Driving Social Change

• Corporate giving as part of planning and strategy • The difference between corporate and nonprofit finances

• “Give and Get Strategy” of corporately-owned life insurance

• Corporate giving as part of planning and strategy • The difference between corporate and nonprofit finances

• “Give and Get Strategy” of corporately-owned life insurance

Nonprofit organizations play a critical role in Canada’s social safety net, yet you may not think of them as being an economic driver.

Consider that nonprofits employ 2.5 million people, making the nonprofit sector the largest employer in Canada, (People First, April 2025. Imagine Canada.) and that Canada’s social sector represents 8.7 % of Canada’s GDP—approximately $189 Billion (yes…with a B).

To meet the evolving needs of Canadian society, our sector had to grow from its grassroots origins of passing the plate at Sunday worship services and the selling of cookies by earnest children. This required the collective, ongoing effort of individuals, businesses and government.

And so, we dedicate the Summer Issue of Foundation Magazine to an examination of the close connections between charities and their corporate partners — done through a variety of lenses to give you a full picture.

To get things started, Eric Saarvala provides a primer on the different ways that corporate philanthropy has become a vital component of a company’s social license to operate, with philanthropy becoming deeply integrated with corporate responsibility, sustainability and environmental, social and governance programs (ESG).

Also in this issue:

❯ Corporate giving can be an important part of planning and strategy for a business and its owner, as a means of building positive brand awareness and attracting and engaging staff, while also taking advantage of corporate tax deductions;

❯ UHN has launched a bold and ambitious initiative, to recruit 100 top early-career scientists from Canada and around the world, funded by socially-minded businesses and individuals;

❯ Why it is critically important for corporate philanthropists to understand the difference between corporate and nonprofit finances: and

❯ The “Give and Get Strategy” of using corporately-owned life insurance to make transformative gifts.

There are many positive impacts resulting from the alignment of corporate philanthropy with community need. This includes: the spiritually uplifting donation of volunteer hours, charitable giving (direct donations and matching employee gifts), and marketing a business’s good corporate citizenship through sponsorship. This is how change happens and how stable communities are built.

Foundation Magazine wants to focus on the big ideas that mean most to you. What do you want to see more of? Less of? What topics have you been waiting for Foundation Magazine to cover? Do you have recommendations of writers you want to hear more from?

Let’s continue the conversation!

Lisa MacDonald Editor-in-Chief lisa@hilborn.com

Jim Hilborn Publisher

Lisa MacDonald Editor-In-Chief lisa@hilborn.com

Marlena McCarthy Copy Editor

Jasmine Stuart Production Manager

Chris Horne Director of Marketing chris@hilborn.com

Jennifer O’Neill Art Director/Design

CONTRIBUTORS

Kimberley Blease

John Bromley

Mark Halpern

George Irish

Russell James

Arin Klug

Tony Maiorino

Nicholas Palahnuk

Kathleen Provost

Julie Quenneville Eric Saarvala SCAN to subscribe

Foundation Magazine is published quarterly by The Hilborn Group.

Foundation Magazine is an independentlyproduced publication not affiliated in any way with any association or organized group. Unsolicited article submissions are welcome. Occasionally Foundation Magazine provides its subscriber mailing list to other companies whose product or service may be of value to readers. If you do not want to receive information this way, email Jasmine@hilborn.com.

PO Box 86, Station C Toronto ON, M6J 3M7 www.charityinfo.ca (416) 554-9403 mary@hilborn.com hilborn-charity-enews

CBY ERIC SAARVALA

orporate philanthropy is a vital component of a company’s social license to operate and has become more deeply integrated with corporate responsibility, sustainability, and environmental, social and governance programs (commonly referenced as “ESG”) over the last few years.

Corporate philanthropy has historically and typically operated as a singular business unit. The community investment team did not usually engage with the sustainability team before ESG became increasingly important to organizations and part of the overall social impact of the company.

Corporate philanthropy, one of the “S” activities in ESG, refers to the initiatives and social causes in the community that are supported by a company’s charitable programs and activities. These activities may include:

❯ financial donations direct from the company or grant from the corporate foundation

❯ employee volunteer programs

❯ in-kind contributions (which may be goods or services to address societal challenges)

❯ cause-related marketing

❯ corporate sponsorships of charities and volunteer grants based on an employee’s volunteerism outside of work

❯ corporation matching; donations to charities supported by their employees

These types of charitable support have become even more critical as the need and demand for services from charities has increased — alongside of higher costof-living expenses; as social issues have become more complex and, as climate events such as wildfires and hurricanes devastate communities.

There is an increasing correlation between the “E” and the “S” of ESG. Environmental events impact charities when people displaced from their homes require food, water, housing and other services. As climate events become more severe and frequent, there will be even more dependence on charities for support.

Financial donations or grants

Corporate donations or grants support vital causes through community investment programs or go directly to organizations that reflect their stated areas of interest. Or, the company may form strategic corporate partnerships that move from transactional to interactive transformational relationships.

Companies that donate at least 1% of pre-tax profits to Canadian communities can receive a Trustmark from Imagine Canada. Since 1988, the PRISM Community Impact Company Network , formerly, the Caring Company Program, reflects companies that commit to community investment through donations which include paid volunteerism of their employees and in-kind contributions.

Employee volunteer programs

Many companies encourage their employees to take on volunteer opportunities, even during work hours, (“paid volunteerism”) because giving back can offer multiple benefits. For example, tasks that require certain skills can offer skillbuilding opportunities.

Companies can also benefit because promoting volunteerism that aligns with their purpose and values can attract talent and enhance employee retention. A social-good software company called Benevity reported that surveyed companies with employees who participated in volunteerism and giving programs reduced turnover by an average of 57%. Some businesses manage, track and measure their employee volunteer efforts using volunteer management software.

Volunteer tasks are traditionally event-based, ie. employees participate at a charity event. Others need help with short or longer-term projects, like updating and enhancing a charity’s website. Some volunteer activities are referred to as “acts of kindness” as the volunteer activity does not benefit a specific charity — such as cleaning up a local park in the community where the company is located.

Great Place To Work is a global leader that helps businesses create employee experiences that make people feel valued and acknowledged for who they are and their unique needs. Their article on the 8 Best Employee Benefits notes that increasingly, people want their paid work to be an extension of their contribution to society. They appreciate companies that offer benefits that encourage volunteerism, which empowers employees to make a difference in their community. The “benefits” may include paid time off to volunteer during work hours, matching donations, or making a donation or grant to the charity that an employee volunteers at in their own time.

Companies may also recognize an employee’s volunteerism outside of the workplace in the form of a donation or grant. Whether employees serve on the board of directors of a charity, volunteer at a soup kitchen or pack food at a food back, companies have programs that offer a donation or grant for volunteerism during personal time. The program can also be referred to as “dollars for doers”. Some companies also offer a “volunteer time off” program where employees can receive personal time off after volunteering with charities in the community for a total number of hours.

An in-kind contribution of goods may be food, hosting a clothing drive, or donations of company products and pro-bono services.

Cause-related marketing leverages a company’s product or service by partnering with a charity to address a social cause. Part of the revenue of the sale of the product or service goes to charity. Businesses may also incorporate a point-of-sale method to capture immediate cash donations for a charitable cause.

Sponsorship of a charity or a charity event or program can be

attractive, offering a company improved brand recognition and reputation. This type of funding usually comes from a company’s marketing budget, and because a charity offers them recognition benefits, sponsorships are not eligible to receive a corporate charitable tax receipt.

While overall program semantics may differ by company, the goals are reflective of a company’s accountabilities to their constituents, interested parties and the public for their impact on the communities and environments where they are operating. Considering the social impact of a company goes beyond corporate philanthropy, however, charitable partnerships still play an important role. For instance, as an environmental sustainability initiative, company volunteers can help a charity to clean up a shoreline or a park or assisting with tree planting may be part of a carbon-offsetting program for a company’s climate strategy.

