Creative Leadership in Philanthropy

• At the heart of philanthropy is story

• Data sovereignty for Canadian charities

• Pointing the way for tomorrow’s leaders

• At the heart of philanthropy is story

• Data sovereignty for Canadian charities

• Pointing the way for tomorrow’s leaders

CAGP is the only Canadian professional association that brings together professional advisors with fundraisers to learn, collaborate and network.

Philanthropy is good for business. It is the glue that binds client’s loyalty to you by extending financial success to social significance.

CAGP helps you improve your value to clients through advanced philanthropic planning advice.

As fundraising gets more engaged in financial, tax and estate planning, ensure your fundraising and finance team are trained in the most current strategies, trends and changes to charity law.

Membership in CAGP brings a suite of tangible assets, tools and products that make membership in CAGP a modest investment with real value.

Our best-in-class educational offerings will help you better understand how to initiate and manage a strategic fundraising program. Connect with other senior leaders, fundraisers and professional advisors with our network of Chapters across Canada.

Asthe debris of winter is slowly washed away by springtime rain, it’s easy to embrace feelings of renewal. The singing call of a cardinal or the determined crocus pushing through to find the sun’s warmth, reinforces the notion of positive days ahead. As the new Editor-in-Chief for Foundation Magazine I am similarly energized by the opportunities this publication offers for all of us to connect on the subject of philanthropy. If you’ve been a long-time reader or sponsor of Foundation Magazine, thank you! You’ll still recognize many of the columnists and features you’ve been enjoying. Over time, we’ll introduce you to other knowledgeable innovators on the topics of: equity and inclusiveness, digital readiness, mentoring and the need to address the labour shortage chronic to our sector.

This Spring issue of Foundation Magazine is dedicated to the art and science of fundraising. As Dr. Russell James explains, it all starts with “Story.” Also in this issue:

❯ How applying for-profit investment logic to charitable giving can maximize the impact of philanthropic donations;

❯ The reasons that Canada’s University Health Network (UHN) a publicly-funded hospital, is at the top of a pedigreed list of healthcare giants; and,

❯ The role that a “giving strategy” has in ensuring individuals and their families are able to achieve a lasting charitable legacy. There are so many valuable take-aways — you won’t want to skip a single article!

Now is also the perfect time to give us your feedback. What do you want to see more of? Less of? What topics have you been waiting for Foundation Magazine to cover? Who would you recommend as a writer/contributor?

Some of you may already know me as the Editor of Charity eNews, a weekly publication full of practical tips and insights for those working in the nonprofit sector. I look forward to taking a deeper dive into the “business of philanthropy” in Foundation Magazine.

Let’s get started!

Lisa MacDonald Editor-in-Chief lisa@hilborn.com

It is often said that fundraising is both art and science. This issue explores how our brains interpret a request to give; opportunities to magnify impact using current philanthropic tools; and, pathways for innovation in fundraising to develop.

Jim Hilborn Publisher

Lisa MacDonald Editor-In-Chief lisa@hilborn.com

Jasmine Stuart Production Manager

Chris Horne Director of Marketing chris@hilborn.com

Jennifer O’Neill Art Director/Design

CONTRIBUTORS

Sandra Baker

Peter Fardy

Laurie Fox

Mark Halpern

George Irish

Russell James

Leanne Kaufman

Nicholas Palahnuk

Kathleen Provost

Julie Quenneville

SCAN to subscribe

Foundation Magazine is published quarterly by The Hilborn Group.

Foundation Magazine is an independentlyproduced publication not affiliated in any way with any association or organized group. Unsolicited article submissions are welcome. Occasionally Foundation Magazine provides its subscriber mailing list to other companies whose product or service may be of value to readers. If you do not want to receive information this way, email Jasmine@hilborn.com.

PO Box 86, Station C Toronto ON, M6J 3M7 www.charityinfo.ca (416) 554-9403 mary@hilborn.com hilborn-charity-enews

Verify Contact Data

Add Elected Official Information

Append Missing Details

Deduplicate Your Data

Correct, standardize & update addresses, names, phones & email addresses

Add demographic, geographic & property data to your member profiles

Merge and remove duplicate accounts & gain a complete 360° view of members & donors

Find previous & incoming elected official contact info such as district, address, phone & social media handles at all levels of government

Don’t let your database become a frightening place of outdated and unusable data. Melissa can improve the quality of your contact data so you can more easily reach your members, attract more donors like your best ones, and prevent fraud. We’ve also acquired Cicero, democracy’s database, which means you can also access the most recent elected official information worldwide.

Let us help you keep your data clean and accurate so you can continue doing what you do best—moving the needle on important issues and bringing help to those in need.

Transform your organization with clean data. Take the next step with Melissa today.

BY LAURIE FOX

Wehave a lot to be proud of when it comes to charitable giving in Canada. As a country, we have a deep-rooted culture of generosity, and it’s now extending beyond our lifetimes. More and more Canadians are embracing the idea of leaving a charitable gift in their Will, helping to fuel a remarkable transformation in the philanthropic landscape.

Legacy giving campaigns like Will Power are making a real difference — not just here but around the world. Approximately twenty countries have national efforts aimed at encouraging people to think differently about giving; helping donors see that their Will, along with other assets like registered funds and life insurance, can be powerful tools for change.

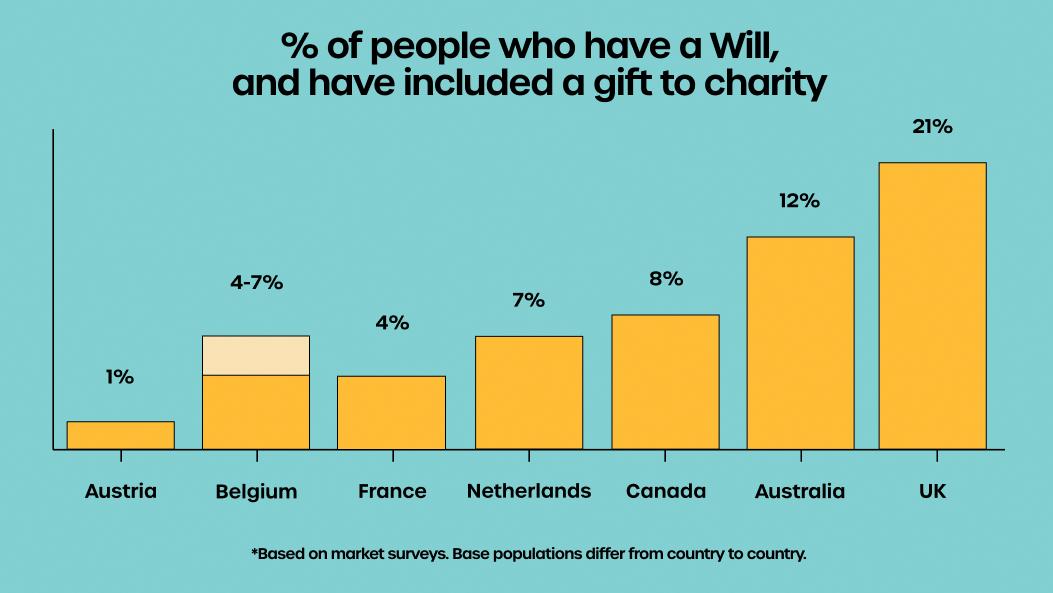

And guess what? Canada is now in the top three globally when it comes to the percentage of people who say they’ve left a gift in their Will to charity!

A rapid rise in legacy giving

Since 2020, the number of Canadians who have confirmed they’ve left a charitable gift in their Will has grown from 5% to 8%. That’s a massive jump, putting us just behind Australia (12%) and the UK (20%).

Since 2020, the number of Canadians who have confirmed they’ve left a charitable gift in their Will has grown from 5% to 8%.

