Q1-2025

Q1-2025

The first quarter of 2025 unfolded against a backdrop of mixed economic signals and shifting consumer behaviors. Rising mortgage rates, stubborn inflation, and geopolitical frictions all contributed to an atmosphere of uncertainty. Yet, across Westchester, Putnam, and Dutchess counties, the residential real estate market exhibited remarkable adaptability and, in many cases, quiet strength.

From south to north, a familiar pattern has re-emerged: as affordability continues to be tested in southern Westchester, buyer activity has radiated outward. Lower Westchester, historically one of the most competitive areas, saw resilient pricing and a slight uptick in sales. But as inventory remained limited and prices climbed, buyers expanded their search parameters geographically, first into Northern Westchester, then into Putnam, and increasingly into Dutchess. This outward flow has created a subtle ripple effect, with each ring absorbing demand from the one below it.

This geographic migration underscores a broader truth: while elevated mortgage rates have slowed decision-making and extended days on market, they have not fundamentally dampened demand. Instead, they have forced buyers to be more discerning and value-driven, creating a landscape where well-priced, move-in ready homes continue to command strong interest, often at or above asking prices.

In Westchester, single-family home sales rose 8.5% compared to Q1 2024. This was accompanied by a 5% increase in the average sale price, which reached $1.18 million. Despite a notable rise in average days on market, from 39 to 67, the sale-to-list price ratio remained a robust 101.5%, suggesting that well-positioned homes are still finding ready buyers. Particularly active submarkets included Scarsdale and Tuckahoe in the south, while Valhalla and White Plains drove notable growth in central Westchester. In the north, Bedford and Chappaqua saw strong appreciation, with median prices climbing by double digits.

In Putnam County, total sales volume declined 9% versus Q1 2024, but that headline masks a more nuanced reality. Median prices rose 10%, indicating that demand has not disappeared, it has simply shifted upmarket. Mahopac, Carmel, and Brewster remain highly active, with buyers drawn to the relative affordability and quality of life just beyond Westchester’s northern border.

