BILLION DOLLAR BLOKES

Blair Chappell and Matthew Horncastle on riding the cycle and getting back to basics.

Are

Blair Chappell and Matthew Horncastle on riding the cycle and getting back to basics.

Are

Green building isn’t just a “nice to have”; it can save thousands over the lifecycle of your home.

That is the finding of economics consultancy firm Infometrics, in research commissioned by New Zealand Green Building Council (NZGBC).

This research reveals that homes built to NZGBC’s 6 Homestar standards save more than $62,000 in electricity and mortgage interest over 30 years; while the upfront average build cost is insignificant – between 0.5-1.5 per cent.

But while this research offers a compelling reason for building green, less than 10 per cent of new properties in Aotearoa achieve green standards.

It’s all about perception. Most people believe that building to Homestar (or other green building standards) is prohibitively expensive. But the true cost is minimal – between $1,000-$2,000 to have an energy model designed that will ensure the right materials and products are put in the right place to make sure the house works.

In this issue we also investigate a leaky building saga in the making. Keeping homes watertight when they are being built is important; but some homes are so watertight water can’t escape them. These homes are unable to “breathe”; moisture created inside the home becomes trapped in walls and can rot the framing.

It’s an interesting story and definitely something to watch out for –the remedies are complex and involve a multifaceted approach and a lot of expertise.

Our cover stars this issue, Matthew Horncastle and Blair Chappell, will be well-known to anyone with an interest in property. As opinionated young men with loads of money, the founders of Williams Corporation have earned themselves plenty of media attention – much of it unpleasant.

But despite the naysayers predicting their downfall, Williams Corporation has recently celebrated a milestone – the creation of $1.3 billion worth of property. Gone are the private jets and megamansions – they are out and about donning their high-vis vests and creating more well-designed new builds around the country. It’s an interesting story and we hope you enjoy reading it.

Joanna Mathers

NZ PROPERTY INVESTOR

MAGAZINE PUBLISHER

Informed Media Limited PO Box 40128, Glenfield, Auckland 0747

PUBLISHERS

Joanna Mathers and Sally Fullam

EDITOR

Joanna Mathers E joanna@informedmedia.co.nz

DESIGN DIRECTOR

Sally Fullam E sally@informedmedia.co.nz

ACCOUNT MANAGER / ADVERTISING SALES

Joanna Mathers E joanna@informedmedia.co.nz M 021 250 7101

WRITER

Sally Lindsay

PROOFREADER

Síana Clifford

SUBSCRIPTIONS

Sally Fullam

Online nzpropertyinvestor.co.nz

E subs@informedmedia.co.nz

PH 022 431 9144

TO SUBSCRIBE GO TO nzpropertyinvestor.co.nz/subscribe

NZ Property Investor has been printed on accredited and fully recyclable paper sourced from sustainably managed and legally harvested forests.

NZ Property Investor sources expert advice on a range of specialist topics. We recommend you get your own independent advice before you take any action, and any action you take is strictly at your own risk. Opinions expressed by contributors are not necessarily those of NZ Property investor or Informed Media Ltd. Informed Media is not liable for any loss or damage (included but not limited to indirect or consequential loss) or for personal injury arising from any action taken.

© 2025 • Informed Media Limited Issue 257

NZ Property Investor is published by Informed Media Limited. The contents are copyright and may not be reproduced without the consent of the Editor. All rights reserved.

Carole Pedder

With over two decades of experience as a chartered accountant and business consultant, Carole is dedicated to understanding her clients’ businesses and providing strategic guidance for sustainable growth.

Debbie Roberts

Debbie Roberts is a financial adviser with 25-plus years’ property investment experience. She co-founded Property Apprentice in 2010 with her husband Paul to help others achieve financial freedom through property investment.

Shadi is the owner of Let’s Rent, an award-winning property management company in Auckland known for its personalised approach and commitment to excellence. With a passion for fostering strong relationships between landlords and tenants, Shadi has built a reputation for integrity, innovation, and professionalism in the industry.

Sarina Gibbon

Sarina is an independent tenancy consultant, industry advocate and established media commentator. Her clients include the Auckland Property Investors Association, Renti and several property management organisations.

Matt Ball

Matt Ball is PR and advocacy manager for the New Zealand Property Investors Federation. Matt has decades of experience in PR and politics, is a property investor and has been a renter. These experiences help him represent and advocate for property investors and push for policy changes that benefit the whole industry.

Matt Baker

Matt Baker joined PMG as CFO in February 2025. In this role, Matt oversees financial reporting, leads compliance, and contributes to property acquisitions and risk management. Before joining PMG, Matt built an extensive career in accounting and finance, spanning over 15 years in highly regulated industries across New Zealand and London.

Eve Prouse

Eve Prouse is a trusted property valuer and respected media commentator specialising in Auckland property markets – in particular South Auckland. Of Pacific heritage, Eve brings a unique, communityrooted perspective to her work.

David Faulkner

David is the general manager of property management for Property Brokers and is recognised as one of the leading experts in the New Zealand property management industry. He has been involved in the industry developing robust policies and procedures, training, and consultation services for many years.

Matthew Gilligan

Matthew Gilligan is a property investor, developer and tax adviser. He is managing director of chartered accounting firm Gilligan Rowe & Associates, where he heads the specialist property and asset planning divisions.

Leonie Freeman

Leonie Freeman is the chief executive of Property Council New Zealand. She has extensive experience in the property industry, having held top positions in both the public and private sector. From creating the concept of what is now realestate.co.nz, to buying and transforming her own residential property management business, she is a leading light in the industry.

Kris Pedersen

Kris Pedersen of Kris Pedersen Mortgages is a commentator on property and finance. His team sources top finance strategies.

Rachel Radford

Rachel Radford is the marketing lead for builderscrack.co.nz, New Zealand’s largest home improvement platform that connects homeowners with tradespeople. Her journalism background, combined with the platform’s comprehensive industry data, provides unique perspectives on nationwide property repairs and renovations.

Auckland has gained 100,000 new homes in the past seven years, writes Sally Lindsay.

Auckland Council’s planning rulebook – the Auckland Unitary Plan – took effect in late 2016 and has increased Auckland’s housing stock by 100,000.

The number of homes built has risen from 10,200 in 2018 to a record 18,100 in 2023, with 17,200 more in 2024. At the end of last year, there were 20,200 new homes in Auckland’s housing pipeline – 13,800 under construction and 6,400 consented but not yet started.

There is clear evidence that consents lead to construction and most projects make it through, says Gary Blick, the council’s chief economist.

“The vast majority of homes consented end up being built, with the data showing more than 90 per

cent become new homes and most begin construction within six months of consent.”

While not every demolition is tracked, he says research shows that for every nine new homes built, one will replace a demolished home while the remaining homes are entirely new, expanding Auckland’s housing supply.

This means about 89 per cent of new homes are net additions to Auckland’s housing stock. This occurs where single homes are replaced with terraced housing or apartments leading to more homes on the same piece of land.

Blick says this is a substantial increase from pre-Unitary Plan levels, highlighting how more flexible planning rules have made a real

• Keep track of arrears, repairs, inspections, owners

• Create tenancy agreements

• Mobile companion apps • Automatic bank feeds

• From just $8.50 per month

difference in delivering more homes.

A shift towards multi-unit housing, such as terraced housing and apartments, reflects people’s preferences, given their budget constraints, to use less land per house in exchange for locations closer to things they need, whether that’s jobs, transport, shops, schools, or other amenities, Blick says.

Looking ahead, he says the focus should remain on enabling housing capacity in accessible places, making it easier for people to live and work near major transport infrastructure – such as the $5 billion City Rail Link (CRL) –giving them faster commutes, better access to jobs and education, and easing pressure on roads.

The government has already stepped in and ordered the council to allow apartment and office buildings of at least 15-storeys high around the Maungawhau (Mt Eden), Kingsland, and Morningside CRL stations.

It has also told the council to upzone new buildings to at least 10-storeys high around Mt Albert and Baldwin Avenue stations, which are ripe for redevelopment, sitting close to Unitec’s campus and Mt Albert’s popular shops and cafes.

“The City Rail Link is a gamechanging investment in the future of Auckland. It will unlock significant economic opportunity, but only if we have a planning system to allow businesses and residents to take advantage of it,” Blick says.

