TSA TACTILE SENSATION ANALYZER

An instrument to objectively measure the overall haptic quality of nonwovens.

Officially unveiled

@ World of Wipes, Atlanta, USA www.emtec-electronic.de

An instrument to objectively measure the overall haptic quality of nonwovens.

Officially unveiled

@ World of Wipes, Atlanta, USA www.emtec-electronic.de

Objective measurement of:

•

softness

available in 2024

with new design and new features!

•

smoothness

•

flexibility + elasticity

•

recovery behaviour

New: thermal conductivity

+ + +

(warm vs. cold handshake)

high resoluted image friction

=

hand feel calculation is possible

Some features are associated with extra costs.

2023

13 18

Solution Center: Chase Machine & Engineering –Custom Converting Equipment

Showcasing solutions for success

A Fortunate Fiber

Executive Q&A with Ananas Anam

By Caryn Smith, Chief Content Officer & Publisher, IFJ

Show Preview: World of Wipes –Seizing Opportunities for Change

Slogan or Substance –Made in America

By Marie O’Mahony

Recycling Conundrum

By Adrian Wilson, International Correspondent, IFJ

Cellulose Fibers Fill the Cotton Gap

By Geoff Fisher, European Editor, IFJ

Technically Speaking

By Chris Plotz

Emerging Frontier

By Adrian Wilson, International Correspondent, IFJ

Recognition: Collaborating on a Career of a Lifetime

6

Viewpoint Recycling … It’s Complicated

By Caryn Smith, Chief Content Officer & Publisher, IFJ

Tech Spotlight

Swedish Textile Machinery Transforming Dyeing and Finishing at ITMA 2023

Tech Notes

New Technology Briefs

Tech Talk

Functional Advanced Textiles: Way Forward Dr. Seshadri Ramkumar, Ph.D., Texas Tech University

The Fiber Year

TFY 2023 – Three-Year Loss of 19 Million Tonnes of Fibers

By Andreas Engelhardt, President, The Fiber Year, GmbH

M&A Insights

The Transfer Portal

By Len LaPorta, Managing Director, Wiley Bros.-Aintree Capital, LLC

Movers & Shakers

Industry News and Notes

We are making the best synthetic textile facilities through the power of Korea in global competition

Applications

Multi Filament Line(PA, PET, PP, Bi-Component)

- High Speed Spinning(POY, FDY, SDY)

- Micro Fiber Spinning

- Bi-Component Conjugate Spinning

Staple Fiber Line

• Industrial Yarn

• Textile Yarn

• Sewing Yarn

• Carbon Fiber

• Lyocell

• Aramid Fiber

• Acrylic Fiber

• Spandex Yarn

Chief Content Officer & Publisher, INDA Media

csmith@inda.org +1 239.225.6137

Visiting Professor, RCA, London https://www.linkedin.com/in/ dr-marie-o-mahony-94776836/

Adrian Wilson International Correspondent, IFJ adawilson@gmail.com +44 7897.913134

Geoff Fisher European Editor, IFJ gfisher@textilemedia.com +44 1603.308158

Director of Technical & Business Development, MiniFIBERS, Inc. cplotz@minifibers.com +1 423.282.4242

Seshadri Ramkumar, Ph.D.

Nonwovens and Advanced Materials Laboratory, Texas Tech University s.ramkumar@ttu.edu

Andreas Engelhardt President

The Fiber Year GmbH engelhardt@thefiberyear.com +41 7145.00682

Len

Managing Director of Investment Banking Wiley Bros.-Aintree Capital llaporta@wileybros.com +1 615.782.4107

“Often when you think you’re at the end of something, you’re at the beginning of something else.”

R– Fred Rogers, Television Personality ecycling and sustainability is my thing. In my career, I have worked with industries that focus on the three Rs – Reduce, Reuse, Recycling, in that order. The goal for recycling-minded industry is always to reduce the “footprint” first, then reuse as much as possible, before recycling (and hoping that the object is responsibly handled in second- or third-life situations).

I have tried to live up to this standard to the best of my ability.

At home, the recycling struggle is real. It took me forever to train my family to separate plastic from soiled waste in our personal trash. I still have to sort it, and I do this even though I know my local waste facilities report being overwhelmed with recycled materials, which are likely not recycled.

A 2022 article in The Guardian shared that according to a Last Beach Cleanup and Beyond Plastics report, the recycling rate for post-consumer plastic was just 5% to 6% in 2021. The Department of Energy also released a research paper, which analyzed data from 2019, and came to the same conclusion, only 5% of plastics are being recycled. Researchers reported “that landfilled plastic waste in the United States has been on the rise for many reasons, including ‘low recycling rates, population growth, consumer preference for single-use plastics, and low disposal fees in certain parts of the country.’”

Around the world it is not much different, or it’s even worse. The U.S. used to sell and ship recycling waste to China, but that ended with China’s 2017 waste import ban. Their waste issue has soared.

I also donate to local charities that sell goods to fund their mission. But the facts on this are also staggering. A whopping 84 percent of our donated clothing ends up in landfills and incinerators, according to the U.S. Environmental Protection Agency.

We all know that if the clothing is synthetic, it is not biodegradable, and eventually will release micro-plastics into the environment.

Some charities that accept home goods have gotten extremely picky, rejecting any damaged goods. So, more and more items are heading directly to landfills. It is overwhelming, don’t you think?

Early in my career, a trip overseas to visit a friend living in a very small town outside of Amsterdam was eye opening. They shopped daily at the grocery for that day’s food. They washed their dirty dishes; but didn’t run water to rinse them, instead using one pan of water. Their showers had pull cords to only release water when it was needed. Furniture and décor were modest, and “vintage.” Vehicles were mostly fixer uppers; nothing like in America.

Maybe it wasn’t a typical town; but maybe they had it right.

I feel like I personally cannot change the way things are. Maybe this is how everyone feels, ineffective to help clean the earth of harmful debris. Maybe we are waiting for others to fix it, or when it is more economical to do so.

Yet, I can’t help but feel responsible for the world I am leaving for my children.

Recently, I attended INDEX 23. One presenter, Pontus Lindstedt from Molnlyke, a Swedish healthcare solutions provider, said something that struck home. He said, “Another way must be possible.” His company is working toward viable options to reduce medical waste.

Maybe more of us just need to adopt that mindset, and ask ourselves, “WHAT other way is possible?”

If you have thoughts on this, I would love to hear them. Email me at csmith@inda.org.

CORRESPONDENT, EUROPE Adrian Wilson

ADVERTISING | SALES

PUBLISHER Driven By Design LLC advertising@inda.media

+1 239.225.6137

BUYER’S GUIDE Joan Oakley

CHINA Zhang Xiaohua

EUROPE & INDIA Sabine Dussey

ITALY Ferruccio & Filippo Silvera UNITED STATES Frank Strazzulla

ADVERTISING COORDINATOR Vickie Smead vsmead@inda.org

+1 919 459 3700 x 3720

AUDIENCE | CIRCULATION

CIRCULATION

FILAMENT

Two members of the Textile Machinery Association of Sweden (TMAS) – are at the forefront of a brand-backed revolution in replacing water and energyintensive technologies for the dyeing and finishing processes that will take center stage at this year’s ITMA exhibition in Milan from June 8-14, 2023.

“There are currently an estimated 90,000 jet dyeing machines in operation worldwide and between 60-70% of them are outdated to a factor of two-to-three in terms of the savings in energy, water and dyes and finishes that can be made – even with the latest conventional systems,” says TMAS secretary general Therese Premler-Andersson. “That productivity gap is considerably higher when considering the latest highly digitized and precise non-contact spray systems for these processes that have been introduced to the market by TMAS companies Baldwin and imogo in the past few years.”

Baldwin’s TexCoat G4, a non-contact spray technology for textile finishing and remoistening engineered and manufactured in Sweden, not only reduces water, chemicals and energy consumption, but also provides the flexibility to adapt to a customer’s requirements in terms of single and doublesided finishing applications.

It is designed to allow a controlled and optimal coverage of the exact amount of finish chemistry for reaching specific characteristics of the fabric through a combination of precision valve technology coupled with optimized software algorithms

to ensure accurate and even finishing coverage with virtually no waste.

TexCoat G4 can reduce water consumption by as much as 50% compared to traditional padding application processes. In today’s world of volatile energy prices, imagine cutting gas and electricity costs by 35-50%. Productivity is also increased by 50% because of the lower wet pick up which allows for higher line speeds. Putting it simply, for replacing every 2-3 pads with a TexCoat G4 is equal to adding the productivity of an additional finishing line at a fraction of the cost, with no additional floor space and no added labor.

