HARDLINES.CA CONNECTING THE HOME IMPROVEMENT INDUSTRY FIRST QUARTER / 2023 HOME IMPROVEMENT QUARTERLY

ORA WINNERS OF THEBEST! Meet our 2022 Outstanding Retailer Award winners LOWE’S TO EXIT CANADA Complete coverage of the biggest news in our industry in a decade HARDLINES CONFERENCE REPORT Our speakers share their expert insights and strategies ALSO INSIDE Canadian Publications Mail Agreement # 42175020. POSTMASTER: Send address changes to Hardlines Home Improvement Quarterly, 1550 Caterpillar Rd, Mississauga, ON L4X 1E7

Deb and Todd Brinson GANDER BAY CASTLE, NEWFOUNDLAND Winners, Retail Spirit Award

Helping our dealers be successful, since 1847. Our Canada-based sales team gives our dealers the attention, knowledge, and expertise they deserve, all backed by the world’s largest independent hardlines distributor. Get in touch to learn how we can help. Orgill.ca

• Quarterly buying events • Purchase planning and support • Strategic, regular sales rep calls • Margin-maximizing retail pricing tools • Unrivaled assortments, planograms, and specialty programs At your service, providing: Grow With Confidence GO WITH ORGILL 1-888-742-8417

JELD-WEN

QUALITY GUARANTEE ENERGY EFFICIENT MADE IN CANADA THE 6X ENERGY STAR ® CANADA MANUFACTURER OF THE YEAR FOR WINDOWS & DOORS, WITH BACK-TO-BACK WINS IN 2021 & 2022 AWARD-WINNING ENERGY EFFICIENCY GR A NT G REENER HOME S

customers

products.

®’s ENERGY STAR certified windows and doors can save your

up to $5,600 through the Canada Greener Homes Grant. Visit jeld-wen.ca to view our full line of energy-efficient

PRESIDENT Michael McLarney mike@hardlines.ca

EDITOR Steve Payne steve@hardlines.ca

ASSOCIATE EDITOR Geoff McLarney geoff@hardlines.ca

CONTRIBUTING WRITER John Caulfield

HardlinesHomeImprovementQuarterlyis published four times a year by Hardlines Inc., 330 Bay Street, Suite 1400, Toronto, ON M5H 2S8. $25 per issue or $90 per year for Canada. Subscriptions to the Continental United States: $105 per year and $35 per issue. All other countries: $130 per year. (Air mail $60 per year additional.) Canadian Publications Mail Agreement # 42175020 POSTMASTER: Send address changes to Hardlines Home Improvement Quarterly, 1550 Caterpillar Rd, Mississauga, ON L4X 1E7.

All editorial contents copyrighted 2023 by Hardlines Inc. No content may be reproduced without prior permission of the publisher.

VICE PRESIDENT & PUBLISHER David Chestnut david@hardlines.ca

HOME IMPROVEMENT QUARTERLY

NUMBER ONE IN THE HOME IMPROVEMENT INDUSTRY. ONLINE AND PRINT.

@Hardlinesnews •

SUBSCRIBER SERVICES ★ FREE TO HOME IMPROVEMENT DEALERS ★ To subscribe, renew your subscription, or change your address or contact information, please contact our Circulation Department at

www.kingmkt.com 877 844 5464 With a national team of sales professionals and brand ambassadors we connect our represented manufacturers to all levels of the industry across Canada. Got your attention? Our national representation will give you that and more!

MARKETING & EVENTS MANAGER Michelle Porter michelle@hardlines.ca ART DIRECTOR Shawn Samson TwoCreative.ca ACCOUNTING accounting@hardlines.ca COVER STORY PHOTOGRAPHY Emma Hutchinson iemmaphotographer.com FIRST QUARTER / 2023 • VOLUME 13, NO. 1 330 Bay Street, Suite 1400, Toronto, ON M5H 2S8 • 416-489-3396

HHIQ is just one facet of the Hardlines Information Network. Since 1995, we’ve been delivering the most up-to-date information directly to you online, in print, and in person. Find out how you can get your message out with us. Contact:

David Chestnut, Vice President & Publisher 416-425-7992 • david@hardlines.ca

www.hardlines.ca

289-997-5408; hardlines@circlink.ca

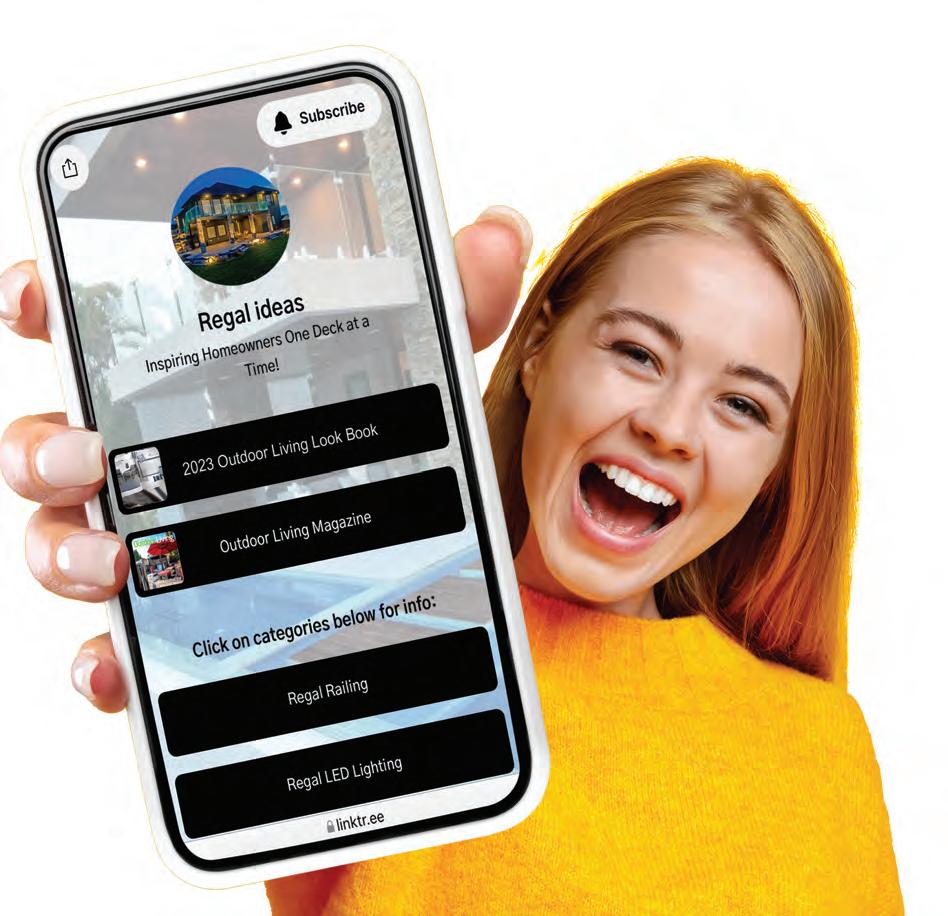

100% DEALER-OWNED

Join a completely Dealer-Owned company today. Dealers share and participate equally without the influence of any external shareholders. Harness our massive buying power, comprehensive distribution, national brand recognition and marketing support.

Scan to learn more

7 FIRST QUARTER / 2023 DEPARTMENTS NEWSROUNDUP Kent must open books to CRA to share its pro accounts Gillfor is unifying branding across all divisions Castle’s business development manager expects big growth Home Hardware’s Laura Baker talks marketing and pro sales With Ace fully integrated, Peavey Mart looks to expand LOWE’S CANADA SOLD Lowe’s will disappear as a brand name in Canada as RONA makes a comeback CONTENTS FIRST QUARTER / 2023 VOLUME 13, NO. 1 9 EDITOR’S MESSAGE Lowe’s Cos. gave Canada its best shot PRODUCT SPOTLIGHT SPECIAL! What’s new in power tools ENDCAP The unassuming retirement Meet this industry’s 2022 Outstanding Retailer Award winners COVER STORY 66 18 PAGE 10 RETAIL TECHNOLOGY A DIGITAL PLAN, SELF-CHECKOUTS, WAREHOOS PRO CORNER THE STATE OF PLAY IN RENTALS CONFERENCE REPORT REUNITING THE INDUSTRY 52 58 A look at all the tech news from the first to the last mile Some retailers are vacating the field while others double down A summary of all eight presentations at the 26th Annual Hardlines Conference 34 THE BEST OF THE BEST 20 SPECIAL FEATURE

Canada Why ?

Looking to add value to your retail business, achieve your goals and grow your customer base? Create your own success story by joining the ACE Canada Dealer network and experience the benefits that come with being a part of the ACE Canada and Peavey Industries LP family.

ACE Canada Dealer service and support includes: No Franchise fees Tremendous buying power of multi-brand Canadian retail leader, Peavey Industries LP Distribution Centres located in Red Deer, Alberta and London, Ontario Retail focused programs International ACE brand recognition National marketing programs tailored to Canadian consumers Dedicated ACE Canada Business Development teams ACE Canada Dealer Buying Shows (Virtual and in person) LBM Supply partnership with industry leading Sexton Group Globally proven retail training programs

Are you a dealer considering converting to the Ace banner? We want to hear from you too – and can provide you with the information you need while highlighting the many benefits of joining the ACE Canada family.