“Enabling greater housing intensification along this corridor will help us maximise the benefits of this investment and provide more homes in a city geared up for growth.” ■

• Keep track of arrears, repairs, inspections, owners • Create tenancy agreements • Mobile companion apps

Automatic bank feeds

From just $8.50 per month

since

Property investors who fail to meet Healthy Homes Standards being targeted by tenancy services departments.

If landlords fail to bring their rentals up to the Healthy Homes Standards (HHS) the Tenancy Tribunal and the Tenancy Services Compliance and Investigations Team (TCIT) are expected to come down hard on them.

Landlords have had from 2021 until July 1 this year to comply with minimum standards for heating, insulation, ventilation, moisture ingress and drainage and draught stopping under the HHS. For many, the solution was simply adding a heat pump or underfloor insulation.

Now the deadline has passed, the Ministry of Business, Innovation and Employment (MBIE), which manages rental bonds for tenancies, is also likely to monitor landlords changing from property managers

to private arrangements, then audit those properties.

New or renewed tenancies must include a signed statement with details of the property’s current level of compliance. Landlords who do not include this statement when required can be fined up to $500 for each tenancy or other enforcement action.

Property managers have been firing landlords who refuse to bring their rentals up to HHS. They say some landlords are dragging their feet over making improvements they have known about for years.

Making a call to fire a landlord is difficult, but property management businesses say they don’t want to be responsible for non-compliant homes and non-compliant landlords, leaving tenants vulnerable.

In a recent Ministry of Housing and

Urban Development survey of HHS compliance, 17 per cent of landlords claimed they had fully met the standards and almost three-quarters had done something to prepare.

Landlords not meeting their obligations under the standards are in breach of the Residential Tenancies Act (RTA) and may face financial penalties of up to $7,200. In addition to the financial penalty, landlords may also be ordered to pay compensation to the tenant and to carry out necessary repairs to bring the property up to standard.

The New Zealand Property Investors Federation says some “accidental landlords” who have put their properties into the rental pool when they didn’t sell for the price they wanted, could be unaware of their obligations. ■

It’s not oversupply, but bad design that’s costing Kiwi developers, a new Squirrel report reveals.

With off-the-plan residential sales tough to come by, Squirrel Mortgages founder John Bolton says the problem is not an over-supply of properties for sale, but developers not building enough of the homes people want to live in.

He says it is easy to blame the problem on high stock levels. While there are pockets of over-supply of townhouses, that doesn’t explain the reason behind slow off-plan sales.

To help developers understand what investors and homebuyers are looking for, Squirrel undertook research through insights agency TRA into what matters for future buyers when looking at new homes.

Initial findings show that 89 per cent of prospective buyers will

consider buying a finished new build, 78 per cent an off-the-plan standalone home, and 58 per cent an off-theplan townhouse.

“So, the market is definitely there,” Bolton says. “But to succeed as a developer, quality design and getting their property market fit is critical.”

Bolton says some developers get the importance of building for their market, and as a result, do extremely well.

“On the single-house build, for example, I think developers have nailed it. There are plenty of group builders who are experts at delivering great homes that people love.”

But he says most of the problems are in the high-density space –townhouses and apartments.

“Developers are falling short with

a lack of consideration about how people want, and don’t want, to live.”

The research shows a good two-bedroom townhouse will need to have wide appeal to young families with one child or downsizers. The key to attracting buyers is that they have to want to live in the house, Bolton says.

“With high house prices, it’s not a short-term stepping stone.”

There’s a good chance that at least one person in the household works from home regularly.

If both bedrooms are being used as that, does the house have a cubby or some other space for a desk? Does it have a window with a pleasant outlook, or is the work space just tucked away somewhere and the householder is left staring at a wall?

Bolton says older buyers will want a toilet downstairs, so they don’t have to traipse up and down stairs. And if there is a toilet downstairs, it needs to be placed strategically – not somewhere everyone can hear you.

A green outlook makes people feel good. It brings in natural light and creates a sense of openness and indoor-outdoor flow.

“If you’ve got a dog, which about one in three people do, having a patch of grass out the back – even a small one – for them is a non-negotiable.”

Things like the height of ceilings can also make a huge difference in terms of how prospective buyers experience the home.

“In a small townhouse, going taller than the standard 2.4m ceiling height can bring in a whole lot of extra light and make it feel more spacious. Building homes that people actually want to buy means developers have to be thinking about all these little details.”

A few years ago, the government removed minimum on-site car-parking requirements for new developments, based on the argument that people are becoming less reliant on cars.

He says it’s not a solution for young families, who need a car to get their kids to school and weekend sports. And it’s also not a solution for professionals who rely on a car to get to work or visit their parents down country.

“Some might not care about a lack

of car parking, but others will be thinking ahead to what happens when they go to sell the property in 5-10 years’ time.”

Privacy – and more specifically inadequate soundproofing – is one of the biggest objections to highdensity living. Bolton says just because someone’s okay sharing a wall with their neighbours doesn’t mean they want to be able to hear their every movement (or vice versa).

Concrete inter-tenancy systems might cost more, but the added benefits – next to no noise transfer and significantly improved fire safety protection – are well worth thinking about if a developer wants their project to stand.

“Doing what they can to limit noise transfer in outdoor spaces is also just as important. What happens when everyone’s got their ranch slider open on a hot summer day?”

He says developers also should think about how to prevent noise transfer between neighbouring properties.

“A recessed porch can make a big difference to the acoustics when it comes to indoor-outdoor flow, but it’s not something we see in a lot of developments.”

For some developers, it feels like the name of the game is to build everything as cheaply and quickly as possible and cram as many units as possible onto a site.

“If that’s the case, developers are headed for trouble,” Bolton says. “Being cost conscious is important –obviously – but good design doesn’t have to cost the earth.”

He says many Kiwi developers, particularly townhouse developers, could learn from Johnny Ive, Apple’s chief design officer. His philosophy is best summed up by this quote:

“We’re surrounded by anonymous, poorly made objects. It’s tempting to think it’s because the people who use them don’t care – just like the people who make them. But what we’ve shown is that people do care. It’s not just about aesthetics. They care about things that are thoughtfully conceived and well-made. Our success [at Apple] is a victory for purity, integrity – for giving a damn.” ■

West Coast, South Island.

REINZ data shows the housing market was more subdued in June, with sales and prices losing the momentum from earlier in the year. Turnover has slowed in the past two months, and prices fell for the first time since late last year. The national median selling price was $770,000, up 0.5 per cent compared to May, but unchanged from June last year. Auckland’s median dropped by 3.4 per cent to $990,000. Ten of the 16 regions had an increase in median prices compared to June last year. The most significant increase was on the West Coast, up 35.5 per cent from $310,000 to $420,000. Southland reached a record high of $502,500 – the first record median price in any region since January. The number of properties sold across the country increased by 20.3 per cent year-on-year, from 4,877 to 5,865. However, in the month sales were down 4 per cent in seasonally adjusted terms, following a 3 per cent fall in May. The median time to sell rose to 48 days, the second month this rose again after having improved in the early part of this year. Looking at properties coming to market, there was a 2.5 per cent decline in listings compared to June last year, totalling 7,612 listings. Inventory levels across the country, however, continue to rise, increasing by 2 per cent year-on-year to 32,384 properties available for sale. Westpac senior economist Michael Gordon says with fixed-term mortgage rates having largely bottomed out, the housing market appears to be settling into a new holding pattern, albeit at higher levels of activity than a year ago. Interest among potential buyers is still apparent, with mortgage applications well above last year’s levels (but no longer rising). Against this, the stock of unsold homes on the market remains high and has hardly budged over the last year. ■

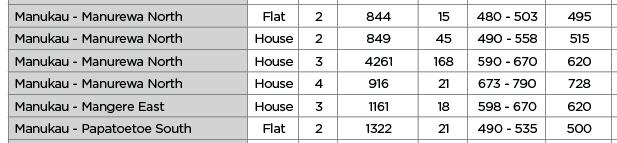

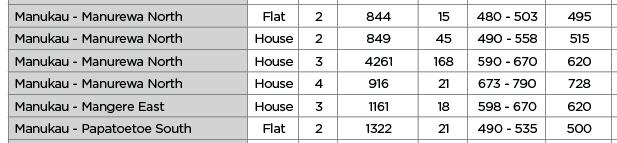

Average rents are still $17 a week lower than they were in June last year. The latest data from realestate.co.nz shows they rose slightly in June to $636 a week, up from $633 a week in May, but down 2.7 per cent from $653 in June last year.

