The official magazine of Home Builders Association of Middle Tennessee

President Kelly Beasley

Vice President Eli Routh

Secretary/Treasurer Danny Clawson

Executive Vice President John Sheley

Editor and Designer Jim Argo

Staff

Connie Nicley Kim Grayson

THE NAIL is published monthly by the Home Builders Association of Middle Tennessee, a non-profit trade association dedicated to promoting the American dream of homeownership to all residents of Middle Tennessee.

SUBMISSIONS: THE NAIL welcomes manuscripts and photos related to the Middle Tennessee housing industry for publication. Editor reserves the right to edit due to content and space limitations.

POSTMASTER: Please send address changes to: HBAMT, 9007 Overlook Boulevard, Brentwood, TN 37027. Phone: (615) 377-1055.

The Coast to Coast Cabinets, Century Communities Sporting Clay Shoot is set for September 23rd. Sign up now to participate.

The annual golf tournament was held last month at the Towhee Club in Spring Hill.

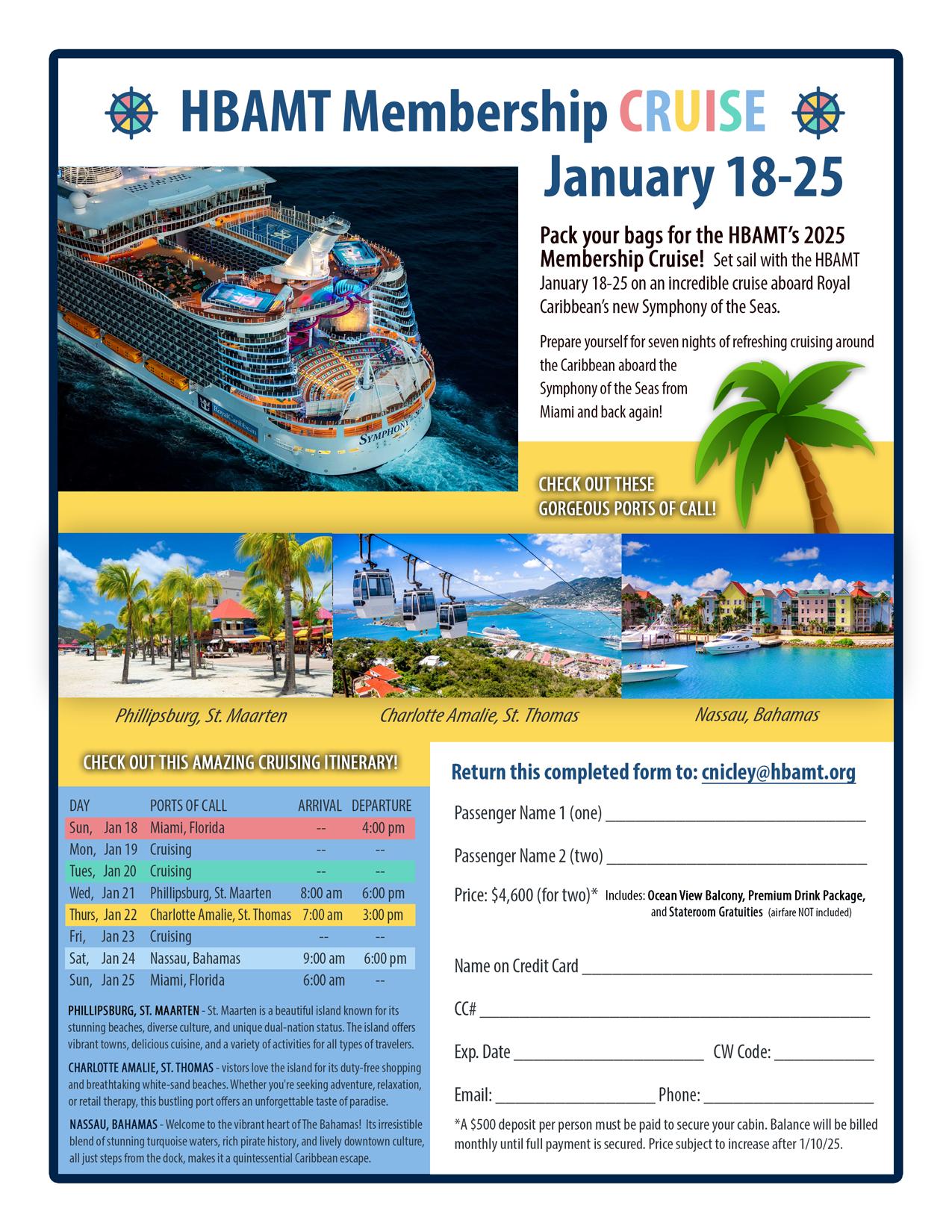

Secure your 2025 Parade of Homes Planbook ad today and reach potential customers for years to come. 18 HBAMT Cruise sets sail in

register now Register now to join the association on a Caribbean Cruise next January.

High mortgage rates, rising construction costs and economic uncertainty continue to deter many potential home buyers during this summer season.

Sales of newly built single-family homes edged 0.6% lower in July, falling to a seasonally adjusted annual rate of 652,000 from an upwardly revised reading in June, according to newly released data from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau. The pace of new home sales is down 8.2% from a year earlier.

“Elevated mortgage rates and ongoing economic uncertainty are weighing heavily on buyer demand,” said Buddy Hughes, chairman of the National Association of Home Builders (NAHB) and a home builder and developer from Lexington, N.C. “Meanwhile, an elevated inventory of unsold homes, fueled by lagging sales, is prompting concerns over potential cutbacks in new construction.”

In July, 17% of new homes were priced below $300,000, while 31% were priced above $500,000.

“Affordability challenges continue to sideline many prospective home buyers,” said Jing Fu, NAHB senior director of forecasting and analysis. “The majority of new homes are now concentrated in the $300,000

to $500,000 price range, reflecting ongoing pressures from elevated interest rates, labor shortages, rising construction costs and inefficient regulatory costs.”

A new home sale occurs when a sales contract is signed, or a deposit is accepted. The home can be in any stage of construction: not yet started, under construction or completed. In addition to adjusting for seasonal effects, the July reading of 652,000 units is the number of homes that would sell if this pace continued for the next 12 months.

