Léger CHIEF OPERATING OFFICER

Orgill has been serving the industry for more than 175 years but what’s more important than how long the company has been around is where it is going. For the past three decades, Orgill has been the fastest-growing distributor in the industry and today, the company continues to invest in enhancing its products, programs and services to continue this legacy of growth.

Find out why thousands of retailers trust Orgill as their partner of choice by visiting Orgill.ca/opportunity.

PRESIDENT

Michael McLarney mike@hardlines.ca

EDITOR-IN-CHIEF

Steve Payne steve@hardlines.ca

ASSOCIATE EDITOR

Geoff McLarney geoff @hardlines.ca

CONTRIBUTING EDITORS

Rebecca Dumais rebecca@hardlines.ca

Sarah McGoldrick sarah@hardlines.ca

CONTRIBUTOR

John Caulfield

ART DIRECTOR

Shawn Samson shawn@twocreative.ca

FIRST QUARTER/2025 // VOLUME 2, NO. 1

2060 Lakeshore Road, Suite 702, Burlington, ON L7R 0G2 • 416-489-3396 @Hardlinesnews • www.hardlines.ca

VICE-PRESIDENT & PUBLISHER

David Chestnut david@hardlines.ca

ACCOUNT MANAGER

Shannon MacLeod shannon@hardlines.ca

SENIOR MARKETING & EVENTS MANAGER

Michelle Porter michelle@hardlines.ca

CLIENT SERVICES MANAGER Jillian MacLeod jillian@hardlines.ca

ACCOUNTING accounting@hardlines.ca

★ FREE TO HOME IMPROVEMENT DEALERS ★ To subscribe, renew your subscription, or change your address or contact information, please contact our Circulation Department at 866-764-0227; hhiq@mysubscription.ca.

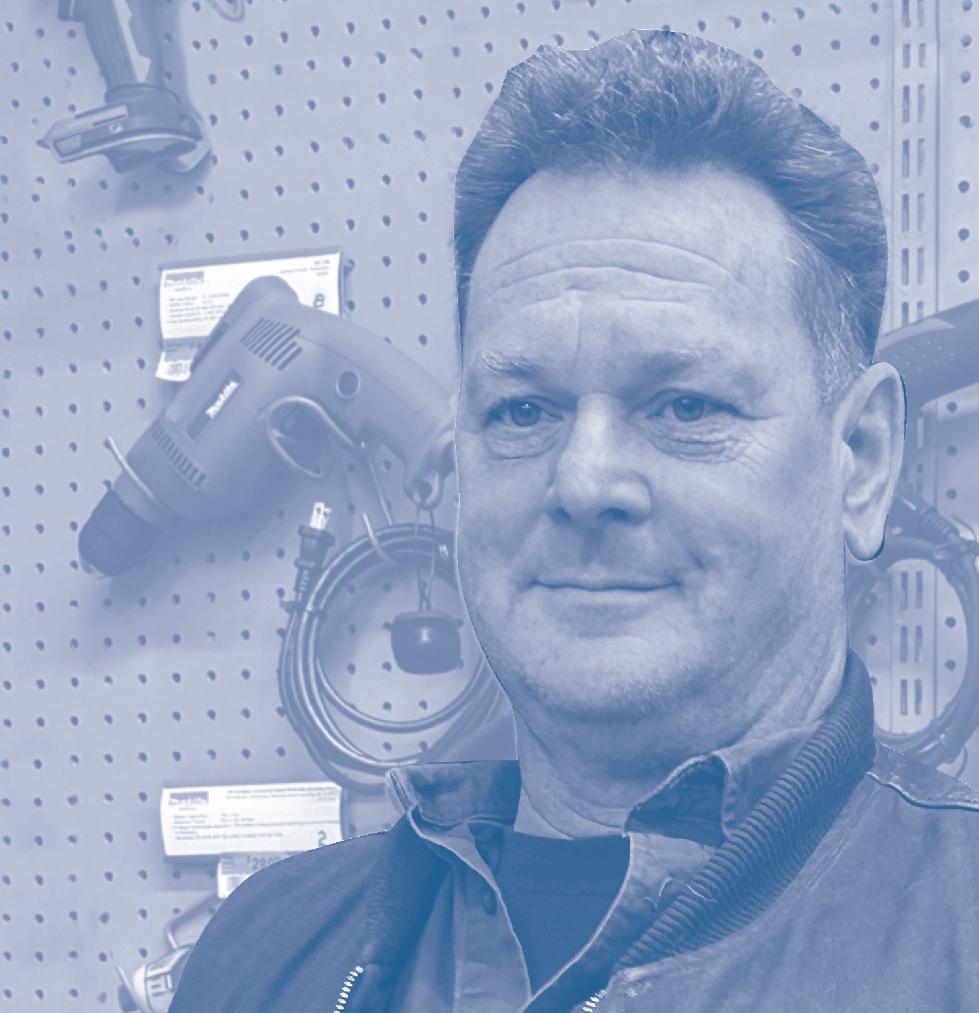

Michelle Chouinard-Kenney GIBSON BUILDING SUPPLIES Aurora, Ont.

Brian Lavigne

EDDY GROUP TIMBER MART Bathurst, N.B.

Luc Léger

ELMWOOD GROUP HOME HARDWARE Moncton, N.B.

Brent Perry ALF CURTIS HOME IMPROVEMENTS Peterborough, Ont.

Gary Sangha CROWN BUILDING SUPPLIES

Surrey, B.C.

Hardlines PRO Dealer is published four times a year by Hardlines Inc., 2060 Lakeshore Road, Suite 702, Burlington, ON L7R 0G2. $25 per issue or $90 per year for Canada. Subscriptions to the Continental United States: $105 per year and $35 per issue. All other countries: $130 per year. (Air mail $60 per year additional.)

Canadian Publications Mail Agreement #42175020. POSTMASTER: Send address changes to Hardlines PRO Dealer, 8799 Highway 89, Alliston, ON L9R 1V1.

All editorial contents ©2025 by Hardlines Inc. No content may be reproduced without prior permission of the publisher.

Hardlines PRO Dealer is just one facet of the Hardlines Information Network. Since 1995, we’ve been delivering the most up-to-date information directly to you online, in print, and in person. Find out how you can get your message out with us. Contact:

Shannon MacLeod, Account Manager 905-691-2492 • shannon@hardlines.ca

Castle signs Groupe Beauchesne

Insulation franchise opens first Canadian location

RONA acquires All-Fab Group

Cooper Equipment Rentals acquires three brands

Target Building Materials gets new owner

Patrick Morin enters Ottawa market

FIRST QUARTER/2025 // VOLUME 2, NUMBER 1

10 8 18 44 70 72 74

EDITORIAL THE GSD ERA

PRODUCTS FOR PROS ROOFING PRODUCTS & TOOLS

MODULAR BUILDING THE GOLDEN FUTURE OF RTM HOMES

MESSAGE FROM THE PUBLISHER PROUDLY SUPPORTING CANADIAN YARDS

INDEX TO ADVERTISERS SEE WHAT’S IN OUR NEXT ISSUE

THE CHALLENGE HOW A RONA DEALER IN NORTHERN ONTARIO MOVES 25,000 LBS OF FREIGHT ACROSS A FROZEN RIVER

The key for dealers is knowing which pros are

A look at valuation ratios, plus why you need a Chartered Business Valuator

A chat with the third-generation dealer-owner at Home Hardware’s Elmwood Group in New Brunswick

Tips from two digital experts whose yards have substantial pro business

An interview with Jeld-Wen’s Lisa Bergeron, one of the industry’s building envelope experts, about what’s coming in fenestration

BY STEVE PAYNE Editor-in-Chief

PRO DEALER

steve@hardlines.ca

Ken Sexton was once a young man living in a Toronto boarding house. He never finished high school. When he died in his 90th year, in 2019, he was wealthy and highly respected. Deservedly so, because he’d built one of Canada’s most successful GSDs, Kenroc Building Materials, based in Regina. (He also started three other companies. One of them, Sexton Group, is today one of our country’s largest LBM buying groups.)

For Sexton, the opportunity to create Kenroc in 1967 was partly a question of capitalizing on a supply shortage.

With the industry facing an increase in housing starts in the millions, pressure on gypsum supplies is expected to return. There are already serious shortages in Western Canada.

One company that has noticed is Gypsum Management & Supply Inc., of Tucker, Ga., which last year bought one of Canada’s premium GSDs, Yvon Building Supply, headquartered in Burlington, Ont. The price? $196.5 million in Canadian dollars. And Yvon only got its start in 2011.

And, along the same lines, see Beauchesne Group’s signing with Castle Building Centres Group ( just turn the page).

We will be following the breaking news on the major gypsum dealers in Canada, here in Pro Dealer, and in our monthly e-newsletter, Pro Dealer Business. Just visit hardlines.ca to sign up for both. There’s no charge if you’re a dealer!

The opportunities that arose for the founder of Kenroc are coming around again. “

Sign-up for Breaking News at Hardlines.ca

Castle Building Centres Group has added a dominant, multi-location Quebec member to its commercial division. Édouard Beauchesne 1985 inc., which has three Greater Montreal units, and its sister company, Distribution Ste-Foy, which has two outlets in the Quebec City area, comprise Groupe Beauchesne. The Castle signing brings the number of pro yards in Castle’s Commercial Builders Supplies division (CBS) to some 25.

Castle president and CEO Ken Jenkins called the deal “a pivotal moment for Castle in Quebec” and referred to Groupe Beauchesne as a “powerhouse.”

Édouard Beauchesne founded the business in 1964 in Montreal. It joined forces with Distribution

Ste-Foy Ltée in 1978. In 2009, it was one of three members of the powerful WSB Titan Group—and contributed the B to its initials. In co-forming WSB, it was joined by Southern Ontario’s Watson Building Supplies and Western Canada’s Shoemaker Drywall Supplies. Two of the three operations were sold to GMS Inc., of Tucker, Ga., in 2018, under the WSB leadership of Doug Skrepnek. But Beauchesne wasn’t a part of that deal.

“We are excited with this new chapter as we team up with Castle. We believe the group is positioned for major growth through this partnership,” said Carl Léonard, president of Groupe Beauchesne.

Carl, who succeeded his father Robert Léonard when he passed in 2018, “is a young entrepreneur who has got people around him that have created just an outstanding team,” Jenkins said.

“The group is highly relationship-centric with their end users. It’s very seldom that you see commercial dealers like a GSD with 100 percent fi delity from their larger contractors. And in Beauchesne’s case, they’re able to capture that.”

