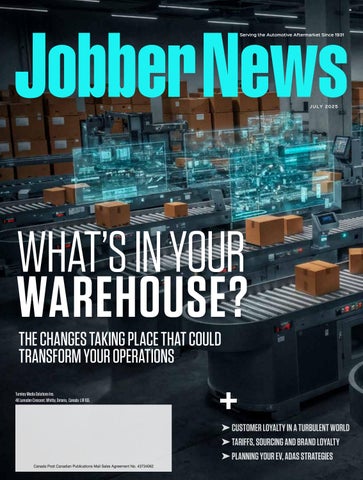

WHAT’S IN YOUR WAREHOUSE?

Recognizing Canada’s top parts distributor

Know an auto repair shop worthy of recognition?

Nominate them now for the prestigious Shop of the Year Award, sponsored by Milwaukee!

THE 2025 SHOP OF THE YEAR

An auto repair shop that has captured the imagination of the community with its unique approach to customer service, dedication to excellence, training, and improving the image of our industry.

Tell us their story:

• What makes this shop special?

• How are they going above and beyond for their customers?

• How are they standing out from their competitors?

• How have they innovated over the last year?

WINNER WILL RECEIVE

- Milwaukee Tool prize pack valued at $3,500, ranging from PACKOUT ™ equipment to tools

- A visit from a Milwaukee Tool representative and Turnkey Media for an award presentation -Shop spotlighted in CARS magazine’s December issue

WE CAN’T WAIT TO HEAR FROM YOU!

We want to recognize a shop that has demonstrated high performance in the bays, shown innovation and creativity— through training, marketing, customer communication and/or sales. Historical success is always a contributing factor.

Deadline: October 12, 2025

Scan here to nominate

Supply chain change |

The automotive aftermarket relies on a strong supply chain and nimble, fast-moving warehouses. But there have been challenges on both fronts in recent times. Here’s a look at the technologies and trends that can help

transaction

Missed an episode of Auto Service World Conversations?

Scan the QR code to catch up!

A ROADMAP FOR OUR AFTERMARKET FUTURE, WITH DONOVAN RINGO

POSITIONING YOUR SHOP FOR SALE, WITH SUNIL PATEL

GLOBAL UNCERTAINTY AND RESILIENCE, WITH BILL HANVEY

THE FUTURE OF AUTOMOTIVE TRAINING, WITH J.F. CHAMPAGNE

SUBSCRIPTION PRICE: $6.99

Jobber News is Canada’s longest-established publication serving the distribution segment of the Canadian automotive aftermarket. It is specifically directed to warehouse distributors, wholesalers, machine shops, and national accounts.

Automotive Group Director | Nickisha Rashid (647) 355-7416

nickisha@turnkey.media

Publisher | Peter Bulmer (585) 653-6768 peter@turnkey.media

Managing Editor | Adam Malik (647) 988-3800 adam@turnkey.media

Contributing Writer | Zakari Krieger, Meagan Moody, Kumar Saha

Creative Director | Samantha Jackson

Video / Audio Engineer | Ashley Mikalauskas, Nicholas Paddison

Sales | Peter Bulmer, (585) 653-6768 peterb@turnkey.media

Delon Rashid, (416) 459-0063 delon@turnkey.media

Nickisha Rashid, (647) 355-7416 nickisha@turnkey.media

Circulation | Delon Rashid, (416) 459-0063 delon@turnkey.media

Production | Tracy Stone tracy@turnkey.media

Jobber News is published by Turnkey Media Solutions Inc. All rights reserved. Printed in Canada. The contents of this publication July not be reproduced or transmitted in any form, either in part or full, including photocopying and recording, without the written consent of the copyright owner. Nor July any part of this publication be stored in a retrieval system of any nature without prior consent.

Canada Post Canadian Publications Mail Sales Product Agreement No. 43734062

“Return Postage Guaranteed” Send change of address notices, undeliverable copies and subscription orders to: Circulation Dept., Jobber News, 48 Lumsden Crescent, Whitby, ON, L1R 1G5

Jobber News Magazine (ISSN#0021-7050) is published six times per year by Turnkey Media Solutions Inc., 48 Lumsden Crescent, Whitby, ON, L1R 1G5

From time to time we make our subscription list available to select companies and organizations whose product or service July interest you. If you do not wish your contact information to be made available, please contact us.

ITAKING CARE OF THE WAREHOUSE

f there’s one thing the automotive aftermarket has never lacked, it’s parts. In fact, the industry can often find it has more than it knows what to do with.

As average vehicle age, complexity increases, breadth of models grows and SKUs multiply, warehouses are bursting at the seams. And yet, despite this abundance, getting the right part to the right place at the right time remains one of its biggest skills.

But that doesn’t mean the stress of housing all those parts needs to be part of the job. Aftermarket systems need to be running at optimal performance just to keep pace.

Warehousing has become the pressure point of the modern supply chain. It’s where the strain of parts proliferation meets the demand for speed, accuracy and customer satisfaction. And this can be an area where things start to break down.

The good news? Solutions are not in short supply. From drones that scan inventory autonomously to AI that predicts stocking needs and streamlines order management, the tools to modernize warehouse operations are already here. It was highlighted by Bill Hanvey during a recent Auto Service World Conversations podcast episode. He noted that AI could help address the industry’s chronic parts proliferation problem by creating more efficient strategies.

“Our marketplace is over-inventoried — but we have to be in order to be able to have that vehicle repaired in a half an hour,” he said.

What’s needed? The industry-wide urgency to adopt these tools.

Strong warehouse practices aren’t just about keeping things tidy. They’re about enabling jobbers and distributors to serve their customers better — faster deliveries, fewer errors and more time spent solving problems instead of chasing down parts. In a business where margins are tight and expectations are high, that kind of efficiency isn’t optional. It’s survival.

And let’s not forget the customer. Whether it’s a repair shop waiting on a critical part or a DIYer expecting immediate availability, delays and inaccuracies in the warehouse ripple all the way down the line. When warehouses run efficiently, everyone benefits: Fewer returns, faster service, better margins and stronger customer relationships.

But technology alone won’t fix what’s broken. It takes leadership, investment and a willingness to rethink how we manage space, people and processes. It means treating warehousing not as a back-office function, but as a strategic asset — one that can make or break the customer experience.

The pace of change in warehouse technology is rapid. Automation tools are evolving by the month. What worked last year might already be outdated. That’s why it’s critical for aftermarket professionals to keep a close eye on trends and be ready to adapt.

We also need honest conversations about the challenges. Labour shortages, rising costs and global disruptions aren’t going away. But a well-run warehouse — one that uses data, automation and smart planning — is better equipped to weather those storms.

President & Managing Partner | Delon Rashid

Head of Sales & Managing Partner | Peter Bulmer

Corporate Office 48 Lumsden Crescent, Whitby, ON, L1R 1G5

As we look ahead, the message is clear: The warehouse is no longer just a place to store parts. It’s the engine that drives the aftermarket forward. Let’s make sure it’s running at full power.