INDUSTRIES LP

www.ace-canada.ca www.joinace.ca joinace@peaveyindustries.com

STEVE PAYNE, EDITOR

LOWE’S RETURNS RONA TO A VERSION OF ITS FORMER SELF

When analysts were asked about Lowe’s Cos.’ sale of its Canadian operations (the deal is to close in the first quarter of this year), a number of them replied that the North Carolinabased big box operator didn’t understand Canada.

That’s a strange take. After all, the retail giant announced its decision to come to Canada all the way back in 2005. It opened its first stores here in 2007. That’s a long time in Canadian retailing to not understand the country. I think we should give Lowe’s more credit than that.

Lowe’s might not have generated quite the profits it wanted to in Canada during its almost two decades here. But credit the company with becoming very familiar with the oddities and complexities of this country.

Lowe’s doubled down on Canada when it, controversially, purchased the RONA and Rénô-Dépôt banners in 2016. At that time, the world’s second-largest home improvement retailer controlled a network of 539 stores in this country.

So Lowe’s did know what it was doing. There was—and remains—a very fine team at the head office in Boucherville, Que.

Tony Cioffi, Lowe’s Canada president, has announced that the Lowe’s brand will be converted over to RONA sometime within the next 10 to 16 months. That HQ at 220 chemin du Tremblay will be a RONA head office once again.

And RONA will once again be privately operated. It will be owned by Sycamore Partners, a New York City-based private equity firm that also owns Staples Business Depot (for six years now), Anne Taylor, Loft, Lane Bryant, Belk, and Talbots. These are all great retail brands. It’s been just over 20 years since RONA was last a private firm, unworried about quarterly forecasts, stock prices, PE ratios, and all the noise of Wall Street. It can say goodbye to all that.

All the newly-owned company has to do now is serve its customers. Including the 213 RONA stores that are independently-owned and, in fact, customers of Lowe’s Canada’s wholesale distribution business.

Based on our discussions with those dealers, many of them couldn’t be happier.

Hardlines Home Improvement Quarterly www.hardlines.ca 9 FIRST QUARTER / 2023

MESSAGE

EDITOR’S

Contrary to popular opinion, Lowe’s was not another American retailer who didn’t understand our country

Many RONA dealers couldn’t be happier. ” steve@hardlines.ca

“

ROUNDUP

LOWE’S SELLS ITS CANADIAN DIVISION TO U.S.-BASED PRIVATE EQUITY FIRM

Lowe’s Cos. is selling its Canadian home improvement operations to Sycamore Partners, a privateequity firm based in New York. At press time, the deal is to close in the first quarter. The price was US$400 million in cash and “a performance-based deferred consideration,” according to Lowe’s.

For that, Sycamore acquires some 450 stores that include 61 Lowe’s big boxes in Canada, 31 RONA big boxes, 20 RénoDépôt big boxes, 120 corporate-owned RONA building supply stores, the wholesale supply business of another 213 independent RONA stores (owned by some 150 dealers) and five Dick’s Lumber outlets in B.C. and Alberta.

Lowe’s Cos., of Mooresville, N.C., entered Canada in 2007 with its own big boxes. It purchased RONA and its ancillary brands for US$2.4 billion in 2016, at that time valued at C$3.2 billion.

“The sale of our Canadian retail business

is an important step toward simplifying the Lowe’s business model. While this business represents approximately seven percent of our full year 2022 sales outlook, it also represents 60 basis points of dilution on our full year 2022 operating margin outlook,” said Marvin Ellison, Lowe’s chairman, president, and CEO.

Sycamore Partners specializes in retail businesses. Its holdings include Staples, Ann Taylor, Loft, Lane Bryant, Belk, Talbots, Dollar Express, and Aeropostale.

LOWE’S STORES IN CANADA TO SWITCH TO RONA

The news that Lowe’s Cos. is selling off its Canadian division to New York City-based Sycamore Partners , a private equity firm, is the biggest jolt to hit the Canadian home improvement industry since 2016 when Lowe’s purchased RONA and its Quebec-based banner Réno-Dépôt.

The announcement has raised more questions than it has answered, many of them from suppliers. In a letter to vendors shortly after the

Other Canadian home improvement retailers are watching the deal with interest.

“It’s too early to say if BMR would be interested in acquiring the RONA business,” said Alexandre Lefebvre, CEO of BMR Group, “especially as we’re looking at the market ahead with concern.”

Regardless of the future of the economy, however, he says his company can continue to have a strong appeal for RONA dealers. “This is an opportunity for BMR—one hundred percent.”

announcement of the sale in early November, Lowe’s Canada president Tony Cioffi said, “Under our new ownership, we will maintain a strong commitment to our Canadian- and Quebec-based vendors, including through our ongoing involvement in the ‘Well Made Here’ initiative, meant to encourage the purchase of domestically manufactured quality products.”

Cioffi also shared that the Lowe’s big box stores will change names eventually. “There are no significant changes planned for the stores. We will eventually move away from the Lowe’s banner in Canada in favour of the RONA banner in a manner that ensures the least possible disruption to our business. Otherwise, you will see minimal change.”

Hardlines Home Improvement Quarterly www.hardlines.ca 10 FIRST QUARTER / 2023

NEWS

THE

OF

HOME IMPROVEMENT INDUSTRY Visit Hardlines.ca for breaking news in the Home Improvement Industry

SPECIAL FEATURE

SPECIAL FEATURE

RONA AFFILIATES OPTIMISTIC

The announcement of the pending sale of Lowe’s Canada to a private equity firm has many RONA dealers expressing optimism.

Lowe’s business in Canada consists of about 450 stores, 213 of them independents, owned by some 150 dealers. They range from small local hardware stores to some of the largest regional building centres in the country. And the collective retail sales of these RONA independents are huge, estimated at around $2 billion. If they formed a buying organization of their own, their combined volumes would be bigger than many major buying groups.

After the announcement of the sale, RONA management began a series of meetings with the dealers to outline the opportunities available to them under the new regime. The larger RONA dealers will almost certainly look at taking over some of the 61 Lowe’s stores in Canada. Those stores will be replaced with RONA branding and, in Quebec, Rénô-Dépot.

But other factors have the dealers excited, as well. A big one is the fact that RONA will be privately held for the first time since RONA went public in 2002. That means dealers will no longer be concerned about

how quarterly results might affect how they get treated. They will also have access to the full range of Lowe’s programs, like VIPpro for contractor customers, and Lowe’s brands including Ego, Craftsman, and Flex.

One of the biggest RONA independent dealers in the country is Fraser Valley Building Supplies (FVBS), with six locations in B.C. FVBS President Ray Cyr said the news was “very positive.”

“It’s an opportunity for us to acquire some corporate stores,” Cyr said. “I believe Sycamore will take a year to evaluate what they’ve got.” Cyr said he liked the idea of Sycamore taking ownership “because they are specialists in the retail arena,” owning Staples and other retail brands.

Another large RONA independent dealer in B.C., Michael Allen, of B.H. Allen Building Centres, with three locations, said that Lowe’s was always going to find it tough slogging when they arrived in this country in 2007. “What they did wrong was they were the last big box in,” Allen said.

Allen told Hardlines that it would have been nice to see the independent dealers offered the opportunity to buy the firm. “Dealers could have ponied up that $400 million,” Allen said. “I know we ourselves would

have put in whatever was needed to have a good position. That was always the negative… we didn’t have control of the brand.”

Andrew Doidge, vice-president of Doidge Building Centres, a ten-store RONA independent in Ontario, was also positive about the news. And he believes Sycamore Partners will hold onto RONA—as the private equity firm has done with the Canadian retailer Staples, which they acquired in 2017.

“They’re a private equity firm, they exist to make money and Lowe’s is a profitable firm in Canada,” Doidge told Hardlines. “RONA is going back to their roots. They are back in the style of company that they started in. And that’s a good thing.”

A further clarification to the announcement was sent out the following morning, reaffirming that Lowe’s Canada will remain headquartered in Boucherville, Que., on the south shore of Montreal. It also notes that the deal includes “a performance-based deferred consideration”—a clarification probably deemed necessary because analysts noted that Lowe’s Cos. received cash for only 16.6 percent of the amount that it had spent on acquiring RONA just over six years earlier.

Lowe’s Canada says it is working to make the transition to the new ownership a “seamless” one, “with minimal disruption for our 26,000 associates. It will remain business as usual, including unchanged compensation and benefits.”

www.hardlines.ca 11 FIRST QUARTER / 2023

KNOWLEDGE IS POWER. Stay in the know every single week with HARDLINES. Subscribe online at Hardlines.ca

Hardlines Home Improvement Quarterly

Kent is required to forward information to the CRA for all contractors belonging to the retailer’s Kent Pro loyalty program who have spent more than $20,000 annually.

KENT MUST OPEN BOOKS TO CRA TO SHARE ITS PRO ACCOUNTS, COURT RULES

The Federal Court of Canada has given the Canada Revenue Agency (CRA) the green light to comb through the records of Kent Building Supplies’ pro and commercial customers.

A division of J.D. Irving, Kent has 48 building centres and big boxes in Atlantic Canada.

In its latest push against the underground economy in construction, the tax agency had applied to the court to obtain “significant data” on pro customers’ purchases from Kent dating back to Jan. 1, 2019.

