THE ECONOMICS DIGEST

Hello, and welcome to the third edition of The Hampton Economics Digest!

In this edition we will take a look at a wide range of topics, from an insight into Britain’s Economic Divide, to The Cost of Time Poverty, along with an in-depth look into the very topical issue of trade tensions, from the US and China to Myanmar.

Despite it being the end of the school year, our writers have been working tirelessly to produce some incredibly high-quality articles. For this, I must thank the entire writing team, Mrs Mullan, and the Media team at Hampton for publishing our work. With that done, all that’s left to say is enjoy!

Charlie Childs

Founder and Editor

Writers: Charlie Childs, Alex Nelson, Alex Rust, Nathaniel Carson, Zaid Ahmed, and Rohan Ladva

As climate risks mount, insurers and lenders are pulling out of high-risk areas leaving homeowners and economies exposed.

With Europe heating up two times fasterthantheglobalaverage,natural disasters,suchaswildfires,flooding, and extreme weather, have become much more frequent and intense. Due to the increasing uncertainty surrounding these events, insurance companies are beginning to find it much more difficult to calculate risk profiles,andevenwhentheycan,the premiums can become astronomically high. This makes it unfeasible to insure certain assets duetothehigherriskofclaiming.

In the past, insurance models have been calculated using vast amounts ofhistoricaldatatopredicttheriskof something happening which would cause a claim to be made. However, with the new unpredictability of natural disasters, lots of this historical data used in the models is renderednullandvoid.Thiscausesa problem,aswithnewclimatechange databeingobtained,newriskprofiles will emerge. This results in higher premiums and even in some cases the withdrawal of insurance cover

altogether.Forexample,duringtheLA wildfires lots of expensive property was burnt, leading to incredibly large insurance payouts. These aren’t sustainableforinsurancecompanies in the long term. State Farm, an insurance company, halted its operations in California due to these wildfires.

Thishasasignificanteffect,asbanks willonlyprovidemortgageswherethe housecanbeinsured,astheproperty actsascollateralintheinstancethat someonedoesnotrepaytheloan.As aresult,wewillseealargeincreasein regional inequality, as it will often become the case that low-income households will be situated in the higher risk areas where house prices willhavedroppedsignificantlydueto thedifficultyingettinginsuranceand therefore mortgages on these properties.Insaferareas,thehousing market will become near unaffordable as these properties become more desirable, and it will take a long time to build a significant

numberofnewhomesintheseareas toincreasesupply.

This is a clear example of market failure, where the free market is not providing ‘merit’ goods such as insurance and mortgages. To correct thisfailureandeliminatethenegative externality caused by it, the government may need to intervene. Some options include subsidising insurance firms to reduce the premiums that people will have to pay,orlettingtheCentralBankplaya largerroleinitsfunctionas‘lenderof last resort’. This will incentivise insurance companies to continue to provide their services, as they will be abletodosoatacheaperratemaking itmorefeasibleforpeople.Itwillhave theaddedbenefitof thecentralbank bailing out insurance firms if a particularly bad disaster occurs. However, there are plenty of downsidestothisintervention,oneof which is the negative effect on our fiscal burden, putting us further in a deficit. In addition, the Central Bank is exposed to instability because if a large-scalenaturaldisasteroccurs,it may have to bail out multiple insurance companies which could cost a significant amount for taxpayers. On a larger scale, this government intervention will likely lead to inflationary pressure, enhancingthecost-of-livingcrisis.

Theotheroptionisn’tanybetter.Ifthe governmentdoesn’tintervene,house prices in at-risk areas will fall massively as buyers will not want to or be able to buy an uninsurable property. As a result, we will see the negative wealth effect occur, which willreduceconfidenceandspending. This severely harms economic growth. What’s more, insurance companies and mortgage providers will see much lower profits and will therefore invest less to save money, furtherharmingtheeconomy.

Thankfully, there are some solutions to this dilemma. First of all, with the advancement of technology, it isn’t far-fetched to say that soon we will have drones to detect and suppress wildfires much faster and more efficiently than emergency services canonsuchalargescale.Thiswould decrease the risk of fires reaching properties, so insurance companies would be able to continue insuring them. Furthermore, the use of AI will helptofindthe most effectivewayof predictingandputtingoutfires,aided byadvancedsatellitedatatomonitor changes.Other,morebroadsolutions include using government policy to influence, for example, the standard of natural disaster resistance in construction to mitigate the damage done by floods and other climaterelated disasters. Moreover, governmentscanworkinpartnership

with the insurance industry to help keep premiums affordable for those areas worst affected by climate change. Indeed, the UK government has already implemented a scheme called ‘Flood Re’ which aims to reduce insurance premiums based on council tax bands for houses in risky areas, with the promise to reimburse insurance companies if excessive damage is caused by flooding.

