‘“

It’s not complicated to do business with Orgill. They have a wide choice of products, warehouses with reliable quantities, tools to fight the competition and facilitate the operation of the business.”

Robert Boyer Owner, Matériaux Robert Boyer

‘“

It’s not complicated to do business with Orgill. They have a wide choice of products, warehouses with reliable quantities, tools to fight the competition and facilitate the operation of the business.”

Robert Boyer Owner, Matériaux Robert Boyer

PRESIDENT

Michael McLarney mike@hardlines.ca

EDITOR-IN-CHIEF

Steve Payne steve@hardlines.ca

ASSOCIATE

EDITOR

Geoff McLarney geoff@hardlines.ca

CONTRIBUTING

EDITORS

Rebecca Dumais rebecca@hardlines.ca

Sarah McGoldrick sarah@hardlines.ca

CONTRIBUTORS

John Caulfield, Frank Condron, Corrie-Ann Knell, Rob Wilbrink

ART DIRECTOR

Shawn Samson shawn@twocreative.ca

FOURTH QUARTER/2024 // VOLUME 1, NO. 1

330 Bay Street, Suite 1400, Toronto, Ontario M5H 2S8 • 416-489-3396 @Hardlinesnews • www.hardlines.ca

VICE-PRESIDENT & PUBLISHER

David Chestnut david@hardlines.ca

ACCOUNT MANAGER

Shannon MacLeod shannon@hardlines.ca

SENIOR MARKETING & EVENTS MANAGER

Michelle Porter michelle@hardlines.ca

CLIENT SERVICES MANAGER Jillian MacLeod jillian@hardlines.ca

ACCOUNTING accounting@hardlines.ca

★ FREE TO HOME IMPROVEMENT DEALERS ★ To subscribe, renew your subscription, or change your address or contact information, please contact our Circulation Department at 866-764-0227; hhiq@mysubscription.ca.

Michelle Chouinard-Kenney GIBSON BUILDING SUPPLIES Aurora, Ont.

Brian Lavigne

EDDY GROUP TIMBER MART

Bathurst, N.B.

Luc Léger

ELMWOOD GROUP HOME HARDWARE Moncton, N.B.

Brent Perry ALF CURTIS HOME IMPROVEMENTS

Peterborough, Ont.

Gary Sangha CROWN BUILDING SUPPLIES

Surrey, B.C.

Hardlines PRO Dealer is published four times a year by Hardlines Inc., 330 Bay Street, Suite 1400, Toronto, ON M5H 2S8. $25 per issue or $90 per year for Canada. Subscriptions to the Continental United States: $105 per year and $35 per issue. All other countries: $130 per year. (Air mail $60 per year additional.)

Canadian Publications Mail Agreement #42175020. POSTMASTER: Send address changes to Hardlines PRO Dealer, 8799 Highway 89, Alliston, ON L9R 1V1.

All editorial contents copyrighted 2024 by Hardlines Inc. No content may be reproduced without prior permission of the publisher.

Hardlines PRO Dealer is just one facet of the Hardlines Information Network. Since 1995, we’ve been delivering the most up-to-date information directly to you online, in print, and in person. Find out how you can get your message out with us. Contact:

Shannon MacLeod, Account Manager 905-691-2492 • shannon@hardlines.ca

Crown Building Supplies opens third store

Castle CEO sees growth opportunity

CGC breaks ground on ecofriendly wallboard plant

Saint-Gobain completes acquisition of Bailey Group

Fenplast acquires Les Portes A.R.D.

Adentra acquires Woolf Distributing

FOURTH QUARTER/2024 // VOLUME 1, NUMBER 1

10 9 18 72 75 77 78

EDITORIAL WANTED: INNOVATION

PRODUCTS FOR PROS

PROFESSIONAL SPRAY FOAM, NAILERS, SIDING, AND MORE

STRATEGY HOME DEPOT PLACES MASSIVE BETS ON PROS

MESSAGE FROM THE PUBLISHER WHY WE LAUNCHED PRO DEALER MAGAZINE

INDEX TO ADVERTISERS SEE WHAT’S IN OUR NEXT ISSUE

THE CHALLENGE HOW COASTAL DRYWALL SUPPLIES DELIVERED THE GOODS TO A HALIFAX HIGH-RISE JOBSITE

An interview with Michelle Chouinard-Kenney, CEO of the family-owned business that comprises Gibson Building Supplies and Chouinard Brothers roofing

Feeling more like a bank than a yard? A discussion about red flags and acceptable risks

The southern Ontario GSD “fits the bill” for GMS’s competitive approach

These boom trucks and forklifts could be some of the toughest workers you will ever employ

Whether you’re building from the ground up, or renovating your store, design strategies for maximizing sales from contractors

If we’re going to speed up the pace of homebuilding, we need new methods

BY STEVE PAYNE Editor-in-Chief PRO DEALER

steve@hardlines.ca

Canada requires 3.9 million new homes by 2031—or so the politicians tell us.

At our current housing starts, we are on track for two million units in that time.

There are limits to the skilled labour force in Canada. We are going to have to double the number of trades and labourers—if we’re going to build the way we’ve built homes for the past 100 years.

So, what if we don’t do that?

What if we increase the number of prefabricated components?

We need more innovations that speed up the pace of building. Like Insulated Concrete Forms. But remember, ICFs were first patented in 1946. It took 50 years for them to become widespread!

In the pages of this premiere issue of Pro Dealer, you will see nothing but innovation. If you’ve got a product that allows pros to build faster, you’ll want to tell us about it.

When Home Depot opens a staggering 17 Flatbed Distribution Centres in North America just to sell pros, as it has, you know that the industry is experiencing some radical changes.

Our goal is to tell you about such innovations before your competitors know about them.

Our goal is to tell you about innovations before your competitors know about them. “

A resolute focus on the customer has led to success for pro dealer Crown Building Supplies in its first decade in business. On Sept. 3, the company celebrated the opening of its third store, in Burnaby, B.C.

The company started with a single store in Surrey, B.C., in 2014. A second store was opened in Abbotsford, B.C., and now, with the Burnaby location, Crown has definitely become a powerful regional chain in the Lower Mainland of the province.

And CEO and co-founder Gary Sangha doesn’t expect it to end there by any means. “There are a few more to come,” he says.

Crown is now a member of AD (Affiliated Distributors) since its previous buying group, Ontario-based TORBSA, merged with the American group in 2022.

The focus of Crown Building Supplies has always been on pro sales, selling to builders throughout the region. But the new store has been designed to service a somewhat different market than Crown’s

Gary Sangha, Crown Building Supplies CEO, and his team recently marked ten years in business for the pro dealer.

first two stores. The customer base is more commercial in Burnaby—which means that Crown expects to sell more steel construction products.

“Our plan is to grow more into a different market, to serve our customer base. We covered the Fraser Valley before and now with this Burnaby location I think we’re going to have a better reach. We’re going to be able to save a lot more on our logistics being on the North Shore as well.”

Sangha himself has been involved in home improvement from an early age, working at a family business owned by his uncle. “When I was in high school, I started in this business. I started at the bottom, everything from building orders in the warehouse to sweeping the floors and packing the board.”

Now that he’s celebrating his third store as a co-owner, Sangha is grateful how far he’s come in a decade as an entrepreneur.

“Of course, during these 10 years we’ve seen a lot of challenges—Covid was the major one. And ever since Covid, the supply chain’s been broken. It hasn’t been fixed yet. Yeah, it’s a lot better, but is it where it needs to be? No.”

While Crown adheres to its GSD roots, more recently it has opened an entirely new operation, a design division, providing a new service for its contractor base.

The aim is to be even more indispensable to pros. “It could be based on product knowledge, it could be based on projects, it could be based on specs,” says Sangha.

“For example, if you’ve got a wall or a ceiling assembly that they proposed, and that product might not be available anymore, or at the given time, we can propose a new assembly. And we have a program in-house, software, that can actually get you that STC [sound transmission class] rating that they might be looking for by switching, basically, to a different manufacturer’s products.”

The team at Crown’s design division will save the architect or designer from having to hunt that alternative product down. “We know the right channels to get that information, versus them not being able to do that. Or do it in a timely manner,” Sangha says.

Through the years, the GSD industry has not changed fundamentally, Sangha says. “The [business] models that you’ve seen 20, 30, 50 years ago—they haven’t changed much. You’re still going

to the contractors. Your practice in terms of getting the product to the site has changed in terms of better equipment. Other than that, the business is as usual—there’s nothing changing.”

But even as Sangha shares that, he also observes how Crown’s commercial customers have changed. As a result, Crown is expanding its offerings.

“I think where we spearhead on leading the industry is where we added more scope to each of our customer’s work. For example, if the drywaller is doing the drywall, they’re already installing a metal frame or wood frame for the doors. So, they’re responsible for that framing to be plumb. And the only thing they’re not installing is the door.”

