Would regulation of the sector prevent unscrupulous property managers from engaging in illegal activity?

There’s been many headlines about landlords operating outside of the Residential Tenancies Act’s (RTA) regulatory framework recently. Unscrupulous operators who prey on migrants’ lack of understanding of tenancy laws – housing them in freezing caravans and illegal boarding houses.

The stories are perfect clickbait, and these fringe figures should never be seen as exemplars of the wider industry. They operate in a black market –a “shadow industry” lurking beneath the surface of the mainstream.

Our lead story addresses this property management underbelly. We discover a shadow industry dedicated to exploiting new arrivals to New Zealand – many of whom can’t speak English and come from countries where tenancy laws are non-existent.

These activities exist within an unregulated market. And while there will always be rogue operators and those who exist on the fringe, wouldn’t a regulated sector, and the associated threat of enforcement, raise standards across the board?

The industry experts that we interviewed are unanimous in their call for regulation.

And it’s not just about tenant protection. David Faulkner from Property Brokers believes that if landlords were aware of the ad hoc nature of money management in some firms, they would be more vocal about the need for regulation.

As he explains, Property Brokers has a trust account that houses clients’ money; and it is regularly audited.

“But many companies don’t have trust accounts. And there’s no compulsion for them to do so. All it would take is one rogue employee to put landlords’ money at risk.”

There are whispers that regulation may be on the horizon. It will be a welcome development for the professional property managers who do a wonderful job of balancing tenants’ and landlords’ needs in an increasingly complex regulatory environment.

Our profile this issue, Nicola Valentine, is adept at finding opportunity in complexity.

Her journey has been complex – she’s dabbled in development, created high-quality boarding houses, and now owns Movapod, a transportable small-home company that offers investors the chance to add value to their existing properties.

She’s navigated the ups and downs of the market and has some great insights into investment success. We are sure you will enjoy her story.

Thanks for reading and enjoy the spring weather.

Many

thanks

Joanna Mathers

NZ PROPERTY INVESTOR

MAGAZINE PUBLISHER

Informed Media Limited PO Box 40128, Glenfield, Auckland 0747

PUBLISHERS

Joanna Mathers and Sally Fullam

EDITOR

Joanna Mathers E joanna@informedmedia.co.nz

DESIGN DIRECTOR

Sally Fullam E sally@informedmedia.co.nz

ACCOUNT MANAGER / ADVERTISING SALES

Joanna Mathers E joanna@informedmedia.co.nz M 021 250 7101

WRITER

Sally Lindsay

PROOFREADER

Síana Clifford

SUBSCRIPTIONS

Sally Fullam

Online nzpropertyinvestor.co.nz

E subs@informedmedia.co.nz

PH 022 431 9144

TO SUBSCRIBE GO TO nzpropertyinvestor.co.nz/subscribe

NZ Property Investor has been printed on accredited and fully recyclable paper sourced from sustainably managed and legally harvested forests.

NZ Property Investor sources expert advice on a range of specialist topics. We recommend you get your own independent advice before you take any action, and any action you take is strictly at your own risk. Opinions expressed by contributors are not necessarily those of NZ Property investor or Informed Media Ltd. Informed Media is not liable for any loss or damage (included but not limited to indirect or consequential loss) or for personal injury arising from any action taken.

© 2025 • Informed Media Limited Issue 258

NZ Property Investor is published by Informed Media Limited. The contents are copyright and may not be reproduced without the consent of the Editor. All rights reserved.

Carole Pedder

With over two decades of experience as a chartered accountant and business consultant, Carole is dedicated to understanding her clients’ businesses and providing strategic guidance for sustainable growth.

Debbie Roberts

Debbie Roberts is a financial adviser with 25-plus years’ property investment experience. She co-founded Property Apprentice in 2010 with her husband Paul to help others achieve financial freedom through property investment.

Shadi Salehpour

Shadi is the owner of Let’s Rent, an award-winning property management company in Auckland known for its personalised approach and commitment to excellence. With a passion for fostering strong relationships between landlords and tenants, Shadi has built a reputation for integrity, innovation, and professionalism in the industry.

Sarina Gibbon

Sarina is an independent tenancy consultant, industry advocate and established media commentator. Her clients include the Auckland Property Investors Association, Renti and several property management organisations.

Matt Ball

Matt Ball is PR and advocacy manager for the New Zealand Property Investors Federation. Matt has decades of experience in PR and politics, is a property investor and has been a renter. These experiences help him represent and advocate for property investors and push for policy changes that benefit the whole industry.

Caleb Pearson

Former winner of The Block NZ Caleb Pearson pursues real-life renos with his wife Alice and documents the progress through their blog, social media and New Zealand Property Investor

Eve Prouse

Eve Prouse is a trusted property valuer and respected media commentator specialising in Auckland property markets – in particular South Auckland. Of Pacific heritage, Eve brings a unique, communityrooted perspective to her work.

David Faulkner

David is the general manager of property management for Property Brokers and is recognised as one of the leading experts in the New Zealand property management industry. He has been involved in the industry developing robust policies and procedures, training, and consultation services for many years.

Paul Money

Paul Money worked for 19 years at LINZ as a property rights analyst, spent six years at a top-tier law firm in Auckland and 11 years at a boutique corporate law firm in the city. He is now an associate at Land Law.

Leonie Freeman

Leonie Freeman is the chief executive of Property Council New Zealand. She has extensive experience in the property industry, having held top positions in both the public and private sector. From creating the concept of what is now realestate.co.nz, to buying and transforming her own residential property management business, she is a leading light in the industry.

Kris Pedersen

Kris Pedersen of Kris Pedersen Mortgages is a commentator on property and finance. His team sources top finance strategies.

Rachel Radford

Rachel Radford is the marketing lead for builderscrack.co.nz, New Zealand’s largest home improvement platform that connects homeowners with tradespeople. Her journalism background, combined with the platform’s comprehensive industry data, provides unique perspectives on nationwide property repairs and renovations.

Townhouses and apartments will dominate Auckland’s skyline and standalone houses sink into the shadows if the government’s new urban development plan for two million houses eventuates, S ally Lindsay reports.

Data from Auckland council shows standalone houses will shrink from 62 per cent of the city’s housing stock to just 27 per cent, while townhouses and apartments will surge from 36 per cent to dominate at 70 per cent.

About 326,000 existing standalone homes currently make up the majority of the city’s housing, compared to about 190,000 terraced homes and apartments.

Over the coming decades, the capacity for terraced homes and apartments is projected to rise to about 370,000, while the number of standalone houses will drop to just 140,000.

This turnaround will come from Auckland’s new draft plan spearheaded

by

RMA Reform Minister, Chris Bishop, which enables 10 and 15-storey apartments within a 10-minute walk of 44 town centres, train stations and rapid bus stations.

It will be a massive shift in how Aucklanders live and it hasn’t gone down well in Auckland’s leafy suburbs resplendent with villas from the turn of last century.

At a recent Mt Eden community meeting organised by local group the Character Coalition, people were alarmed the plan will ruin the charm of their area and the value of their homes.

Council planner Celia Davison told locals the draft plan is “really significant” and will change the way Auckland looks over a very long time. Opponents are concerned existing

roading, water, sewerage and amenities will be overwhelmed as the plan doesn’t include any detailed infrastructure planning.

Mt Eden ward councillor Christine Fletcher says a reality check is needed.

“There will be financial repercussions for an incoming council beyond [...] anything of this scale before, let alone [the] decimation of our community.”

She says the infrastructure needed for intensification will come with a high price tag – over $20 billion to enable 73,650 additional homes in the AlbertEden-Puketāpapa ward alone.

While many at the meeting supported intensification and making the best use of the City Rail Link (CRL), they didn’t want it happening in their

backyard, describing the new plan as a blunt instrument that doesn’t allow for any negotiation where intensification is most suitable.