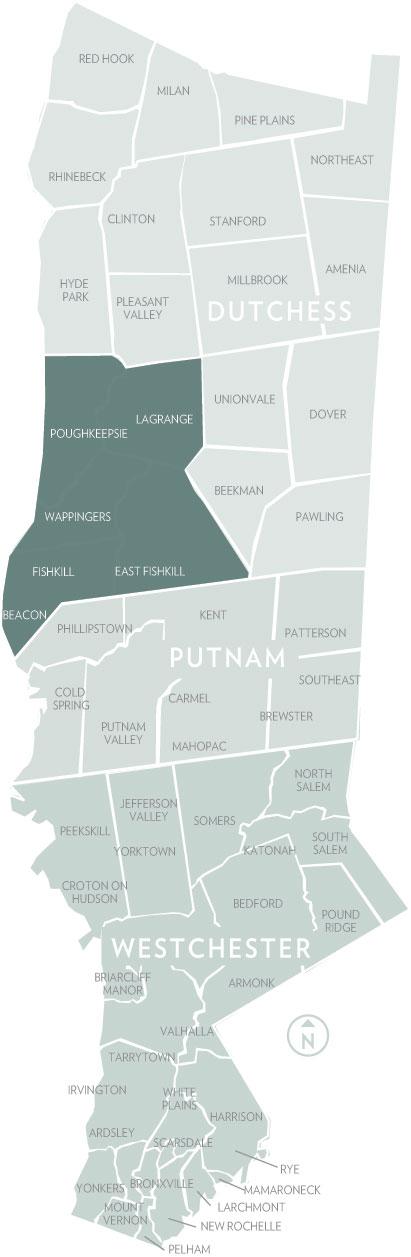

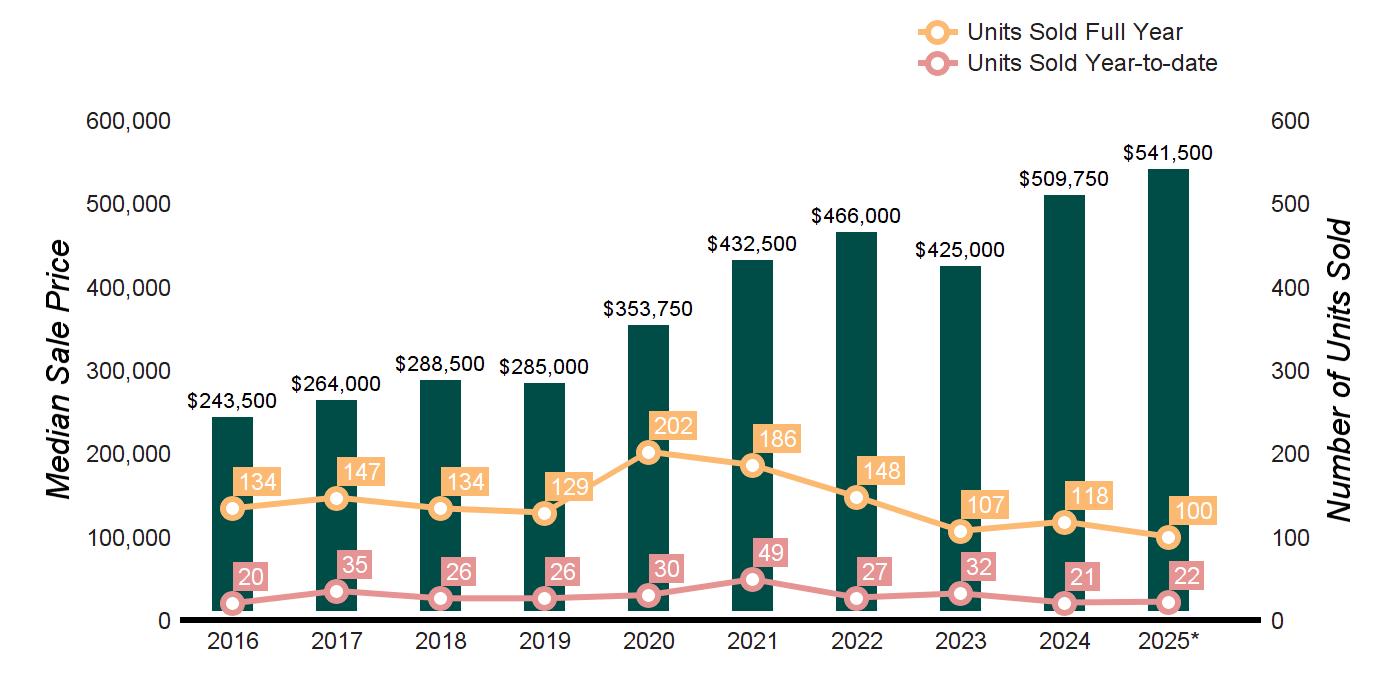

Dutchess County, while not detailed in full within this section, continues to attract interest, particularly in commuterfriendly hubs like Beacon, LaGrange, and Red Hook. These areas are benefiting from the same centrifugal force seen elsewhere: as affordability narrows in southern Westchester, buyers continue moving north in search of value, space, and long-term upside.

Layered on top of these local dynamics are national and global forces. Mortgage rates, which hovered between 6.6% and 6.9% throughout the quarter, are a far cry from the historic lows of the pandemic era. Yet, while they have tempered urgency, they have also motivated a more strategic buyer, one willing to expand search areas and negotiate thoughtfully. Tariff tensions with China and instability in Eastern Europe have quietly pushed up material costs, influencing renovation timelines and pricing. At the same time, strong regional employment and wage growth have helped buyers keep pace.

Looking ahead, the second quarter of 2025 is expected to bring a modest increase in listing activity as would-be sellers grow more comfortable with the new normal of interest rates and recalibrated expectations. Buyers remain ready, but selective. The market is increasingly defined not by price points alone, but by property quality, location, and value alignment.

In this shifting environment, the connective thread is movement, both literal and strategic. Buyers are moving farther, thinking more holistically, and stretching beyond traditional boundaries. Sellers who recognize and adapt to this reality will continue to find success. As Q1 closes, the tone is one of cautious confidence: grounded in data, shaped by macro forces, and propelled by the enduring desire for home.

At Houlihan Lawrence, we recognize that every home sale or purchase is a deeply personal and significant decision, and we remain uniquely positioned, with local expertise, market insight, and trusted relationships, to guide buyers and sellers through every step of the journey.

