ndust

Find out why thousands of retailers trust Orgill as their partner of c ce isiting Orgill. a/oppo u y.

rgill s en ser ing the industr for more 1 5 years but what’s more important h long the compan been around s wh i going. For the past three ades gill has been the fastest-gro ing distributor in the industry and today, the omp ny ontinues to invest enhancing its od c , rograms and services to continue this legacy of growth.

ore im has u ast th e faste i d tod st in e g vices n etaile ice b

EDITOR-IN-CHIEF

Steve Payne steve@hardlines.ca

FEATURES EDITOR

Geoff McLarney geoff @hardlines.ca

CONTRIBUTING EDITORS

Rebecca Dumais rebecca@hardlines.ca

Sarah McGoldrick sarah@hardlines.ca

CONTRIBUTOR

John Caulfield

ART DIRECTOR

Shawn Samson shawn@twocreative.ca

PRESIDENT

Michael McLarney mike@hardlines.ca

SECOND QUARTER/2025 // VOLUME 2, NO. 2

2060 Lakeshore Road, Suite 702, Burlington, ON L7R 0G2 • 905-330-3061 @Hardlinesnews • www.hardlines.ca

VICE-PRESIDENT & PUBLISHER

David Chestnut david@hardlines.ca

ACCOUNT MANAGER

Shannon MacLeod shannon@hardlines.ca

SENIOR MARKETING & EVENTS MANAGER

Michelle Porter michelle@hardlines.ca

CLIENT SERVICES MANAGER Jillian MacLeod jillian@hardlines.ca

ACCOUNTING accounting@hardlines.ca

★ FREE TO HOME IMPROVEMENT DEALERS ★ To subscribe, renew your subscription, or change your address or contact information, please contact our Circulation Department at 866-764-0227; hhiq@mysubscription.ca.

Michelle Chouinard-Kenney GIBSON BUILDING SUPPLIES Aurora, Ont.

Brian Lavigne

EDDY GROUP TIMBER MART

Bathurst, N.B.

Luc Léger

ELMWOOD GROUP HOME HARDWARE Moncton, N.B.

Brent Perry ALF CURTIS HOME IMPROVEMENTS Peterborough, Ont.

Gary Sangha CROWN BUILDING SUPPLIES

Surrey, B.C.

Hardlines PRO Dealer is published four times a year by Hardlines Inc., 2060 Lakeshore Road, Suite 702, Burlington, ON L7R 0G2. $25 per issue or $90 per year for Canada. Subscriptions to the Continental United States: $105 per year and $35 per issue. All other countries: $130 per year. (Air mail $60 per year additional.)

Canadian Publications Mail Agreement #42175020. POSTMASTER: Send address changes to Hardlines PRO Dealer, 8799 Highway 89, Alliston, ON L9R 1V1.

All editorial contents ©2025 by Hardlines Inc. No content may be reproduced without prior permission of the publisher.

Hardlines PRO Dealer is just one facet of the Hardlines Information Network. Since 1995, we’ve been delivering the most up-to-date information directly to you online, in print, and in person. Find out how you can get your message out with us. Contact: Shannon MacLeod, Account Manager 905-691-2492 • shannon@hardlines.ca

Tariff s affect specific categories—but consumer confidence is threatened

Crown Building Supplies acquires Alberta pro dealer

BMR targets pros in new marketing campaign

Home Depot increases sales by 4.5 percent in latest fiscal year

Lowe’s sees sales fall in 2024, acquires contractor finishes firm

GMS Inc. reports ‘pricing resilience’ despite declining market

NGen launches fed-funded homebuilding tech projects

SECOND QUARTER/2025 // VOLUME 2, NUMBER 2

EDITORIAL WE’VE BEEN HERE BEFORE

PRODUCTS FOR PROS WINDOWS & DOORS

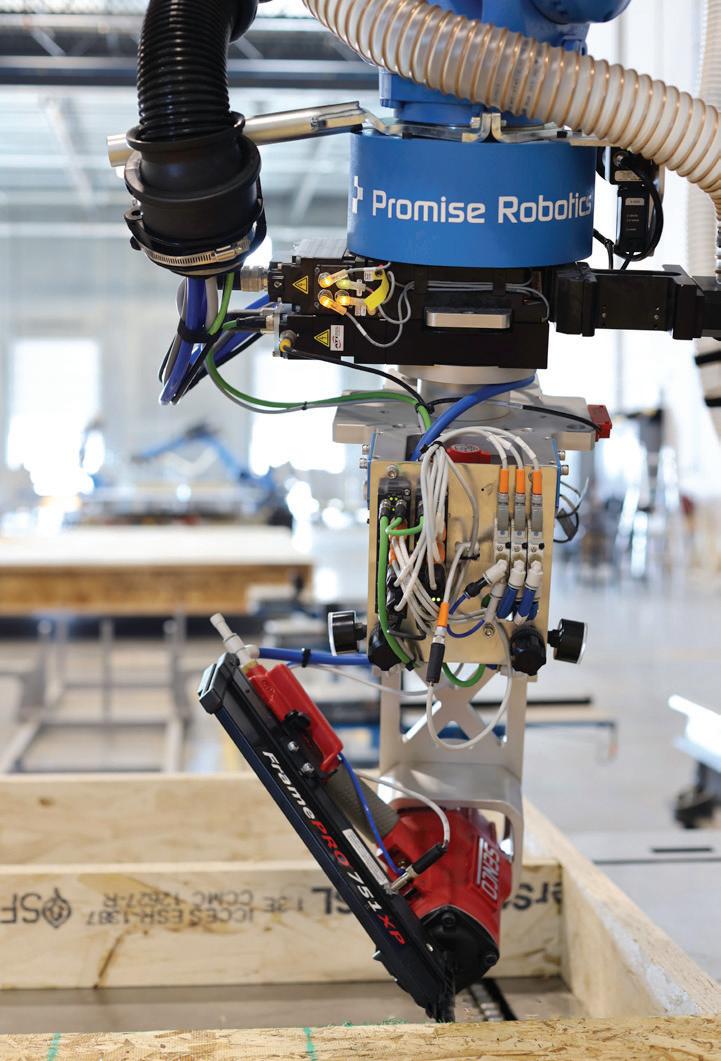

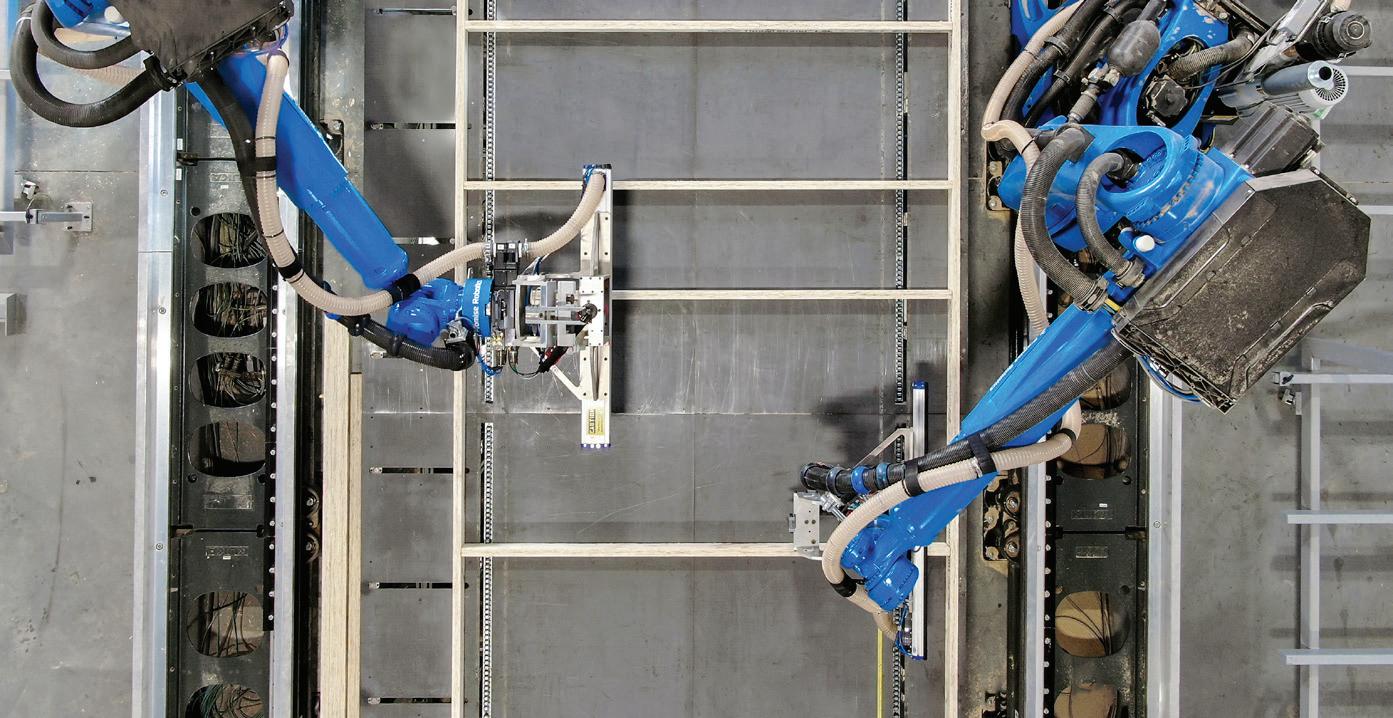

AUTOMATION PROMISE ROBOTICS OPENS AI-DRIVEN HOMEBUILDING FACTORY

VENDOR FORUM AN INTERVIEW WITH STEVE YOUNGBLUT,

An interview with the head of the Canadian Wood Truss Association. Plus: Three operators that are changing the industry

A look at Mission Building Supplies in Edmonton, the recent winner of our Pro Dealer of the Year

Access to ready capital must be weighed against compromising some independence

Economic and HR challenges are reshaping modern fl eet management

An interview with Max De Angelis, the new owner of Target Building Materials in Windsor, Ont.

Easi-Lite® | Type X | M2Tech® | GlasRoc®

Coming in 2025 from North America’s First Zero Carbon** Drywall Production Facility in Montreal

*Up to 60% less embodied carbon as per LCA action plan.

