- September 2025

- September 2025

Touted in China as a potential rival to OpenAI's ChatGPT, DeepSeek’s open-source large language model (LLM) is rapidly permeating nearly every aspect of the world’s second-largest economy. DeepSeek is appearing everywhere—whether in Chinese government offices, nuclear power facilities, or even inside a popular mobile shooting game. Companies across a wide range of industries are eager to announce their successful integration of DeepSeek’s open-source models into their business strategies, and Global Business Outlook will shed further light on the growing euphoria surrounding this development.

Meanwhile, Tesla is grappling with a significant conundrum surrounding one of its flagship vehicles, the Cybertruck. Since deliveries began just over fourteen months ago, Elon Musk’s company has reportedly sold 46,096 of these formidable 7,000-pound electric pickups. Musk previously told investors that Tesla would soon sell 250,000 Cybertrucks annually, yet this target now reflects a sharp decline from the far more ambitious projections he made only weeks before the truck’s launch.

Shifting attention to Japan, where, amid a slowing economy, policymakers and economists are closely observing the rise of the “oshikatsu” phenomenon, increasingly recognising it as an important driver of domestic consumer spending. The trend has captured the interest of analysts, particularly because it resonates strongly with a demographic of “mostly 20- and 30-somethings” who are enthusiastically investing their time and money in supporting their favourite celebrities, anime characters, or lovable mascot icons.

The cover story of Global Business Outlook's July-September edition will centre on SILZ, the developer and operator of Saudi Arabia’s first Special Integrated Logistics Zone, “Riyadh Integrated.” By building an innovative, partnership-driven ecosystem, the company aims to consolidate the Kingdom’s position as a leading force in redefining global logistics for the 21st century, an ambition closely aligned with the broader “Vision 2030” diversification agenda.

Thomas Kranjec Editor kimberly@gbomag.com

06 | Why are Britons not getting jobs?

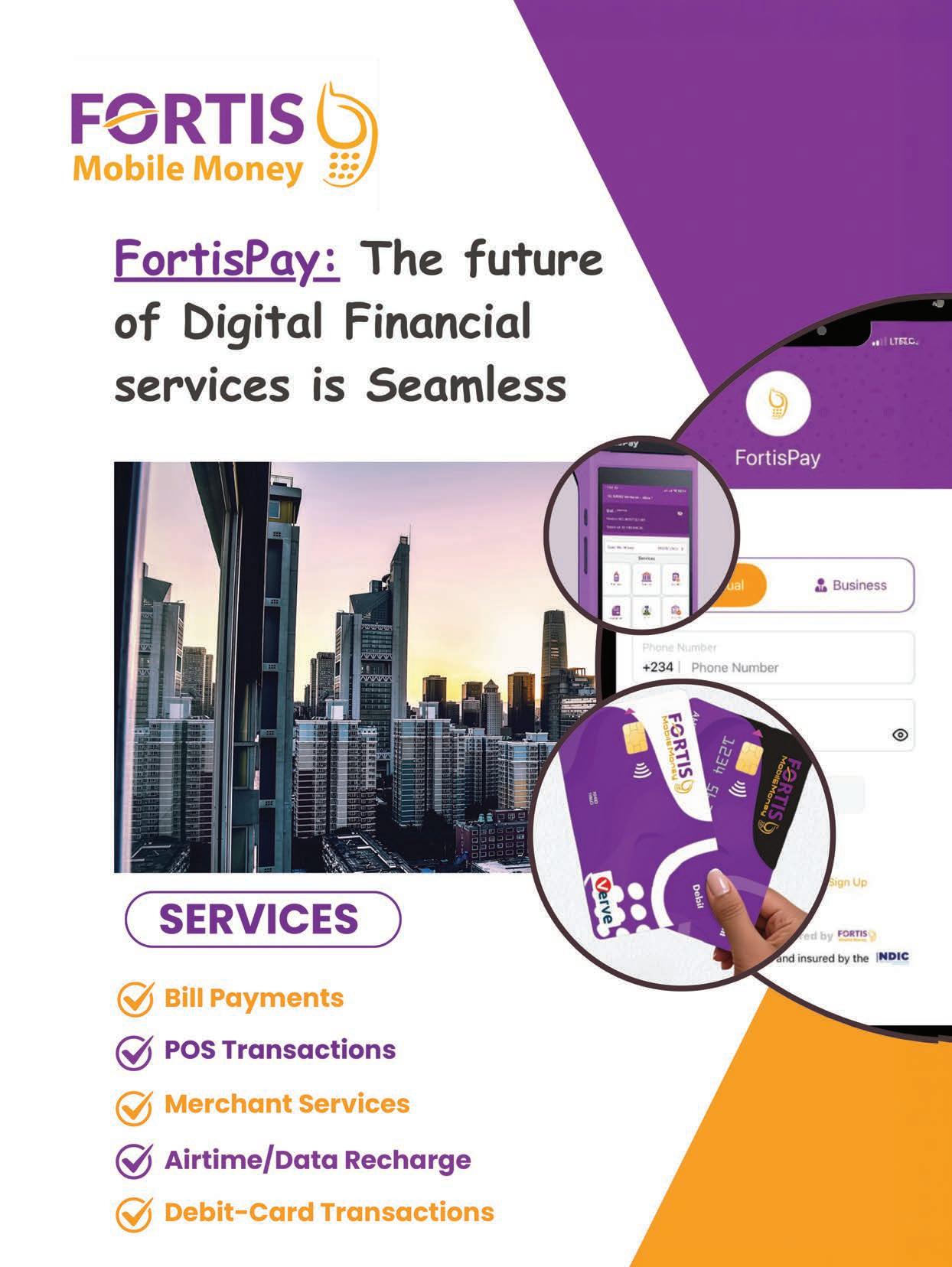

| The cost of change fatigue in modern work 32 | Cashless future: How digital wallets are taking over 42 | Young investors rewrite wealth management rules

52 | Togo's economy thrives despite political challenges

62 | Youth unemployment: A growing crisis for the future

72 | Generative AI reshapes financial sector

82 | When everyone uses AI, no one stands out

Director & Publisher

Krushikesh Raju

Editor

Thomas Kranjec

Production & Design

Brian Williams

David Brenton

Ian Hutchinson

Shankara Prasad

Editorial

Stanley Rogers

Rachel Taylor

Lucas Cooper

Tom Hardy

Business Analysts

Adam Fagoo

Arthur Salt

Jerry Thomas

Sumith Jain

Business Development Manager

Benjamin Clive

Head of Operations

David Pereira

Marketing

Danish Ali

Research Analysts

Richard Sam, Sophia Keller

Accounts Manager

Edyth Taylor

Press & Media Contact

Craig Penn

Registered Office: Global Business Outlook Magazine is the trading name of

Business Outlook Media Ltd

Winston House, 2 Dollis Park, London, England, N3 1HF

Phone: +44 (0) 207 193 3740

Fax: +44 (0) 203 725 9247

Email: media@gbomag.com

GBO Correspondent

Many Britons stated that they could not even locate low-skilled jobs in industries like retail and hospitality to support themselves

Despite the British economy growing by 0.1% in the fourth quarter (beating analysts' expectations), things are not okay with the European country. According to a new survey, vacancies for permanent jobs in the nation declined at their fastest pace for four years in December 2024.

David Hoghton-Carter, a 46-year-old Leeds-based corporate strategy professional, says the current job market is the worst he has ever encountered, even worse than the aftermath of the 2008 financial crisis, which also left him temporarily jobless, and the pandemic.

Hoghton-Carter is still looking for work after almost two years, joining the 1.57 million people in the United Kingdom looking for work between September and November 2024. This group accounts for a small portion of the nearly 11 million working-age people who are deemed "economically inactive" due to a variety of factors, including illness, and do not receive an income, even though they make up the majority of Britain's "unemployment" statistics.

“The job market is nightmarish. Competition is extreme, it’s slim pickings for good roles that suit my skill set, and employer expectations are through the roof,” he said.

Hoghton-Carter was one of several people nationwide who told The Guardian that they had never had such a difficult time finding employment. According to their responses, hundreds of applicants competed for each position, highly skilled graduates had difficulty finding well-paying jobs, and candidates were frequently turned down for positions for which they were qualified and those for which they were overqualified.