“It’s a little different from what our competitors are doing. We’re just diversifying more. [We’ve] got into selling commercial doors, trying to get a bigger share of the pie. We’re already on job sites, so why not sell more of that assembly that we’re already working on? Before, we were basically on the inside. Now we’ve gone to the outside as well.”

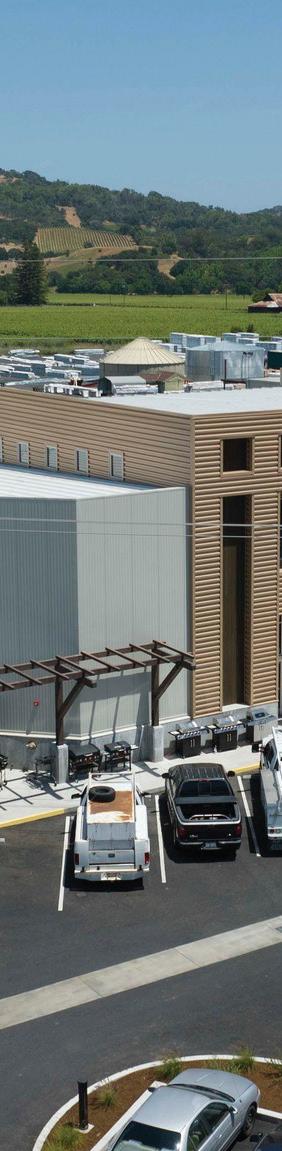

This past summer, CGC Inc. broke ground on the construction of its new wallboard manufacturing plant in Wheatland County, Alta., 70 km southeast of Calgary.

The company, the Canadian division of USG, says the $210 million manufacturing facility will allow it to deliver Sheetrock brand wallboard to residential and commercial customers across Western Canada faster, more sustainably, and more reliably than ever.

According to CGC, the 220,000-square-foot facility on 214 acres will create more than 200 jobs during the construction phase and more than 100 permanent, full-time manufacturing jobs once plant construction is completed in 2026. Plant recruitment and hiring will occur next year. The contract for the construction of the plant was awarded to Ledcor.

The new facility will feature state-of-the-art innovations that enable efficient wallboard production with minimal water usage, energy consumption, and physical waste.

The eco-friendly facility will also feature state-of-the-art innovations that enable efficient wallboard production with minimal water usage, energy consumption, and physical waste. A solar field onsite will generate clean electricity for the plant.

“Today’s ground breaking marks a significant win for CGC operations in Western Canada and our ambitious growth plans in Canada more broadly,” said Chris Griffin, CEO of USG Corporation.

The project was first announced by CGC in 2022, in partnership with Wheatland County, the Alberta Government, Siksika Nation, and Invest Alberta.

“This project underscores our commitment to being the best wallboard manufacturer to do business with, particularly as builders, governments, and communities across Alberta and the West work to expand housing starts, accessibility and affordability,” Griffin said.

“CGC Inc.’s investment in Wheatland County is helping to diversify rural Alberta and create good jobs for hardworking Albertans,” said Matt Jones, Albert minister of jobs, economy, and trade. “This state-of-the-art wallboard facility has helped to expand the manufacturing sector in our province and will ensure residential, commercial, industrial, and institutional sectors can get the wall products they need to get their projects built.”

Ken Jenkins recognizes the growth opportunities for commercial dealers as Canada increases its commitment to more housing over the next five years.

The president and CEO of Castle Building Centres Group recognizes that the strength of his organization still rests firmly with the group’s traditional building supply dealers. But the addition of new members to Castle’s GSD side, Commercial Building Supply (CBS), represents a growth opportunity for that division.

Jenkins points out that the role of the traditional LBM dealer is changing in the big urban centres. In those major markets, commercial construction relies more and more on specialized suppliers, dealers that offer narrower assortments of products such as roofing, drywall, ceiling systems, and foundation products. He says there is a growing distinction between traditional yards and GSDs. “They are two different businesses.”

However, Jenkins sees a future for both models in parallel. “Castle remains committed to

bricks-and-mortar LBM generalists, but the commercial piece allows us penetration into the large urban markets,” he says. “There’s significant volume to be had in those larger urban markets.”

Fenplast, a manufacturer of windows and doors based in Candiac, Que., has acquired Les Portes A.R.D., a steel door manufacturer, through Fenplast’s subsidiary Lajeunesse windows and doors. The acquisition of A.R.D., which has a 57,000 sq.ft. factory in Lachute, Que., will allow for the expansion of Fenplast’s product range.

“We are proud to welcome Les Portes A.R.D. to the Fenplast group. This acquisition is a significant step in our growth strategy, as it allows us to enhance Lajeunesse’s offerings while integrating a talented and dedicated team,” said Jean Marchand, president of Fenplast, in a release in June. “We look forward to collaborating with them to continue providing superior quality products to our customers.”

The acquisition of A.R.D., which has a factory in Lachute, Que., will allow for the expansion of Fenplast’s product range.

“ Our vision is for Home to be Canada’s most trusted and preferred home improvement experience.”

Kevin Macnab, President and CEO of Home Hardware Stores Ltd

For 60 years have been participating equally in our success without the influence of external shareholders. Now, as we approach 1,100 Home stores across Canada, our formula has never changed: Put the dealerowners first in everything we do.

“Our vision is for Home to be Canada’s most trusted and preferred home improvement experience,”

said Kevin Macnab, President and CEO of Home Hardware Stores Ltd. “And our mission is to serve communities through our strong independent dealer network, by providing superior home improvement experiences with

helpful advice, competitive prices, and quality products.”

“Our strength is that our dealerowners maintain their independent businesses while being backed by a trusted Canadian brand,” said Dale MacPherson, Senior Director of Store Operations and Business Development. “This includes maximizing combined buying power for the LBM and hardlines product assortment, rebates through national vendor programs, a national marketing strategy, and dedicated team members at the Dealer Support Centres. All designed to help dealer-owners succeed.”

Walter J. Hachborn Founder

“Over our first 60 years, we have constantly adapted to meet the needs of our dealer-owners and their customers. As our founder, Walter J. Hachborn, said: ‘The road to success is always under construction.’ Now we are entering an era of evolving technology and shifts in consumer behaviour. Rest assured, our dealer-owners will remain our priority however the industry changes.”

“As Home Hardware dealers, we enjoy the culture and the freedom to be the entrepreneurs we want to be. Home was founded on the idea that we are stronger together and that is as true today as it was in 1964. Home Hardware is synonymous with community, reliability, knowledge and trust. What more can we ask for to prove to our customers that we’re here for them?”

Tyler and Deanna Nowochin , Nowco Home Hardware and Rimbey Home Hardware, Alberta

“Being a Home dealer means being part of a group of passionate entrepreneurs who are committed to enhancing the communities they serve. For 60 years and counting, Home Hardware Stores Limited has supported dealers by granting us access to a wide variety of warehouse and LBM products at a competitive price, which gives us the flexibility to adapt to our respective markets. Home Hardware Stores Limited understands that its success is directly correlated with the success of every independent dealer across the country. We all play a key role.”

—Marc-Olivier Lane, Les Entreprises Nova Inc., Québec

“Our family has been a part of Home Hardware since 1971. As third generation dealers, we’re proud to continue our family’s legacy of providing friendly, helpful service to our community. The retail home improvement business is challenging and always evolving. Home’s systems allow us to efficiently optimize our assortment, keep our shelves full, and keep customers coming in the door, so that we can spend our time on our customers, our employees, and the growth of our stores. We feel very lucky to be a part of this winning team.”

—Joe and Jim Proudfoot, Proudfoots Home Hardware Building Centre, Nova Scotia

JOIN A COMPLETELY DEALEROWNED COMPANY TODAY.

Often billed as the largest construction materials supplier in the world, Saint-Gobain, based in Paris, France, grew its presence in Canada when it closed the acquisition, through its CertainTeed Canada subsidiary, of The Bailey Group of Companies, of Concord, Ont., for $880 million in June of this year.

Perhaps best known as Bailey Metal Products by building supply dealers, the company was founded in 1950 as a wire-mesh manufacturer in Ontario by Sam Bailey. It grew to be a full-scale metal framing manufacturer for both residential and commercial customers, remaining family-owned until its acquisition by Saint-Gobain/CertainTeed. At the time of the announcement, Bailey had 12 manufacturing plants across Canada, staffed by some 700 employees, producing $532 million in revenues in 2023.

“With this acquisition, Saint-Gobain reinforces its offer in sustainable construction in the attractive Canadian market,” the company said in a release, citing Bailey’s “innovative installation systems [which improve] the productivity and ergonomics of construction sites.”

Bailey Metal Products, founded in 1950, has grown to be a leader in all kinds of metal framing products, with 12 manufacturing plants across Canada.