“Traditional textile finishing by padding is a wasteful, antiquated process,” says Rick Stanford, Baldwin’s VP of global business development. “High pick-ups drive high energy consumption and frequent bath changes generate a lot of avoidable chemical waste. Brands and mills are thankfully now starting to see environmental and economic benefits with the help of our non-contact precision spray systems. These systems increase product quality, improve mill profitability and deliver quantifiable sustainability benefits.”

Similar impressive savings can also now be made in textile dyeing with imogo’s Dye-Max spray dyeing technology.

It can slash the use of fresh water, wastewater, energy and chemicals by as much as 90% compared to conventional jet dyeing systems as a result of an extremely low liquor ratio of 0.6-0.8 liters per kilo of fabric. At the same time, considerably fewer auxiliary chemicals are required to start with.

The application unit of the Dye-Max consists of a closed chamber containing a series of high speed digitally controlled valves with precision nozzles for accurate and consistent coverage.

Fast changeovers with virtually no waste together with a high production speed enable a high productivity and unmatched production flexibility.

At ITMA 2023, the proven Mini-Max laboratory unit – used alongside Dye-Max installations for pre-determining application volumes and color matching for Right First Time dyeing – will demonstrate the principles of imogo’s technology.

The huge potential of Dye-Max has been quickly recognized by brands seeking solutions to their sustainability targets and an industrial-scale installation is currently being commissioned. Further details will be announced prior to ITMA 2023.

www.tmas.se

For details on how to submit your company’s technology for consideration as a “Technology Spotlight” in IFJ, contact Ken Norberg at ken@ifj.com or +1 202.682.2022.

Kelheim Fibres has teamed up with Italian seamless knitting machine builder Santoni on the manufacture of energy-efficient and zero waste production menstrual underwear.

Under the terms of the project, the specialty viscose fiber manufacturer and Santoni Spa have jointly developed an innovative and sustainable menstrual underwear garment based on advanced machine technology and high-quality performance viscose fibers. The product consists of a soft outer layer and an inlay made from special wood-based fibers from Kelheim. The result is a sustainable and high-performance product that combines comfort and functionality.

The soft outer layer is produced either on the Santoni SM8-TOP2V circular knitting machine or on the SM4-TL2 machine. One of the major advantages of these circular knitting machines is that they significantly reduce the amount of cutting waste or even allow production with zero-waste.

The Santoni XT-Machine, originally developed for the footwear market, is used for the functional inlay of the period panty. The unique XTMachine allows for different layers to be produced with different yarns and knitting structures. This enables all three functions of the inlay – the absorption and distribu tion layer ADL, the absorbent core, and the back layer – to be knitted in a single tube. This reduces production time and costs and enables zero-waste production.

In the inlay, wood based Kelheim specialty fibers such as trilobal Galaxy or the hollow Bramante fiber replace synthetic materials. www.kelheim-fibres.com

British textile testing solutions provider James Heal has developed a solution to improve sustainability of water repellency testing in textiles. The company developed TruRain, the next generation Bundesmann tester with a water recirculation unit. Compared to the traditional options on the market, this new system uses 99% less water during testing based on a weekly program of conducting 150 tests, reducing consumption from 2,100 liters to just 23 liters for the week.

In addition, TruRain makes significant energy cost savings per workday, leading to 83% total cost reduction. Productivity is also increased through greater ease of use than traditional Bundesmann tests and can be run continuously for a week without the need to change the water. An innovative automated shower guard that protects the operator from getting wet during testing is an improvement welcomed by lab technicians using the instrument. www.jamesheal.com

Fong’s Europe has constantly evolved its dyeing systems based on the Airflow principle for achieving excellent dye penetration and uniformity while minimizing color differences between different areas of a fabric.

At ITMA 2023 in Milan, the company will introduce its latest THEN Synergy Airflow and THEN Airjetwin machines which exploit the principle to provide high-quality, efficient and eco-friendly dyeing processes for a variety of fabrics.

The THEN Airflow dyeing machines have several innovative features, including several parallel functions for reducing process time. The VPR system shortens the rinsing time and water usage and the well-proven robust and homogeneous spraying device in the nozzle ensures a uniform dyeing in the shortest process time. The very short liquor ratio also reduces the use of salt and chemicals.

THEN Airflow systems also have a unique dyeing process control system that allows for precise control over dyeing parameters such as temperature, pressure, and chemical dosing, ensuring consistent and high-quality results. www.fongs.eu

The Textile Machinery Association of Sweden (TMAS) will focus on automation at ITMA 2023 in Milan in June. “Technologies such as artificial intelligence (AI), machine learning and automation are becoming increasingly important in the textile industry and Swedish companies will showcase new machines and software that can help streamline production and improve efficiency,” says TMAS secretary general Therese Premler-Andersson.

Among exhibitors are ACG Kinna and its refined robotic pillow filling system, which drew considerable crowds back in 2019. The system has been further developed to include new features such as QR codes with production details. Eton Systems which specialize is

automated handling and thereby minimizing waste by efficient transportation within production will launch its new software platform, ETONingenious™ which is a real-time system used to manage, control and follow up on production in the Eton system. ETONingenious™ continuously gathers, processes and presents powerful, value-adding product information to operators, supervisors, quality control personnel and management. www.tmas.se

An extensive range of technologies and services related to textiles from the UK will be on display at ITMA 2023 Milan, with over 30 members of the British Textile Machinery Association (BTMA) in attendance. “Sustainability, circularity and Industry 4.0 have been the primary themes coming from the market for some time now and our members have responded with innovations spanning the entire supply chain – from fibers to finishing – and with a specific emphasis in many cases on improved software and digitized control solutions,” said BTMA Jason Kent.

Fibre Extrusion Technology (FET), which recently opened the new Fibre Development Centre will showcase its ability to accelerate new fiber trials and product R&D.

Tatham, known for its established machinery for the processing of natural staple fibers – and most notably, its technologies for the decortication, fiber opening and fabric forming of hemp, will showcase its ability to help companies that are entering the field of natural fibers, such as hemp production.

Optima 3D will show its further development of 3D weaving machines, and digital control systems.

FedEx has selected First Line Technology (FLT) of Virginia as one of its Top 100 Small Business entries in the Small Business Grant Competition. FLT was selected for its development of Synthetic Opioid Safety (SOS) kit, which consists of Dahlgren decon formulation and FiberTect decontamination nonwoven wipe. First Line Technology designs and manufactures disaster preparedness and emergency response equipment taking ideas from the lab to lifesaving products. www.firstlinetech.com

Cygnet Texkimp will showcase its extensive portfolio for handling fibers like carbon and glass.

Roaches International, which supplies a range of autoclave and thermosetting technologies, will showcase its well-known textile performance testing instruments, and its innovative machines that can be integrated with existing manufacturing plants.

Alchemie Technology will display its Endeavour, waterless, low energy dyeing and Novara, low energy textile finishing technologies, that seek to disrupt manufacturing processes that are responsible for over 3% of global CO2 emissions and 20% of global water pollution. “Our solutions both dramatically reduce the environmental impact and the cost of dyeing and finishing, which has proven to be a compelling combination,” said Alchemie founder and CEO Dr. Alan Hudd. www.btma.org.uk

