South Carolina is experiencing significant growth, attracting more families due to its appealing climate, beautiful beaches, diverse activities, and welcoming people. This influx has been supported by the state's successful efforts in attracting industries and well-paying jobs. However, with this growth comes a pressing need for more housing, as regulatory costs, rising building material prices, and a shortage of skilled labor have led to a shortage of attainable housing.

To address this issue and promote sustainable housing development, the Home Builders Association (HBA) of South Carolina emphasizes three cornerstone principles for policymakers and community leaders:

1 Local Governm ent Policies & Processes: There is a need to identify impediments within local government policies and processes that affect housing investment Adopting best practices can streamline these processes and remove barriers to development

2 St at e Aut horit y: The state must have clear authority to enforce code and land development laws to ensure a consistent and predictable environment for housing investment

3 Skilled Trades Training: Efforts to train and attract individuals to skilled trades must be dramatically increased and sustained over the long term to address the labor shortage in the construction industry

Local community leaders and elected officials need to recognize the changing landscape of the housing industry. Housing investment should be viewed similarly to other types of economic development investments. Communities aiming to attract jobs must consider their housing stock and the systems in place for land development, new home construction, and renovation of existing homes.

Streamlining review and approval processes is crucial, especially for attainable housing projects, which are disproportionately affected by regulatory costs and delays. According to the National Association of Home Builders (NAHB), 25%of the cost of a new home is now attributable to regulatory costs, including mandated studies, site reviews, delays, permit fees, and code requirements. Communities that streamline these processes will attract more investment, keeping housing affordable and expanding their population and tax base. (con't)

IEfficient practices will not only benefit builders and developers but also local governments and taxpayers. More families and homes lead to more money for schools and local government, creating a positive feedback loop for community growth.