“They’re well positioned in Quebec and they’re of the appetite to want to continue to grow. And that in itself is a mindset that’s not always in play,” Jenkins added. “You’ve got a number of these GSD

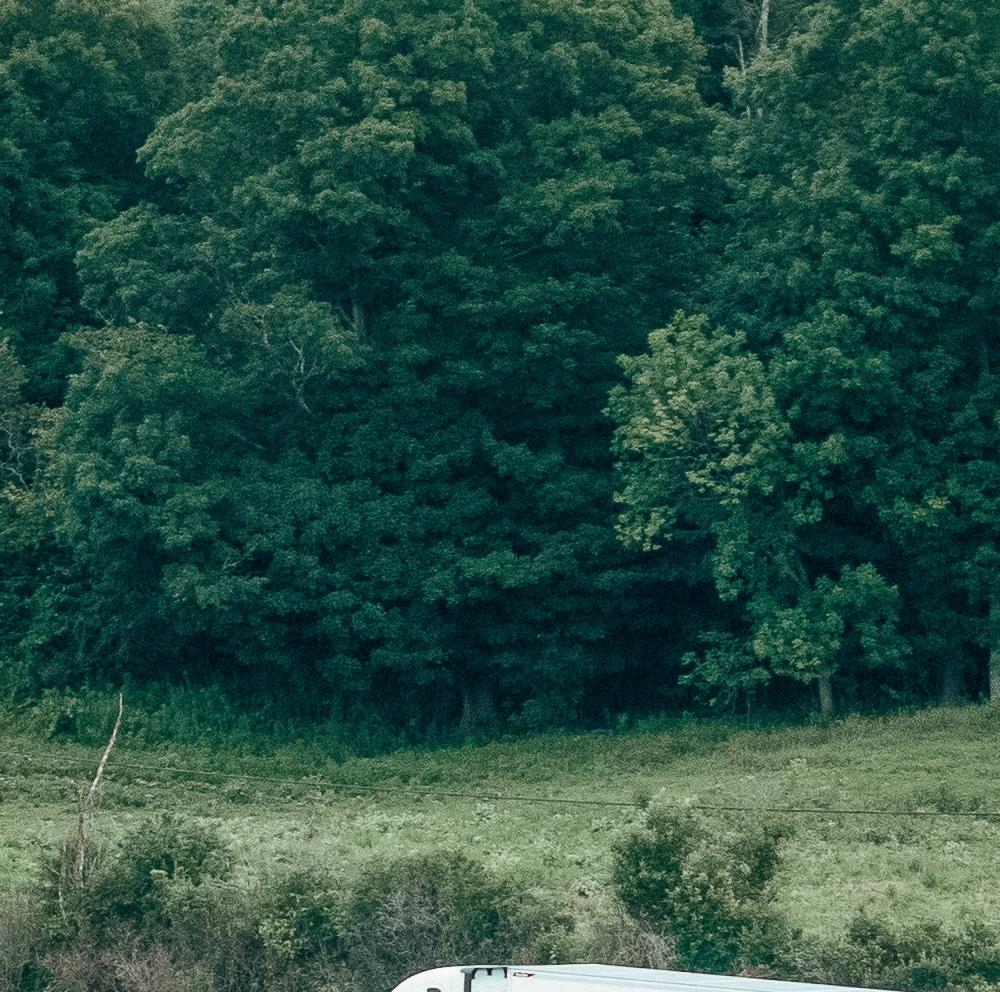

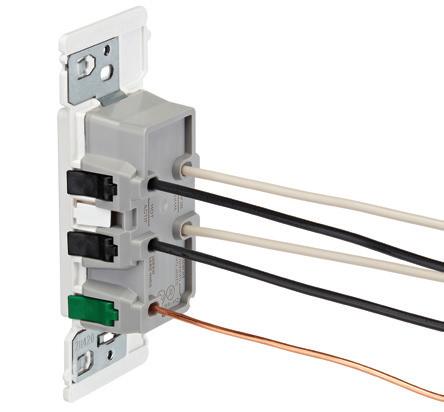

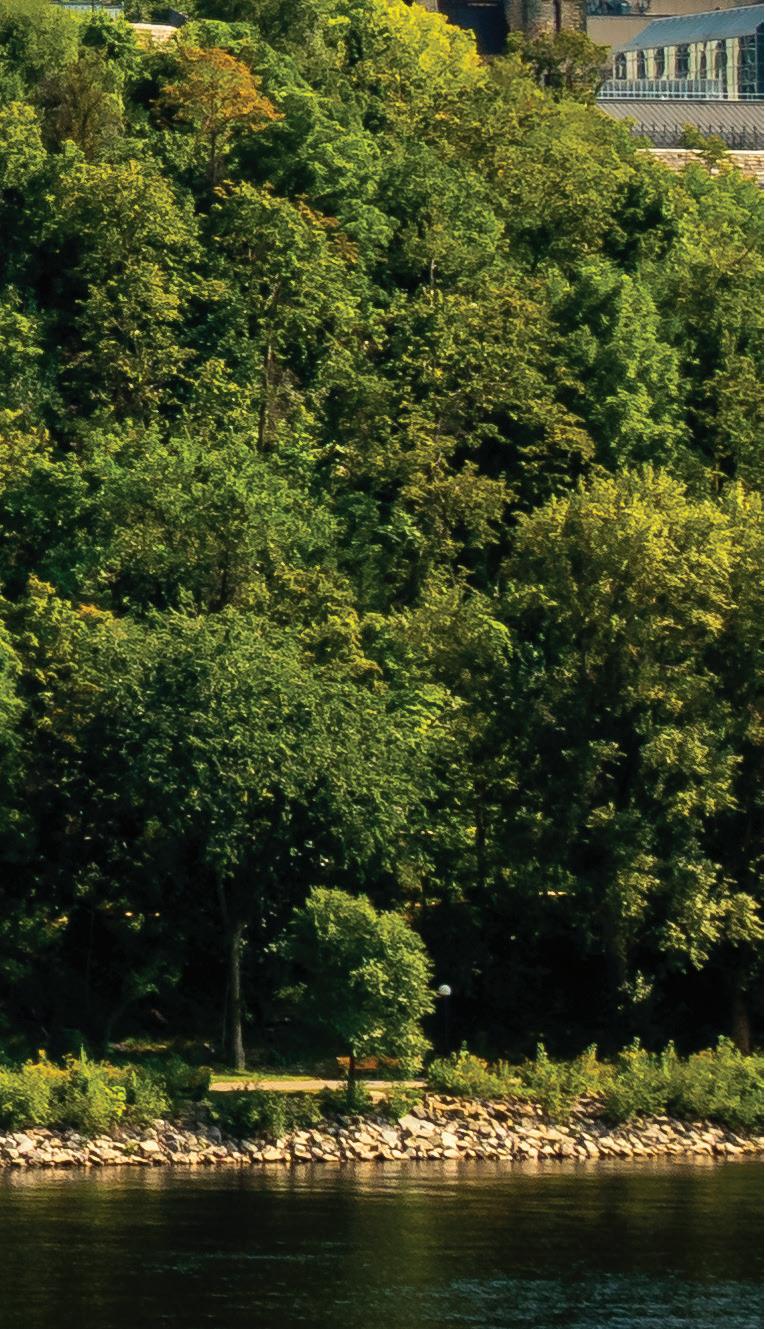

Beauchesne delivering drywall to a condo lowrise. The powerful Quebec GSD has joined the commercial division of Castle Building Centres Group.

commercial models across the country where succession is going to become very, very diffi cult and very apparent.”

Former WSB Titan president Doug Skrepnek appears to have been an instrumental part of the deal with Castle. Skrepnek was absent from the industry since the deal with GMS, but he resurfaced last year as co-owner of Encore Drywall Material Supplies. Encore operates two locations, in Vaughan and Trenton, Ont., which quickly joined Castle last year.

Skrepnek and the Léonard family have been business colleagues and close friends for many years. Bringing Beauchesne into the Castle fold made good sense, Skrepnek says. “I think we chose the right group for growth and we chose the right group for fl exibility.”

Jenkins looks to the big picture and reiterates that succession is going to play a major part in the fortunes of the big GSD players. “We’ve got a bullpen of entrepreneurs that are in that mid-40s to mid-50s range. They are going to take advantage of this next generation in the industry.”

Jenkins has been leading Castle Building Centres Group since 2007, just after Castle formed its fl edgling Commercial Builders Supplies division. “It’s about a balance of business and having the ability to participate in multiple channels to drive overall success. And one of the areas that Castle was deficient in [when Jenkins joined the organization] was in some of that core commodity volume. And I call it manufactured commodities as opposed to woodbased commodities.”

CBS members are in the gypsum, insulation, roofing, and steel segments, for the most part, Jenkins said. He diff erentiates it from the LBM business of traditional yards. “The commercial growth is going to continue to support our overall positioning in the market. But it also gives us a great window into what I consider to be the true cost of goods of some

of the major commodity categories. There’s definitely a detachment between the commercial costing of goods and the retail costing of goods.”

There once was a time when Castle dealer Jack Crombie, of Hudson, Que., could draw laughs from industry gatherings when he joked, as he sometimes did: “I am the sole reason that Castle can call itself a national buying group.” Crombie was one of the very few Castle members, if not the only one, who operated in la belle province.

With the addition of Beauchesne, Castle now has some 50 members in Quebec, the vast majority of whom have joined the group under Jenkins leadership. “We feel that we’ve got a business model that resonates with certain entrepreneurs. And we felt we could be equally successful in Quebec.”

Koala Insulation, with hundreds of franchisees south of the border, has opened its first Canadian location. The vice-presidents of the KitchenerWaterloo, Ont., operation are two experienced franchise entrepreneurs: Justin Prittie and Greg Quaile.

Prittie was only 22 when he opened a Two Men and a Truck moving franchise in Ontario in 2011. Quaile was the co-founder of the meat delivery franchise, TRUlocal, which off ers Canadians from British Columbia to Quebec farm-to-table deliveries of meat and fi sh products.