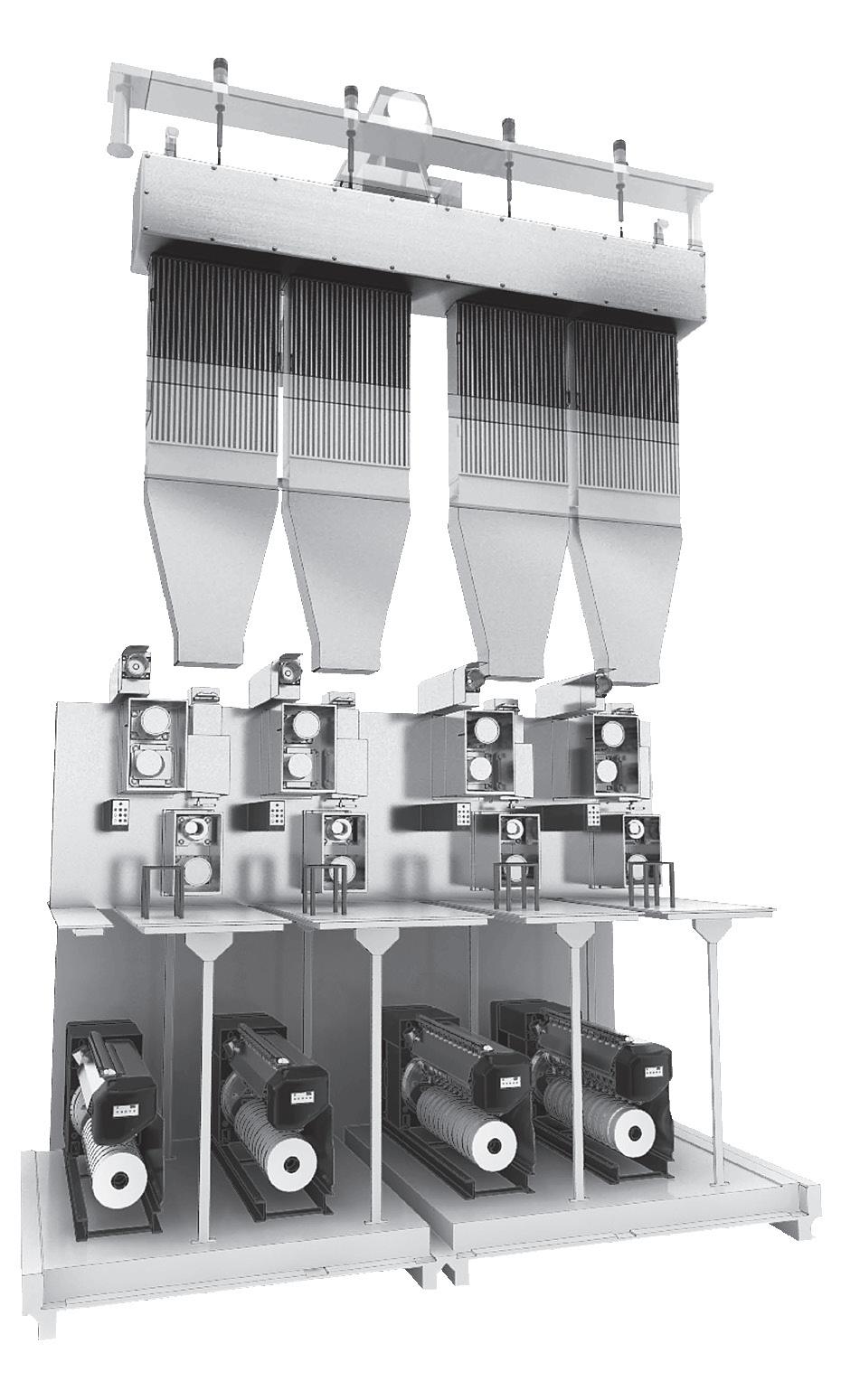

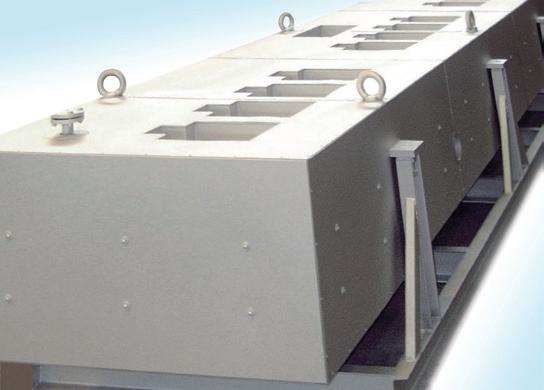

or over 68 years Chase Machine and Engineering has been designing and building a variety of standard and custom converting machinery for WovenNonwoven fabrics, Films and Foils. From integrating independent modules to supplying Full-Scale Production Lines, we offer a comprehensive range of machinery that play an essential role in the success of wellknown brands and products worldwide.

As one of the premier design and manufacturing companies for custom web handling machinery, Chase serves a wide range of customers in the Textile, Medical, Nonwoven, Converting, Geotextile, Extrusion, Filtration, and Packaging Industries. We partner with leading manufacturers to produce application-specific equipment ranging from Festooners, Accumulators, Inspection Machines, Unwinds/Rewinds and Traverse Winders, to Ultrasonic Slitters, Laminators, and CutTo-Length Machines.

Chase specializes in the integration of technologies such as Ultrasonics, Impulse Welding, RF Welding, Band Sealing, Hot Air Welding, Glue Dispensing, Hot Knives and Conventional Blade Slitters as well as Vision and Marking Systems.

Chase is a vertically integrated company, utilizing State-Of-The-Art 3D Solid Modeling Software for our machine designs. Within our 28,000 sq. foot facility, located in West Warwick RI, we program our PLC’s and HMI’s, build our Electrical Control Panels and Machine, Weld/Fabricate, Paint and Assembly our Equipment while maintaining tight control of quality and delivery.

We place a high priority on customer and product confidentiality, and constant-

ly seek to improve our quality and process controls as we help our customers improve their products and processes. Working together with our customers, Chase will deliver equipment that is Newer, Faster, more Efficient, and more Reliable for a timely return on your investment.

For those interested in product development, the Chase Materials Application Lab exists to help your team take their ideas to the next level. Whether creating new products or improving existing ones, Chase can determine the optimum method for manufacturing.

Lab capabilities include web handling systems with ultrasonic technology for laminating, embossing, welding, slitting as well as impulse welding machines.

When you think of a pineapple, what comes to mind is hospitality, luxury, status, and good fortune. Sustainable plant-based textiles do not readily come to mind, but that is exactly what Ananas Anam, the makers of Piñatex®, want you to consider. In fact, the luxury plantbased nonwoven materials developed by company founder Dr. Carmen Hijosa utilizing pineapple bio-waste brings all that the fruit represents into any end use application, and more. The material provides an array of benefits to product developers, offering a unique commercially produced textile that has positive social and economic impacts, while also maintaining a low environmental footprint throughout its life cycle.

The company has achieved B-Corporation certification since 2020, which means they maintain high standards of verified performance, accountability, and transparency on factors from employee benefits and charitable giving to supply chain practices and input materials.

The story of Ananas Anam began while Dr. Hijosa, a leathergoods expert, was consulting on the Philippines leather export industry in the 1990’s. Disturbed by the environmental impact of mass leather production and chemical tanning, she realized this should not continue but knew that PVC alternatives were not the solution. She was driven to research a sustainable alternative.

Inspired by the abundance of natural resources, including the use of plant fibers in traditional weaving such as the delicate Barong Tagalog garments, she sought out to create Piñatex®, and now, utilizing the same raw material, pineapple leaf fiber,

the company has expanded into offering a second product, Piñayarn.

Piñatex ® is used across fashion, accessories, upholstery and automotive industries, and has been used by over 1000 brands worldwide including Hugo Boss, H&M and the Hilton Hotel Bankside. With the new product complimentary to Piñatex, Piñayarn can help create a wider positive impact, serving more industries for new and different products.

Here is the inspiring story told by company executives Josep Taylor, Managing Director of Fibre Processing Plant and Melissa Braithwaite, Piñayarn Product Development Manager.

International Fiber Journal: Tell us about Ananas Anam founder Dr. Carmen Hijosa and her work.

Josep Taylor: As as expert in the leather business, Carmen was consulting for the World Bank. She visited the Philippines and was distressed by the conditions she witnessed. She started visioning a more sustainable way of production, for both the people and the planet. There is not much change you can make with real leather; so, she began researching natural fibers in the Philippines on creating a sustainable replacement.

As a result of her extensive research Hijosa began development of Piñatex® in 2011, filing a patent for the process of transforming fiber into an alternative leather and other textiles.

Melissa Braithwaite: Piñatex® officially launched in 2014 and was first commercialized in 2016. Dr. Carmen saw the opportunity to utilize pineapple harvest

IN THIS ISSUE: JOSEP TAYLOR

Managing Director of Fibre Processing Plant

Piñayarn Product Development Manager

waste – instead of them being burned, which speeds up the preparations to plant again for the next pineapple fruit harvest. Utilizing this waste also provides an opportunity for a second stream of income for communities of farmers. Pineapple fibers had traditionally been used for textiles generations prior for hundreds of years, mainly in raw form. With the Philippines as a global pineapple producer, Dr. Carmen concentrated on the knowledge of the people to help develop these plant-based textile solutions.

IFJ: Share about the company’s facilities.

Taylor: The corporate headquarters is in the UK. Our primary production facility was established in the Philippines to be near the pineapple plantations. Mid-2021, we began development of the factory in Spain as a growth strategy. We are positioned to serve our customers and nearby our suppliers. Plant production began in July 2022.

We have since divided the company into different production units. For instance, in the Philippines they work on developing the nonwoven. In Spain, we prepare the fiber to get carded and to become the newest product line, Piñayarn.

IFJ: How do you work with the farmers on the fiber extraction?

Braithwaite: First, let’s look at the lifecycle of the pineapple. It’s important to know that we partner with farming cooperatives, where their first business priority is the fruit harvest. So, we are never competitive with fruit production. We collaborate with chosen farming cooperatives to extract the fiber from the leaf waste after fruit harvest.