Kent is now required to forward to the CRA the name and contact information, CRA business number or SIN, and total transaction amounts for all contractors belonging to the retailer’s Kent Pro loyalty program who have spent more than $20,000 annually.

Hardlines contacted Kent but was referred to the only statement its parent company

J.D. Irving had issued, to the National Post, calling CRA’s action a “common and routine practice for home improvement retailers in Canada, where select contractors are concerned.”

It is indeed a common and routine practice and it seems to happen regularly in November when the year is coming to a close. Home Depot Canada faced the same battle at this time in 2019. A court order was required, forcing Home Depot Canada to turn over records of sales to its contractor customers for the years 2013 through 2016.

Two years earlier, RONA went to court to attempt to block CRA from doing the same thing. At that time, the feds investigated RONA’s trade customers at some of its stores for the years 2012 to 2015.

In 2018, CRA estimated that the underground economy exceeded $50 billion, with residential construction accounting for about half of that.

BRIEFLY TIMBER MART ADDS QUEBEC MEMBER

Marc Chevalier Inc. in Bedford, Que., has joined TIMBER MART as the group’s newest member dealer. Marc Chevalier Inc. opened in 2022 and offers an array of building materials such as roofing materials and exterior cladding. It occupies a large acreage which includes a 3,000-square-foot store and a 1,500-squarefoot warehouse, with room for future expansion.

CANADIAN TIRE SALES SLIP IN THIRD QUARTER

Canadian Tire Corp. reported Q3 net income of $184.9 million, down from $243.7 million a year prior. Revenues rose to $4.23 billion from $3.91 billion in the comparable period in the previous year. Comp sales at Canadian Tire Retail were up 0.7 percent, driven by the automotive, seasonal and gardening categories.

IKEA TESTS SMALLER STORES IN CANADA

IKEA Canada plans to expand its small-store format with a new location in Scarborough, Ont. It’s set to open at the Scarborough Town Centre in the summer of 2023, serving residents in the east end of Toronto. It will be the company’s second small-format store in Canada, at nearly 81,000 square feet in size.

PEAVEY MART EXPANDS IN BRITISH COLUMBIA

Peavey Industries has opened the doors of its newest store, in Salmon Arm, B.C. The approximately 25,000-square-foot store in Centenoka Park Mall is the third Peavey Mart in the province, joining locations in Dawson Creek and Kamloops, and the chain’s 91st location overall. It followed on the heels of an opening in Bedford, N.S., which was the chain’s first Peavey Mart store in the Maritimes.

Hardlines Home Improvement Quarterly www.hardlines.ca 12 FIRST QUARTER / 2023

NEWSROUNDUP

GILLFOR ENTERS NEW YEAR WITH UNIFIED BRANDING ACROSS ALL DIVISIONS

Canada’s third-largest LBM distributor is poised for strong growth, backed by a new branding initiative that will consolidate its various divisions.

The Ontario-based Gillfor Distribution grew sizably last June 30, when it completed the acquisition of AFA Distribution, a competing LBM distributor based in Bolton, Ont.

Gillfor was established when OWL Distribution in Woodstock, Ont., and McIlveen Lumber, an LBM wholesaler based in Calgary, merged in 2017. A year later, the company added Brown & Rutherford in Winnipeg and Brunswick Valley Distribution, based in Fredericton. But the acquisition of AFA last year moves Gillfor to a new plateau.

And there’s more to come, says Mike Schneider, Gillfor’s VP of business development. The various divisions will shed their names to reinforce the central brand. The consolidation will include merging systems,

financing, and the onboarding of AFA’s 16 warehouses with Gillfor’s existing six. Head office will remain in Woodstock, Ont.

Schneider says this will be a year of rapid growth for Gillfor. The wholesaler’s vision includes working with “best-in-class vendors and developing real partnerships to grow the market and to take share.”

Gillfor is working to combine its offering to its dealer customers across the country. Its base is the specialty building materials

business, while the AFA acquisition adds a broader range of LBM commodities to the mix.

Schneider told Hardlines that Gillfor’s centralized model will enable it to implement its national programs along with a regional sensitivity.

“We have an unbelievable respect for and confidence in our managers at the branches,” Schneider says. “We believe they are the pillars.”

CASTLE’S BUSINESS DEVELOPMENT MANAGER ANTICIPATES ANOTHER STRONG YEAR

With changes to its development team late last year, Castle Building Centres Group is looking to expand its membership.

Doug Keeling took over as the buying group’s director of business development last fall from Bruce Holman, who has retired. Keeling oversees a team of eight people taking care of Castle’s 300-plus members, while connecting with prospects to keep adding to the group’s ranks.

Coming out of the pandemic, the industry

and the economy are confronting a lot of changes, and change is always good for dealer recruitment, Keeling says.

The industry changes include new ownership at rival groups such as Sexton Group and TORBSA, plus the sale of Lowe’s Canada. “We’re coming out of a couple of years that were crazy for all the groups, not just Castle. There have been big changes across various banners. That is causing some dealers to relook at the groups they’re

with,” Keeling says.

Part of that growth has meant splitting the Ontario territory, which has about 100 Castle dealers. The reps there are André Laurin for central and northeastern regions, and Lillian Diaz, for the central and southwestern parts of the province.

Despite the headwinds of rising interest rates and continued inflation, Keeling expects the momentum in the industry to continue.

Hardlines Home Improvement Quarterly www.hardlines.ca 14 FIRST QUARTER / 2023

NEWSROUNDUP

Working for our members every day.

There’s no doubt that consolidation has cut down on the number of product manufacturers. For independent dealers like me, that means less competition between suppliers for my business and less leverage for me to get more competitive pricing for my customers. That’s where I rely on Sexton’s strength to negotiate programs that keep me competitive.”

—Charlie

Hotham, Owner, Hotham Building Materials

Our Promise to You.

Our strength as a buying group is built on four major advantages: We’re a dedicated team of industry professionals focused on your success. We negotiate competitive programs and leverage our strong relationships with vendors to resolve any issues quickly for you. We have a first-class accounting team that promptly delivers accurate rebate payments as promised. Well connected. So you can focus on what matters most — your business.

Hear about our story at 1. 800.665.9209 Learn about our story at sextongroup.com

“

HOME HARDWARE’S LAURA BAKER TALKS MARKETING AND PRO SALES

ome Hardware has a lot on the go, and that has Laura Baker, the company’s chief marketing officer, pretty jazzed. In an exclusive interview with Hardlines, she shared her enthusiasm for the dealer-owned company’s latest initiatives.

Starting with supply chain improvements, Baker explained how Home Hardware had just locked in its ability to ship customers’ orders from any of its three warehouses either direct to store or direct to home. “That omnichannel tent we have for customers to buy, in any channel they choose, is very important to us.”

Tying in each independent dealer to the online sale with an effective attribution

model was a big part of the development process, she said. “Customers will go back and forth and we’ve created a buy-in for the dealer that benefits their own Home Hardware store to have those sales.”

Baker says the look of the dealers’ microsites will change to focus more on each dealer, “and you’ll see that everything we do, not just online, is to put the dealer front and centre.”

Baker then turned her attention to another important customer—contractors and builders. “The pro is a huge component of our business.” That’s now being reflected in everything from product lines specifically for pros, such as Milwaukee power tools

and Home’s own Cat brand of power tools, to a newsletter for trades that features product specials and tips. A beefed-up website offers videos, design and décor articles, and product reviews.

NEWSROUNDUP H STR NG™ IMPACT MORE HOLES PER CHARGE

Laura Baker, chief marketing officer, Home Hardware.

WITH ACE FULLY INTEGRATED, PEAVEY MART LOOKS TO EXPAND

Managing multiple banners keeps Doug Anderson very busy. He’s the president and CEO of Peavey Industries, which operates corporate stores under the Peavey Mart and MainStreet Hardware banners. Anderson also directs the wholesale and branding needs of a group of independent dealers that operate mainly under the Ace banner.

Ace is the newcomer that turned Peavey into a wholesale distributor. But Anderson is investing in growth on all fronts, including new stores under the Peavey Mart banner. One such store opened last fall in Bedford, N.S., marking the first location for the company east of Ontario.

Even with the Ace banner, Peavey has made a point of acquiring and maintaining a few stores as corporate locations—when the opportunity presents itself.

The renewed focus on expansion reflects the realignment of the company following several years of aggressive growth. That included the acquisition of 50-plus TSC stores, mainly in Ontario, in 2017, followed by the takeover of the Ace Canada licence in March 2020 from Lowe’s Canada. The TSC stores were fully switched to the Peavey Mart banner in 2021.

“The TSC changeover was good but there’s always work to do with redirection, etc. But we’re getting good at that.” Anderson says

the lead-up to the rebranding of TSC was carefully plotted, as buying teams were combined and systems consolidated. “We had moved the stores to be more aligned, so by the time of the switch it was just a matter of putting up the new sign.”

Hardlines Home Improvement Quarterly www.hardlines.ca 17 FIRST QUARTER / 2023

UP TO UP TO

Doug Anderson, president and CEO, Peavey Industries.