Bishop says there has been an almost unprecedented level of misinformation spread about the new draft plan change.

“Auckland is not about to be overrun with skyrise apartment buildings, and the tree-lined streets of the suburbs are not about to be destroyed.”

However, he says cities aren’t museums and streets should not be shrines to the past.

The plan replaces Plan Change 78 – the Medium Density Residential Standards (MDRS) devised by the Labour-led government, which allowed three homes of up to three storeys on most residential sections without needing resource consent. There was nothing to stop the building of these homes in flood-prone areas.

The council has been allowed to opt out of Plan Change 78 by adopting Bishop’s new plan. Auckland mayor Wayne Brown says it makes sense and gives the council the chance to stop building on flood plains.

The draft plan introduces stricter regulations for areas prone to flooding and coastal erosion.

The areas most impacted by coastal erosion are the Eastern Bays suburbs of Kohimarama, Mission Bay and St Heliers, and Browns Bay on the North Shore.

All but two Auckland councillors expressed preference for Bishop’s plan. It is likely to go out for public consultation at the end of this month with submissions closing before Christmas.

with our eco-friendly, timber offsite manufactured homes. Perfect for subdivisions, rental properties, or short-term stays. Elevate your portfolio with sustainable designs that appeal to your customers. We streamline paperwork for high-value, hassle-free investment solutions.

Bishop says the “target” of two million houses does not exist.

In Plan Change 78 (alongside what was already in the Unitary Plan), the council was enabling about two million houses in total across the city over the next few decades.

“This new draft plan change carries the same number across, to ensure housing capacity in Auckland doesn’t take a backward step.

“They keyword is ‘enabled’.”

Urban planners say while there has been plenty of scaremongering over how the new plan will change the face of the city, Aucklanders need to keep in mind the plan “enables” that many houses, but it will not necessarily be “feasible”.

Urban designer Emma McInnes, writing on LinkedIn, says what the new plan is doing is “enabling” two million theoretical new houses, but the government is not actually expecting that many houses will be built in the next decade or two, because it is just not “feasible”.

“The reality is while 15-storey buildings have been enabled to support more development, they are not actually feasible.

“This is because properties that lack necessary pipe infrastructure won’t all be able to be developed; some next to parks won’t be built because of height in relation to boundary and sunlight rules; and not all developers are going to want to build to 15 storeys – the higher they go, the harder and more expensive it gets.”

McInnes says it is more likely Auckland will end up with a mixture of building heights and typologies next to each other, which will give neighbourhoods more variety, result

in a mix of neighbours and make it a better city.

She says one important aspect is the number of extra houses built in Auckland will only be decided by demand.

“The council could enable two million houses in Kumeū, but there wouldn’t be that demand for housing there. Enabling more homes next to train stations is where the demand is –especially with the incoming CRL.”

Writing in The New Zealand Herald, Urban Auckland chairwoman Julie Stout says the city must embrace intensification, but the Mt Eden meeting revealed unease about how that transformation will unfold.

“People want to understand the broader implications – on infrastructure, schools, amenities and of course, their own homes and neighbourhoods.”

Stout argues that Auckland urgently needs greater housing diversity to tackle affordability and open the market to those currently locked out.

“Affordability comes with building at scale,” she says. “This plan enables that through increased height and density around transit hubs and town centres.”

She also called for a clear process for local involvement, such as council or community-led precinct plans.

“Locals have a personal stake in ensuring their neighbourhoods thrive – with the right amenities, open spaces and infrastructure. They must be kept informed and involved.”

Bishop is encouraging Aucklanders to have their say during the council’s consultation. “Auckland needs to both grow up and out to solve its housing crisis.” ■

Family violence tenancy-termination rules have been laid out clearly by the Tenancy Tribunal, writes Sally Lindsay .

The Tenancy Tribunal has stated it cannot look behind the circumstances of family violence tenancy-termination applications. As long as the tenancy termination application is given on the prescribed form with qualifying evidence, the tribunal says that is as far as it can go and it must be granted.

A landlord went to the tribunal saying the circumstances and manner in which tenants left her rental, means fixed-term tenancies are only ever worth 48 hours’ notice.

She challenged the validity of the process in relation to a withdrawal for family violence under s56B of the Residential Tenancies Act (RTA).

Her two tenants signed a fixed-term tenancy in December last year and it was due to end in January next year.

In April discussions started about whether the fixed term could be changed to a periodic tenancy. After further talks the landlord gave the tenants copies of documents for terminating the tenancy because of family violence.

During the same month the tenants started looking for somewhere else to live and used the landlord as a reference.

It wasn’t until two months later the tenants then handed the landlord the family violence withdrawal notice for the tenancy together with a completed statutory declaration witnessed by a justice of the peace. They left within the prescribed 48 hours.

The landlord told the tribunal she didn’t feel she could contact the

tenants because of the ruling around privacy for domestic violence victims. Because of that she was unable to determine who they thought the withdrawing victim was.

She argued the termination should be denied on the grounds it did not meet the basic threshold required for a tenant to be released from their part of the ongoing lease.

The tenants told the tribunal they did what they needed to do to protect their family and followed the correct process.

Under regulation 7 of the RTA (termination for physical assault by tenant and withdrawal following family violence) the only information that must be included in the withdrawal notice is the name of the withdrawing tenant, the rental address and the date of the withdrawal.

The withdrawing tenant can make a declaration to be accepted as qualifying evidence, under regulation 8.

The tribunal does not have jurisdiction to determine whether this person is the victim of family violence while a tenant at the rental.

Adjudicator R Harvey-Lane says the tribunal cannot look behind a withdrawal from a tenancy based on family violence if given in the prescribed form with qualifying evidence.

“As the tribunal has no grounds to question the evidential basis for such a statement, it follows that a landlord has no grounds to question the evidential basis of a declaration made by someone under regulation 8.

“The tribunal’s role is to verify the

tenant’s notice and accompanying evidence meet the formal requirements and it is not required to enquire into the merits of a claim, or to determine who the victim and/or perpetrator is.”

The tribunal says the supportingevidence criteria needed for the application are intended to ensure claims are credible and based on evidence. The criteria are designed to ensure that only genuine cases of family violence are considered.

Harvey-Lane says there is no direction in the RTA about assessment of any surrounding circumstances, or consideration of whether the tenants had been applying for other properties or had other motives.

“Presumably this is because the effects of family violence are not always straightforward. It does however make sense that the tenants would want to secure somewhere to live, especially with children involved, prior to giving notice.”

The landlord told the tribunal if the tenants knew they were going to withdraw for family violence reasons, they could have given notice earlier and just put “date pending” while they found another property.

Harvey-Lane says this is misguided. “If the tenants had done so, their notice would have potentially failed to comply with regulation 7, as the date the withdrawal was to take effect would have been excluded.”

It was pointed out the landlord could have talked to the tenants after receiving the notice as it included both tenants. Termination was granted.

Data from realestate.co.nz shows some buyers are paying hundreds of thousands of dollars more simply to gain an additional bedroom.

The cost of upsizing in the housing market is becoming increasingly stark, and the number of bedrooms has become one of the strongest indicators of asking-price differences.

New data from realestate.co.nz highlights the additional value extra bedrooms can add to a property’s asking price; showing number of bedrooms is one of the clearest indicators of price difference in New Zealand’s property market.

Nationally, the average asking price increased by 32 per cent when going from a one to two-bedroom property, and by 31 per cent between a two and three-bedroom home. The step from a three to a four-bedroom home added nearly $400,000 on average, while the move from four to five bedrooms pushed prices up by almost half a million dollars.

The web portal’s spokeswoman Vanessa Williams says the price rises illustrate the influence of home size on value.

“Property owners who are willing to roll up their sleeves and add another bedroom through a smart renovation will likely benefit when selling.”

