ANNUAL JOBBER SURVEY

The World Leader in Automotive Water Leak Repair

OEM Trusted for 30 Years

Knowledgable. Trusted. Reliable.

Go-To Leak Repair Pros for Dealership Service Teams

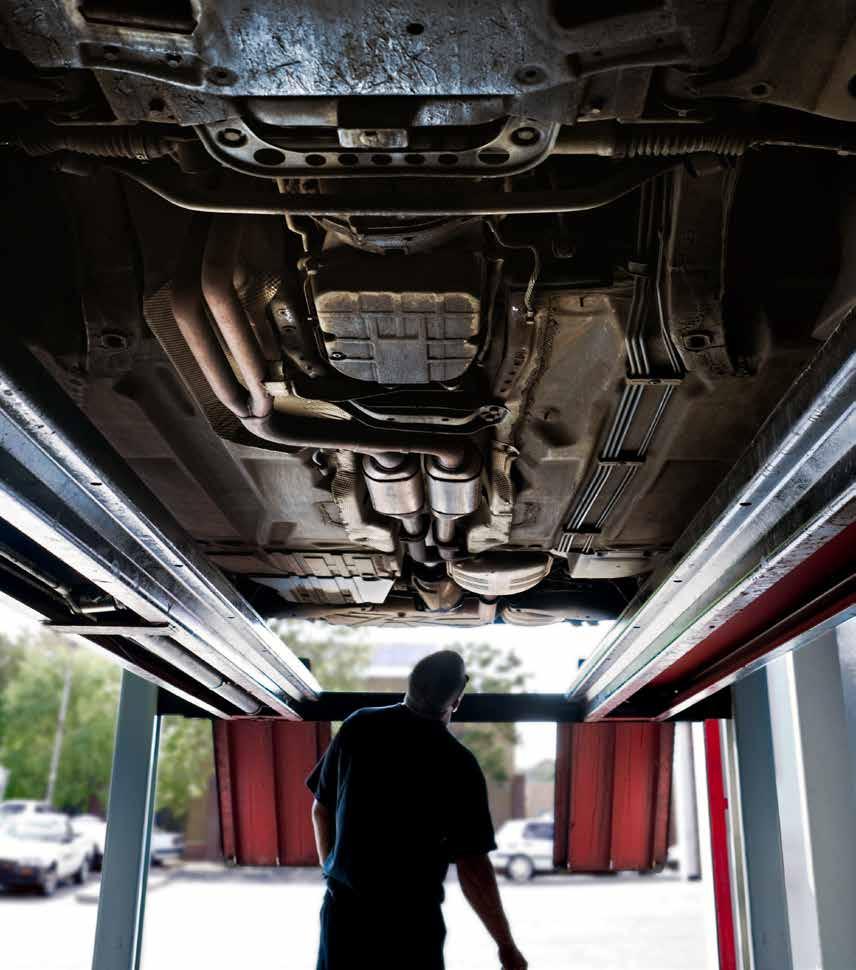

LEAKPRO® is a fully mobile service, proudly serving new and used car dealerships, as well as businesses with vehicle fleets. If you have a vehicle in need of repair, give us a call today to book an appointment!

With over 30 years of experience, LEAKPRO® specializes in diagnosing and repairing water leaks, wind noise, and dust or air infiltration. Our technicians are backed by industry-leading training, proprietary products, and advanced technology, which ensures the issue is identified and resolved right the first time.

By choosing LEAKPRO®, you’re not just protecting your vehicles. You’re improving CSI scores, reducing warranty claims, saving valuable technician hours, and avoiding the cost and hassle of repeat repairs.

Automotive Interior Water Leaks

Sunroof Leak Repair

Sunroof Replacement

Germs are everywhere ... we kill them!

We eliminate odour, disinfect and sanitize all vehicles and interior spaces. As the world leader in vehicle and indoor air quality, we’ll leave your car free of mold, mildew, malodours, germs, bacteria and allergens.

Windshield Leak Repair

Wind Noise Reduction

Headlight Repair

VISIONARIES AT WORK:

TRANSFORMING THE TRADE WITH NOVUS GLASS WINDSOR

At the crossroads of innovation and community spirit, NOVUS Glass Windsor stands as a testament to how auto service shops are future-proofing their businesses by embracing change, technology, and the power of local relationships. Under the leadership of Erik Smith—owner of Windsor Tire Inc., TIRECRAFT, and now NOVUS Glass Windsor—this elite enterprise illustrates what it means to be at the cutting edge of automotive service in Canada’s heartland.

With roots in the Windsor community, Erik’s journey in the automotive industry began humbly—changing tires at 16, working latenight emergency calls, and ultimately building a thriving business known for exceptional commercial and fleet services. “For me, it was about providing for my family and serving my community. The automotive industry became my life’s work because I wanted to create a legacy built on service, trust, and care,” Erik explains.

A Strategic Step Forward

Partnering with NOVUS Glass—part of Fix Network’s family of premium automotive repair brands—was a strategic move for Erik, driven by his commitment to innovation and meeting evolving market needs. He recognized that integrating auto glass and calibration with his successful mechanical and tire operations was the natural next step to elevate his business and better serve customers. “Meeting the NOVUS team showed me they were true innovators. Their expertise in chip and crack repair enables us to deliver even more to our customers while

seamlessly integrating glass, mobile repair, and fleet solutions,” Erik explains. “Glass and calibration are the next frontiers for full-service shops.”

