MagazineHRAI

“PURPOSEFUL PUZZLES” PARTICIPATE TO WIN A GIFT VOUCHER NEW APPOINTMENTS IN A FLASH

HR PERSPECTIVES: THE PEOPLE LENS ON PURPOSE-LED GROWTH

“PURPOSEFUL PUZZLES” PARTICIPATE TO WIN A GIFT VOUCHER NEW APPOINTMENTS IN A FLASH

HR PERSPECTIVES: THE PEOPLE LENS ON PURPOSE-LED GROWTH

HRAI firmly believes in the power of teamwork and the value it brings. When diverse talents and perspectives come together, something extraordinary happens. The collective synergy we create goes beyond what any individual can achieve alone and together we see the potential to make a lasting impact on the world.

In an era where numbers alone no longer tell the full story, the world of finance is undergoing a quiet but powerful transformation. Today, success is not just measured by profit margins, but by the principles that guide them.

This edition explores how finance is stepping into a new role one that balances commercial growth with ethical accountability, sustainability, and long-term resilience From impact investing to ESG frameworks and inclusive financial models, we spotlight voices and practices that are reshaping the purpose of money itself

Because the future of finance isn’t just about returns it’s about responsibility

Happy reading!

DEV TRIPATHY, HEAD OF FINANCE

PHILIPS INDIAN SUBCONTINENT

DR. ANKITA SINGH, FOUNDER, HR ASSOCIATION OF INDIA

HITESH UPPAL, CHIEF FINANCE OFFICER, MAGICBRICKS

NITINKUMAR PAREKH, CHIEF FINANCE OFFICER, ZYDUS LIFESCIENCES LIMITED

PANKAJ VASANI

GROUP CHIEF FINANCIAL OFFICER, CUBE HIGHWAYS INVIT

BHAVYA MISRA CHIEF HUMAN RESOURCE OFFICER, GODREJ CAPITAL

PARTICIPATE TO WIN A GIFT VOUCHER OF INR 5000

48

RAJITA SINGH, CHIEF PEOPLE OFFICER - INDIA, KYNDRYL

CA ABHAY MAHESHWARI, FOUNDER & CEO, ASM WEALTH 40 52 44 25 24

RISHIKESH RAVAL, PRESIDENT - GROUP HUMAN RESOURCES & CORPORATE COMMUNICATIONS

ZYDUS LIFESCIENCE LIMITED

SHWETA MOHANTY HEAD OF HR, SAP IN INDIA

CA PALAK PAVAGADHI FOUNDER, PAVAGADHI SHAH & ASSOCIATES

HARJEET KHANDUJA, SVP- HR, JIO

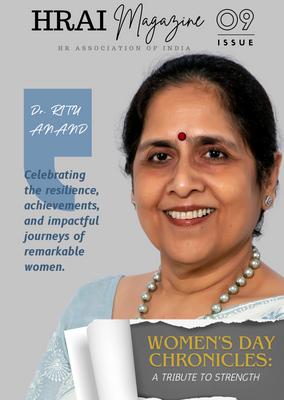

e HR Association of India (HRAI), founded in 2020 is an esteemed non-profit organization that has been playing a pivotal role in shaping the HR landscape in India. Their primary focus is on exploring, discussing, and promoting the latest business scenarios, market trends, change management, and leadership in the HR industry. HRAI is dedicated to creating a community of professionals, learners, and mentors who share their insights and learn from each other to elevate the standard of HR practices in the country

HRAI's success is attributed to its commitment to excellence and tireless efforts in facilitating interactions between HR professionals and subject matter experts. Through its initiatives such as panel discussions, masterclasses, one-on-one talk shows, and Q&A sessions with thought leaders, HRAI provides a platform for professionals to gain in-depth knowledge and practical solutions that can be applied in real-time.

In addition to their educational initiatives, HRAI also recognizes organizations' best practices and individual contributions through awards and conferences. These events celebrate the achievements of exceptional professionals and organizations that have made significant contributions to the HR industry in India. Over the years, HRAI has featured more than 1,000 experts and leading minds in the fields of HR, IT, Marketing, Finance, and more, making it a hub for learning and networking.

For HR professionals in India, HRAI offers unparalleled opportunities to connect with like-minded peers, learn from experts, and gain recognition for their hard work and achievements By joining HRAI, HR professionals can stay updated on the latest trends, best practices, and strategies that can help them take their careers to the next level.

HRAI, founded by Dr. Ankita Singh, drives industry initiatives and organizes prestigious awards for organizations, emerging leaders, and trailblazing women leaders Notable participants include Hindustan Unilever, Birlasoft, Biocon, Lenovo, IHG Hotels, Volvo and more..

Our commitment to excellence is reinforced through partnerships with the Great Managers Institute and top 100 great managers, who have taken masterclasses and featured in Forbes Magazine.

Elite leaders like Dr. TV Rao, Harjeet Khanduja, and Prasenjit Bhattacharya have graced our one-on-one talk shows, enhancing our members' knowledge base.

Our article initiative showcases thought-provoking articles by eminent leaders from organizations like BCCL, EY, Max Life Insurance, SAP, Kotak life, Bajaj Energy, TimesPro, Jio, Welspun Group, Great place to work and Accolite Digital.

The 23 Of 2023 and 24 of 2024 Initiative recognized exceptional leaders and entrepreneurs based on a predetermined theme. Featured leaders include those from organizations Eros Now, Adani Group, Future Generali, Yes Securities, Timezone, Dabur, Yatra, JSW, KPMG Global Services and more. The list also featured notable public figures/Sharktank Jury: Ghazal Alagh, Ritesh Agarwal, Deepinder Goyal and Amit Jain:

BY DEV TRIPATHY

The role of the finance function has evolved significantly over the past two decades. In my early years as a Chartered Accountancy aspirant and young professional, finance was largely viewed as a position of authority and control Today, finance has become a strategic business enabler, influencing everything from value creation and customer experience to regulatory affairs, governance, ethics and environmental stewardship

Corporates are integrating purpose into their strategy to balance employee, customer and investor needs. This improves employee engagement and fosters a common goal beyond transactional relationships

My first experience with this philosophy occurred early in my career at a prominent steel conglomerate. Long before corporate social responsibility (CSR) mandates were established, the company had a policy of

reinvesting a portion of its profits back into the community This practice fostered strong goodwill, enhanced brand loyalty, and ensured smooth, uninterrupted production. It was not charity, but rather a strategic recognition of the symbiosis between social impact and commercial success, demonstrating that they are not opposing forces

My interest in healthcare ignited through personal experiences, particularly when a family member needed an MRI scan. This pivotal moment taught a teen in a middleclass family the essential nature of accessible and affordable healthcare technology. Today, as I work for a leading health technology company, our mission to enhance people's health and well-being through meaningful innovation drives me. The organization aims to improve 2.5 billion lives annually by 2030, a powerful motivator for everyone involved, including myself.

Finance remains responsible for delivering financial success and long-term sustainability. 8

Today’s finance teams are supported by powerful technologies that enhance transparency and accountability.

Profit is essential to invest, innovate and serve stakeholders However, an excessive focus on short-term performance without an overarching sense of purpose can lead to ethical compromises and reputational risks.

CFOs are expected to provide strong financial forecasts and maintain disciplined performance across short, mid and longterm horizons. This requires embedding industry insights, regulatory changes, macroeconomic factors and customer trends into decision-making. Yet, it also requires standing by purpose-driven values, even when difficult.

A case in point came during the COVID-19 pandemic, when our team at Philips consciously decided not to profit from the surge in demand for a critical medical device We believed that, particularly in times of crisis, businesses have a responsibility to prioritise ethical behaviour over short-term financial opportunity

Reflecting on family stories, I connect with a Mahabharata incident on purposeful leadership. During the Rajasuya Yajna, Yudhishthira chose fairness over quick economic gains by not taxing smaller kingdoms unjustly His governance, based on justice and compassion, earned respect for its moral authority Similarly, modern finance leaders should prioritize long-term trust over immediate profits.

as an Enabler of Ethical Finance

Today’s finance teams are supported by powerful technologies that enhance transparency and accountability Digital tools and data analytics enable real-time tracking of risks, performance trends and customer behaviours. AI and machine

learning allows us to predict outcomes, assess ESG impacts and provide balanced perspectives on mid and long-term business scenarios

This marks a significant evolution. Finance no longer operates in isolation, but as a collaborative partner driving organisationwide accountability and ethical decisionmaking.