For companies that have diversity, equity and inclusion (DEI) programs and employee resource groups, there can be purposeful engagement with volunteer and giving opportunities with 2SLGBTQI+ and Indigenous charities or Black-led or Black-serving charities where there is greater need for support. For example, in the “Unfunded: Black Communities Overlooked by Canadian Philanthropy ” report by the Foundation For Black Communities and Carleton University’s Philanthropy and Nonprofit Leadership program, the data shows that Black-led groups received only 0.03 percent of total grants dispersed by the top 10 Canadian foundations in the 2017 and 2018 fiscal years, and Black-serving organizations received only 0.15 percent of grants in the same timeframe.

Companies can engage with such organizations by creating employee learning opportunities, like bringing in speakers to educate employees on Black History Month and the National Day for Truth & Reconciliation and other DEI-aligned activities and events.

low-income people living across Toronto. Fred’s Kitchen offers on-the-job culinary training and employment opportunities to people at risk of homelessness, newcomers, and those facing barriers such as addiction or mental health challenges.

Our financial management company, Raymond James Ltd, practices corporate responsibility through our Raymond James Canada Foundation. One multi-faceted example is our ongoing engagement with the Native Women’s Resource Centre of Toronto (NWRCT). Our 3Macs branch, a division of Raymond James, has built a special relationship with NWRCT and their Executive Director, Pamela Hart. During RJ Cares, our annual volunteer service month in May, our employees participate in various NWRCT volunteer initiatives, and the Foundation matches their donations to the charity. We invited Ms. Hart to present at the 3Macs branch kick-off of RJ Cares month. Our Canadian Mosaic Inclusion Network, an employee resource group of the Raymond James Ltd. National Inclusion Council, provided a grant to NWRCT and hosted Ms. Hart to provide a learning opportunity for Raymond James Ltd.’s employees for the National Day for Truth and Reconciliation. As part of the event, an Indigenous caterer provided the food for the event.

Going beyond corporate philanthropy to create social impact can be achieved within a company’s supply chain. For instance, some Toronto companies with environment sustainability goals lower their carbon footprint by using the courier Good Foot Delivery, a registered charity, which “provides meaningful employment for the neurodivergent community through a reliable, professional courier service delivered via public transit and on foot.”

Another example may be found in Toronto businesses requiring catering for meetings or events using charities like Fred Victor, a social service charitable organization that fosters long-lasting and positive change in the lives of homeless and

While corporate philanthropy is one lever of social impact within a corporate responsibility, sustainability or an ESG program, there are many more business levers and activities that companies can leverage from their business operations to create greater social impact in the communities and environments where they operate.

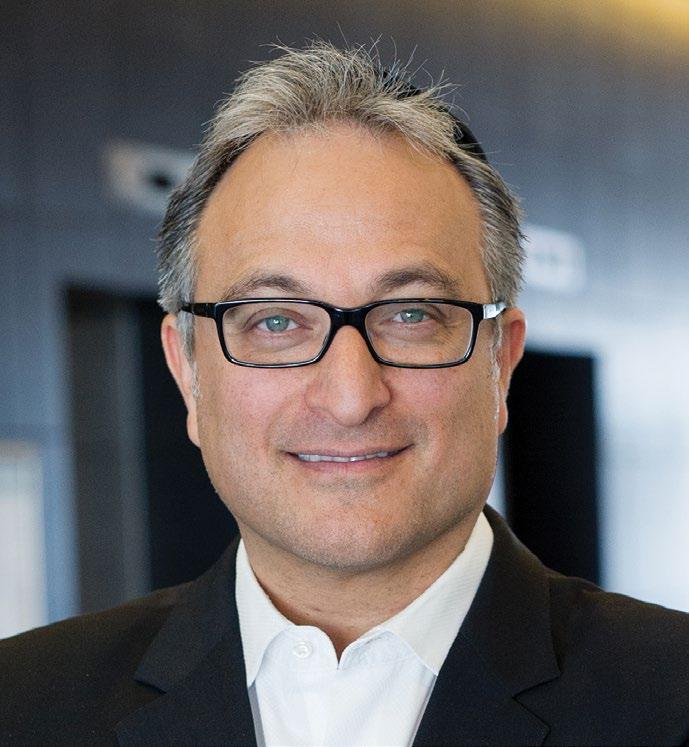

ERIC SAARVALA is Head of Corporate Sustainability, Raymond James Ltd., and Executive Director of the Raymond James Canada Foundation.

Eric has 25+ years of consulting and management experience in social impact through strategic philanthropy, corporate responsibility and sustainability. Eric has also helped organizations advance the United Nations Sustainable Development Goals. He has an Executive MBA from the Ivey Business School at Western University, a Graduate Diploma in Social Responsibility and Sustainability from the University of St. Michael’s College in the UofT (G. Dipl. SR&S).

BY KIMBERLEY BLEASE

Some of the biggest challenges in legacy marketing are inspiring a supporter to have a conversation about their vision for the future, about making their own legacy gifts, or providing confirmation that a legacy gift has been included in their estate plans.

For most charities, over half of legacy gifts come as a surprise from donors not found in your Customer Relations Management system (CRM). We know these donors have been deeply moved, touched or inspired by the work of your organization. Yet, they are not giving in traditional ways as a current donor.

Are there ways to inspire more people to tell us about their future plans? One well-known strategy has always existed, but it’s rarely employed in legacy giving strategies.

Donors love a match!

All of the research and donor affinity surveys Blakely has conducted in the past six years show us that gift matches are the number one way people are inspired to consider a gift or increase a gift. In our latest research, nearly 70% of donors say they’re more likely to give a substantial or legacy gift if a match is on the table.

Matches are not new in legacy giving Legacy matches from corporations and individuals have been used successfully by charities for years, particularly in higher education. They offer significant current and future benefits, but they are often an overlooked tactic for many.

We know that the emergence of younger donors who are very attracted to making planned gifts means that it’s an important consideration in the mix. How can we think differently and incorporate matches into our legacy programs?

First, the matching source can be a business or an individual

Fundraisers often first think of securing a corporate gift for a match first, but there are other options to consider.

Some individual legacy donors are allowing their planned gifts to be made into a match to inspire other legacy gifts. Charities are securing these agreements through conversations with the donor after the confirmation of their gift. People are inspired to inspire others — over 30% of Canadian donors surveyed said that this would be a reason to tell the charity about a gift in their Will!

Second, immediate matches can inspire people to leave legacies and confirm their gift intentions

Many organizations now go beyond just identifying future gifts through formal confirmations. They also take people at their word when they learn of future gifts uncovered in conversations and track those, and steward hand-raisers (those interested or open to leaving you a gift in their estate).

There are still many people who will never tell you that they have included you (30% of donors under 60 and 55% of donors over 60 said there was no solid reason to tell the charity about a planned gift) so treat everyone like they have, or will be including you in their Will!

Use a match to open up conversation, and to obtain confirmations by pointing out that your charity will receive an immediate matching cash gift for every confirmation received as part of a challenge or match campaign. Organizations have used both corporate and individual gifts in this way.

This means putting time and effort into the campaign itself and investing in marketing to drive the conversation and confirmations.

Third, think about matching differently

Legacy giving matching differs from the matches offered in your leadership, major gift, or annual programs, where you match 100% of the gift dollars.

One charity received a match gift of $300,000 from a donor who wanted to inspire more legacies. The charity used that match gift to inspire confirmations, offering an immediate $10,000 cash donation per confirmation for the charity. Their goal was 30 new confirmations, which they exceeded! The match

was capped but the exposure — and the conversations and opportunity to open up legacy engagement — was priceless!

We have seen other successful campaigns that offer cash gifts that match the first 10% of a planned gift. This style of match generates confirmations and reveals the size of gifts, but can limit the uptake, particularly for those people who are making more modest or residual gifts.

Be creative and think seriously about what you are trying to achieve — maybe identifying hand-raisers is your primary goal, so focus your matches on that. Invest in your proposition and campaign to make sure you are reaching past your known, traditional legacy audiences and into audiences that may not have been targeted for legacy engagement previously (or ever).

The biggest opportunity with legacy matching might be working with your colleagues on other teams, including major gifts, annual or corporate giving. Collaboration can help to secure the right match and work through the campaign logistics. Legacy giving should be integrated into every part of your organization, so maybe a match is just the right way to make this happen and change the future through legacy growth now!