**Scopes 1 & 2

the electronics industry

auto sector, everyone is trying to fi gure out how the trade war is going to aff ect prices in their subsector of the economy

Let’s not make that mistake in the pro dealer universe. It’s consumer confi dence that is threatened, not a specifi c SKU.

You can get a tariff s exemption in your industry and still get hit by the recession.

(And please note that I’m writing this several weeks before you received this issue. So things could already be better. Or worse.)

We reached out to Majid Tasharofi, partner and general manager of Standard Building Supplies, with stores in Burnaby and North Vancouver, B.C.

He first pointed out that reciprocal tariff s are a big issue and he’s seeing the price increases right now.

Canada’s Finance Department has levied “retaliatory tariff s” on almost $30 billion worth of imports from the U.S., eff ective March 4, 2025. Many back- and front-end SKUS from our industry are on that very long list.

As Tasharofi notes, the costs are already hitting his business. From the price of engineered wood products from the U.S. to hardware products made south of the border, he’s feeling it.

But then Tasharofi went one better. And gave some good advice.

“We’ve gone back to basics, which is managing our inventory levels well,” said the TIMBER MART member. “We’ve seen this before with Covid. At some point they are going to come off. In the meantime we need to limit our exposure. Trying to make head or tails of it is an incredibly diffi cult thing to do.”

Pass the costs on and wait for change.

BY STEVE PAYNE Editor-in-Chief

PRO DEALER

steve@hardlines.ca

We’ve gone back to basics, which is managing our inventory levels well. “

Sign-up for Breaking News at Hardlines.ca

latter factor dwarfs the SKU-specifi c raising of prices in certain categories.

Peter Turkstra is the owner of Turkstra Lumber, one of Southern Ontario’s biggest pro dealers (with 11 lumberyards plus a truss plant, a mill, a specialty trim and door division, and an industrial division). He says that it is the consumer behaviour impacts that he worries about the most. He says that, long before tariff s, “we were already in a pretty major recession.”

Tariff s, both inbound from the U.S. and outbound to that country, have only just started to impact the Canadian building supply industry at press time (end of April).

The eff ects are twofold. First, there is the SKUspecifi c impact on the cost of goods. And second, there is the impact on consumer behaviour. This

“[The slowdown] might exceed a 70 percent yearover-year decline in housing. The tariff s have only made it worse,” Turkstra says. “What’s happened, of course, is that people clam up. They have job uncertainty. They have future uncertainty. Either way, they’re anxious and watching this gong show [the tariff s pronouncements]. The last thing they want to do is go out and make major investments.”

On the positive side, Turkstra, says the custom homebuilding side of his business is in better shape. There is a diff erence to the slowdowns by region of the country, said Trevor Small, president of the Lumber and Building Materials Association of Ontario (LBMAO).

Close to the Greater Toronto Area, in Ontario, it’s worse. This is because of the price of houses close to the city. Farther away from the GTA, it’s better, Small says. “And, of course it’s better in certain parts of Canada, like Western Canada, excluding British Columbia.”

The LBMAO has tried to educate its vendor members about the tariff s. Small authored an article called ‘Getting Your Products to the United States under the USMCA.’ It appeared in the latest issue of the LBMAO Reporter.

“One area that has been suggested is to make sure that Canadian made products going south are claimed under the USMCA rules,” Small writes. “The USMCA is the free trade agreement that went into eff ect on July 1, 2020 (the new North American free trade agreement). It was set up so that goods could fl ow from Canada, the U.S., or Mexico without duties.

“One method that looks like it may have some benefi t for Canadian exporters is to have their goods USMCA compliant. Currently only about 38 percent of our exports to the United States fall under the USMCA agreement but a significant majority could go compliant with some work to become certifi ed. To fall under the USMCA, the product is required to be between 50 and 75 percent made on this continent—with documents such as a commercial invoice to certify compliance. It is believed that 38 percent of goods now certifi ed could easily grow to 50 percent of our exports with some work.”

Small outlines the steps that vendors are recommended to follow to qualify for a USMCA exemption on tariff s. They include rules of origin, regional value content, and the technicalities of applying for an exemption. Small’s USMCA document may be viewed at www.lbmao.on.ca

Surrey, B.C.-based Crown Building Supplies, which already had three pro stores in the Lower Mainland of B.C., has acquired ADSS Building Supplies, which has two speciality building materials stores in Edmonton and one in Calgary.

“This acquisition represents an exciting new chapter for Crown Building Supplies,” said Gary Sangha, CEO of Crown. “ADSS has built a strong reputation for reliable service and quality products. By combining our resources and expertise—and with the addition of a major facility in Calgary [a 60,000- square-foot distribution and service hub]—we’re positioned to signifi cantly expand our reach and elevate the service we off er to our customers.”

Will Davila, president of ADSS, added: “We are proud of what ADSS has built and the trust we’ve earned. The acquisition by Crown allows us to bring that legacy into a new era, with greater resources, expanded infrastructure, and an even stronger commitment to customer satisfaction.”

Crown is a member of AD Building Supplies – Canada. The buying group’s VP Paul Williams said: “AD Canada is proud to support its members as they pursue smart, strategic growth. The acquisition of ADSS by Crown refl ects the entrepreneurial spirit and long-term thinking that makes our network strong.”

BMR Group has adopted new marketing, touting its stores as the destination for pros. Montreal creative agency Lg2 is delivering a multi-platform marketing campaign. The messages were unveiled in April through various media in Quebec, Ontario, and the Maritimes, including TV, radio, billboards, and digital media.

The campaign includes 15-second multi-platform marketing spots, all featuring taglines that target the contractor customer: “Pour les vrais” (“For the real ones”), “Built for pros,” “The experts’ centre,” and “Less dryers, more drywall.”

“At its core, BMR is defined by exceptional customer service, a team of dedicated experts, a high-quality inventory, and a well-established

network,” BMR CEO Alexandre Lefebvre said in a release. “This new image reinforces our industryrecognized commitment to quality, while staying true to the core values that have made us successful.”

“We wanted to realign our focus on experts to evolve BMR’s brand positioning and image, to become the experts’ centre for professionals,” Marlène Hins, BMR’s VP of marketing and communications, told Pro Dealer. The marketing campaign, she explained, is “based on three key pillars: local, expertise, and products—the right product and quality.”

BMR, she adds, is “already a destination for the contractor clientele but we wanted to put the focus of our campaign on this very business segment, which is one of the pillars of our growth strategy.” At the same time, the company is also keeping a focus on a more skilled retail customer, “DIYers who aspire to be considered pro,” said Hins.

The new campaign encompasses all BMR brands. “Our brand positioning and marketing campaign include all our banners—BMR, BMR Express, BMR Pro, and Potvin & Bouchard—from smaller stores to larger locations, because they all serve, to a certain extent, the pro clientele.”

BMR Group’s new marketing includes 15-second multi-platform marketing spots and billboards, all featuring taglines that target the contractor customer. The campaign began in April.

“

I think wearing the red shirt means something to people across this country.

100% Canadian.

100% Dealer-owned and operated.

When you join the Home Hardware family, you become part of a tight-knit community that’s free from the pressures of external shareholders. Gain access to a trusted brand with personalized resources dedicated to helping your unique business thrive, plus a coastto-coast Dealer network ready to back you every step of the way.

Home Depot, the world’s largest home improvement retailer, increased its sales to US$159.5 billion in fi scal 2024, which ended Feb. 2, 2025. That’s a 4.5 percent increase.

Comparable sales worldwide decreased 1.8 percent for the year, while comp sales in the U.S. declined by the same amount. Net earnings for fi scal 2024 were $14.8 billion, or $14.91 per diluted share, compared with net earnings of $15.1 billion, or $15.11 per diluted share in fi scal 2023.

The company provided some forecasts for the 2025 fi scal year. Total sales growth would be approximately 2.8 percent. Comp sales would grow about 1.0 percent for the year. Gross margin would be approximately 33.4 percent. Diluted earnings would decline approximately 3.0 percent. The

Lowe’s, the world’s second largest home improvement retailer, suff ered a drop in sales of some 3.1 percent in fi scal 2024, which ended Jan. 31, 2025. Sales were US$83.674 billion. Net earnings for the year were $6.957 billion.

In its February investor call, the company provided an outlook for its 2025 fi scal year. Total sales would be between $83.5 and $84.5 billion—in other words about fl at, and comp sales would be fl at to up 1.0 percent.

Lowe’s made a gambit to try to get some contractors back from Home Depot when it announced on April 14 that it would acquire Artisan Design Group (ADG), of Dallas, Tx. Lowe’s is buying

Home Depot said it would open approximately 13 new stores in North America.

Home Depot executives have disclosed that pros represent about half of its sales—while only representing about 10 percent of its customer base. It has a large edge on Lowe’s, the second-largest home improvement retailer in the world, when it comes to serving contractors.

ADG from private-equity fi rm Sterling Group. The purchase cost Lowe’s $1.33 billion. ADG had revenues of $1.80 billion last year. The company provides design, distribution, and installed services for fi nishing products to new homebuilders. It is a major purveyor of fl ooring, cabinets, and countertops.

“With more than 18 million homes needed in the United States by 2033, we expect new-home construction will be a major driver of pro planned spend for the next decade,” said Lowe’s CEO Marvin Ellison in a release. “The acquisition of ADG allows us to build on our momentum with pro planned spend and it is expected to expand our total addressable market by approximately $50 billion.

About 30 percent of Lowe’s sales comes from contractors, analysts say, compared to 50 percent for Home Depot.

GMS Inc., a leading GSD based in Tucker, Ga., with a Canadian division, released its third quarter results for the period ending Jan. 31, 2025.

Net sales increased 0.2 percent in the quarter to US$1.26 billion, while adjusted net income was $36.2 million or $0.92 per diluted share.

“Our results in the quarter refl ect the impact of soft end market demand and steel pricing, both of which deteriorated meaningfully during the last half of the quarter, ultimately driving both lower-than-expected sales and gross margin compression, despite experiencing price and mix

improvement in wallboard and ceilings,” said John C. Turner, Jr., president and CEO of GMS.