A published research revealed that job vacancies in January 2025 fell to their lowest level since August 2020, during the height of the pandemic. In a study conducted by the Recruitment and Employment Confederation and KPMG, employers' demand for permanent emp-

loyees has decreased over the past 17 months.

Hoghton-Carter shared the opinions of many other respondents, believing that British employers were unwilling to invest in training and were demanding more for less money.

"Salaries rarely meet current living costs. It’s a race to the bottom by organisations and businesses, either desperate to save money or prioritising their profit margins," he added.

Additionally, many job seekers observed a significant decline in job postings and application responses since last summer, especially for positions in design, entertainment, marketing, human resources, and information technology. Many attributed the decline in opportunities to economic unpredictability and higher employer expenses since Rachel Reeves' budget was announced last October. They added that several jobs that previously required pro-

fessional expertise were now worth less due to AI.

Graphic designer Owen Winn, who hails from Slough, Berkshire, previously held senior in-house design roles at organisations like O2. He claimed that many companies seem to have replaced his prior roles with AI, which has resulted in a sharp drop in open positions.

“It has been very difficult to find stable employment as a creative. I have applied for hundreds of jobs. I have a body of work that spans 20 years for some of the most wellknown brands in the world, and yet it’s still not enough. It feels like being on the scrap heap at 44," he added.

In his search for long-term roles that match his seniority, Winn has mostly come across poorly defined freelance positions and far lower-level job offers. He recalled one recent freelance opportunity from a company whose website featured AI-generated graphic design for all its content.

Employment rate in the United Kingdom from January 2025 to July 2025 (In Percentage)

Despite the expectation that earning a degree would result in lucrative employment, many graduates reported being compelled to accept part-time or low-paying jobs.

The 29-year-old Manchester resident, Lufty, was one of many highly qualified individuals who were underemployed, meaning they were doing low-paying, frequently part-time jobs for which they were far too qualified. He has a master's degree with distinction in medical microbiology and a first in biology from Russell Group universities, but he has been earning around £24,000 annually working in pubs.

“I’ve been applying for entry-level jobs in science and healthcare, especially for lab assistant positions with the NHS, since I was 23. I’m lucky if I get one interview a year. These are band two entry-level positions, offering less money than I make at the pub. They only require GCSEs or A-levels to apply, and I have two degrees. I tick absolutely every box on the job descriptions. You have to assume it is so competitive that they’re automatically filtering out many applications because of the sheer volume. Or is there some rubbish AI sifting through these applications that keeps spitting mine out?" he said.

“The market has been absolutely abysmal. A couple of years back, I was inundated with offers. This time, I’ve been actively looking for a new role for almost four months, and there are barely any openings. For every job, there are 5001,600 applicants you need to compete with. There just aren’t enough roles to go around," Danielle, who has only managed to find part-time work, said.

Additionally, workers claimed that their hours had been reduced as managers tried to lower labour expenses without reducing the number of employees.

Violeta Munteanu, a product assistant from the West Midlands, said, "My working hours were reduced due to current budget constraints. Many of my friends had their working hours cut to reduce costs."

A significant number of participants stated that they could not even locate lowskilled jobs in industries like retail and hospitality to support themselves.

Source: Statista

Lufty, who borrowed £60,000 to earn his degrees, was one of many people who thought that, despite government and employer messaging that more graduates with STEM degrees were needed in the economy, opportunities in STEM fields were becoming scarcer.

Danielle, 36, a London resident who previously held senior HR positions, was among several seasoned mid-career professionals who experienced underemployment like recent graduates.

These respondents stated that the UK labour market was overflowing with top talent during a period of reduced hiring budgets, and that the number of open positions had significantly decreased due to demand for workers following the initial job cuts caused by the pandemic.

“I haven’t had a job in four years. I’ve applied for about 1,500 jobs. I’m qualified in various things. I’ve applied for everything from being a cleaner in a factory to things associated with my degree. I’m worried about my future. I should be able to support myself financially, but I’m stuck in a village and live with my parents, so I have to claim universal credit. It feels impossible to get a job," a 25-year-old woman from Yorkshire said, who was made redundant when a shop closed.

Many job seekers stated that they were only considering fully remote, hybrid, or more flexible positions, pointing to a mismatch between employer needs and worker expectations.

These individuals stated that it was challenging to attend an office full-time due to several factors, including the high cost of living in neighbourhoods near places of employment and the difficulty in finding appropriate and reasonably priced childcare.

Numerous individuals with years of experience and university degrees

described their struggles as "demoralising," "humiliating," "ridiculous," and "exhausting." Young people and school dropouts without additional credentials also expressed a sense of complete helplessness.

“It’s miserable. No replies on any online job applications despite tailoring CV to the job requirements – for instance, for my Subway application, I put forward my previous McDonald’s work as qualifications instead of my A-levels,” said 20-year-old Sam from Brighton, East Sussex.

Marina, a 26-year-old from Wanstead, east London, claimed that she had been unable to find a permanent job for the last six months. She saw an increase in the pay offered for temporary administrative or hospitality jobs, frequently for ad hoc shifts, but she still felt that it was insufficient to cover her expenses.

“There’s pressure to upskill or gain additional qualifications and experience, but then there are no permanent jobs offered, only temporary contracts. I wonder whether what employers are looking for in people has changed...the economy certainly has," she said. While the economy shows some growth, the UK job market remains tough, with many struggling to find stable, well-paying jobs. Britons will hope for a positive shift in this trend in the months ahead.

Marina, a 26-year-old from Wanstead, east London, claimed that she had been unable to find a permanent job for the last six months. She saw an increase in the pay offered for temporary administrative or hospitality jobs, frequently for ad hoc shifts, but she still felt that it was insufficient to cover her expenses

Cybertruck

Feature

GBO Correspondent

Beyond the issue of Tesla employing the wrong adhesive, the latest Cybertruck recall has brought some striking revelations to light. Since deliveries commenced just over fourteen months ago, Elon Musk’s company has reportedly sold 46,096 of these formidable 7,000-pound electric pickups.

Musk told investors that Tesla would soon sell 250,000 Cybertrucks annually, but this is a significant drop in sales from his predictions made just weeks before the launch. Musk boasted that Tesla had secured "over one million" Cybertruck reservations and that "demand is off the charts" during an earnings call one month before the production vehicle's November 2023 launch.

Initially paying $100 to get into the line, "reservationists" later increased their refundable deposit to $250. Waitlists are frequently created by automakers for models where demand is predicted to exceed supply, but most auto executives don't anticipate that all depositors will complete their orders.

Stephanie Valdez Streaty, director of industry insights for auto tech company Cox Automotive, tells WIRED that the automotive industry strives for a reservation conversion rate of between 2% and 16%.

The Texas Gigafactory, where the Cybertruck is manufactured, has the capacity to produce more than 125,000 of the pickups annually

Source: Tesla First Quarter

6,406

Source: Statista

4,306 5,385

According to that calculation, Tesla's conversion rate is slightly less than 5%. Many experts, accustomed to Tesla's stratospheric sales, might view that as a failure even though it's at the lower end of the conversion scale. The wealthiest automaker in the world is typically not viewed by analysts as a typical automaker. It is worth many times more than companies that sell more cars because its stock trades at a multiple of earnings.

The Texas Gigafactory, where the Cybertruck is manufactured, has the capacity to produce more than 125,000 of the pickups annually. So if manufacturing capacity is any indicator of the sales figures that Tesla was anticipating, the company must be extremely disappointed. However, a January Business Insider article claims that workers were transferred from the "Cyber" production line to a Model Y line as a result of low Cybertruck sales.

Tesla's current high value is based on projected sales of its unreleased robotaxis and humanoid Optimus robots, which, like the Cybertruck, are expected to arrive three years before going into production, and may take several years to massproduce.

At an all-hands meeting on March 20, Musk told Tesla employees, "My predictions have a pretty good track record."

However, no one in the room dared to question Musk about whether he had foreseen the anti-Musk backlash that is severely hurting Tesla's global sales. Additionally, Tesla is not "by far the most innovative company in the car industry," despite Musk's claims during the staff meeting. In terms of autonomous driving and other technologies, Chinese

automakers such as XPeng, Nio, and Li Auto are significantly ahead of Tesla.

