That was then ; this is now

Aggressive recommendations previously made on indexed universal life were likely to cause disappointment. Where do IUL illustrations stand today?

PAGE 14

A man on a mission: with Foresters’ Matt Berman PAGE 8

RILAs: Supporting client goals in retirement

PAGE 30

Empowering new hires in the digital transition

PAGE 42

THIS ISSUE: INDEXED PRODUCTS Life Insurance • Health/Benefits Annuities • Financial Services MAY 2024

Exclusiveinsightsforsecuring yourclients’financialfuture whilegrowingyour businessonPAGE6 Itemized and standard deductions Estate and gift tax exemption Income tax rates Alternative minimum tax Life Insurance • Health/Benefits Annuities • Financial Services MAY 2024

Securing clients’ financial future

How can you equip your clients to survive impending tax changes unscathed?

Delaware Life provides critical insights and strategies to secure your clients’ financial future and grow your business on PAGE 6.

Protect your clients by:

• Leveraging the powerful benefits of tax deferral and nonqualified deferred annuities.

• Seizing the opportunities presented by a few positive changes.

• Anticipating the end of the Tax Cuts and Jobs Act provisions.

• Tackling potential tax changes with expert tips.

Find guidance for navigating Tax Armageddon on PAGE 6.

Then visit https://links.delawarelife.com/INNTLS to see how fixed index annuities can offer a critical advantage against potential tax changes, so your clients come out on top.

PLUS 7 & 10 ANICO Strategy Indexed Annuity PLUS 7 & 10 Financial Growth: Strategies tied to key indices with flexible premium options. Future Security: Lifetime income rider with fixed rate options. Fund Protection: Shielded from market falls with 0% floor, accumulation is tax-deferred. Visit lad.americannational.com for more information or to run a quote.

THE CORPORATIONS MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO THE PRODUCT(S). American National and its agents do not guarantee the performance of any indexed strategies. The Declared Rate Strategy earns interest at an interest rate we declare at the beginning of each Contract Year and is guaranteed for one year. When a person buys this annuity the person is not buying an ownership interest in any stock or index. Indexed strategies earn interest related to the performance of an Index. Whether an indexed strategy earns interest or not and how much interest is earned is dependent on a number of factors: index performance, participation rate, cap and segment term. The performance of the index cannot be predicted over any given period of time. Past history of the Index is no guarantee of future performance. There is not one particular interest crediting strategy that will deliver the most interest under all economic conditions. All Segment Terms are not available in all states. Availability of strategies and Segment Terms subject to change monthly. Form Series FPIA19; LIR19 (Forms may vary by state; Idaho forms ICC19 Form FPIA19, ICC19 Form LIR19). See the contract form for complete details. Neither American National Insurance Company nor its agents offer tax or legal advice. Clients should consult their tax and legal advisors. American National Insurance Company, Galveston, Texas. For Agent Use Only; Not for Distribution or Use with Consumers.

05.2024

Retirement, protected. LAD10120-INN

any federal government agency | No bank/CU guarantee | May lose value AMERICAN NATIONAL INSURANCE COMPANY / 888-501-4043 / lad.americannational.com

Not FDIC/NCUA insured | Not a deposit | Not insured by

ASIA

The Virtual Advisor: How to Use Digital Tools to Better Serve Your Clients

Colleen Bell, President, Innovation and Experience, Cambridge Investment Research, Inc.

In a world where everyone lives on their digital devices, offering virtual services has become not only the norm but an expectation, even in traditionally high-touch industries like financial services. However, executing digital incorporation in our industry requires balancing the client convenience of virtual interactions without losing the personal touch clients expect. The key to striking an equilibrium is making sure the client experience ultimately comes first, with a secondary goal of using the right digital tools to make the relationship more efficient for both the client and advisor.

A Client-First Experience with Virtual Meetings

With lives that are busier and more demanding than ever before, convenience is paramount to a successful client relationship. We have seen virtual meetings work for schools, businesses, and services of all kinds, and incorporating the option to have virtual meetings is a key feature of a client-first approach. This digital option eliminates the need for clients to take time out of their day to travel, while still providing a face-to-face experience. Of course, there will still be clients who prefer on-site meetings, and you should explore each client’s preferences to ensure they will work with your business model.

This digital integration can also help immensely with client retention and business growth. If a client needs to relocate, advisors can continue to provide services by hosting meetings virtually. In addition, advisors are no longer limited by location when it comes to taking on new business. This can be especially beneficial in the case of succession planning, allowing advisors to seamlessly transition regardless of where a successor resides.

Thoughtful Integration of Artificial Intelligence

The goal of integrating digital tools is to provide a better client experience at a lower cost and personnel output. While technology is normally associated with a less personal experience, there are ways to integrate it to make customer relationships even more personal. By using AI to carry out back-office tasks, financial professionals can create more time to actually serve their clients. One great example of this is AI’s ability to assist with routine customer interactions, like scheduling and administrative questions. If used correctly, AI can improve the overall client experience by responding almost immediately to inquiries and effectively reduce a financial professional’s overhead. This creates more time to spend advising clients, building relationships, and providing a white-glove experience.

In addition to giving time back to advisors, AI tools can also facilitate a deeper dive into a client’s history and current needs, helping advisors be more proactive with future plans. New AI tools can help financial professionals better anticipate the needs of clients, and provide more thorough, personalized planning services.

Peace of Mind with Cybersecurity

Trust is a significant facet of the advisor/client relationship. Financial professionals are not only entrusted with managing their clients’ money and providing financial advice, but they are also tasked with safeguarding a great deal of the client’s personal information from malicious actors. In our increasingly virtual world, investments in cybersecurity technology are a necessity, and should be viewed as a direct investment into the relationships financial professionals have with their clients. This inherently client-focused

investment reflects an advisor’s commitment to serving their clients effectively, safely, and securely. Financial professionals can also differentiate their services by providing cybersecurity training and guidance to their clients to protect them from fraud.

Digital Integration

The focus of digital integration should be to drive associate engagement and financial professional satisfaction while discovering new ways to meet the needs of clients. At Cambridge, we use digital integration to support the personalization required by our diverse community of financial professionals. This emphasis on flexibility is core to our service story, and we are actively making investments to leverage new technology in all aspects of what we do and the services we offer.

Cambridge does not force a “fixed” technology stack onto our advisor firms; instead, we support the flexibility needed to allow them to control their own business models and serve their clients according to their own strengths and style of operation. We have made choices to leverage and curate a technology stack that allows us to offer a customized experience on both the firm and individual level. Digital integration is an always-evolving process, but we are rolling out solutions today that will advance the businesses of financial advisors for years to come.

Find more insights to help grow your business, visit https://www. joincambridge.com/insights.

Member FINRA/SIPC

INTERVIEW

8 A man on a mission

Foresters Financial is on a mission to enrich the lives of middle-market families. Matt Berman, Foresters CEO, discusses the fraternal organization’s history and looks into its future.

FEATURE

IUL illustrations: That was then; this is now

By Richard M. Weber

A look at where indexed universal life illustrations stand today.