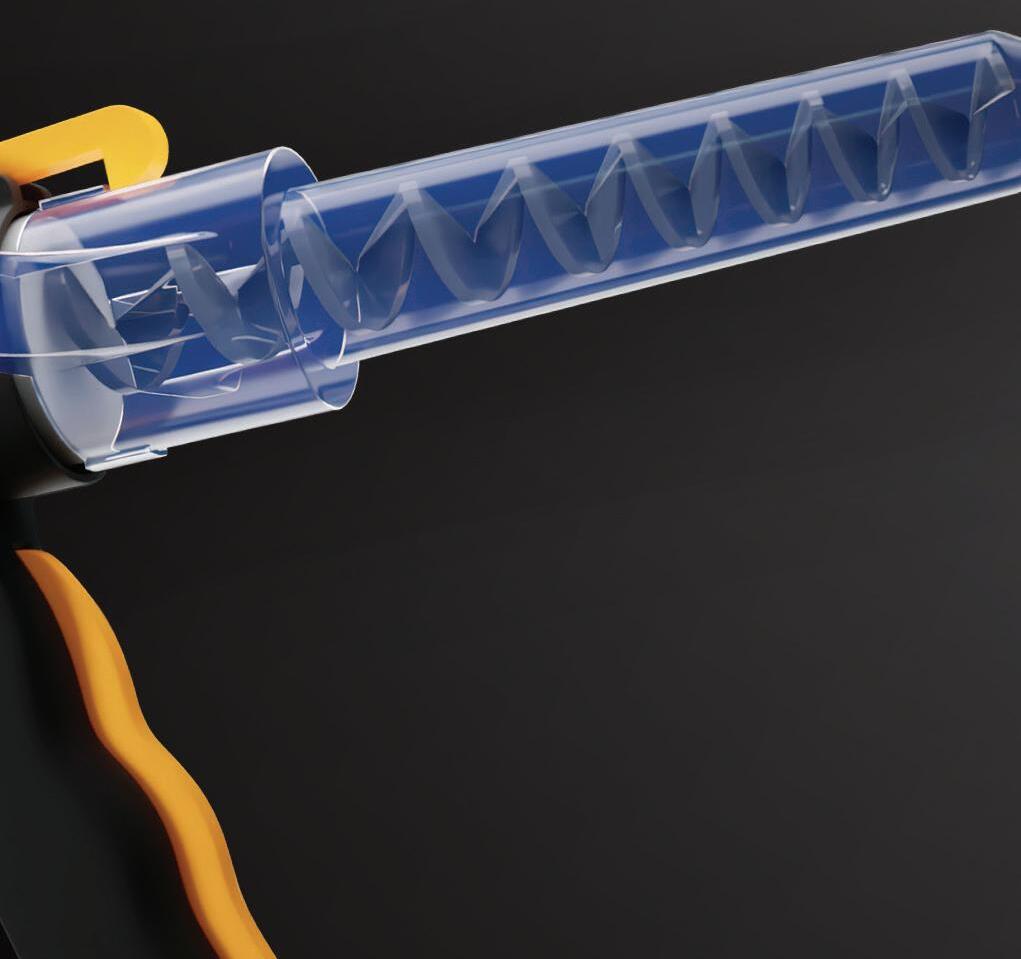

Koala Insulation got its start in Atlanta in 2018, and started franchising in 2020. In less than fi ve years it has signed more than 400 franchises. The business model is to install diff erent types of insulation in residential, commercial, and industrial properties—plus ancillary services such as air-sealing, attic vents, solar attic fans, and insulation removal.

The partners believe they are getting into the insulation business with an advantage: fresh eyes.

“When we started the meat business, we didn’t know anything about meat,” Quaile said. “It enabled us to have a diverse perspective on the business—to look for gaps that weren’t being fi lled right now. The way things have been done in the past is not necessarily the way they should be done. That’s our leg up.”

Prittie pointed out that the insulation industry is very fragmented. “There’s a few big players and a lot of mom and pops. It was the same in the moving industry. It was the ‘Old Dogs’ who don’t feel the need to change the way they do things.”

The partners were on the lookout for a new opportunity in the Canadian franchise industry. Prittie said: “The idea was to find something that was successful in the U.S. and bring it to Canada. Koala Insulation was one of the fastest-growing franchises in the U.S. over the past fi ve years.”

Given their business model, we asked Prittie and Quaile whether they expected to be partners with, or competitors to, home improvement retailers. “Definitely partners,” Quaile said.

Koala Insulation of Kitchener-Waterloo, in Ontario, is the first franchise for the Florida-based firm north of the border. The company has some 400 franchisees.

“

I think wearing the red shirt means something to people across this country.

100% Canadian.

100% Dealer-owned and operated.

When you join the Home Hardware family, you become part of a tight-knit community that’s free from the pressures of external shareholders. Gain access to a trusted brand with personalized resources dedicated to helping your unique business thrive, plus a coastto-coast Dealer network ready to back you every step of the way.

RONA inc. and its owner, private equity firm Sycamore Partners, have announced their acquisition of All-Fab Group, a Winnipeg-based manufacturer of building components. All-Fab provides the light construction industry with roof trusses, fl oor and wall systems, engineered beams, laminated posts, stairs, and garage packages. It operates 18 business units spanning from the Pacifi c Coast to Winnipeg and the U.S. Midwest. Terms of the transaction were not disclosed.

All-Fab Group goes to business under the All-Fab, Nu-Fab, Pacifi c Truss, Truline Truss, Alliance Truss, and Littfin Truss brand names, among others. It had been owned since 2018 by Canadian investment firm PFM Capital Inc. along with Roynat Equity Partners.

“The transaction provides AFG with additional resources to accelerate growth and invest in products and capabilities to better serve developers, builders, and families across Western Canada and the United States,” a RONA inc. press release said.

All-Fab makes trusses, of course, but lots more besides.

The transaction, which was announced on Dec. 23, was reviewed by the federal Competition Bureau. It announced in early January that RONA had agreed to sell its ZyTech truss manufacturing facility in Martensville, Sask., just north of Saskatoon, to private interests.

“The review found that the proposed acquisition was presumptively anti-competitive in the Saskatoon area as it would result in a signifi cant increase in market concentration,” the Competition Bureau said in a release. Specifi cally, the Bureau said that the loss of competition between RONA and All-Fab would result in higher prices in the market.

Groupe Patrick Morin, the Quebec building centre chain, has acquired four building centres from P. Bonhomme Enterprises.

Bonhomme has three Ontario locations (in Rockland, Carleton Place, and Limoges) operating under the Bytown PRO banner, while the fourth store, in the Hull district of Gatineau, Que., is known as Bonhomme PRO. These acquisitions are Patrick Morin’s first stores outside of its home province of Quebec. The value of the purchase was not disclosed.

“After months of discussions, we are extremely

pleased that Mr. Paul Bonhomme has chosen Patrick Morin to take over this company that has been deeply rooted in the Ottawa-Gatineau landscape for over 125 years,” said Louis Turcotte, president of Groupe Patrick Morin.

“We are well aware of the strength of the Bytown PRO and Bonhomme PRO brands, which are highly regarded by the region’s professional clientele, and that’s why we intend to maintain the presence of these well-known and appreciated banners in the local market.”

With strategically positioned facilities and one of the most extensive product offerings, we support our customers in ways few others can Streamlining the supply of quality building materials

Toronto-based Cooper Equipment Rentals, with 80 branches in six provinces, has acquired a trio of rental operations. It announced in February that it had purchased Rent All Centre and Skyhigh Platforms in Ontario, as well as Big Stick Rentals in Alberta.

In a release, Cooper said that the Ontario brands have served contractors and businesses since 1973. “Their full-service rental locations across Cobourg, Port Hope, Peterborough (two branches), Belleville, and Trenton, along with Skyhigh’s aerial specialty location in Whitby, will now operate under the Cooper banner.”

Big Stick Rentals, meanwhile, is based in Grande

Prairie, Alta. Cooper said in the release that it has “built a reputation for reliability and service excellence since its founding in 2013.”

“Big Stick’s strategic location in Grande Prairie strengthens Cooper’s coverage in Western Canada, enabling broader geographic reach, equipment availability, and service fl exibility across Alberta and beyond.”

In 2023, Cooper Equipment Rentals acquired Warner Rentals and Scotty’s Rentals and Landscaping.

Target Building Materials, a Windsor, Ont.-based member of AD Building Supplies – Canada, has announced it is under new ownership since Jan. 15, when Max De Angelis acquired the business.

Established in 1967 as a specialty building materials yard by Maurice “Moe” Drouillard, Target was a founding member of TORBSA, which was acquired by AD in 2022 in a merger that Moe’s son Greg helped to

facilitate. It specializes in residential, industrial, and commercial construction and has many kinds of concrete products, sealants, ceiling tiles, foundation products, waterproofing, insulation, safety products, and tools. Greg is a winner of an industry achievement award from the Lumber and Building Materials Association of Ontario.

De Angelis is the president of Fortis Group, which is one of Canada’s “top 40” construction fi rms—and one of Target’s biggest customers. It pursues large commercial and public projects. Fortis Group was formed in 2016 when De Angelis Construction merged with former Windsor rival STC Construction Group.

Constructed of a durable, reinforcing mat of non-woven glass fibres

IKO Roof-Fast Cap is a self-adhered polymer-modified cap sheet constructed of a durable, reinforcing mat of non-woven glass fibres that has been coated and permeated before applying a mineral surface. Available in a range of attractive colours, including white, dual brown, slate grey, driftwood, and black. Can be used alone or in combination with RoofFast Base. IKO Roof-Fast Base is a self-adhesive product that features the flexibility of a self-adhered installation method that can easily be cold-applied, or using an optional mechanical installation method. iko.com

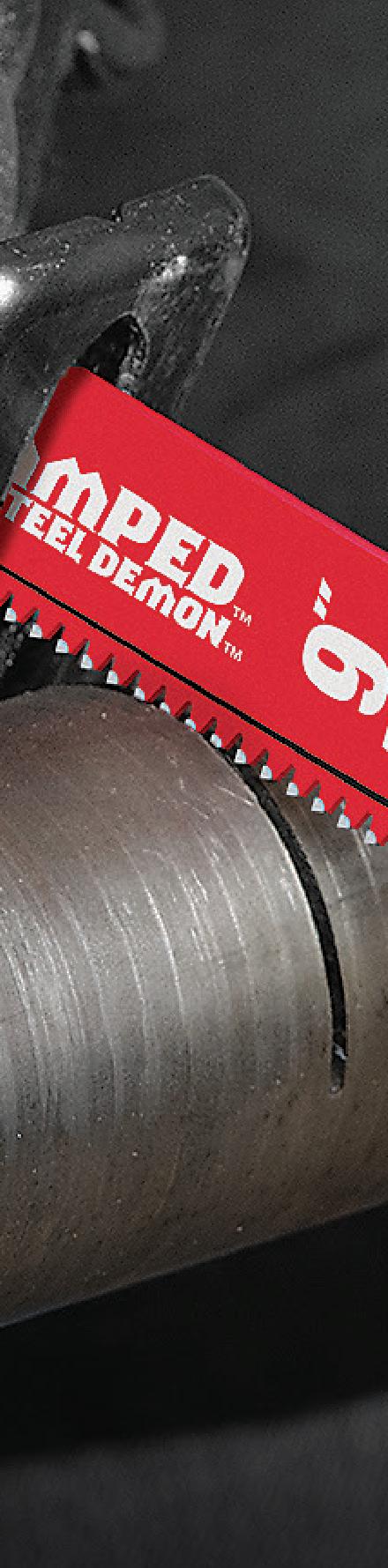

High resistance paired with easy installation

IKO Dynasty premium-quality laminated performance shingles, now available in matte black, offer peace of mind and protection from inclement weather. These shingles are made with a durable, thick coating of weathering asphalt and feature a Class 3 impact resistance rating, potentially helping homeowners qualify for reduced residential insurance premiums, if offered in their area. Enhanced with ArmourZone technology, the shingles are designed to withstand high winds, featuring a limited wind resistance warranty up to 130 mph (210 km/h).

iko.com

Stylish shingles in natural, vibrant colours

BP Canada’s Signature shingles combine durability, style, and unique character. Crafted to withstand the harshest weather conditions, these Canadianmade shingles offer a stunning selection of natural and vibrant colours. With advanced WeatherTite Plus Technology and a reinforced Hurricane Band, they provide outstanding defence against wind-driven rain and blow-offs, along with superior resistance to nail pull-through. saint-gobain.com