Waymo already provides rides in a driverless taxi. Furthermore, Tesla is not alone in its plans for humanoid robots.

According to author Peter Diamandis in a recent TechFirst podcast, there were fifteen other companies in this race, and none of them had a leader as contentious or polarising as Musk.

“This year, we hopefully will be able to make about 5,000 Optimus robots. That’s the size of a Roman legion. Which is like a scary thought. Like a whole legion of robots. I'll be like, whoa,” Musk said.

As he asserted that Tesla would produce "probably 50,000-ish (Optimus robots) next year," Musk's enthusiasm persisted.

“Optimus will be the biggest product of all time by far—nothing will even be close," he asserted.

“Compared to the next largest product ever created, it will be ten times larger. I predict that we will eventually produce tens of millions of robots annually,” the tech and EV billionaire commented, following which he raised the stakes even higher by declaring, “No, Tesla would produce perhaps 100 million robots annually."

Grandiose predictions excite Tesla bulls who believe him when Musk said, “I know more about manufacturing than anyone currently alive on Earth,” but back in the real world, Musk is in charge of a car manufacturing company that can’t even specify the correct grade of panel glue.

Musk's controversial angular pickups are currently experiencing a sharp decline in sales as they are involved in their eighth recall in the last 14 months, which also included problems with trapped accelerator pedals, failing windshield wipers, and potential wheel power loss. Cox Automotive estimates that Cybertruck sales decreased 32.5% in

February compared to the previous month.

“The Cybertruck generated significant buzz with its unique design and ambitious specifications. However, sales have fallen short of expectations due to higher-than-promised prices, lower driving range and payload capacity, and production issues. The unconventional design hasn’t resonated with traditional truck buyers, and strong competition from Rivian and Ford has intensified the market," Cox’s Streaty said.

She goes on to say that the Cybertruck is a "niche product with a unique design and high price point, which may not resonate with mainstream consumers. A major obstacle to the Cybertruck's commercial success is recalls and quality issues, which can seriously erode consumer trust and sales.”

Musk stated during the 2019 unveiling that the production car would go on sale in two years, with a $39,900 model as the starting price. The base model cost $21,000 more than it did when it was actually released in 2023.

The Foundation Series model, which was an early-door special, cost an extra $20,000 even though it only had a lookat-me logo and no other physical differences.

Lifetime cellular connectivity and "free" use of Tesla's Full Self-Driving

(Supervised) system were examples of non-physical benefits.

Experts contacted by Forbes estimate that Tesla invested at least $2 billion in the creation of the Cybertruck. UCLA professor of strategy and sociology Olav Sorenson, who is also the faculty director of the university's Price Centre for Entrepreneurship and Innovation, has estimated that a conventional car might require 200,000 units annually to cover the costs of research and development. Because of its unusual design and stainless-steel body panels, Sorenson estimates that the Cybertruck may need up to 300,000 sales annually.

According to Sorenson, at the current rate of Cybertruck sales, Tesla "probably loses money on everyone." Although it is an inventive vehicle, it has always been uncertain if such a unique design would be well-liked by buyers.

The first car made of stainless steel, the DeLorean, sold only 9,000 units. The PT Cruiser and other mainstream vehicles with unique designs have had trouble turning a profit. Tesla was unfortunate to learn that Musk's wedge wagon had a million or more reservations.

The Cybertruck's now-famous qualitycontrol problems may have contributed to this demand softening more quickly than anticipated.

The

Cybertruck generated significant buzz with its unique design and ambitious specifications. However, sales have fallen short of expectations due to higherthan-promised prices, lower driving range and payload capacity, and production issues - Streaty

Industry Cybertruck

In 2024, Kelley Blue Book estimated that Tesla sold only 38,965 of the angular electric vehicles. With Foundation Series models still available, a model that Tesla was supposed to have stopped selling in October, the company offered discounts in January 2025 to clear Cybertruck inventories

Andy Palmer, the former CEO of Aston Martin, said, "We knew this would be a highly desirable car when we launched reservations for the Valkyrie due to its limited production and the personnel involved in the car's development. People knew they could count on Aston to deliver the new car. We've observed a series of delays and goalpost relocations for the Cybertruck, which suggests unreliability. If the OEM isn't trustworthy, why should customers be?"

According to a northern Maryland reservationist who spoke to WIRED under condition of anonymity, Musk's promise of an electric pickup convinced him to buy. He states that he intended to purchase a truck and that he wanted an electric car for his next vehicle.

"At the time, the Cybertruck was the only electric pickup that appeared to be on the horizon. I cancelled my reservation after the Cybertruck took significantly

longer than anticipated to deliver the mid-tier item, for which I had paid $100 in advance. After the events of the past few years, and particularly the past few months, I would never purchase a Tesla car again,” he added.

The price increase was the dealbreaker for a lot of reservationists. According to Joseph Yoon, consumer insights analyst at the online retailer Edmunds, "The Cybertruck was promised to start at $39,990 when the initial reservations began—a stratospheric difference from the $99,990 Foundation Series trucks that were first available. With an anticipated base MSRP of $60,990 for even the most affordable base model, it's unlikely that many buyers will be willing to pay the enormous price difference."

In 2024, Kelley Blue Book estimated that Tesla sold only 38,965 of the angular electric vehicles. With Foundation Series models still available, a model that Tesla was supposed to have stopped selling in October, the company offered discounts in January 2025 to clear Cybertruck inventories. Low financing rates are now available from Tesla to move Cybertrucks.

In order to sell Foundation Series cars that didn't sell, it has reportedly buffed out the badges to make them resemble standard models. Benefits like free lifetime Supercharging have also been offered by Tesla dealerships in an effort to move more Foundation Series Cybertrucks out.

Even on used car lots, electric pickups are becoming more and more common. It's unlikely that US President Donald Trump's public call for Americans to purchase Musk's vehicles at a White House sales event made much of a difference.

According to Tesla bull Dan Ives, the company is having a "brand tornado crisis moment." Since the year began, the company's stock has fallen by almost 40%, wiping out the value increase it experienced in December 2024 following

Trump's election—a win that Musk helped finance.

Aside from the redesigned Model Y Juniper, Tesla also faces a jaded lineup of products, which is exacerbated by the subsequent hostility towards Musk. The novelty effect that may have increased the Cybertruck's initial sales has definitely worn off. A Morgan research note was released earlier this year.

“Tesla is probably the most expensive stock on the global stock exchanges right now. It could go down 95%—and maybe it should go down 95%," Gardell said.

Gardell sees Tesla as just a car company, but other analysts say it's a tech company with enormous potential for non-auto sales. He finds it hard to comprehend why Tesla is regarded with such respect by the market.

"The valuation of Tesla is incomprehensible," he said on the EFN channel.

He believes that a collision is likely to happen soon. Predicting the exact timing is challenging; it could occur in a month, six months, a year, three years, or even five years. However, during the interview, it was clear that Gardell is convinced it will take place.

Even though Musk recently praised the Cybertruck's five-star overall safety rating from the National Highway Traffic Safety Administration, saying it is "apocalypse-level safe," any Tesla market crash will at least partly be caused by the Cybertruck's lower-than-expected sales.

The day that Tesla's CEO classified his forecasts as having a "pretty good track record" may ultimately be one he regrets. Musk admitted during a 2023 earnings call that the car company had "dug our own grave with the Cybertruck." He might have been right on this one if the brand's current trends continue after this.

Meanwhile, in 2024, Chinese automaker BYD reported 777 billion yuan ($107 billion) in revenue, surpassing US rival Tesla as the two electric vehicle rivals intensify their competition.

Sales of its hybrid cars helped BYD report a 29% rise in revenue over the prior year. This amount was higher than the $97.7 billion in yearly revenue that Elon Musk's Tesla company reported.

Chairman and President Wang Chuanfu praised BYD's "rapid development" in 2024, pointing out that the company was the first in the world to roll out 10 million new energy vehicles in November.

“BYD has become an industry leader in every sector from batteries, electronics to new energy vehicles, breaking the dominance of foreign brands and reshaping the new landscape of the global market,” Wang said in a statement.