Not only can adding an extra bedroom make a property more liveable, but it can also deliver one of the most significant value boosts when it comes time to sell, she says.

On the flip side, buyers need to be aware of the price differences when upsizing.

The most dramatic increases were in Central Otago/Lakes District, where the average asking price of a two-bedroom home was $858,387, compared with $1,412,870 for three bedrooms – a rise of $554,483.

Four-bedroom homes in the area carried an additional 53 per cent premium, and five-bedroom homes were priced nearly $1 million higher than four-bedroom properties, reaching an average of $3,091,115.

By contrast, Auckland buyers faced the sharpest increase when

moving from one to two bedrooms. The average asking price of a onebedroom home was $513,668, but two-bedroom homes cost 50 per cent more, at $772,483.

In Wellington, the equivalent increase was 45 per cent, from $435,116 to $629,991. For larger homes in the capital, the gaps were more gradual, with three, four, and five-bedroom homes priced 33 per cent, 28 per cent, and 31% higher respectively.

In regions such as Waikato and Canterbury, the most notable changes came when upsizing from three to four bedrooms. The price difference was $288,519 in Waikato, representing a 39% rise, and $255,437 in Canterbury, equal to 36%.

Williams says the trends show why demand remains strong for larger properties despite the cost involved.

“These homes are often seen as the ‘forever home,’ so buyers are willing to stretch further to secure them.” ■

Instead of selling a product , we find properties aligned with your long-term investing goals We find the right property for you, in the right market for you

Our experienced investor-buyers’ agents source great deals for Kiwis around the world deals they wouldn’t otherwise find in markets we know inside and out We set you up for long-term success through our local power teams of property experts and trades

Our local investment experts are based in Auckland, Hamilton, Rotorua , Tokoroa , Hawke’s Bay, Wellington, Christchurch, Dunedin, and Invercargill Get in touch

It was a pleasure working with iFindProperty. They made investing in property straightforward, seamless and stress free

Expensive properties foreigners can buy under the relaxation of Golden Visa rules are in short supply.

Foreigners with Active Investor Plus Residency Visas are allowed to buy or build one home in the $5 million-plus price range, but there are only about 7,000 homes across the country in that category.

Cotality chief property economist Kelvin Davidson says $5 million-plus homes make up only about 0.4 per cent or 0.5 per cent of all dwellings.

“In Auckland, there are 4,300, or about 0.8 per cent of all properties. There are another 1,250 in Queenstown, about 5.5 per cent of that market.”

While there might be 7,000 properties in that range, they have to be for sale and in any given year there might be only 5 per cent actually listed – about 300-400. It is a limited pool to choose from.

And like local buyers, foreigners do not want to overpay.

In Auckland most of the expensive and top-end properties are clustered around Herne Bay, St Mary’s Bay and Westmere – all inner-city suburbs.

Davidson says it is unlikely the relaxation of the foreign buyer ban, introduced by the Labour-

led government in 2018 to protect domestic buyers, will have much of an impact on the New Zealand housing market.

He says while it is good news for real estate agents selling at the top end of the market, it won’t change from its subdued state to a fresh boom.

Top-end agency Sotheby’s says the change will be negligible on the housing market, but the economic boost will be significant.

Sotheby’s managing director Mark Harris says given the state of the economy, the country needs as much productive investment as it can get.

“By allowing foreigners on the active investor visa to own a home here, it encourages them to invest in other business ventures in New Zealand, which then leads to capital expenditure and job creation.

“Before the 2018 ban there were many foreign homeowners here, who contributed greatly to the community with business investment.”

Harris says allowing foreign buyers into the country while introducing a value hurdle protects the domestic buyer and limits the number of investors who can purchase.

“In recent years, Australia has benefitted from the investors New Zealand has turned away,” Harris says.

Although the Labour Party says more pressure at the top end of the property market will pull up house prices at the lower levels, it’s not a view widely shared.

Accounting, mortgage, and wealth advice company Lighthouse Capital has a different view.

It says the move sounds significant but will have little impact as it covers less than 1 per cent of the country’s housing stock and the number of eligible buyers is extremely limited.

Harris says there will be no real increase in demand, no uplift in the market, and no meaningful contribution to the wider economy.

However, he believes the move sends an important message to international markets: New Zealand real estate is no longer completely locked away.

“It signals that we’re open for business and that positioning matters. Perception shapes investment decisions.”

Harris also says this could be the first step in a broader strategy to reopen the market to foreign capital.

“If the threshold drops to the $3-5 million range, we’ll start seeing genuine interest, renewed confidence, and economic activity the housing sector needs.”

For now, the change is symbolic, he says. “But if it’s a sign of more to come, the real impact may still be ahead.” ■

Gilligan Rowe & Associates LP (GRA) is a chartered accounting practice that offers clients a full range of taxation and compliance accounting services coupled with specialist property, trust and asset planning advice. As well as completing accounting for individuals, businesses and property investors, GRA provide clients with knowledge through their educational programmes. Over the years we have helped thousands of clients increase their wealth through property investment, maximise their asset protection and minimise their tax liabilities. We are recognised as leading experts in our fields and are committed to helping our clients succeed. To that end we offer a range of services.

Getting your structures set up correctly from the beginning is important. We adopt a holistic approach, with a focus on both asset protection and legally reducing tax.

• Asset planning – asset protection, forming companies and trusts

• Tax advisory – tax optimisation

• Tax lawyers on staff

• Trust specialists and professional trustee services

• Estate planning (wills/memorandum of wishes)

• Property taxation specialists - companies, trust formation, structure optimisation

Accountants with deep understanding of structures and tax planning.

• Normal compliance – annual accounts, tax returns, GST, PAYE etc

• Budgeting and cashflow forecasts

• Insolvency and liquidation

• Assistance with IRD – litigation, audits, investigations

• Clients deal directly with their Client Services Manager (senior chartered accountant)

• Fixed fee so no surprise bills

Book an initial review of your affairs, including property, tax and legal structures - FREE to new clients

PROPERTY / EDUCATION / WEALTH CREATION

Helping our clients succeed.

• Property Investment and Education webinars – free to watch online

• Property School – 7-module comprehensive online course in property investment, from the basics through to more advanced strategies

• Property Development School – how to develop residential property and make a margin worth the time, effort and risk involved; ��-topic online course

• Property portfolio planning and consultation

• GRA Wealth Suite – financial self-analysis and property due diligence software

• Webinars – free webinars on property, tax and related topics

• Blogs

• Facebook – regular updates and market commentary

• Books written by the GRA directors

• Network of suppliers available to clients

• Well-connected with all major banks and finance brokers

Across the country, the median house price dropped by $4,000, or 0.5 per cent year-on-year to $761,000. However, when Auckland is taken out of the equation the median price rose by 1.5 per cent year-on-year to $690,000.

Compared to last year, 13 out of 16 regions had an increase. The most significant year-on-year increases were in Gisborne, up 11.3 per cent from $620,000 to $690,000, Southland, up 8.9 per cent from $427,000 to $465,000, and the West Coast, up 7.8 per cent from $357,000 to $385,000.

Sales across the country stalled in August, with sales declining year-on-year and month-on-month for both New Zealand – down 3.7 per cent and 11.1 per cent respectively – to 5,866 sales, and New Zealand, excluding Auckland –down 1.3 per cent and 11.3 per cent respectively – to 4,052 sales.

Only six regions had an increase in sales compared to August last year. Notable increases were in the Waikato, up 13.2 per cent to 688 sales, Gisborne, up 11.1 per cent to 40 sales and Southland, up 8.1 per cent to 133 sales.

A 9 per cent year-on-year influx of new listings around the country pushed inventory levels to 30,000 properties on the market. It is taking 48 days on average to sell a property.

The House Price Index (HPI) is at 3,577, showing a year-on-year increase of 0.4 per cent and an increase of 0.3 per cent compared to July. Over the past five years, the average annual growth rate of New Zealand’s HPI has been 3.2 per cent.