With Warm Regards,

Liz Nunan President and CEO

WESTCHESTER COUNTY

SingleFamilyHomeOverview

NEW YORK CITY GATEWAY

MountVernon,NewRochelle,Pelham,Yonkers

LOWER WESTCHESTER

Bronxville,Eastchester,Edgemont,Scarsdale, Tuckahoe

THE RIVERTOWNS

Ardsley,BriarcliffManor,DobbsFerry,Elmsford, Hastings,Irvington,MountPleasant,Ossining, Pleasantville,PocanticoHills,Tarrytown

GREATER WHITE PLAINS

Greenburgh,Valhalla,WhitePlains

THE SOUND SHORE

BlindBrook,Harrison,Mamaroneck,Port Chester,RyeCity,RyeNeck

FIRST QUARTER 2025

NORTHERN WESTCHESTER

Bedford,ByramHills,Chappaqua,KatonahLewisboro,NorthSalem,Somers

NORTHWEST WESTCHESTER

Croton-Harmon,HendrickHudson,Lakeland, Peekskill,Yorktown

WESTCHESTER COUNTY

CondominiumOverview

WESTCHESTER COUNTY

Co-OperativeOverview

PUTNAM COUNTY

Brewster,Carmel,Garrison,Haldane,Mahopac, PutnamValley

PUTNAM COUNTY

CondominiumOverview

DUTCHESS COUNTY

SingleFamilyHomeOverview

SOUTHEAST DUTCHESS

Beekman,Dover,Pawling,UnionVale

SOUTHWEST DUTCHESS

Beacon,EastFishkill,Fishkill,LaGrange, Poughkeepsie,Poughkeepsie/City,Wappinger

NORTHEAST DUTCHESS

Amenia,NorthEast,PinePlains,Stanford, Washington

NORTHWEST DUTCHESS

Clinton,HydePark,Milan,PleasantValley,Red Hook,Rhinebeck

DUTCHESS COUNTY

CondominiumOverview

Source: Onekey MLS, SINGLE FAMILY HOMES

MOUNT VERNON, NEW ROCHELLE, PELHAM, YONKERS

Click on a School district to obtain the latest monthly market report.