This progressive approach aligns perfectly with NOVUS Glass and Fix Network’s overarching vision: building Shops of the Future by connecting with the automotive industry’s top operators—those who aren’t just keeping up with change, but driving it. By partnering with distinguished businesses like Windsor Tire Inc., Fix Network continues to expand a network that sets the benchmark for quality, innovation, and customer trust across the country.

People, Culture, and Community

Erik is quick to credit his staff for the shop’s success. “A business is just a name. It’s the people who make the difference.” From BBQ lunches to team bowling nights, Erik’s focus on workplace culture is about more than just positive morale—it’s about building a team that strives for ‘great’ customer service, not just good. “I always say: go the extra mile, do the ‘plus one’ that brings customers back.”

That philosophy has ripple effects into the larger community—whether it’s sponsoring local sports teams, partnering with charitable initiatives, or creating moments of service that make a difference. Erik shares a story: “Once, our technician stopped to help an elderly woman with a flat on the highway—no charge. The next day, her husband brought us his fleet business. Those are the moments that matter. When you focus on doing right by people, you

don’t just earn their business—you earn their confidence for years to come.”

Innovation at Every Turn

NOVUS Glass Windsor isn’t just keeping up—it’s setting the pace. Recent investments include a second Hunter alignment machine, AI-supported dispatch for road service, and digital vehicle inspections for every mechanical job. Their central Command Centre and robust mobile service fleet mean that customers receive seamless support—whether at the shop, on the road, or at a job site.

“Shops of the future aren’t just about technology,” Erik says. “They’re about meeting customers where they are and anticipating what’s next. With NOVUS Glass, we can offer mobile glass repair as naturally as mobile tire repair. We’re ready for whatever the future brings.”

Looking Ahead

With expansion plans underway, a new towing division launched, and the recent addition of NOVUS Glass Windsor to his service operations, Erik is committed to staying ahead. For this strategic visionary and his team, being part of Fix Network means more than joining a network—it’s about setting an example for the community and the industry.

“When the right people, services, and intentions come together, everybody wins—our business, our customers, and the entire Windsor community. That’s the future I want for our shop, and that’s what NOVUS Glass Windsor is all about.”

Automotive Group Director | Nickisha Rashid (647) 355-7416

nickisha@turnkey.media

Publisher | Peter Bulmer (585) 653-6768

peter@turnkey.media

Managing Editor | Adam Malik (647) 988-3800 adam@turnkey.media

Associate Editor | Derek Clouthier

Contributing Writers | Greg Aguilera, Zakari Krieger, Erin Vaughan

Creative Director | Samantha Jackson

Video / Audio Engineer | Ashley Mikalauskas, Nicholas Paddison

Sales | Peter Bulmer, (585) 653-6768 peterb@turnkey.media

Delon Rashid, (416) 459-0063 delon@turnkey.media

Nickisha Rashid, (647) 355-7416 nickisha@turnkey.media

Circulation | Delon Rashid, (416) 459-0063 delon@turnkey.media

Production | Tracy Stone tracy@turnkey.media

CARS magazine is published by Turnkey Media Solutions Inc. All rights reserved. Printed in Canada. The contents of this publication may not be reproduced or transmitted in any form, either in part or full, including photocopying and recording, without the written consent of the copyright owner. Nor may any part of this publication be stored in a retrieval system of any nature without prior consent.

Canada Post Canadian Publications Mail Sales Product Agreement No. 43734062

“Return Postage Guaranteed” Send change of address notices, undeliverable copies and subscription orders to: Circulation Dept., CARS magazine, 48 Lumsden Crescent, Whitby, ON, L1R 1G5

CARS magazine (ISSN# 2368-9129) is published six times per year by Turnkey Media Solutions Inc., 48 Lumsden Crescent, Whitby, ON, L1R 1G5

From time to time we make our subscription list available to select companies and organizations whose product or service may interest you. If you do not wish your contact information to be made available, please contact us.

TTHE PRICE OF PARTNERSHIP

he relationship between jobbers and shop owners is a balancing act in the automotive aftermarket — one that’s being tested by economic pressures, shifting expectations and the ever-present tension between price and availability.

Ask a shop owner what matters most, and you’ll likely hear “inventory” or “availability.” Ask a jobber, and the answer is more likely to be “relationship.” That’s not a contradiction — it’s a reflection of two sides trying to meet in the middle while navigating very different realities.

The 2025 CARS Annual Jobber Survey reveals just how deep this divide can run. While many jobbers say they value trust and communication above all else, they’re also feeling the squeeze of rising costs and unpredictable supply chains. One respondent summed it up bluntly: “Our parts margin has to pay all of our bills.”

That’s not just a complaint — it’s a reality. Jobbers are facing daily price fluctuations, and there’s been no relief on the tariff front.

“With the amount of price changes we are seeing daily, and the on-again off-again proposed tariffs announcements, it’s leaving a lot of uncertainty,” as one jobber put it.

To stay ahead, some are stocking up, saying they’re ordering with a heavy hand to get ahead of price increases driven by tariffs. That kind of forward planning isn’t just about protecting margins — it’s about ensuring shops get what they need, when they need it and at an affordable price.