“Confidence in the property market is tempered with caution,” Lizzy Ryley REINZ chief executive says.

“At this stage, both buyers and sellers appear to be taking a measured approach as they watch how the market unfolds, particularly as we near spring,” she says. ■

Housing supply has overtaken population growth in the country’s biggest city Auckland and the capital is keeping a lid on prices.

Cotality’s latest Property Pulse report shows the supply of new homes in Wellington and Auckland outpacing population growth between 2019 and 2024.

In Wellington, the population actually declined 1 per cent in the five years to 2024, while housing stock rose by 4.3 per cent. This caused the number of residents per home to drop from 2.97 to 2.82.

Auckland’s population grew by a robust 7 per cent over the same period, but this was exceeded by an even stronger 10.3 per cent increase in housing stock. This eased Auckland’s occupancy rate from 3.45 to 3.34 per home.

“This easing in the physical supply and demand balance aligns with the weakness in Auckland’s property values, although it is also worth noting that the recent construction mix in Auckland has been dominated by townhouses, which are smaller and have a naturally lower occupancy rate,” Kelvin Davidson, Cotality chief property economist says.

Nationally, from 2019 to 2024, the population grew by 6.4 per cent, while housing stock increased by 7.5 per cent. This resulted in the average number of people per home easing from 2.99 to 2.96 over the five years.

Davidson says this figure suggests the overall market is well-balanced, with the long-run average of 2.97 people per house sitting close to the existing rate. “This balance is also supported by the recent lack of growth in property values and rentals.” ■

There has been a huge drop in migration-driven population growth over the last two years. It is now down to about 1,000 people a month.

Data from Stats NZ show in the 12 months to July 2023, 214,059 people arrived long-term, but in the 12 months to July this year, just 140,474 arrived long-term. That’s down 73,585, or 34.4 per cent, compared to two years ago.

On the other side of the coin, 98,274 people departed long-term in the 12 months to July 2023, but that had increased to 127,407 in the 12 months to July this year. That’s an increase of 29,133 or 29.6 per cent compared to two years ago.

Of the 140,474 long-term arrivals in the 12 months to July this year, 25,773 were New Zealand citizens returning after an extended stay overseas, and 114,700 were citizens of other countries.

Of the 127,404 people who departed long-term in the 12 months to July this year, 73,406 were New Zealand citizens and 54,001 were citizens of other countries. ■

Stats NZ’s latest building consent figures show 33,879 new homes were consented throughout the country in the 12 months to the end of July this year – just 42 fewer than the 33,921 consented in the 12 months to July last year.

In the month of July this year, 3,252 new homes were consented, down just 3 per cent from the 3,352 new houses consented in the year to July 2024.

Standalone houses were the most popular type of new home, with 15,685 consented in the year, up 1.7 per cent on the previous 12 months, while townhouses and home units were the second most common type of dwelling, with 14,441 consented in the year to July, down 3.4 per cent on the previous 12 months.

Apartment consents were up 26.4 per cent to 2,270 compared to the previous 12 months and retirement village units were down 15.6 per cent to 1,483 on the previous 12 months.

Meanwhile residential building work declined by 9.1 per cent, from $5.243 billion in the second quarter last year to $4.764 billion in the same quarter this year.

And average building cost increases eased back to 1.2 per cent in the 12 months to August from 1.3 per cent in the 12 months to May, QV Costbuilder figures show. ■

ANZ economists have cut their house price growth forecast for the rest of the year to a big fat zero.

Westpac has pulled its earlier 7 per cent forecast back to just 0.6 per cent, while ASB at one point expected a lift of 10 per cent.

A recent Reuters poll points to only a 1.3 per cent rise this year, far below the 5 per cent forecast in February. Prices are expected to rise 5 per cent next year and 4.3 per cent in 2027, suggesting a gradual recovery rather than a sharp rebound.

ANZ, New Zealand’s biggest home loan lender, has trimmed its forecast back from expected 2.5 per cent growth because of soft near-term price momentum.

It also expects the RBNZ’s move to cut the official cash rate (OCR) from 3 per cent to 2.5 per cent by the end of the year to reduce mortgage interest rates.

The ANZ says this will support a gradual recovery in the housing market and the wider economy, and it continues to expect 5 per cent house price growth next year.

However, the economists also point to the possibility of an eventual rise in interest rates.

“While a lower OCR will reduce interest costs for a year or two, neither the RBNZ nor the market expect lower interest rates to stick around for the longer term,” they say.

“Buyers are likely to factor this in –

it can also be seen in the fact that fiveyear mortgage rates have dropped by much less than shorter-term mortgage rates,” their report says.

“On top of this, the cost of council rates and insurance is higher than it was in the past and rents on new tenancies are falling.

“This will collectively temper buyers’ enthusiasm and the willingness of existing owners to hold on to property, even with a lower OCR,” the economists say.

Cotality says it is unlikely people will be rushing out to bid up house prices aggressively over the rest of the year, with the country’s median house price declining for the fifth consecutive month in August. ■

One-year fixed-term mortgages are flavour of the month for new mortgage borrowers – a sign mortgage holders believe rates have further to fall.

The latest RBNZ data shows in July 40.9 per cent of new owneroccupier loans were on a one-year fixed term, up from 39 per cent the previous month.

Investors are also keen on the one-year fixed term, with the share of lending to them at 42.4 per cent. However, this is down 2 per cent from 44.4 per cent in June, figures in the central bank’s new lending fully secured by residential mortgage data series reveal.

In comparison, owner-occupiers share on floating rates was almost half

of the one-year rate at 20.7 per cent dropping from 24.7 per cent in June and 31.6 per cent in May, while the share of mortgages taken out for six months dropped to 6.7 per cent from 8.2 per cent in June.

Floating terms for investors accounted for 22.5 per cent of new lending, down 4 per cent from 26.5 per cent in June. Their share of 18-month fixed terms rose to a 10.1 per cent up 0.6 per cent from 9.5 percent the previous month.

Overall, new residential lending increased to $9 billion in July, up from $8.7 billion in June. Compared to July last year, the total monthly new lending was up 35.9 per cent from $6.6 billion.

New listings have soared in Auckland over the past year for the city’s biggest real estate agency, Barfoot & Thompson.

About 1,622 were received in August, up slightly from 1,605 in July, but up by 11.6 per cent compared to August last year.

That helped keep stock levels high, with the agency having 5,873 properties available for sale at the end of August, down by 3.3 per cent compared to July but up by 13.8 per cent compared to August last year.

August’s stock level was the highest it has been for the

month of August since 2008. Meanwhile, property website realestate.co.nz received 8,769 new listings in August, which was up 9 per cent on August last year and was the most it has received in any month over the three months of winter.

That helped keep the total level of stock for sale high, with realestate.co.nz having 30,000 residential properties available for sale at the end of August, up 1.4 per cent compared to August last year.

That puts stock levels on the site at their highest level for the time of year since 2014 and they have

The share of total new residential lending on fixed interest rate terms increased to 78.5 per cent, up four per cent from June.

New owner occupier lending increased to $6.3 billion, up from $6.1 billion in June. Loans to this group on floating and short-term fixed rates represented 68.3 per cent of new lending. Terms on 18-months fixed accounted for a combined share of 31.7 per cent.

New residential investor mortgage lending rose from $2.4 billion in June to $2.6 billion a month later.

The RBNZ in its Monetary Policy Statement last month suggested it may drop of the OCR to 2.5 per cent by the end of the year. ■

more than doubled since August 2021 when there were just 12,249 residential properties for sale on the website.

The average asking price of the properties listed on realestate.co.nz was $840,547 in August, which was the highest it has been over winter but still down by $11,741 compared to May.