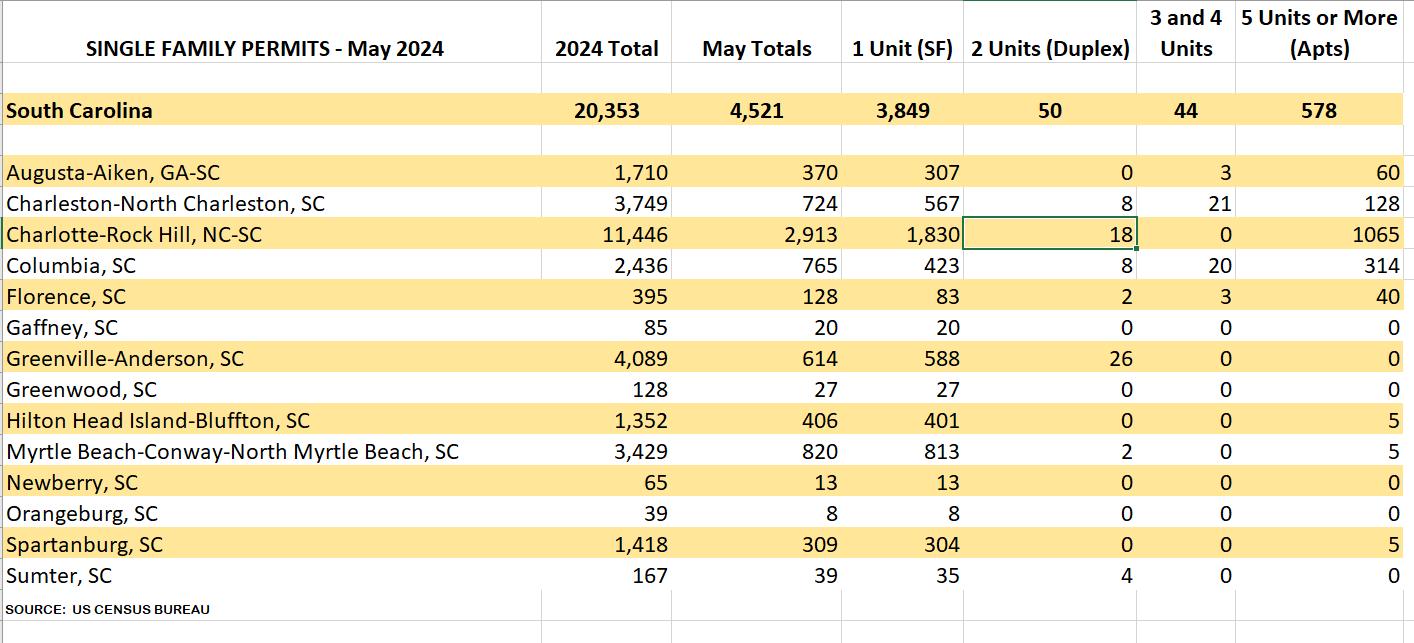

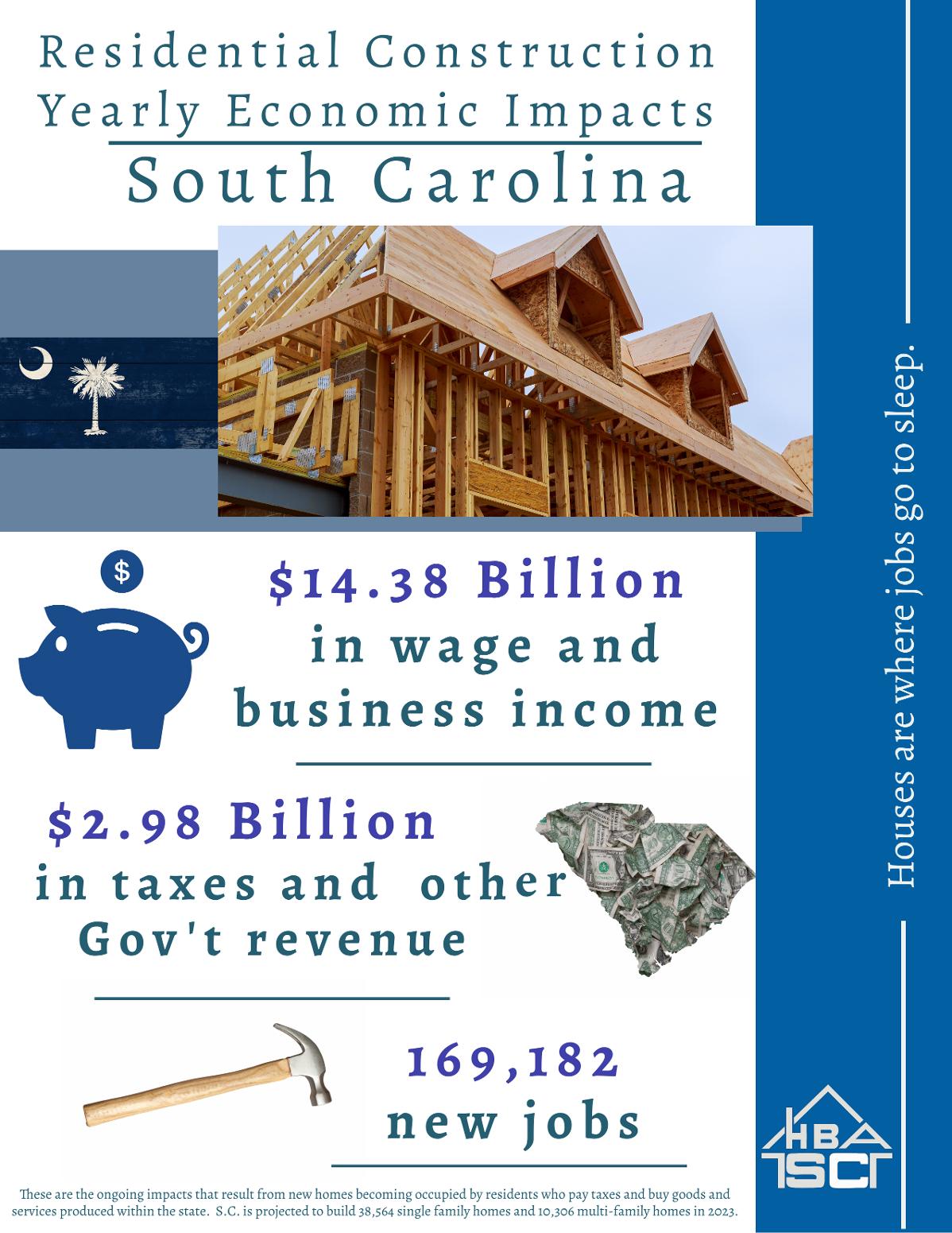

In 2024, South Carolina is projected to build over 38,564 single-family homes and 10,306 multi-family homes, with an estimated economic impact of:

- $14.38 Billion in income for residents,

- $2.89 Billion in taxes and revenue for state and local governments,

- 169,182 new jobs in S.C.

Annually, the impact of these homes includes:

- $2 681 Billion in income for residents,

- $1 162 Billion in taxes and revenue for state and local governments,

- 13,540 new jobs in SC

New resident ial const ruct ion produces an im m ediat e operat ing surplus t o local governm ent s and a $10.53 Billion surplus over 15 years!Expanding South Carolina?s building industry is essential for job creation and population growth, offering numerous positive impacts for the state.

Rob Clemons, HBASCPresident

By Alex James, HBA of SCDirector of Government Affairs

The 2024 South Carolina Legislative Session came to an end on May 9th when the General Assembly adjourned Sine Die. This was the second year of the two-year session so any bill that had not had not passed both chambers by that date is dead and must start the process over again when the general assembly returns in January, 2025. While the session technically ended at 5pm on May 9th. The General Assembly returned twice after that date to elect judges and to pass the final budget and other bills that were sent to conference committee to work out differences between the two chambers. The following is an overview of the housing industry related bills that were taken up this year.

H 4086?Our residential builder licensing bill, intended to overhaul the aged statute and help grow the industry, clarify common misunderstandings and provide greater protection to the public through voluntary education and stronger bonds, passed the House unanimously last year before being held up in the final weeks of this year?s session in the Senate. In the end it appears trial lawyers were worried that the bonding language could make it harder for them to make money from suing builders.

·H.4486-During the final days of the 2023 legislative session, Representative Burns introduced a bill aimed at addressing critical issues surrounding septic tank installations in South Carolina The bill, which passed unanimously in the House, sought to empower the Department of Environmental Services (DES) to establish a program allowing septic tank installers to conduct field evaluation tests. There was not an appetite for this solution in the Senate and so we worked to amend the bill to instead allow engineers who have taken a class from DESto conduct septic field evaluation tests. In the end the bill was held up in the Senate by those that wanted septic installers instead of engineers and would not yield to a pragmatic approach

S 533/ H 3933?In February 2023, the South Carolina Senate and House introduced legislation aimed at reforming the Palmetto State?s civil liability laws, a move long-awaited by the business community. The South Carolina Justice Act sought to modernize liability laws to ensure that businesses are held accountable only for damages proportionate to their fault in civil lawsuits Championed by the South Carolina Coalition for Lawsuit Reform, of which the HBA is a member organization, this bill was crucial for maintaining the state's competitiveness in attracting and retaining job creators while safeguarding the rights of injured individuals. After multiple committee hearings and countless hours of testimony the bill was sent out to the floor of the Senate and ultimately failed to receive a vote The majority of Senators who opposed allowing the bill to have a vote are trial attorneys.