The momentum is undeniable. Will Power’s goal is to see 13% of Canadians committing to a legacy gift by 2030. But at this rate, we’re poised to exceed that target, potentially unlocking billions in donations for Canadian charities. These types of gifts are game-changers, providing long-term funding that allows charities to expand programs, build infrastructure, and serve their communities in transformative ways.

The power of a bequest

Legacy gifts are not just numbers on a chart—they enable reallife impact that shape communities. Consider these examples:

❯ A local shelter shared that a bequest received just before the COVID-19 pandemic was the reason they were able to keep their doors open. Without it, they wouldn’t have had the resources to provide food and shelter to vulnerable populations during a critical time.

❯ A small mental health agency received a bequest from a donor in honor of their sibling. That donation funded a youth schizophrenia program that has helped countless young people recover from early episodes of psychosis. This program simply would not have existed without the donor’s gift.

Stories like these are becoming more common, and illustrate the immense potential of legacy giving to create lasting change.

A global shift

Canada isn’t the only country seeing a shift in attitudes toward charitable bequests. Around the world, legacy giving is gaining traction:

❯ In the UK, the number of people who outright reject the idea of leaving a gift in their Will has dropped from 13% to 9% over the last decade. Today, 77% of UK donors say they are open to leaving a percentage of their estate to charity.

❯ In Finland, willingness to leave a charitable bequest has increased ninefold since 2015.

❯ In Austria, 1 out of every 10 Euros donated to charity now comes from a bequest.

The trend is clear: people everywhere are realizing that legacy giving is an easy and impactful way to make a lasting difference.

Canadian Research: Who’s behind this movement?

Research conducted by the CAGP Foundation and Will Power in 2025 found that in Canada, the number of people interested in leaving a legacy gift jumped from 31% in 2020 to 44% in 2025. That’s an extra 4.7 million Canadians considering a bequest in just five years!

So, who are these new legacy donors?

❯ They’re younger Canadians, primarily under 50.

❯ They’re not ultra-wealthy —most have a household income between $60K and $100K.

❯ They’re financially savvy, thinking about their estates and planning their first Wills.

❯ They’re already charitably inclined and keep up with the news and social issues.

❯ They’re considering an average of two charities for their legacy gift.

When asked why they want to leave a legacy gift, the answers are inspiring:

❯ “I want to help charities I care about continue their good work.”

❯ “I want to leave behind something important and longlasting.”

❯ “I want to set a good example of giving back.”

The biggest hesitation? The fear of disinheriting loved ones. But with proper planning, donors can leave a portion of their estate to charity while ensuring their families are well taken care of.

New legacy donors are younger, not ultra-wealthy but are financially savvy.

The role of charities and advisors

Over the past five years, we’ve seen more charities start to embrace legacy giving as part of their fundraising strategy. Financial advisors and estate planners are also beginning to bring up charitable giving in estate conversations more frequently. But there’s still a long way to go.

Legacy giving is often viewed as a niche practice. Many charities focus on immediate fundraising needs, especially as traditional cash donations decline. Some worry that bringing up gifts in Wills will turn donors off or divert funds from annual giving. But the research shows otherwise; donors who plan on including a charity in their estate plan say it won’t take away from their current giving. In fact, 17% say their legacy planning makes them more likely to increase their charitable donations now.

For charities and advisors, the Will Power campaign provides an easy entry point into this conversation. By joining forces with a national movement, they can access tools, resources, and a wide audience of donors looking to use their Wills for good.

A defining moment for Canadian philanthropy Canada is on the cusp of a major shift in charitable giving. With more donors aware of, and open to, the idea of legacy gifts, we have an incredible opportunity to reshape the future of philanthropy.

The next few years will be critical. By continuing to normalize conversations about gifts in Wills, educating donors, and equipping charities and advisors with the right tools, we can ensure that this momentum doesn’t slow down.

This isn’t just a trend — it’s a fundamental change in how Canadians support the causes they care about. And if we stay the course, we could see billions flowing into the charitable sector, providing stability and innovation for the organizations making a difference in our communities.

LAURIE FOX has been a die-hard charity sector professional for close to two decades. Most recently, Laurie specialized in gift planning at Toronto General & Western Hospital Foundation and Plan International Canada. It was there that Laurie discovered the power of strategic giving to turn the ordinary into the extraordinary; and its potential to help meet some of society’s greatest needs. For the past two years Laurie has been working with the Canadian Association of Gift Planners to develop Will Power, Canada’s new national legacy giving campaign. Check it out at willpower.ca

is the Canadian quarterly publication and media channel which reaches more than 25,000 individual executives in Canada who represent the full charity and foundation sector and the major donor community, as well as the spectrum of companies which support, supply to, and advise all aspects of the not-for-pro t industry.

BY RUSSELL JAMES III, J.D., PH.D., CFP®

Mycareer has always focused on charitable giving. This was true in my practice experience, my research, and my teaching.

But I’ll admit it. I never planned to study story.

I was always more of a “numbers guy.” My law practice focused on tax calculations in estate and gift planning. My fundraising career started in complex planned gifts. When my career shifted to academic research, I focused on quantitative data analysis. My teaching focused on technical aspects in gift planning.

My work was always about philanthropy. But it was more about data than story. It was not about the “soft” side of philanthropy.

And then, something happened. I was in the middle of my decades-long quest to understand philanthropy. (Specifically, I focus on how to encourage generosity.) As usual, I was applying technical, quantitative research methods. And then, quite unexpectedly, I was attacked. I was attacked by story.

What led to this attack? Let me share a little background. Years ago, a local foundation made a gift.1 They purchased a $3 million fMRI (functional magnetic resonance imaging) machine for our university. We were about to have cutting-edge brain-imaging research capabilities. I was excited! This hard science technology would be a perfect way to learn more about charitable decisions.

So, I started to train in fMRI data analysis. (The freedom to chase such schemes is one of the advantages of having tenure.) This might seem like it was a big leap, but it really wasn’t. My Ph.D. had focused on econometric analysis. Data analysis in fMRI is just a complex version of those methods.

Armed with this new fMRI machine, I continued my quest to understand philanthropy. With the help of experienced colleagues, I was now able to use even more technical and quantitative methods.

The first topic I explored was charitable bequest decisions. These aren’t the typical “pocket-change” donations. These are gifts from wealth, not disposable income. They’re often 10x or 100x larger than a donor’s annual giving.2

Charitable bequest decisions uniquely activated “visualized autobiography” brain regions.

How do people think about these largest of donations? After all the neuroimaging and data analysis, I found the answer. What did it show about these major gifts from wealth? What it showed was story.

Let me be more formal. Charitable bequest decisions uniquely activated “visualized autobiography” brain regions. 3 These parts of the brain are used when visualizing personal, autobiographical events from the past. The more strongly these regions were activated, the more interested the person was in making the gift. The gift decision was about life story and life story connections. At the end of a long road of quantitative, technical, “hard science” research, I came to the answer. And the answer was story.

There was an easier way to get this answer. It didn’t actually require a $3 million fMRI machine. A few years before, on the other side of the Atlantic, Dr. Claire Routley wanted to answer the same question. She also wanted to know, “How do people think about charitable bequest decisions?” She took a different approach. She didn’t stick people in a brain scanner. Instead, she talked to them. Her in-depth, qualitative interviews with bequest donors also found an answer. What was the key factor in these decisions? It was the donor’s life-story connection with the cause. Dr. Routley explained, “When discussing which charities they had chosen to remember, there was a clear link with the life narratives of many respondents.”4

Different roads led to the same destination. The quantitative “hard science” approach gave an answer. The qualitative “soft” approach gave the same answer. And the answer was story.

Story and philanthropy are strongly connected. Anthropology reveals just how deep this connection is. Storytelling was fundamental to the origins of human moral action.

Anthropologist Philip Kitcher describes a radical increase in human cooperation that happened about 20,000 years ago.5 This

was shown by dramatically larger human settlements and trading networks.

