Canadian Publications Mail Agreement # 42175020. POSTMASTER: Send address changes to Hardlines Home Improvement Quarterly, 330 Bay Street, Suite 1400, Toronto, ON M5H 2S8 EXCLUSIVE REPORT Sales figures, market shares, and strategies from the industry’s biggest players HARDLINES.CA CONNECTING THE HOME IMPROVEMENT INDUSTRY THIRD QUARTER / 2022 HOME IMPROVEMENT QUARTERLY FEATURE STORY

A MANAGER’S JOURNEY HHIQ interviews Langton Chodokufa about his odyssey from bank employee in Zimbabwe to manager of Home Depot’s South Etobicoke store TOP 20 RETAILERS E-COMMERCE How Amazon’s influence is changing everything and why independents need to up their game

Langton

Chodokufa HOME DEPOT STORE MANAGER Toronto, Ontario

Helping our dealers be successful, since 1847. Our Canada-based sales team gives our dealers the attention, knowledge, and expertise they deserve, all backed by the world’s largest independent hardlines distributor. Get in touch to learn how we can help. Orgill.ca

• Quarterly buying events • Purchase planning and support • Strategic, regular sales rep calls • Margin-maximizing retail pricing tools • Unrivaled assortments, planograms, and specialty programs At your service, providing: Grow With Confidence GO WITH ORGILL 1-888-742-8417

HardlinesHomeImprovementQuarterlyis published four times a year by Hardlines Inc., 330 Bay Street, Suite 1400, Toronto, ON M5H 2S8. $25 per issue or $90 per year for Canada. Subscriptions to the Continental United States: $105 per year and $35 per issue. All other countries: $130 per year. (Air mail $60 per year additional.)

Subscriber Services: To subscribe, renew your subscription, or change your address or contact information, please contact our Circulation Department at 289-997-5408; hardlines@circlink.ca. Canadian Publications Mail Agreement # 42175020

EDITOR

PUBLISHER

VOLUME 12, NO. 3 330 Bay Street, Suite 1400, Toronto, ON M5H 2S8 • 416-489-3396 HOME IMPROVEMENT QUARTERLY HHIQ is just one facet of the Hardlines Information Network. Since 1995, we’ve been delivering the most up-to-date information directly to you online, in print, and in person. Find out how you can get your message out with us. Contact: NUMBER ONE IN THE HOME IMPROVEMENT INDUSTRY. ONLINE AND PRINT. David Chestnut, Vice President & Publisher 416-425-7992 • david@hardlines.ca @Hardlinesnews • www.hardlines.ca www.kingmkt.com 877 844 5464 EXPERTISE Well connected to retailers head offices, distributors and the dealer stores, King’s sales team of professional, knowledgeable experts will grow your sales. We’re connected

POSTMASTER: Send address changes to Hardlines Home Improvement Quarterly, 330 Bay Street, Suite 1400, Toronto, ON M5H 2S8. All editorial contents copyrighted 2022 by Hardlines Inc. No content may be reproduced without prior permission of the publisher. PRESIDENT Michael McLarney mike@hardlines.ca EDITOR Steve Payne steve@hardlines.ca ASSOCIATE

Geoffrey McLarney geoff@hardlines.ca CONTRIBUTING WRITER John Caulfield VICE PRESIDENT &

David Chestnut david@hardlines.ca MARKETING & EVENTS MANAGER Michelle Porter michelle@hardlines.ca ART DIRECTION Shawn Samson TwoCreative.ca ACCOUNTING accounting@hardlines.ca COVER STORY PHOTOGRAPHY Larry Arnal arnalpix.com THIRD QUARTER / 2022 •

100% DEALER-OWNED

Join a completely Dealer-Owned company today. Dealers share and participate equally without the influence of any external shareholders. Harness our massive buying power, comprehensive distribution, national brand recognition and marketing support.

Scan to learn more

How five dealers are meeting supply chain and inflation challenges head on PRO CORNER MAKING DO 66 7 THIRD QUARTER / 2022 DEPARTMENTS NEWSROUNDUP TORBSA merges with AD, a U.S.-based buying group Quebec giant Canac makes changes at the top Gillfor Distribution buys AFA Forest Products Home Hardware’s chief merchant talks shop Canadian Tire rolls out integrated online platform BMR appoints new head buyer and a new COO Lowe’s introduces power tool lines for pros and DIYers CONTENTS THIRD QUARTER / 2022 VOLUME 12, NO. 3 9 Ranking the leading banners in our industry by sales, store counts and market share SPECIAL FEATURE CANADA’S TOP 20 36 EDITOR’S MESSAGE Brave New World, Part 3 PRODUCT SPOTLIGHT SPECIAL! What’s new in kitchen and bath ENDCAP Start ’em young An interview with Langton Chodokufa, store manager at a bustling Home Depot in Etobicoke, Ont. COVER STORY 74 20 PAGE 10 E-COMMERCE FEATURE THE AMAZON PANDEMIC EFFECT 58 Home improvement retailers surged towards online sales during the pandemic. A report on what the leaders are doing 26 A MANAGER’S JOURNEY HARDWARE

STEVE PAYNE, EDITOR

STEVE PAYNE, EDITOR

PART 3 BRAVE NEW WORLD

Abit of industry history. It happens about every three decades—and it’s happening again.

By 1964, the arrival of the American retail chains in Canada was threatening to wipe out the Mom and Pop hardware store. So Walter Hachborn convened a meeting of 122 such dealers at the Flying Dutchman Hotel in Kitchener, Ont., and they voted to form Home Hardware.

Other leading groups formed around that time, too. Powerful, influential and capable of fighting back against chaos, the LBM groups rose up. In Quebec, the Ro-Na brand was even faster out of the gate (1960) than Walter.

Fast forward three decades. The year was 1994. Our Canadian industry got rocked again by the arrival of not one but two American behemoths—Home Depot and Walmart. Our industry went through convulsions again before rearranging itself. Now we had strong co-ops/buying groups and big box retailers.

Fast forward another three decades. The era of e-commerce is “suddenly” upon us. Last year, Amazon pulled in $US 469-billion ($CDN 574-billion). Now

we have strong co-ops and big box retail ing and e-commerce.

How is your store going to react to Brave New World Part 3? How are your vendors going to react?

Well, as the industry realized six decades ago and again three decades ago: It’s not going to be business as usual. Pay attention to what’s happening out there.

This special Top 20 issue of Hardlines Home Improvement Quarterly covers both the brick-and-mortar state of the nation and the e-commerce reality.

Hopefully, you will find some clues in these pages as to your own best path forward. And remember, the package of information you hold in your hand is just a fraction of the data potentially available to you in the Hardlines Retail Report and the Hardlines Market Share Report

To get hooked up with those valuable documents, just send me an email.

Hardlines Home Improvement Quarterly www.hardlines.ca 9 THIRD QUARTER / 2022

MESSAGE

EDITOR’S

It’s been an utterly crazy two years and it looks like it’s about to get even crazier

Seismic changes in our industry occurred in 1964 and 1994. You’ve probably noticed they are happening again.

“ ”

steve@hardlines.ca

NEWSROUNDUP

TORBSA MERGES WITH AD (AFFILIATED DISTRIBUTORS), A $58-BILLION MULTI-INDUSTRY BUYING GROUP

TORBSA Ltd., the Bolton, Ont.based buying group, announced on June 1 that it was merging with a giant U.S.-based buying group, Affiliated Distributors (AD), headquartered in Wayne, Penn.

Prior to the merger with TORBSA, AD Canada, which has recently-expanded its DC in Mississauga, Ont., was already oper ating in multiple construction and indus trial sectors in this country.

“The decision to align our business with AD was one that was scrutinized thor oughly,” said TORBSA president Paul Williams. “TORBSA and its shareholders are truly excited at the road ahead, as we lay the foundation for what will be many years of success as a business.”

Founded in 1966, TORBSA represents 30 members in 40 locations across Canada. But with the merger, a new division of AD has been created: AD Canada Building Supplies. Williams will head this new division, which effectively replaces TORBSA, and TORBSA members will become shareholders of AD Canada. Williams will now report to Rob Dewar, president of AD Canada, while three additional TORBSA employees will join the AD team.

AD is a wholesale buying group formed in 1981 that provides contractor-related and industrial products to some 845plus independent member owners in the U.S., Mexico, and Canada. AD publicizes annual sales of $US 58.5 billion. It operates

Canada, which is merging with TORBSA, has a Canadian head office and distribution centre at 3630 Odyssey Drive, Mississauga. The U.S. head office of AD is in Wayne, Penn.

13 divisions that cover industries includ ing electrical, industrial, safety, bearings and power transmission, plumbing, PVF (pipes, valves and fittings), HVAC, decora tive brands, and building supplies.

“AD brings decades of experience, strong leadership throughout the organization, and strong business ethics and core values that align with our own,” Williams said. “Their scale and expertise across North America give us the strength to compete and succeed

in an ever-changing marketplace.”

AD’s Rob Dewar added that TORBSA’s strong leadership and financial success made the buying group an ideal match for AD. “TORBSA has been a leader in this space for a long time, and our new rela tionship will help us provide more benefits for members, including an increased sup plier portfolio.” The deal also fits with a key priority of AD in recent years to grow its presence in Canada.

Hardlines Home Improvement Quarterly www.hardlines.ca 10 THIRD QUARTER / 2022

OF THE HOME IMPROVEMENT INDUSTRY Visit Hardlines.ca for breaking news in the Home Improvement Industry

AD

BRIEFLY

QUEBEC RETAILER CANAC MAKES CHANGES AT THE TOP

The retirement of Pierre Laberge from the helm of Canac in May has resulted in management changes at the top of the giant home improvement chain. Still, the Laberge family remains firmly in control.

Based in L’Ancienne-Lorette, in the Quebec City region, Canac has 31 stores throughout the province—with number 32 scheduled to open early in 2023—with sales of some $1.3-billion (Hardlines estimate). Canac employs 4,200 people and is the largest family-owned home improvement retailer in Quebec.

Pierre Laberge retired early in May after 45 years in the business. He had been at the helm of both Canac and its parent com pany, Laberge Group, for two years, follow ing the retirement of company founder Jean Laberge, Pierre’s cousin.

Martin Gamache takes over the general manager’s role from Pierre Laberge. He was formerly Canac’s director of operations, a

Pierre Laberge, pictured at right, has retired from the helm of Canac, the 31-store retail chain in Quebec. He had worked in his family’s business for some 45 years.

title Gamache will keep. Gilles Laberge is Laberge Group’s new president, in charge of overseeing all the Laberge companies, including Canac.

All these changes will help support con tinued growth at Canac. It already has a dozen stores in the Quebec City region, but Canac only has four in the greater Montreal area, three of them on the South Shore. Its next store will be in Contrecœur, 57 km northeast of Montreal along the St. Lawrence River. That store is expected to be operational in the first quarter of 2023.

Canac also has an option on a new store near Hawkesbury, Ont., halfway between Montreal and Ottawa on the Ottawa River.

CERTAIN TEED PARENT SAINT-GOBAIN TO ACQUIRE CANADA’S KAYCAN

CertainTeed parent Saint-Gobain—a French conglomerate—has agreed to acquire Kaycan Ltd., the Montreal-based manufacturer and distributor of siding products. The $928-million transaction is slated to close by the end of 2022. The deal includes the planned divesti ture of Kaycan’s small U.S. distribution arm. Saint-Gobain says it intends to hold onto Kaycan’s “locally well-established Canadian distribution.”

HUDSON’S BAY CO. TRANSFERS DOWNTOWN WINNIPEG PROPERTY TO FIRST NATIONS

Hudson’s Bay Co. is transferring own ership of its downtown Winnipeg prop erty to an umbrella group of Manitoba First Nations. The Southern Chiefs’ Organization (SCO) is the recipient of the 600,000-square-foot Beaux Arts build ing. The site will serve as a multipurpose space including 300 housing units, two restaurants, a health clinic, daycare cen tre, and museums.

CASTLE BUILDING CENTRES GROUP’S BRUCE HOLMAN TO RETIRE

Castle Building Centres Group has announced that Bruce Holman will retire as director of business development this summer. Holman has spent nearly two decades building the dealer base for the Mississauga, Ont.-based buying group.

Doug Keeling, who has been business development manager for Ontario since he joined Castle in 2016, will replace Holman in the national role, effective Sept. 1.

www.hardlines.ca 11 THIRD QUARTER / 2022

KNOWLEDGE IS POWER. Stay in the know every single week with HARDLINES. Subscribe online at Hardlines.ca

Hardlines Home Improvement Quarterly

HOME HARDWARE’S CHIEF MERCHANT TALKS SHOP IN NEW HARDLINES PODCAST

Anew podcast from Hardlines fea tures an in-depth conversation with the senior merchant at Home Hardware Stores Ltd.

