2 ISSUE ECONOMICS HARROVIAN

Keyareas

THe Rise of AI

Impact of covid

Sustainability

New policies

THe Rise of AI

Impact of covid

Sustainability

New policies

EDITOR-IN-CHIEF

Vanessa Wang (Gellhorn)

HEAD OF WRITERS

Jeremy Wong (Shaftsebury)

Alastair Fothergill (Peel)

HEAD OF EDITORS

Hannah Nayeer (Anderson)

WRITERS

Vanessa Wang (Gellhorn)

Jeremy Wong (Shaftesbury)

Alastair Fothergill (Peel)

Hannah Nayeer (Anderson)

Selena Liang (Gellhorn)

Derek Lai (Churchill)

Bernice Chui (Anderson)

Sidney Chiu (Gellhorn)

EDITORS

Vanessa Wang (Gellhorn)

Hannah Nayeer (Anderson)

Derek Lai (Churchill)

Sidney Chiu (Gellhorn)

Manci Fang (Keller)

FEATURED ARTISTS

Angie Cheung (Gellhorn)

Cynthia Li (Keller)

Special thanks to the Harrow HK Economics Department

By Vanessa Wang (Gellhorn)

In the 19th century, the average American only owned a few outfits in their wardrobe. Today, brands like Shein drop 2000 new items per day and Americans buy an average of 64 items of clothing annually. Following industrialisation and mass production, modern consumerism has become preoccupied with materialism, status, and competitive consumption. Yet beneath this shift in individual consumption behaviour, there lies a societal trend of corporations manipulating consumers into a culture of disposability.

Consumerism ideology theorises that consumption in large quantities enables economic growth in developing countries: over the past 40 years, China’s industrialisation has caused the number of people under the International Poverty Line to fall by almost 800 million. Nonetheless, overconsumption does not always improve lives To push prices down and stimulate demand, transnational companies exploit individuals in developing regions willing to work for poor conditions and low wages Garment workers in developing countries can be paid as low as just $3.43 per day, and supply chains include 160 million children working in child labour globally. While low-barrier jobs increase employment in developing regions, education inhibition lowers productive capabilities and amplifies income inequality in the long term,

trapping developing regions in low-paying jobs.

Present-day commerce utilises low prices to turn chasing trends into a mass activity, taking advantage of the media to exacerbate trend cycles. Celebrities are photographed never wearing the same thing twice, and consumers are advertised into an unhealthy, spiralling pressure to keep up with daily trends through constant shopping Fast fashion companies like Zara produce up to 52 micro-seasons per year, using sophisticated algorithms to get new styles to market in days. Overconsumption is not a manifestation of individualism, but rather an enslavement of society to the everchanging fads at the cost of global environmental destruction

The fashion industry produces over 92 million tonnes of waste and consumes over 79 trillion litres of water annually. While the entire planet feels the consequences of a warming climate, developing countries bear the heaviest burden, and local economic growth experienced by emerging economies is offset by climate destruction. Pakistan's summer floods in 2022 affected 33 million people, destroyed over one million homes, and flooded 2 million acres of crops

In the escalation of global sustainability concerns, ESG metrics have emerged as a way to evaluate firm sustainability, but these superficial values only seem to justify further destruction. ESG metrics merely reward piecemeal sustainability strategies and insincere promises, allowing corporations to maintain profitability while championing themselves as ‘sustainable’ Zara’s parent company Inditex holds an MSCI rating of AA; simultaneously, it has been linked to large-scale illegal deforestation, slave labour in outsourced factories, and more than 2.5 million CO2 emitted from transportation alone. Even as conscious consumers seek out ethical choices, they are only met with deceitful credentials from greenwashed firms.

Consumers must not be appeased by perfunctory changes; they must demand a systematic shift within commerce towards a global circular economy (CE), where products are designed with sustainability in mind from the beginning Per the EMF, a circular economy ‘redefines growth, focusing on society-wide benefits ’ While CE development has mainly been in developed countries, rapidly urbanising cities need to be prioritised. Industrialisation can be sustainable – the concept of CE ameliorates the burden of natural resources whilst encouraging longterm economic growth. Observing previous CE principles implemented in developing countries, Bangladesh saved US$4 7 million from recycling lead from batteries, and Kolkata’s renewable biogas bus service allowed for a cost-effective method of transportation.