Adam Malik Managing Editor, Jobber News

We want to hear from you about anything you read in Jobber News magazine. Send your email to adam@turnkey.media

GREEN DREAMS, DIRTY TRUTHS

EV WORLD, SPRING 2025

Well-read article. Nice reading truthful informative information. EVs are a political-economical push, not an environmental cure. Thirty years ago, CEO concerns for the next quarter’s earnings are why North America is in the predicament it is in today. What will happen 30 years from now, from forcing a commodity onto the average consumer that they can not afford? The company that builds an affordable, longer-lasting, serviceable vehicle will be the company still standing in 30 years. Governments and manufacturing need to think ahead, learn from the past and smarten up.

Rob Nurse, Bob Nurse Motors

CANADIANS TURN TO INDEPENDENTS AMID RISING COSTS

AUTO SERVICE WORLD, JANUARY 15, 2025

Customer service, trust and relationship building are the big reasons why consumers are choosing independents. They feel welcomed at independents shops unlike dealerships where they are just a number with little to non personal touches. Staff at independents are better educated on vehicle maintenance and repair explanations which goes a long way to building their repeat business.

Bob Ward, The Auto Guys

WHY YOU SHOULD OFFER CHEAP, EVEN FREE, OIL CHANGES

AUTO SERVICE WORLD, JANUARY 21, 2025

When you make the conversation about money before the vehicle is even in your shop, that is the only conversation you will ever have. Been at this for 40-plus years. You get no respect from your clientele or staff when you make things cheap.

Frank Meiboom, M&R Auto Repair

Great way to meet new clients. It’s like speed dating as you get a feel for what the client wants from his service provider. You pick your clients just like you’d find something you like on a speed date. Sometimes you are incompatible. Sometimes you develop great friendships. I did $10 ones and free ones for years when building clientele. You can turn the special on and off and use it when you like.

Rick McMullin, Ricky Ratchets

For years, we have emphasized through articles from industry coaches and trainers that our sector should avoid commoditizing services and engaging in a race to the bottom. Professional automotive repair businesses should focus on providing valuedriven, service-based models. That said, marketing strategies like these undeniably drive traffic and increase car counts. The challenge lies in the fact that few shop owners have the processes or profit margins necessary to absorb the costs associated with low-price oil change programs. This approach can be a slippery slope, potentially leading shops back to price-driven competition on oil services, which undermines profitability and the value of professional service.

Carlo Sabucco, Sil’s Auto Care Centre

Congratulations on winning the race to the bottom. I’m truly happy there are shops like this one out there, to take all of the worst customers that I don’t want coming in my door. This business practice depends on upselling to make your money. I believe my customers and myself are much better off paying the proper price up front, and only being upsold as needed – and again properly charged. It took a very long time to accumulate and educate a good customer base that understands and appreciates this, but i believe it is the right way to do it.

Geoff Walton, Grant Street Garage

MOBILE SERVICE REVIVING DEALERCUSTOMER RELATIONSHIPS

AUTO SERVICE WORLD, JANUARY 30, 2025

Proper vehicle service cannot be performed at off site locations. The technician will not have access to critical components needing inspection. Weather plays a very important role in outside vehicle service. This will be a difficult service to attract technicians. Another important question is inventory. Service vehicles are not able to store a lot of inventory. Too many variable to consider. In my opinion auto service will be very difficult to perform in consumers laneways. Not something I would even consider.

Bob Ward, The Auto Guys

I totally agree with Bob Ward. I have told my customers in the past that if I wanted to work outside, why would I build this nice new building? When I worked at a dealership I was asked to work on an ORV off-site because I had the license to do so. I refused by saying the only mobility my toolbox has is from one service facility to another. If they want me to work off-site, then I will stay off-site.

Barry Makins, Makins Automotive

Scan the QR code for the latest and more in-depth news online.

SHAD’S 50TH IS BIGGEST ONE YET

THE CANADIAN AUTOMOTIVE AFTERMARKET turned out bigger and better than ever for Shad’s R&R, with the most golfers, the most money raised and a milestone passed.

One of the premier charity golf events in the industry, 300 aftermarket pros to hit the links at Woodington Lake Golf Club in Tottenham, Ontario, on June 12. It was the 50th edition of Shad’s, which saw its first ever sell out, and drew in suppliers, jobbers and shop reps from across the country, plus the U.S.

The day raised $270,000 for Muscular Dystrophy Canada. That brought the all-time total raised to more than $6 million. The funds were raised by the hundreds of golfers who paid to take part, plus through raffle prizes donated by industry companies. The day included 18 holes of golf, a dinner event with the raffle and a 50/50 draw.

Brad Shaddick later announced that he will be stepping down as chair of the event and Charlie Grant from Grant Brothers will take over the role. Shaddick will stay on the board.

MASSE TO MOVE FROM UAP TO GPC

GENUINE PARTS COMPANY announced major changes to the leadership structure of its North American operations.

Group president Randy Breaux will retire at the end of the year, and UAP president Alain Masse will take over the newly created role of president for North America Automotive in August.

The announcement noted that Breaux will serve in an advisory role until his retirement to assist in an orderly and seamless transition. Masse, who has been with the company since 2011, he came on board as executive vice president of heavy vehicle parts division at UAP. He was promoted two years later to executive vice president of NAPA. In 2015, he was named president of UAP.

The announcement noted he “is a highly motivated leader with a deep understanding of the automotive aftermarket industry and NAPA business model.”

In his new role, Masse will oversee the automotive businesses across North America, reporting to Will Stengel, president and CEO of GPC.

GPC recently celebrated 100 years of the NAPA brand at an event in Las Vegas.

FEDERATED GIVES HIGHEST HONOUR TO CANUSA’S JONES

JOHN JONES, CEO of Canusa Automotive and Auto Parts Centres (APC), has been awarded the prestigious Art Fisher Memorial Award — Federated Auto Parts’ top recognition for leadership and service.

The honour from Federated recognizes Jones’ long-standing dedication to the organization and the broader automotive aftermarket industry.

Jones leads Canusa Automotive and APC, a Canadian warehouse distributor with more than 65 locations across Ontario. The company specializes in aftermarket parts for light-duty, mediumduty, and performance vehicles.

“The Art Fisher Memorial Award represents the highest honour we can bestow upon a member of our organization,” said Bo Fisher, chairman of Federated Auto Parts. “We are very pleased to recognize John Jones for his exceptional commitment to the mission and values of Federated. I know my father would take great pride in honouring John’s loyal support and the vital role

he plays in advancing Federated and the greater aftermarket community.”

Jones’ connection to the industry began early, working parttime at Canusa/APC before attending college where he studied business and marketing. After graduation, he returned to the company full-time, taking on roles in warehousing, IT, and management before eventually becoming CEO.

SEARCH FOR NEXT AIA CANADA LEADER UNDERWAY

THE AUTOMOTIVE INDUSTRIES ASSOCIATION of Canada has now posted the position in search of a successor for current president and CEO J.F. Champagne, who announced in March that he would be stepping down.

It was at the AIA Canada national conference in the spring that Champagne announced the leadership transition would be forthcoming.

“Through 2025 and into 2026, I’m going to be working with the board of directors to seek, onboard, attract and set up for success the next president and CEO of AIA Canada,”

The Timing Chain Kit Everyone is Talking About

Champagne told attendees.

