Investor survey results inside

ASSET OVERVIEW

How will your portfolio perform in 2025?

INVEST IN WINE

Auctions, websites and where to buy

KIDS AND FINANCE

Teaching those big lessons about money

Investor survey results inside

How will your portfolio perform in 2025?

Auctions, websites and where to buy

Teaching those big lessons about money

the year ahead

08. Meet some of our contributors

10. What we like

Glam flip-flops, skin repair and making money with zero bucks.

14. Autumn inspiration

Enjoy the warm, natural colours of the changing season.

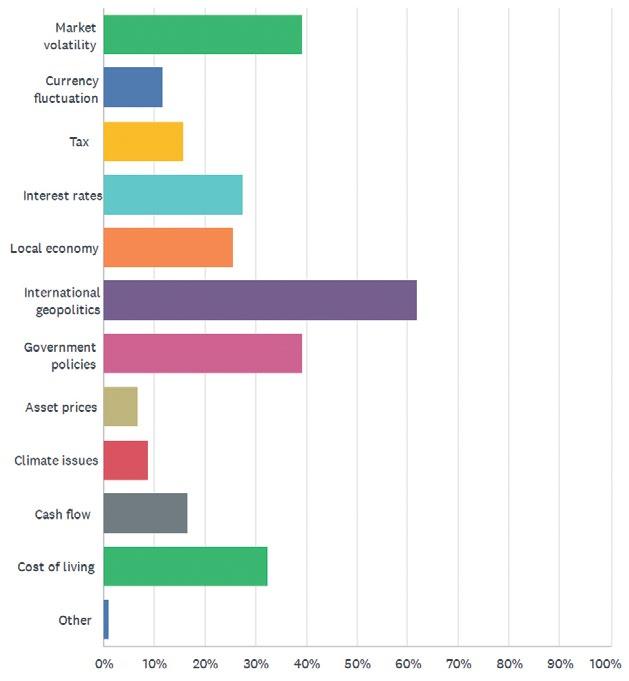

16. Investor sentiment survey

New Zealand investors are jittery about international geopolitics, but positive about their returns this year.

22. Time to take stock of your investments

What you might expect from your assets in 2025.

28. What your financial advisor is (not) telling you?

Paul Quickenden, Easy Crypto’s chief commercial officer, dives into why financial advisors are gun-shy when it comes to crypto.

30. A brief history of the dismal science

Andrew Kenningham explores eight key thinkers who helped shape our understanding of economics.

34. Why women need to network more

Charlotte Clark and Victoria Bahadoor, co-founders of Empower

Her Community, on the power of connection in business.

36. Optimising returns

InvestNow’s Foundation Series Funds combines low fees with tax efficiency.

38. Educating children in finance

Our relationship with money begins at a young age, writes Bridgette Jackson from Equal Exes.

40. Targeted returns

Select Invest offers term-loan investments underpinned by first mortgage security.

42. The big three

Sam Bryden, head of distribution at Nikko AM NZ, shares three questions to ask your financial adviser about KiwiSaver.

44. Money secrets laid bare

Being honest about money matters is vital for any healthy relationship, writes Lynda Moore.

46. Nest-egg thinking

Liv Lewis-Long on why KiwiSaver is such an important tool for ensuring financial wellbeing in retirement.

48. Hidden in plain sight

An investment option has been delivering consistent returns to Kiwis for over a decade.

50. Global snapshot

Forces affecting business, investment and the economy across the globe.

They recognise KiwiSaver clients with higher balances deserve more.

They want their clients to have a clear retirement strategy.

They want to charge a fee-for-service commensurate with the advice given. They want their clients’ KiwiSaver integrated with their overall financial plan.

They value receiving referrals from KiwiWRAP marketing.

They understand KiwiSaver is the future of advice and recognise they need to take control of their value proposition, service and revenue.

“KiwiWRAP is a game changer for my business because it puts me, not the scheme, in control.”

Adam Stewart - Compound Wealth

They want to build comprehensive portfolios using best-of-breed managers. Contact us today

“KiwiWRAP advertising and promotion have led to me securing new clients. It’s a unique offering that gives advisers a real point of difference in attracting new clients looking for something different.”

Joel Robinson - Radical Investment

52. Year of conflicting forces

As Kelvin Davidson from CoreLogic explains, there are likely to be disparate forces at play in 2025 in the property market.

54. Money for nothing

Nichole Lewis is a property investor who uses ‘no money deals’ to create wealth; read on to find out how she does it.

56. Investing in uncertain times

Andrew Nicol on what global events mean for Kiwi property investors.

58. Sustainability central

Central Park is one of New Zealand’s largest mixed-use commercial precincts.

IN YOURSELF

60. Fashion update

The colours and styles of autumn 2025

62. Autumnal offerings

Colour is extremely powerful, so choose wisely when making decisions around your home decor, Mary-Anne Tobin advises.

64. Yield to temptation

Timothy Giles, host of the Full of It podcast and experienced wine writer, on the opportunities wine can offer investors.

66. Rest and reflection

A three-day break at Resolution Retreats has had lasting benefits for Joanna Mathers.

70. Riding high

Joanna Mathers finds herself in safe hands as she climbs into the saddle and takes to the beach for the first time in a decade.

72. Sporting chance

The 2025 Range Rover Sport is a perfect stepping stone towards the luxury Range Rover, but holds its own when it comes to style and performance. Liz Dobson, founder of Automuse.co.nz, takes a test drive.

76. On the road in style

TrailLite motorhomes and caravans are ideal for those who want to hit the road in luxury.

80. Go on, you deserve it

A visit to a skin care clinic has produced a glowing review.

Educational, inspirational printed magazines are a wonderful antidote to digital saturation – and your support helps keep New Zealand publishing alive.

Informed Investor PO Box 40128, Glenfield, Auckland 0747

Informed Investor 33 Federal Street, Auckland Central, Auckland.

Everyone has a different attitude to money, but to make it work for us it’s important to explore how we relate to it.

AS THE EDITOR of Informed Investor, I have always been inspired by those who take risks, identify business niches, and make bold decisions. So last year I made a bold decision myself – purchasing Informed Investor and its sister publication, New Zealand Property Investor, from its previous owners, Opes Partners.

It’s nearly holiday season (the year has flown by) and a good time for reflection. I’m not one for new year’s resolutions, but I do love a bit of soul searching during the spacious summer holidays.

I’m not alone in this venture. Long-term art director Sally Fullam has partnered with me to create a small publishing company (Informed Media) and both magazines are now produced by us.

living, inflation. This year, with interest rates dropping and inflation steady, investors’ attention has moved outwards –to simmering global tensions likely to spill into the market.

Published by: Opes Media www.informedinvestor.co.nz

www.informedinvestor.co.nz

This year I’m going to take a long, hard look at my predisposition to spend. I love shopping (books, clothes and music are my obsessions), but this has got me into a lot of trouble in the past. Now I’m older (and a little wiser) I make sure saving comes before spending, although my current house renovations are certainly stretching the family budget.

Print media has undergone a seismic reconfiguration in the past 10 years. Digital media – with its offshore overlords – has become the go-to for advertising spend. It sees profits sent overseas and journalism in New Zealand has taken a massive hit.

Money is a potent force. It can be used for good or evil and without doubt profoundly influences the trajectory of our lives.

But we strongly believe print can be a wonderful antidote to digital overload. Well-researched, informative, inspirational local stories, beautifully presented in printed magazines, offer readers the chance for full immersion away from the screen. And we are committed to providing those fascinated by investment in all its permutations with a magazine they can rely on every quarter.

Everyone has a different attitude to money. Some (like me) see it as a ticket to good times; others scrimp, save and fear to touch it. Our attitudes are based on a raft of factors – upbringing, financial history, pessimistic or optimistic outlooks – but to make money work for us it’s important to explore how we relate to it.

As any rookie small business owner knows, it’s hard work. There have been curve balls, late nights, and a lot of soul searching. But we’ve made the right decision and we are so excited about the future.

The lead story this issue, written by “money mentalist” Lynda Moore, delves into our “money personalities” – the way in which we relate to money.