The filing was made soon after BYD revealed a new battery technology that it says can charge electric vehicles (EVs) nearly as fast as filling up a car with gas.

Recently, the carmaker announced that its new "Super e-Platform" will enable vehicles equipped with the technology to reach 400 kilometres (about 249 miles) of range with only five minutes of charging.

Analysts praised BYD's new battery platform as "out of this world" and hypothesised that it might cause EV owners to behave very differently.

Shares of BYD listed in Hong Kong have increased 46% so far this year. As a result of growing consumer boycotts and declining demand worldwide, which has been exacerbated by Musk's emergence as a hard-line conservative political figure, Tesla's stock has fallen more than 31% so far this year.

Even though Musk recently praised the Cybertruck's fivestar overall safety rating from the National Highway Traffic Safety Administration, saying it is apocalypse-level safe, any Tesla market crash will at least partly be caused by the Cybertruck's lower-thanexpected sales

GBO Correspondent

SILZ Company

Saudi Arabia

Using advanced technology, industry expertise, and smart infrastructure, SILZ Company has set new efficiency and value-chain integration standards

The 21st-century global supply chain landscape is undergoing a dramatic transformation, placing a premium on speed, efficiency, and seamless connectivity. At the forefront of this change is Saudi Arabia, whose ambitious "Vision 2030" socio-economic diversification agenda aims to position the Kingdom as a global logistics powerhouse. Leading this charge is SILZ, the developer and operator of the Saudi’s first Special Integrated Logistics Zone, "Riyadh Integrated." Global Business Outlook (GBO) will explain in detail how SILZ Company fundamentally redefines integrated logistics, transforming a national vision into an economic reality for global businesses.

According to the leading market research company IMARC Group, the Kingdom's logistics market size was valued at USD 52.7 billion in 2024. IMARC Group estimates the market to reach USD 81.2 billion by 2033, exhibiting a CAGR of 4.9% from 2025 to 2033.

The sector is rapidly growing due to its strategic geographical location, with the Gulf nation now acting as a global trade hub linking Asia, Europe, and Africa. This prime positioning is being leveraged through major ports like Jeddah and Dammam, further enhanced by the GCC-Africa railway land-bridge project.

"These developments streamline supply chain operations and boost trade volumes. The Kingdom's transportation networks and modern warehousing facilities are continuously expanding, meeting increasing demand for efficient cargo movement across multiple sectors, including automotive, food, and retail," IMARC said.

By transforming Saudi Arabia into a regional and global trade hub, the sector is now directly facilitating economic diversification, attracting Foreign Direct Investment (FDI) and generating widespread employment. Take the Riyadh Integrated Zone, for example, which alone is projected to more than 60,000 jobs, contributing substantially to the Kingdom's national GDP.

The logistics sector's development is also propelling the growth of other critical areas, from light assembly to manufacturing, multiplying its positive impact across the entire national economy. And SILZ is quickly becoming the guiding force behind the sector's transformation as a major growth engine.

In an exclusive interview with GBO, Dr. Fadi Al-Buhairan, SILZ CEO, said, "As the leading developer of integrated logistics zones, SILZ Company is directly supporting the National Transport and Logistics Strategy of Saudi Vision 2030. By building the Kingdom’s first fully integrated logistics hub, it is strategically positioning Saudi Arabia at the crossroads of three continents as a global trade powerhouse. Ultimately, SILZ Company is not just constructing infrastructure; it is building the innovative, partnership-driven ecosystem that will define Saudi Arabia's leading role in the future of global logistics."

Using advanced technology, industry expertise, and smart infrastructure, SILZ Company has set new efficiency and value-chain integration standards. The business now aims to become the global benchmark for logistics zones by enabling sustainable, future-ready supply chains, supporting companies investing in the region, while contributing to the bigger goal: the Kingdom’s economic diversification.

As the developer of Special Integrated Logistics Zones, SILZ Company performs activities like infrastructural master planning and attracts strategic tenants and investors from across the Kingdom. The company also issues construction, operations, and occupancy permits, along with liaising with regulators and key stakeholders. Being the operator of such cutting-edge facilities, SILZ leases land,

pre-built warehouses, and build-to-suit facilities, while operating a full-service "One-Stop Shop." It is also delivering value-added logistics services while ensuring infrastructure performance and compliance.

Formed in 2022, SILZ Company has been driven by values like customer centricity, agile delivery, respectful collaboration, and creative innovation. For any business looking to set up its presence in Saudi-based integrated logistics zones, it gets services from SILZ across fronts like technology, facilities management, and security, apart from value-added ones like telecommunication and ICT, consolidation and advanced logistics, e-government integration, branding, media and advertising, and after-sales support and optimisation.

SILZ’s Company Chairman Awad AlSulami stated that SILZ is focused on establishing a robust foundation for the Kingdom’s future in global trade and logistics.

“As the developer and operator of Riyadh Integrated, Saudi Arabia’s first special integrated logistics zone, SILZ is focused on establishing a robust foundation for the Kingdom’s future in global trade and logistics. Our efforts have centred on initiating the development of world-class infrastructure that aligns with international best practices,” he said.

The concept of a logistics-free zone has evolved far beyond mere warehousing. SILZ Company is building a new generation of interconnected logistics hubs based on deep integration and smart technology.

"Riyadh Integrated, the Kingdom’s first free zone, is located just 8 km from King Khalid International Airport and 12 minutes from the King Khalid International Airport Cargo Village. With a focus on light manufacturing, logistics, and trade, it offers a full-service ecosystem including a one-stop shop, value-added services, and competitive incentives like the 50-year tax relief and 100% foreign ownership. It’s built for global industries: ICT, pharma, aerospace, and more," Dr. Fadi Al-Buhairan noted.

The Riyadh Integrated ecosystem has transformed into a connected platform where smart infrastructure, digital solutions, and streamlined government services converge. A pivotal element of this system is the bonded corridor to King Khalid International Airport, which allows for expedited and seamless air cargo movement.

The entire environment is tenant-first, featuring a

one-stop shop for government services, a unified cargo community system, and tailored facilities designed for high-value industries like ICT, pharmaceuticals, and aerospace, across different activities such as light manufacturing, assembly, warehousing, and more. This holistic approach allows businesses to scale quickly and operate with unprecedented agility.

Riyadh Integrated isn't just a logistics park; it is the Kingdom's first Special Integrated Logistics Free Zone (SILZ), established with a unique blend of incentives and advanced infrastructure that sets it apart globally. SILZ's core offerings have been designed to maximise investor value and operational freedom. Apart from incentives like a 50-year tax relief period, 100% foreign ownership, comprehensive VAT and customs exemptions, tenants also enjoy the benefits of relaxed labour laws and a friction-reducing environment.

"The zone provides approximately 2 million square metres of leasable space, including land plots, buildto-suit facilities, and pre-built warehouses. However, its most unique feature is the digital backbone: a smart zoning system providing real-time visibility tools and integrated customs clearance. This technology-driven approach significantly reduces friction, accelerates operations, and ensures a seamless experience for tenants," the CEO added.

While many global zones focus narrowly on either infrastructure or fiscal incentives, Riyadh Integrated distinguishes itself by combining both unparalleled technology and direct connectivity. The bonded corridor to King Khalid International Airport provides a crucial speed and fiscal advantage that enhances its value proposition, particularly for time-sensitive, highvalue goods.

Why is SILZ betting big on Riyadh Integrated? The answer is simple: it's strategic location within the heart of the Kingdom's capital, from where logistics players can access three continents (Asia, Europe, and Africa). Also, not to forget Riyadh's emergence as a fastgrowing urban centre and the Kingdom's expanding aviation network, which is connecting 70% of the global population with the Gulf major through eight-hour flights.

Furthermore, SILZ Company's deep alignment with "Saudi Vision 2030" cements its role as a national champion, ensuring sustained and strong government support. The focused strategy on industry-specific

SILZ Company's Tenant Service is engineered to simplify every step of a business’s journey within the logistics free zone. It provides operational agility from day zero through features like expedited licensing and streamlined permitting

ecosystems, from ICT to pharmaceuticals and aerospace, demonstrates a commitment to building a platform for high-value global supply chains, thereby moving beyond generic logistics solutions.