Saint-Gobain has been on an acquisition drive in Canada over the past two years. In addition to Bailey, its CertainTeed Canada division acquired siding giant Kaycan, based in Pointe-Claire, Que., in 2022, for US$928 million. It paid $1.325 billion for roofing giant Building Products of Canada, of Montreal, in 2023.

These three acquisitions, Saint-Gobain said in a release, have brought its Canadian revenues from $800 million in 2021 to $2.3 billion in 2023. “All three additions complement CertainTeed Canada’s extensive portfolio of interior building materials,” the company said. Bailey will continue to operate under its own brand name.

Adentra Inc., the Langley, B.C.-based wholesale distributor of architectural products, has completed the acquisition of Woolf Distributing Company for US$130 million, Adentra said in a release in July. Woolf is a distributor with three DCs in Wisconsin and Illinois. Adentra, which is publicly-traded on the Toronto Stock Exchange, supplies building products to the industrial, pro dealer, home centres, and architectural/ designer markets. It has 86 facilities in the U.S. and Canada.

Optimize performance on the job

Froth-Pak two component Professional Spray Foam is designed to dispense better, last longer, and cover more area. With this product, contractors and pros get higher yield, faster application, and great performance job after job. The new helical nozzle adds even more precision and efficiency to help pros work cleaner with no mess. DuPont

Froth-Pak Foam Sealant is a two-component, quick-cure polyurethane foam that fills cavities, penetrations and cracks. For professionals only.

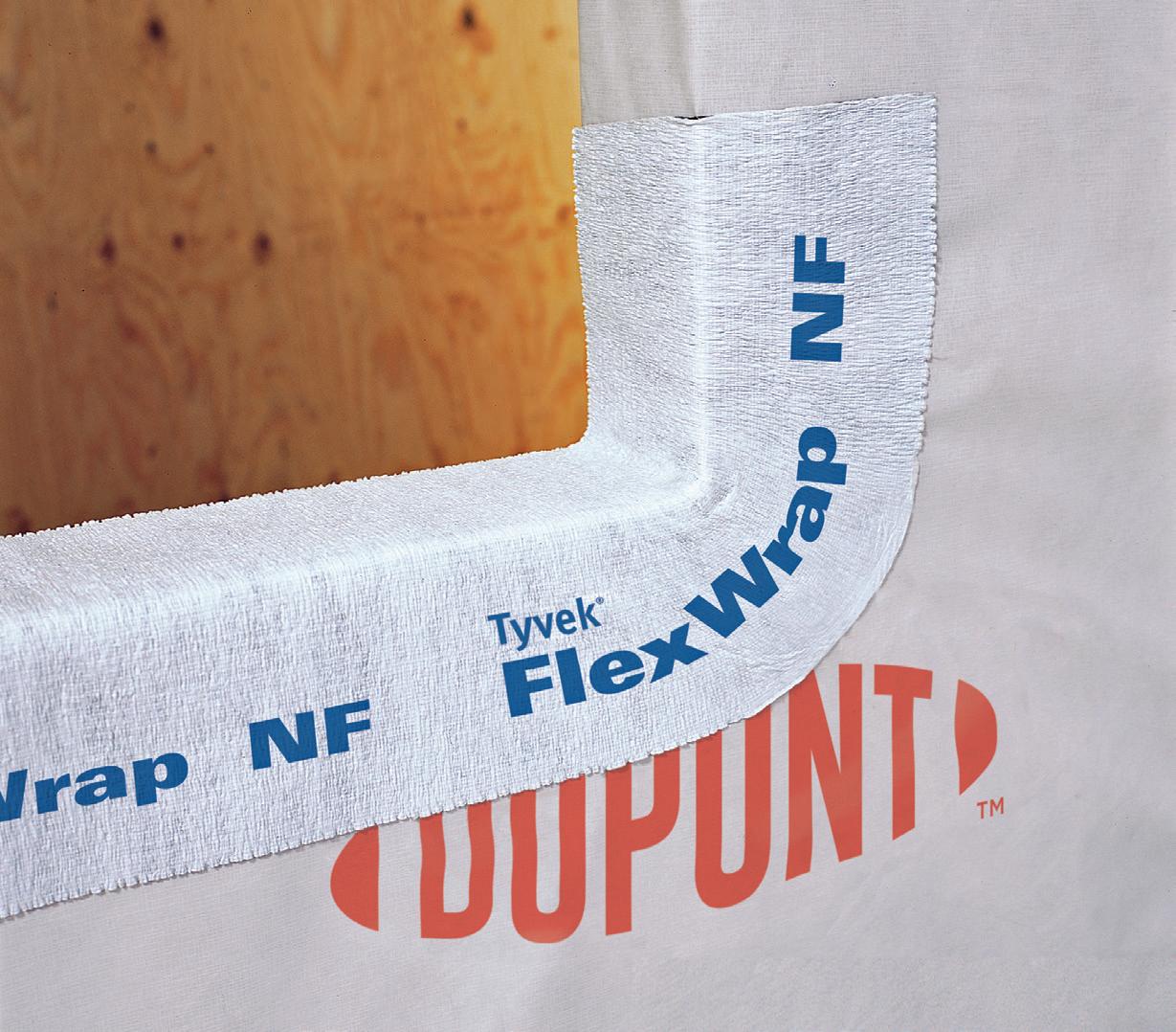

A fastener-free way to prevent water intrusion

DuPont FlexWrap self-adhered flashing does not require mechanical fasteners, even in flexed corner areas around building openings. This allows it to provide easy, one-step insulation for hard-to-seal corners around windows and doors. It has high-performance durability: 100 percent butyl adhesive performs through extreme temperatures. Does not contain asphaltic/ bitumen adhesive materials which many window manufacturers prohibit.

Whether it’s new construction or a retrofit application, DuPont Styrofoam Brand Cladmate CM20 Extruded Polystyrene Insulation (XPS) can help you reduce the potential for moisture condensation in wall cavities and improve energy efficiency in both residential and commercial buildings. It’s a durable, lightweight XPS board often used for interior framed walls, exterior and interior masonry as well as residential basement floor slab insulation—highly desirable for in home comfort.

Classic farmhouse aesthetic for home exteriors

Maibec CanExel’s new Board and Batten profile offers a modern take on the classic farmhouse aesthetic. This profile features vertical lines that enhance the architectural appeal of any home, providing a stylish and durable siding option. Easy to install, low maintenance and engineered for longevity, it boasts a high-density fibre construction that resists fading, cracking, and peeling. Available in six solid colours.

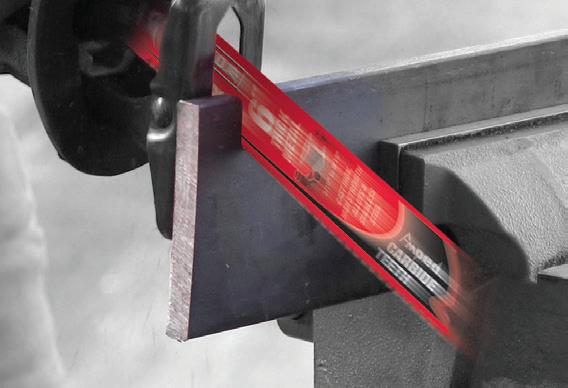

The CN445R3 SuperRoofer by MAX is a state-of-theart roofing nailer, building on the company’s legacy of innovation that began in 1982 when MAX invented the world’s first roofing nailer. Equipped with a full round-head driver blade that allows operators to drive nails in flush for dependable holding power. The nose design blocks tar build-up to 8x longer than conventional tools. The depth adjustment dial allows operators to effortlessly drive nails into hard materials, and control depth of drive when fastening soft materials, for a consistently polished finish.

Designed for pros in demanding construction environments

The HN120 PowerLite by MAX is a high-pressure concrete and steel pin nailer designed for professional use in demanding construction environments. This innovative tool is part of MAX’s PowerLite series, which revolutionized the industry when MAX introduced the world’s first highpressure nailing system in 1994. Powered by a 500 PSI compressor, the HN120 delivers exceptional driving force for fastening into concrete and steel surfaces. Lightweight with less recoil than P.A.T. tools.

The CN890F2 SuperFramer by MAX is a high-performance coil framing nailer designed for professional contractors. This powerful tool drives 2-inch to 3-1/2-inch nails with precision and speed, making it ideal for heavy-duty framing applications. The CN890F2 features the world’s first Anti Double Fire mechanism, first introduced in 1994, which prevents accidental double firing and enhances user safety. Large-capacity magazine holds up to 300 nails.

Create a healthy and safe home

CertainTeed M2Tech Moisture & Mold

Resistant Drywall is the ultimate protection against moisture and mold damage. It is ideal for use in areas that are prone to moisture damage, such as bathrooms, kitchens, basements, and laundry rooms. With its unique formula and easy-to-use design, M2Tech Drywall can help you create a healthy and safe home environment.

