The European Union, G7 and the United States are in no mood of sparing Russia for its Ukraine campaign and they are introducing one sanction after another to punish the country economically.

Moscow’s response to these economic sanctions has been a devastating one, depriving Europe of its shares of energy supply, while focusing more on the Asian market.

Data shows Moscow earning some USD 158 billion through its coal, oil and natural gas sales from February to August this year and more than half of that revenue came from Europe alone, which is still pitching for a price cap on the energy sales.

The Nord Stream pipelines connecting Russia with Europe have also seen sabotage attacks, along with 'maintenance issues'. EU countries are now scrambling for alternative sources of energy, while their domestic population stares at a greater crisis as the harsh winter nears.

Despite a rise in Russia’s overall revenue flow from the energy trade, the total export volume in this sector has dropped by some 18% due to trade sanctions. While the European Union has cut its imports from Moscow by 35% in the last few months, they have also banned Russian coal within their jurisdiction. The nuclear energy supply from Moscow remains out of this sanctions’ ambit.

The standoff between the United States and OPEC+ on the move to cut daily oil production by two million barrels and the subsequent energy price rise is also complicating the matter further.

Under these circumstances, we at GBO have done our cover story on the magnitude of the ongoing crisis and how it is adversely affecting not only Europe but the global economy as well.

Thomas Kranjec Editor kimberly@gbomag.com

Director & Publisher

Krushikesh Raju

Editor

Thomas Kranjec

Production & Design

Brian Williams

David Brenton Ian Hutchinson Shankara Prasad

Editorial

Stanley Rogers, Ashley Samberg Rachel Taylor, Lucas Cooper

Peter D’Souza Stella Thomas Sneha Shet Ryan Anderson Sumith MK

Benjamin Clive, Avinash Nair, Mike Lloyd

Danish Ali

Richard Sam, Sophia

Taylor

(0)

The US seems to have played a major role in the price cap on Russian oil

A price cap on Russian oil has been proposed by the world’s seven-largest industrialized economies in an effort to further limit the Kremlin's capacity to finance its onslaught in Ukraine and to safeguard consumers amid rising energy costs.

The G-7's efforts to set a price cap on Russian oil are not without its challenges, however, as energy pundits have serious doubts about the validity of the idea.

The Kremlin, for its part, has cautioned that any attempt to put a price restriction on Russian oil will cause more negative impacts than positive ones.

The US seems to have played a major role in the price cap on Russian oil. When explaining the concept to her European counterparts in May, US Treasury Secretary Janet Yellen asserted that it would act as a tariff or cap on Russian oil and benefit Europe while waiting for a complete ban to be imposed.

Later in the same month, the EU decided to impose a gradual embargo on Russian oil till 2022 end. This was only possible after several weeks of hard negotiations among the 27 nations.

One of the most significant customers for the Russian government, the bloc used to import around 25% of its oil needs from that country. This move of stopping oil purchases is an attempt to harm Russia’s economy, for its unprovoked invasion of Ukraine. But here's the catch: some European Union countries are heavily dependent on Russian fossil fuels.

US President Joe Biden presented the idea of an oil price cap to

the rest of the G-7 leaders over the weekend of June 25 and 26 and his counterparts agreed to look at how to do it. The G-7 comprises the US, Canada, France, Germany, Italy, the UK and Japan.

Over the weekend of June 25 and 26, US President Joe Biden brought up the idea of an oil price cap to the other G-7 leaders, and they all agreed to look into how to execute it. The United States, Canada, France, Germany, Italy, the United Kingdom, and Japan make up the G-7.

Olaf Scholz, the chancellor of Germany, said the plan required "a lot of work" to materialise since it was an ambitious one.

In an email to CNBC, a spokesperson for the European Commission, the executive arm of the EU, said, “We share the G7 countries’ concerns about the burden of energy price increases and market instability, and how these aggravate inequalities nationally and internationally.”

"In this context, as tasked by the European Leaders, the Commission will continue our work on ways to curb rising energy prices, including assessing the feasibility

of introducing temporary import price caps where appropriate," the spokesperson added. He further stated that the discussions are considered “a matter of urgency.”

Energy analysts have questioned exactly how the G-7 can impose a price ceiling for Russian oil, warning that the plan could backfire if key consumers are not involved, and time may be running out to make it workable.

Neil Atkinson, an independent oil analyst, said, “I'm one of those scratching my head." “Something like this could only work if you get all of the key producers and crucially all of the key consumers working together and then finding some way of enforcing whatever plan you come up with. And the reality is that the biggest consumers of Russian oil, or amongst the biggest consumers of Russian oil, are China and India,” he added.

Discounted Russian crude has benefitted China and India, according to Atkinson. When compared to the global benchmark Brent crude futures price of $110 per barrel,

Russian oil has been selling at a significant discount of $30 or more, and China and India have been purchasing it.

Atkinson also emphasised a lack of consensus about Russia's invasion of Ukraine given that China and India have not denounced the Kremlin directly.

Atkinson said, "In any event, the Russians won’t just sit there and do nothing. They can play games with supplies of oil and indeed gas...they can mess with the G-7′s head in some respect so I think this plan is really a non-starter."

In an interview with CNBC, Energy Aspects co-founder and director of research Amrita Sen said, "For me, honestly the mechanism doesn’t work. They haven’t thought it through, they haven’t spoken to India and China...Do we really think they are going to agree to this? And do we really think that Russia will actually accept this and not retaliate? I think this sounds like a very, very good theoretical concept but it is just not going to work in practice."

Amrita pointed out that the countries

around the globe are on the same wavelength with Western policymakers, especially when it comes to energy security, which is "the biggest misconception right now.” "I think that really needs to go away," she added.

Energy research firm Rystad's senior vice president Claudio Galimberti stated that insurance is the most direct means to impose a price cap on Russian oil.

Claudio said, "The International Group of Protection & Indemnity Clubs in London covers around 95% of the global oil shipping fleet. Western countries could try to impose a price cap by letting buyers keep that insurance, as long as they agree to pay no more than a certain price cap for the Russian oil on board. However, there are many obstacles that could derail such a plan."

The fact that Russia might decide not to sell at the prices set by the cap, especially if the benchmark is excessively low and near to the cost of production, was one of the most evident examples, according to Galimberti.

Russian President Vladimir Putin has previously demonstrated his willingness to stop supplying so-called "unfriendly countries" with natural gas if they don't agree to his gas-for-ruble payment conditions.

Galimberti said that China is the “next most likely obstacle." He felt that since Beijing may decide for geopolitical reasons “to lend support to Russia by accepting inferior Russian insurance and therefore facilitate a loophole for the price cap.”

“Still, a price cap is surely a measure worth considering at this stage, albeit time is running out, as the EU is determined to ban imports of Russian oil by the end of the year,” Galimberti affirmed.

Even prominent personalities from the oil industry themselves have questioned the idea.

During an interaction with the press in Singapore last week, Shell CEO Ben van

Beurden, said, "I am not entirely sure how that would work or who gets punished most, insurance companies or somebody else. I am not saying that it definitely can’t work, it’s premature to draw conclusions like this. They can definitely look at it if only we know what to comply with if that would come into effect, it’s not as easy or as trivial as it sounds.”

Russia has cautioned that any effort to control the price of Russian oil might sabotage the energy system and drive up commodity prices.

The effort by Western leaders to explore setting a price ceiling was characterised by Russian Deputy Prime Minister Alexander Novak as "another attempt to intrude into the market mechanisms which may only lead to market's disequilibrium...which would lead to [a] price increase."

Alexander was sure that Russia would restart oil production at pre-sanction levels in the coming months because a substantial percentage of Russian crude had been transferred to Asian markets.

Germany Economy Minister Robert Habeck has asked the utility firms to increase the gas prices for the customers, which in turn will help in lowering the demand for natural gas.

This development comes after the head of the International Energy Agency warned Europe that Russia is planning to cut off gas exports to the region starting this winter.

The governments have been asked to work on reducing the demand for fuels and keeping the nuclear power plants open.

Fatih Birol, the Executive Director of the International Energy Agency has mentioned that there will be a reduction in supplies in the coming weeks as Gazprom announced that they will be cutting the

deliveries via the pipeline by around 40%, stating the reason behind this as “maintenance work”.