What happened? What was the great leap forward that suddenly allowed humans to function in large groups? What allowed cooperation in networks outside the village? Kitcher suggests that the crucial step that allowed for this extended cooperation was an “enlargement and refinement of sympathy.” This was made fixed through a “compendia of rules, parables, and stories.”6

The key was the invention of story. Prosocial cooperative behavior began to grow. It began to grow through story. Story allowed it to be created, transmitted, and maintained.

This isn’t just a matter of pre-historic speculation. The Agta are an indigenous hunter-gatherer tribe. They live in an isolated area of the Philippine Islands. Anthropologist Andrea Migliano analyzed stories from the Agta’s oral traditions. She found that “most of the content was about cooperation, egalitarianism, and gender equality.” 7

This is story in its original, natural, prehistoric form. What was its function? To communicate and maintain cooperative moral behavior.

We’ve heard about the “moral of the story.” But it may be that “the story is the moral.” In other words, story is the key that unlocks prosocial morality. Without story, prosocial cooperative behavior can’t be created. It can’t be maintained. It can’t be transmitted. Professor of philosophy Phil Hopkins explains, “Ethics, then, requires and is embedded in stories. We tell stories … about the way things relate in the world, the way the world itself is, such that this or that character or action is right or good.”8

The story is the moral. It’s the source of prosocial cooperative behavior. We can see this in prehistoric anthropology. We can see this in indigenous tribes. We can also see this in modern preschoolers.

Cognitive development researchers have found this. Preschoolers with higher exposure to storybooks develop stronger social-emotional skills. But it’s not just

Exposure to stories increases empathy and prosocial actions.

the volume of storybook exposure that matters. Specific story elements predict the development of empathy and socialemotional skills. This comes from stories with —

❯ “whole, well-rounded, characters,”

❯ “that trigger the reader’s identification” and

❯ “evoke emotional responses.”

These story elements increase prosocial development in preschoolers. We’ll see later, they also drive fundraising success.

And what about us? What about grownups in a massively connected, cooperative, modern civilization? Findings across many experiments show similar results. Exposure to stories increases empathy and prosocial actions.11

Also, consider this. Suppose we want to know which social behavior is and is not permitted. Where do we go? We have laws. Some experts — lawyers — provide guidance. Other experts — judges — mete out punishment. These people are not just experts on statutes. Mostly, they are experts on stories.

We call these stories “case law.” Law students spend little time memorizing statutes. Instead, they focus on stories. Becoming a lawyer is about learning to think like a lawyer.12 This is the work of understanding stories and story interpretation. The real essence of human cooperative behavior is found in stories. Even in complex modern society, this is still true.

Conclusion

Despite my best efforts, understanding philanthropy inevitably led me to story. But it doesn’t matter what road we take.

❯ We can use the hard science of neuroimaging.

❯ We can employ the qualitative nuance of in-depth interviews.

❯ We can explore pre-historic human society.

❯ We can examine modern anthropology.

❯ We can track preschool psychological development.

❯ We can even look at the practice of law.

Whatever road we take, the destination is the same. At the heart of any social cooperative behavior is story. At the heart of philanthropy is story. At the heart of fundraising is story.

RUSSELL JAMES III, J.D., Ph.D., CFP® is a chaired professor in the Department of Personal Financial Planning at Texas Tech University where he directs the on-campus and online graduate program in Charitable Financial Planning (planned giving). He graduated, cum laude, from the University of Missouri School of Law where he was a member of the Missouri Law Review and received the United Missouri Bank Award for Most Outstanding Work in Gift and Estate Taxation and Planning. He also holds a Ph.D. in consumer economics from the University of Missouri, where his dissertation was on charitable giving.

1 The gift came from the CH Foundation. This is the same foundation that later established the endowed professorship that I now hold as the CH Foundation Chair in Personal Financial Planning.

2 Decedents in 2007 with estates of under $2 million, $2 to <$5 million, $5 to <$10 million, $10 to <$50 million, $50 to <$100 million, and $100 million+, produced charitable estate gifts averaging 3.5 times, 20 times, 25 times, 28 times, 50 times, and 103 times, respectively, their average annual giving in the last five years prior to death. Steuerle, C. E., Bourne, J., Ovalle, J., Raub, B., Newcomb, J., & Steele, E. (2018). Patterns of giving by the wealthy. Urban Institute. p. 13. https://www.urban.org/sites/default/files/ publication/99018/patterns_of_giving_by_the_wealthy_2.pdf.

3 James, R. N., III. & O’Boyle, M. W. (2014). Charitable estate planning as visualized autobiography: An fMRI study of its neural correlates. Nonprofit and Voluntary Sector Quarterly, 43(2), 355-373.

4 Routley, C. J. (2011). Leaving a charitable legacy: Social influence, the self and symbolic immortality [Ph.D. dissertation]. University of the West of England. p. 220.

5 Kitcher, P. (2006). Ethics and evolution: How to get here from there. In F. B. M. de Waal (Ed.), Primates and philosophers: How morality evolved (pp. 120-139). Princeton University Press.

6 Id at 137.

7 Yong, E. (2017, December 5). The desirability of storytellers. The Atlantic. https://www.theatlantic.com/ science/archive/2017/12/the-origins-of-storytelling/547502/

8 Hopkins, P. (2015). Mass moralizing: Marketing and moral storytelling. Lexington Books. p. 19.

9 Mar, R. A., Tackett, J. L., & Moore, C. (2010). Exposure to media and theory-of-mind development in preschoolers. Cognitive Development, 25(1), 69-78.

10 Aram, D., & Aviram, S. (2009). Mothers’ storybook reading and kindergartners’ socioemotional and literacy development. Reading Psychology, 30(2), 175-194. p. 176.

11 Dodell-Feder, D., & Tamir, D. I. (2018). Fiction reading has a small positive impact on social cognition: A meta-analysis. Journal of Experimental Psychology: General, 147(11), 1713-1727; Rathje, S., Hackel, L., & Zaki, J. (2021). Attending live theatre improves empathy, changes attitudes, and leads to prosocial behavior. Journal of Experimental Social Psychology, 95, 104138.

12 Mertz, E. (2007). The language of law school: Learning to “think like a lawyer”. Oxford University Press.

Donors who restrict their gifts to avoid funding “bricks & mortar” or “overhead’ may unintentionally hinder a charity’s mission. Insights from investing in for-profit companies can help inform a more effective approach to philanthropy.

BY PETER FARDY

Most people involved in philanthropy have, at some point, heard a donor declare they do not want their gifts used for “bricks & mortar,” “overhead,” or some other aspect of a charity’s operations. These self-imposed restrictions are often deeply rooted and may stem from reasons such as:

❯ The donor had an earlier experience that left them feeling their gift had not made the impact they hoped for.

❯ They may prefer that their gift be deployed at the “front line,” where they believe it will have a greater impact on the people the charity serves.

❯ They may think the charitable organization already has ample resources in the areas they refuse to fund (e.g., “they already have enough space” or “they seem to have a lot of admin staff”).

❯ They may believe that those who lead charities lack the business mindset required to make tough decisions about managing the organization, allocating resources efficiently, or effectively prioritizing expenditures.

These are legitimate concerns, but rather than coming up with a set of restrictions based on them to be applied to all gifts, donors are better served by considering the specific circumstances charities are facing at that moment and what will make the greatest difference in their ability to effectively pursue their mission. This requires a little more scrutiny or due diligence, but no more than what the same donor may apply to investments they have made in forprofit enterprises, especially if a significant amount of money is involved.

“Astute donors are prepared to defer decisions about allocating resources to the professionals who run the organization.”

The needs of nonprofits change over time

Consider the example of a small hospice. To deliver on its mission — to provide a peaceful, comfortable, and dignified end-of-life experience to clients and their families — the hospice requires professional healthcare providers, dedicated support staff, spiritual advisors, a corps of volunteers, and a suitable place for patients and their families to access and benefit from what they have to offer. As the number of elderly and terminally ill community members grows, so does the need for places like this.