Marianne Thompson is the company’s chief merchandising officer. On the lat est episode of the Hardlines What’s In Store podcast, she shares details of Home Hardware’s investments in its supply chain—and how it’s using new technology to track selling cycles, manage product orders, and get closer to its customers.

Thompson also talks about the new buy ing team in St. Jacobs. Following her arrival in 2019, a number of company veterans retired and both the hardware and LBM buying teams underwent a reorganization. New buyers joined Home Hardware from industries such as grocery—and even from competitors.

For example, Carol Crystal joined Home Hardware from Lowe’s Canada in 2020 as director, merchandise hardlines. Recently Crystal, whose background also includes Walmart Canada and the Hudson’s Bay Co.,

was promoted to VP, merchandise LBM. “Our strength at Home Hardware lies in ensuring that our talent and our cul ture remain a competitive advantage,” Thompson says. “And it continues to propel our business forward as we really stay focused on our vision, which is to be

Canada’s most trusted and preferred home improvement retail brand.”

The full conversation with Marianne Thompson is available for free from Hardlines.ca. Just click on the Podcast tab at the top of the page to register.

GILLFOR DISTRIBUTION EXPANDS NATIONAL REACH WITH TAKEOVER OF AFA FOREST PRODUCTS

Gillfor Distribution Inc. announced in May its acquisition of AFA Forest Products Inc., the LBM distributor headquartered in Bolton, Ont. AFA owns and operates 13 distribution facilities, serving the entire Canadian retail home improvement market.

Gillfor says it will operate “in parallel” with AFA “until a full operational assessment is completed and a seamless integration can be executed.”

Headed by Grant Yegavian, CEO, and presi

dent Murray Finkbiner, AFA is the latest acqui sition by Gillfor in its ongoing effort to firmly establish its position as a key national player on the building materials distribution scene. Based in Woodstock, Ont., Gillfor is the brainchild of the Gill brothers. In 2012 they determined they wanted to establish a national distribution channel for the fam ily’s cedar production in British Columbia. “This acquisition will elevate Gillfor to be amongst the largest Canadian distributors

for building products, and allow us to truly provide local partnerships from coast to coast,” says Gary Gill, chairman of Gillfor Distribution.

Gillfor Distribution was established when OWL Distribution in Woodstock, Ont., and McIlveen Lumber, an LBM wholesaler based in Calgary, merged to form the new business in 2017. A year later, the company added Brown & Rutherford in Winnipeg and Brunswick Valley Distribution, based in Fredericton.

Hardlines Home Improvement Quarterly www.hardlines.ca 12 THIRD QUARTER / 2022 NEWS

ROUNDUP

Marianne Thompson, chief merchandising officer at Home Hardware Stores, is interviewed in a new Hardlines podcast.

There are over 7 million under-insulated attics in Canada.^ Drive your business and differentiate from the competition. This AttiCat® System provides business opportunities targeting the:

Small contractor who can do the job for homeowners. Local roofing contractor already working in homeowner attics. Your customers will appreciate the savings on their heating and cooling costs. *

OWENS

®

®

owenscorning.ca THE PINK PANTHER™ & © 1964–2022 Metro-Goldwyn-Mayer Studios Inc. All Rights Reserved. The colour PINK is a registered trademark of Owens Corning. © 2022 Owens Corning. All Rights Reserved. ^Based on Stats Canada Census 2006 and code analysis by industry expert, Keith Wilson. *Savings vary depending on original amount of insulation in your home, climate, house size, air leaks, and personal energy use and living habits.

GROWING YOUR BUSINESS WITH THE

CORNING

ATTICAT

EXPANDING BLOWN-IN INSULATION SYSTEM.

CANADIAN TIRE ROLLS OUT INTEGRATED ONLINE PLATFORM

he future belongs to retailers who can provide the most seam less experience across digital and physical channels,” said Greg Hicks, president and CEO of Canadian Tire Corporation during a recent teleconfer ence with investment analysts and media.

“We are investing to provide a seamless end-to-end connection along the supply chain and to our customers across which ever channel they choose,” Hicks said, not ing that a new integrated platform is being rolled out to facilitate that connection.

One way that Canadian Tire has been working this year to enhance its omnichannel experience is through the deployment of in-store technology. These enhancements include the installation of electronic shelf labels, which, through a designated app, guide customers directly to products in the store.

Canadian Tire has also added pickup lockers at 86 more CTR stores, while at its Sport Chek stores, DoorDash delivery

Canadian Tire is pledging to create a “seamless” e-commerce experience for its customers, across all its brands.

is being used to get products to customers’ doors. The company expected 90 percent of Sport Chek’s e-commerce customers to be serviced by DoorDash by the end of Q2.

The initiative to expand Canadian Tire’s omnichannel experience is called “One Digital.” This is “a future-safe digi tal ecosystem that will serve as the new, single digital platform used across all CTC banners,” Hicks said. The platform was tested in New Brunswick in Q1 and has now been introduced nationally at all CTC stores. The company also plans to bring its banners Mark’s, Sport Chek, Triangle, and Party City onto One Digital by the end of the year.

“It’s a critical part of our evolution from a company made up of disconnected banners, brands, and services to an enter prise-wide platform where all banners and channels collectively amplify and render each other more valuable, creating a truly differentiated customer experi ence,” Hicks said.

SLEGG BUILDING MATERIALS CELEBRATES 75TH ANNIVERSARY, HOLDS PRO SHOW

Slegg Building Materials, with 12 locations on Vancouver Island, is celebrating its 75th anniversary this year. The Slegg organization is in an upbeat mood for another reason, too. On May 6, Slegg held its 2022 Slegg Pro Show, the first such live event in two years owing to COVID-19 restrictions. The event took place in Victoria, B.C.

WALMART CANADA EQUIPS EMPLOYEES WITH WEARABLE RING SCANNERS

Walmart Canada is providing its retail staff with wearable ring scanners. The devices are designed to simplify and speed up workers’ abil ity to fulfill online grocery orders. The company ordered more than 1,500 of the wearables in May. Employees can use them to scan products by pushing a button with their thumbs.

KENT OPENS BIG BOX IN MONCTON

Kent Building Supplies has opened its latest big box store, this time in Moncton, N.B. The store features modernized displays and enhanced sig nage to aid customer flow, along with expanded product assortments, a drive-through lumber yard, year-round garden centre, cut shop, and a large pro service desk. There’s also a bigger online pickup area than in existing Kent stores.

GROCERY CHAIN METRO NIXES

SINGLE-USE PLASTIC BAGS

Metro will no longer sell single-use plastic bags at its stores beginning this fall. The grocer says the move will mean that 330 million bags will be kept out of circulation annually. The move away from plastic bags follows other retailers who have phased out single-use plastics. Most recently, Walmart Canada pulled them from their stores in April.

Hardlines Home Improvement Quarterly www.hardlines.ca 14 THIRD QUARTER / 2022

BRIEFLY

NEWSROUNDUP

“T

Yesterday. Today. Tomorrow. Outstanding.

Kohltech’s outstanding service, warranty coverage, pricing and environmental sustainability has established our brand as a proud Canadian industry leader.

We deliver innovative, high-performance windows and entrance systems that make your customer’s house feel like home.

Here’s to 40 years of outstanding in all that we do.

kohltech.com

BMR APPOINTS NEW HEAD BUYER, CHIEF OPERATING OFFICER

management shuffle at the head office of Boucherville, Que.-based BMR Group has resulted in a new head buyer, a new COO, and the departure of at least one senior executive.

A

Charles Grégoire-Béliveau is the new top merchant. He has been named vice president, merchandising. He joined BMR in 2016 as director, purchasing for corporate stores. In that role, he led the merger of the purchas ing, distribution, and corporate stores teams. He also increased BMR’s imports from Asia. He was promoted in 2020 to senior direc tor, merchandising before getting this latest title. Grégoire-Béliveau is also chairman of Éco-Peinture, an organization that regulates paint recycling in Quebec.

The other major change at BMR is a new chief operations officer. Antonio Di Pasquale joined the group in 2020 as vice president, supply chain and operational excellence. In his new role, Di Pasquale

will oversee all of BMR’s operations.

Meanwhile, Jonathan Gendreau, who had been BMR’s VP business development, mar keting, and customer experience, has left the organization. He had been with BMR since 2017.

BMR has seen a number of changes at head office over the past year and a half. In March 2021, Alexandre Lefebvre was appointed CEO, replacing Pascal Houle as head of the group. Lefebvre came over from Lefebvre & Benoît, a large commercial dealer that is owned by BMR.

BMR officials say the latest changes are aimed at continuing to grow the dealer in eastern Canada. Along with its strong pres ence in Quebec, where it has more than 230 stores, BMR has long been present in the Maritimes and particularly New Brunswick, where it has 11 stores. The group’s biggest expansion opportunity seems to be in Ontario, where it has some 20 locations.

LOWE’S CANADA INTRODUCES POWER TOOL LINES FOR CONTRACTORS AND DIYERS

Lowe’s Canada will roll out two dedicated power tool lines in its stores over the next few months. The Flex and Kobalt brands are already in Lowe’s U.S. stores.

Flex is a power tool line for contractors and pros. The Flex line first arrived in Lowe’s stores in the U.S. just over a year ago as part of the retailer’s strategy to strengthen its connection with contractors. It’s produced by Chervon, a global tool manufacturer, which also manufactures Kobalt’s cordless power tool lines for Lowe’s.

The new lines are already available online, but they’ll be gradually introduced to stores beginning with Réno-Dépôt. Lowe’s stores will get the lines in the fall.

“These two brands are real game chang ers for DIYers and contractors nationwide,” said Chris West, SVP merchandising at Lowe’s Canada. “(They) set new standards in the mar ket in their respective categories and offer more value to our customers.”

For the pro customer, Flex cordless tools boast fast charging times, long runtimes, and

more power. Lowe’s, RONA, and Réno-Dépôt customers currently have access to some 30 Flex products, but this range is expected to grow later in the year with a second wave of products that feature lithium batteries.

“The addition of this brand is exciting news for our professional customers,” said Jeff Oben, senior director, pro sales - in store, at Lowe’s Canada. “Things move fast on a job site, so it’s essential for contractors to have reli able, high-performance tools that allow them to do more work, more efficiently.”

Hardlines Home Improvement Quarterly www.hardlines.ca 16 THIRD QUARTER / 2022

NEWS

ROUNDUP

Charles Grégoire-Béliveau

Antonio Di Pasquale

join Sexton Group, you join a network of professionals dedicated to the success of your business. We negotiate competitive programs and leverage our strong relationships with vendors to resolve any issues quickly for you. We have a first-class accounting team that promptly delivers accurate rebate payments as promised. This is your independent business. Sexton Group provides the right support so that you can achieve success on your terms!

Hear about our story at 1.800.665.9209 Learn about our story at sextongroup.com “ ” Working for our members every day.

Rick

Garrah Owner and founder REP WINDOWS AND DOORS Kingston, Ontario

us. Our Business Development Manager saw my vision for expanding the business from day one. With the group’s support and volume pricing, we had the opportunity to branch out and get into new product lines. That grew the retail side of our business to the point where it’s now bigger than the wholesale side.

Talk to us today

Sexton has been great for

When you

B.C. BUILDING SUPPLY ASSOCIATION CONFRONTS CHALLENGES IN HIRING

Aresearch study to figure out how to make the home improvement industry more attractive to poten tial workers has been commissioned by the Building Supply Industry Association (BSIA) of British Columbia. Funding is being provided by the province’s Ministry of Advanced Education and Skills Training. The study is being conducted by R.A. Malatest and Associates.

“It’s an 18-month deep dive into our industry,” says Thomas Foreman, president of the BSIA. Frustrated by the shortcomings of the industry in terms of recruitment and succession planning, Foreman wanted to build a blueprint to help member compan ies, which include dealers and suppliers, to tap into the province’s workforce.

Like everywhere in North America, staffing in B.C. has become a huge issue. Yet, at the same time, the industry is busier than it has been in two decades, preventing many companies from having the luxury to look ahead and plan their talent acqui sition strategies. “All of us see what the challenges are,” Foreman says.

Take training, for example. Most of the focus in this area is on entry-level skills, important enough for any new employee. But, with some exceptions, there’s a lack of meaningful training for managers and other senior people, Foreman points out.

The answer, Foreman says, is to get more data on who the future workforce repre sents, and what their values are. Malatest and Associates has been constructing and

conducting surveys and focus groups to gather that data. The study is now in phase two, and Foreman expects the final report to be ready next spring.