Featuring the world’s first Anti Double-Fire mechanism

The CN890F2 SuperFramer by MAX is a high-performance coil framing nailer designed for professional contractors. This powerful tool drives 2-inch to 3-1/2 inch nails with precision and speed, making it ideal for heavy-duty framing applications. The CN890F2 features the world’s first Anti Double-Fire mechanism, first introduced in 1994. This feature prevents accidental double-firing and enhances user safety. A large-capacity magazine holds up to 300 nails. maxusacorp.com

Shingles designed to withstand wind and blue-green algae

Timberline UHDZ Shingles feature our patented Dual Shadow Line for dramatic sunset shadows all day. They off er the 30-year StainGuard Plus PRO limited warranty against blue-green algae discoloration. Plus, when installed with the required combination of four qualifying GAF accessories, they are eligible for the 15-year WindProven infinite-speed limited wind warranty. taigabuilding.com

Available in solar-powered, wired-in, and manual options

VELUX off ers a full range of skylight products and accessories to fi t the needs of any space. The product line includes the solar-powered “Fresh Air” vented skylight. Fitted with a solar panel, this skylight collects the sun’s energy and uses it to open and close this skylight with a touch of a button. Also available: electric “Fresh Air” vented skylights powered by a home’s electricity and with remote control operation; and manual “Fresh Air” vented skylights for installations within reach of the operator. velux.ca

The smart roofing solution is built to last Portland/Snap-Lok panels feature pre-punched slots with a hidden fastener system for quick and secure installation. They also come with a pre-finished paint system to resist fading, cracking, and shrinking, backed by a 40-year paint warranty. Portland/Snap-Lok panels come in 16” or 12” (12” panels are special order and will have longer lead time) coverage and either 26-gauge or 24-gauge steel. Portland/Snap-Lok panels are built to last. westmansteel.ca

Where the beauty of nature meets the strength of steel

Made from premium 28-gauge steel, these shingles are designed to last a lifetime. Featuring innovative Quadra-Loc technology, each shingle locks securely on all four sides, providing water-tight protection and resilience against extreme weather conditions. The True Nature product line includes a seamless, matching trim system and advanced water-shedding channels to efficiently divert water from the underlayment, reducing the risk of leaks and water damage. These shingles are an ecofriendly choice that combines sustainability with long-lasting performance.

vicwest.com

“When I buy through TIMBER MART, I have the confidence of knowing that I’m getting some of the highest rebate returns in the industry. TIMBER MART is not a public corporation, it’s a buying group where the returns are ours. That’s transparency I can trust.”

BY STEVE PAYNE

To answer that question, many dealers turn to a Chartered Business Valuator

“I try to buy stock in businesses that are so wonderful that an idiot can run them. Because sooner or later, one of them will.”

So said Warren Buffett, the eighth-richest person in the world, who clearly knows a good investment when he sees it.

In that bon mot from the Wizard of Omaha, Buffett was talking about investing in big corporations, not family-owned, private businesses. There are, in fact, precious few successful idiots among Canada’s dealer-owners.

Therefore, figuring out a lumberyard’s intrinsic value is very difficult without considering the contributions of the dealer-owner.

“The value of a building supply business is often tied up in the owner,” says Bill Morrison, former executive at Hudson’s Bay Co., Foot Locker, IKEA, TruServ Canada, and Ace Hardware.

This industry-specific fact creates an obstacle for determining the value of an independent pro yard (or hardware store, home centre, paint store, or family-owned business in general).

What’s my business worth? Morrison lists a number of diffi culties with the process. “The reality is that there are so many variables. Each business opportunity is unique.” The journey to determining the market value of your pro yard starts with your accountant, Morrison suggests.

One of the professional specialties that can be consulted in determining the market value of a firm is a

— Bill Morrison, veteran retail executive “

The value of a building supply business is often tied up in the owner.”

Chartered Business Valuator (CBV).

Pro Dealer spoke to Dr. Christine Sawchuk who is the CEO of the Toronto-based CBV Institute. She said that there are just shy of 3,000 CBVs in Canada—and a further 800 students who are training to become a CBV. Many CBVs have a professional accounting designation, such as a CA or a CFA.

Fifteen years ago, Sawchuk says, “95 percent” of CBVs were accountants. “Now that number is about 70 percent.” In recent years, the profession has

“If you’re selling to an external party, you may only get one chance to get a really good price. You want to make sure you’re maximizing your value.”

—Dr. Christine Sawchuk, CEO of the CBV Institute

diversified to include professionals with broader business backgrounds, such as business brokers, engineers, and other types of professional.

Owner-operators who are looking to hire a valuator can use the “Find a CBV” function at cbvinstitute.com. But if you’re looking to sell your pro yard—or any business—Sawchuk recommends getting the process started early.

“I would say three to four years is almost on the low end. I would encourage people to look more like six to eight years in advance. And there’s a few different reasons for that.”

The reasons include the tendency, particularly in Canada, to run personal expenses through private businesses. Or have personal assets mixed up with business assets. “And what you want to do is remove all those personal items so you get a picture of what the business is actually earning,” Sawchuk said.

“That way you can tell a story to a potential purchaser and they can be assured that they’re looking at clean books—and that they can rely on those numbers.”

The other major reason to start work early on the process of selling a business is for tax planning purposes, especially the federal capital gains tax—and minimizing its bite requires clean books, Sawchuk observed.

“That’s from the accounting side of things, but just as important or more important, who are you selling the business to? Is it an external party? Is it an existing employee or an employee group? Are you selling it to someone in your family? Who wants

this business? And how do we train this person, to make sure they can take over the business successfully? How do we transition relationships to this new person? And those are all things that can take years and years.”

As Sawchuk points out, especially with the sale of a private business, if you’re selling to an external party, you may only get one chance to get a really good price. You want to make sure you’re maximizing your value. At the same time, you want to make sure that the valuation is reasonable so that a potential purchaser is not leaving the deal on the table and walking away.

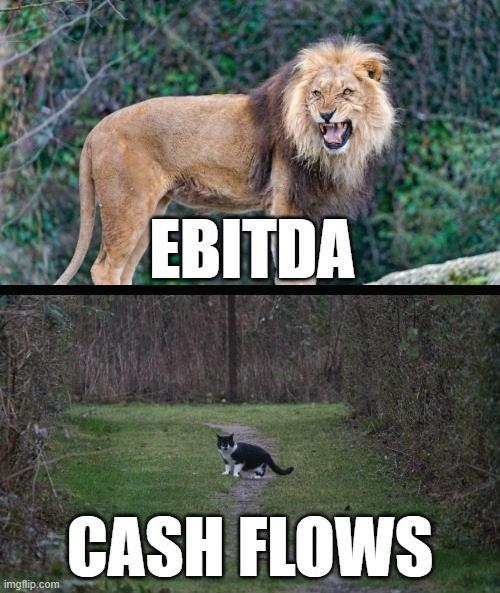

Because publicly-traded corporations change hands with all key metrics of the transactions disclosed, there is a vast publicly-accessible database that shows their market value price in terms of multiples. Most commonly, multiples of EBITDA (earnings before interest, taxes, depreciation, and amortization) are used to calculate—for larger companies—what that enterprise might be worth.

EBITDA multiples are freely available—if inaccurate. For example, one Utah-based consultant, Peak Business Valuation, publishes that the average building materials store (there is no such thing, but this is for illustrative purposes) is worth 2.04 to 3.95 times its EBITDA—meaning the “average” multiple would be three times EBITDA. Meaning a yard, yielding an average EBITDA over time of $350,000, would be “worth” about three times that, or $1,050,000.

LINE OF CONTINUALLY INNOVATIVE INSULATION DEDICATED SUPPORT FROM YOUR JM SALES TEAM

PERFORMANCE THAT MEETS EVOLVING CODE REQUIREMENTS THE

“A common overlook by the owner of a business is to say, ‘Oh my real estate’s worth this, and my company produces this much cash flow. But they forget they need to deduct off a market rent.”

—Kent Brown, MNP

This is obviously a fabricated number, since the calculations don’t consider the value of the inventory, or the debt that the business is carrying, or the competitive set, or the city or town that the business is in, or the owner’s compensation for running the store, or how the pro market is doing, or any other financial metric other than EBITDA.

There are also multiples available for Seller’s Discretionary Earnings (SDE), which is more commonly used in the valuations of small- and medium-sized businesses in which the owner also operates the business—like a family-owned pro yard. SDE is traditionally higher than EBITDA, because the formula for SDE is EBITDA plus the (fair market) compensation paid to the owner, plus any other perks that he is getting out of the business, financially. There are also multiples to valuate businesses based on revenues alone (often unreliable).

partner with accounting firm RLB LLB, often uses the amusing pictorial difference (see lower left) between EBITDA and cash flows.

Pro Dealer interviewed Victoria, B.C.-based Kent Brown, a CBV who is with the national professional services firm MNP. Brown is a partner with the Valuation and Litigation Support Services group at MNP. He replied to our enquiry about the accuracy of multiples with the reality check that business valuation “is more of a process than a formula.”

EBITDA, being earnings before interest, taxes, and depreciation of assets, is a sometimes misleadingly high number in the first place.

Guelph, Ont.-based Omar

Chaudry, a CBV ( see also next page) who is a

Omar

a CBV

“Essentially, when a CBV comes in, our job is to determine what the business operations are worth,” Brown said. “If you use a multiple of seller’s discretionary earnings, you’re essentially valuing the job plus the business. One tries to differentiate the two by adjusting for a market wage for the owner or manager that does the work, because that’s how you differentiate between a labour value and a business value. And that’s one of the key things, in any valuation: really understanding what you’re selling.”

“This is the most common adjustment that valuators do,” Brown said. “And it’s also the most common area for overlook by a business owner.”

MNP is one of Canada’s leading professional service firms. Headquartered in Calgary, it has more than 150 offices across Canada.

We also asked Brown to comment on the difference between the real estate of a pro yard and the

business operations of that yard. “When it comes to the business and the real estate, there is a diff erence in risk. Obviously real estate is going to be a little bit less risky as a long-term play than an operating business,” Brown said.

“One of the key things to evaluating these types of entities is separating the two. So, we would value a business operation and the real estate separately.

Owners sometimes deduct expenses through their company which may not be absolutely necessary for their firm

One of the business valuation tools that is particularly needed in Canada and the U.S. is Normalization of Earnings.

We asked Omar Chaudry to explain the process to us. Chaudry is a CPA, CA, and CBV who is a partner with the Ontario-based accounting firm RLB. Chaudry is based at the RLB offi ces in Guelph, Ont., and the firm also has locations in Fergus, Kitchener, Orangeville, and Shelburne, Ont.

Even though the company may own both, you need to notionally separate the two.”

“And how you do that is by applying a rental factor to the business operations. So, again, a common overlook by the owner of a business is to say, ‘Oh my real estate’s worth this, and my company produces this much cash fl ow.’ But they forget they need to deduct off a market rent.”