Legacy giving isn’t just about the future — it’s about the conversations you start today. Matching can be the spark.

KIMBERLEY BLEASE is EVP, Strategic Growth & Innovation for Blakely Inc. With over 39 years of experience in corporate and not-for-profit leadership, Kimberley is a fundraiser and marketer with a focus on delivering lifetime value and real donor engagement. She is a sought-after speaker on the topics of high value giving, planned giving/legacy and trends in the sector. As EVP at Blakely Inc., she heads the creation of new products and solutions, facilitates client workshops that drive growth and change-management, and heads Blakely’s thought leadership platform — The Blakely exchange. kimberley@blakelyfundraising.com

BY HEATHER CLARA YOUNG

Astute corporate philanthropists seek that sweet spot where the charity’s mission resonates with corporate values and priorities, and where the scale and profile of patron and beneficiary are a good fit.

When evaluating applications for support, they also scrutinize program budgets and often require financial reporting to show that their donation will be used responsibly and effectively. Differences in financial perspective can lead to potential misunderstandings between the donor and charity.

The fact is that charities approach finance differently than corporations. Further, “biz school” curriculum rarely addresses the not-for-profit sector in-depth, so business folk may tend to interpret nonprofit financials through an incompatible lens.

Let’s review some radical differences that reveal the roots of the distinction between businesses and charities.

Expenses – bad or good?

Let’s start with expense — such a common, day-to-day term that everyone feels they understand it. Yet, expenses lie at the heart of the difference between nonprofit and commercial mentalities.

The CPA Canada Handbook — the bible of accounting practice in Canada — defines expenses as “decreases in economic resources.” That sounds bad! However, expenses must be incurred to operate the business and, ultimately, generate a profit. The common saying is that you have to spend money to make money.

In the nonprofit world, we flip that on its head. We’re not “for profit.” We’re “for” something else — mandate, mission, and the

good we want to do in the world. Charities raise money so that they can spend it on activities that deliver the greatest impact on their cause or community — in other words, expenses are good — the reverse of business leaders restricting costs to generate a more favourable bottom line.

Nonetheless, charities, just as much as businesses, place great importance on managing costs. A charity that cannot live within its means won’t be around for long. Strategic spending is crucial in all sectors, although the underlying thinking may be different.

It’s also true that a non-profit’s delivery of community value may have a commercial dimension — a theatre selling tickets; a college selling registrations. In these cases, the classic approach to expense applies, but charity regulation puts guardrails around commercial activity. According to CRA , “[Fee-based] programs remain charitable as long as they manifest the two essential characteristics of charity — altruism and public benefit.”1

The logical extension of this approach to spending money is that nonprofit financial planning will never be based purely on financial considerations. As corporate philanthropists are well aware, it’s common for charities to proceed with money-losing programs and activities based on mandate and community need, and to make up the shortfall through other means, including donations.

It’s unwise to decide on nonprofit support solely by looking at financials

An important take-away for all those who decide which charities to support largely based on their financials — and I’m thinking about individual and corporate donors, potential volunteer Board members, and lenders — is that you may need to broaden

your thinking to fairly evaluate a charity’s operating results.

Language shapes our thinking, and the charitable sector has distinct accounting terminology that sets it apart from the commercial world.

Businesses aim to generate a profit for their owners. While charities are allowed to make money, they name the result differently. Surplus — the nonprofit term — describes an amount exceeding what was required. The opposite — deficit — indicates a shortfall or deficiency compared to what was needed. That puts a very different spin on it!

The idea of sufficiency is baked into nonprofit financial vocabulary. The accumulation of wealth drives business, but a well-managed charity seeks to accumulate the optimal amount to secure its longevity. The rest is poured into community service.

We see this on the balance sheet, too, where the equity section (commercial language) is replaced by net assets (nonprofit language).

All of us who studied introductory accounting for business will remember the basic accounting equation:

This equation describes the accumulation of a company’s assets. We acquired some of them via borrowing (liabilities), and some from our own resources (equity). A savvy business owner knows how to utilize borrowing to drive the business forward. Common business ratios include the debt-to-equity ratio and the return on equity — measurements of the owner’s acumen at building wealth.

In the nonprofit sector, we restate the basic accounting equation as follows:

Conceptually, we’re looking at the same things! Net assets, functionally, are the same as equity. Note that the business world isolates the term assets meaning liabilities plus equity. The nonprofit world isolates the term net assets meaning what’s left of assets after debt is paid.

The commercial balance sheet focuses on the accumulation of wealth, while the nonprofit version supports an evaluation of whether the organization’s residual value is sufficient to secure its future.

We can dive even deeper.

Leaving aside owner’s equity (or contributed capital), which doesn’t exist in the nonprofit world because there are no owners, businesses subdivide their equity into current earnings and retained earnings — that is, this year’s profit, and the historical profit over the company’s lifetime. Business owners want to measure the wealth generated from their operations. Making the time period distinction (last year versus previous history) is helpful for analysis.

Not-for-profits also need to evaluate how operations impact their overall wealth. A surplus increases net assets, and a deficit depletes them. That’s important information for evaluating sustainability and setting next year’s budget goals. However, the nonprofit balance sheet lays out the net assets section according to an entirely different framework: whether that residual value is accessible or restricted.

We need to spend a few minutes on revenue to unpack that comment.

Charities’ revenue is for general use or restricted By and large, when a business generates revenue, it can do whatever it likes with the money. A sale is an exchange of goods or services for money — and once the exchange is concluded, the seller walks away with no further obligations.

The same is true for nonprofits with commercial activities, such as the theatre company selling tickets and the college selling course registrations. After the applause, after the final exam, that’s it! The seller’s obligation to the buyer has been satisfied.

When averaging the income of all of the charities in Canada, no-strings-attached revenues from sales comprise only 8% of charity income, according to the Charities Directorate2. The rest of the sector’s income comes from government (70%) and philanthropy (22%). While some philanthropic support also arrives with no strings (e.g., many individual donations), institutional support is typically earmarked for a defined (restricted) purpose.

Readers of a nonprofit’s financial statements need to know what portion of the charity’s net assets is restricted , and what’s available for general use . Financial statements disclose the amount that’s been invested in capital assets (inaccessible because it’s sunk ); the portion that’s externally restricted by a third-party agreement; the portion that’s internally restricted by the Board of Directors; and the rest — which is unrestricted.

It’s important to recognize that those last two — unrestricted and internally restricted net assets — are both under the Board’s control. Combined, they yield a key indicator of the organization’s sustainability, and its ability to carry on with planned operations.

As you can see, Accounting 101 leaves much unsaid about the peculiarities of nonprofits! Corporate patrons and their charitable beneficiaries can only benefit by a clearer understanding of their distinct approaches to finance.

HEATHER CLARA YOUNG, CPB founded Young Associates in 1993 to provide bookkeeping, payroll, training, consulting and outsourced CFO services to not-for-profits and charities, specializing in the arts and culture sector. Heather teaches accounting and financial management in Humber College’s Arts Management program, and has taught for Humber’s Fundraising and Volunteer Management program and University of Toronto’s Arts Management program. Her book Finance for the Arts in Canada (2005, 2024) is a self-study textbook and reference source on how to master arts-sector nonprofit accounting and financial management skills.

1. https://www.canada.ca/en/revenue-agency/services/charities-giving/charities/policies-guidance/ policy-statement-019-what-a-related-business.html

2. https://www.canada.ca/en/revenue-agency/services/charities-giving/charities/about-charitiesdirectorate/report-on-charities-program/report-on-charities-program-2023-2024.html

BY ARIN KLUG

When I was a kid, I loved baseball. Whenever I saw a group of kids my age playing at the park across the street,

I’d grab my glove and rush over.

The only problem? I was painfully shy. I’d hover near the diamond — close enough to be noticed, far enough to stay out of the way — secretly hoping someone would call out to me, “Wanna play?” When they did, I felt both happy and relieved.