Climate change is undoubtedly causing disruption across the world, including in developed countries like those in Europe, with housing markets and insurance companies starting to be negatively affected. However, the difficulties in providing insurance and mortgages can be solved with a strong effort to introduce technology and innovation into the industry, paired with government policy to provide more concrete support for those people andfirmsmostatrisk.

Charlie Childs

The decline of work, coupled with the rise in sickness benefits, deepens the economic divide in Britain.

Formostofhistory,thelabourmarket has been divided into the employed and the unemployed. These figures remain one of the most heavily discussed econometrics in the country. But this neglects a growing third category: those unable to participateintheworkforce.

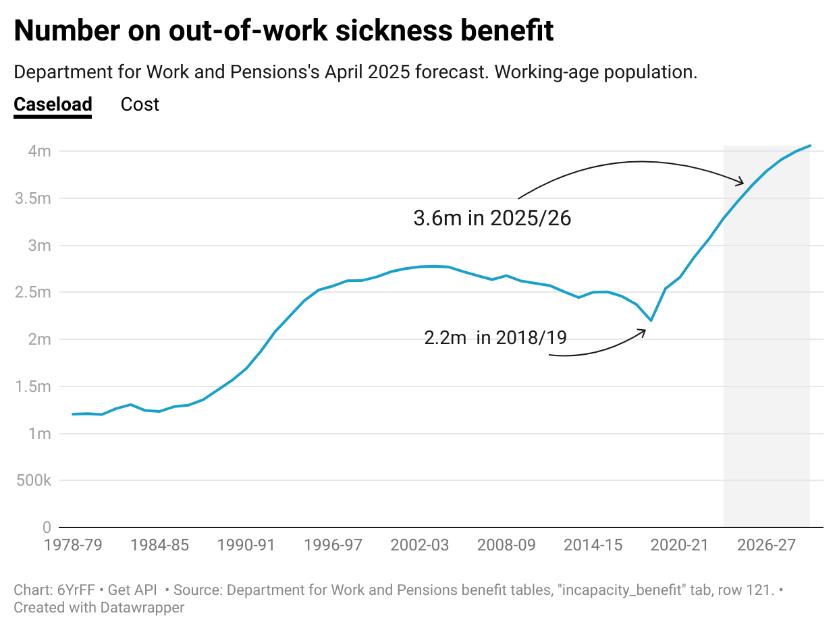

In every society, there are some people unfit for work who deserve to belookedafterwithcompassion.But in Britain, the number of people on sickness benefits has risen from 2.2 million to 3.6 million over the last sevenyears.Mentalhealthisnowthe biggest reason behind Personal Independence Payment (PIP) benefits, intended to offset the cost of a disability. PIP approvals for mental health-related issues have risen from around 4,000 a month to above 11,000 a month over the last fiveyears.

Medical records do not show illness rising at a comparable rate. The Department for Work and Pensions (DWP)isthegovernmentdepartment that manages welfare. Above is a graph adapted from their data and projections of sickness benefits claimants.

The surge was most likely caused by changesinthewaysicknessbenefits were assessed. Since the pandemic, the proportion of sickness benefit assessments carried out over the phoneincreasedfromzerotoaround two-thirds. The approval rate for Universal Credit (UC) sickness benefitsdoubledfrom40%in2010to 80% in 2022. At its peak in 2020 Q3, 98% of people who applied for the benefit were accepted. The staggering toll of losing 1.4 million workers to sickness benefits never made it into public discussion because it did not appear in unemploymentfigures.

Out-of-work benefit is the broader term including unemployment and other out-of-work benefits (sickness benefit is a subsection of this). The

total number of people claiming any sortofout-of-workbenefitshasrisen to 6.3 million today. This is comparable to the population of Denmark, Norway or Slovakia. It also makes Britain the only G7 country (and one of the only European countries) to have fewer people in work, orlookingforit,than itdidpreCovid.