IN THE FIELD

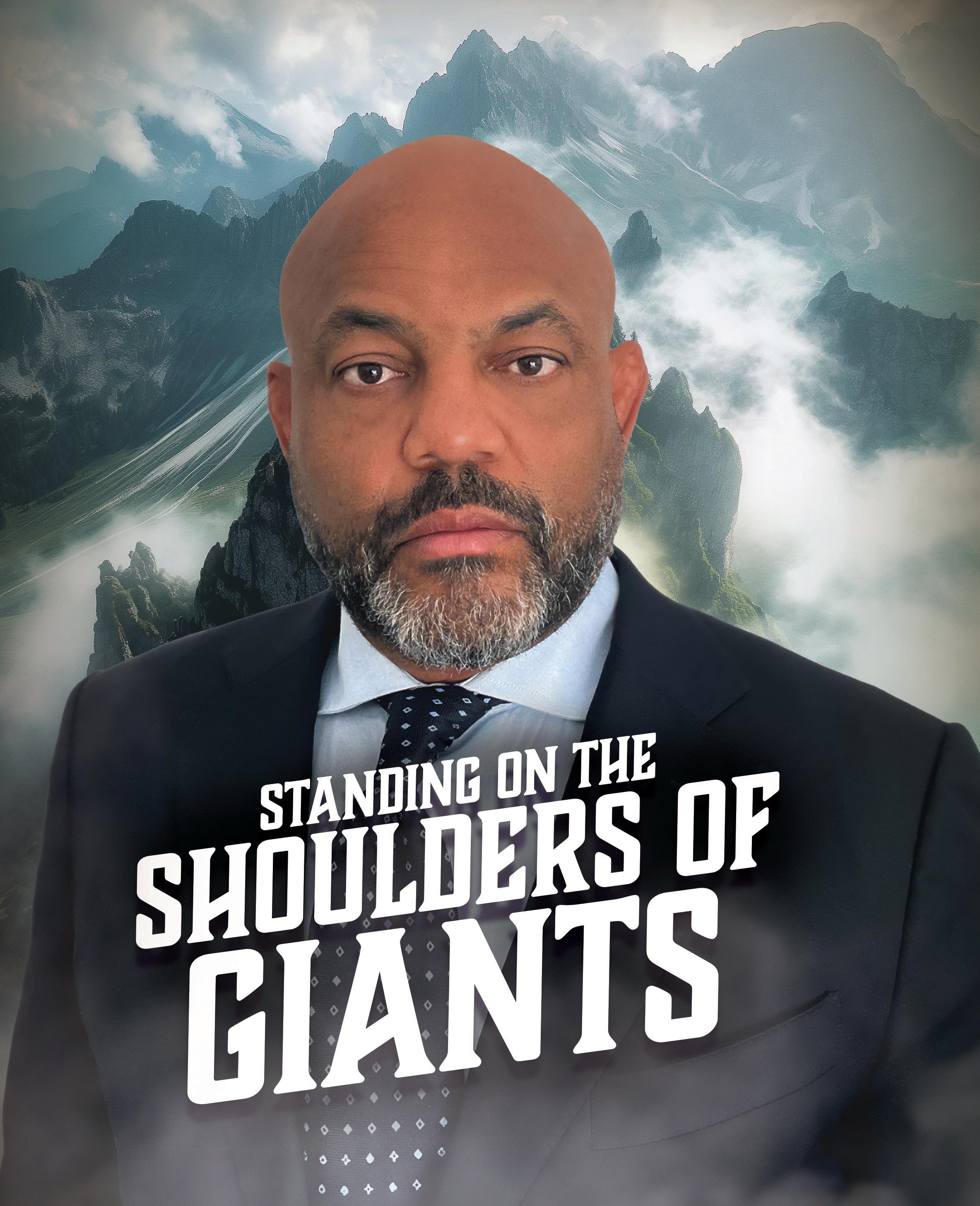

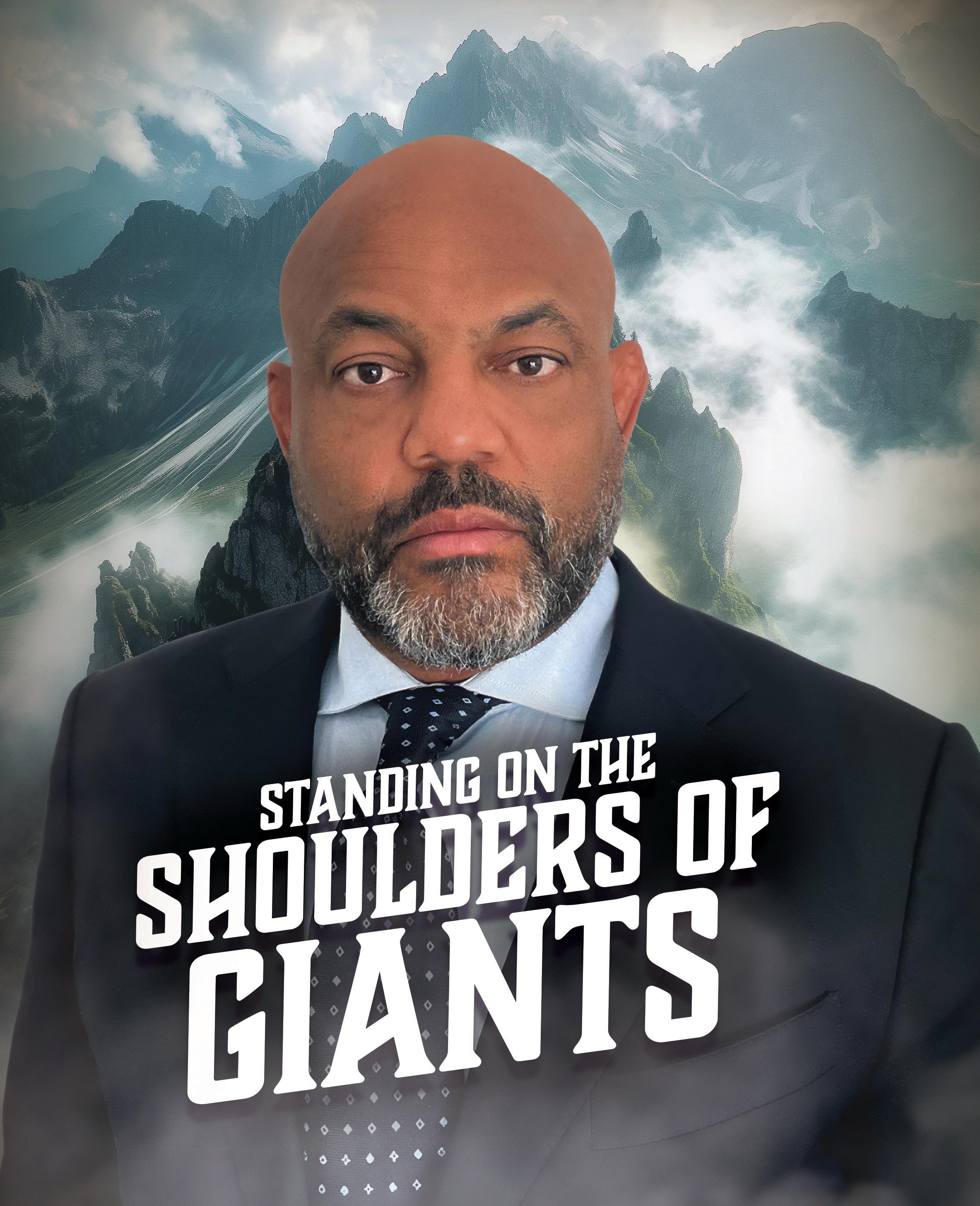

20 Standing on the shoulders of giants

By Rayne Morgan

Bryan Simms is at the forefront of an effort to revive one of the nation’s oldest Blackowned carriers.

LIFE

34 Navigating the changing benefits landscape

By Heather Deichler

Many workers are confused about their benefits beyond traditional medical plans. ADVISORNEWS

38 Saving for college can impact your clients’ retirement

By Carol Bogosian

26 The importance of life insurance in long-term care planning

By Milorad Markovic

Hybrid life insurance is one alternative to pay for long-term care.

ANNUITY

30 RILAs: Supporting client goals in retirement

By Susan Rupe

Structured annuities with income benefits increase the likelihood of retirees having assets left at age 100.

An advisor can help clients achieve these two competing financial goals. BUSINESS

40 8 critical steps to drive sales

By Casey Cunningham

The words that transform salespeople into sales powerhouses.

IN THE KNOW

42 Navigating the digital transition: Empowering new hires

By Ken Leibow

Rapidly evolving technology poses a special challenge when onboarding new employees.

2 InsuranceNewsNet Magazine » May 2024

InsuranceNewsNet.com/topics/magazine View and share the articles from this month’s issue

online » read it

IN THIS ISSUE

MAY 2024 » VOLUME 17, NUMBER 05 INSURANCE & FINANCIAL MEDIA NETWORK 150 Corporate Center Drive • Suite 200 • Camp Hill, PA 17011 717.441.9357 www.InsuranceNewsNet.com PUBLISHER Paul Feldman EDITOR-IN-CHIEF John Forcucci MANAGING EDITOR Susan Rupe SENIOR EDITOR John Hilton CREATIVE DIRECTOR Jacob Haas SENIOR CONTENT STRATEGIST Lori Fogle EMAIL & DIGITAL MARKETING SPECIALIST Megan Kofmehl TRAFFIC COORDINATOR Sorayah Talarek MEDIA OPERATIONS DIRECTOR Ashley McHugh NATIONAL ACCOUNT DIRECTOR Brian Henderson NATIONAL ACCOUNT DIRECTOR Tobi Schneier DATABASE ADMINISTRATOR Sapana Shah STAFF ACCOUNTANT Katie Turner Copyright 2024 Insurance & Financial Media Network. All rights reserved. Reproduction or use without permission of editorial or graphic content in any manner is strictly prohibited. How to Reach Us: You may e-mail editor@insurancenewsnet.com, send your letter to 150 Corporate Center Drive, Suite 200, Camp Hill, PA 17011, fax 866.381.8630 or call 717.441.9357. Reprints: Copyright permission can be obtained through InsuranceNewsNet at 717.441.9357, Ext. 125, or reprints@insurancenewsnet.com. Editorial Inquiries: You may e-mail editor@insurancenewsnet.com or call 717.441.9357, ext. 117. Advertising Inquiries: To access InsuranceNewsNet Magazine’s online media kit, go to www.innmediakit.comor call 717.441.9357, Ext. 125, for a sales representative. Postmaster: Send address changes to InsuranceNewsNet Magazine, 150 Corporate Center Drive, Suite 200, Camp Hill, PA 17011. Please allow four weeks for completion of changes. Legal Disclaimer: This publication contains general financial information. It should not be relied upon as a substitute for professional financial or legal advice. We make every effort to offer accurate information, but errors may occur due to the nature of the subject matter and our interpretation of any laws and regulations involved. We provide this information as is, without warranties of any kind, either express or implied. InsuranceNewsNet shall not be liable regardless of the cause or duration for any errors, inaccuracies, omissions or other defects in, or untimeliness or inauthenticity of, the information published herein. Address Corrections: Update your address at insurancenewsnetmagazine.com