Still, the perception gap remains. Shops want parts fast and at a fair price. Jobbers want loyalty and understanding. One jobber captured the tension as such: “Communication is the best to build a relationship and it’s also the fastest way to kill a relationship as well.”

This isn’t to say jobbers are ignoring availability. In fact, many are going out of their way to maintain high inventory levels despite the risks. But they’re also asking for a bit of grace. They want shops to understand that behind every part on the shelf is a calculation — one that involves freight costs, supplier delays, and yes, tariffs.

And while shops may be tempted to chase the lowest price to appease customers, jobbers warn that this can backfire. One respondent pointed to the growing frustration with quality concerns and customer expectations.

So where do we go from here?

It starts with empathy. Jobbers and shops are partners, not opponents. Each side has its pressures and each side has its priorities. But the best partnerships are built on mutual understanding.

Jobbers need to keep listening — to what shops need, to how they’re evolving, and to where they’re struggling. Shops, in turn, need to recognize the effort it takes to keep shelves stocked and prices stable in a volatile market. And parts proliferation is a real issue. It’s difficult to have each and every part of the wide variety of vehicles out there, both in terms of platform and age.

President & Managing Partner | Delon Rashid Head of Sales & Managing Partner | Peter Bulmer

Corporate Office

48 Lumsden Crescent, Whitby, ON, L1R 1G5

At the end of the day, the real price of partnership isn’t just measured in dollars — it’s measured in trust.

Adam Malik Managing Editor, CARS

We want to hear from you about anything you read in CARS magazine. Send your email to adam@turnkey.media

CANADIANS TURN TO INDEPENDENTS AMID RISING COSTS

AUTO SERVICE WORLD, JANUARY 15, 2025

Customer service, trust and relationship building are the big reasons why consumers are choosing independents. They feel welcomed at independents shops unlike dealerships where they are just a number with little to non personal touches. Staff at independents are better educated on vehicle maintenance and repair explanations which goes a long way to building their repeat business.

Bob Ward, The Auto Guys

WORKING SMARTER AND HARDER

CARS, FEBRUARY 2025

Your alternative approach to running a business isn’t new— coaches and consultants have been repeating this message for 30 years. The reality is that seasoned technicians are the ones buying our shops, not Wall Street bankers. All of you started as technicians and gradually transitioned out of the bays over time. That’s the

real message that should be shared with the next generation — not “Sorry, you wasted 10 years perfecting a skill. Now you have to give it up to operate the business for the good of the industry.” For me, stepping away from the bay wasn’t an option, but looking back, I’m glad I persevered. I’ve built something I’m proud of, and my journey could inspire the next wave of shop owners. But because I won’t “drink the Kool-Aid,” I am frowned upon. Just because you can’t — or don’t want to — stay in the bays while maintaining a balanced life doesn’t mean I or anyone else can’t do it.

Rob Nurse, Bob Nurse Motors

VEHICLE INVENTORY SWINGS BACK, MAYBE TOO FAR

AUTO SERVICE WORLD, JANUARY 24, 2025

These manufacturers need to manufacture what the market actually wants. Times are tough. The lots are full of top-of-theline models. There is currently not much market for $40k Civics and Corollas, and not every pickup buyer wants an $80k half-ton.

Geoff Walton, Grant Street Garage

ANY AND EVERY PART, THAT’S NAPA KNOW-HOW.

Scan the QR code for the latest and more in-depth news online.

THE MUFFLERMAN ACQUIRES ONTARIO SHOP

THE MUFFLERMAN ANNOUNCED it has acquired 4 Aces Auto Centre in Peterborough, Ontario.

The deal closed on April 30. 4 Aces has been in the area for more than 20 years, owned and operated by Darryl Breadner. All employees will remain with the business as 4 Aces will continue to operate as an independent auto mechanical garage within The Mufflerman Group.

“We are thrilled to welcome 4 Aces into our family of brands,” said Costa Haitas, president of The Mufflerman. “Darryl and his team have established an exceptional service centre in the Peterborough market, renowned for their commitment to excellence and customer satisfaction. Their dedication to quality,

service and trust perfectly aligns with our values, and we look forward to achieving great success together."

The network has 29 locations, with 21 operating as corporateowned locations through its five different brands — including The Mufflerman, EuroMechanic and Fleet Specialties, Sil's and 4 Aces — plus eight franchised locations under the Superior Tire & Auto brand.

ECCLES AUTO ADDS GLASS SERVICE FROM NOVUS

NOVUS GLASS HAS expanded, adding a location in Dundas, Ontario, helping expand Eccles Auto Service.

The new automotive glass repair and replacement location joins

a local repair shop that has been in business for more than 40 years near Hamilton.

The shop is now owned by Scott Eccles, who purchased the business from his parents Bruce and Claire in 2019. He grew up in the shop, starting out by from washing the shop floors on weekends. He then attended business school and became a licensed 310S technician.

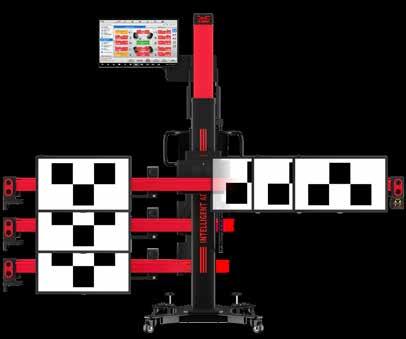

While adding the two-bay Novus Glass service, he has invested in the Hunter Ultimate ADAS machine, meaning the shop can offer comprehensive services in both glass replacement and ADAS calibrations.