Like any organization, its needs have evolved over time. At some point, the hospice may have found that more support staff were needed so that frontline care providers could spend less time on administrative matters and more time at the bedside. At another time, as interest and demand for their services grew, it may have become clear that an expanded, purpose-built facility would allow them to do much more of this good work.

What was most important in each of these cases was the mission (the “why”), which rarely, if ever, changes, while the resources needed to help the organization best fulfill its mission (the “what”) usually change over time.

Astute donors start with the “why” — the charity’s mission — before considering the “what” — how best to support it. To assess what the priorities truly are at a given time, they engage in conversations with leadership to gain valuable insight that allows them to make an informed decision. While others may balk at the idea of their gift being used for support staff (overhead) or a facility (bricks and mortar), astute donors are open to considering the possibility that these needs are the right priorities. They are also prepared to defer decisions about allocating resources to the professionals who run the organization.

For any organization (charitable or for-profit) to be successful, it needs to find an effective way to balance the allocation of resources across all the functional areas that are required to deliver service. All these functions are important, but over- or under-investment in any of them can negatively impact the quality of service and the ability of the organization to achieve its mission. In the case of the hospice, donors who respond to a request for help may be unduly impeding the charity’s ability to be most effective by prescribing how their gift is to be used. Considering infrastructure and overhead to be generally less necessary ignores the fact that they are a necessary part of the mix in any organization.

A useful way to think about this is to draw a parallel between the decision to make a financial investment in a company and the decision to make a philanthropic investment in a charitable organization. For our purposes, a financial investment is one made primarily to generate a financial return for the investor, while a philanthropic investment is made to help create a positive impact on a community or address a societal issue — without any

financial return to the donor (though I would argue that there is personal fulfillment returned to the donor).

Whether a person is investing in a business for financial return or in a charity for impact, they want the same thing in both cases: for the organization to be successful.

Let’s use the example of an early-stage company that has developed proprietary technology allowing it to produce ultra-thin, highly flexible solar panels. Although there are many potential applications for the product, one of the most compelling is the idea that sheets of this film could be applied to the roofs of electric vehicles to allow their batteries to be recharged while being driven. Not only could that be of great value to EV owners, but it would help reduce non-renewable energy consumption and decrease the carbon footprint. As successful field trials continue and manufacturing processes improve, the company is seeking further investment to fuel its growth — and a plan to achieve it.

To be successful, this company needs engineers, salespeople, operational managers, labs, testing facilities, office space, a travel budget, computing equipment, and a long list of other requirements. When people think of a company like this, they are likely not picturing the people behind the scenes or the roof over their heads, but they probably would not argue about their necessity.

Likewise, it is unlikely that a financial investor would stipulate that they do not want their funding used for some specific aspect of the company’s plan. It would be unusual for them to say something like, “Don’t spend my money on office space, warehouses, labs, or overhead.” That’s because, in conducting even basic due diligence, an investor is looking at the overall business plan for signs that give them confidence in the organization’s ability to succeed. If the plan looks solid and the company has what it needs to be successful, the investor is likely to commit. They usually believe that the company’s leadership is in a better position to decide how resources should be allocated. If not, they should not invest.

Evaluating an investment opportunity usually involves some form of due diligence to assess the strength of the business and its likelihood of success.

Among the key questions an investor might ask are:

❯ Credible Plan: How solid is the plan to achieve the targeted outcomes? Does it instill confidence? What concerns does it raise?

❯ Capability: Does the company have the right expertise and infrastructure to succeed?

❯ Key Dependencies and Risks: What does success depend on? What are the risks and how well is the company prepared to deal with them?

❯ Critical Personnel: Is the CEO/President the right person

to lead this organization? Do they have a strong leadership team? Who are the critical employees? What would happen if any of them left the company?

❯ Use of Funds: What do they need the new funding for? Are these the right priorities at this point in the company’s development?

Only when the investor is reasonably satisfied with the answers to these questions (and likely many more) will they consider investing. They hold the leadership of the company accountable for implementing the plan and achieving success.

It is not unheard of for someone who follows a disciplined process when making financial investments to apply restrictions to their philanthropic gifts. Why the different approach?

Both donors and the charitable organizations they choose to support will benefit from a similar form of due diligence before gift commitments are made. Variations on the same questions would be applied — simply substitute the word “charity” for “company” in the list provided.

Once reasonably satisfied that the charity has the right plan, people, expertise, capacity, and resources to succeed, a donor will be better served by entrusting decisions about resource allocation to the organization’s leadership. Just as with a financial investor, the philanthropic investor should expect that the plan presented to them will be implemented and that progress toward achieving the targeted outcomes will be reported.

This simplified philanthropic decision tree looks something like this:

This approach does not guarantee success in philanthropic impact any more than it does in financial investing, but it can improve the likelihood of success. By starting with mission, looking at how the charity plans to pursue it, then deciding whether you have confidence in the organization’s ability to deliver, you can make a well-informed decision about giving, while avoiding the temptation to becoming overly prescriptive about how your gift is to be used.

The Canadian Nonprofit Employer of Choice (NEOC) Award is the “Made-in-Canada” recognition program for the nonprofit sector from coast to coast. This program is designed to build employee engagement, attract top employees, retain staff and develop a magnetic corporate culture.

Here are just some of the benefits:

• More quality candidates

• More engaged workforce

• Reduced attrition

• Positive employer branding

• Higher donor satisfaction/loyalty

• Increased productivity

• Lower operating costs

What do the winners receive?

• Personalized Award plaque

• Recognition in a special feature of Charity eNews

• Press release

• Unlimited use of the NEOC logo

• Listing on the NEOC and Hilborn websites

• Confidential review of results and recommendations for continuous improvement

Whether you win the award or not, your survey data summary reports will provide the insights you need to make your workplace a top employer!

If you are interested in participating in the program or learning more about the process, please go the website: www.neoc.ca or contact Mary Singleton at: mary@hilborn.com

“We don’t want our donor data going to the US.”

BY GEORGE IRISH

Two decades ago, I heard this statement many times. Canadian charities were setting up their first web donation forms and fundraisers faced a new question: How could they embrace new online fundraising tools while still maintaining control over sensitive donor information? Worries about cross-border data flows were real — and for good reason.

Today, we face a similar issue with artificial intelligence (AI). AI can improve how fundraisers identify prospects, personalize appeals, and predict giving patterns. But it brings back the question of data sovereignty with renewed urgency. Where does donor data go when it’s processed by AI systems? Who controls it? Whose laws apply?

For Canadian charities, these aren’t just abstract worries. Donor data is both a sacred trust and a key asset. It holds personal, financial, and behavioural information that needs careful stewardship.

AI excels at uncovering patterns in donor behaviour. It can analyze thousands of data points to predict which prospects are most likely to give, what amounts they might give, and what messaging will resonate most strongly. Some Canadian charities already use AI tools for donor analytics and report significant improvements in fundraising results.

AI’s ability to deliver powerful data insights makes charitable donor data more valuable than ever. For Canadian charities, it also highlights important data sovereignty concerns.

Data sovereignty means more than, “Is my data stored in Canada?” It looks at the entire data lifecycle, from collection and processing to storage and deletion. Online data often travels through international networks — even when sending an email from Calgary to Vancouver — and may be crossing borders without your knowledge.

Donor data is both a sacred trust and a key asset

True data sovereignty means ensuring that data stays entirely within Canadian borders and follows Canadian privacy laws. Personal Information Protection and Electronic Documents Act (PIPEDA) and provincial legislation like Quebec’s Law 25 set out regulations for data handling, with stricter rules for public sector and sensitive personal information.

Popular US-based and owned AI chat services like ChatGPT and Claude, answer user questions by processing the data on their own servers — mostly located outside Canada. This crossborder flow exposes user data to different legal systems and brings possible risks.

When donor data crosses borders, it falls under different legal systems with varying privacy protections. This is especially concerning today with cross-border tariff threats and political turmoil in the United States.