This in turn could be the beginning of a huge shortage by preventing the filing of the storage facilities in order to prepare for the upcoming winter season.

Commenting on this, Robert Habeck has stated that the Russian energy plant Gazprom’s decision to cut supplies of natural gas to the European countries was a “political” move.

When asked if gas rationing would be needed, Habeck said, “Hopefully never” but added, “Of course, I cannot rule it out.”

With this news, the EU countries are rushing to refill the storage sites. Germany plans to reach 90% of its capacity by November.

In response to their decision to put sanctions on the Kremlin over its invasion of Ukraine, numerous EU members have seen Moscow limit or even stop their gas deliveries in recent weeks.

G7 bans Russian gold Meanwhile, in a series of latest repercussions against Russia, US President Joe Biden announced that the US and other Group of Seven (G7) leading nations (France, Italy, Canada, Germany, US, UK, Japan) will ban imports. To prevent the impact of Russia’s invasion of Ukraine from fracturing the international coalition, Biden and his counterparts will meet supplies and combat the inflation of gold from Russia. The principal new economic restriction against Russia that emerged from the summit appears to be the prohibition on gold imports, which may result in a fine of tens of billions of dollars.

Nigeria was to elevate the failing economy and to take strong actions against corruption

GBO CorrespondentOil has been more of a curse than a blessing in Nigeria. In a textbook example of what scholars refer to as the "resource curse," the West African country has failed to reach its full potential due to weak government institutions and inadequate management of the huge income.

The term, which was first coined in 1994 by Prof. Richard Auty, describes a country's incapacity to exploit its unexpected wealth to better the lives of its people and support its economy. Contrary to popular belief, countries with abundant natural resources experience a greater level of poverty and corruption than they do positive economic development, and they paradoxically experience much slower growth and development than countries without such resources.

These countries, which rely heavily on the

export of their natural resources, generally have slower growth rates, lower levels of human development, and higher levels of inequality and poverty. They have also been discovered to have worse institutions and more conflict than economies with limited or very less resources.

It results from the distinct phenomenon of oil exploitation rather than possession and is primarily caused by weak institutions and poor political governance. Multinational corporations, national and foreign governments, foreign financiers and investors, as well as the structures of states and private actors in oil exporting countries, all influence this phenomenon.

Resource wealth can have catastrophic effects. Livelihoods and economies in oilexporting countries like Nigeria, Venezuela,

is the main indicator of the resource curse. Worldwide, an estimated $2 trillion is stolen annually in the form of corruption. With this much money, the world's infrastructure gap could be closed, malaria could be cured, and children across the world could be provided education.

Corruption is "an abuse of entrusted power for personal or private gain," according to Transparency International. In 1996, James D. Wolfensohn, the World Bank President at the time, referred to corruption as cancer and urged all nations to work toward transparency and accountability to combat its eroding impacts on society. He listed the effects as shifting resources from the poor to the wealthy, increasing business costs, deterring foreign direct investment (FDI), decreasing public spending, misusing aid, and undermining equitable national development.

The integrity of individuals and institutions is damaged as a result of corruption. Combining social, political, and economic dynamics, it weakens democratic institutions, disempowers sovereign states, and adds to the instability that is stoked by public mistrust and resentment. It undermines democracy by devaluing the voting system, subverting the rule of law, and erecting new bureaucratic hindrances whose sole purpose is to demand bribes.

Self-interest, fear, greed, and the thirst for power are just a few of the many reasons for corruption, but the effects always remain the same, damaging, and long-lasting.

Any country's ability to handle an infusion of petro-dollars is a tough issue.

counties struggle to handle the surplus cash in a responsible manner. They frequently launch huge, expensive projects without doing thorough due diligence or feasibility studies, putting wise investments at risk. Priority is given to spending on initiatives with lower priorities. They spend lavishly while accelerating ongoing projects.

Then, in response to rising inflation brought on by productivity that is unsurpassed, they scramble to

the liquidity and loosen up on financial propriety and discipline. The interaction of these variables causes the currency to appreciate, hastening the economy's downfall and making non-oil sectors less competitive as exchange rates shoot up. The non-oil industries in the Netherlands were on the verge of extinction as a result of this particular phenomenon, also referred to as the "Dutch illness."

According to studies, an imbalance develops after an oil boom since the nonoil industries are left underdeveloped. The growing oil sector siphons out labour and capital from vital but less lucrative industries like agriculture, leaving them depleted as demand for those resources rises.

As a result of the windfall's associated abundance, which resulted in enormous revenues, greater incomes, and superior returns on investments, administrations find themselves in the uncharted ground. Higher incentives for corruption are created when public finances are managed in an incompetent and inexperienced way.

Newfound wealth raises expectations among the masses, which increases demands for resources from both state institutions and civil society. The unemployed, unions and the middle class all call for the creation of more employment while also demanding higher salaries for the same jobs. As bureaucracies grow, they quickly lose their effectiveness or competence, which adds to the growth of foreign debt and trade deficits.

A "rentier state" or economic trap evolves. The majority or the whole of the state's total revenue comes from the rents paid by foreign individuals, businesses, or governments. This causes the non-oil industries to contract, inflation to skyrocket, imports to rise in both quantity and price, and more money to be spent on political vanity projects, subsidies, and welfare programmes to offset rising living expenses and the depletion of foreign exchange.

Other countries have overcome the resource curse and led their economies to success through clever management and

tenacity. Most Nigerian people believe that the country has so far failed. But only time will tell if it is destined to fall into failure.

One of the major promises of Nigerian President Muhammadu Buhari during his 2015 election campaign was to elevate the failing economy and to take strong actions against corruption.

His presidential campaign had substantial support from the electorate of the country, who were looking for a breakthrough in the struggle against immense corruption. In the lead-up to the elections, even the media extolled his integrity.

Interacting with DW, Nigeria's Olabisi Onabanjo University economy professor Sheriffdeen Tella said, "One of the major plans on which the present government... came on board, was to tackle corruption. But it has not been able to do so. In fact, the level of corruption has increased so much that people have lost hope in his ability to do this. And corruption has actually fought back. It has not only affected the education sector, it also affected the health sector and all other sectors of the economy."

Many Nigerians lamented how their lives have gotten worse since Buhari took office and cast doubt on his commitment to wage a war against corruption.

Lanre Arogundade, former president of the National Association of Nigerian Students, argued that the concerns raised by people were valid.

He said, "Nobody can blame Nigerians if at this stage they are doubting the anti-graft war or its effectiveness. And the reason for this cannot be far-fetched. One can give the striking example of the allegation against the accountant general of the federation that he single-handedly stole about 80 billion naira [around €180 million]."

A financial study showed that 365 million naira would be spent in a year if 1 million naira were spent every day. Thus, it would take ten years to spend all 80 billion naira,

or around 3.6 billion, and 36 trillion naira to spend over 100 years.

In Nigeria, corruption is unquestionably not a recent phenomenon. It has long been a fundamental part of Nigerian society, permeating almost every aspect of the West African nation.

Nigeria placed 154th out of 180 nations on the Corruption Index published by Transparency International in 2021.

Anecdotal evidence suggests that corruption is socially and culturally acceptable since it benefits members of the family, tribe, or ethnic group.

When ex-Nigerian President Goodluck Jonathan stepped down from office, the country was on the verge of collapse as a result of rampant corruption.

The most populated country in West Africa, Nigeria, is reportedly getting deeper into corruption muck seven years after a historic shift of power justified by the need to eradicate corruption in Nigeria.

Through the anti-graft agency, EFCC, Buhari has arrested, detained, and even prosecuted some public office holders in order to highlight the significance of anticorruption for socio-economic growth, which is being raised globally. The most recent arrest was the nation's accountant-general for the staggeringly massive fraud he's been committing for years.

However, many Nigerians argue that the battle against corruption should go beyond investigations, arrests, and convictions and instead focus on prevention, something the Buhari regime lacks.

"What we have not seen under this government is the prevention of corruption such that it keeps happening again, and again, and again," Arogundade concluded. The fraud committed during the past eight years will be made public after the current Buhari administration leaves office because law enforcement and anticorruption organizations are currently hesitant to do so.