Seamless solid exterior wood siding

Natural Elements Ultra Light Trimboard offers a versatile and durable solution for exterior trim applications. Made from solid wood, it’s lightweight, easy-to-handle, and easy to install. It’s naturally resistant to rot, decay, and insects, ensuring longlasting performance. The trimboard is also fingerjointed and kiln-dried to resist warping, cracking, and splitting. Available in a variety of painted finishes, including black, white, and colours to match Maibec CanExel siding. Also available: a one-piece corner option for easy installation.

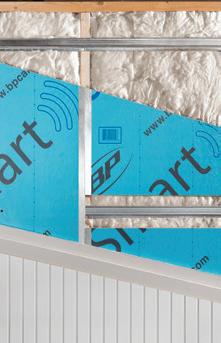

Twelve exclusive colour blends BP’s Signature shingles perfectly balance performance, lifestyle, and individuality. These one-of-a-kind shingles are designed to resist the worst weather. They also deliver a versatile range of beautiful and natural colours. Signature shingles ensure superior protection against blow-offs and wind-driven rain thanks to their high resistance to nail pull-through and their innovative Weather-Tite Plus Technology featuring the Hurricane Band.

Resists settling, breakdown, and sagging from vibration

JM Formaldehyde-free thermal and acoustical insulation for wood, engineered wood, and steel framing is made of long, resilient glass fibres bonded with a thermosetting resin. A wide range of thermal resistance is available to provide thermal control for both vertical and horizontal applications. Will not off-gas formaldehyde in the indoor environment. Thermally efficient: provides effective resistance to heat transfer with R-values up to R-50 for wood and steel frames and R-28 for engineered wood frames.

Johns Manville Climate Pro blow-in loose-fill fibreglass insulation is a premium alternative to cellulose. It’s blown into attics, nonconforming spaces and hard-to-reach areas, like corners, edges and around framing. When it’s applied to the recommended thickness and specifications, it improves energy efficiency. And unlike cellulose, it won’t settle, decay or provide food for animals or microbes. It’s effective for the life of the home.

Kaycan’s Urbanix Aluminum Siding collection offers a sleek, modern solution for contemporary home designs. It delivers exceptional durability while resisting rust and rot, ensuring long-lasting performance. Its clean lines and superior thickness create a striking, minimalist aesthetic that adds both curb appeal and modern elegance to any home. Perfect for homeowners seeking a durable and stylish upgrade.

BY CORRIE-ANN KNELL

Acceptable risks, reg flags, and getting your money from contractors

Not all customers are created equal. While some are loyal, pay their bills on time, and schedule material deliveries well in advance, others shop around, pay on their own terms, and require materials as needed.

system is a necessary evil in this day and age. It is also a fantastic tool for retailers and their reliable customers to build strong partnerships—making it easier for your contractor partners to acquire goods and pay for them while simultaneously streamlining dealer revenue and increasing volume.

Credit systems, however, can quickly become a double-edged sword. If left unmanaged, they can turn into collection issues and, ultimately, have disastrous cash flow consequences.

To help navigate these sometimes thorny issues, Pro Dealer reached out to two of our industry’s credit management experts: Brent Perry, president of Alf Curtis Home Improvements, a Castle member with three locations in southern Ontario, and his credit manager, Lorelei Humphries.

Whether you’re a corporate franchise, multi-store regional player or a rural yard, chances are you have an accounts receivables (AR) system. Today,

AR customers account for, on average, between 60 percent and 80 percent of pro sales in any given calendar year. This, understandably, makes some dealers feel more like banks than retailers.

Perry says his AR clients account for 65 percent of his sales across his three locations (Peterborough, Lindsay and Belleville, Ont.) This means, Perry and Humphries are managing about 4,000 individual in-house credit customers. Keeping on top of all of them is no small feat. Humphries dedicates all her time to reporting, tracking, collecting, and growing each client. With the help of her software program, Falcon Catalyst, she can maintain a balance between helping small business partners grow and getting the money owed.

Humphries says that having the “right tools” will help you maintain a healthy AR routine. “Our program provides me with daily account reports. It will notify me immediately if someone goes over their limit and will tell me which of our employees has authorized the overage,” she explains.

To become an AR customer at Alf Curtis, Humphries requires a credit application, references, positive Equifax, and a signed personal guarantee. Personal guarantees are admissible in court, allowing creditors to collect from corporate officers personally should the company be dissolved. This document is one of the most important pieces of the puzzle, Perry says.

“A personal guarantee is going to give you a lot of safety in court situations, but it is important that the document be signed by a company officer. I’ve seen

bookkeepers sign them, and we have rejected those applications. She could be fired next week!”

While Alf Curtis does enforce a six-month probationary period for new accounts, when asked if he uses different protocols between new and existing clients, Perry says no.

“The only difference is our history with the customer,” Perry says. “If they have worked with us for years, and have paid their bills on time, we will make allowances when it comes to their limits. But we are very firm on when we receive payment and that those payments are made in full.”

Perry admits increasing credit limits would be the only example of an acceptable risk. But he insists that new credit agreements must be signed. “We’ll work with our partners to help them grow their

A signed credit application including clear and concise terms of use

Two to three credit references

A positive credit check from Equifax or TransUnion

A signed personal guarantee from a company officer

Obtain and review corporate profiles

businesses. However, in a situation where you have to seek legal intervention, updated documents will make a difference in getting what is actually owed.”

Not all customers are created equal. While some are loyal, pay their bills on time, and schedule material deliveries well in advance, others shop around, pay on their own terms, and require materials as needed. Though the latter does not necessarily predict a delinquent credit customer, Perry asserts that poor communication styles from contractors equate to a red flag when it comes to AR.

“We don’t mind working with our customers. If their business is set up to pay every 60 days, we’ll

A personal guarantee is going to give you a lot of safety in court situations, but it is important that the document be signed by a company officer. I’ve seen bookkeepers sign them, and we have rejected those applications. She could be fired next week!

build something into our pricing to offset our interest. It’s when they don’t communicate. When they don’t let you know what’s going on or even pick up the phone when you call. That’s when you know.”

When asked about the potential boom expected later next year and whether it will impact his credit management strategy, Perry says: “In times of growth you will have more inventory and more sitting in your AR accounts. With longer wait times for our contractors, late closings, you must be careful about your operating costs.” He continues, “I go by this equation: If my [combined] inventory dollar value and my AR account totals are equal to or greater than what I owe the bank, I am good. If I owe more to the bank than what those [combined] numbers are, I’m screwed. The bank always wins.”

During busy times, Humphries continues her due diligence. She pulls credit checks to ensure her clients aren’t being over-leveraged, and that bills are being paid on time. Perry recalls a time when the numbers didn’t add up. What had otherwise been a profitable year for Alf Curtis Home Improvements was being crimped by credit card service fees that hit the stores’ bottom line to the tune of $220,000.

Credit cards are a mandatory form of acceptable payment in Canada. Merchants decline this form of renumeration at their peril. However, for commodities-based businesses, such transactions tend to eat away at your margins.

“After holding these accounts for 30 days, giving out our 15 percent [pro] discount and paying the interest, it adds up: allowing customers to pay by credit cards was taking two to three points off my profit,” Perry said.

“Because we were able to separate our AR business from our retail business, we no longer accept credit card payments on accounts.”

Evolve Stone installs 10x faster with only a nail gun. Its lightweight design and full-through colour offer lasting durability in a variety of styles and shades. With this product, it’s easy to achieve a professional finish.

This is an insight the Government of Canada has since picked up on. A ruling made in October 2022 allows retail businesses to include a purchase fee to customers who choose to pay by credit card.

To which Perry affirms, “For higher margin businesses, it becomes a wash. But for us in commodities, where the margins are tighter, it’s necessary.”

Big box home improvement retailers seem to have many advantages over independent dealers. Perry says that how they handle credit management isn’t one of them. He contends that because big outfits like Home Depot don’t hold their own AR, and prefer the use of third-party agencies like Citibank, borrowing is “cumbersome” for their pro customers.

Humphries explains: “Sometimes it takes these agencies three to five business days to even

respond. I’m able to tell them (the customer) exactly what’s going on in their account. There’s no loyalty between big boxes and the customers. There’s no face to face. They won’t even supply references to us on their behalf. So, we’re better equipped to help them grow, which we do and we are proud of.”