Rents fluctuate across the country – in Wellington they dropped by a hefty 10.9 per cent to $625 a week compared to $701 a week at the same time last year. Renters in Hawke’s Bay also experienced a greater-thanaverage drop in rental prices, down 6.6 per cent from $677 in June 2024 to $632 this year.

In the South Island rents surged on the West Coast, with the average weekly price of $433, 9.1 per cent higher than the same time last year, when the weekly rent sat at $396. The average weekly rental price in Otago has also risen, from $571 in June last year to $616 the same month this year, a year-on-year increase of 8 per cent. Southland’s average weekly rent of $489 in June was the region’s highest on record, 6.1 per cent more than June last year when it was $461 a week.

The biggest monthly increase was in Coromandel, where the average asking rent increased by $42 a week, from $571 in May to $613 in June.

In Auckland, the country’s largest rental market by far, the monthly asking rent increased by just $2 a week, from $696 in May to $698 in June, but was down by $20 a week compared to June last year. ■

Further cooling in migrant arrivals to a two-and-a-half-year low –about half the historic average – is likely to dampen medium-term inflation and support lower interest rates. Stats NZ figures show just 14,800 people were added to the population in the year ended May compared to more than 84,000 the year before. In 12 months, 139,356 migrants arrived, down from 189,557 in the previous 12 months (-26.5 per cent). There was net gain of 16,415 people from India, 8,885 from China, 8,871 from Philippines and 5,687 from Sri Lanka. Of the migrants arriving, 33,170 had work visas, 30,157 had student visas, 29,208 were New Zealand or Australian citizens, 25,382 had visitor visas and 19,963 had residence visas. At the same time record levels of people left the country – 124,548 compared to 109,275 (+14 per cent) in the previous 12 months. Meanwhile, the number of New Zealanders who left for Australia last year was the highest in more than a decade – just under 30,000 – marginally higher than in 2023. However, it was the highest since it peaked in 2012, at nearly 44,000. ■

Barfoot & Thompson’s selling prices are slowing increasing. Auckland’s biggest real estate agency’s average selling price in rose from $1,085,751 in May to $1,130,835 in June, up by $45,084, or 4 per cent for the month, but down by $105,501, or 9 per cent compared to June last year. The median selling price increased by $53,000, or 6 per cent from $928,000 in May to $981,500 in June, but remained down by $38,500, or 4 per cent compared to June last year. The agency sold 876 properties, up by 29 per cent compared to June last year and the strongest in a June month since 2021. However, stock levels remain high, with Barfoot & Thompson having 5,831 properties available – a 17 year high. ■

The property market has hit 2.5 years of flat average asking prices, with the national price down 0.9 per cent year-on-year in June to $855,360, realestate.co.nz says. This reflects a market with minimal movement since December 2022. The national average asking price has not been over $900,000 since then. Vanessa Williams, realestate.co.nz spokeswoman, says the market reality is flat. “There is little movement and when there is any change, it tends to be in the regions.” Regional trends vary significantly. Southland had a second consecutive record-high average asking price of $568,647, up 8.6 per cent from the previous year. In contrast, Northland’s prices fell 9.1 per cent to $773,681 – the first time the region’s average asking price has dropped below $800,000 since July 2024. In Auckland, the country’s largest housing market, the average asking price declined to $982,679 in June, down from $1,023,760 in May, a drop of $41,081 (4 per cent). This is the first time this year that Auckland’s average asking price has been below $1 million. ■

Property values ticked up by 0.2 per cent in June, reversing two minor monthly falls of -0.1 per cent a piece in April and May, Cotality’s latest Hedonic Value Index (HVI) shows. At $815,389 in June, property values remain 16.1 per cent down from the January 2022 peak, however they have managed to edge up by a total of 1.1 per cent since September last year and by 0.6 per cent this year so far. Median values were unchanged in Auckland and Wellington compared to May, but up slightly for the month in Hamilton 0.3 per cent, Tauranga 0.6 per cent, Christchurch 0.6 per cent and Dunedin

0.2 per cent. Cotality chief property economist Kelvin Davidson says June’s figures emphasised the current variability of the market. “On the one hand, mortgage rates have come down a long way, and that benefits borrowers whether they’re in Whangārei or Winton,” he says. “But the normal upwards influence this would tend to have on sales volumes and property values is currently being dampened by other forces. In particular, the abundance of listings on the market means most buyers aren’t in a rush and can be quite tough when it comes to price negotiations,” he says. ■

Data from credit bureau Centrix and RBNZ show different pictures for mortgage arrears. Centrix figures show the number of mortgage holders struggling to make their repayments dipped by 700, or 1.44 per cent, from April to May. In total there were 21,900 borrowers overdue on their repayments. RBNZ data shows non-performing mortgage loans increased by $28 million in May to nearly $2.5 billion. That was a rise of 1.2 per cent from April and is up significantly from $1.2 billion in May 2023. Of this number $534 million was impaired, a rise of $30 million or 6 per cent from April. While mortgage arrears are improving, according to Centrix, 15,000 people are in hardship and struggling to pay their bills – an increase of 300 from April and up 14 per cent from a year ago. Almost half of

these cases (46 per cent) were due to difficulties paying mortgages, a rise of 19 per cent year-on-year. This has been happening since mortgage rates have come down by about 2 per cent since August last year. Non-performing loans have risen to just under 0.7 per cent of the country’s outstanding $372 billion mortgage book on housing stock worth $1.62 trillion, RBNZ data series reveal. Non-performing loans past due but not impaired have dropped a tad and stand at $1.915 billion, down from $1.916 billion in April. They stood at $1.57 billion a year ago. After the GFC non-performing loans rose to 1.2 per cent; they are not predicted to reach that level, despite mortgage holders suffering under high interest rates over 2022/23. The RBNZ had predicted they would peak at 0.7 per cent this year. ■

House price forecasts for this rest of this year have been downgraded by economists at the ANZ (the country’s biggest mortgage lender) and BNZ. ANZ is now forecasting just 2.5 per cent price growth, while the BNZ has dropped its forecast to between 2-4 per cent. For next year both the banks believe there will be 5 per cent growth. ANZ says because indicators of the balance between supply and demand continue to drift sideways, it has downgraded its forecast. ANZ chief economist Sharon Zollner says the 225 basis points of official cash rate (OCR) cuts delivered by the RBNZ in this easing cycle (from 5.5 per cent to 3.25 per cent) has been a tailwind to the housing market, but the upswing in house prices has been muted compared to other easing cycles. “We expect the housing market will heat up a touch next year following further OCR reductions and a strengthening and broadening economic recovery, leading to more significant increase in house prices of 5 per cent over 2026.” At BNZ chief economist Mike Jones says prices remain glacial. “Stirring shakier demand in with our existing concerns about elevated supply, points to this dynamic continuing. We’ve shaded our 2025 annual house price inflation forecast down to a 2-4 per cent range accordingly. Previously, it was 5-7 per cent. ■

The rate of decline in building consents has slowed. Stats NZ latest figures show 33,530 new dwellings were consented in the 12 months to May this year. The annual rate of decline is slowing, from -11.5 per cent in the year to May 2023, to -22.8 per cent in the year to May 2024 and -3.8 per cent in the year to May 2025. In the May month this year 3,151 new homes were consented, down just 0.8 per cent compared to May last year. Consents for stand-alone houses were up 2.4 per cent compared to the previous 12 months and apartment consents were up 6.2 per cent compared to the previous 12 months, while retirement village units were down 4.5 per cent for the year which follows a 47.3 per cent decline in the previous 12 months, and townhouses and home units were down 11 per cent. The total estimated value of residential building work consented in the 12 months to May this year was $17.391 billion, down 4.5 per cent compared to the previous 12 months. ■

The Reserve Bank may need to cut rates as inflation softens, writes Kris Pedersen .

New Zealand’s June quarter inflation data has come in softer than expected, and it may be the signal the Reserve Bank of New Zealand (RBNZ) needs to shift gears. Annual inflation rose modestly to 2.7 per cent from 2.5 per cent in March, but crucially, it remained within the RBNZ’s 1-3 per cent target band for the fourth straight quarter.