“We are a community-based business. I believe that as a business, if you support your neighbours, they will support you,” said Scott.

OK TIRE HONOURS TOP DEALERS, PARTNERS

OK TIRE CELEBRATED INDUSTRY achievements and community engagement at its 2025 Annual Conference, held over three days in Cancun, Mexico.

The conference brought together dealers, vendors and corporate leaders from across the country for strategy sessions, training workshops and a tradeshow highlighting the latest in automotive products and services.

The National Store of the Year was OK Tire Saanichton, B.C. Commercial Store of the Year was OK Tire Baden, Ont. Two new award categories were introduced this year — the Community Grassroots Partner of the Year and the Service Partner Award — among a full slate of dealer and partner recognitions.

IMPOSSIBLE

FAILING

“Our annual conference is a celebration of everything this proudly 100 per cent Canadian company stands for,” said Shane Butner, director of marketing and communications for OK Tire. “It is a chance to bring together all of our outstanding partners in the automotive space, as well as offers a chance to highlight some of the standout dealers in our network and reinforce OK Tire’s longstanding and deep-rooted commitment to community engagement.”

For the full list of award winners, visit www. autoserviceworld.com

FATHER-SON TEAM NAMED FOUNTAIN TIRE

MVPS

A FATHER AND SON FROM Greater Sudbury, Ont., have been recognized as standout leaders in Canada’s automotive service sector.

Robin and Cory Lafortune, co-owners of Fountain Tire Val Caron, have been named Fountain Tire’s Most Valuable Players (MVPs) for 2024. The annual award recognizes topperforming store owners from among 167 locations across the country.

“Robin and Cory lead equally with their heads, their hearts and their hands,” said Jason Herle, chief executive officer at Fountain Tire. “They gain the trust of many by caring greatly for their team and customers alike. Their commitment to growth and safety is second-to-none, and they represent Fountain Tire proudly in the local community. Their approach embodies Fountain Tire’s philosophy of ‘we’re on this road together.’”

The Lafortunes were chosen from 142 fellow owner-operators for their dedication to safety, business performance and community involvement. Since opening in 2012, their Val Caron store has steadily expanded — doubling its physical footprint and growing from a five-person team to 20 staff members.

Robin, who previously managed a tire retread plant in Sudbury for two decades, became a Fountain Tire partner in 2012. His son, Cory, joined the business as a co-owner in 2016 after gaining experience in the tire industry right out of high school.

GROUPE TOUCHETTE TO SUPPLY OK TIRE

OK TIRE STORES INC. and Groupe Touchette Inc. have entered into a strategic partnership that will see Groupe Touchette become the official distributor for OK Tire’s 325 independently owned and operated retail locations nationwide.

Both companies will continue to operate independently under the new agreement.

“As two homegrown Canadian companies committed to serving local communities, this partnership reflects our shared dedication to quality, reliability and innovation,” said Shayne Casey, chairman of the board and interim CEO and president of OK Tire Stores Inc.

The partnership will allow both companies to leverage each other’s strengths, including Groupe Touchette’s national network of more than 40 distribution centres and OK Tire’s coast-to-coast retail footprint.

“We see this partnership as a natural evolution in our mission to deliver exceptional value to customers across Canada,” said Paul Hyshka, associate vice-president sales, independent and commercial at Groupe Touchette.

U.S. AVERAGE VEHICLE AGE UP TO ANOTHER NEW HIGH

THE AVERAGE AGE of light vehicles in the U.S. rose to a record 12.8 years in 2024, marking the second straight year of a two-month increase, according to new data from S&P Global Mobility.

By comparison, Canada sat at 10.5 years as of last summer.

The number of passenger cars dropped below 100 million for the first time since the 1970s. The average age of passenger cars climbed to 14.5 years, while light trucks reached 11.9 years. Battery electric vehicles (BEVs) showed signs of aging for the first time in years, with their average age rising to 3.7 years. Plug-in hybrids held steady at 4.9 years and traditional hybrids declined from 6.9 to 6.4 years.

By The Numbers

Stats that put the North American automotive aftermarket into perspective

50%

Half of fleet managers expect half of their fleets to be electrified by 2030, showing high ambition for electrification in the coming years.

Frost & Sullivan

19.7% 76%

22

The number of vehicle models priced under $30,000 has fallen from 72 to 22 since 2019 as OEs shift away from lower-priced options.

Cloud Theory

73%

Electric vehicles had higher average replacement rates in 11 out of 15 top product and component categories than internal combustion engine vehicles.

104%

Retailer profit fell year over year in December 2024, primarily driven by rising inventory levels, with fewer vehicles selling above the MSRP.

J.D. Power

Drivetrain

"Drivetrain" searches surged on eBay Motors, while "Crate Motor" searches rose 82% and “Exhaust System” searches increased more than 13%.

eBay Motors

Drivers believe they have been overcharged for repairs or maintenance work. These bills generate more distrust, confusion and frustration than any other type of bill.

Jerry

80 days

It’s a five-year high for days-to-move at dealerships. Elevated new vehicle prices are leaving vehicles on dealer lots, pointing to a challenging sales environment. Cloud Theory

"Teacher wanted me to learn a new vocabulary word a day and thanks to your temper, I'm learning some good ones."