COPENHAGEN DIY SUMMIT HEARS PREDICTIONS ON

DURATION

OF SUPPLY CHAIN WOES, INFLATION

Expect the supply chain to remain in disar ray in our industry for at least another eight months. Nor will inflation go away any time before that, though it will likely start to ease into 2023.

These were just some of the predictions shared in early June by Mark Herbek, execu tive director, home improvement, at the Cleveland Research Co.

Herbek was speaking to 900 home improvement executives from around the world—including Hardlines—at the eighth DIY Summit, in Copenhagen, Denmark.

Herbek noted that home improvement retail was up 35 percent in the U.S. over two years under COVID (comparable to growth in Canada, according to Hardlines). Out-ofstocks continue to run as high as 25 percent and this will extend the home improvement cycle as people push out projects until prod uct is available. “But more dollars will be chasing fewer products and this is resulting in staggering inflation,” Herbek said.

While online sales continue to stay rela tively healthy, in-store traffic has flattened, compared with pre-COVID rates. “We are past the peak in the U.S.,” Herbek notes. “We are now seeing a declining environment.” He said that it has taken “from 10 to 17 months” his torically for this cycle to recover.

Hardlines Home Improvement Quarterly www.hardlines.ca 18 THIRD QUARTER / 2022

NEWSROUNDUP

Thomas Foreman, president of the BSIA of BC, says his organization is conducting a study to assist recruitment strategies.

Mark Herbek of the Cleveland Research Co. addresses delegates at the recent DIY Summit held in Copenhagen.

ONLINE TO IN HAND We arm you with the tools you need to build your own online store and take on the competition. Get started with the ecommerce platform that enables you to sell, deliver and process payments online. Start selling online today! Visit toolbx.com/hardlines

Kitchen&Bath SPOTLIGHT

Extended reach makes for a clean sink

Isenberg’s Velox faucet is constructed of premium stainless steel with a pull-down faucet and dual function sprayer whose extended reach can easily and thoroughly clean all areas around the sink. All thin-film, ceramic-based finishes are oven-cured and finished to perfection for a durable product that is resistant to corrosion, scratches, and chips. Available with a matching soap dispenser, Velox features single-hole installation and is ADA- and WaterSense-compliant. www.isenbergfaucets.com

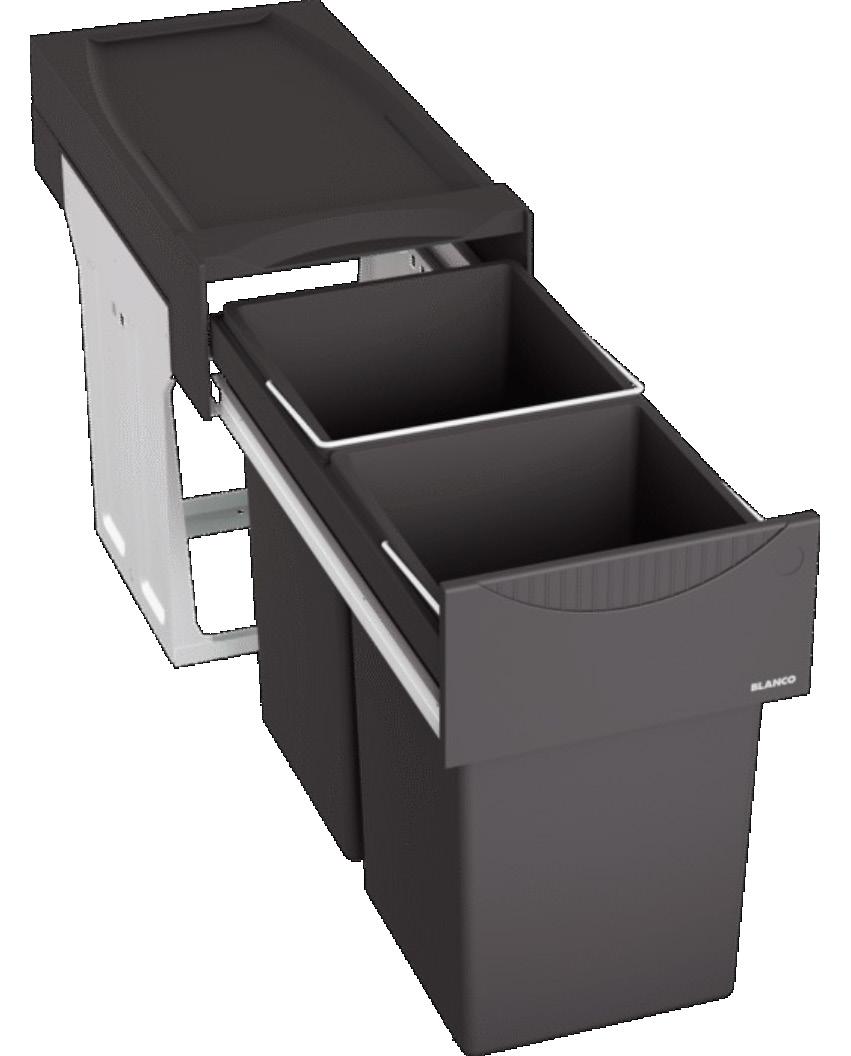

Minimize clutter with handy below-sink storage

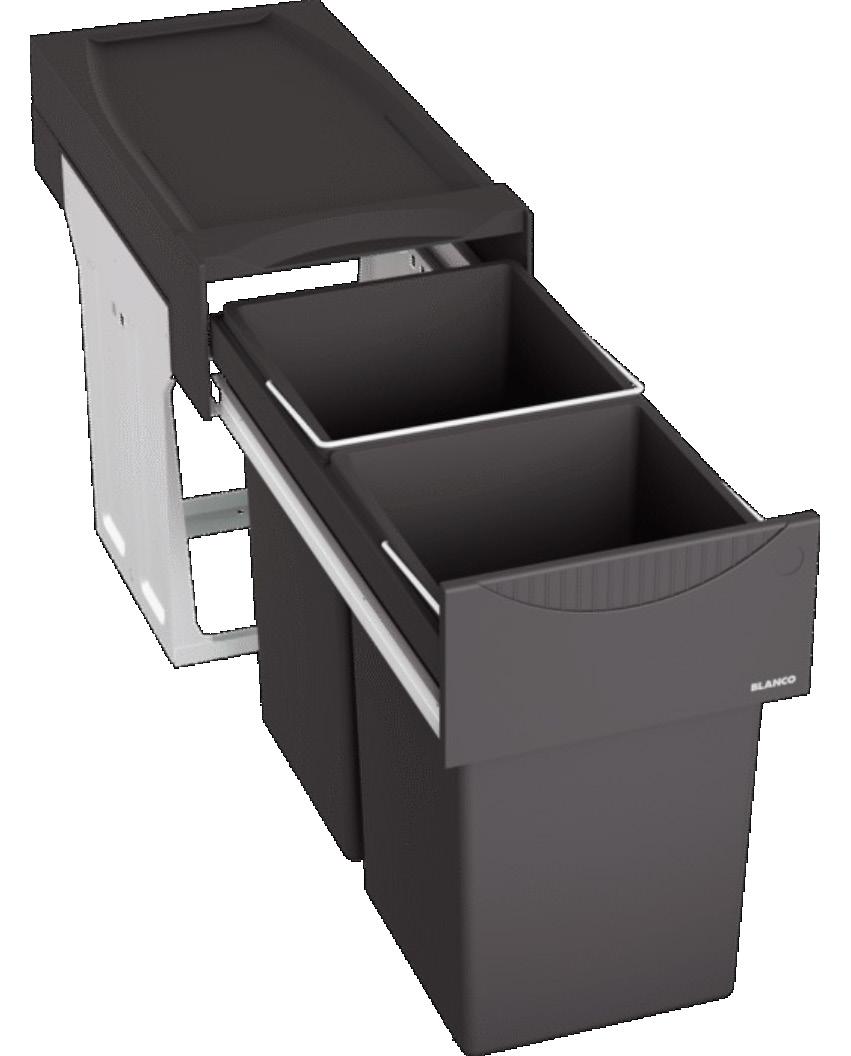

Blanco’s new Botton II organizational system maximizes storage for recycling, cleaning supplies, and more. It fits seamlessly below the sink base cabinet and boasts easy to access under-the-sink organization, including two removable four-gallon bins with handles and a top shelf for additional storage. Install easily on the bottom of the cabinet with just four screws. www.blanco.com

Art Deco-style faucets in multiple styles and colours

The Rivana faucet collection from Blanco features a geometrical square base which transitions into a round spout with a streamlined pull-down spray head, blending organic shapes with ergonomic function. Inspired by Art Deco design, the full Rivana family includes three styles: Semi-Professional, High Arc, and Bar. The faucets are available in Chrome, PVD Steel, Satin Gold, and Matte Black, and are complemented by a soap dispenser. www.blanco.com

Hardlines Home Improvement Quarterly 20 THIRD QUARTER / 2022

BY GEOFF M c LARNEY

Easy-to-clean baths with no colour bleed

BainUltra’s Celestia baths are made with FineStone, composed of refined minerals and pure liquid acrylic inspiration from the sky. Equipped with thermal insulation, the baths resist hot temperatures and are strong and durable. Light and colour resistant, with no colour bleed or wear, they are non-porous, hygienic, and easy to clean and repair. www.bainultra.com

Sliding shower panels are easy to clean

At 8mm, Maax’s Inverto Sliding Shower Door Glass panels feature Lotus easy clean glass protection. It fits showers with 70-1⁄2-in. wall clearance, and the glass extends to 74-in. Two sliding glass panels make for flexible entryway or plumbing access on the left or on the right. Sleek and square elements for a modern look. Combine a shower door with a return panel for a corner shower. www.maax.ca

Cut chlorine levels and adjust spray setting

American Standard’s Spectra Filtered 4-Spray Hand Shower Rail System reduces chlorine levels in the shower by at least 50 percent. The filter is built into the rail system so it’s easy to change and eliminates the need for a bulky add-on filter. The hand shower features four spray functions, from a drenching rain to a pulsating massage, and is mounted on an adjustable, smooth-gliding holder. www.americanstandard.ca

Hardlines Home Improvement Quarterly 21 THIRD QUARTER / 2022 KITCHEN & BATH SPOTLIGHT

www.hardlines.ca

Get chilled sparkling water instantly

The GROHE Blue Chilled and Sparkling 2.0 Faucet gives homeowners instant access to filtered chilled water, medium carbonated, or full sparkling water, and unfiltered tap water in one technologically advanced design. Use the push button with LED ring to dispense the preferred water and its single lever handle to dispense tap water. The pull-down kitchen faucet is equipped with WiFi and Bluetooth to monitor faucet performance, track, and notify users of CO2 usage, filter status, and control water portioning via the app. www.grohe.ca

Bidet toilet is packed with features

The DXV AT200® LS SpaLet bidet toilet combines luxury design and performance paired with personalized hygiene, comfort, and cleansing features to pamper in comfort for a fresh, out-of-the-shower feeling. Advanced features harness the power of technology to keep your room smelling fresh, with air circulation, room refresh deodorizer, and an air shield deodorizer. A soft night light illuminates the seat and bowl. The seat includes an aerated feminine wash and aerated posterior wash with dual adjustable self-cleaning nozzles, plus a heated toilet seat with adjustable temperature settings. www.dxv.com

Hand shower is easy to install, easy to release

Inspired by natural elements and soft modern lines, Moen’s 6-Function Hand Shower in Chrome offers a streamlined look that fits into any décor. The Magnetix docking system allows for easy release and securely snaps the hand shower back into place. The included 84-inch kink-free metal hose extends your reach and flexibility. Installation is quick and easy, requiring only a wrench and three simple steps. www.moen.ca

Hardlines Home Improvement Quarterly www.hardlines.ca 22 THIRD QUARTER / 2022 Kitchen&Bath SPOTLIGHT

Self-paced leadership training is here. Get started today.

NHPA offers three online courses to help managers learn effective leadership, communication, problem-solving and financial management skills.

Your Leadership Style

In this introductory course, managers will learn about their unique leadership style and strengths that will provide a framework for their ongoing leadership growth and career development needs.

Leading Your Team

This course teaches managers the critical components of building and leading a team, including communication skills, conflict management, talent development and ongoing performance management.

Financial Management

This course focuses on the key financial management skills that developing leaders need to manage the financial side of the business, including the basics of expense control, budgeting and benchmarking.

Join one of our interactive group sessions or start a self-paced option today. Enroll at YourNHPA.org/fol.

