DIGITAL INNOVATIONS

IN THE HUNGARIAN BANKING SECTOR

Innovative digital banking solutions of the last 10 years

April 2023

IN THE HUNGARIAN BANKING SECTOR

Innovative digital banking solutions of the last 10 years

April 2023

Almost a decade ago, branchless digital banking seemed unthinkable. The legal environment, the lack of technology and innovative solutions did not allow 100% online banking, however the first digital bank still managed to appear in Hungary. Today, the vision of digital banking has become a reality and the possibility to request and use (almost) the entire range of financial services online has come within reach.

In this publication, we review digital innovations in the domestic banking sector, which have played a key role in enhancing customer experience and in the implementation of branchless digital banking.

Thirteen years ago, when 100% branchless banking seemed unthinkable, Gránit Bank was the first bank in Hungary to adopt a digital business model, and time has proven us right.

Today, it is clear that the mobile phone in your hand can be your "bank," allowing you to manage your everyday finances quickly, easily, cost-effectively and with a great customer experience, while still retaining the personal touch of being able to reach your bank advisor from anywhere via video bank. Our goal is to always be responsive to our customers’ needs, introducing them to the banking experience.

We are pleased to present to our readers this publication, which showcases the digital banking innovations of the last 10 years and the cutting-edge solutions of Gránit Bank. I would like to thank my colleagues for their joint, value-creating work that led us to achieve these results, and our increasing number of customers for choosing Gránit Bank as their banking partner.

The emergence of new technologies in the financial sector has both contributed significantly to the digital transformation of banks and paved the way for the emergence of cost-effective digital banks that respond rapidly to customer needs and offer great customer experience.

The more digitalization permeates the economy and society, the more the role of financial technologies in banking operations and strategies will develop.

The regulatory environment determines the way banks operate, the speed of digital transformation of the banking sector, and the possibility to use new technologies and introduce new business models.

The regulator ensures the stability of the financial intermediary system and protects consumer interests, while also providing digitalization guidelines to facilitate the development of the banking sector.

Competition between market players is boosted not only by the digital developments of competitors, but also by the actions of neobanks and fintech companies, where digital innovation based on user needs can provide a competitive advantage.

Innovative banks not only respond to the challenges of the market environment, but also shape it through their digital approach and innovations.

The decision by bank management to use digitalization and innovation in a marketfollowing or market-shaping way to meet the challenges posed by changes in the technological, regulatory, and market environment plays a key role in the digital transformation of the entire banking sector.

If the management is committed to making banking and the operation of the bank more efficient with innovative, cutting-edge digital banking solutions year after year, this will be reflected in the bank's profitability and the value it creates for customers.

Management's options are limited by the level of authority, degree of freedom and resources available to accelerate a digital transformation and the implementations of innovations ahead of the market. However, it is not the size of the bank and the amount of resources devoted to development that will determine which banks become the flagships of digitalization and digital banking innovations.

The key is the management approach that includes intuition, agility and confidence in the organization's ability to deliver.

In the past 10 years (between 2012 and 2022), a large number - and compared to previous decades, a significantly large number - of innovative digital solutions emerged in domestic banks, but most of these are not yet widely adopted. However, in the coming years, more and more banks will follow the example of innovative banks and make available most of the digital solutions presented in this publication.

The last ten years can be seen as the first phase of digital transformation, with innovative banks paving the way for more conservative banks, legislators, and regulators.

For retail and business users, banking developments become visible and perceptible when they experience faster, simpler, and more intuitive financial transactions.

However, in order to achieve this, not only the front-end digital interfaces, but also the back-end systems and processes need to be developed. The latter is less visible, but rather more perceptible for end users.

Key areas of innovation between 2012 and 2022 determining the digital transformation of the domestic banking sector tangible (visible and perceptible) for end users (retail and business customers alike).