“Economic uncertainty, general aff ordability, and tight lending conditions, combined with adverse winter weather disruptions, all contributed to reduced levels of activities in each of our end markets.”

GMS was founded in 1971. It operates a network of more than 300 distribution centres with extensive product off erings in wallboard, ceilings, steel framing, and complementary products. In addition, GMS operates nearly 100 tool sales, rental, and service centres. It mostly serves the residential and commercial contractor customer base across the U.S. and Canada. GMS acquired Yvon Building Supply, Toronto, in July 2024, for an aggregate purchase price of up to CAD$196.5 million. And it previously bought two other dealers in Canada during the fi scal year that ended April 30, 2024.

The Government of Canada, in its 2024 budget, announced $50 million over the next two years for a Homebuilding Technology and Innovation Fund. The feds did this because they said that Canadian homebuilders need to triple the rate of housing production to meet demand projected for 2030. And there’s more.

Ottawa also said that the unit cost of building homes needed to drop by 54 percent. And carbon emissions needed to drop by more than 20 percent per home. And labour productivity needed to increase by 60 percent to compensate for a shrinking workforce.

Pursuant to these goals, NGen (Next Generation Manufacturing Canada) has announced its first cohort of projects through its “Advanced Manufacturing Homebuilding Challenge.”

A press release on March 21 said that “NGen’s initial investment of $33 million has spurred an

additional $62 million in industry investment to launch 12 project consortia involving 33 partners from across the country.”

While NGen is an “industry-led non-profi t organization,” its press releases say, this is a project of Ottawa’s Ministry of Innovation, Science and Economic Development Canada.

The 12 projects listed in the first round of funding include a robotics and digitalization project for modular wood construction in Montreal and Carleton, Que., a rapid modular housing facility in Ancaster, Ont.; an advanced manufacturing for aff ordable home building project in Guelph, Ont.; a mass timber urban housing platform in the Vancouver area; and micro-factories for aff ordable prefabricated housing in the Yukon.

Learn more and see the complete list of projects at ngen.ca.

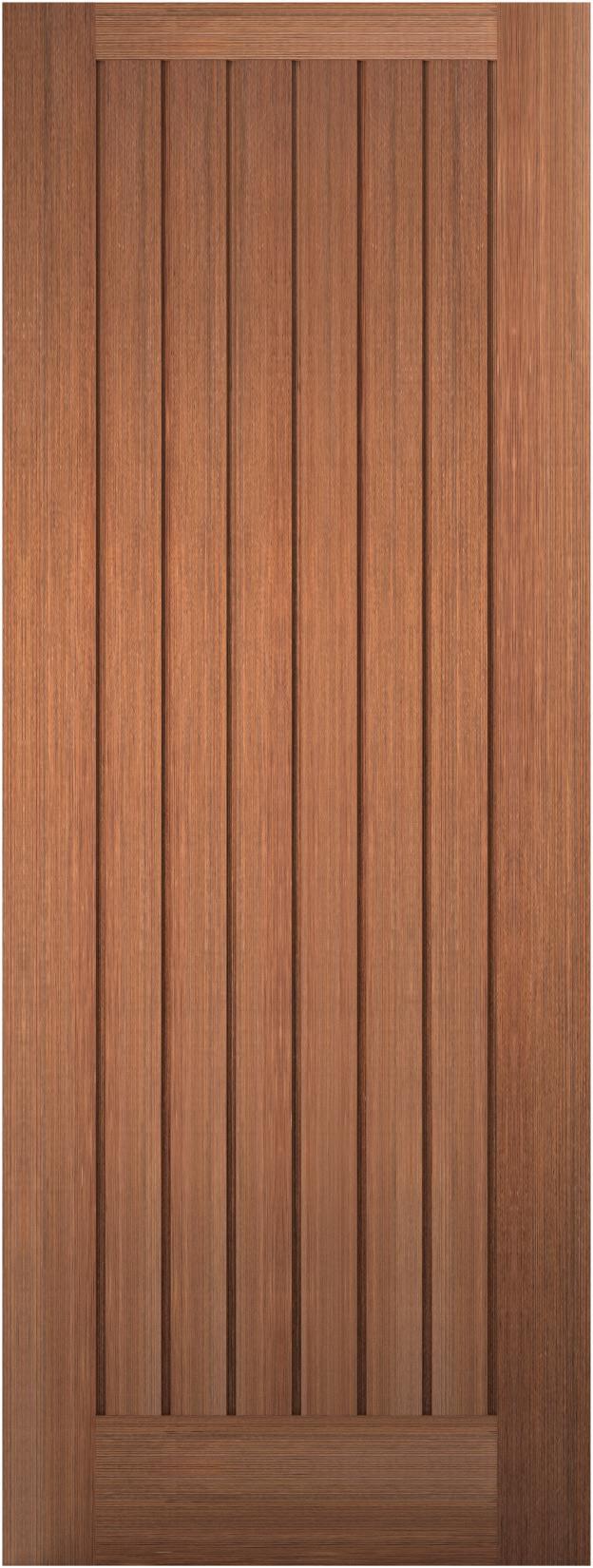

Bruster rustic knotty alder fibreglass door

Bruster showcases rustic European design with timeless craftsmanship. Inspired by traditional countryside homes, it features a Knotty Alder fibreglass wood grain complete with unique knots, enhanced by the Cashew stain that highlights its natural beauty. Curved lines, carved details, and metal accents like clavos and speakeasy grilles evoke historic architectural charm. More than an entryway, Bruster is a statement piece, blending old-world elegance with modern appeal for those who value rustic aesthetics. mastergrain.com

Pro window and door polyurethane foam sealant

Great Stuff Pro Window & Door Polyurethane Foam Sealant quickly and cleanly forms airtight, water-resistant seals between framework and rough openings with the precision professionals expect. The sealant expands and contracts to allow for various weather conditions. It is reusable for 30 days when left attached to the Great Stuff Pro dispensing gun. It bonds to vinyl, wood, and metal frames and is available in a yellowcoloured foam for high visibility. dupont.com

JWC8500 vinyl windows

As climate change reshapes the way we live, Canadian homeowners are facing new challenges. These windows are energy efficient, delivering products that reduce energy consumption, lowering reliance on heating and cooling systems, leading to lower energy costs and a reduced environmental impact. Maximizing energy efficiency, durability, and style, these windows not only enhance the comfort of Canadian homes but also promotes environmental responsibility.

jeld-wen.ca

Select symmetrical patio door

The Select Asymmetrical Patio Door is a premium vinyl sliding door that delivers practicality, performance, quality, and affordability in one package. An adjustable Teflon slide ensures smooth and effortless operation for long-lasting durability. A positive interlock system reduces air infiltration, improving energy efficiency and comfort. Designed for enhanced energy efficiency, it’s available in an eight-foot width with a three-foot operator and five-foot fixed panel.

kohltech.com

The Hybrid Flexible Depth Door System is designed to accommodate modern construction methods, including insulated concrete forms (ICF) and other deeper wall depths up to 10-5/8 inches. It easily integrates with ICF and other deep wall structures, ensuring seamless installation in various building projects and providing structural integrity while allowing for effortless installation. The addition of an aesthetic screw cover ensures a polished, professional finish. Available in both dual and triple glazing. kohltech.com

A fastener-free way to prevent water intrusion

A self-adhering butyl flashing that integrates with DuPont air and water barriers, DuPont FlexWrap is a one-step solution for keeping water from seeping through window and door sills. The selfadhered flashing does not require mechanical fasteners, even in flexed corner areas around building openings. This allows it to provide easy, one-step insulation for hard-to-seal corners around windows and doors. It’s effective across a range of window and door designs and a wide range of typical wall substrates. dupont.com

Chantelle is a sophisticated blend of elegance and character that refreshes the classic plank door design. This design enhances various home styles, from traditional to transitional. Available with horizontal or vertical simulated divided lites. Featuring high-quality construction and thoughtful details, this door showcases craftsmanship for those who appreciate both form and function.

mastergrain.com

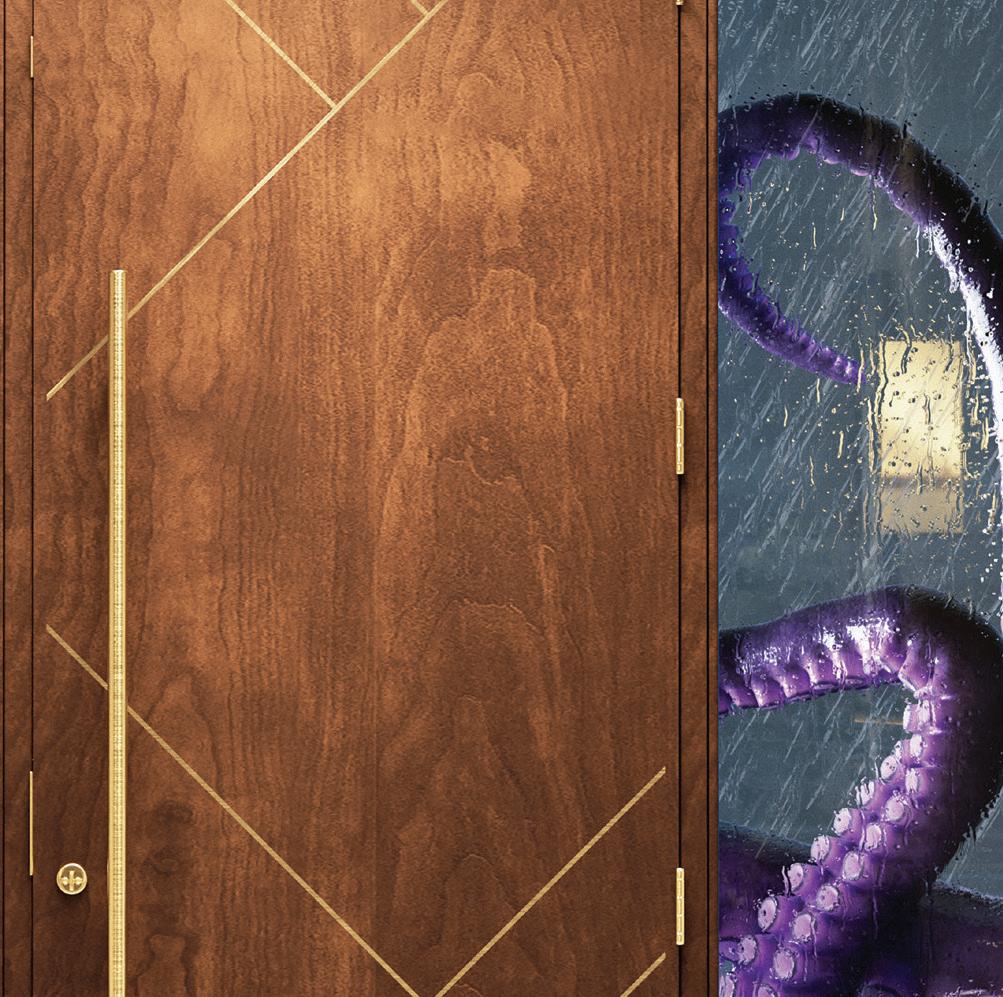

Logan contemporary cherry stainless inlay door

Logan delivers a sophisticated and distinctive presence that is ideal for those who appreciate modern design. Rooted in purposeful minimalism, this door showcases strong lines that off er a fresh aesthetic. What sets Logan apart is its use of contemporary black mirrored stainless-steel inlays paired with a bold black tone-on-tone finish to create an elevated element of surprise. mastergrain.com