In this issue we reveal the results of our annual Informed Investor sentiment survey, powered by InvestNow. The results are riveting.

Last year the concerns of investors were locally focused – interest rates, cost of

Based on extensive research and the contents of her excellent book, Conversations with Money: A Love Story, she digs deep into our histories, explores how our attitudes change

Managing editor

Editor

Joanna Mathers – joanna@informedmedia.co.nz

Joanna Mathers

Design director

Art Director

Sally Fullam – sally@informedmedia.co.nz

Mark Glover

Account manager

Account Manager

Joanna Mathers – joanna@informedmedia.co.nz

Stephanie Bryant – 021 165 8018

Subscriptions

Subscriptions

Sally Fullam – subs@informedmedia.co.nz

Jill Lewis – subscriptions@informedinvestor.co.nz

More than 60 per cent of investors surveyed listed “international geopolitics” as their number one concern this year. Trump’s tariffs, ongoing wars, political unrest – are all factors that may lead to a tempestuous 2025.

and develop over our life, and explains how people can develop better relationships with money.

We’ve also modified a quiz taken from Lynda’s website (moneymentalist.com) so you can discover your own “money personality”. It’s quick, easy, and a bit of fun, but it should also get you thinking. This is a great Christmas holiday activity to share with friends and family over a glass (or bottle) of bubbly.

But that’s not the whole story. Granted, investors are jittery about global conditions, but there is also positivity around their returns this year. The local outlook is good compared with previous years. There are GDP growth projections, and the stability of inflation is likely to fuel business confidence.

It’s likely to be an unpredictable year, but if we hunker down and ride out any storms, there may well be opportunities to capitalise on.

Amy Hamilton Chadwick delves into another sort of money personality this issue: the financial pessimist. If you’ve been stung before, it makes sense that you’d be cautious around investing. But as Amy explains, fear of doing anything (or “analysis paralysis”) can prevent you from embracing a brighter financial future.

Informed Investor is an investment magazine published quarterly by Informed Media. You need Informed Investor ’s written permission to reproduce any part of the magazine.

Informed Investor is an investment magazine published quarterly by Opes Media. You need Informed Investor’s written permission to reproduce any part of the magazine.

Advertising statements and editorial opinions in Informed Investor reflect the views of the editorial contributors and advertisers, not Informed Investor and its staff.

Advertising statements and editorial opinions in Informed Investor reflect the views of the advertisers and editorial contributors, not Informed Investor and its staff.

We also check out the new convertible Mini, the importance of goal setting, and how electric cars are changing transport economy worldwide.

We really hope you find inspiration in the pages of our magazine and wish you all the very best for this festive season.

Elsewhere in this issue we explore how different assets have been performing and how they are likely to perform going forward. Our international correspondent, Andrew Kenningham, provides us with a gripping overview of key economic theorists and we share some beautiful products, a new wine investment column, and great ideas for weekend activities.

Thanks so much and take care.

Take care and happy holidays.

Informed Investor ’s content comes from sources that Informed Investor considers accurate, but we don’t guarantee its accuracy. Charts in Informed Investor are visually indicative, not exact. The content of Informed Investor is intended as general information only, and you use it at your own risk: Informed Investor magazine is not liable to anybody in any way at all. Informed Investor does not contain financial advice as defined by the Financial Advisers Act 2008. Consult a suitably qualified financial adviser before making investment decisions.

Informed Investor’s content comes from sources that Informed Investor considers accurate, but we don’t guarantee its accuracy. Charts in Informed Investor are visually indicative, not exact. The content of Informed Investor is intended as general information only, and you use it at your own risk: Informed Investor magazine is not liable to anybody in any way at all. Informed Investor does not contain financial advice as defined by the Financial Advisers Act 2008. Consult a suitably qualified financial adviser before making investment decisions.

Joanna Mathers Editor

Joanna Mathers Editor

Sub editor

Resident economist

Mike Deacon

Ed McKnight Printer

Proofreader

Webstar

Siana Clifford Printer

Webstar

Retail Distributor Are Direct

Retail distributor Are Direct

This magazine is subject to NZ Media Council procedures. A complaint must first be directed in writing, within one month of publication, to the email address, joanna@informedmedia.co.nz. If not satisfied with the response, the complaint may be referred to the Media Council PO Box 10-879, The Terrace, Wellington 6143; info@mediacouncil.org.nz . Or use the online complaint form at www.mediacouncil.org.nz . Please include copies of the article and all correspondence with the publication.

This magazine is subject to NZ Media Council procedures. A complaint must first be directed in writing, within one month of publication, to the email address, stephanie@informedinvestor.co.nz. If not satisfied with the response, the complaint may be referred to the Media Council PO Box 10-879, The Terrace, Wellington 6143; info@mediacouncil.org.nz. Or use the online complaint form at www.mediacouncil.org.nz. Please include copies of the article and all correspondence with the publication.

Informed Investor magazine does not give any representation regarding the quality, accuracy, completeness or merchantability of the information in this publication or that it is fit for any purpose.

Informed Investor magazine does not give any representation regarding the quality, accuracy, completeness or merchantability of the information in this publication or that it is fit for any purpose.

To advertise in Informed Investor, you must accept Informed Investor magazine’s advertising terms and conditions. Please contact joanna@informedmedia.co.nz about advertising.

To advertise in Informed Investor, you must accept Informed Investor magazine’s advertising terms and conditions. Please contact Stephanie@informedinvestor.co.nz about advertising.

Informed Investor is printed on environmentally responsible paper. The paper is produced using elemental chlorine-free pulp, sourced from sustainable and legally harvested farmed trees. The magazine is recyclable.

Informed Investor is printed on environmentally responsible paper. The paper is produced using elemental chlorine-free pulp, sourced from sustainable and legally harvested farmed trees. The magazine is recyclable.

PRINT ISSN 2744-6085

DIGITAL ISSN 2744-6093

PRINT ISSN 2744-6085

DIGITAL ISSN 2744-6093

TIMOTHY GILES

Timothy Giles is our wine enthusiast. For 30 years he has been sharing his enthusiasm for fine and funky wines as a writer, trainer, list curator and podcast host. To build up a thirst he enjoys open water swimming, triathlons and is a Level football referee in Auckland. Dad-of-one goal is to share more of his wine cellar with his daughter than is left to her.

LYNDA MOORE

With over 30 years of experience in accounting and an in-depth focus on money psychology, Lynda has made it her mission to help people stop stressing about money and start mastering it. She’s not your typical accountant – she’s a money mentor who understands that financial success isn’t just about spreadsheets and budgets; it’s about mindset, behaviour, and making money work for you.

NICHOLE LEWIS

Nichole Lewis is an award-winning author of the international best seller Property Quadrants and CEO of The Property Lifestyle. Her philosophy is to help people create a better lifestyle through property, hoping that, in turn, they will help others to do the same.

Bridgette Jackson is a CDC-certified divorce/separation coach with a postgraduate dispute resolution qualification. She is also a trained divorce mediator (AIMNZ), a relationship coach (Institute for Life Coach Training), and a member of the Institute of Executive Coaching and Leadership (accredited by the ICF –International Coaching Federation).

Paul is the chief commercial officer at Easy Crypto. He is passionate about what the blockchain and crypto sector can do for New Zealand and has spent most of his career in the corporate sector, working with disruptive technology and helping to build lightweight digital businesses that can be exported to the world. He is on the Executive Council for Blockchain NZ.

Charlotte, a branding strategist and alignment coach, and Victoria, a personal brand photographer and ADHD coach, empower women to build impactful businesses with confidence. Through their global community, they create opportunities for connection, growth, and visibility in a space where women feel truly seen and supported.

Kelvin joined CoreLogic in March 2018 as senior research analyst, before moving into his current role of chief economist. He brings with him a wealth of experience, having spent 15 years working largely in private sector economic consultancies in both New Zealand and the UK. Contributors

CAMERON BAGRIE

KELVIN DAVIDSON

KELVIN DAVIDSON

Cameron is the managing director of Bagrie Economics, a boutique research firm. He was previously chief economist at ANZ, a position he held for over 11 years.