"One of the major plans on which the present government... came on board, was to tackle corruption. But it has not been able to do so. In fact, the level of corruption has increased so much that people have lost hope in his ability to do this"

— Sheriffdeen Tella

In the first quarter of 2022, Uber drivers earned on average £29.72 per hour

GBO Correspondent

InJune, during the middle of the nationwide rail strike, the demand for cabs skyrocketed in the UK. But instead of taking advantage of it, a group of Uber drivers choose that they would also strike for 24 hours. Hundreds of Uber cab drivers marched towards the company's London office in Aldgate Tower in protest, whining about the poor pay and the arbitrary management by the algorithm.

It was just another regular day for Uber driver Abdurzak Hadi. The 44-year-old father of three landed in England in 1992 as a refugee, having fled Somalia’s vicious civil war. When he grew up, he became a minicab driver. And after a few years in 2014, he signed up with Uber.

Hadi dropped off his youngest son at school on the day of the strike before leaving his home in north London on his bicycle

drivers were self-employed contractors, as it has claimed across the globe. The Supreme Court ultimately ruled in favour of the UK drivers in 2021, giving them triumph in their legal battle. To secure their rights, they had to fight against Uber's constant appeals for those six long years.

Hadi was awe-struck during the entire course of the process. He thought, “Wow, how am I one of the guys sitting here in this court – an average person from Somalia, from a deprived background, coming to London, talking to other immigrant drivers, being able to take a huge corporation to court. It was unbelievable. I felt I was part of history.”

Hadi felt good being an Uber driver. He distinctly recalls the excitement he felt at the promised revolution in the cab industry when Uber launched in London. The US startup boasted about empowering

entrepreneurs and gave the impression that their algorithm would miraculously match supply and demand, resulting in the creation of well-paying jobs.

Uber was giving drivers huge financial bonuses and giving customers who brought friends on board £50 in credit. In order to undercut fellow competitors, get drivers onto the platform, and control the cab market, it was using billions of dollars in investor money to pay for these subsidies.

Hadi said, “It was honey at that point, yeah honey."

But prices were quickly slashed. Uber's invasion of the cab market raised the waiting time as well. The commission charged to drivers was increased from 20% to 25%.

Currently, Hadi claims that it takes him 14 hours to make what he used to make in only five hours during his initial days. He

also asserts that, despite Uber's opaque and changeable price, he believes its commission can occasionally reach even 35 percent or higher.

By 2015, Hadi realized that his family was eligible for tax credits, which are welfare payments for those who are working for low pay because prices had fallen. “So Uber is in effect heavily subsidised by you, the taxpayer.”

Hadi recalls the dawning of truth at the time when he experienced his first faceoff with violence. He saw five inebriated males waiting to get into his car despite having accepted a booking on the app for just four passengers. Since he did not have a licence or insurance for more than four, he declined them. One of them lost his cool and slammed his car door. No friendly controller was available to call. The only way to report was through a message on the app, and he claims he got what seemed to be a cut-and-paste response.

Despite the bad experience, he stayed with Uber because he believed it would provide him the freedom to choose his place of employment. Hadi worked for Uber near Great Ormond Street Hospital while his son Mohamed underwent leukemia treatment. He would accept rides for a few hours at a time before taking over from his wife at Mohamed's bedside and then returning to work to make more money. However, the flexibility was not as perfect as he had planned; he frequently found himself sent to far-off locations from where he needed to travel in order to return.

In spite of all the efforts Hadi took to save him, his son passed away in 2019. The treatment was often a very painful one and Hadi to this day is haunted by a sense of guilt.

“Was it worth it to put him through it all? You don’t expect to bury your son, you expect the son to bury you. It’s the worst thing that could happen to any parent," an emotional Hadi said.

He still bypasses Uber trips that take him near the hospital.

According to Uber, it now provides

insurance for drivers in emergency situations. Hadi, however, did not think it was necessary to inform Uber about the family's situation back then.

“There was no human interaction, no one to understand what misery you are going through. It’s a system, and so only the system will get back to you. It’s a system designed to manipulate drivers and squeeze them as much as possible," he said.

What Are The Earth-Shattering Uber Files?

Mark MacGann, the 52-year-old career lobbyist, who worked for Uber from 2014 to 2016, has admitted that he was the whistleblower of the 124,000 corporate data known as The Uber Files that were given to The Guardian.

The stock of internal emails, texts, and documents of 182 gigabytes was obtained by The Guardian and shared with the International Consortium of Investigative Journalists (ICIJ) and its media partners around the world.

It demonstrates how the ride-hailing start-up transformed into a global giant by utilizing technology, skirting legal requirements, and engaging in aggressive lobbying with governments during the period of its drastic expansion.

The files contain 124,000 records from the period 2013-2017 — which contains around 83,000 internal company emails, memos, presentations, and WhatsApp messages.

Many of those millions of drivers are likely already aware of Uber's erratic pay structure. When entering new markets, it significantly subsidised drivers to draw in a pool of vehicles big enough to provide customers with immediate service and undercut taxis. The leak shows that Uber sought to reduce what it paid drivers as quickly as it could because these subsidies required spending billions of dollars from investors.

Uber aggressively subsidised rides in each city as it launched, and it planned the price cuts that drivers like Hadi experienced

Uber spent a lot of money trying to "buy revenue," as the presentation put it. A senior management spoke about "burning the burn," or reducing subsidies, at the same meeting

as a devastating loss of income. This was revealed in one presentation to dozens of Uber managers gathered for a summit in the company's Amsterdam headquarters in January 2015.

Uber spent a lot of money trying to "buy revenue," as the presentation put it. A senior management spoke about "burning the burn," or reducing subsidies, at the same meeting.

One of the slides read, “Young city: you are still subsidising your market. Get a real feel for the net fare/hour at which supply scales. Make sure drivers don’t end up making more than they need to stick around."

In Paris, where Uber had been functioning for a while, the subsidy had been eliminated, and the business was now only offering incentives of $0.10 per hour while generating $23.40 in income every hour. Already, there was a push on the drivers. In Cape Town, original Uber subsidies of $4 per hour were reduced to almost nothing.

66-year-old Derick Ongansie can still clearly recall how those cuts affected him. After taking a vacation from work due to cancer in 2014, he invested in three vehicles to start a business as an Uber driver in Cape Town. Uber's sales pitches about how much money might be made lured him in. He claimed that the first year was extremely successful and that he could earn up to $290 per day.

But after a year, Uber began to reduce some of the perks it was giving before launching a new service that had a much lower fare.

He said, “That’s when we all started crashing. Uber was taking us for a ride."

According to him, he made around one-third as much money driving for Uber in his third year as opposed to his first. He calculated his salary typically amounts to less than $1 an hour after expenses including fuel, insurance, phone, and car upkeep. In

fact, this was the same as what the other drivers were facing across the world.

Responding to the charges, Uber stated that the amount spent on initial subsidies and the unavoidable cuts were all part of its business model for expansion.

Uber’s head of public affairs Jill Hazelbaker said, "Our interests are aligned with drivers, ensuring they have a positive experience of earning on the platform. Otherwise, drivers would go elsewhere."

The Uber files revealed that whenever the drivers fought back, Uber made changes to the algorithm to suit its purpose.

In October 2014 in Italy, when Uber had cut prices and driver payments, a manager reported an "attempted strike/mutiny, with extremely low supply, around 50 drivers teaming up to be offline. This led us to apply extraordinarily high incentives this past week, which worked better than expected: 300-400 supply hours more than forecast."

He claimed that the cost had “a burn rate of 38%”.

The foundation of Uber's business model is the use of dynamic pricing to influence employees' decisions on when, where, and how long they work, as well as how many drivers are in any given area. When it first began, it insisted that all of its drivers be independent contractors, offloading the expenses and risk of running a transportation business onto them. Instead of calling itself a service provider, it referred to itself as a tech business. However, the UK Supreme Court determined that in reality, it had extensive control over the drivers, who were also its employees.

Some drivers today feel trapped rather than just in control as a result of rising fuel costs and pricing that does not reflect those increases. Many people borrowed money to buy cars that were customized to Uber's needs on the promise of large gains, only to discover when prices fell, they had to work extremely long hours to pay off their debts before they could start earning a living.

The victory in the supreme court by

Hadi and other taxi drivers was a landmark win for workers in the gig economy. After that, some GMB driver members reached agreements, and Uber claims that it now has a more collaborative strategy involving collaboration with unions. In May 2021, Uber and the GMB union agreed to a collective agreement, and as a result, Uber now pays holiday pay, pension contributions, and the hourly minimum wage. It claims that last quarter's commission in London was in line with the 23 percent global average.