CAR-TOONS

APPLICATIONS:

Seized

Fuel

Seatbelt

Suspension Exhaust

ON THE ROAD

Midwest Auto Care Alliance Vision Hi-Tech Training & Expo

March 6-9, 2025

Kansas City, Kansas

The Vision HiTech Training and Expo provided industry pros with the latest training, from management to technical. With more than 3,500 attendees from Canada, the U.S., Australia and more at the Overland Park Convention Centre, two expos were held — the HiTech Tool Expo saw tool exhibitors show off the latest offerings. The Vision Expo saw the aisles packed with attendees to check out the latest in tools, shop management software, business solutions and more.

TUNING INTO YOUR BUSINESS

Shops need to take time to be strategic as impacts on your business show no sings of slowing down

// By Zakari Krieger

As we are well into the second quarter of 2025, the overarching theme across the automotive aftermarket remains one of continuous change.

From economic indicators to shifting political dynamics, the first 90 days tested the adaptability of businesses in every corner of our industry. Among the many conversations I’ve had with shop owners, suppliers and industry leaders, the consistent

topics include tariffs, consumer confidence, the Canadian political climate and the broader health of the national economy.

In March, Canada’s Consumer Price Index (CPI) rose modestly—0.3% month-over-month and 2.3% per cent year-overyear — signaling a tempered pace of inflation. Despite signs of broader economic deceleration, largely tied to ongoing global trade tensions, the Bank of Canada held its policy interest rate at 2.75 per

cent during its mid-April meeting. The decision reflected caution, particularly in light of evolving tariff dynamics and their potential long-term effects on price inflation and supply chain stability.

For many aftermarket businesses, the uncertainty around trade policy — especially regarding products governed under the USMCA agreement — has forced a deeper evaluation of supplier relationships, procurement strategies and market competitiveness. I’ve seen a growing number of companies formalize these evaluations into structured frameworks to manage risk and maintain their positioning.

Encouragingly, as we moved through April, the sentiment across the industry began to stabilize. Business leaders, much like consumers, started gaining clarity on how reciprocal tariffs might play out and what adjustments were needed operationally.

This shift in outlook coincided with a healthy rebound in shop car counts following seasonal slowdowns in January and February. That early-year uncertainty had, for some, echoed the unease of the early pandemic era. But now, confidence is gradually returning.

In many of my monthly thought pieces, I’ve emphasized the importance of focusing inward — on the controllable aspects of the business. As external forces swirl, successful shop owners have found strength in the fundamentals: Increasing customer share of wallet, enhancing the customer experience and establishing internal roadmaps to drive consistency and growth.

One simple but powerful question I often ask owners is this: “What percentage of your week do you spend working on your business — not just in it?” Documenting a plan, following through and revisiting that plan regularly is where transformation begins.

Especially now, cutting out the noise and tuning into your business is more essential than ever.

The agility of the aftermarket has long been one of its defining strengths. We’ve historically outmaneuvered OEMs by being faster, more flexible and more attuned to customer needs. And while we face rising vehicle costs and tightening margins, we still hold a competitive advantage in our ability to act decisively and entrepreneurially.

So what does that mean for shop owners today? It means starting small — but starting. It means tidying up your shop, refining your customer touchpoints, developing a digital marketing strategy, and investing in the human and mental resources that will elevate your operation. Incremental improvements, consistently executed, build world-class businesses — one week at a time.

Those who commit to being the best become the best. But it takes focus. It takes discipline. And it takes the willingness to look inward.

I challenge every shop owner reading this to block out time — every single week — to work on a plan. Seek out a coach, a peer network or a trusted advisor. Surround yourself with the resources that will help you make meaningful progress and insulate your business from external volatility.

Now is the time to double down on what you can control — and take confident steps forward in building the best shop in your community.

Zakari Krieger is the Fix Network, Canadian vice president of Prime CarCare, responsible for the Canadian retail business, encompassing the Speedy Auto Service and Novus Auto Glass business lines

UNDER PRESSURE

Jobbers are facing mounting pressure from multiple areas. Here’s what they’re dealing with, how they’re focused on their shop customers and where they see room for improvement. // By Adam Malik

The automotive aftermarket is no stranger to change, but 2025 has brought a perfect storm of economic headwinds that’s testing the resilience of jobbers across Canada. As the cost of doing business climbs and global supply chains tighten, parts retailers are being forced to rethink how they manage inventory, pricing and customer expectations.

At the heart of the issue is uncertainty — uncertainty around tariffs, around interest rates and around the flow of goods from overseas. The cost of borrowing remains high, increasing the level of difficulty for jobbers to invest in inventory or expand their operations. For many, purchasing power has been diminished and every dollar spent has to stretch further than ever before.

Meanwhile, the global shipping slowdown is beginning to bite. The world’s five largest containership operators say bookings for eastbound trans-Pacific shipments are down by at least a third. In early May, the Port of Los Angeles expected container arrivals to be down by 30 per cent week over week. There are clear signals that the flow of parts and products from overseas is slowing.

Aftermarket companies, according to Auto Care Association president and CEO Bill Hanvey, are even refusing to accept shipments that originate from China for fear of the exorbitant tariffs.