Emphasizing continuity, Champagne was clear that he’s “not going anywhere” immediately. He plans to remain actively involved through part of 2026, ensuring a smooth handover of leadership responsibilities.

The posting notes the importance of the association and the role it plays in the country’s collision, aftermarket and mechanical sectors. The candidate will be responsible for AIA Canada’s leadership by “sustaining a positive public awareness of the auto care industry, recommend strategic direction to the board, and safeguard lasting and constructive relationships with government, industry, and a variety of member groups.”

The role means being the face of the organization, representing its brand and mandates, while being a trusted industry partner. The group is looking for someone in the Montreal-Ottawa-Toronto corridor. The ability to speak English and French is considered a great asset.

THE BURDEN OF VEHICLE OWNERSHIP

CANADIANS' VIEWS ON CAR ownership are shifting from

OE-quality chains that prevent stretch Precision-machined sprockets and ber reinforced guides

Two year/100,000km parts and labor warranty

Detailed installation instructions

a symbol of freedom to a significant financial burden, according to Turo's fourth annual Car Ownership Index.

Despite 70 per cent of Canadians feeling their monthly car costs are too high, 78 per cent believe it's impossible to live without a car.

Car ownership costs jumped 9 per cent in the last year, rising from $5,025 to $5,497 annually. This increase has led 55 per cent of Canadians to adjust their spending to reduce car-related expenses, and 42 per cent are sacrificing other areas of their lives. The financial strain is particularly acute for younger Canadians (25-44), who report average annual costs of $7,029, significantly higher than the $3,728 for those 65 and older. Families also bear a heavier burden, averaging $7,252 annually compared to $4,793 for households without children.

"With life getting so much more expensive, Canadians are looking for more ways to save on car expenses and supplement the cost of ownership,” said Bassem El-Rahimy, Turo's vice president.

The financial pressure is expected to intensify with proposed tariffs potentially raising costs by an additional 25 per cent.

Despite the rising costs, Canadians remain heavily reliant on their vehicles. This has spurred a growing interest in solutions like car sharing or leasing. Among those who have tried car sharing, 87 per cent would use it again, a rise of 8 per cent in 18 months, primarily due to its affordability and convenience for activities like domestic travel, errands and business trips.

RETAIL SALES CLOUDED BY UNCERTAINTY

THERE WAS GROWTH across all areas of retail automotive sales, but caution is being mixed in as uncertainty looms.

“While at first blush changes in retail sales in Canada in the first quarter of 2025 seem to show significant variation, the true picture is likely not as diverse as it first appears,” said an analysis from DesRosiers Automotive Consultants about the first quarter

of retail sales this year.

Automotive parts, accessories and tires grew 4.7 per cent compared to Q1 2024, ahead of gasoline sales, which were up 0.9 per cent. Used vehicle dealers saw the biggest growth at 11.4 per cent, with new vehicle dealers coming in second at 7.1 per cent growth.

However, the comparables are not a great starting point, DesRosiers’ analysis stated.

“For example, for used vehicle dealers, the first quarter of 2024 was notably weak as consumers could finally purchase a new vehicle without a months-long wait — and as a result, used vehicle prices fell sharply in Q1 2024,” it noted.

The consultancy also noted that gas prices saw a big jump in March 2024. “So the decline we have seen in March 2025 (and weak growth in the quarter as a whole) is more the result of changing price per litre than growth/decline in gas volumes,” it said.

The average price of gas dipped from $1.698 in April 2024 to $1.392 in April 2025, meaning there is expected weakness in gas station retail sales in the second quarter of this year.

However, these comparables aren’t as much of an issue when looking at the aftermarket and new vehicle market. This likely represents a more accurate picture of the market performance to

start the year, the group noted.

“While the hangover from 2024 complicates the 2025 retail sales numbers, looking forward the added complexity of the ongoing tariff chaos will impact prices (and sales) in the auto sector for the rest of 2025,” said Andrew King, Desrosiers’ managing partner. “While U.S. trade action against Canada has stabilized somewhat for the time being, we are still far away from any certainty.”

U.S. AVERAGE AGE RISES

THE AVERAGE AGE OF LIGHT vehicles in the U.S. rose to a record 12.8 years in 2024, marking the second straight year of a two-month increase, according to new data from S&P Global Mobility.

By comparison, Canada sat at 10.5 years as of last summer.

Despite vehicle registrations surpassing 16 million last year for the first time since 2019, they weren’t enough to offset aging trends in the 289 million-strong U.S. vehicle fleet, which saw a steady 4.5 per cent scrappage rate. The number of passenger cars dropped below 100 million for the first time since the 1970s.

“Passenger cars are continuing a steady decline toward

the real-time visibility you need to optimize processes across every area of your parts distribution business. Epicor is the preferred ERP, catalog, business intelligence, and eCommerce provider to leading distributors, program groups, jobbers, dealerships, and retail chains. Our solutions help aftermarket businesses achieve unsurpassed category intelligence, best-in-class operating efficiency, and exceptional customer satisfaction and loyalty. LEARN

equilibrium as consumer preference shifts to light trucks,” said Todd Campau, aftermarket practice lead at S&P Global Mobility. “The vehicle fleet continues to demonstrate impressive resilience even as it faces stress from high new and used prices and economic uncertainty.”

The average age of passenger cars climbed to 14.5 years, while light trucks reached 11.9 years. Battery electric vehicles (BEVs) showed signs of aging for the first time in years, with their average age rising to 3.7 years. Plug-in hybrids held steady at 4.9 years and traditional hybrids declined from 6.9 to 6.4 years.

“Consumer preference currently is favouring hybrid and plug-in hybrid options over fully battery electric vehicles to a large extent, driving average age to flat or even negative for those propulsion types,” said Campau. “Alternative propulsion average age will continue to depend heavily on consumer sentiment for the next several years as they continue to build overall share in the vehicle fleet.”

With more vehicles moving into the aftermarket space — especially those from high-registration years between 2015 and 2019 — opportunities for maintenance and repair are expected to grow.

Brian Mielko, is the new president and chief executive officer of OK Tire Stores Inc. He was most recently with Sailun Tire.

Mevotech has appointed Matt Weiss as its new executive vice president of sales. He will lead the company’s North American sales team.

MEMA, The Vehicle Suppliers Association, announced the retirement of its president and CEO, Bill Long. The move is effective January 3, 2026.

Paul McCarthy will take over as president of MEMA, The Vehicle Suppliers Association in January 2026. He is currently MEMA Aftermarket Suppliers president.

KYB announced the promotion of Ryan Dickerman from national sales manager to director of sales. He has been with KYB for almost 18 years.

25_005844_Jobber_News_JUL_CN Mod: May 16, 2025 9:56 AM Print: 06/04/25 page 1 v2.5

By The Numbers

Stats that put the North American automotive aftermarket into perspective

$54,950 19.7% 104%

Average transaction price for a light truck in Canada slowed in 2024 but still hit a new high. For passenger cars, average transaction price came in at $45,813.

DesRosiers Automotive Consultants

$270,000

The most money ever raised in one year by the Shad’s R&R industry golf tournament in support of Muscular Dystrophy Canada.