“With demand up following the pandemic, UK Uber drivers are earning more than ever – in the first quarter of 2022, they earned on average £29.72 per hour, including holiday pay, when actively engaged on the app. The combination of higher earnings, new protections such as holiday pay and trade union recognition in the UK has led to more than 10,000 new drivers signing up with Uber in recent months.”

The amount of £29.72 is the total after Uber's commission fee is subtracted, but before drivers' expenses for car rental, insurance, and fuel. When determining whether a driver has earned less than the minimum wage per hour, Uber enables drivers to charge 45p per mile, the amount established by HMRC more than a decade ago.

Speaking about the concessions, GMB's national officer for transportation, Mick Rix, said he now intended to negotiate higher charges for drivers to reflect actual fuel costs and more support from Uber for drivers who experience unjust ratings or harassment from customers.

He said, "It’s going well; we’ve had lots of dialogue with senior management."

But for the ADCU, the fight is far from over because Uber won't consider the time that drivers must wait when determining how much they must be paid.

The ADCU contends that for Uber to live up to its promise of being "everyone's private driver," it needs to have plenty of cars available as soon as a user opens the app. For drivers, waiting times frequently make up

35-45% of their time logged on. The two key demands of the June strikes were payment for waiting for time and access to their data.

Hadi only uses the Uber app, but according to the firm, many drivers in the UK can use other apps while they are linked up with Uber as well, so there is no reason to pay to wait time when they might be multi-apping.

The uprising has gone global. In a number of recent court decisions, drivers in Spain, Switzerland, the Netherlands, and France have gained rights as Uber employees. In South Africa, Ongansie was one of seven drivers who sued Uber for violating their rights as employees and assisted in organising demonstrations. They prevailed, but Uber overturned the decision on appeal due to a technicality: because they were employed by Uber HQ in the Netherlands, the company correctly argued that bringing their claim there would require them to travel more than 8,000 kilometers.

Where employees have acquired rights, Uber has pushed back. The firm contributed to a group of gig economy companies that paid $220 million to have a California court's ruling that drivers were employees overturned.

Hadi currently spends six days a week working somewhere between 40 to 50 hours on the Uber app in London. Given the cost of fuel, he estimates that, after operational expenses are deducted, his hourly salary on Uber is around £8, which is considerably less than the £9.50 legal minimum wage in the UK. He claims that after fees and waiting time, he only receives roughly around $5–$6 per hour. When presented with these numbers, Uber remained silent.

“The honey is gone, now it’s vinegar,” Hadi said.

Despite all these drawbacks, when questioned why he still continues to work with Uber, Hadi said, "I love driving and meeting and talking to lots of people. And I can’t go elsewhere because they control so much of the London market, there’s not enough work left elsewhere.”

The ADCU contends that for Uber to live up to its promise of being "everyone's private driver," it needs to have plenty of cars available as soon as a user opens the app. For drivers, waiting times frequently make up 35-45% of their time logged on. The two key demands of the June strikes were payment for waiting for time and access to their dataFeature \ Uber Cabs

AfterRussia launched its military offensive against Ukraine in February 2022, the United States and Europe came up with sanctions to discipline Moscow. In May, the European Union (EU) went for a partial ban on Russian oil imports, except those obtained through pipelines via Hungary, Slovakia, and the Czech Republic until 2022 end. As a result, crude oil prices shot up. Along with Hungary, Italy protested against the move, as its Sicily refinery gets the raw materials from Russia. Now, the EU is planning to escalate the situation by capping the Russian energy supply. Moscow, in response, has diverted its energy exports to Asian countries such as China and India at discounted rates, while reducing the natural gas deliveries to Germany and other EU nations through the strategic Nord Stream 1 pipeline.

Once the proposed EU oil sanctions come into effect in December, it will ban European tankers and insurance mechanisms from helping Russia to ship oil to other markets (mostly Asia). It will be backed up by another price cap from the US. As per the measures announced by the Joe Biden government, tankers carrying Russian oil post-December can retain their IG insurance (Spill liability insurance provided by a consortium named International Group or 'IG'), in return for selling the product with discounts. This will ensure an uninterrupted oil supply while Moscow continues to face repercussions for its Ukraine invasion.

The effects have been adverse, especially in Europe. EU restrictions and countersanctions from Russia have sent energy prices soaring, resulting in upshooting of agricultural costs and food prices. The ongoing energy crisis has also resulted in increasing coal usage globally. Taking the EU as a case study, its coal usage rate increased by 14% in 2021 and will reach 21% by 2022end. Many countries in the region will likely go for coal as the substitute for natural gas as winter nears. Global coal consumption is expected to rise by 0.7% this year which amounts to 8 billion tonnes in total, thereby putting the plans of transitioning to greener, sustainable energy sources on the back burner.

Germany, Europe's largest economy is showing signs of recession, with its IFO survey of business confidence maintaining a downward spiral amid unprecedented inflation. The index dropped to 84.3 percentage points in September from 88.5 percentage points in August which is the lowest since the 2008 global financial crisis. Sectors such as bakeries, which need uninterrupted energy supplies, are facing a bleak future. German Chancellor Olaf Scholz visited Saudi Arabia, UAE and Qatar and signed energy deals as a compensatory measure.

The United Kingdom has already entered a recession, thanks to the energy crisis and a falling pound. The Bank of England (BoE) has already raised the key base rates by 0.5 percentage points to 2.25% and more such hikes are expected in coming months. Media reports have dubbed the ongoing crisis as the worst one post 1980s, with the country heading for a second consecutive quarter of falling output. Its GDP has already slumped by 0.1%, and BoE has predicted another 0.1% decline in the upcoming third quarter.

While the government has introduced a new mini-budget with salient features such as a cut in household taxes and energy bills, the most vulnerable of the British society are expected to face soaring energy bills in the coming winter, with food prices going up as well. In August, natural gas prices reached the mark of $3100 per 1000 cubic meters. If it continues at this rate, European power stations will be staring at a shutdown-kind of the situation ahead of the winter. The average electricity bills have increased by 300% this year, shattering the records of the past five years.

The EU governance has its own share of contributions to the problem. For example, despite the announcement from the Liz Truss government regarding the energy bill, UK’s National Energy Action charity

The United Kingdom has already entered a recession, thanks to the energy crisis and a falling pound. The Bank of England (BoE) has already raised the key base rates by 0.5 percentage points to 2.25% and more such hikes are expected in coming months

projects about 8.5 million households facing energy poverty in the upcoming winter. Kosovo and some European regions are already suffering bouts of power blackouts. Russia has already threatened about gas prices hitting $5000/1000m3 by 2022 end. In Europe, the demand for oil and natural gas increases only during the winter season, as the existing room heating devices are petroleum-fuelled.

Europe's dependence on Russian-supplied energy can be summed up in the following stats: It imports 40% of its natural gas from Moscow, while for coal and oil, the figures touch 46% and 27% respectively. Russia is using this dependence against the West, as its state-owned Gazprom has restricted its gas exports through the Nord Stream pipeline, thereby forcing the EU bloc to stare at energy starvation. While some experts believe that Russian President Vladimir Putin may not order a complete halting of gas supply to the crisis-hit continent, as Russia has made over $120 billion in the last ten years through the energy trade. But, the International Monetary Fund (IMF) thinks otherwise, given Moscow's ferocious stance against the EU bloc on the Ukraine issue. Post-2021, Russia slowed

down its energy production activities in the EU region. This year, Gazprom initially demanded payment in rubles after sanctions kicked in, then cut off buyers in Finland, Denmark, Germany, Netherlands, Poland, and Bulgaria, as those companies refused to entertain the condition.

In June, it reduced gas flows below 40% through the Nord Stream 1 pipeline and blamed Siemens-made gas compressor turbines behind the move. Russia arm twisted Canada and got an exemption from sanctions so the turbines could be returned to the strategically important pipeline. Even after all these things, the pipeline was shut down for ten days for 'maintenance purposes'. On July 21, supplies resumed but in six days, news emerged about the pipeline working at about 20% of its capacity. Again, there was a shutdown between August 31 and September 2. Meanwhile, Russia's daily energy supply to China rose by more than 300%. For Ukraine, Moscow has maintained its contractual obligation, till the terms and conditions end in 2024. Talking about erstwhile Soviet states, between July to August, Gazprom reportedly stopped gas supplies to Latvia, citing a violation of gas withdrawal conditions. While the company didn't offer any proper explanation,

experts saw a connection between this and the Baltic country passing a resolution to ban Russian gas imports from January 2023. The company is now burning off Europe's share of natural gas in its facilities, with one such incident being reported in the Portovaya compressor station.