Barfoot & Thompson sold 889 properties in August, down from 957 in July and unchanged from the 889 it sold in August last year.

The average selling price was slightly weaker, dropping from $1,100,355 in July to $1,081,032 in August, down $19,323, or 1.8 per cent, while the median price was unchanged from July at $950,000, which was just $2,500 lower than August last year.

A notable feature of Barfoot’s sales in August was the number of properties that sold for under $1 million.

“They made up 56 per cent of all sales and this highlights the growing attraction of lower cost townhouses and apartments - three years ago sales in this price category made up 41 per cent of sales,” Peter Thompson, Barfoot & Thompson managing director says.

Conversely, sales of property over $2 million were at their lowest level in five months. ■

Kris Pedersen says we should expect a 25-basis points drop in the next OCR review.

At the time of writing the June GDP numbers had not yet come out, which will play a part in the Reserve Bank’s decision as to how they handle the final two cash rate reviews in 2025.

The Reserve Bank had been predicting a 0.3 per cent drop for the quarter and this may mean a drop down to 2.5 per cent by year’s end. I expect we will see a 25-basis point drop at the October 8 review date if the drop is in the general region of the 0.3 per cent.

We won’t receive the September quarter GDP results until midDecember, which will be after the RBNZ’s final official cash rate (OCR) decision for 2025. However, between the October and November OCR decisions, we’ll get the September quarter inflation data on October 20, followed by the September quarter labour market data on November 5.

Just before this was written, figures were released showing that the monthly selected price indexes – a subset of data that represents less than half of the consumer price index (CPI), but is still helpful in indicating the direction of the CPI – had dropped more than anticipated.

While inflation is expected to hit –or at least get very close to – the top of their mandated range of 1-3 per cent, expectations are that this should drop and be closer to 2.3 per cent by the March quarter next year. There is growing discussion around whether the current mandated inflation target remains appropriate.

For decades, globalisation helped to keep prices down, but the shift toward a less interconnected world –exemplified by Donald Trump’s trade war – has changed that dynamic.

This shift raises the question of whether it is time to reconsider what level of inflation should be deemed acceptable. Proposals have surfaced suggesting an adjustment of the mandated band to 2-3 per cent. Such a change would, over time, likely result in higher interest rates, as inflation expectations would naturally adjust upward from where they currently sit.

With the recent resignation of the

Reserve Bank chairman Neil Quigley, we will need a replacement for him and a new governor to replace Adrian Orr.

Considering the criticism that the Reserve Bank has faced, and the fact that the appointee will be approved by the National Finance Minister, there may be a different approach moving forward.

At present I am still leaning towards the short-term rates of either 6 or 12 months, fixed with the intention of looking to lock in longer term rates when we appear to be closer to the bottom of where the cash rate sits. ■

The interest rates specified in this table were accurate on 12 September 2025. Interest rates are subject to change without notice. Different fees and charges apply to each loan depending on the motgage lender. Seek expert advice to determine the mortgage lender that is right for you and your circumstances. A disclosure statement is available on request and free of charge.

There has been an increase in new listings targeted at investors, which indicates a more dynamic market, according to realestate.co.nz data.

There was an 8.9 per cent year-on-year increase in homes targeted at investors in August, according to realestate.co.nz data.

Most notable is a 25.5 per cent annual increase in one-bedroom properties targeted at investors, with Auckland and Wellington both showing increases for this typology, at 28.8 per cent and 50 per cent, respectively.

Three-bedroom properties targeted at investors also saw an increase –10.7 per cent – with an 8 per cent increase in four-plus-bedroom homes and a 3.7 per cent increase in two-bedroom homes.

Looking at Auckland specifically, there were increases in new listings targeted at investors across all typologies. There was a notable increase in four-plus-bedroom homes of 24.8 per cent year-on-year and an increase in three-bedroom homes of 21.1 per cent. In Waikato, threebedroom homes targeted at investors increased by 39.2 per cent, with an increase of 25.5 per cent across the board.

Vanessa Williams, spokesperson at realestate.co.nz, says the data points to increased confidence in the Auckland investor market.

“In August, national new listings rose 9 per cent year-on-year, with

realestate.co.nz has been helping people buy, sell, or rent property since 1996. Established before Google, realestate.co.nz is New Zealand’s longest-standing property website and the official website of the real estate industry.

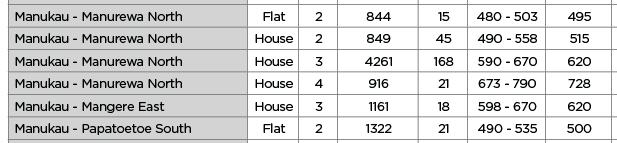

LEFT Auckland saw an increase in investor-targeted four-bedroom homes of 24.8 per cent year-on-year.

RIGHT Listings for onebedroom units targeted at investors grew 50 per cent year-on-year in Wellington.

Auckland seeing an even stronger lift – up 13.4 per cent.”

She says it’s typical to see an uplift in new listings as we head into spring.

“This year, the seasonal increase arrived a little earlier. A recent run of OCR cuts is likely a factor; a year ago, the OCR was at 5.25 per cent, while today it’s at 3 per cent. Those lower rates will be giving investors more confidence.”

Wellington experienced an increase in investor-targeted listings of 14 per cent across all typologies, with fourplus-bedroom home listings increasing by 25 per cent.

Conversely, Canterbury experienced a downturn in investor-targeted listings of 4.6 per cent, with two-bedroom homes experiencing a significant drop of 21 per cent year-on-year.

“Overall, new listings in Canterbury were down 2 per cent compared to the same time last year, suggesting some hesitancy among sellers in the region. In contrast, new rental listings rose sharply, climbing 29 per cent year-on-year.”

This supports the anecdotal evidence that owners of townhouses in the area (which are likely to be two-bedroom typologies) are currently favouring the rental market.

Nevertheless, Williams says there is a general lift in momentum across the market, according to their figures.

“A surge in new listings during August and a stable supply pool give buyers options while prices remain stable. Heightened activity in investor-targeted listings signals fresh opportunities for investors looking to capitalise on a more dynamic market.” ■

Our experts address your property queries

Do you have a burning property investment question you need an answer for? Whether you are just starting out in property investment, or an experienced investor, email joanna@informedmedia.co.nz to have your questions answered.

Matthew Gilligan

Gilligan Rowe + Associates, gra.co.nz

Kris Pedersen

Kris Pedersen Mortgages, krispedersen mortgages.co.nz

Mark Withers

PKF Withers Tsang, pkfwt.co.nz

QWe are looking for advice on loan structure of an investment property. We have a family home plus a residential investment property. The family home is owned by us personally and the rental is owned by an existing company we had set up for a previous commercial investment. We have a $400,000 mortgage secured against the family home and no mortgage on the rental as it was a cash purchase (funds from sale of previous commercial investment). Obviously, it would be better to have the mortgage secured against the rental property for tax purposes. How do we go about this? Can we transfer the mortgage to the company rental? Do we need to buy/sell to ourselves? Any advice would be appreciated?

ASarina Gibbon Independent tenancy consultant, sarina@tenancy advisory.co.nz

Ryan Weir

Propertyscouts, propertyscouts.nz

This is an excellent question, and I want to start by dispelling a common myth. The myth is that all you need to do to get a deduction for interest is to secure the borrowing against the rental. This is a myth because security does not matter from a tax point of view. It is very important for commercial reasons, and I am not dismissing the significance of what you offer the bank as security for your borrowing from a commercial point of view. What I am saying is that it is not determinative from a tax point of view. What matters from a tax point of view is (i) who borrowed the money and (ii) what did you borrow it for? The problem that you will have is that you have borrowed $400,000 to buy the home and for that reason interest is not deductible. If you simply switch the property that the bank has as security from the home to the rental, that will not change the fact that you borrowed the money to buy the home. That said, there will likely be a path to getting at least some, if not all, of interest deductible. It may involve selling the rental property out of the company, but that can generate negative tax consequences depending on how long the property has been owned for (for example, you do not want to transfer a property into new ownership within two years of buying the property, triggering application of the bright line rule). This means other options will need to be considered in terms of how to better structure the borrowing. Without knowing more detail of your circumstances I cannot give any definitive advice. I strongly recommend you get asset planning and tax advice from a professional.