For jobbers, this could mean more pressure to make the right

inventory bets. Some are responding by buying ahead of additional potential tariff hikes and implementation, hoping to lock in pricing and availability before the next wave of economic turbulence hits. But that strategy comes with risk — especially when cash flow is already under strain.

“We have also made the point in discussions that there’s been no relief on the auto tariffs yet for automotive aftermarket suppliers,” said Paul McCarthy, president of MEMA Aftermarket Suppliers, during a second-quarter media call.

He noted that the aftermarket has a bigger impact on the average consumer than the new vehicle market — and most people aren’t even in the market for new vehicles as they can’t afford them. DesRosiers Automotive Consultants reported that the average price for a new vehicle in Canada at the end of 2024 surpassed $45,000 for a passenger car and hit almost $55,000 for a light truck.

And then there’s the issue of pricing. As costs rise at every stage of the supply chain — from manufacturing to shipping to warehousing — those increases inevitably make their way to the end customer. Consumers are already feeling the pinch and jobbers are caught in the middle, trying to maintain margins without alienating shop partners.

The 2025 CARS Annual Jobber Survey reflects this tension. Respondents cited parts prices, supply chain disruptions and economic

uncertainty as their top concerns. One jobber noted they were “ordering on the heavier side in anticipation of the tariffs,” while another pointed out that “our parts margin has to pay all of our bills.” These aren’t just passing frustrations — they’re signs of a sector under real pressure.

Yet amid the challenges, there’s also resilience. Jobbers are adapting, finding new ways to serve their customers, and leaning into the relationships that have always been the backbone of the industry.

This year’s survey paints a picture of an industry in flux — one that’s grappling with global forces but still grounded in local relationships. It explores what jobbers are saying, what they’re doing, how they’re preparing for whatever comes next — and how they view the state of how their shop partners are doing business.

BIGGEST CHALLENGE

If 2024 was a year of adaptation, 2025 has been a year of endurance. Jobbers across Canada are navigating a complex web of economic, technological and supply chain pressures — and the road ahead doesn’t look much smoother.

When asked about their biggest challenge over the past year, jobbers were nearly unanimous: Parts prices topped the list. The cost of goods has continued to climb, squeezing margins and forcing tough decisions on what to stock and how to price it.

But pricing wasn’t the only concern. Several jobbers flagged parts availability and supply chain disruptions, which have made it difficult to meet customer expectations.

“With the amount [of] price changes we are seeing daily, and the on again off again proposed tariffs announcements, it’s leaving a lot of uncertainty in the automotive market,” one jobber said.

Another pointed to industry consolidation as a looming issue.

“Acquisitions are limiting our ability to shop around for the best products as there are fewer manufacturers to choose from,” they commented.

Staying lean was also a theme among the comments, saying that a top challenge was to keep prices low while one pointed out that they’re going to “focus on controllable factors.”

Lack of proper business management skills

Do ASP shops take the need for management and technical training seriously enough?

I can count on the best shops to be there

They say they do, but they don't show up for events

No, they say they're too busy to go to classes

What has been your biggest challenge over the last year?

How will they stay ahead of these challenges? “Personable and knowledgeable front-line people,” observed a jobber.

To sum it up, jobbers are juggling rising costs, shifting technologies and a supply chain that’s anything but predictable. But they’re also adapting, strategizing and staying focused on what they can control.

When it comes to inventory, they’re not worried … yet. As noted, they’re buying ahead of anticipated higher expenses. One jobber noted that inventory is good, but they do “expect a few supply issues.”

The widening spectrum of vehicle age is adding to the challenge, however. They noted their inventory levels are getting “higher and higher” and that “a lot of parts are getting harder to find.”

RELATIONSHIPS

The dynamics of jobber-shop partnerships have always been complex, but the Annual Jobber Survey revealed some intriguing shifts in priorities. While relationships remain a cornerstone for jobbers, the importance of price and availability has surged, reflecting the economic pressures your partners are facing.

In 2024, 52 per cent of respondents cited

33.3% 33.3% 11.1% 22.2%

relationships as the most important aspect of the jobber-shop partnership. This year, that number has dropped to 44 per cent. Meanwhile, the emphasis on price has jumped from 5 per cent to 33 per cent, and availability has also seen a significant increase, from 11 per cent to 33 per cent.

But those relationships can quickly erode. If a shop wants to stay in the good books of their jobber, there are relatively simple boxes to check.

The fastest way to build trust, according to respondents, is to be reliable and consistent.

“Be of your word; integrity,” one jobber advised.

Communication-themed responses came up regularly in the responses.

“Communication is the best [way] to build a relationship and it's also the fastest way to kill a relationship as well,” one jobber said, indicating that poor communication or a non-existent communicative relationship does no one any favours.

Jobbers want to deal with personable people as well — just as a shop wants the same type of person answering their calls.

And when you’re on the phone, “Discuss with the supplier what parts are quality products,” one advised.

“Having the parts available and delivering good service will usually build a strong relationship and not going through with your promises/ commitments will crush it quickly,” summed up another response.

UNDERSTANDING

Behind every part delivered and every invoice sent, there’s a story jobbers wish their shop customers knew. Respondents were asked to share what they most want shops to understand about the challenges they face. The answers reveal a mix of economic strain, operational complexity and a deep desire for mutual respect.

One of the most common refrains was about the financial pressure jobbers are under.

“Our parts margin has to pay all of our bills,” one jobber simply put it.