Shad’s R&R

22

The number of vehicle models priced under $30,000 has fallen from 72 to 22 since 2019 as OEs shift away from lowerpriced options

Cloud Theory

Retailer profit fell year over year in December 2024, primarily driven by rising inventory levels, with fewer vehicles selling above the MSRP

J.D. Power

88.1%

The light truck market is dominating light vehicle sales with sales rising 4.7% in the first quarter. Intermediate luxury SUV sales were up 18.9%

DesRosiers Automotive Consultants

"Drivetrain" searches surged on eBay Motors, while "Crate Motor" searches rose 82% and “Exhaust System” searches increased more than 13%.

eBay Motors

12.8 years 73%

Average vehicle age in the United States grew by two months to a new high in 2024, matching growth from the year before.

S&P Global Mobility

Electric vehicles had higher average replacement rates in 11 out of 15 top product and component categories than internal combustion engine vehicles. IMR Inc.

ON THE ROAD

MEMA Aftermarket Suppliers Vision Conference

April 2, 2025

Chicago, Illinois

Top executives from across the industry gathered in Chicago during so-called Liberation Day, where the U.S. federal government slapped tariffs on countries around the world. The timing of the day and event allowed for many discussions about the challenges and issues moving forward for the automotive industry overall, including the automotive aftermarket. Presentations also explored customer engagement, digitization, e-commerce strategies, artificial intelligence, connected vehicles and other innovations and how these areas can and will affect the industry.

THE CHANGING FACE OF LOYALTY

// By Kumar Saha

Astrange contradiction has emerged in the recently published Jobber News Annual Shop Survey

Last year’s data showed that 45 per cent of shops ranked product availability as the most important factor for making a jobber a shop’s first call. In 2025, that number dropped to 41 per cent. This year, more garages deemed their relationships with jobbers as most important — 31 per cent of shops picked relationships as top influencer, up from 26 per cent last year.

So, you would think that trust and loyalty matter more than ever, right? That’s where things get a little trickier. According to the data, nearly a quarter of independent service shops now call five or more distributors when sourcing parts — up from 10 per cent in 2024. Even more striking, 11 per cent now buy from seven or more — a number that didn’t even hit 5 per cent last year. Not exactly a thumping “yeah” for loyalty.

This isn’t a blip. It’s both a signal and warning: Relationships matter. But in an increasingly volatile and digital world, shops are spreading out their risk and trust across more partners in search of inventory availability.

The latest survey numbers might lead distributors to believe past alliances — the bedrock of the aftermarket business — remain ascendant, but jobbers that can’t provide the right part at the right time will still end up losing the sale to their competition.

Canadian shop owners face ever-mounting pressures on their business. Budgets mean garages have little room for error. If a regular jobber can’t get the right part fast and at a fair price, they’ll pivot — often to competitors within the same banner or outside it altogether.

So, what’s driving shops to fragment their spend? Trade and tariff headwinds are a clear and present factor. While we don’t have the same direct tariff exposure as the U.S., our supply chains are deeply tied to global sourcing. Parts shortages, shipping delays and currency fluctuations have made it harder for

jobbers to promise consistent delivery. In particular, electronics and emission-related components — many sourced from China or the U.S.—have become more unpredictable in cost and lead time. These factors erode the “go-to jobber” model.

Shops also face economic pressure. Interest rates remain high. Vehicle complexity is rising. Customer expectations (including price transparency) have jumped. Shops can’t afford to wait. When one source fails, they immediately pivot — often to less traditional players, including online marketplaces.

Recent network consolidation maybe a factor as well. In Canada, the banner system — UniSelect’s Bumper to Bumper, NAPA, PartSource, Bestbuy Distributors and others — has traditionally helped jobbers stand out. But with mergers, some lines are blurring. This may have created overlap and confusion at the shop level, making it easier for shops to rationalize buying across multiple sources.

knowledgeable, responsive local parts rep remains a key differentiator. Jobbers should empower their reps with tools, training and real-time support to resolve issues quickly — whether it’s sourcing hard-to-find parts, handling warranty claims or offering repair advice. The jobber of the future is not just a reliable supplier; they are a local logistics hub, digital enabler and problem-solver rolled into one.

If you can’t answer “Do you have it now?” with confidence, expect to be replaced — quickly.

Kumar Saha

Kumar

Here are some strategies to get ahead of the competition:

Get smarter with local inventory

Rather than stocking broadly, stock strategically. Focus on top-moving SKUs by region, vehicle population and seasonal needs. Use local data to anticipate demand — especially for high-failure items like wheel bearings, sensors, or winterspecific SKUs. Jobbers — especially those serving mixed fleets in urban areas — can do the same with the right forecasting tools.

Build redundancy into sourcing

Distributors should consider dual-sourcing key categories — not just from Asia or the U.S., but from emerging North American suppliers as a hedge against disruption. Many suppliers did this after COVID-related port disruptions and have since enjoyed more resilient supply performance. Smaller jobbers can work with distributors offering flexible sourcing models to reduce wait times.

Invest in digital ordering and visibility

Thanks to their experiences from personal purchases, shop owners and employees increasingly expect Amazon-style convenience: Real-time inventory lookup, VIN-specific fitment and quick ordering. Tools must deliver on that promise — or risk losing ground to RockAuto, PartsAvatar and others. Even the most relationship-driven shop can be swayed by speed and simplicity.

Reinforce your human advantage

The data is clear — relationships still matter. A

IA1000 AUTOMATED WHEEL ALIGNMENT & ADAS CALIBRATION SYSTEM

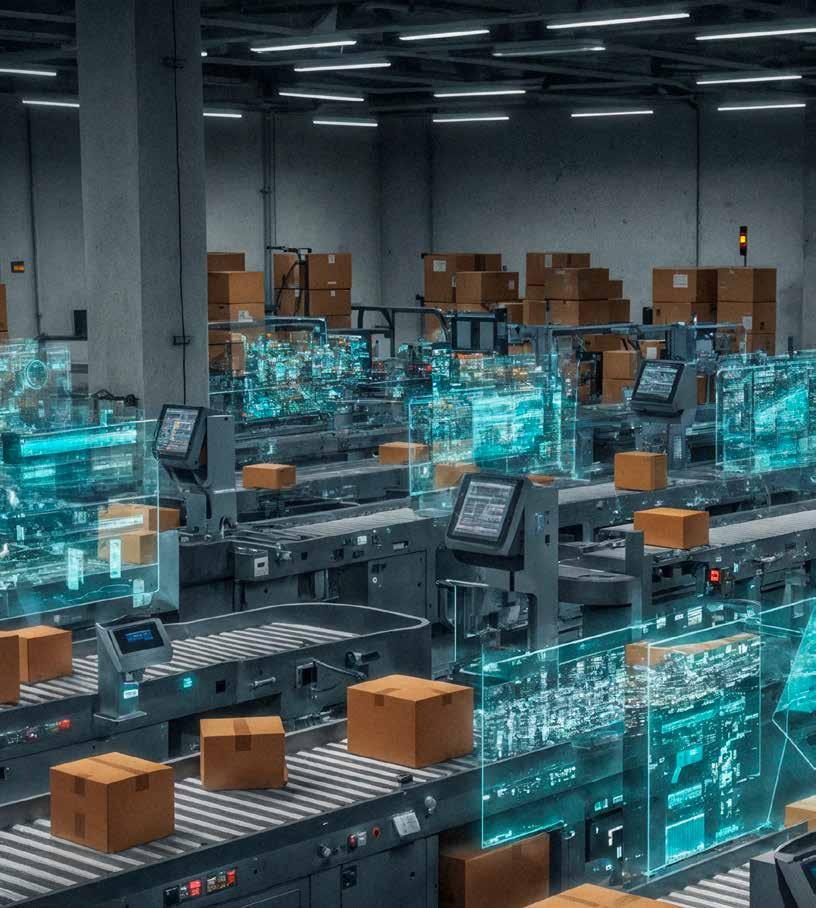

DRIVING SUPPLY CHAIN CHANGE

How AI and new technologies are transforming warehouse operations and the overall logistics sector //