BY GEOFF M c LARNEY

P werTools

SPOTLIGHT

The future of cleaning has arrived

Clean more efficiently with the new Makita 18V LXT Brushless Cordless 3.0L Smart Robotic Vacuum. Equipped with a mapping function that allows it to automatically return to its initial position, it will clean an area of 600m² with up to 200 minutes of run time. It’s also available in a kit (DRC300PT2) that includes two Makita 18V LXT Batteries and a Makita Dual Port Rapid Charger. www.makita.ca

Makita’s first 14" Cordless Power Cutter

The new Makita 80V max XGT Brushless Cordless 14-inch Power Cutter is designed to tackle masonry and metal materials in any renovation. With power to wet or dry cut single passes up to 5 inches deep, it claims to provide up to 55 percent more cuts per charge in concrete and up to 20 percent more cuts per charge in metal. Available in a 5.0Ah or 8.0Ah kit with four 40V max XGT batteries and a 40V max XGT Dual Port Rapid Charger, or as a stand-alone tool. www.makita.ca

Get notified when it’s time to reload this nailer

From DeWalt’s Atomic Compact 20V Max series, the Brushless Cordless 23-gauge Pin Nailer boasts a high-output brushless motor and is capable of driving 23-gauge pin nails from 5/8 inch up to 1-1/2 inches in length into a variety of woods, including solid oak. The tool’s runtime allows it to drive, on average, 2,000 nails per charge to help maximize uninterrupted work time. For jobsite efficiency, the low nail lockout system with LED indicator informs users when it is time to reload. www.dewalt.ca

Hardlines Home Improvement Quarterly www.hardlines.ca 18 FIRST QUARTER / 2023

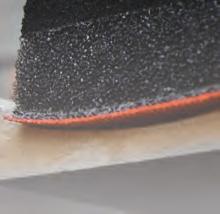

Cooling coating prolongs cutting life

Diablo’s new range of Steel Demon Amped reciprocating saw blades bring innovation to thick metal cutting with the industry’s first industrial-grade coating Black Industrial Cooling Element (I.C.E.). The ultraslick Black I.C.E. provides a cool and clean cutting edge and ultra-superior chip evacuation. Highperformance carbide increases cutting life in metal cutting applications ranging in thickness from 3/16 inches to 9/16 inches. www.diablotools.com

Spade Bits make drilling holes easy

Diablo’s Demo Demon Spade Bits promise durable and effortless hole drilling for nail-embedded wood. The Demo-Edge dual cutting edges, coupled with a self-feeding Dura-Tip, power through nail hits for a smooth drilling experience and up to 60 times longer life. An optimized curved paddle design enhances the chip evacuation process for more holes per charge. www.diablotools.com

Comfort and power go cordless

Bosch’s optimized cutout tool delivers corded performance and convenience. Every drywaller knows that a mechanical sliding switch is where the most failures and repairs happen on a cutout tool. Bosch has created a simple solution: a dustresistant mechanism that keeps material and debris from entering the switch and causing failure. And keep working all day: a single 4Ah battery charge will handle 330 linear feet or cut openings for over 250 single gang junction boxes. www.boschtools.com

Portable table saw promises corded performance on the jobsite

Bosch’s ProFactor 8 1/4-inch table saw provides 25-inch ripping capacity to the right of the blade for cutting sheet goods. Bosch’s BiTurbo system combines a custom brushless high-output motor designed to run off the enhanced output of its 8Ah Core18V batteries. This table saw allows you to work longer by getting 192 linear feet per 8Ah batter charge, or 48 cuts, and nearly double that when using the ProFactor exclusive 12Ah battery. www.boschtools.com

Hardlines Home Improvement Quarterly 19 FIRST QUARTER / 2023 POWER TOOLS SPOTLIGHT

HARDLINES CONFERENCE REUNITES THE INDUSTRY IN NIAGARA-ON-THE-LAKE

The 26th Annual Hardlines Conference hosted almost 150 delegates at the Queen’s Landing Hotel in Niagara-on-the-Lake, Ont., in October. A large number of additional delegates across the country watched the presentations on their devices.

The two-day event attracted a veritable who’s who of the industry, with attendees from BMR, Castle, Federated Co-op, Home Hardware, Lowe’s/RONA, Peavey Industries, and Sexton Group, among others. Virtual delegates included top execs from Home Depot as well as a number of key independent dealers. The vendor community was well represented with sponsoring manufacturers, wholesalers, sales agents, and distributors in attendance. Industry associations were represented from both sides of the border.

The traditional opening pub night, held in a nearby Irish pub and hosted by RONA, was packed. There was also a sense of relief: For many delegates this was their first national gathering in our industry in almost three years.

www.hardlines.ca 20 FIRST QUARTER / 2023

Hardlines Home Improvement

Quarterly

CONFERENCE SERIES 2022

Photos: Anand Sheoran, My Photographer Portraits Inc.

CONFERENCE

COVERAGE

A large crowd attends the awards gala, including (foreground from left) Michael Foltin, Cinzia Angeloni, and Diego Mazzone, all from ORA sponsor JR Tech.

HOW TO ATTRACT AND KEEP GOOD EMPLOYEES

ERIC PALMER VP and GM of the Sexton Group

ERIC PALMER VP and GM of the Sexton Group

Eric Palmer, VP and GM of the Sexton Group, gave a presentation entitled, “The Evolution of a Team.” He told delegates that “change can be unexpected, but it is inevitable.”

Palmer’s employer is a case in point. PFM Capital Inc., of Regina, will be the new majority owner of the Sexton Family of Companies in a deal that was expected to close by the end of 2022.

Palmer said he was “team member 22” when he joined the organization in January 2016. He was promoted to VP and GM of the buying group in February 2020. He cited his strong relationship with Steve Buckle, CEO of the parent company, as an asset. Palmer noted that each employee at the firm is encouraged to have a career plan in place. Total honesty is also a hallmark of the

company: “It’s hard to hear what you’re not doing well,” Palmer said frankly. But the support and training are there. “We provide, for example, Dale Carnegie training to all employees.” The company believes in getting out on the road, too. Given the constraints of the pandemic, the management team asked, “Should we send people to the WRLA show? Yes! Send them there!”

Palmer then put up a slide he called his “unscientific hiring matrix.” It consisted of quadrants entitled: Experience, Runway, Outside Perspective, and Industry Knowledge.

These are all important, Palmer said, because obviously the company wants experience, but Sexton Group also wants runway in a new hire—they want someone to have years of contributions ahead of them. He said his firm likes to recruit employees who have the perspective of other industries. But they also value work experience in this somewhat unique industry.

Palmer put up one of the more memorable slides of the day, quoting digital marketing guru Perry Belcher: “Nothing will kill a great employee faster than watching you tolerate a bad one.”

Hardlines Home Improvement Quarterly www.hardlines.ca 21 FIRST QUARTER / 2023

Eric Palmer was “team member 22” when he joined Sexton Group in 2016. Now he’s the buying group’s VP and GM.

Michael McLarney, founder and president of Hardlines, welcomes delegates.

CONFERENCE SERIES 2022 CONFERENCE COVERAGE

HOW TO BUILD A MULTI-STORE OPERATION

ROB AND JOANNE LAWRIE Home Hardware Dealer-Owners

Rob and Joanne Lawrie won an Outstanding Retailer Award in the Retail Spirit category at last year’s conference. They were back this year as presenters.

The couple talked about their company’s growth from a single store in Annapolis Royal, N.S., founded by Rob’s parents, Beth and Robin Lawrie, to the couple’s seven Home Hardware stores today.

When they began the expansion of their (now) regional chain, it wasn’t all roses. But Rob recalls he got courage and resolve from some advice that was passed onto him at a Home Hardware dealer market by another successful multi-outlet dealer. “Whatever you do, do not stop at two stores,” said the dealer. “Do not do it!”

Joanne says that one of the many things they have learned along the way was “learning the expectations that the community has of you.” Running a hardware store (they also own stores under the Home Hardware

Building Centre banner, as well as a Home Furniture Store) really embeds you in the community, Joanne said. It results in expectations that have to be met in ways that other types of businesses might not encounter.

For example, the Lawries have greatly expanded the services they offer at these seven stores. “We are part of the fishing community, for example,” Rob said. “It’s not uncommon for us to be down at the wharf helping to lift an engine out of a boat.”

Joanne talked about the extra expectations that have come with expansion (they purchased four of their seven stores in a cluster in 2019). “We doubled our sales,

we doubled our staff, and we doubled our expectations and responsibilities overnight,” Joanne said.

The strategy for sanity? Simple, Joanne says: “Focus on the customer.” Customer service is everything.

Rob said the future of the independent home improvement store is, in fact, dependent on operators like the Lawries who are prepared to buy out other dealers and give their stores a new life. “A lot of people [who run stores in this industry] are at retirement age,” Rob said. “I believe that multi-store owners can be a solution. And not just in our banner, literally across the country.”

Hardlines Home Improvement Quarterly www.hardlines.ca 22 FIRST QUARTER / 2023

Rob and Joanne Lawrie, who own seven Home Hardware stores in Nova Scotia, said many retiring dealers will look to sell to multi-store operators like them.

The Outstanding Retailer Awards was celebrating its 30th anniversary.

A large Home Hardware delegation celebrated its two ORA winning stores, from Grande Prairie, Alberta (see page 42), and St-Raymond, Quebec (see page 38).