3 4

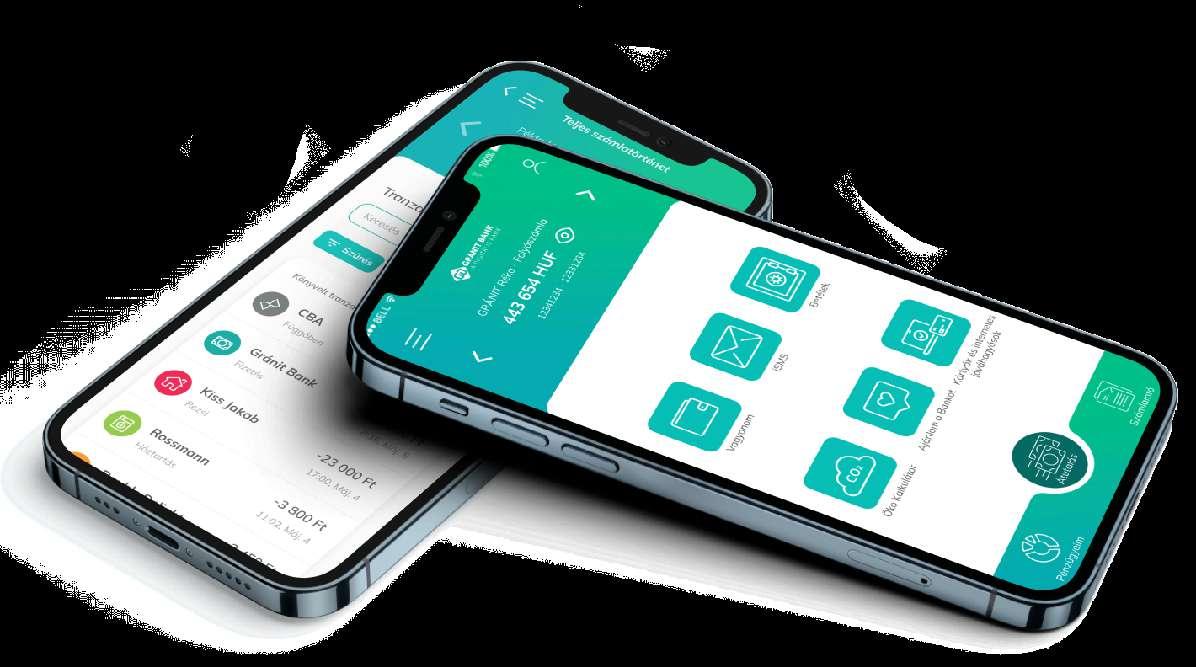

5 EVERYDAY FINANCES ON MOBILE

AUTOMATED CLIENT COMMUNICATION

TRACKING CARD MANAGEMENT

CUSTOMIZED FINANCES CHATBOTS

MULTIBANKING GREEN FINANCES

VIRTUAL FINANCIAL ASSISTANT

FINANCIAL PLANNER

CUSTOMIZED OFFERS

SOLUTIONS FOR CHILDREN

1

VIDEO BANK

2

REMOTE CUSTOMER IDENTIFICATION AND CONTRACTING

3 MORTGAGE LOAN APPLICATION ONLINE

4

100% ONLINE FINANCIAL PRODUCTS (for new customers, with online contracting)

Video banking is a remote banking tool that offers the experience of personal contact. Clients can use their device capable of video calling (e.g. computer, tablet, smartphone) to contact a bank administrator, with whom they can handle their affairs in the same way as they would in person at a branch.

Gránit Bank pioneered video banking in Hungary - and was among the first in Europe - in 2012. Since then, Gránit Bank has been one of the banks to offer the widest range of banking services that can be handled via video bank.

Opening an account via “video chat”

1 was the first to implement

Opening an account with “selfie”

Full-scale “selfie” account

1 was the first to implement

Remote banking received a significant boost from new regulations introduced in the summer of 2017, which created the possibility to open accounts 100% online.

Not only customer identification and screening, but also the conclusion of the contract can be done through a single video call of about 10 minutes. Gránit Bank is the first bank in Hungary to offer this option to its customers.

With the development of the regulation, customers can open an account not only via video call, but also by taking a selfie photo and taking a photo of their ID card. If the customer possesses an ID card with a biometric identifier, they can open a full-scale account with no limitations online by capturing a single selfie photo. Gránit Bank was the first to introduce this service, as well.

Due to regulations, mortgage loan applications cannot be made 100% online, but digital self-service solutions can help customers shorten the process. Thanks to these digital innovations, a single visit to the branch is enough.

With the "Online calculation and preliminary credit assessment," customers can find out in minutes the amount of loan they are eligible for.