NHPA

Foundations of Leadership Program

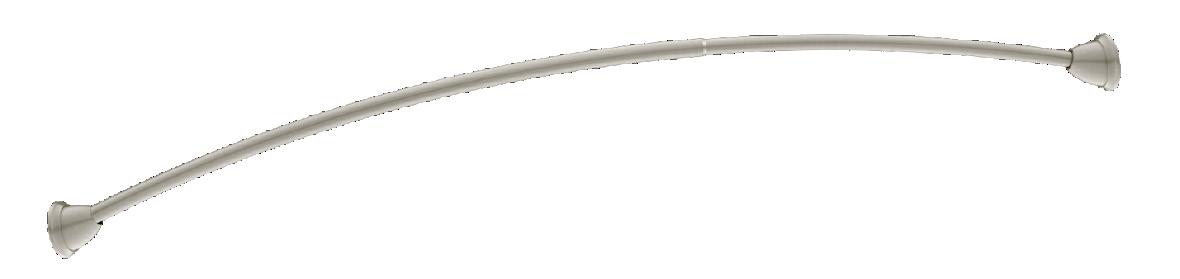

Moen’s Tension Curved Shower Rod has a bowed design that offers extra room to move in the shower. This tension curved shower rod is corrosion-resistant for reliable long-lasting use. Its adjustable design allows easy installation with no cutting necessary. The included decorative covers add a stylish element while helping to conceal the mounting hardware. Pivoting flanges allow you to securely install the rod on uneven walls in minutes, with no cutting required. www.moen.ca

For a safer bath with no wall damage

Taymor’s Suction Assist Bar offers additional balance and stability in the shower or anywhere else in the home. The suction cups secure instantly to smooth, non-porous surfaces such as glass, fibreglass, or tile. With flip-up locking tabs, the cups are easy to install with no tools required and no damage to walls. Available in white and grey or white and blue finish. www.taymor.ca

A faucet that is a functional work of art

Equipped with everything you need to prep, cook, and clean in the kitchen, this Bruton faucet is a functional work of art. The coil and the knurling details are both practical and decorative, adding to the performance and the timeless design. It’s beautifully symmetrical and offers maximum clearance and reach. Available in polished chrome, stainless steel, matte black and brushed gold. www.pfisterfaucets.com

Hardlines Home Improvement Quarterly www.hardlines.ca 24 THIRD QUARTER / 2022 Kitchen&Bath SPOTLIGHT

Each issue of Hardlines Dealer News features: 4 News to help store owners and managers stay current on the latest trends in their market; 4 Tips for smart retailers who want to identify ways to manage their operations more successfully; 4 Insights to help dealers hire smarter, merchandise better and manage more effectively; 4 Concrete ideas for managing budgets, merchandising products and identifying best practices. Tips and information for home improvement dealers to your inbox every month! Targeted squarely at store owners and managers, Hardlines Dealer News is a monthly email newsletter with content designed especially for dealers and owners who want to run their businesses at maximum efficiency. Sign up today for free dealernews.ca

INTERVIEW BY STEVE PAYNE

JOURNEY A MANAGER’S

LANGTON CHODOKUFA has come a long way since his decision, 21 years ago, to reluctantly leave his family and move from Mutare, Zimbabwe, to North America.

“It was supposed to be for a two-year stint,” he told HHIQ. “Getting experience in a developed economy would be advantageous for the career roles that I aspired to.” Langton’s first stop, Cleveland, was not an easy place to find a job. “I became frustrated with my job search,” he confesses. But one day he walked into a Home Depot which had set up a recruiting kiosk. Two decades later, and one more country on his odyssey later, Langton is the proud store manager of Home Depot’s store #7011, South Etobicoke (Toronto).

Hardlines Home Improvement Quarterly www.hardlines.ca 26 THIRD QUARTER / 2022 COVER FEATURE LANGTON CHODOKUFA

Photography: Larry Arnal

I am naturally attracted to the impossible task in the room.

“ ”

MANAGER’S

Quarterly www.hardlines.ca 27 THIRD QUARTER / 2022

Hardlines Home Improvement

LET’S START WITH YOUR BASIC CAREER PATH AT HOME DEPOT.

I started at Home Depot in Cleveland as a cashier. I’ve now worked for three differ ent divisions—Northern Division, Expo Division and the Canadian Division. I relocated to Canada for family reasons and really loved how Home Depot supported me through that. I was in the U.S. from 2001 and then I moved in 2006 to Oakville, Ont. I was promoted to an assistant store manager role in the Brampton market in 2007, and then, ultimately, I became a store manager.

TELL US ABOUT YOUR DECISION TO COME TO NORTH AMERICA.

My previous work experience in Zimbabwe was in banking. When I immigrated to the United States, it was supposed to be for a two-year stint. Getting experience in a developed economy would be advantageous for the career roles that I aspired to. Not only that, the thrill of what I would learn and the person I would grow into! However, I became frustrated with my job search in Cleveland. Sometime down the road, I walked into a Home Depot, and there was a kiosk. I filled out the application right there. When I was hired, I worked as a cashier for

three days. But I was taking a computer sci ence and engineering degree at the time, so the store manager moved me to work with the computers in the store.

GROWING UP IN ZIMBABWE, WHAT DID YOU WANT TO DO FOR A LIVING?

In high school, I had the privilege of win ning some academic awards a couple of times, allowing me to access some events. There was an event with different speakers at my school. Two of the speakers sat on various boards of high-profile organiza tions at the time. I thought it was so cool that someone could be in a position to help create environments for others to prosper.

Since childhood, I have always been a sucker for hard work and I am naturally attracted to the impossible task in the room.

HOW DOES THAT PASSION TRANSLATE TO YOUR ROLE AS STORE MANAGER?

It definitely connects to my store manager role. There are a lot of different roles to play. As a store manager, you can pretty much make of it what you want to make it. There’s endless stuff to do. Every day is different, always trying to figure out the next big thing that pushes your team to be able to deliver on customers’ ever-shifting needs.

My passion is really about how do I leave the environment I’m in a little bit better

Hardlines Home Improvement Quarterly 28 THIRD QUARTER / 2022

www.hardlines.ca COVER FEATURE LANGTON CHODOKUFA

Langton Chodokufa confers with Sabrina Scrivo (left), human resources manager at Home Depot South Etobicoke and (centre) Trey Reynolds, operations assistant store manager.

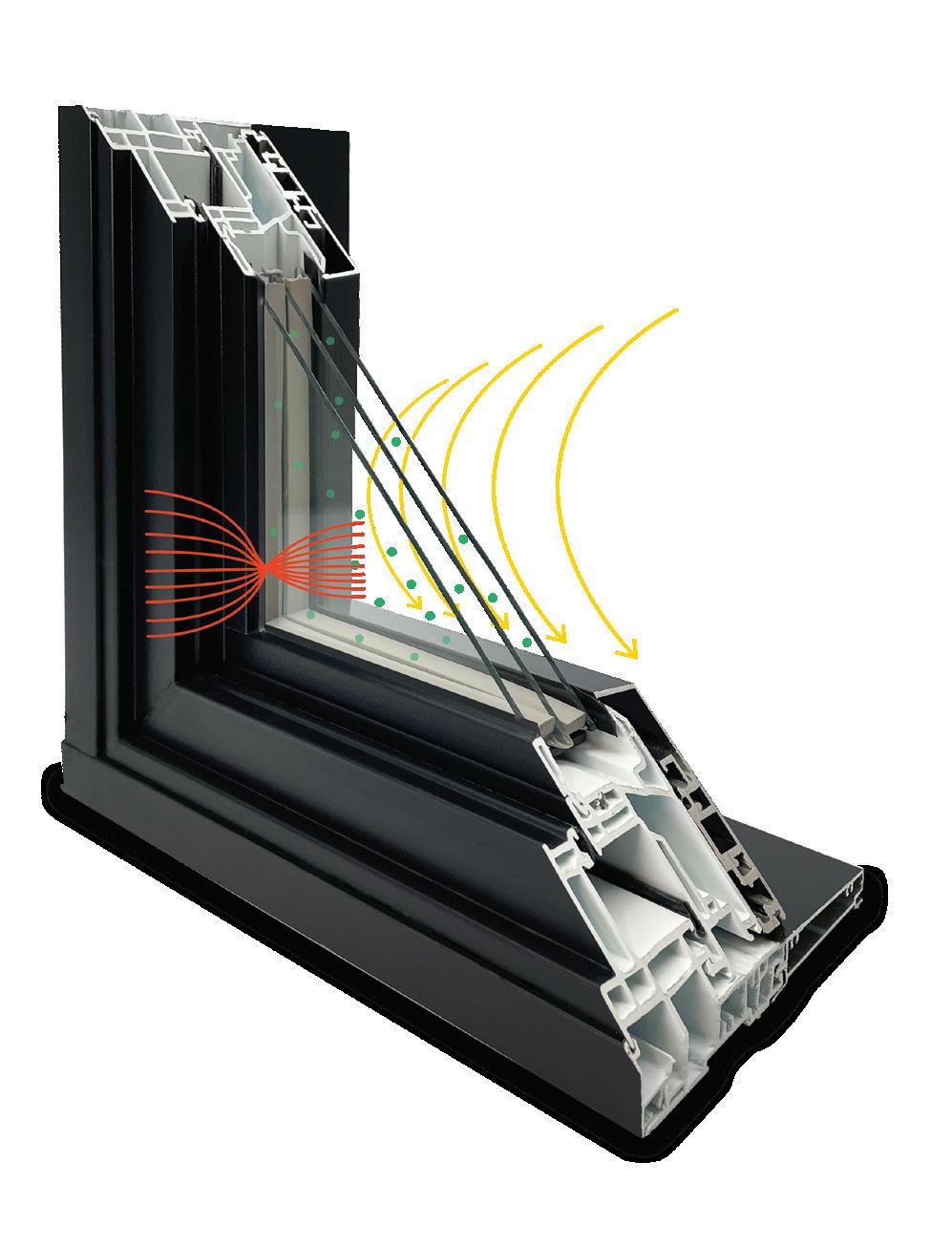

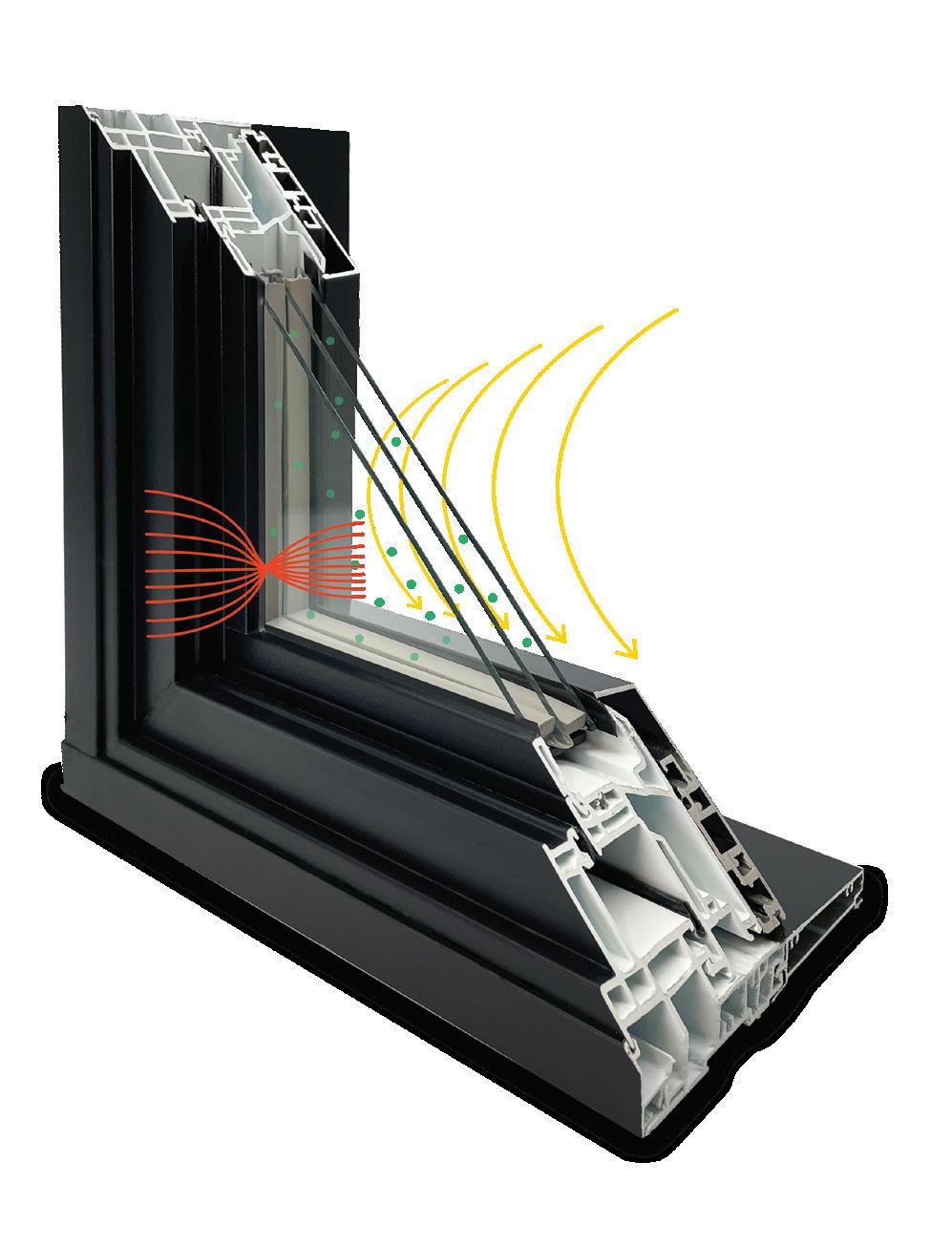

Every Northern Tri-Pane Collection™ window is made in Canada and specifically designed for life in Canadian climates. The exterior pane and increased air spaces insulate the interior panes to reduce radiant heat, regulate the temperature inside the home and block unwanted outside noise.