·S.1017?This bill addresses a side effect of the Low-Income Housing Tax Credit Overhaul bills that have been passed over the last two years that created a loophole where a multifamily development could get a 100%property tax reduction if a non-profit entity was a partner on the project with as little as a 1%stake in the project Several existing for-profit multifamily complexes took advantage of this loophole by bringing on a nonprofit as a nominal partner thereby reducing their property tax bill by 100% from what they paid the prior year. This bill was passed unanimously by both bodies and links the amount of property tax reduction to the proportion of ownership of the property by a nonprofit up to 50%, at or above which the property receives a 100%property tax reduction, however a last-minute addition by the city of Rock Hill to correlate the area median income to zip code ended up killing the bill Because of the change the bill went to conference committee and the House and Senate were unable to reach a compromise before they returned to Columbia on June 26th So this loophole will remain open for another year and many more projects are expected to take advantage of it during that time potentially having significant impacts on municipalities expected property tax revenue

·S.1021?This bill to extend the Abandoned Buildings Revitalization Act until the end of 2035 was passed by a unanimous vote in the Senate and 98-8 vote in the House The tax credit may not exceed seven hundred thousand dollars for any taxpayer in a tax year for each abandoned building site.

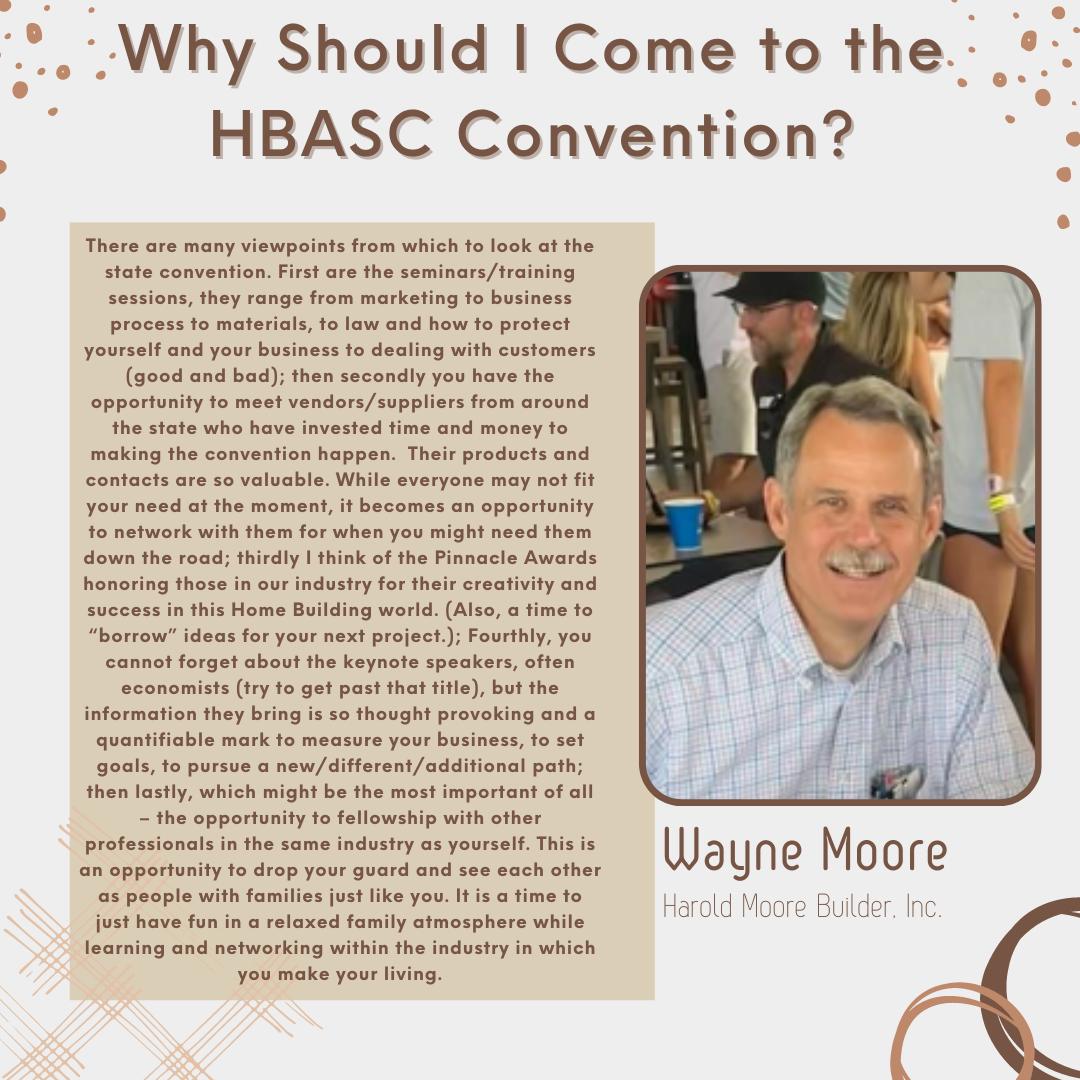

H BASC Con ven ti on October 11-13th at the M ar i n a In n at Gr an de Dun es i n M yr tl e Beach.