New single-family home inventory held steady at 499,000 residences marketed for sale as of July. This is 0.6% lower than the previous month, and 7.3% higher than a year ago. At the current sales pace, the months’ supply for new homes remained elevated at 9.2 compared to 7.9 a year ago. Completed, ready-to-occupy inventory stood at 121,000 homes in July, the highest level since 2009.

The median new home sale price was $403,800, down 5.9% from a year ago. The decline can be primarily attributed to home builders rising use of sales incentives.

Regionally, on a year-to-date basis, new home sales are down in all four regions, falling 23.1% in the Northeast, 4.2% in the Midwest, 1.4% in the South and 6.2% in the West. n

Elevated mortgage rates, weak buyer traffic and ongoing supply-side challenges continued to act as a drag on builder confidence in August, as sentiment levels remain in a holding pattern at a low level.

Builder confidence in the market for newly built single-family homes was 32 in August, down one point from July, according to the NAHB/Wells Fargo Housing Market Index (HMI) released recently. Builder sentiment has now been in negative territory for 16 consecutive months and has hovered at a relatively low reading between 32 and 34 since May.

“Affordability continues to be the top challenge for the housing market and buyers are waiting for mortgage rates to drop to move forward,” said NAHB Chairman Buddy Hughes. “Builders are also grappling with supply-side headwinds, including ongoing frustrations with regulatory policies

connected to developing land and building homes.”

“Housing affordability is central to the outlook for economic growth and inflation,” said NAHB Chief Economist Robert Dietz. “Given a slowing housing market and other recent economic data, the Fed’s monetary policy committee should return to lowering the federal funds rate, which will reduce financing costs for housing construction and indirectly help mortgage interest rates.”

In further signs of a soft housing market, the latest HMI survey also revealed that 37% of builders reported cutting prices in August, down from 38% in July. This share has remained at 37% or 38% for the past three months. Meanwhile, the average price reduction was 5% in August, the same as it’s been every month since last November. The use of sales incentives was 66% in August, up from 62% in July and the highest percent-

Single-family housing starts posted a modest gain in July as builders continue to contend with challenging housing affordability conditions and a host of supply-side headwinds, including labor shortages, elevated construction costs and inefficient regulatory costs.

