Monthly Market Update

Monthly Market Update

July 2025

June 2025 Real Estate Market Update: More Inventory, Balanced Conditions, and Renewed

Condo Interest

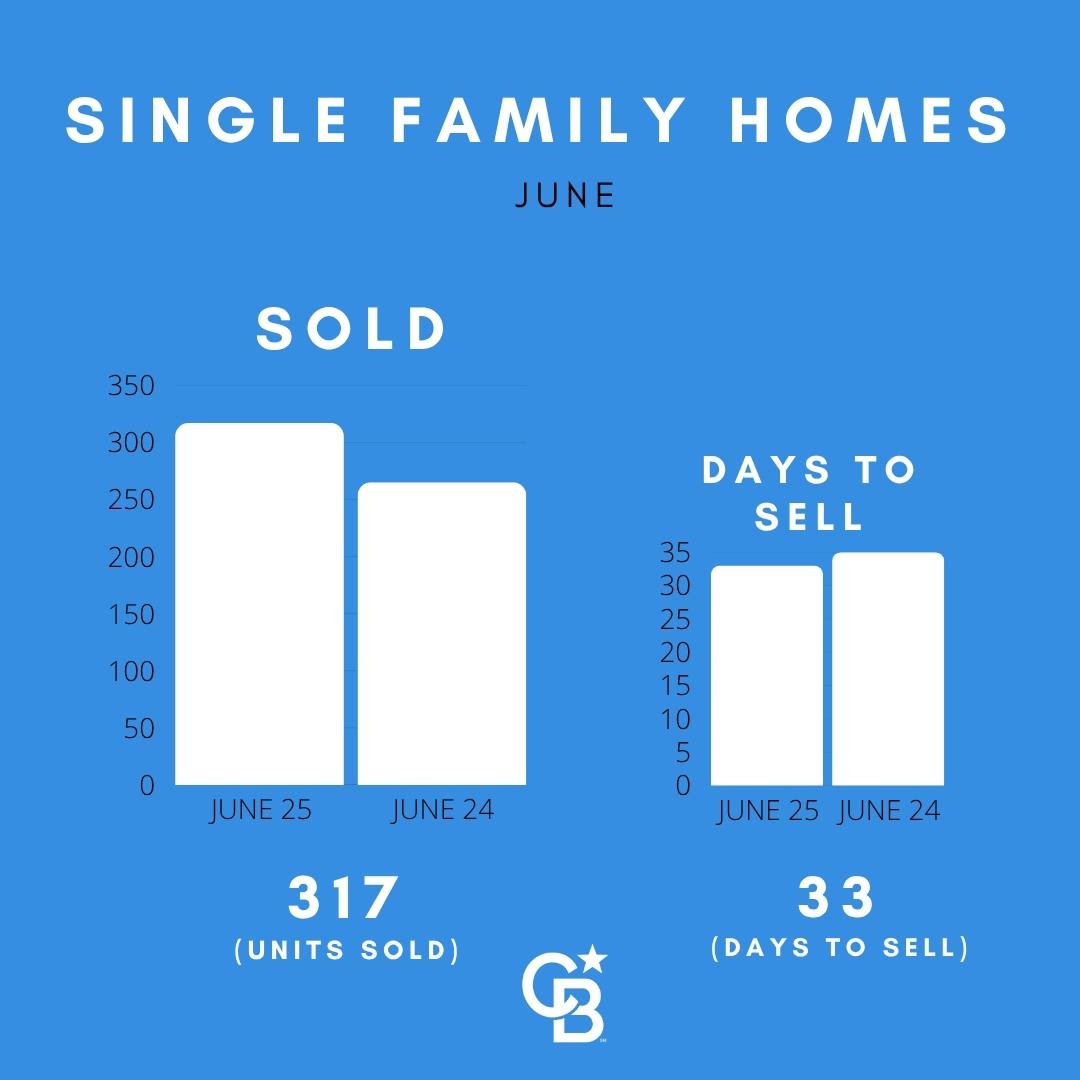

The Victoria real estate market showed continued strength through June, marking a clear shift from the unpredictable, pandemic and politically-driven trends of the past few years. According to Victoria Real Estate Board Chair Dirk VanderWal, “We observed a fairly robust real estate market in the month of June,” with the region now experiencing more typical market patterns.

Inventory on the Rise

At the end of June 2025, there were 3,778 active listings on the Victoria Real Estate Board’s MLS® system. This represents a 1.7% increase from May 2025 and a notable 9.2% rise compared to June 2024, when only 3,460 homes were for sale. We have experienced consecutive months of a healthy and balanced market that includes listing inventory levels we have not seen in a decade. This means more choices for buyers and more realistic pricing expectations for sellers.