Unemploymenthasremainedat4.6± 1% for the last decade. Under the radarofunemployment,theworkingage population receiving out-of-work benefits has risen to 15%. Sickness benefits rocketed and hotspots emerged in which at least a third, if not more, were claiming sickness benefits. The most notable neighbourhoods in Britain include Central Blackpool and Grimsby East Marsh & Port, with 51% and 54% respectivelyonout-of-workbenefits.

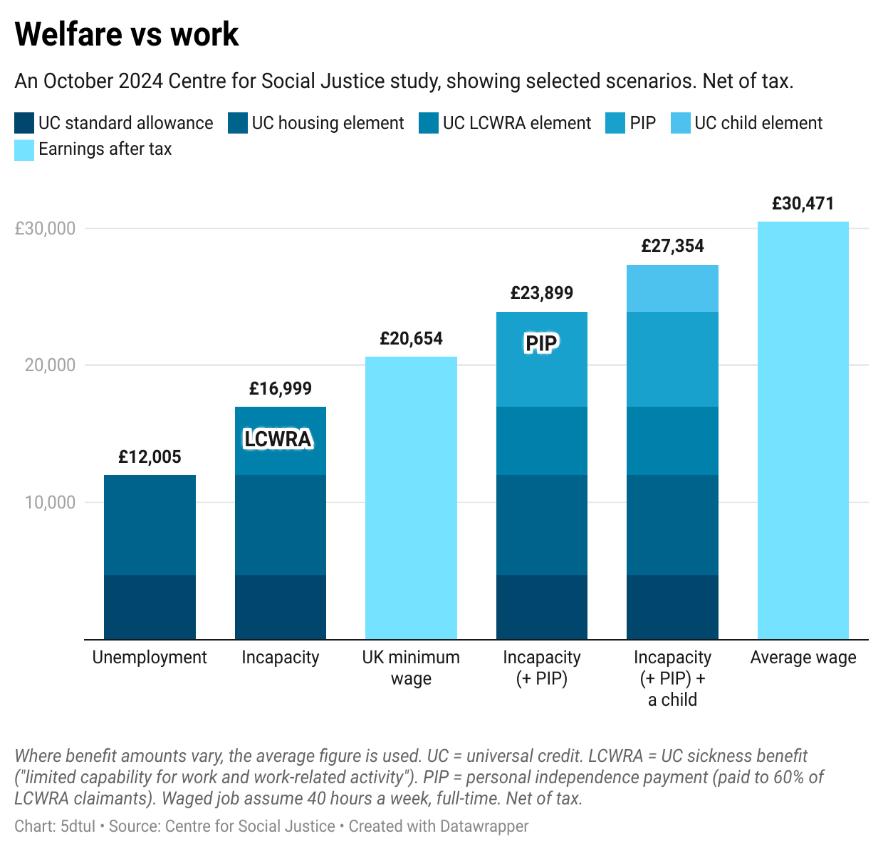

Birmingham and Blackpool both surpass 25% of the working-age population receiving out-of-work benefits. This is comparable to peak unemployment during the Great Depression in America. One reason why this is often overlooked is the mind-boggling complexity of the benefits system, combining several overlapping payments. The system worksasfollows:

Being placed in the high-sickness category(LimitedCapabilityforWork and Related Activities, or LCWRA) adds an extra £5,000 a year. 70% of sickness benefit claimants also receivethePIP,whichis£6,900ayear.

An unemployed person receives standard UC, which is £4,700 a year. All claimants also get housing support: the UC housing element, which averages at £7,300 a year.

By this stage, the whole package is almost£24,000ayear,exceedingthe £20,700 a year a full-time worker would receive on minimum wage. Child allowances increase this further, with more if the child is categorised as disabled. The graph, adapted from a Centre for Social Justice study below illustrates how different benefits can be received together.

The Labour-run Barnsley Council published a report last year entitled Pathways to Work. It highlighted “incentives in the benefits system whereby claimants get higher weekly payments if they claim incapacity on

thebasisofpoormentalhealththanif theyareabletoactivelyseekwork”.

However, the situation is not so simple. People receiving out-of-work benefits often suffer from poor health, a lack of education and childhoodtrauma.Lifeexpectancyin low-employment neighbourhoods can be ten years below the national average. A “complex range of barriers” hinders them from finding work;theyneedmorehelpthanjusta cheque.

The situation isn't simply a monetary one-nofigurescancapturethesocial impact of chronic worklessness. The same report notes “the societal consequences in lost income, status and belonging for each person without the opportunity to work are catastrophic”.