By Steve Payne

Warren Cinquina is vice-president of operations at London Truss, in London, Ont. It’s an independent truss plant with one unusual aspect— it’s the only truss plant in Canada that makes its own truss connectors.

Cinquina has been working for London Truss, which is celebrating its 50th anniversary this year, since 1989. He has an applied math degree from Western University—and an MBA.

London Truss is owned by Sam Rattazzi, whose father started the business.

Cinquina is the current president of the Canadian Wood Truss Association (CWTA). Pro Dealer

An interview with Warren Cinquina, president of the Canadian Wood Truss Association (CWTA)

interviewed Cinquina about the future of the truss industry in Canada.

The capital expenditure required to open a truss plant must be big. There’s all that technology, for starters.

Well, the technology is not in its infancy. But, yes, the CapEx required for a truss plant is fairly big because of the amount of steel required as far as the tables, the presses, and the equipment to move large trusses. If you take our truss presses, which have been in operation now—some of them—for over 20 years, just to retool them is a big expense. When we retooled one press out of eight, it was $80,000. And the saws are three-quarters of a million dollars now because of the technology.

The workers cost a lot of money as well. Isn’t technology reducing the amount of labour?

Yes, but now you have to have a worker who understands all that complicated equipment in your plant, in case it breaks down. Or you have to have somebody on call who understands that equipment, like an electrical technician or a computer technician.

From time to time a lumberyard will buy a truss plant. What are the challenges they typically face?

The big challenge is the diff erence between a truss plant and a lumberyard. Now, they’re starting to get it because they’re leaving truss guys to run truss plants. But I remember when Cashway bought their first truss plant near Peterborough [Ont.], a few decades ago. They found out that the production culture is completely diff erent. I’m not going to say that it’s easier to run a lumberyard but the skill sets to be successful are diff erent. Truss plants tend to focus on design and production. Whereas lumberyards require extremely complicated logistics and retail customer support.

Is the evolution of truss plants leading them to sell more ancillary products, other than the roof and fl oor trusses they make themselves?

Yes, we are a reseller who carries LVLs. And now some truss plants have moved into panelization. But we [at London Truss] haven’t gotten into the panel game yet. But the margins with wall panels are thinner. You’re basically nailing a square together. And

you’re always going to get beat by a framer with low overheads uless it’s a large project with an economy of scale. So, unless the market changes where you have a labour shortage for framers and margins get higher, you may as well focus on trusses.

Some custom home builders complain that they can’t get trusses without long lead times because of tract builders doing deals with truss manufacturers. Is this a real national problem or just a regional problem?

I think it’s regional. You’re just going to base your business on what you think is going to make you the best money, right? It’s going to be based on whatever you think is going to be your best practice.

Canada has some truss manufacturers that are great at dealing with larger builders. At London Truss we aim to provide service to all types of builders. Between Sam and I, our combined experience is probably 60 years. We’ve seen everything and we’ll take on any project. The contractor who says, ‘Oh, these plants won’t do this or this plant will only do this,’ is likely regional. Or maybe they just called one or two plants.

At London Truss, you make your own truss plates, which is unusual among Canadian truss plants. How did you make the decision to fabricate your own?

We’ve been punching plates almost as long as we’ve been doing trusses. It’s just something we do. Again, we’re kind of truss geeks here. We’ve been doing this for a long time. Part of our vertical inte-

When you design a truss, it’s kind of like music, an orchestra. It has to be 100 percent. If you send it to the jobsite and it doesn’t fit, it costs you a lot of money. “

gration was to start stamping our own plates and managing our own software and testing, et cetera. I’ve been on the board of the Truss Plate Institute of Canada [TPIC] for about 25 years. I believe our work with TPIC contributes to the skill of our design and engineering departments.

Speaking of associations, what are the big issues that you as an industry are working toward?

Quality control, standards, and tolerances. Back in the day, there were no tolerances. And so, TPIC created an appendix of tolerances for plants to go by. And that turned into a national quality standard. Recently, the TPIC manual made quality control mandatory. Since the National Building Code of Canada recognizes the TPIC manual for quality control, it’s now mandatory for all truss plants in Canada.

There is a consolidation happening in the truss industry, just like other industries. Can you comment on that?

The market’s looking for it, right? You have a lot of cottage plants, mom-and-pop shops, from the 70s or 80s. They might even be second-generation and ready to retire now. Some of these plants, they’re in good locations, they’re strong plants, they’ve got great people. And consolidation really helps a lot of these employees in the industry. It’s not a bad or a good thing. It’s just an opportunity that exists.

“Being a part of Sexton Group has signi cantly elevated our business. Even though they have over 450 members across Canada, we always feel heard and valued as if we are part of the Sexton family. Their powerful network of members across the country has been invaluable, providing us with insights and connections that have helped us grow. They excel at connecting suppliers with members, ensuring we have access to the best products at the most competitive prices. We couldn’t be more pleased with our partnership.

Markus Lange, EG Penner Building Centre

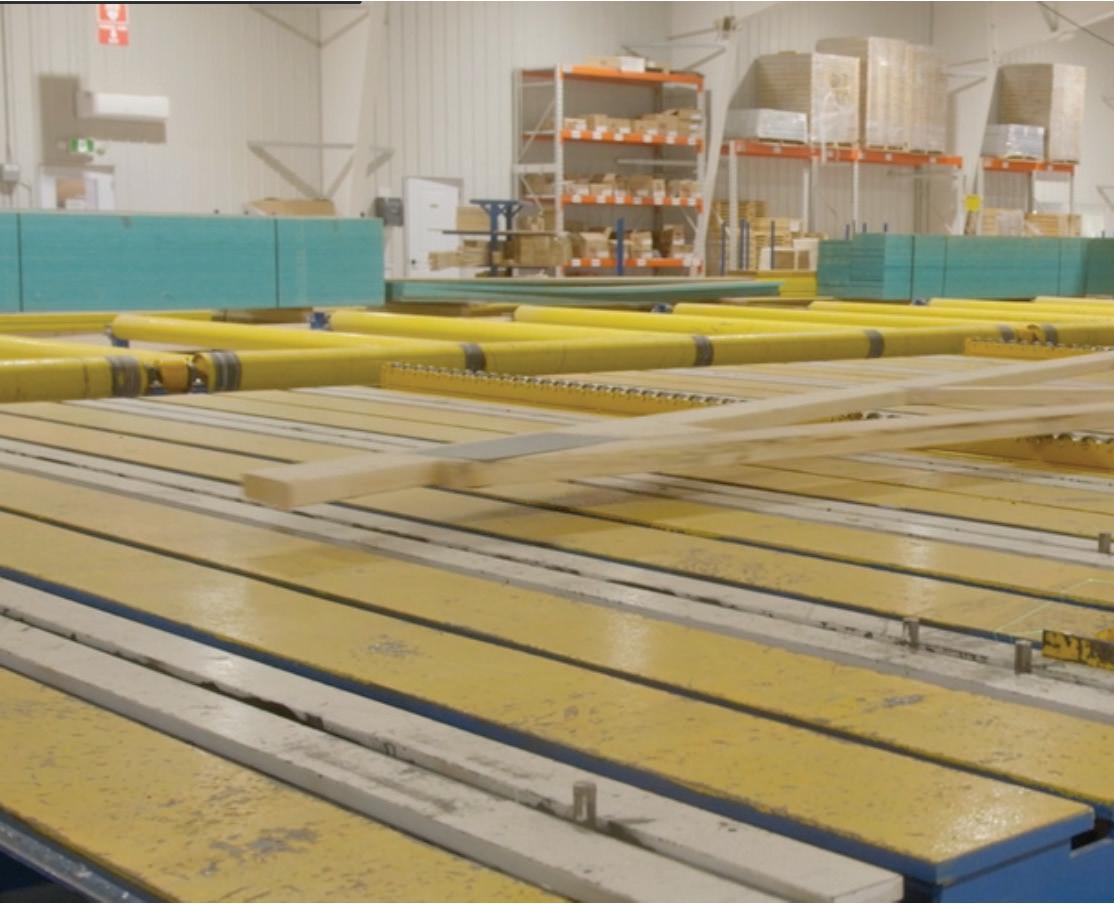

Island Structural Systems Inc., the province’s newest truss plant, adds a second line

Island Structural Systems Inc. (ISSI), which opened in Kensington, P.E.I., in January 2024, is adding a second production line.

GM and owner Matthew Bowness said the idea for opening ISSI was based on truss shortages in the province. “The lead times for builders could be eight to 12 weeks even before Covid.” It got worse when the Covid boom in homebuilding hit. Then, the island was facing up to a six-month lead time for trusses. Not an acceptable situation, Bowness thought.

He gathered investors together, and was helped in his fundraising by the Atlantic Canada Opportunities Agency (ACOA). It put a “repayable contribution” of $2 million into the mix.