Adjusting for a big repair, like the roof of the warehouse that needs replacing, is not a normal, ongoing expense for the business. “So it makes it look like you didn’t make any money that year,” Chaudry said.

“And you might have a really good year where you might have to do something in a rush for a client. And it’s very high margin. But it’s something you only have once every 10 years. A buyer can’t rely on that happening every year. So we have to normalize all that activity.”

Omar Chaudry

“A big part of our job is fi guring out Normalization of Earnings,” Chaudry said. “We basically have to go through the books and identify all these types of items (that are personal or unusual),” Chaudry says.

“There are expenses that you can argue are business, or you can argue are personal. And you want to get the best tax treatment for that. But when somebody is selling, we normalize the earnings.”

“And that’s what we present to a potential buyer. We say, here’s the actual financials that were filed. But this is an adjusted earnings schedule, which shows how many expenses are in there which, once you buy this company, you’re not going to incur these expenses.”

There are also related party transactions. A business owner will have one corporation for their business, and one corporation where they own the real estate. And one corporation pays rent to the other. The owner can choose to pay as little rent as possible.

“And so now you’re kind of exaggerating the earnings of the business because you’re not paying a fair market rent. So these types of things we have to adjust for as well.”

“We call it recasting—or pro forma financials— where we say, had this been properly normalized, this is what it would look like.”

There is no attempt to create a second set of books. “The goal is to create a scenario where you can say to the new buyer, ‘This is what you can expect.’”

Luc Léger became COO of his family’s eight-unit Home Hardware Building Centre business in 2021.

He’s got a new generation’s energy and outlook.

The Elmwood Group is one of Home Hardware’s biggest pro dealers in the country

HEAD OFFICE: Moncton, N.B.

STORES: 8 in New Brunswick

LOCATIONS: Elmwood Home Hardware Building Centre (HHBC), Dieppe HHBC, Magnetic Hill HHBC, Downey HHBC, Tediche HHBC, Elmwood Design Centre, Magnetic Hill Home Furniture, Grande-Digue Home Building Centre.

FOUNDED: In 1974 by Alfred and Marie Léger

You’re 34 years old, pretty young to be a COO, and you represent the third generation of your family business. When did you start working in the store?

I officially joined the payroll at 15 years old. My first job? Pricing individual sheets of sandpaper—a tedious task that anyone who’s done it knows can be tough on the fingers. My father made sure I gained experience in every department, from receiving shipments from the Home Hardware truck and stocking shelves to mastering the key departments and assisting at the contractor desk. I even spent time in the lumberyard, loading and delivering products. After completing my post-secondary education, I progressed through roles in purchasing and operations before becoming COO. Now, as we close out the year [this interview was done in December], I’m excited to share that by 2025, my wife Andrée and I will officially be dealer-owners!

You were the point person for the family on your latest acquisitions in Grand-Digue and the Tediche store, about a half hour northeast of Moncton. You bought them in December 2021. It was right in the middle of the pandemic! We did it for our customers. We have many customers that have projects in these coastal communities and are now able to use their Elmwood Group charge account in these stores. It simplified the shopping process and created a one-stop shop for them.

Your father, Alvin, came back during Covid to a more central role in the business?

COVID was a shock. We were all uncertain about what the coming months would bring. With regulations changing at a rapid pace, having my father’s experience and leadership was invaluable in navigating the challenges ahead. It was eye-opening

I remember his colleagues saying, ‘Your dad’s really good on the floor!’ And then to see it for yourself, it was really cool!”

to witness his hands-on approach—engaging with the business on the front lines rather than just from a management level. We had to get back to basics, and in doing so, we saw firsthand how he operated in his era. I remember his colleagues saying, “Your dad’s great on the floor.” Seeing it for myself was not only insightful—it was really cool.

When did your father start giving you the autonomy in management?

My engagement level drastically increased about 10 years ago when we implemented our new point-of-sale system. It was a major shift for the company, and naturally, some key staff began

questioning how these changes would impact their daily routines. While some embraced the challenge, others chose a different path, which ultimately gave me the opportunity to start building my own team. The implementation affected every aspect of the business, and as I saw its potential unfold, my level of involvement and commitment grew even stronger.

You’ve managed to have a pretty good social media operation to market your store. Our director of marketing played a key role in strengthening our social media presence by implementing innovative strategies that boosted engagement and brand visibility. He and his team

Downey HHBC

Easi-Lite® | Type X | M2Tech® | GlasRoc®

Coming in 2025 from North America’s First Zero Carbon** Drywall Production Facility in Montreal

*Up to 60% less embodied carbon as per LCA action plan.

**Scopes 1 & 2

do an incredible job of bringing customers through our doors. Most of our marketing is handled digitally in-house, while we also fully commit to all Home Hardware Stores Ltd. marketing programs. This approach allows us to leverage a strong mix of digital and traditional channels to reach as many customers as possible.

A few months into his role, our director proposed a bold idea—shifting entirely to a local digital strategy and eliminating traditional marketing altogether. My face dropped. He was asking me to move away from a strategy that had worked for 45 years, the same one my grandparents and parents had relied on,

using billboards, radio, and print. I told him I needed to think about it.

The next morning, I walked in and said, “Let’s do it.”

Your Elmwood Group podcast is not just about home improvements, or even about home improvements at all. For example, a recent video interviewed a local Acadian film company!

It’s an exciting new way to showcase our local people while leveraging our growing audience to highlight what’s happening in the community. Our customers and followers can then share that

content on their own social channels, creating a ripple effect that extends our reach even further. Our brand isn’t just about shopping—it’s about giving back to the community in meaningful ways. I truly believe Home Hardware embodies this across Canada, and a podcast is the perfect way to bring that message to life.

You’ve also got, among your eight outlets, a furniture store.

This year, we launched a new e-commerce website for our furniture store, making it easier than ever for customers to shop online. People want to research

products, check live in-store inventory, and choose between home delivery or in-store pickup—all at their convenience. This platform not only enhances the shopping experience but also allows us to connect with both existing and new customers in a whole new way.

Your father, Alvin, got into the furniture store business in 2006. They called it a combo store. Home dealers across Canada were starting to embrace this concept, and when Alvin and my mother, Rachelle, saw the opportunity in Moncton, they went for it.

He was asking me to move away from every marketing method that my grandparents and father used, like billboards, radio, and print!” “

You’re about 70 percent contractor sales. How do you reach out to pros?

We have a team of five account managers—our outside sales reps—who serve as the first point of contact for our pro customers. To ensure their success, we surround them with the right support system, including inside sales specialists, estimators, purchasers, and a dedicated delivery team with a variety of truck options. Additionally, our yard team—comprising pickers, receivers, and logistics members—plays a crucial role in keeping

operations running smoothly. At each of our locations, our pro desk teams stand ready to assist customers with their urgent, on-the-go pickups.

To enhance efficiency, we centralized our shipping operations through two stores, allowing us to streamline distribution while keeping operations as efficient as possible for our customers. Expanding our footprint with two coastal community stores has also added tremendous value, giving both existing and new customers the ability to shop across all of our locations using a single charge account.

By simplifying the purchasing process, we’ve strengthened trust with our pro customers.

Our strong local marketing presence allows us to showcase the incredible projects our customers are working on across various social channels, reaching thousands of followers. This added value is something larger competitors simply can’t offer.

What’s your attitude toward the competition?

We’ve stayed focused on what has made us successful over the years—sticking to our core values. By consistently executing on them, we not only drive results but also strengthen our reputation, helping us build a trusted and recognizable brand.

What about appliances?

When a major player exited the market, we gained significant traction. In town, we’ve been able to capitalize on multi-unit projects and provide excellent service to homeowners. Meanwhile, our

coastal stores have found great success catering to cottage owners and local residents.

What’s your next priority?

Our goal is to ensure we’re built for the next 50 years. That means putting our customers and employees first in every decision we make, continuously adapting to their evolving needs in this ever-changing environment.

To what do you attribute your success?

Our success is rooted in strong family values that have been passed down for generations. We believe in always putting the customer first and staying true to our moral code. But success isn’t achieved alone—we’ve been fortunate to have incredible staff and loyal customers who have believed in us year after year. Risk and sacrifice are never easy, but they are essential ingredients for growth and long-term success.

BY STEVE PAYNE

Canada is looking for an extra 3.9 million home starts in seven years. How’s that going to happen? Pre-fab units, your time has come!

The Canada Mortgage and Housing Corporation (CMHC) has published a famous number which everybody loves to cite. We need 3.9 million home starts—over and above expected production—by 2031, the federal agency says.

BuildForce Canada, a national statistical agency for the construction industry, has another daunting number. It says that 134,000 residential construction workers will retire over the next decade. They will be partially replaced by only 117,000 onsite labourers and trades, studies show.

That’s the magnitude, in two numbers, of the labour crunch that awaits the home building industry. We need to almost triple the production of our housing—with 17,000 fewer workers to do it—over the next seven years. We need to reach 800,000 housing starts a year. The current pace is 250,000.

“We’re facing a significant challenge,” says Doug Keeling, director of business development for Castle Building Centres Group. “We’re continuing to

“We need to reach 800,000 housing starts a year, CMHC says. The current pace is 250,000 annually.

lose skilled tradespeople, and we’re not replacing them quickly enough. Even maintaining the traditional pace of building 250,000 homes annually will be difficult, let alone reaching 800,000 a year. It’s simply not feasible.”

If it’s not doable, then what is going to happen?

Basic economics says that the pressures on the housing supply will mount and prices will move higher. Solutions will be sought by consumers. One of the beneficiaries of the situation will be RTM (ready to move) home builders. And one of the best examples of that, a Castle member, is Warman Home Centre in Warman, Sask., north of Saskatoon.

Warman’s home manufacturing operation dates back to 1984, when the owners of the home centre, Frank Rennai and David Holst, started their Warman Homes business, including RTM homes.

If you were to imagine a successful home centre with all the conceivable offshoots from the retail

store, this would be it. Its five divisions include the main Warman Home Centre, plus Warman Homes, Warman Cabinets, Warman Metals, and Warman Truss.

Rennai and Holst sold the business, Reho Holdings, to a management-led buyout using financial muscle from the Golden Opportunities Fund, an affiliate of a pension fund in Saskatchewan, in 2012.

At the time, Golden Opportunities published that Reho had annual sales of $80 million and 185 employees, making the most of Warman’s status as one of the first “bedroom communities” serving Saskatoon, 20 km south. Jobs were plentiful in the city, it was an easy commute, and land prices were lower—the perfect place to build a pro yard.

The move away from higher-priced retail in Saskatchewan’s cities, to more rural areas, has driven

the RTM homes business, says current president Rick Casavant.

“The RTM business has been strong. It’s very hard to get the contractors to leave the cities,” for onsite building in secondary markets, Casavant told Pro Dealer.