IspentaweekinBlackpoolworkingin a youth centre, where I saw the profound impact this can have. The deprivationinBlackpoolisexpressed in several ways, from high crime and drug rates to the fact that 30% of childrenleaveschoolwithoutasingle GCSE.

cohesion.Thoseonsicknessbenefits are not just erased from unemployment statistics and the public debate, but plunged into a complex welfare system from which they are unlikely to receive the help theyreallyneed.

Perhaps this is an overlooked aspect oflabourmarketeconomics.Itishard togrowaneconomywhen15%ofthe working-age population is being paid nottowork.Byignoringthosecaught in the third category of out-of-work benefit,wecannotseethedamageto communitiesandthefrayingofsocial

Alex Nelson

Time poverty is a rising inequality that drains health, limits opportunities, and remains overlooked in public policy.

In 1977, economist Clair Brown concluded that poverty measures focused solely on income, ignoring the unpaid labour required to maintain households. Her insight led to the introduction of a new concept known as time poverty the experience of having too much to do andnotenoughtimetodoit.

Time poverty extends further than consistently feeling busy. For example, a single parent required to work two jobs may on paper meet their basic material needs, but lacks the time to cook nutritious meals, exercise, or rest. This represents an often-overlooked burden with significant personal and societal consequences.

Crucially, time poverty is unequally distributed,oftenalonggenderedand socio-economic lines. Globally, women spend on average four and a halfhoursadayonunpaidcarework, more than double what men do. In many low-income countries, girls often shoulder a disproportionate proportion of unpaid labour. In SubSaharan Africa alone, women and girls spend an estimated total of two

hundred million hours each day collecting water. This comes at the expense of education or paid work, bothcrucialtoescapingpoverty.

Aswithmaterialpoverty,timepoverty carries severe consequences for generalhealthandwellbeing.Studies from the American Time Use Survey concludedthattime-poorindividuals exercise less and have poor diets. In Canada, the biggest barrier to participating in regular physical activityisnotduetocost,butinstead a lack of time. The result, more sedentary lifestyles and increased vulnerabilitytochronicconditions.

Time poverty is not just an individual affliction, but a systemic one. The 2020perspectivebyGiurge,Whillans, and West highlights its macroeconomic implications. They arguetimepovertyreducesworkforce efficiencyandperpetuatesinequality. In Singapore, for example, irregular shift schedules among low-wage workers are contributing to mental health struggles and fractured family lives,demonstratingthelinkbetween low-wagesandtimepoverty.

At the root of this crisis is an economic paradox: low-income workersarecompelledtoworklonger paid hours, while also managing the burden of unpaid domestic labourleavingthemwithnotimeorenergyto pursue a better future. Alarmingly, in a survey of 2.5 million Americans, subjective time scarcity had a stronger negative impact on wellbeingthanunemployment.

Despite this, government policy exclusively focuses on material poverty.Billionsarespentaddressing income gaps, while the profound consequences of time scarcity remainunaddressed.

What is needed is a shift in both policy and mindset. Infrastructure that reduces commute time, affordable childcare, flexible scheduling, and walkable cities can reclaim time for millions. Valuing unpaid care work in national accounts would also bring longoverdue recognition to what economists once considered invisible.

Only by addressing time poverty, can webegintobuildsocieties,whichare notonlywealthier,butfairerandmore inclusive.

Alex Rust

The US dollar looks like it may be loosening its grip over its monopoly of the global reserve currency.

The global reserve currency is the currency which most governments and central banks hold around the world. This helps to stabilise a country’s own currency in times of economic shock – if a currency is rapidly losing value, a central bank cansellthereservecurrencyandbuy their own currency, increasing demand and propping up the value. Furthermore, it is useful in payment for commodities and oil which are usually priced in the global reserve currency, and in settling debts more easily.

From the 5th century BC, there have been plenty of internationally recognised currencies, including but notlimitedtotheGreekdrachma,the Roman denarius and the Venetian ducat. However, the first reserve currency was created in earnest by theSpanish,duetotheabundanceof silver in the Spain-controlled portion of the Americas. They were able to mint vast quantities of consistently sized and weighted silver coins, which were trusted and readily available. This allowed trade to be

funded across Europe, Asia and the Americas.