With the "Digital Customer Account" solution, customers can start the loan application and upload the necessary documents for the loan application on the internet. After a successful credit assessment, all they have to do is visit the branch at the end of the process.

New customers can not only open a bank account online, but can also take out loans, apply for a digital debit card, and buy government bonds. This was made available for the first time in Hungary by Gránit Bank.

Today, the regulator has made it possible for most financial products to be managed from home, from application to conclusion of the contract, without visiting a branch.

2017

This decree was a milestone in the history of digital banking in Hungary. It created the possibility to carry out customer identification and screening as the conclusion of a contract on the internet, by video call, with the assistance of a live bank administrator. This was the key step towards making financial products 100% available online.

2018

This decree made it possible to open a so-called limited-use account online by taking a selfie photo, without the assistance of a bank administrator.

2020

This decree paved the way for opening a full-scale account online by taking a selfie photo and scanning the chip of the ID card with NFC.

2017

Innovative banks have been waiting for a long time for the legal conditions to be in place for the online opening of an account. As soon as the respective regulation came into force, innovative banks immediately introduced online account opening via video call. Gránit Bank was the first to do so.

2020

Opening a limited-use account with a selfie

The simple and quick process involves entering a few details, taking photos of the identification documents, and electronic signing of the contract, so an application can be initiated in just a few minutes.

2020

Gránit Bank also pioneered in this area and made it possible to open a full-scale account by taking a selfie photo and scanning ID card details via NFC.

Opening an account online via the Gránit VideoBank system (2017)

At Gránit Bank, a unique technology and methodology has been developed that makes document checking and verification processes equivalent to personal identification. The system used by Gránit Bank integrates international solutions in the field of video identification, in addition to meeting legal requirements.

Opening a full-scale account with selfie (2020)

Through Gránit Bank's eBank app, one can open a full-scale bank account with no restrictions by taking a selfie photo,taking photos of ID cards, andscanning the ID card’s chip based on NFC technology without video or in-branch identification.

Key indicators:

91% of retail clients opened account via Gránit VideoBank and with selfie.

97% of Childbirth Incentive Loan applicants managed the entire process online.

75% of government securities purchases were made online without visiting a branch.

(available since 2020)

The Bank's innovation ensures the card function is moved to the mobile phone on the next day of account opening, regardless of whether the account was opened with selfie identification, in the video bank or at a branch.

The virtual card can be used until the physical card is activated, up to a maximum of 60 days. Thereafter, the physical card can be digitized to a mobile device in the usual way.

CONTACTLESS MOBILE PAYMENT

1 2 3 INSTALMENT PAYMENTS 2.0

INSTANT TRANSFER

In September 2016, contactless mobile bank payments, without the need to change SIM cards, were introduced in Hungary, enabling users to make payments with their smartphone in the same way as with their contactless bank card.

At the end of September 2022, after six years, more than 1.6 million payment cards had been registered in a mobile wallet capable of contactless payments.

Tokenization 2014

In 2014, card companies (payment technology companies, e.g. Mastercard, Visa) introduced tokenization technology to securely link payment cards to mobile wallets (e.g. Apple Pay, Google Pay).

Tokenization protects the cardholder's data by replacing the physical card number with a unique, alternative identifier, known as a token.

When users use their mobile phones to pay, the token, not the real card number, is used in the transaction.

Thanks to the dynamically changing component (tokens) in each payment, tokenization makes transactions more secure, thereby reducing fraud in digital payments.

2016

After many years of market experimentation, tokenization technology laid the foundations for the widespread use of contactless mobile payments in Hungary in 2016.

The first contactless mobile banking solution for Android users - not requiring SIM card replacement.

2019

In May 2019, Apple Pay was launched at the first domestic bank. Since then, in just under three years, 11 domestic banks have made the service available.

2021

In April 2021, Google Pay was launched at the first domestic bank. Since then, in just under two years, 6 domestic banks have made the service available.

(2019)

In July 2019, Gránit Bank was one of the first (second in a tie) to introduce Apple Pay in Hungary.

A few months after the launch of Google Pay in Hungary, Gránit Bank also made the service available. Just behind the podium, Gránit Bank was also in the lead.

95% of retail clients having contactless mobile payment solution use their mobile phones for payment

8,5 times a month on average.