These windows also meet the highest ENERGY STAR® certification criteria to ensure energy conservation and reduction of seasonal heating and cooling costs.

JELD-WEN windows can be finished in a complement of colours from our premium paint options or with FiniShield™, our latest colour technology for windows with black exteriors and/or interiors.

JELD-WEN windows are available everywhere quality windows and doors are sold.

To learn more or to find a local dealer visit: TrueTriPane.com

With the Northern Tri-Pane Collection™ featuring True Tri-Pane Technology™

1

3

Reduction

Only JELD-WEN® True Tri-Pane Technology™ can offer:

Superior Efficiency 2 Enhanced Home Comfort

Exterior Noise

than how I found it? When you’re talking about extending that into our associates lives, I think about how I can make things different for my associates. Improve things for them and with them. Help support them in their goals.

I also really love product excitement and

bringing that to my associates and custom ers. I really love the idea of the challenge in that. How do we bring a product to life? How do we communicate that? It’s exciting in the sense that it’s always thrilling and it keeps you on your toes. And I love seeing how our associates take on that challenge every day.

WHO HAVE BEEN SOME OF YOUR MENTORS?

Eileen Hooker was one of my first men tors. She was a computer room supervisor at Home Depot. Everything she did, she really strived for excellence, and she was one of a kind. Eileen took me on from my early career days at Home Depot and she would just give me opportunities to experi ment. She was amazing, always there—no matter what—to support me. Eileen was really important to me. I stayed in contact with her until she passed a few years ago.

The work ethic I have now is from my Dad. He’s passed, but he used to work for the provincial government in Zimbabwe. He would take me to work sometimes and the reason I would go is because we got to have lunch together—and he had a com puter, which he let me play games on. Back then, computers were a big thing!

My Dad was tireless. His role was as an operational officer—it was his work to make sure communities were safe and provided for. It was amazing to me how he would do that selflessly. He’d give away personal stuff to ensure communities had what they required. He would organize food, or count less times he’d walk home after lending his car out to someone, to help a community member. My family and I have sponsored families all my life and we raised funds for an orphanage in Uganda during the pan demic. This past holiday, our store helped support 65 families with meals for the week. I love that Home Depot is an enabler for such activities to happen.

Hardlines Home Improvement Quarterly 30 THIRD QUARTER / 2022

www.hardlines.ca COVER FEATURE LANGTON CHODOKUFA

My passion is really about how do I leave the environment I’m in a little bit better than how I found it?

“ ”

WHAT WERE SOME OF THE BUSINESS CHALLENGES OF THE PANDEMIC?

I think the biggest challenge for the team was the conversion of our business model. Everything changed with those initial lock downs. But even though that was incred ibly difficult for us, our associates just kept showing up. They could have stopped com ing to work at least until such a time that they could assess the severity of what was going on, but they didn’t. That was really incredible. They really wanted to make it work, support the community and do what they could.

WHAT’S CHANGED ABOUT WORKING FOR HOME DEPOT SINCE YOU STARTED IN 2001?

The fantastic part of Home Depot is just how we’ve been evolving as a company. We’ve really improved operational aspects in different internal departments to work more cohesively—we truly are becoming One Home Depot. Concerning the industry itself, it’s around the evolution of our cus tomers. Seeing the evolution of each gener ation go through its life stages. Customers today have different shopping styles, they define value differently and what they define as “convenience” is totally different

compared to 20 years ago. I love that we find a way to position ourselves as a des tination for each of our diverse customers’ needs. We have the services that the ‘do it for me’ customers want; we have the threehour express shipping that the pros and the Generation Z customers want. I really love that we look at what each generation values. You see that in the growth of our services, and how our associates go about helping our customers in the aisles.

HOW HAS DIGITAL TECH CHANGED YOUR JOB?

In the beginning, it was a rough start, but let’s remember, I’ve been here for more than 20 years. It wasn’t necessarily just on the technology, but at that time, everyone was just trying to figure this all out. When you’re used to one way, this created a lot of challenges. But overall, it has been amazing, and it’s made my job a lot easier; it’s made my team’s job a lot easier. Now we can’t wait to hear the next thing that’s coming out.

AS A MANAGER, HOW DO YOU SEE YOUR ROLE IN DEVELOPING TALENT AT YOUR STORE?

Managers can truly set the foundation to help individuals become who they want to become. A store of individuals who maybe

don’t see that in themselves yet. That is at the very top of my list. If someone were to say to me, write a job description for your role, I would say I’m there to facilitate a place that people can grow in—in their careers and as people.

WHAT ARE YOUR SOME OF YOUR HOBBIES?

I love watching (children’s animated TV show) Peppa Pig with the kids, and there’s not an episode I don’t know. Beyond that, I love fishing. The quietness on the water, it brings me closer to nature. I used to do it by myself when I first started, but with six kids, it’s always a party. My boat is already packed with just my family! I also fish with friends—we get together a few times in the summer.

WHAT IS YOUR BIGGEST WEAKNESS?

I can’t stand still! I’m always on the move doing something or learning something new. I take classes often, and I’ve enrolled myself at York University, which lets me sign up for courses of interest. I took critical thinking, and it was interesting. I also may want to take a marketing course in addi tion to core business courses. Information is always changing.

Hardlines Home Improvement Quarterly 32 THIRD QUARTER / 2022

www.hardlines.ca COVER FEATURE LANGTON CHODOKUFA

Langton in the power tool corral with (from left) Antonio (Tony) Stampone, supervisor of the merchandising execution team (MET); Sabrina Scrivo, human resources manager; Hydie Vicente, MET associate; and Trey Reynolds, operations assistant store manager.

Beauty and Performance from your Trusted Brand

Wolmanized® Outdoor® Wood with Tanatone® colourant has decades of proven performance in protecting wood from its natural enemies - termites and fungal decay. • Above ground, ground contact and freshwater applications • Long-lasting protection with built-in colourant • Fasteners – manufacturer recommendations and building code compliant WolmanizedWood.com

HOW DO YOU FIND TIME FOR ALL THIS?

I don’t even know, I guess I find time within my down time. Most of this happens when the kids go to bed. I jump on online classes, I’ll read books, or sometimes I get audio books, so I can listen to my books while I’m driving to work. I look forward to my drive that way, as it’s a little longer than a normal commute.

WHO IS YOUR FAVOURITE AUTHOR?

It depends on what topic I’m reading. If it’s business or if it’s philosophical, it’s differ ent. But in general, one book I read over and over again is Over The Top by Zig Ziglar. If I don’t have something to read, I will pick

Hardlines Home Improvement Quarterly www.hardlines.ca 34 THIRD QUARTER / 2022

COVER FEATURE LANGTON CHODOKUFA Business Software Built for the Lumber Industry We deliver complete business management solutions to help lumber businesses improve margins and cut costs. Contact us to find out more. 919.379.3800 info@kerridgecsna.com www.kerridgecsna.com Your business. Your way. Hardlines.indd 1 5/23/2022 1:04:50 PM Home Depot store #7011’s Sabrina Scrivo, Langton Chodokufa, and Hydie Vicente.

that book up, and I always get something new out of it.

DO YOU HAVE A FAVOURITE PRO SPORTS PLAYER?

This one’s a little biased because I came from the Cleveland area, so Lebron James.

WHAT WAS THE MOST EXCITING DAY OF YOUR LIFE?

For me, it’s when I got married. It was the top highlight of my life for me, and with each kid, their birth was just over the top—these were are all extraordinary, life-defining moments for me. When it comes to working, the best days are when you’re able to facili tate someone getting closer to the role they’re working towards—that’s the most gratifying.

When you see you’ve had an impact in an environment you helped to create or foster, a positive impact on people as they work towards a goal. Those are exciting moments.

WHAT WAS THE BIGGEST CHALLENGE YOU HAVE EVER OVERCOME?

My biggest challenge was leaving my family in Zimbabwe—new territory, restarting life again, and restarting my career. I was one of the youngest to hold the position I had at the bank I worked at—and it was a pretty big bank—and I left all that and my family.

I came to the U.S. to start in a place where I didn’t know what was around the corner. The only aspect I understood of the culture was what I had read. That was challenging.

WHAT WOULD YOU WANT YOUR COMMUNITY TO SAY ABOUT YOUR STORE?

What I would really want is that my store’s name comes up in important personal con versations. That would mean so much to me and our associates who work so hard to serve our community. To have touched an individual to the point where they… speak about something (at our store) that had a significant impact on them. That they can’t help in those private conversations but share a positive experience that we helped create. It would be most humbling to hear Home Depot played a small part in helping to meet that opportunity—touching and leaving the communities we serve a little bit better than when we first got there.

Fast,

Hardlines Home Improvement Quarterly www.hardlines.ca 35 THIRD QUARTER / 2022

your smartphones, tablets and other electronic devices up and running is essential to staying connected to

you

device

outlet

you.

cmyk with trapping PMS : 376C & 2758C CMYK : Green (C=50, M=0, Y=100, K=0) Blue (C=100, M=76, Y=0, K-38)

Adapter-Free Charging Keeping

family, friends and business. Whether

have one

or many, we have a Leviton USB

that is right for

Available in both 15 and 20 Amp.

www.leviton.com

BY THE EDITORS OF HARDLINES

FEATURE CANADA’S TOP 20

TOP20 HOME IMPROVEMENT RETAILERS Hardlines Home Improvement Quarterly www.hardlines.ca 36 THIRD QUARTER / 2022

CANADA’S

country’s home improvement retailers enjoyed another banner year in 2021—the second year of COVID restrictions.

Canadians continued to plough money into their homes as other spending options were reduced. In spite of supply chain problems, HARDLINES estimates our industry grew by 11.3 per cent last year, bringing total retail* sales to over $58-billion. Here’s how that breaks out...

*Sales to end users—consumers, contractors and industry

The

Home Improvement Quarterly www.hardlines.ca 37 THIRD QUARTER / 2022

Hardlines

October 18 & 19, 2022

NIAGARA-ON-THE-LAKE, ONTARIO www.hardlinesconference.ca

It’s Time to Re-connect.

October 18 & 19, 2022 at the beautiful Queen’s Landing Hotel in the historic town of Niagara-on-the-Lake, Ontario, just 80 minutes from Toronto. Join other top retailers and managers from across the country, along with leaders from the key retail banners and buying groups, their wholesalers, and vendors. PLUS:

Canada’s only national awards program dedicated to celebrating the achievements of hardware, home improvement and building supply dealers and their staff.

Can’t make the trip in person?

This year, you can attend the Conference and Awards Gala virtually. We’ll make it easy to join your fellow retailers and celebrate award winners and top speakers!

CONFERENCE

Join us in person for the 26th

SERIES 2022

Annual Hardlines Conference

The Outstanding Retailer Awards

A fantastic networking experience!

This year’s event will feature some of North America’s top thought leaders in hardware and home improvement retail, who will share their stories and their insights on the future of retail. MEET OUR SPEAKERS:

The 26th Annual Hardlines Conference

October 18 & 19, 2022

NIAGARA-ON-THE-LAKE, ON www.hardlinesconference.ca

AGENDA AT-A-GLANCE

OCTOBER 17 TH

OPENING NIGHT RONA Pub Night 7:00pm – 9:00pm

OCTOBER 18TH DAY 1

Breakfast, Lunch & Sessions 8:00am – 3:35pm

Home Hardware Industry Reception 4:30pm – 6:00pm

Outstanding Retailer Awards 6:00pm - 9:00pm

OCTOBER 19TH DAY 2 Breakfast & Sessions 8:00am – 11:50am TITLE SPONSOR

CONFERENCE SERIES 2022

Plus lots of networking time with colleagues and customers!