While this small uptick in headline inflation might raise eyebrows, the broader picture is one of easing domestic price pressures and growing slack in the economy – conditions that suggest the RBNZ may need to consider cutting the official cash rate (OCR) as early as August.

Most economists had expected a higher number – around 2.8 per cent to 2.9 per cent – so the actual outcome came as a relative relief. The drivers of inflation were largely out of the RBNZ’s control: imported costs, such as food and electricity, continue to lift prices, while petrol prices fell 8 per cent year-on-year, helping to soften the overall impact.

More importantly, underlying inflation remains contained. Core inflation, which excludes volatile items like food and fuel, ticked up just 0.1 percentage points to 2.7 per cent. That’s a far cry from the entrenched inflationary pressures that plagued the economy just 12-18 months ago.

Signs of easing are evident across the CPI basket. The share of goods and services declining in price increased to 35 per cent, up from 30 per cent last quarter. A growing portion of

the index either stayed flat or rose by less than 3 per cent annually –further proof that price pressures are broadening out to the downside.

The largest contributor to annual inflation was local authority rates, which rose 12.2 per cent, but even that spike dates back to the September 2024 quarter. Cultural services (including streaming) saw a sharp quarterly rise, but these are isolated categories – not systemic inflation drivers.

Given that the economy still has ample spare capacity, and that global risks are increasingly tilted toward a slowdown, there’s a growing argument that maintaining a restrictive stance may no longer be appropriate. Domestic inflation is cooling, consumer spending is softening,

and the broader CPI dynamics show inflation is no longer as sticky or widespread.

If the RBNZ waits too long, it risks over-tightening into a weakening economy. A measured rate cut in August could help support growth without reigniting inflation – a balancing act the RBNZ may now be compelled to perform.

At the moment, the three-year rate is appealing for conservative investors, but personally, I still prefer the 12-month option. I believe the OCR will need to fall further than what the Reserve Bank is currently forecasting. There could be benefit in trying to hedge over different rate terms, but in most cases, I believe 12 months gives time to take us closer to the bottom of this rate cycle and then I believe it makes more sense to hedge. ■

The interest rates specified in this table were accurate on 10 July 2025. Interest rates are subject to change without notice. Different fees and charges apply to each loan depending on the motgage lender. Seek expert advice to determine the mortgage lender that is right for you and your circumstances. A disclosure statement is available on request and free of charge.

Data from realestate.co.nz reveals a slight year-on-year bump in listings targeted at investors, even though the month-on-month figures are down.

While realestate.co.nz data shows investortargeted listings are at their lowest level since last December, they are actually up year-on-year. Listings nationwide sat at 2,930 in June – down from 3,804 in May. Regional listings also reflected this trend – with a 25 per cent drop in listings in Auckland (from 1,734 in May to 1,307 in June); another 25 per cent decrease (from 478 to 359) in Canterbury; and a 27 per cent drop off in Wellington. The only regions to buck the trend in June were Central North Island and Northland – which experienced 26 per cent and 5 per cent increases in investor-targeted listings respectively.

This drop in listings is likely to be seasonal, however: with year-on-year data painting a rosier picture.

“If we look year-on-year, investortargeted listings are up by 2.6 per cent, suggesting there is slightly more optimism among investors this June than at the same time last year. For

context, new listings for all residential dwellings across New Zealand were down 2.5 per cent year-on-year during June,” she continues.

The national average asking price of investor-targeted listings increased from $944,189 to $963,481 (2 per cent), with one-bedroom, threebedroom, and four-bedroom plus listings all heading slightly upwards.

“When comparing this to all residential listings, the increase in asking price bucks the national trend again,” says Williams.

“Average asking prices were down both month-on-month and year-on-year by 0.9 per cent, so while it’s a slight increase it’s a positive sign for investors.”

“We usually like to see three months of increases in a row to call it a trend –which hasn’t been the case – but if we look year-on-year, the average asking price is also up, so in line with the new listings lift during June, this could be an early sign of optimism in the investor market.”

realestate.co.nz has been helping people buy, sell, or rent property since 1996. Established before Google, realestate.co.nz is New Zealand’s longest-standing property website and the official website of the real estate industry.

According to realestate.co.nz data around new builds, apartments and units are taking longer to sell than older homes. Apartments are staying on the site 85 per cent longer and units 117 days longer than non-new builds.

If we look at the Canterbury market, we can see a drop-off in investortargeted listings for two-bedroom homes – from 164 in February to 74 in June.

As this area has a preponderance of new builds, often smaller typologies, it may indicate that investors are choosing to move their new-build apartments and units into the rental pool rather than trying to sell in a weaker market.

“The decline in investor-targeted listings in Canterbury could indicate less demand.

“If we look at the rental data for the region, there was a spike in new listings during March, but this didn’t carry on into June,” says Williams. ■

LEFT June saw Wellington experience a 27 per cent month-on-month drop-off in investor-targeted listings. Canterbury also saw a drop off since May, by 25 per cent.

Our experts address your property queries

Do you have a burning property investment question you need an answer for? Whether you are just starting out in property investment, or an experienced investor, email joanna@informedmedia.co.nz to have your questions answered.

Matthew Gilligan

Gilligan Rowe + Associates, gra.co.nz

Kris Pedersen

Kris Pedersen Mortgages, krispedersen mortgages.co.nz

Mark Withers

PKF Withers Tsang, pkfwt.co.nz

QWe have five investment properties. The property we live in is freehold and the mortgages on two of our investment properties are paid off. The current mortgage is $1.2 million. We are not strapped for cash but want to explore interest-only loans. Are there any advantages or disadvantages in doing this? We are just under 60 years of age.

AFirstly, I would recommend that you make sure that the bank who you have the mortgages with on the three investment properties doesn’t still hold security on your home or the two investment properties you’ve said are paid off. Almost every day I see clients who believe that a property has no mortgage connected to it, because they have paid a particular loan split off. But as the banks don’t immediately release the security, the mortgage itself is actually still in place and cross-secured against other property.

Sarina Gibbon Independent tenancy consultant, sarina@tenancy advisory.co.nz

Ryan Weir

Propertyscouts, propertyscouts.nz

In answering your questions about interest-only loans, it is a case of deciding your overall strategy. Going interest only which may give you better cashflow, which is fine if you want to concentrate on living more now versus reducing debt. You mention that you are not “strapped for cash”. If you are sitting on cash, consider restructuring part of your mortgage into either an offset or revolving credit, which may also decrease your mortgage payments and improve your cashflow, while still giving you the flexibility of having access to your cash. At your age I would recommend that you consider split banking the three investment properties if they are all with one bank, to give you more flexibility when you decide to retire. If you decide to sell one you need to be aware that if there is residual debt left over with that bank, that the bank will require you to go through a full loan application process at discharge. If you can’t meet their current loan affordability requirements then they will look to take full sales proceeds and apply that to your remaining debt. ■

Kris Pedersen

QWhat is the best way to manage rowdy tenants? We have tenants who pay their bills and keep the place clean, but they have parties most weekends. We don’t want to lose the tenants as they are looking after the house well, but the neighbours keep calling noise control. Are the tenants breaking any RTA rules? What advice do you have?

AThis isn’t a cookie-cutter situation. You’re not dealing with a broken pipe or unpaid rent. You’re managing people, with rights, obligations and opinions. There isn’t a singular “best way” to handle this. There’s only the right way for your situation, and it depends on things you haven’t told me: what kind of tenancy is this, how frequently the noise occurs, have there been any official warnings, and what is your tenant’s position?

Still, you’re piggy-in-the-middle and here is a framework to help you get to the best outcome.

You say the tenants are taking care of the place and paying on time. Good. That’s minimum standard, not a badge of honour. A good tenant understands they are part of a community. That means their right to party like it’s 1999 ends where someone else’s sleep begins.

This isn’t just about the law. Your relationship with your tenant isn’t

purely transactional; it is also custodial. There’s a person on the other side of this, living in a home you control. That puts you in a position of power. And how you use that power sets the tone of the relationship. Lead with humanity, and you build trust. Lead with blame, and you invite conflict.

Don’t rush to vilify. I often see landlords default to blaming tenants the moment someone else kicks up a stink. Check your bias. Sometimes the issue is real. Sometimes it’s just grown-ups needing to sort it out amongst themselves. So why are you volunteering as an unpaid therapist?