® COMPLETE STAIR SYSTEM FRAMELESS GLASS RAILING SYSTEM ® ADA COMPLIANT HANDRAIL urbanrail® ®

HOW THE ‘INVERTED PYRAMID’ WORKS AT LOWE’S CANADA

TONY CIOFFI, President, Lowe’s Canada

Tony Cioffi, president of Lowe’s Canada, might have given a totally different presentation if Lowe’s Cos.’ sale of its Canadian operations had come three weeks before his presentation and not three weeks after, as it did.

That agreement, announced in early November, to sell Lowe’s 450 Canadian stores, including RONA, Réno-Dépôt, and Dicks Lumber, to New York-based private equity firm Sycamore Partners set the industry alight with speculation. Cioffi’s first major announcement after the sale was that the Lowe’s brand will disappear in Canada—over time—and the RONA brand will take its place. Cioffi also reiterated the company’s commitment to keep working closely with Canadian vendors.

But at the Hardlines Conference, before the sale, Cioffi talked mostly about Lowe’s principles—and how they have served Lowe’s Canada very well during the pandemic.

“Our employees focus on what we call the Big Three,” Cioffi said. “Customer service is number one; being in stock is number two;

and having a clean and safe store is number three. Everything we do surrounds those three things.”

Cioffi then talked about the “inverted pyramid,” which is a mantra at Lowe’s. In this “servant leadership” model, the customers are at the top; the head office executives are at the very bottom. “I work for the store support centres, who look after the associates, who look after our customers. If we do a better job of looking after our associates, they will do a better job of looking after our customers. And the best way to do that is to give them technological advantages. (See page 52 for an article on the various tech features that Lowe’s Canada was able to deploy so successfully during the pandemic.)

“I can tell you we’re in supply chain optimization right now,” Cioffi said. He cited the opening of a brand new 1.23-millionsquare-foot bulk DC just north of Calgary, and the planned construction of another large DC in Ontario. “Really, the objective is getting the product to the customer over the last mile.”

“Today, the norm is people expect their product to be delivered in two to three days. Soon, same day will be the expectation. Frankly, 33 percent of customers today already expect same-day delivery. The scary stat is that 50 percent of your customers go on your website and look for a product, select the product, go to the checkout, and then when they look at the delivery expectations… if it doesn’t meet their needs, 50 percent of those customers leave to go somewhere else.”

“So getting to same-day delivery is not years away. Same-day is almost today.”

Hardlines Home Improvement Quarterly www.hardlines.ca 24 FIRST QUARTER / 2023

CONFERENCE SERIES 2022 CONFERENCE COVERAGE

Tony Cioffi: “If we do a better job of looking after our associates, they will do a better job of looking after our customers.”

Hardlines

publisher David Chestnut emcees the awards gala.

ORA winner Marianne Moisan at the BMR/Acceo/Belanger table.

Lowe’s Canada president Tony Cioffi explains his firm’s pickup lockers.

WHY A CORPORATE EXEC FOUNDED HER OWN COOKWARES STORE

ALISON FLETCHER, Owner, Cookery

Alison Fletcher, owner of Cookery—a cookware retailer with five stores in Toronto and Montreal —opened day one of the Hardlines Conference with a no-holdsbarred description of the career battles she has gone through in several decades in the food and beverage industry. Cookery’s charismatic owner urged delegates to follow their dreams—and the data.

Fletcher also spoke about talent and her own career path. She presented her “Ego Meter,” a screen on which bad experiences at firms resulted in a steep downward line. And she’s worked for a lot of corporations, including Maple Leaf Foods, Tim Hortons, the George Weston Co., and Burger King.

“I’m going to tell you, warts and all, about my journey,” she promised.

After climbing the corporate ladder at both big brands and consulting firms, Fletcher got unceremoniously fired from her top marketing post at Burger King. She had then seen enough of working for other people. “I was 43 years old, I’m a woman, I’m in management. I realized I’m going to have to chase work.” But that was something she didn’t want to do anymore. Instead, she decided it was time to “do what I loved in a way that I loved to do it.”

“A former colleague said to me that every

time I was on vacation, they’d noticed that I would go into kitchen cookware stores… I discovered that food was my passion. My love language is cooking! Does anyone else here [in the audience] love cooking? Oh, your love language is hardware!”

“I had always dreamt about my own business. But I needed data to make all my decisions. I wanted cooking courses at the centre of the business.” And she wanted to have a store that could be a positive part of the community. “I wanted to be able to walk down the street and have someone say, ‘Hey, Alison!’ ”

www.hardlines.ca 25 FIRST QUARTER / 2023

Hardlines Home Improvement Quarterly

Possibly the most frank and engaging presentation at the Hardlines Conference came from Cookery’s Alison Fletcher.

Geoff McLarney, Hardlines’ Montreal-based associate editor.

Hardlines’ Jillian MacLeod and Michelle “The Showrunner” Porter.

Alex Yakovyshenko, Haney’s Builders’ Supplies; Gary Sangha of Crown Building Supplies; and BSIABC’s Thomas Foreman.

CONFERENCE COVERAGE

LEADERSHIP AND COMMUNICATION STYLES AT WORK

ZAIDA FAZLIC, VP, People and Culture, Taiga Building Products

Zaida Fazlic, VP people, culture and change management at Taiga Building Products, gave a presentation on the skills required to be a good leader. She talked about collaborative leadership and servant leadership, which both require listening carefully and authentically to the feedback and needs of employees.

“At Taiga all of our leadership team takes part in team-building exercises. It’s a talent assessment tool. Some people are people-oriented, some are process-oriented, and some are results-oriented.”

Process-oriented people are interested in the rules. They are methodical, they are analytical, and they are safety oriented. Results-oriented people are interested in the “win,” achieving a successful outcome. They have a tendency only to look at the process when the results are negative. People-oriented people favour maintaining good relationships at all costs.

The different orientations are expressed in different communication styles. “Conflict can arise,” Fazlic said, “when we communicate to people who have other styles in communication than we prefer.”

Regardless of the communication style you bring to the workplace, it’s important to moderate it—or at least self-monitor it, lest it derail your career, she said. “Margaret Thatcher [UK prime minister in the 1980s who earned the nickname, ‘The Iron Lady’] is a great example of a strength taken too far.” She was ruthless and blunt, which worked at times. But she also humiliated her team members in public. Ultimately, she was brought down by her own political party.

So it’s important not to overdose on one particular communication style, whatever yours happens to be. In fact, Fazlic said, “It’s possible to borrow elements from different leadership styles and still be true to yourself.”

Hardlines Home Improvement Quarterly www.hardlines.ca 26 FIRST QUARTER / 2023

CONFERENCE SERIES 2022

Zaida Fazlic pointed out that conflict in the workplace can arise when we try to communicate in a style that is different from that of our co-workers’.

Relaxing at the traditional RONA pub night: (Front, from left) Kim Laurette, A.O. Smith; Krista Hamilton, McDonald Sales; Paul Crawford, King Marketing; (Rear) Michael McLarney and David Chestnut, Hardlines.

ORA winner Marc-André Lebel, BMR Pierre Naud; Tannis Bourgeois, Grunthal Lumber.

Syl Haisan, C.A.Fischer Lumber Co.; Dale MacPherson, Home Hardware Stores; Kevin Gillman, Grande Prairie Home Hardware Building Centre, an ORA winner.

Christine Joannou, Luxo Marbre; Marie-Eve Morin, Belanger Laminates.

EXPANSION AND PRODUCT MIX CHANGES AT ‘GROUPE BMR 2.0’

CHARLES GRÉGOIRE-BÉLIVEAU, VP Merchandising, BMR Group

Charles Grégoire-Béliveau, VP merchandising at BMR, took Hardlines Conference delegates through a tour of what he called “BMR 2.0.” Self-quarantined due to Covid, he appeared on a video screen from his home in Quebec. BMR, a subsidiary of Sollio Cooperative Group (formerly La Coop fédérée), has more than 275 stores in Quebec and, increasingly, outside it.

The Quebec-based buying group and retailer is continuing to sign new dealers in Ontario and the Atlantic Provinces as well as pursuing expansion in its home province. It has four formats: the “full featured” BMR store, BMR Pro, BMR Express, and AgriZone—which exists both as a standalone store and as a store-within-a-store, specializing in the farm market, including the maple-sugar industry.

“We are building BMR 2.0 and our vision is to be the leading independent retailer [in our industry] in Canada,” Grégoire-Béliveau said.

BMR’s top merchant outlined his company’s product assortment review over the previous 14 months, focusing on four categories.

The company has done a thorough review of its product assortment over the past 14 months, Grégoire-Béliveau revealed. “We are going to be investing in specific categories: building materials, plumbing—where the number one project is kitchen and bath, flooring, and seasonal.”

In addition to listing these categories as opportunities, Grégoire-Béliveau didn’t shy away from mentioning “a number of

challenges” that the industry faces. He cited inflation, consumer-spending patterns having changed so much after the pandemic (namely online shopping), the difficulty of attracting labour, the housing market slowdown, and interest rate increases.

www.hardlines.ca 27 FIRST QUARTER / 2023

Hardlines Home Improvement Quarterly

At the pub night, Sheila Carr, Mountain View Building Materials; Liz Kovach, WRLA; Sarah Hounslow, BMF; ORA winner Deb Brinson, Gander Bay Castle.