If it happens, then, as per the IMF predictions, the GDP of Hungary, Slovakia, and the Czech Republic could go down up to 6%. Global economic growth will see a 2.6% slump by the 2022 end, followed by another 2% in 2023. European countries have already gone for new renewable energy projects, including the construction of the new Liquefied Natural Gas (LNG) terminal for more imports from the US and Azerbaijan. They are even mulling new nuclear power plants. As per the experts, these initiatives will take some six to ten years to get completed. Still, the road looks long. Despite its anti-Russian stance, Europe has increased Russian diesel import by 22% since 2022 July and paid €85 billion for this, an increase of €6.6 billion since 2021. The European Commission has started implementing measures to cut short Russian gas imports by 100 bcm by the 2022 end and further aiming for a 15% reduction by March 2023.

In a research paper titled 'How higher oil prices could affect euro area potential output', backed by the European Central Bank, the increase in energy prices has been termed as a 'significant supply shock' which will affect the region's economy. It also said that the oil prices (from 2022 to 2024) in US dollars would remain around 40% higher than the 2017-19 range. The study also cited the Ukraine war and the subsequent supply chain bottleneck behind the oil price rise.

The Organization of the Petroleum Exporting Countries (OPEC) in May cut its forecast for growth in world oil demand in 2022 for a second straight month, citing the Ukraine war, inflation, and COVID. Its monthly report said that the world demand would rise by 3.36 million barrels per day (BPD) in 2022, down 310,000 BPD from its previous forecast. In the initial days of the Ukraine crisis, oil prices reached above $139 per barrel,

the highest since the year 2008. It batted for global consumption to surpass the 100 million BPD mark by 2022-end. If the forecast comes true, then this year's annual average will just exceed the 2019 price tag as well. The report also lowered 2022's economic growth forecast to 3.5% from 3.9%, giving a hint about another recession. OPEC+ (OPEC plus Russia) has also seen a dip in its oil output due to western sanctions on Russia. Its April output rose by 153,000 BPD to 28.65 million BPD, lagging behind the 254,000 BPD rise mandated under the OPEC+ deal. It cut its growth forecast for 2022's nonOPEC supply by 300,000 BPD. The forecast for Russian output has been reduced by 360,000 BPD, whereas US supply rose by 880,000 BPD. The whole chain of events suggests another 2008-09 like crisis situation for the oil and energy sector.

In 2008 June, oil prices came down from $133.88 to $39.09 in February 2009, while natural gas prices tanked from $12.69 to $4.52. While from the mid-1980s to 2003, the crude oil price was under $25, as per the New York Mercantile Exchange (NYMEX), it rose above $30 by the

The world demand would rise by 3.36 million barrels per day (BPD) in 2022, down 310,000 BPD from its previous forecast

2003 end, touched the $60 mark by 2005, and peaked at $147.30 in early months of 2008. While geopolitical tensions such as Israel-Lebanon 2006 conflicts, North Korean missile tests, row around the Iranian nuclear program, along with the falling dollar, were cited behind the rise, reports

pointed towards petroleum reserves decline and subsequent financial speculations. When the global recession arrived in 2008, energy demand shrunk and oil prices collapsed to a record low of $32. It got steady by August 2009 and remained in a broad trading range between $70 and $120 till 2014 and reached the 2003 levels by 2016. In 2018, with a record increase in oil production, the US became the leader in the field as 2018 arrived.

In the US, gasoline consumption saw a declining trend. From 0.4% in 2007, it tanked by 0.5% in 2008. The oil prices reached a record-setting high and then crashed down, all in the same year of 2008, resulting in a 1.2 Mbbl (190,000 m3)/day contraction. It was the largest annual decline since 1980 in US history. Countries such as China and India used the fuel subsidy option to protect their domestic population from higher market prices. However, Beijing removed the measure in 2008 as its governmental cost rose. In June of that year, the country hiked its retail fuel prices by as much as 18%. Most Asian countries, including Malaysia, Indonesia, Taiwan, and India followed the suit. A Reuters report on the 2008 crisis, stated that other than Japan, Hong Kong, Singapore, and South Korea, other Asian countries opted for the subsidy route. However, it also pointed out a drawback of the measure by saying that subsidies are not enough to battle the oil price hike and countries with weaker financial set-ups won't gain from this. It cited the examples of Indonesia, Taiwan, Sri Lanka, Bangladesh, India, and Malaysia either raising fuel prices in their domestic markets or working towards it.

After 2000, volatility in global prices became a new phenomenon and it emerged as one of the key factors during the 2008 crisis. An increase in oil prices as per currencies' fluctuations became a driving force in the global economy. A classic case study was the dollar. From 2002 to 2008, in the US, the oil price reached from $20.37 to nearly $100 and became expensive by 4.91 times. In the same period, the Taiwanese dollar gained value over its US counterparts and the fuel there became

costly by 4.53 times. The same price tag rose by 4.10 and 2.94 times respectively in Japan and Eurozone as Yen and Euro gained their values as well. The message was clear, 'if the dollar index rises, so will the price tag of crude oil '. The US also saw high oil prices contributing to inflation averaging 3.3% during the 2005–2006 calendar, which was way above the 2.5% mark since 1995.

For the developing and less-affluent economies, crude oil price rise witnessed a fall in GDP and employment rates, affecting the poor. For example, reports back in 2007-08 suggested that in South Africa, with a 125% hike in the crude oil price, employment and GDP rates went down by 2%. Household consumption was also reduced by 7%. The country had to reduce its gold production as well.

The larger impact was felt globally in the form of a recession and pressure on the banking system amid sliding oil prices. November and December of the year 2008 saw a falling global demand growth. Talking about the unstable crude oil price, in 2009, it fell below $35 in February, then rose back to the November 2008 mark of $55 by May. In 2011, it rebounded above the $100 per barrel mark due to the political protests and civil wars in the Middle East and North Africa, along with the Iran sanctions. Till 2014, the rate fluctuated around $100. During 2014-15, the global oil sector saw the oversupply phenomena again, as the US registered a significant increase in oil production from its 2008 levels. In 2016, OPEC Reference Basket fell to $22.48 per barrel.

The European Commission is determined to go ahead with the energy price cap on Russian supplies to the continent. The US is also pressuring the EU to get the cap in place by December 5, in an effort to choke the oceanic trade paths for Moscow. But a lack of consensus among the EU members on the price cap move, with Hungary and Cyprus expressing their reservations.

But implementing the price cap and shipping ban moves, also backed by the G7, looks difficult to implement. Greece owns the majority of the oil tankers in the region and the UK contributes to the oil trade with its insurance industry. Also, India and China haven’t joined the ‘price cap’ bandwagon either, indicating that Russia has an alternative

market still open, after the measures kick in December. The biggest sufferer of this whole economic warfare will be Europe again.