By Derek Clouthier

In an industry built on precision, timing and availability, the success of the automotive aftermarket relies on the strength of its supply chain. From retail outlets to distributors, every link in the warehouse operations chain affects how quickly and efficiently customers get what they need.

And in 2025, that chain is being pulled in new directions.

Warehouses are no longer just storage spaces — they’re becoming high-tech hubs powered by drones, robotics and artificial intelligence. These technologies are slashing labour costs, boosting inventory accuracy and giving shop owners and distributors real-time visibility into their operations. At the same time, procurement is undergoing a quiet revolution, with AI agents now capable of negotiating contracts, generating market reports and even managing entire sourcing workflows.

But it’s not just about automation. The global landscape is shifting, too. Geopolitical tensions, emerging uncertainty and rising regulatory pressures are forcing businesses to rethink how and where they source materials. For the auto care industry, that means building more resilient, flexible supply networks that can weather disruption — whether it’s a port strike, economic uncertainty or a policy change.

This year’s trends point to a future where supply chains are smarter, faster and more autonomous. But they also demand a new kind of leadership — one that blends technology with strategy and innovation with adaptability. For aftermarket professionals, staying ahead means embracing these changes, not just reacting to them.

Marrying robotics and technology

Robotics and technology go hand in hand, but if they don’t work in unison, warehouse operations are

likely to encounter setbacks.

As Jim Hoefflin, CEO of Softeon, told an audience at Manifest 2025, there’s still a great deal of variation in how robotics and technology are deployed in warehouse environments.

“It’s like first-generation WMS [warehouse management systems], and they’re just starting,” he said. “They’re good at how they create their workflow. They bring you different automation substances. I think the key to all of it is how you set that up.”

Hoefflin said his company dedicates significant time to warehouse execution and communication, helping customers adapt and offering ongoing support.

“Automation products are changing by the week or month. You can’t buy something and sit around for any amount of time,” he said.

Josip Cesic, CEO of Gideon, said that in his company’s operations —which involve loading and unloading truck trailers across multiple industries — robotics must be flexible and capable of making decisions in real time.

“These days, with all the investments in AI and computing, robots are really able to solve those moving problems,” he said.

Although typically separate from electronic processes inside a facility, Cesic said loading bays offer a good starting point for automation.

“There are a number of technologies that can enable or help optimize processes across a facility, but the loading bay is relatively separated,” he said. “So from an adoption perspective, it’s a really great use case to start and learn about automation and take the journey forward.”

Corvus Robotics develops inventory drones that fly autonomously and scan pallet labels to enable fully automated inventory tracking.

Jackie Wu, CEO and co-founder of Corvus Robotics, said the ability to deploy quickly in varied environments depends on strong integration with existing technology.

“Some of the core technologies that are mature allow us to set up these drones,” said Wu.

Hoefflin said he encourages customers to focus on delivering faster, higher-value solutions to elevate productivity.

“All of this automation is really good at upsetting what was the industry norm, and we’re in a better position today,” he said.

Drones transform warehouse operations

Warehouses are increasingly adopting automation as companies look for new ways to reduce costs, improve accuracy and ease the physical burden on workers. The emergence of drones is making an impact.

At the NextGen Supply Chain Conference in Chicago late last year, AJ Raaker, director of warehouse development with Taylor Logistics, discussed how drones can enhance inventory accuracy and efficiency — especially when paired with artificial intelligence tools like visionbased systems, which deliver richer data than traditional barcodes.

“Here’s what it looks like: A commercially off-the-shelf drone flies itself, takes images of inventory locations and converts those into data like case counts, occupancy levels and inventory matches,” said Raaker.

Drones boost efficiency by collecting billions of data points weekly, providing insights into inventory status, damage and location. These benefits extend to customer visibility, SLA accuracy and labour savings.

“In a facility with about 20,000 rack locations, we were able to cut about 87 per cent of the labour required for inventory management, giving time back to other programs,” said Raaker.

Gather AI supplies warehouse drones for inventory management, helping businesses save money, reduce losses and improve both productivity and revenue. Their setup includes mapping rack locations

using QR codes, integrating with the WMS and training staff on how to use the technology.

The drones operate autonomously and don’t rely on Wi-Fi, making them easier to scale.

Raaker said early iterations of the AI struggled with specific tasks, like counting bags of dog food. But machine learning and ongoing data collection steadily improved accuracy.

“But as we collected more data, our learning got better,” he said.

Taylor Logistics ultimately achieved better inventory accuracy, cost savings and higher customer satisfaction.

“Our customers can virtually walk through the warehouse from anywhere in the world,” said Raaker. “This is AI having a real, tangible impact on supply chains — improving inventory accuracy while reducing labour.”

AI helps transform procurement

Artificial intelligence (AI) is transforming the supply chain sector — and procurement is no exception.

Ryan Polk, senior director analyst with Gartner, outlined three megatrends shaping procurement. As AI adoption accelerates, he said the real challenge lies not in the technology, but in the people managing it.

“The challenge isn’t the tech — it’s the people,” said Polk. “We’re trying to run AI initiatives like IT projects, but they require a total operating model shift.”

Agentic AI models can expand operational context, apply reasoning and integrate multiple types of information to communicate, process or understand tasks.

“Yesterday’s models were largely trained on the accuracy of their output,” said Polk. “Today’s models are being trained on how they reason their way to that output in the first place.”

Thanks to these capabilities, AI agents can begin automating routine procurement tasks.

“When we say an agent, what I’m referring to is an AI model that has the ability to, one, perceive an environment, and two, act on that environment, independent of a human,” said Polk. “There are agents that can help with negotiating supplier contracts. There are other agents that are coming online that can help prepare market research reports based on publicly available information and provide those back to category managers and sourcing managers.”

Polk added that multiagent systems are on the way, with the potential to automate entire procurement processes.

A human user provides a prompt. An orchestrator agent sends the request to sourcing, negotiations and contracts agents. Once processed, a human reviews the output before a compliance agent deploys the results.

While there’s ongoing concern about AI replacing humans, Polk stressed the need for collaboration between the two.

AI can handle repeatable tasks, but humans will still be needed for edge cases and exceptions — frequent challenges in supply chains.