The RONA pub night vibrates to the sounds of The Danny Boys.

No Hardlines Conference would be complete without Michael playing the harmonica.

ECONOMIST SAYS ‘UNCERTAINTY AND CAUTION’ ARE WHAT’S AHEAD

PETER NORMAN, VP and Chief Economist, Altus Group

Altus Group economist Peter Norman was blunt at the outset of his presentation. “Uncertainty and caution are what we’re going to talk about this morning,” he warned. “But also some good things,” he promised.

First the good news. Canada is not likely to experience a housing crash, Norman said. But interest rate hikes will likely mean the heady times for home improvement retailers are over.

“If your industry involves construction, you’ll have found that business has been quite good lately,” Norman said. “But the economy is in transition and all sorts of stuff is going on.”

Inflation was the first topic that Norman tackled in his analysis of that “stuff.” The Consumer Price Index was up 6.9 percent in August, the most recent month for which stats were available at the time of Norman’s presentation. Transportation cost increases led the way at 10.2 percent in August, food was at a 9.6 percent increase, and shelter was up 6.6 percent year-over-year.

Norman predicted “one more 75-point change” in the Bank of Canada policy interest rate to come. He was slightly pessimistic. A week after his speech, the central bank

18 months … then we might see that rate come down.”

And there’s more behind the Bank of Canada’s rate increases, Norman said. In addition to inflation control, the central bankers are attempting to support the Canadian dollar.

In addition to presenting an “uncertainty and caution” view of the 2023 economy, Norman pointed out that (at the time of the conference) 500,000 more Canadians were employed than a year previous.

raised its rate by 50 basis points to 3.75 per cent. He compared that to the three previous peaks over the past 20 years: 3.0 percent in October 2008, 4.5 percent in November 2007, and 5.75 percent in January 2001.

Norman forecast that the Bank of Canada rate will stay around 4.0 percent for “12 to

Still, the effect of the interest rate increases on retail sales are easy to predict. “If you’re taking out a mortgage right now, you are paying roughly twice the rate you were about a year ago,” Norman said. “The market effect is that house prices come down. It is not a bubble bursting but the

market is adjusting to these new rates.”

“People renewing their mortgages, who got them four or five years ago, have no choice but to renew at these new rates. And they will not be spending as much money in hardware stores.”

Norman had good news to share, as well. “500,000 more people have jobs than a year ago,” he said. However, the peak employment month was June and employment has been flat since then. Firms have slowed their hiring because of risk, Norman said.

The overriding question is: “Are we going into a recession or not?”

Norman said yes. “Expectations are that the recession will last through the end of [2023].” Ending on good news, the economy is being stimulated by lots of new consumers, Norman said. “We had almost 656,000 immigrants last year. That’s 703,000 new Canadians including the birth rate.”

Hardlines Home Improvement Quarterly www.hardlines.ca 28 FIRST QUARTER / 2023 CONFERENCE SERIES 2022 CONFERENCE COVERAGE

”

Expectations are that the recession will last through the end of [2023].

“

DISCOVER THE ADVANTAGES OF RONA, VISIT rona.ca/ becomeRONA BE PART OF SOMETHING BIGGER becomeRONA@rona.ca WESTERN CANADA Tony Perillo 204-218-5808 tony.perillo@rona.ca QUEBEC Yanick Hamel 418-455-2148 yanick.hamel@rona.ca ONTARIO & MARITIMES Scott Wilson 519-281-1824 scott.wilson@rona.ca NATIONAL Josée Desrosiers 418-391-7101 josee.desrosiers@rona.ca Matthew Wagstaff & Ryan McKay RONA Black Diamond, Alberta RONA dealers since 2004 ‘’ADDING A RETAIL COMPONENT to our store has created stability for our business. THE BRAND helps create a balance between retail/hardware and LBM.’’

WHY OUR SUPPLY CHAINS KEEP FAILING —AND HOW TO FIX THEM

DOUG STEPHENS, Retail Prophet

Industries need to learn from the experience of Covid-related supply chain disruptions to mitigate the next global crisis. That was “Retail Prophet” Doug Stephens’ message at the Hardlines Conference.

“We haven’t learned much about supply chains in at least 160 years,” Stephens told conference delegates. “We’ve seen this movie before.” He pointed to the example of the U.S. cotton trade in the mid-19th century. Powered by slave labour that gave it “what many would consider an unfair advantage in pricing,” the U.S. did a booming world trade in the material.

U.S. cotton made up two-thirds of cotton imports in the United Kingdom, which in turn exported finished cotton goods around the world. An estimated one in five U.K. workers was reliant on the American cotton trade at that time, Stephens said. When the U.S. Civil War hit, the cotton supply to the U.K. was choked off, and the country went into an economic crisis.

“You would have thought that we might

have learned our lesson [about putting] all our eggs in one basket,” Stephens observed, but there has been little innovation in supply chain management since then.

“In truth, our supply chains today are not sophisticated and they’re not advanced.

rethinking of supply chain infrastructure.

First, the model of risk shifting needs to be replaced with risk sharing. Stephens characterized the current dominant approach as a game of “hot potato,” with manufacturers, wholesalers, and retail-

Like the U.S. in the 19th century, “today, China is the world’s everything factory.” Stephens said.

“The problem isn’t really Covid and it isn’t really China, as much as some have tried to point the finger at both. It is our industry’s myopic, almost singular focus on lowest landed cost.”

Taking the form of a lesson-learned review, Stephens’ talk sketched out three principles that are needed to guide the

Stephens said that most supply chains today operate on a few microscopic pieces of information, much as they did when they failed 160 years ago.

ers seeking to push risk onto each other. “Shared risk needs to become a core business objective,” he said, in order to avoid “data silos or deserts.”

Next, the rebuilding needs to foster transparency. Most firms, Stephens said, have a pretty good mental map of their first-tier vendors. But “by the time you get to their second-tier vendors, it gets a bit murky. By the time you get to their vendors’ vendors’ vendors, it’s a black box.”

Finally, intelligence will be key to a sound rebuilding. “Surprisingly, most supply chains even today operate on a few microscopic pieces of info: what is our sales velocity, what is our on-hand, what is in transit, what’s our turnaround?”

A broader intelligence strategy, on the other hand, could take into account data ranging from climate statistics to industrial sales trends to raw materials pricing. “The most sophisticated organizations are now getting into what we call digital twinning,” creating “a working digital model” of the business “that works in tandem with the operating organization.”

Ultimately, the retail futurist concluded, “we have a choice to decide what futurism will be.”

Hardlines Home Improvement Quarterly www.hardlines.ca 32 FIRST QUARTER / 2023 CONFERENCE SERIES 2022 CONFERENCE

COVERAGE

”

The problem isn’t really Covid and it isn’t really China. It is our industry’s myopic, almost singular focus on lowest landed cost.

“

IN APPRECIATION OF OUR SPONSORS!

The industry gathered once again at our October conference in Niagara-on-the-Lake, Ontario.

Outstanding Retailer Award winners joined exceptional dealers of various banners, head office executives, manufacturers, distributors and agents—from coast to coast. All were there to listen to presentations from some of the brightest minds in our industry.

Only because of our sponsors was this possible. Thanks to these companies listed here, our industry was able to come together for mutual benefit and in the spirit of cooperation. We were all made stronger.

THANK YOU!

Chestnut | Vice President and Publisher

Chestnut | Vice President and Publisher

SEE YOU THIS FALL IN WHISTLER Fairmont Chateau Whistler, BC October 17 & 18, 2023 HARDLINESCONFERENCE.CA

David

The prestigious Outstanding Retailer Awards (ORAs) were presented in October at the Hardlines Conference in Niagara-on-the-Lake, Ont. Owners and managers from eight visionary home improvement retailers came up on stage at a gala dinner at the Queen’s Landing Hotel to receive their awards. Congratulations to all of our winners!

RETAIL

SPIRIT

AWARD GANDER BAY BUILDING SUPPLIES (CASTLE)

Gander Bay, Newfoundland

TODD AND DEB BRINSON exemplify what the Outstanding Retailer Awards are all about. The couple knew nothing about hardware or building supply retailing when they took a giant leap of faith and bought the store in Gander Bay in 2007. They had both been working at an auto parts factory in Kitchener, Ont. Converting to the Castle banner after they bought this store in Deb’s hometown, the couple brilliantly run their business in a town with less than 2,000 residents. The passion and pride that the Brinsons feel for their enterprise is replicated in each of the other ORA winners you will meet in the pages ahead.

Hardlines Home Improvement Quarterly 34 FIRST QUARTER / 2023

Photo: Emma Hutchinson

HARDLINES CONFERENCE 2022

Home Improvement Quarterly www.hardlines.ca 35 FIRST QUARTER / 2023

Hardlines

Retail Spirit Award

GANDER BAY BUILDING SUPPLIES

Cove, Gander Bay, Newfoundland and Labrador

Deb Brinson grew up in this tiny town on the Atlantic Ocean, 45 minutes from Gander. In 2007, she and her husband, Todd, were living in Kitchener, Ont., where they both had jobs in the auto industry.

“Like all Newfoundlanders who live on the mainland, you do look forward to the day that you can move back home,” Deb recalled. Then the Gander Bay store went up for sale. “We thought, how hard could it be?”