Though credit systems lend control over budgets, scenarios can arise where getting your money back is completely out of your hands. When it comes to collections, heading to court is the last place you want to find yourself. After the recession of 1992, Perry found himself in hot water. Hit with a $300,000 bankruptcy from a customer, the chances of recovering the money looked bleak. Perry’s only

Banks can loan up to 50 percent of inventory values and up to 75 percent of receivables

Being a part of Sexton Group has signi cantly elevated our business. Even though they have over 450 members across Canada, we always feel heard and valued as if we are part of the Sexton family. Their powerful network of members across the country has been invaluable, providing us with insights and connections that have helped us expand our business. The seminars and meetings they o er are incredibly bene cial, keeping us informed and ahead in a tough market. Sexton also excels at connecting suppliers with members, ensuring we have access to the best products at the most competitive prices. We couldn’t be more pleased with our partnership! ”

—Markus Lange, EG Penner Building Centre

Our strength as a buying group is built on four major advantages: We’re a dedicated team of industry professionals focused on your success. We negotiate competitive programs and leverage our strong relationships with vendors to resolve any issues quickly for you. We have a rst-class accounting team that promptly delivers accurate rebate payments as promised.

Building up client credit may create a bigger exposure to risk, but in nurturing those relationships you can look for bigger margins over time.

option was to contest the bankruptcy. Eventually, he overturned it. “It cost me personally,” he says passionately. “But it was the principle of it!”

Apparently, the debtor had failed to pay many local businesses, leaving some in crisis. Though it would take years for the principles to be paid back, Perry was proud he could be a champion for his community. While the court ruling was deemed favourable in this case, after a near decade-long battle, it begs the question: does it really pay to go to court?

The gavel can swing both ways. Rare but not unheard of is the situation where the customer has legally gone after the retailer for unmet product and service agreements. Perry says it’s happened to him.

“We’ve been taken to court by customers who believe we have short-changed them on materials. We have our drivers take photos of every lift delivered. The photos are then uploaded into our system as reference.” He laughs, “It’s saved our asses a number of times.”

While not all dealers choose to—or are large enough to—support a full-time accounts receivable manager, Perry suggests having someone consistently oversee things will go a long way.

TIP: Incentivize on time payments with discounts on materials

When asked what makes a good credit manager he replies, “Someone who can build good rapport with customers, is an excellent communicator, and has the ability to be firm.” For smaller yards Perry recommends electing someone who is versatile, that can help in other aspects of the business, such as sales.

The tightrope walk that is credit management must occur equally when times are slow or when businesses are booming.

When managed properly, the AR cycle will regulate cash flow and allow you to expand your operating loans (that’s what extending credit is, in short) to grow. It will also, simultaneously, increase a dealer’s ability to build stronger relationships with pro clients.

Building up client credit may create a bigger exposure to risk, but in nurturing those relationships you can look for bigger margins over time. The trick then becomes keeping your balance and not falling from the rope.

LINE OF CONTINUALLY INNOVATIVE INSULATION DEDICATED SUPPORT FROM YOUR JM SALES TEAM

PERFORMANCE THAT MEETS EVOLVING CODE REQUIREMENTS THE

BY FRANK CONDRON

From the truck-mounted cranes at HIAB, to the new entry in the market, Bobcat, here are some of the toughest lumberyard workers you will ever employ

operators have to take a number of factors into account. Maximizing productivity requires power and load capacity from handling equipment, of course. But maintaining productivity is just as dependent on durability and safety; downtime due to mechanical problems or operator injury, or product loss due to breakage, can also eat into an operator’s bottom line. Picking the right equipment for your application is key, and there are lots of options on the market to choose from. Here are just a few options from some industry leaders.

The eX.HIPRO truck-mounted crane from HIAB is designed to achieve peak productivity while maximizing energy efficiency. The crane’s pressure-compensated and load-sensing hydraulics optimize oil flow, which reduces both fuel consumption and CO2 emissions. The eX.HIPRO’s Dynamic RPM and automatic start/stop functionality minimize the environmental impact of the diesel platform, and the system is fully compatible with electric vehicles. The unit features the SPACEevo control system, the latest in intelligent control technology, which is designed to execute smooth and fluid simultaneous movements in tight spaces.

The intuitive crane controls and safety sensor features allow for ease of handling, ensuring fast, precise, and damage-free deliveries.

From construction lumber to next-generation building materials

At DOMAN, we supply a broad range of premium building products to retailers throughout Canada. With strategically positioned facilities and one of the most extensive product offerings of value-added treated lumber, we support our clients in ways few others can.

Built for the most challenging materials handling environments, the CAT DP60HP-DP100CP internal combustion Forklift Series combines high-performance internal combustion engines with enhanced operator comfort and safety features to maximize productivity and reduce the cost of ownership. These 13,000-22,000 lb. capacity, pneumatic tire lift trucks are powered by a turbocharged, four-cylinder Kubota V3800 diesel engine that generates massive torque at low rpms while producing low emissions. A large meter panel features a warning system that alerts the operator to protect the machine’s critical components, and the simplified design has fewer service points for quicker, simpler maintenance.

When most people think of a Bobcat, they think of the powerful and manoeuvrable little earthmovers that are ubiquitous in the landscaping trade. Well, earlier this year the Bobcat Company expanded its product line with the introduction of a line of forklifts. This brand expansion first began to take shape in 2023, when Bobcat’s parent company, the South Korean multinational manufacturer Doosan Group, decided to move a number of its machine products, including forklifts, over to the Bobcat brand in North America. The new Bobcat product lines include internal combustion cushion tire and pneumatic tire forklifts, electric counterbalance forklifts, narrow aisle forklifts, pallet trucks/stacker forklifts and warehouse vehicles. Bobcat forklifts are now available at all traditional Bobcat dealers in North America. Customers can search bobcat.com/dealer to find a dealer near them.

Toyota’s 48V and 80V Electric Pneumatic Forklifts are designed to handle both indoor and outdoor operation with full customization based on application and operator preference. With a load capacity ranging from 3,000 to 4,000 lbs. (48V) and 4,000 to 17,500 lbs. (80V), these machines include electric power steering, regenerative braking, and speed controls to help extend battery life and cut down on recharging time. For outdoor applications, an optional steel operator cabin is available, complete with wrap-around windshields and wipers.

Materials handling in lumberyard applications calls for maximum load capacity as well as strength and durability. The Toyota High-Capacity Core IC Pneumatic forklift line is designed to handle massive loads in challenging outdoor environments. Powered by a Cummins 4-cylinder diesel engine delivering 173 HP, this line is available in five different models ranging in load capacity from 22,000 to 30,000 lbs. The drive train features an electronically controlled DANA TE-10 transmission, and engine protection and high capacity cooling systems help to limit downtime due to maintenance issues. Operator features include a touch-screen display with advanced diagnostics and fingertip hydraulic controls, and a pillar free front window offers unobstructed sightlines.

The model G2 Three-Wheel Electric Counter balance Forklift from HELI is designed to deliver maximum control and stability in confined spaces. This rear-wheel-drive electric machine offers lownoise operation and zero emissions with a minimum turning radius of 1.46 metres, making it well-suited for indoor warehouse and covered storage environ ments. The 48V-platform emphasizes charging efficiency and all-day uninterrupted operation and the unit is powered by a maintenance-free IP54 AC motor. The load-sensitive hydraulic system works to reduce overheating and an ultra-low-torque steering gear helps to reduce torque while steering for smoother operation.

HELI’s model G3 Heavy-Duty Pneumatic LPG Forklift is designed to handle large-scale tasks both indoors and out. With a load capacity range of 11,000 to 22,000 lbs., the G3’s pneumatic tires offer traction and stability on the uneven surfaces often found in lumberyards. A vibration shock reduction system reduces the bouncing that can occur over uneven surfaces when the unit is under load. Power is provided by a Cummins diesel. A wet-braking system with forcedoil cooling ensures reliable braking under extreme conditions. Safety features include an “Operator-Present” system that cuts power to the machine when the driver leaves the operator seat suddenly, as well as an optional reverse image system and warning light.

BY JOHN CAULFIELD

The southern Ontario GSD “fits the bill” for GMS’s competitive approach

“The transaction provides the expansion-minded Yvon Building Supply with the support of a deep-pocketed partner that historically has sought opportunities to grow organically and through acquisition.

It would have been easy

to shrug off that $196.5 million transaction, which closed in July, as just another inevitable example of a U.S. company skimming market share from its northern neighbour. That impression would have been accurate, albeit only to a point. The acquisition consolidated Gypsum Management and Supply Inc.’s hold on first place in the GSD rankings in North America. But the deal also revealed GMS’s broader strategy of bolstering its profitability—which was down in its latest fiscal year—by increasing sales of products that complement its stores’ core categories of

wallboard, steel framing, and ceilings. GMS, based in Tucker, Ga., is in serious growth-mode.

The transaction provides the expansion-minded seven-location Yvon Building Supply, headquartered in Burlington, Ont., with the support of a deep-pocketed partner that historically has sought opportunities to grow organically and through acquisition. (Beside its purchase of YBS, GMS Inc. previously bought two other dealers in Canada during the 12 months that ended April 30.)

The YBS-GMS deal’s timing coincides with the expectation, by market watchers, that demand for

drywall and other building products could surge if slumping new-home construction bounces back during the next two years.