A pre-fab operation requires labour, too. But Casavant says there are Warman Homes’ employees that go right back to the founding of the business 40 years ago. “We can employ people and keep them employed,” he says. Whereas onsite builders go through cycles of boom and bust, Warman Homes has been steady. It ships RTM homes to all three prairie provinces plus the northern United States.

The advantages of RTM homes are that construction can be up to 50 percent faster than site-built homes. “

The advantages of RTM homes are that construction can be up to 50 percent faster than sitebuilt homes, and costs can be 20 percent lower, according to a report from management consulting firm McKinsey. The Modular Building Institute, an organization in Charlottesville, Va., says the market share in Canada of modular structures surpassed six percent of total square footage in 2022, three times what it was in 2015.

The factory-built housing opportunity is bigger than RTM homes, obviously. Panelization, where whole walls and roof systems are prefabricated similar to truss plant operations, has been the stock in trade of companies like All-Fab, in Western Canada, for a long time. Yet modularization and panelization have traditionally been outgrowths of lumber dealers, not standalone manufacturers.

As the statistics show that we need to dramatically ramp up the speed of housing construction, there will be opportunities for RTM home builders to expand into factory-built components heading to on-site builds.

“We are looking at it,” Casavant says.

Being a part of Sexton Group has signi cantly elevated our business. Even though they have over 450 members across Canada, we always feel heard and valued as if we are part of the Sexton family. Their powerful network of members across the country has been invaluable, providing us with insights and connections that have helped us expand our business. The seminars and meetings they o er are incredibly bene cial, keeping us informed and ahead in a tough market. Sexton also excels at connecting suppliers with members, ensuring we have access to the best products at the most competitive prices. We couldn’t be more pleased with our partnership! ”

—Markus Lange, EG Penner Building Centre

Our strength as a buying group is built on four major advantages: We’re a dedicated team of industry professionals focused on your success. We negotiate competitive programs and leverage our strong relationships with vendors to resolve any issues quickly for you. We have a rst-class accounting team that promptly delivers accurate rebate payments as promised.

BY JOHN CAULFIELD

The key for dealers is knowing which pros are active in pursuing publicsector projects

“Government-funded projects account for up to 12 percent of annual revenue for Senso Group Building Supplies, a pro dealer in Toronto.”

2023, Canada’s national and provincial governments spent more than $33 billion on building construction and infrastructure through the “Investing in Canada Infrastructure” program.

That program had committed over $180 billion for various projects across the nation, according to the latest available data.

Funding is delivered through bilateral agreements between the federal government’s Housing, Infrastructure and Communities Canada agency, which tracks the status of projects, and each of the provinces and territories. The amount—which probably doesn’t reflect the full extent of government spending in this sector—indicates that there’s a lot of cash floating around out there for building materials suppliers to tap into.

Capturing a piece of that pie can add substantially to a pro dealer’s business. For example, product shipments to government-funded projects account for between seven percent and 12 percent of annual revenue for Senso Group Building Supplies in Toronto, Ont., according to its president Cynthia Prazeres-Mare.

Like many pro dealers, Senso gets this business through its contractor customers that do the heavy

lifting in terms of negotiating contracts with the government for materials and labor. Senso typically provides materials for the building envelope, and the majority of those construction or renovation projects are hospitals and schools.

It helps that Senso, an AD member, has been in business for 35 years, so most of its public sector orders come from word-of-mouth contacts.

Still, pro dealers that want to expand their sales as suppliers to government projects should promote themselves to that end. They need to consider the transportation, protocol, and inventory implications of shipping to what are usually large and complex projects that might have some funding and scheduling quirks.

“Getting government work depends on who lands the contract, and we hope it’s one of our customers,” says Paul Mutter, purchasing manager for Merkley Supply in Ottawa, which specializes in masonry.

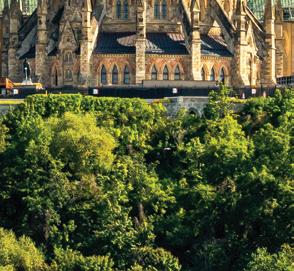

One of his company’s bigger recent supply projects is the rehabilitation of the Centre Block of the Parliament Buildings in Ottawa. When it’s all finished by 2031, it will have cost taxpayers between $4.5 billion and $5 billion. The project is the largest and most complex heritage renovation in Canada’s history.

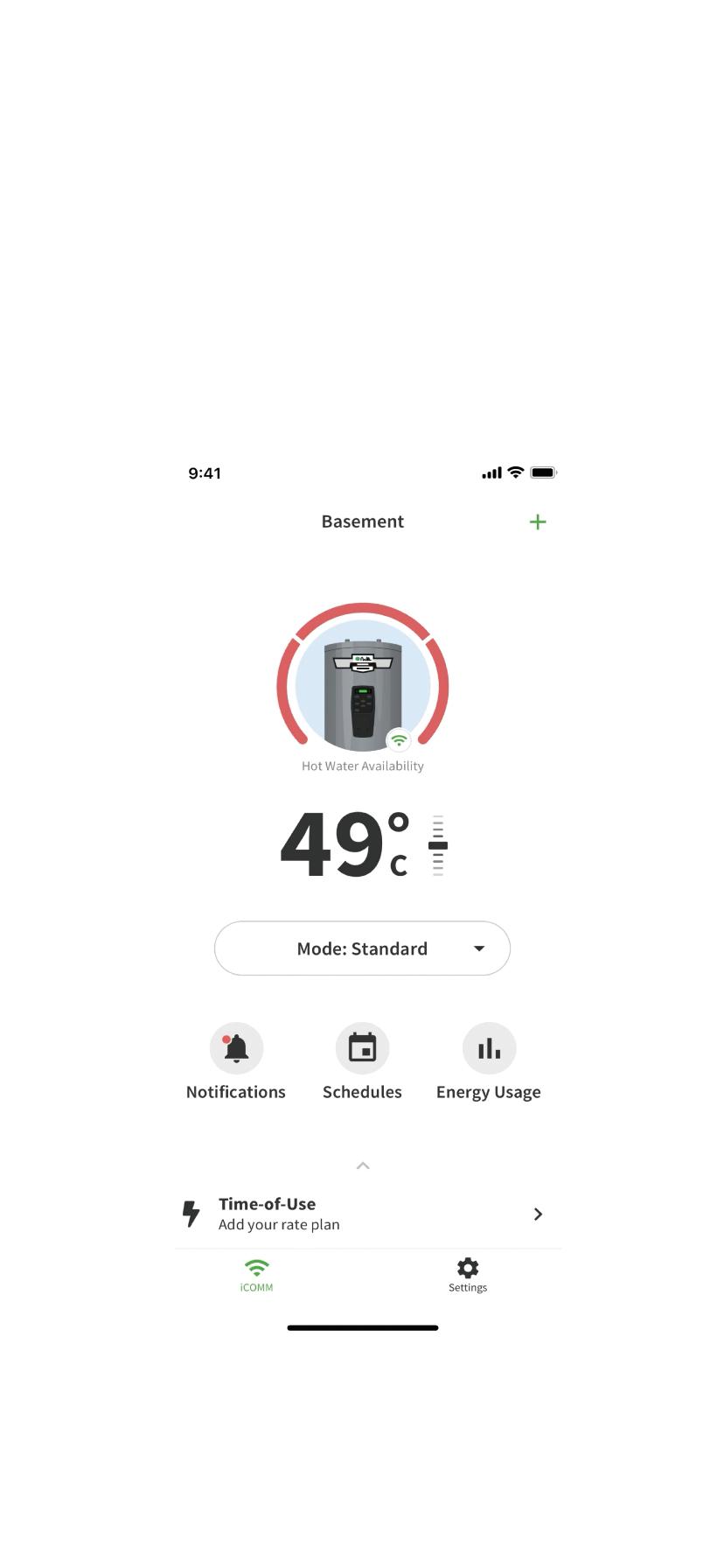

Maximize comfort by pre-planning times for hot water usage.

Input time-of-day usage rates into the app to track energy costs.

Immediate alerts allow quick response to leaking water.

One of Merkley Supply’s recent projects is supplying the masonry for the renovation of Centre Block of the Parliament Buildings in Ottawa. It’s almost a $5 billion renovation.

Merkley Supply is working with Atwill Morin, which specializes in masonry restoration; and the general contractors PCL and Ellis Don Construction. The project, which is scheduled for completion by 2031, is being managed by the federal agency Public Services and Procurement Canada, which handles goods and services purchasing.

Mutter says this project’s biggest challenge is meeting the expectations of its architects—HOK, in association with Architecture49, DFS, and ERA Architects— for bricks that match the building’s 1920s-era exterior.

While there are exceptions of pro dealers that bid for government contracts directly, most prefer to participate as a supplier for contractors, thereby avoiding the red tape involved in the bid process. According to the federal government website CanadaBuys (www.CanadaBuys.canada.ca), potential bidders need to set up an SAP Business Network account, and provide their Canada Revenue Agency (CRA) business number. For contracts that aren’t processed through the network, bidders need to register via the Supplier Registration Information (SRI) website with a Procurement business number.

It’s advantageous to also be registered with SELECT, a database of prequalified suppliers. SELECT is used to invite suppliers to bid on real estate and construction services valued below $100,000. (CanadaBuys publishes notices of tender opportunities for goods over $25,000 and services over $40,000.)

The solicitation of bids and quotes from potential suppliers is usually conducted through an Invitation to Tender, a Request for Proposal, a Request for

Standing Offer, or a Request for Supply Arrangement. In a standing offer, the prices are preset; supply arrangements allow government departments to solicit bids from pools of prequalified suppliers.

In the event a supplier wants to introduce a new product as part of its contract, that product needs to be vetted for approval through the Canadian Construction Materials Centre, which applies criteria for safety, manufacturing, composition, performance, usage, and maintenance. The product’s compliance with an applicable building, fire, plumbing, and energy codes is regulated at the point of use.

Canadian Commercial Corporation (CCC), the government-to-government contracting agency, asserts that it’s a “must” for a goods or services provider to promote itself as a capable government supplier. It states, too, that suppliers have a better shot at bidding initially on contracts valued at $25,000 or less, partly because they can be selected on a competitive or noncompetitive basis.

CCC notes that the lion’s share of government contracts still goes to small businesses, with the value of those contracts valued at $1 million or less. Prazeres-Mare of Senso Group points out, though, that margins on shipments related to government-funded project orders can depend on the length of the contract. When Pro Dealer interviewed her in November, Prazeres-Mare said her yard was still storing inventory for an order that had been placed last summer.

This process can also be frustrating in its inconsistency for pro dealers.

Wolmanized® Outdoor® Wood (protected with Wolman® NB Copper Azole) with Tanatone® colourant has decades of proven performance in protecting wood from its natural enemies - termites and fungal decay.

• Above Ground, Ground Contact and freshwater applications

• Long-lasting protection with built-in colourant

• Fasteners – follow manufacturer recommendations

Advanced Building Materials lobbies the government “as much as possible,” mostly by targeting employees like engineers “who can help us.”