The promise of AI in fundraising

For fundraisers, AI offers the chance to do more with less. In a sector always short on resources, AI can help identify, engage, and retain donors more effectively and boost fundraising income.

For example, U.S. laws like the CLOUD Act allow American authorities to request data from U.S. companies, even if that data is stored in other countries. This could apply to companies operating AI services, although the Act mainly targets communication and cloud storage providers.

Today’s AI data sovereignty concerns mirror those faced by Canadian charities when online donation platforms first appeared, but with heightened stakes. Fundraisers face a new

challenge to understand where sensitive donor data travels when processed by AI systems and understanding which laws apply at each step, but the legal landscape extends beyond data storage and handling.

Charities must also consider how AI systems use live data to update their models, and whether they were developed with data that respects privacy and copyright laws — an important area not fully covered by current regulations.

Canadian-developed AI solutions preserving sovereignty

Among the emerging Canadian options, Cohere stands at the front with its Sovereign AI Infrastructure Initiative. Backed by a $240 million federal partnership, Cohere is developing Canada’s first dedicated AI data centre scheduled for completion in 2025.

This project will feature:

❯ AI data processors hosted exclusively in Canadian facilities,

❯ end-to-end data processing within national borders, and

The reputational risk can’t be overstated. Donors entrust charities with personal and financial information based on relationships of trust. When data crosses borders without proper safeguards or disclosure, that trust is compromised. In a sector where reputation is currency, breaches can seriously harm donor relationships and fundraising results.

The good news is that the situation is improving. New options are emerging to help Canadian charities maintain data sovereignty while still benefiting from AI’s capabilities.

AI data sovereignty has gained significant attention from the Canadian government in recent years. Recognizing both the strategic importance of AI development and the need to maintain control over Canadian data, federal authorities have launched ambitious initiatives to develop truly sovereign AI infrastructure. The $2-billion Canadian Sovereign AI Compute Strategy directly addresses infrastructure gaps that have led organizations to rely on foreign AI-processing capabilities.

For charities navigating these waters today, the picture is unclear. While various AI providers claim support for data residency or compliance, none currently offer comprehensive solutions that address all aspects of true data sovereignty — from ownership and control to processing location and regulatory alignment. Organizations need to carefully evaluate claims and understand the limitations of existing offerings.

Data sovereignty means more than, “Is my data stored in Canada?”

…data sovereignty isn’t just a compliance checkbox, but a fundamental part of responsible stewardship

❯ Zero-data transborder routing enforced at the network level.

These are all critical components for keeping sensitive data entirely within Canada.

Other Canadian data service providers, such as Cloud Metric, Typica.ai, and LXT offer tailored AI solutions that address aspects of the sovereignty challenge, such as PIPEDA-compliant data processing, secure Canada-located data centres, or AI models trained using privacycompliant data sets. These are promising alternatives to US-based services, but come with concerns around capability, cost, and implementation requirements.

For a user-friendly, sovereigntyaligned AI assistant you can start using today, Cohere offers Coral (https:// coral.cohere.com/) — a conversational AI chatbot comparable to ChatGPT and Claude. The Coral platform uses Cohere’s Command R+ AI model and supports multiple interfaces, including both chat and API access, making it accessible for organizations of all sizes.

It is Important to note that despite Cohere’s Canadian roots and commitment to sovereign infrastructure, until a truly sovereign AI infrastructure is developed for Canada, there’s no guaranteed protection against crossborder data flows.

The path forward

The landscape of AI sovereignty in Canada is changing rapidly. With the Canadian Sovereign AI Compute Strategy addressing critical infrastructure gaps, charities can expect more robust Canadian AI options in the coming years.

In the next few years (2025-2027) we will likely see new commercial AI services that fully comply with Canada’s data sovereignty requirements, backed by government-supported infrastructure and clear guidelines for what constitutes genuine compliance.

For charitable organizations preparing for this future, a few practical steps can align innovation with data sovereignty:

❯ First, conduct an audit of current and planned AI implementations, with special attention to where donor data travels throughout the workflow. Many organizations discover sovereignty gaps they didn’t know existed.

❯ Second, examine Canadian alternatives like Cohere that offer both immediate functionality and roadmaps aligned with emerging sovereignty infrastructure. The ability to test these tools through free tiers provides low-risk entry points.

❯ Third, develop your own data governance rules that specifically address AI processing, and clarify what donor information can be

Coral by cohere is an AI chatbot similar to ChatGPT

❯ Canadian-owned and based

❯ Committed to Canadian AI data sovereignty

❯ Building Canada’s 1st AI data centre

https://coral.cohere.com

shared with which systems under what circumstances.

❯ Finally, engage your donors transparently about AI usage, explaining both the benefits and the safeguards implemented to protect their information.

Building a sovereign AI future together

Twenty years ago, Canadian charities faced a data sovereignty challenge with the appearance of US-based online donation platforms. Our charitable sector responded by collaborating to support donation-processing alternatives that respected Canadian data sovereignty, sharing knowledge and best practices that benefited the entire community.

Today’s AI revolution calls for a similar collective action to foster Canadian AI tools that honour data sovereignty while delivering powerful new capabilities. The lesson remains the same: innovation and data protection don’t need to be opposing forces.

Charitable AI service providers should recognize that data sovereignty isn’t just a compliance checkbox, but a fundamental part of responsible stewardship in the AI age. As tools like Cohere’s Canadiandeveloped systems mature, charities will have improved opportunities to advance their missions through AI while keeping donor data where it belongs — under Canadian control, protected by Canadian values, and governed by Canadian law.

GEORGE IRISH is a veteran of strategy, coaching and consulting for AI-powered charity fundraising. He works with Amnesty International Canada and Greenpeace among other organizations. He writes this column exclusively for each issue of Foundation Magazine.

BY SANDRA BAKER

Iget it! You are swamped. Your multi-faceted role requires you to be an expert in every aspect of your charity, from the cost of office coffee through to the minute details of every program you run.

And, you must be an expert in human resources, budget management, governance, information technology and social media…all in five (or is it seven?) days a week.

You have expert fundraising staff, so surely you can leave all the donor relations work to the staff, right?

Not so right.

You are your own best fundraiser

Your organization needs revenue to run well. The more, the better, to achieve your mission. Why not trade revenue and cash flow challenges for wonderful conversations that advance relationships with your loyal and supportive donors?

As CEO, you have many tools at your disposal. Compared to your fundraising staff, your donor conversations are easier, more effective and compelling!

Here are a few of the reasons why:

❯ You are the only person with full line-of-sight on expenses, program needs and revenue.

❯ Because you are in the field, gathering stories from the front-line that can be shared with your donors.

❯ Your board work connects you with board member’s dreams for the charity; you can speak to new directions and growth plans.

❯ Asking donors for advice and ideas is more successful, because you have the tools to lead the implementation of their ideas.

❯ With your direct access and working relationships with your board, you are best positioned to match individual board members with philanthropy work.

Donors love talking directly with the CEO. They appreciate your insight, your commitment and your ability to share meaningful impact stories. Having conversations about the donor’s philanthropy becomes natural and easy.

Here are some quick things you can do now to put donor

relations on the centre of your desk. Pick just one or two of these ideas, so that you can sustain the work while managing other priorities. Consider adding one more in a couple of months!

1. Call the last five donors who’ve given to your charity. Express your gratitude, and find out what they love about the work you do. Ask for advice on how to continue to build organizational momentum. Give yourself five weeks to complete and document these calls. It’s my recommendation that you neither filter the list by gift size, donor capacity, nor type of gift. And, please, don’t second guess the timing of your call, or send an advance request for permission to call. Just call.

2. Mail a hand-written letter to the past year’s top five donors. Express your thanks. Tell them about the brighter future they are making for your clients. Invite them to visit!

3. Commit to completing one daily task that advances a donor relationship. Even a quick 7 p.m. thank-you email makes a big difference, and keeps you committed to your donor relations work. End every day by celebrating that you have completed one donor-focused activity.