The couple had no experience in building supply retailing. Yet, Deb and Todd’s determination to make a going concern out of a small store in this town of just 1,300 residents has pulled them through.

They have complementary skills. “I pick up where she leaves off. And she picks up where I leave off,” Todd says.

The store, founded in 1912, used to sell everything—even gasoline that they pumped out of barrels. Back in the day, most of the customers arrived by boat. Customers still arrive in boats! “There’s a different culture here, that’s for sure,” Deb says.

Jobs are not plentiful here. Many of the

locals fly to and from jobs in Alberta’s oil patch. Owing to the pandemic, those same workers were grounded for much of 2020 and 2021. Local housing starts dropped to zero.

Today, life has restarted in Gander Bay. Deb and Todd are busy once again. And their bond with their community is even stronger for the experience. Hardlines

Improvement Quarterly www.hardlines.ca 36 FIRST QUARTER / 2023

Home

HARDLINES CONFERENCE

WINNER

Victoria

2022

Deb Brinson (right), co-owner, with store staff member Ruth Purchase.

Like all Newfoundlanders on the mainland, they dreamed of the day they could move home.

“ ”

Today. Tomorrow. Outstanding.

outstanding service, warranty coverage, pricing and environmental sustainability has

our brand

industry leader. We deliver innovative, high-performance windows and entrance systems that make your customer’s house feel like home. Here’s to 40 years of outstanding in

that we do.

Yesterday.

Kohltech’s

established

as a proud Canadian

all

kohltech.com

JEAN DENIS HOME HARDWARE

St-Raymond, Que.

Husband-and-wife owners Sophie Denis and Philippe Moisan represent the fourth generation of their family to run this store. Sophie’s grandfather, Jean Denis, founded the business in St-Raymond, 40 kilometres northwest of Quebec City, in 1928.

Sophie and Philippe took over the store in 2000, adopting the Home Hardware banner in the process. Over the past 22 years they have grown the business spectacularly, moving to a new building in 2006. They added impressive plumbing and décor showrooms along the way.

Says Sophie: “Without the vision of Home Hardware co-founder Walter Hachborn, we wouldn’t be where we are now.”

There has been extraordinary sales growth at this store during the past two years. Ninety-five years after it was founded,

this powerhouse store has outstanding visual appeal. The merchandising is on point. It’s an exciting and uplifting environment for customers.

And this business is a marketing machine, using flair and imagination to promote its offerings. It is a leader on Facebook, with

videos created in the store taking the brand out into the community. This message is extended with local TV and movie theatre advertising.

And there are some master strokes of marketing: For example, ten years ago, Philippe and Sophie purchased a 1948 Chevy pick-up truck and repainted it in Home Hardware livery. It takes the store’s brand all over town.

The store lifted the town’s spirits with vintage cars again in 2021 in the middle of the pandemic. It organized a Covid-safe event that attracted 95 classic vehicles from all over Quebec. Congratulations, Sophie and Philippe, for being named Best Hardware Store in 2022.

Hardlines Home Improvement Quarterly www.hardlines.ca 38 FIRST QUARTER / 2023 HARDLINES CONFERENCE WINNER

(From left) Philippe Moisan and Sophie Denis, owners; Diego Mazzone, JR Tech, the sponsor of the award.

Best Hardware Store

Without the vision of Home Hardware founder Walter Hachborn, we wouldn’t be where we are now.

2022

“ ”

GRUNTHAL LUMBER (CASTLE)

Grunthal, Manitoba

This Castle Building Centre, 70 kilometres south of Winnipeg, is co-owned by Murray Rempel and Mel Funk. The hardware manager is Mike Bourgeois.

While the store has changed hands throughout its 78 years in business, the employees have tended to stay in place. No doubt that is due to the way the owners and managers take time to truly listen to their staff.

In 2021, a dream came true for Grunthal Lumber. The business moved across the street from its existing 4,000 square feet of retail to a new 10,000-square-foot location.

“It opened up a big new retail world for all of us,” says Mike Bourgeois. With the help of hardware wholesaler Orgill, the store was able to expand its front end significantly.

Grunthal Lumber remains the dominant player in its marketplace when it comes to LBM. Its impressive eight warehouses sit on 7.5 acres of land. And its fleet of 12 delivery trucks and 11 forklifts are constantly busy.

The store’s design and drafting department offers a virtual reality experience for its customers. They can “walk around” and see what their new home or renovation will look like—well before the contractors ever start to build!

Grunthal Lumber believes strongly in digital marketing. In a town of just 2,000

residents, the business employs a full-time marketing person who is an expert at social media. The result? Grunthal Lumber has about as many Instagram followers as the town has residents!

Today, this store does more business in a week than Murray Rempel was doing all year when he bought the business in 1995. An Outstanding Retailer indeed!

Hardlines Home Improvement Quarterly www.hardlines.ca 40 FIRST QUARTER / 2023 HARDLINES CONFERENCE Best Building Supply Under 15,000 Square Feet WINNER

2022

Mike Bourgeois (right), hardware manager at Grunthal Lumber, with Gino Allegro, Johns Manville, sponsor of the award.

The store is doing more business in a week than Murray Rempel was doing all year when he bought the operation in 1995.

“ ”

DO GOOD. INSTALL JM.

JM is working to make sure that everything you use in your home is free of potential pollutants and irritants and benefits our earth. That’s why we make a full line of Formadehyde-Free insulation and use recycled glass in our manufacturing practices.

Choose JM—good for the earth and good for your family.

JM.com

GRANDE PRAIRIE HOME HARDWARE BUILDING CENTRE

Grande Prairie, Alberta

Grande Prairie Home Hardware Building Centre is in Peace River Country in northwestern Alberta, 450 kilometres north of Edmonton. A former Beaver Lumber, the store was purchased by C.A. Fischer owner Ken McCourt in 2012. C.A. Fisher has an impressive 15 Home Hardware stores in Western Canada.

Our judges noted that this store faced some of the most intense competition of any of this year’s entries.

Within just a few minutes’ drive of this Home Hardware Building Centre are seven daunting competitors: Nelson Lumber, RONA, Home Depot, Wal-Mart, Canadian Tire, Windsor Plywood and Costco.

The competitive heat means that store manager Kevin Gillman and his staff are laser-focused on providing an incredibly high standard of customer service.

And it’s working. This store had by far the highest sales increase last year of any of this year’s Outstanding Retailer Award entries.

The business has done superbly well since the owners almost doubled the retail

footprint of this business four years ago.

The 25,000-square-foot store’s advertising is intensive, particularly radio advertising. The store’s community outreach is relentless. The store goes the extra mile to provide all the services that contractors need: door manufacturing, a stair shop, a truss plant, and more.

For its superb services to its community— in one of the most competitive marketplaces outside of a major city in the entire country—Grande Prairie Home Hardware Building Centre is a worthy winner of a 2022 Outstanding Retailer Award. Hardlines

Home Improvement Quarterly www.hardlines.ca 42 FIRST QUARTER / 2023 HARDLINES CONFERENCE Best Building Supply Over 15,000 Square Feet WINNER

2022

Kevin Gillman (centre), manager, with Syl Haisan (left) from store owner C.A. Fischer Lumber Co., and Adam Gollan, Trex, sponsor of the award.

This store brings a laser-focus on service to one of the most competitive home improvement markets in all of Canada.

“ ”

REFLECTS THE SUN AND YOUR SENSE OF STYLE. Start by designing your outdoor space with the tranquil tones that define your style. Then, lay down the durable decking that has unyielding shell protection with fade, stain, scratch and mold-resistance. You’ll have a clean conscience knowing it is made up of 95% recycled materials and can feel secure with its 25-Year Limited Residential and Fade & Stain warranties. TREX TRANSCEND®LINEAGE, ENGINEERED TO KEEP ITS COOL EVEN WHEN IT’S HOT * . *Although Trex Transcend Lineage is designed to be cooler than most other composite decking products of a similar color, on a hot sunny day, it will get hot. On hot days, care should be taken to avoid extended contact between exposed skin and the deck surface, especially with young children and those with special needs. taigabuilding.com JASPER

LOWE’S PICKERING

Pickering, Ontario

corporate store, Lowe’s Pickering has been managed for the last six years by Angelo Tzogas. He says there is no secret behind his store’s success: It all starts with the staff.

A

“We train and mentor a passionate group of associates,” Angelo says. “We nurture their service delivery by connecting with them, making them feel part of our family, addressing their concerns in a timely manner… and giving them the tools they need to grow and succeed.”

Angelo says that pandemic lockdowns completely changed the way his Lowe’s store did business. Luckily, this store just east of

The marketing obviously had to change significantly, too. In 2021, a completely digital flyer, which had never been tried before, was deployed. Lowe’s Canada uses

the area were constructed between 1981 to 1990. A high percentage were constructed between 1961 to 1980. That makes for a lot of renovation customers.

But this obviously attracts competitors, too. There are two Home Depots within five kilometres of this Lowe’s. And a Canadian Tire is in the very same parking lot.

Toronto—and the entire Lowe’s Canada network—was able to leverage its e-commerce head start on its competitors.

what it calls its “360-degree retargeting strategy” involving all social, Google and video tools, to maximize revenue.

