and doing what may be appropriate for the client long-term.” It’s a major win for credibility and for clients who want a smoother experience, not a rollercoaster.

value gain mid-year and wonder if they should hold or lock in,” Luke explained. “With lockable options, they don’t have to guess. They can act or set rules that act for them. It’s powerful, and it brings a sense of control and reassurance.”

Of course, a strategy only works if it’s easy to understand. That’s where our partnership with Ensight, Allianz’s next-generation illustration system experience, comes in.

Ensight simplifies complex illustrations by making them visual, interactive, and intuitive. Financial professionals can show clients exactly how their policy is diversified, walk through “what-if” scenarios, and tailor recommendations based on risk profiles—without overwhelming them with charts and jargon. “Clients don’t want spreadsheets. They want clarity. Ensight lets us give them that.” shared Luke.

For financial professionals, it can mean fewer hours spent explaining why one index didn’t perform as expected. For

“Allianz IUL products offer up to 16 allocation options—built from five indexes, three bonus structures, non-bonus options, multiple crediting methods, and a fixed account— allowing financial professionals to tailor strategies to fit each client’s comfort level with risk and long-term goals.”

clients, it can mean reassurance. They can see for themselves that their policy is designed to absorb change, not react to it.

When clients understand their policy and aren’t second-guessing potential results, it can build trust. Financial professionals aren’t stuck in the cycle of defending index choices year after year and are able to start focusing on what matters: helping clients stay on track.

Diversification can relieve the pressure of being “right” about market direction. It can turn a volatile experience

into a smoother ride. Consistency—and results—over the longer term may be more important to the client than a single year of outsized performance.

Allianz was one of the first carriers to launch volatility-controlled indexes in IUL back in 2014. They have remained committed to innovation ever since—from developing lockable indexes to pushing the conversation around diversification forward.

“Allianz is not just innovating to stand out,” Luke says. “We’re innovating to push

the industry forward. Our goal is to help financial professionals deliver better outcomes and build deeper trust with their clients.” That’s why Allianz is out in the field, presenting, training, and partnering with FMOs and financial professionals to make these ideas actionable.

The future of IUL isn’t just about chasing performance. It’s about building resilient products designed to stand the test of time and seek to deliver results in any market. Allianz hopes other carriers will follow their lead in telling the diversification story and find a way to make diversification part of their product strategy. •

Diversifying within a policy does not ensure that it will be credited with interest in any given year. Bonused products may include higher surrender charges, longer surrender periods, lower rates, or other restrictions that are not included in similar products that don’t offer a bonus.

Although an external market index may affect your interest credited, your policy does not directly participate in any stock or equity or bond investments. You are not buying shares in any stock or index.

Exercising an Index Lock may result in a credit higher or lower than if the Index Lock had not been exercised. Guarantees are backed solely by the financial strength and claims-paying ability of Allianz Life Insurance Company of North America. Products are issued by Allianz Life Insurance Company of North America, 5701 Golden Hills Drive, Minneapolis, MN 55416-1297.

This content does not apply in the state of New York.

Product and feature availability may vary by state and broker/dealer. For financial professional use only – not for use with the public.

As financial products grow more complex and customer expectations rapidly evolve, innovation must be more than a slogan—it’s a necessity. For Allianz Life Insurance Company of North America (Allianz), innovation means building sustainable value, designing for real-world needs, and staying focused on the long-term benefit of policyholders.

“Allianz is often first to market with new ideas,” says Jakob Erickson, product actuary at Allianz. “But what really sets us apart is our commitment to innovation that’s backed by strong pricing discipline and thoughtful execution. We don’t just launch something because we can. We do it when we believe it will provide value over the long term.”

This deliberate approach has helped Allianz earn and maintain its position as a leading provider of indexed universal life (IUL) insurance in the U.S. for the past five years.1 It’s a leadership role built on innovation, integrity, and a time-tested ability to deliver value.