Pl ati n um

The 2024 Home Attainability Conference had an impressive turnout.

Thanksto our wonderful sponsors: Watch the conference videoshere.

Our t rip t o D.C. w as filled w it h m eaningful conversat ions w it h our congressional delegat ion. We w ould like t o t hank our am azing sponsors Sout heast ern Insurance Consult ant s, LLC and Execut ive Const ruct ion Hom es Colum bia!

Greenville HBA's Spring Golf Tournament wasa tremendoussuccessand an absolute blast!

Greenville HBA's had an incredible night at the HBA Spring Block Party-Night at the Greenville Drive!

Membersof the Building Industry Association of Central SC (BIA) BassTournament wasa lot of fun for all.

Michael Allen, Coast al Engineering &Test ing

Todd Anderson, The Traffic Group

James FitzGerald, Advant age Elevat or LLC

Mark Gargula, World Insurance

Cameron Gilmore, Forever Law n Charlest on

Adam Grass, Hobson Builders

Anthony Jackson, FloorBoss LLC

Michael McGuinn, The Designery

Roger Medlock, Ark-La-Tex Financial Services

Flavio Mendonca, Floor It and Moore

David Nilson, Nilson Van & St orage Inc

Vince Simpkins, Blossm an Gas

Zach Spencer, Bainbridge

Trey Willis, JW Const ruct ion of Ridgeland LLC

Paul Bird, Bird Built Cust om Hom es

Kevin Cunningham, Cunningham Cont ract ors

Troy Dolin, Gut t erGuy Gut t erSupply

Judso Haley, Todd Haley & Associat es

Janna Hart, Carolina Lant erns & Light ing

Jonathan Hart, Crawl Logic

Zack Middleton, Middlet on St ruct ural and Design Engineering

Corey Munson, Residential Structures P.C.

Zach Pace, Pace's Com fort Cooling

Sean Oddis, Spire Charlest on

Fernando Posada, Int ernat ional Const ruct ion Services

Gates Shellhaas, Gracew orks Const ruct ion

Christopher Smith, PG Builder Pro

Drew Takach, KB Kit chen and Bat h Concept s

Jeff Scott, CCS Builders Inc

Dan Hobbs, Bilt Wise St ruct ures

Randy Collins, Collins Realt y Inc.

Charlotte Groce, Palm et t o Out door Spaces

Jeremy Hutchins, Green River Log Cabins

Jeff Plunkett, Fred Anderson Chevy

John Roberts, Home Builders Ins.

Mike Beiler, Clim at eMast er Geot herm al

Trina Montalbano, D. R. Hort on Inc.

John Montgomery, Mont gom ery Developm ent Associat ed

Roger Nutt, TNC Engineering LLC

Randy Geid, Triangle Brick

Adam Olson, Three Oaks Const ruct ion LLC

Tim Taylor, Cart er Lum ber

Andy Lepin, Hom eTeam Pest Defense

Adam Jones, Coast al Engineering &Test ing

John Roberts, The Traffic Group

Mark Boyce, True Hom es

Tena Cornwell, Sout h St at e Bank

Josh Hartsoe, Cram er Pest Cont rol

Daniel Krause, Krause Renovat ions

J. Scott Price, Colt on Builders Inc.

Harley Ashbaugh, AWD of Savannah

Dalton Cornforth, Palm et t o Ext erm inat ors Inc.

Jeff Dinkle, Eco Coast al Hom es

Chris Donald, Carolina Cont ract ors Inc.

Randy Downing, CCS LLC

Eric Eckert, Epperson Service Expert s

Andrea Eldred, Elem ent Const ruct ion

Karen Groves, D2R Builders LLC

Steve Hawley, The Hom e Elevat or

Lisa Henry, Coast al St at e Banks

Hugh Hobus, RCH Const ruct ion Inc.

JT Hooper, Palm et t o Bluff Builders

Justin Imel, Back 9 Turf & Greens

Dylan Knight, Alside Supply

Donna Lang, Allen Pat t erson Builders

Trey McLaughlin, NFP

Coast al Signat ure Hom es, Inc.