Necessity is the mother of invention. Corporations must be forced to realise that over-consumerism is outdated, and stakeholders need to view sustainability as a self-interest instead of conflict. Successful CE programs require consumer pressure, local government support, and a national framework conducive to CE finance. While 81% of green investments in developed economies are funded privately, only 14% in developing countries are This means securing funding for pilot projects will be crucial for developing regions. Through public-private partnership, China’s sludge-to-energy program reduced emissions by almost 98% and was financially breaking With a support network, minor green projects are able to scale to a systems-level circular economy, driving economic growth while maintaining environmental protection.

Adam Smith once stated, “Consumption is the sole end and purpose of all production.” Yet, modern society features firms manipulating consumers through deceiving practices – it is time for consumers to take control of their wardrobes, their consumption, and the direction the world takes.

By Alastair Fothergill (Peel)

The emergence of the gig economy is evident across the globe and is often characterised by conflict due to its contrasting approach towards employer-employee relations. While the gig economy has revolutionised industries and created new income streams, the classification of gig workers as “independent contractors” exempts them of access to employee benefits such as healthcare, sick leave or retirement savings This is where the heart of the conflict lies: are gig workers “independent contractors” or “employees”?

Analysing the conflict

The Worker Perspective: Insecurity and Inequality

The gig economy’s business model is based around the idea of freedom and flexibility for its workers. However, the lack of economic stability far outweighs this false sense of freedom. A study estimates that “the pay guarantee for Uber and Lyft drivers is actually the equivalent of a wage of $5 64 per hour” (UC Berkeley Labour Centre, 2019), which is below the minimum wage of “$7 25 per hour” (Bureau of Labour Statistics, 2019). There are also additional necessary costs that must be considered, such as gas or vehicle maintenance. All things considered, the gig workers’ financial freedom is much lower than it appears to be.

The Corporate Perspective: Flexibility and Cost Efficiency

The easy access to the gig workers’ services allows companies to keep labour costs low and allocate more money for investment and growth. However, such a flexible workforce comes with its challenges. Managing a dispersed and temporary workforce can be complex, mainly due to the basis that most gig workers are doing their job as a side-hustle, combined with a lack of company supervision, which may lead to a decrease in labour productivity Furthermore, by avoiding traditional employment relations, businesses deviate their financial risks onto their workers It is argued that the “flexibility” narrative is often overstated, as gig workers have little bargaining power and face inconsistent earnings.

In 2019, the California Assembly Bill 5 (AB 5) stated that all wage-earning workers are entitled to be classified as employees with usual labour protections However, this led to ridesharing companies funding a ballot initiative, Proposition 22, to exempt both ridesharing and delivery companies from the AB 5 requirements, granting them the right to classify their drivers as independent contractors. There have been few regulatory disputes regarding this issue, but none of them

have concluded with a proper solution to the conflict.

A promising resolution for the conflict in the gig economy is the development of hybrid employment models. By remodeling traditional employment labeling, hybrid models address the challenges of gig work, while maintaining the business models of the gig economy.

The model introduces a ‘third classification’ for gig workers. It ensures workers are granted portable benefits, allowing them access to traditional employee benefits such as health insurance, sick leave and guaranteed minimum pay, while also maintaining flexibility and support for different work schedules. Workers can also retain the ability to work across multiple platforms, ensuring labour mobility is preserved. The hybrid model also tackles the issue of transparency and fairness between workers and employers, preventing workers from unfair penalisation

In conclusion, the hybrid employment models provide a promising resolution to the conflict between gig economy companies and workers by creating a fairer system that benefits workers, companies and consumers alike. However, for the hybrid models to succeed, appropriate management and supervision must be upheld. They must also be carefully designed and implemented, requiring collaboration between workers, companies and governments.

By Derek Lai (Churchill)

The rapid pace of technological advancement has ushered in a new era of digital transformation that is reshaping traditional industries Once-stalwart companies that have operated in the same manner for decades, or even centuries, are now recognising the urgent need to adapt their strategies and business models to capitalise on the benefits of digitisation This essay will examine the key drivers behind this digital transformation trend, analyse the approaches companies are taking, and consider the impact it is having on traditional industries.

