Gulf Credit Union ... from Anywhere!

We are committed to investing in the growth of our employees, members, and communities. As we continue to expand our footprint, consolidating our office operations to become more efficient is imperative. Building our new Administration Building is one of the steps to fulfilling our goals of "Expanding our Impact" in our communities. Our beam signing ceremony was held at the construction site of our administration building, next to our Mid County location. As the signatures were written on the beam, there was a collective feeling of unity. This beam, which will become the centerpiece of the structure, represents the teamwork that supports this project. Thank you to all who were in attendance, and special thanks to G&G Enterprises for being a part of our company's growth and success.

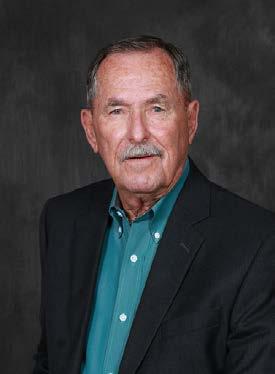

Our Annual Meeting was held February 21, 2023 at the Groves location. This year we had two board of director positions up for election and we are pleased to announce the results. Karen Brown has been re-elected to serve on the board for a three year term. Barry Gorman has been re-elected as Vice Chairman for a three year term.

Gulf Credit Union is here to help you with the purchase of residential investment property, cash out equity loans, or refinancing existing loans. We offer great rates and quick turnaround times, with friendly staff to guide you through the process!

Things to know:

Down Payment- As an industry standard, when purchasing rental property, a 20% down payment will be required.

Credit Score- Commercial loans require a higher credit score than typical consumer loans. Be prepared by monitoring your credit score in advance, and making sure that all your monthly notes are made timely.

Interest Rate- We offer competitive interest rates, with flexible terms to suit your investment property needs. Rates vary due to many factors; contact us to find your qualifying rate.

To apply for an investment property loan, contact one of our friendly staff members, or download an application from our website at gecu.org!

Subject to credit approval. Rates and terms may apply.

Some children earn cash by doing small jobs for friends or neighbors. Others start a career as an entrepreneur by opening their own lemonade stand or starting a window-washing business. Still others are given regular amounts of money from their parents as an allowance. However your child earns or receives money, remember to use it as a teaching tool. Done correctly, money can help a child learn to create a spending plan and live by it. The sooner you teach your children the basics about budgeting, the better, and the 3 jar money system is a great way to get started.

The saving jar teaches kids to set and work toward goals. This shouldn’t be money put away for an unclear purpose. It should be specific. It could help to create a general “rule” with your child, like 30% of their money should always go to saving or for every $2 in the spending jar, one should go to savinghowever you and your child decide to prioritize and divide the money is fine. The goal is to impart the importance of saving and begin building the habit.

The overall goal is to use the money your child earns as a way of teaching them how to create a spending plan and live by it. The 3 jar system is a popular way to begin teaching children how to budget. With this system, you give your child three clear jars, each representing a different fund: spending, saving, and giving. The child will then divide their money into the jars with your guidance. Budgeting their money in this way teaches children to actively plan for their current and future wants. Encourage your child to stick to their budget. If they fall short in one category, the goal is to help the child modify their behavior or budget instead of pulling from another jar. For example, if your child would like to spend more money than they have in the spending jar, they should re-prioritize their wants, earn more money, or rethink their budget instead of pulling from the saving or giving jars.

The spending jar is all about what kids want to buy now. This is how they finance little things like candy bars or trinkets at the grocery store. This budget can also include budgeting for bigger things like clothing, school supplies, or even food if you decide you want your child to pay for some of those things themselves. Just remember that you need to give them an avenue to earn the money to cover whatever you expect them to pay for.

The giving jar encourages children to think about others. Help them choose a cause that’s important to them, perhaps a charity that supports a cause that is near and dear to them. The giving jar can also go toward gifts for other people - a birthday gift for a friend, a thank you present for a teacher, etc. When it comes time to donate the money they’ve saved, do your best to find a way to show them the impact of their generosity. Even a little goes a long way, and this is a great way to teach that principle.

The idea is for your child to set the money aside and you to help them invest it, perhaps by buying a few shares with their money in your portfolio. This crucial life skill helps people build their wealth and secure their future.

Once your child gets the hang of the 3 jar money system and begins to master general budgeting concepts, the next step will be to bring them, and their jars into one of our convenient locations to open their first account. This will give you the chance to teach them about interest and how storing their money at a credit union will keep it safe.

• Be aware of your surroundings, particularly at night.

• Have your card ready and in your hand as you approach the ATM.

• Visually inspect the ATM for possible skimming devices.