This is ISSI’s second year of business. And the roof and fl oor truss manufacturer is adding a second production line. Something that the business plan for ISSI didn’t predict until year fi ve, Bowness said.

This is a truly independent truss plant. It sells to every channel it can: building supply dealers, home-

builders, farm building contractors, commercial clients, plus homeowners building their own homes.

The 25,000 square foot facility is state-of-the-art, with high-tech Simpson Strong-Tie equipment that builds a lot of trusses at a high rate of speed. The plant also makes laminated veneer lumber (LVL).

P.E.I. is now self-suffi cient in trusses. Bowness said he doesn’t have to search farther afi eld, for example to New Brunswick, for customers. ISSI opened with 18 employees in January 2024 and now, with the new production line coming on-stream, that is expected to increase to 32 employees.

Island Structural Systems’ 25,000 square foot facility is state-of-the-art, with high-tech Simpson Strong-Tie equipment that builds a lot of trusses at a high rate of speed.

Iranian

Born in Iran, Hadi Abassi came to Canada in 1982, when he was 26. Like many immigrants, he went to work at McDonald’s—not an auspicious start to his corporte career.

But Abassi had grander goals in mind. During a previous stint in the U.K., he had picked up a degree in mechanical engineering from Swindon Technical College. He gravitated from McDonald’s to construction, becoming a salesman for windows.

In 1999, he’d saved enough in 15 years to plunk down $45,000 to purchase a tiny truss plant in Nanaimo, B.C. It had revenues of $95,000 a year.

Fast forward to today. Hadi Abassi is one of the most important consolidators in the truss manufacturing industry in Canada. His company, Atlas Engineered Products (AEP), owns eight truss plants in four provinces. AEP is publicly-traded on the TSX Venture exchange—and it’s really just getting started.

Atlas Engineered Products owns eight truss plants in four provinces.

AEP will bring the capital to the mom and pops, technology will be brought in, and Canada will become a world leader in the factory assembly of housing components. That’s Abassi’s vision.

When he took AEP public in 2017, Abassi says, revenues were $8 million. Revenues peaked at $61.9 million in 2022, before falling commodity prices post-Covid led to a 20 percent drop in sales in 2023.

AEP started acquiring truss plants in 2018, when it bought its second facility, Clinton Building Components, in Southern Ontario. Two other truss plants would follow that year: Satellite Building Components, in Eastern Ontario. And Pacer Building Components, in Southwestern Ontario.

AEP and Abassi are not coy about outlining their game plan for Canada’s truss, wall panels, and engineered wood products industry. It’s a “fragmented industry populated by independents unable to invest in transformation,” AEP says on its website.

In 2019, AEP bought South Central Building Systems in Carman, Man. In 2020, it purchased Novum Building Components in Abbotsford, B.C. In 2022, the company acquired Hi-Tec Industries, on Vancouver Island, just 17 km from AEP’s original plant in Nanaimo.

A big deal was next. AEP acquired New Brunswick’s Léon Chouinard et Fils (LCF) for $26 million in cash. LCF generated $25.7 million in revenues in 2022.

Hadi Abassi is one of the most important consolidators in the truss manufacturing industry in Canada.

Finally, in December 2024, AEP acquired 42 acres of land in Colborne, Ont., 140 km east of Toronto. There, AEP plans to build a high-tech housing components factory.

A division of United Lumber Home Hardware Building Centres, this manufacturing facility is state-of-the-art

As befi ts one of the largest Home

Hardware pro dealers in Canada, United Lumber has a state-of-the-art truss plant, United Truss, located in Innsifil, Ont., an hour north of Toronto.

United Lumber operates yards in Barrie, Bolton, and Georgetown, Ont.

David Sandke, operations manager at United Truss, refl ects on the decision of ownership to get into the truss plant business in 1997.

David Sandke

“We bought a little truss plant called Action Truss. We took it over, rented the building that it was in,” Sandke recalls [this was three years before he started working at the truss plant]. “It was a learn by trialand-error type of idea. We had old technology. We had C-clamps and old saws and old wooden fl ip tables.”

When ownership saw truss sales taking off, if they got high-tech equipment, a decision was made. The Innisfil plant opened in 2004.

The automated laser system and the “pucks” that press the truss plates into the lumber, are expensive. Like about $15,000 to $20,000 apiece for each

United Truss is perfectly positioned an hour north of Toronto. From this location, it can serve a huge territory.

Before United made the investment of millions of dollars, we did a lot of time studies.”

puck, Sandke calculates. “That’s a million dollar investment for just one line, allowing for American dollars,” he says. And United Truss has four such lines.

United Truss is in the custom homes business. The old-fashioned way of building trusses, with manual pucks (not laseroperated), wouldn’t cut it in United’s sector.

“Back in the day, when we had just regular pucks and the metal tables, we could be 30- to 45-minutes for a setup of one truss. And there’s a lot of one-truss setups in the custom home business. As you can imagine, it’s ineffi cient.”

Before United Truss made the investment, “we did a bunch of time studies,” Sandke said. “Because of that investment, we turned 30 minutes into 30 seconds.”

By Steve Payne

Mission Building Supplies won the Best Pro Dealer award at the 2024 Outstanding Retailer Awards. It’s a testament to five generations of the Clement family

The Clement family has a long history in the lumber and building materials industry in Western Canada.

The patriarch of the family, Thomas Franklin Clement (1855-1932), was born in the farm town of Elderslie, Bruce County, Ont. By about 1902 he was the first operator of the Home Lumber Yard in Sanford, Man., where he had a farm at the edge of town. He was also the first grain buyer for the community’s grain elevator that had been built along the recently established Canadian Northern Railway.

114 Avenue NW, Edmonton

WAREHOUSE SPACE: 45,500 sq.ft.

LAND: 6.0 acres

FOUNDED: 1985

BUYING GROUP: Castle Building Centres Group

142 Street NW, Edmonton

BUILDING SPACE: 24,000 sq. ft.

LAND: 4.3 acres

ACQUIRED: 2023

BUYING GROUP: Castle Building Centres Group

The second generation of the family to be in the LBM industry was Russell Robert Clement (18871962), the second son of the Sanford farmer. He rode the rails on the Prairies, setting up lumberyards for Monarch Lumber, accompanied by a competing agent for Beaver Lumber.

The third generation of the family to work in this industry was Thomas Clement Sr. (1928-2004). He was born and raised in Saskatoon, and started out in the LBM industry much like his father. He worked for Canfor Lumber and Revelstoke Lumber Co., moving through the cities of Brandon, Man.; Humboldt, Sask.; and Calgary, among others. With three partners, the senior Tom Clement started Westwood Forest Products in Edmonton.

Tom Clement II and his wife, Karen, purchased Mission Building Supplies in the Edmonton suburb of St. Albert in 1985. They bought the yard from Al Pitchko, who had once worked for Tom Clement Sr. at Canfor. Pitchko remains a worthy competitor to Mission with his Mr. Plywood business.

After relocating the store in 1990, Tom and Karen engaged in a tremendous period of growth. Don Clement, one of their sons, joined the family enterprise in 2004. He assumed leadership in 2022 and currently serves as Mission Building Supplies’ president.

LINE OF CONTINUALLY INNOVATIVE INSULATION DEDICATED SUPPORT FROM YOUR JM SALES TEAM

PERFORMANCE THAT MEETS EVOLVING CODE REQUIREMENTS THE

When Don Clement joined the business two decades ago, he said he knew where the success of the yard came from. “It was the deep-rooted passion my father, grandfather, and generations before them had for this industry.”

“The passion is not limited to the family but extends to our dedicated staff, many of whom have made Mission their home for numerous years,” he observed. The business has 58 full-time employees.

“Our team at Mission comprises exceptional individuals with extensive tenures,” Don wrote in

Karen Clement was 30 when she and Tom acquired Mission Building Supplies. Before that, Karen had worked at two financial institutions in Edmonton. She had worked her way up from being a teller to the personal and commercial loans department.

his Outstanding Retailer Award entry. “We have shipper/receivers and engineering technologists who have been with us over 20 years, multiple truck drivers with over 15 years of service, a sales team with members exceeding 10 years, and retired sales staff who dedicated over three decades to Mission.”

The customer base, 75 percent of which is contractors building new homes, has been loyal, too. Many of those builders have extended for two generations, “mirroring our own family’s generational involvement,” Don said.

She learned self-confidence when she was sent to collect $800 from a member of a motorcycle gang. Repossession of the man’s prized possession, a Harley Davidson, was in the cards. “He took out his pocket and fl ipped out all the money he owed us,” Karen recalls.

The male domination of the lumber industry didn’t bother Karen. Around 2010 she became the first female chairperson of the Western Retail Lumber Association (WRLA, now called Supply-Build Canada). “Being in a man’s industry, they didn’t understand my personality,” Karen says. “It was tough.

At that time, I was the only woman on the board.”

Karen looks at her financial training as the perfect background for being a business partner of a lumberyard. But she knew next to nothing, at first, about the lumber industry. A lot of it she learned from her husband’s father, Tom Clement Sr.

“Tom’s dad would sit with me and we’d have lunch together regularly. He would teach me all about the industry. He would explain all kinds of stuff, such as lumber gradings, board feet, and how to read the stamp on a 2x4, or on a sheet of plywood.”

Karen and Tom Clement first purchased the business, then located in the Edmonton suburb of St. Albert, in 1985.

Mission’s mission statement is “Old School Service for Today’s Builders.” Don refl ects on those six words. “It’s not just a set of words, it’s a legacy that traces back to my grandfather. It embodies the core values of hard work and honesty that have guided us through the years. This belief instills the notion that, at the end of the day, you should feel a sense of pride in your accomplishments, in how you’ve assisted others, and in upholding the traditional values of an honest day’s work.”

Mission’s primary focus is on Edmonton and its surrounding communities, although they have also delivered materials to contractors in northern B.C., Saskatchewan, Manitoba, Ontario, and Alaska.

Sourcing lumber from top-tier mills is a priority to ensure Mission’s customers can construct high-quality homes.