HEALTH/BENEFITS

INSURANCE & FINANCIAL MEDIA NE TWORK 8 14

Allianz Life Insurance Company of North America Product and feature availability may vary by state and broker/dealer. This content does not apply in the state of New York. Allianz Life Insurance Company of North America does not provide financial planning services. Guarantees are backed by the financial strength and claims-paying ability of Allianz Life Insurance Company of North America. For financial professional use only – not for use with the public. M-8094-A (4/2024) Illustrations with Impact , powered by Ensight , TM available from us WATCH THE VIDEO → Scan the QR code, or visit → www.allianzlife.com/Ensight Customized, interactive policy proposals –quick with a click Instantly create

policy

and

explains

the benefits of Allianz Life Pro+® Advantage Fixed Index Universal Life Insurance Policy.

customized proposals –with interactive charts that use actual

values,

content that

all

Navigating the complex terrain of IUL illustrations

In the labyrinthian world of personal finance and insurance, indexed universal life insurance stands out as a particularly intricate product. Known for their flexibility and potential for cash value growth linked to stock market indices, IUL policies have gained popularity as a multifaceted financial tool. However, these policies are often accompanied by the potential for misunderstanding, particularly regarding the illustrations commonly used to explain their benefits

IUL policies offer a unique blend of life insurance coverage and investment potential, with the cash value of the policy tied to the performance of a stock market index, such as the S&P 500. Unlike traditional whole life policies, IUL policies provide the opportunity for higher returns due to this market linkage, while also offering a degree of protection against market downturns through a guaranteed minimum interest rate. This dual promise of security and growth is what attracts many individuals to IUL insurance.

Overly optimistic illustrations

The heart of the issue lies in the illustrations used to depict the potential growth of an IUL policy’s cash value. These illustrations often project future values based on historical market performance or assumed

interest rates. However, the inherent volatility of the stock market means that past performance is not a reliable indicator of future results. Illustrations that show an uninterrupted upward trajectory can give a false sense of security and lead to overly optimistic expectations.

Also, these illustrations may not adequately account for the impact of fees, which can significantly erode the policy’s cash value over time. The cost of insurance, administrative fees and potential charges for additional riders can diminish the returns depicted by illustrations. When these costs are not transparently conveyed, policyholders may be caught off guard by the lower-than-expected growth of their cash value.

The responsibility of insurance agents

Agents bear the responsibility of ensuring that clients fully understand the complexities and risks associated with IUL policies. This includes providing a balanced view of the potential returns, highlighting the uncertainties of market-linked growth, and clearly explaining the impact of fees and charges.

It’s crucial to resist the temptation to use overly optimistic illustrations as a sales tool. Instead, agents should present a range of scenarios, including worst-case

projections, to give clients a more comprehensive understanding of the potential outcomes. This approach promotes informed decision-making and sets realistic expectations, reducing the likelihood of future dissatisfaction.

Navigating the way forward

To best serve individuals considering an IUL policy, it is essential that agents and advisors approach these products with a critical eye. Prospective policyholders should:

Provide clarity: Provide detailed explanations of the illustrations and the assumptions behind them.

Deliver a solid understanding of fees: Provide a breakdown of all charges associated with the policy and their impact on potential returns.

Consider the long term: Explain that IUL policies are complex financial instruments best suited for long-term financial planning.

For insurance agents, the path forward involves a commitment to transparency and education. By providing clients with a balanced and clear explanation of IUL policies, agents can build trust and ensure that their clients are making informed decisions based on realistic expectations.

IUL policies offer a powerful combination of life insurance protection and investment potential. However, the illustrations commonly used to explain their benefits must be approached with caution. Insurance agents have an important role to play in ensuring that these illustrations do not lead to overstated expectations. By providing transparency and promoting informed decision-making, agents ensure the true potential of IUL policies can be realized without falling into the trap of overpromising.

John Forcucci Editor-in-chief

4 InsuranceNewsNet Magazine » May 2024 WELCOME LETTER FROM THE EDITOR

$1.6T in US home value uninsured

One in 13 American homeowners does not have home insurance coverage, the equivalent of $1.6 trillion in uninsured home value, according to a new report by the Consumer Federation of America.

The top 5 states with the highest percentages of uninsured homeowners

1

2

4

5

Source: Consumer Federation of America

The most likely homeowners to go uninsured were Hispanic and African American households, seniors, lower income-earners, and those living in Miami and Houston — two cities extremely vulnerable to climate change.

CFA’s top finding is that in 2021, 6.1 million homeowners lacked homeowners insurance coverage. That’s equivalent to 7.4% of homeowners, or one in 13 homeowners across the United States.

Of the $1.6 trillion in home value that is without coverage, $339 billion is owned by Hispanic households and $206 billion is owned by Black households. Additionally, homes built before 2000 were almost twice as likely to be uninsured than homes built in the past two decades, while 35% of manufactured homes were uninsured.

FEELINGS OF FINANCIAL INSECURITY HIT RECORD HIGH

Even though Americans have a more optimistic view of the direction of the U.S. economy than they did a year ago, their feelings of financial insecurity have hit a record high, according to Northwestern Mutual’s 2024 Planning & Progress Study.

More than half (54%) of U.S. adults believe the country will enter a recession this year. Although this number represents a majority of adults, it’s still a big drop from the two-thirds (67%) who predicted a recession last year, the survey pointed out. These more positive economic expectations were seen across generations.

At the same time, Americans’ feelings of personal financial insecurity are on the rise. One-third (33%) of adults said that they don’t feel financially secure.

DID YOU KNOW

QUOTABLE

After a global pandemic, market volatility and now persistent inflation, financial shock fatigue is setting in.

—

Andy Jones, Northwestern Mutual Managing Director

varied significantly across regions, with half of insurers still expecting the U.S. to enter a recession in the next two to three years. However, a higher proportion of insurers overseas don’t see the U.S. economy entering recession in the next five years, compared with just 7% of respondents from the Americas.

This represents a jump from 27% who said the same last year, and it is the highest level of insecurity recorded in the study’s history.

GOLDMAN SACHS FINDS ‘CAUTIOUS OPTIMISM’

It has been a tough couple of years for asset managers and insurance companies, and some have struggled just to stay even. But things might be changing, and the storm clouds could be parting. A major survey by Goldman Sachs of 359 CIOs and CFOs, representing more than $13 trillion in global balance sheet assets, indicated some “cautious optimism” and positivity for a change

The 13th annual Goldman Sachs Asset Management Global Insurance Survey found respondents eager to put last year in the rearview mirror. A drop in bank lending, escalating geopolitical tensions, and the impending elections generated enormous uncertainty in global markets.

But by the fall, the U.S. Federal Reserve paused its interest rate hikes, which resulted in a moderation of the tightening cycle, and even began talking about cutting rates.

Expectations for a recession in the U.S.

WHAT’S BOOSTING THE U.S. ECONOMY?

Immigration is boosting the U.S. economy and has been “really underestimated,” said Joyce Chang, chair of global research at JPMorgan. Chang’s remarks came as the Federal Reserve raised its U.S. gross domestic product growth projection to 2.1% for 2024 — up from the 1.4% the Fed predicted in December.

“We are still seeing the phenomena around the globe that services inflation is still well above where it was before the pandemic, so we’re looking at 3% for core Consumer Price Index, but I think one thing that was really underestimated in the U.S. was the immigration story,” Chang told CNBC.

“The U.S. population is almost 6 million higher than it was two years ago or so, and so that has accounted for a lot of the increase in consumption, when you see the very low unemployment numbers as well.”

The number of workers aged 75 and older is expected to nearly double in the next decade.

Source: U.S. Bureau of Labor Statistics

May 2024 » InsuranceNewsNet Magazine 5 NEWSWIRES

?

:

Mississippi (13%)

New Mexico (13%)

Louisiana (12%)

3

West Virginia (11%)

Alaska (11%)

Tax Armageddon Is Coming, but You and Your Clients Can Come Out on Top

By Deborah A. Miner, JD, CFP®, CLU®, ChFC®, RICP®

By Deborah A. Miner, JD, CFP®, CLU®, ChFC®, RICP®

It’s easy to be distracted by all that is going on both in the financial world and elsewhere. But amid these distractions, it’s crucial not to overlook the looming deadline for tax changes. And if you’ve been wondering about the potential impact of these tax changes, you’re not alone.

We’ve coined the term “Tax Armageddon” to emphasize the importance of this information for you and your clients. Barring legislative intervention, the Tax Cuts and Jobs Act (TCJA) of 2017 is due to sunset in 2025. While this might not be a widely discussed topic yet, preparing for these changes is critical. Luckily, the combination of the value of tax deferral and one of the best times in history to buy an annuity creates a win-win situation for all. By highlighting the benefits of tax-deferred solutions — such as nonqualified deferred annuities — you can help your clients secure their financial future while also growing your business.