Excessive focus on short-term performance without an overarching sense of purpose can lead to ethical compromises and reputational risks.

The rise of Environmental, Social, and Governance (ESG) frameworks has brought non-financial metrics firmly into the finance function’s domain Finance leaders are now responsible for measuring and reporting carbon footprints, community investments, workplace diversity, and responsible procurement. Stakeholders and consumers increasingly expect companies to integrate ESG considerations into core business strategies ESG practices not only provide competitive advantage but also foster brand loyalty and trust They are no longer optional add-ons but an essential component of long-term business viability. Everyday when I come across the ESG guidelines, which emphasize care for people, patients and the planet, reflect a comprehensive approach to sustainability.

Organizations that integrate purpose and responsibility alongside profitability are demonstrating the coexistence of these 10

values. By investing in cleaner technologies, affordable healthcare solutions, or responsible resource allocation, finance plays a pivotal role in achieving these outcomes The alignment of the finance function with organizational purpose significantly influences decision-making, resource allocation, and the ability to deliver value to both shareholders and the broader community Finance is frequently observed acting as a strategic partner, engaging with customers, partners, and vendors to understand their needs and design various solutions such as Public Private Partnerships, leasing arrangements, and performance-linked payment options. These initiatives make investments viable and affordable for customers, particularly in the health infrastructure, which is critically needed. Concurrently, it addresses our brand's purpose of providing "Better Care for More People"

Conclusion: Finance at the Crossroads of Purpose and Profit

Purpose-driven finance is crucial and a competitive necessity Finance professionals must balance business success with societal impact. The future lies in not just reporting performance but guiding organizations towards sustainable, ethical growth. Act purposefully, guided by ethics, and free from greed. "Finance with Purpose" focuses on creating lasting good for all stakeholders. “Act with purpose, in alignment with your role (dharma), guided by ethics, and detached from greed ” - This is the very heart of “Finance with Purpose” where financial stewardship isn’t just about maximizing shareholder value, but about creating lasting good for all stakeholders, true to one ’ s dharma

Dev is the Head of Finance for the India Subcontinent and oversees a business unit covering a broader region With more than 20 years of experience in finance and business management, Dev provides strategic support to business leaders and serves on the Philips India Board. He promotes collaboration, sustainable growth and a resilient, compliant culture.

Dev has been with Philips for over 17 years, playing a key role in the Company's growth and various transformations. He has worked across industries such as Healthcare, FMCG, Port Operations, Steel and Food Dev is people-focused and finds purpose in his work.

BY BHAVYA MISRA

In an era defined by trust deficits and shifting expectations, culture has emerged as the most resilient and underutilised form of capital. Not an accessory to business strategy, but a foundational asset – one that shapes identity, drives performance, and builds long-term value.

In the financial services sector, where credibility often precedes capital, culture operates as a quiet differentiator. When built on ethics, expressed through inclusion, and reinforced by people practices, culture compounds. It does not depreciate with time, but appreciates with every stakeholder interaction.

No longer relegated to the sidelines, HR today plays a central role in driving business outcomes Progressive organisations like Godrej Capital embed HR into the core of growth strategy – shaping talent roadmaps, aligning workforce capability with business goals, and influencing customer experience through people decisions

A research by PwC reveals that 87% of

leaders now see HR as a driver of value creation rather than a cost centre. This shift reflects a broader truth, that when talent aligns with purpose, performance follows.

For instance, when Godrej Capital’s subsidiary, Godrej Housing Finance, launched its affordable housing offering to promote financial inclusion among low-income groups, it took a purposeful step toward deepening its presence in underserved markets by opening offices in Tier 2 and Tier 3 geographies. This move was not just a business expansion, but a strategic alignment of purpose and operational agility

HR played a pivotal role in enabling this transition by driving culturally contextual hiring, developing hyperlocal talent pipelines, and ensuring the organisation’s values were embedded from the ground up.

From identifying candidates who understood regional nuances to rolling out scalable learning interventions that built capabilities aligned with customer needs, HR was not a back-end support function, it was a front-line business enabler.

In a world where both trust and attention are in short supply, it is culture that leaves a lasting mark.

In BFSI institutions, this kind of HR-business integration accelerates market entry, enhances local trust, and ensures readiness to scale in diverse and underpenetrated geographies It demonstrates how HR, when aligned with business strategy, can unlock both growth and inclusivity

True inclusion transcends policy. It must manifest across employees, customers, channel partners, and the broader ecosystem. In financial services, where trust is transactional and reputations are built through consistency, inclusive practices often become competitive advantage

Forward-looking organisations, including Godrej Capital, have now expanded DEI beyond internal charters.

From onboarding talent across the queer spectrum and PwD – supported by comprehensive mediclaim policies that include gender affirmation procedures, to designing lending journeys for underserved segments, inclusion has been operationalised, not just idealised

Sensitisation of field staff, inclusive communication in vernacular languages, and partnerships with women-led businesses all reflect a cultural orientation that sees diversity not as a goal, but as a way of working.

In 2020, McKinsey reported that organisations in the top quartile for gender and ethnic diversity outperform their industry peers by 25–36% in profitability Beyond the numbers this shows that inclusive cultures make employees and customers feel safe.

Culture reveals itself in moments of truth – a health emergency, a caregiving responsibility, a career pivot. Institutions that build policies around these moments create lasting trust.

Leading practices include:

Uncapped sick leaves based on mutual trust, without medical scrutiny

Creche support and gradual reintegration post-parental leave

Gender-neutral healthcare coverage. Flexible work models tailored to different life stages

Leave policies designed to support employees caring for elderly family members.

These policies reflect a belief that productivity and empathy are not opposing forces – they reinforce each other

Internal metrics from progressive organisations show 20–25% higher retention and engagement among employees who feel supported during life transitions Culture, in this context, becomes not just ethical capital, but emotional equity

Rapid technological shifts and evolving customer expectations demand more than functional training Learning must be continuous, self-directed, and deeply embedded in the culture.

Organisations that prioritise learning as a moral and strategic imperative report higher adaptability, stronger innovation pipelines, and better internal mobility When over 80% of employees voluntarily engage in digital learning journeys, it signals a workforce that

sees growth not as entitlement, but as accountability. In high-trust cultures, learning becomes less about compliance and more about contribution

Conclusion: When Culture Becomes Capital Capital may fund operations, but culture fuels reputation, and in a world where both trust and attention are in short supply, it is culture that leaves a lasting mark. When ethics guide decisions, purpose shapes policies, and inclusion becomes second nature, culture shifts from being an abstract ideal to a real and measurable advantage

This kind of culture can’t be borrowed, bought or outsourced It must be built through intent, consistency and care. Because ultimately, culture is not what’s written in a handbook. It is what lives in everyday actions, grows quietly over time and shows up strongest when no one is watching.

Bhavya Misra, CHRO at Godrej Capital, brings nearly 20 years of HR experience across Technology, FMCG, and Retail, with leadership roles at PepsiCo, Bharti Walmart, and Lenovo. She specializes in Talent Management, Organizational Transformation, and Business Partnering.At Godrej Capital, she champions DEI initiatives, focusing on LGBTQIA+ and PWD inclusion, and drives gender balance in the workplace Known for her empathetic and pragmatic approach, Bhavya ensures employee well-being remains central to business decisions.An alumna of MDI Gurgaon and St. Stephen’s College, Delhi, she continues to shape a diverse, inclusive, and high-performing culture

BY AMIT DAS

“In looking for people to hire, look for three qualities: integrity, intelligence, and energy. And if they don’t have the first, the other two will kill you ” Warren Buffett

Warren Buffett’s words remind us that, irrespective of scale or speed, integrity is the true north of leadership In today’s business landscape where profitability metrics often steal the spotlight integrity remains the compass that ensures decisions not only generate returns, but endure in reputation and trust. And at the heart of fostering that integrity? HR professionals who design, model, and institutionalize values-driven people practices.