The store functions on effi ciency and is able to complete 90 percent of its deliveries on the same day or the next day. The sales team conducts job estimates at no charge and can also provide complimentary site visits.

“The passion is not limited to the family but extends to our dedicated staff, many of whom have made Mission their home for numerous years.

One of the biggest feathers in the cap of the new president, Don Clement, shortly after he assumed the leadership role in 2022, was the acquisition of Edmonton Roof Truss in the fall of 2023. He acquired the truss business in partnership with his wife, Nicole Caney-Clement. The addition of a truss plant to Mission Building Supplies marked the first signifi-

cant extension of the business since it transitioned from a retail to a contractor-based model in 1990.

“Despite encountering some challenges during its first nine months of operation, we are thrilled about the plant’s potential to thrive independently and contribute to the ongoing expansion of Mission Building Supplies,” the company wrote in its Outstanding Retailer Award entry.

We’ve been doing this long enough to know that control leads to consistency. With decades of experience, long-standing mill partnerships, and the latest technology integrated at our treating facilities, Taiga Exterior Wood performs and looks the part job after job. Taiga treated wood is

Edmonton Roof Truss has been building trusses since 1978. It provides Alberta and surrounding provinces and territories with roof, fl oor, and garage trusses. It also supplies its customers with engineered wood.

In spite of the big news that the truss plant acquisition made in the industry, Mission has not really stopped growing since the outset. The original store, when it was acquired, was 4,000 square feet and had a couple acres of yard space.

In 1990, Mission moved to a 6,000-square-foot building in Edmonton. And in 1995 it moved to its current location, occupying at that time 9,500 square feet and 4.5 acres of yard. In 2015, Mission purchased the building next door and could now boast a combined space of 36,000 square feet of warehouse and six acres of yard.

“

Old School Service for Today’s Builders is not just a set of words,” Don Clement says. “It’s a legacy that traces back to my grandfather.”

Tom Clement II recalls living in Humboldt, Sask., where his father was managing a Revelstoke

Lumber Co. yard. “I would have probably been fi ve years old,” he said. “My father would go down there on a Saturday to do his paperwork. My job was to pick up all the pieces of string and banding that held the lumber together and sweep out the saw shed. I got 25 cents a day to do that.”

“Another recollection of my father was during the Calgary Stampede. Dad would take one of the [Revelstoke] delivery trucks and put the hoist part way up. He nailed bleachers on the deck so people could sit and watch the Stampede parade go by.”

Tom Sr. was at a Canfor function when he heard

Al Pitchko say that he’d like to sell his yard in the suburbs of Edmonton.

“The company wasn’t that expensive, but the inventory was,” Tom said. “We ended up borrowing money for the inventory from my dad to get started.”

A pivotal decision was made in 1990, fi ve years after Tom and Karen bought Mission. They decided to relocate the business to Edmonton and concentrate exclusively on serving contractors.

“We moved into a really dirty, grungy quonset hut,” Tom recalled. “We set up the business there and got it all cleaned up. The owner said, ‘Oh, you’ve got it looking nice! I think I’ll sell.’”

“Tom got very annoyed,” Karen said. “He left the offi ce and drove about three blocks away and came across a building that was for sale. We bought it with little money down and three mortgages.”

BySarah McGoldrick

spite of

that Canada’s housing shortage is offering to pro dealers, the industry is being hit by multiple headwinds right now. Trade wars and fears of a recession (and simultaneous inflation) have damaged consumer confidence.

As a result of these economic pressures, fleet managers are being forced to find new ways to mitigate the impact. Delivering the goods has never been more demanding.

Hamilton, Ont.-based Turkstra Lumber has been delivering LBM across Ontario since 1953. Peter Turkstra is the third-generation owner. He’s a chief executive officer who has seen the economy weather many storms. Yet his company has always found innovative ways to pivot and grow.

The company’s primary customers are 75 percent contractors and 25 percent retail, with a recently added e-commerce component to expedite orders

and delivery. The company has 11 locations and five specialty divisions.

Pro Dealer contacted Peter Turkstra about fleet management, primarily. But Turkstra wanted to talk about the impact of the tariffs, excessive development charges from municipalities, and other industry impediments to growth.

He noted that struggles with fleet management were well underway before the pandemic. It created vehicle shortages and made supply chains unpredictable—long before the tariffs.

“The cost of any kind of vehicle is dramatically higher than it was 10 years ago, off-the-charts higher,” he said. He noted the sharp rise in the cost of boom trucks and Moffetts—even before the tariffs. “The cost per dollar-kilometre is just dramatically higher than it used to be.”

There are so many Turkstra Lumber customers— the company has some 3,600 accounts—that rising

Matériaux J.C. Brunet, a member of BMR, is one of the bigger pro dealers in the province of Quebec. Shown here is part of their fleet at their Saint-Joseph-du-Lac location.

The cost of any kind of vehicle is dramatically higher than it was 10 years ago, off-the-charts higher.

delivery costs are not incremental. Peter Turkstra pointed out that, for most pro yards, delivery charges have not kept pace with behind-the-scenes costs and wage inflation.

To mitigate the negative impact, the company has developed a coordinated delivery structure utilizing a small team that reviews every order and determines the best place to send it from.

“It might be central out of Stoney Creek [Ont.], which is our central distribution yard, or it could be that they fired it off to a local branch. Part of that would depend on what’s being ordered, and the timeline, and also where the inventory is.”

Specialized equipment for rooftop delivery is expensive, Small said. “It costs a lot to buy new, and it is expensive to maintain. Truck-mounted forklift costs have almost doubled since I bought my first one in 2008.”

“Customers, either tradespeople or retailers, do not want to pay those costs. I never was able to get a perfect solution to have delivery costs paid for by our customers.”

Trevor Small, president of the Lumber and Building Materials Association of Ontario (LBMAO), told Pro Dealer that meeting delivery challenges is a constant concern for his members.

“In the building materials industry, the trade-off has always been how to recover the cost of deliveries while not having your customer look to other suppliers,” he said. Small has worked for both suppliers and a family retail operation in his career.

He said each pro dealer has to determine how much delivery recovery they are willing to include and how much they think the customer will pay.

Meeting and fulfilling government and insurance company regulations is another problem for small fleet operators, Small said. Larger fleets may have specialists who can devote the time to keep records for both equipment and operators.

Achieving this, he said, starts with having a competent point person to manage the maintenance and record-keeping. He said finding and keeping that key person is a challenge in today’s marketplace—as is the driver shortage.

“It is important to hire drivers who want to be in the role you are hiring for. Many operators are just

placeholders and are willing to move on if they think the grass is greener. I tried to make hires who fi t into our organization’s culture,” Small said.

The important question is: what motivates an employee?

“Some want just money; others want time off. Some are looking to advance into more prominent roles. While driving is a skill that is important, and we took new potential hires on the road to see how they performed, it is not the only thing.” The correct fi t to your business can help keep someone long-term.

Then there’s demographics. An ageing population will lead to a significant deficit in drivers in the near future. New data from Immigration Canada shows that the country could face a shortage of over 25,000 truck drivers by 2025, and more than 55,000 by 2035.

“

Companies can also benefit from route optimization tools and strategies to reduce fuel usage and drive time.

downtime, causing disrupted operations as an ongoing challenge for fl eet managers.

Additionally, he said, ensuring the company is maximizing assets is key to maintaining both efficiency and profi tability.

“Effi ciency starts with smart routing—optimizing routes to cut down on unnecessary travel is essential. Reducing dead calls and dead miles makes a big impact. Investing in fl eet management software is also crucial for real-time tracking and data-driven decision-making,” Cyr said.

And as economic challenges continue to rattle the industry, however, Cyr predicted further shifts in fl eet management.

“I would estimate that at least 60 percent of framers [in Cyr’s marketplaces] do not have projects right now. They’re not working. They’re on the sidelines. It’s expected that new home construction may be off over 50 percent this year, year over year. And that’s not because of the tariff s, by the way. That’s pre-tariff s. We don’t even know how much worse it’s going to get.”

Ray Cyr, president and CEO of RONA Fraser Valley Building Supplies Inc., a six-outlet operation in British Columbia, said that one of the biggest challenges fl eet managers are facing is keeping their fl eet on the road. He pointed to unpredictable maintenance costs, leading to unexpected vehicle

As fl eet managers grapple with a more tense trading situation at the border between Canada and the U.S., Cyr warned that businesses involved in cross-border shipping should expect signifi cant customs delays in the future, resulting in “wasted driver hours.”

Paired with increased fuel prices and higher costs for new trucks and replacement parts, Cyr warned

this can strain budgets and disrupt fleet planning. Preventive maintenance is key.

“It helps avoid costly breakdowns and unexpected repairs,” Cyr said. “Replacing ageing units before they fail can save money in the long run. Companies can also benefit from route optimization tools and strategies to reduce fuel usage and drive time,” he said.

In 2024, Home Hardware announced the addition of two Volvo VNR electric trucks to its fleet. The company noted that these vehicles were the first zero tailpipe emission vehicles to join the banner.

The trucks were added to the fleet to handle last-mile deliveries from the company’s distribution centre in St. Jacobs, Ont., to stores within a radius of 100 to 150 kilometres.

“Currently, we have two electric day cab trucks operating out of our St. Jacobs distribution centre, and we’ve recently added a new electric yard (shunt) truck to support operations on-site. The feedback from our drivers has been overwhelmingly

positive,” said Jason Libralesso, director of transportation at Home Hardware Stores Limited.

Libralesso added that some of his drivers were initially skeptical but have quickly embraced the EVs. They appreciate the quiet, smooth ride and have found the power and performance more than adequate.

“This kind of reception is not only encouraging, it’s great for driver retention and helps attract future talent to our fleet,” he said.

The EVs are used for daily store deliveries and shuttling between Home Hardware’s satellite warehouses. The electric shunt truck, which has been operational for about a month, is “performing very well,” according to Libralesso. “Traditional shunt trucks are notoriously loud, so this EV significantly improves the working environment and makes our yard operations quieter, not just for our team but also for our neighbours.”

Libralesso added the company is continuing to optimize routes to expand the use of these EVs and is actively exploring opportunities to add more as technology and infrastructure continue to advance.