Shauna Phillips, R&D Legal Bookkeeping LLC

Mike Trezza, Trezza Term it e & Pest Cont rol

Jason Wilmott, Unit ed Sit e Services

Devin Lynch, Sout hern Fence

Chris Minick, Floor Coverings Int ernat ional of HHI

Jonathan Ward, 15 Day Kit chen and Bat h LLC

Laura Wilson, Set t he St age Hilt on Head Savannah

Amanda Berkman, Merit age Hom es

Denise Blackburn Gay, Market ing St rat egies

Jacob Brey, First Choice Plum bing Services

Tyler Johnson, First Choice Plum bing Services

Sonny Joyner, Builders First Source

Maddie Koury, WMBF New s

Christopher Lilly, Great Sout hern Hom es

Maria Lita, WMBF New s

Robert Mosher, Rest orat ion 1

Sharon Navarra, St ricklands Hom e

Fernando Posada, Int ernat ional Const ruct ion Services

Noam Pyade, Am ericana

Kasey Rogers, Palm et t o Prot ect ion Film s

Nick Rosier, BELFOR

Christopher Smith, LG Builder Pro

Ryan Spagnolo, TD Bank

Jason Tomlinson, TD Bank

Eric Vizzini, WMBF New s

Kaleb Wentzel, Rest orat ion 1

Jim Alicchio, Hom eTeam Pest Defense

Josh Barber, WFB FOX TV

Christian Bassily, Low count ry Light ing St udio

Jon Bowman, Hom eTeam Pest Defense

Brent Christensen, Dream Finder Hom es

Joseph Dore, Dream Finder Hom es

Dawn Ferry, Hom eTeam Pest Defense

Andrew Finch, Corning Credit Union

Vicki Hall, KB Kit chen & Bat h

Jim Lee, Palm et t o Ext erm inat ors Inc

Charlene Leone, Dom inion Energy

Jenny Littleton, Low count ry Light ing St udio

Chase Button, Beachside Refinishing LLC

Holly Clay, CBM Services

Will Dodson, Grey Shore Cont ract ing

Mark Eudy, The Erosion Com pany

Rachel Hodges, Blue Kangaroo Packout z

Chris Quade, Beach Air LLC

Steven Riddei, Hom eTeam Pest Defense

Matt Sedota, Bryne Acquist ion Group

Julia Wellman, Dream Finder Hom es

William Adkins, Bat t le LP Gas

Shawn Becker, Am eri Built Inc.

Joseph Arrowood, RW Supply + Design

Bob Barreto, Falcon Real Est at e Developm ent

Kiersten Bell, LS Hom es

Avery Brumlow, Mort on Builders

Brandon Chaves, Chaves Cust om Hom es

Elias Contis, Greek Renovat ions

Lucy Cruz, JCallahan Concret e

Lea Dwyer, DRB Hom es

Steven Dyal, Berkshire Hat haw ay Hom eServices

Tracie Elliott, Floor & Decor

Justin Fowler, Parks Buick GMC

Kasey Fowler, Hunt er Quinn Hom es LLC

Wendell Hawkins, Wendell Haw kins P.A.