Beyond a Buzzword: Integrity as a Way of Being Guided by HR

Far too often, integrity is relegated to a poster on the wall or a slide in a deck. But real integrity is neither episodic nor ornamental it’s woven into every choice, big or small. It’s honoring commitments when no one ’ s watching, choosing fairness over convenience, and treating stakeholders with respect, even when outcomes disappoint.

HR’s role is critical here: by embedding integrity into performance frameworks, competency models, and leadership assessments, HR ensures that values aren’t optional extras but core criteria for every role. Through training modules and coaching programs, HR equips leaders and teams to recognize ethical dilemmas and navigate them with confidence

Defining moments often occur in the grey zones. Years ago, our HR team partnered with business leaders to roll out a new talent policy structurally sound and meritocratic, yet poised to draw criticism for its optics. The easier path would have been to delay yet HR designed a phased communication plan, hosted open forums explaining the policy’s rationale, and fielded tough questions

The immediate backlash tested our resolve

But trust grew as employees saw HR and leadership aligned in intent. Over twelve months, attrition costs fell by 12% a testament to how HR-driven transparency can turn integrity into measurable financial impact.

HR’s role is to advocate for employee well-being and longterm culture, even when business pressures mount.

HR as Curator

Culture isn’t forged at annual town halls it’s shaped in weekly check-ins, hallway conversations, and even WhatsApp threads HR curates these everyday moments by establishing rituals like “Stories of Courage” in all-hands meetings where peers share instances of integrity in action. Whether it’s calling out misconduct, delaying a product launch over quality concerns, or refusing to compromise compliance, these narratives reinforce that ethical behavior is our norm.

By training managers to spot and celebrate these moments, HR ensures they propagate across teams turning individual acts of courage into organizational memory.

The HR-Finance Collaboration: Aligning for Sustainable Goals

Finance may measure outcomes, but HR influences behaviors that drive them. HR’s domain expertise in people analytics and engagement metrics positions it as a bridge to finance For instance, our HR team cocreated with the CFO a balanced scorecard linking revenue growth, employee engagement, and compliance indicators.

When HR designed the engagement survey and correlated it with performance data, we discovered that high-trust teams outperformed others by 15% in productivity. Integrating these insights into incentive structures led to a 7% increase in topline revenue and an 18% drop in employee grievances This “people-led profits” model shows how HR-finance collaboration anchors ethical performance to financial outcomes.

When It’s Institutionalized HR as Architect

Individual integrity must be supported by robust systems. HR architects recruitment processes, promotion panels, and recognition programs that reward the right behaviours.

Hiring: HR screens for real-world examples of ethical courage, using scenario-based interviews to assess integrity.

Promotion: HR ensures succession committees evaluate not only performance records but also how candidates handled ethical dilemmas and upheld team trust.

Recognition: HR designs award criteria that spotlight employees who spoke up against wrongdoing or upheld compliance under pressure

By institutionalizing these steps, HR transforms integrity from a personal choice into an organizational competency ensuring every employee understands that ethical conduct drives sustainable profit.

Courage: The Muscle Behind Integrity— HR as Enabler

Integrity in calm waters is easy its true test lies in turbulence. When metrics dip, the temptation is to chase short-term gains at people’s expense. HR’s role is to advocate for employee well-being and long-term culture, even when business pressures mount.

In downturns, our HR team led wellness initiatives, maintained transparent communication, and provided leadership coaching to balance performance expectations with empathy The result? During a 10% market slowdown, our

engaged workforce continued innovating, buffering the business against external shocks

Leadership with integrity isn’t about perfection; it’s about accountability, transparency, and the courage to choose values over convenience.

Integrity isn’t mere avoidance of wrongdoing. It’s consistency, selfawareness, and accountability. Leaders and their HR partners should reflect regularly:

Am I the same person in the boardroom and the cafeteria?

Do I say “ we ” in success and “I” in crisis? Do I accept accolades when they’re not fully earned?

By sharing these reflections in leadership forums and HR communities of practice, HR fosters collective accountability ensuring that values stay front and center.

Quarterly results drive reports, but trust paves the path for enduring success. Leadership with integrity isn’t about perfection; it’s about accountability, transparency, and the courage to choose values over convenience HR professionals play a pivotal role designing frameworks, facilitating dialogues, and partnering with finance to balance profit with purpose.

When HR champions these principles, organizations not only prosper they build legacies of trust and ethical excellence And that is the kind of leadership that truly endures.

Amit Das is the Director-HR & CHRO at The Times of India Group, where he leads Human Capital function for one of India’s most influential media conglomerate. With over 36 years of experience across reputed organizations such as Britannia Industries, Vodafone, RPG Group, CESC Ltd., and Taj Group of Hotels, he has led large-scale organizational transformation initiatives and seamlessly integrated HR with business strategy to drive sustainable growth across diverse industries. Beyond the corporate world, Amit has played strategic Advisory roles with Government institutions and contributes actively to leading Academic Institutions as a thought leader and industry mentor

BY DR. ANKITA SINGH

What if your next big business breakthrough isn’t hiding in your product roadmap but in the conversation between your CHRO and CFO?

In today’s fast-changing world, organizations are no longer asking whether people strategy should align with business goals they’re asking how quickly it can The lines between workforce experience and financial performance are blurring, and the most successful companies are the ones where HR and Finance don’t just collaborate they co-lead

Traditionally, HR was seen as the custodian of people, culture, and engagement, while Finance was the gatekeeper of resources, risk, and ROI. But this siloed view is rapidly becoming outdated. The future of work requires a new paradigm one where people and profits are not seen as competing priorities, but as co-dependent levers of long-term growth.

According to a 2024 PwC study, 83% of CEOs believe that investing in people and

culture is critical for future growth but only 33% feel their HR and Finance teams are aligned in delivering that vision. That’s a serious gap and a massive opportunity

We’re operating in an era shaped by technological disruption, shifting demographics, remote work, ESG priorities, and rising employee expectations This complexity demands integrated decisions around cost, capability, and culture And that’s exactly where the HR-Finance alliance becomes a strategic gamechanger.

HR today is not just a function it is the connective tissue that brings together business strategy, human capability, employee experience, and operational agility. Whether it's compensation design, digital transformation, DEIB strategy, or M&A integration, HR sits at the intersection of people, process, and performance.

From hiring to retiring, every employee interaction is an opportunity to drive both engagement and efficiency But doing so

The belonging, trust, and well-being are intangible. That the true impact of culture is beyond the grasp of numbers.

requires strong alignment with Finance. Together, these functions can ensure that workforce initiatives are not only purposeled but also profit-smart.

In essence, HR is the architect of employee experience but Finance helps ensure that the blueprint is scalable, sustainable, and impactful

One of the persistent challenges in HRFinance alignment is the notion of ROI Return on Investment For years, HR professionals have viewed ROI with hesitation, sometimes even defensiveness. We believe that emotions can’t be measured. That belonging, trust, and wellbeing are intangible That the true impact of culture is beyond the grasp of numbers.

While it's true that human behavior isn’t always linear or predictable, what we often forget is this: impact can be measured— and must be. Not every metric needs to strip the soul out of what we do. But as HR leaders, we need to bridge the emotionalcommercial divide.

When culture is embedded into operations, it stops being something HR drives — and becomes something the business breathes.

When the CFO asks, “What return are we seeing from our investments in L&D or wellness?” that’s not a lack of empathy That’s a legitimate, responsible, and necessary question And we must be ready with data, outcomes, and insights.

If attrition has dropped by 8% after introducing a mentorship program, that’s impact.

If our internal mobility saves ₹40 lakh per year in hiring costs, that’s impact.