Key indicators:

Proportion of cards digitized into mobile phones within the total active card portfolio at Gránit Bank

44,3%

Gránit Pay*

Apple Pay Google Pay

Distribution of the share of mobile payments by Gránit Bank clients using contactless mobile payments

*Payment solution is being phased out, migration of clients to Google Pay is in progress.

64%

Launch of Instant Payment System

was among the first to implement

Instant transfer initiated by scanning a QR code

was among the first to implement

was among the first to implement

On 2 March 2020, the National Bank of Hungary launched the Instant Payment System (AFR) in Hungary, thanks to which domestic HUF transfers typically reach the beneficiary within 1-2 seconds.

This is a dimensional change that will provide the basis for the spread of innovative account-based payment solutions.

All banks and payment institutions with payment accounts in Hungary have joined the instant payment system, so all retail and business clients with payment accounts can enjoy the benefits of instant transfers in Hungary.

The spread of account-based payment solutions will be facilitated by the new package of measures of the National Bank of Hungary, which will enter into force on 1 January 2023, and will require all banks to ensure the receipt of payment requests and the National Bank’s standard QR code scanning functionality in their mobile banking application by 1 February 2024 at the latest.

These measures will make a significant contribution to the spread of new, innovative account-based payment solutions.

2020

As of 2 March 2020, it has become possible to send and receive payment requests. A payment request is a standardized message sent to the payer's current account containing the data necessary to set up an immediate transfer order.

Gránit Bank was among the first to introduce the sending and receiving of payment requests in April 2020. Gránit Bank clients can not only send to client payment requests inside the bank, but also to clients outside the bank. They can also receive payment requests from clients outside the bank.

From the day of the launch of the Instant Payment System, an instant transfer order can also be issued by scanning a QR code, which has opened the way for the introduction of new types of account-based payment solutions.

In October 2020, Granit Bank was among the first to make it possible to initiate a transfer by scanning a standard MNB QR code. The bank's clients can use the Gránit eBank mobile application to create or scan a QR code to initiate a direct transfer.

the first

solutions tailored to business needs were launched as an alternative to card payments.

on payment requests.

Selecting the installment facility at the card terminal at the time of purchase

At the time of payment at the card terminal, the customer can choose to pay for the goods either in full or in monthly installments. The customer can take the goods right away and the bank will only deduct the full amount periodically in equal monthly installments later.

Selecting payment by installments option in the netbank, mobile bank after a card payment

In the bank's mobile app or web interface, installment facility can be applied for after card payments.

Nowadays, deferred payments, or installment payments, are enjoying a renaissance. Thanks to digitalization, users can now, at the time of card purchase, choose at the card terminal or a in few days within a few days of the purchase in the netbank, mobile banking application, whether they want to pay the full amount of the goods immediately or periodically, even taking out a zero interest installment plan.

1 2 CARD MANAGEMENT

MOBILE WALLET

MULTIBANKING 3 4

GREEN FINANCES

5

Based on the expectations towards financial services of the Alpha and Z generations growing up with smartphones in hand, we are convinced that mobile devices will become almost the exclusive tool in banking and credit card management.

Péter Jendrolovics

Gránit Bank Deputy CEO, Retail Division

Péter Jendrolovics

Gránit Bank Deputy CEO, Retail Division

Mobile wallets are typically applications that run on the mobile phone, where one can securely store payment card details to make payments more convenient, faster, and safer in many situations.

There are mobile wallets where it is possible to store tickets, public transport passes, loyalty cards, or even boarding passes.

Some mobile wallets also act as digital wallets, which means that one can pay with saved card details in a web environment, so that the mobile wallet can be used not only for mobile payment, but also for payments in web shops and mobile apps.

Nowadays, most domestic banks already provide the possibility to change card limits, suspend or block cards in the mobile banking application quickly and easily with just a few clicks.

Since 2015, Gránit Bank clients have been able to block their bank cards with a single touch in the Gránit eBank mobile application.

In the Gránit eBank application, you can click on the padlock icon to temporarily lock or unlock the card at any time.

Open banking allows users to track their account history with different banks in a single interface - even in a smartly processed, automatically categorized format.

You cannot pay with a blocked (padlocked) debit card, and the digital debit card assigned to it will also be temporarily suspended.

The menu can also be used to set the automatic lock time.

