Gulf Credit Union is proud to celebrate 85 years of dedicated service to our members and community. Since our founding in 1939, Gulf Credit Union has been committed to providing financial solutions that empower individuals and families, while fostering a culture of trust, integrity, and community support. Over the decades, we have grown and adapted, constantly innovating to meet the changing needs of our members. This remarkable milestone is a testament to the credit union's unwavering dedication to its mission and its ongoing promise to help members achieve financial success for generations to come.

Here are a few key events from 1939, the year Gulf was founded:

• Germany invaded Poland and started World War ll.

• Texas A&M won the National Championship in football.

• A gallon of milk was 50 cents.

• The first air-conditioned car was a Packard that rolled out in Chicago.

• The yield sign, or give way sign, was invented.

At Gulf Credit Union, we take pride in providing personalized, friendly service that’s tailored to your needs. Whether you’re visiting us in person, over the phone, or online, we’re here to help you every step of the way. Thank you for being a valued member of Gulf Credit Union.

Cheers to 85 years of excellence, with many more to come!

Todd L. Gaudin President/CEO

Our Annual Meeting was held February 18, 2025, at the Groves location. This year we had three board of director positions up for election, and we are pleased to announce the results.

Jason Howard, Johnny Lewallen and Robert Lovelace were re-elected to the board of directors.

, and so are scammers, ready to exploit unsuspecting taxpayers with fraudulent schemes. It’s essential to stay vigilant and protect yourself from falling victim to scammers' tricks and tactics. Scammers may impersonate the IRS, demand immediate payments, or even threaten legal action. They use pressure tactics to create a sense of urgency and try various methods to gather as much information as possible.

To safeguard yourself, follow these steps:

• Recognize and verify IRS communications:

The IRS primarily contacts taxpayers through written notices sent by mail. They will never contact you via phone, email, or text for immediate payments. Be skeptical of any phone calls, emails, or texts claiming to be from the IRS.

• Avoid sharing personal information: Never disclose sensitive information about yourself or any financial details to unsolicited callers or emails. And if unsure of the caller, ask for a call-back number and verify it independently.

• Use secure filing methods:

File your taxes through trusted professionals or IRSapproved e-filing systems.

• Monitor your accounts:

Check for unauthorized activity regularly and let your credit union know as soon as you see something you did not authorize come out of your account. Stay alert and informed!

• Report fraud promptly:

If you suspect you’ve encountered a tax scam, report it immediately to the IRS at https://www.irs.gov/privacydisclosure/report-phishing, and let your credit union know as well!

At Gulf Credit Union, we’re committed to protecting our members, standing strong to fight scammers, and safeguard your financial future.

AI phone scams are an emerging risk as they target a diverse range of victims. These scams leverage advanced AI technology to replicate voices and create compelling, fraudulent communications that are difficult to recognize from real ones. The key to staying safe from AI phone scams is awareness. Some red flags that should make you pause and say, “Wait a minute”, are:

Be wary of calls from unknown numbers. The best solution is to avoid answering unfamiliar numbers. You can also contact your phone provider and inquire about software that will spot potential scam numbers or numbers outside your area.

Scammers will try to create a sense of urgency to cloud your judgment. Stay calm and ask questions. Don’t be distressed into making a quick decision, especially if you are asked to send money. Verify the information given to you.

Requests to send a wire, gift cards, or cryptocurrency are suspicious and should raise alarm. These payments are preferred by scammers because they are untraceable and usually impossible to retrieve.

Stay vigilant,

and do not give your personal identifying information to sources you are not familiar with.

Please join us in congratulating the following employees on their promotions! We are excited to see the wonderful things each will do in their new position.

Unlock financial independence with our teen checking account designed for anyone between the ages of 10 through 17. Contact us today to get signed up.

Our DOUBLE DIGITS Teen Account will start you on a journey towards financial freedom.

• Membership fee provided by the credit union

• Access to online, mobile and video banking

• No minimum balance required in checking account

• FREE debit card

• Electronic statements

• Overdraft protection from savings to checking

• Rewards for excelling in school

Gulf Credit Union... from Anywhere!

• Be aware of your surroundings, especially at night.

• Have your card ready and in your hand as you approach the ATM.

• Visually inspect the ATM for possible skimming devices.

• Be careful that no one can see you enter your PIN.

• To keep your account information confidential, always take your receipts or transaction records with you.

• Do not count or visually display any money you receive from the ATM.

• If you are using a drive-up ATM, ensure passenger windows are rolled up and all doors are locked.

• If the ATM lights are not working, do not use it.

• Use ATMs inside buildings whenever possible.

• Utilize our remote control card feature to assist in preventing fraud.

• Park close to the ATM in a well-lit area.

• Take another person with you whenever possible.

• Always protect your cards and keep them a safe place.

• Do not leave your card lying around at home or at work.

• Immediately notify your financial institution if your card is lost or stolen.

• Keep your Personal Identification Number (PIN) secret.

• Never give any information about your card or PIN over the phone.