If leadership development increases manager effectiveness scores by 15%, that’s impact.

ROI isn’t about reducing people to numbers. It’s about elevating our work to a level where it’s understood, respected, and invested in.

The need for HR and Finance to co-create strategy is no longer optional. It’s essential.

Here’s how this partnership plays out in realworld priorities:

Workforce costs make up 70% of total operating expenses in most service-based companies. Aligning headcount planning with skill forecasting and business cycles requires Finance’s financial modeling and HR’s talent insights This is not about trimming; it’s about targeted growth.

Variable pay, ESOPs, PLI, and long-term incentive plans must balance motivation with metrics. Finance ensures these programs are sustainable. HR ensures they are motivating Together, they build a payfor-performance culture that is equitable, transparent, and impactful

LinkedIn’s 2024 Workplace Learning Report states that companies with strong learning cultures are 92% more likely to innovate and 56% more likely to be first to market But upskilling is expensive. Finance helps HR identify which capabilities are truly business-critical and worth the investment.

Absenteeism and burnout cost the global economy over $1 trillion annually (WHO)

When HR proposes mental health initiatives, Finance helps quantify the benefits reduced sick days, higher productivity, better retention. This shared accountability ensures well-being isn’t just good-hearted it’s good business.

Gone are the days when HR proposed and Finance disposed Today, we need to see ourselves as growth partners equally responsible for outcomes

This means:

Creating shared dashboards for people and performance metrics

Having joint KPIs that include workforce efficiency, talent ROI, and digital adoption

Participating in each other’s strategy meetings not as guests, but as contributors.

In many organizations, the CHRO-CFO alliance is already delivering strong results. According to a BCG report, companies where HR and Finance co-lead transformation efforts are 3x more likely to achieve desired outcomes in digital and talent innovation.

The future of work is not about replacing humans with AI or reducing cost to survive It’s about reimagining value human and financial And that value is created when Finance ensures scalability and HR ensures sustainability.

As Head of HR, I’ve learned that sustainable growth is not just a financial outcome it’s a human achievement. Culture without business sense lacks direction, and financial decisions without a people lens risk disengagement.

The future demands more than coordination between HR and Finance it calls for coownership When we align not just on metrics but on intent, we unlock a shared purpose: to build organizations where people thrive and profits follow. Because the companies that will lead tomorrow are those that see talent not just as a cost, but as the catalyst for transformation.

Dr. Ankita Singh is the CPO & Board Director, CIGNEX & Relevance Lab. With 22+ years in HR, primarily in the ITES sector, Ankita has driven transformation through performance-driven practices and inclusive culture. At CIGNEX, her leadership helped the company earn multiple “Great Place to Work” certifications (2017–2021). She has been recognized as “Woman Leader of the Year” by The Times of India Group and featured in Forbes India’s “Top 100 Managers ” Ankita holds an MBA in HR+IT, an Executive MBA from SCMHRD, and a Ph D in Management A respected voice in the industry, Ankita blends strategic insight with a passion for people development and culture building

True success is measured not by what we achieve quickly, but by what we sustain ethically.

Every now and then, I make it a point to visit colleges in the remote corners of India. The places where ambition meets grit in its purest form On one such visit, I found myself in a quiet, dusty town, surrounded by fields, where a modest college stood tall, not in architecture but in impact.

I was welcomed by the founder of the college, a soft-spoken man with eyes that carried decades of purpose. After meeting some students and faculty, I turned to him and said, you are doing something truly meaningful here He smiled, and what followed was a conversation that stayed with me. He told me that wAhen he started, it was all about teaching Simple classrooms, passionate teachers, affordable fees. The mission was

clear, to make education accessible He did not think in terms of business then. But things have changed. Expectations have evolved. He said, Now every stakeholder sees value differently Parents want placements They calculate ROI. Students want more than just lectures. They seek a life experience. Employers want graduates who are ready to perform from day one

To respond, the college had to evolve too. They began investing equally in academics, career support, campus life, and research Then came the most revealing part

The founder told me he had a choice He could have slashed budgets for academics and research, and instead diverted funds toward unethical shortcuts like under-the-table payments for better placements That would have won quick applause from parents and created a temporary spike in job offers. But it would

have also meant producing graduates unprepared for the long haul, undermining their careers and eroding the college’s credibility over time

That moment hit me. He chose the harder road, one paved with integrity, purpose, and long-term thinking He chose to build a legacy, not just a placement report That’s what finance with purpose looks like. It is not just about where the money goes. It’s about why it goes there It is about making choices that might not win in the short term, but build something honest, lasting, and deeply human in the long run.

In a world that often celebrates speed and shortcuts, his story is a powerful reminder. True success is measured not by what we achieve quickly, but by what we sustain ethically

Harjeet Khanduja is an international speaker, author, poet, influencer, inventor and an HR leader. He is also known as RK Laxman of Business He is currently working as the Senior Vice President HR at Reliance Jio He has 4 published patents and authored 7 bestseller books. Harjeet has been a LinkedIn Power Profile, TEDx speaker, Guest Faculty at IIM Ahmedabad, Board Member of Federation of World Academics, Global Thought Leader, Global Digital Ambassador Harjeet features in Top 200 Global Leadership Voices and ET Top 20 HR Influencers.

Wealth isn’t just about accumulation-it’s about direction Where is your money going? What story does it tell? In a world obsessed with shortcuts like getrich-quick schemes, speculative bets, and overnight success, the real magic still lies in planting trees whose shade & fruits we may never enjoy! The magic lies in not just compounding returns, but compounding values and legacies

Investing isn’t merely a financial act; it’s a lesson in patience and perspective When you commit to the long term, you ’ re doing more than growing wealth- you ’ re modelling discipline for the next generation In a time when instant gratification lures young minds into various traps & temptations such as online betting, derivative trading or reckless spending, showing them the strength of steady, purposeful investing is a gift no inheritance can match

When you commit to the long term, you ’ re doing more than growing wealth- you ’ re modelling discipline for the next generation.

Money amassed for its own sake is a hollow victory. But money when passed forward as a baton to fund education, spark innovation, or lift communities, gains meaning beyond digits on a statement

The marginal utility of wealth doesn’t decline when it fuels purpose; it compounds in the lives it touches Imagine teaching your children not just to inherit wealth, but to steward it. That’s how dynasties of wisdom begin.

Simply staying the course, avoiding greed-driven risks, respecting the power of time, and building capital that outlives you is a form of stewardship

The wealth you preserve and grow today can fund the necessities of the less privileged and the dreams of the worthy And that’s a return no market crash can erase

When we next review our portfolio, we must ask ourselves: What trees am I planting? Because the fruits of tomorrow grow from the choices we make today.

CA Abhay Maheshwari, Founder & CEO of ASM Wealth, is a Chartered Accountant and MBA from Indiana University in the US. He has over a decade of experience in the IT & Financial Services Sector and international experience having worked in the Private Equity space in Singapore Abhay has been an active investor since his teenage years and already seen 2 full market cycles. Along with his team, he manages over ₹150 crore in investments across Mutual Funds and Direct Equities Abhay's goal is to empower people by teaching them about personal finance so that they can choose the right strategies & advisors, while not getting carried away by false promises, narratives and misselling. Abhay can be reached at 9892696758/9987675877

Abhay asmwealth@gmail com

https://www linkedin com/in/abhaymaheshwari/

BY NITINKUMAR PAREKH

Business and Profit: Business of Business is to do business and driving force for any business is earning of profits. For ages business understands the language of money and finance works as a business partner in helping realise the business objective of making profits

In commerce education and in finance courses, every student is taught about money measurement concept! What can be translated into money makes sense and what cannot be translated remains an abstract! With every industrial revolution the tools and techniques of money making or profit making have undergone sea change, but the end objective has only got strengthened.