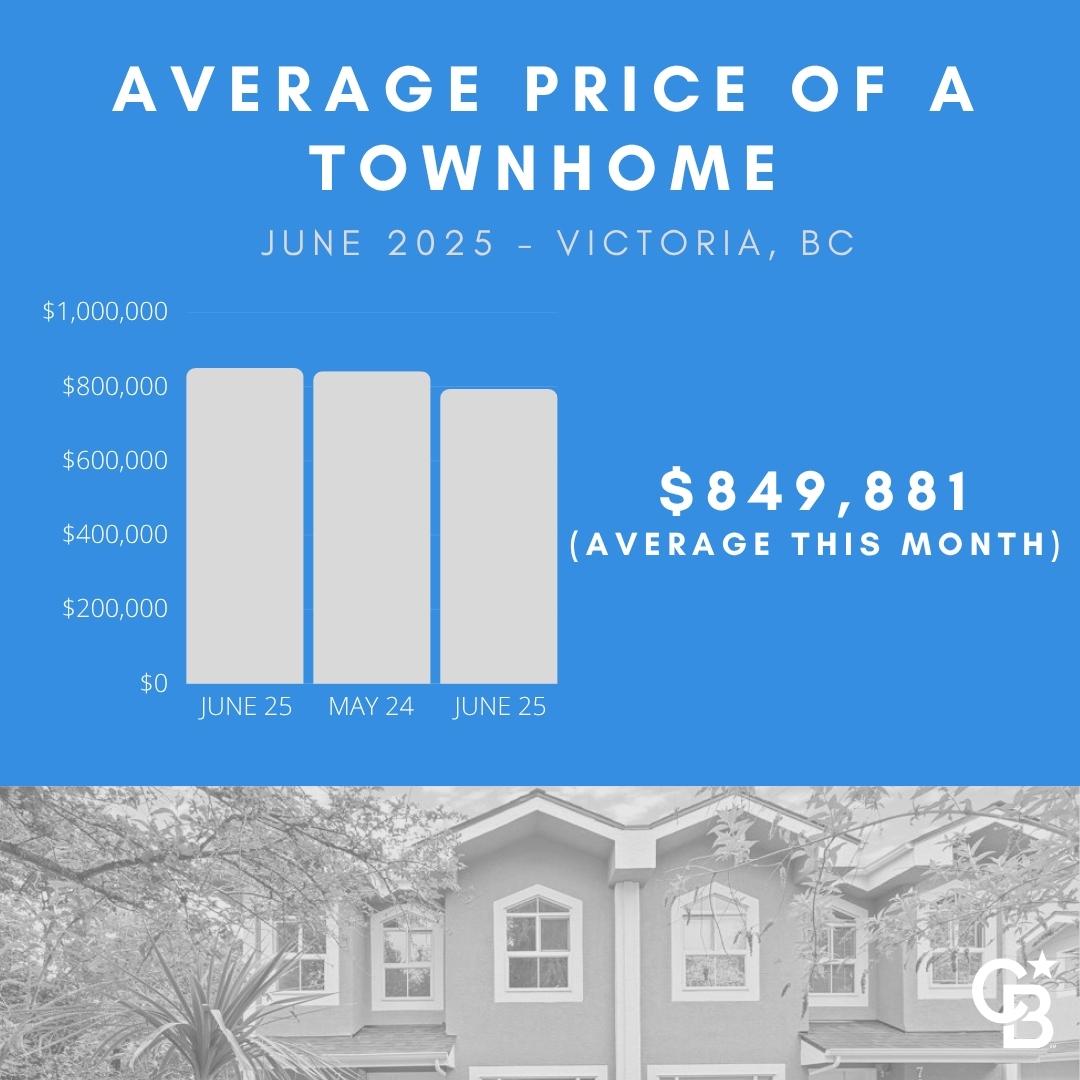

Condos Make a Comeback

One standout trend in June was a surge in condo sales. After a slower spring for the condo market, June saw buyers return in larger numbers. It seems that condo buyers were back in the market and very active in June.. This could signal the start of a summer trend, especially as condos remain one of the more affordable entry points into the Victoria housing market.