The Power of a Proprietary Platform

What truly differentiates Allianz in the IUL space is its use of a dynamic hedging platform through an in-house affiliate. While most carriers rely on third-party investment banks to manage their risk exposure, Allianz took a bold step in 2006 to build a dedicated hedging team in Allianz Investment Management U.S. LLC (AIM US), a wholly owned subsidiary of Allianz. The move has been instrumental in Allianz’s ability to innovate quickly and cost-effectively.

“Our use of the AIM US dynamic inhouse hedging platform allows us to execute what I call ‘instant innovation,” Erickson explains. “There’s no friction from working with external banks, no minimums, and no extra fees. That means we can experiment, iterate, and bring new ideas to market with speed.”

That agility has allowed Allianz to develop industry-first features like Index Lock , which enables customers the opportunity to lock in an index value one time per policy year. Offered at no additional cost, this feature has delivered real results: policyholders have locked in more than $100 million in gains, with an average locked interest credit of 9.8%.1

Allianz has a long history of being first to market with game-changing features. It introduced volatility-controlled indexes to the IUL space as early as 2014—years before the broader industry began to follow suit. The company also pioneered crediting methods like monthly sum in 2005 and has continued evolving with newer methods like the Blended Index Strategy in 2008 and the Trigger Method in 2013.

comes the potential for larger swings.”

Allianz also takes a quality-over-quantity approach. Instead of overwhelming clients with dozens of options, the company offers a curated lineup of indexes, each rigorously tested and aligned with longterm policyholder needs.

“It’s not about offering the most options. It’s about offering the right ones,” Erickson adds. “Our lineup offers our customers the potential to earn credits regardless of the environment, whether that’s through a competitive fixed rate, an uncapped equity index or something in between. ”

While technological innovation is a major driver, it’s customer value that ultimately guides Allianz’s product development. “My role is to take what’s technically possible and translate that into something that creates value for customers,” says Erickson. “We always ask, ‘How can this

• Top 5 IUL and FIA carrier over the past 5 years1

• 1st to Market with volatility-controlled indexes

• Index Lock feature has enabled over $100M in locked gains with average credit of 9.8%2

• Since 2006, average index credit: 6.4% vs. fixed account: 3.75%3

• 4 lockable indexes available—currently more than any other IUL competitor...

Today, the company offers four lockable indexes, further empowering customers to take a level of control of their IUL policy results and giving financial professionals new tools to tailor strategies.

“Each of our index offerings is designed with a different return profile in mind,” Erickson notes. “Some use elements like volatility control to produce more predictable returns. Others have more exposure to the equity markets and with that

help someone achieve financial goals?’”

This philosophy shows up in multiple ways. Allianz’s IUL products allow policyholders to access available cash value through policy loans and withdrawals and allocate loans across different index allocations, tailoring their strategy during the accumulation or income phase of their contracts. Guaranteed bonuses, guaranteed loan rates, transparency in product design, and

client-friendly illustrations further reinforce Allianz’s customer-first philosophy.

“Flexibility, transparency, and guarantees in the right places—that’s what sets us apart,” says Erickson. “We’ve been guaranteeing our loan rate on our IUL products for over a decade. That stability can give customers a sense of reassurance.”

It’s also evident in the company’s investment in support tools, like Ensight , a digital illustration experience that helps financial professional visually communicate hypothetical results and potential outcomes.

“When financial professionals can show the potential value visually, it can help clients make more informed decisions—and strengthen that trust,” Erickson says.

Resilience in a Volatile World Innovation alone isn’t enough—it must be sustainable and resilient. Allianz’s approach to risk management is built on a solid foundation of actuarial soundness and financial strength. The insurance carrier’s conservative investment philosophy ensures that product promises are backed by strong reserves and a stable bond portfolio.

But it’s on the hedging side where things get exciting. The AIM US dynamic hedging team has weathered multiple market downturns, including the 2008 financial crisis and more recent volatility. While some competitors were forced to halt sales or reprice their indexed products during market disruptions, Allianz’s internally managed hedges continued to perform as designed.

Allianz doesn’t just react to industry trends. It anticipates them. The company has been at the forefront of product evolution, from volatility-controlled indexes introduced in 2014 to the more recent expansion of lockable index features.