However, since last few years, the business owners and leaders have started realising the pitfalls and shortsightedness of chasing profit at any cost-especially at the cost of planet and people The Triple Bottom Line (TBL) approach considers three dimensions: Profit, People and Planet Thus, we have entered into new refreshing era of

sustainable profit based on solid principles of ESG-Environment, Social and Governance. Let me touch upon these three important aspects of Purpose, Planet and People to drive profit making

Purpose: Purpose is the main driving force and is much wider and holistic as compared making profits It is the core pillar of organisation’s mission. Interestingly, purpose-driven businesses can and should be among the most profitable businesses on earth. Purpose-driven strategies are proven drivers of value creation According to a Deloitte study:

High-purpose companies double their value up to four times faster. Sustainable products sell at a 39 5% price premium.

Consumers are more than four times more likely to trust and recommend purpose-focused brands.

Zydus’s corporate slogan is ‘Dedicated to Life’ This is not a rhetoric but what the organisation stands for. Every organisation 26

encounters some situations in its life where the organisation needs to live upto its purpose even if it is at the cost of making profits or losing the opportunity to make more profits. Let me give one example During Covid-19 epidemic, before vaccines were made available, Remdesivir Injection was considered as the only lifesaving medical treatment Zydus happened to be amongst largest producers of Remdesivir Injection. Our Chairman Mr. Pankaj Patel told that it is not the time to make the profits but time to serve the patients and country at large, going by the principle of patient centricity. Zydus Remdesivir Injection price was the lowest When other producers reduced the prices, Zydus reduced it further. As a CFO, I can vouch that by reduction in selling price of Remdesivir Injection, we would have lost opportunity to earn some hundreds of crores in profits but going by the corporate philosophy of ‘Dedicated to Life’, it was a just a step in the right direction Also, Zydus was the first company in the world to work on DNA based Covid vaccine By the time, we were ready, the epidemic had subsided and thus ultimately Zydus did not sell DNA based vaccine. Here again we lost some money but there was a smile and pride on the face of every Zydans that we have lived up to our corporate purpose of ‘Dedicated to Life.’

Planet: We all owe a great to our planet and it is our utmost duty not to do anything which can harm our earth and environment Zydus is at the forefront in meeting ESG goals A number of measures in maintaining ecological balance are being taken by Zydus. This includes installation of renewable power plant on hybrid basis and water purification of Banganga Lake, amongst others Significant investments are done for employee safety and Zydus has

changed the medical facility set up of Dahod district by putting up Zydus Medical College and Hospital- a great CSR initiative Zydus also encourages and supports grassroot innovation by youngsters, as a part of Zydus Innovation initiatives.

The people-oriented approach and fair and equitable business practices motivate people to deliver their best.

People: People are the core assets of any organisation-much beyond and much more valuable than both tangible and intangible assets on the right-hand side of the balance sheet. A Great Place to Work study found that when employees know how their role contributes to a company ’ s purpose, the organization’s employee retention, wellbeing, and stock market performance all improve. In Zydus, we say that ‘We build people to build our businesses.’ This statement bears testimony of time and is an epitome of sound HR practices, which makes Zydus No 1 organization in India in terms of Future Ready Organisation. No wonder, Zydus continues to occupy a prominent place in the list of ‘Great Places to Work.’

The organisation is able to not only attract but motivate and retain talent for decades This organisation fortunately has history of many people who started their career with Zydus and retired from Zydus. The peopleoriented approach and fair and equitable business practices motivate people to deliver their best. Zydus is absolutely punctual when it comes to performance review and increment decisions. For

example, in my association of 16 years with Zydus, we have every year got our revised April salary in May month without any exception This practice shows the employee commitment and employee respect. Our Chairman Mr. Pankaj Patel is awarded Padam Bhushan award in 2025 and he has dedicated this award to 27000 Zydans working across the globe

CFO has a business partner role and also a role to take care of interests of all stakeholders and ensure corporate governance. Zydus Finance Vision statement is:

‘To be a trusted partner to all stakeholders in collectively building Zydus a global lifesciences company ’ and Zydus Finance mission is toCollaborate actively in capital allocation and strategic business decisions to maximize stakeholders’ value, Safeguard the interests of the organization as a conscious keeper, and Strive continuously to improve standards of corporate governance

The CFO has to champion the cause of ethical business practices and ensure that the organisation does not take any steps which may bring short term gains to the company but can adversely affect the longterm sustainable future of the company, its people or employees, customers, vendors, business partners, shareholders, or planet

The renowned authors John Mackey and Raj Sisodia explain in Conscious Capitalism, that "Conscious businesses are galvanized by higher purposes that serve, align, and integrate the interests of all their major

stakeholders." The CFO, working with the CEO may follow these guiding principles to balance the objectives of profit with ethics and long-term impact:

For CEOs and CFOs, articulating a clear, specific corporate purpose is critical it sets the tone for strategic decisions and aligns stakeholders including employees, customers, vendors, and society. A strong purpose anchors business goals in widely accepted societal values.

Corporate purpose must go beyond slogans it should be embedded into every strategy, policy, and action. CFOs must treat this alignment as essential for long-term sustainability. For instance, Zydus involved senior leaders in shaping its core values to ensure commitment and alignment. Frequent employee engagement drives morale, productivity, and retention

Sustaining organizational direction requires consistent communication of the company ’ s vision and mission through town halls, newsletters, offsites, and leadership messages New employees must be introduced to these during onboarding to ensure alignment from day one

Internal talent should be prioritized to build visible career paths. HR should promote job rotation, enrichment, and leadership development programs that embed core values and ethical thinking. Training must foster decision-making aligned with longterm value and purpose over short-term profit

Companies must share material information promptly and uphold integrity through audits, stakeholder feedback, and fair related-party transactions.

5. Reinforce Values in Practice

HR must regularly reinforce desired behaviors by rewarding value-aligned actions. Performance systems should reflect this e g , linking bonuses to ESG or CSR goals strengthening purpose-led performance

6. Balance Profit with Purpose

CFOs must guide leadership in balancing profit with purpose, using real examples to show how ethical decisions align with company goals. Zydus’s Ethics and Conduct Policy serves as a practical guide for employee decision-making in challenging situations.

7. Strengthen Corporate Governance Transparency and accountability underpin governance. Companies must share material information promptly and uphold integrity through audits, stakeholder feedback, and fair related-party transactions. This is vital for public companies facing regulatory and investor scrutiny.

8. Build for a Sustainable Future

Stakeholders expect long-term thinking in growth plans, capital structure, dividends, and leadership succession. Risk management covering areas like cyber threats and business continuity must evolve with the times to ensure resilience and sustainability

Mr. Nitinkumar D Parekh has brilliant academic track with 6 qualifications including CA, CFA and MBA from IIM, Ahmedabad He is serving as a Group Chief Financial Officer in Zydus Lifesciences Limited, having annual turnover of more than Rs. 22000 crores. He possesses 4 decades of post-qualification experience in finance, legal and IT functions

Mr Parekh is recipient of more than 20 awards in the decade, including Best CFO-Healthcare & Pharma from Assocham (2025) and India’s Best CFO-Large Enterprises by Businessworld in 2021

Mr Parekh is a regular speaker at several forums. It is interesting to note that this finance expert is having a great passion for literature and music and is a good poet. His three books of poems are published in the last 3 years and ‘Aasman’ music album based on his Gazals is released by renowned Playback singer Manhar Udhas.

A news initiative spotlighting recent appointments and key leadership movements in the corporate world.

BY

With India facing a staggering $10.1 trillion funding gap to achieve net-zero emissions by 2070, the need for a new financial paradigm has never been more urgent. Gone are the days when profit alone defined success. Today, a quiet revolution is sweeping India’s financial landscape, where businesses, investors, and consumers demand purpose alongside prosperity "Finance with Purpose" is more than a buzzword it’s a transformative approach that aligns financial strategies with ethical values and long-term societal impact. Indian companies are proving that profitability and purpose can thrive together, challenging the old profit-first mindset.

Finance was once a simple equation: maximize returns, minimize risks. But this model has shown its limits The 2008 global financial crisis and India’s pressing environmental challenges like depleting groundwater and scorching heatwaves reveal the hidden costs of unchecked profitchasing. Stakeholders are now asking:

What’s the real price of short-term gains?

