The largest home improvement retailer in the world unveils its first Flatbed Distribution Centre in Canada to serve contractors

Estimated retail sales, store counts, market shares, and strategies from the top banners

SURVEY OF

How the rise of GSDs led to the rise of today’s contractor yards

Orgill’s commitment to getting products into your store is paramount. Our modern, private fleet of 400+ trucks are all driven by Orgill employees. Not only do our drivers keep things running smoothly, but our operational model controls our expenses and we pass these savings along to our dealers.

We’ll go the extra mile for you. Contact us today.

GYPSUM INSULATION

CEILINGS

ROOFING

SIDING RAINWARE

TRIMS

PVC WINDOWS

PVC PATIO DOORS

ROOFING

INSULATION

SOUNDPROOFING

HOUSE WRAP

HOME IMPROVEMENT QUARTERLY

THIRD QUARTER / 2024 • VOLUME 14, NO. 3

330 Bay Street, Suite 1400, Toronto, ON M5H 2S8 • 416-489-3396

@Hardlinesnews • www.hardlines.ca

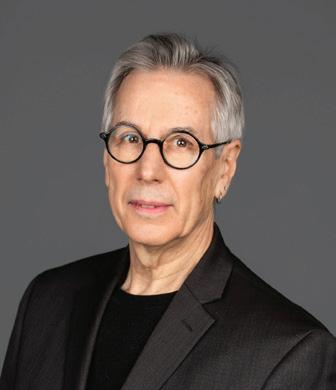

PRESIDENT

Michael McLarney mike@hardlines.ca

EDITOR

Steve Payne steve@hardlines.ca

ASSOCIATE EDITOR

Geoff McLarney geoff@hardlines.ca

CONTRIBUTING EDITOR

John Caulfi eld

ADMINISTRATIVE & SALES ASSISTANT

Jillian MacLeod jillian@hardlines.ca

VICE-PRESIDENT & PUBLISHER

David Chestnut david@hardlines.ca

MARKETING & EVENTS MANAGER

Michelle Porter michelle@hardlines.ca

ART DIRECTOR

Shawn Samson TwoCreative.ca

ACCOUNTING accounting@hardlines.ca

COVER PHOTOGRAPHY

Larry Arnal arnalpix.com

SUBSCRIBER SERVICES ★ FREE TO HOME IMPROVEMENT DEALERS ★

To subscribe, renew your subscription, or change your address or contact information, please contact our Circulation Department at 866-764-0227; hhiq@mysubscription.ca

HardlinesHomeImprovementQuarterlyis published four times a year by Hardlines Inc.,

330 Bay Street, Suite 1400, Toronto, ON M5H 2S8. $25 per issue or $90 per year for Canada.

Subscriptions to the Continental United States: $105 per year and $35 per issue. All other countries: $130 per year. (Air mail $60 per year additional.)

Canadian Publications Mail Agreement # 42175020

POSTMASTER: Send address changes to Hardlines Home Improvement Quarterly, 8799 Highway 89, Alliston, ON L9R 1V1.

All editorial contents copyrighted 2024 by Hardlines Inc. No content may be reproduced without prior permission of the publisher.

NUMBER ONE IN THE HOME IMPROVEMENT INDUSTRY. ONLINE AND PRINT.

HHIQ is just one facet of the Hardlines Information Network. Since 1995, we’ve been delivering the most up-to-date information directly to you online, in print, and in person. Find out how you can get your message out with us. Contact:

David Chestnut, Vice-President & Publisher 416-425-7992 • david@hardlines.ca

Peavey Industries to end its relationship with Ace in Canada

RONA has a new president/CEO —plus a new look for indies

Peavey CEO Doug Anderson talks about cautious growth

Canac’s growth continues with store opening east of Montreal

Independents fared better post-Covid than big boxes: Hardlines report

Timber Mart CEO Bernie Owens discusses the value of Air Miles for his dealers

Upcoming Hardlines Conference to be held in the province of Quebec

ABSDA Building Supply Expo

“one of our best shows in decades”

McMunn & Yates adds three stores in Manitoba

Lee Valley Tools’ new Ottawaarea distribution centre is up and running

Orgill steps up tech to serve its dealers, says CEO Boyden Moore

EDITOR’S MESSAGE Covid hangover

PRODUCT SPOTLIGHT What’s new in paint and sundries

PUBLISHER’S MESSAGE Why we’re going to Charlevoix

ENDCAP

P.E.I. Home Hardware buys a furniture store

Join a completely Dealer-Owned company today.

Dealers share and participate equally without the influence of any external shareholders. Harness our massive buying power, comprehensive distribution, national brand recognition and marketing support.

STEVE PAYNE, EDITOR

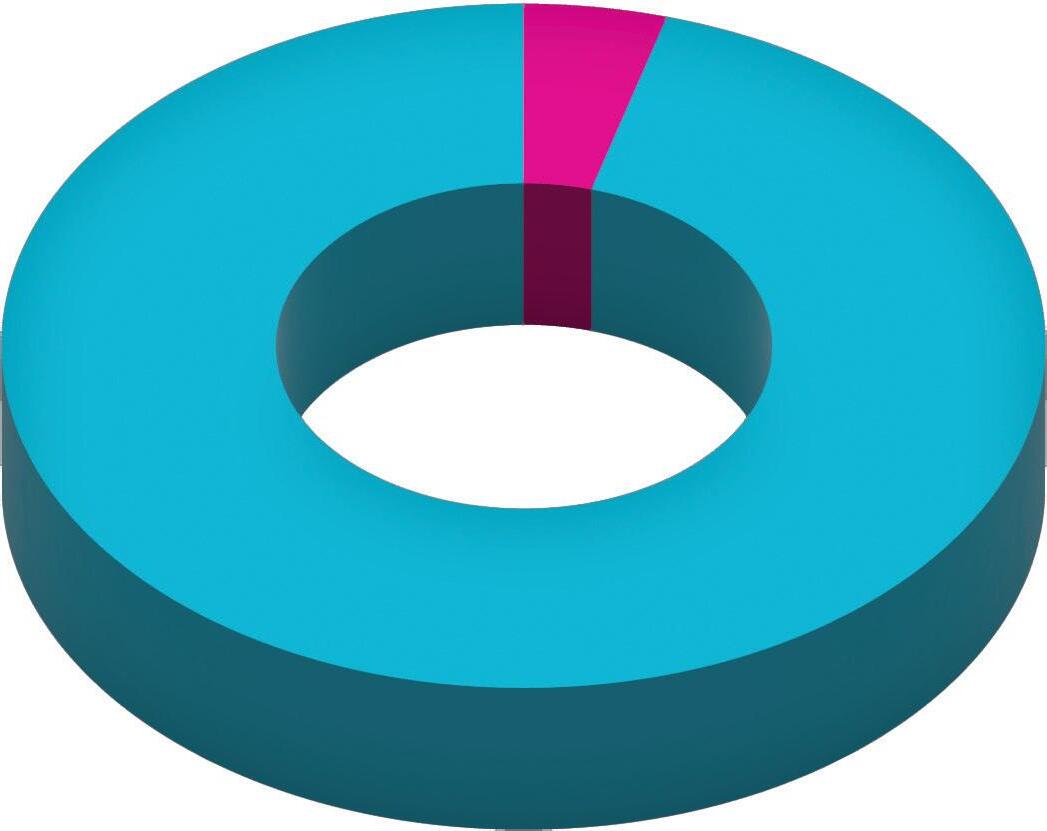

Retail sales dropped 3.5 percent in our industry last year, Hardlines calculates. How we did the math, what the implications are, and what the future holds.

As detailed in this issue, our industry actually contracted 3.5 percent in retail sales last year. That might not seem like much—given the negative numbers in annual reports from publicly-traded retailers. But in a year when inflation ran at 3.9 percent, as 2023’s Consumer Price Index tells us, that’s a hefty 7.4 percent drop in real spending by consumers.

All of these numbers were entirely predictable.

First, the Bank of Canada hiked its policy interest rate (its central rate at which it lends money to banks) from 4.25 percent in January of last year to 5.00 percent by mid-summer of 2023. That ground the real estate market to a halt—and nothing stimulates spending in our industry like people moving houses.

And two, most retailers had come off three hugely successful years with double-digit sales increases in 2020 (15.5 percent) and 2021 (11.3 percent). In 2022, the industry slowed down, but still posted an increase (4.2 percent). The lockdowns and lack of spending options in travel and entertainment were good for business in home improvement.

After the industry grew by a third during the pandemic, a soft landing was always

going to happen. We aren’t officially in a recession—but it sure feels like one. The good news is that a homebuilding boom is coming to Canada. We have no choice. Governments everywhere are trying to loosen construction permit red tape, stimulate the market, and provide funding.