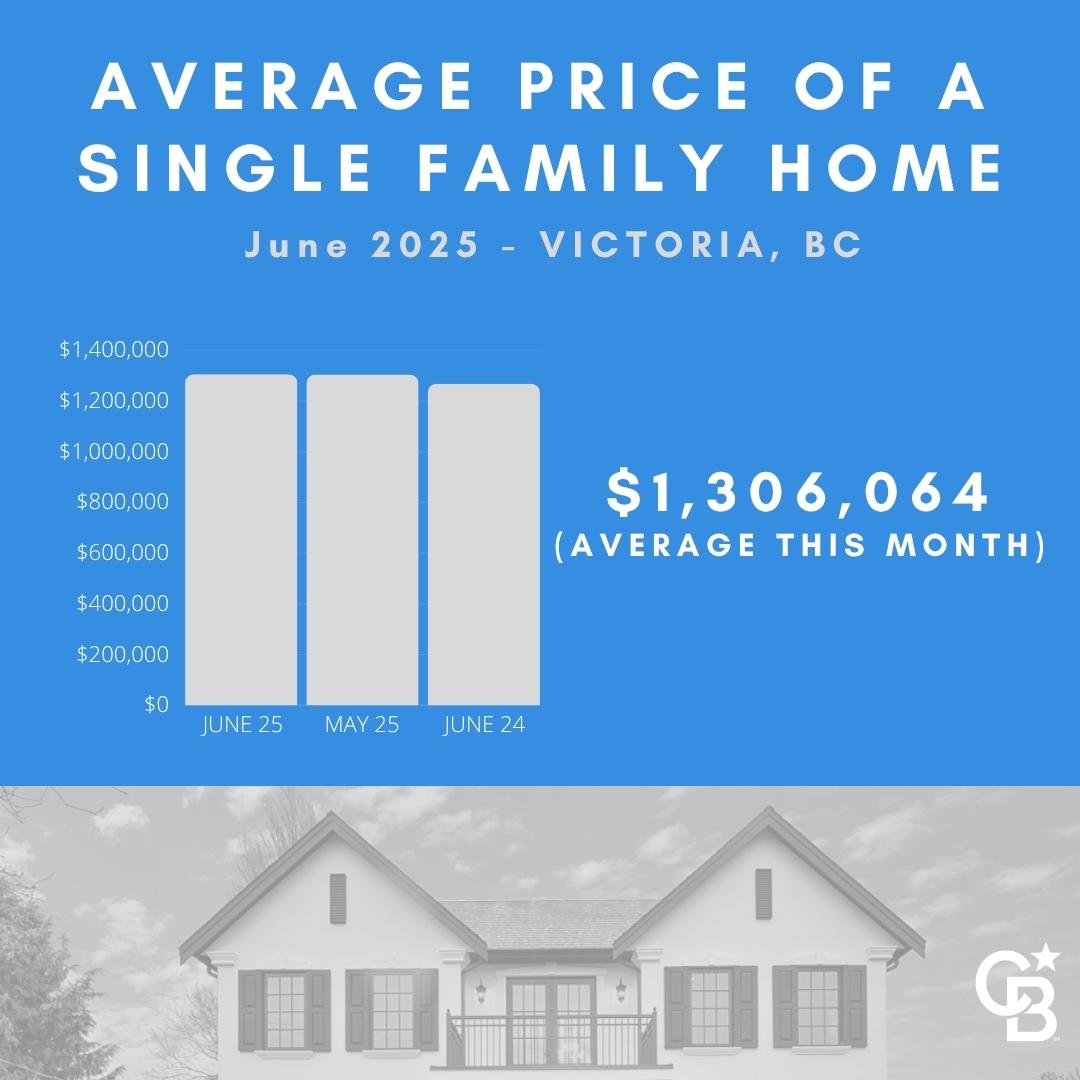

Pricing Trends: Slight Shifts

Prices remained relatively stable, with minor changes month over month. The benchmark price for a single-family home in Victoria’s core was $1,325,400 in June—up 2.3% from June 2024, though slightly down from May 2025. Condos saw a small year-over-year drop, with the benchmark price at $562,800, down 0.9% from June 2024 and also slightly down from the previous month.

Affordability Slowly Improving

Nationally, housing affordability has shown some improvement. RBC reports that their affordability index fell to 55.1% in early 2025 from 60.7% a year ago. This means the share of household income required to own a home has decreased slightly, thanks to lower interest rates, steady income growth, and small drops in home prices. While affordability still lags behind pre-pandemic levels, RBC economist Robert Hogue sees a positive trend: “We see earlier interest rate cuts continuing to favourably impact affordability.”

Condos in particular have seen the most notable improvements, with some cities—like Toronto, Edmonton, and Winnipeg—seeing affordability return to near pre-pandemic levels.

What This Means for Buyers and Sellers

With more inventory, stable prices, and improving affordability, now is a great time to consider making a move—whether you’re looking to buy or sell. We can be your best resource for navigating current market conditions and making informed decisions.

Thinking about buying or selling this summer? Let’s talk—Victoria’s balanced market may offer the perfect.

Sincerely,

Michele, Mark and Eric