Brent Hawthorne, Ryan Hom es

Gabe Hill, JCallahan Concret e

Mitchell Jones, Mort on Builders

Anna Joseph, Parks Buick GMC

Mark Linke, Parks Buick GMC

David McGinnis, McGinnis Real Est at e

Yesenia Mendoza, Mort on Builders

Leslie Minnis, Park Nat ional Bank

Stephen Morrison, MoreSun Tim ber Fram es

Santiago Navarro, Taw anda Group LLC

Josh ONeal, Air Tight Solut ions

Fernando Posada, Int ernat ional Const ruct ion Services

Stephanie Przestrzelski, Keller William s Greenville Upst at e

Laura Ros, Reedy Propert y Group

Josh Rusher, Trum an Builders

Sarah Sain, Sain Hom es

Jeannette Schnell, Coldw ell Banker Caine

Kevin Sexton, Lut her & Lew is

Lindsey Twining, Reedy Propert y Group

Xavier Tiberghien, Parks Buick GMC

Christopher Ward, First Nat ional Bank of PA

Frank Warren, HMF Am ericana

Christopher Barfield, Am erica's Best Hom e Repair

Bob Barreto, Falcon Real Est at e Developm ent

Carols Beltran, CABA Const ruct ion

Mike Brown, Anvil Market ing Co

Natalia Brown, DRB Hom es

Jordan Bursch, HA Developm ent

Sam Butler, Reedy Property Group

Dan Butts, Fift h Third Bank

David Catoe, Hunt er Quinn Hom es LLC

Brandon Chaves, Chaves Cust om Hom es

Greg Christofolo, Dream zt ech US Inc

Elias Contis, Greek Renovat ions

David Cravey, Fort ify Building Solut ions

Anderson Drake, Reedy Propert y Managem ent

Karin Gierman, AHS Upst at e Sout h Carolina

Morris Hardigree, Fift h Third Bank

Jodi Hemingway, Floor & Decor

Anastasia Howard, Merit age Hom es of Sout h Carolina

Rachel Hurst, Cardinal Wast e Services

Adam Jones, HMC Builders Inc

Fred Mead, The Opex Group

Rob Morris, Plent eous Builder

Miguel Posada, International Construction Services

Pamela Pyms, Prem ier Sot hebys Int ernat ional Realt y

John Roberts, Hom e Builders Insurance SVCS

Jameila Royal, Keller William s Greenvile Upst at e

Scott Sullivan, Bella Syst em s Cust om Closet

William Taylor, Reedy Propert y Group

Calvin Wright, Calvin Wright Design Works LLC

Daniel Basham, Cassell Brot hers Hom e Services

Jennifer Basilico, Vanir Inst alled Sales of Colum bia

Keith Berry, MAKK Hom es LLC

Luke Bishop, Bishops Land Service LLC

Grant Haney, McGuinn Hybrid Hom es

Taylor Hayes, CAMS

Heath Haywood, CSI Erosion

Doug Herlong, BMC

Rus Horton, First Com m unit y Bank

Rachael Hurst, Cardinal Wast e Services

Byron Lawson, BLB Hom es

Clark McCarthy, VaVia Colum bia

Steven Palmer, Sign Perks

Craig Richardson, Hoover Building & Trusses

Barbara Ricker, Hom e Advant age Realt y

Cody Shoars, Blaney Builders LLC

Grayson Vazquez, Mungo Hom es

Elizabeth Walker, Guild Mort gage Com pany

Justin Waring, 4D Engineering

Melanie West, Coldw ell Banker Realt y

John Wolfe, Brabham Griffin Insurance LLC

Ryan Arnold, Ryan Hom es

Joseph Carbonaro, Mungo Hom es

Mikie Carroccio, Pult e Group

Allison Cranford, TD Bank

Nick Duesler, McGuinn Hybrid Hom es

Cole Felschow, Cryst al Pools LLC

Clint Galloway, Gallow ay Fam ily Hom es

Cynthia Giles, Cut Throat Market ing

Bob Lewis, MidSout h Term it e & Pest Cont rol

John Meany, Woodford Plyw ood

Scott Morrison, Morr Group Inc

Tracey Perlman, The Law Office of Tracey R Perlm an

Christian Pettway, CS Ext eriors

Dennis Rabon, Budget Blinds of Nort heast Colum bia

Craig Richardson, Hoover Building & Trusses

March 2024

Na Zhao, Ph D

Economics and Housing Policy

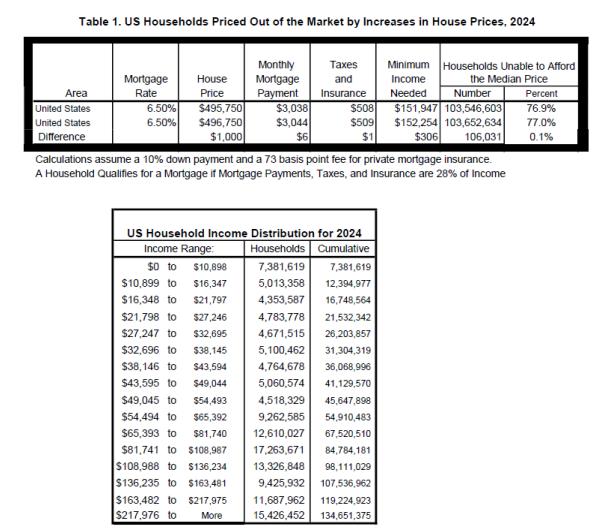

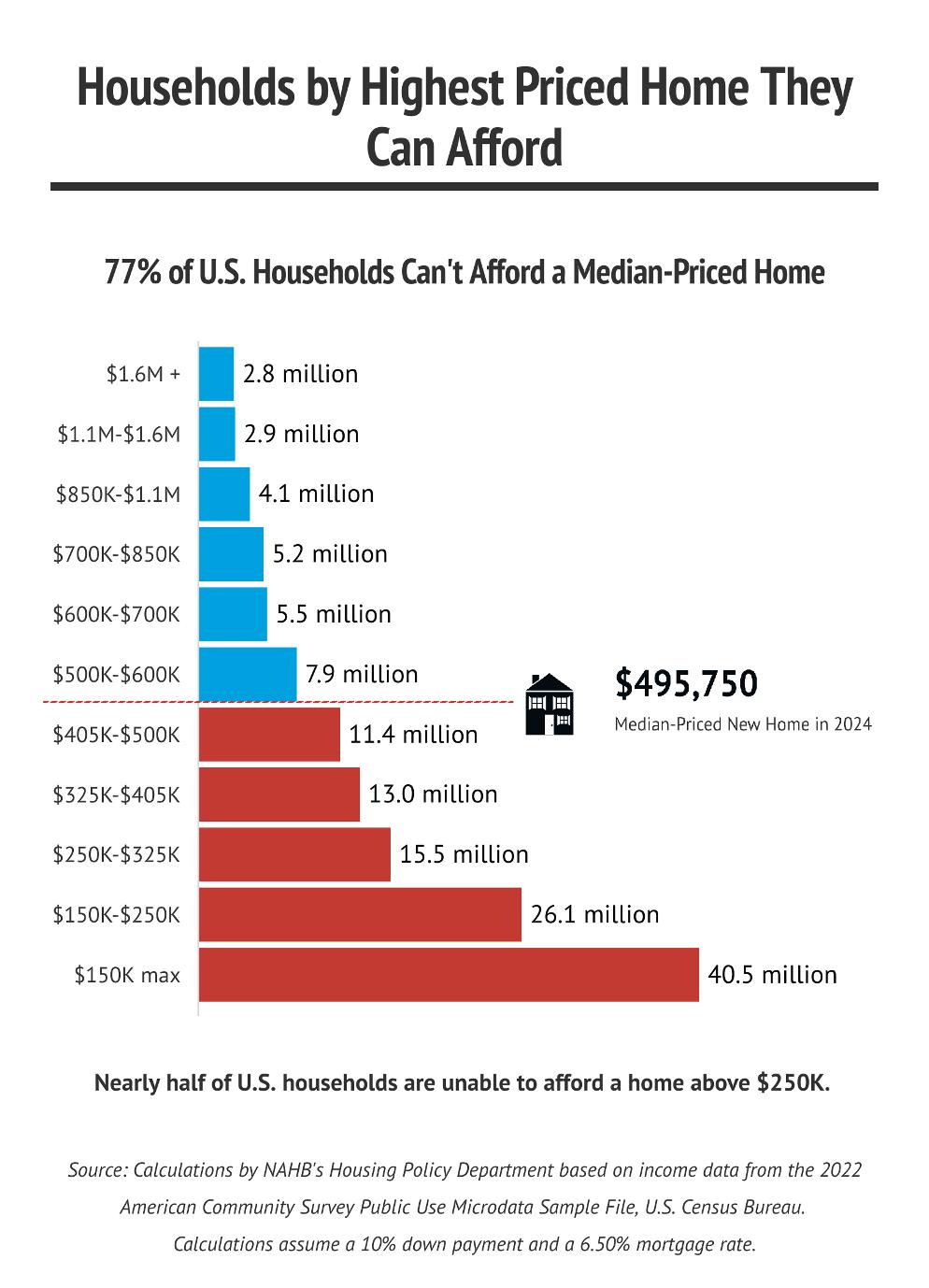

This article updates NAHB's analysis showing how rising home prices and interests rater affect the affordability of housing. One of the main results is that affordability is a serious problem even before any further price or interest rates increases NAHB's estimates for 2024 show that 103.5 million households-76 9%of all U S households-are already not able to afford a median priced new home ($495,7501 )

The 2024 estimates further indicate that a $1,000 increase in the median price of a new home would price an additional 106,031 households out of the market, and that a 25-basis point increase in the 30-year fixed mortgage rate (from 6 50%to 6 75%) would price approximately 1/1 million households from the housing market. In addition to the national numbers, the article includes equivalent affordability and priced-out results for individual states and more than 300 metropolitan areas.

The NAHB price-out model uses the ability to qualify a mortgage to measure housing affordability This method is generally relevant because most home buyets finance their new home purchase with conventional loans, following widely recognized underwriting standards The standard NAHB adopts for its priced-out estimates is that the sum of the mortgage payment (including the principal amount, loan interest, property tax, homeowners' property and private mortgage insurance premiums (PITI), is no more than 28 percent of monthly gross household income.