Led by solid multifamily production, overall housing starts increased 5.2% in July to a seasonally adjusted annual rate of 1.43 million units, according to a report from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau.

The July reading of 1.43 million starts is the number of housing units builders would begin if development kept this pace for the next 12 months. Within this overall number, single-family starts increased 2.8% to a 939,000 seasonally adjusted annual rate and are down 4.2% on a year-to-date basis. The multifamily sector, which includes apartment buildings and condos, increased 9.9% to an annualized 489,000 pace.

“Single-family production continues to

operate at reduced levels due to ongoing housing affordability challenges, including persistently high mortgage rates, the skilled labor shortage and excessive regulatory costs,”

age in the post-Covid period.

Derived from a monthly survey that NAHB has been conducting for more than 40 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

The HMI index gauging current sales conditions fell one point in August to a level of 35 while the component measuring sales expectations in the next six months held steady at 43. The gauge charting traffic of prospective buyers posted a two-point gain to 22 but remains at a very low level.

Looking at the three-month moving averages for regional HMI scores, the Northeast fell one point to 44, the Midwest gained one point to 42, the South dropped one point to 29 and the West declined one point to 24 n

said Buddy Hughes, NAHB chairman. “These headwinds were reflected in our latest builder survey, which indicates that affordability is the top challenge to the housing market.”

“The slowdown in single-family home building has narrowed the home building pipeline,” said NAHB Chief Economist Robert Dietz. “There are currently 621,000 single-family homes under construction, down 1% in July and 3.7% lower than a year ago. This is the lowest level since early 2021 as builders pull back on supply.”

On a regional and year-to-date basis, combined single-family and multifamily starts were 10.2% higher in the Northeast, 17.7% higher in the Midwest, 2.4% lower in the South and 0.5% lower in the West.

Overall permits decreased 2.8% to a 1.35-million-unit annualized rate in July. Single-family permits increased 0.5% to an 870,000-unit rate and are down 5.8% on a year-to-date basis. Multifamily permits decreased 8.2% to a 484,000 pace.

Looking at regional permit data on a yearto-date basis, permits were 16.6% lower in the Northeast, 9.1% higher in the Midwest, 3.4% lower in the South and 5.1% lower in the West n

September 23rd

Please return your completed registration form (provided below) to the HBAMT to enter. ALL COMPANY TEAMS MUST BE A MEMBER OF THE HBAMT (all teams must have at least one HBAMT member playing)

Select one, print player(s) name(s) below: r FOURSOME: Print names of players. Four (4) players per team ($900 per team). **Team not guaranteed for shoot until payment received** r SINGLE SHOOTER: Print name of player. $250 per shooter. **Shooter not guaranteed for shoot until payment received** 1.)

Make checks payable to HBAMT; cc payment below* HBAMT - 9007 Overlook Blvd,

Breakfast

l

l

l

l

l

l

The James Hardie Golf Tournament was held Thursday, August 15 at the Towhee Club in Columbia, Tenn. Over 300 golfers competed in the annual event while enjoying food and beverages from a course filled with tournament sponsors.

Look for more details and images in the upcoming issue of The Nail. Additional photos courtesy of Ruthanne Hanlon at Pittsburgh Paints available at: https://ladygracephotography.pixieset. com/guestlogin/hbamtannualgolfevent/

A big thanks again to our title sponsor James Hardie Building Products and to all the tournament sponsors who are recognized on page sixteen. n

Winners of the Helicopter Golf Ball Drop were awarded during the tournament. Nic Freeman (above left, with HBAMT President Kelly Beasley) from the Ole South Properties foursome took home the $800 cash prize following the exciting drop. Nic's ticket number matched the golf ball that landed closest to the pin after it was dropped from the copter. Brad Cass from the Sim-Lohman group took home the second-place $200 prize. Brad's teammate BJ Phillips (above right, with Rachel Holloway and Beasley) accepted the prize in his absence.