Quite often, the pineapple leaves get burnt to remove field waste and prepare for a second fruit harvest. Utilizing the field waste helps to reduce CO2 emissions. We work with them to extract fiber, using a decorticating machine as part of their farming practices. After extraction, the fibers get washed in water and then are dried naturally in the sun. At this

point, Ananas Anam buys the fibers. The fibers get sent to our facilities in the Philippines or Spain to be mechanically processed to textile grade standard, before being processed into either Piñatex® or Piñayarn.

We work with the farming cooperatives through the whole process for social and quality reasons. We help them with their training, and sometimes provide the machinery. We ensure that the work sites are safe, and that they know all the correct ways in which to extract fibers.

While the process is labor intensive, we’ve already had quite a lot of progress in automating our farming machinery. For us, the most beneficial positive impact we make is to provide an abundance of jobs in these rural communities.

It is important to note that in every step in our process, we utilize waste. For example, any waste from the extraction process is then repurposed as bio content for soil nutrition. It is beneficial for the plants to get the positive nutrients back into the soil, so it’s a closed loop system.

Taylor: We partner with several farming co-operatives and farms and provide over 550 jobs. The company is growing, and our sources are growing, including farmers now in Bangladesh and Africa. It is most important to our company to have a positive social impact. The entire family – except children – can work on fiber extraction which is beneficial for their livelihood. Conditions of the workers is our priority, so we conduct audits to check compliance with the agreed upon rules.

IFJ: Tell us about your purification process?

Taylor: Once we have fibers, we treat the fluff-like pineapple leaf fiber (PALF) with natural enzymes to remove any impurities. We don’t use any chemicals or bleach, so this sets us apart from others who do. I would say that to my knowledge we are the only ones that are doing this enzymatic process. Then, we cut them to the length dependent on the end use.

For the drying process, while we have industrial dryers in Spain, in the Philippines we are lucky to have the sunlight or drying ovens. We rely on natural sunlight in our facilities which is more sustainable in terms of energy. With sunlight it might take longer, but we’re not using any resources except the sun and the air.

IFJ: How much do you produce and how many brands are using the fiber?

Taylor: We are producing, last year, about 260 tonnes.

We have clients in over 90 countries and many brands we work with, whom we co-brand with marketing. For instance, most notably Nike® launched the Happy Pineapple shoe brand. Hugo Boss,

H&M and the Hilton Hotel Bankside are some other large brand partners. Also, it’s a plus especially for smaller brands to distinguish themselves, and associate with the name of Piñatex®, because it provides the certainty that we are vegan, chemical free, we are traceable, and totally sustainable.

IFJ: What are GOTS certified pigments that you utilize?

Braithwaite: That means we use water and energy-efficient pigments and have achieved Zero Discharge of Hazardous Chemicals (ZDHC) compliance. To make the Original, Pluma and Mineral collections, the Piñafelt is colored using GOTS certified pigments. Then a resin top coating is applied to give additional strength, durability and water resistance. A foil is heat pressed on to create the Metallic collection and a high solid PU transfer coating is used to create Piñatex® Performance and Light.

IFJ: What are Ananas Anam collections?

Taylor: Piñatex ® has five collections. Original, Mineral, Metallic and Performance all have a non-woven felt backing, but slightly differ with the top coating and finished look. Piñatex® Light has a knitted backing and is the thinnest collection to date. End use and applications include footwear, accessories, apparel and interiors.

IFJ: What is the Piñayarn and how did it come about?

Braithwaite: Piñayarn came about in 2020 when the company won a grant from the UK government through UKFT to produce sustainable PPE alternative (facemasks) made from the same pineapple leaf fibers as Piñatex®.

To create these facemasks, we had to create yarn to an industrial standard and therefore we needed to create a new supply chain for the company, and on-board suppliers and producers for this yarn and facemasks.

There had been some questions on how Piñatex® can be used in a wider variety of products to offer more flexibility and lighter weight. So, essentially Piñayarn grew to be the second product offering to compliment Piñatex® and to supply our customers with the potential of creating more products using this yarn that Piñatex® wouldn't have been able to supply at that time.

It’s also an alternative to the yarns that are already on the market for a higher environmental impact. The same clients that use that use Piñatex® are interested and use Piñayarn.

IFJ: How do you help companies with their sustainability stories?

Taylor: We have a great opportunity to help grow a sustainable mindset. Many companies are not going to change overnight, but there is lots of interest to have lower-impact materials. It takes time.

Our business model helps to unlock the potential of natural fibers and bring socio-economic stability to rural areas of the Philippines and Bangladesh. We are always looking for brand partners and companies to align with our vision both socially and ecologically.

Braithwaite: We make it quite easy for brands because they all have various ways of how they view sustainability, and how they want to market their products. We have a full Life Cycle Analysis for both of our products – Piñatex® and Piñayarn. Our LCA measures the full impact of the product, from the carbon footprint, water usage, to toxicity, and transport emissions. We work closely with our customers sharing data on our products to help them calculate the impact of their end products.

IFJ: How do you view the sustainability adoption rate of the industry?

Taylor: It is pure economics. It is a change of model. It takes time. Everybody is aware the world needs to change. A company like ours, we see the future. We only have one planet, and we must take care of it. Corporations understand that they must change, but they still have the economic part to factor in. It is the future.

The consumer is the one who chooses which way to go, this is the reality. The consumer still does not know all information that we know in this industry. Carmen says, we must teach school children the importance of sustainability and to respect the planet, as well as to be more conscious on new ways of producing things.

Braithwaite: On product development, it is easiest sometimes to work with small brands and companies because they can react to change much quicker and easier. I also think adopters of nonwoven and plant-based non-woven materials need to appreciate the excellent qualities Piñatex® offers, and not compare it to leather. These materials are not going to react the same as protein-based leather goods.

I agree, education is key. Also what is essential, is the need for the textile industry to be more closed loop from the start. We know that microfibers and waste streams are a huge problem for any sort of textiles. Fully closed loop systems would help, as well as the ability to compost materials –that’s the future of sustainable fabrics.

IFJ: What are the plans for the company?

Taylor: Our edge is that we can trace producers and partners in our supply chain, this is so important. Others don’t have this kind of engagement with the landowners or fiber producers.

This is a business. We want to show our customers that when they choose us as a supplier, this is a good business decision.

Braithwaite: We listen to the customers and what they need. We ultimately make raw materials for our customers to make their products. But, along the way, if we can somehow make a sustainable difference for our customers by using our material, that’s our future.

Piñatex® is used across fashion, accessories, upholstery and automotive industries, and has been used by over 1000 brands worldwide including Hugo Boss, H&M and the Hilton Hotel Bankside. Ananas Anam fiber processing plant in Canet de Mar, Spain. Ananas Anam q PALF pineapple leaf fiber. Ananas Anam

Innovation across industry niches often overlaps in methodology, technology and manufacturing. The best and brightest of the wipes niche are invited to join at the World of Wipes® International Conference, known as WOW, in Atlanta from July 17-20, 2023. When looking for sustainability solutions for filtration and textiles, there is much to learn from producers of wipes, still in high consumer demand and still in the hotseat of sustainability. The event presented by INDA, Association of the Nonwoven Fabrics Industry, spotlights current insights and future trends driving this surging $11 billion industry forward. The event attracts more than 400 professionals and a host of tabletop exhibiting companies.

“I’m very excited to see the program evolve to meet the changing dynamics of the industry,” says WOW Committee Chair Jonathan M. Layer, Director of Commercial Business Development and Marketing, Fibertex Nonwovens. “I’m especially confident that adding new sessions, such as the CEO Panel and Energy Inputs, will provide unique added value and perspective to the event. The committee focused on ensuring that we’re putting forth the best content addressing the most critical topics in the industry.”

This year, WOW introduces new elements for attendees, including pre-conference webinars. The pre-show webinars are a new place to connect, converse and to gain content. Details on the offerings can be found at www.worldofwipes.org/ preconference-webinars.html.

Among the regular networking opportunities, another new aspect are the WOW LIGHTNING TALKS – “supersized elevator speeches” from industry suppliers. This is a limited-space, firstcome opportunity for tabletop exhibitors to present their latest innovations just

ahead of the networking reception to get attendees excited about their innovations.

WOW’s featured WIPES ACADEMY provides an educational deep dive into operational excellence, presented by Instructor Heidi Beatty, CEO, and Paul Davies, Ph.D., Senior Consultant, Crown Abbey, LLC. It is directed at raw material and packaging suppliers, brand and private label wipe converters, retail buyers, research and development professionals, marketing and product managers, and rising entrepreneurs.