Tony Cioffi President

LOWE’S CANADA

Eric Palmer VP & General Manager SEXTON GROUP

Rob & Joanne Lawrie Owners THE LAWRIE GROUP OF HOME HARDWARE STORES

Alison Fletcher Owner THE COOKERY STORE

Dan Tratensek COO & Publisher NHPA

Peter Norman VP & Chief Economist

ALTUS GROUP

Charles Grégoire-Béliveau VP, Merchandising BMR GROUP

Zaida Fazlic VP, People & Culture TAIGA BUILDING PRODUCTS

RETAIL

Doug Stephens

Founder

PROPHET

1. THE HOME DEPOT CANADA

HQ: Toronto, Ont.

2021 SALES: $11.673-billion

STORES: 182

The world’s largest home improvement retailer is also the number one player by sales in Canada. The Home Depot Canada is a business division of The Home Depot in Atlanta. The parent company had US$151.2billion in 2021 sales—up a whopping 14.4

percent from 2020. Orange Crush had 2,137 stores last year in Canada, the U.S., and Mexico.

Here in Canada, the company has held steady with 182 stores for the past decade, concentrating on increasing sales from its existing stores rather than adding new loca tions. The growth effort is being directed at both in-store sales and e-commerce sales, that latter in what the company calls its “endless aisle” (which contains a reported one million SKUs).

One of Home Depot Canada’s key target markets for growth is the pro customer. In the U.S., contractors represent 12 percent of Home Depot’s customers. Services for pros include designated service counters in the stores and online connections such as Pro Xtra, which ties pro members to the Home Depot’s commercial credit card. Benefits of this program include rewards on all pur chases, 365-day in-store returns, and the ability to issue cards to trusted members of contractors’ staffs.

2. HOME HARDWARE STORES

HQ: St. Jacobs, Ont.

2021 SALES: $8.875-billion

STORES: 1,053

The largest Canadian-owned banner in the retail home improvement industry, Home Hardware Stores continued to develop its e-commerce technology in 2021. After many years offering BOPIS (buy online pick-up in store) through its thousand-plus

Hardlines Home Improvement Quarterly www.hardlines.ca 40 THIRD QUARTER / 2022

Size of the industry year over year (sales $millions) 2017 2018 2019 2020 2021 $60,000 $55,000 $50,000 $45,000 $40,000 $44,030 5.4% $45,644 3.7% $45.500 -0.3% $52,534 15.5% $58,467 11.3% FEATURE CANADA’S TOP 20

DISCOVER THE ADVANTAGES OF RONA, VISIT rona.ca/ becomeRONA BE PART OF SOMETHING BIGGER becomeRONA@rona.ca WESTERN CANADA Tony Perillo 204-218-5805 QUEBEC Pierre Nolet 514-213-9162 ONTARIO Glen Duczek 416-528-7131 ONTARIO & MARITIMES Scott Wilson 519-281-1824 NATIONAL Josée Desrosiers 418-391-7101 Matthew Wagstaff & Ryan McKay RONA Black Diamond, Alberta RONA dealers since 2004 ‘’ADDING A RETAIL COMPONENT to our store has created stability for our business. THE BRAND helps create a balance between retail/hardware and LBM.’’

stores, Home Hardware is now offering BOSTH (buy online ship to home) from its Wetaskiwin, Alta., distribution centre. A BOSTH functionality will soon be oper ational from the Home Hardware central DC in St. Jacobs, Ont., too 2021 was a year of further expansion into Quebec for Home Hardware. Early last year it partnered with Groupe Turcotte (a Home Hardware dealer in Quebec with seven stores) to purchase home improve ment retail chain Patrick Morin (see sep arate listing). This added an impressive 21 stores and a distribution centre to Home Hardware’s roster in Quebec.

Like many retailers during the con tinuing supply chain disruptions of 2021, Home Hardware has moved up its seasonal ordering times to accommodate the longer lead times from Asia. It has also decided to secure more product that in the past and has worked hard to move product between its three main DCs to keep its dealers sup plied. Home Hardware Stores has also seen an influx of new buyers, some of them from big boxes and mass merchants with which Home Hardware competes.

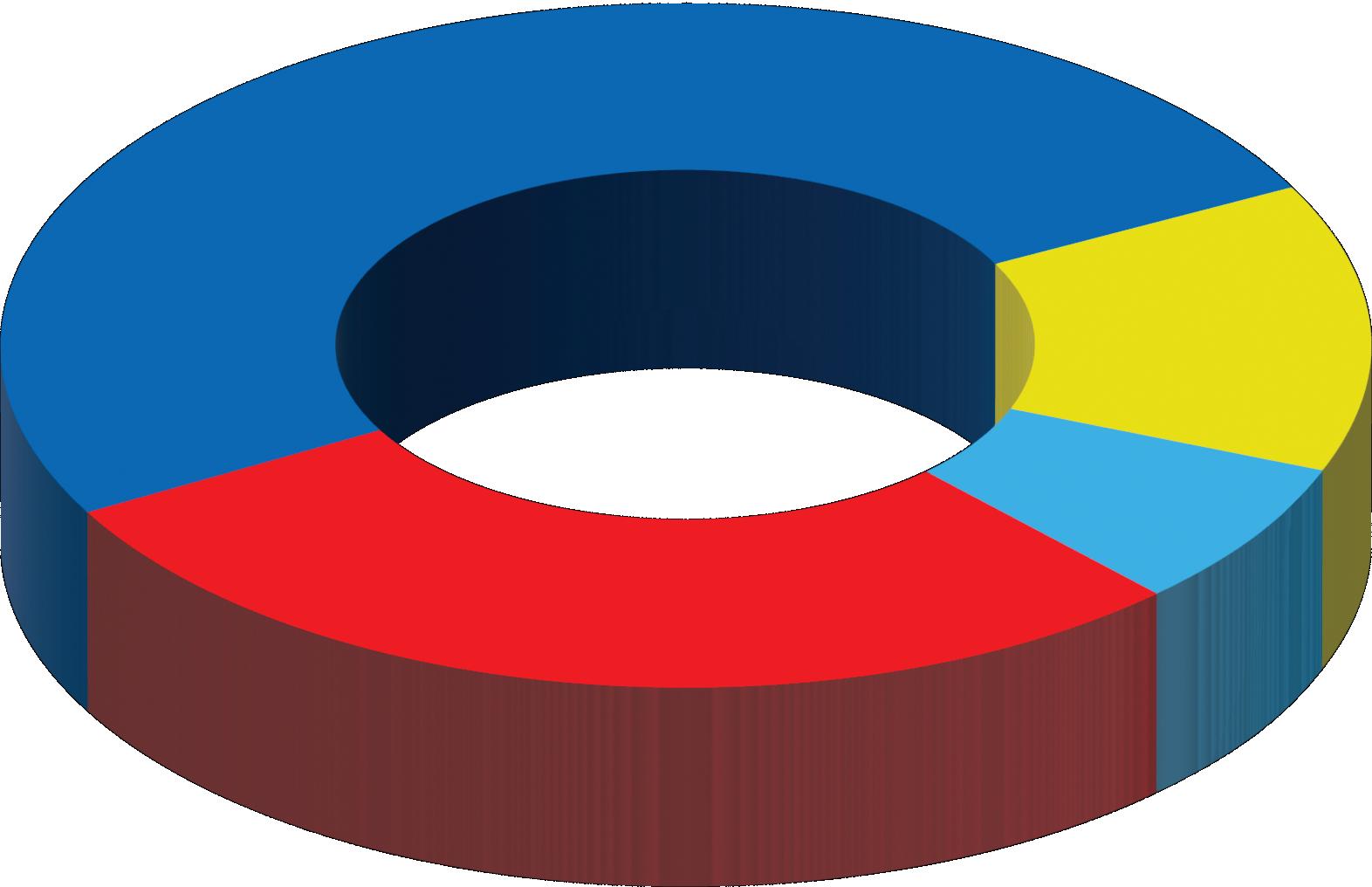

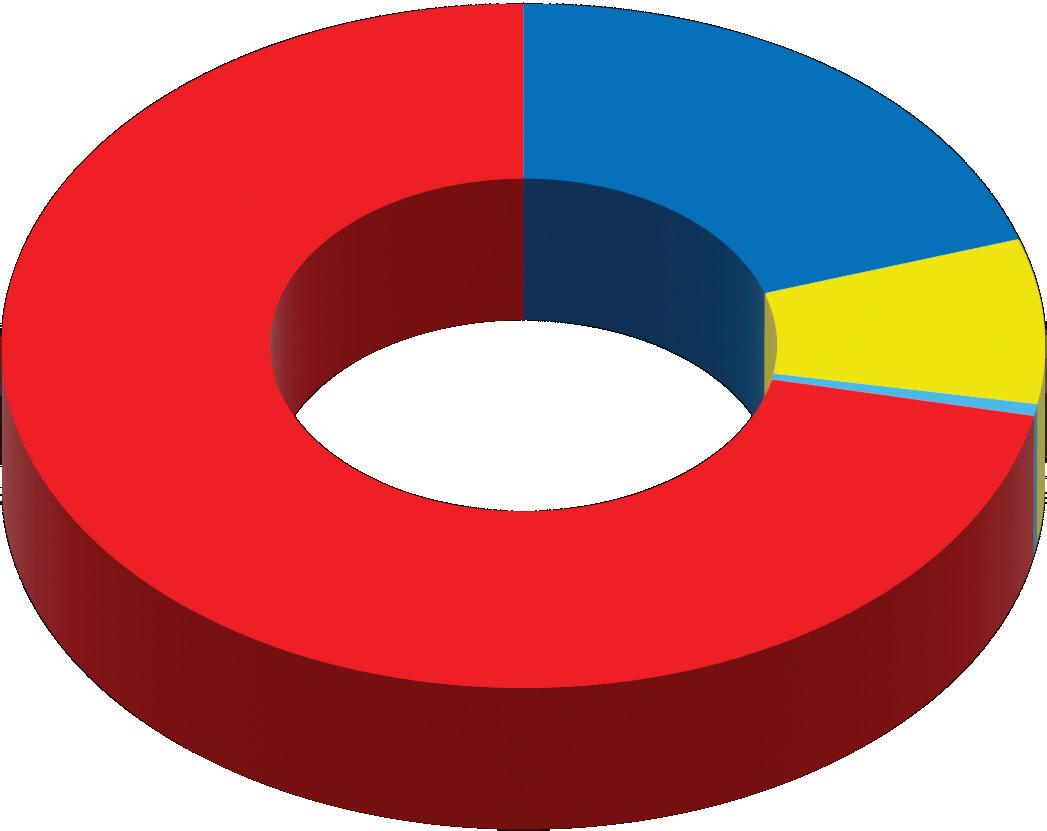

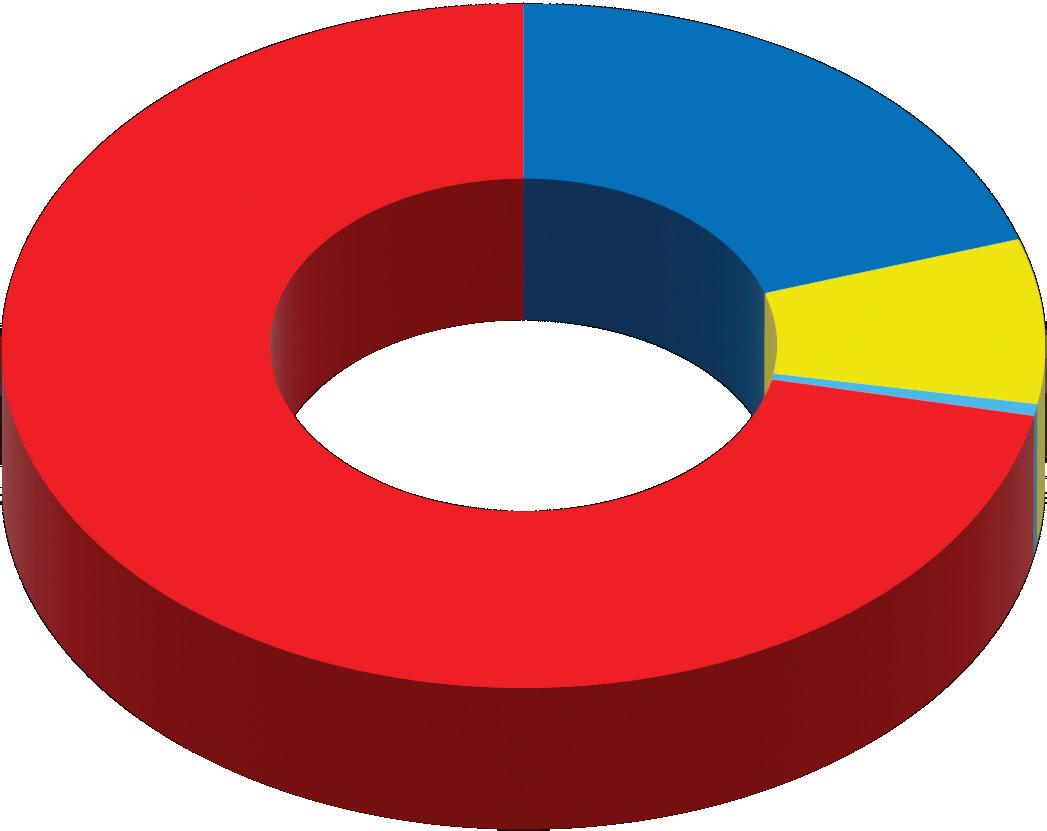

Market share of big box stores ($millions)

Home Depot Canada $11,763 20.1%

Lowe’s Canada* $4,687 8.0%

Kent* $432 0.7%

Rest of the Industry $41,585 71.1%

* Sales from these retailers’ big box stores only.

investments in e-commerce. It did signifi cant business from internet tools like its online paint selector (a first in Canada). It installed significant numbers of blue tooth-powered lockers to permit “contact less” customer pick-up. And it continued to expand its controlled and house brands.

vice-president, finance, and he had served as interim president of the Canadian oper ations once before.