Rising costs are squeezing profitability. Jobbers want shops to know that pricing isn’t arbitrary — it’s a reflection of the real costs of doing business.

Several jobbers pointed to ongoing issues with parts availability, whether it’s delays from overseas suppliers or inconsistent inventory from manufacturers.

As consumers feel the pinch financially, their buying choices are varied. Some are choosing affordable options, while others see the value of investment in their vehicle. Having such a wide range of options ready to go out the door is a challenge.

“Parts proliferation,” one highlighted as a challenge.

“Delivery schedules from our WDs. How returns affect our productivity and cost of doing business,” said another.

They’re trying — really, pointed out another. Your jobber wants you to know “that we are very busy and trying very hard to be the best we can be, but sometimes we make a mistake or fall short on expectations, but it is not on purpose and we will try to learn from it and hopefully not repeat,” they said. “There are many times we simply get overloaded with orders and no matter how many

people we have, there would still be a problem. We just don’t have a regulator to control the orders coming in.”

Lastly, one highlighted the value of working with your physical jobber as opposed to a virtual parts distributor.

“The value of a brick-and-mortar parts store has to offer them versus online parts stores that may have cheaper parts,” they said.

FALLING SHORT

Jobbers have a front-row seat to the daily operations of their ASP customers — and they’re not shy about pointing out where they see deficiencies. They were asked to identify the most common mistakes they see shops make. The responses paint a clear picture of recurring issues in the field.

Two themes dominated the responses: buying cheap parts (33 per cent) and poor business

management (22 per cent). While “buy cheap parts” was the top answer in 2025, it’s worth noting that this issue actually increased from 24 per cent in 2024. On the other hand, “lack of proper business management skills” saw a notable drop — from 33 per cent in 2024 to a smaller share this year — though it still featured prominently in open-text responses.

Jobbers expressed frustration with shops that prioritize price over quality. One respondent said shops are “catering to price shoppers” and “should be only offering quality.” Another noted that many ASPs “don’t understand nor care to” improve their business practices, suggesting a lack of interest in long-term growth.

“Perhaps they are too busy or they feel that the customer will perceive the extra work as unnecessary but they should make the time to do so, or train the techs to do so, as usually the car owner does not know the workings of their car and if conveyed properly, the shops could show the customer that they are trying to help prevent bigger problems and inconvenience later on, by doing the maintenance or repair now,” a jobber explained.

When asked why these issues persist, jobbers pointed to a mix of inexperience, lack

In your view, what is the most important aspect of the

33.3% 11.1% 11.1% 44.4%

of training and short-term thinking. Some shops rely too heavily on supplier-suggested retail pricing without understanding markup strategies. Others simply don’t invest in the tools or training needed to run a modern, efficient business.

As one jobber summed it up bluntly: “Good technician does not always make a good shop owner.”

A skilled technician goes through training, invests in equipment and gains confidence through experience. That makes them as important as any professional job you can imagine out there, one jobber pointed out. They need to view themselves as such.

“Skilled technicians should value their time and knowledge no less than any other profession,

such as a doctor, lawyer, professor, etc.,” they wrote. “A professional technician is not the equivalent of an orderly, secretary or teacher’s aid. Diagnostic time is more valuable than installer time.”

TRAINING: A MISSED OPPORTUNITY

The survey also asked whether ASPs take management and technical training seriously. The results suggest a disconnect between what shops say and what they do.

While the data improved this year in some areas, it became more concerning in others. For example, the number of jobbers that reported shops saying they’re too busy to attend fell from 62 per cent to 44 per cent. However, there was a jump from 10 per cent to 33 per cent of jobbers saying their shop customers committed to attending training but didn’t show up.

Jobbers are clearly frustrated by the lack of follow-through. One noted that many techs “hide behind the pandemic-era excuse” of preferring online training but then fail to complete it.

“There is a vast amount of inexpensive or free training available but not much accountability for employees to take courses and demonstrate understanding of what the course taught,” they continued. “In-person training is invaluable when attended. Networking with others, sharing knowledge and writing a short exam to earn a certificate are all great benefits, not to mention if there is a meal.”

Location is an issue, noted one jobber. “The good shops want the training and will make the time, but unfortunately, we are geographically somewhat isolated, making it hard for most shops to attend hands-on training, while online training just doesn’t seem to have the attraction required.”

Others understood that techs work long hours all week and getting excited for afterhours training doesn’t excite them.

Another, however, noted that “I see a lot of smaller shops not investing in their techs to keep up with the changing technology in today’s vehicles.”

WE ASKED:

piece of advice would you give your shop customers going forward?

Work on the belief that a customer will expect to pay more for a job than receiving a poor quality job. Base all bills on the pretense that a customer will pay a bit more than for a bad job.

Be open to participate in training. Take the time to learn about products, warranties, and the support jobbers and manufacturers can provide. Be open and honest about what is holding them back from increasing their volume.

We will face these uncertain times together, we care about your shops and businesses succeeding as much as ours.

Be patient with us, work with us, don’t just complain. If we work as a team it will be better for both parties.

Keep up on business trends and measure your business growth.

Gather more information to order more on each order to lessen delivery time wasted.

THE RIGHT PART

WORLDPAC DRIVEN TO DELIVER BETTER SERVICE, POWERED BY NEW OWNERSHIP

As a premier wholesale distributor of original automotive parts, Worldpac is in its strongest position yet to lead the industry in customer service innovation.