James Hardie Building Products -

title sponsors

DR Horton - Lunch

Huskey Building Supply - Breakfast

United Communications - Wrap-Up

Platinum sponsors

American Heating and Cooling

Aurora Lighting

Builders First Source

Carter Lumber

Ferguson

ifoam

Lennar

M2 Group

Pittsburgh Paints Co.

RaganSmith

T-Square Engineering

US Lumber

Gold sponsors

Arcxis

Ashton Woods

Blind Ambitions

Cosentino

Henley Supply

Infinity Pools LLC

Metro Carpets

N & A Elite Construction

Pulte Group

Sealing Agents

Silver sponsors

31-W Insulation

Bank OZK

California Closets of Tennessee

Capital One

CBUSA

CMG Home Loans

CMP Sweeping

Consistent Capital

Davidson Homes

DominionX

Force Roofing Systems

Goat Turf

Greenrise

Hale Insurance LLC

Inspired Closets Nashville

Intex Contracting

Ole South

OneTrust Home Loans

OX Engineered Products

Parksite

PDI Kitchen, Bath & Lighting

ProVolt

Pulley & Associates Rate

Renovative Building Group

Robert F Henry Tile Co.

Sherwin Wiliams

Sims-Lohman

The Agency

The Tile Shop

TimberTown

Tolbert Marketing & Events

Tuscan Iron Entries

VaVia Nashville

Walk Your Plans Nashville

Winstead PC

Hospitality sponsors

Hayes Insulation

Intex Contracting

T-Square Engineering

TrusJoist

The 2025 Parade of Homes at Rosebrooke

At every Parade event each attendee is handed a magazine as they walk through the front gate - the Parade Plan Book.

The Plan Book is a tremendous opportunity to put your message into the hands of pre-qualified customers who refer to the book several months after the Parade of Homes is over!

Plan Book Advertising Rates

Half Page 7.5” x4.75” (Horizontal) $960

Full Page 7.5”x10” 8.75”x 11.25” (B1eed) $1,440

(Bleed)

$3,900

Email jargo@hbamt.org for ad specs and availability.

If your company depends on new homes or related products, furnishings or services, here’s one opportunity you can’t pass up -- the 2025 Parade of Homes at Rosebrooke! Secure your space in the Plan Book or reserve an Exhibit Booth today.

Here’s your chance to demonstrate your product or service to the thousands of qualified prospects who pass through the Parade of Homes exhibit center when they enter and leave the show. As with Plan Book advertising, the exhibit center produces virtually all pre-qualified customers!

It’s like opening up shop and having thousands of prospects visit your show room the first two weeks you’re in business. What other medium could come close to producing those kinds of results? The Parade ranks first of all home shows in the nation and you can take advantage of the prestige this show enjoys.

Exhibit Booth Price? $750

Each booth in the Parade of Homes exhibit center measures 10’ x 6’ at the front entrance where patrons must enter and exit -- perfect for eye-popping kiosks and marketing publications!

2025 PARADE OF HOMES - PROMOTIONAL OPPORTUNITIES COMMITMENT FORM

Return completed form to: HBAMT, 9007 Overlook Blvd., Brentwood, TN 37027 | Email: jargo@hbamt org

PLAN BOOK AD - please check the size of ad you would like to secure in the 2025 Plan Book: r Half Page r Full Page

EXHIBIT BOOTH SPACE - please check here to secure your 2025 Exhibit Booth Space: r

Your name: ____________________________________ Company: _____________________________________ Cell: _________________________________________

Twenty SPIKES (in bold) increased their recruitment numbers last month. What is a SPIKE?

SPIKES recruit new members and help the association retain members. Here is the latest SPIKE report as of July 31st, 2025.

Mitzi

CHEATHAM COUNTY CHAPTER

Chapter President - Roy Miles

Cheatham County Chapter details are being planned. Next meeting: to be announced.

RSVP to: cnicley@hbamt.org

DICKSON COUNTY CHAPTER

Chapter President - Matt Spann

Dickson County Chapter meetings are typically held on the third Thursday of the month. Next meeting: to be announced.