Allianz is also deeply involved in shaping regulatory discussions, with internal teams that actively adapt to changes without compromising value or compliance. “I’ve personally worked through five major regulatory updates,” Erickson says. “No matter the environment, we’ve always found a way to deliver value. That’s the power of being engaged and agile.”

Innovation at Allianz also stems from cross-functional collaboration, pulling ideas from product teams, the hedging team, financial professionals, and beyond. “Sometimes the best ideas come from a single conversation,” Erickson notes. “Index Lock came from a discussion about a new index. Someone from the hedging team said, ‘We can let customers lock this in for free.’ That became one of our most powerful features.”

Ultimately, all this innovation is paying off for customers. Since 2006, policies using Allianz’s indexed strategies have averaged a 6.4% crediting rate, compared to 3.75% in fixed accounts.2 That 2.65% outperformance, year over year, can have a profound impact on long-term wealth accumulation.

Even if future index returns produce more conservative results, the added value can still be significant. “Even if we temper expectations and say 1.5% may be more realistic long-term, that’s still real,

consistent added value for the customer,” Erickson says.

With more than 20 years of leadership in indexed products, Allianz continues to push the boundaries of what’s possible. The company continues to evolve with the needs of clients and financial professionals, leveraging internal knowledge , advanced technology, and a deeply held commitment to innovation with integrity.

“We take pride in launching products that are built to last,” Erickson says. “We want clients to be satisfied not just in year one, but in year ten, year twenty, and beyond.” For financial professionals and their clients, that can mean reassurance, knowing that the strategies they choose are backed by strength, stability, and a company built for the long haul.

“We’re proud of what we’ve built,” says Erickson. “And we’re just getting started.” •

1 Q1 2020-Q4 2024 U S Retail Individual Life Insurance Sales BY CHANNEL with All Splits, based on annualized with excess premium, LIMRA.

2 Results based on 30,114 unique locks from 11/29/2019 – 12/31/2024. Potential interest will vary. Past results are not a guarantee of future results.

3 The average interest credited shows IUL insurance policy crediting history of Allianz® IUL policies from 3/1/2006 through 12/31/2024 and do not include policy fee and charges. We chose this time frame to ensure that we present the most complete 12-month data available for this study. Credits are based on actual caps, participation rates, and interest rates that have been applied to inforce policies. Products included in analysis include all IUL products sold since 2006. All products have not been available during the entire duration of the example shown.

Policy loans and withdrawals will reduce the available cash value and death benefit and may cause the policy to lapse, or affect guarantees against lapse. Withdrawals in excess of premiums paid will be subject to ordinary income tax. Additional premium payments may be required to keep the policy in force. In the event of a lapse, outstanding policy loans in excess of unrecovered cost basis will be subject to ordinary income tax. If a policy is a modified endowment contract (MEC), policy loans and withdrawals will be taxable as ordinary income to the extent there are earnings in the policy. If any of these features are exercised prior to age 59½ on a MEC, a 10% federal additional tax may be imposed. Tax laws are subject to change and you should consult a tax professional.

Bonused products may include higher surrender charges, longer surrender periods, lower rates, or other restrictions that are not included in similar products that don’t offer a bonus.

Although an external market index may affect your interest credited, your policy does not directly participate in any stock or equity or bond investments. You are not buying shares in any stock or index.

Because the index value locks at the end of the day, the value used to determine your index credit may be higher or lower than at the time of the request. Exercising an Index Lock may result in a credit higher or lower than if the Index Lock had not been exercised. We will not provide advice or notification regarding whether to exercise an Index Lock or the optimal time for doing so.

Allianz Investment Management U.S. LLC provides investment management and hedging services to the broader Allianz Group.

Guarantees are backed solely by the financial strength and claims-paying ability of Allianz Life Insurance Company of North America.

Products are issued by Allianz Life Insurance Company of North America, 5701 Golden Hills Drive, Minneapolis, MN 55416-1297.

This content does not apply in the state of New York.

Product and feature availability may vary by state and broker/dealer.

For financial professional use only – not for use with the public.