Talking to Your Clients About Tax Deferral

As a financial professional, you know the value of tax deferral but your clients might need a refresher. Here’s a quick pitch you can use to help them understand how they can benefit from tax-deferred savings vehicles like nonqualified deferred annuities.

Tax deferral helps your clients keep more of their money working for them. A nonqualified deferred annuity can:

» Allow them to delay paying taxes on their earnings.

» Provide more control over their income and the ability to take advantage of the benefits of compounding.

» Potentially help them avoid “stealth” taxes such as the taxation of Social Security benefits, the income-related monthly adjustment amount surtax on Medicare Parts B and D premiums, the net investment income tax, and other income thresholds that can eat into their retirement savings.

While these features are beneficial at any time, they will become even more important if and when TCJA expires.

Preparing for the TCJA Sunset

As TCJA’s expiration looms, it’s essential to anticipate how its changes could impact your clients’ tax bill. If the act sunsets, tax rates will revert to their 2017 levels, potentially leading to higher taxes for many individuals. The following consequences should be considered in helping clients mitigate their tax burden.

Standard deduction cut in half: If TCJA sunsets in 2025, income tax rates will revert to the 2017 rates and generally less generous thresholds in 2026. But that’s not the only provision that will impact taxes owed. TCJA doubled the then-current standard deduction. If the act sunsets in 2025, the standard deduction will be cut in half. In 2024, it’s $29,200 for married couples filing jointly and $14,600 for single filers.

Return of personal exemptions: TCJA also eliminated the personal exemption. If the act sunsets, the personal exemption will return and will be indexed for the intervening years. Generally, the personal exemption could be claimed for each taxpayer and each person claimed as a dependent. Unfortunately, deductions for personal exemptions were subject to a phaseout, and a return of this could adversely affect high-income earners. Specifically, the exemptions phased out by 2% for every $2,500 of adjusted gross income (AGI) over the threshold (every $1,250 for those married filing separately). Any resulting reduction would apply to all personal exemptions.

Reinstatement of the limitation on itemized deductions: TCJA eliminated the overall limitation on itemized deductions — often called the Pease limitation.

If the act sunsets, the Pease limitation on itemized deductions will return in 2026. The beginning threshold of the phaseout range in 2017 was the same as for the personal exemption, but it worked a little differently. For every dollar of AGI over the specified threshold, 3% of that amount would be subtracted from the taxpayer’s itemized deductions. In addition, there was no ending threshold since the number of itemized deductions is unlimited, as opposed to the personal exemption being a set amount.

Keep in mind that increasing deductions — that is, using tax-saving strategies such as charitable deductions — still makes sense when and if the Pease limitation on itemized deductions returns in 2026. In any case, the more deductions the better. Managing your clients’ income and tax brackets can play a critical role in minimizing taxes paid.

AMT impact on more taxpayers: An important provision for clients that will sunset, and one often forgotten, is the alternative minimum tax (AMT). Briefly, the AMT requires certain taxpayers to compute their income tax liability twice, once under the ordinary individual income tax rules and again under AMT rules that allow fewer tax preferences, and then pay whichever is highest.

Since TCJA, the AMT has only affected ultra-high-income earners due to increased exemptions and phaseout thresholds. For instance, the phaseout thresholds increased to $500,000 for single filers and $1,000,000 for married couples filing joint returns. And these amounts continue

to be indexed for inflation — for example, the phaseout of the exemption for married couples filing jointly in 2024 is $1,218,700-$1,751,900. Without any new legislation, the 2017 exemption amounts and phaseout limits will return in 2026, although they will be indexed for the intervening years.

According to the Tax Policy Center Briefing Book, the AMT affected approximately 5.1 million taxpayers in 2017. The book estimates that after TCJA’s passage, the number of taxpayers fell to just 200,000 in 2018 and would remain constant through 2025. Barring legislation, it will affect 6.7 million in 2026 and rise to 7.6 million by 2030. It is estimated that the AMT will affect about 50% of taxpayers with $200,000 in income. How many of these will be among your clients?

Reduction of estate and gift tax exemption: In addition to the income tax changes, TCJA doubled the then-current estate and gift tax exemption from $5,000,000 to $10,000,000 beginning in 2018, subject to indexing. The estate and gift tax amount for 2024 is $13,610,000 per person and $27,220,000 per married couple. If there is no legislation, the estate and gift tax exemption will revert to $5,000,000, indexed for intervening years since 2011 – most likely it will be around $6,000,000 or $7,000,000.

Possibly the Only Welcome Changes

The sunset of TCJA carries significant implications for tax planning strategies and your clients. Among the few favorable changes is the elimination of the state and local tax (SALT) cap. In addition to the Pease limitation, TCJA made several other changes to itemized deductions, most of which were not considered taxpayer friendly. The most notorious was the $10,000 limitation for SALT deductions. Since 2017, numerous efforts have been made to increase the SALT cap, but none made it into law. The cap on the SALT deduction will go away in 2026 if no new tax legislation is passed.

Some welcome changes:

Source: TCJA, Secs. 11042, 11023, 11043, 11044

5 Tips to Tackle Potential Tax Changes

With myriad changes on the horizon, now is the time to make yourself invaluable to your clients. Here are some top tips to consider.

1. Accelerate income: If income taxes are going up, then clients may want to consider ways to accelerate income. They can consider executing Roth conversions, selling capital assets with large gains, and exercising stock options in 2024 and 2025.

2. Diversify taxes: Remember the importance of tax diversification when looking at retirement solutions. Clients need taxable, tax-deferred and tax-free buckets of income to manage their income tax brackets in retirement.

3. Gift assets: If income from certain income-producing assets is not needed for current or future living expenses, then consider gifting such assets to family members in lower income tax brackets.

4. Gather a team: For clients who may have a taxable estate, start working with estate planning attorneys now.

5. Flexibility is key: Ensure that your clients’ retirement solutions offer flexibility. For example, Delaware Life’s nonqualified deferred annuities offer:

• Income control. Your clients can decide when to take or forgo distributions.

• The ability to delay the choice of single or joint income until income is needed.

• The ability to delay taxation until income is taken, when they may be in a lower tax bracket.

To learn more about how fixed index annuities can be the perfect weapon to help your clients get a leg up on tax changes, scan the code or visit https://links.delawarelife.com/INNTLS.

For complete information regarding the Tax Cuts and Jobs Act, please visit https://bit.ly/tcja2024

Annuities are long-term investment vehicles designed for retirement purposes. Annuity contracts contain exclusions, limitations, reductions of benefits and terms for keeping them in force.

Customers buying an annuity to fund an IRA or qualified retirement plan should do so for reasons other than tax deferral. IRAs and qualified plans – such as 401(k)s and 403(b)s – are already tax-deferred. Therefore, an annuity should be used only to fund an IRA or qualified plan to benefit from the annuity’s features other than tax deferral.

Delaware Life Insurance Company (Zionsville, IN) is authorized to transact business in all states (except New York), the District of Columbia, Puerto Rico and the U.S. Virgin Islands, and is a member of Group One Thousand One LLC (Group1001).

This information is for informational purposes only and should not be relied on for tax or legal purposes. Financial professionals and their clients should not rely on this information as applicable to their particular situation.

2024030034 EXP 03/25

Itemized deduction TCJA Upon expiration SALT Limited to $10,000 Unlimited Mortgage interest Limited to first $750,000 of indebtedness Limited to first $1,000,000 of indebtedness Mortgafe interest; home equity Limited to home improvement Limited to first $100,000 (unless home improvement) Personal casualty and theft loss Limited to federally declared disaster Not limited to federally declared disaster

An

INTERVIEW

Matt Berman says he’s in a unique position as president and CEO of Foresters Financial, a 150-year-old fraternal organization with a mission to enrich the lives of middle-market families.

8 InsuranceNewsNet Magazine » May 2024

interview with Paul Feldman, publisher

Matt Berman said that while Foresters Financial looks economically like a mutual, the difference is that “we are operating with mission, with purpose. Our North Star is simply enriching the lives of middle-market families.”

While most fraternal organizations have a religious or cultural denomination, Berman says “Foresters is unique in that we are nondenominational.” He credits “the foresight of our founders thinking about this charter to enrich the well-being of middle-market families in their communities” a century and a half ago.

Prior to serving in his current position, Berman is credited with heading the transformation of Foresters’ distribution channels, product portfolio, operations and underwriting. His achievements also include new agent-intermediated and direct-to-consumer sales partnerships, diversifying the product portfolio and a commitment to enhancing the digital customer journey. He has championed a culture of well-being by introducing firstin-market products and member benefits protecting individuals living with diabetes.

In this interview with InsuranceNewsNet Publisher Paul Feldman, Berman describes how Foresters is committed to building a better future, starting with protecting the financial futures of its members and their families.