Now, you’ve asked about the RTA, so let’s talk about the RTA. Section 40(2) (c) prohibits the tenant from interfering with the “reasonable peace, comfort, or privacy” of any other person residing in the neighbourhood. So yes, repeated noise complaints could amount to a breach. You’d be within your rights to issue a 14-day notice to remedy. But unless the noise is extreme, repeated and well-documented, it is unlikely to meet the threshold for termination under s56. And no, being “a bit loud” on a Saturday doesn’t constitute harassment, so unlawful act claims won’t fly either.

Before you do anything, be clear about what you actually want. The RTA provides multiple pathways for dealing with rowdy tenants. It’s a bit like a choose-your-own-adventure game; you need to figure out what adventure

you’re up for this time. The direction you take depends very much on the leadership, discipline and purpose you bring to the situation.

• Want to keep the tenant and restore neighbour goodwill? Start with a direct conversation. Be specific, constructive and firm. If the behaviour continues, document it and consider issuing a 14-day notice. Or, if things escalate, serve an anti-social strike under s55A.

• Want the problem to go away without confrontation? Let noise control do its job. You are not the town’s sheriff. And you’re certainly not the neighbour’s mama.

• Want to end the tenancy and move on? Weigh up your legal rights (including checking that you’re not issuing a retaliatory notice), any obligations under a body corporate or title covenant, and your business goals. Be honest with yourself, are you making a strategic play or just trying to avoid discomfort?

Whatever you do, stop waiting for the law to give you a one-size-fitsall answer. It won’t. You’re running a tenancy, not a complaints department. This is about people management, business discipline and making decisions that support your long game, even when the bass is thumping next door. ■

Sarina Gibbon

QIs pressing the test button on a smoke alarm enough to meet my responsibilities as a landlord, or is there a better way to check they’re working?

AThis is something a lot of landlords get wrong. Pressing the test button on a smoke alarm doesn’t actually check if it can detect smoke – it just checks the battery and circuitry. So if it beeps, all you really know is that the power’s working, not whether the alarm will go off in a real fire. To properly test a smoke alarm, use a smoke alarm test aerosol – basically smoke in a can. They’re cheap and easy to find at most hardware stores. A quick spray under the alarm should trigger it if the sensor’s working. Also worth a reminder – smoke alarms are legally required within every bedroom or within 3m of every bedroom door, and on every level of the house, even if nobody sleeps on that floor. Landlords are considered PCBUs (Persons Conducting a Business or Undertaking) under the Health and Safety at Work Act. That puts a legal duty to take all reasonable steps to keep tenants safe – and that includes making sure smoke alarms are both installed correctly and working properly. So yes, press the button at inspections – but at least once a year, do a proper smoke test, check expiry dates, and give the alarms a clean.

Ryan Weir

QWe have just bought an investment property. We are looking at putting a workshop at the rear of the property to run our business from. It has dual access. The business will pay rent. The mortgage will need topping up, so it will be negatively geared. We are wondering about the best way to structure this in terms of the entity overseeing the IP.

AThat is a great question, but as is so often the case, it is not possible for me to give a definitive answer without knowing more detail. The appropriate structure for any asset or business depends on the specifics. In the context of this property, you have pointed out that it will be partially residential use and partially commercial use, and it will likely run at a tax loss. You also refer to the fact that you run your own

QI am looking at expenses for my tax return. We had an insurance payout for a bathroom leak. Do I use the full cost of repairs or just the difference between the payout and what the actual cost was?

AIf the repair is to an incomeearning asset and is not capital in nature the cost of the repair is tax deductible. That said, the cost of the repair is your actual net cost. So, if you have received an insurance refund in relation to the

business. If you run your business through a company (which hopefully you do) then one possible solution here would be to have a second company with identical shareholding acquire the property. We often recommend our clients employ a “wholly-owned group” structure, with the involvement of a trust to hold the shares in the business and investment companies (subject to the proviso that often the clients hold one share in each company personally, so as to be eligible to be allocated shareholder salaries when appropriate). So to sum up, a new company may well work for you here, particularly if you already have a company for your business activities. However, you should seek advice from a competent professional who can have a look at the entirety of your structure and come up with a solution that fits best.

Matthew Gilligan

repair, this is netted against the cost and the claim is for the net difference. It’s also worth stating the obvious, perhaps: the insurance premium itself is also a tax-deductible cost.

Mark Withers

Tel: 09 522 7955 | Email: info@gra.co.nz | www.gra.co.nz

chartered accountants specialising in property, tax and trusts

It’s gone for now, but it pays to be aware that interest deductibility could be back if the government changes, as Matt Ball from NZ Property Investors Federation explains.

When we paid our tax bills earlier this year, it was a reminder for many of the removal of interest deductibility. But the idea is not yet dead and buried.

In May the Green Party released its budget, which included a promise to remove interest deductibility. It sees it as a “loophole” that “wealthy landlords” don’t deserve. Te Pāti Māori also support the policy.

We’ll have to wait and see what Labour does. They haven’t committed to a tax policy yet, but are considering several options, including wealth tax, capital gains tax and removing interest deductibility.

We wanted to get a quick temperature check on how investors might react if the policy was reinstated. A snap member poll in June showed that while some investors will take it in their stride, 77 per cent of 224 respondents said they would have to take some action to mitigate the impact.

When we looked at what they say they’d do, it got interesting. Just under half of respondents said they’d put up rent – if possible. A difficult option now, and even in good times you can’t increase rent more than people can afford, but anecdotally it was a widespread option last time. Particularly from those who had well-under-market rents.

Ten percent said they’d stop using a property manager to reduce costs, and just under a third said they’d defer maintenance or upgrades, because they’d no longer be able to afford them. This is in line with a survey done by NZPIF following the removal of interest deductibility last time, which showed that landlords were indeed delaying maintenance and upgrades.

In a way, it’s the least-impact option. Stop, wait and hope.

Forty-two per cent said they’d sell some property to reduce or eliminate their mortgage. This of course only applies if you have more than one property.

Again, anecdotally, we know this happened last time, particularly as the policy started to bite and people were being hit by provisional tax bills.

Finally, just under a third said they’d sell their portfolio and get out of the business. That’s easy to say in a survey, but it’s a big step to take in the real world.

As best we can tell from last time, that doesn’t seem to have happened. When you look at the IRD numbers of taxpayers reporting rental income, it was stable, around 300,000, for the period interest deductibility was removed.

Whether or not you’d go through with selling rentals next time around would depend on many factors, including your own circumstances at the time and the state of the property market, but let’s imagine if that happened.

There are around 304,000 property investors in New Zealand, with around 565,000 homes between them, or just under two each. Based on the responses to our survey, up to 85,000 investors could sell all their property, meaning around 157,000 homes hitting the market. To put that into perspective, there were 71,881 houses sold in New Zealand in 2024.

The upheaval would be unprecedented. Unless all those homes – or even a high proportion – could be sold to other investors or to tenants, we are potentially looking at massive social upheaval. Families will be forced

to move house, kids will be forced to move schools, adults may have to change jobs, move towns and so on.

There’s no way that much supply could be handled without crashing the market, so it’s likely to happen over a longer period, possibly leading to depressed house prices over several years. The current housing market is a good example of what happens when supply exceeds demand. Imagine current conditions extending over three, four or more years as investors head for the exit. Homeowners are not going to be happy.

I find it hard to believe any government would want these things to happen. I also believe that if politicians really thought through the consequences of this policy, they would see that what I’ve pointed out above is possible. I get the feeling that some think we’re exaggerating, crying wolf to stop a policy that will cost us money.

What I don’t think they realise is that now investors have first-hand experience of the “tenant tax”, many won’t wait around to find out what happens. I know people who are selling properties “just in case”. Better safe than sorry.

My job – with your help – is to make sure our politicians understand the implications of bringing this policy back. I want to expand on the survey above by recreating a survey done by NZPIF back in 2021 when this policy was first proposed. I want to know if and how attitudes have changed since then and what investors are planning to do.