As a result, the number of households that qualify for mortgages for a certain priced home depends on the household income distribution in an area and the mortgage interest rate at that time The most recent detailed household income distributions for all states and metro areas are from the 2022 American Community Survey (ACS) NAHB adjusts the income distributions to reflect the income and population changes that may happen from 2022 to 2024 The income distribution is adjusted for inflation using the 2023 median family income at the state and metro levels and then extrapolated into 2024 The number of households in 2024 is projected by the growth rate of households from 2021 to 2022

Other key assumptions in the NAHB?s calculation include a standard 10%down payment and a 30-year fixed rate mortgage at an interest rate of 6.55%with zero points. For a loan with this down payment, private mortgage insurance is required by lenders and thus included as part of PITI. The model assumes the annual private mortgage insurance premium is 73 basis points, based on the standard assumption of a national median credit score of 738 and 10%down payment and 30-year fixed mortgage rate. Effective local property tax rates and homeowner insurance rates are derived from the 2022 American Community Survey (ACS), with the U.S. average effective property tax rate being $9.05 per $1,000 of property value and average homeowner insurance at $3.24 per $1,000 of property value

To calculate median new home prices across states and metropolitan areas, NAHB relies on data from the Census Bureau?s Building Permits Survey and the Survey of Construction. Initially, we determine the average value of new home permits for each state and metro area using data from the 2022 Building Permits Survey It is important to note that permit values typically represent construction costs only and exclude the cost of raw land, brokerage commissions, marketing or financing costs. To convert from average permit values to median new home prices, NAHB employs scaling mark-ups ratios These ratios are derived by comparing the median new home prices to the average permit values for each division, as estimated from the Survey of Construction. Furthermore, to manage the extreme estimates in median new home prices, NAHB implements a quantile-based flooring and capping method. This method identifies outliers by comparing the estimated median new home prices to the median values of newly built homes from the American Community Survey. The outliers are then adjusted by setting a cap at the 90th percentile value and establishing a floor at the 10th percentile value, making sure that the estimates reflect a more accurate and realistic range of new home prices. Finally, the median new home prices are projected forward to 2024 using the latest NAHB home price forecasts.

Under these assumptions, this minimum income required to purchase a $495,750 new home at the mortgage rate of 6.5%is $151,947. With the total number of 134.6 million households in the United States, approximately 103.5 million, or about 76.9%, would not be able to afford a new median priced home valued at $495,750 in 2024. A $1,000 home price increase will further price 106,031 households out of the market for this home. These are the households that can qualify for a mortgage before a $1,000 increase but not afterwards, as shown in Table 1 below.

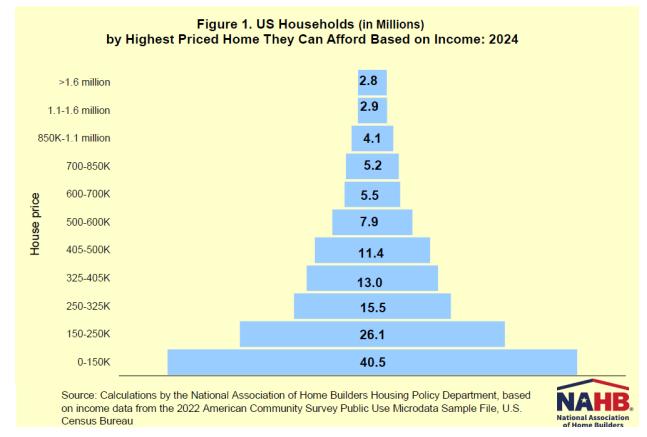

NAHB uses similar calculations and assumptions to create a housing affordability pyramid showing the number of households able to purchase a home at each step. For example, the minimum income required to purchase a $150,000 home at the mortgage rate of 6.5%is $45,975. In 2024, about 40.5 million households in the U.S. are estimated to have incomes no more than that threshold and, therefore, can only afford to buy homes priced no more than $150,000. These 40.5 million households form the bottom step of the pyramid (Figure 1). Of the remaining households who can afford a home priced at $150,000, 26.1 million can only afford to pay a top price of somewhere between $150,000 and $250,000 (the second step on the pyramid). Each step represents a maximum affordable price range for fewer and fewer households. Housing affordability is a great concern for households with annual income at the lower end of the distribution.