At the heart of this shift is the convergence of three critical factors (Verhoef, 2012): technological advancements, evolving consumer behaviours, and intensifying digital competition The proliferation of cutting-edge digital technologies, such as artificial intelligence, and big data analytics has empowered traditional firms to enhance their product development, operational efficiency, and customer experiences in ways that were previously unimaginable. Simultaneously, consumer expectations have rapidly evolved, in part due to the Covid-19 pandemic, with an increased demand for personalised and omnichannel experiences. Additionally, according to Statista, global e-commerce revenue surpassed USD5 7 trillion in 2023, up 430% from 2014. In short, failing to meet these

heightened expectations has left many traditional players vulnerable to digitally native competitors who are able to deliver superior value In response, companies are pursuing two primary approaches (Berman, 2012) to digital transformation: reshaping their customer value proposition and transforming their operating models. By integrating digital and physical elements, firms can extend their offerings and create new revenue streams For instance, the iconic toy company LEGO has harnessed digital tools like 3D printing to accelerate new product development, reduce time-to-market, and improve quality. Moreover, LEGO has demonstrated its digital networking capabilities by empowering content creators to generate and customise products, ultimately driving greater brand engagement and value

Complementing this customer-centric focus, companies are also revamping their internal operations and processes through the application of data analytics and digital platforms. A 2018 Harvard Business Review study found that Uber's platform-based model, underpinned by sophisticated data analytics and AI, has enabled the company to achieve significantly higher margins and operational efficiency compared to traditional industry players By optimising the allocation of resources and enhancing cross-channel

integration, these digital transformation initiatives are helping organisations deliver exceptional customer experiences while simultaneously improving their own bottom line

While the benefits of digital transformation are clear, implementing these changes is no easy feat. A McKinsey & Company study revealed that a staggering 70% of digital transformation projects fail due to resistance and lack of buy-in from employees. This underscores the importance of effective change management, as traditional businesses must navigate the cultural and organisational challenges inherent in such sweeping transformations.

Nonetheless, the imperative to embrace digital transformation is undeniable As McKinsey & Company states, "By powering the principles of operational excellence with digital and analytics, and adding a laser focus on holistic impact, companies can achieve a true step change in performance " Those who successfully harness the power of digital technologies will be well-positioned to thrive in the years to come

By Hannah Nayeer (Anderson)

The rise in digital infrastructure and social media has transformed the way businesses operate, shifting marketing from traditional models to dynamic, data-driven platforms Propelling a rise in the platform economy, where the traditional advertising model has been disrupted, drastically reinforcing the move from physical to digital transactions and reshaping growth strategies In scale and significance the digital economy has become impossible to disregard however questions arise of its long-term sustainability. Are firms truly benefiting on the innovative potential of this shift? Or will this be the rise of dominant platforms reinforcing uniformity and limiting competition in the long run

Within the platform economy there has been a shift in reliance on firms ownership of physical assets to controlling interactions between consumers through insight into their data Since the pandemic, 54% of consumers have shifted more to online spending and there is a positive trend rate in the growth predicted for the future. A key factor of the platform economy is the network effect The network effect is where value increases as more users join and attract more participants, spurring business growth Therefore it’s valuable for businesses to harness strategies the platform economy provides to retain consumer engagement as the platform becomes increasingly saturated.

For example, Netflix uses sophisticated algorithms to create personalised recommendations - increasing user engagement This data generated improves Netflix’s services, attracting more users and creating a reinforcing cycle that enhances consumer offerings and contributes to the company's growth despite being within the highly competitive video streaming industry

This flexibility to innovate allows businesses to swiftly adapt to market changes as the large quantities of user data collected give a clear indication of a firm’s target audience’s needs and challenges. Another example is Spotify adapting to the needs of its users as it tracks user listening habits to generate information that machine learning algorithms analyse to enhance the platform This differs from other rival streaming platforms that struggle to adjust, forcing these rival firms to compete through innovation fuelled by the rapid technological development we’ve seen in the past decade This then results in intensified competition on market entry, with increased quality, more consumer choices and generally lower prices.

To summarise, the network effect drives a reciprocal flow between consumer interaction and data-driven adaptation, fuelling a continuous cycle of innovation and refinement - unrivalled to competitors still reliant on nondigital models. However this growth comes with its own set of disadvantages, as the mechanisms that drive it’s success lead to its own unintended consequences

Albeit the undeniable benefits in efficiency and innovation, its over-reliance on algorithmic feedback has become its own double edged sword Beneath a surface of data driven success may lie a more nuanced reality - where the pursuit of innovation leads to a cycle of imitation rather than originality Platform homogenisation refers to the growing trend of online tech platforms adopting similar features, typically the features that aim to maximise consumer engagement.