“There’s typically data somewhere within the organization that describes how we go from point A to point B,” said Polk. “It usually exists in policies and procedures. We believe that agents are going to be best suited to support and take over, or at least augment in some way, shape or form, that work because there’s data somewhere within the organization that we can use to train AI models.

ANY AND EVERY PART, THAT’S NAPA KNOW-HOW.

“But there’s another portion of work that we all do as well — non-standard, atypical work that doesn’t follow established rules or procedures.”

As AI takes on more standardized tasks, procurement skillsets will evolve. Human-AI collaboration, data literacy, prompt engineering, inductive analysis and strategic thinking will become increasingly important. Skills like negotiation and data visualization may decline in demand.

Uncertainty

Polk also pointed to rising global regulations as a significant factor reshaping procurement.

“There are new regulations popping up in different locations related to better risk management, more protectionism, more sustainability and more consumer protection,” he said. “We’re seeing the sheer volume of regulations really challenge what we all do — challenge us to comply in different ways.”

He added that although countries may regulate similar issues — like data privacy or digital sovereignty — they often do so in different ways, complicating compliance.

And then there’s the impact of growing protectionist trade policies.

To respond to geopolitical instability, Polk said businesses should evaluate four strategic options:

■ Divesting: Relocating procurement operations;

■ Decoupling: Building separate, independent ecosystems;

■ Diversifying: Adding new suppliers outside existing regions;

■ Doubling down: Expanding current supplier networks for resilience.

But there are other uncertainties on the rise as well, such as energy uncertainty. Polk warned that demand — driven by AI data centres, population growth and economic expansion — may lead to electricity rationing in countries like the U.S., India, Australia, Brazil and potentially Canada.

“If the current trajectory holds true, what we’re likely to start seeing is more and more electricity rationing,” he said. “We need to think about our energy strategies much more strategically than we are today.”

As energy becomes more decentralized, digitized and decarbonized, he said companies must treat it as a critical spend category and build strong partnerships in the space.

This year’s trends

Looking at 2025, AI is set to remain a powerful force in the supply chain world. Whether it’s optimizing warehouses, enhancing inventory management, improving transportation, increasing productivity or building resilience, those who use the technology wisely will reap the benefits.

“AI will continue to be one of the most transformative forces in supply chain management next year and beyond, driving advancements across three key areas: Productivity, process and product,” said Paul Magel, president of the business applications and technology outsourcing division at Computer Generated Solutions and its BlueCherry team.

Magel said AI will boost productivity through better daily operations and decision-making. On the product side, he expects AI to become central to many tech platforms, enabling smarter automation.

“AI will evolve to a point where systems can operate independently — analyzing data, solving problems and taking action without user input, leading to a more seamless and self-

"AI will continue to be one of the most transformative forces in supply chain management next year and beyond, driving advancements across three key areas: Productivity, process and product."

sufficient supply chain,” he said.

AI will also help mitigate global disruptions like the Canadian rail and U.S. East Coast port strikes.

“Looking ahead to 2025, supply chain teams will increase their investments in AI solutions across the end-to-end supply chain, focusing particularly on improving predictive analytics and scenario planning capabilities to enhance resilience and agility,” said Jeff Trino, supply chain leader at Genpact.

“While both the Canadian rail and U.S. port strikes were resolved fairly quickly, they left suppliers scrambling to reroute products. If there’s one thing 2024 taught us, it’s that supply chain disruptions will occur, and preparing for them seems to be an obvious step for suppliers to take in 2025 to stay ahead of the curve.”

And AI will continue to revolutionize order management as well.

“Traditionally, the order management process has been time- and labour-intensive. It can take hours for a human to triage a new request, interpret and classify it, match it with data and triage it before sending it to the client,” said Trino. “Now, AI agent models can auto-classify client requests, remember prior interactions and generate recommendations for the next best action, which are quickly reviewed by team members for accuracy. That’s hours of saved time across the team, allowing them to focus on more strategic, customer-facing activities.”

Better analytics will also drive smarter decision-making.

“Access to real-time visibility and predictive analytics relies on quality data and smart data management practices,” said Trino. “AI can help enrich data catalogues, cleanse data sets and detect anomalies. Organizations with AI embedded throughout the supply chain —

across planning, sourcing, making, delivering and aftersales functions — can respond to disruptions more quickly and make data-backed decisions to redirect goods and inventory.”

Improved forecasting, driven by AI, will allow companies to optimize stocking levels based on historical behaviour, market trends and macroeconomic signals.

“As the predictive capabilities of AI models improve, the target level of inventory to be produced and stocked can be adjusted to maximize profitability,” said Trino.

AI in warehouses

Warehouse operations continue to be among the top adopters of AI and robotics. Bill Stenger, head of sales for the Americas at Swisslog, said adaptable technologies that use data to improve efficiency are leading the way.

“Collaborative robotics will play a key role in adapting to labour availability and productivity challenges,” said Stenger. “These technologies will allow operations to run longer, helping meet customers’ expectations for service levels.”

He also pointed to AI’s importance in addressing the labour shortage.

“You don’t have employees with 10, 15 or 20 years of experience who know the ins and outs of operations,” he said. “We need to empower employees who will be with us for one, three or five years with data and decision-making tools. AI will play a crucial role in providing suggestions to operators, helping them make smarter decisions and boosting their confidence.”

ON THE ROAD

May 15-17, 2025

Celebrating a major milestone while keeping an eye on providing new tools and technology were the focus of the NAPA Now event in Las Vegas. With 3,500 NAPA Auto Care and store owners in attendance, plus executives from the U.S., Canada and Australia, the show floor provided training opportunities, vendor showcases and the latest in advanced training technologies, all while marking 100 years since the launch of the NAPA brand. The show also announced the launch of the NAPA Autotech XcceleratoR program, an AI-driven XR (extended reality) workforce development platform and included a concert performance by Lady A.

NAPA Now

Las Vegas, Nevada

See the event reel on Instagram

NEW VEHICLE TRENDS

From the costs of new vehicles in Canada to what they’re buying, here are the latest car buying trends in Canada

// By Adam Malik

The price of new vehicles in Canada has levelled off in the last year — but there has still been a significant increase over the last 10 years.

DesRosiers Automotive Consultants reported that the average price for a new vehicle at the end of 2024 surpassed $45,000 for a passenger car and almost $55,000 for a light truck. And these prices could escalate further as a result of tariffs.

The group noted that there has been “significant growth” in the last 10 years when it comes to the average transaction price for new light vehicles. Passenger cars in 2015 sat at an average of $28,675 — that has grown to $45,813 in 2024. That’s a 60 per cent increase.

Light trucks, meanwhile, saw a jump from $38,477 in 2015 to $54,950 last year — an increase of 43 per cent.

These jumps came even though price increases calmed in the last year. The passenger car average transaction price increased 2 per cent from 2023 to 2024 and the light truck average increased just 1 per cent

“A notable levelling off after the sharp increases noted for 2022 and 2023,” the analysis noted.