The transition from strategic vision to tangible achievement has been rapid. Since its launch in 2022, Riyadh Integrated has secured major international tenants, solidifying its position as a preferred Middle East hub. Notable corporate additions in the zone include Lenovo, Sapphire, iHerb/ CJ Logistics, Unipart Logistics, Chalhoub Group, Shein, and Boeing/Bahri Logistics.

Talking about the groundbreaking of Lenovo's new state-of-the-art manufacturing facility at Riyadh Integrated, which happened in 2025, has given a fresh boost to the Kingdom’s manufacturing dreams, as the plant will build millions of Saudi-made laptops and desktops, along with servers.

The manufacturing facility will span across a 200,000 square metre site, strategically located just 15 minutes from King Khalid International Airport within Riyadh Integrated Logistics Zone. The factory will benefit from streamlined logistics, efficient infrastructure, and seamless connectivity, and be closer to customers across the Middle East and North Africa (MENA) region.

This initiative is the result of a strategic collaboration between Lenovo and Alat, an innovative Public Investment Fund (PIF) company committed to transforming global industries and establishing a world-class manufacturing hub in the Kingdom.

Talking about the key operational milestones that SILZ has achieved, mention must be made of the establishment of the first true operational trade zone in the Kingdom, facilitating faster customs clearance and multi-modal cargo movement. The zone has also successfully rolled out the one-stop-shop tenant portal, apart from keeping the delivery of Phase 1

infrastructure on schedule.

These achievements showcase SILZ Company's capability to move swiftly from blueprint to execution, thereby reinforcing its pivotal role in Saudi Arabia's integrated logistics transformation.

SILZ Company's Tenant Service is engineered to simplify every step of a business’s journey within the logistics free zone. It provides operational agility from day zero through features like expedited licensing and streamlined permitting, dedicated account managers, and 24/7 digital service portals.

"For companies looking to leverage Saudi Arabia's vast and growing market, this translates to faster import and export processing, significantly reduced supply chain costs, and immediate access to global partners co-located within the zone. By actively removing operational barriers, SILZ Company enables businesses to focus entirely on their core objectives: growth and innovation," Dr. Fadi Al-Buhairan asserted.

Following the official inauguration of Phase 1 infrastructure of the Riyadh Integrated Project, Egis, a global leader in architecture, construction engineering, consulting, and operations and maintenance services, announced serving as a Package Administration and Supervision Consultant (PASC) at Riyadh Integrated.

Egis will contribute to the oversight of critical infrastructure works that form the backbone of Riyadh Integrated, in collaboration with other supervision partners. This includes a comprehensive network of roads, utilities, landscaping, perimeter fencing, utility buildings, and key enabling works, all planned and delivered with long-term scalability and operational efficiency in mind.

As per the global property consultancy Knight Frank, more than 1.3 million sqm of new warehouse space was delivered in the first half of 2025 as Saudi Arabia’s

industrial and logistics sector experienced double-digit rental growth and near-full occupancy across its major cities.

Riyadh reinforced its position as the Kingdom’s main logistics hub in H1, with warehouse stock increasing by 3.5% to 28.9 million sqm, while the Saudi capital's industrial and manufacturing facilities expanded by 1.4% to 16.2 million sqm.

Against this backdrop, SILZ Company is all set to ramp up logistics further. Its game-changing works at Riyadh Integrated haven’t gone unnoticed either, as the venture got nominated for four prestigious industry awards recognising its outstanding achievements in logistics operational efficiency, advanced infrastructure, and technological innovation.

At the prestigious Saudi Logistics Awards 2025, SILZ Company was awarded top honours in three of the four nominated categories: “Logistics Hub of the Year,” “Logistics Real Estate Company of the Year,” and a highly commended “Logistics Leader of the Year” awarded to CEO Dr.

Fadi Al-Buhairan, emphasising SILZ Company’s commitment to transforming Saudi Arabia’s logistics landscape and solidifying its position as a global integrated logistics hub, in alignment with Saudi Vision 2030.

SILZ Company, which has disrupted the Kingdom’s logistics sector by leveraging advanced smart systems for cargo tracking, digital documentation, and smart zone management, looks committed to continuous improvement and strategic expansion. As it perfects its operational playbook in Riyadh Integrated, the company is already laying the groundwork for future zones, extending its transformative impact across the Kingdom.

SILZ

Company is all set to ramp up logistics further. Its game-changing works at Riyadh Integrated haven’t gone unnoticed either, as the venture got nominated for four prestigious industry awards recognising its outstanding achievements in logistics operational efficiency, advanced infrastructure, and technological innovation

Industry Change Fatigue

Analysis

GBO Correspondent

Corporate finance is the one area where change fatigue is most evident

The idea that "change is the only constant" was first put forth by the Greek philosopher Heraclitus, who lived before Socrates. However, the rate of change in today's business environment frequently appears to be faster than executives' and their teams' ability to adjust.

The phenomenon known as "change fatigue," which is hardly a fad driven by HR, can have a negative impact on the bottom line through decreased productivity, workforce turnover, and employees' diminished capacity to adjust to additional change.

According to Hilary Richards, vice president and analyst in the finance practice at consulting firm Gartner, based in Stamford, Connecticut, executives should "be treating change fatigue as a business risk."

When it comes to implementing new technologies or responding to external changes, the majority of businesses seem to be constantly changing.

According to a survey conducted by San Franciscobased software-as-a-service company WalkMe, more than 75% of businesses update their business models every two to five years. Corporate finance is the one area where change fatigue is most evident.

When a business adopts enterprise resource planning, digital transformations, and artificial intelligence (AI), finance departments take on a variety of new strategic roles.

As per Richards, CFOs are tasked with managing cash, promoting growth, and implementing process changes. However, the WalkMe study indicates that only one-third of corporate change initiatives are considered successful.

Around 8% of US healthcare spending is related to workplace stress, and two-thirds of employees report burnout during transformation drives.

A recent survey from Orgvue, a platform for organisational design and planning with headquarters in London, found that around 38% of CEOs would prefer to resign rather than oversee a significant change.

Jenny Magic, founder and CEO of Build Better Change, a consultancy based in Austin, Texas, and co-author of "Change Fatigue: Flip Teams From Burnout to Buy-In," notes that her clients' capacity to adjust to change started to decline in 2017.

She remembers, "Middle managers and the people who do the work were less capable of carrying it out, even though top leadership was interested." Her firm's most recent report "validates that things are not getting better."

“The average employee experienced 10 planned enterprise changes in 2022, up from two in 2016, and there is no reason to expect the pace to slow. But the workforce has hit the wall; the share of employees willing to support

enterprise change collapsed to just 38% in 2022, compared with 74% in 2016,” a Gartner report notes.

In response, some companies are coming up with innovative solutions; examples include relative upstarts and corporate behemoths like Danone and Liberty Mutual. Businesses are also opting between hiring change management consultants from reputable consultancies or from niche, up-and-coming rivals.

Apart from offering executive advice, these more well-known experts also conduct conferences, conduct training, and write articles like "Three Ways to Minimise Change Fatigue Among Financial Teams."

Consultants advocate for solutions that tackle two types of change: accumulative change and large-scale transformation. Larger scope and faster speed are typically preferred in major initiatives. However, there are indications that more gradual solutions may be less traumatic and more effective.

These initiatives are typically put into place in response to significant outside events, like a sharp decline in the economy, the COVID-19 pandemic and its aftermath, or significant technological advancements like AI. However, Orgvue CEO Oliver Shaw contends that this may be a reflection of antiquated thinking.

“Change came along a lot less frequently, even a couple of decades ago. Executives developed impulses, to act: ‘Change is needed now!’ As a banker who lived through the 2008 financial crisis, I thought at the end of that, I would never see anything like it again,” he said.

Events that used to be considered unique, now seem commonplace. Shaw argues that in a world that is constantly changing, full-bore transformation might be too harsh. Risks include high severance pay and additional expenses associated with widespread layoffs.

According to Orgvue's data, Fortune 500 companies that experienced significant workforce restructuring in 2023 paid out $32.7 billion in severance pay that year and carried over an additional $10.9 billion in charges or liabilities into 2024.