Jason Sifft, president of Muskoka Lumber and Building Supply, a TIMBER MART member based in Port Carling, Ont., says his company used to supply lumber for the occasional bridge project. Sifft says that the government has made it tougher for contractors to bid with its “crazy” insurance and bond requirements, and all the paperwork that’s involved to register as a vendor.

Local small contractors must also contend with larger pro companies in Greater Toronto that, says Sifft, are willing to bid low for contracts “and hope they can make up the difference through change orders.”

Competition for government contracts is definitely a factor, at a time when government spending on construction projects has dipped a bit in recent years. Some big regional distributors, such as Doman Building Materials Group, are said to be active players in this supply sector. And U.S. vendors are also seeking to expand their business from Canada.

In a report it published in 2022, the information solutions firm Deltek estimated that U.S.-based vendors receive between 25 percent and 35 percent of all Canadian public-sector spending, and that construction is the second-largest among five industries to which U.S. suppliers are guaranteed access in Canada via the World Trade Organization Agreement on Government Procurement.

Mutter says that Merkley Supply, which has been in business for 65 years, doesn’t shrink from competition for supplying government projects. “If a new

contractor came into this market, they’d come to us first because we’re the number one choice in town.” And Ottawa, of course, almost always has government projects in the works, including the $192 million construction of a new library and archives building, and expanding Ottawa Hospital’s campus.

Mutter says his company hasn’t needed to make any substantive changes, in manpower or to its delivery fleet, to stay in the game and handle order shipments from government contracts as they arise. “It’s all about management and timelines,” he explains.

Advanced Building Materials in Sarnia, Ont., another TIMBER MART member, has about one percent of its business going into government-funded projects, says its owner, Norm Williams.

Advanced differs from the other pro dealers contacted for this article in having bid directly with government agencies such as Parks Canada and the Ministry of Transportation in Ontario.

Williams said contracts like these are for very specific products; e.g., for Parks Canada, Advanced has supplied Ertec Environmental’s species-at-risk exclusion fencing. (Drainage and erosion control are among Advanced’s specialties. It is currently supplying a large road development that will run through an Indigenous-owned reservation that requires more environmental protection than a typical infrastructure job. Advanced provides that protection.)

He said to get government contracts—or at least get on the government’s radar—Advanced lobbies the government “as much as possible,” mostly by targeting employees like engineers “who can help us.” And for larger-scale supply contracts, Advanced might need to beef up its inventory so that the government job doesn’t disrupt Advanced’s regular business with pros.

While government contracts are a minuscule part of Advanced’s sales, Williams says his company would like to attract more of this business, noting that “the money is always there.”

Two dealers show the rest of us how to do digital outreach to customers. The first piece of advice: don’t get hung up on ‘paralysis by analysis’

BY SARAH McGOLDRICK & GEOFF McLARNEY

There

has been a societal shift in how consumers—including contractors—receive information.

refl ects end-user tastes and trends—and that includes the tastes and trends of contractors. Platforms such as TikTok and Instagram not only tell consumers about the latest products and deals but also provide a space to make purchases and infl uence other buyers about their choices.

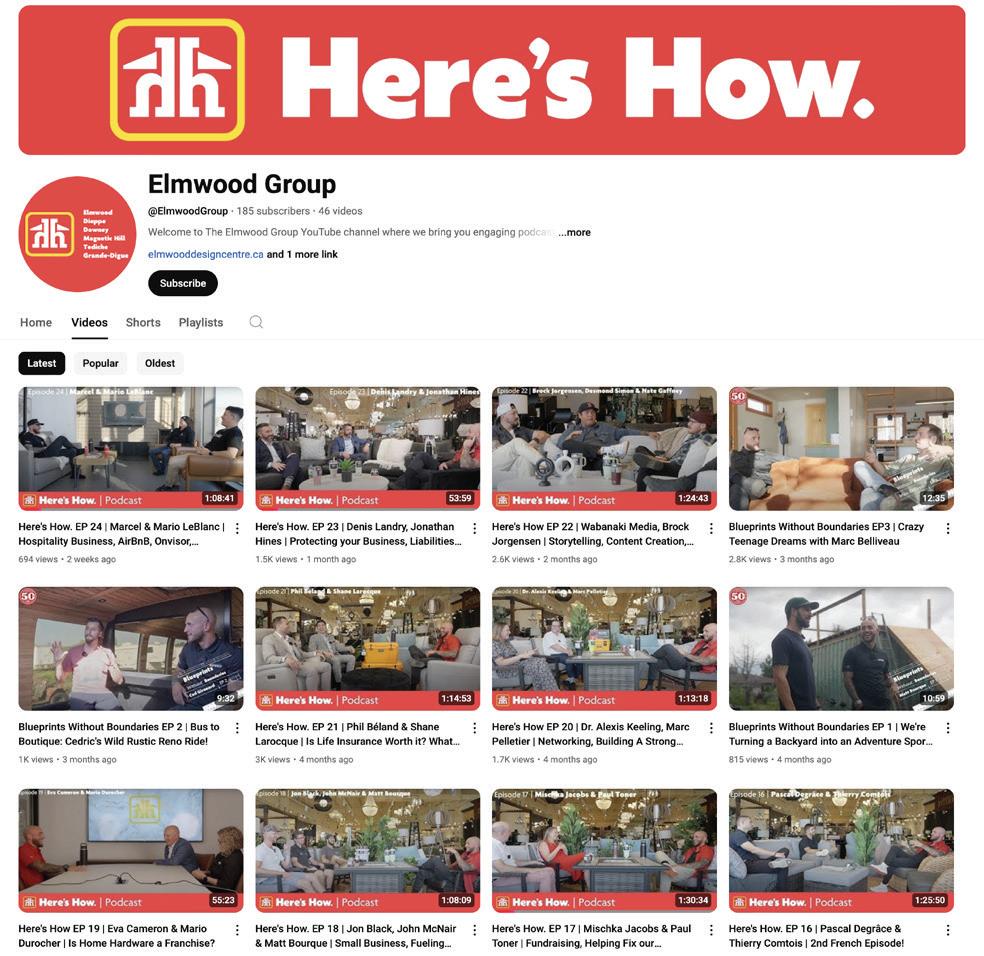

In this article we look at two powerhouses of digital marketing, independent dealers who excel in catering to contractors: The Elmwood Group, a multiple-outlet Home Hardware dealer in New Brunswick, and Quincaillerie Laroche-Tremblay, a Castle dealer in Quebec.

Social shopping, as it has been dubbed (it is also called social commerce) now generates in excess of $5 billion dollars in retail sales in Canada. The exact proportion of social shopping in the $61 billion home improvement industry is unknown, but contractors are enthusiastic users of social media. And confi dence continues to rise in social shopping, with 47 percent of Canadians reporting they have bought goods or services through social media.

To meet this demand, businesses are putting their marketing dollars into digital media. Choosing the right platform often remains the biggest barrier to entry as companies grapple with understanding

the best way to reach consumers that will generate sales. YouTube may be the most popular space to learn about products, but in Canada, Facebook is the space where the most social-shopping transactions begin.

Jonathon Stephenson is director of marketing and design operations at the Moncton, N.B.-based Elmwood Group. This business is an eight-unit operation that incorporates six Home Hardware Building Centre stores, a design centre, a furniture sales operation, and more.

Stephenson met the third-generation dealer owner of Elmwood Group, Luc Léger (who is featured on the cover of this issue and is interviewed on page 30) at the University of Moncton, where he developed an interest in digital marketing. Léger calls Stephenson “the strategy” when it comes to digital marketing.

The business has found new ways to use social media tools like TikTok, Instagram, and Facebook to build customer loyalty and grow sales.

Stephenson told Pro Dealer that the Elmwood Group has reached almost 100 percent digital marketing penetration, with Facebook remaining the company’s top platform of choice. The business also recently added a podcast that is designed to reach out to its customer base in ways that don’t always include home improvements, furniture, or design— which is a stroke of genius, as it turns out, since it attracts a wider audience.

Léger calls Elmwood’s podcast series “like a local newspaper, only just for us.” It has recently featured, for example, Stephenson’s interview with an Acadian film company that Elmwood counts among its customers.

Other recent episodes have included interviews with two hospitality industry entrepreneurs, a

media company that was interviewed about creating content, and an insurance expert talking about risk.

A repeating feature of the podcast is called Blueprints Without Boundaries. It features interviews with customers about home renovation and cottage building in southeastern New Brunswick.

“We do about two episodes a month [of our podcast], and then we kind of accentuate that with Instagram and TikTok,” Stephenson said. “There we are primarily doing just our video content. We’ve been focusing quite a bit on doing some pretty cool campaigns for video. So those are all original pieces that we create there,” he said, adding these spaces are where the business is establishing its digital identity.

The company is also squarely focused on brand building, something he says a lot of dealers struggle to do on their own. Stephenson pointed out that there has been a societal shift in how consumers—including contractors—receive information. Though the task may seem overwhelming, he suggests starting small and building on one platform before branching out.

“For us in Moncton, we’ve had a population growth that, I think, is the biggest increase by percentage in Canada. So, we’re obviously focusing on trying to tap into that market of newcomers.”

can now claim an industry leading 24 - Month shelf life

Jobs finished faster due to less clogging

IMPROVED MIXING

Improved foam consistency saves time and money

LESS DRIPPING

Less dripping means less mess life.

The Elmwood Group does two episodes a month of its podcast, which are given a boost with Instagram and TikTok.

In an effort to reach a wide range of consumers, Stephenson and his team created a YouTube feature that allows them to become DIY-ers. They are given a project, similar to what a customer may encounter, and then they begin putting the project together.

Other passion projects demonstrate how you can take the ordinary and make it extraordinary. One project featured was a DIY bus flip that transformed a vintage bus into a house on wheels.

“I think it’s pretty cool with this campaign specifically, as we were just the two marketing guys trying out these projects and going through their own DIY journey of being guys that don’t really know a lot about DIY but are trying to learn as they go,” Stephenson said.

He added that many companies make their DIY demonstrations out of reach to the average consumer with “over the top projects.” He said that

making it more relatable motivates consumers to take on home projects.

His team also added a podcast to their list of digital marketing tools with dealer-focused information featuring industry experts. The episodes run for approximately 90 minutes, and the company shares full-length and short clips across their social media platforms, creating countless opportunities for content.

Stephenson doesn’t think there is any other dealer with a podcast that’s specifically focused on weaving home improvement content with non-home improvement content. The name of the Elmwood podcasts that are about home improvements is, deliberately, Here’s How, which is the slogan for Home Hardware. He said their ideal listener is someone who is at a crossroads in their career, such as a recent grad or someone looking to take that next step in their career journey. The goal of the podcast is to offer broad insight to any listener.”

