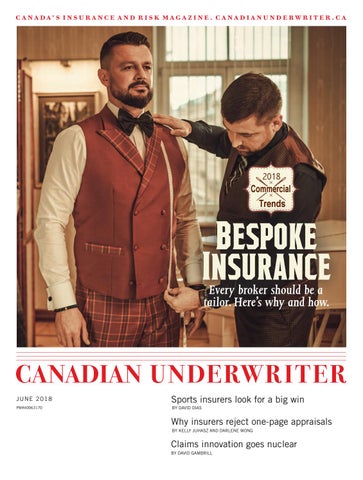

2018 Commercial Commercial Trends

BESPOKE

INSURANCE Every broker should be a tailor. Here’s why and how.

JUN E 2018

Sports insurers look for a big win

PM#40063170

BY DAVID DIAS

Why insurers reject one-page appraisals BY KELLY JUHASZ AND DARLENE WONG

Claims innovation goes nuclear BY DAVID GAMBRILL