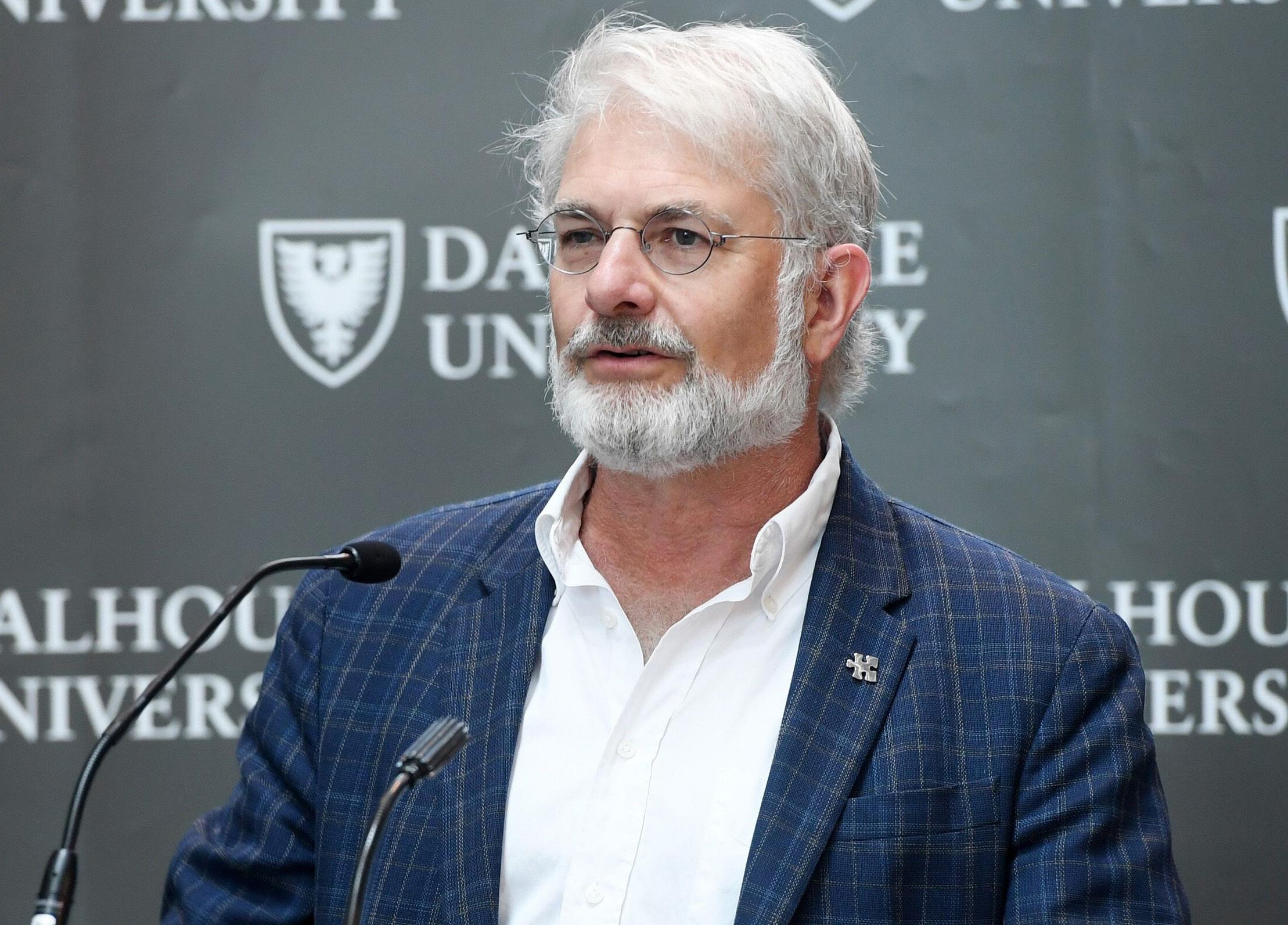

Global Business Outlook caught up with eminent geologist Grant Wach, who shared his insights about the ongoing energy crisis in Europe, soaring energy bills, the 2008 oil crisis, and much more.

Professor Grant Wach began his career advising worldwide for multinational companies in the energy sector and is now Professor of Geoscience at Dalhousie University. His research includes energy sustainability, geothermal energy, and carbon storage; his research goal is to understand the reservoir component of petroleum, CCUS and geothermal systems; part of the path to carbon neutrality, and the steps towards the energy transition/ diversification the world is now undergoing.

He is an expert advisor to the Energy Sustainability Committee of the UNECE and the team released their technology brief on CCUS. He has advised the Nova Scotia government on Carbon Storage and Sequestration. Professor Grant Wach co-led the EAGE Workshop on Geothermal in Latin America, with follow-on courses to the EAGE worldwide on Geothermal and CCS in 2022.

Having completed his D.Phil. (Geology) from the University of Oxford, he was the first recipient of the AAPG Foundation Professor of the Year Award, awarded the prestigious Darcy McGee Beacon Fellowship, and was the recipient of the CSPG Stanley Slipper Gold Medal for outstanding contributions to exploration and development, teaching, and mentorship.

GBO: Despite its huge dependence on Russian natural gas, Europe decided to cut down its supply. Europe is now scrambling for alternative sources to fill the energy void. What is your take on it?

Professor Grant Wach: A year ago, I lectured on the

The world demand would rise by 3.36 million barrels per day (BPD) in 2022, down 310,000 BPD from its previous forecast

“Energy Transition and Our Winter of Discontent”. This year it will be another winter of discontent, and even more extreme. Hopefully not with the escalation of Russia’s invasion of Ukraine. The winter of discontent will cross the borders of Eastern Europe and continue not only in Western Europe but throughout Africa and the Middle East where energy security and allied foodstuffs will continue to put pressure on the populace and likely lead to civil unrest.

We will see rising prices for energy at all levels for industry and particularly for the people of all nations in Europe and this will cause real hardships and increase costs beyond energy for example food supplies. As an example, Germany decommissioned their nuclear plants and are now scrambling to bring in coal and reactivate its thermal electric plants and are scrambling to replace the gas supplies that

were coming from Russia with alternative energy sources and LNG products from other nations including the United States. The war in Ukraine by Russia is forcing Europe to move far more rapidly to develop alternative energy sources but this does take time and there are complexities in supply. For example, Poland is part of the EEC and as such are bound by the agreements which include the reduction of CO2 emissions. Whereas Russia is not bound by limits on coal production.

When the EU announced the partial oil import ban from Russia, we saw Hungary and Italy protesting the move. Now reports are emerging on the lack of unity among European energy

Ministers on imposing a price cap on the gas supply. What do you think about these developments?

Hungary and Italy are responding to the price cap based on their understanding and projections of what will happen this winter. They want to ensure that they have energy supplies for their populations and industries. As we have seen with OPEC it's always difficult to put in place energy pricing standards. We see embargoes being circumvented and sometimes broken. I believe we will see some standardization of pricing but I do not think it will solve the issue of high energy costs for Europe. My understanding is the price gap is to help penalize Russia for the war in Ukraine but I expect there will still be some increasing markets for example Asia and India for gas resources from Russia.

Reports of commoners suffering due to the living cost crisis, and high energy bills capture the front page of news dailies. Do you believe that the EU bloc unintentionally ended up troubling its domestic population, while maintaining the ‘AntiRussia’ stance?

It was a risk the European Union took. They decided to rightly take an anti-Russian stance for the invasion of Ukraine. Yes, the ramifications are taking hold and there is a scramble to find alternative energy sources including natural gas supplies, particularly LNG. We are a long way from a hydrogen economy so it's not practical to think about hydrogen now. Wind and other renewables are not going to replace the flexibility that natural gas supplies and thermal coal generation and of course Nuclear which is promoted as carbon neutral. Of course, these large-scale plants take several years to be designed, built and commissioned. So yes there will be backlash from the people of the European Union nations.

Russia has diverted a majority of its energy supplies to the Asian markets, whereas Gazprom has cut down Europe’s share of natural gas. With the Nord Stream pipeline not even working on its 30% capacity due to ‘maintenance issues’, is Russia benefitting from the whole episode as they have backup markets to compensate for the revenue loss in the EU region?

Yes, Russia has been scrambling to develop alternative markets, particularly in Asia but remember unless gas is LNG (liquid natural gas) it is going to be difficult to transport unless there are pipelines in place. I am not sure of the LNG capacity and tanker availability in Russia, to transport to these alternative markets. Remember how long it took to put the Nordstream pipelines in place and now they will not be used. It is also very perplexing how the pipeline was damaged by subsea explosions.

If we have to draw the parallels between the oil crisis in 2008 and the one unfolding right now, how would you analyse the present energy shortage in Europe?

It is understood that the energy shortages in 2008 really came at the end of a long energy crisis with developing economies increasing demand and financial speculation that led to the crash. Also with tension in the Middle East, we saw very high oil prices but I don't think we can draw a clear parallel to what we see now in Europe with the invasion of Ukraine by Russia.

During the 2008 crisis, some Asian countries offered oil subsidies on a short-term basis to their domestic populations to protect them from the global price hike. Do you believe a crisis-ridden economy like the UK can afford a similar option this winter?