For example, when TikTok’s success was noticed by other industry leaders, like Meta, Snapchat, and Google, they all introduced short-form video into their platforms. This growing trend of major tech companies assimilating almost identical features into their products reinforces an oligopolistic structure within the market. Our primary platforms are appearing increasingly similar making it increasingly difficult for new firms to break into the market. With these tech giants stifling fair competition by leveraging off oligopolistic power there have become new implications for innovation.

While the network effect has allowed companies to quickly copy and integrate features from their competitors it quickly leads to a homogenised tech landscape across the platform economy. This trend is the most apparent amongst media giants who have the resources and market dominance to continuously adapt. This continuous adaptation has caused firms to become more reactive than imaginative, prioritising algorithms over originality and thereby reducing the diversity of consumer experiences.

As a result of this, the question arises: Is there room for further innovation in this space, or have we reached a point of saturation? Whilst market dominators continue to refine their products, emerging technologies and shifts in consumer demand may still create new opportunities to disrupt this growing oligopolistic market

By Jeremy Wong (Shaftesbury)

Artificial Intelligence is defined as “the ability of a digital computer or computer-controlled robot to perform tasks commonly associated with intelligent beings”. It has become a more relevant topic of discussion in recent years, due to the exponential emergence of ChatGPT, a generative pre-trained transformer that generates a natural language response to a given prompt or input, through the use of AI, which has been used in different sectors of the economy, such as education and healthcare. This extract will discuss both the advantages and disadvantages of the increased usage of AI, as while artificial intelligence will enhance economic productivity and globalisation, the socio-economic challenges it creates may outweigh the benefits. Issues such as the development of self-aware AI, displacement of low-skilled jobs, and the reinforcement of stereotypes due to AI's existing biases will burden humanity in the coming decades.

The advancement of AI can create a “barbellshaped economy,” leading to disparity between social groups. Larger firms can access and implement efficient self-aware AI, while smaller firms, lacking funding for research, struggle to maximise productivity. This imbalance can result in market monopolisation, as smaller companies cannot compete, stifling innovation and diversity.

Additionally, the inequality extends between developed and developing countries - as in developed economies, around 60% of jobs are affected by AI, with sectors like technology and logistics increasingly replacing labour with machine learning. While this boosts productivity and revenue for larger firms, AI’s prevalence causes job displacement, contributing to rising unemployment rates in developed areas like the UK, which has seen a 0.5% increase since 2022. Moreover, developing countries face challenges in adopting AI due to lower digital literacy and skills, widening the gap between their labour force and that of high-income nations, ultimately diminishing global economic interconnectedness.

However, if managed properly, the benefits from the development of AI and the increased automation of routine tasks could not only boost the productive capacity of the economy but also lead to significant cost reductions for firms and businesses. This is done through the application of AI into training courses, learning, and development: leading to labour forces having access to personalised feedback and practical simulations of tasks For example, in education, AI can be utilised and adapted to suit individual students' methods of learning and understanding.

AI can recognise patterns in strengths and weaknesses and help provide alternative feedback to the teachers This makes the labour force more skilled, productive and able to perform tasks more efficiently; therefore, as the quality of output and production increases, this increases the long-run aggregate supply and therefore leads to real economic growth. Furthermore, although AI has the potential to widen the skill gap between less and more developed countries, the efficiency and proficiency of AI can help reduce time spent on learning skills that can be automated and therefore allow for the allocation of resources to shift and increase economic development in lower-income countries as well.

Generative AI will also help make the economy more globalised and inclusive of all social groups: through its ability to absorb and tailor information to different social groups, as well as being able to translate information into different languages to help overcome cultural barriers Examples of AI’s function in making material customised towards specific groups of people can be seen in transforming text to audio or creating braille patterns that can be read by the visually impaired, making content more accessible globally to anyone Additionally, AI’s ability to scan databases and gather sources instantaneously allows for information to be more accurate and checked to be credible.