Paul Feldman: You were recently named CEO and president of Foresters Financial. You were previously the president of their U.S. division. How do your responsibilities change compared to your previous position?

Matt Berman: In my former role, I was president of the U.S. and the Canada divisions. And so, my line of sight was laser focused on the profitability of those two divisions. In this new role, the mandate is much broader.

We have a business in the U.K., so my line of sight now expands across our global footprint, and I have all of the additional functional areas — whether it’s human resources, legal, finance — that now fall under my mandate. Now I’m in this seat and engaging with our board of directors, engaging with all our stakeholders around the globe — it has been a big step forward.

Feldman: You’ve had an illustrious career in insurance. Tell us a little bit about your background.

Matt Berman: I’ve been fortunate to have seen the insurance business from both the property and casualty sector as well as the life and savings sector. Before coming to Foresters, I spent 10 years at AXA, which is now Equitable. And those were amazing years — the experience I had, the things I learned. In many ways, it was a Ph.D. in the life insurance sector, and it was an incredible journey. Prior to that, I spent most of my years on the property and casualty side, both on the principal side of

differentiates us is that we are operating with mission, with purpose. There are fraternals in our ecosystem that have an affiliation to either religion or maybe cultural heritage. Foresters is unique in that we are nondenominational. We don’t have a religious affiliation we don’t have an affiliation to any cultural heritage.

Our North Star is simply enriching the lives of middle-market families. And that nexus of well-being has been part of our charter for 150 years. What that means, more practically speaking, is that a portion of our earnings goes back to our members, and it goes back to our members in the form of benefits.

Our ability to collaborate, to work well together and be resourceful has given us a lot of wind in our sails. But in terms of more practical or, let’s say, business-focused priorities, we continue to invest in technology.

the business — more focused on the underwriting and on the intermediary side. In those years in the property and casualty sector, I was focused on large commercial risk, looking at professional liability, directors and officers, liability errors, and admissions liability — the totality of all of it. It has given me some fantastic perspective on the movement of capital, the value of underwriting. And I think it showed me the immense gravity that we have as an industry to not only buoy financial markets but provide a social good to our customers and our clients.

Feldman: Foresters is a fraternal company. Tell us a little bit about what makes that different.

Matt Berman: In the life insurance sector, you have stock companies and you have the mutuals. I think the delineation is very clear. On the mutual side, the policyholders own the entity; on the stock side, you have shareholders. In many ways, we look economically like a mutual, but what

Now, those benefits could be scholarship opportunities, granting opportunities. We have invested in wellness platforms. When you think about the importance of purpose to social well-being, these are elements to our organization, elements within our DNA that have been alive and authentic for a century and a half.

We will be a fraternal for another 150 years. I find our structure to be unique. I am forever fascinated by the foresight of our founders’ thinking about this charter to enrich the well-being of middle-market families in their communities. As I’m sure you’ve seen, many organizations — not necessarily life and savings or property and casualty insurers, but organizations around corporate North America — are embracing this concept of social responsibility and purpose. I laugh a little bit because I feel like folks have gotten newfound religion on this topic of purpose. Purpose has been in our DNA for 150 years.

Not only does the structure enable financial strength, but it also allows me and

A MAN ON A MISSION — WITH MATT BERMAN INTERVIEW May 2024 » InsuranceNewsNet Magazine 9

“In any given year, you see us supporting granting; we’re out in the field with advisors and members building playgrounds. And that sense of well-being is powerful.”

my executive team and all of our employees to think equally about the long term and the short term. We’re not handcuffed to Wall Street or analysts thinking about “Hey, where do earnings per share land this quarter?” Sometimes you have to plant the seed for something that may not be immediate, and we can do that inside of our construct. But I think what makes us even more unique inside of this fraternal framework is our ability to earmark a portion of our earnings, bring it back to our membership and make sure that it’s complementary to the products and offerings we provide.

I’m a big believer that at our core, what differentiates us in this fraternal world is that we were founded on volunteerism. In any given year, you see us supporting granting; we’re out in the field with advisors and members building playgrounds. And that sense of well-being is powerful.

We’ve invested in these engagement platforms. We partnered with a Swiss insurtech, dacadoo, and our members are eligible to participate in this custom-designed engagement platform that allows individuals to engage in healthy activities, engage in volunteerism. There’s a reward system based on that platform. But I think the hurdle for us is whether a policyholder will see their life insurance company as their health advisor. I think that’s still a mindset hurdle. We should promote these wellness platforms because it’s a win-win for all stakeholders. But it may not seem so intuitive at the customer level. For us, it’s easier because it has been in our DNA; it’s

in our mission to support well-being. But the industry as a whole has a way to go.

Feldman: One of the things that I noticed on your website, through your communications and certainly in this conversation, is the use of “members” rather than “policyholders.” Policyholder feels like a number to me. A member seems like something I’m a part of. I know that you do a lot of things, from scholarships to all kinds of funding. What are some of the things that members get through Foresters?

Matt Berman: You mentioned the scholarship opportunities, the granting opportunities. Granting is big. It allows individuals to accumulate grant dollars so they can do good work in their community. Our granting platform allows members to promote a range of activities. We’re really proud of that. We have a partnership with an organization, LawAssure, which provides assistance on all sorts of areas around building a will, estate planning — again, services that are complementary to what we do as a life insurance organization.

With our partnership with Dacadoo, members can immediately, on registration, download an app that has been custom designed between Foresters and Dacadoo to allow our members to manage their well-being in a fun, engaging way. That covers so many dimensions — nutrition, exercise or, again, back to our

core volunteerism. And members can accumulate reward points on a number of items on the app.

Feldman: You have a 150-year history. What are you seeing right now? What does your future look like?

Matt Berman: I am positive we’ll be around for another 150 years. Focusing on our future is front and center. My guiding compass has always been sticking to the fundamentals. I take a lot of pride in the culture that we’ve built. It’s the aggregate of generations of leaders and individuals contributing to our experiences collectively.

Our ability to collaborate, to work well together and be resourceful has given us a lot of wind in our sails. But in terms of more practical or, let’s say, business-focused priorities, we continue to invest in technology. Technology is a key enabler for all of our stakeholders, whether that’s our employees, our advisors or our members. We continue to focus on data to make sure that we can deliver accurate, precise decisions for our future members and do it in a way that’s seamless.

Finally, we’re making sure that we have state-of-the-art products in terms of driving value for our members and investing in our advisors. The advisor is critical in our world. There’s certainly a place for direct-to-consumer opportunities, and we’ve invested in direct-to-consumer opportunities. The lion’s share of business sold inside the life and savings sector will be intermediated because everyone’s needs are different. And the advisor is so critical to making what we do a reality.

Feldman: So how are you investing in advisors?

Matt Berman: We want to make sure that they have the best technology. We are looking to make their experiences with us turnkey. We’ve made a footprint in our specific sector through nonmedical underwriting. A portion of our business can be underwritten without blood or fluid. And we must ensure that we have the best data to make the best possible decisions. An advantage for the advisor and for our end customer is that the experience can be very transactional — as opposed to applying for life insurance, working with

10 InsuranceNewsNet Magazine » May 2024 INTERVIEW A MAN ON A MISSION — WITH MATT BERMAN

a paramedic to get blood and fluid, and going through the underwriting process that could take up to 30 days.

The life insurance sector hasn’t been known as the bellwether of customer experience, but that’s not to say we can’t be. No one wakes up in the morning thinking that “Hey, I want to go out and explore all of my options around protection or supplemental retirement savings.” It’s usually initiated by an advisor. And for that reason, it’s important that the advisor has the best technology, they can enjoy the best experience and they can get paid quickly. And that is just so important to make sure that they’re driving the best possible outcomes for their clients.

Feldman: Tell me a bit about the products Foresters Financial offers.

Matt Berman: I’ll start with the U.K. That’s an investments business, and we manage and sell child trust funds. So think about tax-advantaged growth for children. In North America, we are a life insurance business. We have a Canadian division; we have a U.S. division. Within both those divisions, we have a full suite of life insurance offerings. We offer universal life in the U.S., not in Canada. We have a suite of term products, and that’s really where we’re hyperfocused right now. Our big product is our par (participating) whole life product both in the U.S. and Canada. For an organization like ours, we have a strong durable balance sheet. We can provide those products; we can price them effectively. We’ve designed them innovatively, and they compete with the big mutuals. And what makes us a bit unique is that we have this offering inside of independent distribution, both in the U.S. and Canada. The trending from all the industry data suggests that there is more interest with par whole life. It’s one of those products that offers an immense amount of stability in a world that feels more complex with every passing year.

Feldman: In the U.S., you distribute mostly through independent distribution. Is that correct?

Matt Berman: That’s right. We had a career captive sales force, but we sold that when we divested a number of assets. We

had an asset manager, a broker-dealer and a career sales force that was attached to the broker-dealer. They were selling asset management products as well as life insurance products. But for the good of the entire organization, we wanted to stick within our core capabilities. We felt that some of those businesses were better partnered and aligned with businesses that were strictly in the asset management sector. Our distribution today, both in the U.S. and Canada, is independent distribution.