Quebec was the primary driver for price increases with an overall light vehicle transaction price jump of 4.5 per cent from 2023 to 2024. DesRosiers said this was most likely caused by the rush for more expensive ZEVs in the province at the tail end of 2024, prior to provincial rebates being dropped.

What comes next is to be determined as a trade war looms, said DesRosiers managing partner Andrew King.

“While we have seen some steps away from a full-scale trade war in the auto sector, the prices for new vehicles are still expected to increase,” he said. “Of course, the exact scale of these changes remains to be seen as the situation continues to be in flux and the U.S. administration pursues its ‘shoot first, aim later’ policies.”

Light trucks increasingly dominate

The light truck market continued its dominance as being most preferred by consumers, accounting for 88.1 per cent of total new light vehicle sales to start 2025.

Sales rose 4.7 per cent in the first quarter, driven by strong performances in the SUV, van and pickup segments, according to DesRosiers.

Meanwhile, the passenger car market continued its struggles, with an overall decline of 9.3 per cent in the first quarter.

“Consumer preferences continued to adjust the segment-level sales picture in the first quarter of 2025, complicated by rapid declines in BEV sales,” observed Andrew King, managing partner at DesRosiers. “Looking forward, with tariffs now in place on U.S.-built vehicles, we may yet again see further changes as vehicle companies, dealers and consumers adapt to the new market realities.”

"While we have seen some steps away from a full-scale trade war in the auto sector, the prices for new vehicles are still expected to increase."

ADAPTING TO THE CHALLENGES

How the impact of tariffs, sourcing and the erosion of brand loyalty is impacting jobbers //

By Zakari Krieger

The automotive aftermarket is facing a perfect storm in 2025: Rising tariffs, softening consumer demand and a rapidly shifting brand landscape. While trade policy headlines often center on geopolitical maneuvering, the downstream impact on warehouse distributors, jobbers and, ultimately, shop owners and vehicle owners in Canada is very real.

Among the most pressing concerns for the industry are the trade tariffs being implemented by the United States on goods sourced from China and other low-cost manufacturing regions. Though these are U.S. policies, Canadian aftermarket supply chains are deeply integrated with American distribution systems, making the consequences unavoidable for domestic players.

Mini-Ductor® Venom HP

The Mini-Ductor Venom HP is the highest powered MiniDuctor at 1800 watts. This handheld induction heater generates high-frequency magnetic fields to produce a flameless heat™ that releases ferrous metal from rust, corrosion and thread lock compounds.

APPLICATIONS:

Seized Lugnuts

Fuel Tank Straps

Seatbelt Bolts

Suspension

Exhaust Manifold Bolts

O2 Sensors

Incline Connectors & 100’s more!

Tariffs, supply chain recalibration

The result of this disruption is clear: Increased landed costs and uncertainty around pricing. However, many major WDs have been preparing for this shift for years. A growing number have developed robust direct import and private label programs that bypass traditional distribution models, eliminating unnecessary layers and cost.

These strategies involve dedicated import warehouses, streamlined logistics and full integration with their existing DC networks.

For jobbers, these direct-sourced and private label offerings create alternatives to traditional national brands. And while they were once considered supplementary or price-point fillers, private labels are now core parts of many jobbers’ product mix — offering healthy margins and better pricing control amid inflationary pressure.

But it’s not just about cost anymore.

The rise of product proliferation

In parallel, the aftermarket is contending with product proliferation at an unprecedented scale. Platforms and powertrains are evolving rapidly. Between internal combustion engines, hybrids, EVs and now plug-in hybrids gaining traction in Canada, the SKU count has ballooned.

It’s no longer feasible for jobbers to stock multiple branded options for every part category.

This has made the role of strategic sourcing and intelligent inventory management critical. More SKUs mean more complexity, more capital tied up in inventory and greater risk of obsolescence. It also puts pressure on jobbers to make decisions about which

brands — and which parts — truly matter to their customer base.

Brand loyalty

For decades, brand loyalty served as a predictable pillar in the aftermarket. Shops swore by certain brands because of perceived quality, ease of warranty or historical relationships. But that’s changing. Today’s consumer is price-sensitive, skeptical and increasingly willing to take advice from their shop — not a label. Simultaneously, shop owners are becoming more open to new brands, especially those that offer consistent availability, solid warranty support and compelling margins.

The trust once embedded in brand logos is now being transferred to jobbers and shops themselves. If a jobber can stand behind a product — branded or private label — and the shop can confidently install it, many end users won’t push back. This shift is accelerating as inflation forces all stakeholders to reassess what quality and value really mean.

As brand loyalty softens, the jobber’s role becomes more influential. You’re not just moving boxes — you’re curating product choices that affect shop profitability and customer satisfaction. With so many brands flooding the market, especially in categories like braking, filtration, and undercar components, jobbers need to help shops cut through the noise.

Zakari Krieger is the Fix Network, Canadian vice president of Prime CarCare, responsible for the Canadian retail business, encompassing the Speedy Auto Service and Novus Auto Glass business lines

BEYOND THE HYPE OF EVS AND ADAS

What jobbers and shops need to know now about these emerging technologies

//

By Meagan Moody

Electric vehicles and advanced driver-assistance systems dominate headlines. But for most aftermarket businesses, headlines don’t pay the bills. Service bays and stocked shelves do.

For Canadian jobbers and repair shops, the question isn’t whether EVs and ADAS are coming. They’re already here. The smarter question is: Are they worth acting on now? And if so, how?

As we look beyond the hype of these technologies, let’s explore how to evaluate real opportunities behind the buzz and build a smart, staged plan to engage these two fast-evolving segments.

EVs: A slow burn, not a sudden shift

The Canadian EV market continues to grow, but adoption is uneven across provinces, and many independent repair shops still see limited EV volume. While government targets and incentives did accelerate interest, EVs currently make up fewer than than 10 per cent of vehicles on Canadian roads.

This means opportunity, not urgency.

Start with data, not assumptions

Before expanding your EV inventory, assess the vehicle mix in your market. Use

"Avoid tying up cash flow in slowmoving specialty SKUs or diagnostic gear if your customer base isn’t ready."

VIN-level data or shop feedback to track EV traffic in your area.

If there aren’t Teslas, Bolts, or Ioniqs on the lift, there’s no need to overstock high-voltage parts.

Think parts and people

EV service isn’t just about parts. It requires different training and safety protocols. Jobbers can add value by connecting shops with certified EV training programs or helping source EV-safe tools and PPE. This support helps shops feel more confident offering EV services and builds loyalty.

Don’t forget hybrids

In many regions, hybrids still outnumber full EVs. Hybrids often share platforms with their ICE counterparts and offer a practical entry point for shops to get comfortable with electrified systems. Distributors should consider hybrid maintenance parts as a strategic bridge to the EV market.

Caution: Overcommitting too soon

Avoid tying up cash flow in slow-moving specialty SKUs or diagnostic gear if your customer base isn’t ready. EV strategy should be phased, with each investment aligned to observed demand, not industry hype.

ADAS: A more immediate disruption

Unlike EVs, ADAS technology is showing up everywhere. From lane departure alerts to adaptive cruise control, these systems are becoming standard. They affect collision repairs, windshield replacements, alignment and more.