Kelvin joined CoreLogic in March 2018 as senior research analyst, before moving into his current role of chief economist. He brings with him a wealth of experience, having spent 15 years working largely in private sector economic consultancies in both New Zealand and the UK.

MARTIN HAWES

SAM BRYDEN

ANDREW KENNINGHAM

Martin is the chairman of the Summer KiwiSaver Investment Committee. He’s an authorised financial adviser and offers his services throughout New Zealand.

Sam Bryden is Head of Distribution at Nikko AM NZ.

With over 18 years’ experience in investment management and financial markets, the last six of these at Nikko AM, he is responsible for leading the firm’s sales, marketing and client servicing.

Andrew is the chief Europe economist for Capital Economics.He was previously an economic adviser for the United Kingdom Foreign Exchange.

CAMERON BAGRIE

KELVIN DAVIDSON

LIV LEWIS LONG

Cameron is the managing director of Bagrie Economics, a boutique research firm. He was previously chief economist at ANZ, a position he held for over 11 years.

Kelvin joined CoreLogic in March 2018 as senior research analyst, before moving into his current role of chief economist. He brings with him a wealth of experience, having spent 15 years working largely in private sector economic consultancies in both New Zealand and the UK.

Liv is a passionate finance educator, writer and podcaster, and set up Simplicity’s Money Made Simple podcast to help level up financial literacy in NZ. She also heads up their marketing team, with over 15 years’ experience in brand, communications and storytelling.

MARTIN HAWES

ANDREW KENNINGHAM

ANDREW KENNINGHAM

Andrew is the chief Europe economist for Capital Economics. He was previously an economic adviser for the United Kingdom Foreign Exchange.

ANDREW NICOL

MARY-ANNE TOBIN

SAM STUBBS

Andrew is an authorised financial adviser and the managing partner of Opes Partners. He has more than 15 years’ experience in banking, finance, and property.

Former senior underwriter turned qualified interior designer, Mary-Anne Tobin is constantly viewing the latest international trends and incorporating these into her designs. She also blends modern day aesthetics with practical solutions.

Sam is the founder and MD of Simplicity, New Zealand’s only low-cost, nonprofit funds manager. Previously from the banking world having worked for Goldman Sachs and NatWest Markets in London and Hong Kong, Sam believes the finance industry should be as much a force for good as a source of profit.

Andrew is the chief Europe economist for Capital Economics.He was previously an economic adviser for the United Kingdom Foreign Exchange.

Martin is the chairman of the Summer KiwiSaver Investment Committee. He’s an authorised financial adviser and offers his services throughout New Zealand.

ANDREW NICOL

ANDREW NICOL

SAM STUBBS

Andrew is an authorised financial adviser and the managing partner of Opes Partners. He has more than 15 years’ experience in banking, finance, and property.

Andrew is an authorised financial adviser and the managing partner of Opes Partners. He has more than 15 years’ experience in banking, finance, and property.

Sam is the founder and MD of Simplicity, New Zealand’s only low-cost, nonprofit funds manager. Previously from the banking world having worked for Goldman Sachs and NatWest Markets in London and Hong Kong, Sam believes the finance industry should be as much a force for good as a source of profit.

Glam flip-flops, skin repair and making money with zero bucks.

Aesop’s Aurner Eau de Parfum draws on the poetic tensions between tenderness and strength to subvert the expectations of a floral fragrance. With spice and metallic notes and herbaceous depths, this has a floral heart with roots in sumptuous woods. Created with Aesop’s longterm collaborator Céline Barel, the fragrance combines key ingredients of magnolia leaf, Roman chamomile and cedar heart for a resolutely unorthodox aroma. Coinciding with the launch, multisensory evocations of the Eau de Parfum will allow its defiant nature to bloom – including Aesop’s first ever jewellery collaboration. $275.00 from aesop.com/nz

Summer may be over but there’s still plenty of warm weather ahead for beach and poolside lounging. Autumn in Aotearoa is often dreamy – balmy days ahead of the bluster of winter – and there’s still a chance to rock your latest pedicure with a pair of Croc Getaway Platform Flips. These little honeys feature a cushioned footbed, providing all-day comfort, whether you’re lounging poolside or exploring city streets. Pairing effortlessly with any outfit for any occasion, it’s the fashionable and functional sandal of the season. Available at Crocs.co.nz and in-store, RRP: $99.99.

If your skin needs a plumping boost, Boost Lab’s 2D-Hyaluronic Hydro Boost Serum is a great option. Affordable luxury at just RRP $34.95 it’s ideal for injecting volume, hyradation and plumpness back into your skin. It contains hydrolysed hyaluronic acid, which is a powerful humectant that draws and binds moisture into the skin, and helps reduce the appearance of dry, rough and dull skin.

Murad Cellular Hydration Barrier Repair Mask is an intensely soothing, deeply hydrating overnight treatment that repairs dry, red and rough skin at the cellular level. Featuring bilberry seed oil that provides essential fatty acids (omegas 3 and 6) for healthier barriers, it also has hibiscus extract, known to deliver potent hydration that and quickly moisturises to protect from water loss. You’ll wake up to deeply hydrated, softer, calmer and soothed skin with more strength, radiance and less redness. For a single purchase from the website murad.co.nz you’ll spend $144 or have it sent to you each month for $136.80 – a 5 per cent discount.

This is a simple glass water bottle with hydration tracking designed to help you meet your daily recommended water needs.

A truly modern water bottle, this Bink Day bottle can go with you anywhere. A day-in, day-out bottle to keep you hydrated and healthy, the Bink Day bottle in bubblegum is $59.95 from littlewhimsy.co.nz.

It’s possible to make money from property without investing a cent yourself, according to Nichole Lewis. Her new book No Money Deals outlines how strategic partnerships, contemporaneous deals and key relationships can offer you the chance to grow your money, when you have no money. The book outlines real life stories of people Nichole has partnered with and shows how she helped them buy property with no money. It’s a hard concept to get your head around, but it’s certainly something worth investigating if you have an interest in property. It’s available in good bookstores nationwide for just $29.99.

ˈglō-bəl

‘of, relating to, or involving the entire world’

Merriam-Webster Dictionary

‘To argue against the global economy is like stating opposition to the weather –it continues whether you like it or not’

– John McCain, former US senator

POWERED

BY

New Zealand investors are jittery about international geopolitics, but positive about their returns this year, our annual investor sentiment survey reveals.

New Zealand investors are jittery about international geopolitics, but positive about their returns this year, our annual investor sentiment survey reveals.

‘Ongoing wars, political unrest, and a possible reset of the global rules of engagement has investors jittery’

WHEN ASKED TO state their biggest investment-related concerns in last year’s Informed Investor sentiment survey, investors answered unequivocally –interest rates, cost of living and inflation. The focus was local – macroeconomic factors that could be mitigated by central bank monetary policy.

But the focus has shifted. Fears about local economic conditions have given way to broader unrest around international geopolitics – in fact, more than 60 per cent of respondents in this year’s survey named international geopolitics as their primary concern.

It makes sense. Ongoing wars, political unrest, and a possible reset of the global rules of economic engagement under Donald Trump has investors worried.

The rise of the far right, isolationism, the threat of trade wars based on US tariffs, and retaliatory counter-tariffs, is creating a simmering global unease, palpable even in our relative isolation. Investors inhabit a global market and what happens overseas, happens here.

In a statement last month, Reserve Bank of New Zealand (RBNZ) head Adrian Orr said while inflation is low and stable, the volatile international landscape may have an impact on our economy.

What are your main concerns as an investor looking at the year ahead?

‘Investors were, on the whole, positive about their returns this year’

He stated that there is GDP and employment growth coming through, “but [there is] geoeconomic fragmentation, so global potential growth will be lower, and we will see international price volatility.”

Mike Heath from New Zealand-based investment platform InvestNow, agrees. He says the uncertainty posed by regional wars, changes in ruling parties and leaders or regional differences in economic performance all introduce uncertainty.