Prior to its purchase of YBS, GMS Canada operated 37 locations throughout Canada under such regional banners as Slegg Building Materials (Vancouver Island), B.C. Ceiling Systems (Richmond, B.C.), Shoemaker Drywall Supplies (Calgary), Watson

Building Supplies (Vaughan, Ont.), Blair Building Materials (Maple, Ont.), Rigney Building Supplies (Kingston, Ont.), and D.L. Building Materials (Ottawa and Gatineau, Que.).

These Canadian brands generated 12.2 percent of GMS Inc.’s US$5.5 billion in revenue during its latest

fiscal year. 55 percent of GMS Inc.’s sales came from supplying commercial projects, and 45 percent from residential projects. Drywall accounted for 41.1 percent of GMS Inc.’s fiscal-year 2024 revenue,

Wolmanized® Outdoor® Wood (protected with Wolman® NB Copper Azole) with Tanatone® colourant has decades of proven performance in protecting wood from its natural enemies - termites and fungal decay.

• Above Ground, Ground Contact and freshwater applications

• Long-lasting protection with built-in colourant

• Fasteners – follow manufacturer recommendations

ceilings 12.6 percent, steel framing 16.2 percent, and complementary products—such as tools, fasteners, adhesives, benches and scaffolding, safety and protection—29.9 percent.

For those who favour minutiae, GMS Inc. also reported, in its year-end April 30, 2024 annual report, net sales per day for drywall ($9 million, up 4.3 percent), ceilings ($2.7 million, up 9.7 percent), steel framing ($3.3 million, down 6.6 percent), and complementary products ($6.2 million, up 2.4 percent).

GMS’s core building materials are relatively lower-margin products, and the company reported a 17.1 percent decline in net income, to US$276.1 million, in fiscal year 2024. Its locations also face fierce competition on both sides of the Canada-U.S. border.

Paul Green, president of GMS Canada, said GMS Inc. became aware that Yvon Building Supply might be for sale last September, when National Bank—which

Yvon retained to shop the company—sent out a Request for Proposals. (Green said that GMS wasn’t the only potential bidder.)

At the time, Yvon Building Supply was generating $190 million in annual revenue from its GSD outlets that incorporate three ancillary businesses: Yvon Insulation, Right Fit Foam Insulation, and Laminated Glass Technologies.

YBS dates back to 2011, when Tom Scott, its founder and president, acquired a small, familyowned business called Yvon Insulation and, soon after, launched Yvon Building Supply that, within one year, had 19,000 square feet of warehouse space. Scott, now 56, did not respond to emailed or texted requests for an interview. But his daughter, Rebecca, sketched out her father’s background and the company’s history in an essay she posted on the local-news.ca website in July 2022. Scott’s career began as a labourer, from which he worked his way up the ladder at a construction company to vice-president. However, he was laid off in 2010,

and found himself doing landscaping and painting jobs, from which he heard about Yvon Insulation.

Scott has built Yvon Building Supply into a province-wide business with 195 employees and 90 rolling pieces of equipment, said Green. Like GMS, Yvon has grown through acquisition in Ontario: in 2019 it purchased Arrlin Interior Supply in Etobicoke; in 2021 it added Oldershaw Building Supply in Chatham; and the next year bought Costa Building Supply outlets in Concord and Cambridge, Ont.

On its website, Yvon Building Supply states that its “main goal for the foreseeable future includes expansion into Eastern and Western Canada.”

The decision to sell Yvon Building Supply, said Green, was not Scott’s alone; Scott was part of a shareholder group whose number is confidential but included at least one notable investor: Alexandre

An Yvon Building Supply delivery truck offloads wallboard and insulation products at a southern Ontario condominium jobsite.

“

The

negotiating parties included YBS’s Tom Scott and Jake Stephenson,

GMS Canada’s Paul Green and GMS Inc.’s Ajay Harpalani, and representatives from the National Bank of Canada.

Lefebvre, president of the distributor Lefebvre & Benoit, and current CEO of BMR Group. Green described Lefebvre as a “passive” investor.

It was the shareholder group that retained National Bank. “The group just thought it was the right time to divest,” explained Green. Yvon had successfully gotten to a certain scale and density but, at its current size, would have struggled to keep up competitively with the projected growth of the commercial and residential markets.

Green was directly involved in the negotiations preceding the sale, as was Tom Scott. Also involved were representatives of National Bank; Jake Stephenson, YBS’s vice-president of business development; and GMS Inc.’s corporate development team led by Ajay Harpalani, from Georgia. The parties signed a Letter of Intent to sell on February 14, 2024, pending approval of the Competition Bureau.

GMS Inc. was attracted to Yvon Building Supply as an asset for several reasons, said Green. For one thing, as a GSD “it was already in our space.”

Second, GMS was looking to increase its footprint in Ontario, “and you have to meet the moment.” GMS

performance. Weather or not.

A network of support when and where you need it.

The members of the DuPont Specialist Network share one thing in common: a passion for building science. Each Specialist is highly trained with an in-depth knowledge of building envelope performance and best practices. Working with architects, specifiers, builders, general contractors and installers, your DuPont Specialist offers the onsite guidance, training and expertise it takes to remove the stress of change and increase the opportunity of a satisfied customer.

Years as a Tyvek® Specialist - 12

Favourite Product - DuPont™ FlexWrap™ because it helps prevent water damage.

Fun Fact - I have 13 grandkids.

Years as a Tyvek® Specialist - 11

Favourite Product – DuPont™ Flexwrap™ EZ because it easily conforms to irregular surfaces.

Fun Fact - I enjoy skydiving and have 4 kids and 3 dogs.

Years as a Tyvek® Specialist - 8

Favourite Product - DuPont™ Drain Wrap® for its high drainage efficiency behind all siding types and Styrofoam™ insulation.

Fun Fact - I am an avid mountain biker.

Years as a Tyvek® Specialist - 23

Favourite Product - DuPont™ FlexWrap™ one-step installation for hard-to-seal corners around windows and doors.

Fun Fact - In total I have more than 20,000 hours of training.

also saw this acquisition as part of a larger opportunity to increase sales and market share. Yvon, said Green, “fit the bill perfectly.”

Scott and four other executives stayed on to manage Yvon Building Supply under GMS Canada’s umbrella. During an earnings teleconference on June 20, GMS Inc.’s president and CEO John C. Turner, Jr., spoke about the importance of acquiring “expertise” to achieving the company’s growth objectives. “We bought a growth-business plan,” said Green.

Yvon Building Supply also continues to operate under its own market brand, a pattern that GMS prefers across North America, where it supports 56 brands, according to its website.

Normally, when one company acquires another, there’s an effort made to reduce operational redundancies to cut costs. But that doesn’t appear to be

YBS will work in tandem with Watson Building Supplies, as both overlapping (former) competitors are now under the same GMS umbrella. They intend to complement each other to fill in “white spaces” in their markets.

part of GMS’s game plan for Yvon Building Supply. Several of Yvon’s locations overlap with GMS Canada’s stores that operate under the Watson Building Supplies banner. Green said that the Watson and Yvon stores will now work in tandem, which might include handling each other’s overflow. Being part of GMS will help Yvon fill in some of the “white spaces” in its Ontario market coverage.

Eventually, said Green, there could be synergies in back-office functions and joint product purchases.

On July 1, Yvon Building Supply ended its membership with the ILDC that began in 2018. But given that 28 percent of Yvon’s annual sales already come from complementary products, Green doesn’t anticipate much change in its merchandise mix, at least initially.

Green said that GMS Canada expects doubledigit sales growth from Yvon Building Supply in fiscal year 2025. Margins, overall, are expected to improve for wallboard.

GMS Canada, said Green, intends to make a “big push” into supplying commercial construction and renovation projects, and it sees “robust growth” in demand coming from institutional building, like healthcare. “Our drive will be with the pro customer,” and not primarily at retail. In a previous interview, Green said that one of GMS Canada’s competitive advantages was a delivery fleet that can accommodate just about any project size.

GMS is rolling out its Yard of the Future with Wi-Fi and tablets that facilitate paperless order picking and loading technologies. Turner, in his presentation to analysts, said that GMS is installing “advanced” ERP systems with purchasing capabilities.

Turner added that GMS is promoting the value of its e-commerce platform, on which 70 percent of GMS’s U.S. customers have created online accounts, and a growing number are paying for purchases online.

Gibson Building Supplies isn’t the first pro dealer to have its roots in a contracting firm. But it’s unusual to have the contracting firm grow so fiercely even as the building supply partner embarks on a strategy of growth by acquisition. We recently interviewed Michelle Chouinard-Kenney, CEO of the family-owned business that consists of Gibson Building Supplies and Chouinard Brothers roofing in southern Ontario.