3. LOWE’S CANADA/RONA

HQ: Boucherville, Que.

2021 SALES: $8.53-billion STORES: 445

2021 was another pandemic year in which Lowe’s benefited from its ability to make

Lowe’s’ business model in Canada is radically different from its U.S. operations. Only its big box stores up here follow its American model. Lowe’s inherited from its 2016 takeover of RONA a 496 store net work in Canada, many of them owned and operated by independents. The corporate RONA stores include a mix of full-size big boxes, mini big-boxes (proximity stores), and building supply stores. Lowe’s Canada also operates 20 Réno-Dépôt stores in Quebec that are very strong with contract ors and five Dick’s Lumber yards in B.C. and Alberta.

On Jan. 6, 2022, Tony Cioffi was appointed president of Lowe’s Canada, reporting to Tony Hurst in the U.S., who had held the top role in Canada for two years. Cioffi had joined the company in 2016 as senior

4. CANADIAN TIRE RETAIL

HQ: Toronto, Ont.

2021 SALES: $7.87-billion*

* hardware/home improvement only

STORES: 504

Canadian Tire Corp. owns a range of retail brands, including Sport Chek, PartSource, Mark’s, Helly Hansen, and Party City. The

Hardlines Home Improvement Quarterly www.hardlines.ca 42 THIRD QUARTER / 2022

TOP 20

FEATURE CANADA’S

Building for Tomorrow National coverage Access to products when and where you need it. In-stock and special order programs Showroom merchandising support available Innovative products Solutions for residential, agricultural and commercial projects For over 90 years, Vicwest has supported the home improvement market, through: Scan the QR code to contact your regional rep or visit vicwest.com/dealers Metal Roof Tiles Steel Siding Hidden and Exposed Fasteners Roll Formed Profiles Vicwest has you covered.

company’s flagship Canadian Tire Retail stores are focused on the hardware, house wares, and sporting goods sectors. Stores are located in every province and territory except Nunavut. They’re independently operated and co-owned by Canadian Tire’s franchise, or associate, dealers. The dealers own the fixtures, equipment, and inventory, while the head office owns the real estate. The company is celebrating its 100th anni versary this year.

Throughout COVID, Canadian Tire stores became go-to destinations for home repairs (the stores do not carry lumber, commodities, or other building materials). A surge in online sales early in the pan demic was accompanied by bad publicity about Canadian Tire’s online systems crashing under the strain. Heavily publi cized investments in the company’s omni channel presence have followed.

Canadian Tire managed to double its number of online customers from 2019 to 2021. The Triangle Rewards program is an important part of this effort. It ties all the Canadian Tire banners together under one online brand. It is also proving to be an effective way to connect with younger customers.

Buying group sales and market shares ($millions)

BMR Group*

5. INDEPENDENT LUMBER DEALERS

CO-OPERATIVE

HQ: Ajax, Ont.

2021 SALES: $4.561-billion

STORES: 120

Composed of mostly large regional LBM players, the ILDC has negotiated deals for its members since 1964. The scope of its

TOTAL Rest of the Industry $36,625 62.6%

* BMR’s sales have been backed out of ILDC’s total for this table, as BMR is also a member of ILDC. Therefore, the total of ILDC’s actual market share will be a combination of BMR and ILDC

Hardlines Home Improvement Quarterly www.hardlines.ca 44 THIRD QUARTER / 2022

Buying Group 2021 Retail Sales Market Share

$1,534 2.6% Castle Building Centres $1,887 3.2% Delroc Industries $908 1.6% Home Hardware (building and home centres only) $6,391 10.9% ILDC* $3,027 5.2% Sexton Group $3,300 5.6% TIMBER MART $4,080 7.0% TORBSA $715 1.2% TOTAL Buying Groups $21,842 37.4%

TOP 20

FEATURE CANADA’S

Get More Support at the Negotiating Table

A Line Acoustic Supply has been serving the construction industry for more than 30 years. We specialize in acoustic ceilings and advanced metal ceiling systems, as well as drywall and other building materials. I am the third generation that has been handed the torch to move the company forward.

“ ”

Joining TORBSA was like adding an extra hammer in our toolbelt.

Joining TORBSA has been one of the best moves our company has made. Not only have we expanded our product offering, but we’ve been able to make better deals with our existing vendors, improving our bottom line. Having TORBSA at the negotiation table is like having an extra hammer in your toolbelt. And each member is also a shareholder, so TORBSA’s transparency is second to none. The staff at TORBSA are some of the hardest working people out there, constantly challenging the status quo and finding new opportunities. We look forward to working with them for years to come.

For more information about TORBSA, call Paul Williams at 1-866-865-1689

Ryan Hillier-Spurr GENERAL MANAGER A LINE ACOUSTIC SUPPLY INC.

Ryan Hillier-Spurr GENERAL MANAGER A LINE ACOUSTIC SUPPLY INC.

www.torbsa.com

Photo: Justine Apple Photography

Hardlines Home Improvement Quarterly www.hardlines.ca 46 THIRD QUARTER / 2022 FEATURE Groupe Yves Gagnon CANAC E.G. PENNER BUILDING CENTRES ÉVOLUTION DISTRIBUTION PLUS 60 OTHER MEMBERS PRESTON HARDWARE AD CANADA (INCLUDES TORBSA) OCTO HARDWARE THE HOME DEPOT (U.S.) HD Supply Canada ALLIANCE INTERNATIONAL LLC DO IT BEST (U.S.) HOME HARDWARE STORES Home Furniture Patrick Morin Home Hardware Home Building Centre Home Hardware Building Centre RONA Building Centres (Corporate) Lowe’s Ace Canada RONA Dick’s Lumber RONA Home and Garden/ RONA L’éntrepôt RONA Affiliated Dealers (Independents) Big Box Stores Réno-Dépôt Contractor Stores LOWE’S COS. (U.S.) Specialty Dealers Commercial Building Supplies (CBS) Traditional Building Centres CASTLE BUILDING CENTRES GROUP PEAVEY INDUSTRIES Peavey Mart MainStreet Hardware LOWE’S CANADA BANNER 2022 MAP THE HOME DEPOT CANADA CANADA’S TOP 20

ranktheminanyway,butmerelytoshowhowtheyarerelated. ©2022 Hardlines Inc.

NOTE:Theplacementofthegroupsinthischartdoesnotintendto

Hardlines Home Improvement Quarterly www.hardlines.ca 47 THIRD QUARTER / 2022 Potvin & Bouchard Agrizone Watson Building Supplies BMR Express Shoemaker Drywall Supplies BMR Pro Le Groupe Beauchesne BMR Expert Slegg Building Materials BC Ceilings Ltd. Rigney Building Supplies D.L. Building Materials

COOPERATIVE GROUP BYCO GMS INC. (U.S.) Windsor Plywood Delroc Industries Sexton Group UFA Farm and Ranch Supply ALLROC Tool FBM FOUNDATION BUILDING MATERIALS (U.S.) Co-op WSB Titan INDEPENDENT LUMBER DEALERS CO-OPERATIVE SPANCAN FEDERATED CO-OPERATIVES LTD. TIMBER MART Bytown Lumber Quincaillerie Ste-Helene Copp Building Materials Ltd. Emard Bros. Lumber Company Ltd. Fries Tallman Lumber (1976) Inc. Igloo Building Supplies Group Matério Laurentiens Inc. J&H Builder’s Warehouse McMunn & Yates Building Supplies Ltd. Kent Building Supplies Simcoe Block Ltd. Soo Mill & Lumber Company Ltd. Les Entreprises P. Bonhomme Ltée Star Building Materials L. Villeneuve & Cie (1973) Ltée Turkstra Lumber Company Ltd. Jacques Laferté Ltée United Building Products Yvon Building Supplies BMR Group Lefebvre & Benoit

SOLLIO

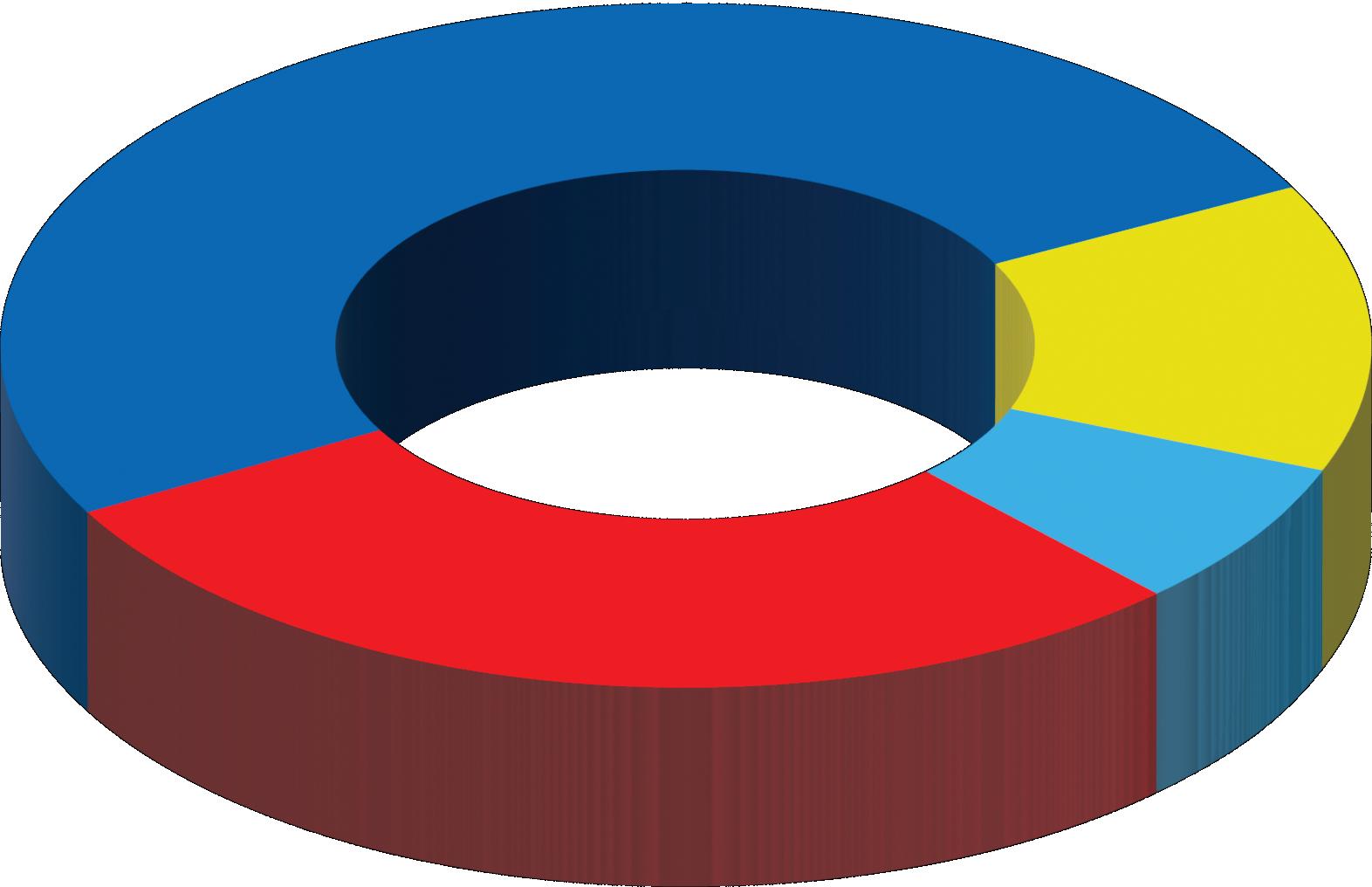

Building Centres 3,108 stores $29.647 billion 50.7%

Canadian Tire* 504 stores $7.870 billion 13.5%

Hardware Stores 1,007 stores $4.158 billion 7.1%

Big Boxes 302 stores $16.792 billion 28.7%

Hardlines Home Improvement Quarterly www.hardlines.ca 48 THIRD QUARTER / 2022 FEATURE Yukon 18 British Columbia 610 Alberta 607 Saskatchewan 312 Manitoba 245 Ontario 1,453

and

164

Newfoundland

Labrador

Prince Edward Island 36 Nova Scotia 188 New Brunswick 174 Quebec 1,089 Nunavut 6 Northwest Territories 19

home improvement stores by province/territory

store type CANADA’S TOP 20

Total stores 4,921

Total

Market share by

* Home category only, excluding sporting goods and auto.