Each year, WOW shines a light on excellence in innovation. The World of Wipes Innovation Award® recognizes companies from within the value chain that utilize nonwoven fabric/ technology in a way that expands the usage of nonwovens, in categories such as raw materials, roll goods, converting, packaging, active ingredients, binders, additives and end-use products.

Gaining market intelligence is a priority to WOW attendees. Over 30 speakers

are expected to share their expertise and insight over the two and a half days of the main event. Attendees are encouraged to lean in and learn from their peers who are moving the needle towards a sustainable future and supporting cross-industry collaboration.

The new CEO Panel promises a look at priorities and predictions, moderated by Chris Astley, Consultant. Inflation, supply chain and capacity/demand balance remain top concerns for wipe producers in 2023. Discussion topics will touch on inflationary impacts across an organization, surging wages, re-shoring, as well as domestic and international drivers to supply/demand balance. The panelists are Steve Gallo, CEO, Diamond Wipes; Markus Müller, Sales Director, Reifenhäuser Reicofil GmbH & Co. KG; R.J. Rudolph, Group Director – CMS-RT, Rockline Industries; Jodi Russell, Vice President R&D, Cleaning Innovation, Packaging & Sustainability, The Clorox Company; and, Robert Weilminster, EVP & General Manager, U.S. & Canada –Health, Hygiene, and Specialties Division, Berry Global.

There are pressing issues that the wipes industry must address in coming

years to remain strong. “We as machine supplier must find solutions to deal with supply chain issues, high energy costs, inflation and the general political situation especially in Europe,” notes panel participant Markus Müller. “The industry must deal with the general ‘plastic shaming,’ i.e., sustainability requirements, such as how to produce wipes energy and resource-efficient, as well as how to avoid ‘green-washing’ in this context.” The hope is that attendees will hear about challenges in this industry and understand possible solutions.

“I want attendees get a better understanding of the evolving landscape of the entire wipes sector post-pandemic,” Jodi Russell comments. “What has changed? What has stayed the same?”

Russell believes the industry must address technology and business issues. On technology she cites: “Asset utilization –how does the industry cope with unpredictable demand cycles?; Transitioning from plastic to non-plastic materials in a cost-effective manner without compromising on attributes consumer expects; and, AI – how will it integrate and be adopted into the nonwovens industry?”

On business, issues include to: “Reverse trend on commoditization across all wipes categories – what type of messaging can the trade create to upgrade the perception of wipes products as a premium experience?; and, to gain a better understanding of changing regulatory landscape and its impact on various vectors, specifically the tightening legislative/regulatory landscape around plastic waste,” she says.

A series of power-sessions weave together one urgent industry issue – “Plastic Policy: Closing the ‘Intentional’ Gap.” Moderated by Olivia Reiber, Key Accounts Manager, Wipes & Specialties, Berry Global, she leads the analytical presentations from Matt Seaholm, CEO, Plastics Industry Association, Murat Dogru, General Manager, EDANA, as well as a representative from Kimberly-Clark Corporation.

“The Nonwoven Wipes Supply Chain Response to ‘Plastics Free’” with presenter Phil Mango, President, Philip Mango Consulting, considers the European Union’s Single Use Plastics Directive and

its explicit inclusion of disposable wipes in 2019, which calls for an accelerated response from the industry. Much of the response has been product related, but he suggests that the better answer is a broader, total supply chain response from raw material providers, production equipment suppliers, nonwoven producers and wipes converters who all play important roles.

Rounding out the day’s discussion are three discussions on sustainability manufacturing practices, reducing CO2 footprint while targeting CO2 neutrality by 2035 and utilizing technologies for sustainable products.

WOW’s second full day presents consumer-centric sessions: “Give the People What They Want! A Road Trip Through the Consumer Mindset on Plastics, Packaging, Recycling, and What They Expect from the Brands They Buy From” with Suzanne Shelton, President & CEO, Shelton Group; “Closeness to the Consumer – Goodwipes to Uranus: To Boldly Go Where No Toilet Paper Company Has Gone Before” presented by Sam Nebel, Co-Founder, Goodwipes; “A Holistic Approach Towards Wet Wipes

Preservation,” with Paul Salama, Ph.D., CTO & Head of Innovation, Sharon Laboratories; and “Transparency in the Supply Chain,” with moderator Jonathan Layer, Director of Commercial Business Development and Marketing, Fibertex Nonwovens.

The final half-day on day three explores the flushability factor, a topic INDA is tackling head on. Five industry experts will present aspects of the issue from fiber innovation, legislative issues, and standards development.

“It’s my hope that the attendees will walk away with a clearer picture of the industry dynamics in a way that allows them to make informed decisions to guide their businesses,” says Layer. “I also want to encourage innovation in the way we operate – not only in product development but also in supply chain, strategy, and operational sustainability. WOW is the must-attend event of the industry and this year’s program will set the bar in enabling success for each attendee or exhibitor.”

www.worldofwipes.org

Gaining market intelligence is a priority to WOW attendees. Over 30 speakers are expected to share their expertise and insight over the two and a half days of the main event.

By Marie O’Mahony

By Marie O’Mahony

Politicians like nothing better than a catchy slogan: “Made in America” and “Buy American” certainly fit those criteria, but are these phrases beguilingly simple? The origins can be traced back to the Buy American Act of 1933, when legislation required the federal government to purchase American-made iron, steel and manufactured goods where possible. Under the guidance provided, a product could be described as made in America if it met the requisite minimum 50% of its materials or constituent parts having originated in the United States. More recently, one of the very few things that the Trump and Biden administrations have agreed on is the desirability to move manufacturing back, near-shoring or re-shoring, in addition to encouraging American consumers to purchase American-made products more consciously.

While the U.S. textile industry is in favor of these policies, the counter and temperance arguments ought not be ignored. “Buy American policies actually cost jobs” is an argument made by Adam Posen, President of the Peterson Institute for International Economics (PIIE), writing in the Spring 2023 issue of Foreign Policy magazine. The National Council of Textile Organisations (NCTO) meanwhile point to a U.S. textile industry supply chain that employed 538,067 workers in 2022, as well as government estimates that each textile manufacturing job itself supports three further jobs.

The purpose of this article is not to express an opinion on the U.S. policy, but instead to look at some of the proposals emerging from the debate that have the potential to make the textile industry stronger, while generating positive societal impacts that stretch beyond U.S. borders.

The U.S. is the third largest exporter of textile-related products in the world with textile and apparel shipments worth $65.8 billion in 2022 according to the National Council of Textile Organizations (NCTO). An impressive figure but might it be higher?

In Posen’s claim that “Buy American policies actually cost jobs,” he points to “rules of origin” as increasing product costs thereby making U.S. business less competitive on the international marketplace. Under the North American Free Trade Agreement (NAFTA), the “yarn-forward” agreement demanded that the majority of textiles and apparel from the yarn stage forward had to be made within the region in order to qualify for duty-free status.

There were some exceptions, which the United States-Mexico-Canada Agreement (USMCA) looks to close through the introduction of “chapter rules,” thereby extending the application of rules to sewing threads, narrow elastic bands, pocketing, and coated fabric.

Bill Jackson, interviewed last year in his position as Assistant U.S. Trade Representative for Textiles, described the measures as having “strengthened the regional supply chain for textiles and provide new market opportunities for the U.S. textile and apparel sector.” Jackson pointed to the Dominican Republic Central America FTA (CAFTA-DR) trade agreement that under the yarn-forward rules gives apparel made in Central America duty-free access to the U.S. market, providing what he believed to be a “foundation upon which the industry can grow, while at the same time supporting jobs in the U.S. industry, which supplies much of the fibers, yarn and fabric used in apparel production in CAFTA-DR countries.” The U.S. government has been encouraging new investment with CAFTA-DR partners to strengthen the regional supply chain.

Reflecting industry views, Steve Schiffman, president of the Advanced Textiles Association (ATA) comments: “The stance of [United States Industrial and Narrow Fabrics Institute] USINFI is that it needs to continue to be Yarn Forward, and the rules of origin should not be weakened to offer other countries the chance at an

end run around the current requirements. USINFI opposes any attempt to weaken the Yarn Forward rule of origin under the CAFTA-DR or any free trade agreement.”

Trade lawyer Lori Wallach, directs the Rethink Trade program at the American Economic Liberties Project, and cautions that “this [Biden] administration has articulated goals like creating good jobs for workers with and without college degrees and strengthening economic resilience, and our trade policy and deals must deliver not damage that.”