Looking back with the benefit of a little perspective, I know that if I’d just had the courage to ask, I would have spent a lot less time worrying, and a lot more time doing something I loved. Sometimes, asking a simple question can make a big difference.

A conversation that rarely happens

Before launching Epilogue, a legally binding online Will service, I was an estate planning lawyer. Like many in the profession, I generally let the client lead when discussing their personal wishes for estate distribution. If a client brought up charitable giving, we’d work it into the estate plan, but if not, I didn’t explicitly ask the client to consider it.

Upon reflection, I think part of it was not wanting to come off as suggesting it’s something the client should be doing if they weren’t otherwise interested. I didn’t want to overstep. I just assumed that if it mattered to them, they’d say so.

However, when we built Epilogue, we took a different approach. We baked a question about charitable giving into every

user’s Will planning questionnaire. Just a simple prompt: “Some people like to make donations in their Will to support charities that are important to them. Is this something you’d like to do?”

No persuasion, emphasis, or fanfare — just a quiet invitation.

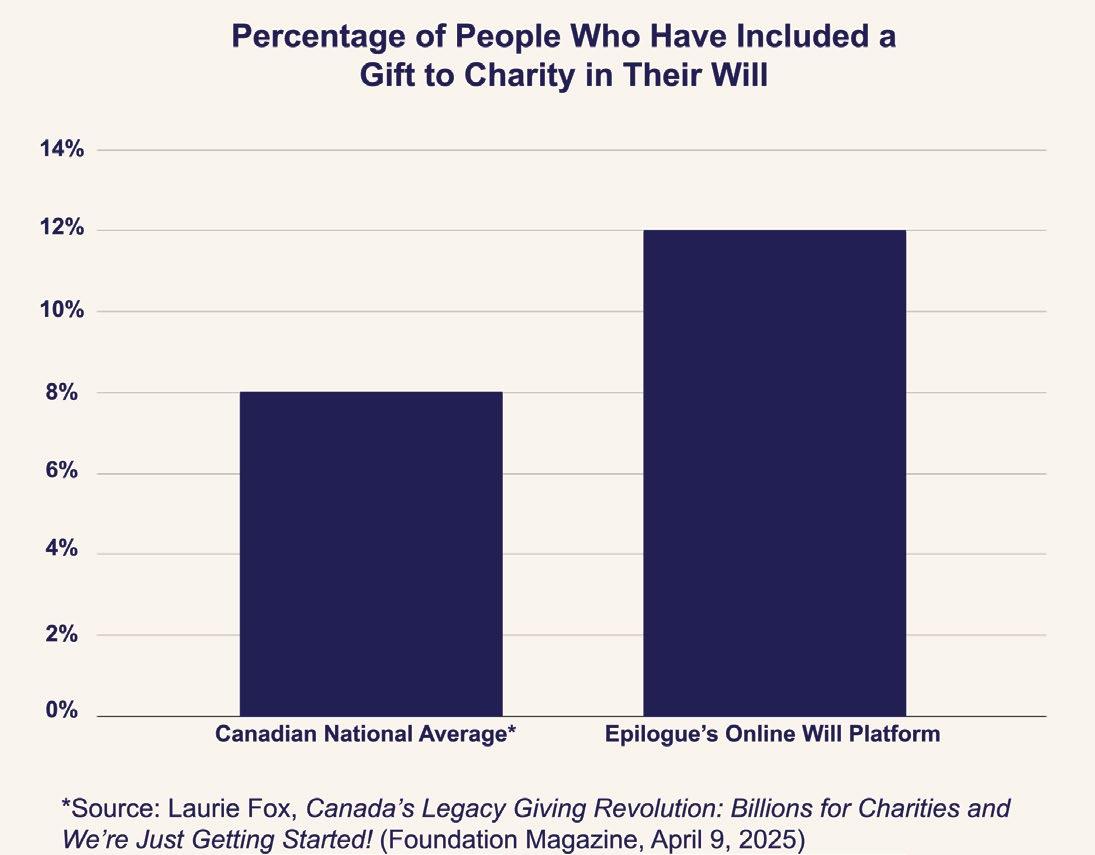

The result? Around 12% of users include a charitable gift in their Will. That’s about 50% higher than the national average in Canada, where about 8% of people include a charitable gift in their Will

Why are we seeing this difference? I think it’s simply because we ask the question.

In the absence of a prompt, charitable giving often remains invisible.

An opportunity hiding in plain sight

The takeaway is that people — ordinary Canadians — are more open to including a gift in their Will than their advisors may assume. But these individuals won’t take the initiative on their own. Not because they’re opposed to it, but simply because it doesn’t cross their mind.

In the absence of a prompt, charitable giving often remains invisible. Not consciously rejected — just never surfaced.

Clients don’t raise the idea of including a legacy gift because it’s rarely presented as a standard part of the estate planning conversation. But once you make the question part of your process, it feels obvious and not so out of place.

The art of the nudge

To be clear, this isn’t about turning estate planning professionals into fundraising advocates. It’s about creating space. Making sure that charitable giving has a seat at the table alongside the other decisions, like the choice of executor or guardian.

Here are a few ways to integrate the conversation, naturally and professionally.

❯ Timing matters: Casually introduce the idea as part of the conversation about beneficiaries. For example: “Your children are going to be the main beneficiaries of your Will, but you also have the option to include one or more charities, if you’d like.”

❯ Stay neutral and inclusive: Avoid implying that they should give. Instead, keep the language neutral. “Are there any causes or organizations you currently support that you’d also like to recognize in your Will?”

❯ Frame the gift as a legacy, not a donation: This isn’t like a one-time gift—it’s part of how someone will be remembered. That framing often resonates more deeply than thinking about it in the same way as a monthly donation or a one-off gift during someone’s lifetime.

❯ Identify and address concerns: Some clients raise the idea of a legacy gift when asked about the remote “family disaster” scenario (i.e. no living descendants). This may reflect a willingness to give, coupled with a fear of taking too much away from surviving family members. Consider whether this may open the door to a discussion about including a smaller (but far less contingent) gift that won’t adversely affect the client’s surviving family.

❯ Let them say no: Sometimes the most important part of a good question is that it’s easy to decline. Clients need to feel that the suggestion is just that.

As a professional advisor, your primary role is to help your clients achieve their estate and financial planning objectives. But you’re also in a position to unlock possibilities—ones your clients may not even realize are available to them.

A well-placed question isn’t pushy. It’s powerful.

A well-placed question isn’t pushy. It’s powerful. It’s a chance to help a client live out their values, create a legacy, and support causes they care about — without ever having to change their lifestyle. We don’t need to convince clients to be charitable. We just need to ask.

ARIN KLUG is Co-Founder and Chief Operating Officer of Epilogue

Arin founded Epilogue, an online platform that makes it easy and affordable for Canadians to create their own Wills and other important estate planning documents. With a background in both computer science and law — a rare combination — Arin helped build a platform that is not only user-friendly but also secure and legally robust. As part of its focus on estate planning, Epilogue partners with Canadian charities to help them secure more legacy gifts in Wills. Before launching Epilogue, Arin practiced as a tax and estate planning lawyer in Toronto, helping his clients achieve their estate planning, business succession, and philanthropic goals.

Where strategy meets social change. Join sector leaders, fundraisers, and changemakers from across Canada for a one-day event that goes beyond inspiration — offering real-world results.

Omni King Edward Hotel · Toronto

A half-day workshop with Russell James, Ph.D.

Learn James’s evidence-based approach to using appreciative inquiry with donor to make transformational donations.

Space is limited to 40 participants.

Tickets include access to James’s closing plenary keynote talk at CNFC 2025.

Plus speakers working across Canada, bringing you actionable insights on strategy, analytics, mission, media, and member-driven fundraising.

Nonprofits & Charities: Register and receive free donorappeal advertising in the 2025 Canadian Giving Guide. Send more delegates, get more visibility.

Businesses Serving the Sector: Your pass includes bonus marketing in Foundation Magazine and Hilborn Charity eNews — ads, banners, and more. Expand your brand and connect with sector leaders.

Make your conference attendance work harder.