Purpose-driven finance offers an answer. It weaves ethical priorities known as ESG factors (Environmental, Social, and Governance) into the fabric of financial decisions ESG refers to criteria that assess a company ’ s impact on the planet, its people, and its governance practices, guiding investments toward sustainability and fairness. Indian pioneers are embracing this shift Take Tata Group: through its Tata Sustainability Group, it drives renewable energy and community upliftment In 2024, Tata Power scaled its renewable capacity to 4.9 GW, supporting India’s net-zero ambitions Infosys, a tech giant, hit carbon neutrality in 2020 and posted a $3.2 billion net profit in FY 2024, showing purpose and profit in harmony.

Ethics anchor purpose-driven finance. Indian consumers, more informed than ever, crave transparency 68% prefer brands with strong ESG commitments, according to a 2024 EY survey. Gen Z employees echo this 32

sentiment, with 62% valuing ethical workplaces over larger paychecks, as reported by Deloitte India. Companies that ignore this risk losing talent and trust

Corporate governance ties it all together. Past scandals like Satyam’s fraud highlight the fallout of ethical failures, while leaders like HDFC Bank shine Named among Ethisphere’s 2025 World’s Most Ethical Companies, HDFC serves over 8 crore customers and issued $1 3 billion in ESG bonds in 2024. Still, ethical alignment isn’t easy higher costs and tangled supply chains pose real hurdles, though trailblazers like Patagonia prove it’s possible

Greenwashing, however, looms large. Some firms inflate ESG claims to lure investors, eroding credibility. SEBI’s Business Responsibility and Sustainability Reporting (BRSR) framework fights back, mandating stricter disclosures. Ethics isn’t just a moral stance it’s a market advantage

Purpose-driven finance looks beyond the next quarter, tackling India’s climate and social crises head-on Climate change threatens $1.7 trillion in global GDP by 2050, with India facing severe risks like 45°C heatwaves and shrinking water tables. Ignoring these perils courts disaster think stranded assets and lost value.

Indian companies are acting Reliance Industries poured $10 billion into its New Energy arm, aiming for 100 GW of renewable energy by 2030. Its 2024 solar module facility, India’s largest, aligns with the nation’s 500 GW non-fossil fuel target This isn’t charity it’s strategy. ESG-focused funds often outpace traditional ones, with MSCI data showing sustainable indices

beating peers by over 4% annually. Purpose pays off

Inclusivity matters too SEWA Bank, a microfinance pioneer since 1974, has empowered 8 crore low-income borrowers with a Rs 4 2 lakh crore loan portfolio by June 2024. By backing rural women and small businesses, it fuels equity and growth Private credit, hitting $9.2 billion across 163 deals in 2024, also channels funds into ESG-aligned sectors like real estate and tech, amplifying societal benefits.

Measuring impact remains tricky ESG metrics lack uniformity, though tools like the Global Reporting Initiative (GRI) and Sustainalytics help. Emerging solutions, like the Task Force on Climate-related Financial Disclosures (TCFD), are refining standards, offering hope. Critics claim ESG dilutes returns, but evidence suggests otherwise sustainable funds hold their own or better. Policy is stepping up. RBI and SEBI tighten ESG rules, while the 2025 Union Budget earmarked $1.4 billion for green energy. Yet, bridging that $10 1 trillion net-zero gap demands bold public-private partnerships. 34

Finance with Purpose is India’s blueprint for a thriving future. From Tata’s green energy leap to SEWA’s microfinance milestone, Indian firms show profit and purpose are two sides of the same coin. With 86% of global investors eyeing India’s private equity market set to grow from $61.5 million to $347 million by 2033 the opportunity is ripe.

Leaders must weave ESG into every decision, from supply chains to boardrooms. Investors should fuel ethical innovators Consumers can tip the scales by choosing purpose-driven brands. Together, we can forge a Viksit Bharat by 2047 developed, equitable, and sustainable. The clock is ticking let’s make finance a force for good.

Hitesh is a seasoned finance leader with 20+ years of experience transforming financial strategy into business growth

As CFO of Magicbricks since 2009, he has spearheaded M&A, strategic fundraising, ERP rollout, and pre-IPO initiatives solidifying the brand’s industry leadership. A Chartered Accountant with certifications in Information System Auditing, Ethical Hacking, IFRS and AI/ ML, Blockchain specialisation, he seamlessly bridges finance and technology.

Hitesh is a two-time ICAI CFO Award winner (2020, 2024) and has earned accolades including the CFO 100 Award, Best CFO – ECommerce, Indian Achiever’s CFO of the Year, Financial Leadership Award, and multiple features in the CFO Powerlist.

Known for building high-performing teams and driving innovation, his leadership reflects a rare blend of strategic vision, operational excellence, and digital foresight

BY PANKAJ VASANI

Introduction: The Dawn of Conscientious Capital

In the traditional corridors of finance, success has long been measured by balance sheets and bottom lines Profit, efficiency, and shareholder returns formed the trinity of financial purpose Yet, as we stand at the confluence of unprecedented global challenges - climate change, inequality, digital disruption, and geopolitical shifts - a quiet but powerful metamorphosis is underway

Finance, once perceived as the cold custodian of capital, is now being called to don a warmer, more conscientious mantle. We are witnessing the rise of finance with purpose - an evolved financial philosophy that seeks not merely to enrich but to uplift, not solely to optimise but to harmonise.

The Renaissance of Conscience in Capital

The phrase “finance with purpose ” is not just a lofty ideal; it is fast becoming a strategic imperative. In boardrooms and policy summits across the globe, a fundamental question is echoing louder:

Today, more and more institutions are embracing Environmental, Social, and Governance (ESG) frameworks, not as tickbox compliance rituals but as core strategic priorities.

Asset managers are integrating ESG scores into investment models.

Banks are designing green loan products and sustainability-linked bonds.

Venture capital is flowing into clean tech, inclusive fintech, and regenerative agriculture

The invisible hand of the market is, at last, being guided by a visible heart

“The financials were clear,” a CFO of a global infrastructure firm once told me. “But our board approved the project not only because of the IRR - but because we knew our grandchildren would be proud of this choice ”

It is in such moments that finance sheds its sterility and assumes its noblest form. 36

We are witnessing the rise of finance with purpose - an evolved financial philosophy that seeks not merely to enrich but to uplift, not solely to optimise but to harmonise.

Sceptics often caricature purpose-driven finance as a costly indulgence But this view is increasingly obsolete. In fact, a growing body of research demonstrates that ethical and sustainable businesses tend to outperform over the long term. Purpose and profit are not enemies - they are dance partners.

Consider:

Under Paul Polman's stewardship, Unilever embedded sustainability deep into its business model, resulting in a rise in brand equity and investor confidence Tesla eschewed short-term profits for long-term vision-and created one of the most valuable companies in the world In India, SELCO empowers rural communities through solar lighting, while the Tata Group continues to blend legacy with philanthropy.

Each of these examples illustrates that the pursuit of purpose is not a liability - but a lever of legacy.

CFOs, treasurers, and financial strategists must now embrace a new mandate Financial stewardship is no longer limited to safeguarding monetary assets; it now includes curating societal and ecological value.

Modern finance leaders must:

Weigh not just internal rates of return but externalities

Factor in carbon footprints in capital budgeting

Evaluate M&A strategies through the

lens of community impact.

View tax planning as a matter of fairness, not just efficiency.

In one mandate I led, a mid-cap firm pursuing AI-based automation faced potential job losses in a small township Rather than abandon the project, we phased it in with a local skilling initiative The result? Higher productivity, minimal disruption, and stronger stakeholder trust. Such is the alchemy of finance when guided by empathy.

The tyranny of the quarterly earnings cycle has long distorted incentives. Short-termism breeds myopia-sacrificing sustainability, innovation, and ethics for immediate margins

Purpose-driven finance looks beyond the next quarter, tackling India’s climate and social crises head-on.

Yet today, a shift is underway: Investors and Shareholders are demanding long-term resilience. Regulators are pushing for climate disclosures and responsible lending norms.