However, the rise of industrial Britain coincided with a shift to the gold standard.Britainbecametheprimary exporter of manufactured goods and services, and, as a result, 60% of all global trade used pounds sterling. Londonbecameapowerhouseinthe insurance and commodity markets, and British capital was the largest source of foreign investment in the world. However, the Great Depression forced Britain, and subsequentlyalotofothercountries, offthegoldstandard.Thiswasdueto speculative attacks – when a lot of a country’s currency is sold at once. This greatly decreased the value of the pound, and the country’s monetary measures’effectiveness to solve this issue were diminished by the controlling nature of the gold standard.

After World War II, when the USA emerged as the world’s clear superpower, the international financial system was based on the Bretton Woods system. This agreement, masterminded by John

Maynard Keynes and Harry Dexter White, placed the US dollar as the foundation of the international financial system, with the US government agreeing that other central banks could sell their US dollarsatafixedgoldrate.

Since 1971, when President Nixon suspended the convertibility of dollars to gold, the global reserve currency has become a ‘fully fiat’ money system – a currency not backed by any precious metal. All of theworld’smajorcurrenciesarenow fiat currencies. In the wake of the COVID-19pandemic,therewerecalls for a new Bretton Woods system, reforming the World Bank and the InternationalMonetaryFundtobetter suit today’s world. The new system would have focussed on issues such as decreasing inequality and stopping climate change. However, such an arrangement was never agreedupon.

Today, the US dollar remains the world’s dominant global reserve currency. However, President Donald Trump’s seemingly erratic policy decisions over the past months have meant that the US dollar is no longer asstrongandreliableasitoncewas.

European Central Bank data has shown that gold has overtaken the euro as a reserve asset for central banks around the world, as institutions sell their US dollars. A draft of an EU statement which was discussedatasummitonthe27thof June showed France was pushing for morecommonborrowing.Theyargue that the euro could be a strong alternativeforinvestorslookingtosell their dollars, especially if more joint debt is issued. Countries with a high national debt, including France, Spain and Italy, have long argued for more joint borrowing so they can spend more on issues such as defence without adding to their national burden. However, it is thought that Germany and Holland are staunchly opposed to any such measures, asthey would have to pay ahigherproportionofanydebt.

Meanwhile,atopanalystfromScope RatingsreportedthattheUK’sreserve currency status may be diminishing. Surging national debt, which is now around100%ofGDP,isthoughttobe putting investors off the UK market. This is not helped by the fact that interest rates are still relatively high, withthebaserateat 4.25%,meaning thecostofborrowingishigh.

The US dollar will continue to dominatethereservecurrencyscene for the foreseeable future, and probably a long time after that. However, there is currently an opportunity for other countries to capitalise on some of the weakness beingshown.

President Trump’s recent tightening of tariffs on Chinese goods has intensified the USChina trade war.

The US-China Tariff Trade war has been ongoing for multiple years now, first escalating in 2018 when Trump imposed tariffs on Chinese goods, such as steel and aluminium. One reason for these sudden tariffs was the accusations made by the US of China engaging in unfair trade practices such as excessive state subsidies,makingmanyUSfirmsless competitive. The US’s trade balance with China has historically been in a deficit, and so Trump also aimed to reducethisdeficitby makingimports less attractive and therefore decreasing them. This however, caused China to retaliate with their own tariffs on US exports, beginning thestillongoingtradewar.

Tensions in this area begun to take a backseat as Trump left office in 2021 but have recently re-escalated following his return to presidency in January 2025. The newly elected president has now increased tariffs on steel and aluminium imports to 50% for all countries (from 25% on steel and 10% on aluminium initially imposed in 2018). This is an all-time high, causing further disputes and questions about how China should react.

So far, China’s main source of reaction has simply been to increase tariffs of their own, hence causing this trade war. But the issue is that this cannot be sustainable, as eventually a point will be reached where tariffs are so high that economic activity drops drastically, harming growth for both countries. This situation can be analysed using the concept of game theory, which looks closely at the strategic interactions between two individual parties and how they affect each other. A simplified payoff matrix (a table to display all the potential outcomes based on what China and theUSdo)canbecreated:

China Cooperates China imposes tariffs

US Cooperates Economic growth for both Economic advantage for China

US loses face

US imposes tariffs Economic advantage for US China loses face Economic loss for both

There are three main scenarios to take from the above matrix. Firstly, if both China and the US were to cooperate, both would likely experience economic growth due to

moreopenandfreetrade.Secondly,if one country-imposed tariffs and the other did not, the country imposing the tariffs could expect a short-term economic advantage, due to increased exports compared to imports and perhaps increased productioninthetariffedsectors.On the other hand, the country cooperating would find it more difficulttoexport,harmingeconomic growth. The last scenario is if both countries impose tariffs, in which case both would face decreased tradeandeconomicslowdowns.