Matthew Gilligan

QIs it true that you can only get a chattels valuation within the first year of buying an investment property? I have just bought a property that is pretty run down and has a tenant in it so I can’t renovate it immediately. It is still worth getting a chattels valuation or it is pointless as it is a beat up property?

QJust interested to hear your thoughts on how long to fix now that the OCR is expected to go down to 2.5 per cent. We have two houses coming off fixed interest rates soon.

AYes, it will be necessary to identify items of depreciable property in the year the property is acquired. There is a three-step test for determining if items are separate chattels that can be depreciated that are distinct from the building.

1. Determine if the item is attached to the building

2. Determine if the item is an integral part of the building, would the building be considered complete without it?

3. Is the item built into the building such that it has become part of the fabric of the building?

Where a renovation is planned it may be possible to identify and determine a reasonable secondhand value of the non-building depreciable assets acquired on acquisition, either with a chattel valuation or by researching a reasonable estimate of value. If these items are scrapped as part of the renovation a loss on disposal of the item can then be claimed. The replacement items acquired as part of the renovation can be depreciated based on their cost without the need for a separate valuation provided a costing of the items acquired is available.

Mark Withers

AI am leaning towards 12 months still. I think this will be cheaper rather than rolling two back-to-back six-month terms, but prefer the 12-month term as I think we should start to see some improvement in the economy over the next 12 months and there will come a time when it makes sense to hedge risk and either fix for longer or split debt and fix on

different terms. I have to give a plug for Jarrod Kerr, the Kiwibank economist as I believe he has consistently been the most accurate over the past three to four years. He generally comes out with weekly commentary and it is worth keeping an ear out to what he is saying over the next 12 months in particular.

Kris Pedersen

QI rent out a property with two self-contained tenancies (upstairs and downstairs). The property has one power meter. Rent for both tenancies is $650 per week, including power. Usage was steady for months, then rose sharply

QMy tenant was recently arrested for drug dealing and is now in custody. Prior to this I had already served a termination notice and the tenancy is due to end in a couple of months. I’ve been in contact with their barrister who has said it’s unlikely the tenant will be bailed back to the property – they’re likely to remain on remand and eventually receive a prison sentence. So, it’s looking very likely the tenant won’t return to collect their belongings before the tenancy ends. What should I do if there’s still a house full of stuff when I take possession?

AThis is one of those situations where planning ahead will save you a lot of headaches down the track. The Residential Tenancies Act (RTA) sets out a clear process for dealing with abandoned goods, even in circumstances like

after the downstairs tenant bought an EV. Nothing else has changed at the property, so I can only assume the increase is due to the tenant charging his car at the property. If I install check meters on both units now, can I charge the downstairs tenant for the increase in their power bill (ie the new power bill minus the average monthly power before the spike)?

AI don’t speak cars, but given that my EV has barely made a difference to my bills, I suggest that you start by testing your assumption. Correlation is not causation. Get a qualified electrician to audit the load profile and figure out whether there is anything else at play.

Turning to the law. Assuming your agreement contains an unqualified statement along the lines of “rent is $650 (including power)”, then it is $650, including power. While a check meter will support your ability to meet the attribution standard under section 39, it does not let you unilaterally turn

this. You have two options.

The safer approach is to file an application with the Tenancy Tribunal now (under section 62B of the RTA), asking for an order authorising disposal of any goods left behind. Filing now gets you into the queue early, though if the tribunal can’t serve the tenant due to them being in custody, the application might get delayed or parked. This is the recommended path, as it gives you the strongest legal footing if your actions are ever questioned later.

The self-assessment approach allows you to make a call yourself. If you assess the goods and reasonably believe they’re worth less than the cost to store, transport and sell, you’re allowed to dispose of them immediately under section 62A. If they’re worth more, you store them offsite for 35 days before selling.

A very good first step – before any disposal decisions are made – is to try contacting the tenant’s family to see if they’re willing to collect the

an inclusive rent into pass-through charges mid-tenancy. While the Residential Tenancies Act is silent on diminishing benefits as a function of rent, it is commercially imprudent to reduce the tenant’s benefit without a corresponding concession on rent. Try negotiating a variation to ensure business and cash-flow continuity. If an agreement is not forthcoming, you could consider relying on Graeme Geraghty v Urupani Raui and make a limited s85 application for a reasonable and estimated clawback. I can’t predict what the tribunal would decide, but certainly Geraghty shows some judicial sensitivity to preserving the benefits of the bargain for the landlord, which should give claimants some confidence. Looking to the future, I recommend using a check meter to enable “virgin rent” agreements that treat power separately, as otherwise an s85 application could produce unpredictable results for the landlord.

Sarina Gibbon

belongings. This shows you’re taking reasonable steps to preserve the tenant’s interests, and often results in a faster and cleaner outcome.

One word of caution: don’t overestimate the value of household contents. I recently cleared out a fully furnished eight-bedroom house and, after selling 34 items, only netted $2,500. Unless there are vehicles or high-value items, most contents aren’t worth much. Be aware that personal documents must not be discarded. These need to be securely stored and handed to the police if the tenant doesn’t collect them. Whatever route you take, documentation is your safety net. Take photos, document valuations (supported by Trade Me listings), estimate disposal costs, and keep records of any attempts you’ve made to contact family. Having a solid paper trail will protect you if your actions are ever challenged.

Ryan Weir

Tel: 09 522 7955 | Email: info@gra.co.nz | www.gra.co.nz

chartered accountants specialising in property, tax and trusts

Matt Ball, of New Zealand Property Investors Federation, on the increasing professionalisation of landlording.

When I first bought an investment property, way back in 1997, the Residential Tenancies Act 1986 (RTA) had been in place for just over a decade. Things were still fairly informal and if I’m honest, there wasn’t all that much oversight. In general, landlords and tenants rubbed along pretty well. Times have changed. Over the years the RTA has been amended to include more rules, major and minor, which govern the way we rent property.

These changes have included things like healthy homes standards, rules around how you must interact with tenants, when you can and can’t give notice and even a rule requiring you

to tell your tenants you’re insured. Later this year we’ll all be dealing with new rules around pets, and it won’t stop there.

At the time of writing, parliament will soon debate a bill put forward by a Labour MP to register boarding house operators. Other MPs have put forward bills to require landlords to provide curtains, restrict how often you can carry out inspections, limit rent increases and one to create a healthy homes certification scheme. A landlord register is probably only a matter of time, it’s Green Party policy and would likely be supported by Labour. We shouldn’t be surprised – it’s a given that over time rules and regulation generally increase.

At this point I’ll make it clear this isn’t a grizzle about all the changes that have happened over the last quarter of a century. Things like healthy homes have clearly been beneficial, and they’ve created a level playing field so that landlords who look after their properties and tenants aren’t disadvantaged by being undercut on rents by landlords who don’t.

Getting the bad apples out of our industry benefits everyone.

Rather I want to point out that the rule changes are, over time, forcing the professionalisation of our business. This is no bad thing, but it does mean that we landlords must take our business seriously. We need to know

the rules and follow them, and we need to actively manage our properties. If you don’t, you can come unstuck very fast.

The key thing for any landlord to remember is that you are operating a business. It’s not a hobby, it’s not a passive investment, it requires management. If you manage it well, you and your tenants will be better off. If you don’t, and things go wrong, they can go very wrong.