The 2024 priced-out estimates for all states and the District of Columbia are shown in Table 2 This table presents the projected 2024 median new home price estimates and the minimum income to secure a mortgage, the number and the percent of households who cannot afford the new homes It also shows how a $1,000 increase in price could impact the number of households Vermont stands out as the state with the highest share of households unable to afford the median-priced new home before any price changes, with approximately 92%of its households falling short on the income needed for a mortgage to buy a median-priced new homes Connecticut and Hawaii follow closely, with 89%and 88 5%of households respectively, facing similar affordability challenges for new homes at the median prices On the other hand, Virginia is the state with better affordability, where the median new home price is $462,000, however, around 66%of households still find these new homes unaffordable

Table 3 shows the 2024 priced-out estimates for over 300 metropolitan statistical areas and metro divisions, focusing on those with populations exceeding 650,000. San Jose-Sunnyvale-Santa Clara metro area in California stands out due to its exceptionally high median new home price of $1,685,593, requiring a minimum household income of $487,773. This makes it the metro area with the highest percentage of households unable to afford the median-priced new homes. In contrast, the Washington, DCmetro area presents a more accessible market, where around 37% households are capable of purchasing new median-priced homes. This indicates a relatively higher level of affordability compared to San Jose metro area.

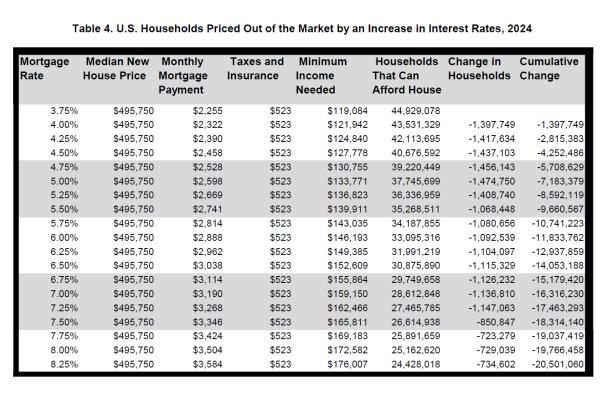

The NAHB 2024 priced-out estimates also present how interest rates affect the number of households that would be priced out of the new home market. If mortgage interest rate increase, the monthly mortgage payments will rise as well and therefore higher household income thresholds are needed to qualify for a mortgage loan. Table 4 shows the number of households priced out of the market for a new median priced home at $ 495,750 by each 25 basis-point increase in interest rate from 3.75%to 8.25%. When interest rates increase from 6.5%to 6.75%, around 1.13 million households can no longer afford buying median-priced new homes. Moreover, about 917,000 households would be squeezed out of the market if interest rate goes up to 7.25%from 7%. This diminishing effect happens because only a few households at the smaller end of household income distribution will be affected. In contrast, when interest rates are relatively low, a 25 basis-point increase would affect a larger number of households at the larger section of the income distribution. If the mortgage interest rate goes down from 6.5%to 5.5%, around 4.4 million more households will qualify the mortgage for the new homes at the median price of $495,750.

President : Rob Clem ons, Murrells Inlet

Vice President : Eddie Yandle, Colum bia

Treasurer: Doug Jam es, Charlest on

Secret ary: Hal Dillard, Greer

Im m ediat e Past President : Louie Hopkins, Florence

Dist rict #1 Vice President : Andy Barber, Charlest on

Dist rict #2 Vice President : Kevin St eelm an, Colum bia

Dist rict #3 Vice President : Johnny Uldrick, Greenw ood

Dist rict #4 Vice President : Mark Aut orino, Inm an

Dist rict #5 Vice President : Ken Gibson, Hart sville

Associat es Vice President : Bennet t Griffin, Colum bia

Legislat ive Chairpersons: Darryl Hall, Florence, Andy Whit e, Lexingt on

Mem bership Chairperson: Ed Byrd, Colum bia

NAHB Nat ional Represent at ive: Brandon Edw ards, Hilt on Head

NAHB St at e Represent at ive: Bart Bart let t , Colum bia

EO Council Chairperson: Taylor Lyles, Greenville

HBASC St aff:

Execut ive Direct or: Mark Nix

Direct or of Governm ent Affairs: Alex Jam es

Direct or of Regulat ory Affairs: Jam es Graves

Direct or of Account ing: Kim Halt er

Direct or of Operat ions: Tara Morrison

Dist rict #1 - Charlest on HBA and t he Hilt on Head Area HBA

Dist rict #2 - BIA of Cent ral SC , HBA of Lancast er, HBA of Orangeburg/ Bam berg/ Calhoun, HBA of York

Dist rict #3 - HBA of Aiken, HBA of Anderson, Lakelands HBA and t he HBA of Oconee

Dist rict #4 - HBA of Cherokee, HBA of Greenville and t he HBA of Spart anburg

Dist rict #5 - Horry/ Georget ow n HBA and t he HBA of t he Great er Pee Dee