Save your spot today at canadiannationalfundraisingconference.ca

BY JOHN BROMLEY

Donor-advised funds (DAFs) can sound more complicated than they are. In practice, a DAF is remarkably simple: it’s an account you open to manage your charitable giving. Think of it as a kind of savings account, only this one is for giving back.

In a world where the vast majority of financial tools are built for charities, the DAF offers donors what they need to be more thoughtful, strategic, and organized about their giving. Any donor — an individual, a group of people, a company — can open a DAF.

DAFs are typically offered by registered charitable foundations through financial institutions, community foundations, and specialized services like Charitable Impact. Here’s how they work: The donor contributes funds to their DAF account as a charitable donation. They receive a charitable tax receipt for their contributions. Depending on the DAF provider, the money in the account can be granted to any registered charity or another qualified donee, once the donor is ready to make those decisions. In most cases, funds remaining in the DAF account can be invested, allowing the giving balance to grow.

A key advantage of the DAF is that it separates the decision to make donations into the DAF, from the donor’s decisions on which charities will receive grants from that fund. In fact, all other benefits of the DAF—of which there are many, such as giving anonymously—stem from this core value proposition.

Why is this the most important benefit of the DAF? Thanks to this separation, donors can focus more on each major decision point in their holistic giving journey.

For example, on the donation side, how much money am I prepared to give away? Do I want to make that donation in monthly amounts or give one lump sum? Do I want to donate cash and/or another asset type, like public securities?

On the grant-giving side, considerations include: which cause

do I want to focus on? Within that, which specific charities do I want to support? Do I make this decision alone, or make joint decisions with my family, work colleagues, or others? Do I want to share my name with the charities I support or remain anonymous?

The DAF is a tool to help you seek out those answers. Scientific research across cognitive psychology and behavioural economics corroborates that our decision-making improves when we have less to think about. In my experience, separating donation and grantmaking reduces stress and regret from reactive giving. It also increases joy and confidence.

With all of giving activity centralized in one place, the donor can easily track their donations and grants, learning from the giving history they’ve established to inform future decisions. The DAF’s history also equates to a resume of charitable giving.

In the past, why have DAFS mostly been used by wealthy people?

Despite their practical benefits, DAFs still have an access and perception problem. For years, DAFs have been viewed as tools for high-net-worth individuals. That reputation didn’t appear out of nowhere.

You see, DAFs have required considerable back-end administration: processing contributions, managing balances, disbursing grants to multiple charities, and maintaining records…all of which had to be done with largely manual systems. As a result, it made economic sense for DAF providers to support a small number of large donor accounts. In addition, the organizations administering the DAFs often charged fees based on assets under management, naturally favouring donors whose large balances could justify the administrative effort. So, it’s no surprise that DAFs became synonymous with high-networth philanthropy.

DAFS are now possible for every donor, regardless of donation size Today’s DAF platforms use technology that has drastically reduced the daily administrative burden associated with managing these accounts. Tasks that once required data entry, spreadsheet management, and cheque writing are now automated. The cost of servicing a DAF — let alone opening one — has dropped. This makes it possible for DAF providers to support tens of thousands of donors, regardless of how much they wish to give.

Across North America, new platforms prioritize accessibility and user experience. Their goal is to engage more people and companies into making charitable giving a part of who they are and what they do.

This is a typical DAF donor story.

Jason, a retired business owner, opened a DAF and made an irrevocable donation of a significant gift of public company shares, taking advantage of the tax incentives the Canadian government gives to donors. Following DAF policies, an investment advisor manages those assets, enabling them to grow. Jason is not under immediate pressure to grant all of that money out. He has the time and space to thoughtfully consider which causes and geographies matter most to him and which charities he wants to support.

Other stories will be more relatable to you, but are not the type we expect from a DAF.

Amanda, a teacher and mom of two kids, is managing a tight family budget. Nonetheless, she’s committed to being charitable and contributes $100 a month to the DAF account she manages with her spouse. That regular contribution means she has charitable money ready to give regularly. From the account, she makes two automatically recurring monthly grants to charities she loves, one to the house of worship they attend and the other to a local food bank where they also volunteer. Wanting her children to understand what it means to give back, Amanda also allocates small monthly grants from her account to DAF accounts she set

up for each of her kids as a charitable allowance. The kids choose where and when to give that money away. Giving, for Amanda, is not a tax strategy. It’s a family value.

Or this example:

A local manufacturing business that donates a set percentage of its profit quarterly into its DAF account, taking a charitable tax receipt for their company. They use half of it to match the charitable gifts made by their employees. They use the other half to support various philanthropic initiatives in their local area, often brought to them by their customers and suppliers. The DAF dramatically decreases the amount of time they spend tracking and administering their giving program, time they can put to more productive use elsewhere.

These stories are different from one another, and they should be. Donors are as unique as their personalities. However, the tool helping each of them manage their giving is the same: the DAF.

When a retiree in Victoria, a teacher in Winnipeg, a local business in Halifax, and a seventh grader in Montreal can use the same infrastructure as a major philanthropist, it challenges the idea that you have to be rich to be a philanthropist. It reminds us that generosity is something shared. After all, we all care for causes that can create desirable change. The DAF is the tool for donors — people and companies — who put their beliefs and donations into action.

You don’t need to give away a lot of money to benefit from a DAF; you just have to be committed to making giving a part of your life.

JOHN BROMLEY, Founder and CEO, Charitable Impact

Charitable Impact is a modern donor-advised fund platform that empowers Canadians to engage more personally and intentionally with charitable giving, creating the change they want to see in the world. It offers flexible tools and support for people to plan their giving, support meaningful causes, and collaborate with others to grow their collective impact. Since 2011, more than 210,000 Canadians have donated over $1.5 billion through Charitable Impact DAFs. Learn more: https://www.charitableimpact.com/

BY TONY MAIORINO

For incorporated business owners, corporate giving can exist in many ways and offer a range of benefits. Looking at it from a holistic lens, we know that the act of corporate philanthropy, regardless of the form of giving, is integral for creating meaningful impact in and across communities. At the same time, for a business and its owner, corporate giving can be an important part of overall planning and strategy— think tax planning, attracting and retaining talent, and building brand, for example.

Findings from the CanadaHelps Giving Report show that financial gifts to charities from primary funding sources such as corporations are in decline. This may present an important opportunity for those in the philanthropic sectors to highlight the potentially multi-faceted benefits that corporate giving may provide for corporations and their owners.

Here are five key reasons for those with corporations to focus on corporate philanthropy.

1Utilizing the corporate donation tax deduction

From a tax planning perspective, charitable donations can be an important part of the conversation as it relates to a corporation’s taxable income. For incorporated business owners who make a donation through their corporation to a qualified donee, the corporation is entitled to a tax deduction (for the donation amount) against their taxable income. By making a corporate donation, corporations can reduce their taxable income, thus decreasing their tax liability.

In general, a corporation can claim a deduction for charitable donations up to 75% of the corporation’s net income for the year. And, if the corporation doesn’t want to claim the full donation amount in a particular year, donations can be carried forward for up to five years for tax purposes; this offers a degree of flexibility for the tax deduction to be applied in a year or years

where the corporation’s tax liability may be higher, helping to offset those taxes.

2Considering capital gains: Donating publicly traded securities

In some situations, it may be tax effective for a corporation to donate certain types of securities directly to a qualified donee, rather than make a cash donation. This may be the case, for example, if a corporation has publicly traded securities with large accrued capital gains. When using this approach, the corporation can deduct the full market value of the securities donated against its taxable income as a charitable donation, reducing the corporation’s tax bill.

Also, the capital gain on the securities donated to a qualified donee may be reduced or eliminated (dependent upon certain qualifying criteria that the donated securities must meet). Another benefit when qualifying securities are donated in-kind is that the full capital gain associated with the donated securities is added to the capital dividend account. This may increase the amount that can be withdrawn from the company tax-free. In all instances, before making a donation of securities, it’s important to consult with a qualified tax advisor and confirm that the registered charity can accept this kind of in-kind donation.