Hardlines Home Improvement Quarterly www.hardlines.ca 49 THIRD QUARTER / 2022

The

2 Home

3 Lowe’s

5 ILDC

6 TIMBER

7 Sexton

8 Castle

9 BMR

10

11

12 GMS/WSB

13 Delroc

14 TORBSA

15 Federated Co-operatives

16 Peavey Industries

17 UFA

18 FBM/Winroc

19 Patrick Morin

20 Windsor Plywood

TOTALS

Top 20 banner groups 2021 retail sales ($millions) Rank Company 2021 2020 Change Stores Notes 1

Home Depot Canada $11,673 $10,437 11.8% 182 Sales do not include HD Supply Canada.

Hardware Stores $8,875 $7,732 14.8% 1053

Canada $8,530 $7,891 8.1% 445 Includes RONA, Réno-Dépôt and Dick’s Lumber. 4 Canadian Tire $7,870 $7,327 7.4% 504 Home category only, excluding sporting goods and auto.

$4,561 $4,416 3.3% 120 Sales include separately-listed BMR, Federated Co-operatives and Kent.

MART $4,080 $3,526 15.7% 603

Group $3,300 $2,430 35.8% 465 Sales include separately-listed UFA.

Building Centres $1,887 $1,685 12.0% 293

Group $1,534 $1,364 12.5% 266

Canac $1,300 $1,075 20.9% 31

Kent Building Materials $1,151 $1,079 6.7% 48

Titan $975 $855 14.0% 32

$908 $811 12.0% 136 Sales include separately-listed Windsor.

$715 $650 10.0% 40 Merged with AD Canada on July 1, 2022.

$644 $556 15.8% 92

$509 $475 7.2% 92 Includes Peavey Mart, Ace Canada and Main Street Hardware.

$414 $367 12.8% 34

$389 $351 10.8% 27

$380 $346 9.8% 21 Owned by Home Hardware. Not included in Home Hardware sales figure above.

$326 $306 6.5% 53

$55,952 $49,661 12.7% 4,537

membership ranges from other buying groups (Federated Co-operatives, BMR), to powerhouse regional operators (such as Kent, with 48 locations, some of them big boxes, in Atlantic Canada), to family businesses clustered around a central medium-sized city (like Copp’s Buildall, London, Ont.), to single location outlets (for example, J&H Builders Warehouse, Saskatoon). Together, ILDC members control some 120 stores (not inluding Federated Co-operatives and BMR). In early 2021, ILDC lost an important mem ber in Quebec when Patrick Morin was purchased by Groupe Turcotte (Home Hardware).

FEATURE

6. TIMBER MART

HQ: Calgary, Alta.

2021 SALES: $4.08-billion STORES: 603

Claiming to have the highest volume drywall purchases of any buying group, TIMBER MART experienced another year in 2021 in which LBM prices stayed ele vated because of the pandemic. TIMBER MART welcomed important new Quebec members last year and it also picked up dealers in the Toronto and Ottawa areas, as well as one in B.C. The group realigned its LBM buying function last year. Last fall, Bruno Baldessari, an industry veteran formerly at competitor BMR, was hired as vice president of forest products trad ing. Several new traders were recruited to join his team, with a goal to expand the product offerings available to the group’s approximately 600 member stores.

7. SEXTON GROUP

HQ: Winnipeg, Man.

2021 SALES: $3.3-billion STORES: 465

Sexton, once a regional buying group that operated mostly in Western Canada, has long since transformed itself into a national player. But there is still one province where it hopes to grow. Eric Palmer, vice presi dent and general manager of the group, told Hardlines in a 2021 podcast that expansion in La Belle Province was very much on the agenda. “We are committed to bringing the full value of the Sexton Group to Quebec,” Palmer said. Sexton has an LBM supply agreement with Ace dealers and their licence holder in Canada, Peavey Industries.

9. BMR GROUP

HQ: Boucherville, Que.

2021 SALES: $1.534-billion STORES: 266

The largest Quebec-owned home improvement retailer, BMR got a new CEO last year. Alexandre Lefebvre took over in March from Pascal Houle, who was then named CEO of BMR’s parent company Sollio Cooperative Group (Formerly La Coop fédérée) later in the year. In 2021, BMR Group continued its growth outside of Quebec. It welcomed a dealer in Shippagan, N.B., last year and it also signed stores in Kemptville, Hawkesbury, and Winchester, Ont. The Boucherville, Que.-based group has identified Ontario as a key target for expansion beyond its existing 19 stores there. In June 2022, BMR appointed a new head buyer, Charles Grégoire-Béliveau, and a new COO, Antonio Di Pasquale.

8. CASTLE BUILDING CENTRES

HQ: Mississauga, Ont.

2021 SALES: $1.887-billion STORES: 293

Ken Jenkins, who has been leading Castle Building Centres Group since 2007, recently added the CEO role to his existing title of president. During Jenkins’ 15 years at the helm, Castle has grown from just over 200 dealer locations to almost 300 outlets today. They consist of building supply dealers, hardware stores, and specialty and com mercial dealers. Castle has locations in every region of the country except Yukon and the Northwest Territories. The group has been actively adding new members across the country in recent years. Castle’s commercial division is called Commercial Builders Supply.

10. CANAC

HQ: Quebec City, Que.

2021 SALES: $1.3-billion

STORES: 31

Canac is a powerful home improvement retail chain owned by the Laberge family. It has 31 stores in Quebec with only a handful in the Greater Montreal Area, so Canac still has room to grow substantially in the prov ince before the company enters (as company officials promise) the Ontario market. To fuel its ongoing expansion, Canac has been expanding its DCs substantially, completing

Hardlines Home Improvement Quarterly www.hardlines.ca 50 THIRD QUARTER / 2022

CANADA’S TOP 20

SPC LUXURY VINYL FLOORING 100% WATERPROOF STONE POLYMER CORE IXPE ACOUSTIC PAD taigabuilding.com A luxury appearance with all the properties to make it last. With many plank and tile decors available it’s bound to appeal to a multitude of tastes while providing both beauty and durability. HOARFROST WHOEVER SAID 100% WATERPROOF WAS ONLY RESERVED FOR THE KITCHEN, WAS OUT TO LUNCH.

Hardlines Home Improvement Quarterly www.hardlines.ca 52 THIRD QUARTER / 2022 FEATURE CANADA’S TOP 20 Big box sales ($millions) and market share (%) 2017 2018 2019 2020 2021 $12,500 $10,000 $7,500 $5,000 $2,500 $0 $40,000 $37,500 $35,000 n Home Depot Canada n Lowe’s Canada* n Kent* n Rest of the Industry * Sales from these retailers’ big box stores only. Sales $millions $35,970 74.6% $37,445 74.8% $37,445 74.4% $37,565 71.5% $41,783 71.5% $3,807 7.9% $306 0.6% $8,150 16.9% $3,817 7.6% $324 0.6% $8,473 16.9% $3,674 7.3% $342 0.7% $8,845 17.6% $4,154 7.9% $4,490 7.7% $404 0.8% $432 0.7% $10,437 19.9% $11,763 20.1%

www.bmfonline.com

ALLEN RONA North Vancouver, Powell River and Salmon Arm, B.C. STORE PLANNING | STORE FIXTURES | LBM DISPLAYS | GRAPHIC DESIGN & SIGNAGE | INSTALLATION | SERVICE COUNTERS

did these renovations because

our stores. We

these communities.

we

our stores

spectacular. And working with BMF,

produce.” Brian Glen Director of North American Sales 416-389-6070 bglen@bmfonline.com Contact BMF About Your Store and Fixture Design Challenges: Industry Partner in Store Renovation

MICHAEL

“We

of pride in

are a big part of

So,

wanted

to be absolutely

that’s exactly what we were able to

a second building in Drummondville, Que. in January of this year. It is now building a DC (and a store) in Lévis, Que. on the south shore of the St. Lawrence River near Quebec City. Canac’s next store opening looks like it will be in Contrecoeur (east of Montreal) in spring 2023.

FEATURE

“largest independently-owned drywall supplier in the country with 23 locations.” After further growth, WSB Titan was pur chased in 2018 by GMS Inc., a large wall board distributor based in Atlanta. The seven Canadian dealers currently in the group have grown considerably—and some of them, like multi-outlet Slegg Building Materials on Vancouver Island, are fullscale building supply operations.

thoroughly,” said TORBSA president Paul Williams. “TORBSA and its shareholders are truly excited at the road ahead, as we lay the foundation for what will be many years of success as a business.” Founded in 1966, TORBSA represents 30 members in 40 loca tions across Canada. AD is based in Wayne, Penn., and buys contractor-related and indus trial products for some 845-plus member owners in the U.S., Mexico, and Canada.

11. KENT BUILDING MATERIALS

HQ: Saint John, N.B.

2021 SALES: $1.151-billion

STORES: 48

A subsidiary of the J.D. Irving company, Kent is the only retailer other than Lowe’s Canada to go to market with a multi-format big box and building supply store blend. Kent opened its latest big box store in March 2022 in Moncton, N.B. The store features mod ernized displays and enhanced signage to aid customer flow, along with expanded product assortments, a drive-through lumberyard, and more. In March 2021, Kent launched a new customer loyalty program with Exchange Solutions, a Boston-based firm. Kent’s new program gives its customers access to exclu sive offers and rewards—and increases Kent’s e-commerce presence. Exchange Solutions also counts Lowe’s Canada among its clients.

13. DELROC

HQ: Langley, B.C.

2021 SALES: $908-million

STORES: 136

Approaching its 50th anniversary in 2024, Delroc is a privately-owned buying group founded by entrepreneur Bruno Mauro of Dryco Building Supplies in Langley, B.C.

Today, Delroc buys for 33 members repre senting 136 stores. It negotiates in a wide range of building material categories. It is strongest in B.C., where it has 69 dealer locations, followed by Alberta with 27. It has 19 dealer locations in Ontario and four in Atlantic Canada. Its largest member is B.C.based Windsor Building Supplies—which has its own listing at position 20.

15. FEDERATED CO-OPERATIVES

HQ: Saskatoon, Sask.

2021 SALES: $644-million STORES: 92

Federated Co-ops is one of the coun try’s largest farm co-ops. On the retail side, it supplies member co-ops through out Western Canada that have ag centres, supermarkets, convenience stores, depart ment stores, and home centres.

This last category is serviced by FCL’s Home and Building Solutions business. To support its stores, FCL is building a new LBM distribution hub on a 6.7-acre site out side of Regina. The $7.5-million investment will allow FCL to procure and distribute materials such as lumber, drywall, and deck ing materials from a centralized facility to Co-op Home Centres in Manitoba and most of Saskatchewan. A second facility in Alberta is planned to be operational in 2023.

12. GMS/WSB TITAN

HQ: Surrey, B.C.

2021 SALES: $975-million

STORES: 32

WSB Titan was formed as a commercial building supplies buying group in 2009 by three regional building supply dealers representing the Prairies, Ontario and Quebec. The new firm billed itself as the

14. TORBSA

HQ: Bolton, Ont.

2021 SALES: $715-million

STORES: 40