At an international level, a number of companies and financial institutions have implemented sustainable operations and, in addition to reducing their own ecological footprint, provide services that are designed to promote sustainability.*

These services include, for example, video banking, online banking, digital credit management, or an ecological footprint calculated on the basis of bank card spending.

*Source: National Bank of Hungary

Gránit Bank is one of the first banks worldwide to introduce the Mastercard Carbon Calculator, which allows cardholders to see the impact of their purchases on the environment in their mobile bank.

Gránit Bank provides its clients the opportunity to use the calculator for tracking, based on their card purchases, their personal CO2 emissions that accompany their daily lives.

They can easily offset their emissions by planting CO2absorbing trees with a few clicks in the app, with the help of a domestic foundation, and monitor the CO2 offsetting effect of their own trees on a daily basis.

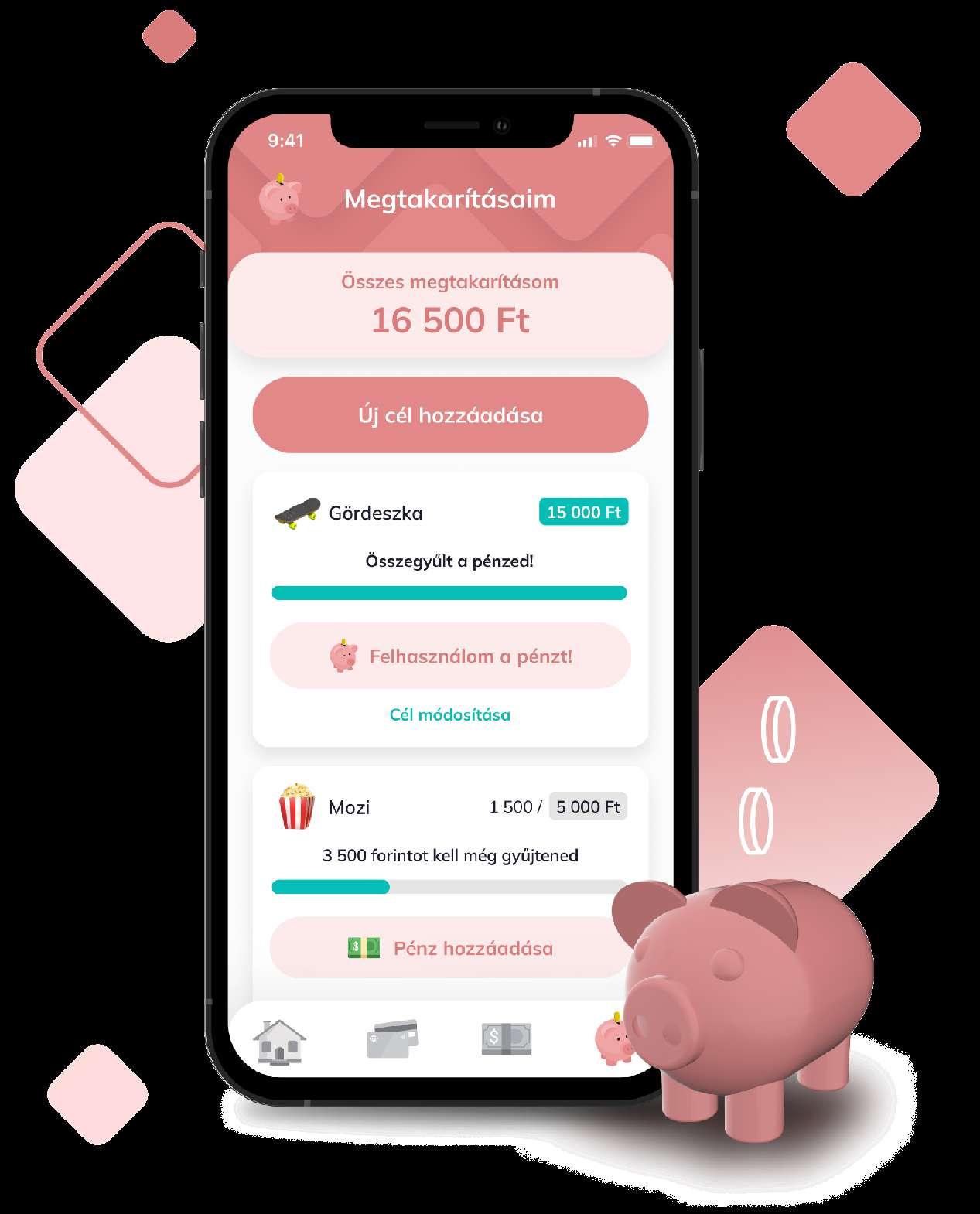

Financial education cannot start early enough. It is quintessential to teach children what it means to earn money and what it means to manage and save the income they have.