Consumers, especially Gen Z, are rewarding brands that care.

38

To thrive in this new order, finance must adopt new tools:

Integrated reporting

Impact-weighted accounts

Stakeholder capitalism metrics

The purpose must no longer be a decorative flourish in annual reports It must be embedded into the DNA of financial decision-making.

Innovation is the bridge that connects capital with conscience - solving old problems in new, sustainable ways.

Innovation: The Bridge Between Purpose and Profit

Purpose-driven finance is not about charityit is about intelligent, intentional innovation Across industries, we see examples of this synthesis:

Fintechs offering micro-loans with behavioural nudges for financial wellness.

Green bonds financing climate-resilient infrastructure.

Blockchain enables transparent ESG tracking.

Even derivatives are being reimagined to hedge climate risks

Innovation is the bridge that connects

capital with conscience - solving old problems in new, sustainable ways.

Conclusion: A Finance Worthy of the Future As custodians of capital, we must ask ourselves:

What kind of world are we financing?

Finance with purpose is not a utopian dream-it is an evolutionary necessity. Resilience can no longer be built on profits alone.

Empathy, ethics, and environmental stewardship must co-author the financial narrative

Let us reject the false dichotomy between commerce and conscience. Let us craft finance that funds not just profits but progress, not just expansion but evolution.

Let us remember that finance, at its best, is not an end but a means-a mighty enabler, a catalyst of futures, a mirror of our values

Let us, therefore, wield the power of capital not just with skill - but with soul

Pankaj Vasani is the Senior finance and business leader with over two and half decades of experience in executive roles and as a board & audit committee member. Currently working as the Group Chief Financial Officer with Cube Highways InvIT. Previously worked in leadership roles with Publicis Groupe, Vodafone, Coca-Cola, Subros & in advisory.

BY RAJTA SINGH

In the Bhagavad Gita, Krishna tells Arjuna: "Yad yad ācarati śreṣṭhas tat tad evetaro janaḥ" – Whatever the leader does, others follow

It’s a verse I return to often, especially when I think about culture. Culture isn’t what we say on values posters. It’s what we model, fund, and protect when no one ’ s watching It’s what we fight for when pressure mounts. It’s not a mood; it’s muscle memory

I learned this not from a boardroom, but from my dining table Growing up, I watched my parents run a well-oiled household not just with discipline, but with unwavering clarity on what mattered. There were months when finances were stretched, yet some things never got cut: the house help’s bonus, our school fees, langar monthly, celebrations, contributions for a cause, the food we shared with guests. These weren’t just budget decisions They were reflections of our family's culture our operating model of ethics and priorities.

That’s when I realised: culture is a form of capital

Not the kind you count in rupees, but the kind you draw from when the world is uncertain the reserve of trust, integrity, and shared meaning that keeps an organisation (or a home) standing tall when everything else is under strain

And in today's corporate context, embedding ethics and purpose into the DNA of an organisation is not a “nice-to-have.” It's a non-negotiable The organisations that will thrive tomorrow aren’t just the ones with the strongest balance sheets they’re the ones whose values don’t vanish when the numbers dip.

Purpose and Ethics Aren’t Departments They’re Direction

Too many organizations treat purpose like a CSR campaign, and ethics like a compliance tick box That’s like building a home and outsourcing the foundation.

The best cultures don’t put ethics in the policy document they embed it into decision rights Into pricing conversations Into how vendors are paid and how exits are handled. Purpose is not a poster; it’s a pattern

It’s visible in whether your company pays interns fairly In whether your hiring is biased toward pedigree or potential. In how you talk about profits and what you ’ re willing to trade to get there.

Culture as Capital: How Do You Know You Have It? Think of it like family wealth. You know you ’ ve inherited a strong culture when:

People speak up without fear, and listen without judgment

Managers are measured not just on output, but on how they lead

Decisions are consistent not just convenient

You recover from mistakes with humility, not spin

This is cultural capital. It creates compounding returns in trust, reputation, resilience. And in a world where attention is fleeting and choices are many, trust is the only sustainable currency

Examples from Work and Life

Imagine you ’ re building a team for a mission-critical project. One candidate has all the skills, but is known for cutting corners and hoarding credit. Another is still learning, but deeply collaborative, curious, and values-driven. Whom do you choose?

If your answer is the first, your culture may deliver results but not respect. If your answer is the second, you ' re investing in cultural capital.

At home, when a child lies once, we don’t put them on a PIP. We talk, we understand, we course-correct Culture isn’t built by punishment it’s built by presence. And in organisations, we often forget this very human principle.

When culture is embedded into operations, it stops being something HR drives — and becomes something the business breathes.

Embedding Culture in the Operating Model

Culture becomes capital when it moves from intent to infrastructure:

Budgets reflect values: Wellness, inclusion, learning not just tech upgrades and headcount

Performance metrics include behavior: Not just what was achieved, but how Leadership KPIs include trust-building and ethical decision-making

Purpose is part of product design and goto-market strategies When culture is embedded into operations, it stops being something HR drives and becomes something the business breathes.

This Matters Now More Than Ever

We live in times of hyper-transparency. Employees post reviews while still employed Customers choose brands based on stances Investors track not just your financial returns, but your social ones.

In such a world, culture isn’t the backdrop it’s the brand.

You can’t pivot your way out of a toxic workplace. You can’t rebrand your way out of moral failure. The only way forward is to build deep to embed ethics and purpose into the DNA so completely that even in 42

crisis, they remain intact.

In the Gita, Krishna never gives Arjuna a one-line answer He gives him perspective He shifts the lens from winning a battle to understanding why we fight it

That’s exactly what culture asks of us too. Not “what’s your policy,” but “what’s your posture?” Not “what do you reward,” but “what do you walk past quietly?”

Culture isn’t the side dish to business. It’s the main course It shows up in calendars, in budgets, in how you talk in rooms where power sits heavy

So here’s the question I leave you with not to answer quickly, but to sit with:

If someone studied only your decisions not your decks or dialogues what would they say your culture really is?

Because in the end, culture isn’t what we articulate It’s what we allocate time, money, energy, and truth.

Rajita Singh is the Chief People Officer at Kyndryl India, overseeing HR operations. Formerly leading HR at Broadridge Financial Solutions India, she played a pivotal role in enhancing the company ' s brand as an employer of choice. Rajita is the youngest Convenor of the CII HR-IR Panel for the State and is actively engaged in NASSCOM Beyond work, she enjoys car racing, Bharatnatyam dancing, counseling, meditation, doodling, and reading

Culture, too, is an enabler. HR ensures that values such as integrity, accountability, and inclusivity are interwoven in the organizational fabric.

BY RISHIKESH RAVAL

As an HR leader, I believe the concept of “Finance with Purpose” is essential in today’s times. It’s about aligning financial strategy with integrity, long-term impact, and people-centric values. Our role in HR is pivotal in shaping a culture where profit and purpose co-exist meaningfully. By doing this we are serving the interests of our shareholders, employees, customers and society at large.

‘Finance with Purpose’ requires businesses to move beyond traditional metrics and embrace ESG (Environmental, Social, and Governance) principles. From an HR standpoint, this involves building capabilities that foster a culture of transparency and embed shared purpose in the eco-system.

Purpose-driven finance attracts purposedriven people Today’s workforce, particularly the younger generation, seeks employers whose values align with their own. When a company is transparent about how its financial success emerges from ethical practices, social impact, and longterm sustainability, it becomes a magnet for top talent HR plays a strategic role in

amplifying this narrative through purpose-led talent development and people-centric initiatives.

Culture, too, is an enabler. HR ensures that values such as integrity, accountability, and inclusivity are interwoven in the organizational fabric. Performance management systems, recognition programme, and even compensation structures should reflect more than just financial results they should reward behaviour that contributes to long-term value creation. This helps organizations take action that are beneficial not only for the business, but for society at large.