3Being aware of Alternative Minimum Tax

Still within tax planning, Alternative Minimum Tax (AMT) is another important consideration for those seeking to reduce their taxes payable through making a donation. AMT is a tax that aims to ensure every Canadian pays a minimum amount of tax and that prevents some high-income earners from paying little or no tax because of certain tax incentives.

With some recent changes to AMT, many were left re-evaluating their charitable giving plans because of the impact on the tax treatment of charitable donations by individuals. As a result, for tax purposes, corporate charitable giving can be a more attractive option (versus making donations personally).

This approach may be advantageous from a tax perspective because AMT applies only to individuals and not to corporations.

Within wealth planning, among current topics related to charitable giving, how AMT may affect one’s charitable giving continues to be a common question. With that in mind, it’s crucial for individuals to work with a qualified tax advisor to determine if AMT would apply and to stay informed on further potential changes.

As part of business owner planning, a key question many may ask is how to attract top talent and foster an environment where employees are keen to stay longterm. Alongside financial incentives and offerings like employer-sponsored savings plans, benefits programs or enhanced retirement benefits, a structured and wellcommunicated corporate giving program may function as a competitive edge to draw talent to the business and boost employee retention and engagement.

According to one study from Imagine Canada, among those surveyed, 50% of job seekers considered their employer’s reputation for charitable and community work before accepting the job. And, employees who feel their company is highly committed to community are more satisfied with their jobs, are likely to recommend their company to others, and strongly agree that they share a common social purpose with their company.

For incorporated business owners and their companies, a thoughtful and well-

defined corporate giving program may also be impactful to build trust and expand brand awareness and reputation among clients or customers. In times when a highly competitive marketplace exists across many industries, corporate philanthropy can be a significant differentiator. For example, when clients or customers see a business making efforts to help communities or causes through corporate giving, research indicates that can positively influence consumer decisions. Or, when a business pursues corporate philanthropy and supports causes or charitable organizations that align with the company’s core values — or that resonate with a client’s or consumer’s values—studies show that brand loyalty is more likely to increase, and people will tend to build a long-term connection to that business or brand.

From a community perspective, a company’s corporate giving can also serve to strengthen ties with the communities it serves and/or operates within. With a long-term commitment to community investment, businesses can play a vital role in creating sustainable impact and making a difference, locally or beyond, through their corporate giving programs.

TONY MAIORINO, is Head of Family Office Services team RBC Wealth Management Canada.

Tony has over 30 years of experience advising high-net-worth clients in Canada, and often contributes to publications on various topics within wealth planning. His team of over 250 professionals provides legal, tax and financial planning expertise to help advisor teams within the Wealth Management Canada segment deliver integrated wealth management and planning to high-net-worth clients and their families. For more information, visit: https://www.rbcwm.com/en-ca/videos/our-approach.

BY JULIE QUENNEVILLE

JULIE QUENNEVILLE

When philanthropy fuels a nation’s health care innovation

anada has always punched above its weight in health care and medical discovery. From the discovery of insulin to the identification of stem cells and the development of their ground-breaking therapeutic use, some of the world’s most important breakthroughs have Canadian roots.

And today, our country remains home to one of the world’s top medical institutions: University Health Network (UHN), proudly ranked Canada’s #1 hospital and the #1 publicly-funded hospital in the world for seven years in a row by Newsweek

In a world where science, technology and health are converging at unprecedented speeds, leadership in health innovation is about looking ahead. It takes vision, partnership and bold, homegrown investment in Canada’s future. At a time when Canada’s future hangs in the balance, we need to act swiftly to secure that future.

That’s why UHN launched the Canada Leads 100 Challenge, a bold and ambitious initiative to make Canada the world’s top destination for medical research and innovation.

Canada Leads brings together the strength of public institutions, and private and corporate philanthropy to recruit 100 top early-career scientists from Canada and around the world to UHN.

This program will supercharge life-changing research, accelerate discoveries from the lab to patients, and drive innovation that benefits people across Canada and beyond.

And the benefits don’t stop there.

leader in health science. And, perhaps most importantly, our families, friends, colleagues and communities benefit from made-in-Canada discoveries first.

Philanthropic support gives us the opportunity to offer the world’s best and brightest medical minds a home to bring their boldest ideas to life. Private and corporate philanthropy play a central role in this ambitious vision. Within a week, UHN Foundation was able to raise an initial $15 million for Canada Leads — enough funding for our first 50 new recruits.

These visionary founding private donors aren’t just funding research — they’re co-creating a new model of nationbuilding through innovation. They understand that strategic philanthropy doesn’t just improve lives—it enhances national competitiveness, attracts global talent and turns Canada into a destination for investment and impact. UHN’s discoveries are Canada’s discoveries. And Canada Leads makes sure we can continue to be a driver of medical innovation.

As CEO of UHN Foundation, I’ve seen firsthand the power of corporate philanthropy to transform institutions.

But what we’re seeing with Canada Leads is something even greater.

It has become a movement where giving both fulfills corporate strategy, and becomes a strategic lever for national advancement. Where the corporate sector becomes a vital partner in shaping our country’s future.

Canada’s business leaders: the time to join our pivotal movement is now.

This is an investment in Canadian talent, Canadian jobs, Canadian industry and Canadian health.

Canada Leads is a call to action — it’s an opportunity to invest in our people, our health, our prosperity and our place in the world.

This is what philanthropy in Canada must become: not just giving back, but giving forward — with purpose, with patriotism, and with the conviction that Canada is in a position to lead.

Because when Canada leads — we all win.

JULIE QUENNEVILLE, CEO, University Health Network Foundation. Since 2023, under Julie’s leadership, UHN Foundation has achieved incredible success on milestone capital campaigns for a new surgical tower at Toronto Western Hospital. She also heads the Canada Leads 100 Challenge. In her past role as President and CEO of McGill University Health Centre Foundation, she grew revenue by 350 per cent, expertly navigated the integration of three foundations, and built a team recognized as one of Canada’s Most Admired Corporate Cultures. She writes this column exclusively for each issue of Foundation Magazine.

BY GEORGE IRISH

We’re two years into the Age of Artificial Intelligence (AI), and for the charitable and nonprofit sector the picture is looking alarmingly unbalanced.

Big tech investors are pouring billions into silicon-valley AI startups while nonprofits are still watching from the sidelines.

Many charitable organizations with tightening budgets are hesitating to invest in AI, understandably worried about the cost, bias, data privacy, and impacts on the communities they serve. These concerns are valid. However, taking advantage of AI can amplify the voices of nonprofits, helping them to better serve marginalized people and causes.

Now is the time for nonprofits to use AI to extend their capabilities, streamline operations, and free up staff for missioncritical work.

The AI funding challenge for nonprofits

Some nonprofits face financial barriers to implementing even basic AI tools like ChatGPT. A $20 per month fee per user seems affordable, but it adds up quickly when you’re making AI tools available to your full staff. While businesses can see quick returns on AI investments that improve productivity and efficiency, most nonprofits have longer ROI timelines.

This funding gap creates more than just a tech divide—it puts nonprofits at a strategic disadvantage.

Research shows that adopting AI tools delivers solid returns through better efficiency. Organizations using AI report up to 30% lower administrative costs and 40% higher productivity. Yet philanthropic investment in nonprofit tech remains tiny and funding sources are few — less than 2% of foundation grants support technology adoption.

Yet, allocating funds to AI can generate significant benefits that help nonprofits thrive in today’s challenging climate:

❯ Better donor engagement: AI tools can segment audiences, predict giving patterns, and tailor messages to specific interests.

❯ Data-driven decisions: AI-powered analytics help

organizations understand program impacts and community needs.

❯ Automated routine work: Administrative burdens like data entry and reports can be streamlined, freeing staff for relationship-building.

❯ Wider reach: Automated translation, chatbots, and personalized content let nonprofits engage broader audiences without hiring more staff.

Investing in AI isn’t optional any longer. For staying relevant, it’s essential.

There’s good news: help is on the way. A growing ecosystem of corporate giving, government grants, and AI-for-Good-backers is emerging.

…less than 2% of foundation grants support technology adoption.