A 2024 Bloomberg study of Securities and Exchange Commission listings found that additional costs of dumping workers include decreased productivity (roughly six months), a rise in voluntary departures,

Approximately 71% of employees feel overwhelmed by the amount of change at work

Around 32% of change-fatigued employees say they feel less productive, and 48% report feeling more tired at work due to excessive workplace changes

Nearly 73% of employees impacted by organizational change experience moderate to high change fatigue

On average, change-fatigued employees perform 5% worse than the average employee

83% of change-fatigued employees feel their employer does not offer enough tools to support their adaptation to workplace changes

Source: Capterra/Gartner

higher unemployment insurance taxes, and higher legal fees, primarily to avoid lawsuits over accusations of discrimination.

In order to avoid expensive, reactive, and high-risk transformation projects, Danone adopted a different strategy when considering a significant change.

As highlighted in an Orgvue case study, this was achieved by using a "continuous design approach to organisational development."

To better monitor labour demand and supply, the Paris-based multinational food and beverage company reduced its planning period from annual to quarterly and redesigned its human resources procedures rather than eliminating jobs. Shaw claims that they were able to understand how to make adjustments over time.

Like any disease, prevention is sometimes the best "remedy." In 2023, the Swedish payments fintech Klarna sought to cut costs by outsourcing roughly 500 jobs across 10 markets to two partner companies, thereby reducing trauma through layoffs.

Internally, it started a campaign to embrace costcutting AI and put a stop to hiring. Shaw observes, "They are using AI to increase their margins."

Companies with leaders who "understand organisations as systems" include Danone and Klarna. Shaw claims that if the typical company has an attrition rate of 15%, it should be able to use that in conjunction with internal reassignments to make significant reductions without causing undue stress.

San Diego-based broker C3 Risk and Insurance Services plunged into what initially appeared to be an extremely challenging and intricate integration process following a merger. Employees were worried about their futures at the company. On the technology to use, no one could agree.

In order to aid in the process, Imperio Consulting, based in Florida, brought in Eric Brown, its founder and CEO. As a former member of the United States Special Forces, Brown utilises his experience in his work. Instead, the US military refers to it as "operator syndrome."

Uncertainty and constant pressure can deplete people.

“The corporate world mirrors that experience in many ways, especially in finance, with its tech overload, unpredictable markets, and ever-changing regulations. It’s like trying to stay steady on shifting sand, and it can be exhausting," he said.

"We should slow down now so we can speed up later," Brown remembers saying to a client. Soldiers perceive it as a "crawl, walk, run" pattern.

With support from C3's senior leadership, Brown was able to use team-building activities and resources to help integrate that strategy into the integration plan.

He said, "They took it to heart," spending money on staff training and communication.

“Both the San Diego Business Journal and Business Insurance named C3 a top place to work in 2023 and 2024. C3 is a rock star," Brown continues.

C3’s experience also points up the need to address the second of the two types of change fatigue that consultants identify, namely the accumulation of small changes. The structural integrity of an organisation may eventually be threatened by them, much like water that accumulates behind the figurative creaky dam.

Gartner observes that the almost constant accumulation of relatively minor changes that impact job descriptions, team composition, and managerial strategies has made employees feel more stressed. When changes are implemented top-down without discussion or debate, employees feel disempowered. To prevent 1,000 fatiguerelated cuts, Liberty Mutual developed a procedure to identify workers' assumptions and fears. Analysis

The initial questions were designed to assist employees in embracing change. Employee engagement and feedback, along with change workshops, were among the tools. These kinds of programmes can aid in addressing issues that are hidden beneath the surface.

“Most of the senior C-suite focuses on the tip of the iceberg. It’s what they’re paid for. But your team will run into that iceberg," Richards concluded.

What if we were to say that the heat produced by the human body is also a waste product of our metabolism? According to a study from the Cornell University Ergonomics Web, every square foot of the human body emits heat equivalent to about 19 matches per hour. However, much of this heat escapes into the atmosphere.

According to Muhammad Muddasar, PhD candidate at the School of Engineering, University of Limerick, this heat can be

harnessed to produce energy. While his research has shown it is possible, Muddasar and his colleagues are working on methods to capture and store body heat for energy generation using eco-friendly materials.

The aim is to develop a device that generates energy and stores it, essentially functioning as a built-in power bank for wearable technology. By tapping into body heat as a power source, this innovation could dramatically extend the battery life of devices like smartwatches, fitness trackers, and GPS units, potentially allowing them to

The aim is to develop a device that generates energy and stores it, essentially functioning as a built-in power bank for wearable technology

Source: International Energy Agency

operate for days, weeks, or indefinitely without recharging.

"It isn’t just our bodies that produce waste heat. In our technologically advanced world, substantial waste heat is generated daily, from the engines of our vehicles to the machines that manufacture goods," he said.

According to PhD candidate Muddasar, "Typically, this heat is also released into the atmosphere, representing a significant missed opportunity for energy recovery. The emerging concept of waste heat recovery seeks to address this inefficiency. By harnessing this otherwise wasted energy, industries can improve their operational efficiency and contribute to a more sustainable environment."

Muddasar identified the "thermoelectric effect" as a phenomenon that can help turn the heat mentioned above into electricity. All it requires is a temperature difference that will generate an electric potential as electrons flow from the hot side to the cool side, creating usable electrical energy.

Thermoelectricity is a two-way process. It can refer to how a temperature difference between the two sides of a material generates electrical power, or to the reverse. In the reverse process, applying an electric current through a material can create a temperature difference between its two sides, which can be used to heat or cool things without combustion or moving parts. This is a field in which MIT (Massachusetts Institute of Technology) has been doing pioneering work for decades.

Muddasar explains that conventional thermoelectric materials are often made from cadmium, lead, or mercury. These materials come with environmental and health risks that limit their practical applications. However, he has found a solution in the form of wood, which is a safer and more sustainable alternative, to give his "waste heat production" idea a concrete form.

"Wood has been integral to human civilisations for centuries, serving as a source of building materials and fuel. We are uncovering the potential of woodderived materials to convert waste heat, often lost in industrial processes, into valuable electricity," he explained, reiterating that this approach will enhance energy efficiency and redefine how we view everyday materials as essential components of sustainable energy solutions.

In collaboration with the University of Valencia, Muddasar's team at the University of Limerick has already developed a sustainable method to convert waste heat into electricity using Irish wood products, particularly lignin, a byproduct of the paper industry.

Speaking about the material, the International Lignin Institute states, "Lignin is an organic substance that binds the cells, fibres, and vessels that constitute wood and the lignified elements of plants, such as straw. After cellulose, it is the most abundant renewable carbon source on Earth. Between 40 and 50 million tons per year are produced worldwide as a mostly non-commercialised waste product. As a natural and renewable raw material, obtainable at an affordable cost, lignin's substitution potential extends to any products currently sourced from petrochemical substances."

“Our study shows that lignin-based membranes, when soaked in a salt solution, can efficiently convert low-temperature waste heat (below 200°C) into electricity. The temperature difference across the lignin membrane causes ions (charged atoms) in the salt solution to move. Positive ions drift toward the cooler side, while negative ions move toward the warmer side. This separation of charges creates an electric potential difference across the membrane, which can be harnessed as electrical energy,” the research body noted.

Since around 66% of industrial waste heat falls within this temperature range, this innovation presents a significant

opportunity for eco-friendly energy solutions.

The new technology has the potential to make a big difference in many areas. Industries such as manufacturing, which produce large amounts of leftover heat, could see major benefits by turning that waste heat into electricity. This would help them save energy and reduce their impact on the environment.

This technology could be used in various settings, from providing power in remote areas to powering sensors and devices in everyday applications. Its ecofriendly nature makes it a promising solution for sustainable energy generation in buildings and infrastructure.

According to Muddasar, capturing energy from waste heat is just the first step; the most critical challenge lies in effectively storing the end product. One option could have been supercapacitors—energy storage devices that rapidly charge and discharge electricity, thus becoming an essential tool for applications requiring quick power delivery.

A supercapacitor is a battery-like device that stores and releases electricity. Instead of storing energy in the form of chemicals, supercapacitors store electricity in a static state, making them better at rapidly charging and discharging energy.