• Be careful that no one can see you enter your PIN at the ATM.

• To keep your account information confidential, always take your receipts or transaction records with you.

• Do not count or visually display any money you received from the ATM.

• If you are using a drive-up ATM, be sure passenger windows are rolled up and all doors are locked.

• If the lights at the ATM are not working, don't use it.

• Use ATMs inside the building whenever possible.

• Utilize our remote control card feature to assist in preventing fraud.

• Always protect your ATM/Debit/Credit card and keep it in a safe place.

• Do not leave your card lying around the house or on your desk at work.

• Immediately notify your financial institution if it is lost or stolen.

• Keep your Personal Identification Number (PIN) a secret.

• Never give any information about your card or PIN over the telephone.

• Park close to the ATM in a well-lit area.

• Take another person with you, if at all possible.

If you have a problem with the services provided by this credit union, please contact us at:

Gulf Credit Union

PO Box 848

Groves, TX 77619

Telephone Number 409.963.1191 or email address info@gecu.org

The credit union is incorporated under the laws of the State of Texas and under state law is subject to regulatory oversight by the Texas Credit Union Department. If any dispute is not resolved to your satisfaction, you may also file a complaint against the credit union by contacting the Texas Credit Union Department through one of the means indicated below: in Person, U.S. Mail or Email: 914 East Anderson Lane Austin, TX 78752-1699

Telephone: 512.837.9236 | Fax: 512.832.0278

Website: www.cud.texas.gov

Email: complaints@cud.texas.gov

According to Section 91.315 of the Texas Administrative Code, upon request members of Gulf Credit Union are entitled to review or receive a copy of the most recent version of the following credit union documents: balance sheet and income statement, summary of the most recent annual audit, written board policy regarding access to the articles of incorporation, bylaws, rules, guidelines, board policies and copies thereof and Internal Revenue Service Form 990.

Please make requests by writing to Gulf Credit Union

ATTN: Office of the President/CEO PO Box 848

Groves, TX 77619 or by phone: 409.963.1191

Our 1st Time Auto Buyer program is designed to help our members that don’t have any car buying experience. To qualify, you just need to meet the following criteria:

• 6 month employment history

• Max finance amount of $20,000

• 10% cash down or qualified co-borrower

• Have direct deposit and set loan on auto pay

• No previous auto history and no derogatory credit

You may be eligible to refinance at a lower rate after one year of on time payments! Contact our loan department for more details. Subject to credit approval. Rates and terms may vary.

Criminals committing mail theft-related check fraud generally target the U.S. Mail in order to steal personal checks, business checks, tax refund checks, and checks related to government assistance programs such as Social Security payments and Unemployment benefits. Criminals will generally steal all types of checks in the U.S. Mail as part of a mail theft scheme, but business checks may be more valuable because business accounts are often well-funded and may take longer for the victim to notice the fraud.

• Tell someone you trust and contact your financial institution before you act.

• Never take a check for more than your selling price.

• Never send money back to someone who sent you a check.

PHONE PRIZE SCAMS • FAKE JOBS • ROMANCES

MONEY MULES • MYSTERY SHOPPERS

Receive a check in the mail, and you are not sure why?

The latest trend is the money mule. A money mule is someone who transfers or moves illegally acquired money on behalf of someone else. You could receive a phone call from someone that you think is your friend. Your 'friend' convinces you to make a mobile deposit to your checking account. You soon realize after the deposit they are NOT your friend, but someone who could be using you to send them funds. They may try to convince you to keep a portion for yourself. In reality, you are left owing the entire amount.

Because we love that you're a member of Gulf Credit Union, we are bringing you special savings on TurboTax this tax season. Get a head start on your taxes and take advantage of member discounts that help make filing your taxes easier. Members can enjoy savings of up to $15 off TurboTax federal products when you sign up or log in using the link or scanning the QR code below. File taxes your way with America's #1 tax prep provider. Whether you choose to hand off your taxes, get help from experts or file on your own, TurboTax always guarantees your maximum refund.

MAY

Memorial Day

Monday, May 29

JUNE

Juneteenth

Monday, June 19

JULY

Independence Day

Tuesday, July 4

SEPTEMBER

Labor Day

Monday, September 4

OCTOBER

Columbus Day

Monday, October 9

NOVEMBER

Veterans Day

Saturday, November 11

Thanksgiving Day/Holiday

Thursday, November 23

Friday, November 24

Saturday, November 25

DECEMBER

Christmas Eve/Day

Saturday, December 23

Monday, December 25

Tuesday, December 26

Please contact a member service representative at 409.963.1191 or 800.448.5328 to update your email address, home address, phone number and/or any other contact information that may have recently changed.