BY CORRIE-ANN KNELL

Ten years from now, installation is going to look different, I think. Not to mention there will be less people doing it.” “

is a 32-year veteran of the building materials industry who has seen both sides of the contractor desk. Her father, Lucien Chouinard, with his brother, Ernest, founded a southern Ontario roofing contracting firm called Chouinard Bros. in 1972. Twenty-seven years later, in 1999, the family business had a retailing arm that became one of the largest exterior envelope dealers to pros in the Greater Toronto Area, Gibson Building Supplies. Chouinard-Kenney is CEO of both firms. She recently sat down with us to talk about the complexities a partly vertical company involves, her management philosophies, and her goals for the future.

As a second-generation owner, can you tell us a little bit about your succession process? Did you always want to be in the family business? It was poor. It was not planned well. I wanted to be a lawyer. When I worked for the family business as a teen, there were a lot of menial tasks and clerical tasks. Those are not drivers for me. Later, my brother passed away. [Editor’s note: Chouinard-Kenney was at the time studying for her undergraduate degree at Western University in London, Ont.] My mother wasn’t in a good headspace, so I came home to help. But this was in a different capacity, so it interested me more.

In a previous interview, you’ve discussed your love of mentorship. How has that developed now that you are at the helm? Have you created any initiatives to develop your staff and future leaders?

I don’t get to, as much as I would like to right now. Partially because, our succession planning wasn’t as well organized as it could have been. We are on the

third generation, and I don’t think I will be the best mentor for my son. [Editor’s note: She is referring to her youngest son, Cullen. Her eldest son, Max, currently manages Chouinard Brothers’ commercial installation business, and the middle son, Owen, also works in the company.] We have, sort of, outsourced support for him. I am his mom first; I know he has learned our core beliefs and core values. So, we have selected someone to mentor him in a professional

Gibson Building Supplies, a Sexton member, is celebrating its 25th anniversary this year. This is one of the signs put up at its Aurora, Ont., headquarters.

MADE FROM RECYCLED AND RECYCLABLE MATERIALS

• Acoustic performance up to STC 71.

• Natural, lightweight, easy to cut and less dusty to install.

• Integrated vapour barrier for exterior wall assemblies.

• UL-Certified and tested by CNRC/NRC.

• CCMC 14065-R

One of our initiatives is to find people who can lead. We’ll take future leaders and test the water with them. We offer a three-day leadership program and send groups to be trained with the union.

capacity, from whom he can learn the things that I may not necessarily be able to teach him.

My father was very hands-on in his approach to mentorship whereas I am much more reserved. I like to sit down with people and let them learn. I am very okay with people making mistakes, then helping them work through the mistakes, but there are some leaders that like to stop the mistake before it happens. For me, if it doesn’t create a financial crisis, I think it’s better to let my staff find solutions.

One of our initiatives is to find people who can lead. We’ll take future leaders and test the water

with them. We offer a three-day leadership program and send groups to be trained with the union. We’ve invested significantly for, I’d say, 12 months trying to really develop leadership skills and determine how they will develop in five or 10 years. And we ask [ourselves], do we have the right people in our camp? Are we going to need to look outside to hire? Which employees think they can be developed but may not necessarily be the right candidate? Those are conversations that we have now because 10 years creeps up quickly. At 60, if I am looking to retire, who’s succeeding behind me?

Inside Gibson’s Aurora , Ont., warehouse the order of the day is neat and tidy. Gibson has grown since 1999 to eight locations, including the first acquisition outside of Ontario, last year, in Dartmouth, N.S.

Tradespeople are beginning to age out. Are you reaching out to the community and helping to develop men and women looking to learn a skilled trade?

[Shortage of trades] is a huge issue. I think we’re all in the [same] position whether you’re a box store, an independent, or you own multiple stores. The reality is our tradesmen are aging out. And if we all run in separate directions and try and tap into the limited resource, we’re not going to be that successful. This endeavour needs to be pushed as a group.

I’ve sat with some of the other contractors and talked about it. Look at someone from Florida. In Florida every roof requires a permit. Permits cost $250 but, that by itself won’t break the price of someone doing the roof. It does, however, clean up the industry. It stops hook-and-ladder guys that don’t pay proper compensation and don’t train their guys well. We need to take some of these trades and professionalize them.

A lot of money from the provincial government is going into these programs. But what people are forgetting is most of the money is being delivered into Red Seal programs. Because the government can

monitor it and they can see it where it is being used. But unfortunately, houses aren’t built by just electricians and plumbers. We need bricklayers, drywallers, framers, and roofers. None of those trades are Red Seal. So, they’re not getting the money and effort put into them. These conversations are happening but there hasn’t been a lot of action. We need action.

In a previous interview you’ve mentioned expanding nationally by taking advantage of complementary avenues in your product and service assortments. Can you expand on this? We recently purchased a store in Dartmouth, Nova Scotia. [Editor’s note: Gibson’s acquisition of Capstone Building Products, another pro dealer, took place in January 2023.] For us, acquisitions are a little bit different than the big players who purchase multiple yards because we’re so hands-on. It’s also difficult to do, in some cases, because there can be some pushback from previous owners.

For us, purchasing existing retail operations is more about how they will transition into our philosophy. We look for businesses and people who look like ourselves, who feel like ourselves, and who go to market like us. We need to have a very similar moral fibre. We’re not set up to just go in, rip off the Band-Aid, and say, “Now you’re one of us!” That would be against our grain. Don’t get me wrong, we know what opportunities we miss by going about it this way but we’ve also seen how our transition with Dartmouth has been very successful.

The original owners [Lloyd Ruelland and Mike Cotters] are there. They still make decisions. They still treat it like it’s their own store. We provide the support and we’ll be there when they decide to transition out.

Eight-outlet Gibson specializes in building envelope products in general, not just roofing supplies. Its lines include cladding and siding, insulation, and ventilation products, all with a focus on the pro customer.

Ideas & Inspiration

For more project ideas: domanbm.com

ONE-PIECE CORNERS

ONE-PIECE CORNERS

ONE-PIECE CORNERS

Natural Elements® Ultra-Light Wood Trim now offers a one-piece corner option. Available in a variety of painted finishes including black, white and primed, this lightweight wood trim is durable and long-lasting while being naturally resistant to rot and decay.

Natural Elements® Ultra-Light Wood Trim now offers a one-piece corner option. Available in a variety of painted finishes including black, white and primed, this lightweight wood trim is durable and long-lasting while being naturally resistant to rot and decay.

Natural Elements® Ultra-Light Wood Trim now offers a one-piece corner option. Available in a variety of painted finishes including black, white and primed, this lightweight wood trim is durable and long-lasting while being naturally resistant to rot and decay.

JAMES HARDIE FIBER CEMENT SIDING

James Hardie® Fiber Cement Siding is known for its durabilty and weather resistance. ColorPlus® Techology offers protection from damaging UV rays to ensure long-lasting vibrant colour. Enjoy the peace of mind that comes with a low-maintenance exterior, backed by a 30-year non-prorated substrate warranty.

James Hardie® Fiber Cement Siding is known for its durabilty and weather resistance. ColorPlus® Techology offers protection from damaging UV rays to ensure long-lasting vibrant colour. Enjoy the peace of mind that comes with a low-maintenance exterior, backed by a 30-year non-prorated substrate warranty.

James Hardie® Fiber Cement Siding is known for its durabilty and weather resistance. ColorPlus® Techology offers protection from damaging UV rays to ensure long-lasting vibrant colour. Enjoy the peace of mind that comes with a low-maintenance exterior, backed by a 30-year non-prorated substrate warranty.

VERSATEX PVC BUILDING PRODUCTS

VERSATEX Building Products are made from free-foam cellular PVC and provide long-lasting protection without the need for paint or sealant. VERSATEX offers a variety of products including trimboards, sheets, corners, moldings, tongue and groove profiles, soffits, fascia, frieze, and column wraps.

VERSATEX Building Products are made from free-foam cellular PVC and provide long-lasting protection without the need for paint or sealant. VERSATEX offers a variety of products including trimboards, sheets, corners, moldings, tongue and groove profiles, soffits, fascia, frieze, and column wraps.

VERSATEX Building Products are made from free-foam cellular PVC and provide long-lasting protection without the need for paint or sealant. VERSATEX offers a variety of products including trimboards, sheets, corners, moldings, tongue and groove profiles, soffits, fascia, frieze, and column wraps.

I just hired four young guys out of college. I had them figure out a calculation. They used AI. I wouldn’t even think to use AI. I would be at my desk using my big old calculator.

So, essentially, you’ve made a succession plan for them?

Yes, they were ready to sell. We all know it was an opportune time. [When] we came out of Covid, everyone’s numbers looked good. They were selling high, and we accepted what we were buying. We also had conversations and asked: “Do you want to lock the door and walk away? Do you want to continue working? How do you feel about this?”

They were able to say, “If we still have control and it feels like it’s ours, we’re happy to work.” That’s trust! Big businesses can’t work on trust. We can as independents. We make our own rules. They have rules they are governed by.