Additionally, supercapacitors don’t degrade in the same way as lithium-ion batteries, which improves the lifespan of electric vehicles and reduces the environmental impact of lithium-ion power cells. Supercapacitors enjoy a clear advantage over lithium-ion and nickel-cadmium batteries due to their ability to charge and discharge rapidly.

However, Muddasar believes that to capture energy from waste heat and store it, a supercapacitor is not the ideal option because its reliance on fossil fuel-derived carbon materials raises sustainability concerns, underscoring the need for renewable alternatives in its production.

"Our research group has discovered that lignin-based porous carbon can serve as an electrode in supercapacitors for energy storage generated from harvesting waste heat using a lignin membrane. This process allows the lignin membrane to capture and convert waste heat into electrical energy, while the porous carbon structure facilitates rapid movement and storage of ions. By providing a green alternative that avoids harmful chemicals and reliance on fossil fuels, this approach offers a sustainable solution for energy storage from waste heat," he concluded.

A supercapacitor is a battery-like device that stores and releases electricity. Instead of storing energy in the form of chemicals, supercapacitors store electricity in a static state, making them better at rapidly charging and discharging energy

UAE-based Space42 is now building the first Sovereign Mobility Cloud for the Gulf country through its Sovereign Public Cloud, based on Microsoft Azure. This solution will help deploy autonomous mobility solutions faster and keep data hosted and compliant with national regulations, as announced on the sidelines of the Dubai World Congress (DWC).

The Sovereign Mobility Cloud will give the UAE a sovereign-enabled platform for intelligent transport. At its core, the cloud will provide a trusted infrastructure for mobility data and autonomous systems; critical platforms for HD mapping, telematics, fleet operations, traffic management, and digital twins; and a secure platform for data sharing across government, industry, and research stakeholders.

The initiative will also establish reference

deployments, regulatory sandboxes, and test hubs with UAE transport authorities, while engaging global automotive, technology, and academic partners to scale the ecosystem. The programme will allow Space42 to lead application deployment, liaise with regulators, and drive adoption through pilots, demonstrations, and commercial rollouts.

The initiative will also establish reference deployments, regulatory sandboxes, and test hubs with UAE transport authorities

Amid ongoing US-China geopolitical tensions, Chinese autonomous driving developer Momenta is considering shifting its IPO to Hong Kong from New York, according to Reuters. If the news proves true, then Momenta will join the growing list of Chinese companies opting to debut in the Asian financial hub.

The potential change in Momenta's listing venue comes after the expiration, in June 2025, of an approval by China's securities regulator to list in the United States, which was granted in mid-2024.

Momenta is a leading Chinese supplier of advanced driverassistance system features, similar

to Tesla's self-driving technology, that can navigate urban traffic under human drivers' supervision. The company recently informed some of its investors its plan to potentially list in Hong Kong in 2026, the Reuters report claimed, adding that things are at an early stage and may change with the evolving geopolitical situation.

The possible shift in Momenta's listing venue underscores Hong Kong's position as the primary offshore fundraising venue for Chinese companies amid Washington's continued threat to delist Chinese firms from American exchanges.

The company, backed by Toyota Motor and German auto supplier Bosch, is also reportedly working on a pre-IPO fundraising round.

French energy major TotalEnergies' plan to sell mature, polluting assets and pay down debt has suffered a setback, as its sale of a minority stake in a Nigerian onshore oil producer has fallen through. TotalEnergies agreed in July 2024 to sell its 10% stake in Shell Petroleum Development Company of Nigeria Limited (SPDC) to Mauritius-based Chappal Energies, one of a wave of divestments by oil majors in recent years of onshore Nigerian oil assets.

However, regulatory approval for the sale, granted in October 2024, has now been withdrawn because the two sides have not met the financial commitments

required to complete the deal, according to Eniola Akinkuoto, spokesperson for the Nigerian Upstream Petroleum Regulatory Commission.

According to reports, while Chappal failed to raise the $860 million, TotalEnergies did not fulfil its requirement to pay regulatory fees and cover funds for environmental rehabilitation and future liabilities.

TotalEnergies is now burdened with its stake in a business that has faced numerous oil spills due to theft, sabotage, and operational issues, leading to expensive repairs and high-profile lawsuits.

Saudi Arabia has imposed a five-year freeze on rent increases for residential and commercial properties in Riyadh to stabilise housing costs and ensure fairness between landlords and tenants, according to new regulations approved by the Council of Ministers and enacted through a royal decree.

The new rules, which went into effect on September 25, 2025, now prohibit rent increases for five years in existing or new contracts within Riyadh's urban boundary, and the framework may be applied to other cities and governorates as necessary, as determined by the Real Estate General Authority with the approval of the Council of Economic and Development Affairs.

Any vacant properties in Riyadh will be assigned a fixed rent at the level of the most recently registered contract. For units that have never been rented, landlords and tenants can negotiate the initial rent freely.

All contracts must be registered on the “Ejar” platform, and landlords or tenants have 60 days to object, after which the contract data will be considered final and binding. Automatic renewals will also be standardised. Lease agreements will renew automatically across the country.

Digital Wallets

Analysis

GBO Correspondent

Although digital wallets are becoming more popular globally, adoption rates differ greatly by geographic location

Global business has historically relied on cash, but in an era of fast digital acceleration, its supremacy is no longer assured. Contactless transactions, digital wallets, and mobile payments are revolutionising the way individuals and organisations exchange money. The debate is no longer about whether a cashless future is imminent, but rather how soon it will happen and what obstacles it will present, as governments and financial institutions are spearheading digital innovation.

Digital wallets are changing how businesses and consumers transact. Juniper Research projects that there will be 5.8 billion digital wallet users globally by 2029, a substantial 35% increase from the 4.3 billion users in 2024. This increase highlights how cashless transactions are becoming more common.

The rise of e-commerce and government-sponsored programmes is speeding up the adoption of digital payments in highgrowth areas, where this trend is especially noticeable. Digital wallets are replacing physical cash as the main payment method throughout Asia-Pacific and Latin America, transforming financial ecosystems. Central banks are also investigating digital currencies (CBDCs) as a supplement or possible replacement for conventional monetary systems.

A crucial question that arises as digital payment networks expand is how financial systems can balance innovation, security, and accessibility in a rapidly digitising world.

Digital wallets: The new normal Digital wallets, formerly a specialised technology, have quickly taken over as the preferred payment mechanism for millions of people worldwide, changing the face of commerce. As consumer preferences shift toward seamless digital transactions, mobile payment solutions are becoming increasingly common in everyday life.

Digital wallets are becoming more popular in the US over conventional payment methods. According to Capital One, 64% of Americans use digital wallets just as frequently as cash or conventional cards, and 53% of Americans now prefer them. In high-growth economies around the world, the trend is even more noticeable.

According to the Global Payments Report, digital wallets, which account for 21% of regional e-commerce transactions in 2023, are the payment method with the fastest growth rate in Latin America.

The question of whether digital wallets will completely replace cash or if a hybrid payment system will persist is becoming increasingly pressing as these technologies become more integrated into international financial networks. The prospect of a cashless future is a significant consideration for all stakeholders in the financial sector.

What is the reason behind the growing popularity of digital wallets? It is driven by developments in financial technology,

convenience, and security.

The ability to pay with a tap or a scan instead of cash or credit cards is becoming increasingly popular among consumers. Additionally, digital wallets are being integrated more widely into retail and e-commerce transactions, streamlining the payment process across all sectors.

Central Bank Digital Currencies (CBDCs) are also affecting this change. The Atlantic Council reports that 134 nations, or 98% of the world's GDP, are investigating CBDCs, indicating a shift toward the widespread use of digital currencies. Additionally, customers are moving away from cash and toward digital alternatives that offer secure payment methods and immediate access to funds as mobile banking infrastructure grows.

According to Worldpay’s 10th Global Payments Report, by 2030, digital wallets are expected to comprise more than half (52%) of e-commerce transaction value and 30% of pointof-sale transaction value. By contrast, the report predicts

Source: Worldpay Global Payments Report

that credit cards will comprise only 22% of e-commerce transaction value and 32% of point-of-sale purchases in 2030, down from 40% of online purchases and 48% of point-of-sale purchases in 2014.