Funding sources that can help Canadian nonprofits to harness AI’s potential

The major AI tech players have already recognized the crucial role that nonprofits play in charting the path to ethical AI. Many have created philanthropy programs to support nonprofit AI adoption, ranging from discounted tools to funding and technical help.

Microsoft Philanthropies leads in nonprofit AI support. Their Nonprofit Leadership Summit has become a key forum where nonprofit leaders share practical AI strategies. Microsoft Copilot for Nonprofits offers subsidized access to advanced AI that works with existing Microsoft 365 nonprofit tools.

A growing ecosystem of corporate giving, government grants, and AI-for-Goodbackers is emerging.

Google.org has launched the Generative AI Accelerator, a global program combining significant funding, six months of handson technical mentorship, and structured training. Additionally, eligible nonprofits can use AI features—including Gemini— in Google Workspace for Nonprofits at no cost, with more advanced AI tools available at discounted rates in paid editions.

OpenAI offers a 20% discount on ChatGPT Team and up to 25% off on Enterprise plans for eligible nonprofits. These tools are widely used for grant writing and proposal development, with organizations reporting substantial time savings and improved efficiency. Through a partnership with the GitLab Foundation, OpenAI provides API access credits and technical support to nonprofits building custom AI applications.

Anthropic’s Claude AI, designed with a constitutional AI approach emphasizing safety and ethics, offers tools that align with nonprofit values. Their AI for Science Program provides up to $20,000 in API credits to research-focused nonprofits and academic teams with significant social impact potential.

Government and Industry funding opportunities: Through a growing array of targeted grants, funding programs, and technical support, these organizations are helping nonprofits, research institutions, and businesses access the resources they need to innovate with AI.

Regional Artificial Intelligence Initiative is part of Canada’s $200 million national investment in AI, delivered through regional development agencies to accelerate AI adoption and commercialization across sectors. Nonprofits are eligible for up to 90% coverage of eligible costs for non-commercial AI projects, making this initiative a valuable opportunity for organizations aiming to integrate AI into areas like healthcare, clean technology, or agriculture, even with limited upfront resources.

Scale AI, Canada’s national AI innovation cluster, funds collaborative projects that bring together nonprofits, businesses, and academic institutions to develop and deploy AI solutions. Rather than direct grants, Scale AI reimburses 40-50% of eligible project costs (and up to 100% for healthcare projects), supporting expenses such as salaries, research, and technology — making it a strong option for nonprofits that can partner with businesses or researchers to address social or sectoral challenges using AI.

National Research Council Canada’s Industrial Research Assistance Program (IRAP) primarily funds small- and medium-sized businesses but encourages partnerships with nonprofits for technology-driven community projects. While nonprofits are not usually direct recipients, those collaborating with a small- or medium-sized business can benefit from IRAP’s support — covering up to 80% of technical salaries and 50%

of contractor costs — making it a practical pathway for nonprofits to co-develop AI solutions with private sector partners for social impact.

Provincial programs: Ontario’s AI Hub offers training, networking, and advocacy to help organizations — including nonprofits — adopt artificial intelligence, though direct funding is not explicitly mentioned. Quebec’s support for Frenchlanguage AI applications is referenced in policy discussions, but specific nonprofit funding details are limited.

RBC Tech for Nature is a $100-million initiative supporting nonprofits and universities that use AI and digital tools for environmental sustainability, often in partnership with academic institutions.

The TD Ready Challenge awards up to $1 million annually to nonprofits and charities for innovative projects, including those using AI, with focus areas that change each year. Technical support is not always included.

BMO supports nonprofits through partnerships, mentorship, and funding for AI-related projects, often collaborating with organizations like the Vector Institute, though it does not offer a dedicated AI grant program for nonprofits.

AI for Good and Tech to the Rescue’s AI for Changemakers: These are two examples of tech consortiums and platforms that connect nonprofits

with pro-bono AI experts, shared resources, and open-source tools. These collaborations are designed to bridge the technology gap for nonprofits, providing access to AI talent, mentorship, and technology that accelerates social impact and helps organizations achieve their goals more efficiently.

By leveraging these grant and support programs, nonprofits can gain greater access to cutting-edge AI technology, funding, and expertise and get a solid start down the AI adoption path.

Applying for AI grants

Nonprofits and charities applying for AI grants need more than just enthusiasm for the new technology. You need to have a strategic approach that demonstrates how AI will advance your organization’s core mission. Here are some key tips to strengthen your application:

1. Show mission-driven impact

Clearly articulate how AI will directly enhance your mission delivery, not just add technical complexity. Funders want to see that AI is a tool for greater impact, not an end in itself.

❯ Develop realistic technical plans: Outline achievable project milestones and technical requirements.

❯ Build sustainable budgets: Present a budget that covers both initial implementation and ongoing maintenance.

❯ Include strong evaluation frameworks: Define metrics to measure both technical performance and mission-related outcomes.

2. Demonstrate organizational capacity

An assessment of your current capacity reassures funders of your AI-readiness and highlights where support is needed.

❯ Audit your digital and IT infrastructure: Document your existing systems, data quality, and integration needs to establish a clear starting picture.

❯ Identify staff skills and AI leaders: Inventory technical expertise and AI-enthusiasm within

your team to identify strengths, gaps, and champions.

3. Clear needs statement

Funders are more likely to support projects that address clear, missioncritical needs.

❯ Differentiate essential vs. optional functions: Focus your proposal on high-impact, missioncritical applications of AI.

❯ Conduct a pain-point analysis: Quantify current inefficiencies to demonstrate where AI can deliver measurable improvements.

❯ Highlight ROI potential: Show how the project will be financially sustainable, potentially generating value beyond the initial grant.

4. Address ethics and organizational culture

Responsible AI adoption is a top concern for funders.

❯ Demonstrate value alignment: Explain how your approach to AI aligns with your organization’s values and the funder’s priorities.

❯ Showcase privacy and data ethics: Provide a clear overview of your data management and privacy practices.

❯ Plan for change management: Identify potential resistance and include a budget for staff training and communication to support organizational buy-in.

5. Start with practical, high-impact projects Begin with projects that are achievable and visible, building momentum for future work.

❯ Identify “low-hanging fruit”: Propose simple, high-visibility projects for your initial funding request.

❯ Select effective pilot projects: Use pilots to test potential AI tools and gain vital insights before you commit significant resources.

❯ Map your support ecosystem: Show how you will leverage partnerships and existing resources to maximize the funder’s investment.

By following these tips, you’ll present a compelling, credible case for AI funding

that balances ambition with realism and responsibility.

AI-empowered nonprofits lead the way to responsible AI

Strong nonprofit voices are needed to make the vision of safe, responsible, and inclusive AI a reality. As more nonprofits actively join the AI revolution, they’re bringing vital perspectives on equity, accessibility, and community impact that are otherwise missed. The time for hesitation is over—your organization’s unique mission and community insights are too valuable to leave on the sidelines of this technological transformation.

Do we really want to leave the future of AI to Microsoft, Google, and Facebook?

GEORGE IRISH is a veteran of strategy, coaching and consulting for AI-powered charity fundraising. He works with Amnesty International Canada and Greenpeace among other organizations. He writes this column exclusively for each issue of Foundation Magazine.

Helping nonprofits thrive in a tech-driven world

CCNDR’s purpose is to provide the essential non-profit sector with the skills and tools it needs to thrive and serve the needs of the community.

Pulling together a large and diverse group of experts, CCNDR provides support to charities and nonprofits, helping them to confidently adopt and use technology and data to advance their mission and multiply their impact.

❯ Sector research: They produce and share insights on Canada’s nonprofit tech workforce and digital skills.

❯ Collaboration & support: They enable partnerships and provide expert advice to ensure equitable and ethical AI adoption across the sector.

❯ Practical resources provided to help organizations navigate AI adoption.

Learn more and sign up for CCNDR’s email newsletter at www.ccndr.ca

BY MARK HALPERN

Among all the reasons people give to charity, reducing their taxes is often far down the list. According to a survey by the Charities Aid Foundation in the U.K., more important reasons people give are:

❯ 96%: personal values including a sense of morality and ethics

❯ 75%: belief in a specific cause

❯ 71%: faith and religion

❯ 61%: personal experiences

❯ 13%: tax savings

In other words, personal passion drives giving much more than an intellectual understanding of our tax system.