Meanwhile, there are some people who will peruse this Top 20 issue and wonder where we get all our data from. It’s a huge task that our editorial team takes months to complete. We collect surveys from both independent and corporate dealers on business conditions. We take into account store openings, closings, and banner changes. We look at retail square footage. We compare our industry with StatCan data on the retail trade. We look for the fine print in annual reports from American firms where they break out Canadian sales (usually towards the back of the document).

All of this goes into a giant spreadsheet we affectionally call The Big Kahuna. Order the Hardlines Retail Report (visit hardlines.ca) to get your own summary of its calculations.

steve@hardlines.ca

Between 2020 and 2022, the industry grew by a third. This is a slowdown that was always going to happen. “ ”

ed Deer, Alta.-based Peavey Industries LP will end its relationship with Ace Hardware International on Dec. 31 of this year. Peavey has been the licensee of the Ace banner in Canada since 2020.

In a release, Peavey said that the decision “underscores the growth trajectory that Ace Canada has experienced, evolving from Peavey Industries LP’s acquisition of the Ace Canada master licence from Lowe’s in 2020. This period has been filled with shared aspirations for growth and a steadfast commitment to supporting local Canadian-owned retail.”

The original deal had some knocks against it from the very start. Peavey signed the deal to take over the Ace licence in Canada at the end of 2019, just weeks before the world was shut down by Covid. The licence had previously been held by Lowe’s Canada, which inherited the Ace business as part of Lowe’s acquisition of RONA inc. three years earlier.

The irony of that deal did not escape the management at Ace Hardware Corp. in the U.S. (its headquarters are in Oak Brook, Ill., a suburb of Chicago). Lowe’s happens to be one of Ace’s biggest competitors in the U.S.

With the move of Ace to Peavey Industries, the future of the venerable brand, which sits atop some 5,800 stores in 60 countries, appeared more secure than ever. While Lowe’s Canada always maintained a commitment to those smaller Ace dealers, it had plenty of other changes to cope with as it faced Covid, then new owners of its own.

With Peavey, the Ace business was back

in the hands of a Canadian company— and a western-based one at that. Under the leadership of CEO Doug Anderson, Ace was another part of Peavey’s trajectory as a truly national retail hardware company, with “aspirations for growth and a steadfast commitment to supporting local Canadianowned retail.”

But it had to develop a wholesale business to supply the more than 100 Ace dealers that came along with the deal. Many of these are smaller hardware stores serving rural or remote communities. But even these fit with Peavey’s vision to support “small retailers and local communities that are the backbone of our economy.” Peavey’s own banner, Peavey Mart, consists entirely of corporatelyowned farm and hardware stores, many serving secondary and rural markets.

As some Ace stores are building centres, Lowe’s Canada continued supplying them with building supplies until Peavey made a deal with Sexton Group in Winnipeg to manage that side of the business.

But the one-two punch of pandemic and the slowing Canadian economy that followed took its toll. Over time, the number

There are more than 70 Ace stores in Canada who will be affected by the recent decision by Peavey Industries to end its relationship with Ace Hardware in this country at the end of 2024.

of Ace dealers was reduced, some through banner conversions and some through culling by Peavey as it sought a good fit with the Ace dealers themselves. Now, there are just over 70 Ace dealers in Canada.

“Over the past few years, the retail landscape has faced numerous challenges, including the global pandemic, supply chain disruptions, inflation-induced consumer behaviour changes, and increased operational costs, particularly in smaller, remote markets,” Peavey explained in the release. “These factors have prompted a strategic re-evaluation by Peavey Industries LP leading to the decision to end our relationship with Ace Hardware International.”

Peavey said its relationship with Ace dealers in Canada will be “business as usual” until the end of the year. During that time, Peavey says it remains committed to supporting the Ace dealers. “We pledge to maintain open communication and provide assistance and guidance to all affected parties.”

Change is in the air at RONA inc. with the announcements, in rapid succession, that it has a new look for affiliated (independent) dealers, it will say goodbye to its Réno-Dépôt banner in Quebec, and it has a new president and CEO, J.P. (Jean-Pierre) Towner.

Towner joined RONA inc. as CFO in October 2023. He replaces Andrew Iacobucci, who joined the firm as president and CEO exactly one year prior to Towner’s appointment, following a 20-year career in the grocery industry. Before joining RONA, Towner spent three years at Dollarama as CFO; prior to that he served as EVP and CFO at Pomerleau Inc., a commercial construction company based in Saint-Georges, Que.

Two days after the new president and CEO was announced, RONA revealed that it was fully launching a new visual identity for its stores owned by affiliates (independents). “The goal of this initiative is to turn the spotlight on RONA independent dealers by showcasing their entrepreneurial side, while leveraging the notoriety of the RONA brand,” the company said in a release.

Introduced at RONA Connexia (RONA inc.’s meeting for independents) last fall, there are a number of distinctive elements in the new look for affiliates. They include the creation of a logo specific to dealer-owners, which includes their company name, “to help customers easily identify RONA stores owned by independent dealers,” the company said. The new look also includes design of a new outdoor pylon bearing the words “Dealer Owner.” There will be a sticker displayed on the main door of the stores, bearing the words “Dealer Owner” and the year the store was founded. There will also be “creation of wall panels presenting the history and values of each store.”

The first store to get RONA’s new look for affiliates was RONA Iberville. Shown are the father-daughter owners, Raynald and Audrey Archambault.

On the corporate store side, RONA announced in May that it would extend its utilization of the new RONA+ banner that was originally conceived as a replacement for Lowe’s when that company sold its stores in Canada, including RONA, to private equity firm Sycamore Partners.

Three of the Réno-Dépôt stores in Quebec had been rebranded RONA+ by the time the company announced that the pro-focused banner would be gone by the end of the year. Sixteen more Réno-Dépôt stores will be converted to RONA+. One Réno-Dépôt will be closed (in Quebec City).

And that is not the end of the RONA+ conversions. RONA Home & Garden Waterdown, near Hamilton, Ont., is being converted now, while RONA Home & Garden Winnipeg and RONA l’Entrepôt Quebec City will celebrate their reopenings this fall.

RONA inc. has welcomed six new dealers as independent affiliates. They are RONA Quincaillerie Saint-Jean-Baptiste in Quebec, RONA Manotick and RONA Timmins in Ontario, RONA Lac La Biche and RONA Olds in Alberta, and RONA Agassiz in British Columbia.

Two stores in Alberta, Medicine Hat Home Hardware Building Centre and Alta-Wide Building Supplies, have joined the Home Hardware banner. The stores are owned by Lisa and Mark Brumm, who also own a third store in the province, Sylvan Lake Home Hardware Building Centre, which became a Home store in 2023.

Home Hardware Stores Ltd. and the Toronto Blue Jays have launched the BeautiTone Balcony at Toronto’s Rogers Centre. The BeautiTone Balcony features two tiers of standing room and a reserved group space for up to 40 guests. BeautiTone, Home Hardware’s private label paint brand, is the Jays’ official paint.

AD Canada has been recognized as a Great Place to Work for the second year in a row, according to the Top Workplace rankings by Energage LLC, an HR technology company. In addition, AD Canada has been recognized in the ranks of 2024 Best Workplaces in Canada among firms with fewer than 100 Canadian employees.

Peavey Industries, the Red Deer, Alta.based retail farm and hardware chain, announced recently that it would no longer be the licensee of the Ace Hardware brand in Canada, e ective Dec. 31, 2024. (See page 14.)

Hardlines sat down with Peavey Industries’ CEO, Doug Anderson, to discuss the growth of his chain before the Ace announcement was made.

Peavey will count on its Peavey Mart banner as well as its MainStreet Hardware brand to drive its business going forward.

e hardware and farm lines are supplied from Peavey’s distribution centres in Red Deer, Alta., and London, Ont., while LBM is supplied through an agreement with Winnipeg-based Sexton Group.

Recently, Anderson shared his concerns for the economy, which is a ecting retail in general. In addition, many of the farm communities that his stores serve have been further challenged by droughts and water shortages. He identi ed some growth in the latter part of last year, but in ation and

high interest rates are impacting customers everywhere. “But we’ve seen some strength in the new year,” he adds.

e company is not standing still. Anderson points to a new Peavey Mart in Steinbach, Man., which opened in March. e 28,800-square-foot building features a 1,440-square-foot greenhouse and even has a dog-washing station.

While he sees further opportunities for new Peavey Mart stores across Canada, he stresses the caution he expressed earlier.

“It’s just about us making sure that the timing is right—and recognizing that the timing for aggressive expansion is not now.” Looking ahead, however, he does identify both the Maritimes and British Columbia as opportunities for future strategic growth.

Anderson adds that Peavey Mart’s digital presence has been strong, especially following a series of upgrades implemented over the past six months, including better content and enhanced search capabilities, “and customers are responding nicely.”

Quebec home improvement retailer Canac has a new store in Sorel-Tracy, Que., roughly midway between Montreal and TroisRivières. The location opened in May.