Through GPTs, data can be more precise as well as detect phishing scams and misinformation Finally, AI can be used to make business decisions that are not clouded by human judgement It will benefit firms that have gathered data, where AI can be used for analysis and to help generate strategies for investment that have no human bias or recognise patterns and trends that humans may not be able to do

On its current trajectory, AI will be increasingly embedded in every sector of the economy. The current absence of regulatory oversight in the development and research of AI causes the risk of further application of AI into the economy to outweigh the additional productivity and potential growth it may provide. However, arguments could be made that AI can bridge economic activity to become more interconnected and globalised, however this does not account for the inconsistent access to technology between more and less developed countries. Instead of decreasing the skill gap and digital literacy between high- and low-income countries, AI will curse humanity for the next few decades to come and contribute to a less diversifiedworld economy

By Bernice Chui (Anderson)

In late 2019, patients in Wuhan, China, began to experience pneumonia-like symptoms that resisted standard medical treatments. The World Health Organisation was then notified, and as time progressed, authorities labelled the unknown virus as the “2019 Novel Coronavirus,” now known as COVID-19. The virus gradually spread to countries around the globe, and soon, the world went into lockdown.

This epidemic has caused a devastating worldwide recession both within and between countries Lockdowns, supply chain disruptions, and changes in customer behaviour collectively created rapid economic shocks, particularly affecting high-contact service industries. The pandemic triggered both short-term disruption and accelerated long-term changes in how worldwide economies function Examples include the rise of remote jobs and changes in global trading patterns, among other things. Even in 2021, three years after the initial outbreak, countries around the world remain in recession. This article will look at the pandemic's immediate economic impact, the long-term effects it caused, and the future consequences for world economies

The COVID-19 pandemic resulted in a significant contraction of the global Gross Domestic Product (GDP) in 2020, with the United Kingdom's economy experiencing a historic decline of 9.9%. This downturn was primarily attributable to strict coronavirus restrictions that severely affected economic output. As the Office for National Statistics (ONS) reported, this reduction was twice the size of the prior largest annual decrease on record

According to the International Monetary Fund (IMF), the proportion of unemployed individuals in the United States will reach 8 9% in 2020, up from 3 7% in 2019, signifying the end of a decade of employment growth. Some sectors, such as tourism, were particularly affected as travel restrictions in each country tightened significantly, and businesses that focused on retail and hospitality continued to be impacted by the lowered consumer spending and reduced demand for their services Conversely, the healthcare and pharmaceuticals sectors experienced a surge in demand for medical supplies and vaccines, underscoring the pandemic's complex impact on the economy.

As vaccinations roll out and lockdowns conclude, it might seem that COVID-19's influence has waned significantly Yet, the virus's impact remains undeniable, profoundly altering our society: the pandemic's social, economic, and cultural effects will linger for years, potentially over a decade. The shift to remote work has solidified its place in numerous industries, prompting a greater reliance on digital tools and platforms such as Zoom and Microsoft Teams.

This transformation significantly impacts commercial real estate and the urban economy. Additionally, there's been a surge in online shopping and delivery services, mirroring shifts in consumer preferences towards health and sustainability The pandemic also spurred a reassessment of supply chains, with an increased focus on resilience and localisation, alongside a rise in automation and robotics to reduce dependence on human labour. The pandemic's social, economic, and cultural effects will resonate for years, if not decades. It’s essential to acknowledge these changes promptly to effectively navigate their implications.

Additionally, corporations are rethinking their strategies to adopt sustainability and social responsibility in response to heightened consumer awareness. This transformation enhances brand loyalty and contributes to building a more sustainable economy. Policymakers must prioritise support for affected industries while fostering innovation and adaptation.

Understanding these patterns will be crucial for developing resilient economies that can withstand future shocks By applying the lessons learned from the pandemic, societies can establish better economies across the world There is an ever-increasing need for flexible fiscal and monetary policies that are capable of responding to future economic crises such as an unprecedented pandemic like COVID Policymakers must prioritise the adaptability of economic initiatives, ensuring that they can be quickly altered to meet unexpected problems

In summary, the COVID-19 pandemic has caused specific economic disruptions and severe long-term changes in how economies across the world operate The historically significant decline in GDP, consequential job losses, and sector-specific impacts highlight the immediate consequences of the pandemic. As the world adapts to life after COVID, there will be increasing use of remote work, digital progression, and changing consumer behaviours that will continue to shape economies across the globe. The increasing focus on supply chain resilience and the rise of technology illustrates how sectors are improving in response to the pandemic's challenges This enables us to better prepare for future possible challenges while also working on the potential for innovation and resilience in a rapidly changing economy

By Sidney Chiu (Gellhorn)

Imagine a flat of eight square meters, furnished with nothing but a makeshift toilet being shared by ten tenants. Each bed mouldy and hidden behind its own sliding door This is the infamous coffin house that more than 200,000 Hong Kongers call home. Many locals grow up hearing about the horrendous conditions they live in, where bed bugs and drug dealers are daily realities That, however, is about to change under Chief Executive John Lee's new legislation.