In the time I’ve worked for New Zealand Property Investors Federation (NZPIF) I’ve noticed that a high proportion of the “landlord ruined by bad tenants” stories so beloved of media involve an inexperienced or accidental landlord. I don’t mean this in a victimblaming sense – tenants who don’t pay rent or damage property are the ones at fault. What I’m pointing out is that when problems arise, it’s more often the inexperienced landlords who come unstuck.

Let me give you a recent example. Due to personal circumstances, an investor needed to rent out their second small property. An accidental landlord, if you like. They did some things right, took out landlord insurance and got a great tenant. Then it started to go wrong. A new tenant moved in, was fine to start with, but stopped paying rent. Damaged

the property. Eventually left, over 18 weeks in arrears.

The owner was successful in the Tenancy Tribunal, with an award of more than $13,000 in their favour, but they’re unlikely to see it. The insurance company won’t cover the rent arrears (this is standard) and because the damage was caused by multiple events, the claims are eaten up by the excess. The owner is now in a tough financial situation.

When you look at the detail of the case it appears that while the tenant was at fault, an experienced landlord could have significantly mitigated the damage.

The tenant was over 18 weeks in arrears – addressing late rent payments immediately and using the RTA provisions correctly could have limited this loss significantly – or turned it round altogether. Regular property inspections – or at least a visit once the tenant stopped paying rent – would have revealed the damage sooner, and again, could have limited the loss.

It’s a tragic case. The landlord in question has had to take money out of their KiwiSaver to cover the costs and may have to sell their investment property at a time when the housing market is low. No-one wants to see this sort of thing happen.

The advice the NZPIF would like to give to new and prospective landlords is this. If you want to manage your own property, that’s great. It really is a wonderful and rewarding business – but learn how.

The best way is to join a property investors association to get free advice and support. There are 17 associations around the country, all of them have lots of super-experienced investors who enjoy passing on their investing wisdom. Once you join an association, you can do our RentSkills course for free. It’s a great course, which takes you through the ins and outs of the RTA – even experienced investors will learn something.

If you don’t want to manage your property, get a good property manager to do it for you. There are many great property managers around the country and it’s interesting to note that the proportion of investors using property managers is growing over time. Given most investors have a day job – and the law is increasingly complex – getting a professional to take care of things for you can give you peace of mind.

Finally, if you want a passive investment, this isn’t the business for you. Put your money into KiwiSaver. It could save you a lot of heartbreak. ■

Profile Nicola Valentine

Nicola Valentine specialises in finding opportunity where others see roadblocks – and she’s built a successful portfolio and new business through it, as Joanna Mathers reports.

Photography by Jemma Mitchell

Nicola Valentine was just 18 years old when she made a decision that would foreshadow her life’s direction – she bought her first property.

It was 1999, and with a $16,000 loan from her parents she secured a $75,000 Hornby doer-upper, the worst house on the street, sitting beneath five towering power lines. Although it was a house that few would have found appealing, Nicola had grown up in a family where property investment was second nature, and she appreciated how important it was to get on the ladder early.

Her father Martin Evans was the president of the New Zealand Property Investors Federation in the 2000s. He had also founded A1 Property Managers, so property wasn’t an abstract concept or a distant ambition for Nicola – it was in her DNA.

“From mowing student lawns to painting rentals, I was hands-on with my parents’ properties, it was just part of life,” she says.

She would go on to build a portfolio – and a tiny home business called Movapod – that reflected her ongoing passion for property.

After leaving school, Nicola studied a Bachelor of Design at Massey, followed by an MBA at the University of Canterbury. She met her husband Tim at 16, and in 2003 the pair moved to London for their OE. By 2005, they were back in New Zealand with $30,000 in savings and ready to grow their wealth.

Their first joint venture was purchasing and relocating Nicola’s parents’ bach at Lake Brunner to a new site in Moana. All-in, it cost $150,000, and two years later they sold it for $270,000. Around the same

time, they sold Nicola’s Hornby house under the power lines for $175,000. And by 2007, the couple had realised strong early profits, but were hungry for more adventure.

That same year, they moved to Perth. Nicola worked in tech, Tim as a bricklayer, but property was never far away. In 2008, they bought land and began developing build-to-rent and build-to-sell homes.

It was a crash course in project management and tenant relations during unsteady times in a declining market just after the global financial crisis. They learned what tenants wanted in a home and how to plan a development from start to finish. But it wasn’t without mistakes.

“We didn’t know how to manage tenants – we didn’t do credit checks, and we didn’t price the houses properly, we were very green” Nicola admits.

Those lessons would become the foundation for their next chapter.

Nicola and Tim returned home in 2012, after the devastating Canterbury earthquakes, bringing with them property-development experiences and their first child.

“It was a weird market,” recalls Nicola. “It was stagnant and there was a lot of uncertainty after the earthquakes – people were really reluctant to do much.”

Instead of shying away, they leaned into the opportunities they saw. The couple began buying houses around the University of Canterbury, and converting them into student accommodation. With yields of 9.5 per cent, the strategy proved successful, and they reinvested profits into more properties.

Nicola and Tim were hands-on renovators, pouring their energy into adding more bedrooms, updating kitchens, bathrooms, and living spaces. Renovations soon gave way to boarding houses; purpose-built dwellings with en-suite bedrooms that

Profile Nicola Valentine

‘From mowing student lawns to painting rentals, I was hands-on with my parents’ properties, it was just part of life’

appealed to tenants and delivered both yield and capital gain.

They developed five boarding houses (five to six bedrooms each) and built a reputation for combining smart design with financial return. Yet tenant management fees were eroding profits, so the couple began to self-manage their growing property portfolio, today managing 50 tenancies themselves.

By 2020, with tenancy law changes enforcing the 90-day termination of fixed term tenacies, they pivoted again – selling some student rentals and securing five RMD sites for multiunit development. Consents were approved, but when Covid and supply

shortages hit, they land-banked the projects, waiting for the right moment.

The idea for Movapod came from a simple observation: many property owners had land that was underutilised, including their own.

In 2022, Nicola and Tim launched Movapod, specialising in transportable, high-quality homes built off-site and delivered ready to live in.

Adding small, self-contained dwellings to those sites instantly increased yields, provided flexible accommodation, and met the growing demand for affordable housing.

The success of Movapod represents many years of hard work, dedication and a deep understand of what makes property investment successful.

It was to this end that Nicola and Tim’s developed the new business.

They began designing and building compact, versatile pods that could be placed in the backyards of existing properties. Each pod was built to New Zealand standards, with licensed builders, plumbers, and electricians ensuring quality and compliance.

“Movapods are handcrafted with our clients in mind,” Nicola explains. “They’re designed for every purpose – a bach with friends and family, an office, or a second dwelling to generate income.”

Movapods are manufactured entirely in New Zealand using robust materials: Coloursteel roofing, timber framing,

Weathertex or Coloursteel cladding, plywood interiors or gib, and doubleglazed aluminium windows. Options include full kitchens, bathrooms, and furnishings, making each pod adaptable to its intended use.

And they come with council Code of Compliance Certificates, giving clients the confidence that they are built to a very high standard.

Nicola and her team work closely with property investors and real estate agents to identify sites where pods can add the most value. Investors can effectively boost their rental income without needing to buy new land or undertake large-scale developments.

“For high cash flow, it’s a nobrainer,” says Nicola.

Movapod is thriving, with 10 units delivered this year alone. For Nicola,

it represents the culmination of two decades of experience – design skills honed at university, instincts inherited from family, lessons learned the hard way, and an entrepreneurial drive that has never waned.

From the Hornby house under the power lines, boarding houses to multi-unit property developments and now to modular homes redefining small-space living, Nicola has built a career on finding value where others might not. Movapod is both the latest chapter and a vision for the future: smarter, smaller, better homes.