“The value of investments may well move up and down more often and with magnitudes greater than what people will have typically experienced,” he says.

“Investment professionals, financial advisers and investment managers all keep a really close eye on what is going on, but even they cannot predict the impact of all these factors.”

Europe economist for Capital Economics in London and Informed Investor contributor, Andrew Kenningham, has insight into how European investors are reacting to the unrest: “They are jittery.”

“This is obvious both when you meet investors and when you read the financial media.”

But there is a disconnect between those anxieties and the performance of the equity market, which has been good. He says the more immediate concerns for investors in the UK are “the risk of persistently high inflation and high interest rates [in the UK], as well as concerns about the impact of tax hikes on business investment.”

Positivity surfaces

Although international geopolitics is a concern, the investors who took part in our survey were relatively positive about their returns this year.

When asked about their outlook for 2025, 35.58 per cent were “somewhat positive” about their returns, 21.15 per cent were “positive” about returns, and 6.3 per cent “very positive”.

While nearly 30 per cent of investors had “neutral” expectations around their returns, less than 9 per cent had negative expectations. This positivity could be due to several factors, Heath explains.

“I think it could simply be a function of people’s view that we are coming out the other side of a really challenging few years, and their fundamental belief that things will and can only get better.

“Having been through the turmoil of Covid, cost of living and inflation challenges and high interest rates, the key indicators are starting to turn into a more positive direction,” he says.

The positivity is likely to lead to further investment in the short-term. A whopping 95 per cent of investors stated they will be investing this year, with shares being the top choice for investors – more on this later.

The survey also revealed that investors have a high level of confidence in their ability to make good choices about investing. For better or worse, this has led to a reluctance to use financial advisors.

They were used by only 21 per cent of respondents, with the rest relying on their own knowledge. This could be due to the age and experience of the respondents –17 per cent have been investing for over 10 years, with 38 per cent investing for over 20 years – but there may be other factors at play.

“People do not like to appear ignorant and/or uninformed,” says Heath. “Therefore, they are reluctant to meet with a financial expert for matters of pride – not a good thing at all.

“After all you have no issue going to a doctor, dentist or lawyer if you need their expert help.”

He adds that people have a natural disposition to seek advice/opinion from

friends and family, particularly if they appear to be more engaged in a topic.

“I think the challenge here is with the financial advisers – they need to lift their profile and make sure their offering is accessible to people of all walks of life and differing levels of investable assets/ investing knowledge.”

An interesting outtake from the survey was the high income level of respondents. Five per cent list their annual salary as $1 million-plus; 10 per cent earned over $250,000 and 20 per cent earn between $150,000-$250,000 a year.

The respondents were most confident about buying shares in 2025; 66 per cent said they would invest in this asset class, with 46 per cent interested in managed funds, 41 per cent interested in ETFs, and 37 per cent listing residential property.

Heath believes the popularity of shares is due to the general awareness around the nature of them: “People know what a share is and what owning a share means.”

But this knowledge should not preclude investors seeking financial advice from experts. Do you feel positive or negative about returns in 2025?

What assets are you most likely to invest in?

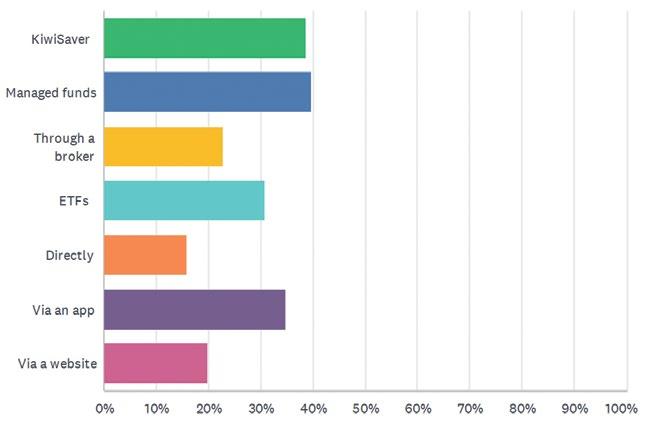

How do you prefer to buy shares?

“The challenge with shares, unless you are an investing expert (and even they don’t always get it right), is picking the best stock for your investment goals and needs.

“Stock picking is extremely hard and shouldn’t simply come down to a brand or product you know or like. This is where advisers come into their own, or even better, invest in managed funds, where the investment manager does the picking for you and manages it every day to deliver the optimal outcome.”

KiwiSaver continues to offer everyday New Zealanders with access to investment markets, and our respondents feel confident in their knowledge of how it works. With 73 per cent claiming to be either reasonably or very confident in their understanding of KiwiSaver, KiwiSaver remains a well-known scheme with good buy-in from Kiwis.

But KiwiSaver may also be the one place in which average Kiwi investors feel the impact of Trump’s trade wars.

KiwiSaver providers invest in offshore assets, therefore any turbulence in the US or European economy due to businesses being lumped with tariffs, may lead to a market downturn. This could be reflected in our returns in the short term.

This knowledge also translates to term deposits (where 77 per cent claimed to reasonably or very confident in their knowledge).

Managed funds are less well understood: 60 per cent of respondents were reasonably or very confident in their knowledge, but nearly 40 per cent had less confidence in this area.

The perception of investors as speculatory wide boys, taking high-risk gambles for instant rewards, was dispelled in our survey results.

In fact, a meagre 1.9 per cent of respondents claimed their motivation for investing was speculation and quick creation of wealth. Rather, the respondents stated they invested for security and family reasons.

Retirement security is the main reason they invest; with 77 per cent of those surveyed stating this was their primary driver. Growing wealth for family was

the impetus of 52 per cent of investors, with the generation of income chosen by 32 per cent.

Lesser chosen motivators were keeping assets safe (17.14 per cent) and keeping up a family tradition (3.8 per cent).

And another interesting concept is shattered in this survey. No longer a male domain, 50 per cent of our respondents were women, 47 per cent male, and 1.9 per cent non-binary.

Heath, from InvestNow, says this is not surprising.

“We’ve always enjoyed a pretty consistent, and largely even, split of male and female investors.

“Sure, there have been specific initiatives and efforts right across the investment industry to more actively engage with women, but I also think it is a function of the compounding effects of attempts to lift awareness amongst all Kiwis re the importance of getting involved in your investments and financial futures.” T

We explore how different asset classes performed last year, what they may achieve in 2025, and what you need to know if you’re planning to invest.

The New Zealand stock market experienced significant growth in 2024. The market, measured by the S&P/NZX 50 Index, ended the year with an 11.4 per cent increase, a notable gain given the 2.6 per cent rise of 2023.

The upward momentum was evident from mid-June as expectations of a loosening of monetary policy grew.

Between March 2023 and November 2024, the Reserve Bank of New Zealand cut the official cash rate from 5.5 per cent to 4.25 per cent, which further fueled a surge in activity.

Blackpearl Group, a New Zealand-based data-driven cloud service provider, was last year’s top performer, with their reported revenue of $10.4 million, representing a 126 per cent increase from the previous year. This underpinned a remarkable 136.36 per cent return for investors last year.

A lack of large catastrophic events, improved claims performance, premium growth and operational efficiencies saw Tower achieve a net profit after tax of $85.5 million last year, a dramatic turnaround from the $1 million it lost in 2023. This led to a 122.6 per cent growth in stock value last year.

In 2024, Gentrack Group, a New Zealand-based based software company that provides billing, customer management, and data analytics solutions primarily for utilities and airports worldwide, also experienced significant growth. This was due to a 25.5 per cent increase in revenue, which reached $213.2 million. Their share price surged 24 per cent to a record high $11.65 following the announcement of its full-year results.

This year the NZ share market is likely to be influenced by the balancing act of domestic economic recovery and global uncertainties.

Reserve Bank of New Zealand (RBNZ) reduced the official cash rate (OCR) to 3.75 per cent in February, and government budget projections point to a decline to 3 per cent by year-end. The monetary easing aims to stimulate economic activity by encouraging consumer spending and business investments. There are GDP growth projections and inflation stabilisation is likely to fuel business confidence.