All you have to do is fill out the survey and share it with other investors you know. I’d love to get as big a response as possible, to make sure that politicians have to listen. Because they need to. The alternative is grim. ■

property accountants

asset protection consultants

tax advisers

property educators

Gilligan Rowe & Associates LP (GRA) is a chartered accounting practice that offers clients a full range of taxation and compliance accounting services coupled with specialist property, trust and asset planning advice. As well as completing accounting for individuals, businesses and property investors, GRA provide clients with knowledge through their educational programmes. Over the years we have helped thousands of clients increase their wealth through property investment, maximise their asset protection and minimise their tax liabilities.

We are recognised as leading experts in our fields and are committed to helping our clients succeed. To that end we offer a range of services.

Getting your structures set up correctly from the beginning is important. We adopt a holistic approach, with a focus on both asset protection and legally reducing tax.

• Asset protection

• Setting up trusts and companies

• Tax advisory

Book an initial review of your affairs, including property, tax and legal structures - FREE to new clients

Tel: +64 9 522 7955 | Email: info@gra.co.nz | www.gra.co.nz

Accountants with deep understanding of structures and tax planning.

• Annual accounts, tax returns, GST etc

• Insolvency and liquidation

• Budgeting and cashflow forecasts

Helping our clients succeed.

• Free webinars on property and tax

• Property School and Development School courses

• Property consultancy – portfolio planning

Profile Matthew Horncastle and Blair Chappell

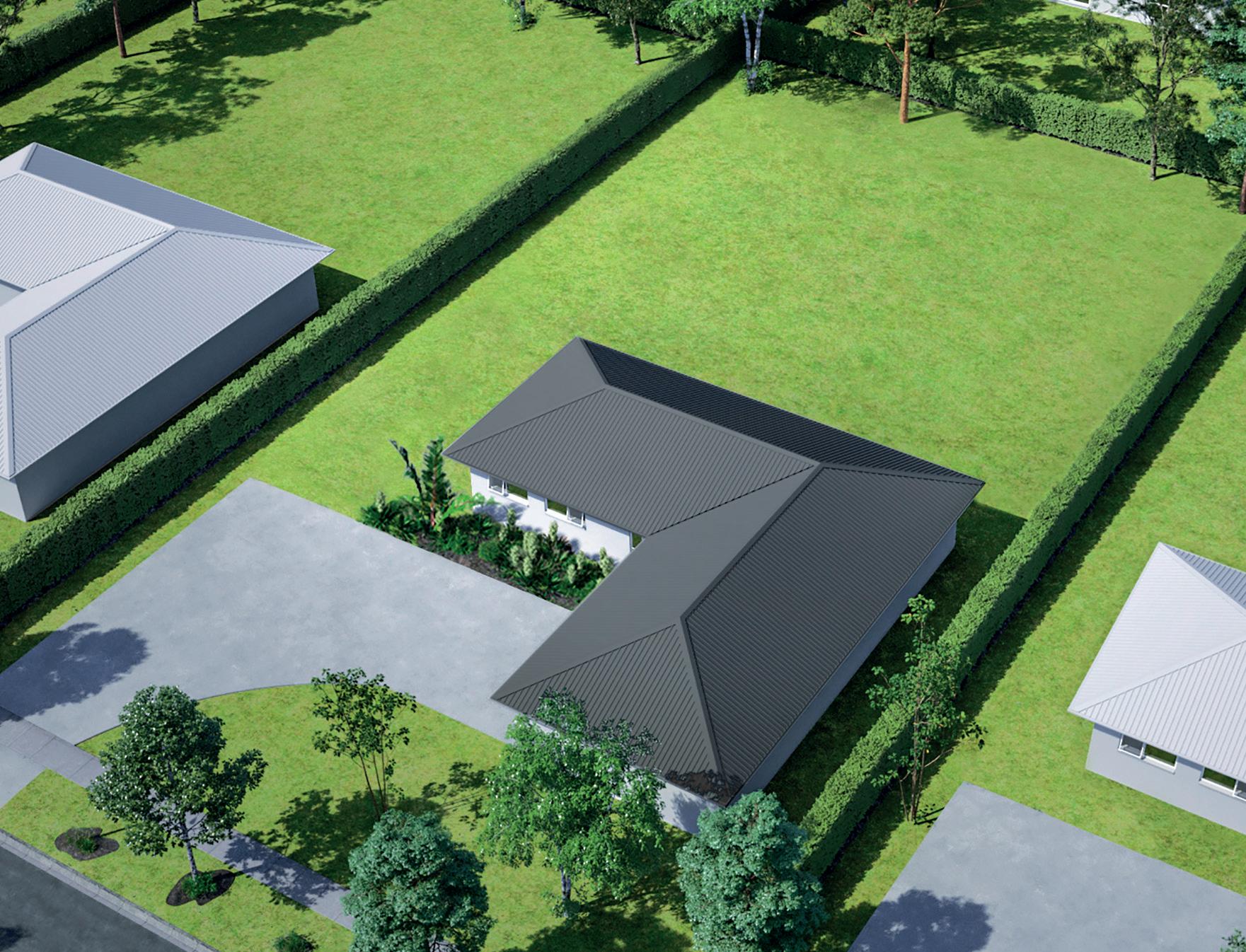

Matthew Horncastle and Blair Chappell of William’s Corporation talk to Joanna Mathers about $1 billion worth of new builds, riding the property cycle, and proving the detractors wrong.

Photography Digital Simple

“We were young, loud, wealthy with a libertarian world view. This made us the perfect story, some loved us and wanted to see it go all the way. Others did not like the success and wanted to see us fail so they could tell everyone they told them so.”

Matthew Horncastle is used to making waves. He and co-owner/ co-founder of Christchurch-based developers Williams Corporation, Blair Chappell, have never shied away from the public eye.

Their upward trajectory from young bucks to property tycoons has been played out in the media; as were their difficulties during the post-Covid property bust.

But the pair – whose company went from selling 95 houses in a month to just three in a month after the market crash – have managed to ride the cycle and prove naysayers wrong. And they have recently celebrated an impressive milestone – $1.3 billion dollars-worth of new builds in 13 years.

“We were one of the largest companies in New Zealand, through one of the most violent economic environments and we transacted the business. Without missing any payments or losing any external capital – it cost us some of our equity to protect everyone else,” says Matthew.

It’s something they are very proud of.

In September 2017, Matthew and Blair were the cover stars of New Zealand Property Investor. Williams

Corporation – they share William as a middle name – had just achieved a $30 million turnover; they were just 23.

Matthew and Blair met when they were 10 years old. They both came from families who were involved in property and the Christchurch market.

Matthew’s father and mother started a property company – Horncastle Holdings, which became Horncastle Homes – which at its peak was one of the largest property companies in New Zealand. And Blair’s father, Grant Chappell, was the owner of a Harcourts office and a top agent in Christchurch.

Matthew had left school at age 16 and trained as a builder; Blair had earned a bachelor’s degree in information and communications technology. Together they had developed businesses in fencing, waste management and solar panels at a young age: “They were not overly successful,” says Matthew.

Development was their last stab at creating their own business; and despite the success of their families they were not given any financial help in growing their own company.

Blair Chappell (left) and Matthew Horncastle have played an integral role in the rebuild of Christchurch.

While they only made just $10,000 on their first development, they had a vision to be part of the rebuild of Christchurch.

“Our thesis was people wanted quality homes, good location and price and would sacrifice car parking and size,” says Matthew.

Christchurch traditionally is a very conservative city. Williams Corporation’s vision represented a property paradigm shift.

Taking sites in great locations with rundown houses, their model was to build high-quality townhouses, many without car parks, for sale to first home buyers at very competitive prices.

“[Our vision] was bold and different, it drew criticism, but sales happened faster than we could build,” says Matthew.

Quality has always been integral to the Williams Corporation ethos. They have long prided themselves on utilising engineering and innovation that allows for smart construction that goes beyond building code expectations.

“We have always made sure that each property is not just beautiful, but meticulously designed to last,” says Matthew.

“Engineering every element for longevity, we guarantee a product that stands the test of time and performance, not just looks great on day one.”

Their fast success reflected the appreciation for this quality and the mood for change in Christchurch. Pundits flocked to buy their builds – in a city destroyed by earthquakes, their vision reflected a wider renaissance of Christchurch as a modern, international city.

Blair Chappell (left) has a qualification in information and communications technology.

And at the peak of the property market – the boom time of 2020-2021 – Williams Corporation topped out at $53 million of sales in one month.

“From 2014-2021 we built a massive company from nothing,” says Matthew. “But then the market started dropping.”