As we navigate a more technical era in the construction industry, are there any new and interesting products or innovations you find fascinating or worth watching?

We get some [roofing] tools that help with efficiencies. One is called the Pitch Hopper—it’s a triangular rig that the guys can work from. It almost works like a platform. There are different jacking systems. Now, we’re seeing some minor changes but nothing that’s going to light the world on fire.

In new construction, trades work almost exclusively from machines now because of the pitches of some of these roofs. It makes me wonder: when we go to redo these houses in the future, how we are going to reroof? Because, in 20 years, we won’t be able work from machines. People have pools. They have landscaping. So, how are these houses going to be done legally? They can’t be done legally swinging from a rope, that’s a safety issue. Ten years from now, installation is going to look different, I think. Not to mention there will be less people doing it.

With the next generation of the labour force entering the workplace, how are you retaining and developing your staff to prepare for the potential boom in the construction industry?

I read an article a couple days ago. Even if the government said right now, “Here’s all the money you need to build four million units,” they can’t be built. We don’t have the workforce. So, our boom isn’t going to look any bigger than what we just went through [with the pandemic]. We’ve been through this. It’s not like our volume can double. The cost per unit might go up. But if we can only do a thousand houses, that’s all we can do because we have limited tradesmen. So, it can’t look that much different.

We’re not getting younger people often in trades. I just hired four young guys out of college. I had them figure out a calculation. They used AI. I wouldn’t even think to use AI. I would be at my desk using my big old calculator. If I had made them sit down and do it my way, that may have made them uncomfortable and potentially made them look for work elsewhere. Their know-how with technology is an advantage.

As both a retailer and roofing installation company, how do you navigate your relationship with your contractor partners?

Really tough, initially. We had a really hard time with that. It’s very important that our application

company does not compete with our customers. However, if you’re not a customer and don’t have any intention of being a customer, well, game on! Because we came from the application side first, we have a strong understanding of the consumer. So, when we design strategies and when we make processes, they come from the perspective of benefiting the customer.

We’re very good at the application and customer service. Even guys who are completely against buying from us, have over the years transitioned to being our customers because we do it so well.

And trust me, many of our competitors use that as their tagline against us. Often, we will bow out

Michelle Chouinard-Kenney didn’t always plan to run the enterprise co-founded by her father, Lucien, and her uncle, Ernest. She was intending to go to law school when she was called back to the family business by difficult circumstances.

It’s very important that our application company does not compete with our [Gibson’s] customers. However, if you’re not a customer and don’t have any intention of being a customer, well, game on!

of bids if it is against a customer. Even if we’ve done the legwork on the drawings and the measurements, we will even give it to them to work from.

Vendor relationships are crucial when it comes down to the bottom line. How do you select your vendor partners? What does it take to build loyalty?

We really try and pick vendors that are partners. Some vendors you have to choose because customers demand that product. We’re very strategic about who we pick. We need to know: what does it look like, how can we work together? Who’s coming in to do the PK? Who’s being taught? We make full rollout programs on new lines. For us, it’s imperative that our key vendors are partners.

Over the past 18 months, we have seen a slowdown in Ontario’s real estate market. What kind of challenges has this created for you?

We discussed this in our production meeting today. I said, “Everyone at this table needs to understand that we make money, we may even lose money, in times like these. But we’re here for the long haul. And we need to use this opportunity, maybe not for jobs (and not to cut positions), but to ask, what could we be doing better?”

This is the time to build better habits. Because next time we go into a busy cycle, our guys are going to be three years older. Some may retire. So, we must be better going into the next cycle. We make incentive plans. We look for challenges from previous builds and ask, how can we be better?

Then we find ways to improve. That’s been our focus for the last 12 months. Because it’s coming. Let’s be ready. Let’s not be behind.

As a tenured and experienced professional in the building supply industry can you discuss some of your insights on the current state of the market and your predictions for the future?

I’d say, the market will stay slow for 12 more months. We have a lull in shingles, as there will be a product change from asphalt to fiberglass. There will be a shortage of labour. That will be our biggest hiccup in the future. I think it’s going to look the way it always has. Maybe, a bit more steel roofing. We’re seeing different cladding now, not everything is brick.

We still need people to do it. Again, this will be the greatest challenge. I don’t feel there will be a big grand explosion of millions of units being built. Or an extended slowdown. We’ve had some significant immigration. We have people who need homes. The ball will keep rolling. It has slowed down, but it will pick up again.

With multiple retail locations, what do you attribute your success to?

Our success comes from being fair to our employees. We treat our people well, which has led to a lot of tenured staff. This creates a wealth of institutional knowledge which translates directly back to the customer. That’s why we have been able to expand and acquire other businesses. We look for people who hold the same values when it comes to how they go to market. That won’t change.

By Rob Wilbrink CEO, BMF

LOCATION: Healdsburg, California

OWNERS: Eric Ziedrich, Janet Gaylor Ziedrich

BUILDING SIZE: 43,000 sq.ft.

YEARS IN BUSINESS: 149

BUYING GROUP: LMC

GRAND REOPENING: June 2023

MERCHANDISING/DESIGN: BMF

Contractors account for the majority of sales at most independent building supply dealers. With most communities having multiple lumberyards, attracting customers with a great store design is essential.

Whether renovating these stores, or designing them from the ground up, here are some key factors to consider in the planning process.

LOCATION: Woodstock, Ontario

OWNERS: Jamie Adams, Tasha Birtch

FRONT-END STORE SIZE: 10,000 sq.ft.

YEARS IN BUSINESS: 61

BUYING GROUP: Castle Building Centres

GRAND REOPENING: September 2023

MERCHANDISING/DESIGN: BMF

Contractors generally prioritize quality over price. They use their tools every day and tend to be brand loyal. It’s best to skip the good and stock the better and best. High-quality tools, blades, fasteners, adhesives, coatings, and building materials are more reliable and save time on the job. Contractor-oriented stores will have broader assortments of specialty fasteners, structural hardware, adhesives, and safety products than a typical home centre. Contractors depend on their local dealer to have ample stock of the items they need most so it’s effective for stores to maintain a list of top SKUs that should never be out of stock. Fixtures that include overhead storage are a great way to accommodate extra stock and make it easy to locate, manage, and replenish.

When renovating or building a new store, dealers often see it as an opportunity to attract more DIY traffic. They are tempted to dabble in product categories in which they are ill-equipped to compete. If they do so, they risk weakening their overall presentation and market reputation. The most effective way to improve a contractor-focused store and build sales is to stay focused on its core customer first and foremost. Existing customers will become more loyal and increase their purchases while attracting more customers similar to them. Ironically, this is also the best way to attract serious DIY customers who tend to spend more money, appreciate a higher-quality product assortment, and enjoy shopping where the pros shop. Experimenting in categories that don’t make sense for contractors is seldom worth the effort. Pro customers hate tripping over patio furniture on the way to the contractor desk and aren’t impressed by toys, automotive products, or pool supplies.

Showrooms should extend beyond hardware to showcase roofing, siding, doors, windows, decking, and trim options. Building materials often account for 70 to 80 percent of sales for pro stores, so displaying them is a key part of any good contractor store design. For some yards, décor categories such as flooring, kitchens, and bath also make sense to display. Attractive displays of higher-end building materials create a space which contractors can recommend to their clients to visit and browse. This saves the contractor time, increases their sales potential, promotes informed purchase decisions from homeowners, and enhances the quality and impact of their projects. Pros’ customers can create a virtuous cycle as word-of-mouth spreads about the great displays at the local contractor yard.

Higher-quality merchandise increases the risk of theft. Expensive tools are a regular target of thieves and require preventive measures. Smart pro store designers recommend bollards in front of entrances and facilities to lock up tools. Dead corners should be avoided with all aisles readily visible off main high-traffic aisles, and where possible, from service desks and offices. Cameras, motion detectors, and perimeter alarms are a necessary consideration. Separate contractor entrances should be locked during evening hours.

Contractors have different needs than most retail customers. They are best served by experienced staff at a dedicated contractor service counter. Relationships are important and interactions are often daily. The service area should include desks, a stand-up counter, as well as an extended counter to make it easy to roll out and discuss project plans. In busy stores, a queuing aisle helps minimize wait times. Having a coffee station near the desk adds to the social interaction while saving time for pros otherwise spent at Tim Hortons. Convenient parking next to the contractor entrance is also a plus.

A well-designed contractor store is easy to shop. Clear directional signage helps customers quickly find what they are looking for. Departments should all run off a main aisle rather than being stacked behind each other. Ideally, the contractor desk should have clear sight lines down the main aisle. Consumables are generally the most profitable items with the fastest turns and should be visible and conveniently located close to the service desk or at least close to the main aisle. Product adjacencies need to make sense with related products merchandised close together to reduce unnecessary steps. A covered cold storage and loading area is a big plus for contractors, and new yards are increasingly including drive -through lumberyards in their design.