Feldman: What are some of the challenges you’re seeing in distribution? There have been a lot of mergers and acquisitions. How does that affect you at the carrier level?

Matt Berman: I would say that we have not seen any big shifts in behavior. We’re certainly vigilant. We’ve been tracking all that’s been happening with the privateequity-fueled consolidation that you’re seeing. There have been a number of players that have been very active over the past five years. We maintain excellent relationships with those distribution organizations at the top of the house.

What I see happening inside those consolidations is that they’re looking to drive scale through a better allocation of resources. We keep our eyes on it. We want to make sure that the partnership is durable, that it’s working. But yes, it certainly could pose some challenges down the road, but nothing is without its challenges.

Feldman: Everything is easier because you don’t have hundreds of different distributors all funneling into you.

Matt Berman: We are connecting at so many touch points. We certainly have relationships at the top of the house, so to speak, to make sure that our strategy aligns with theirs and we can support them and they can support us. But cascading down into the partner level and then looking at the advisors, we’re engaged with everybody in that value chain. You have to be. I think that’s where, as a life insurance company supporting these organizations with a number of advisors that roll up into these organizations, that scalability can be very beneficial for us.

Feldman: There has been a lot of talk about this declining agent force. Are you seeing that on your side? People are aging out of the business. I don’t know that we’re bringing enough people into the business.

Matt Berman: It is a great question. We definitely saw a surge during COVID-19. I think the urgency of life insurance during the pandemic spiked interest in our market. A lot of individuals came into this marketplace as a second career, perhaps being displaced given the challenges of the pandemic on the economy at the outset. That has plateaued, but we’re still seeing incredible interest — individuals looking for that second career or individuals looking to find perhaps an opportunity that’s financially and socially rewarding. We’re seeing good momentum on appointments, and those degrees of interest are coming into our sector where they’re needed most to begin addressing the protection gap.

Feldman: What type of technology investments are you making? Where do you see artificial intelligence playing a role?

Matt Berman: That has been the question of the day, right? We’ve been investing in AI for quite some time. At this point, you may classify it as fundamental. We’ve invested in technology that allows us to expedite what I will call transactions that don’t necessarily require emotional intelligence. You could also make the case that underwriting has spent a fair amount of time investing in rudimentary AI to accelerate that life cycle in the risk assessment process.

In many ways, you could say that the industry as a whole — and certainly our organization — has invested in those technologies. In terms of where generative AI would play out, I see more opportunities in our operations ecosystem.

The customer requires emotional intelligence in the transaction. I would never want to make AI a substitute for emotional intelligence. But to the degree that there are transactions that are easily supported by self-service and internal transactions that are invisible to the customer, we will continue to invest. But I don’t want to sacrifice the moments where our customers need us most.

May 2024 » InsuranceNewsNet Magazine 11 A MAN ON A MISSION — WITH MATT BERMAN INTERVIEW

The importance of longevity literacy—and managing the risks—in retirement

We polled financial professionals and retirement investors to provide new information and uncover new insights on retirement planning opportunities related to longevity risk.

See the survey stats:1

1/3 (32%) NEARLY

of investors surveyed may be under-predicting their potential longevity.

RISK: Retirement savers may be vulnerable to outliving their assets.

INVESTORS AGE

55 to 59

Are more likely to underpredict life expectancy than those age 60+.

In addition, those who consider themselves in poor health are more likely to under-predict their life expectancy.

RISK: These factors make longevity a unique challenge to pre-retirement planning.

>40% of investors surveyed rely on the age of a parent at death to project their life expectancy.

RISK: The vast majority of people are over or underpredicting their longevity.

87 YEARS

Average life expectancy predicted by investors surveyed

90-93 YEARS

Life expectancy routinely predicted by most financial professionals who predict one

RISK: One third of financial professionals surveyed report 25% or more of their clients would be at risk of outliving their assets if they live to age 90.

Not FDIC/NCUA insured • May lose value • Not bank/CU guaranteed • Not a deposit • Not insured by any federal agency

Jackson® is the marketing name for Jackson Financial Inc., Jackson National Life Insurance Company® (Home Office: Lansing, Michigan), and Jackson National Life Insurance Company of New York® (Home Office: Purchase, New York). Jackson National Life Distributors LLC, member FINRA.

Longer lives reinforce the need for reliable lifetime income. Many investors are interested in guaranteed† income products to insure against longevity risk.

60%

of investors surveyed believe it is valuable for retirees to pay for essential expenses with income that is guaranteed for life.‡

>80%

55%

of investors surveyed are interested in an annuity that provides guaranteed lifetime income.

This far outpaces the current ownership rates of annuities. Many economists believe insuring against longevity risk by purchasing an annuity is an optimal but underused approach.2

Learn more at jackson.com/researchcenter or call your financial professional.

59%

of investors surveyed viewed a financial product that provided a lifetime income stream at least somewhat valuable.

of financial professionals surveyed, who recommend annuities that provide guaranteed lifetime income say less than half the clients they suggest them to purchase one.

What are annuities?

Annuities are long-term, tax-deferred vehicles designed for retirement. Variable annuities involve investment risks and may lose value. Earnings are taxable as ordinary income when distributed. Individuals may be subject to a 10% additional tax for withdrawals before age 59½ unless an except to the tax is met. Add-on living benefits are available for an extra charge in addition to the ongoing fees and expenses of the variable annuity and may be subject to conditions and limitations.

† Guarantees are backed by the claims-paying ability of the issuing insurance company.

‡ There is no guarantee that a variable annuity will provide sufficient supplemental retirement income.

1 Jackson’s study on addressing longevity risk, conducted in partnership with Greenwald & Associates and the Center for Retirement Research at Boston College, surveyed 1,009 investors between 55 and 84 years of age and at least shared financial decision-making responsibilities in their household. Of the respondents, 109 had assets of between $100,000 and $199,999, and 900 had assets of at least $200,000. Additionally, 400 financial professionals with three or more years of experience at a firm with at least 75 clients and $30 million in assets under management were surveyed. Surveys were conducted online from June 12 to July 7, 2023.

2 Hallie Davis et. al., Global Financial Literacy Excellence Center, “Examining the Barrier to Annuity Ownership for Older Americans,” October 6, 2021.

Greenwald & Associates and the Center for Retirement Research at Boston College are not affiliated with Jackson National Life Distributors LLC.

CMN105806 02/24

That was then ; this is now

Aggressive recommendations previously made on indexed universal life were likely to cause disappointment.

Where do IUL illustrations stand today?

BY RICHARD M. WEBER

COVER STORY 14 InsuranceNewsNet Magazine » May 2024

My July 2013 feature article for InsuranceNewsNet Magazine, “Illustrated Promises; Unmet Expectations,” addressed a problem in which insurance regulations that were approved in the mid-1990s were resulting in illustration outcomes that were

unlikely to occur and likely to cause disappointment. Further, policy illustrations continued to be used to project future values, a purpose regulators and the Society of Actuaries had long refuted.

By 2013, policy illustrations were again coming under regulatory scrutiny as the National Association of Insurance Commissioners was beginning to address indexed universal life, a relatively new product that was quickly becoming a best-seller among the different forms of universal life insurance. IUL was a very different variation of UL that hadn’t even existed when the current illustration regulation was finalized in 1995. When nonguaranteed bonuses were included, illustration net crediting rates of 8% or 9% were not uncommon — deployed as constant (but nonguaranteed) accumulation assumptions over many decades.

IUL is the most recent generation of UL insurance products to come along since UL was introduced in 1978. Variable universal life — a security — became popular in the late 1980s, and then along came guaranteed universal life during the latter part of the 1990s.

Right on time for the decennary evolution of UL products, IUL began to gain traction in the recovery from the Great Recession. IUL intends to be a nonsecurity blend of earlier iterations of UL and VUL, with all the advantages

of flexible premiums and none of the potential disadvantages of volatile subaccount values that could produce negative forces on cash value accumulation. What makes IUL both attractive and challenging to illustrate is that there is no “earned interest rate underlying the disciplined current scale” to serve as a maximum (but also persistent) projection rate when producing an IUL illustration. IUL defies conventional wisdom when it comes to developing an appropriate policy illustration rate, especially when following the Goldilocks Rule — not too high, not too low, but just right. Consider the following recent situations involving complex life insurance products, compounded by aggressive recommendations for implementation.

1. IUL and premium financing for retirement income

Fifty-seven-year-old Victor K’s longtime trusted financial planner had an important idea to share with him: a wealth generation plan. And it was such a valuable planning concept that the planner went ahead and initiated a similar plan for himself. The essence of the presentation — primarily drawn from a policy illustration — included:

» Apply for an IUL policy in the amount of $5 million.

» Use a 1035 exchange of an existing $1 million par whole life policy with $300,000 of surrender value plus pay premiums of $320,000 a year for 10 years, but arrange premium financing to pay all those premiums.

» In Year 11, repay the $3.5 million bank-financed premium loan (and accumulated interest) out of policy cash values.