Discover

Enhance your exterior with DAVINCI Intense Board & Batten –our premium vertical vinyl siding panels designed for exceptional durability and standout curb appeal. Now available in three rich, dark colours, this collection brings a modern twist to rustic charm, delivering a striking, high-end look to any home.

By John Caulfield

On Jan. 13, RONA inc. and its owner, New York City-based private-equity firm Sycamore Partners, completed their acquisition of All-Fab Group (AFG), a Manitoba-based building materials distributor whose 18 locations serve retailers in Western Canada and the U.S.

As is often the case when private equity gets involved, this acquisition gave rise to unanswered questions about its financial terms, its strategic purpose, and how RONA planned to integrate AFG into its network and operations.

RONA and Sycamore acquired AFG from funds controlled by PFM Capital and Roynat Equity Partners. Those two private equity firms, along with BDC Capital, are majority stakeholders in Sexton Family of Companies (SFOC), made up of fi ve busi-

Canadian private equity is interested in wetting its investment whistle on the building-supply sector.

nesses that include Sexton Group and Kenroc Building Materials. In 2022, when PFM, Roynat, and BDC secured their current ownership stake, they framed that transaction as providing the means for SFOC to continue to execute its growth strategy nationally.

Sycamore acquired RONA and other Canadian retail assets from Lowe’s Cos. in early 2023. In a fire sale, Sycamore paid US$491 million in cash for RONA (less than one-fifth of what Lowe’s paid in 2016), plus a performance-based contingent consideration with a fair value of US$21 million. At the time of the Sycamore deal, RONA, with 232 corporate and 210 dealer-owned stores, was contributing 5.2 percent of Lowe’s total North American revenue. For selling off RONA, Lowe’s recorded a US$2.54 billion loss-onsale impairment.

The RONA-Sycamore-AFG deals suggested to some industry watchers that, under the right circumstances, Canadian private equity is interested in wetting its investment whistle on the building-supply sector. In the U.S., after all, several large building supply distributors have private equity money in them. These include Atlanta-based US LBM, with more than 450 locations. In October 2023, Platinum Equity acquired a stake in US LBM from Bain Capital Private Equity.

Over the previous three years under Bain’s ownership, the company had nearly tripled its sales and profi t through mergers and acquisitions as well as supply-chain optimization. “US LBM has built an impressive, diversifi ed business with scale,”

observed Jacob Kotzubei, Platinum’s co-president, at the time of his company’s purchase.

Private equity has also shown a parallel interest in investing in home services. Last October, citing Pitchbook as its source, the Wall Street Journal reported that private equity, since 2022, had purchased nearly 800 skilled-trade companies, such as HVAC installers, with an eye toward bundling them regionally.

Canada, too, has witnessed this trend. For example, last June, Right Time Group of Companies, a leading home services provider majority-owned by the private equity firm Gryphon Investors, acquired Toronto-based Belyea Bros. Limited Heating, Cooling, and Electrical. This was Right Time’s 22nd acquisition. A few months earlier, during March 2024, Burlington, Ont.-based private

equity firm Newlook Capital, through one of its portfolio companies, Plumbing Master, acquired the previously family-owned Midtown Plumbing in Bell, Calif. The deal expanded Plumbing Master’s footprint in the industrial services sector.

When it comes to investing in building supply retailers, getting at private equity’s motivations and expectations is a challenge because the PE firms are generally circumspect to a fault. Michael Freitag, a spokesman for Sycamore Partners, told Pro Dealer that the firm does not participate in media interviews. Other retailer-focused private equity firms we reached out to— including TriWest Capital Partners, Birch Hill Equity Partners, Stern Partners, and

MORE efficient *

Only 45 dBA, the Voltex® AL is similar to a fridge running.

Switch modes to meet your needs and maximize savings.

COOLS & Dehumidifies

An added benefit for basements.

*Compared to a standard electric water heater of similar gallon capacity.

Save up to 75% on water heating bills*! Plus manage hot water usage and receive alerts using our free app.

Fulcrum Capital Partners—did not return voice or email messages requesting comment.

Analysts who cover retailers for firms like Desjardins Securities, BMO Capital Markets, and CIBC World Markets either declined to be interviewed or didn’t return requests for comment.

But there are some breadcrumbs one can follow along this trail. The Canadian Venture Capital & Private Equity Association (CVCA), which tracks venture capital and private equity transactions in Canada, estimated there were 658 private equity deals valued at $27.5 billion in 2024. Eighty percent of these deals and 89 percent of their aggregate dollar value were for companies based in either Ontario or Quebec. More than half of the dollar value ($15.2 billion) went to acquire stakes in 117 tech companies. The manufacturing and industrial sectors also were deal magnets. By comparison, the “consumer/retail” sector accounted for 59 deals valued at $4.1 billion. CVCA did not break out transactions specifically involving building supply retailers. But there were at least two prominent private-equity manouevres in Canada’s retail building-supply space last year.

On Jan. 30, 2024, the firm Clayton, Dubilier & Rice (CD&R) completed its acquisition of a “significant

ownership position” in California-based Foundation Building Materials (FBM), with more than 300 retail locations in North America, 27 of which are in Canada. CD&R bought that interest from affiliates of American Securities, which had acquired then-publicly-traded FBM in November 2020 for US$1.37 billion, including debt. (American Securities still owns the majority stake in FBM. Kevin Penn, American Securities’ managing director, said his firm’s partnership with CD&R “accelerates [FBM’s] growth course,” without providing specifics.)

In May 2024, KV Capital, a “Canadian alternative investment manager,” entered a strategic partnership with employee-owned Nelson Lumber and its prefab homebuilding division, Nelson Homes. That move marked a “significant expansion” of KV’s private equity division into the building products arena, the firm stated. To execute this deal, KV Capital “worked alongside” ATB Private Equity, BDC Capital, and Nelson’s employee-shareholders. KV stated at the time that this transaction (whose terms weren’t disclosed) would support real estate development in markets where KV operates.

Why settle for less? For beauty, convenience, durability and ease of installation, ALIGN® Composite Cladding from Gentek® is the best of all worlds while delivering the distinctive look of real wood.

Vinyl, wood and fiber cement siding don’t match up. ALIGN never needs painted. It’s moisture resistant, so it won’t swell or warp. It’s impact resistant against dents, dings and hail. Its insulating performance prevents energy loss.

ALIGN gets an upgrade. A full suite of accessories like J-channel, trim and corner post profiles, colour-matched to ALIGN 7" plank and 12" vertical Board & Batten.

These accessories are part of the full ALIGN solution that creates a seamless, high-end finish with fewer crew members and no caulking, sealing or painting required.

More cost savings

Increased time savings

Easier installation

Better quality

Longer durability

Beautiful results

Find ALIGN Composite Cladding and ALIGN accessories at your closest Gentek retailer.

(Catherine O‘Neill, KV Capital’s spokesperson, did not respond to requests for comment.)

A few months after this partnership was cemented, in July 2024, Edmonton-based Nelson Lumber—which already was operating in the Alberta markets of Edmonton, Grande Prairie, Lloydminster, and Slave Lake—expanded into Calgary by carving out a four-acre parcel for a new store on land owned by Nelson Homes. Perhaps it was a coincidence, but last October Nelson Lumber named David Fraser as its new CEO. Fraser previously was president of Regency Fireplace Products and president of Assa Abloy’s door systems business.

Curtis Graham, Nelson Lumber’s sales manager in Calgary, referred questions about the market expansion to Fraser, who did not respond to requests for comment. “I’ll tell you one thing,” said Graham. “KV is the reason we expanded into Calgary.”

Scalability is an important consideration for private equity’s investment choices. And while Canada’s retail building supply sector is dominated by buying groups, individual markets are still highly fragmented and potentially ripe for the kinds of consolidation opportunities that PE firms crave.

Private equity firms often provide access to capital that otherwise wouldn’t be available to building supply retailers. That capital can help retailers realize their growth ambitions. And because private equity generally takes a longer view of its investments, that money isn’t as reactionary to sudden market gyrations.

But there are tradeoff s when retailers dip into the private equity well. For one thing, PE firms are obsessed with growth as a component of their eventual exit strategies, and debt from relentless expansion typically gets layered onto the acquired company’s balance sheet. PE firms are notorious for

tacking on performance and advisory fees that have been known to add 20 percent or more to the cost of a transaction. And PE firms are not reputed for their transparency, a trait that can obscure some convoluted ownership scenarios.

For example, the building materials distributor Taiga Building Products, with 15 distribution centres in Canada, is officially a publicly traded company. Until recently, however, nearly 70 percent of its common stock was owned by Avarga Ltd., part of Singapore-based Zico Trust. Last November, the business entrepreneur and analyst Dr. Kooi Ong Tong acquired 183.2 million shares of Avarga’s stock, bumping his total to 481.5 million shares, or 53 percent of the shares outstanding. By doing so, he now owns or controls 69.7 percent of Taiga. The rationale behind this transaction was not revealed publicly.

It’s not uncommon for private equity firms to take active roles in the operations of the companies in which they invest. That involvement can manifest itself in various ways, depending on the investor’s return-on-investment parameters, among other things. The extent that such operational involvement is acceptable to building supply retailers is likely to be a factor in whether private equity penetrates deeper into a sector whose owners have prided themselves on their entrepreneurialism.

When Sycamore Partners completed its acquisition of Lowe’s Canadian retail businesses, Stefan Kaluzny, Sycamore’s managing director, proclaimed RONA to be “once again an independent company headquartered in Boucherville, Quebec.” Just how “independently” RONA controls its own destiny might, for better or worse, serve as a litmus test for other dealers thinking about getting into bed with private equity partners.

What's on the inside matters. Unlike doors that may look similar, Upwardor's Canadian-made quality ensures enduring performance, built to withstand the test of time and every season. Choose the lasting reliability that's designed for life.

By Steve Payne

Promise Robotics plans to turn out a million square feet of housing annually on a Calgary assembly line

Starting this summer, there will be a new customer in homebuilding in Alberta—and it uses robots.

Promise Robotics is opening a new 60,000-squarefoot warehouse in Calgary where robots will create modular panels for housing. Promise calls the facility and technology its “Homebuilding Factory-as-aService” (FaaS) platform.