4. Meet with your fundraising staff. Ask them to generate a list of what they like about the philanthropy work they are doing, and things they wonder about. This is not meant to be a planning session, but more of a get-you-plugged-in session

5. Meet with your finance staff. Do the same as with fundraising staff but specific to donor and donations activity. Where do they get bogged down? What do they think they could do to help support the drive for more donor giving? Can they see ways to improve efficiency in processing donations, while maintaining service to donors?

6. Bring your philanthropy work to the board table regularly, by setting your own metrics and reporting on your progress to your board chair and to your board.

With your unique organizational view, including your knowledge of finance, program, and vision, you are your own best fundraiser.

SANDRA BAKER, CFRE is Director of Advancement at Hamilton District Christian High, as well as a charitable sector consultant.

JULIE QUENNEVILLE

BY JULIE QUENNEVILLE

InFebruary, Newsweek released its highly anticipated ranking of the world’s top hospitals, and for the second year in a row, University Health Network (UHN) was ranked #3 in the world. Second only to Mayo Clinic and Cleveland Clinic in the United States, UHN’s recognition is already an incredible achievement. But to be the only publicly funded hospital — a Canadian hospital — at the top of this pedigreed list of healthcare giants is what resonates most for me and many of my colleagues at UHN Foundation. Let me explain why.

Our work as fundraisers is rooted in service. Service to UHN, service to patients and service to our community. The time, effort and dedication we put into raising money for UHN is helping to solve some of health care’s biggest challenges. What drives us is not about awards or accolades, but about finding ways to support the teams who are working to defy the status quo — for every Canadian in need of UHN’s expert care, and for people around the world.

Every major milestone UHN has reached, whether it’s pioneering new treatments, research breakthroughs or expanding access to world-class care to communities beyond our hospitals’ walls, has been made possible by the generosity of donors who share our vision of finding new and better treatments and curing disease. This latest recognition from Newsweek reinforces what we have always known: when a community rallies together, we can achieve the extraordinary. In our line of work, it’s not uncommon to hear people say that they don’t feel they have “enough” to contribute to make a real difference, and I could not disagree more. It is thanks to every donation, from one to one million dollars, that we are leading the way and making tangible change.

UHN’s Gattuso Centre for Social Medicine is a powerful example of how fundraising can help bridge the gap between public need and medical innovation. In 2004, 100 patients experiencing homelessness accounted for more than 4,000 visits to the UHN emergency department (ED) — about 5% of all ED visits that year. From Canada’s first prescribed social housing to peer support workers in the ED, the Gattuso Centre is not only alleviating the strain on our EDs, but it’s also providing

our most vulnerable patients with the specialized care they need. Through collaboration with community organizations, this initiative guarantees that individuals with lived experience of homelessness, mental health challenges and substance use disorders receive comprehensive, continuous care — guiding them from the hospital back into their home communities with the support they need.

Recently, we were able to expand UHN’s social medicine program, bringing it farther into the community and ultimately, giving it the chance to help even more people in need. The expansion will offer additional health and social services from psychiatry to nursing and personal support care to patients in the coming year.

The Gattuso Centre is a testament to the fact that, when donors back our biggest and boldest ideas, we can tackle some of healthcare’s greatest challenges and drive meaningful, lasting change. Our donors are not just supporters, they are partners in innovation. They enable us to recruit and retain the brightest minds in medicine and push the boundaries of what is possible. Philanthropy ensures that the best health care is not only available today, but continues to evolve for future generations — transcending borders and economic status.

As we celebrate this milestone for Canada, we recognize that none of it would be possible without the individuals, families and organizations who believe in our mission — including our staff. Their generosity and dedication to the cause are woven into every breakthrough, every patient success story and every step forward. Community support has brought us this far. I look forward to seeing what we will achieve together next.

JULIE QUENNEVILLE is the CEO of UHN Foundation. Quenneville’s acknowledged dedication to health care has earned her numerous accolades, including being named one of Canada’s Most Powerful Women; one of Concordia University’s Top 50 under 50; and receiving the Medal of the Quebec National Assembly. She serves as Chair of the Banff Forum and is a member of the Executive Committee of the 2024 President’s Cup, a global team golf competition which will be played in Montreal. Her vast knowledge of philanthropy, modern business strategy, and government relations has made her a sought-after speaker on multiple platforms. Quenneville is a change agent, a passionate advocate for innovative research, and a firm believer that advancing medicine is a global responsibility. She writes this column exclusively for each issue of Foundation Magazine.

BY LEANNE KAUFMAN

Many Canadians have charitable intentions. In my role, we are seeing a significant increase in clients wanting to learn more about how they can be strategic in their charitable giving in life and in their estates. They not only want to develop a philanthropic strategy, but they are also interested in using a variety of charitable structures to allow them to see their charitable impact today and elongated across generations.

In addition to direct gifts to charity, clients are increasingly turning to options like donor-advised funds (DAFs), private foundations, and even charitable remainder trusts to leave their legacy. These giving vehicles offer more ways to streamline their giving over a longer period, and with potentially positive tax implications.

Canadians want to give

A couple of years ago, RBC Royal Trust commissioned an Ipsos survey on estate planning. From that survey we learned that Canadians are prioritizing charitable giving, are open to diverse strategies of how and when to give and that there’s a notable interest in philanthropy among younger Canadians.

When Canadians are in the moment of creating their Wills, many are choosing to give. Some may have clear and defined charitable intentions but most would benefit from help with planning their giving strategy most effectively.

they offer peace of mind that their charitable intentions and legacy will be carried out according to their wishes, all while being professionally administered.

When a donor chooses to give through a DAF, they can submit grant recommendations through their advisor to the public foundation for the charities they would like to support. Donations into a DAF can be in the form of money or other types of assets, such as publicly traded shares or life insurance. DAFs allow the donor the flexibility to customize their giving for the immediate, interim and longer term — meaning the funds can be distributed to specific charities based on the donors’ grant recommendation legacy wishes.

Indirect giving allows donors to build a philanthropic strategy.

While giving directly to a charity continues to be the most well-known option, indirect giving vehicles, which offer a variety of managed philanthropic options for potential donors, are becoming increasingly popular as they allow donors to build a philanthropic strategy for their own legacy, and that of their family.

i. Donor-advised funds

From what we are hearing when talking to our clients, DAFs are one of the most popular indirect giving vehicles because

Donors like DAFs because of their flexibility and the ease with which an individual, family or estate can establish and contribute to one without the time or costs that a private foundation requires. DAFs can be established at a public foundation, which takes care of the administration over the fund’s lifetime. Donors can also contribute to the fund as often as they choose after the initial donation, including in tandem to planned direct gifts in life or bequeathed in their Will.

Donors appreciate DAFs as a giving strategy because they can continue to have conversations with their charities of choice about what programs they want their funds to support. Because passions can change over time, they also have the continued ability to define where their donations go, without having to change their Will or incur legal costs to do so. It’s as simple as updating their charitable recommendations with their investment advisor or with the public foundation directly.

Private foundations are perhaps more well-known than DAFs and have always been a popular choice for high-net-worth and affluent families. Although they may require more hands-on administration by donors, private foundations offer a way to create a family legacy through charitable giving now and

BY KATHLEEN A. PROVOST, CFRE, MAdEd

Asa professional fundraiser I always ask myself how I can share some of my learnings with other professionals. Since 2019, I have chosen to write this column, expressing my opinion and observations on our ever-evolving sector. For 2025, I thought I would add to my voice — by speaking with colleagues, friends, and other experts to provide additional perspectives.