One of President Biden’s first actions when he was appointed to office in 2021 was the signing of two Executive Orders aimed at reducing vulnerabilities in the supply chain. One outcome was the National Strategy for a Resilient Public Health Supply Chain (2021), a roadmap for building and sustaining resilient supply chains for PPE and other essential medical products. The risk of obsolescence makes it too

risky for the government to store a high level of inventory in the Strategic National Stockpile (SNS). “I think the roadmap for building and sustaining resilient supply chains for PPE and other essential medical products is a good start and we’ll have to see how it plays out in the future,” believes Steve Schiffman. “USINFI supports legislation such as the [Homeland Procurement Reform] HOPR act which includes medical PPE, uniforms, etc. This is to help government contracts go to small businesses. This is an example of legislation that is part of the building blocks to help strengthen the supply chain.”

The demand for PPE is not consistent and this has already impacted U.S. mask producers with the American Mask Association estimating by September 2021 that as many as ten out of twenty-nine domestic manufacturers had ceased production, with some being forced to file for bankruptcy. There is the potential to put safeguards in place particularly for smaller producers. One possibility would be reservation contracts, whereby the government could exercise an option with suppliers for increased production should the need arise.

“Detailed research has repeatedly shown that policies aimed at maximizing domestic manufacturing employment rather than the development and adoption of new technologies are not only doomed to fail but crowd out the very industrial and trade policies that contribute the most to innovation, national security, and decarbonization,” warns Posen. He argues for the prioritization of technology adoption over technology production. This is an important differentiation, with so much focus on the protection of intellectual property (IP) the risk is of technology obsolescence before an innovation has been properly taken up. The outcome is to starve the next level of innovation that is served by the iterative process of lessons learned and improvements needed that can only be properly seen when a technology is used at scale.

The move to a more digitally connected manufacturing environment, such as

In Posen’s claim that “Buy American policies actually cost jobs,” he points to “rules of origin” as increasing product costs thereby making U.S. business less competitive on the international marketplace.The Advanced Functional Fabrics of America (AFFOA) is spearheading the push for advanced and smart manufacturing as essential to the timely commercialisation of innovation in textiles and apparel, particularly smart textiles and wearables.

Marie O’Mahony

industry were lost in the period between 1979-2019 as the industry looked overseas for low-cost manufacturing.

The United States Fashion Industry Association undertakes an annual USFIA Benchmarking Study, with most recent being for 2022. It points to respondents concerns about attracting and retaining employees, moving the issue from one of medium ranking to one of the top five business challenges they face. Companies have indicated an average of six different positions they are looking to hire: supply chain specialists; sourcing specialists; environmental sustainability-related specialists; market analysts; and, trade and custom compliance specialists.

Industry 4.0, further exacerbates this negative impact. Technology adoption provides the opportunity for a more highly skilled and engaged textile workforce, essential for good employee retention. However, education and training is not the only issue, as experience in Europe shows. Germany has an abundance of training centers from the Textilakademie NRW to the Texoversum at Reutlingen University, yet in 2021 there were 63,000 apprenticeship and training positions that remained unfilled. The pandemic would partly account for this, however one third of these remained unfilled at the end of 2022 in the region of Saxony and Thuringia alone, according to Dr. Uwe Mazura, Director General, Confederation of the German Textile and Fashion Industry. Demographic changes are one reason, according to Dr. Mazura, with more people retiring from the industry than there are young people entering.

While Germany is looking at ways to attract and retain a young workforce, the UK launched a campaign in Spring 2023 to entice recent retirees back to the workforce. An estimated 630,000 people retired in UK between 2019 and 2022 and the British government wants them back at work. In the U.A. Jerome Powell, the Fed Chairman, bemoans 3.5 million

people absent from the workplace since the pandemic, with many over 50 years old and, like the UK, often newly retired. In the UK, around 42% of the workforce is aged over 50 with the figure set to rise to 47% by 2030 – the figure in U.S. is thought to be one third of that.

To attract recent retirees, “work will need to offer different incentives – flexibility, purpose and community, for example,” according to Aviva Wittenberg-Cox writing in Forbes magazine earlier this year, pointing to an additional expectation that an employer should offer “a conscious rejection of ageist systems and policies, the continued investment and development of careers for people 50+.”

In 2022, most of the apparel sold in America was manufactured in other countries, with the Sourcing Journal putting the figure as high as 97%. The U.S. Bureau of Statistics estimates that 81% of jobs in the

In contrast, the report also found no sign that fashion companies planned to near or re-shore manufacturing, with positions in sewing machine operators and general management their least likely positions to increase. Asia remains the strongest supply source for U.S. fashion, with over 37.5% planning to source for a greater number of suppliers and countries over the next two years. CAFTA-DR is growing in importance for the apparel industry with 60% of respondents planning to increase their sourcing from the region as part of a sourcing diversification strategy.

“Made in America” and “Buy American” are prompts for deeper questioning around benefits and impacts, from economic to social and environmental.

Dr. Marie O’Mahony is an industry consultant, author and academic. She the author of several books on advanced and smart textiles published by Thames and Hudson.

Switzerland ranked top in the list of the world’s most innovative countries for the 12th year running in 2022, keeping the USA in second place, according to Vancouver, British Columbia-based media company Visual Capitalist, using data from the United Nations’ WIPO Global Innovation Index.

This ranking may come as a surprise to many since globally, four of the five biggest R&D spending companies – Amazon, Alphabet, Microsoft and Apple – are all in the USA.

Switzerland’s intellectual property rules, however, are considered worldclass and they are complemented by strong collaboration between universities and industry. In addition, the country attracts top talent thanks to its high quality of living.

Innovation was very much to the fore at a press event held in Bern from March 16-18, 2023 by industry association Swiss Textile Machinery, ahead of this year’s ITMA exhibition in Milan from June 8-14. A key focus, not surprisingly, was on sustainable production and specifically new processing options for textile waste.

“The separate collection of this waste will become mandatory for all EU member states on January 1, 2025, when its landfilling or incineration will be banned,” explained association president Ernesto Maurer. “A major aim is to greatly increase the use of fiber-to-fiber recycling from the current pitifully low level of just one per cent.”

Switzerland is the base for two of the leading manufacturers of conventional textile spinning technology – Saurer and

Rieter – and both outlined the challenges of accommodating recycled fibers in their production lines.

“Today only between 30-35% of textiles are collected separately, but by 2030 the aim in Europe is that up to 80% will be recycled in some way and that the share of fiber-to-fiber recycling will grow to 18-26%,” said Saurer’s managing director Marcus Rennekamp. “A high degree of contamination, lower production speeds and a lot of personnel intervention are all common consequences of using recycled short-staple fibers in a rotor spinning mill.

“Extreme recycling is the new challenge for yarn producers, with ultra-short fibers bringing conventional spinning machines to their limits. We have developed a patented performance kit for dealing with these ultra-short fibers and

the first trials using it have shown an increase in production of more than 30%.”

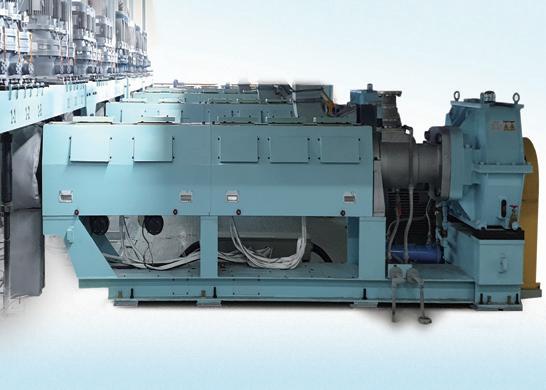

Fully automatic rotor spinning essentially consists of four key processes – spinning, winding, automatic piecing (splicing) and the automatic doffing (removal and replacement) of yarn packages, or bobbins.

On the Saurer Autocoro spinning machine, the first three processes have been integrated into each individual spinning position through individual drive technology and the new doffing cleaning units (DCUs) on the Autocoro 10 system have been designed to help spinners to achieve both higher yarn quality and personnel efficiency.

When doffing a package, rotor cleaning is carried out simultaneously by the DCUs which travel from spinning position to spinning position. Up to eight DCUs can

be configured differently on Autocoro machines depending on the machine length, package size, yarn count and raw material.

Each DCU can be precisely adjusted to the quality requirements of its lots and work areas and the most important task in the context of yarn quality assurance is to clean the rotors, both pneumatically and mechanically. On the Autocoro 10, this is now even more efficient, with cleaning processes digitally controlled using the latest linear motor technology. A new movement mode for the cleaning scraper has been integrated, and its positioning in the rotor groove is more precise and significantly more efficient thanks to an additional circuit.