SUPPLY DEMAND ANALYSIS

31, 2025

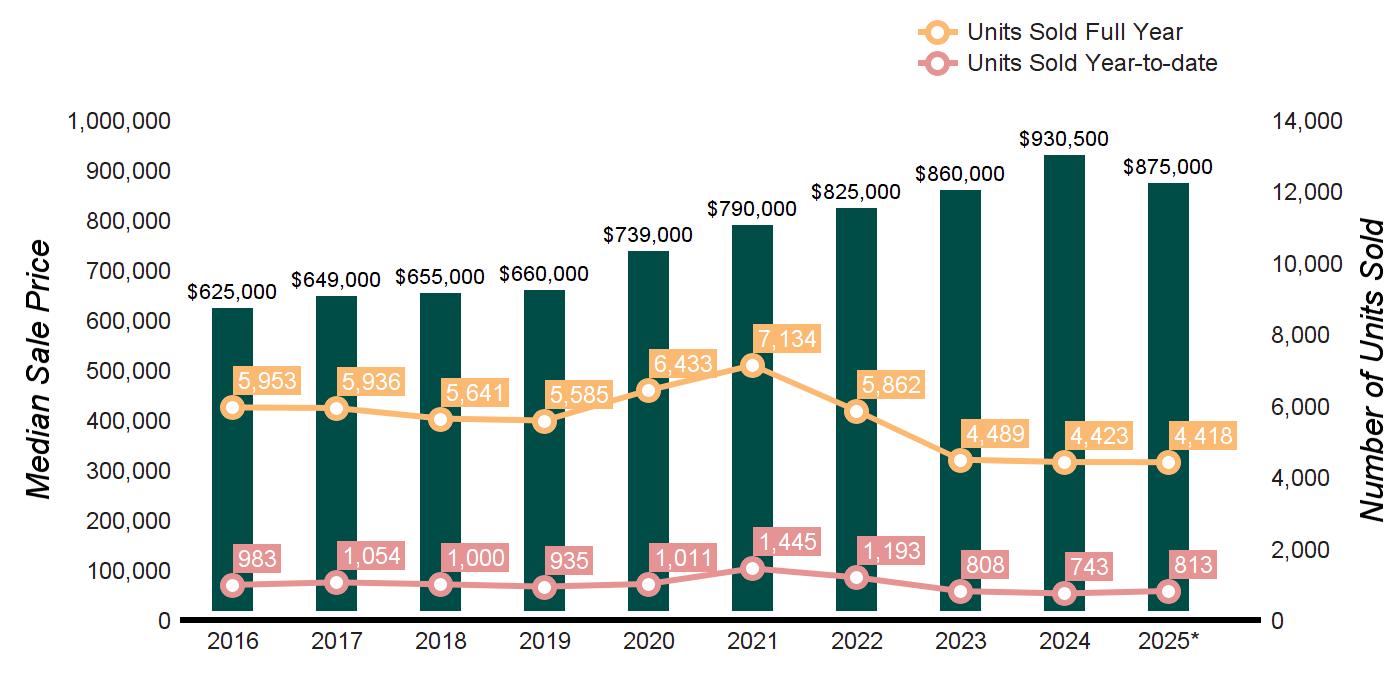

MARKET HISTORY

Source: Onekey MLS, Single-family homes, Zone 6

BRONXVILLE, EASTCHESTER, EDGEMONT, SCARSDALE, TUCKAHOE

Click on a School district to obtain the latest monthly market report.

AS OF MARCH 31, 2025

31, 2024

ARDSLEY, BRIARCLIFF MANOR, DOBBS FERRY, ELMSFORD, HASTINGS, IRVINGTON, MOUNT PLEASANT OSSINING, PLEASANTVILLE, POCANTICO HILLS, TARRYTOWN

Click on a School district to obtain the latest monthly market report.

OF MARCH 31, 2025

31, 2024

Source: Onekey MLS, Single-family homes, Zone 4

GREENBURGH, VALHALLA, WHITE PLAINS

Click on a School district to obtain the latest monthly market report.

SUPPLY DEMAND ANALYSIS AS OF MARCH 31, 2025

OF MARCH 31, 2024

MARKET HISTORY

BLIND BROOK, HARRISON, MAMARONECK, PORT CHESTER, RYE CITY, RYE NECK Click on a School district to obtain the latest monthly market report.

ANALYSIS

OF MARCH 31, 2025

31, 2024

BEDFORD, BYRAM HILLS, CHAPPAQUA, KATONAH-LEWISBORO, NORTH SALEM, SOMERS Click on a School district to obtain the latest monthly market report.

AS OF MARCH 31, 2025

31, 2024

SOLD

CLICK ON A SCHOOL DISTRICT FOR THE LATEST MONTHLY MARKET REPORT. CROTON–HARMON HENDRICK HUDSON LAKELAND PEEKSKILL

Source: Onekey MLS, Single-family homes, Zone 1

CROTON–HARMON, HENDRICK HUDSON, LAKELAND, PEEKSKILL, YORKTOWN

Click on a School district to obtain the latest monthly market report.

SUPPLY DEMAND ANALYSIS

OF MARCH 31, 2025

31, 2024

MARKET HISTORY

Demand Ratio Key 1-4:

BREWSTER, CARMEL, GARRISON, HALDANE, LAKELAND, MAHOPAC, PUTNAM VALLEY Click on a School district to obtain the latest monthly market report.