Store manager Gilok Chang Kai was joined by members of the Laberge family who own Canac, Canac general director Martin Gamache, and merchandising director Daniel Châtelain. Elected officials on hand included Sorel-Tracy mayor Patrick Péloquin.

“The media define us as a big box, but we operate on proximity,” Châtelain said,

describing the close cooperation across departments. The store clocks in at more than 40,000 square feet and boasts a building materials warehouse of over 31,000 square feet, along with an outdoor lumber yard.

Charles Laberge, Canac’s senior business development manager, noted that there is “strong potential in our market for entrepreneurs looking for specific guidance” on products.

All staff positions in the store have already been filled. Some employees were wooed

from competitors, while others are locals who jumped at the chance to quit their commute to Montreal.

The privately owned chain is in the midst of a $200 million, fi ve-year expansion effort. Its Walmart-style strategy of everyday low pricing over promotional specials appeals to Quebecers. Since the takeover of RONA by Sycamore Partners, a New York-based equity fund, Canac has touted itself as a homegrown alternative. The retailer’s next opening is slated for the fall in Rivière-du-Loup.

While every retailer faced their challenges through the pandemic, Hardlines has data that shows some did better than others. In fact, the groups representing independent dealers actually pulled ahead of the big box retailers.

That trend is borne out by data in the 2023 Hardlines Retail Report, which gathers sales and intel to the end of 2022 to track the size and growth of the retail home improvement industry in Canada. Much of that data is drawn from our survey of the retail dealers and managers themselves.

According to the Retail Report, during the first two years of the pandemic, 2020 and 2021, the industry enjoyed tremendous growth. According to the Hardlines data, by 2022, sales remained strong, but yearover-year increases started to normalize. While overall sales growth in the industry was up over 11 percent in 2021, those gains were tempered in 2022, up overall by 4.6

Broken down by store format, those increases varied according to retail type. Building centres enjoyed the strongest growth by far in 2022, with overall estimated sales up 6.5 percent from 2021. At the other end of the spectrum, hardware stores had the smallest gain in 2022, up only 1.3 percent year over year. Hardware stores had grown almost 16 percent in 2021, as consumers sought out the convenience factor of local hardware retailers.

Big box stores, however, with their larger formats and bigger overheads, were impacted more seriously by the slowdowns in 2022. Their estimated collective sales were up only 2.7 percent.

The 2024 edition of the Hardlines Retail Report , which uses year-end data from 2023, will be available in July. For more information, contact Jillian MacLeod at the Hardlines World Headquarters: jillian@

Castle Building Centres Group has signed Eastcut Wood Building Solutions in Trenton, N.S. The business is owned by Donald MacDonald, who founded the business in 2019. Castle has also added O’Connor Hardware in Oro-Medonte, Ont. Founded in 1996, it is under the new ownership of Brent and Sarah Johnston.

Kent Building Supplies has opened a new store on Findlay Blvd. in Riverview, N.B. It replaces another location that is now closed on Coverdale Rd. The new location opened in April with a contractor event before its grand opening. It hosted some 30 vendors and attracted 250 pro customers.

Canadian Tire has been recognized as one of Canada’s most trusted brands. In Léger Marketing’s Reputation 2024 study, Canadian Tire landed in the third spot, behind international brands Google and Sony. Last year, it ranked number four.

Independents have fared better than big boxes recently. Part of this is due to better branding, such as Home Hardware’s paint brand shown here.

A storage rack that had visible damage or wear, according to a WorkSafeBC report, cost a Penticton, B.C., RONA store a $330,507 fine recently. WorkSafeBC is the province’s safety agency. It sometimes conducts random investigations of workplaces involving construction materials. The rack in question was subject to a “stop use” order from the agency. However, the store did not repair or replace the rack, the report said. In addition to the worn or damaged racking, “No information was available about the rack’s rated capacity or loading or unloading instructions,” the WorkSafeBC report said.

Loyalty programs are playing an increasingly important role in the o erings of many home improvement retailers. And the movement last September as Home Hardware joined Scotiabank’s Scene+ program, which includes partners like Sobeys, IGA, Foodland, and FreshCo , bears out how much e ort is going into netuning these programs.

One customer points program that took a hit was Air Miles Canada. It was once a national leader and Canada’s “most recognized” loyalty card program. It had steadily built up its retail partners in this country since 1992.

However, in February 2021, Air Miles Canada began to decline sharply. Lowe’s Canada le the program, along with its brands RONA and Réno-Dépôt. Two months later the program su ered a further setback when the Liquor Control Board of Ontario le the program. In 2022, Staples Canada abandoned Air Miles. e biggest blow of all might have been the defection the same year of Empire Co., the parent of Sobeys, Safeway, Farm Boy, Foodland, IGA, and other grocery stores (which are now members of rival program Scene+).

In the retail home improvement industry, two major brands, Kent Building Supplies in Atlantic Canada, and TIMBER MART nationally, continue to use Air Miles. Most recently, the loyalty program added a new twist. Air Miles Receipts o ers a way to “layer over” existing retailer programs by allowing consumers to scan their receipts with an in-program app and earn bonus points and o ers.

“I do believe there’s value for the dealers that Air Miles can deliver,” TIMBER

MART president and CEO Bernie Owens told Hardlines. He expects that the new ownership by BMO will add more “anchor” users that will rebuild the program’s pro le. In fact, Owens shares that the issuance of Air Miles points by TIMBER MART dealers increased in 2023. “ at shows there’s still value in it.” e program, he adds, is available at the discretion of each dealer, who can evaluate its merits for their own markets.

“I look at Air Miles and say, ‘what are the options out there?’ It’s to build loyalty for dealers at an a ordable cost.” He believes BMO has an opportunity to provide better analysis that can help dealers understand their customers. “If these points systems don’t add value to our dealers, we’ll have to look somewhere else.”

Gypsum Management & Supply Inc. announced Q4 sales of US$1.41 billion, up 8.4 percent from a year earlier. Net income declined 25.4 percent to $56.4 million, compared to $75.6 million in the previous Q4. For its fiscal year 2024, which ended April 30, GMS saw sales grow by 3.2 percent to $5.5 billion. Annual net income came to $276.1 million, a 17.1 percent decrease from $333.0 million in 2023.

The Home Depot has completed its acquisition of SRS Distribution, Inc., a building products distributor with more than 760 locations across 47 U.S. states. The deal, first announced March 28, is worth about US$18.25 billion. SRS serves professional roofers, landscapers, and pool contractors, with a sales force of 2,500 and a fl eet of some 4,000 trucks. Home Depot expects the acquisition to accelerate its growth with the residential contractor and builder with bulk orders.

Canadian Tire Corp. is building a new store at the Stanley Park Mall in Kitchener. The new Canadian Tire store, which is forecast to open this fall, will replace the existing Canadian Tire store at Victoria and Frederick streets in Kitchener. The new store will occupy the location vacated by Walmart at the mall.

Home Hardware Stores Ltd. has announced the appointment of John Pierce as chief retail operations officer. Reporting to CEO and president Kevin Macnab, he will oversee field operations, dealer support functions, business development, real estate and construction, store design and space planning, Home’s Innovation Centre, communications, events, and public relations. Pierce’s previous role was VP of retail business development.

RONA is on a mission to become the country’s strongest dealer network. We’ve adopted a new program and strategy—and it’s working wonders. We’ve already onboarded 11 stores across the country this year alone. We can’t wait to welcome yours.

• Boost your profits: Access to exclusive programs designed to maximize your store’s profitability.

• Grow your business: Benefit from our revamped business positioning tailored to your needs, and your clients’ needs too.

• Get world-class support: Reach new heights with the expertise and resources backed by industry leaders like us.

• Embrace the new you: Upgrade your branding and store layout working with our team of experts.

Join us and, together, let’s build the future of retail.

his fall marks the 28th annual Hardlines Conference, an event which has long been unique in Canada for drawing the entire industry together. No matter which banner the attending dealers belong to, or which products (from hardlines to building supply) the delegate vendors are supplying them with, they have met at the Hardlines Conference every October.

e conference was traditionally held in the Toronto and southern Ontario areas. But last year, the Hardlines team decided that, in order to better represent the national industry, it would take its premiere event on the road—to Whistler, B.C.

e huge success of that event propelled Hardlines to continue the national tour.

is fall, the conference will be held in Charlevoix, Quebec, east of Quebec City, on Oct. 22 and 23, 2024. A spectacular hotel, the Fairmont Le Manoir Richelieu is the venue. Hardlines’ collaborator this year is AQMAT, Quebec’s building materials and hardware trade association.

e Outstanding Retailer Awards will mark the centrepiece of the Hardlines Conference at the awards gala on the evening of Oct. 22. Once again, eight of the industry’s top retail stores will be honoured—all the way from Best Hardware Store, to Best Large Surface Retailer, and Young Retailer of the Year, among others.

e speakers line-up is, all the way through, probably the strongest in the history of the Hardlines Conference.