This new cleaning technology loosens and removes even the most stubborn dirt and sticky residue in the rotor to leave them impeccably clean and leading to a more reproducible yarn quality, regardless of fiber type.

systems over the past decade and we are now responding to the latest challenge of the five million tons of recycled fibers that will need to be accommodated by spinners in the next five years,” Rennekamp concluded.

Saurer sold more than a million spindles on deliveries of its Autocoro spinning units in 2022.

Franziska Häfeli, head of marketing and systems for spinning machine specialist Rieter, outlined the options for recycling via either mechanical tearing, which is already established, or by emerging chemical recycling processes for both cotton waste and blends which break down fibers into their chemical building blocks. This can involve, for example, spinning new fibers from pulp in processes being largely developed in Scandinavia, or the melt spinning of recycled PET pellets to make new polyester yarns.

Virgin cotton, she said, has an average short-fiber content of 24.6%, but short-

fiber content in recycled pre-consumer yarn waste has an average short fiber content of 46.9%, which makes turning it into new yarns challenging.

Many Rieter customers, however, have been processing such yarn waste for decades, with the preferred option being on the company’s R37 or R70 rotor machines.

“Many of these spinners have not even claimed to be using this recycled material and have included it purely for making raw material costs,” Häfli said. “Rotor spinning is best suited for processing yarns with a high short-fiber content but there is also now an increasing demand for recycled ring yarns which need a higher tenacity to go into weaving, but fiber counts for soft touch fabrics are the goal. This, however, is very difficult due to the neps and high short fiber content.”

This problem is considerably greater when it comes to post-consumer waste, even if it is comparatively pure, she added.

A batch of fibers from recycled white 100% cotton t-shirts, for example, will have an average short-fiber content of 71.3%, with an average fiber length of just 9.8mm.

Rieter has been involved in the two-year Texcircle project with partners Coop, Lucerne University, Rieter, Rohner, Ruckstuhl, Texaid and Workfashion, to explore the potential of integrating different types of recycled waste into textile supply chains.

During market launch tests, the cleaning technology proved effective for all fibers that are difficult to spin, including recycled and regenerated types.

A patent on the DCU has now been granted and the new rotor cleaning system will be integrated into all newly delivered Autocoro 10 systems from Summer 2023, as well as being made available for retrofitting to older machines.

“We have achieved an energy consumption reduction of 38% on Autocoro

Funded by the Swiss Innovation agency Innosuisse, other project partners include the Federal Office of Civilian Service (ZIVI), Nikin and Tiger Liz Textiles, with additional support through collaborations with nonwovens producer Jakob Härdi and yarn spinner Marchi & Fildi.

At the Bern conference, six prototypes at various stages of the production process were displayed from the project, the result of joint developments spanning design, collection and sorting trials through to tearing and spinning production trials.

The project was able to recycle 2.5 tons of pre- and post-consumer textile waste into product prototypes, with Swiss sock maker Rohner already commercializing sports socks made from 50% ring spun yarns made from a consignment of surplus ZIVI t-shirts and unworn pants from Coop bakeries, along, with 50% Lenzing Refibra, which also consists of recycled post-consumer waste and regular virgin cellulose.

Other prototypes included a sweater knitted from recycled denim jeans with Rieter rotor yarns, with the percentage of recycled fibers between 70 and 90%, and carpet made from old winter coats with a wool content of at least 70%. Prototype bags and fleeces were also developed from raw materials including shredded old black t-shirts and polyester padding collected by Texaid and processed by Jakob Härdi.

Building on its findings, Rieter plans to unveil a number of new developments related to recycling and system integration through digitization at ITMA 2023, with a focus on cost per kg of yarn, raw material, energy consumption and automation. It will also extend its Com4 branding program to include certain recycled yarn content ranges.

A third Swiss company, Uster Technologies, also plays a crucial role in the conventional fiber spinning world.

The Uster Statistics have become the industry benchmark for achieving and guaranteeing quality in yarn spinning. First introduced as a three-page document back in 1957, the reference manual now includes some 4,500 graphs and

process parameter guidelines and the 2023 edition will include a section on the processing of recycled fibers for the first time. Now available as an app, the 2022 edition has been downloaded more than 23,000 times.

Uster’s executive vice-president of marketing and business development Sivakumar Narayanan said that a major bottleneck in spinning with recycled yarns is achieving the necessary quality.

“Spinning yarn blends of virgin and recycled fibers is a much bigger challenge than any other commonly used blend, but the results can still be acceptable with comprehensive quality testing, knowhow and experience,” he said. “The use of mechanically recycled fibers in spinning has specific quality considerations – such fibers have a higher short fiber and nep content and may often be colored, particularly if post-consumer material is used. It’s also true that recycled yarns have limitations in terms of fineness.”

Officially, a yarn can be branded “recycled” when spun with more than 20% recycled fibers, according to the Global Recycled Standard (GRS), a voluntary product specification for tracking and verifying the recycled content of materials in a final product.

“Blending virgin and recycled cotton together is well known as a challenge for spinners,” Narayanan said. “The smartest spinners and world-class processes simply can’t overcome the fact that some important quality parameters will be adversely affected and even the most sophisticated spinning machinery won’t fix the problem. Awareness of the risk of yarn quality deterioration with recycled fiber blends means that quality control is the only way to assure customer satisfaction and even then, the task is far from simple. When spinning new materials, Uster strongly recommends taking both numeric test results and graphic evaluations into account, to eliminate the risk of problems in further processing.”

“The experience of spinners around the world combined with the latest technology in quality control and analysis systems, represent a promising basis for the future,” concluded Ernesto Maurer. “The new reality of the need for closer communication and cooperation will include all players from fiber to fabric. It’s an essential debate for everyone – and the member companies of Swiss Textile Machinery are ready to assist in accelerating this transformation.”

Further new developments were presented at the Bern conference by the companies Autefa, Benninger, Bluesign, Crealet, Heberlein, Itema, Jakob Müller, Loepfe, Luwa, Retech, Santex Rimar, Stäubli, Steiger and Swinsol.

Adrian Wilson is an international correspondent for International Fiber Journal. He is a leading journalist covering fiber, filtration, nonwovens and technical textiles. He can be reached at adawilson@gmail.com.

Awareness of the risk of yarn quality deterioration with recycled fiber blends means that quality control is the only way to assure customer satisfaction and even then, the task is far from simple.Rieter’s Franziska Häfeli explains the processes explored in the two-year Texcircle project. A.Wilson

Cellulose fibers are steadily making their way into a wide range of applications, including textiles, hygiene products and packaging. These fibers have a low ecological footprint, produce no microparticles and consist of 100% renewable carbon.

Cellulose is the main component of plant cell walls and a natural polymer. It is bio-based and biodegradable, even in marine environments, where its degradation does not cause any microplastic particles.

Moreover, cellulose fibers when washed do not produce microplastics –unlike the laundering of synthetic fiber clothing, which is estimated to be the cause of 35% of the marine microplastics already in the world’s oceans.

In addition, various production technologies for extracting cellulose from plants can be used for the recycling of cellulose, which offers the possibility of circularity of the material.

With a compound annual growth rate of 5 to 10% in recent years, the use of cellulose fibers within the global textile market is increasing, with major investments being made in the circular bio-economy.

Similar growth rates are expected in the future, which makes cellulosic fibers among the fastest growing fiber group in the textile sector.

The textile industry has identified two ways of reducing its pollution: fiber-tofiber recycling and upcycling of textile waste. At the same time, the packaging industry is looking into alternative materials, including the use of recycled textile fibers. However, the recycling of cellulose does present some hurdles.

The fourth Cellulose Fibres Conference (CFC) held in March in Cologne, Germany, and online, organized by Nova-Institut, examined how technology can overcome these obstacles, how markets can achieve circularity of the material, and how the cellulose fibers industry can contribute to the sustainability and circularity of the textile sector.

This unique two-day event, first held in 2020, focused on the increasing use of cellulose fibers in the fields of textiles, hygiene products and packaging. It attracted more than 225 participants from 30 countries, with 42 speakers and special panelists – of whom more than 40% were female, coinciding with International Women’s Day on March 8 – around

20 exhibitors and almost 20 poster presentations, both onsite and online.

The conference presented several case studies that introduced novel solutions that attempt to solve the dilemma of textile waste recycling. Other new application fields included cellulosic materials as a precursor for carbon fibers and the use of post-consumer clothing as a raw material to produce protective packaging.

Wood pulp is forecast to account for around 7% of global textile fiber production in 2025. However, cellulose fiber producers are now looking for alternatives to wood as a raw material – the fibers can be made from residues, by-products and side-streams of various industrial processes, explained Dr. Asta Partanen, senior expert, Nova-Institut.