The sales growth of this Lowe’s store is aided by the rapidly ageing housing stock in the immediate area. A quarter of the homes in

The sales growth of this Lowe’s store is aided by the rapidly ageing housing stock in the immediate area. A quarter of the homes in

Hardlines Home Improvement Quarterly www.hardlines.ca 44 FIRST QUARTER / 2023 HARDLINES CONFERENCE

Large Surface Retailer WINNER

Best

2022

Angelo Tzogas, store manager, with Beth Casson, National Hardware Show, the sponsor of the award.

Connecting with the store’s staff and making them feel part of the family is important at this store, manager Angelo Tzogas says.

“ ”

Beauty

your Trusted Brand Wolmanized® Outdoor® Wood with Tanatone® colourant has decades of proven performance in protecting wood from its natural enemies - termites and fungal decay. • Above ground, ground contact and freshwater applications • Long-lasting protection with built-in colourant • Fasteners – manufacturer recommendations and building code compliant WolmanizedWood.com

and Performance from

BMR PIERRE NAUD INC.

Trois-Rivières, Quebec

This Trois-Rivières store is part of a six-store regional chain that dates back to 1890. That year, Pierre Naud opened a window and door manufacturing business out of his house in St-Thècle, Que.

The Trois-Rivières store was added to the organization by current owners MarcAndré Lebel and Philippe Lebel, descendants of Pierre Naud, in 2012.

The brothers set about extensively renovating and expanding the store in 2017. And then, shortly after the renovations were complete, a devastating fire occurred—it all burned down.

The store manager, Jessica Bastarache, wrote in her entry for these awards that this terrible fire was the most important test that any of the owners and staff had ever faced. The contractors proved their loyalty. And then some. It was a “beautiful solidarity,” says Jessica.

It’s worth noting that this store is literally surrounded by excellent competitors, including a Canac location 250 metres away. And there are two major big boxes within just two kilometres.

When the store was rebuilt from the fire, an entirely new and unique concept of customer service was put into play.

Instead of just a regular contractor desk

and a separate cashier, contractor-consultant employees are deployed to attach themselves to the pros from the moment they walk through the doors.

Every single one of the 25 employees at Pierre Naud Inc. in Trois-Rivières can be proud to share in this award.

Hardlines Home Improvement Quarterly www.hardlines.ca 46 FIRST QUARTER / 2023 HARDLINES CONFERENCE

Contractor

WINNER

Best

Specialist

2022

Marc-André Lebel and Philippe Lebel (centre), owners, with (left) Jake Smith, NHPA, and (right) Bob Cutter, NHPA, sponsors of the award.

“

When the store burned to the ground shortly after it was renovated, manager Jessica Bastarache noticed ‘a beautiful solidarity’ from the contractors who gathered to rebuild it.

”

Each issue of Hardlines Dealer News features: 4 News to help store owners and managers stay current on the latest trends in their market; 4 Tips for smart retailers who want to identify ways to manage their operations more successfully; 4 Insights to help dealers hire smarter, merchandise better and manage more effectively; 4 Concrete ideas for managing budgets, merchandising products and identifying best practices. Tips and information for home improvement dealers to your inbox every month! Targeted squarely at store owners and managers, Hardlines Dealer News is a monthly email newsletter with content designed especially for dealers and owners who want to run their businesses at maximum efficiency. Sign up today for free dealernews.ca

Young

Retailers

of the Year MARIANNE AND MATHIEU MOISAN

BMR Paulin Moisan, St-Raymond, Que.

These cousins, 28 and 33 years of age when they entered the ORAs last summer, are the grandchildren of the founders of the store, Paulin Moisan and Thérèse Dion, who founded their hardware store in 1961.

The legacy of these two entrepreneurs is still celebrated in St-Raymond, near Quebec City. A special “Paulin” beer was brewed to commemorate the store’s 60th anniversary!

Mathieu and Marianne started working in the store while they were in school. They both knew they wanted to be proprietors of the business one day.

But the second generation of the Moisan family had a strict rule for any third-generation family members who wanted to become owners. They would have to go work somewhere else first!

So, after formal studies in sales and architectural drawing, Mathieu went to work as a construction estimator for a non-family company.

Marianne, meanwhile, studied accounting and attained her professional accounting

designation. She worked for several years as a controller in the aviation industry.

Now Marianne and Mathieu are back at the family store as owners—since April 2021.

merchandised and visually striking stores in our industry.

The two cousins have very different skill sets. Marianne has the operations, finance and HR skills. Mathieu has the construction, sales, purchasing and logistics skills. “Our personality differences lead to a wonderful synergy,” Marianne says.

Back in 2011, the business relocated to allow for expansion. Today, this 15,000-square-foot store is one of the best

Hardlines Home Improvement Quarterly www.hardlines.ca 48 FIRST QUARTER / 2023 HARDLINES CONFERENCE

WINNER

2022

Mathieu Moisan and Marianne Moisan (centre), dealer-owners, with Trevor Schellenberg (left) and Jason McIntyre (right), Acceo, the sponsor of the award.

Our personality differences lead to a wonderful synergy.

“ ”

acceoselfcheckout.com Connected to our solutions A solution to labour shortage Easy and fast payment Self-Checkout NEW

Leader

DOIDGE BUILDING CENTRES, RONA FORT ERIE

Fort Erie, Ontario

This store is owned by Dennis Doidge and run by long-standing manager Jeff Hill. It’s one of 10 Doidge Group stores in Southern Ontario. The Fort Erie building supply store switched banners to RONA four years ago.

Today, the business is doing eight times the volume that the store was doing when Dennis Doidge purchased it in 2007. But RONA Fort Erie is also highly successful as a community leader.

Fort Erie is a city of just 30,000 residents across the Niagara River from Buffalo, New York. It has small town, community values. “We Love Fort Erie” is the store’s official slogan. The store’s core values are: “Respect, Responsibility, Unity, Service and Common Good.”

To give just one of dozens of examples of the store’s Common Good philosophy, in the fall of 2019, Fort Erie RONA held a charity barbecue for Amanda Martin’s children. Amanda had lost her life trying to save her son from drowning in the Niagara River. RONA Fort Erie raised $26,000 for Amanda’s son and daughter.

The store donates annually to a local food bank. It gave $46,600 last fall, which made it the leading independent donor in the Lowe’s Canada Heroes campaign.

The company also gives large donations to The Heart and Stroke Foundation, Big Brothers and Big Sisters, Boys and Girls Club, Meals on Wheels, and many more.

During the pandemic, RONA Fort Erie regularly donated food for health care workers at the local hospital as well as at three long-term care homes.

Improvement Quarterly www.hardlines.ca 50 FIRST QUARTER / 2023 HARDLINES

Says manager Jeff Hill: “We don’t do this for financial gain. We do it out of the goodness of our staff’s and customers’ hearts.”

Hardlines Home

CONFERENCE

Marc Robichaud Community

WINNER

2022

(From left) Jake den Hollander, regional manager; Sarah Hounslow, BMF, the sponsor of the award; Jeff Hill, store manager; Andrew Doidge, VP Doidge Group.

We don’t do this for financial gain. We do it out of the goodness of our staff’s and customer’s hearts.

“ ”

www.bmfonline.com

ALLEN RONA North Vancouver, Powell River and Salmon Arm, B.C. STORE PLANNING | STORE FIXTURES | LBM DISPLAYS | GRAPHIC DESIGN & SIGNAGE | INSTALLATION | SERVICE COUNTERS

did these renovations because of pride in our stores. We are

part of these communities. So, we wanted our stores to be

spectacular. And working with BMF,

produce.” Mark Ehrlick VP Sales & Marketing 905-630-6445 mehrlick@bmfonline.com Contact BMF About Your Store and Fixture Design Challenges: Industry Partner in Store Renovation

MICHAEL

“We

a big

absolutely

that’s exactly what we were able to

HOW LOWE’S USED TECH DURING COVID

The pending sale of Lowe’s Canada to a private equity firm doesn’t obscure the fact that it was already doing pretty well with the “gadgets”

echnology is not just about gadgets,” said Lowe’s Canada president Tony Cioffi to a packed ballroom at the recent Hardlines Conference in Niagara-on-the-Lake, Ont. “Because gadgets are just gadgets.”

“T

“But by giving our associates the tools to be more productive, they can do a better job at looking after our customers,” Cioffi explained. “I’ll give you some examples.”

The examples (which we explore in this article) have no doubt been explained by Cioffi to the pending new owners at Sycamore Partners. That private equity firm intends to pay $400-million in cash (plus an unspecified performance incentive) for Lowe’s Canada’s entire operations, with the deal to close early this year. Sycamore will get 450 stores including Lowe’s Canada’s corporate stores, RONA’s corporate stores and the wholesale business of RONA independents, plus Réno-Dépôt stores and a handful of Dick’s Lumber stores. (See page 10 for more on the acquisition.)

And Sycamore will also get some DCs that are among the biggest in Canada (including the newly-opened 1.23-millionsquare-feet DC just north of Calgary). And a lot of retail tech. A whole lot of retail tech. Let’s look at the technology that Cioffi was explaining at the Hardlines Conference.

ZEBRA HANDHELD DEVICES

“We put Zebra devices in the hands of all of our associates in the last couple of years,” Cioffi said. Lowe’s Canada wasn’t alone— the Illinois-based Zebra Technologies