Delegates will hear from some of the biggest retailers in the industry, such as Alain Ménard, senior vice president of RONA inc., and Sherri Amos, director of dealer support at Home Hardware Stores Ltd. e largest Quebec-owned home

improvement retailer will be represented by Alexandre Lefebvre, CEO of BMR Group.

Specialty retailers will come to the podium, too. Tools retailer extraordinaire Lee Valley Tools will be represented by their president and CEO, Jason Tasse. One of the most important pro dealers in the country, Gibson Building Supplies, will be present in the person of their CEO, Michelle Chouinard-Kenney. IKEA, one of the most successful retailers in world history, will be represented by the Canadian division’s sustainability manager, Heléne Loberg. e European home improvement industry has many lessons for Canada. e Hardlines Conference is pleased to welcome to our shores for the rst time David Collas, general manager of Les Mousquetaires group, based in France. e retail group includes one of the most in uential powers in European home improvement retailing, Bricomarché, among other banners.

Some speakers will provide insights

The Fairmont Le Manoir Richelieu will be the spectacular venue of the Hardlines Conference on Oct. 22 and 23, 2024.

into the important component parts of home improvement retailing. Wellknown broadcaster and HR expert Pierre Battah provide lessons from his leadership rm. Housing and land economist Peter Norman, from Altus Group, will give his annual analysis of the dollars and cents side of the general economy and how our industry ts in. e conference will even have an appearance from Hugo Girard, former world champion strongman.

Finally, Richard Darveau, president of AQMAT, and Michael McLarney, founder of Hardlines Inc., will provide their analyses of the state of the industry, what we’ve come through, and what probably comes next.

e 28th Annual Hardlines Conference will be held at the Fairmont Le Manoir Richelieu, on Oct. 22 and 23, 2024, east of Quebec City. Retail dealers and their sta get special pricing. Contact michelle@hardlines.ca for your discount! And check out the full line-up of speakers on pages 10 and 11.

comes a comprehensive suite of smart home safety devices to help protect your home and the people inside. Plus, they interconnect with existing Kidde hardwired alarms** – when one alarm sounds, they all sound, and an alert is sent to your phone.

Smoke + Carbon Monoxide Alarm with smart features

Water Leak + Freeze Detector

Smoke + Carbon Monoxide Alarm with Indoor Air Quality Monitor

*Based on total household installations as of December 2021.

**Only the Smoke + Carbon Monoxide Alarm and Smoke + Carbon Monoxide Alarm with Indoor Air Quality Monitor connect with other Kidde alarms that have hardwired AC interconnect capability

The Atlantic Building Supply Dealers Association (ABSDA) held its annual Building Supply Expo trade in March at the Halifax Convention Centre.

“Our trade show oor space was totally sold out for the rst time at the Halifax venue,” said Denis Melanson, ABSDA president.

e meet and greet opening night on March 5 drew a crowd of close to 600 people. Live music was supplied by e Kiln Dried Studs. “ ey decided to forgo their fee and play music for us in exchange for a donation to the IWK Heath Centre’s children’s hospital in Halifax,” Melanson told Hardlines. e ABSDA committed $3,000 to the cause—and real estate entrepreneur Adam Barrett, who has just purchased three RONA stores in the Halifax area, matched the $3,000 donation.

A third, anonymous donation of $2,500 to IWK children’s hospital soon followed. Kiln Dried Studs’ drummer, Steve Foran, sold band T-shirts through the night to supplement

Trade show space at the ABSDA show in March, held in Halifax, was totally sold out for the fi rst time at this venue.

the donation. All told, over $12,000 was raised for IWK at the ABSDA Expo.

At the awards gala on March 6, 720 attendees saw Ryan Buck of Buck’s Home Building Centre, Bridgewater, N.S., win the award for Young Leader of the Year. Retailer of the Year went to Yvon Godin, a TIMBER MART dealer from Neguac, N.B. e Salesperson of the Year award went

to Sheldon Atkinson, Gentek. ABSDA’s Industry Achievement award went to Kevin Pelley from Kohltech Windows.

“Expo 2024 will go on record as one of our best shows in the past decades,” said Melanson. Next year’s ABSDA Building Supply Expo will return to Halifax on Mar. 5 and 6, 2025, to celebrate the association’s 70th anniversary.

McMunn & Yates, the home improvement chain based in Dauphin, Man., has 22 stores in western Canada, with 16 of them in its home province of Manitoba. Now, the opening of three new locations expands the retailer’s reach in the West.

“This was our acquisition of the Canadian Lumber stores, owned by Henry and Brenda Friesen, in the southern Manitoba communities of Winkler, Morden, and Altona,” says McMunn & Yates president Jason Yates. The three stores are in the southern part of Manitoba, not far from the U.S. border. They

had comprised the business that was founded in 1987 by Henry Friesen and his father Harry Friesen. When the Friesens decided to sell their shares, McMunn & Yates acquired the stores in the summer of 2023.

The majority of McMunn & Yates stores are spread through the centre of the province, including the retailer’s home city of Dauphin, with additional locations close to the TransCanada Highway from Steinbach to Winnipeg to Brandon. The most northerly store is in Thompson, Man. There are also two stores in Saskatchewan and two in northwestern

Ontario. The southern expansion takes the company into fresh territory.

“This region is a busy and active area of Manitoba and is a nice fi t for our store model,” says Yates.

Even though the acquisitions took place almost a year ago, Yates explains the timing of the recent openings. “We have been working on renovations and merchandising changes the past several months. We co-ordinated the new store opening sale to be in conjunction with our annual anniversary sale held at our other stores.”

Installing digital price tags from JRTech Solutions was a no brainer! These labels have increased our efficiency in terms of price modifications resulting in increased profits. The price tags look slick and sharp, with the larger price tags providing us with a new way of pricing and displaying information on featured items, bringing our retail displays to a new level of professionalism.”

Lee Valley Tools has opened its Auto-Store, a “micro-ful lment centre” in Carp, a community in eastern Ontario that is part of the city of Ottawa.

e facility has allowed Lee Valley to consolidate 36,000 square feet of picking operations into 6,000 square feet, freeing up space to expand manufacturing.

e facility boasts 18,000 bin locations and 42 shuttles or bots on top of the structure to retrieve products for warehouse pickers. With the new system, the 200-plus operators in the DC can process over 250 orders in an hour. at’s more than double the previous output.

In a release, president and COO Jason Tasse said the DC is “more than a business decision: it’s a commitment to our roots here in Ottawa and prosperity for the Canadian economy.” In 2023, Lee Valley Tools celebrated its 45th year in business.

rough the implementation of technology, the company will work

to elevate e ciency and augment job satisfaction and protection for employees.

e investment in modernizing operations is expected to enhance business operations and production during peak shopping periods, reducing handling times, and increasing order e ciency.

e automatic picking system has been in the works since the early days of Covid.

At that time, the company recognized the critical importance of online sales and began a series of initiatives to strengthen that part of its business. Automating parts

Orgill Inc., the Memphis-based hardware wholesaler, has a range of customers in Canada. It supplies independent hardware and building supply dealers in every region of the country. The distributor has sales of close to US$4 billion, shipping more than 75,000 SKUs from seven distribution centres in the U.S. and one in Canada. But despite its size, this company is working hard to keep up its technology cutting edge.

Boyden Moore, Orgill’s president and CEO, spoke with Hardlines during the company’s

Spring Dealer Market, held in Orlando, Fla., earlier this year. He shared how Orgill is moving forward, with a strategy that has included a new tech lead, dealer-targeted online supports, and even robots.

“A few years ago we brought in a new CIO/ CTO role, Mark Hamer,” says Moore. “His charge from me was to modernize our technical infrastructure. He’s made some big gains for us.”

Now, even AI is being used. This includes 70 robots at Orgill’s DC in Tifton, Ga. The robots are doing demand picking and they

of the picking process will free up the company to re-direct employees to more essential, higher-paying functions.

“By investing in manufacturing and automation, we are strengthening our foundation and helping employees with tasks that involve undesirable work, like repetitive li ing and walking all day,” said Tasse. “ e more e cient we can make our operations, the more exibility we have to adapt to disruptions that may occur during seasonal hiring periods and can scale appropriately as needed.”

work overnight moving stock around based on the next day’s orders. “So the pick cycle is efficient when the workers come in the next day,” Moore says.

“We’re using artificial intelligence to see how the pick waves are coming and how they could be rearranged in the modules to be the most efficient when the people come in.”

Technology has been updated and refined for Orgill’s dealer customers, as well. Dealer services include an integrated e-commerce product that is hosted on a dealer’s own website. The platform gives customers access to anything the dealer sells, not just the products supplied from Orgill.

“When I buy through TIMBER MART, I have the confidence of knowing that I’m getting some of the highest rebate returns in the industry. TIMBER MART is not a public corporation, it’s a buying group where the returns are ours. That’s transparency I can trust.”