The post-Covid property slump hit everybody. In 2021, the market started dropping – prices would eventually shrink by 20 per cent.

In the first six months of 2022, Insolvency and Trustee Service data reveals that more than 100 construction companies went into liquidation –25 per cent of all insolvencies in the country. In the first five months of 2023, 199 construction firms were liquidated, a 72 per cent jump compared to 116 in the same period last year.

So it was inevitable that Williams Corporation, one of the country’s leading developers, would be affected. They were always open about what was happening in the business.

“We had to reduce staffing from 214 to 65 and to move to smaller offices,” says Matthew.

“And there were a lot of negative stories about us – the general market did not believe we would be able to trade the cycle.”

Matthew and Blair’s struggles were ripe fodder in a media environment hooked on clickbait headlines.

“There was a time where there were negative articles about us 11 days in a row,” remembers Matthew.

And he feels that Williams Corporation was unfairly targeted.

“We’ve noticed a troubling trend in the press, an eagerness to spotlight supposed financial struggles that simply aren’t occurring,” he continues.

“That kind of coverage unnerves prospective Kiwi homebuyers, who start to question whether buying from us is safe. As a result, our staff bear the brunt of this fallout. When buyers grow hesitant due to media-driven uncertainty it has a direct impact on their earnings, morale, and livelihood.”

What upset them most, he says, is that that the team’s confidence was

shaken by narratives that painted them in a negative light, especially when they were working tirelessly to serve every client.

As an aside, a lesser-known aspect of the Williams Corporation empire is their wholesale property-backed funds, only available to wholesale investors.

Launching in 2019, with the idea that wealthy “mum and dad” type investors would be ideal backers for some of their projects, they soon realised they needed to scale up their vision.

“As our projects got larger, it was harder to find funders. So we realised that if we put all our funders together they could fund our projects together.”

The original redemption period was six months, with a clause that allowed them to extend to 12 months in challenging economic times. In their first fund update, the fund had $8.4 million – at the peak they had $158 million under management.

During the downturn they had to utilise this the redemption clause (leading to gleeful headlines in mainstream media alluding to

‘From 2014-2021 we built a massive company from nothing. But then the market started dropping’

Williams’ dire financial straits.)

But the wealth creation from the period leading up to the property crash, and Matthew and Blair’s personal equity, allowed them to protect all external parties.

“We never missed a legally due redemption, we never missed a dividend payment, we never had $1 of loss,” says Matthew.

Williams Corporation currently has $90 million under management and the fund has a loyal base of about $85 million that sticks with them.

While the naysayers may have doubted Williams Corporation’s ability to come out of the property crash alive, cost-cutting measures, plus new strategies and expectations, have seen them bounce back.

An aggressive expansion into Australia, launched in 2021 with offices in Sydney, Melbourne and Brisbane, had to be paused.

“We had a consented development in Brisbane, and about to start construction. But as the market started to weaken in New Zealand, we sold everything and brought the money home to keep our reserves as full as possible for the pending recession,” says Matthew.

And about two years ago, they started to identify new properties that had demand in the current market. They developed “extremely adorable” townhouse studios and one-bedroom townhouses in Bath St and Ferry Rd in Christchurch. Off the back of these, they launched larger developments –they have very affordable price points and some also feature communal

areas with a “wellness hub” including spa, sauna, cold-plunge pool, outdoor showers, grass and native landscaping.

These have brought transaction volume and margins into the group in a challenging market – one of the projects at 12 Bath St saw 51 of 57 units either sold or under contract before construction even started.

They have also launched a series of joint ventures so the group is less susceptible to the cyclical nature of property development.

These include a co-ownership company Own With Williams that provides equity for customers and allows them to purchase; a property management company called Managed by Williams; and Airhome, prefabricated homes that can be transported across New Zealand.

Matthew says that they have now settled into a good rhythm – selling 17-30 houses a month. While settlements by financial year are significantly lower than in the boomtimes, they are still healthy – in 2025, Williams Corporation completed and settled on 209 homes – a higher number than in 2020.

Their public persona has also undergone a strategic reset. Astute readers of public sentiment, Matthew and Blair realised that the Insta posts of private jets and mega mansions weren’t ideal when much of the country was struggling – including their own clients.

So they are once again donning high-vis vests and seen out and about on sites – getting back to basics.

Matthew is about to have a baby with his partner Hannah, a big reset for a workaholic who has built an empire from the ground up; and Blair has married his partner Georgia.

Their story should act as inspiration for others with big ideas; when executed with prescience and clear strategic direction, they can soar. They have managed to survive where so many others have failed. And they have been a key factor in the regeneration of a city that was broken and looking for visionaries to facilitate its resurrection. ■

The best buildings incorporate cutting-edge design with in-depth analysis. In this two-part feature we explore why green building practices can increase the life-span and liveability of a home and look at a looming crisis around moisture in walls – and how to prevent it.

Wellington-based property investor

Jackie ThomasTeague has gone beyond what most landlords do for their tenants. Thomas-Teague has upgraded her 10 rental properties to ensure they meet New Zealand Green Building Council’s (NZGBC) HomeFit PLUS certification.

Part of her motivation for spending around $10,000 on each property was to improve life for her tenants. She recognises that more than 25 per cent of renters will be over 65 in the next few years – a much bigger demographic than currently.

After the retrofits, her tenants started telling her what a huge difference it had made to their lives.

“My tenants’ energy bills have dropped (on average) by about $100 a month, which means they have more money for discretionary spending.”

She has had no rent arrears since

Green building has benefits that not many fully understand. Sally Lindsay investigates why building sustainably is well worth the upfront investment.

the retrofit, as tenants are not having issues meeting their other regular payment obligations. And she has not raised her tenants’ rent despite the upgrades.

Recent research by economics consultancy firm Infometrics (commissioned by NZGBC) shows that homes built to NZGBC’s 6 Homestar standards can save more than $62,000 in electricity and mortgage interest over 30 years. The upfront average build cost is insignificant –0.5-1.5 per cent more standard homes.

Building to 6 Homestar standards creates warmer, drier, more comfortable and cost-efficient homes. But less than 10 per cent of new properties in Aotearoa achieve this standard.

There is a perception that building to Homestar (and other green building standards) is prohibitively expensive. But even if the upfront costs are higher, the benefits of building green can quickly outweigh the initial outlay.

Homestar ratings represent a home that performs well; and there is an increasing body of evidence showing it need not be expensive.

Matthew Cutler-Welsh, NZGBC residential business development manager, says people’s hesitancy around initial expenses are representative of a wider hesitancy to pay for good design.

But the true cost is actually minimal.

“[You will be paying between] $1,000-$2,000 for an energy model for a $1 million new home, which is massively impactful. It ensures the right materials and products are put in the right place to make sure the house works.”

There is more research to back up Cutler-Welsh’s contention that building to Homestar standards need not be expensive.

Engineering consultancy firm Aurecon (working with quantity surveyors Kwanto) found the cost of building to 6 Homestar varied from:

• no additional cost for a twobedroom terrace in Christchurch and Wellington, to

• 1.3 per cent extra for a four-bedroom stand-alone home in Christchurch.

NZGBC is leading the charge for better designed and built homes. It believes that the way people live, and what they expect from their homes, has evolved, but this is not reflected by the current Building Code.

Cutler-Welsh says there is a growing awareness that Building Code standards are no longer fit for purpose.

He says that people are increasingly concerned that buying houses off the plan – built to Building Code standards – leaves them vulnerable. He is aware of buyers having to spend an extra $20,000-$50,000 to ensure their homes are warm, dry and healthy.

While there have been some changes to the Building Code – raised insulation standards for example – this only meets minimum requirements internationally. And there is a particular issue with ventilation.

“[There are no] requirements for reliable ventilation; and the Building Code is completely silent on summer temperatures,” says Cutler-Welsh.

“So, there is nothing to protect homeowners and renters from summer heat and higher air-conditioning bills.”

In other countries, governments have strengthened their building standards. Scotland, which has a similar population to New Zealand, is aiming for a mandatory Passivhaus (passive house) building code by early 2028. The New Zealand government is not even contemplating that.

Premium Homes sales manager

Grant McSherry says the challenge is educating people that there are better options than building to the standard Building Code.

The Christchurch-based company builds to Health Based Building’s foreverbreathe specification, which is well above the Building Code.