In this simplified model, both the US and China imposing tariffs in clearly the worst option, as it also harms world trade in general. However, as mentioned previously, this is the current situation, and this is a clear indication of how, by acting for only the country’s individual gain, a suboptimal position between both countriesmaybereachedinstead.

influenced by them acting in their self-interest, not wanting to concede to another superpower to protect their own country, potentially a form ofpopulistpolicy.

According to this model, the optimal strategy for US and China is for both to cooperate. But this may not be possible, as we must, for example, consider why Trump imposed these tariffs in the first place, due to potential unfair trade methods from China and a concern of decreased competitiveness of US firms. In addition, decisions made by the respective governments are also dependentonwhetherthetargetisin the short or long term. It is worth mentioning that decisions may be

As the trade war continues, we are currently seeing deals being made betweenthetwocountries,andsome US tariffs on Chinese imports are starting to be a lowered, a positive sign. However, in a world with a very dynamicmarket,itisstillveryhardto determine what the perfect trade strategyreallyis.

Zaid Ahmed

Since Myanmar’s military coup in 2021, the country has descended into a civil conflict that has severely impacted both its economy and trade dynamics.

Recent assessments indicate that Myanmar’s economy contracted by approximately 10% relative to 2019 figures,andgrowthprospectsremain bleak. The World Bank anticipates a mere 1% growth for the fiscal years 2024–2025. This ongoing turmoil has disrupted trade both domestically and with neighbouring countries, including China, Thailand, India, and Bangladesh.

From April to December 2023, Myanmar experienced a loss exceeding $122 million in border trade compared to the previous year. The trade volume also fell sharply from approximately $1 billion in April 2024 to $684 million by May 2024. Armed conflicts have obstructed numeroustraderoutes,particularlyin northern regions adjacent to China. Historically, 91% of overland trade utilised five major border posts; however, hostilities in northern Shan State have precipitated a significant 41% reduction in trade volume. For example,theMusecrossingbetween MyanmarandChina,thelargestpoint of entry, incurred a trade loss amountingto$371million.

Trade relations with Thailand have similarly deteriorated. Myawaddy, previously the most active trade

point, accounted for close to 25% of Myanmar's overall trade but witnessed an 87% decline from April to July 2024, plummeting from $556 million to $71 million. In addition, trade routes to the west, towards Bangladesh and India, have nearly ceased, leading to critical shortages infuel,medicine,andfoodsuppliesin thoseareas.Merchantshaveresorted tousingcoastalportsinThailandand China, which has resulted in increasedcostsandextendeddelays. Various sectors have experienced significantsetbacks. Exportssuch as rice, pulses, and fish are facing challenges due to hazardous roads and blockades. The textiles and electronics industries, vital components of Myanmar’s manufacturing sector, have suffered losses of up to 30% owing to power outages and factory shutdowns. Additionally, jade and mineral exports, once substantial sources of revenue,haveseenmarkeddeclines. InRuili,akeyhubforjadeprocessing that once generated around $1.4 billion annually, half of the domestic markets for jade have ceased operations. Although the energy sectorhasremainedstable,ithasyet toreturntopre-conflictlevels.

The civil war is inflicting long-lasting damage on the economy. Over three million individuals have been displaced, resulting in a significant labour shortage. The kyat's value has diminished by more than 60% since 2021, leading to heightened inflation ratesanda57%increaseintheprices of commodities, placing additional strain on businesses. Foreign direct investment in manufacturing has plummeted from $4.8 billion in 2017 to an alarming $112 million in 2023, indicating that international firms consider investing in Myanmar too riskyatthemoment.

While the global repercussions may not be immediately evident, their significance cannot be understated. Myanmar plays a pivotal role in the production of rare earth metals, which are crucial for renewable energy technologies. Disruptions in the supply of these materials have caused price volatility in world markets. Furthermore, illicit trade activities aimed at funding armed groups present security and environmental challenges for neighbouring countries, alongside themovementofrefugeesandhealth crisestranscendingborders.

example of how internal conflict in a smaller economy can still cause major disruptions in trade and affect globalstability.

Myanmar'scivilwarhasdistressedits trade systems and weakened economictieswiththeregion.Border closures, inflation, insecurity, and lack of investment are all hindering recovery and complicating regional tradeintegration.Myanmarisaprime

Rohan Ladva