BY GEOFF M c LARNEY

Valspar Canada’s Accolade Interior Paint + Primer applies fl awlessly with an ultra-smooth finish and long-lasting colour. It is made with an advanced stain-blocking formula and gives a mildew-resistant finish to keep projects looking beautiful for longer. Exceptional durability provides resistance against scuffs and scrubs to ensure hard work lasts.

www.valspar.ca

Valspar’s Medallion Plus Exterior Paint + Primer provides all-season beauty and protection with a flexible finish that resists cracking and peeling. Its Rain Ready technology means projects can be ready in just two hours. The formula guards the freshly painted surface from runs, blisters, or water marks once rain showers begin.

www.valspar.ca

A favourite of both Pro and DIY customers, the Purdy XL applicator works in all types of environments, both interior and exterior. These medium-stiff brushes are designed for latex- and oil-based paints, primers, and stains. The polyester blend bristles are easy to clean and offer superior durability and abrasion resistance. Ideal for walls, ceilings and trim, the brushes come with handles in a variety of shapes and sizes for optimal comfort. www.purdy.com

An applicator designed specifically for Minwax Woodcare Coatings is now available in Canada! These specialty stain brushes ensure fl awless application, maximize coating performance, and conveniently fi t into Minwax quart cans for less cleanup. With consistent packaging designs between coatings and applicators, customers get a seamless shopping experience and easier selection. Stainless steel ferrules help to resist corrosion, while natural hardwood handles provide added comfort. www.minwax.ca

Bona SuperSport ClearSeal is a completely clear waterborne sealer that dries quickly and is easy to abrade. With a clear formulation and no added pigments, the product highlights the natural beauty of any maple hardwood sport fl oor. SuperSport ClearSeal provides an initial layer that prevents the finish from penetrating into the wood. It maintains the appearance of colorants applied prior to seal coat and provides a more consistent and uniform wear layer. www.bona.ca

Sherwin-Williams’ “Loneliest Color” (Kingdom Gold SW 6698) spotlights an overlooked shade. Kingdom Gold SW is described as “a luminous hue that under pressure, emerges refined and stunning.” Set apart by its green undertones and high saturation, Kingdom Gold suggests abundance, nourishment, and the culmination of hard work. www.sherwin-williams.com

Stanley’s Rustmax XT Anti-Rust Enamel is available in white or black (fl at or gloss), or seven other pre-mixed colours. It provides twice the coverage per can of lesser competing products, allowing up to 30 square feet of coverage. Its 15-minute fast dry minimizes downtime, allowing parts manipulation within minutes. The brush-on version dries in six hours. www.stanleytools.ca

Woodluxe is a premium all-weather exterior stain that helps protect and beautify siding, decks, porches, fences, and furniture. Its advanced formula minimizes film buildup, cracking, and peeling, while allowing for easier recoating. Woodluxe delivers one-coat coverage with minimal lap marks for a consistent finish. It’s suitable for a variety of vertical and horizontal surfaces, including decks, wood fences, and outdoor wood furniture. www.benjaminmoore.ca

Rust-Oleum’s HOME Transformations kits are more durable than standard paint and require no stripping, sanding, or priming. Each contains a 118ml Original Krud Kutter Cleaner Degreaser, an 887ml HOME Transformations Base Coat, and an 887ml Home Transformations Top Coat. Three options are available. The Cabinet Coating Kit is offered in 45 colour options and is suitable for laminate, melamine, and wood. The Countertop Coating Kit is available in 39 colour options and is suitable for ceramic tile, laminate, melamine, porcelain tile, and wood. The Floor Coating Kit comes in 34 colours options, in Matte and Semi-Gloss finishes, and works on a variety of substrate fl oors. www.rustoleum.ca

In 2024, the NHPA Independents Conference and The Hardware Conference will come together to form the Independent Home Improvement Conference (IHI).

Join hundreds of retailers and channel partners for this dynamic three-day learning and networking event at the JW Marriott Marco Island Beach Resort in Florida on August 27-29.

FrogTape Pro Grade painter’s tape combines the value of a traditional blue painter’s tape with PaintBlock technology. PaintBlock forms a micro-barrier sealing the edges of the tape to prevent paint bleed and deliver sharp paint line performance. Designed for use with latex paint, it allows for 14-day clean removal, masking cured painted walls and trim, glass, and metal. www.shurtape.com

Sico Perma-Flex Exterior Fabric spray paint provides maximum UV protection for fabrics such as vinyl, leather, rugs, etc. It offers coverage in eight colour options while preserving the soft feel of fabric. It also dries in 5 minutes, making it ideal for those looking for a quick solution. www.sico.ca

Sico Perma-Flex All Surface is an indoor and outdoor paint and primer that uses a lacquer-based technology to deliver an ultra-durable finish on surfaces ranging from as wood and metal to plastic and glass. In addition to the fi ve-minute dry time, All Surface will not run or drip thanks to a unique spray pattern that covers with fewer spray passes than a traditional conical spray paint. All Surface is available in 24 colour options. www.sico.ca

Using our free app, they can manage hot water usage, maximize comfort, and receive alerts.

Maximize comfort by pre-planning times for hot water usage.

Input time-of-day usage rates into the app to track energy costs.

Immediate alerts allow quick response to leaking water.

Elements detect water levels, providing Dry Fire Protection.

BY STEVE PAYNE

Home Depot Canada’s director of pro experience, ARMAN MIRZA , talks about his company’s first Flatbed Distribution Centre near Toronto

Home Depot Canada executives, pictured l-r: Serge Carestia, vice-president, supply chain; Harry Lafferty, general manager, Flatbed Distribution Centre; Luca Gagatek, director, supply chain distribution; Arman Mirza, director, pro experience; Mario Singh, supply chain manager.

Home Depot Canada’s new Flatbed Distribution Centre (FDC) in Mississauga, Ont. measures 600,000 square feet overall. Approximately half of the space is dedicated to the pro-focused FDC. The other half is a Bulk Distribution Centre (BDC) serving Home Depot stores in the Greater Toronto Area and surrounding areas.

Home Depot Canada has opened a new Flatbed Distribution Centre (FDC) to supply the bulk needs of contractors. It’s in Mississauga, Ont., near Toronto Pearson International Airport. It will ramp up the scale, quite significantly, of the company’s ability to serve contractors with larger needs than can adequately be served from the stores.

Hardlines took a tour of the facility recently, accompanied by Arman Mirza, director of pro experience for Home Depot Canada, as well as senior supply chain executives from the company.

The facility measures 600,000 square feet overall. Approximately half of the space is dedicated to the pro-focused FDC. The other half is a Bulk Distribution Centre (BDC) serving Home Depot stores in the Greater Toronto Area.

When the facility is fully operational this summer, some 54 Home Depot stores will be able to ship directly out of the FDC to contractor jobsites on flatbed trucks with Moffetts or boom trucks, with

products from stores at scale, which is the way the Home Depot previously did it, was difficult.

This is the first FDC in Canada. There are already 17 FDCs in the U.S., the first one

What the FDC does is, one, bring the scale to the table so pros can deal with us as a one-stop shop. But also, two, we offer the breadth because we also offer [pro products] through our stores.

the pros maintaining their own relationships with the stores. Contractors who need bulk supplies—especially the heavy, large, unwieldy products that go into construction projects—will benefit from the FDC, the company says. Shipping such

”

opening in 2020 in Dallas, Texas. The company says there will be lots more—including in Canada. Home Depot is clearly going after the contractor market big time, on a scale that it could never imagine when it was founded in 1978.

can now claim an industry leading 24 - Month shelf life.

Pros now make up almost 50 percent of the retailer’s sales, the company says, in the U.S. The Canadian division lags slightly behind that percentage, but we are quickly catching up in this country, says Mirza.

Mirza has worked for Home Depot for 13 years, 11 of which were in the supply chain. He’s been director of pro experience for two years. Prior to that, Mirza was at Loblaw Cos. in their supply chain. And before that, he was with a consultant serving retail clients—again with a supply chain focus. So nobody knows better than Mirza that contractors have unique supply needs. The sector wasn’t being fully served by shipping bulk products out of Home Depot Canada’s 182 stores.

The disadvantages of using that model were obvious. Entire aisles of stores would have to be closed while the forklifts went to work on big orders of drywall or lumber, disrupting the store, and inconveniencing other customers. The stores were adequately set up for smaller contractors. But not for the big game contractors that Home Depot has set its sights on.

Toronto’s FDC was up and running last fall—and it is just completing its ramp up. This summer, it will be fully operational. It started, Mirza says, by offering next-day delivery for orders placed by 1 p.m., and that has now been moved to a 4 p.m. cut off. This summer, that is expected to move to even later—with an 8 p.m. deadline for orders.