31, 2025

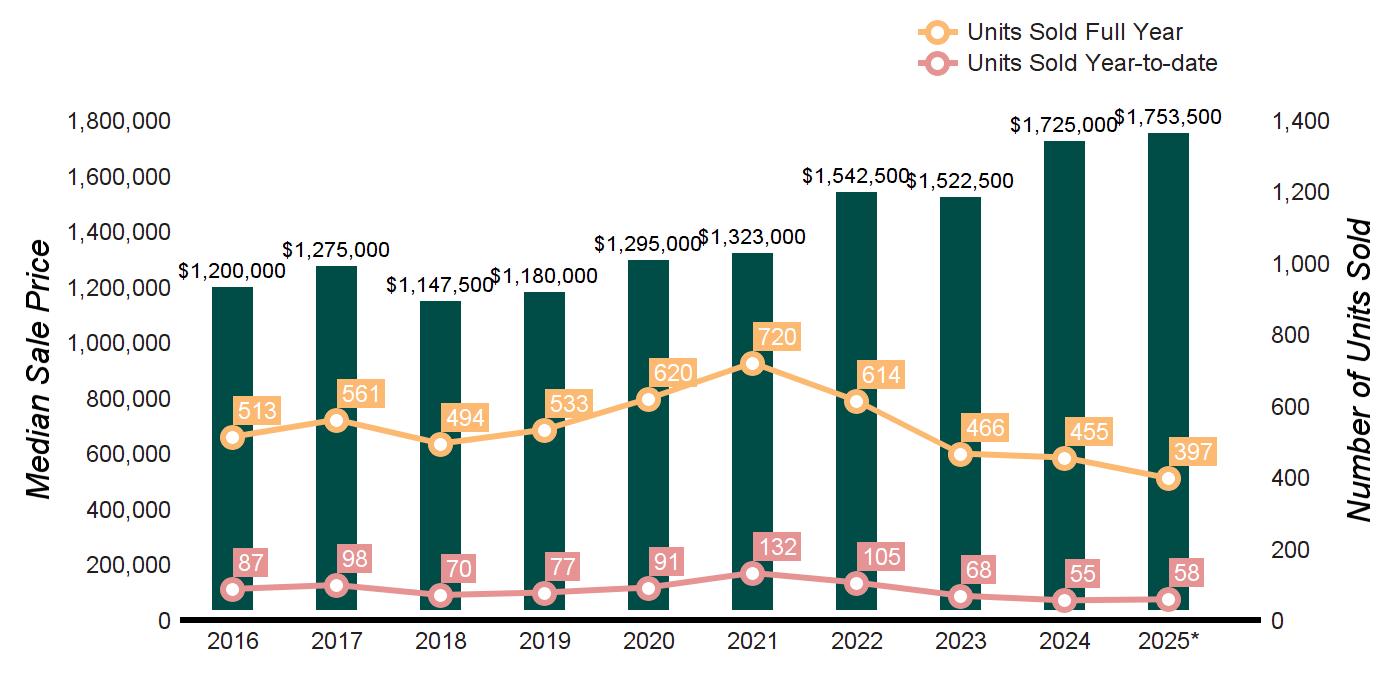

MARKET HISTORY

BEACON, EAST FISHKILL, FISHKILL, LA GRANGE, POUGHKEEPSIE TWP, POUGHKEEPSIE CITY, WAPPINGER

Click to obtain a specific town/city monthly market report.