Allianz Life Insurance Company of North America leads the way with Index Lock, an industry-first indexed universal life (IUL) insurance feature that empowers clients to lock in an index value, once anytime during the crediting period — as long as the index change is positive. It’s smart, simple, and offered at no additional cost. Thousands of clients are locking in gains. Are yours?

$100+ Million Locked-In Gains

Clients are actively protecting their accumulation.

4 lockable indexes available Currently more than any other IUL competitor.

→ How it Works

• Lock manually during favorable conditions

• Set automatic triggers based on predefined targets

With Index Lock, your clients don’t need to time the market. They can have a level of control . 9.8% Average Locked Interest Rate Real results. Real returns.

30,114 Unique Locks Set That’s 30,114 moments of reassurance.

• Potentially capture gains and protect from market downturns —no guesswork required

Results based on 30,114 unique locks from 11/29/2019 – 12/31/2024. Potential interest will vary. Past results are not a guarantee of future results. Guarantees are backed solely by the financial strength and claims-paying ability of Allianz Life Insurance Company of North America. Product and feature availability may vary by state and broker/dealer. This notice does not apply in the state of New York.

Products are issued by Allianz Life Insurance Company of North America, 5701 Golden Hills Drive, Minneapolis, MN 55416-1297. For financial professional use only – not for use with the public.

For financial professionals working with business owners, navigating the intricacies of succession planning can be daunting. That’s why Allianz Life Insurance Company of North America (Allianz) has launched the Life Advanced Markets turnkey program—a powerful and creative solution that helps financial professionals initiate and elevate business succession planning conversations with small business clients.

With a robust library of tools, sample legal documents, and integrated life insurance funding strategies like indexed universal life (IUL) insurance, this program helps position Allianz-appointed financial professionals as valuable partners in clients’ long-term business succession planning.

“The turnkey program is a set of tools and resources designed to equip financial professionals, their clients, and even clients’ professional advisors, like attorneys and CPAs, to create and maintain a plan for successful business succession, exit, and transition,” says Robert Richert, Advanced Markets Senior Director at Allianz.

Richert’s inspiration for the program stems from his years of experience as a practicing attorney, formerly in private law practice, and later as a life insurance agent and wealth strategist in the upper Midwest.

Working with small business owners, farmers, and ranchers in rural communities, he noticed that while business owners wanted to plan for succession, their local legal counsel often lacked deep expertise in the field and in some cases the resources necessary to get started creating an effective succession plan.

“These attorneys were jacks-of-alltrades,” says Richert. “They might be handling a divorce case one day, a DUI defense the next, and didn’t always have the technical knowledge to create or finalize a plan or keep a business succession plan moving forward.”

The Allianz turnkey program was built to fill that gap—providing high-quality, attorney-authored documents that attorneys can easily tailor to fit their client’s specific needs and pairing those tools with proven life insurance solutions like IUL.

While the program does not offer legal or tax advice, it offers an extensive framework to help business owners and their team of professionals build momentum in succession planning. Financial professionals can lean on this support to confidently guide clients through initial planning conversations— while highlighting the strategic benefits of leveraging IUL insurance policies for funding buy-sell agreements or key person coverage.

The program is geared toward Allianz-appointed life insurance agents and their small business clients. Richert defines a small business as typically having less than 100 employees and being closely held, commonly structured as either a sole proprietorship, partnership, LLC, or S Corp.

Whether the business has never created a succession plan (but recognizes the need to do so) or needs to revisit an outdated plan, the program offers a clear on-ramp to meaningful succession planning—backed by a flexible funding

strategy using life insurance. IUL is often an effective option due to its flexibility and its ability to provide death benefit protection along with potential for cash value accumulation that can be accessed for retirement or business needs.1

At the core of the program are practical, ready-to-use tools:

• Specimen documents: Including hybrid (“wait and see”) buy-sell agreements, promissory notes, spousal consents, corporate resolutions, and split-dollar agreements.

• Funding comparison grids: To evaluate cash, installment sales, life insurance, and disability insurance as funding options—highlighting the strengths of IUL for long-term business continuity planning.

• Valuation method charts: Comparing common valuation methods such as stated value, book value, appraised value, and more.