The rollout of the FDC parallels other pro initiatives. For example, by 2025, Home Depot Canada aims to offer payment on receipt for large pro orders, as opposed to

payment at time of purchase. And the retailer is looking at ways to offer fixed pricing on commodities to contractors and builders that are pricing jobs out months in advance.

Every time you check the news, politicians are promising to invest billions in new housing in this country. There’s no doubt

“It’s our approach to go after the opportunity,” he replied. “To provide a quick and consistent and enjoyable experience for our pro customers. Everything we do in our strategy is customer-backed. We talk to our pros about what they are looking for, and how we can make it easier for them to do their jobs, including building more housing.”

“The experience we want to provide is

Everything we do in our strategy is customer-backed. We talk to our pros about what they are looking for, and how we can make it easier for them to do their jobs. “ ”

that Canada faces the worst housing shortage since after World War 2. The industry is likely at the start of its biggest boom since that era, too. We asked Mirza about what the strategy is for Home Depot.

fast delivery, consistent service, and the depth of inventory they need to do those bigger jobs.”

Nothing in the business landscape today wasn’t transformed by the pandemic. That

includes e-commerce, a big part of Home Depot’s roll out of the FDC.

“During Covid we scaled up our e-commerce option and introduced a curbside pick-up option. It was safer for our customers and associates. Those options continue to be offered today because, again, we want to be customer-led. Overall, for the pro, we have the brands they want at the value they expect, and the service they need. Our job is to make their job easier and that’s what guides us every day.”

The ability of the pro to order online on their devices is part of the strategy, of course. And Home Depot’s payment terms could possibly change, too. “A lot of the pros who are doing larger jobs, they have the expectation that they should pay when

they get the product,” Mirza said. “So that’s scheduled for 2025: pay upon receipt. It’s something we are working towards and will require an upgrade of our systems.”

What about pros recent experiences with rampant inflation, when in 2021, contractors took many a bath on fixed price contracts that they had signed before Covid? Industry stats at the time showed that a thousand board feet of framing lumber cost an average of $550 before Covid hit. That rose within a year to $1,500.

Will Home Depot allow contractors to lock in futures prices of lumber? “This is our theme of listening to our customers,” Mirza replies. “It requires some system changes and partnering with partners in the financing space. And making sure we can support that pricing over the longer term. We’ll need to think through those to do items and plan out that capability. So, when we

do launch it, it’s what the customers want and they have a great experience.”

There’s no question that serving the serious home builder (or commercial builder) from the same facilities that serve the general public is problematic.

sales force for larger accounts that can use the FDC, they can use the stores, and they can partner with some of our vendors to go direct in some cases.”

“Home Depot also has a brand called HD Supply, which is a company that offers maintenance, repair, and operations (MRO) services for their clients. Like in the hospi-

One of the differentiators of our offering is: pros know us as a great place to shop for what they need, especially when they need something quickly and urgently. “ ”

“The uniqueness of those types of customers is scale,” Mirza said. “And part of the FDC is about scaling up for those larger projects. And we also have a dedicated

tality space, or the institutional space.” The Home Depot’s plan for the pro customer includes the MRO sector—again, enhanced by the FDC.

Finally, the Home Depot isn’t getting into the pro game for the first time. It already knows a significant amount about its contractor customers—and they know about Home Depot, too.

Mirza sums it up this way: “One of the differentiators of our offering is: pros know us as a great place to shop for what they need, especially when they need something quickly and urgently. How we’re adding to that perception is dealing with them on their larger projects.”

“In their current state they may be dealing with multiple suppliers. They may have to go to their drywall supplier for drywall, to their lumber supplier for lumber—so they’re dealing with multiple partners, negotiating different prices, getting a different delivery experience, getting multiple deliveries. There’s friction in the process of dealing with multiple partners.”

“What the FDC does is, one, bring the scale to the table so they can deal with us as a one-stop shop; but also, two, [we can] offer the breadth because we also offer [pro products] through our stores.”

“So it’s, one, scale, and two, one-stop shopping.”

Leviton Decora Weather-Resistant Switches, with their sleek appearance and smooth operation, provide a stylish and convenient way to control outdoor lighting, motor loads, and more directly from the home or building’s exterior. This all-in-one solution eliminates the need for the addition of an outdoor protective cover.

The new Decora Weather-Resistant Switch is the latest addition to the Leviton line of protective outdoor solutions which includes weather-resistant receptacles, GFCIs and USB Charger Devices.

The Decora Weather-Resistant devices feature UV stabilized thermoplastic construction and extra corrosion protection to withstand the rigors of exposure to the elements.

BY MICHAEL M c LARNEY

The head of Home Depot’s Canadian operations talks frankly about the opportunities for growing the company’s pro business with new services and facilities

Canadians are turning more and more to contractors to get their home repairs and renovations done, says Michael Rowe, president of Home Depot Canada. And his company is evolving to meet that demand. In conversation with Hardlines, he shares his enthusiasm for the latest, and likely the biggest, step the retailer has made in recent years to cater to pros more effectively.

That initiative is a new Flatbed Distribution Centre (FDC), which opened late last year in Mississauga, Ont., west of Toronto. The 300,000-square-foot FDC is designed to get large loads of products directly to contractor jobsites. It receives and fulfils pro orders sent in by area stores, taking the pressure off those stores to manage the large orders themselves. Those orders, typically too big for one store to ship, are instead shipped directly to the contractor from the FDC.

Home Depot Canada is currently getting the FDC up and running at full capacity to fill an important part of the retailer’s supply chain. This summer, the facility is expected to ship orders on behalf of 54 Home Depot stores in and around the Greater Toronto Area. The 300,000-square-foot FDC shares space with an equally large Bulk Distribution Centre (BDC), which ships commodities to the stores themselves.

The rollout of the FDC parallels other pro initiatives. For example, by 2025, Home Depot Canada aims to offer payment on receipt for large pro orders, as opposed to payment at time of purchase. And the

Michael Rowe, president of

says the ratio of pro customer sales in his division is close to the 50 percent of revenues south of the border.

There are lots of spaces we’re evaluating right now and working with our real estate teams to identify appropriate population growth and centres. “ ”

retailer is looking at ways to offer fixed pricing on commodities to contractors and builders that are pricing jobs for clients months in advance. The company also renamed its contractor loyalty program to Pro Xtra to align with the U.S. program of the same name. “Renaming this was quite an accelerator for us,” Rowe says.

Canada’s largest home improvement retailer remains committed to its consumer business and expects to build more stores to serve those channels. Meanwhile, Home Depot recognizes the importance of the pro customer and sees huge growth potential in that sector. In fact, in the U.S., 10 percent of its customers are pros and builders, but they account for almost 50 percent of Home Depot’s sales.

According to Rowe, the Canadian division lags when it comes to attracting pros, but that’s changing and the new FDC is key to making that happen. “The ratio of pros here in Canada is very, very close now. We’re not far behind.”

The new Flatbed Distribution Centre, which has a fleet of large flatbed trucks delivering products by next day if orders are place as late as 4 p.m. (a deadline the company is working to push to 8 p.m.) will go a long way to putting Home Depot on the radar of Canadian contractors. And as the country expands its new housing programs, the potential is huge. But Rowe is still not satisfied. “There’s more to do, clearly.”

That includes the likelihood of even more FDCs in Canada. There are already 17 in the U.S., with more planned. “We’ll add more BDCs and FDCs in smaller markets.” Rowe wouldn’t confirm other locations or timelines. “We’re largely figuring out ourselves how many FDCs.” The obvious suspects are expected to be on the list: Vancouver, Edmonton, possibly Calgary, and Montreal. One thing Home Depot Canada has not done in recent years is open a new store. The last one was in 2015 in Vaughan, Ont., north of Toronto. That brought the Canadian division’s store count up to 182. Since then? Nothing in nine years.

Arman Mirza, director of pro experience with Home Depot Canada, stands on a loading ramp at the FDC with (background) Mario Singh and Harry Lafferty, supply chain experts.

The company in Atlanta said last year that it expected to build 80 new stores in five years—but it did not specify how many of them would be in Canada. “We’re constantly looking,” said Rowe. “There are lots of spaces we’re evaluating right now and working with our real estate teams to identify appropriate population growth and centres.

BY THE EDITORS OF HARDLINES

After industry retail sales increased by about a third during the pandemic, last year the long-awaited flattening out arrived. Hardlines calculates that home improvement retail sales dropped by 3.5 percent in 2023. Interest rates are part of it, but so are the related effects of inflation. In the next 15 pages we analyze Canada’s Top 20 banner groups.

The drop off in sales continued in 2023 after pandemic-created, record-smashing increases for most home improvement retailers in 2020 and 2021—leading to a year of transition in 2022, in which the industry grew by less than the rate of inflation. Inflation settled down to an average of 3.9 percent in Canada last year, but our industry’s retail sales dropped by 3.5 percent. That means, for 2023, the industry was off a whopping 7.4 percent in constant dollar terms.