OF MARCH 31, 2025

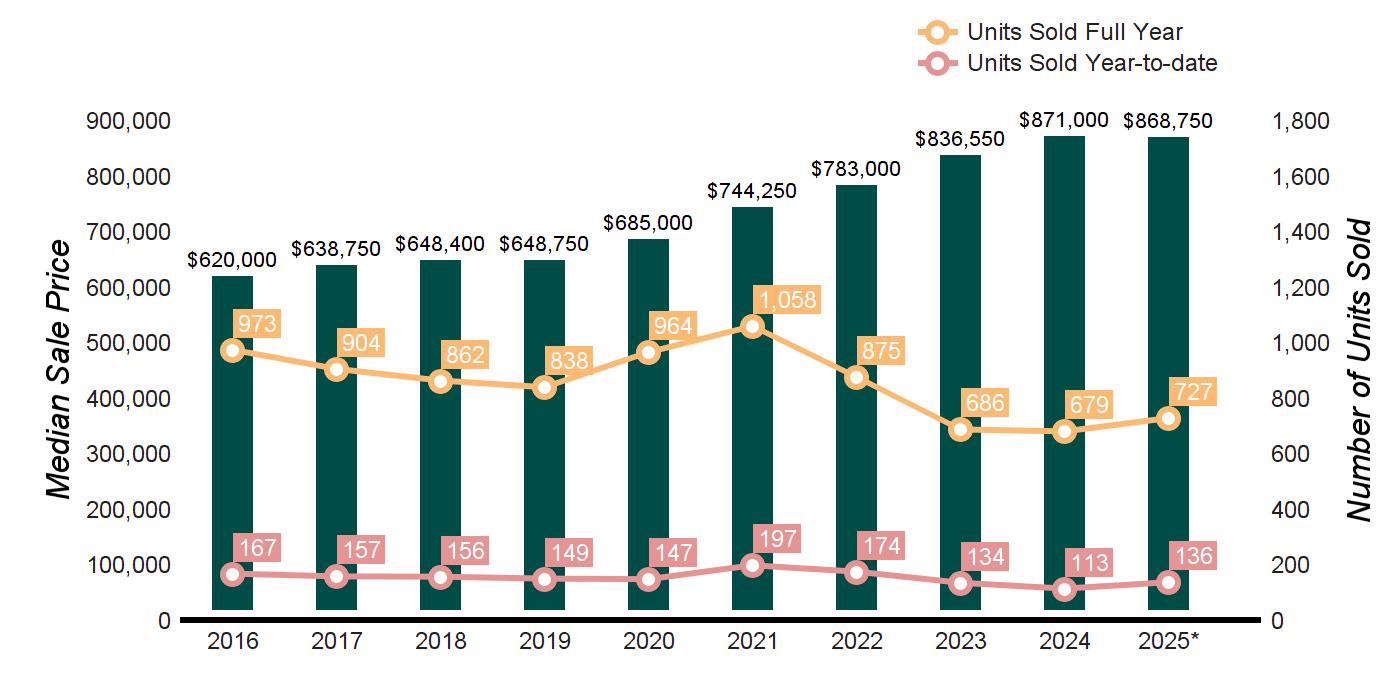

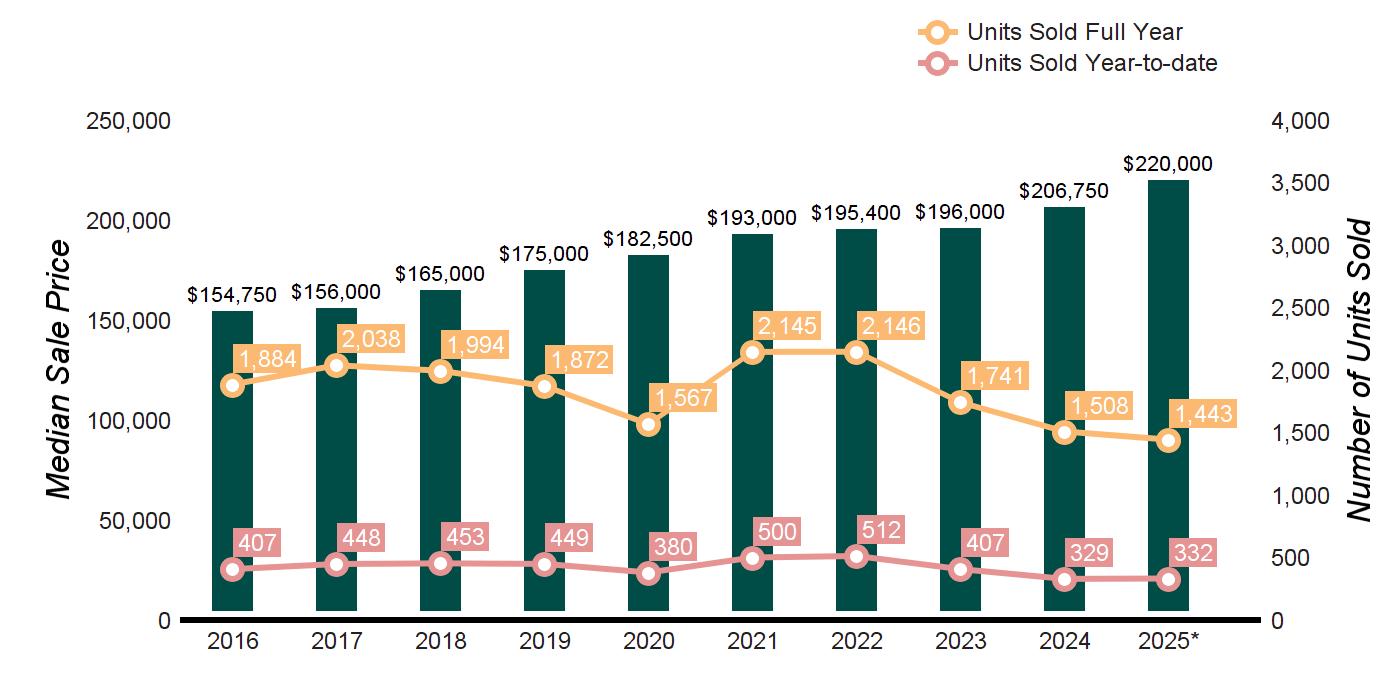

MARKET HISTORY

Source: Onekey MLS.