Pro Builder recently interviewed Promise Robotics co-founder and CEO Ramtin Attar, a former architect and Autodesk employee, about the opportunity. Which is, according to press releases, simply to “deliver homes faster with signifi cantly fewer resources.”

“I spent 13 years at Autodesk [a software company that developed AutoCAD software],” Attar told us. “This industry has been building homes the same way for a century. The labour shortages, the escalating cost, and the supply needed is going to put a lot of pressure on this industry.”

Attar’s co-founder in the venture is Reza Nasseri, a homebuilder. Attar describes Nasseri this way:

“He has committed his entire life to advancing construction and homebuilding.”

“I said, ‘Reza, how do you think we can make this accessible to the rest of the industry?’ We need foundational innovation in this industry,” Attar said. “We raised investments and we started building our

artifi cial intelligence model for construction.”

Promise Robotics uses the same robots that are used in auto plants. “It’s a commodity, it’s off the shelf, the costs keep coming down,” Attar said. “Right now, the cost of that robot in automotive plants is about 30 cents an hour.”

“We take the same thing, we add the construction belt tool to it, and a Promise Robotics brain.”

“In automotive, you’ve got fi ve players that basically produce every single car in the world. So they’re highly motivated. Whereas the construction industry is highly fragmented.

“What we have done is to say, we can actually get robots to not care what they’re building. And essen-

tially advance enough to build highly variable things.”

By fabricating modular panels, Promise Robotics’ Calgary plant will be able to produce up to 1,000,000 square feet of housing annually, Attar said. The new plant is building on the success of Promise Robotics’ factory in Edmonton.

Interview by Rebecca Dumais

Pro

president of CGC Inc., about the deeper layers to the housing production issue

Canada’s housing crisis is more than a problem of supply and demand—it’s a tale of strained supply chains, shifting trade policies, and a construction industry racing against rising costs and population growth.

Pro Dealer interviewed CGC president Steve Youngblut about how solving the housing crunch requires more than business-as-usual approaches— it demands collaboration across every link in the construction chain.

Material availability is often cited as a major factor in construction delays. How do material shortages specifically affect timelines?

Our primary focus is drywall, and there’s a finite supply of wallboard in the market between domestic manufacturers and what’s currently allowed to be imported. With the current U.S.-Canada trade relations, Canada could have fewer options, making our capacity to manufacture materials locally even more important. In any given year, we can only properly complete about 215,000 to 225,000 homes with the currently available wallboard capacity. CGC ships a substantial volume of product from Eastern to Western Canada, and with transportation complications, delays can occur.

What role does CGC play in the availability of housing materials, and how has its involvement shaped the housing market in Canada?

CGC’s $210-million investment to build its newest manufacturing plant in Wheatland County outside of Calgary is underway (its forecasted completion is in 2026). The plant will significantly reduce the distance our wallboard products travel to Western Canada, while providing the entire country with more product supply.

What are the primary factors affecting the availability of building materials, and how do these factors impact housing affordability?

Before the 2016 tariff, all Canadian manufacturers were importing material from the U.S. The tariff effectively cut off that supply, taking the equivalent of 60,000 homes’ worth of material out of the market. The main raw material is gypsum, which is a natural rock. We can also leverage synthetic gypsum, a by-product of coal-fired power plant scrubbers, which is historically more affordable. However, as coal-fired plants continue to shut down across the U.S., the demand for naturally occurring gypsum rock has increased. And, since wallboard production relies on paper, and the pandemic saw a surge

In any given year, [Canada] can only properly complete about 215,000 to 225,000 homes with the currently available wallboard capacity.

in demand for paper packaging, it further drove up costs. We’re focusing on tightening supply chains and increasing our domestic manufacturing capabilities.

How does CGC balance maintaining high production levels with the ongoing challenges of raw material sourcing, especially during supply chain disruptions?

In 2023, we announced our $104-million investment to re-launch our state-of-the-art gypsum quarry in Little Narrows, Cape Breton, Nova Scotia. Through this investment we are securing rock resources for future generations, a commitment that echoes our overarching purpose to make tomorrow a home for us all.

Our investment in Nova Scotia is part of the over $300 million CGC is investing in mining and manufacturing projects in Little Narrows, N.S., and Wheatland, Alta., to ensure a steady supply of high-quality gypsum to our manufacturing plants.

What role do government regulations and policies play in exacerbating or alleviating material supply issues in housing construction?

When we collaborated with the Alberta government to secure permits and approvals for the new Wheatland plant, we could see early in the process they were committed to removing needless hurdles, and they shared our priorities.

Looking forward, what do you think needs to happen for the housing industry in Canada to achieve a balance between supply, demand, and affordability?

If manufacturers, logistics providers, distributors, along with our customers and government entities, can come together and work towards a common goal of building the homes Canadians need and can afford, we can uncover new and innovative solutions. This includes governments at all levels from municipal to federal; their participation is essential to achieving meaningful progress.

All players in the home construction supply chain have a responsibility to innovate and expand our capacity for us to work more efficiently and produce less waste.

By Geoff McLarney

After more than half a century and two generations, a pro yard in Ontario has recently undergone a rapid succession. The buyer is one of the yard’s biggest contractor customers

Buying a company from an extremely well-respected family with good core values is a good fit. “

from Detroit, Windsor, Ont., is a hub of public construction projects. Investor Max De Angelis has experience in a number of ventures, including as the head of a prominent contracting firm, Fortis Group Construction Inc.

Fortis is a big player in all types of construction. With three Ontario offices, in Tecumseh, just east of Windsor; London; and Vaughan, the company has over 150 employees. De Angelis is a seasoned business owner.

That know-how will stand him in good stead as the new owner of a pro-oriented building supplies retailer, as he explained to Pro Dealer

Target Building Materials was a family business for more than 50 years. Greg Drouillard, who had reluctantly joined the business in 1974, had been its owner since 2001, when he took it over from his father, founder Maurice “Moe” Drouillard.

Target specializes in residential, industrial, and commercial construction. Its offerings include various concrete products, sealants, ceiling tiles, foundation products, waterproofing, insulation, safety products, and tools.

As a TORBSA member, Greg Drouillard served on the group’s board from 2001 to 2007, the latter two years as chair. During 2007, he was also president of the Specialty Tools & Fasteners Distributors Association (STAFDA).

Drouillard was key to negotiating TORBSA’s merger in 2022 with Affiliated Distributors (AD). The LBM group is now known as AD Building SuppliesCanada. Under Greg’s watch, Target staked out its turf in the commercial market, which benefited from the major public works that have unfolded in Windsor in recent decades.

He also fended off, at considerable expense, a legal battle with a certain U.S. discount department store over the business’s name during a short-lived foray north of the border.

That contest, Greg Drouillard told Hardlines in 2018, entailed “six years of living hell … and a lot of lawyer fees.” In the end, Target Corp. settled on a policy of “cohabitation” with Drouillard’s business, before withdrawing from Canada altogether

in 2015 after just four years.

In 2017, the yard celebrated its 50th anniversary, marking the occasion with a series of contractor thank-you events. That year, at its annual gala, the Lumber and Building Materials Association of Ontario presented Greg with its lifetime Industry Achievement Award.

The following year, he delved into the project of creating a showroom, converting a portion of the store’s warehouse for the purpose.

But after weathering the pandemic, the family had to confront tough decisions about the future of the business last year, when Moe died and Greg became seriously ill. In the end, local contractor Max De Angelis stepped up to acquire Target, as “the next generation” of the Drouillard family “wasn’t interested in taking over,” according to De Angelis.

Introducing the 2-in-1 Total 1™ Bath Waste system with Offset & Direct waste configurations in one bagand no wasted parts!

Why carry two bath waste kits when one does it all? Our 2-in-1 design covers both key configurations, saving you space, time, and money. One kit, every job, zero hassle.

Proudly Made in Canada. and done.

Fortis will obviously become a large client, which helps. It allows us to expand our product line.

A mutual acquaintance suggested De Angelis as a good candidate to take over, he recalls. “For the last few years I’ve been assembling different businesses here and there. I know the Drouillard family very well through their accountant. A business evaluator, another mutual acquaintance, approached me and said it would be a good fit.

“They know I’m the type of guy that if I’m interested, I can close and get the deal done. I thought it was a very interesting opportunity.” De Angelis notes that Target is the third business he has acquired that’s more than 50 years old. “Buying a company from an extremely well-respected family with good core values is a good fit.”

De Angelis is not a family member, but he’s no stranger to the Drouillards either. “Greg was actually one of the guys who helped me start my first summer business when I was 18 years old. I had a driveway sealing business that expanded into installations, interlocking brick, tennis courts.”

Today, De Angelis owns or co-owns several firms. Fortis Construction Group is one of Canada’s top 40 construction firms and a major customer of Target Building Materials. It pursues large commercial and public projects.

There is no shortage of those in Windsor, where construction of a new hospital is slated for 2026 and where the Gordie Howe International Bridge, scheduled to open later this year, is a $6 billion project.

One of the other firms that De Angelis owns is called The Hurricane Group, which consists of Hurricane Hydrovac, Hurricane SMS, Heaton Sanitation, and Ken

Max De Angelis, the new owner of Target Building Materials, owns or co-owns several firms. One of them is Fortis Construction Group, one of Canada’s top 40 construction firms and a major customer of Target Building Materials.

Lapain & Sons Ltd. Across De Angelis’s holdings, his interests include construction, sanitation, directional drilling, and masonry.

De Angelis stresses that he has acquired Target in his personal capacity and cautions against “the misconception that this is a Fortis-owned business.”

All of his companies, he explains, are standalone entities. At the same time, “I do like to purchase companies that are in our space,” and Target “certainly fits with what we do.”

De Angelis says his “forte is finding good opportunities and then connecting the dots with clients. Target has a wide customer base and we’re trying to resolidify the relationships with these clients. We’re trying to bring in more stock and more inventory.

“Over the last few years the company kind of got quiet,” De Angelis observes, while expressing his

hope that “a fresh face and a fresh approach combined with that 57-year history and great staff” can revive its fortunes.