TheBiggerTheyComeTheHarderThey Fall was a smash hit for Jimmy Cliff in 1972. The Jamaican reggae singer’s song could provide the soundtrack for

a Hardlines presentation about 2023’s numbers. After all, the biggest home improvement retailer in the world, Home Depot, reported a drop of 3.0 percent in revenues worldwide last year—and comp store sales declined 3.2 percent. The number two on our list, Home Hardware Stores, doesn’t release its sales figures to the public, but we believe it likely felt the pinch, too. RONA inc., our number three, experienced a drop in a year in which it closed some big boxes. And publicly-traded Canadian Tire’s consolidated retail sales dropped 3.9 percent last year. All told, the top four home improvement retailers didn’t have banner years.

HQ: Toronto, Ont.

2023 RETAIL SALES: $11.565 billion STORES: 182

Like other retailers in 2023, Home Depot experienced a drop in sales a er three years of unprecedented growth in home improvement, driven by the pandemic. Whereas some retailers called the year sobering or slow, Ted Decker, chair, president, and CEO of the world’s biggest home improvement retailer called it “a year of moderation.”

Such was the o cial statement from the top of a company with US$339 billion in market capitalization (at the time of writing). Moderation meant a year in which Home Depot did US$152.7 billion in revenues, a decrease of 3.0 percent from scal 2022. Gross pro t was US$51.0 billion, or 33.4 percent. Net earnings were reported at

US$15.1 billion, or 9.9 percent, a full percentage point down from the 10.9 percent the company earned in 2022. Still the company managed its drop in traffic well, keeping inventory turns more or less constant at 4.3 last year compared to 4.2 in 2022. And Home Depot’s common shares rose 9.7 percent during 2023, ending at US$346.55— still far from the record of US$415.01 on the last day of 2021.

But with a drop in sales of 3.0 percent, combined with an average inflation of 4.1 percent in the U.S., and 3.9 percent in Canada, 2023 was an unexceptional year for Home Depot. Comp store sales were down 3.2 percent. But Decker also called 2023 a “year of opportunity.” What opportunity?

To gain market share, in part, with a return to store openings. Eight new stores were opened in the U.S. last year, and five new stores were opened in Mexico.

Since 2008, the Home Depot has looked at increasing store productivity—and lately e-commerce—which represented 14.8 percent of the company’s sales last year, as a driver of growth rather than new stores.

In this country, there have been 182 Home Depot stores for nine years now, with the last opening of an orange big box on April 30, 2015, in Vaughan, Ont., just north of Toronto. It remains to be seen whether Canada will be included in the 80 new stores Atlanta predicted last year that it would open before the end of 2027. Home Depot already has 2,335 stores in North America, including the U.S., Canada, Mexico, Puerto Rico and the U.S. Virgin Islands.

The Canadian division did participate in a major construction project—of a DC, not a store—last year. Home Depot says its flatbed distribution centre (FDC) in Mississauga, Ont., northwest of Toronto, will serve 54 of its stores in the Greater Toronto Area. It will ship direct to largescale builders with heavy products at scale. The 600,000-square-foot facility is divided into an FDC and a “stock and flow” facility to serve the stores.

Overall, Canada’s FDC aligns with

strategy south of the border, which is set to take on the pro market much more seriously. Michael Rowe (see interview on page 42 of this issue), president of Home Depot Canada, told Hardlines that the FDC will have a major impact on how it serves pros in the Greater Toronto Area, the seventh largest big box centre in North America.

HQ: St. Jacobs, Ont.

2023 RETAIL SALES: $9.093 billion

STORES: 1,036

While Home Hardware no longer shares its exact sales figures with Hardlines, we continue to keep them near the top of our list of top retail groups in the country. It has some 1,036 points of sale across Canada, operating under the following banners: Home Hardware (hardware), Home Hardware Building Centre (home centre), Home Building Centre (lumberyard), and Home Furniture (home goods, appliances, and décor).

About seven years ago, the company began to reposition itself as a retail company, moving away from its focus on providing wholesale services to its dealers, who are also Home Hardware’s shareholders. Current president and CEO Kevin Macnab inherited this mandate, and spent five years implementing and guiding the company through new territory. Despite the repositioning, the company remains focused on supporting those dealers in the markets they serve.

Home Hardware is celebrating its 60th birthday this year. The company got its start in the small town of St. Jacobs, nestled in the heart of southern Ontario’s Mennonite country, back in 1964. That’s when Walter Hachborn, Henry Sittler, and silent partner Arthur Zilliax laid the groundwork for what would become Canada’s largest dealer-owned home improvement retailer. Throughout that time, the company has had only four CEOs, starting with Hachborn himself.

INTRODUCING ALIGN® 12" BOARD & BATTEN COMPOSITE CLADDING FROM GENTEK® Building on the success of our original ALIGN Composite Cladding, this latest advancement offers the same exceptional beauty, durability and ease of installation in a sleek board and batten design. Elevate your projects with the best exterior cladding yet.

INTRODUCING ALIGN® 12" BOARD & BATTEN COMPOSITE CLADDING FROM GENTEK®. Building on the success of our original ALIGN Composite Cladding, this latest advancement offers the same exceptional beauty, durability and ease of installation in a sleek board and batten design. Elevate your projects with the best exterior cladding yet.

EASIER INSTALLATION

12" profile width with 3/4" projection and integral batten strip; available in two textures.

1001 Corporate Drive Burlington, ON L7L 5V5 gentek.ca Make us a part of your home.

EASIER INSTALLATION

TRADE-FRIENDLY

12" profile width with 3/4" projection and integral batten strip; available in two textures.

Strong, lightweight construction is easier and quicker to install than fibre cement; no skilled labour, special tools or respirators needed.

TRADE-FRIENDLY

(GP)2 TECHNOLOGY®

Ensures lower expansion and greater structural integrity.

Strong, lightweight construction is easier and quicker to install than fibre cement; no skilled labour, special tools or respirators needed.

(GP)2 TECHNOLOGY®

FASTER TURNAROUND TIME, LESS LABOUR

Ensures lower expansion and greater structural integrity.

No sealing, touching up, joint flashing or caulking.

FASTER TURNAROUND TIME, LESS LABOUR

No sealing, touching up, joint flashing or caulking.

Discover the value of ALIGN at gentek.ca/align

Macnab announced in May that he will soon retire, agreeing to stay on to help his replacement during the transition.

The company’s anniversary being the backdrop for reconsidering and redefining Home Hardware’s guiding principles. Home Hardware’s purpose is to improve life at home. “Our vision is for home to be Canada’s most trusted and preferred home improvement experience. So we’re very focused on experience,” said Macnab.

One trend that Home Hardware is taking advantage of is the tiny homes market. Through its Beaver Homes and Cottages and the Backyard Package Projects program, Home is developing smaller, affordable secondary living spaces—some as small as 200 square feet.

Home Hardware has encouraged its dealers through the years to expand their assortments and become full-line home centres, but it still sees the value of traditional hardware stores, including in urban markets, where real estate is expensive. But the company recognizes the importance of having stores in those markets, where accessibility becomes a plus for Home’s growing online presence.

Home has invested heavily in updating its online fulfilment capabilities and now provides quick turnaround on e-commerce orders either to area stores for pick-up or

directly to customers’ homes. Shipments are made through its three distribution centres, in St. Jacobs, Ont., Debert, N.S., and Wetaskiwin, Alta. It also has a manufacturing and distribution facility in Elmira, Ont., near the St. Jacobs head office. There, the company produces its own line of paint, as well as other chemical products.

The contractor customer is important to Home Hardware dealers and the company has introduced many services and programs to better serve the pro. The latest initiative is a contractor credit card. Developed in partnership with Scotiabank, the Scotia Home Hardware Pro Visa Business Card has been designed to support the trades and construction customers. The new card ties in with Home Hardware’s existing Scene+ loyalty program, which was introduced in September 2023 after Home Hardware parted ways with Aeroplan.

HQ: Boucherville, Que.

2023 RETAIL SALES: $8.454 billion STORES: 425

RONA was a Canadian-owned business operating stores under the RONA, Réno-Dépôt, and Dick’s Lumber banners until 2016, when it was acquired for US$2.3 billion by Lowe’s Cos., based out of Mooresville, N.C. Lowe’s had opened

its first stores in Canada in 2007 and continued to operate those big boxes alongside the various RONA banners. It also began gradually converting larger-surface RONA stores to the Lowe’s banner—except in Quebec, where the RONA and Réno-Dépôt names were sacrosanct.

Lowe’s shareholders, concentrated in the U.S., always struggled to wrap their heads around this multi-banner strategy. The company was also unaccustomed to the wholesaling role it played to the many independent affiliate dealers under the RONA banner. During the Covid lockdowns, housing permit pressure placed particular stress on Lowe’s operations in Canada, always more dependent on LBM than its U.S. business.