Yes, there have been talks in the UK about offering energy subsidies to the population and I see other nations in Europe also taking this approach. Of course, there needs to be some sort of help with home heating costs and some relief to businesses and industry, and we could see closures of businesses and unemployment that can lead to further unrest.

Keep in mind that there are often significant taxes associated with petrol prices. We have all seen the little stickers at the gas pumps when you fill your vehicle with petrol. This is one of the things that the government could

do very quickly, is reduce the amount of taxes that are taken at the pumps. Alberta, in Canada, took this initiative and the reduced price of the pump in Canada.

Vladimir Putin has the option of completely stopping the energy supplies to the European bloc this winter. But doing this will cost the Russian economy as the pipelines toward the West have fetched some $120 billion to Moscow since 2012. Will Russia opt for this move that might put a dent in its economy?

Vladimir Putin may wish to continue to penalize the European bloc for their support of Ukraine, and may wish to continue to interrupt energy supplies to Europe, but I believe this will increase the domestic pressure on him to resolve the Ukrainian crisis, once people see that there will be a further impact to the Russian economy, by not having these sales to Europe.

Although European countries have announced new energy projects, including nuclear plants, to cut down dependence on Russia, those look like long-term plans. What do they need to do to solve the immediate power shortage crisis?

Yes, these are long-term solutions including for example developing thermal power generation from coal, with reduced emissions of sulfur and nitrous oxide. But we have to find alternatives, and develop new alternative energy sources, as example, one thing that would work relatively quickly would be installing more geothermal energy that could be done on a smaller scale.

SedHeat is what we call it, allowing buildings to be heated and cooled by heat pumps in the ground. All that is required is a temperature differential. Geostorage is also very important to smooth out the fluctuations from renewable energy sources. Also, we need to have much more development of central heating and cooling in a large city block and building energy efficiency in our building constructions. We need to improve the electric power grid distribution, and ensure that pipeline networks can be more interchangeable between nations for the distribution of petroleum products, and eventual conversion to hydrogen. And of course more emphasis on public transport.

Russia has been scrambling to develop alternative markets, particularly in Asia but remember unless gas is LNG (liquid natural gas) it is going to be difficult to transport unless there are pipelines in place

GBO Correspondent

GBO Correspondent

A consultancy's analysts, Capital Economics, predict slight declines of 5–10% in the United States and Great Britain

The southernmost city in Canada, Windsor, was the location of Diana Mousaly's months-long property hunt. The peak of COVID-19 coincided with an increase in prices throughout the nation. Before ultimately settling on a home last September, Ms. Mousaly, a 27-year-old clerk at the neighborhood police department, inspected close to 100 properties and submitted around 60 offers, many of which were hundreds of thousands of Canadian dollars above the asking price. Her parents bought a house for half the price ten years ago. But, she sighs, "It's four times bigger than mine."

It's possible that Ms. Mousaly made a poor purchase. Canada's real estate market has been scorching hot for the past 20 years and has only gotten hotter. Things have calmed down now as prices have decreased for three straight months. In other irrational markets, the same is valid. The cost of property has fallen for three months in a row in New Zealand, where valuations at the end of 2021 were up by 45 percent since the start of the pandemic. The most considerable monthly price reduction during the global financial crisis of 2007–2009 occurred in Sweden in June when prices dropped by about 4%. Every two of five houses in Australia were worth less than three months ago.

Higher borrowing rates decrease buyer enthusiasm even in areas where values are still rising. Loan applications are down by more than a quarter from their peak in January, although monthly payments on a typical new mortgage in America are now three-quarters higher than they were three years ago. As a result, a 13-year low in first-time purchasers has been reached.

In Britain, some of the foam is also being blown away. In April, mortgage approvals returned to levels from before the outbreak. However, home sales in May decreased by 10% from last year's month.

How far will prices drop if the global real estate boom finally stalls? A consultancy's analysts, Capital Economics, predict slight declines of 5–10% in the United States and Great Britain. Due to the prevalence of fixed-rate loans in these nations, homeowners are less likely to be forced to sell due to increasing mortgage expenses. However, economists predict a 15% price decline in Australia and Sweden. Canada and New Zealand are especially exposed to rate increases because of their more significant levels of household debt; prices in these nations could decrease by 20%.

Two considerations should prevent house price

declines. One is the lack of housing in most wealthy nations. According to estimates, America will need between 3.8 million and 5.8 million new homes by 2030; England will need 345,000 new homes a year and is now creating half that amount, and Canada will need an additional 3.5 million homes by 2030 if development continues at its current rate. Tight labor markets are the other cause. People are less likely to fall behind on their payments because of the low unemployment rate in many wealthy nations. This should prevent a decline on the scale of the financial crisis in all but the shakiest markets when combined with improved household finances.

Yet we will feel the hurt differently everywhere. Hotspots for pandemics are particularly at risk. The hunt for expansive gardens or green space during lockdowns

put housing markets into a frenzy. Parisians immigrated to rural France. Istanbul's Turkish population relocated to resort areas. Londoners who wanted to take advantage of remote work migrated to green communities like Richmond and Dulwich or left the city, searching for less expensive housing.

These markets are beginning to show cracks. Fewer bidding wars are occurring in American mountain towns and sunbelt areas that draw wealthy Californians and New Yorkers. For example, three-fifths of the properties for sale in Boise, Idaho, had their price reduced in June, compared to more than half in Salt Lake City, Utah. What remains to be seen is how low prices will go.

The Royal Bank of Canada predicts that domestic sales will decline by more than 40% from their peak in 2021, which would be worse than the financial crisis's 38% decline. There might not be as much drama elsewhere. Any reduction, though, may surprise owners used to prices moving in only one direction.

A housing bubble, often known as a "real estate bubble," is when the price of housing rises quickly due to a growth in demand, a housing shortage, and emotional buying.

A sustained period of below-average interest rates is another important factor that may be to blame. More individuals can purchase thanks to lower rates, which increases demand. In addition, when investors see that house prices are rising, they also enter the market, which increases demand even more.

The phenomenon is a bubble that will unavoidably burst at some point. It often explodes when interest rates increase once more, eradicating demand. Between 2007 and 2010, this is what took place.

A housing bubble is a market circumstance when prices increase above what most people consider acceptable or sustainable. Looking at home prices with household income is one practical approach to spot this condition: The

median home price is roughly four times the median household income in a housing market that is in balance. A bubble forms when it begins to exceed five times.

When the demand for housing exceeds the supply, a bubble can also develop; in this case, housing prices must often rise quickly and unreasonably quickly. Homebuyers may feel they must overpay to enter the market as a result, while sellers may believe they can demand top money to exit. The bubble eventually bursts, causing a decline in property values.

The distinction between a true housing bubble and a simply scorching real estate market is crucial. Hot markets are regionalized and influenced by regional factors. Although hot markets frequently occur—a hot market has been prevalent over most of the United States for some years—bubbles are uncommon. The effects of a burst housing bubble, which may include falling property values and an increase in foreclosures, may spread throughout the greater economy.

What results in a housing bubble, and how can you recognize one?

A housing bubble is frequently a sign of inflating prices artificially. That condition can be caused by various variables, including a quickly rising demand and a shortage of resources to meet it. Low mortgage rates, lax credit criteria, and broad investor speculation are further potential contributing causes.

Low rates cause more people to buy, which decreases supply, which causes more people to buy, and so on. Real estate supply can take some time to adjust and add inventory; in some markets, it may not even be possible to do so promptly. The average homebuyer may be priced entirely out of the market when professional house flippers and real estate investment companies are factored in.

If a housing bubble were a balloon, all it would take to deflate it would be one puncture. Of course, many factors might cause a housing bubble to burst, but an abrupt increase in interest rates is typically to blame.

When a bubble bursts, the effects on investors, homeowners, and the economy as a whole may be disastrous. Banks and other lending institutions may be left with mortgages for homes no longer worth the amount borrowed or the price paid when property prices fall. This might lead to banks restricting credit to consumers and businesses, decreasing overall credit and dampening overall economic activity.

Additionally, homeowners may struggle if values drop significantly. Buyers run the danger of ending up "underwater" if they overpay during a bubble's inflated prices and later prices decline. When the house's value has decreased below the loan balance, a mortgage is said to be underwater; in other words, the homeowner now owes more on the mortgage than the house is worth. One of the most common effects of a housing bubble is for homeowners to be in a negative equity position, commonly known as being underwater in their homes.