Earlier in 2021, Beijing official Xia Baolong visited Hong Kong and expressed concerns about the subdivided units (SDUs), urging that they be eradicated by 2049 Three years later, Lee proposed a series of regulations to address the issue. Dwellings smaller than eight square meters and rooms with a ceiling height of less than 2.5 meters are to undergo reconstruction, aiming to offer "building safety, fire safety and hygiene" While the transition is taking place, current tenants will be displaced from their shelter This puts a huge population under the threat of Hong Kong's exorbitant rents and the idea of homelessness. According to Wong (2022), the city's housing market has been ranked as the least affordable across the world for over a decade.

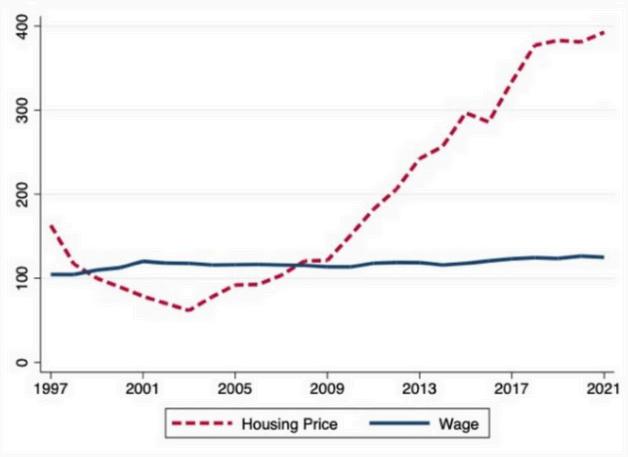

Over the span of seventeen years, "the real price index of residential homes rose by 239 percent" and rental prices continue to rise by 10% each year This can simply be explained by the idea that supply is unable to keep up with demand. In past decades, Hong Kong has seen demands arriving with foreign talents and international students, while recent homebuyers come primarily from Mainland China.

“When more people want to live in an area, we either build more homes to accommodate them or squeeze them in to the existing housing stock, with those people bidding up the price of living there”

These words of Myers, Bowman, and Southwood (2021), are especially true in a region with just a little over 1000 square kilometres of land Residents come in, demanding housing way faster than construction companies can build.

The surging of housing prices is only exacerbated as policies of the Hong Kong Monetary Authority (HKMA) focus on easing mortgage restrictions. As part of the October 2024 countercyclical macroprudential measures, the maximum loan-to-value ratio was raised to 70%, and the debt servicing ratio was adjusted to 50%, effectively lowering the cost of borrowing. This made it easier for citizens to claim their own homes and encouraged investors to pour money into the housing sector.

While short-term economic growth seemed to take place, people are, in fact, experiencing a lower quality of life. A greater portion of income is now dedicated to paying mortgages or rent, and in many cases, both adults must work to support a moderate family. In Western countries, people often end up moving into rural areas; but in Hong Kong, even rural land is limited. As such, lower-income families are left out of better housing options and forced to move further away from well-paid jobs. It becomes increasingly difficult to sustain expenses and purchase properties, especially when housing prices rise at a much higher rate than real income This often pushes people back into cheaper housing options, such as coffin or cage homes

In conclusion, while the 2024 policies introduced by Chief Executive John Lee aim to alleviate some of Hong Kong’s dire housing conditions, they fail to offer a comprehensive solution to the city's underlying crisis The transformation of SDUs and the reconstruction of dilapidated homes may improve living standards for some, but it does not tackle the broader issues of affordability and housing supply Displaced tenants face a grim future in an already saturated market where rising rents and low availability push lower-income families further into precarity

By Selena Liang (Gellhorn)

In today’s rapidly developing world, artificial intelligence (AI) is a new but controversial technology that has caught our attention This rapid development has resulted in intense debates about it AI allows computers or machines to learn how humans do, such as through problem-solving, decision-making, and creativity Depending on how we use AI and the policies we make to regulate it, it can have negative or positive effects on society and the economy. There are two main types of AI: weak AI, also known as narrow AI, (which performs small, specific tasks like self-driving cars) and strong AI, or artificial general intelligence Strong AI is the intelligence of a machine that can understand and learn any intelligent task that humans can Allowing it to assist humans in solving complicated problems like the popular AI ChatGPT.