“We’re trying to show that the path to success, whether it’s in our industry or not, there are many ways to get there. Each person that comes onto the show, we asked them, how did you do it? I think that’s a cool way to connect with stories that are

DURABLE AND LOW-MAINTENANCE VINYL AND ALUMINUM CONSTRUCTION

ALUMINUM-CLAD EXTERIOR, OFFERED IN AN ATTRACTIVE SELECTION OF COLOURS

SLEEK, LOW-PROFILE HARDWARE DESIGN

ENERGY-EFFICIENT DUAL-PANE AND TRI-PANE LOW-E GLASS OPTIONS

26% LOWER PROFILE FRAME INCREASES GLASS AREA

UP TO 22% BETTER ENERGY EFFICIENCY

With the unique changes of our Canadian climate, the demand for energy-efficient products that can stand up to the elements is higher than ever. JELD-WEN of Canada proudly introduces the groundbreaking JWC8500 series window —a perfect blend of style, performance, and energy savings, meticulously engineered to exceed expectations. Our newest JELD-WEN® window, the JWC8500 hybrid option exceeds performance, in all regions of Canada, offering an aluminum-clad exterior finish with an exquisite selection of colours to choose from.

Discover the advantages of JELD-WEN of Canada’s most energy-efficient window. Our 8500 series windows are 2030-rated to meet Canada’s U-Factor 0.14 (U.S./I-P) / 0.82 (Metric/SI) or ER 44 building codes, and are designed to significantly reduce energy costs while ensuring year-round comfort in your home.

Tailored to meet the regional needs of homeowners, our windows are the perfect fit when planning a renovation or new home build, seamlessly blending functionality and style to suit any project.

Discover the JWC8500 series window from JELD-WEN of Canada—and experience the future of home comfort and efficiency.

in our community. But also, again, make our brand relatable to something that someone might have had an emotional connection to, and I think that’s really what’s powerful.” he said

The one roadblock that fellow dealers will face who are just starting out is “paralysis by analysis,” Stephenson said. He said the way to get started in the digital marketing space is to simply dive right in.

“My one piece of advice is, pick one thing that you feel most comfortable doing, whether it’s taking a photo, whether it’s taking a video or whatnot, and start there. It’s a humbling experience, obviously, but once you put it out there, learn from the feedback that you get on any of your social media platforms.”

I started doing this when Facebook started, so in 2007, and if I look back at the content that I used to create there, I would cringe looking at it.”

He said many businesses get hung up on what the right kind of content should be. Instead, he recom-

mends starting with one, whether it be Facebook, Instagram, or TikTok and expanding from there. Stephenson suggests starting slow, posting one piece of content per week.

“A dealer could start in 2025 and say, ‘Hey, I’m going to post one time a week.’ At the end of the year, they will have 52 pieces of content. I’m sure they’ll be really proud to see where they got to.”

One young retailer in Quebec, who bought into this family’s store when many small businesses were coping with succession challenges, has lit up social media with his charismatic sales pitches.

Phyl Liquide (as in liquidation) is the online persona of Phylip Savard-Tremblay. With his father, Marc Tremblay, he is co-owner of Quincaillerie Tremblay Laroche, doing as business as QTL, in Métabetchouan-Lac-à-la-Croix, on the shores of Quebec’s Lac Saint-Jean. Savard-Tremblay won the Outstanding Retailer Award for Young Retailer of the Year last year.

The liquidation department opened in 2022, with Phyl Liquide as its social media spokesperson and sales proceeds invested in local community organizations. As Savard-Tremblay describes it, driving discount sales through digital platforms was an intuitive step.

Phylip Savard-Tremblay is co-owner of Quincaillerie Tremblay Laroche in Métabetchouan-Lac-à-la-Croix, on the shores of Quebec’s Lac Saint-Jean.

“How do you attract customers into the store? They’re at home. And what are they doing? They’re on social media networks!” Thus, Phyl Liquide was born.” He now posts a video under the alias of Phyl Liquide every Monday.

“It was the pandemic, so everyone was saying home, respecting the rules,” he recalls. “All that led me to pitch it to my father and his associate: maybe we could make videos on Facebook and try to see if that draws people into the store” to buy up unsold inventory.

Father and son then expanded into Facebook Marketplace, and the Phyl Liquide moniker soon followed. “We clicked on the camera, started the video, and that’s when the name practically appeared, and it stuck.”

He says his signature sign-off, “Hé, à tantôt!” (Hey, see you soon!”) developed after a few videos, as the “pressure to continue fine-tuning” rose. Under his guidance, the business moved from posting once a month to once daily.

The role is a natural combination of Savard-Tremblay’s talents: not only has he been working in the store since he was 14, but he also studied radio broadcasting in college.

His preference for social media extends to marketing, where the store focuses its efforts on platforms like Facebook Marketplace more than traditional media.

“We prefer to invest in Facebook rather than radio or TV. Since then, we’re sure that our advertising is reaching our customers and people from our area, instead of outside of it, which is the case with television.”

It’s also an efficient way to offer sales online without the responsibilities of a traditional e-commerce

system, requiring no additional staff. “People look for deals on Marketplace, and it’s one of the best places to find new customers,” says Savard-Tremblay.

Since the store joined the platform, he adds, “people from Quebec City, Montreal, Gatineau, the Beauce, and beyond have been showing up at our store to pick up our products or have them delivered. It’s totally crazy!”

Each week, Phyl Liquide’s latest video goes live at 6:30 a.m. “There’s no shortage of subjects: liquidation videos, product presentations, staff recruitment.” Often, he says, “customers are talking to us about it when we open our doors at 8 o’clock!” Customers “come into the store looking for Phyl Liquide and wanting to talk” to him.

At QTL, just over half of the business comes from contractors or industrial clients, compared to about 70 percent at the Elmwood Group. Is there a theory that makes pro stores more amenable to social media marketing?

Léger says that often, professional contractors are themselves very effective digital marketers. So it’s simply a question of following their activities and posts and promoting them on the dealer’s own channels. After all, a customer is a customer is a customer.

BY GEOFF McLARNEY

As advances in green building technologies develop, standards

for building

envelopes are getting higher. Jeld-Wen’s LISA BERGERON spoke to Pro Dealer about how window and door manufacturing is keeping pace.

Changes are coming to the energy standards for building construction in Canada, and Jeld-Wen Canada is looking to stay ahead of the curve. Lisa Bergeron, the door and window maker’s director of business development and government affairs, sat down with us to talk about what’s next for energy efficiency in homebuilding.

Building construction in Canada is guided by two sets of standards: a regulatory framework of minimum criteria, and the voluntary industry program Energy Star. The latter’s criteria have not been updated since 2020, Bergeron explains, prompting Canada’s Department of Natural Resources to revive the Energy Efficient Fenestration Steering Committee.

The body represents stakeholders in the window and door manufacturing sector in dialogue with the department. “Our job as a committee is really to advise [Natural Resources Canada] on what the next criteria should be,” Bergeron explains. “But it really is consultative. We can recommend all we want; at the end of the day, the government decides what they want to do.”

With an Energy Star qualification, businesses can market their products as meeting the highest level of standards for energy efficiency, exceeding the mandatory regulatory minimums. Because governments have strengthened their criteria, manufacturers have had to respond by adapting their

product offerings, in turn raising the bar for the top products in the field.

Natural Resources Canada, Bergeron says, has historically wanted Energy Star to comprise “the top 25 percent of the products sold. I believe that as the energy requirements for code get ramped up, so does the product selection and offering in Canada. So, that’s why the criteria need to always be improved.”

Based on discussions with Natural Resources Canada, Bergeron says the expectation is that new Energy Star standards would come into effect

in January 2027. “Historically they have been giving 18 months for manufacturers to adapt to the new criteria,” including any changes to packaging and labelling.

“So we would expect that sometime in June 2025 we would have criteria pretty much ready for publication to be enacted in January 2027.”

In Quebec, she points out, homes must use Energy Star-approved windows in order to qualify for funding under the province’s Novoclimat program. Otherwise, Energy Star is entirely voluntary. Canada’s National Building Code is the model which serves as the basis for provincial building codes. These codes set bare minimums for what

The National Building Code of Canada sets bare minimums for what Bergeron calls ‘the lousiest home you can build without going to jail.’ Six provinces have adopted that code as-is.”

Bergeron calls “the lousiest home you can build without going to jail.”

In six provinces, the code has been adopted as-is. British Columbia, Alberta, Ontario, and Quebec have provincial codes based on the model, though municipalities in Quebec are not obliged to adopt its code. But recently, Bergeron says, all provinces and territories have signed on to an agreement to adopt a harmonized building code.

“We are in public review right now for the 2025 code,” Bergeron explains, with publication slated for the end of the calendar year.

“The harmonized code now has diff erent committees and diff erent sectors that they’re looking at,” among them energy effi ciency.

would be traditionally heating mode. So, even in the winter, you would find that some rooms could overheat if you were relying only on windows that would help that have high solar gain.”

As Jeld-Wen’s point person for government relations, Bergeron was party to negotiations about building code standards for windows and doors that will make homeowners, especially seniors, safer from the risk of overheating. “The new proposed solar heat gain cap was modeled on our industry’s data and modeling work.”

Lisa Bergeron

“We expect it to be some time in 2027 for it to be adopted nationally. The provinces and territories have all agreed to adopt the [harmonized] code by 18 months after the 2025 publication.”

One aspect of homebuilding under consideration is standards for solar heat gain, which Bergeron defi nes as “the ability of a window or a glass to absorb heat from the sun.” This can be helpful, as “it allows you to utilize the sun in winter to warm your home.”

At the same time, it can present challenges.

“As houses become more effi cient, the envelope becomes more effi cient, and window-to-wall ratios or size of windows are increasing. It’s becoming a problem where there’s overheating even in what

The new harmonized code will be structured into tiers, from a bare-minimum Tier 1 to Tier 5, which Bergeron defines as “net zero or net zero-ready.” This builds on current practice in B.C. but is a novelty elsewhere in the country.

“Once that tier system has been put in place, municipalities could mandate that in their jurisdiction, you need to meet Tier 3 or 4. Some municipalities might require builders to build in the upper echelons.”

The updates to the code mean that the Energy Star program will have to step up its game on an accelerated timeline. “The adoption of a new code is going to force better energy requirements for buildings as a whole,” says Bergeron, including for windows “which are obviously a big part of the building envelope.”

Previously, for Energy Star, “the changes had been every five years, so this is the first year that we’re actually going faster [than] the five-year mark.”

For Bergeron, reviewing both regulatory and voluntary standards is a timely exercise.

“Climate change is obviously real, and flooding is also a problem. There’s no better time

to look at trying to build homes that will stand up to the modeling that the government has put together, more resilient houses that will be able to stand the test of time.”

“It is not going to cost less. But the cost of having to rebuild, or having to replace earlier, because you haven’t built to better standards? That’s probably a bigger cost.”

John Magri, director of programs at Winnipegbased Sexton Group, recently gave his take on how his group chooses which window manufacturers to partner with.

“As building codes evolve, [window] innovations are pushed further to meet stricter performance standards. The 2030 building code targets are driving window manufacturers to develop even more efficient solutions,” Magri said.

“When evaluating any vendor partner, it’s critical for us to consider several key factors to ensure a successful partnership that meets both current and future needs.”