Given that the housing sector is a critical economic driver, the economy is frequently severely damaged when a housing bubble bursts. As a result, a recession or, in extreme situations, even a crash could occur.

The implosion of a real estate bubble that started in the 2000s was a factor in the financial crisis of 2007–2008. Early in 2006, housing prices reached their peak. When the Fed began raising rates in 2006 and 2007, housing prices began to fall. The Case-Shiller Home Price Index announced its most significant price decline on December 30, 2008. Millions

of homes were foreclosed upon because many homeowners could not repay their debts, resulting in mortgage defaults. The Great Recession is the name given to the economic disaster that followed this bubble's deflation.

Low-interest rates on mortgages and a high number of first-time homebuyers are sometimes linked to housing bubbles. Sounds recognizable? It makes sense that many people are wondering if there will be a housing bubble in 2022.

The majority of specialists and economists concur that the market is not about to experience a bubble burst like it did in the early 2000s. There are several reasons why analysts do not predict a coming crisis, although the housing market is still quite hot. These include persistently high demand, limited inventory levels (although housing inventory is gradually increasing), and significantly stricter financing rules.

The number of foreclosures may decline due to these tougher credit conditions. However, if a recession occurs, many individuals would probably lose their jobs and be unable to pay their mortgages. Therefore, the impact of stricter borrowing rules may be minimal if this occurs.

A bubble might not be the ideal moment to shop if you're among the many individuals seeking to purchase a home. Staying put and waiting it out might be a good option if you have the luxury of doing so, and your perseverance will probably be rewarded. However, if you can't wait, complete your homework before making an offer on a house whose price might be exorbitant. A knowledgeable local real estate agent can assist you in deciding what's best for you and perhaps even help you uncover a hidden gem in a competitive market.

Bedik people say that despite the process of cultivating fonio being a laborious one it is easy and reliable

GBO CorrespondentJean-Pierre Kamara took a handful of small seeds and showered them over the freshly ploughed land near his village located in Senegal’s southern foothills.

More clay dirt is being loosened for sowing by a group of young guys in front of him, while aged villagers follow behind and rake the soil back over the seeds.

The village works conscientiously as a unit to grow fonio (one of the oldest cultivated grains in Africa), an invaluable grain that is essential to their nutrition and may be harvested in as short as six weeks. They break only at midday to replenish peanuts and palm wine.

Bedik people say that despite the process of cultivating fonio being a laborious one it is easy and reliable.

They pointed out that it is grown naturally, unlike mainstream crops such as rice and wheat, which is much harder to grow.

Harvest time

6 Weeks

Consumed in Burkina Faso, Guinea, Senegal, Mali, Nigeria

Other names

Acha, Iburura, Hungry rice

chemicals used; it just grows naturally and then we harvest it. We don’t add anything."

Academics and policymakers are now advocating for fonio to be adopted more extensively in Africa in order to increase food security, along with other native foods like Ethiopia's teff, as well as cassava and various millets and legumes.

Following the UN's stern warning that the countries located in the Horn of Africa are facing extreme hunger, this move comes into play.

Many others have been hugely impacted by increasing wheat prices caused due to Russia’s invasion of Ukraine.

Recently, International Finance Corporation MD Makhtar Diop stated that these crops were underutilized and need research, marketing, and massive investment.

These indigenous foods could lessen the dependence of the continent on imported wheat, rice, and maize, which are currently the main mainstays of most people's diets but typically do not grow well in Africa. These traditional foods have greater nutritional values and are drought resistant.

Because of the fact that so little of the continent is suitable for cultivating the crop, the African Development Bank's proposal to increase food security by investing $1 billion in growing wheat in Africa has been met with skepticism.

The main ingredient of Senegal's current diet is its ability to import around 70% of its rice. Four regions alone contribute 436,000 tonnes of domestically cultivated rice.

Senegal, which does not grow wheat, in 2020, contributed only 2% of its imports. Wheat made up 2% of Senegal's imports in 2020 as it is not grown there.

According to the UN’s Food and Agriculture Organization, in 2019, Senegal produced just around 5,100 tonnes of fonio with most of the contribution coming from around the south-eastern Kédougou region. However, there are initiatives taken to increase production. Senegal's neighbours Guinea produces 530,000 tonnes of grain.

Forgotten Crops Society co-founder and agronomist Michel Ghanem feels that more investment needs to come in for these foods that have been neglected.

Ghanem said, "In sub-Saharan Africa, the diets were not wheat-based. They’re shifting; they’re becoming wheat-based, unfortunately, which is leading to non-communicable diseases, obesity, and all sorts."

“You have lots of indigenous crops – like teff, fonio, sorghum – that people still eat today but have been neglected by funding agencies, the international research organisations, but definitely not by consumers. And it’s now that we should invest in these because they could close that [food] gap," he added.

Researchers believe that these foods that have been neglected for ages have several nutritional benefits and possess important micronutrients as well.

The US National Research Council conducted a study on neglected African crops in the 1990s and discovered that while teff was high in protein, amino acids, and iron, fonio and finger millet were rich in the critical amino acid methionine, which is frequently missing in western diets.

Western researchers for long had misunderstood Fonio and labelled it as 'hungry rice' as it was consumed more during the food scarcity periods because of its reliable and quick growth.

In addition to providing far greater hunger satisfaction than the predominant grains, fonio, according to Kamara, also has a nuttier flavour and texture that people enjoy.

Kamara said, “During festivals, when we have lots of guests and want to honour someone, we give them fonio – it’s a privilege."

Slow Food International vice-president Edie Mukiibi pointed out that the destruction of biodiversity in agriculture was because colonialism forced "monoculture" farming on Africa and other colonised areas.

According to Mukiibi, during colonialism, significant areas of land were taken over for plantations that produced cash crops like

sugar, tea, and cocoa for export, while during the "green revolution" of the 20th century, the notion of growing high-yield grains to fight starvation was supported.

Mukiibi said, “The plantations kept on growing, supported by the colonial governments in the global south, and they did not contribute to biodiversity. They cleared large areas of diverse land, which initially was covered by the traditional intercropped African farming systems or the ‘milpa’ systems in Latin America, like in Mexico."

As people could no longer feed on the area cleared for the crops, Mukiibi continues, they changed their diets.

According to Mukiibi, indigenous grains are much better suited to surviving when planted alongside other crops than popular imports, which necessitate ecosystem adaptation to maintain the proper conditions.

The doctors have recommended indigenous food to diabetic patients, while health food brands and aid organisations have also been promoting them.

Fonio has recently gained in popularity and may now be found on restaurant menus in the more affluent areas of Senegal's capital Dakar.

Export supporters believe that by increasing the crop's profitability, farmers will be motivated to cultivate more fonio.

New York-based Senegalese chef Pierre Thiam, who co-founded Yolélé to buy the grain from smallholder farmers and market it as a "superfood" in the west, has been one of the most vocal proponents of fonio.

Yolélé works with SOS Sahel, an aid organisation that assists farmers in enhancing their lands and raising fonio output in an effort to fight unemployment in the area. By 2024, the NGO hopes to have increased production by 900 tonnes.

Aissatou Ndiaye, 75, who cultivates fonio on 50 hectares of land close to Kédougou and imports it from Mali and Guinea for sale, claims that she has benefited from NGO assistance and funding, but she is worried that some of the new interest is displacing locals from their source of income.

Ndiaye said, “There is a European buyer who comes here with big containers, fills it with the harvest from their local partners, and sells it all abroad. It should be feeding the population here. I can’t support them taking everything and selling it outside. That’s not fair. It’s not helping the farmers."

“There is big potential for fonio growing, you can grow as much as you want, the yield is much better than rice or maize – the only problem is that we need help improving the processing for harvest. I would like to grow more than I do, but I don’t have the machinery to harvest anymore,” she added.

Ndiaye is aware that more research will be needed to ascertain whether technology can make the labor-intensive process of cutting fonio grass and removing the husks less onerous. However, she is concerned that scientists would focus on genetically modifying the grain to ensure higher yields.

“We need more research, but they shouldn’t spoil it or damage it; they shouldn’t add anything to it. It might seem good to increase the yield but it’s not good for the nutrition. Fonio is natural – I want it to be protected and not to be spoiled so it becomes like other foods," she concluded.