But global trade disputes and geopolitical fragmentation present risks that could impact our exportdriven economy, potentially leading to market volatility.

The forex market in 2024 was marked by a strong US dollar, geopolitical unrest, and volatility in developed and emerging currencies.

The performance of the US dollar was largely due to the Federal Reserve taking a cautious approach to monetary policy, as chair Jerome Powell sought to bring inflation under control.

‘ Forex is complex and investors need to capitalise on fluctuations in exchange rates between currencies’

Political uncertainties in Europe adversely influenced Eurozone economies. In France and Germany, the resignations of key political figures and early elections contributed to the euro’s decline. The euro depreciated 5.7 per cent against the dollar and muted economic growth prompted expectations of further rate cuts by the European Central Bank.

In Britain the pound remained relatively stable (it ended 2024 around the same as 2023) but the snap election called by then prime minister Rishi Sunak led to significant volatility, with GBP/USD experiencing one of the largest historical single-day declines.

Some emerging market currencies stood out, with the Chilean peso and Brazilian real appreciating against the dollar. This was driven by favourable interest rates and chatter around central banks reducing borrowing costs to stimulate growth.

This year, the forex market is likely to be driven by volatility caused by Trump tariffs, ongoing conflicts, and political unrest.

“We can expect volatility in the forex market,” says Chris Smith, general manager at CMC Markets. “US trade policies and geopolitical uncertainty will be the key watch-outs in the coming months.”

Forex is complex and investors need to capitalise on fluctuations in exchange rates between currencies, Smith says. Many macro and technical forces move currencies, so risk can be high. “The market is open 24 hours a day and can be quite volatile.

“Taking an FX position can be short or longer-term; it just comes down to your expectations, position sizing and risk management. Some use FX trading for hedging or speculating purposes.”

It’s necessary for investors to take an active role in their forex investment. The current challenging geopolitical environment will add layers of complexity for traders trying to navigate the markets. It’s not for the fainthearted (or the inexperienced) and investors need to be well-versed in the geopolitics of the countries whose currencies they are trading.

“Successful forex traders need to have a deep understanding of financial markets and economics, and the risks can be difficult to identify for those who are not as

‘ While less volatile than some other investments, index funds do carry risk’

well-versed in these areas,” warns Smith.

But time and in-depth research can help investors understand the risks and make more educated calls.

“When done properly, it is possible to take advantage of the volatility in the market, but it’s important to remember that investments always carry risk no matter how much you might know.”

Major indices had a decent year in 2024, with the US S&P 500 rising 27 per cent. In fact, the past two years has seen it grow 57 per cent, the largest increase since the 1990s.

But past success is no guarantee of future performance: Trump’s tariffs have increased the likelihood of escalating trade wars and growing global tensions could make life difficult for some businesses, which in turn could impact the performance of the major indices.

Index funds replicate the performance of a market index by tracking a broad spread of different stocks. The S&P 500, which mirrors the top 500 stocks listed on stock exchanges in the US, is one of the most recognisable and best performing.

“Index funds tend to offer broad exposure to the market and are usually used for longer-term investments,” says Smith. “One of the best aspects of index investing is the index will rotate out the underperforming companies and replace with the new companies that are stronger.”

Novice and experienced investors can utilise index funds as a form of passive investment that doesn’t require a handson approach.

“They can cover stock markets with weightings across Europe, US, Australia, for example, or they can be single country focused or industry sector,” Smith says.

While less volatile than some other investments, index funds do carry risk. As indices are tied into the performance of companies, market forces that impact companies (including earnings

performance) spread across indices, particularly when those companies are all in the same sector or country.

“Macroeconomic forces like the overall economic health of a country or consumer confidence can impact indices. If consumers aren’t willing to spend, then companies can start to struggle.”

Smith suggests those who invest in indices should also keep an eye on corporate earnings because these numbers will often determine how well companies are doing.

“Many indices have a high weighting to the biggest companies in the world such as the ‘magnificent seven’ – namely Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA and Tesla – which make up over 40 per cent of the Nasdaq 100 index.”

The global environment – politics, war, events such as Covid-19 – can have a huge impact on the performance of indices.

“The pandemic gave us a stark reminder of how vulnerable markets are to major events,” says Smith.

‘By the tail end of the year, with Trump’s election and promises of an SEC overhaul, Bitcoin is at an all-time high’

Anyone with even a passing interest in crypto will be aware of the effect Trump has had on this volatile asset. Bitcoin, the bellwether for crypto performance, topped US$100,000 (peaking at US$103,332) in early December and others followed, with Ethereum (the world’s second largest crypto asset) also peaking in December and Solana reaching its highest price in January.

Trump’s embrace of crypto, and the promise of regulatory clarity with a changing of the guard at the United States Security and Exchange Commission (which has traditionally been crypto shy, mounting numerous lawsuits against leading crypto providers) underpinned this market enthusiasm.

Hester Peirce, head of the SEC’s Crypto Task Force, has been charged with establishing the legal status of digital assets – the Republican Party being far more open to crypto than their Democratic forebears.

This could be a major turning point for the assets, says Paul Quickenden, chief commercial operator for Easy Crypto.

“Traders have traditionally been left in an ambiguous position with regard

to the status of Bitcoin and other major crytocurrencies: there was no legal clarity around what they were trading,” he says.

But if the SEC clarifies the status of cryptocurrencies and codifies this in law, it will offer more surety to traders and financial advisers.

Last year started positively for crypto, with Bitcoin spot ETFs being approved by the SEC, and several Bitcoin ETFs established. This occurred prior to the four-year Bitcoin “halving” (which sees miners’ compensation reduced by 50 per cent) an event which has traditionally seen the value increase.

Bitcoin reached a peak of just over US$70,000 in March 2024, before the halving, and fell to the sub US$60,000s in September last year as some cautious new investors exited the ETF market.

But by the tail end of the year, with Trump’s election and promises of an SEC overhaul, Bitcoin is at an all-time high.

Quickenden says 2024 was extremely positive for his company, with buyers re-emerging from hibernation and actively trading. The change of guard in the States, while not directly impacting the New Zealand market,

fueled international positivity around cryptocurrency.

But crypto assets aren’t created equal. There are over a million types of tradable crypto assets, many of them are highly speculatory, and there is need for extreme caution in this space.

Bitcoin is the flagbearer for crypto, and other assets tend to follow its lead. Solana experienced solid growth in 2024, and SEC has recently acknowledged an application for a spot Solana ETF (only Bitcoin and

(not) telling you?

Paul Quickenden, Easy Crypto’s chief commercial officer, dives into why financial advisors are gun-shy when it comes to crypto.

NEW YEAR, NEW YOU. Your personal to-do-list says it’s time to get your finances sorted. So, you book a coffee with your financial advisor, and she spends an hour going over your finances, the different types of assets, the funds you can invest in, and your goals and risk appetite. Crypto was only briefly glossed over as part of a long list of possible investments. Once you have both finished coffee, you ask her if she owns any crypto. “Plenty!” is the reply! So why isn’t she talking to you about it?

A recent Bitwise study confirmed the worst – financial advisors are happily investing their own funds in crypto, but not their clients’ funds. Although around half of financial advisors own crypto as part of their own portfolio, only 22 per cent of them were making any client allocation to crypto. And of the other 78 per cent of financial advisors who hadn’t allocated client funds to crypto,

only 18 per cent of them lean towards doing so (at some point).

So what’s stopping your financial advisor from, well, advising?

The answer is two little words with big implications: volatility and regulation.

Let’s start with volatility. Financial advisors don’t like it because when portfolio values go down, they have to have tough conversations.

Time horizons are often forgotten and essentially, they get the blame for “giving bad advice”. Investors will also often take drastic action in response to volatility. We saw this in New Zealand over Covid when people experienced a fall in their KiwiSaver portfolios and responded by taking all the volatile assets out – moving from aggressive funds to conservative –for instance.

The downside of this approach is that without those types of allocations, your returns are hobbled. And if you aren’t beating inflation, you are going backwards in real terms. If, conversely, we think

about some level of volatility and risk as a positive, then this opens up a whole new way to get ahead. Sometimes it’s just about zooming out, as short-and-longterm-charts will often demonstrate.