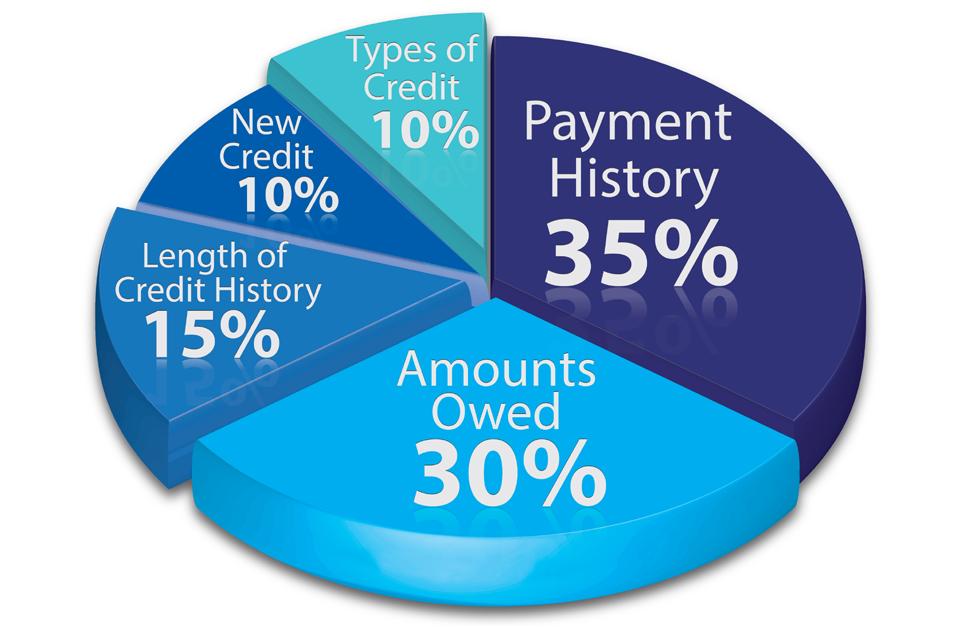

Having a good credit score can benefit you in a number of ways. The better your score is, the lower your interest rates will be, which means more money in your pocket after you pay your bills each month. Your credit score also affects your ability to get a loan, add on to existing loans, or even get a job or an apartment. Your credit score is determined by your credit history, including how you’ve paid on past loans and how many loans you’ve had.

Lenders, potential employers, landlords, and even insurance companies may look at your credit report when you apply for a loan, rent an apartment, obtain insurance, or look for a job. This information tells them how you handle your financial obligations, whether you have filed for bankruptcy in the past, and helps them determine how likely you are to repay a new loan or obligation. Typically, credit scores fall within the 350–850 range, with higher scores indicating better credit and lower interest rates. Scores on the lower end of the range suggest to businesses that you are a higher risk, which may result in being charged a higher interest rate due to uncertainty about future obligations.

Protect your credit by checking it regularly at AnnualCreditReport.com to ensure all reported information is accurate and that no fraudulent accounts are listed. If you are reviewing your reports due to a data breach, be sure to look for suspicious accounts from creditors you do not recognize. If you identify potential identity theft on your report, dispute the information with the appropriate credit bureau. You can also freeze your credit at any time by contacting each of the three credit bureaus.

It’s important to remember that credit scores fluctuate, so try to keep it within a healthy range, so that you can take advantage of the best rates and rewards programs available!

Protect Your Credit Union! Congress is considering new tax policies that could impact credit unions and their members. The Don’t Tax My Credit Union campaign is fighting to keep credit unions tax-exempt, so they can continue offering lower fees, better rates, and valuable services to members like you.

Our professional lending team can help customize a loan for you that offers competitive rates and flexible terms! To apply, contact us today to make an appointment or download our commercial application and checklist at gecu.org.

We

Be the trusted financial partner by delivering innovative solutions that provide value and convenience to our members.

Lobby Hours

Monday – Thursday 8:30 am – 5:00 pm Friday 8:30 am – 5:30 pm

Drive-Thru Hours Lobby Hours

Monday – Thursday 8:00 am – 6:00 pm Saturday 9:00 am – Noon

Drive-Thru Hours Monday – Thursday 8:30 am – 5:00 pm Friday 8:30 am – 5:30 pm Monday – Thursday 8:00 am – 5:00 pm Friday 8:00 am – 5:30 pm MAILING ADDRESS PO Box 848, Groves, TX 77619-0848 memberservice@gecu.org • 409.963.1191 • 800.448.5328

ADMINISTRATION OFFICE 2779 A. Aero Drive, Port Arthur, TX 77640 Call 409.963.1191 for an appointment.

NAME

Karen Brown, Chairwoman 2026

Logan Delcambre, Vice Chairman 2027

Joshua Lege, Secretary/Treasurer 2027

Barry Gorman 2026

ADVISORY DIRECTORS

Jason Howard 2028

Johnny Lewallen 2028

Robert Lovelace 2028

APRIL

OCTOBER

Good Friday/Easter Friday, April 18 Saturday, April 19

Columbus Day Monday, October 13

MAY

Memorial Day Monday, May 26

NOVEMBER Veterans Day Tuesday, November 11

Dr. Francisco Alvarez 2026

Michael McCorvy 2026

JUNE Juneteenth Thursday, June 19

Thanksgiving Thursday, November 27 Friday, November 28 Saturday, November 29

JULY

DECEMBER

Independence Day Friday, July 4

SEPTEMBER

Christmas Thursday, December 25 Friday, December 26 Saturday, December 27

Labor Day Monday, September 1