In childhood, as with many other issues, it is helpful to introduce children gradually to the world of money in a fun and playful way.*

*Source: Pénziránytű (Financial Compass)

Parents can introduce their children to the world of finance from a very young age with the Gránit Family mobile app, which offers better services than other children's financial apps available on the market in many ways.

One of its notable features is that it can be used from the age of 6 and is linked to a full-scale Family Junior bank account that the child can open online with the parent from home, without having to visit a bank branch.

Children can use the app to save money for a purpose of their choice, and parents can set different tasks in exchange for more pocket-money.

75% of retail clients have active mobile bank registration.

Retail clients using the Eco Calculator sent a donation to plant more than

4000 trees

to reduce their ecological footprint tracked in the calculator.

42% of retail clients have used the Gránit Lock service.

Lock and activate bank cards with a single click in the Gránit eBank mobile app.

CHATBOTS

PUSH MESSAGES 1 2 3

VIRTUAL FINANCIAL ASSISTANT

Thanks to the development of technology, the spread of broadband internet and smartphones, and the digitalization of the financial sector, digital communication with clients have become more cost-effective and efficient.

The dawn of real-time mass customization is here, and today one-way communication has turned into a digital dialogue.

For many years, banks notified their clients about bank transactions by text messages, at a cost for both banks and the clients.

As mobile banking applications began to spread, so did push messages, which offered a free alternative to costly text messaging.

Chatbots have opened up new horizons in client communication and in meeting the information needs of clients.

A chatbot is a pre-programmed chat application that sends a response to a specific question. With the development of technology, such as artificial intelligence, more advanced and intelligent chatbots have emerged, which are able to recognize the free text of user questions.

Virtual assistants are computer programs that can understand and simulate human conversation, make suggestions, predictions, and even initiate conversations.

It is easy to confuse digital assistants with chatbots, as the former are actually a more advanced type of the latter, capable of more complex interactions.

Digital assistants must be taught to recognize and predict patterns of behavior. And they need a lot of data, data sources, so that the algorithms and data models running in the background can provide the best response to the user's preferences.

Gránit Bank was the first to introduce push notifications in the mobile banking app, which it called iSMS.

Gránit Bank customers can be notified by iSMS message free of charge about:

‣ their daily account balance,

‣ debits and credits,

‣ credit card transactions,

‣ the bank's news and promotions.

1 2 3

MICRO SAVINGS

4

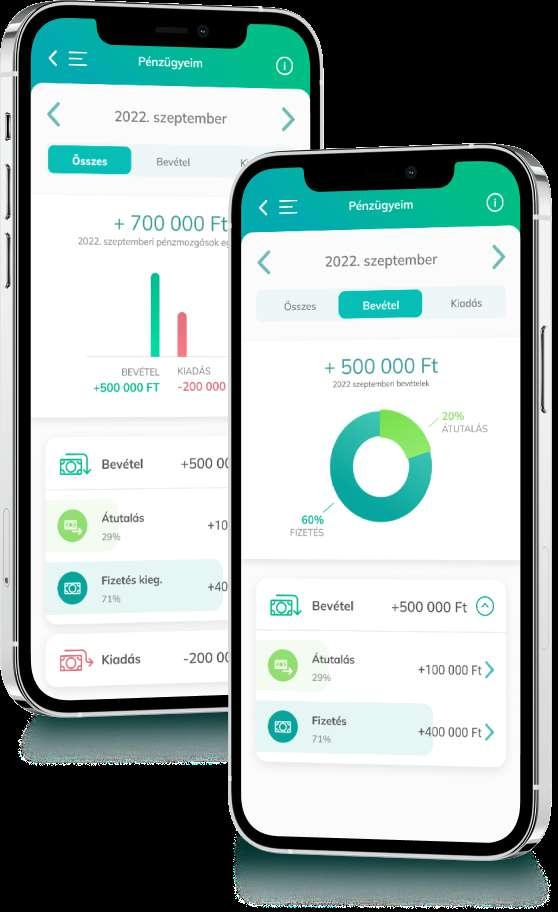

EXPENSE TRACKING (Personal financial) management)

FINANCIAL PLANNER

CUSTOMIZED OFFERS

In 2012, the first personal financial management application was launched in Hungary, enabling users to track their spending more effectively. As technology developed, account history quickly became valuable, leading to a better understanding of finances for users and the introduction of new types of discount plans for banks.

