Deregistration of Foreign Firms from U.S. Stock Markets Kathleen Bakarich Department of Accounting, Taxation and Legal Studies in Business Findings

Why Study Deregistrations?

IFRS/US GAAP firms

Cross-Listings and Deregistrations on Major U.S. Exchanges (as % of total foreign listings)

Domestic GAAP firms

Is there an effect on:

Home market accounting environment

.4

9%

8%

1) Shareholder value

6%

3) Audit fees 5%

following deregistration, and if so does it differ depending on the:

Home market regulatory environment 4%

3%

2%

1%

0% 2004

2005

2006

2007

2008

Cross-Listings

2009

2010

2011

2012

2013

Deregistrations

Why Study Accounting Standards?

-.4

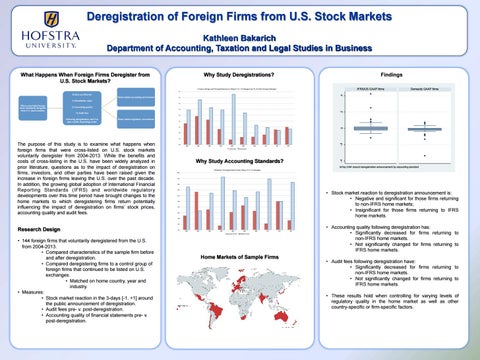

The purpose of this study is to examine what happens when foreign firms that were cross-listed on U.S. stock markets voluntarily deregister from 2004-2013. While the benefits and costs of cross-listing in the U.S. have been widely analyzed in prior literature, questions as to the impact of deregistration on firms, investors, and other parties have been raised given the increase in foreign firms leaving the U.S. over the past decade. In addition, the growing global adoption of International Financial Reporting Standards (IFRS) and worldwide regulatory developments over this time period have brought changes to the home markets to which deregistering firms return potentially influencing the impact of deregistration on firms’ stock prices, accounting quality and audit fees.

3-Day CAR around deregistration announcement by accounting standard Voluntary Deregistrations from Major U.S. Exchanges 100%

90%

80%

70%

• Stock market reaction to deregistration announcement is: • Negative and significant for those firms returning to non-IFRS home markets; • Insignificant for those firms returning to IFRS home markets.

60%

50%

40%

30%

20%

10%

Research Design

0% 2004

2005

2006

2007

2008

Domestic GAAP

• 144 foreign firms that voluntarily deregistered from the U.S. from 2004-2013. • Compared characteristics of the sample firm before and after deregistration. • Compared deregistering firms to a control group of foreign firms that continued to be listed on U.S. exchanges. • Matched on home country, year and industry. • Measures: • Stock market reaction in the 3-days [-1, +1] around the public announcement of deregistration. • Audit fees pre- v. post-deregistration. • Accounting quality of financial statements pre- v. post-deregistration.

0

2) Accounting quality

-.2

When cross-listed foreign firms voluntarily deregister from U.S. stock markets:

.2

7%

Cumulative Abnormal Return

What Happens When Foreign Firms Deregister from U.S. Stock Markets?

2009

2010

2011

2012

IFRS/US GAAP

Home Markets of Sample Firms

2013

• Accounting quality following deregistration has: • Significantly decreased for firms returning to non-IFRS home markets. • Not significantly changed for firms returning to IFRS home markets. • Audit fees following deregistration have: • Significantly decreased for firms returning to non-IFRS home markets. • Not significantly changed for firms returning to IFRS home markets. • These results hold when controlling for varying levels of regulatory quality in the home market as well as other country-specific or firm-specific factors.