» Sit back and collect $200,000 a year of tax-free income for the rest of his life beginning at age 70 — with policy withdrawals and loans as far as age 120, or however long he lived.

IUL ILLUSTRATIONS: THAT WAS THEN; THIS IS NOW COVER STORY May 2024 » InsuranceNewsNet Magazine 15

Read the full July 2013 article at https://bit.ly/weber2013

» He would still have $4.5 million of net death benefit at an average life expectancy (89) or $70 million if he lived to 120.

But in fact, assuming the policy can redeem the third-party premium financing (and replace it with an internal policy loan), there was less than a 50% probability the plan would be viable after even the first retirement cash flow. There was less than a 10% probability of success well before average life expectancy.

2. IUL for retirement income

Seventy-year-old physician Gregory J’s new financial planner suggested Greg use his professional practice’s profit-sharing plan to buy a $5 million IUL policy and then sell the policy 10 years later from the profit-sharing plan to Greg’s irrevocable life insurance trust.

» A total of $2 million in premiums was to be paid by the retirement plan, prefunding all future premiums and illustrating $100,000 annual tax-free income beginning at age 65 — with policy withdrawals and loans for as long as his wife lived, up to age 100 — under a spousal withdrawal provision of the ILIT.

» However, the client funded only $1.5 million of the intended funding, and the agent neglected to drop the death benefit from $6.5 million to $1.5 million in Year 8 as originally illustrated.

As a result , there was only a 27% probability the plan would be viable to age 100.

3. IUL and premium financing for retirement income

Fifty-two-year-old physician Jennifer R. had a $3 million 20-pay whole life policy with a $110,000 annual premium that began to strain Jennifer’s budget.

» She asked her long-time insurance agent (who sold the original policy) to see if she could reduce her premium obligation. He responded with a proposal to exchange the whole life’s $500,000 cash value for a premium-financed IUL policy illustrating $260,000 annual tax-free income beginning at age 65 — with policy withdrawals and loans as long as she lived, up to age 100.

But in fact , when we reduced the longterm cap expectation to 7% from 9% to expand on that possibility, the first failure occurred at age 84, and there was a 91% probability the plan would not be viable to age 100.

What do these insurance cases have in common?

For at least the past 10 years, high-end life insurance sales have been less about protecting a family, business or charity from financial loss due to the insured’s premature death, and more about accumulating large amounts of cash values from which to withdraw and borrow substantial income tax-free cash flow from the policy at and during retirement.

For an even longer period of time, high net worth individuals have been encouraged to borrow the substantial upfront

buyer, but the policy illustration misleads sellers and buyers into believing cash value accumulation occurs with a constant rate of return. It does not. Cash value at the end of a segment year can be less than it was the prior year, depending on the charge side of the ledger.

To be fair, in the cases I cited earlier, there was no evidence the licensed agent intended to defraud the client. But these cases highlight negligence in using a policy illustration as the exclusive means of understanding — and selling — a concept that ultimately caused great harm and financial loss to the client and likely to the advisors. All three of these life insurance cases are currently being litigated.

The primary reason market-based policies fail to deliver on illustrated promises is that the dollar sequence of return risk

Section 1: Illustrated Policy Benefits

premiums with which to fund those socalled retirement benefits. At the same time, lenders have steadily reduced their minimum personal financial criteria for making such policy loans. Placing large life insurance policies into retirement plans is another form of premium financing.

We still hear the rallying cry supporting IUL: “Zero is your hero!” Except it isn’t. IUL policies have some attractive long-term attributes for the right type of

cannot be evaluated with the tools currently made available to agents and their clients. But appropriate tools do exist. As a form of statistical analysis, Monte Carlo assessment can provide an understanding of the degree to which policy illustrations continue to fail expectations.

What is Monte Carlo?

Assuming an otherwise identical set of illustration details such as an assumed

COVER STORY IUL ILLUSTRATIONS: THAT WAS THEN; THIS IS NOW 16 InsuranceNewsNet Magazine » May 2024

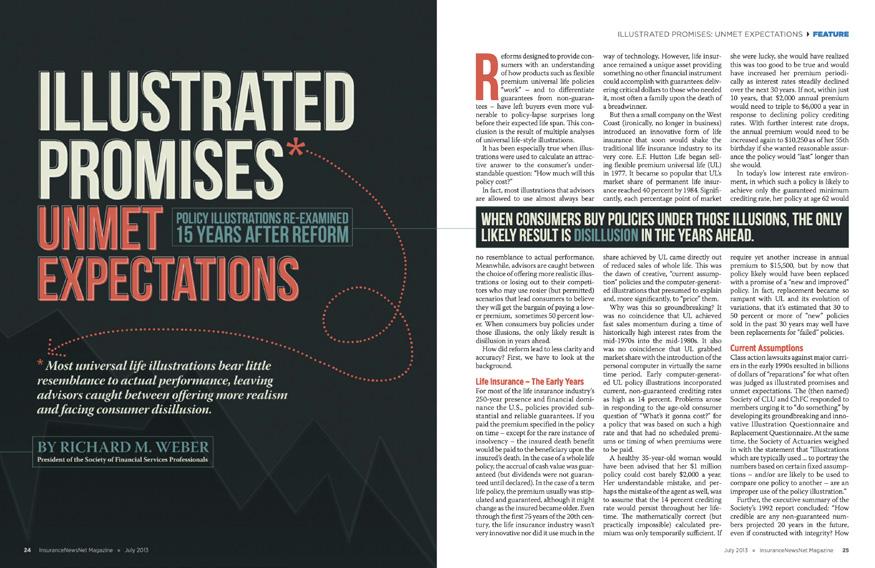

45M Preferred NS 1-Yr S&P500® / 10% Cap 6.30% Policy Illustration as of Jan 11, 2024 Premium Policy Cash Surr Death Age Outlay Loan Value Benefit 45 $25,000 $2,646 $632,930 64 $25,000 $915,325 $1,319,009 TOTAL $500,000 65 $78,280 $893,262 $1,301,403 84 $78,280 $41,569 $337,460 TOTAL $1,565,600 99 $10,994 $10,994 $500,000 $1,565,600

premium, death benefit, age/gender/class, etc., Monte Carlo analysis applies 1,000 or more unique randomization scenarios to the buyer’s assumed asset allocation/index of choice (i.e., the methodology by which the policy accumulates long-term value).

Of course, over the life of the insured, policy credits must exceed policy debits for the policy to sustain and become a death benefit. As a result of this randomization process, Monte Carlo analysis estimates the probability of success among those many scenarios of returns for the buyer to access entirely new insights into the policy being reviewed.

Life insurance companies have long used Monte Carlo to estimate their longterm profits in a number of design scenarios for new policies, but agents have been on their own in using similar technology with their prospects and clients.

Monte Carlo analysis, when properly applied, is the only method to form an unbiased outcome expectation that cannot be manipulated.

The question for the client that makes this process so useful is “What is your minimum acceptable probability of success?” Most prospects will indicate something between 80% and 90%; after all, it is life insurance! By the way, if a potential buyer’s minimum threshold is 100% certainty, they probably should look at a policy style with more underlying guarantees!

Section 1 is a typical summary of an actual, current sales illustration: paying a premium of $25,000 a year for 20 years, and the following year expecting to withdraw and borrow $78,280 for another 20 years. To put it more simply, that’s a total of $500,000 into the policy and $1,565,600 out of the policy, for an ostensible long-term 6% after-tax equivalent rate of return (since there is no tax) on premiums and cash flows, plus an illustrated net death benefit of $243,000 at age 89 (average life expectancy).

That’s a very attractive projected outcome. Unfortunately, it’s predicated on the assumption of a constant 6.3% (illustrated) crediting rate every year for the next 76 years. Since that is not a realistic assumption (neither in the magnitude of the return nor in its expected duration) it is much more useful to instead determine the probability of successfully achieving these premiums, withdrawal and

AGENTS AND BROKERS PRINCIPLES OF ETHICAL MARKET CONDUCT

Each insurance agent and broker subscribing to these principles commits themselves in all matters affecting the sale of individually sold life and annuity products:

1.

I will conduct business according to high standards of honesty and fairness and render that service to my clients which, in the same circumstances, I would apply to or demand for myself.

2.

I will provide competent and customer-focused sales and service and will maintain a level of professional competence through a lifetime commitment to professional growth and continuing education.

3.

I acknowledge the different constituents whom I serve: insurance companies and the wider insurance industry, my clients, my client’s advisers, my community, and my family — and I will ethically resolve any conflicts that might arise between those relationships.

4.

I will communicate fully and effectively so that clients receive appropriate recommendations that balance the natural inclination to maximize benefits, tempered by their unique tolerance — or lack of tolerance — for risk.

5.

I will deliver to my client a statement of business processes, methods of compensation, and other disclosures appropriate to an open and professional business relationship.