That being said, reducing tax while donating, as a happy side effect, enables donors to give more than they planned or give the same amount at a lower cost, and one of the most tax-effective ways to donate is through a corporation. Let’s explore the whys and hows of this strategy.

unused deduction can be carried forward for use within the next five years.

Some corporations may consider using appreciated securities to donate to charity.

Here’s an example of a gift in question. Let’s say a corporation bought $500,000 worth of various securities: public stock, exchange-traded funds, mutual funds, and segregated funds, and they’re now worth $1 million.

Corporations must resist the urge to sell the securities, and donate the proceeds. If they did, they would have to pay capital gains tax of $135,000 (27% of the $500,000 gain). The final cash donation ends up being $865,000.

Instead, consider the magic that happens when a corporation donates appreciated securities as an in-kind gift to a charity. Although doing so also offers good benefits to an individual who makes such a donation, there are even better advantages for corporations.

…personal passion drives giving much more than an intellectual understanding of our tax system.

When people make personal donations, they get a charitable tax receipt, which is a non-refundable tax credit they can use to mitigate up to 75% of their net taxable income. There’s also the option to carry forward the tax credit (or unused portions of it) for up to five years.

Donating cash through a corporation offers even better tax advantages. The donor receives a full deduction (rather than a tax credit) against net taxable corporate income. Any or all of an

With either personal or corporate donations, you don’t have to pay tax on the capital gain, and the charitable donation receipt can be used to reduce net taxable income now, or at any time during the next five years.

What’s different is that donating corporately means the amount of the capital gain is credited to the corporation’s capital dividend account (CDA) and can now be withdrawn from the corporation tax-free!

In this example, the donation results in a $500,000 credit to the corporation’s CDA, and there’s no tax on future withdrawals against that credit. That saves a further 47% tax that you would have paid had you withdrawn the $500,000 directly from the corporation.

Effectively, depending on provincial corporate tax rates, this roughly doubles the total tax savings and creates a tax-free pipeline that converts corporate dollars into personal dollars.

Amplify gifts with corporate-owned life insurance using the “Give & Get Strategy” Life insurance can be used strategically in many ways to amplify

personal gifts to charity — but there are ways that it, too, can be even more powerful when purchased through a corporation.

When corporate dollars are used to pay life insurance premiums, the death benefit is credited to the CDA, allowing that money to flow through to assigned beneficiaries tax-free, effectively turning corporate money into personal dollars. And, beyond tax-effective estate planning, corporate-owned life insurance has the power to amplify philanthropic gifts, when the beneficiary is a charity.

Here’s a quick case study.

Imagine a couple, both age 65 and very successful entrepreneurs. Their net worth is $60 million held in personal registered and non-registered accounts, along with significant corporate assets shared with other partners. Their estimated tax liability when the second spouse dies is $12.5 million. They’re concerned about that, and they’re also passionate about leaving a substantial legacy to their favourite charitable causes.

They have four basic options to cover the anticipated eventual $12.5 million tax bill:

1. keep cash available for that purpose,

2. instruct that the estate borrow to cover the cost,

3. instruct that the estate sell assets (such as a cottage, business or real estate investments) to cover the after-tax cost, or,

4. buy life insurance. Generally, the last option is the most attractive – and corporately owned life insurance is often the best approach.

At their age, the couple can likely buy a corporately-owned joint last-to-die policy that will be worth $12.5 million when the second spouse dies. The policy requires premium payments of about $160,000 annually over 20 years, or $320,000 annually over 10 years. Either way, the premiums will cost the corporation approximately $3.2 million of corporate money to cover their personal tax bill.

But we’ve established this couple also wants to leave a charitable legacy. They know that the charitable tax receipt on a very large gift will result in a 50 percent tax deduction. So instead, this couple buys a $25 million dollar policy at a cost of about $6.4 million, and makes the beneficiary their charity. The

$25 million tax receipt is then used to reduce their final tax liability to zero. As a bonus, their substantial donation has created an enduring family legacy.

Leveraged charitable arrangements

By giving through a corporation, there is another way to use life insurance to give generously that doesn’t cost anything. A business owner can take a sum of money, say $500,000, from his investment portfolio, and through his business, buy a permanent policy that offers an initial death benefit of $10 million, which grows over his lifetime.

The business owner pays $500,000 annual premiums for 10 years, and these premiums are considered “cash value” that can be used as collateral in getting loans. In the first year, he takes out a business loan worth 100 percent of his cash value, and reinvests the borrowed funds in his stock portfolio, which makes the interest he pays on the loan a tax-deductible business expense.

He increases his loan by $500,000 every year, generating a loan of $5 million. By the time of his death, his policy is worth $15 million, and he’s left instructions for his estate to repay his loan from his death

benefit, and to donate the balance to his favourite charity ($10 million). The $10 million charitable tax receipt covers his estate’s entire tax liability of $5 million.

Recognition can be inspirational

Today, many charities fully understand the value of legacy gifts and are happy to recognize future donors while they are alive, if they so desire. This recognition reinforces the donor’s role as a community and corporate leader during their lifetime and enhances a business’s reputation as a caring contributor to its community. It often also inspires children and grandchildren to follow in the older generation’s philanthropic footsteps.

Help donors do even more good

Charitably-minded people already want to do good. Corporate philanthropy can help them do even more good — but are advised to seek expert advice to make the most of the opportunity.

MARK HALPERN, CEO at WEALTHinsurance.com is a wellknown CFP, TEP, MFA-P (Certified Financial Planner, Trust & Estate Practitioner, Master Financial Advisor—Philanthropy). Mark@WEALTHinsurance.com He writes this column exclusively for each issue of Foundation Magazine.

O ering professional prospect research, training, and fundraising strategy. Editor and contributor to “Prospect Research in Canada”, Canada’s first book on prospect research.

BY NICHOLAS PALAHNUK

In this series, Nick talks with other philanthropic leaders who help to “get money moving” by addressing systemic barriers to giving. This edition features innovator and collaborator Teresa Virani, who has been a pioneer in the Canadian philanthropic landscape. Teresa’s most recent role is Executive Director, Philanthropy at Nicola Wealth.

NICK: We’ve spoken about the emerging trend of spending down foundation and DAF assets. What are you seeing in the sector?

TERESA: What still stands out to me is the fact that my role even exists. It says a lot about how seriously Nicola Wealth takes giving — not just as something we support, but as something we’re committed to building thoughtfully and sustainably. My role exists to help bring more strategy and cohesion to our giving and to shape a direction that reflects both our values and the people behind the work. It’s tied into how we think about what matters to our clients, how we support our team, and how we engage with the community. One of our core values is Share the Pie — the idea that we all benefit when we give back — and that shows up in very real ways across the firm.

for a client who wants to give back in a more structured way, or for a staff member championing a cause they care deeply about.

One of the things I’m proud of is how we support our staff in giving back.

We offer two paid volunteer days, match donations and fundraising efforts, and provide grants to support the causes our team is involved with (as volunteers, serving on boards, or long-time supporters). We also have a staff-led committee that guides our corporate giving. It means our staff feel a real sense of connection to the work we’re doing, and that matters. The connection — with clients and charities, and within our own team — is what makes this work so meaningful to me.

A Q Q

NICK: That’s inspiring! Many families look to their advisors for wholistic financial planning, including philanthropic advice. A recent poll showed that while 87% of affluent families wanted to make a positive social impact through philanthropy, only 6% had their advisors bring up the topic. Tell us about the wealth management process at Nicola Wealth and how philanthropy fits into that?

When I stepped into the role, a lot of great work was already happening, but in different places. Part of my job has been to bring it all under one umbrella—for clarity but also so we can be more intentional about where and how we give. We’ve structured our efforts around three areas: corporate giving, philanthropic sponsorships, and the Nicola Wealth Private Giving Foundation — a donor-advised fund platform we created to support our clients with their giving. Each area plays a different role, but they’re all part of a larger goal to make giving easier and more meaningful — whether that’s