There are some some exemplary digital banking innovations also in Hungary. These are taking a new approach to helping bank customers achieve their savings goals by harnessing the potential of digital financial technologies.

Clients of a certain domestic bank can round up the value of their debit card purchases to HUF 10, 100 or 1,000. Once a personal savings target has been set, the solution automatically saves the rounding difference for each card payment, which is compounded daily.

The bank rewards the achievement of the target with an interest premium.

(PFM = Personal Finance Management)

Innovative banks have recognized that intelligent processing of account history, automatic categorization and visualization of expenses can all help clients track their spending and increase financial awareness.

Users can customize the statements on an intuitive graphical interface to better understand which areas of their spending to focus on.

They can also set up separate notifications for each spending category to keep more control over their spending.

A banking application is also available in Hungary, allowing users to review the long-term development of their assets. They can also see how their financial situation may evolve if they spend their money resourcefully or not.

The financial planner can also help them assess the short-, medium-, and long-term investment options available to help them achieve their financial goals.

Users can use the planner to develop their conscious investment and self-care strategies.

Users can also benefit from a cash-back rebate plan based on their purchasing and card usage habits.

The idea behind new generation plans is that bank clients receive automatic cashback on their purchases from the merchants that are relevant to them, without the use of coupons, discount codes, or loyalty cards.

These programmes are different from simple loyalty programmes in that the discounts are personalized, tailored to the client’s shopping habits.

88%

of the bank’s retail clients use My Finances function on a daily basis to keep track of their income and expenses.

Gránit Bank is the first bank to make available a financial manager functionality in a mobile banking application, which allows the bank's clients to assess their expenditure and income structure at a glance.

Over the past ten years, digital banking innovations have typically targeted retail clients, but in recent years, exemplary initiatives have also been launched for the business sector.

Digital banking solutions for retail clients are slowly becoming available for businesses, and digital banking solutions focused on business needs are emerging.

Administration of matters through video bank

Mobile wallet, digital wallet for business card

Online loan application

Online billing and finances in a single point

Payment solutions

Compared to the retail segment, the possibility of managing matters through video bank is still in its infancy in the entrepreneurial, micro and small business segments, but there are some exemplary solutions available.

New clients - sole traders, partnerships - can now also open a bank account remotely via video without visiting a branch.

And existing business customers can use the video bank to change data, change account packages, open sub-accounts, apply for a card acceptance terminal, or to request a netbank password.

Business cards issued by large and medium-sized domestic banks can typically be added to a mobile wallet for contactless payments, such as Apple Pay, Google Pay, or a wallet issued by the bank.

Some mobile wallets (e.g. Apple Pay, Google Pay) also act as digital wallets, so businesses can use digital wallets without having to enter their card details in online shops that accept wallet(s).

There is still no example of 100% online administration of loans for sole traders, micro and small businesses, especially for new clients, but promising digital initiatives are already present in Hungary.

A few banks already have access to a credit calculator to help businesses assess in advance the amount of the loan they may be eligible to receive.

In this area, the launch of Gránit Bank’s NHP Hajrá online loan application was a dimensional change, which has been an exemplary solution ever since.

NHP Hajrá with online application (2020)

Gránit Bank wanted to provide a game-changing solution with its innovation for the SME sector.

The bank was the first in Hungary to offer the NHP Hajrá loan with instant online pre-screening, data entry, digital document upload, and fast online application.

In recent years, a number of outstanding banking initiatives appeared that typically provide billing and financial management in an integrated way for sole traders, micro- and small businesses, helping them reduce administrative burdens related to finances.

Businesses can manage online billing, review their expenditure and income and keep track of the settlement of their invoices issued on a single interface.

There are banks that offer innovative new payment solutions beyond the traditional POS terminal-based card acceptance, even specifically tailored to the needs of smaller businesses.