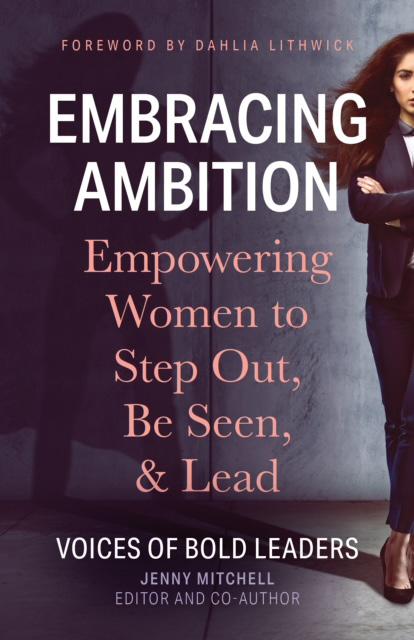

A few weeks ago, I called my friend Jenny, executive coach and fundraising professional, to ask what she was noticing about leaders in the charitable sector. After all, she’d just edited and co-authored “Embracing Ambition”, a collection of women CEOs’ voices from across North America, who shared their experiences of what it feels like to lead in this current environment.

When I think of Jenny, “building relationships” always comes to mind and in our recent chat, Jenny and I discussed the pandemic and its impact on setting up new rules of engagement between fundraisers and their stakeholders. It is today’s new social milieu, and the pressure people are experiencing, that led Jenny to observe that people in our sector are questioning the “why” of fundraising. Jenny shared the example of a major gift officer who questioned the need to raise funds for scholarships, if socially, we believe education is to be accessible to all!

We explored the role leadership plays in shaping our charitable sector and concluded that questioning the “why” of fundraising illuminates a generational difference between individual leaders and their approach to fundraising. Currently, it would seem

that there is a transition between two worlds of leaders, and the transference of knowledge, or sharing best practices is not “cookie cutter”. As Jenny stated, today’s leaders need more appreciative inquiry and coaching to be able to answer “why” we fundraise.

People are questioning the ‘why’ of fundraising.

Jenny and I were in agreement that the hierarchical structures we have come to know need to be blown apart. Jenny’s recent newsletter “A paradigm for leadership”, offers a perspective on different leadership styles. I share Jenny’s observation that, “a leader must know and see the other person deeply, valuing the relationship, not just the role they are completing”.

The fact that our social milieu, and our charitable sector are experiencing pressures, means we must take the time to reassess how today’s leaders need to evolve to prepare tomorrow’s leaders. In the January issue of Philanthropist Journal, Sherlyn Assam, Canadian freelance writer and editor based in the UK, said, “It becomes challenging to navigate the day-to-day demands of the work while still envisioning and working toward transformative new ways of doing this work”.

The current model we use to bring together a group of well-intended volunteers as expert leaders — such as a Board, a Cabinet or a Committee — to guide our fundraising process does not provide a forum to answer “why” we do what we do. Leadership today is expressed by bringing together talented people to solve problems; to get things done. Perhaps further reflection is required. What if onboarding practices were seen as an opportunity to deepen our understanding and develop a shared vision for the purpose of fundraising that goes beyond raising dollars.

existing rules, methods and processes. However, to enable new fundraising approaches to emerge, we may need to evolve our leadership models.

In February 2024, Sharon Riley asked, via the Philanthropist Journal, what was “top of mind” for leaders in the charitable and nonprofit sector”? Paul Nazareth responded that “creativity and generosity is alive and well, but there’s a disconnect between fundraising, philanthropy, and generosity”. According to Paul, we need philanthropy to be focused on people’s humanity. This means we must make time to re-think the purpose of

Leadership needs to be renewed. It needs to be relevant and reflect the reality of the people it serves.”

- Senator Ratna Omidvar

Assam also asked, “Do we still need women’s leadership programs? In that same issue of the Philanthropist Journal, Suzanne Duncan, vice president of philanthropy at the Canadian Women’s Foundation clarified, “We need very tangible support, along with creative development of new solutions and new ways of approaching leadership. It therefore becomes difficult to mandate change, inclusion or transformation in an organization if you don’t have leadership buy-in”.

To ensure transformation at many levels, we need current leaders: CEOs, volunteer leaders, Board or Committee members, and the next generation of leaders to work together. We are witnessing a healthy trend — questioning and challenging

fundraising and its correlation to building relationships within our own teams and eventually with all of our stakeholders. This is how we will evolve towards a new iteration of philanthropy.

The answer may lie in the communities we build. When we bring individuals together (as a Board or other advisory group), they are confident about the expertise they bring to the community — they offer leadership. This community’s amalgamated expertise will help to inform our decisions. However, even if someone lacks an area of expertise (because we cannot be experts in everything), they may feel compelled as a “leader” to offer solutions too quickly. We see this too often in the fundraising sector. Everyone has an opinion and a solution to offer.

Being aware of personal expertise, enables you to develop trust and

confidence. When you also take the time to understand areas needing professional growth, you build responsiveness. Both are necessary to deepen relationships and allows for dialogue to be more open and inspirational. This supports a successful exchange of knowledge between current leaders and the next generation. This dialogue is sometimes referred to as “Community Base Fundraising” versus “Donor Base Fundraising”. It is when we come together and discuss “why” we need to do what we are currently doing, or why what we are currently doing needs to change.

The way by which we bring leaders together, and the mandate we expect them to deliver, needs to allow for creativity. Furthermore, assessing the approach we use to work with leaders (those within our organizations, volunteer leaders, or community leaders) allows us to evolve our approach to leadership.

At the end of our conversation, Jenny and I both concluded that something is broken in the social sector but I say, if something is broken — let’s fix it! By shifting to a new model of philanthropy, as Nazareth called it — a model of generosity, leadership conversations between generations will expand and new, innovative fundraising approaches will develop.

Author’s Note: Jenny offers more leadership tips in her podcast, Underdog Leadership. I invite you to listen to her series.

KATHLEEN A. PROVOST is the Vice President, Philanthropy and Communications at United for Literacy (previously Frontier College), a national organization working in partnerships with communities across Canada, offering free tutoring and mentoring to adults, youth, and children who are looking for literacy and numeracy support. Kathleen has over 30 years of experience in the charitable sector. She has been a Certified Fundraising Executive (CFRE) since 2007 and a long-time member and volunteer for the Association of Fundraising Professionals (AFP). She has received numerous recognitions during her career, including the Queen Elizabeth II Diamond Jubilee Medal for her contributions to the charitable sector and was recognized as 2021 Fundraiser of the Year in Nova Scotia. She writes this column exclusively for each issue of Foundation Magazine.

BY NICHOLAS PALAHNUK

In this series, Nick talks with other philanthropic leaders who help to “get money moving” by addressing systemic barriers to giving. This edition features collaborator, connector, and advisor Sara Byrnell, who has mobilized giving in Canada at extraordinary levels during her career. Sara is Executive Director and national lead of KPMG Family Office’s philanthropic advisory practice.

A Q

NICK: We’ve spoken about the emerging trend of spending down foundation and DAF assets. What are you seeing in the sector?

SARA: In Canada, we are hearing more and more clients say they are considering the option of spending down their philanthropic assets in foundations. What’s interesting is that this conversation isn’t limited to one type of client — we are seeing it across multiple generations — ranging from families whose foundations have existed for decades, to third generation family members taking on new leadership roles with their family philanthropy. The motivations for potentially spending down their capital also vary, from not having heirs to pass along the responsibilities of running a foundation, to a next generation that believes donating as much money as possible to the social impact sector will have the greatest effects.

Clients are realizing that their philanthropy is not merely an act of generosity, but a vital responsibility to drive positive change in the world. By choosing to spend down their assets more quickly, they are embracing a transformative role that can foster lasting impact.

This trend is also an important part of our conversations with clients as they create new foundations or donor-advised funds. Understanding their vision for giving, and the impact they hope to achieve, helps to guide how assets are allocated to various causes. Spending down over time can be an effective strategy towards achieving their goals, however, it certainly doesn’t apply to everyone. Depending on the area of interest, clients are also looking to grow their capital to ensure funding is available to help address long-term challenges. It’s essential that each unique situation be approached with a strategic mindset, reviewing multiple scenarios to find the approach that will best help to achieve their goals.