Consequently, Lowe’s sold the Canadian business in February 2023 to Sycamore Partners, a based private equity firm based in New York City. The transaction included all of Lowe’s Canada’s retail brands: RONA, Lowe’s, Réno-Dépôt, and Dick’s Lumber.

As a result, RONA is once again a private company—albeit still an American one—for the first time since it went public in 2002. It has maintained its head office in Boucherville, Que., on the South Shore of Montreal, and continues to operate and service a network of some 425 corporate and affiliated dealer stores across Canada.

Engineered wood siding and trim in brushed smooth finish creates a simple, clean look.

Provides a modern look with durable siding and trim

Works with many architectural styles including Modern Farmhouse, updated Ranch and Cape Cod

Can be used to create eye-catching details

Now available in 16 versatile prefinished colors, the ExpertFinish® color collection is guaranteed to look great and remain durable for years to come due to a factory finish with acrylic latex paint. ExpertFinish Lap also features a proprietary joint that helps you avoid the need for seam caulking, joint molds, or pan flashing.

NOTE:Theplacementofthegroupsinthischartdoesnotintendto ranktheminanyway,butmerelytoshowhowtheyarerelated.

DURABLE AND LOW-MAINTENANCE VINYL AND ALUMINUM CONSTRUCTION

ALUMINUM-CLAD EXTERIOR, OFFERED IN AN ATTRACTIVE SELECTION OF COLOURS

SLEEK, LOW-PROFILE HARDWARE DESIGN

ENERGY-EFFICIENT DUAL-PANE AND TRI-PANE LOW-E GLASS OPTIONS

26% LOWER PROFILE FRAME INCREASES GLASS AREA

UP TO 22% BETTER ENERGY EFFICIENCY

With the unique changes of our Canadian climate, the demand for energy-efficient products that can stand up to the elements is higher than ever. JELD-WEN® of Canada proudly introduces the groundbreaking JWC8500 series window—a perfect blend of style, performance, and energy savings, meticulously engineered to exceed expectations. Our newest JWC8500 hybrid option exceeds performance, in all regions of Canada, offering an aluminum-clad exterior finish with an exquisite selection of colours to choose from.

Discover the advantages of JELD-WEN of Canada’s most energy-efficient window. Our 8500 series windows are 2030-rated to meet Canada’s U-Factor 0.14 (U.S./I-P) / 0.82 (Metric/SI) or ER 44 building codes, and are designed to significantly reduce energy costs while ensuring year-round comfort in your home.

Tailored to meet the regional needs of homeowners, our windows are the perfect fit when planning a renovation or new home build, seamlessly blending functionality and style to suit any project.

Discover the JWC8500 series window from JELD-WEN of Canada —and experience the future of home comfort and efficiency.

The new owners also set about phasing out the Lowe’s banner in Canada beginning in the summer of 2023. A few such stores simply closed, but most were converted to a newly created RONA+ banner, which is also being used to replace Réno-Dépôt locations in Quebec. RONA+ is also taking the place of some RONA Home and Garden locations, as well as certain RONA L’entrepôt stores.

Last October, the business grew through an acquisition by its Dick’s Lumber segment. ZyTech Building System, based on Balzac, Alta., makes and distributes building components and engineered wood products. The purchase is meant to allow Dick’s to capitalize on the developer and builder market in the western provinces.

Major executive shakeups took place at RONA in 2024. Just before press time, president and CEO Andrew Iacobucci departed. His replacement was an internal candidate, J.P. (Jean-Philippe) Towner, formerly the CFO.

RONA inc. has reduced its staff, too. The company announced two waves of layoffs, the first related to the closing of two of its DCs. That created 300 layoffs. A major reorganization followed in June 2023, which included the elimination of 500 more positions.

In the spring, the company welcomed six new affiliates in Quebec, British Columbia, and Alberta. RONA also completed the sale of its distribution centre in Terrebonne, a suburb of Montreal, to BMTC Group, a Montreal-based holding company, with a lease-back deal. The cessation of regular operations at the facility had been announced back in January.

HQ: Toronto, Ont.

2023 RETAIL SALES: $7.723 billion*

STORES: 502

* hardware and home improvement only Canadian Tire Corp. is a unique Canadian retail phenomenon. It has 502 stores under the Canadian Tire banner (which Hardlines measures for the Top 20

rankings) and all are owned by Canadian Tire associate dealers. They range in size from 3,200 to about 100,000 square feet, with the largest one in Ottawa measuring 136,000 square feet in size.

Canadian Tire offers more than 186,000 products in 205 product categories across five divisions: Automotive, Fixing, Living, Playing, and Seasonal & Gardening. Most of the Canadian Tire stores also provide automotive services.

Like other publicly-held retail home improvement companies, Canadian Tire saw its revenue and profits get squeezed through 2023. Hit by lower customer demand and higher-than-expected inventories, revenue and sales were down. The company was further affected by a fire at one of its distribution centres in the Greater Toronto Area. Operating efficiencies that resulted from the fire were estimated to cost Canadian Tire $32 million.

“Our performance last year fell short of our expectations as our team continues to navigate a challenging macroeconomic environment,” said Greg Hicks, president and CEO of Canadian Tire Corp.

For the full year, Canadian Tire’s consolidated retail sales were $18.50 billion, down 3.9 percent. Consolidated retail sales, excluding petroleum, decreased 3.1 percent and consolidated comp sales were down 2.9 percent. Consolidated revenue for the company declined 6.5 percent to $16.66 billion. Revenue, excluding petroleum, decreased by 6.1 percent compared to the same period last year, with the decline in the retail segment partially offset by financial services growth.

“In the near-term, we are taking a measured and cautious approach to our operating plans. While the pace of our investments has slowed, we remain committed to our strategy as we balance tough short-term decisions with our long-term objectives,” added Hicks.

The company has made huge inroads with its online sales strategy. That strategy has been supported by the company’s Triangle Rewards program, which applies to all Canadian Tire-owned banners, including Sport Chek and Mark’s. The development of the membership in Triangle Rewards has increased basket size and shopping

Kohltech’s outstanding service, warranty coverage, pricing and environmental sustainability has established our brand as a proud Canadian industry leader. We deliver innovative, high-performance windows and entrance systems that make your customer’s house feel like home.

kohltech .com

frequency among members compared to non-member customers.

The company made some staff cuts during the last quarter of 2023. The initiative resulted in targeted headcount reductions to reduce staffing levels by three percent, or about 200 people. In addition, the elimination of open job vacancies was expected to take company’s headcount down by another three percent compared to 2022.

And some changes occurred with existing staff. Michael Magennis, a 30-year veteran merchant at Canadian Tire, and most recently SVP general merchandising, got a new role earlier this year. He is now SVP, petroleum and special initiatives. Micheline Davies is now Canadian Tire’s chief merchant. She was formerly SVP, automotive. Canadian Tire continues to invest in, and expand, its range of private-label products. Proprietary brands now account for a significant percentage of the stores’ sales. Through two product development labs, in Calgary and Toronto, the retail chain is trying to bring 12,000 newly-developed SKUs to market by the end of 2025.

HQ: Ajax, Ont.

2023 RETAIL SALES: $4.442 billion

STORES: 500

Celebrating its 60th anniversary this year, the Independent Lumber Dealers Co-operative (ILDC), is a buying group that features some of the most powerful regional chains in the LBM business. Take for example its sole Atlantic Canada member, Kent, which is typical of the influence ILDC wields. It has 48 stores including a lot of big boxes. Kent absolutely dominates

both the retail home improvement and GSD businesses in its provinces (see separate report on Kent). In Ontario, Turkstra Lumber weighs in at some 11 locations. Then there is Bonhomme in Quebec and Bytown Lumber in the Ottawa/Gatineau area. Combined, the Bonhomme/Bytown group represents some 10 outlets, and they are major players, too. BMR Group buys through the ILDC, bringing their 275 stores into the buying power of the ILDC. Copp Building Materials in the London, Ont. market is legendary for its local clout. In Western Canada, Federated Co-operatives buys through the ILDC, bringing 104 home and garden and farm stores into the mix. ILDC member McMunn & Yates is up to 22 stores in southern Manitoba, with its three stores acquired from Canadian Lumber having their grand reopenings in May 2023. All told, ILDC represents the fifth largest buying power in this industry when it sits down to negotiate with vendors. It is a member of the hardlines buying group Spancan.

HQ: Calgary, Alta.

2023 RETAIL SALES: $4.262 billion STORES: 603

The biggest news from the past year for TIMBER MART, the national building supplies buying group, was the opening of a new three-acre LBM distribution facility in Winnipeg in October 2023. It sits within a six-hour radius of the group’s dealers in Saskatchewan, Manitoba, and northwestern Ontario. It joins existing DCs in Langley, B.C.; Mount Forest, Ont.; and St-Nicolas, Que. Quebec growth is important to TIMBER MART. It announced the signing of a major independent dealer in Montreal,