Investment time horizons are important. The research is clear – holding assets over a long period of time tends to outperform short-term trading. Bitcoin and crypto are volatile, but over a decent (five-year) time horizon, the trend has been consistently up and to the right.

Volatility also presents opportunities as investors can purchase assets at lower prices during market dips. This benefits investors when they dollar-cost average and it enables investors to lower the average cost per coin over time.

Regulation has also held a lot of advisors back. Rupert Carlyon from Kōura Wealth, who is a pioneer in integrating crypto into KiwiSaver funds, explains that “it’s a huge concern for advisors because any advice they give needs to be well researched, typically relying on research from large investment houses either in New Zealand or offshore. If you can’t use that research to clearly show that it was in the client’s best interests to recommend investing in a product, you open yourself

up to regulatory pressure if you get a complaint.

“Lots of advisors understand and believe in crypto, but regulation and reticence from the large global investment firms prevents them from feeling they can openly and confidently advise on it.”

Finally, it would do everyone a disservice not to mention compensation. Because investors can buy crypto products directly, this challenges the commissionbased revenue model of some financial advisors. Financial advisors are going to have to adapt.

It is no surprise, then, that investors are taking things into their own hands. Now, it’s becoming a case of “doing what they do, not what they say”.

Before you hit ‘buy’

But, if you are going to get into crypto alone (sans advisor), you should “do your own research”.

We’ve summarised some basics for you below.

Bitcoin has been the standout performer of the past decade, outpacing all other asset classes. The S&P

Cryptocurrency Broad Digital Market Index, launched in 2021, has soared 826 per cent since inception (88 per cent annualised), with Bitcoin leading the charge. But while the long-term gains are undeniable, Bitcoin’s journey isn’t a straight line: it often moves independently of traditional markets, making it a unique diversifier in an investment portfolio.

Even conservative analysts recognise its low correlation with stocks and bonds, which can help smooth out market volatility.

Beyond diversification, Bitcoin also enhances portfolio performance through its strong Sharpe Ratio (0.96), a measure of risk-adjusted returns. In simple terms, it offers high returns relative to the risk taken. Adding even a small allocation of Bitcoin to a KiwiSaver or investment portfolio can improve overall returns without amplifying volatility – a counterintuitive but powerful advantage for long-term investors. T

Ways to access crypto

• Use a local platform: Kiwi crypto exchange Easy Crypto offers a secure, fast onboarding experience for Kiwis, plus tools, education and simplicity.

• Other platforms: Be mindful of credit card and withdrawal fees when using offshore platforms - do your research and check reviews.

• ETFs: Nervous about diving in? ETFs can be a starting point, but remember, you’re paying someone else to manage your crypto.

• KiwiSaver: You could also consider KiwiSaver providers like Kōura Wealth that include crypto options in their portfolios.

Disclaimer: Investing in Bitcoin and other cryptocurrencies carries risk. Always do your own research or seek professional advice.

Andrew Kenningham explores eight key thinkers who helped shape our understanding of economics.

suggested I write about the history of economics, the first question was “which economists should I highlight? Those with the most colourful biographies, the most influential, or my personal favourites?” In the end I have whittled it down to eight of the greats, including one Kiwi. Enjoy!

Adam Smith and the magic of the market (1723-1790)

Adam Smith was arguably both the first and the greatest ever economist. An eccentric Scottish genius, he lived in the late 18th century, at a time when the British Empire was at its height, industrialisation was getting under way, and the importance of markets was expanding as the country moved from peasant agriculture to manufacturing.

Smith coined two phrases that revolutionised economic thought. The “invisible hand” describes the seemingly mysterious process by which goods are made and transported to people without any overall coordination.

For example, he pointed out that no planner was needed for the baker to supply bread early each morning. And the “division of labour” refers to manufacturing being more efficient if workers specialise in a particular element of the production process – rather than working as individual craftsmen, as was commonplace back then.

These concepts remain relevant 250 years later. Indeed, the division of labour has gone far further than Smith could possibly have imagined. The iPhone, for example, is famously made in 43 different countries and involves numerous different companies.

Thomas Malthus and fear of population growth (1766-1834)

The rather harsh description of economics

as the “dismal science” was inspired by Thomas Malthus. A vicar and self-taught economist, Malthus argued in An Essay on the Principle of Population (1798) that humans are doomed to suffer famine and plague forever because the population will always grow faster than agricultural output. This was certainly a gloomy conclusion, but not a ridiculous one given that it has been true for most of human history.

Ironically, though, things were beginning to change just at the time when Malthus was writing. Since then, agricultural production has risen more than he could ever have imagined and population growth has slowed due to improvements in contraception and preferences for smaller families. The spectre of famine has been averted in much of the world.

Malthus was one of the first people to think and write about, population but not the last. Gary Becker won the Nobel Prize for arguing, among other things, that family size reflects a trade-off between the “quantity” and “quality” of children – the quality being not the child’s IQ or attractiveness, but how much time and money a parent can devote to them. He came up with this idea at a time when families were large. More recently, economists have worried not that the birth rate is too low rather than too high.

David Ricardo and the gains from trade (1772-1823)

Among economists, David Ricardo is known as an advocate of free trade. In particular, he explained why all countries could be better off if they trade, including countries that are not the most efficient producers of any particular commodities: he called this his theory of comparative advantage.

‘Phillips is one of a handful of economists to have achieved the ultimate accolade of having a curve named after him’

BELOW RIGHT Joan Robinson

Ricardo’s views on free-trade policy became the conventional wisdom during the 19th century, particularly in the United Kingdom. But trade policy has remained controversial and many people have supported the use of trade barriers in certain circumstances. Alexander Hamilton – he of the Broadway musical and the first US Secretary of the Treasury – argued that tariffs would help the young United States develop its industrial base. East Asian countries adopted the same approach after World War II. Donald Trump advocates tariffs to slow the emergence of China and protect US jobs –even if they are jobs in areas where the US has no comparative advantage.

Alban William Phillips crocodile hunter and economist (1914-1975)

Alban William Phillips was born in Te Rehunga, New Zealand, and had an unusual resume for an economist. He worked as a crocodile hunter and in a gold mine, busked with a violin and spent more than three years as a Japanese prisoner of war, where he learnt Mandarin and made a tiny shortwave radio concealed in the heel of his shoe. Later, as a professor at the London School of Economics, Philips made a model of the economy from Perspex pipes and plastic tanks in which flowing water represented household, government and business expenditure. (The machine is kept in the Reserve Bank of New Zealand.)

Students of economics may not know about his crocodile hunting skills, but

they will know his name because it has been immortalised in textbooks. Phillips is one of a handful of economists to have achieved the ultimate accolade of having a curve named after him.

The Phillips curve has had an interesting and varied life of its own. In its original form, it showed that there was a trade-off between unemployment and inflation: policymakers could choose lower inflation, but only if they accepted higher unemployment. In later variants, the Phillips curve suggested that there was no relationship between the two, so completely contradicting the original version.

John Maynard Keynes revolutionary conservative (1883-1946)

John Maynard Keynes was a revolutionary thinker who defended the capitalist system. He had many accomplishments in politics, the arts and finance – and had romantic relationships with the author Lytton Strachey and painter Duncan Grant, before marrying the Russian ballerina Lydia Lopokova.

Keynes and his colleagues invented macroeconomics, which means the study of the economy as a whole rather than the study of individual markets.

He rejected the idea that the market would always bring things back into balance of its own accord: Smith’s “invisible hand” may put bread on the table, but did not guarantee full employment. Keynes’ suggested solution was to use

government spending and tax powers to regulate the aggregate economy. In contrast, economists had previously thought that the budget should always be balanced. His influence is so profound that we use his way of thinking almost subconsciously these days.