When employees understand how their roles contribute to broader financial goals and how those goals connect to a meaningful purpose they become more engaged. It brings in greater involvement and ownership

A workforce that sees the “why” behind business decisions is more likely to champion them. During the Covid years, we as an organisation, decided to supply a critical therapy, Remdesivir at the most economical price of Rs. 899. This was done so that people across the country could avail this drug at the 45

most affordable price. As a global lifesciences company with a purpose to empower people to lead healthier and more fulfilled lives, this was a mission close to our heart. During the entire phase, our manufacturing plants were working round the clock, our research centres were working on the novel plasmid DNA vaccine to prevent Covid and all other teams were at work every single day despite the odds, to ensure that there was no disruption in supplies These efforts were inspired by our Management’s vision that the organisation will do everything it takes to help the nation fight the healthcare crisis.

When we align our financial goals with longterm vision and overarching purpose, we create organizations that are not only successful but respected and resilient.

Organisations today need to strike the balance between profit, integrity, and impact. It requires continuous dialogue and adaptation HR is uniquely positioned to champion ‘Finance with Purpose’ by creating a strong foundation of culture, mentoring new leaders, and engaging employees for a shared mission, vision and goals. When we align our financial goals with long-term vision and overarching purpose, we create organizations that are not only successful but respected and resilient This is the future of work, and HR is best placed to lead the way

Rishikesh Raval is the President – Group Human Resources & Corporate Communications, Zydus Lifesciences Ltd With over two decades of experience, Rishikesh has made a remarkable impact in human behavior, organizational development, and cultural transformation across leading MNCs and Indian enterprises. Known for his expertise in Programmed Change Management, he has successfully built scalable, performance-driven organizational architectures. His journey spans roles at Sarabhai Group, Glaxo, and Pfizer, and he is acclaimed for leading large-scale transformations, building cross-cultural leadership teams, and turning HR capabilities into strategic business advantages. His strengths include managing complex global workforces, driving turnarounds, shaping high-performance cultures, and nurturing leadership talent for the future.

THESE AREN’T JUST RIDDLES THEY’RE REFLECTIONS OF THE VALUES THAT SHAPE MEANINGFUL GROWTH. READY TO DECODE THE BALANCE BETWEEN PROFIT AND PURPOSE?

��⚖

I help busine sk? I balance books, , j What principle am I built on?

➡ Hint: It’s not just about numbers it’s about doing what’s right

I drive success, but I don’t race. I consider people, planet, and pace. Short-term wins don’t cloud my sight, I focus on future done ethically right. What kind of mindset is this?

➡ Hint: It’s the lens that looks beyond quarterly results.

I’m present in budgets, yet beyond math, Guiding leaders down the ethical path When money talks, I also ask “Should it?” Not just “Can we?”, but “Is it fit?” What kind of decision-making is this?

➡ Hint: It blends business acumen with moral judgment.

BY CA PALAK PAVAGADHI

As a Chartered Accountant who has walked the corridors of global boardrooms and pored over the ledger lines of both multinational corporations and family‐run enterprises, I am continually struck by one immutable truth: financial independence is not a matter of birthright but of stewardship. Young professionals today regardless of whether they were “fed with a silver spoon or a golden one ” share a common aspiration: to generate assets that yield sustainable, passive income streams and, in so doing, secure personal liberty and contribute meaningfully to society

In Rich Dad Poor Dad, Robert Kiyosaki famously contrasts the mindset of employees with that of entrepreneurs and investors:

“The poor and the middle-class work for money. The rich have money work for them.” This simple yet profound insight underpins the leap from active to passive income

Consider the example of Warren Buffett, who began buying shares at age eleven and built Berkshire Hathaway into a conglomerate whose insurance float

underwrites investments across industries His patience and discipline illustrate how compounding both financial and intellectual creates exponential wealth over decades.

On the other end of the spectrum, the story of Enron serves as a cautionary tale. Executives traded on opaque “special purpose entities” and aggressive mark-to-market accounting to paint a façade of profitability. When the bubble burst in 2001, thousands lost jobs, pensions evaporated, and trust in financial disclosures was severely dented.

Hard work remains the most reliable vehicle toward asset accumulation. Yet effort alone is insufficient without leverage whether of capital, networks, or expertise

Capital Leverage: A young private‐equity analyst structured a club‐deal to acquire a distressed manufacturing unit By pooling capital and securing a vendor note, the consortium reduced equity outlay by 40%, then deployed lean Six Sigma principles to double EBITDA in eighteen months

Network Leverage: In The Startup of You, Reid Hoffman emphasizes that “ your 48

In today’s growthdriven organizations, culture is a form of capital, one that drives performance, engagement, and trust.

network is the asset that travels with you. ” A colleague leveraged alumni connections to secure seed funding for a fintech platform, then enlisted former auditors to ensure robust compliance accelerating both growth and credibility.

Knowledge Leverage: As accountants, we appreciate Benjamin Graham’s dictum from The Intelligent Investor: “Investment is most intelligent when it is most businesslike.”

Conducting deep due diligence understanding the economic moat, competitive positioning, and regulatory landscape turns raw savings into well‐positioned, revenue‐generating assets.

Shortcuts may yield swift gains, but they erode the bedrock of reputation an asset no ledger can fully capture. Consider Bernard Madoff, whose Ponzi scheme promised astonishing returns until his house of cards collapsed, costing investors over $65 billion and landing him in prison for life.

In contrast, Patagonia, under Yvon Chouinard’s leadership, has pledged 1% of sales to environmental causes and turned transparency into a differentiator Their annual Environmental & Social Responsibility report goes beyond metrics, narrating stories of river clean-ups and fair-wage audits reinforcing customer loyalty and employee pride Their balance sheet may not be the flashiest, but their brand equity is indelible.

A truly purposeful financier thinks decades ahead. The Norwegian Sovereign Wealth Fund invests the country’s oil revenues globally, preserving capital for future generations. Similarly, family offices

worldwide are shifting allocations toward impact investments renewable energy, affordable housing, health‐tech recognizing that the yield on a sustainable world far outstrips any single‐digit return

As Chartered Accountants, we guide clients to structure trusts, endowments, and philanthropic vehicles that marry tax efficiency with societal benefit.

YOUR PROCESS, “UNWAVERING INTEGRITY” BECOMES MORE THAN AN IDEAL

I offer three pillars for your financial journey: Intentional Asset Allocation

Balance growth (equities, private equity) with resilience (real estate, fixed income) and impact (green bonds, social enterprise). Rigorous Due Diligence

Embrace the spirit of Philip Fisher’s Common Stocks and Uncommon Profits: seek companies with visionary management, robust R&D pipelines, and ethical supply chains

In Good to Great, Jim Collins observes that Level 5 leaders couple fierce resolve with personal humility. Let your compass be calibrated by transparency and accountability. By embedding real-world checks and clear reporting into your process, “unwavering integrity” becomes more than an ideal it becomes the concrete way you

build trust, protect reputation, and sustain long-term performance

Financial independence is not a destination but a responsibility. Every asset you acquire, every structure you advise, and every return you harvest carries an implicit contract with society.

As Chartered Accountants and stewards of capital, our highest calling is to ensure that “ money works for us ” in ways that uplift yielding profits that amplify rather than diminish human potential. In the words of John Maynard Keynes,

“The long run is a misleading guide to current affairs In the long run we are all dead. But the long run is where we make our stand.”

So let us build with purpose, invest with principle, and leave a legacy richer than any balance sheet can measure.

With over 25 years of experience in law and taxation, CA Palak Pavagadhi is a passionate professional committed to solving complex tax issues and serving society through expert counsel. He is the Founder of Pavagadhi Shah & Associates and a mentor with MBReS Consulting Services LLP and Aspan Consultancy LLP

An accomplished speaker and mentor to over 7,500 Chartered Accountants, he brings deep expertise in litigation and assessment procedures at both national and international levels He serves on the Board Committee of the Global Business Round Table (Investment Committee) and has made significant contributions through ICAI committees, including the BOS(A), Corporate & Allied Laws, and the Financial Review and Restructuring Board.

BY SHWETA MOHANTY