More About Sara Byrnell: With a lifelong commitment to philanthropy and volunteering, Sara Byrnell is an experienced social impact sector leader with a demonstrated history of raising funds to advance international development and healthcare initiatives. Her areas of expertise include visioning and strategy development, philanthropy education, charity due diligence, corporate philanthropy, and volunteer management. She is experienced in cultivating, negotiating, and stewarding complex, multi-milliondollar partnerships between charitable organizations and high-net-worth individuals, foundations, and corporations across Canada.

NICK: That’s certainly been our experience. We are often speaking with individuals we lovingly refer to as “spend-down curious” philanthropists, as well as those creating new foundations and donoradvised funds on what their goals are for the longevity of the fund. Broadly speaking, how are you advising people considering this?

Q A

SARA: It’s crucial for clients to adopt a forward-thinking mindset and develop a comprehensive plan for their philanthropy. Many individuals who contribute to organizations limit their vision to a short-term horizon of just 2 to 5 years, overlooking the importance of a long-term strategy. Our role is to assist them in visualizing how their philanthropic goals can align with their available resources, empowering them to feel confident in either gradually reducing or strategically increasing their donations over time. This planning process is not just a one-time

Many individuals overlook the importance of a long-term strategy.

discussion. It is a dynamic, multi-year journey that evolves as life events unfold and family priorities shift. Engaging loved ones in these discussions, along with the social impact organizations they support, is vital for crafting a robust and effective spend-down strategy. Our ultimate objective with clients is to get money moving to the organizations that are best positioned to drive the transformative change they aspire to see. By fostering these meaningful conversations and strategic planning, we can ensure that philanthropic capital is used in the most impactful way possible.

QNICK: Yes, we’ve seen the power of having a plan. Our research at

PhilanthPro shows that having a dynamic granting plan increases confidence and gets money moving with intentionality. I appreciate you bringing social impact organizations into the conversation. We know that individuals are the largest source of nonprofit funding in Canada. How do you see the social impact sector involved in these conversations?

SARA: The social impact sector plays a significant role in supporting the concept of spending down foundations or donor-advised funds. Organizations on the frontlines represent the lived experience of those they support and have critical expertise and knowledge

Ato drive change. However, they also need to be visionary. As we think about addressing significant challenges, leaders of organizations and fundraisers must be bold in how they plan to accomplish their goals if they want to partner with clients looking to spend down assets. Donors need inspiration to infuse large donations into projects, but they also need confidence that there is a strong vision, strategy, plan and the right team to execute it.

Social impact organizations have the critical expertise and knowledge to drive change.

O ering professional prospect research, training, and fundraising strategy. Editor and contributor to “Prospect Research in Canada”, Canada’s first book on prospect research.

Fundraisers who dare to dream big — those with “moonshot” ideas — will find themselves in a unique position to forge powerful partnerships with donors committed to spending down their philanthropic capital. It’s crucial that they have a short-term plan of how to spend an infusion of a large amount of capital, but also strategize for the long-term after these transformational gifts come to an end. Sustainability can be a key factor in decision-making for clients who want to have an immediate impact, but also want to ensure the work continues well into the future.

NICK PALAHNUK, Founder of PhilanthPro, talks with experts about strategic philanthropy as part of a series with Foundation Magazine PhilanthPro is innovative software that brings the power of financial planning to philanthropy so people can confidently create and manage bold, intentional charitable plans to maximize their positive impact.

BY MARK HALPERN

Charities often worry that approaching important donors about planned legacy giving will delay gifts — because the ask will prompt donors to shift the sums they have earmarked for their favourite causes now to a later date. They fret that a promised legacy gift will take the place of immediate support and be detrimental to a charity’s nearterm goals. What’s important to remember is that donors aren’t playing a zero-sum game.

In my experience working with successful business owners, entrepreneurs and affluent families, engaging in planned legacy giving often deepens a donor’s commitment to charities. When approached with estate planning strategies that include philanthropy to meet charitable objectives and save taxes, if asked whether they plan to cut back on current gifts, their response is usually “why not both?”

It’s a response that’s backed up by research. Donors who decide to make a legacy gift—whether it’s a bequest in the Will or naming a charity as the beneficiary of a life insurance policy or registered plan such as a Registered Retirement Savings Plan (RRSP) or Registered Retirement Income Plan (RRIF) — increase current giving by 41%-70%. In effect, planned legacy giving strengthens a donor’s partnership with a charity and can make them even more loyal contributors today and in the future.

The philanthropic conversation

By introducing philanthropy, we earned permission to engage in a more comprehensive conversation.

All of this means that it’s well worth exploring more sophisticated approaches to attract donations than the traditional ask for gifts paid for with cash, cheques or credit cards. In fact, we’ve identified more than twenty-five ways that generous people can be more charitable — maximizing giving while minimizing taxes — and that includes planned legacy giving.

Here’s just one example. In December, I met with a family who had accumulated a real estate fortune. They came to us because of our expertise with strategic philanthropy as part of estate planning to minimize tax and maximize legacy. It was the “thin edge of the wedge” of having the ability to convert taxes into charity that really caught their attention and captured their imagination. Had we remained focused on estate planning and tax minimization, (which they really do need) it would have been a short meeting. As it was, by introducing philanthropy, we earned permission to engage in a more comprehensive conversation — and, of course, their chosen charities will benefit from the family’s generosity.

In a meeting that included their accountants, we explained that charitable donations can be used to mitigate 100% of the taxes due on an estate in the year of death and the year before death; every $2 donated, can save $1 of tax. For this family, it meant that they wrote a cheque for $7 million to their family foundation, instead of writing a cheque for $3.4 million to the Canada Revenue Agency.

We reviewed the late parents Will and found that it gave enough latitude to allow the gift to happen as part of the executors’ duties to minimize taxes that would include charitable giving on death. It’s important to emphasize this point. Our clients and your donors must have a Will and the proper language in the Will to realize their generosity on their terminal return, especially if they didn’t make provisions for a legacy gift before death. (Please reach out to me, I’m happy to share examples that you can use for your donors).

The work with this family has also created the potential for philanthropic planning with other family members and also with their accountants’ clients. These conversations, without question,

…donors must have a Will and the proper language in the Will to realize their generosity.

open doors — whether they’re initiated by a team like ours or a charitable organization.

A place to start

Initiate conversations with donors by sharing these two strategies.

Strategy #1: Purchase life insurance within a foundation

Private foundations and donor-advised funds often don’t know they can pay for, own and be the beneficiary of a life insurance policy and that premium payments do not count towards the requirement to distribute a minimum of 5% of last year’s average assets within the year. This means you’re not dialling back this year’s donations by purchasing life insurance that will provide a large legacy gift down the road.

We’ve been executing this type of planning work using Canada Life’s My Par Gift. I advised on the development of this innovative product, which is the first life insurance policy built specifically for charities. Its unique feature is that there is only one premium, so it’s one-and-done. One private foundation we consult with invested a one-time premium of $1 million that will eventually become $12 million — an outstanding return on investment. I use a golf analogy to explain the amplifying effects of life insurance. If you give somebody a putter and tell them to hit the ball as far as they can, they might reach 50 yards. But if you give them a driver, the ball will go 250 yards.

Just as important, a policy like My Par Gift produces a dividend every year that can be taken out as cash and given to charity annually. Again, there’s potential to boost current gifts, while setting up a large long-term legacy.

Arrange efficient gifts from corporations or holding companies

For individuals, one of the best ways to donate to charity is to give in-kind appreciated public securities, such as stocks, mutual funds, exchange-traded funds and segregated funds. That’s because it’s tax efficient. There is no capital gains tax. For example, if somebody has $2 million in equities with an adjusted cost base of $1 million, the $1 million capital gain is taxable when the equities are sold. On the other hand, donating those stocks in kind means you pay no capital gains tax and you get a charitable receipt for the fair market value of the donation that can help you save taxes today.

Give and get