Joan Robinson imperfect competition, imperfect economist (1903-1983)

Joan Robinson may have been the best modern economist not to have won the Nobel Prize. She was one of John Maynard Keynes’s entourage and made major contributions to economics in her own right. She coined many new

terms including “macroeconomics”, “monopsony” and “imperfect competition”. And she worked on issues ranging from regulation of uncompetitive markets to the impact of gender discrimination in the labour market.

Robinson was a communist sympathiser who became more radical as she got older – eventually even writing an apology for Chairman Mao’s cultural revolution. That may not have been a smart move had she wanted to win the Nobel Prize.

John Nash phantoms, games and oligopolies (1928-2015)

Mathematician and genius John Nash introduced game theory to economics. This is a branch of mathematics used to analyse situations when decisions by one party affect those of another.

Sadly, Nash suffered from schizophrenia for much of his life. He became known as the “phantom of Princeton” as he haunted the university occasionally leaving cryptic messages on blackboards. But he later recovered and received the Nobel prize.

Nash’s legacy is that economists now analyse markets in which there are only a handful of producers using game theory. Classic examples are OPEC (the cartel of oil-producing nations) and the airline industry (which is dominated by just two firms, Boeing and Airbus).

Elinor Ostrom institutions and communities (1933-2012)

The tragedy of the commons is the observation that commonly owned land or property is often over-used. The original idea can be traced back to a British economist called William Forster Lloyd who described this phenomenon in the context of shepherds in an English village: the shepherds over-grazed the land with the result that grass quality suffered.

Elinor Ostrom identified many examples in which this “tragedy” was avoided. For example, communal use of water basins and agreed fishing rights could prevent over-use. She showed that organisations and norms of behaviour provided a solution to the paradox.

It is unclear whether such an approach could be applied to the greatest and most

worrying example of the tragedy of the commons: climate change. But Ostrom’s worldview is strikingly practical and a welcome antidote to the notion of the “dismal science”.

Ostrom is also one among numerous economists who have incorporated understanding of institutions and behavioural norms to economic situations. She did so at a when the professions was becoming ever more abstract and mathematical.

Conclusion: an ever-changing science

These eight great thinkers have not had the last word on how the economy works: after all, the world does not stand still, so economics is always changing. Think how artificial intelligence, 3D printing and the replacement of cash with virtual money may change things. So as the world evolves, future economists will no doubt come up with new models to describe it. T

Charlotte Clark and Victoria Bahadoor, co-founders of Empower Her Community, explore the power of genuine connection in business.

SUCCESS IN BUSINESS isn’t just about strategy, skill, or luck – it’s also about who you surround yourself with. The right people, the right conversations, and the right support system can change the entire trajectory of your career. But for so many women in business, the journey can feel isolating. Entrepreneurship is often glorified as a solo mission, but the truth is, no one truly succeeds alone.

Women, more than ever, need strong, intentional networks. Not just to exchange business cards or gain referrals, but to find spaces where they can be seen, heard, and championed. Spaces where their dreams aren’t too big, where ambition isn’t intimidating, and where success is celebrated, not envied. The power of genuine networking isn’t just in growing your business – it’s in growing yourself. Too often, traditional networking events leave women feeling disconnected. Forced pitches, surface-level conversations, and the pressure to “sell yourself” can feel uncomfortable and ineffective. That’s why spaces designed specifically for women, by women are so powerful. When women gather in the right rooms, magic happens. It’s not about handing out business cards – it’s about creating real connections. It’s about surrounding yourself with women who inspire you to dream bigger, take bolder action, and step into your full potential.

That’s exactly why we created Empower Her Community. It started as a single event, a way to bring women in business together in a space that felt safe, inspiring, and energising. But it quickly became clear that this was something so many women needed. The demand for something deeper, more meaningful, and more transformative was undeniable. What started as one event turned into a

movement – now spanning across New Zealand, Australia, the UK and Bali with 20-plus global networking hubs, an Inner Circle membership, and retreats that offer not just business growth, but deep personal transformation.

Women thrive when they are surrounded by others who get it. Who understand the late nights, the selfdoubt, the pressure to balance it all. Who celebrate their wins as if they were their own and push them to take up space unapologetically. Empower Her has become that space – a community that isn’t about competition but about lifting each other higher. It’s about showing up not just for yourself, but for the women standing beside you.

The impact of the right connections is undeniable. Through our community, we’ve watched women go from hesitant entrepreneurs to confident business leaders. We’ve seen them land opportunities they never thought possible – media features, speaking engagements, collaborations, and life-changing clients – all because they put themselves in the right rooms. We’ve seen women walk into their first networking event filled with nerves, only to leave with new friendships, a fresh perspective, and the momentum they needed to take their next big step.

Networking is no longer a nice-tohave – it’s a necessity. The world moves fast, and opportunities don’t always come knocking at your door. You have to put yourself out there. You have to be willing to be seen. You have to step into spaces where you can grow, evolve, and expand your vision for what’s possible. Because the truth is, no one succeeds by doing it alone.

At Empower Her, we don’t just provide networking events – we provide

a platform. A place where women can not only connect but also become leaders. Our Inner Circle offers expert-led masterclasses, accountability, and a highvalue online membership designed to give women the tools they need to grow their businesses. Our in-person networking hubs create space for authentic, meaningful conversations – where you’re not just asked what you do, but who you are and what impact you want to make. Our retreats, like our upcoming Bali Retreat in July, are designed for deep connection, personal transformation, and taking your business to the next level in an environment that inspires you to think bigger.

But we also know that community isn’t just about attending – it’s about contributing. That’s why we actively provide a platform for women to step into leadership. Whether it’s speaking at our events, hosting a masterclass, running a local networking hub, or collaborating on new projects, we create opportunities for women to be seen and celebrated for the expertise they bring. When one woman rises, she brings others with her. And that’s the ripple effect we’re creating. This isn’t just about networking. This is about rewriting the rules of how women show up in business. It’s about creating real success, built on real relationships. It’s about knowing that when women come together with intention, the ripple effect is unstoppable.

We’re not just building businesses. We’re building a movement. And we’d love for you to be part of it. T

Join us at Empower Her Community and start making connections that will change everything. www.empowerhercommunity.com

SINCE THEY WERE first launched in 2020, InvestNow’s Foundation Series Funds have been hugely popular among investors.

The funds currently have more than $400 million under management across a suite of diversified and international equities funds, including funds that offer cost-effective exposure to some of the world’s most popular ETFs.

And there are more options coming.

The secret is two-fold. The Foundation Series Funds are housed within a taxefficient structure, which can provide savings of up to 0.55 per cent per year, compared to investing directly into the same underlying offshore ETF. The funds also have some of the lowest management fees of any fund in New Zealand, with fund options featuring management fees as low as 0.03 per cent per annum*.

At InvestNow, we believe that high costs should not be a barrier to accessing quality investment strategies. The mission of the Foundation Series Funds is to provide greater value for investors by offering cost and tax efficient exposure to leading investments, including access to some of the renowned names in the industry such as Vanguard and Charles Schwab.

The Foundation Series Funds are managed in-house by InvestNow and structured as PIE funds, which are taxed at a maximum rate of 28 per cent. In contrast, investing directly into the offshore ETFs that the funds are exposed to would mean investors are taxed at a marginal tax rate of up to 39 per cent.

The material difference between these two rates is larger than the numerical 11 per cent difference. In real terms, you could side-step a roughly 40 per cent higher tax bill by investing via a PIE fund rather than directly into the ETF itself.

The international equities funds within the Foundation Series Funds range also feature super-low annual management fees, in line with those charged by the offshore ETFs themselves.

The annual fee and tax savings from this cost-efficient fund structure was purposely designed to help maximise value for long-term investors.

We started the Foundation Series Funds with the view that robust, long-term investment outcomes are underpinned by the core principles of diversification and efficient portfolio construction.

These values have been incorporated to provide a broad set of fund offerings that are designed to form the “foundation” of any investment portfolio.