Card acceptance no longer requires a POS terminal since a mobile phone can be converted into a card acceptance terminal - a solution that is becoming more and more available at domestic banks.

And in addition to card acceptance, new payment solutions based on the instant payment system (e.g. payment request) offer a competitive way for businesses to replace cash transactions.

FairPay by Gránit Bank (2022)

Payment requests based on instant transfer for traders, universities, and private individuals.

When Gránit Bank was founded in 2010, its "born digital” business model was based on digital channels. Year after year, it has been a market leader with innovative financial solutions that offer its clients outstanding UX and convenience - even from home, without queuing in a branchto manage their everyday finances.

In 2012, the bank was the first in Hungary to introduce administration of matters via video bank and then, a few years later, the possibility of opening a bank account through video chat.

Gránit Bank was also the first in Europe to make mobile Android payments available, developed in partnership with Mastercard, and it was the first commercial bank worldwide to integrate an Eco Calculator in its mobile bank app for presenting the ecological footprint of card purchases.

The past 10 years were full of exciting technological innovations in the banking sector, which this publication summarizes and presents to the reader, together with the digital innovations of Gránit Bank.

Gránit Bank: The flagship of digital banking innovations

banking innovations of Gránit Bank

banking innovations

locking and unlocking bank card in Gránit eBank (Gránit Card Lock)

Gránit Pay

client identification and contracting via video bank

market environment

mobile wallet with banking background

Android-based contactless mobile payment

installment payment option on POS

Decree No. 19/2017 of the National Bank of Hungary tokenization

Apple Pay Android Pay

“My Finances” expense tracking (PFM)

Apple Pay

Payment request and payment with QR code

Google Pay

Gránit FairPay

buying and selling government securities via video bank

2018

online account opening

2019

NHP HAJRÁ online application

instant virtual card issue opening a fullscale account with selfie

loan administration through personal digital client account

2020

2021

Eco Calculator Gránit Family App

digital mortgage loan with online pre-screening

100% online Childbirth Incentive Loan

2022

micro savings

“selfie” account full-scale “selfie” account online loan

financial planner

Apple Pay

open banking (PSD2)

Decree No. 45/2018 of the National Bank of Hungary

Decree No. 34/2019 of the National Bank of Hungary

AFR Google Pay

machine learning artificial intelligence

Google Pay

Garmin Pay

Xiaomi Pay account-based payment solutions new type of card payment multibanking chatbot

virtual assistant

customized discounts

Decree No. 26/2020 of the National Bank of Hungary

NLP voicebot

DYNAMIC GROWTH FOR 13 YEARS ALREADY

STABLE PROFIT

Profit before taxes in 2022:

DYNAMIC GROWTH EFFICIENT OPERATION

Balance sheet total on 31.12.2022:

Composition of the portfolio

13,0 billion HUF 9 years

Continuously profitable operation for

1020 billion HUF two-digit

99,98% share of high quality clients

Growth

The share of costs of operation in the balance sheet total

1,02%*

*Without bank tax and extra-profit tax

Gránit Bank has excellent liquidity and credit quality, as well as a high Capital Adequacy Ratio.

The share of costs of operation in the balance sheet total (%)

Gránit Bank’s cost of operation / balance sheet total indicator is significantly lower than the bank sector average.

2,01%*

in over 1,02%*

12,5 years 30 years of operation

of operation

Gránit Bank Credit institution system

*Without bank tax and extra-profit tax

Issued by: Gránit Bank

Publisher in charge: FinTech Group Kft.

Senior editor: Gábor Lemák

Professional proofreader: Szilvia Egri

The publication was produced the participation of:

László Hankiss, Deputy CEO

Andrea Csicsáky, General Manager

Emília Papp, Head of Communication and PR Department

Contact:

Emília Papp

Head of Communication and PR

Email: papp.emilia@granitbank.hu

Web: granitbank.hu

2023 Gránit Bank. All rights reserved!

This publication is to be read as a whole.

The illustrations used in this publication are used under licence from Adobe Systems Software Ltd. pursuant to the terms of a license agreement between FinTech Group Ltd. and Adobe Systems Software Ireland Ltd.

The illustrations, photos and logos used in this publication are protected by copyright. Use of illustrations, photos and logos is prohibited. The use of the content in whole or in part is subject to the prior written consent of Gránit Bank.