But with global cotton production stagnant, the cellulose gap has been filled in recent years by the growth in synthetic fibers. Manuel Steiner, business development director of LIST Technology, Switzerland, highlighted the need to find new sources of cellulose. Recycled cotton-rich textiles as a raw material for the lyocell dissolving technology could be a solution, he said.

Dr. Alexander Deutsche, R&D director at Metsä Tissue, pointed out that raw materials from renewable resources are essential for an effective circular economy. Ensuring recyclability and efficient fiber reuse while reducing and replacing plastic as part of the shift from fossil-based raw materials to renewable biomaterials is the ultimate goal, added Anna-Stiina Jääskeläinen of Kemira, Finland.

According to the Ellen MacArthur Foundation, used and unused textile materials valued at US$100 billion are wasted each year. Meanwhile, Textile Exchange estimates that less than 1% of textile fibers are made from textile waste owing to the lack of textile-to-textile recycling systems, adding that global textile fiber production, which has doubled in 20 years to 109 million tonnes in 2020, is expected to grow 34% to 146 million tonnes in 2030.

During a panel discussion at CFC, participants agreed that an effective textile collection system is far from reality and that this will take time to implement. It will also require close cooperation –and trust – between the whole textile value chain. In addition, designing for circularity and end-of-life solutions will be key requirements.

The EU-funded New Cotton Project comprises a consortium of 12 participants across the textile industry production value chain to demonstrate that creating new clothing from regenerated cotton textile waste can be commercially viable.

The project has demonstrated a cellulose carbamate technology that allows the transformation of textile waste into cost-efficient, cotton-like Infinna fibers with superior qualities, said Paula Sarsa-

ma of Finland’s Infinited Fiber Company, one of the project’s participants and the lead innovator.

She explained that overcoming potential bottlenecks to scaling up circular textile production will require:

• finding steady and suitable postconsumer textile streams;

• developing suitable machinery for the separation and fiber identification processes;

• defining suitable textile streams from sorters to recyclers;

• ensuring financial viability of recycling post-consumer garments into new fibers; and

• understanding the post-consumer market and comparing these results to market data on feedstock availability, production flows and current disposal alternatives, such as landfill or incineration.

In collaboration with major global brands Adidas and H&M, biodegradable activewear and denim apparel were made from 100% post-consumer textile waste clothing as part of the New Cotton Project and launched to consumers in autumn 2022.

TexChain 3 is a project led by The Loop Factory and Wargön Innovation, together with 32 textile producers and stakeholders in Sweden. The project explores the possibility of generating a more circular flow of textile residuals that mainly originates from worn-out workwear and production-related waste streams.

Trials have been made within eight different prototypes with industrial waste as the raw material, with the goal of creating five products ready for commercialization. Maria Ström and Roos Mulder of The Loop Factory outlined some of the pilot projects, which include upcycling and recycling workwear, and developing a material mixture from old train seats for further processing into new products.

With the market for reusable diapers currently valued at US$53 billion a year with an annual growth rate of 5%, products currently on the market often lack reliability. Due to the high volumes of fluids involved, a highly absorbent construction with fast acquisition and optimized fluid distribution is required to deliver no leakage and low rewet to the skin.

At this year’s CFC, Germany-based start-up Sumo and German specialty viscose fiber manufacturer Kelheim Fibres presented their high-performance absorbent pads for a reusable diaper, which

According to Natalie Wunder, project manager at Kelheim Fibres, and Luisa Kahlfeldt, founder and designer of Sumo, the washable, fitted cloth diaper consists of a waterproof cover and absorbent inserts.

Kelheim’s functionalized viscose fibers with adjusted cross-sections have been integrated, together with polylactic acid bicomponent fibers, into a needlepunched/thermally bonded nonwoven construction to produce a high-performance absorbent pad that uses no fossilbased materials.

Birgit Kosan, of the Thüringisches Institut für Textil- und Kunststoff-Forschung (TITK), Germany, explained that the lyocell process is a particularly environmentally friendly process with almost complete solvent recycling.

Although wood-based dissolving pulps for lyocell applications are well

blend of locally sourced unbleached summer hemp and Lyohemp, a regenerated fiber made from hemp straw. This underwent a rotor spinning process followed by knitting on flat-bed knitting machines.

ments made from 100% wheat straw, and the first prototypes have shown the technical feasibility of bio-based garments with good properties of the wheat straw cellulose-based textiles.

For more than 50 years, Fi-Tech has successfully worked with manufacturers of machines and key techical components used in the production of:

Our customers trust us to provide the best quality and rely on our commitment to their needs when exploring new opportunities to grow and to improve their manufacturing businesses.

Equally, our suppliers highly value the service, dedication, and access to the markets we provide.

Rita Valério of CeNTI – Centre for Nanotechnology and Smart Materials, Portugal, outlined the Fiber4Fiber project, which aims to develop optimized dissolving pulp from Portuguese Eucalyptus globulus trees to produce man-made cellulosic fibers, such as lyocell and viscose, which can be traced along the value chain.

As part of the project, modified lyocell fibers are being developed with properties that are appealing to the end user and meet more demanding technical and performance requirements in the market, such as antimicrobial and flame-retardant properties.

Much of the second day of the Cellulose Fibres Conference was devoted to the results from the EU-funded GRETE project, which aims to overcome the bottlenecks in the wood-to-textile value chain, explained Joan Colon of the BETA Tech Center, University of Vic–Central University of Catalonia, Spain.

The initiative aims to improve the existing textile value chain by using a new raw material based on standard paper-grade pulps, implementing novel green technologies based on ionic liquid chemicals and a recovery process for cellulose dissolution with a novel post-modification process to obtain regenerated man-made cellulosic fibers with improved technical properties.

For the third time, Nova-Institut organized the Cellulose Fibre Innovation of the Year award, sponsored by GIG Karasek, Austria, as part of the Cologne event. The conference advisory board selected six products from 20 nominations, which were put to an audience vote on the first day of the event, with the awards ceremony taking place in the evening.

In a close-run competition, the overall winner was Nullarbor high-tenacity lyocell fibers made from bacterial cellulose. Developed by Nanollose of Australia and Birla Cellulose of India, Nullarbor is significantly stronger than lyocell made from woodbased pulp – even adding small amounts of bacterial cellulose to wood pulp increases the fiber toughness, said Nanollose executive chairman Wayne Best.

The first pilot batch of 260 kg of Nullarbor (from the Latin Nulla arbor, meaning “no trees”) was produced in 2022 with a 20% bacterial pulp share, and several fabrics and garments have been produced with this fiber. The collaboration between Nanollose and Birla Cellulose is now focusing on increasing the production scale and amount of bacterial pulp in the fiber.

Second place in the innovation award went to Renewcell of Sweden for Circulose, a branded dissolving pulp made from 100% textile waste, such as used clothing and production scraps, which provides a material for fashion that is fully recycled, recyclable, biodegradable and of virgin-equivalent quality. Circulose can be used by fiber producers to make staple fibers or filaments such as viscose, lyocell, modal, acetate or other types of man-made cellulosic fibers.

Third place was awarded to Vybrana, a new-generation banana fiber upcycled from agricultural waste from Gencrest Bio Products, India. Raw fibers are extracted from the banana pseudo-stem

at the end of the plant’s lifecycle and the biomass waste is treated by Gencrest’s Fiberzyme technology, which removes the high lignin content and other impurities and helps fiber fibrillation. The company’s proprietary cottonization process provides fine, spinnable cellulose staple fibers suitable for blending with other staple fibers and can be spun on any conventional spinning systems, explained Sandesh Saxena, head of marketing.

The other innovation award nominees were HeiQ AeoniQ, a climate-positive continuous cellulose filament yarn that reproduces the properties of polyester and polyamide yarns in a cellulosic, biodegradable and endlessly recyclable

fiber; Lenzing’s Tencel Luxe lyocell yarn that offers an alternative to silk, long-staple cotton and petroleum-based synthetic filament yarns; and sustainable, plasticfree, biodegradable and compostable sanitary pads from Sparkle Innovations, USA.

Next year’s Cellulose Fibres Conference will be held from March 13-14, 2024, again in Cologne. For further information, visit www.cellulose-fibres.eu

Geoff Fisher is the European editor of International Fiber Journal, editor of MobileTex and a director of UK-based Textile Media Services, a B2B publisher of news and market reports on transport textiles, medical textiles, smart materials and emerging markets. He has more than 35 years of experience covering fibers and technical textiles. He can be contacted at gfisher@textilemedia.com or +44 1603 308158.

Agricultural and seaweed residues were investigated as feedstock for the HighPerCell process, which uses ionic liquids as the direct solvent in the spinning of cellulose filaments.