The funds range began with two diversified funds – the Foundation Series Balanced Fund and Foundation Series Growth Fund, before adding a set of international equities funds – the Foundation Series US 500 Fund and Foundation Series Total World Fund –available in both in hedged and unhedged variants, which invest into the popular Vanguard S&P 500 ETF and Vanguard Total World Stock ETF respectively. T

*The Foundation Series US 500 Fund, Foundation Series Hedged US 500 Fund, Foundation Series Total World Fund, Foundation Series Hedged Total World Fund, Foundation Series US Dividend Equity Fund and Foundation Series Global ESG Fund are all subject to a transaction fee charge of 0.50% for all Buy Orders (Entry Fee) and 0.50% for all Sell Orders (Exit Fee).

Due to their popularity, we are pleased to be able to grow the Foundation Series Funds line-up with three new fund options that appeal to a wider range of evolving investor needs.

The Foundation Series US Dividend Equity Fund invests solely into the Schwab US Dividend Equity ETF, and offers dividend-orientated investors access to a low-cost solution that charges a management fee of just 0.06 per cent pa, in line with the underlying ETF.

The Foundation Series Global ESG Fund provides investors with access to a low-cost, ESG-screened global shares fund that is powered by popular Vanguard ETFs (Vanguard ESG US Stock ETF and the Vanguard ESG International Stock ETF) and comes with a management fee of just 0.10 per cent pa.

The Foundation Series High Growth Fund adds a more aggressive diversified fund option that is exposed to almost all growth assets such as local and global shares, while also featuring an ESG investment strategy and a management fee of just 0.37 per cent pa.

The revamped Foundation Series Funds now provide an even greater range of building blocks for Kiwis looking to create a low-cost, diversified portfolio.

By innovating the vehicle through which investors can access world-leading investments, we empower investors to more effectively achieve their goals; both financially and from a values perspective.

It’s the same investment strategy that you can get elsewhere, and the same world-leading products that many Kiwis would already be familiar with. What’s different is the cost-effective PIE fund vehicle through which investors can access these funds, and that can lead to more meaningful returns.

To find out more about InvestNow’s Foundation Series funds, visit www.investnow.co.nz/foundationseries

Disclaimer: This information is provided by InvestNow Saving and Investment Service Limited (“InvestNow”). The information and any opinions in this publication are based on sources that InvestNow believes are reliable and accurate. InvestNow, its directors, officers and employees make no representations or warranties of any kind as to the accuracy or completeness of the information contained in this publication and disclaim liability for any loss, damage, cost or expense that may arise from any reliance on the information or any opinions, conclusions or recommendations contained in it, whether that loss or damage is caused by any fault or negligence on the part of InvestNow, or otherwise, except for any statutory liability which cannot be excluded. All opinions and market commentary reflect InvestNow’s judgment on the date of this publication and are subject to change without notice. This disclaimer extends to any entity that may distribute this publication. The information in this publication is not intended to be financial advice for the purposes of the Financial Markets Conduct Act 2013, as amended by the Financial Services Legislation Amendment Act 2019. In particular, in preparing this document, InvestNow did not take into account the investment objectives, financial situation and particular needs of any particular person. Professional investment advice from an appropriately qualified adviser is recommended before making any investment. The issuer and manager of the Foundation Series Funds is FundRock NZ Limited. A Product Disclosure Statement is available at www.investnow.co.nz. There are always risks associated with an investment and an investor should read all disclosure material carefully before making an investment decision.

Our relationship with money begins at a young age, and our upbringing often influences our perceptions, writes Bridgette Jackson from Equal Exes.

WHEN FINANCIAL STRESS is present in childhood – perhaps due to economic hardship, living pay cycle to pay cycle, or constant analysis to ensure every dollar is accounted for – those attitudes can carry into adulthood. Alternatively, if money is saved excessively or spent freely, especially when a child has parents in separate households, these experiences will also shape financial behaviours later in life.

The key to long-term financial success isn’t just how much you earn; it’s about how you think about money and the behaviours you model for your family. Without positive financial habits, young people may struggle with money management or make costly mistakes.

Akin to learning to drive or developing healthy eating habits, financial habits formed in childhood and early adulthood tend to persist throughout life. If young people learn to budget, save, and invest early, they will likely make confident financial decisions later.

Key early habits set the foundation for success. Understanding the difference between needs and wants early prevents overspending, and impulse buying later. Having an allowance or tracking earnings from a part-time job teaches accountability and responsible financial management.

Helping young people to save small amounts consistently can instil discipline and provide a sense of security and selfworth, and being introduced to investing early and understanding compound interest and long-term wealth-building concepts will help foster a proactive financial mindset.

Children are more likely to adopt similar

habits when they observe their parents making sensible financial decisions, such as saving for big-ticket items, rather than relying on debt. They are also influenced when parents openly discuss financial goals.

Children who witness their parents living beyond their means, such as constantly upgrading cars or taking on debt, may learn to assume these behaviours as normal. This can be especially true when separated parents have vastly different spending habits, with one indulging while the other struggles. Conversely, if parents educate their children on how to use their money, such as saving, responsible spending, and investing, they will foster confidence and resilience in financial matters. This approach prepares young adults with an informed perspective rather than learning through costly mistakes.

Breaking free from a cycle of financial stress has become increasingly challenging, especially given the economic conditions since 2020. These conditions have impacted many people, regardless of location or income level. Some families have struggled with debt, worked to rebuild their savings safety net, or avoided financial discussions altogether, which can lead to additional relationship stresses.

What matters now is a focus on financial recovery, positive communication and establishing good habits. But there are ways to change the narrative.

Try to move from scarcity to an abundance mindset. Focus on how money can work for you rather than dwelling on what you lack; your

children will be listening and learning.

You may have made poor financial decisions in the past, but they don’t define the future; what matters is the lessons learned from them. If you talk openly about money, it helps break down stigma and improves financial literacy. Utilise books, podcasts, and online resources to provide valuable insights.

Financial literacy is a lifelong journey, and the earlier good habits are introduced, the better. This is especially important as we transition to a largely cashless society. Teaching children, teenagers, and young adults about money in a way that is relevant to their life stage helps build confidence and independence. T

Bridgette Jackson is a CDC-certified Divorce/ Separation Coach with a postgraduate dispute resolution qualification. She is also a trained divorce mediator (AIMNZ), a Relationship Coach (Institute for Life Coach Training), and a member of the Institute of Executive Coaching and Leadership (accredited by the ICF - International Coaching Federation). Bridgette is also a Certified Organisational Coach, Level One with IECL (Institute of Executive and Leadership Coaching) and an enrolled barrister and solicitor of the High Court of New Zealand.

• Ages 5–10 Introduce the concept of money, earning, and saving. Use pocket money or chores to teach the idea that money is earned, not given.

• Ages 11–15 Teach budgeting, needs vs. wants, and the value of saving towards goals. Start discussing bank accounts, KiwiSaver, and digital banking.

• Ages 16–18 Reinforce the importance of managing income from part-time jobs, understanding student loans, and avoiding debt traps. Introduce investing basics and compound interest.

• Ages 19+ Encourage financial independence through budgeting apps, emergency funds, and long-term financial planning, including KiwiSaver contributions and diversified investing.

• Use real-life examples. Show them how you budget for groceries or plan holiday savings. If they have a mobile phone, a great way to do this is to set up a budgeting app and have them track their spending money.

• Involve them in financial decisions. For example, let them compare prices when shopping or help plan a family outing within a set budget.

• Gamify learning – apps like Banqer, MyBudgetPal, or Sorted.org.nz tools make learning about money and tracking it fun and interactive.

Select Invest offers term-loan investments underpinned by first mortgage security.

PROPERTY HAS LONG been viewed as an excellent option for investors. Under the right conditions, property can offer both capital gains and steady cashflow. Like all investment classes, property has its cons also including that traditional direct property investment can be very hands-on, including managing tenants and navigating regular legislative changes brought in by successive governments.

Investors are exploring other investment classes that require less management. Select Invest offers one such class of investment – term-loan investments underpinned by first mortgage security, allowing investors to choose from a range of loan profiles and target returns. The first mortgages that underpin these loans provide propertyrelated security while offering targeted fixed returns, without the effort required for self-managed investments.

Key investment features include:

· target returns from 8% per annum (net of fees, before tax)

· investment terms between 6-18 months