Free w/RSVP, Lunch = Dutch Treat (lunch free w/RSVP pending sponsorship)

RSVP to: cnicley@hbamt.org

MAURY COUNTY CHAPTER

Chapter President - Sam Gray

Maury County Chapter meetings are typically held on the first Tuesday of the month.

Next meeting: Wed., Sept. 10th, 11:30 a.m. at the Graymere County Club - 2100 Country Club Ln, Columbia, 38401 Topic: "Maury County Zoning Codes Update & Forecast,' with Robert Caldiraro, Building Director, Maury County. FREE w/RSVP thanks to Ingram Construction, Shaw Home Builders, Traditions Glass, TriStar Elite Realty, and Electronic Express

$20 w/o RSVP

PLEASE RSVP to cnicley@hbamt.org

METRO/NASHVILLE CHAPTER

Chapter President - Lisa Underwood

Metro/Nashville Chapter details are typically held on the

fourth Thursday of the month.

Next meeting: Thursday, September 25th - 11:30 a.m. at the HBAMT - 9007 Overlook Blvd, Brentwood, 37027. Topic: Developers Roundtable - with Kelly Beasley, James Carbine, Davis Lamb Rob Pease, and Dudley Smith. $25 per person w/RSVP - LUNCH SERVED RSVP to: cnicley@hbamt.org

ROBERTSON COUNTY CHAPTER

Robertson County Chapter details are currently being planned. Next meeting: to be announced. RSVP to: cnicley@hbamt.org

SUMNER COUNTY CHAPTER

Chapter President - Joe Dalton

The Sumner County Chapter typically meets on the third Tuesday of the month. Next meeting: to be announced. RSVP to: cnicley@hbamt.org

WILLIAMSON COUNTY CHAPTER

Chapter President - Rachel Holloway

Williamson County Chapter meetings are typically held on the third Tuesday of the month. Next meeting: to be announced.

FREE w/RSVP pending sponsorship.

RSVP to: cnicley@hbamt.org

WILSON COUNTY CHAPTER

Chapter President - Margaret Tolbert

Wilson County Chapter meetings are typically held on the second Thursday of the month.

Next meeting: to be announced.

FREE with RSVP pending sponsorship.

RSVP to: cnicley@hbamt.org

HBAMT REMODELERS COUNCIL

The HBAMT Remodelers Council meets at varying locations throughout the year.

Next meeting: to be announced.

RSVP to RMC meetings and events to: cnicley@hbamt.org

INFILL BUILDERS COUNCIL

Infill Builders Council meetings are typically held on the last Wednesday of the month.

Next meeting: to be announced.

FREE w/RSVP pending sponsorship.

RSVP to: cnicley@hbamt.org

MIDDLE TENN SALES & MARKETING COUNCIL Council President - Chuck Payne

The SMC typically meets on the first Thursday of the month. Next meeting: Thursday, September 4th, 4-6 p.m. at Tennessee Valley Homes. 127 SE Pkwy Ct, Franklin, TN 37064

Topic: Builders Exchange - Join the SMC for round two of our Generational Panel! With David McGowan, James Carbine, Jimmy Franks, John Floyd, Kelly Beasley, Danny Clawson, Eli Routh, and Brandon Rickman.

SMC Members Free w/RSVP thanks to Piedmont Natural Gas, Carbine & Associates, Tennessee Valley Homes, and DR Horton. Charcuterie cart provided by Tolbert Marketing & Events. NON-SMC MEMBERS MUST RSVP and PAY: $25 with RSVP; $30 w/o RSVP

**HBAMT members must be a paid member of the Sales & Marketing Council in order to receive council rates**

RSVP to: cnicley@hbamt.org

$0 enrollment fee with code: FITNESSGOALS²

Plus 9,400+ additional premium exercise studios at 20% - 70% off retail1

Bundle and save. Get $5 off each additional gym you join.3

No long-term contracts. Easily sign up, switch gyms, or cancel online with no fees or penalties.

Connect 1-on-1 with a personal well-being coach for motivation in nutrition, stress management, sleep, and more at no additional cost.

Create a free account to get instant access to 14,000+ on-demand workout videos!

1

3