However, cards continue to remain a critical part of digital wallet usage in America and abroad. The report further notes that seven in ten digital wallets in the world’s largest economy are funded by cards, tied with Australia (70%) and followed by the United Kingdom (67%), India (56%), Brazil (53%), and China (46%). Cash usage has been declining in the United States and will continue to drop in the coming years.

Although digital wallets are becoming more popular globally, adoption rates differ greatly by geographic location. In Sweden, where cash is used in less than 10% of transactions, some stores have stopped accepting actual currency, hastening the country's shift to a culture that is almost entirely cashless.

With 969 million active users as of mid-2024, China remains at the forefront of mobile payments. Cash is becoming a less common means of payment as mobile payments accounted for 73.2% of consumer transactions in 2023.

These two economies serve as examples of how government regulations, consumer

behaviour, and financial infrastructure influence the pace at which various nations are adopting digital payments.

As cashless infrastructure is expanded across Asia-Pacific through governmentled efforts, digital wallets continue to rise in popularity. Thailand has launched a digital wallet stimulus programme to encourage digital purchases, while Singapore and other nations have promoted the adoption of cashless transactions through focused initiatives like “Hawkers Go Digital.”

Additionally, by expanding infrastructure and reforming policies, several regional governments are strengthening cashless ecosystems. According to SilkPay, more than 40% of international e-commerce transactions will take place through digital wallets by 2025.

Threats to cybersecurity, such as identity theft, financial fraud, and data breaches, continue to be major issues. Since digital wallets hold private financial data, hackers are always looking for ways to access them.

Financial institutions and payment processors are making significant investments in biometric authentication, AI-driven fraud detection, and real-time transaction monitoring to address these problems. Global security standards are reinforced by regulatory frameworks like Know Your Customer (KYC), the PSD2 guideline from Europe, and anti-money laundering (AML) laws.

Protecting their digital wallets is another responsibility of consumers. Kaspersky cybersecurity experts caution that using public Wi-Fi without authorisation, creating weak passwords, and falling for phishing scams are all serious risks. It is advised that users enable two-factor authentication (2FA) and monitor their accounts for unusual activity. Top 10 countries with the highest digital wallet penetration in 2024 (In Percentage)

Can cash survive the digital age?

It seems doubtful that cash will completely disappear very soon, even as digital wallets are transforming how payments are made. For unbanked and underbanked people, cash is still crucial to financial inclusion, especially in rural and developing regions. Cash transactions, in contrast to digital payments, are untraceable, providing anonymity that consumers concerned about data tracking or surveillance value. Cash also acts as a fallback in case digital payment systems fail due to natural catastrophes, cyberattacks, or power outages.

Other nations, like Germany and Japan, nevertheless place a higher priority on using cash because of consumer preference and economic stability, even if Sweden is quickly approaching a cashless society.

The trend toward digital payments points to a gradual shift rather than cash's sudden demise. According to PYMNTS research, 86% of consumers in major economies are now familiar with digital wallets, yet many still use a combination of traditional and digital payment methods.

Regulators are looking into methods to keep digital payments inclusive and accessible in light of this changing environment. For instance, the European

Central Bank is evaluating how a digital euro may supplement currency and guarantee financial inclusion for people who would find it difficult to adapt to completely digital transactions.

Ensuring inclusivity, security, and accessibility will be essential to the longterm viability of digital wallets as they evolve. The financial landscape will be further shaped by emerging technologies such as decentralised finance (DeFi), blockchain-based payments, and nextgeneration near-field communication (NFC) advancements.

To create robust digital ecosystems that can adapt to changing customer demands, financial institutions, technology companies, and regulators must work together. How they will handle a world where digital and traditional payments coexist is the fundamental question, not just whether cash will go extinct.

The shift to digital wallets is accelerating globally, driven by technological advancements, convenience, and growing government support. While cash still holds relevance in some regions, the future of payments will likely be dominated by digital solutions.

For unbanked and underbanked people, cash is still crucial to financial inclusion, especially in rural and developing regions. Cash transactions, in contrast to digital payments, are untraceable, providing anonymity that consumers concerned about data tracking or surveillance value

The notorious confetti feature of Robinhood was one of the warning signs that initially raised awareness of the gamification problem

The most important element in creating wealth is investing in assets that provide income. Stocks primarily form the foundation of many retirement accounts. Regretfully, in 2021, roughly 56% of Americans owned stocks.

Robinhood has attempted to promote more stock market participation by incorporating game-like elements into its trading software. It operates in this manner to promote the goal of "making finance accessible to everyone."

While it sounds great, the gamification of investing encourages tactics that work better for brokerages than for investors. This is all the information you need to understand the procedure, including how it operates, why it's risky, and how to stay safe.

What does investing gamification entail?

Adding features to investment apps that improve the user experience by making it more interesting, intuitive, or aesthetically pleasing is known as the "gamification of investing." The goal is to make trading stocks more enjoyable for the customer, like playing a video game.

On the other hand, imagine a dull black-and-white screen covered in financial jargon and unintelligible indicators. Such a user interface, daunting to those unfamiliar with it, is likely to deter potential investors. GBO Correspondent

The animation received so much negative feedback that Robinhood eventually took it off its app. Ironically, they completely missed the meaning and substituted floating geometric designs for the confetti

An approachable and friendly investing app may seem like a beneficial thing. In theory, it might be helpful, but there are certain limitations. In reality, many gamification elements border on deception and manipulation, which can diminish the experience.

Because of this, the practice has drawn criticism, and authorities are stepping in. The public was formally asked to provide feedback on investing gamification and "digital engagement practices" by the Securities and Exchange Commission (SEC).

The Financial Industry Regulatory Authority (FINRA) has indicated that it would like to follow suit. Both agencies wish to determine whether regulatory action is required to safeguard consumers from the dangers these practices pose.

In a more severe move, Massachusetts Commonwealth Secretary William Galvin accused Robinhood of utilising "aggressive tactics to attract new, often inexperienced investors" and "gamification strategies to encourage and entice continuous and repetitive use of its trading application."

The risks associated with investment gamification are difficult to convey as a mere theoretical concept. Let's examine some of the real procedures that platforms like Robinhood are putting in place to bring things a bit closer to reality.

The notorious confetti feature of Robinhood was one of the warning signs that initially raised awareness of the gamification problem. Earlier iterations of the programme reinforced the notion that every deal was a cause for celebration by letting confetti fall across your screen after each trade.

In actuality, increasing the number of trades you make is an excellent way to lose money. The average investor is frequently far better off adopting a less aggressive investing strategy, and stock traders nearly always lose.

The animation received so much negative feedback that Robinhood eventually took it off its app. Ironically, they completely missed the meaning and substituted floating geometric designs for the confetti.

The financial services sector faces

heavy regulation for good reason. People frequently risk losing the money they use to pay for their children's education, put food on the table, and fund their retirements.

Disclosure requirements are a major component of such legislation. For this reason, payday lenders must disclose that their prices are not long-term viable, and publicly traded corporations must provide disclaimers with their financial statements.

Unfortunately, playful game-like interfaces rarely accommodate these kinds of acknowledgements. In a world where individuals rarely read terms and conditions, this poses a significant risk. Customers are unlikely to take important information seriously unless providers make it easily accessible.

The emphasis on trending stocks is among the most hazardous aspects of gamification. Apps frequently show the stocks with the biggest price changes, whether positive or negative, much like you would see the top ten scorers in a competitive video game.

These lists funnel investors into a volatile handful of stocks that are far from guaranteed to be profitable, even though there are many investment options available today. Indeed, they are frequently the most overbought equities on the market.

These lists encourage terrible investing practices, particularly among younger investors who are more susceptible to manipulation. In their constant pursuit of the newest and most exciting opportunities, they may end up investing heavily in a stock simply because it moved more than others that day.

Research has shown that attentioninduced trading negatively affects Robinhood users. The top equities bought every day had a dismal average 20-day return of -4.7%.

These apps use lottery systems to encourage behaviour that may not be optimal for you.

They can further numb users to the hazards involved by making the experience feel more like gambling than investing.

“For instance, I recently received an email from Coinbase regarding their most recent sweepstakes. Eight lucky winners will receive prizes totalling $500,000. You only need to make a trade of $100 or more to be eligible for the sweepstakes,” Certified Public Accountant Nick Gallo wrote in a blog for Finmasters.