Her personal goals remain clear: to grow high-demand rental portfolios and expand into joint-venture developments across New Zealand. Professionally, her mission with Movapod is just as bold –to lead the way in modular living and prove that small spaces can create big opportunities. ■

Oyster helps New Zealanders grow wealth through commercial property investment.

Our specialist team targets long-term asset performance through a disciplined investment strategy that delivers both regular income today and capital growth tomorrow. Quality assets. Strong tenants. Active management.

“Investing with Oyster Group has been seamless and rewarding. Their expertise in high-quality commercial properties delivers strong capital growth and solid monthly returns. With expert management, I can ‘bottom drawer’ my investment, set it and forget it - while reaping the benefits.”

— Rashid, Investor

If you’d like to participate in our next opportunity, contact Jordan Jennings

In an unregulated sector, unscrupulous property managers are operating under the RTA radar. But change may be on the horizon, as Joanna Mathers discovers.

In mid-2017, something unusual began taking shape inside a light-industrial building in Manurewa, South Auckland. Prefabricated cabins were being hauled inside and lined up; an interior shanty town – with little light, warmth or ventilation – created.

Within months, the building housed 22 shipping-container-sized cabins. And migrant workers, new to New Zealand and unfamiliar with local laws, had moved in.

The rooms were cramped, crowded, and lacked basic fire safety systems or proper means of escape. The building had never been

consented for residential use, yet it became “home” to these workers.

The operation was overseen by Auckland commercial property director Paul Knights, acting through a company called 4 Corners Investment. Despite being aware that that boarding activity on the site was unlawful, the site was used for that purpose for nearly two years.

Knights lived in the apartment above the ersatz “boarding house” – collecting rent from the workers below.

Earlier this year, he was fined $54,000 in the District Court. Auckland Council welcomed the

ruling, calling the case a clear example of exploitative and unsafe accommodation targeting migrant workers. For many in the industry, this was one example of a much broader problem.

In the shadows

New Zealand’s official rental system is governed by the Residential Tenancies Act (RTA) and Healthy Homes standards, which set minimum requirements for heating, insulation, and ventilation.

But beneath this lies a shadow market – one that preys on those least able to defend themselves.

“Migrants who can’t speak English and don’t understand tenancy law are incredibly vulnerable,” says Wallace Wang, a veteran property manager and owner of Auckland’s Mission Property Management.

With more than two decades in the industry, he has seen the rise of unregulated “property managers” who market rooms and houses through social media and community networks.

“These operators don’t follow the RTA. They don’t lodge bonds, they collect cash without receipts, and they overcrowd properties. Because they speak the same language or come from the same cultural community,

migrants trust them. But that trust is being abused.”

Wang recalls a landlord who was squeezing four tenants into a single 20m2 room with one bunk bed. The tenants, all new migrants, accepted the arrangement.

“They didn’t expect much when it came to housing,” Wang explains. “And that’s the mindset these unregulated managers take advantage of.”

Sarina Gibbon, general manager of the Auckland Property Investors Association and tenancy consultant and coach, says there is a “secondary

market” operating beneath New Zealand’s mainstream rental market. As she explains, there is a chasm between the official RTA-compliant market and the informal practices happening in some communities.

“Some [of these property managers] don’t even bother lodging bonds. There is a subculture of renting that exists outside the mainstream, and property managers working in this space are often completely untouched by tenancy law.”

Because these managers often operate within migrant communities –often presenting themselves as trusted insiders – many tenants assume they are legitimate. But without legal protections, migrants are at high risks of exploitation: unlawful fees, unsafe housing, withheld bonds, or intimidation if they complain.

Wang says that within this secondary shadow market, bonds are often not lodged, leaving tenants without protection. Rent is often collected in cash with no receipts, making disputes impossible to prove. Many properties are unheated, uninsulated, or overcrowded. Migrants are charged unlawful “key money” or administrative fees just to view or secure a property. And in the worst cases, tenants are threatened with

eviction if they attempt to assert their rights.

“These aren’t abstract technical issues,” Wang says. “They affect people’s health, financial security, and dignity. For migrants, who often lack the language skills to navigate the system, the impacts can be devastating.”

While there are always going to be unscrupulous operators, regulation of any sector raises the bar. And unlike real estate agents, who must be licensed and adhere to a strict code of conduct, property managers in New Zealand operate in a legal vacuum. Anyone can set up shop with no training, no registration, and no oversight.

The previous Labour government attempted to change this with the Residential Property Managers Bill, which would have introduced licensing, training requirements, and mandatory trust account audits.

But earlier this year, the coalition government discharged the bill,

‘We work hard to be fair to both tenants and landlords, but we get tarnished by a minority who are in this purely for profit’

SHADI SALEHPOUR

arguing it was too heavy-handed and would push up costs for renters. The decision left many in the industry disappointed.

Shadi Salehpour, director of Let’s Rent and a property manager with over 15 years’ experience, calls it a major setback.

“The majority of us good operators were disappointed the bill did not go through. We work hard to be fair to both tenants and landlords, but we get tarnished by a minority who are in this purely for profit. Regulation would have helped set minimum standards and given us recognition as professionals.”

And the absence of regulation doesn’t only harm tenants – it leaves

landlords exposed as well.

David Faulkner, general manager of property management at Property Brokers, has been working in the property management sector for two decades. He says that there are significant financial risks when property managers don’t use trust accounts or have regular auditing processes.

“At Property Brokers, we operate a trust account, and $20 million of clients’ money flows through it every month,” Faulkner explains. “But many companies don’t have trust accounts, and there’s no compulsion for them to do so. All it would take is one rogue employee to put landlords’ money at risk.”

He says that many landlords aren’t aware that their property managers have thousands (or millions) of dollars sitting in their bank accounts; there is no regulatory oversight that protects this. While Property Brokers is regularly audited (something that it is no legal requirement to undertake) many smaller operators have a far more casual approach.

“Once landlords start to become aware of the risk involved with this I believe that change will start to occur in the industry.”

The Ministry of Housing and Urban Development (HUD) acknowledges that there are issues around the lack of regulation. Spokesperson Charles Mabbett says “the agency is exploring options for a light-touch regulatory regime for property managers,” noting concerns about migrants and others facing language barriers.

But critics argue enforcement under the current framework is almost entirely reactive – dependent on tenants lodging complaints. Migrants, fearing eviction, reprisals, or even deportation, are among the least likely to speak up.

And landlords need to be more engaged with the process – regulation of the sector is extremely important as it would protect landlords’ money as well as vulnerable tenants.

For those caught in exploitative arrangements, the toll is more than financial. Unsafe housing increases health and safety risks. Withheld bonds or unlawful fees drain already limited resources. The constant threat of eviction leaves many living in fear, too anxious to assert their rights.

“These aren’t abstract policy issues,” Wang says. “They’re about real people living in overcrowded garages or paying cash to unregulated managers who threaten them if they speak up. Without regulation, we’ll keep seeing migrants being exploited in exactly this way.”

Advocates say reform must be two-pronged: better enforcement and education, alongside mandatory licensing and training. Clearer information for tenants – translated into multiple languages – would help migrants understand their rights.

“Regulation won’t magically make unethical people ethical,” Salehpour admits. “But it will create minimum standards and accountability. That’s the least we can do to protect people who are new to this country and trying to build a life.”

Two recent cases in Queenstown illustrate how not following tenancy laws can result in huge penalties for landlords.

Queenstown landlords Conrad Goodger and James Truong have been heavily penalised for illegally operating boarding houses in the district.

Goodger was fined $81,050 by Tenancy Tribunal on behalf of 117 tenants across four properties in September.

Truong was ordered to pay $113,723 earlier this year for breaches of the Residential Tenancies Act (RTA), and had to refund 40 per cent of the rent paid when his property was operating as an unlawful boarding house.

The decision was made on behalf of 22 tenants, mainly migrant workers employed in Queenstown’s hospitality industry.