Understand the calibration challenge

Shops are discovering that even simple repairs can trigger the need for ADAS recalibration. Without the right tools, training or space, many are forced to send the vehicle elsewhere. This disrupts workflow and cuts revenue.

Jobbers can step in by educating shops on when calibration is required and what’s needed to do it in-house.

Know what shops are up against

Proper calibration often requires long bays, level floors and specialized targets — things many shops lack. Liability concerns also make some hesitant to touch ADAS at all.

Jobbers can help by offering training resources, consulting on workflow changes and connecting shops with trusted mobile calibration providers.

Opportunity signals to watch

If you’re seeing these signs, it may be time to act:

■ Shops turning away late-model vehicles due to ADAS

■ Increased customer callbacks after basic repairs

■ Technicians unsure of when or how to calibrate

ADAS represents a real opportunity, especially for those who move early with the right partnerships and tools. But success comes from supporting customers with practical solutions, not just new products. Move with purpose, not pressure.

Building a playbook for what’s next

Here’s how jobbers and shops can approach EVs and ADAS with confidence, not chaos:

1. Assess your local market: No two regions are the same. Start with shop feedback, vehicle parc, and repair trends.

2. Identify early adopters: Some customers are already exploring EV or ADAS work. Support them first. Their success becomes a blueprint for others.

3. Invest in education before inventory: Training is a safer early investment than slow-moving parts or costly equipment.

4. Test, learn, scale: Run small pilots. Try new SKUs or services with select accounts. Evaluate outcomes before expanding.

5. Be the translator: There’s a lot of noise in the market, and every level of the supply chain is looking upstream for clarity. Your role isn’t just to sell — it’s to guide.

Conclusion

EVs and ADAS aren’t just new technologies. They’re new business models. The key isn’t to panic or pivot overnight, but to plan with intention and start building capability where it matters most. That begins with listening to your market, identifying real demand, and supporting customers through training, tools, and smart partnerships.

Those who move with focus and purpose, rather than urgency, will be best positioned to lead the next chapter of Canada’s aftermarket.

BAYWATCH

CV AXEL

Transit Inc. announced the launch of new products under its Kugel brand, the CV Axle New Assembly and the CV Intermediate Shaft. The CV Axle New Assembly is a new unit designed to meet original equipment standards for fit, form and function. Built entirely from new materials, it eliminates the need for core returns. The assembly features 3D OEM FIT Technology, ensuring a plugand-play, hassle-free replacement experience with a direct fit guarantee to original equipment. All necessary hardware is included where required. www.transitinc.com

GAUGES

Continental has expanded its line of VDO SingleViu Gauges, designed for use as original equipment or service replacements. These gauges are compatible with both traditional analog senders and J1939 or OBDII CAN networks. Each gauge features a microprocessor that allows dual-input capability, switching from its default analog input to J1939/OBDII CAN via the SingleViu configuration software. Speedometers and tachometers can also display J1939 system fault codes. www.continental-aftermarket.com

WHEEL HUB HARDWARE KITS

BCA Bearings has added to the Wheel Hub with Hardware Kits product line. This adds 27 new SKUs for popular import and domestic applications and coverage for more than 16.3 million vehicles in operation. These kits include a premium OE-quality wheel bearing that includes the hardware needed to install them. The hardware included varies by SKU and includes hub mounting bolts/studs, axle/ CV nuts, axle/CV bolts, axle/CV washers, snap rings/circlips, dust caps, grease seals, and O-rings. www.bcabearings.com

UNMATCHED

Setting the standard for quality, durability & performance.

Experience Schaeffler’s reliable OEM repair solutions, engineered for quality and efficiency. Maximize uptime, reduce costs, and ensure easy maintenance with our durable components.

www.vls.schaeffler.us

ENGINE MASTERKIT

SKF Automotive introduced new products at Automechanika this year. The engine Masterkit is a comprehensive service solution that combines the water pump and timing belt kit with the auxiliary belt and tensioners kit in one package solution. SKF will also manufacture CV joints and driveshafts in-house at its Italian OE Airasca facility. www.vehicleaftermarket.skf.com

PARTS ANNOUNCEMENT

ADAS TARGETS

Hunter Engineering announced that 13 ADAS calibration target packages may now be bought online through the HunterNet 2 customer portal. The OEM-approved targets can be used for various ADAS calibration procedures with Hunter’s Ultimate ADAS system, such as surround-view, lane watch and forward-facing cameras and radar. The selection includes camera calibration targets for Honda, Nissan, Toyota, Ford and GM vehicles, as well as universal radar plates and cube reflectors. www.hunter.com

Dayco added 55 new parts to its portfolio: 41 new branched and quick connect hoses, covering primarily medium- and heavyduty vehicle applications, 11 new water pumps and three new serpentine belt kit part numbers. It has transformed its hose product line adding new numbers with exact fitment and redesigning old hose applications when necessary. The Dayco water pump SKUs introduced cover 22 million light-duty vehicles on the road. The serpentine belt kit line is also expanding with more than two million VIO covered with the three new kits. na.daycoaftermarket.com

IGNITION COILS

Standard Motor Products’ recently released Standard Coils add coverage for the 2021-2023 Ford F-150, 2023-20 Subaru Legacy and Outback and 2022-19 Mercedes-Benz cars and SUVs. Additional new coverage includes popular vehicles like the 2022-2024 Volkswagen Jetta and Taos, 2023-2024 Ford Super Duty trucks, and the 2015-2020 Alfa Romeo 4C. Currently, fifteen Blue Streak Ignition Coil Multipacks are available for popular vehicles, with additional applications in development. www.standardbrand.com

CAR-TOONS

BAYWATCH

TORQUE CONVERTERS

Schaeffler’s Vehicle Lifetime Solutions division added new Luk TorCon 68RFE and 48RE applications. The 68RFE design ensures peak performance under any condition, featuring a quad-plate clutch system, delivering greater torque capacity that outperforms some triple plate billet converters on the market by up to 60 per cent.

The Luk TorCon 68RFE is compatible with 2009-2021 RAM 2500 & 3500 trucks with 6.7L Cummins Turbo Diesel engines. www.repexpert.us

reliable and high-quality solutions for Tesla drive units. They are compatible with Model S (February 2012-March 2016) and Model X (September 2015-February 2021). www.baanpowertrain.com

Covering the EV repair market

We cover:

• Technical articles, how-to guides

• Newest government and private sector news

• New product alerts

• Vehicle innovations, and what’s coming to your shop

• Consumer habits and what to expect from your customers

• And much more!

Quality Built Close To Home

• 100% Made in Cambridge, ON Canada

• No Global Supply Chain Issues Equals Quick Service to Your Customers

• Top Performance for ANY Vehicle

- Passenger, Light Duty, Medium Duty, Heavy Duty, Air Disc, Emergency Services

• Good, Better, Best Options for All Market Segments and Budgets

- MAX DUTY, PLATINUM, PRO, & STAR

• Our Brakes Do Not Merely Pacify; They EXCEED Your Expectations!

- Long Lasting (Great Value)

- Smooth Braking (Comfort)

- Clean Materials (100% Copper Free Formulas)

- Quiet (Enjoyable Braking Experience)