AI has brought significant economic growth, including industry productivity and efficiency improvements. Research has studied the effect of AI tools on worker performance, and the most recent estimates indicate that AI enhances performance in specific tasks by 10% to 56% The potential effect of AI on the productivity growth rate is estimated to be 1.5% annually, with estimates of reaching 18% in 10 years This results in a 30% productivity increase in cognitive tasks, which comprise 60% of labour inputs

However, increased negative aspects of AI have been brought to light as well Firstly, AI risks economic inequality and may cause job displacement. According to a survey, half of the American population thinks the increased use of AI will lead to more income inequality and a more polarised society (IPSOS research, 2023) Due to the knowledge needed to use and collaborate with AI, high-income workers benefit most from AI-driven productivity boosts, as they are more familiar with these technologies. Narrow AI has been widely used to replace manual labour, not impacting those in decision-making jobs. This may not be the case after generative AI impacts the workplace, as they are more rational and valuable tools in decision-making.

An increasing number, 62%, of the younger generation believes there is a high chance of AI replacing their jobs in the next 5 years In addition, two-thirds think the government should act on AI to protect jobs and prevent further income inequality and polarisation (IPSOS research, 2023). This data summarise one conclusion: AI will increase the income and wealth gap, creating an even more polarised society

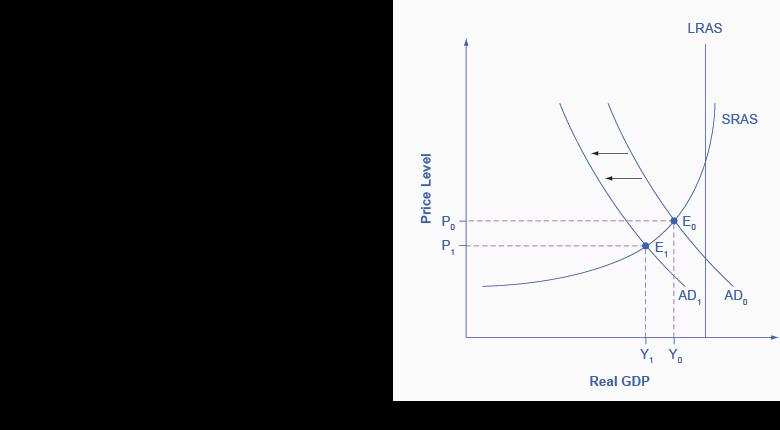

AI also contributes to shaping the gig economy. The ‘gig economy’ refers to a labour market that relies heavily on temporary and part-time positions filled by independent contractors and freelancers rather than fulltime workers (The Investopedia team, 2022) AI is used to match customers and workers. An example of this is food delivery services Customers order on an app; the restaurant receives a notification that someone wants an order; the driver notices that an order needs to be delivered from one place to another. AI acts as a platform for all of this to happen smoothly. The rise of AI expands the gig economy, leading to a growing number of temporary and precarious jobs; temporary jobs could result in a decrease in consumer confidence as jobs become less secure, which reduces consumption in the economy, leading to a reduction in the aggregate demand curve, resulting in a shrinking economy from Y0 to Y1.

Furtherly, socio-economic challenges ahead of us that the emergence of AI may cause include worsened inequalities An example is AI in the workplace. AI's power to increase productivity for simple tasks makes it a perfect assistant for complex, usually high-income jobs. However, as it is more efficient for systematic tasks, it may replace low-skilled jobs that are repetitive and typically lower-income. This results in an even more significant gap between society's high and low-income sectors. A solution for this is to make AI a complement for workers, helping them be more efficient and produce higher-quality work instead of replacing them. Research has shown that, with the help of AI, average worker improvement is at 14% (PMC, 2024). On a global perspective, AI may increase the gap between developing and developed countries. Because AI development is costly compared to developed countries, developing countries have less money to spend on advancing AI technologies. They also have other vital areas to invest in, resulting in an even more significant divide between them.

To conclude, the future of our world could be drastically different depending on how we use and regulate AI In an idealistic world, with correct regulations for AI, we would achieve a more productive and efficient society If not, we may face a more polarised society with compromised digital security Therefore, taking action to further engage with AI’s socio-economic implications is essential for economic growth