Agents

May 2024 » InsuranceNewsNet Magazine 17 IUL ILLUSTRATIONS: THAT WAS THEN; THIS IS NOW COVER STORY

and Brokers Principles of Ethical Market Conduct is copyrighted, but permission is granted to any licensed life insurance agent, securities representative, or financial advisor who wishes to use these principles intact and as printed above.

ultimate death benefit results — using an asset allocation similar to the chosen index — with its guaranteed floor of 0% and current cap.

As can be seen in Section 2 , a Monte Carlo analysis using the prospect’s asset allocation mapped to an appropriate index suggests there is only a 4% probability

to age 100. The overwhelming number of hypothetical observations will lapse prior even to average life expectancy, with half of all anticipated failures occurring by illustration age 78.

Four percent is a pretty low likelihood with its 960 projected failures out of 1,000 hypothetical trials between now

to the question “What’s your minimum acceptable probability of success for this purchase of insurance?”

Assuming the prospect comes up with the typical 90% response, we can provide a reasonable expectation for this proposal in Section 3: There is currently a very high probability the prospect can count

Life Insurance Sustainability Analytics

the plan can successfully pay out the expected payments of $78,280 from ages 65 through 84 and maintain the policy until death. In fact, only 40 of the 1,000 hypothetical variations in this analysis sustain

and age 84 — and we assume it would undoubtedly be unacceptable if the client had this information.

Nonetheless, the other part of the process must seek the prospect’s response

As a result of this randomization process, Monte Carlo analysis estimates the probability of success among those many scenarios of returns for the buyer to access entirely new insights into the policy being reviewed.

on cash flow at retirement in the amount of approximately $53,000 per year for 20 years for a projected after-tax return of 4.5%. Periodic reassessment should warn of any failure possibilities well in advance.

What is your standard of care obligation?

Licensed insurance agents have among the lowest state-imposed obligations to standards of care in the financial services industry. By contrast, approximately 14,800 Registered Investment Advisory firms and their more than 350,000 investment advisory representatives have statutory-imposed fiduciary duties to their clients. Fiduciary duties to their clients are membership-imposed

18 InsuranceNewsNet Magazine » May 2024 COVER STORY IUL ILLUSTRATIONS: THAT WAS THEN; THIS IS NOW

Expected Cash Flow: $78,280 X 20 Revised Cash Flow: $53,000 X 20 0 20 40 60 80 100 120 140 160 180 70 72 74 76 78 80 82 84 86 88 90 92 94 96 98 100 0 20 40 60 80 100 120 140 160 180 70 72 74 76 78 80 82 84 86 88 90 92 94 96 98 100 960 Lapses out of 1,000 Trials 100 Lapses out of 1,000 Trials

- Testing Illustration Assumptions

Section 2 Section 3

on 100,000 CFP professionals, while 640,000 registered representatives (this number includes an overlap with IARs) have a standard of obligation to their broker-dealers and are bound to the equal care obligations of Reg-BI.

In addition to their obligations under the Employee Retirement Income Security Act, the Department of Labor is considering a rule requiring licensed insurance agents to act as fiduciaries when selling annuities to IRAs. And, finally, about 20,500 New York State insurance agents selling life and annuity products to residents of New York are now required under New York’s Regulation 187 to work only in the client’s best interest and to make only recommendations that are suitable to their prospective clients.

By and large, licensed agents in the other 49 states are not required to act with higher standards of care due to legislation, regulation or membership.

Research from Stanford Law Review looked at the career paths of former registered representatives who, because of their own actions and penalties from the Financial Industry Regulatory Authority, were no longer allowed to sell securities. Where did those reps go? They mostly went into the life insurance business. Why? Because they could, with much easier qualifying exams and substantially lower standards of care.

It is unclear whether the higher standard of care applicable to, for example, an IAR or a registered representative does or does not automatically carry over as a duty to activities additionally pursued with a client as a licensed insurance agent. We know the duty is all-inclusive as it applies to CFP professionals in the process of providing financial advice. And by definition, the duty applies to insurance activities with New York residents regardless of an advisor’s other credentials or designations.

The extent of that duty is not yet resolved. For example, a California agent who is also an IAR providing financial advice and investment services and life insurance products to a client either 1) has no elevated duty on the life insurance portion of their insurance work, because California does not impose a best interest/suitability rule for life insurance on its licensed insurance agents, or 2) does have such a duty because their overall

Best interest standards do not mean imposing on clients what we think is in their best interest. Subsequent disappointment can lead to client harm and then lawsuits.

client obligations as an IAR or a registered representative supersede the lower state-imposed insurance standard.

When the law is not clear — or it is ambiguous or different between states — beware of unintended consequences. In the most extreme example, it’s up to a jury to decide!

Alternatively …

I suggest financial advisors assume they will be held to the highest duty applicable to their various designations and licensure, and provide advice and ongoing management to their clients as appropriate to the various products — including insurance — they have chosen to represent.

The way most of us were trained to sell insurance products was to become knowledgeable and share our expertise with the client, implying that because of our knowledge and experience, we can tell you what’s in your best interest.

But it can’t work that way any longer. Best interest standards do not mean imposing on clients what we think is in their best interest. Subsequent disappointment can lead to client harm and then lawsuits. The evolving standard of care is to make certain that clients have the opportunity to choose products they perceive are suitable to their circumstances and are in their best interest, and best practices suggest providing written recommendations to help them along the way (protecting ourselves later on).

Securities, banking, retirement planning and financial advice are largely regulated at the federal level. However, consider the vast difference in the required client standard of care for licensed agents between New York and California

in the sale of life insurance. Standard of care regulation at the state level leaves even the most professional life insurance agents wondering how to meet their cross-state obligations. But the high standard is not impossible, nor does it have to be onerous. It just takes a commitment to focus on the client with skill, diligence, prudence, knowledge and client loyalty.

I am always reminded of the professional pledge of the Society of Financial Service Professionals:

“In all my professional relationships, I pledge myself to the following rule of ethical conduct: I shall, in the light of all conditions surrounding those I serve, which I shall make every conscientious effort to ascertain and understand, render that service which, in the same circumstances, I would apply to myself.”

Richard M. Weber, MBA, CLU, AEP (Distinguished), is a 57-year veteran of the life insurance industry, having been a successful agent, a home office executive, a software designer, author of four books and more than 400 published articles, and an educator. He is the co-creator of Certified Insurance Fiduciary, an online program for advisors wanting to enhance the scope of their advisory services. He may be contacted at richard.weber@innfeedback.com.

May 2024 » InsuranceNewsNet Magazine 19 IUL ILLUSTRATIONS: THAT WAS THEN; THIS IS NOW COVER STORY

or any other?

of our award-winning

licensure and reprint options. Find out more at innreprints.com.

Like this article

Take advantage

journalism,

Visit

Change 20 InsuranceNewsNet Magazine » May 2024

the Fıeld A

With Agents of

BRYAN SIMMS

is at the forefront of an effort to revive one of the nation’s oldest Black-owned carriers.

By Rayne Morgan

In the 1900s, as countless African Americans found themselves barred from life insurance coverage, Black-owned carriers like Mammoth Life and Accident Insurance Co. emerged with a mission to help people of color get the insurance products they need.

Over a century later, the historical Mammoth name has been revived under the helm of Bryan Simms and Paul Ford, two men of color who saw the need for the original company’s vision to continue today.

Mammoth Life & Reinsurance Co. was founded in 2021, carrying the same mission as its namesake but now equipped

Many others followed over the years.

It’s a history MLRC’s founders know well.

“There were about 38 to 50 of these Black-owned insurance companies that existed and came up, all with a similar origin story — faith-based institutions partnered with captains of industry who were former slaves,” Simms explained.

Such businesses flourished at first, but most dwindled by the 1990s. Today, there are only two Black-owned insurance companies still doing business in the U.S.

One of those businesses is Atlanta Life, the final remnant of the Black-owned businesses that were created in the peak years of the early 20th century.

The other is the new Mammoth Life, picking up the mantle of the original company.

“We did all the research in the world and found a historical society that owned the trademark for what was Mammoth Life and Accident Company, founded in 1915 by former slaves for the purpose of

with new technology, carried forward by its access to the largest network of agents of color in America and employing a strategy of targeted community outreach through trusted centers of influence.

“We’re not trying to become the newest brand on the market that can stand by itself,” Simms, MLRC president, said. “We realize we must stand on the shoulders of giants in order to achieve gigantic work.”

Unchanged historical bias

Discrimination through restrictive underwriting requirements has long barred African Americans and other people of color from accessing even basic life insurance in the United States.

Research from LIMRA indicates that as of 2023, more than 100 million Americans are still underinsured — the majority of whom are people of color.

The same challenge existed as early as the 1800s, leading to the first Blackowned insurance firms being created.

creating financial services products for communities of color,” Simms said.

The trademark owners were happy to let Simms and Ford use the Mammoth title. While MLRC’s name differs from the original company, it is “based on and inspired by that great historical brand.”

A personal passion

The challenges facing underserved communities of color in terms of insurance coverage and financial well-being are personal for MLRC’s founders. This is why Simms, whose background is in investment banking, is “wildly passionate” about the positive impact Mammoth can have.