He says many builders and architects focus 100 per cent on airtightness and claim their homes are green because they use less energy.

“To us that is the tip of the iceberg, and anybody could buy an existing

home and make that claim.”

Premium Homes use materials that are natural – low to no toxin – rather than synthetic; they do not wrap houses in plastic or install barriers for moisture. Rather, they use a wall system that relies on wool as the engine room to manage humidity.

This costs about 15 per cent more than a home erected to the Building Code standards, but the outlay can be regained in energy savings. The company is also finding the foreverbreathe-certified properties are increasing in value when sold.

“The houses might cost 15 per cent more to build, but in a recent sale, owners got 18 per cent more than they would have for a standard build. And that was in a hard, flat market.”

Toby Tilsley of Raglan-based Craft Homes has been building passive homes for the past 15 years, after getting tired of erecting “rubbish homes” to the Building Code standard.

“The Building Code has never really changed. Even though it is getting better slowly, it is still miles away from where it needs to be. The worst home can be legally built.”

Passive homes are the top tier of green New Zealand homes.

Because of the extra technology that goes into a passive home, a 200m2 home takes about 4,000 hours to build and costs about $6,500m2, compared to the average of $4,000m2

A passive home sits at about 20°C year-round and is mechanically ventilated, creating a healthier environment. Over an hour, a passive house might have 0.6 heat changes, whereas a standard home built to code can have seven to 11 heat changes.

“It is quite a significant difference. There is a lot less humidity and passive houses don’t need a lot of heating and cooling, keeping energy costs down. That is what people who approach us are mainly interested in.”

Tilsley says while the idea of building green appeals to most people, they forget about the cost. He feels this is a key reason why the Building Code hasn’t changed.

“Building companies will probably lobby against passive houses and the code changing too rapidly, because they believe it will drive up costs.”

But those living in homes built to healthy and green standards, can testify to how life-changing this can be. Thomas-Teague has seen this first hand.

“One of my tenants was frequently at the hospital emergency room with her child, who has asthma,” she says.

“They have not been back since the changes were made.”

To receive a Homestar rating, a house must meet additional performance and sustainability requirements above and beyond the New Zealand Building Code. Homestar provides a clear framework for better design and build for a more efficient home. It’s an independent rating tool for assessing the health, efficiency, and sustainability of homes across Aotearoa New Zealand. Homestar rates on a scale of 6 to 10 so that homeowners and professionals can better understand where their home or design fits and steps they can take to improve to a better, healthier standard. nzgbc.org.nz/introduction-to-homestar

Developed by NZGBC, HomeFit is an assessment and certification tool that homeowners can use to establish the warmth, dryness, safety and efficiency of their homes. The process begins with an online questionnaire that allows you to get an idea of how your home is performing. Once this is completed, you will be given suggestions on how to ensure your home is up to standard for HomeFit certification. An assessor can then be contacted through the website; they will come to the house and ensure it meets the criteria for HomeFit certification. HomeFitPLUS is a more stringent version of this: it requires homes to have more insulation (including wall insulation); more energy-efficient lights; energy-efficient heating; and energy efficient hot water. Having a HomeFitPLUS stamp for your home will differentiate it from the rest of the market when it comes to selling. homefit.org.nz

A passive home is a building designed to be exceptionally energyefficient and comfortable, requiring very little energy for heating and cooling. This is achieved through a combination of careful design, high-quality insulation, airtight construction, and sophisticated

www.eveprouse.co.nz

Alooming catastrophe may be hidden inside the walls of some of our newbuild homes. It’s a silent killer – moisture accumulation that cannot escape.

It comes from everyday activities such as cooking, showering, and even breathing: a family of four in one home can produce about 20 litres a day of moisture. In an airtight home without proper ventilation, this moisture can lead to condensation on walls, windows, and other surfaces.

This creates the perfect environment for mould and mildew. In large amounts, this can affect a home’s structure.

It is a problem that worsened as the building envelope was tightened to stop external water moisture from getting into houses after the scale of the leaky building crisis was revealed. That crisis is amongst the biggest human-made disasters in the country’s history, affecting about 174,000 homes.

It is still costing councils tens of millions of dollars. In the year to October 2024, Auckland Council alone had paid out $25 million in weathertightness-related claims.

The new disaster is a slow, rolling issue, similar to the leaky building crisis, Matthew Cutler-Welsh, New Zealand Green Building Council residential business development manager says.

New Zealand could be headed for another moisture-related building crisis, according to the New Zealand Green Building Council.

“It only becomes evident when moisture accumulates and mould starts to grow inside walls, but unless a wall is opened up, homeowners are unlikely to notice, until it becomes a really big problem. It’s a potential looming second round of leaky buildings, but this time from moisture accumulating from inside of homes, rather than from the outside.”

Blair Chappell from Williams Corporation explains that the risk is greatest when highly insulated, panelised envelopes are paired with inadequate ventilation strategies or when a home is undersized and over occupied and never ventilated by the occupants. He says that there needs to be a combination of measures used to prevent this.

“We use timber-framed construction with a drained and ventilated cavity,” he says.

“That assembly ‘breathes’ far more freely than poorly detailed SIP-panel builds, which don’t fully encapsulate the flow-on effects of a SIP panel (less breathability). Trapped vapour is much less prevalent in traditional timber construction.”

The problem has arisen from airtight homes being built after the New Zealand Building Code was tightened.

Clause E2 now requires roofs, wall claddings and openings to be built to prevent external moisture causing undue dampness or damage. However, this is a catch-22 situation.

“While we’ve stopped water getting into homes, we’ve prevented water moisture getting out,” says Cutler-Welsh.

Clause E3 of the code relating to internal moisture has not been updated to allow for moisture to easily get out, nor have ventilation requirements he says. The only real requirement is for waterproofing in the bathroom – making sure there are no liquid water leaks.

“There has been no action at all on ventilation requirements to help dry out houses. The more airtight the home, the more important ventilation becomes,” Cutler-Welsh says.

It is the one element of residential construction that has proven almost totally resistant to improvement.

“We may have made our homes more airtight, beefed up the insulation and installed much better windows, but the quality of air in these homes might be – if anything – getting worse.”

It has been a major problem overseas for some time. Recent reports and research have outlined “toxic home syndrome” as a condition affecting 15.3 million homes across the

UK, which has seen people’s health deteriorate as the result of poor quality air circulating inside their properties.

In New Zealand it is a growing industry concern, and it is the most obvious part of the Building Code that needs attention and urgent priority by the Ministry of Business, Innovation and Employment’s (MBIE), which administers the code, he says.

Writing in Newsroom earlier this year, Dr Griffin Cherrill, who has a PhD in Building Science from Victoria University, says the Building Code requirements for managing the indoor environment are relatively basic.

“Combined with this, we’re using an overly simplistic method to assess and minimise condensation and mould growth on internal surfaces. We need to find a better way to do this.”

Under the Building Code, the method used in clause E3 to assess moisture on the internal surfaces of timber-framed walls and roofs fails to adequately consider how thermal bridges influence surface temperature. This does not reliably eliminate the

‘It only becomes evident when moisture accumulates and mould starts to grow inside walls, but unless a wall is opened up, homeowners are unlikely to notice it until it becomes a really big problem’

MATTHEW CUTLER-WELSH

risk of condensation and mould, Cherrill stated.

Thermal bridges are created by building materials that bypass insulation – for example, a timber stud in a wall. Because timber is a less effective insulator, the more thermal bridges in a wall, the greater the influence on surface temperatures, and therefore, the risk of condensation and mould.

Cherrill says it makes more sense for the Building Code to use a wholebuilding simulation that calculates internal temperature and relative humidity, rather than focusing on individual components.

Whole-building simulations require detailed information about

a house to reliably calculate its internal climate. This includes the overall geometry of the building, the properties of materials that make up the construction, as well as good information about ventilation, heating and cooling systems, and how the house is used by the occupants.

He says adopting a whole-building approach to risk assessment could be used to demonstrate compliance not only with the Building Code’s internal moisture requirements but also with its energy-efficiency standard. It could also be used to assess and mitigate the risk of overheating, which is increasingly becoming an issue, especially in apartments.

Chappell says the industry’s challenge isn’t the Building Code itself. He says the industry needs to integrate ventilation, drainage, and occupant behaviour into one coherent system.