BEEKMAN, DOVER, PAWLING, UNION VALE

Click to obtain a specific town/city monthly market report.

SUPPLY

ANALYSIS AS OF MARCH 31, 2025 AS OF MARCH 31, 2024

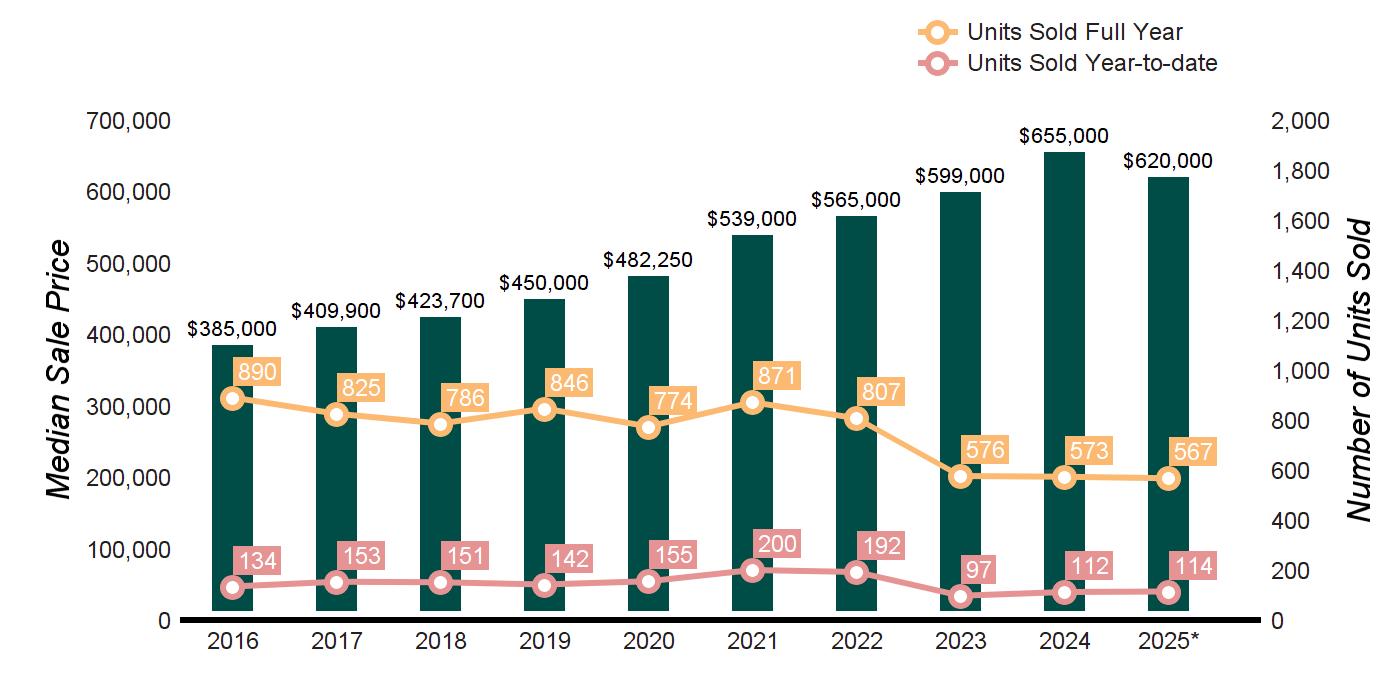

MARKET HISTORY

Source: Onekey MLS.

CLICK TO OBTAIN A SPECIFIC TOWN/CITY MONTHLY MARKET REPORT.

CLINTON, HYDE PARK, MILAN, PLEASANT VALLEY, RED HOOK, RHINEBECK

Click to obtain a specific town/city monthly market report.

SUPPLY

31, 2025

HOMES SOLD

Source: Onekey MLS.

TO OBTAIN A SPECIFIC TOWN/CITY MONTHLY MARKET REPORT.

MEDIAN SALE PRICE

AMENIA, NORTH EAST, PINE PLAINS, STANFORD, WASHINGTON

Click to obtain a specific town/city monthly market report.

SUPPLY DEMAND ANALYSIS AS OF MARCH 31, 2025

31, 2024

MARKET HISTORY

Demand Ratio Key 1-4: