Q1-2025

Q1-2025

Columbia County entered the first quarter of 2025 with a renewed sense of contrast. The narrative here is not one of broad-based growth or universal cooling, but rather a highly segmented market shaped by micro-geography, property type, and price sensitivity. Some towns experienced a surge in high-end activity, while others saw transactions stall entirely. It is a story of pockets, pockets of demand, pockets of inventory, and pockets of transformation.

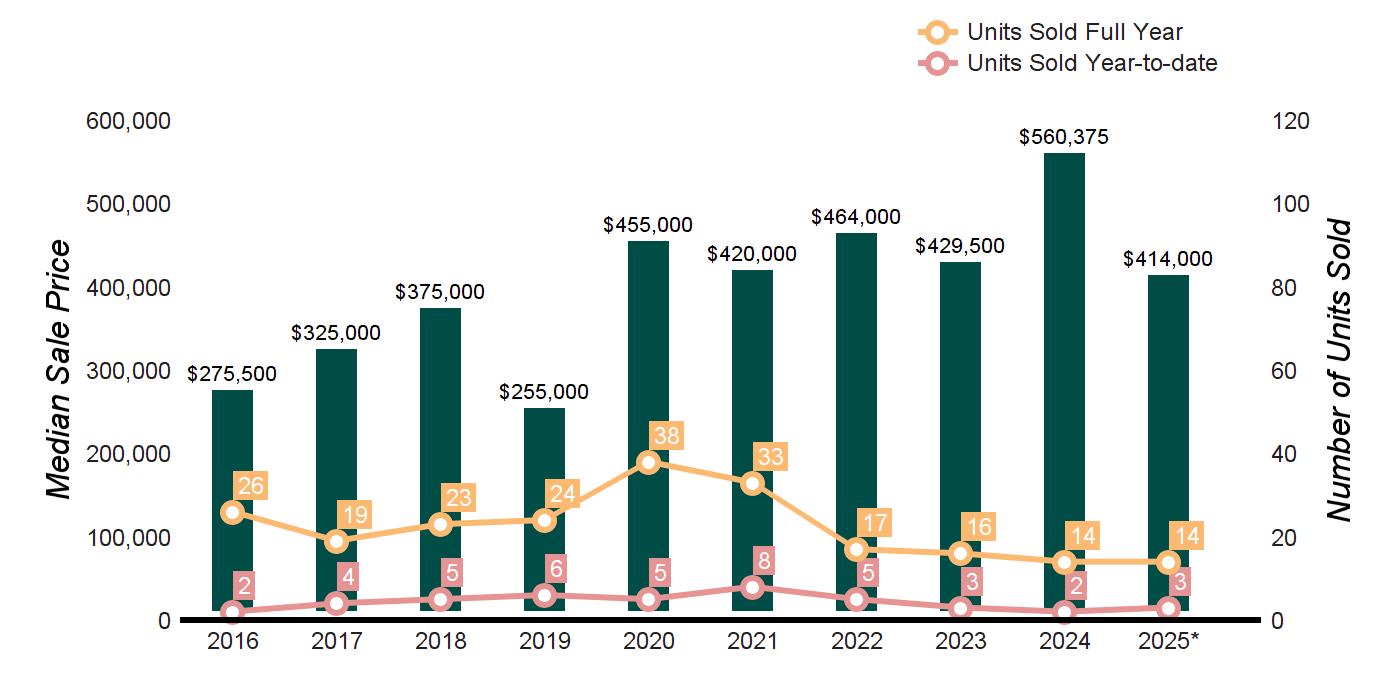

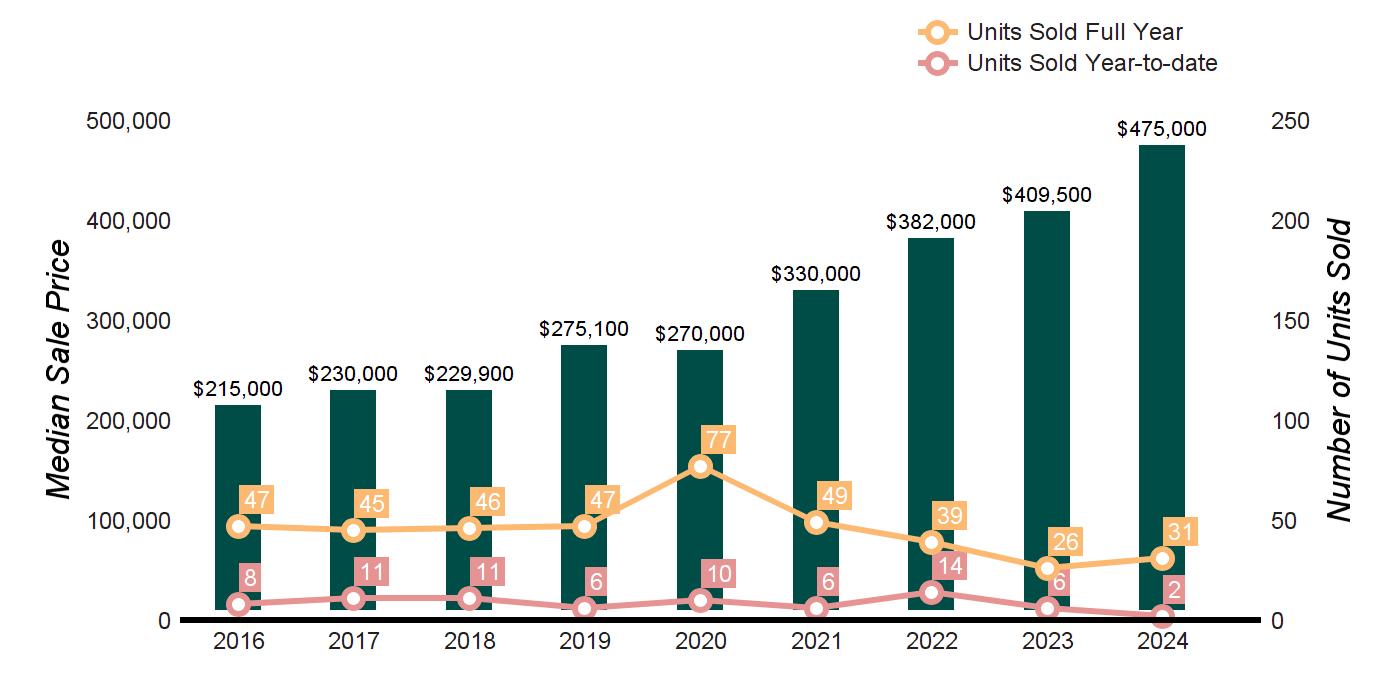

Activity varied drastically by town. Chatham, for example, posted a 75 percent increase in homes sold and saw its median price more than double year over year. Its average days on market dropped from 64 to just 16, signaling quick absorption and high demand for the right product. In contrast, nearby Copake reported zero homes sold in the quarter, down from two the year prior. This juxtaposition reflects not just differing inventory levels, but buyer hesitance at certain price points or conditions.

Some of the strongest pricing momentum came from smaller volume towns. In Austerlitz, the average sale price more than doubled, while price per square foot jumped nearly 19 percent. Meanwhile, Canaan saw prices rise modestly overall, but with volatility in median pricing and a dramatic spike in days on market, suggesting a mix of buyer and seller misalignment.

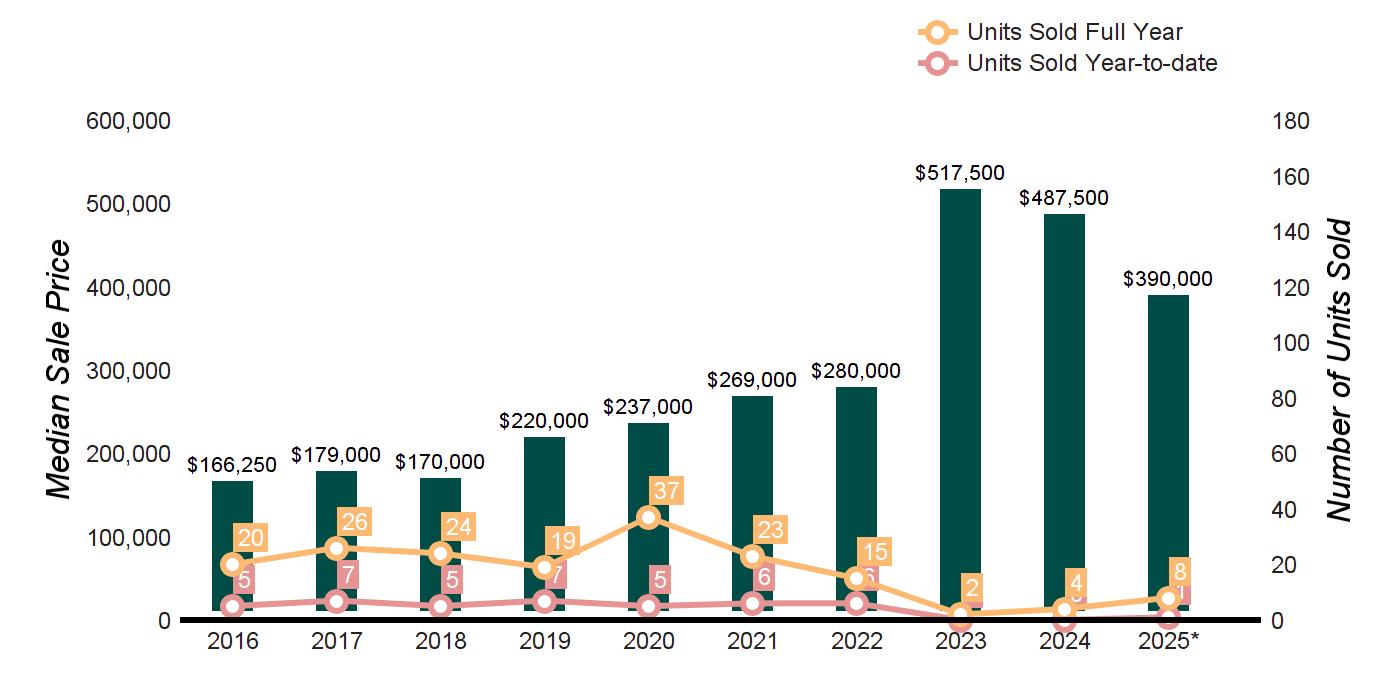

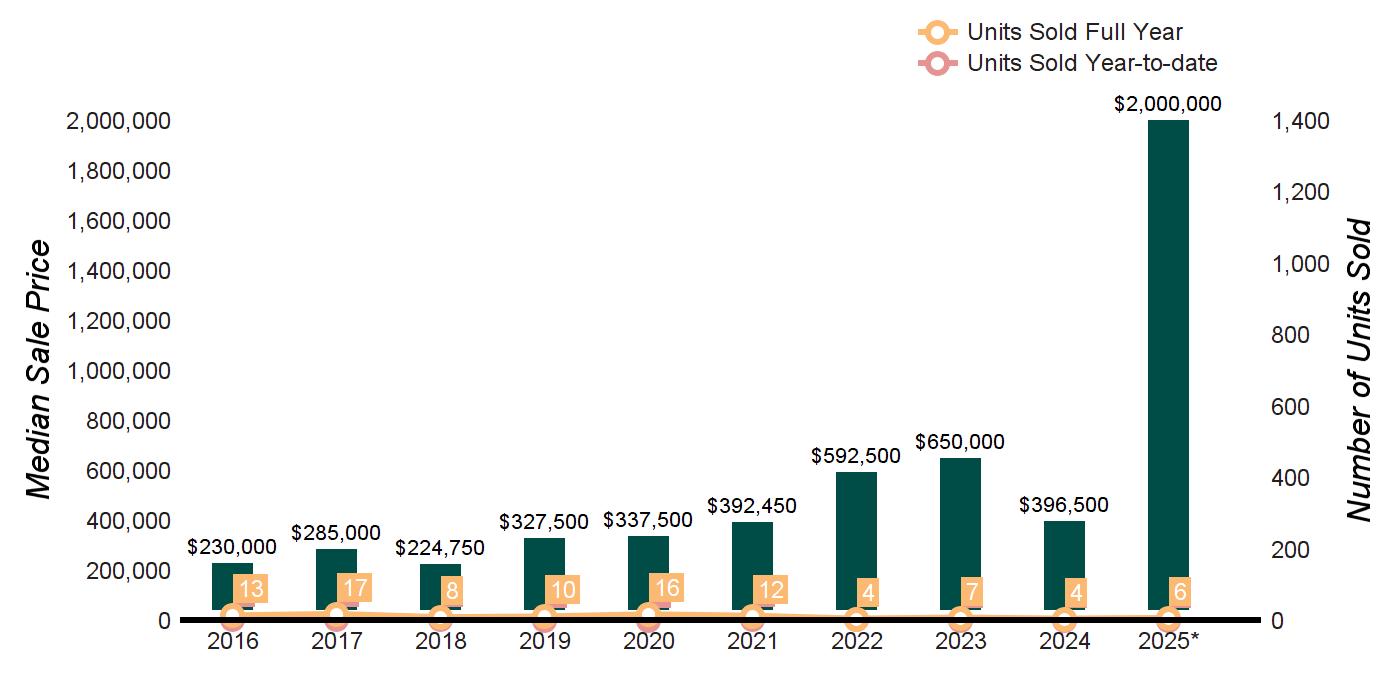

The luxury market continued to influence headline statistics. A single $2 million transaction in Taghkanic, for instance, skewed averages upward in an otherwise quiet quarter. In Germantown and Hillsdale, price appreciation was substantial but uneven. Germantown’s average price fell slightly, while the median plummeted nearly 44 percent, a sign that fewer luxury listings may have traded hands even if demand at the top end remains.

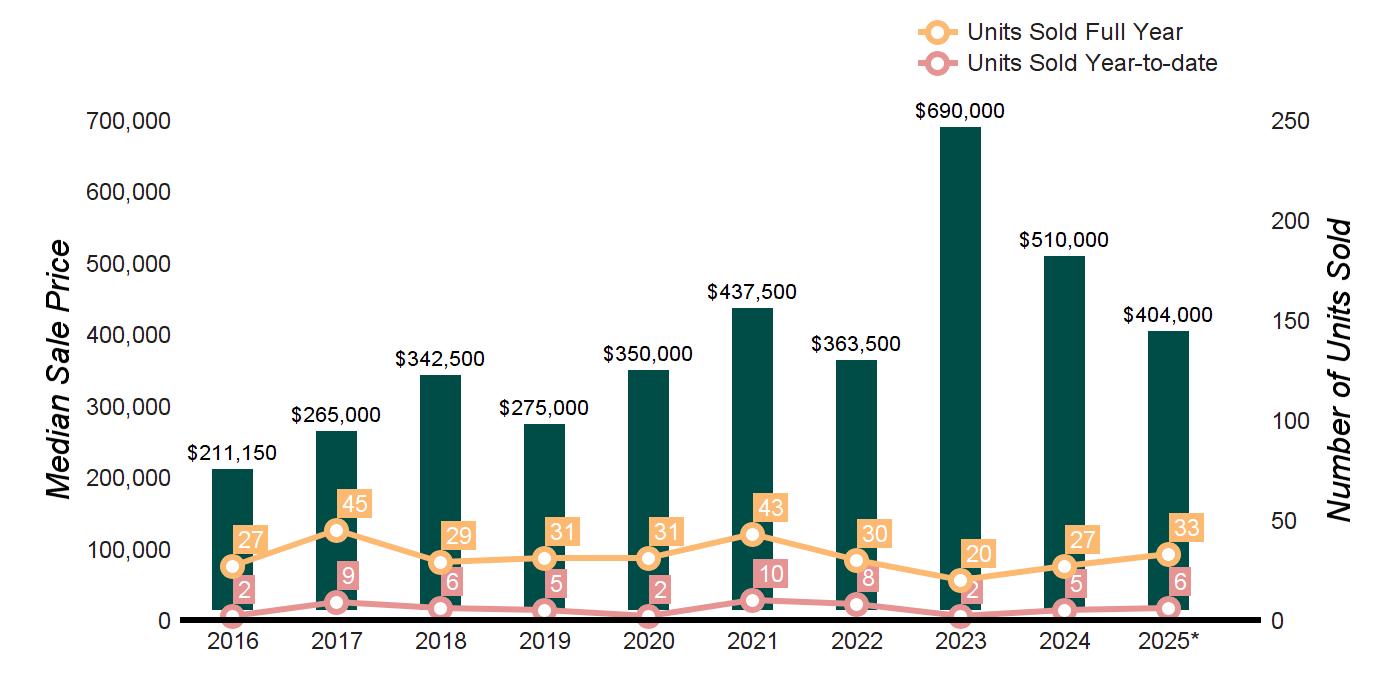

Hudson, often considered the cultural and economic anchor of the county, experienced a different kind of shift. Sales volume fell by 24 percent, yet the average and median prices nearly doubled. Days on market remained relatively low, and the saleto-list ratio rose slightly, suggesting strength in the quality tier of listings. This points to a market not cooling, but becoming more concentrated around desirable, well-positioned properties.

Broadly speaking, the quarter showed that Columbia County is maturing into a more bifurcated real estate environment. Transactions are being driven less by general sentiment and more by precise alignment between buyer expectations and property offerings. Homes that are well-priced, move-in ready, or architecturally distinct are commanding premiums. Others, particularly those requiring updates or situated farther from commuter corridors, are sitting longer or not selling at all.

As the spring market begins to take shape, the county sits on the edge of opportunity. Sellers with realistic pricing and strong presentation will benefit from continued interest, especially from second-home buyers and city dwellers seeking weekend retreats. However, volatility should be expected. With mortgage rates still hovering near seven percent and inventory trickling in sporadically, timing and strategy will define success.

Columbia County's real estate story in Q1 2025 is best understood not by averages, but by attention to detail. Micro-market performance, property condition, and pricing strategy continue to play an outsized role in outcomes. For buyers and sellers alike, success will hinge on nuanced understanding and local insight.

At Houlihan Lawrence, we recognize that every home sale or purchase is a deeply personal and significant decision, and we remain uniquely positioned, with local expertise, market insight, and trusted relationships, to guide buyers and sellers through every step of the journey.

With Warm Regards,

Liz Nunan President and CEO

FIRST QUARTER 2025

STUYVESANT

Source : CGND MLS

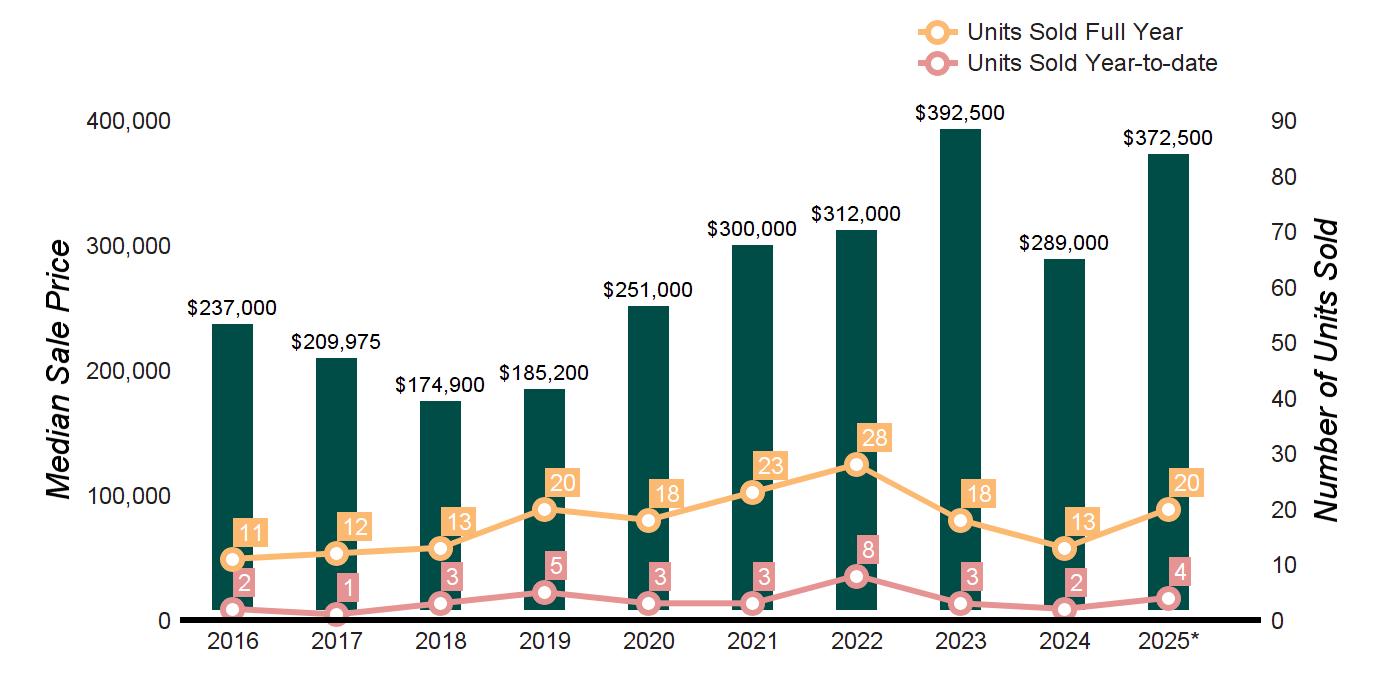

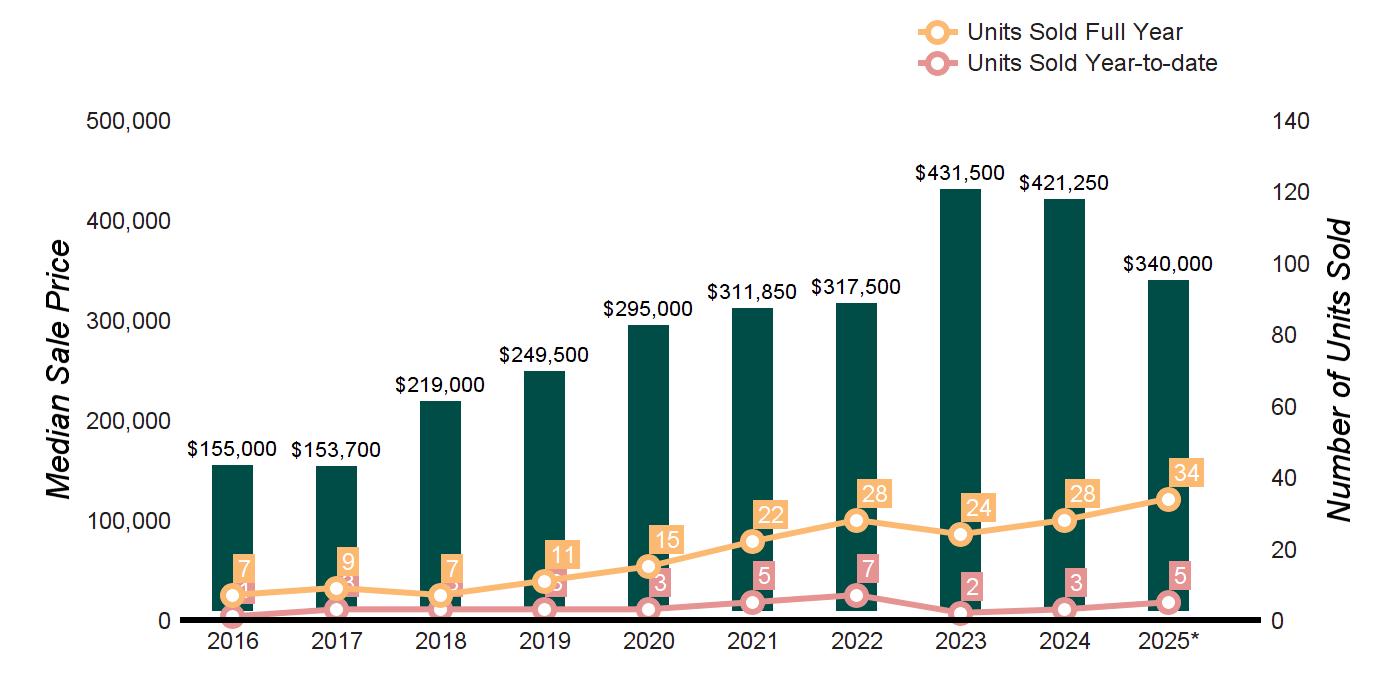

TEN-YEAR MARKET HISTORY

Source : CGND MLS

Source : CGND MLS

Source : CGND MLS

Source : CGND MLS

Source : CGND MLS

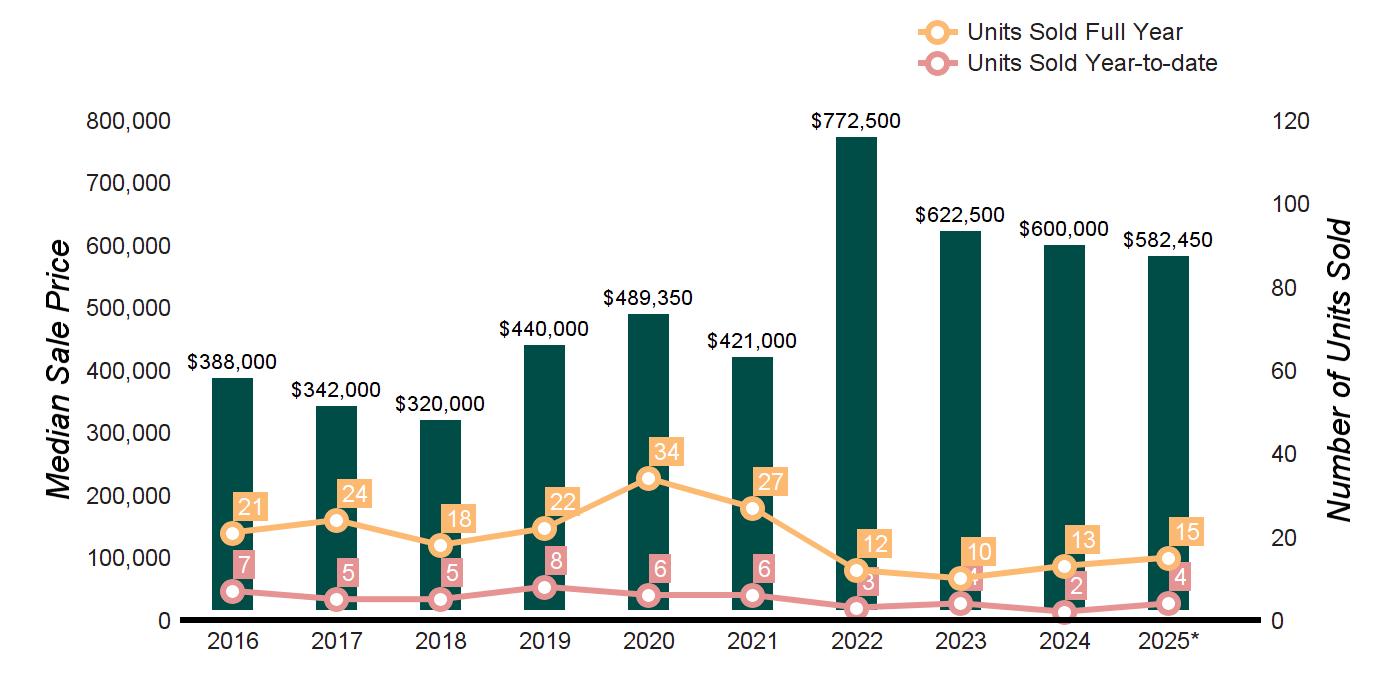

TEN-YEAR MARKET HISTORY

Source : CGND MLS

Source : CGND MLS

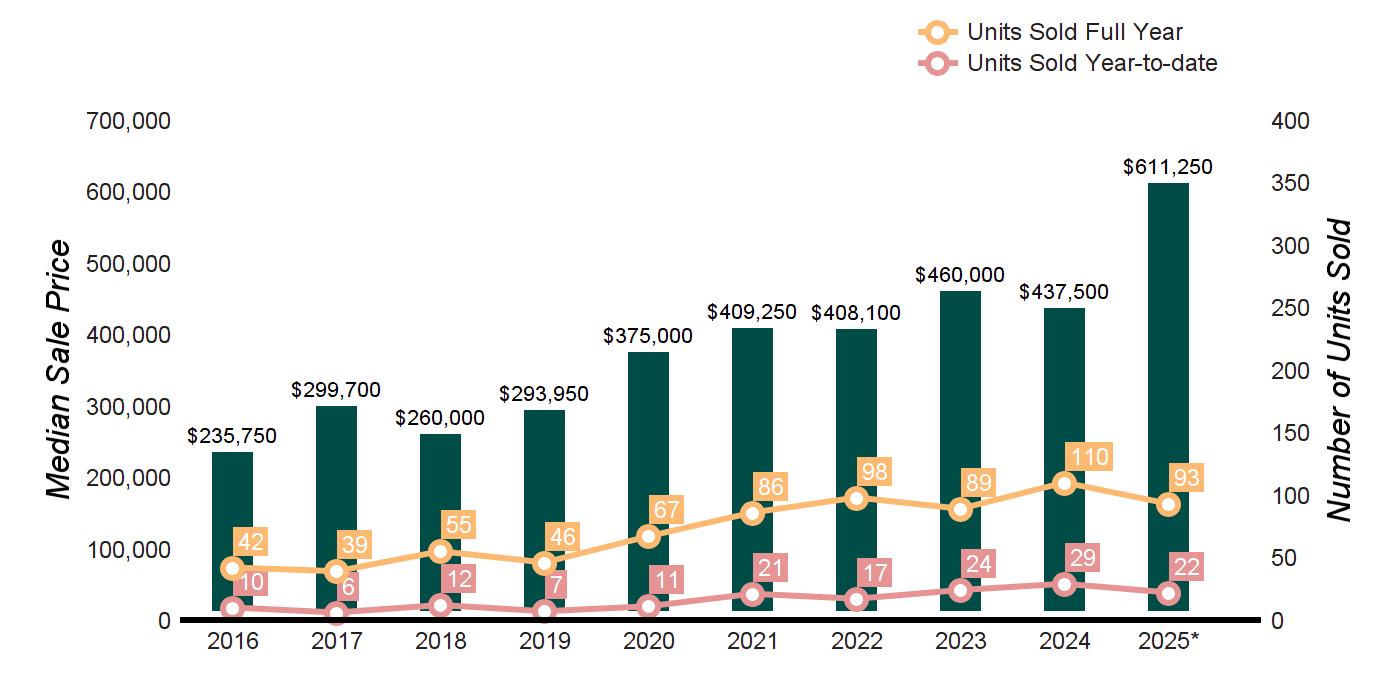

TEN-YEAR MARKET HISTORY

Source : CGND MLS

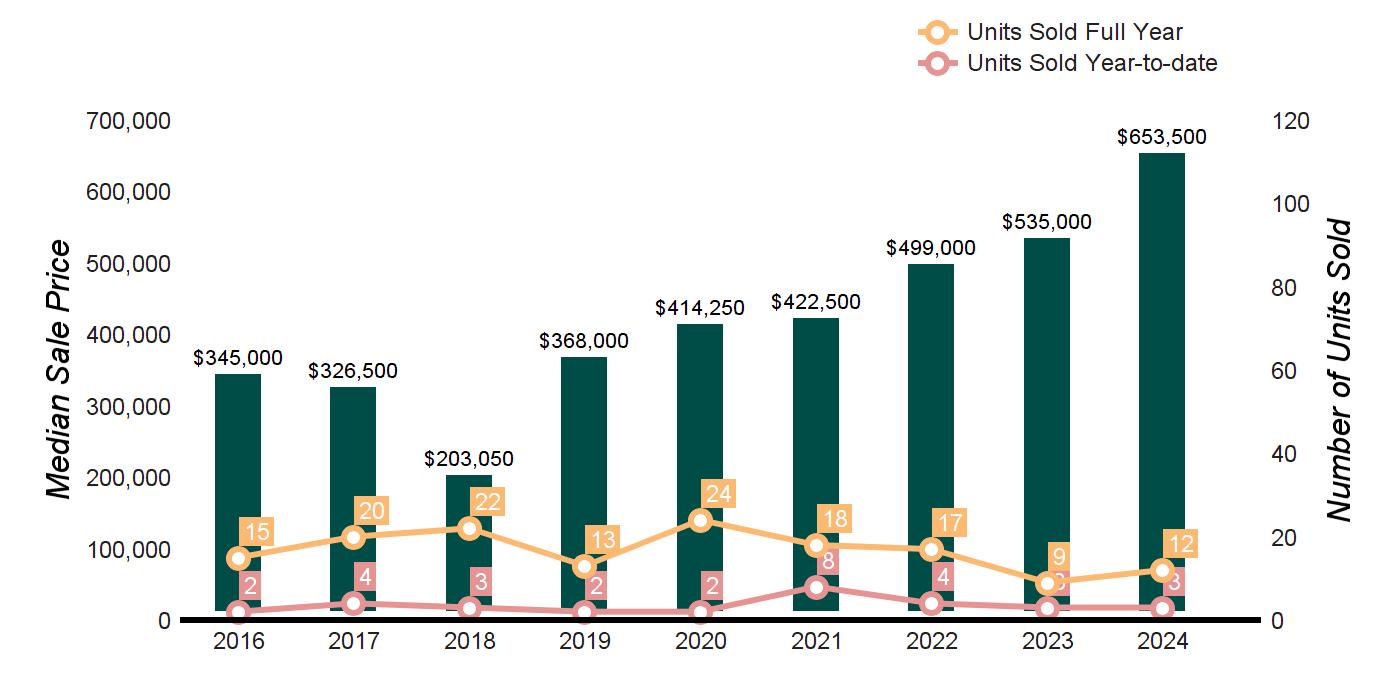

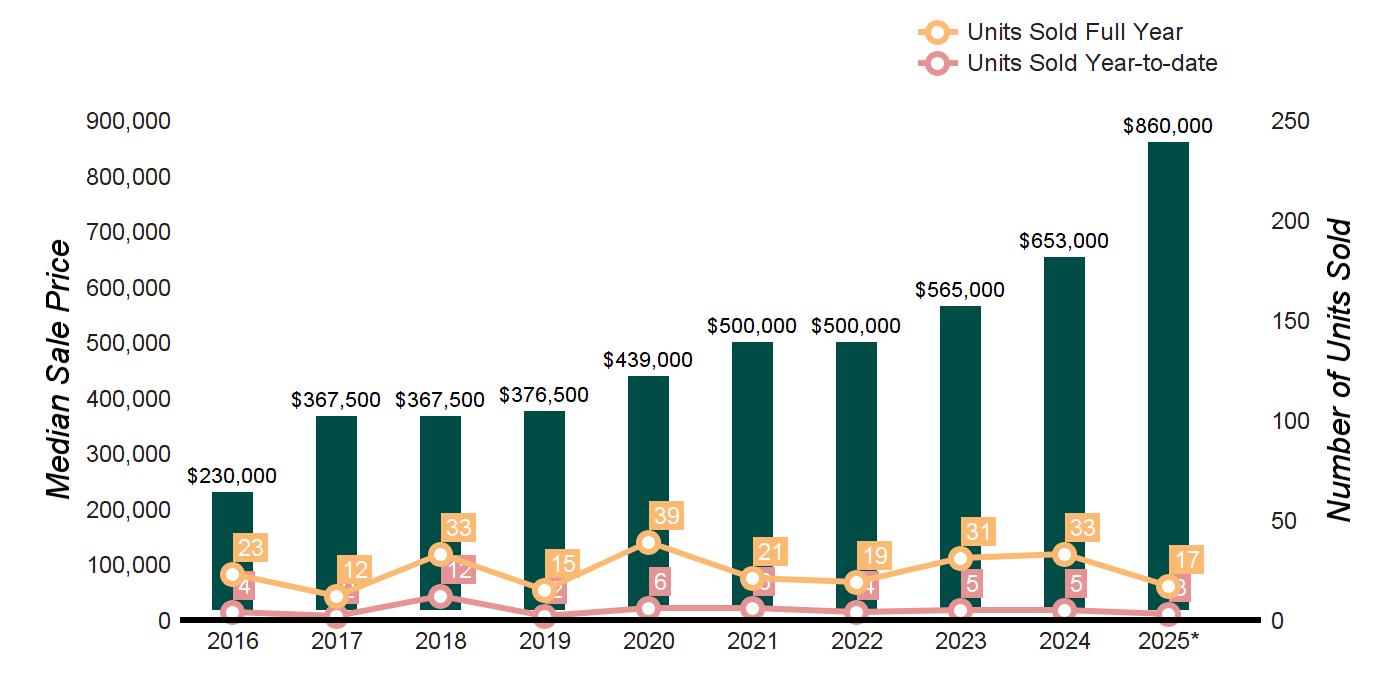

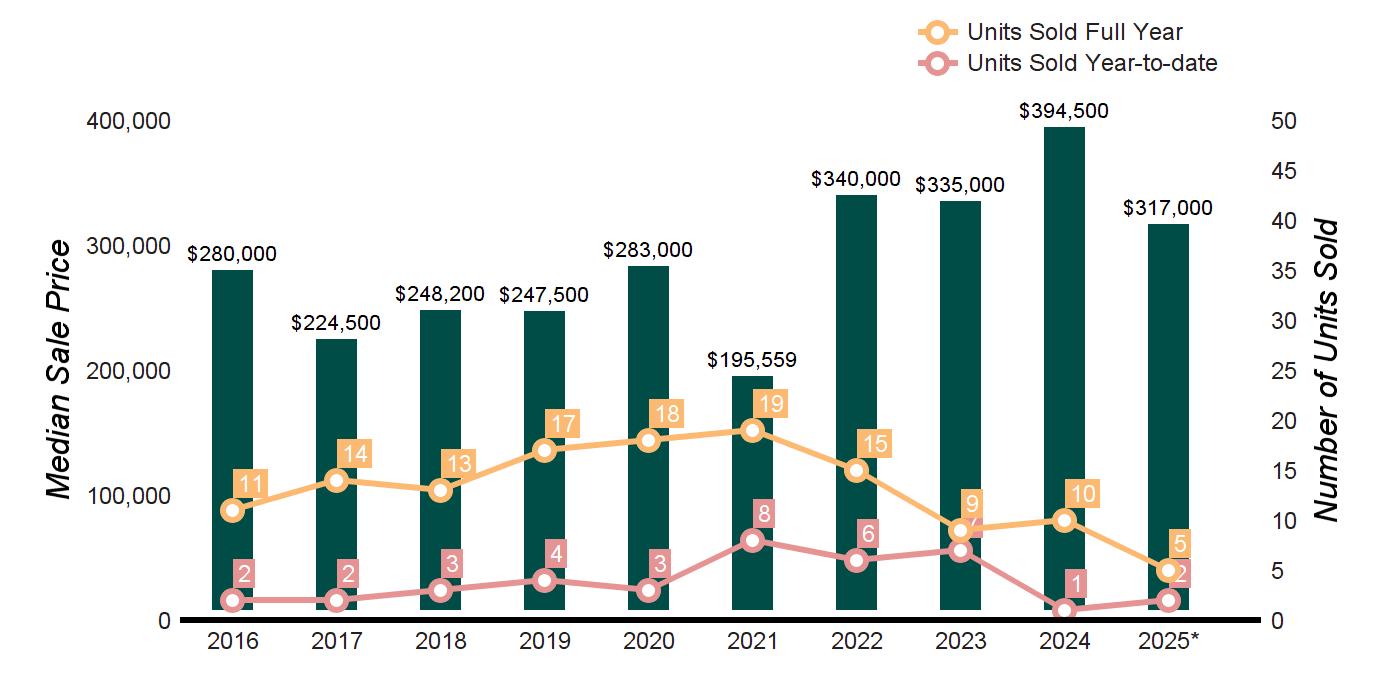

TEN-YEAR MARKET HISTORY

Source : CGND MLS

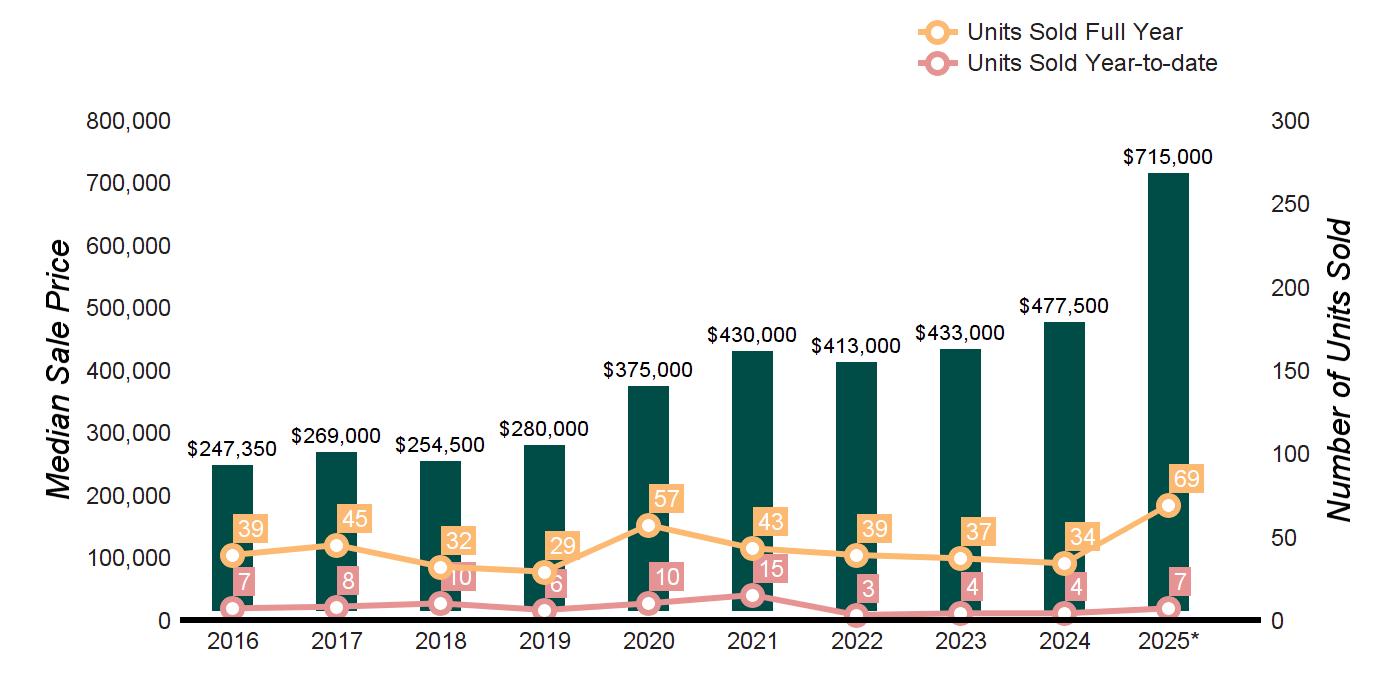

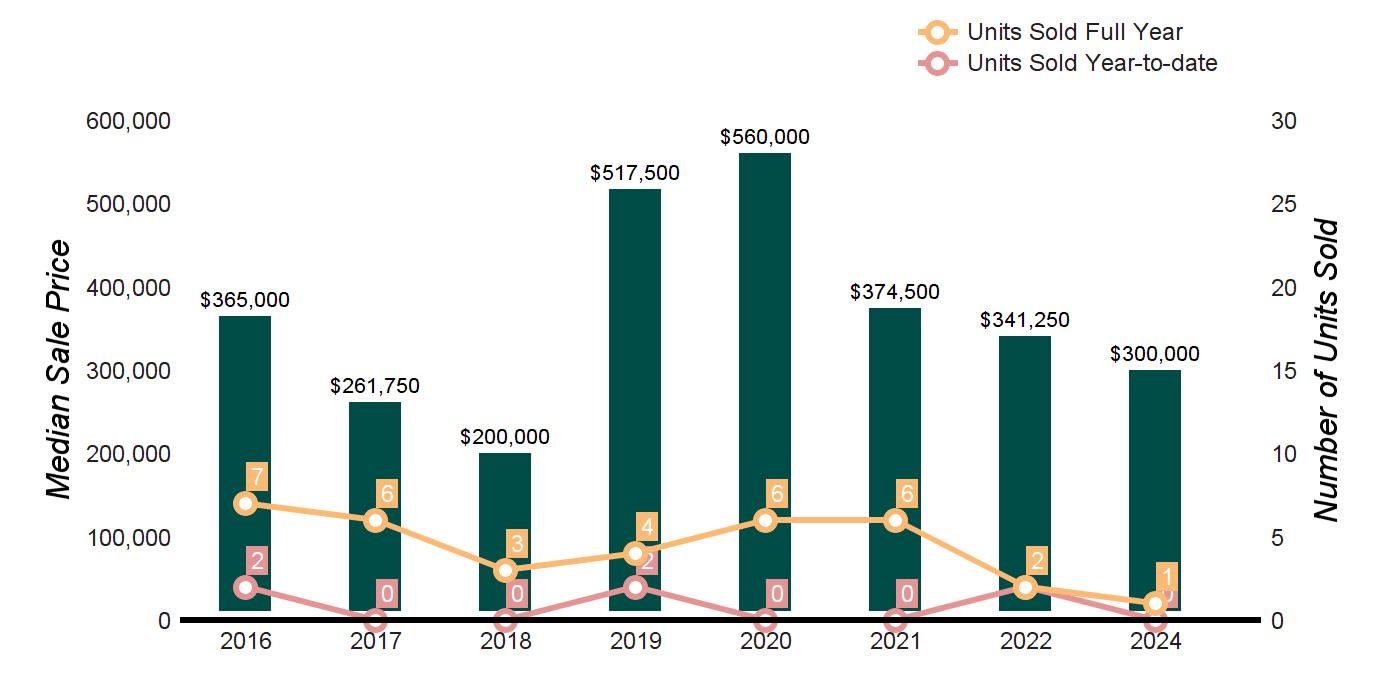

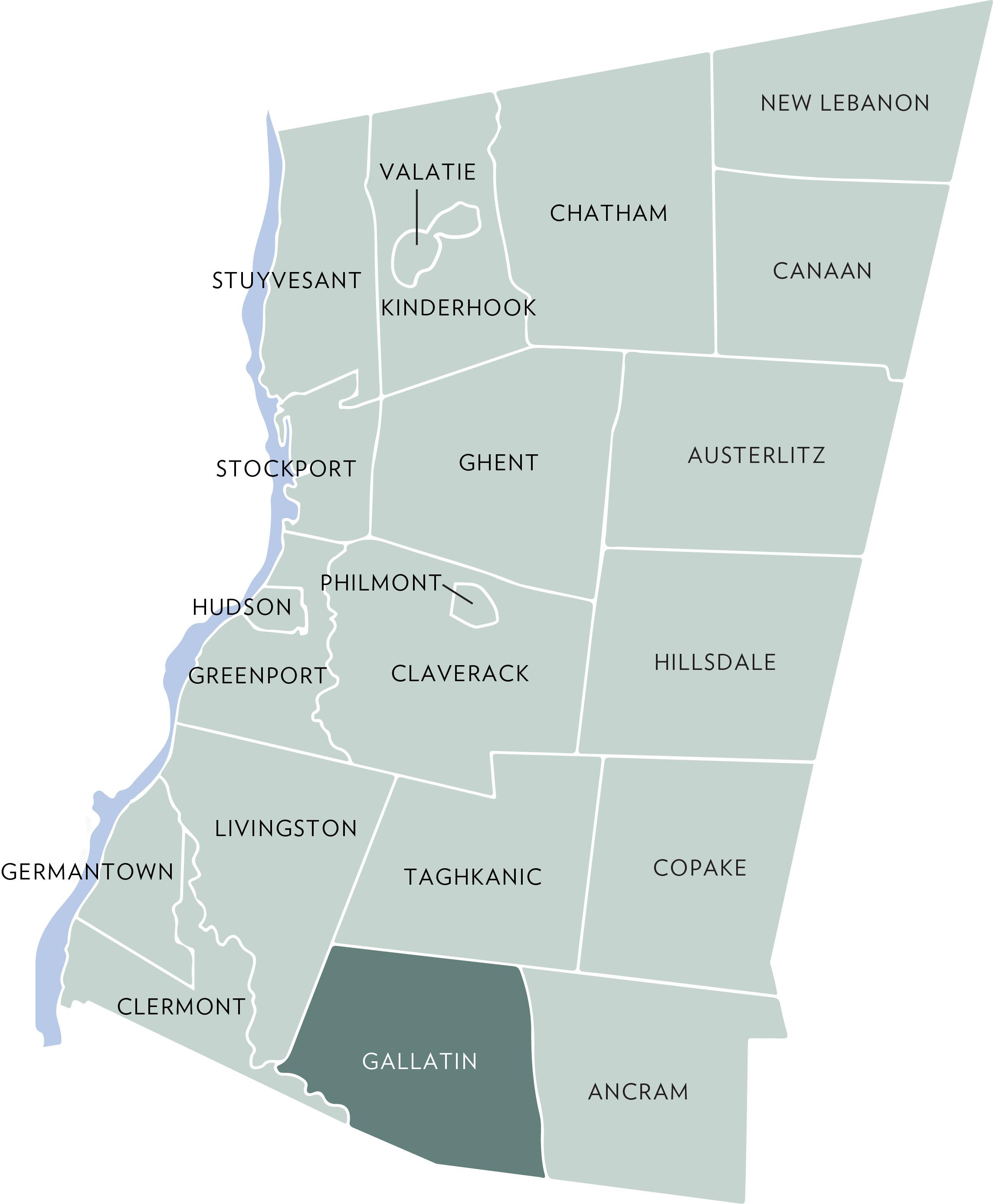

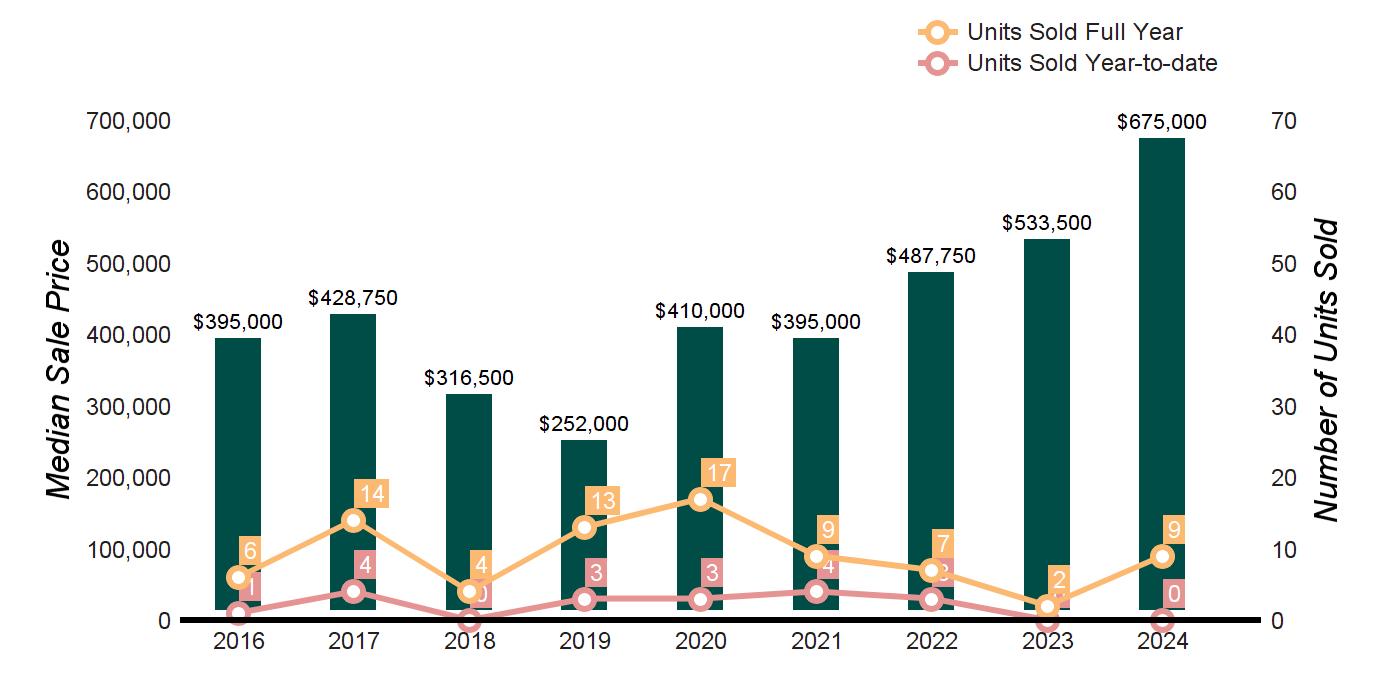

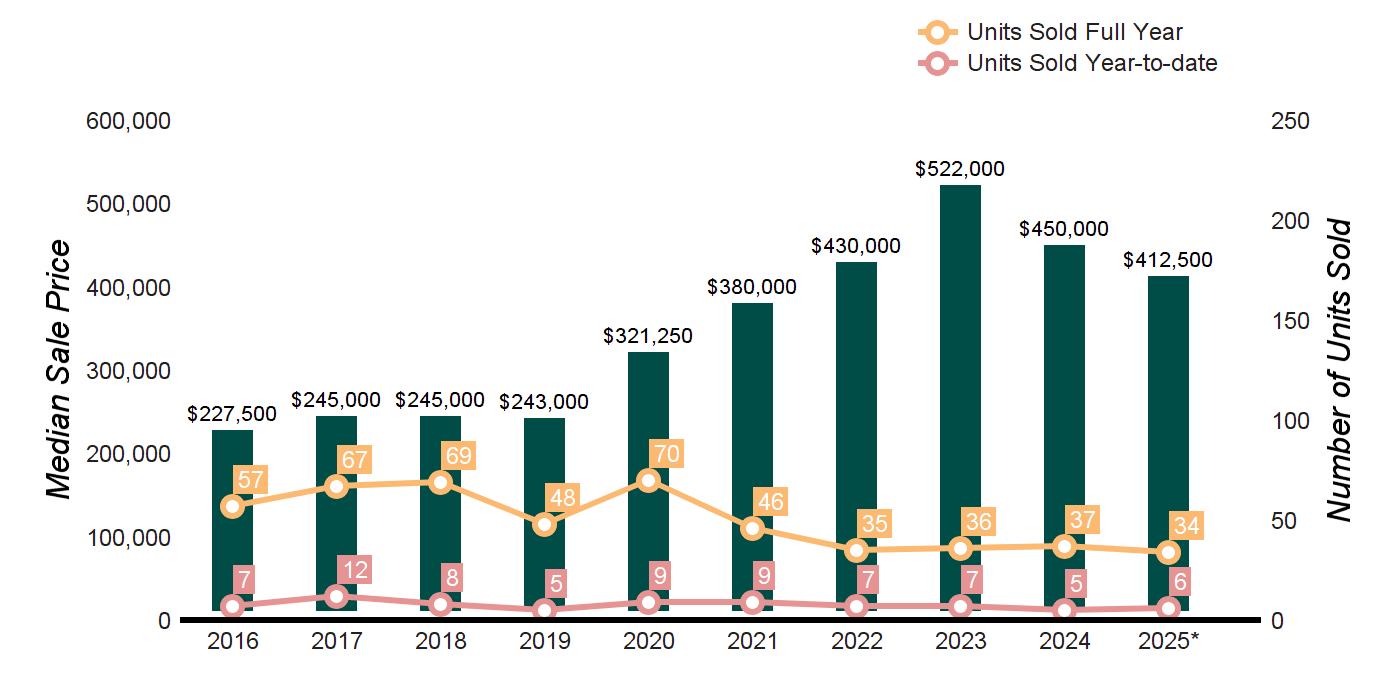

MARKET HISTORY

Source : CGND MLS

Source : CGND MLS

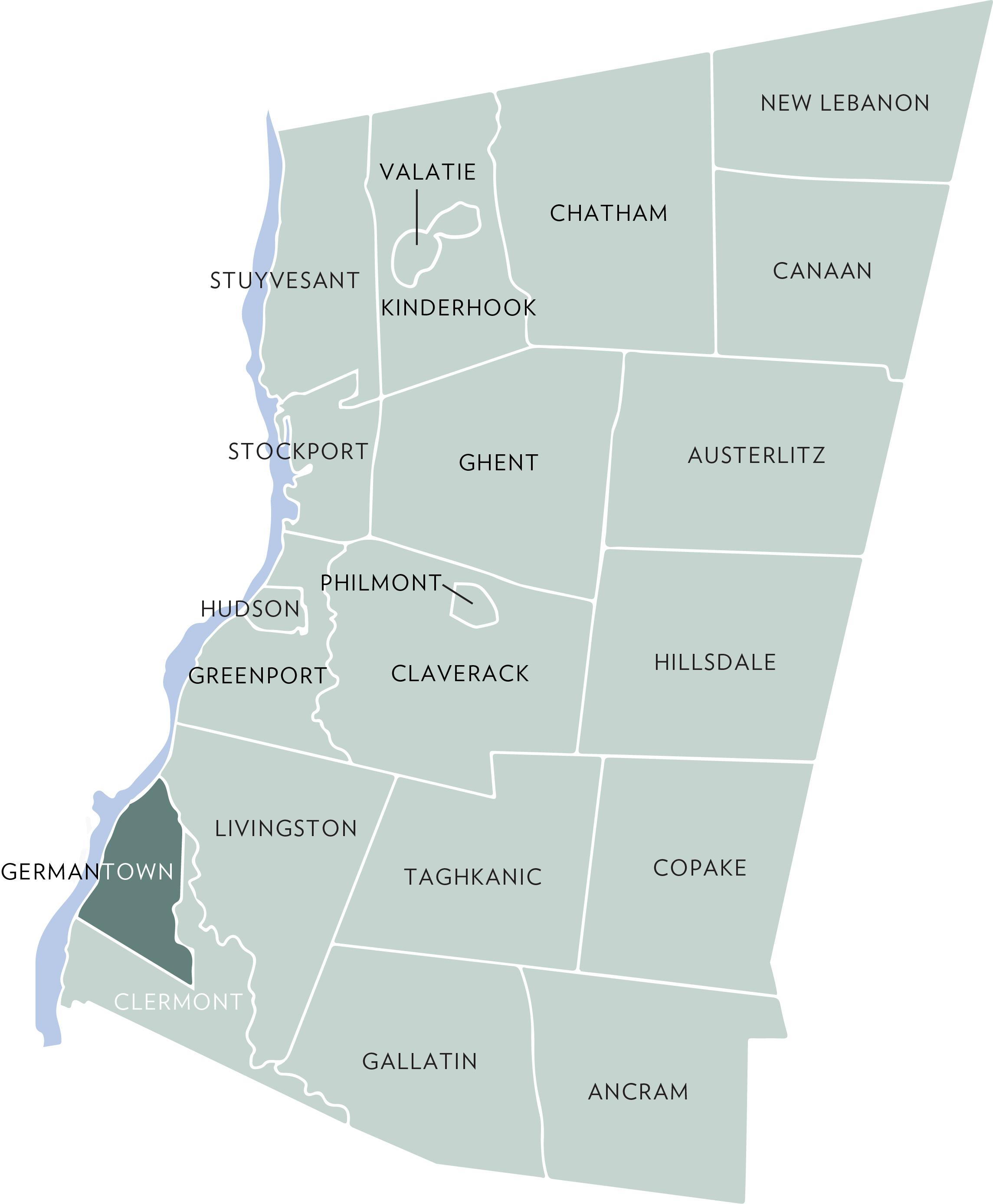

MARKET HISTORY

Source : CGND MLS

Source : CGND MLS

Source : CGND MLS

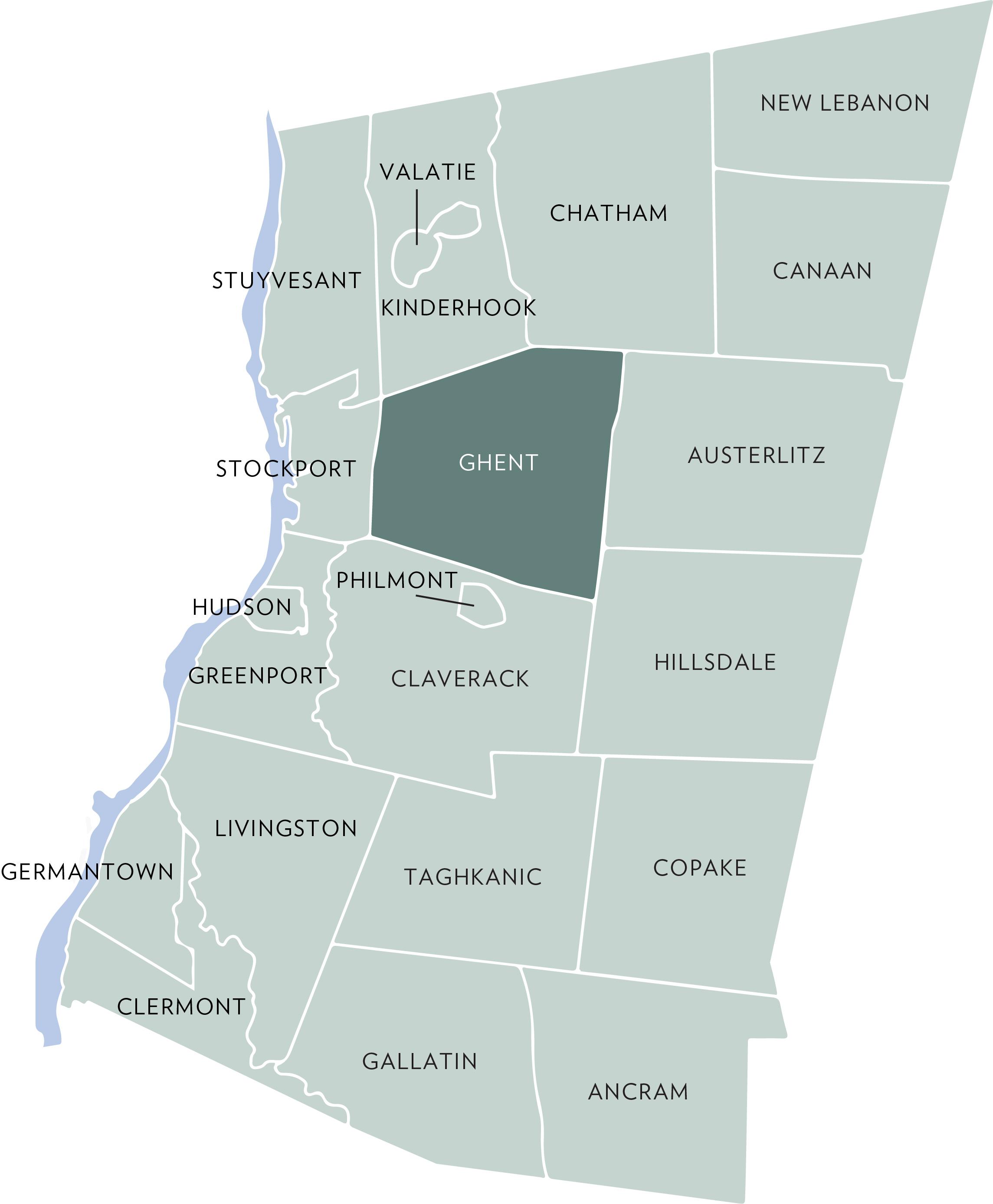

MARKET HISTORY

Source : CGND MLS

Source : CGND MLS

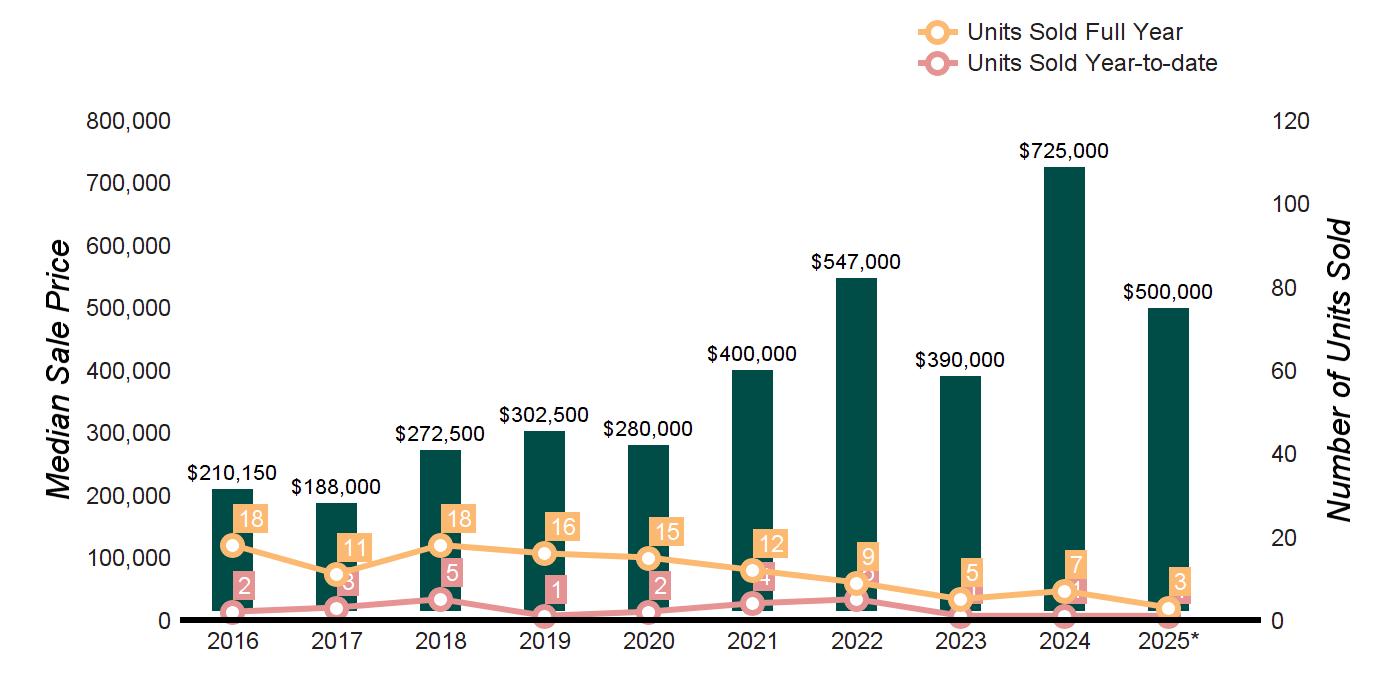

MARKET HISTORY

Source : CGND MLS

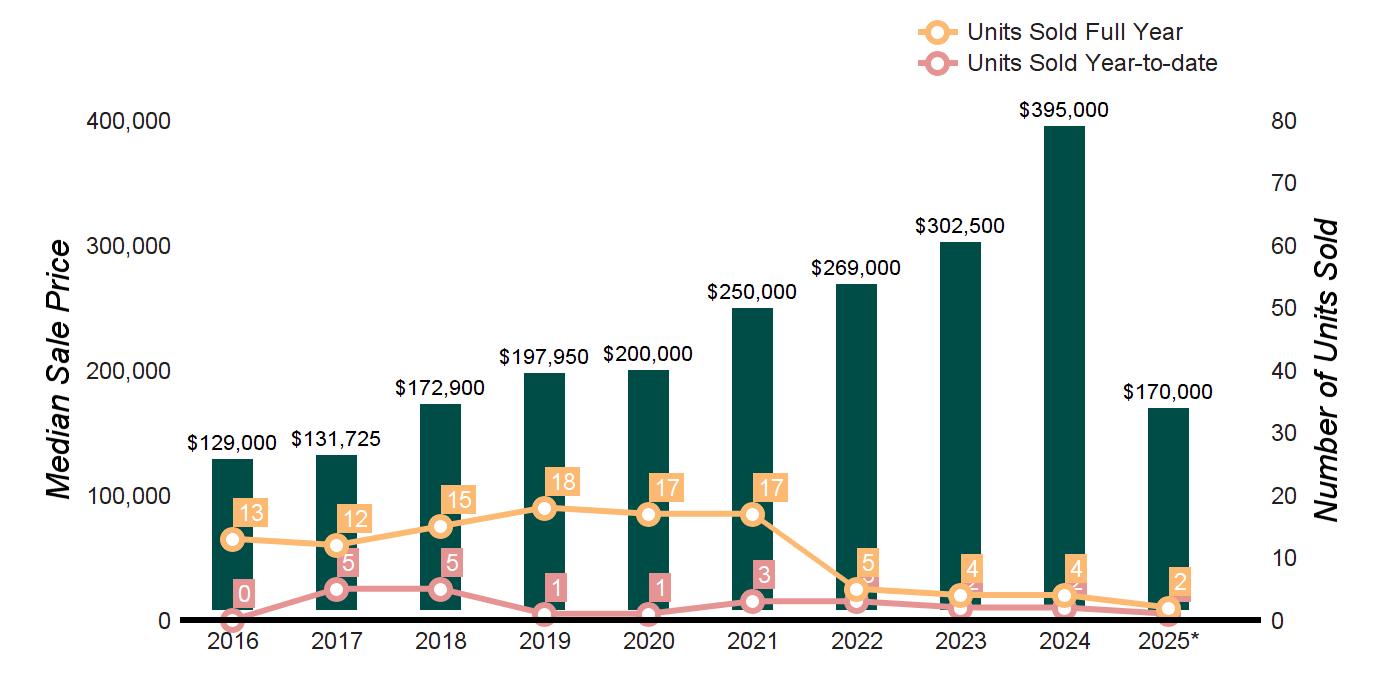

TEN-YEAR MARKET HISTORY

Source : CGND MLS

Source : CGND MLS