In November 2024, investment firm Carlyle acquired Worldpac from Advance Auto Parts. Carlyle shares Worldpac’s vision, its enthusiasm for customer satisfaction and a focus on investing in new and innovative opportunities.

“It starts with a shared vision that Worldpac was, is, and will be the market leader in the auto aftermarket,” said John Hamilton, president and CEO of Worldpac. “Carlyle believes the strengths in our assortment, in our speedDIAL platform and, most importantly, the bonds of mutual loyalty built over decades between us and our customers all combine to make us a pre-eminent company.”

But success doesn’t mean there isn’t room to improve.

Whether it’s adding more branches to its network, enhancing the capabilities of existing branches and distribution centres, expanding delivery routes or tapping into new customer segments, Hamilton said Carlyle is the ideal partner to help achieve these goals.

At the heart of all Worldpac’s plans for growth and productivity is one core focus: providing better service to its customers.

“Better service means better availability of our parts in local warehouses and faster deliveries,” said Hamilton. “We have over 200,000 SKUs that we have to deliver out of more than 320 locations to tens of thousands of customers – and we have to do it within an hour or two after our customer places the order. That is an enormously complex challenge, but we have a good sense of what parts should be stocked where.”

Ensuring each location is stocked with the right parts based on customer demand has been a key priority, and Hamilton said strong progress has been made in a short period.

Speeding up delivery times is another major focus.

“We’ve expanded the number of delivery runs we make each day by quite a large number, so when our customer is waiting for our next delivery, it will arrive sooner than before,” said Hamilton.

OPPORTUNITIES FOR FURTHER GROWTH

Worldpac recognizes the importance of continuing to expand its portfolio geographically, digitally and operationally.

But identifying opportunities and being able to execute on them are two

different things – something Hamilton is confident the company can do.

“The good news is that Worldpac has the internal desire and capabilities to execute,” he said. “We’ll grow geographically by adding new branches at a rate we haven’t seen in quite a few years. We will also be broadening the assortment of parts in over 100 of our branches in the Northeast and Mid-Atlantic United States.”

The company will also grow digitally by improving its e-commerce platform to ensure it remains an indispensable tool for customers. It also plans to upgrade the information technology backbone supporting Worldpac’s warehouses and fulfilment centres.

“Lastly, our assortment, our delivery model, our branch network and our team members offer value to new customers who have not traditionally been our focus,” said Hamilton. “They are now.”

IT ALL STARTS WITH PEOPLE

In an era of ongoing change and uncertainty, the ability to adapt is vital for any company striving to maintain excellence in customer service and meet rising expectations.

Worldpac has long demonstrated the ability to pivot when needed,

PART AT THE RIGHT TIME

thanks largely to the strength of its staff.

“The Worldpac team has always been very in tune with the market and our customers,” said Hamilton. “The people are critical. They are the ones who make it happen. My job is to create an environment that enables and empowers all of our team members to do so.”

Now operating as an independent company, Worldpac is building on its talent pool by adding new team members who bring a combination of expertise and experience.

BUILDING ON THE PAST

Following the Carlyle acquisition, Hamilton stepped into the role of president and CEO, succeeding Bob Cushing, who now serves as a strategic advisor to the company.

“I want to thank the Carlyle team for recognizing Worldpac’s achievements and potential with their investment in Worldpac’s future,” Cushing said in November 2024. “Carlyle’s investment will accelerate Worldpac’s growth and continued focus on delivering ‘the right part at the right time.’”

Wes Bieligk, a partner at Carlyle, also praised Worldpac’s success and

expressed excitement about continuing to build on its legacy.

“Worldpac is a great business, and we are confident that our experience in the automotive aftermarket and with industrial carveouts will support its growth as an independent company,” he said. “We look forward to supporting John and the Worldpac team in achieving its strategic goals and unlocking its full potential.”

Hamilton brings a wealth of industry experience to the role, having served as an advisor to Carlyle for several years. He was previously president and CEO at Veyance Technologies, Electro-Motive Diesel and the Tokheim Corporation, and served as executive chair of the board at EDAC Technologies and Nordco Inc.

“We believe that we are the pre-eminent supplier of parts to the automotive aftermarket,” said Hamilton. “We’ll be employing new tools, new technologies and new approaches to get even better. Our customers will continue to be our core focus, making sure they have ‘the right part at the right time.’”

For your automotive parts needs, visit worldpac.com or worldpac.ca to get the right part at the right time.

DEVELOPING YOUR PLAYBOOK

You don’t need to have all the answers written out — you need to empower your team to fill in the blanks // By Erin Vaughan

Ahe mechanical automotive service market in Canada faced significant challenges in 2024 and appears poised for continued turbulence as we head into 2025.

Do you ever feel like you’re surrounded by “experts” trying to sell you the next get-rich-quick scheme or lose-weightfast diet? Maybe you read this space and wonder if the advice given actually works, or if I’m just making suggestions that I think would work.

I get it. I’m a fairly sceptical person myself and I often question the “experts.”

Well, I’m here to tell you that I’m putting my money where my mouth is — I’ve just moved 5 provinces away from my shop.

Am I scared? Yes. Do I believe I have an excellent team that can handle the business without me? Absolutely.

Why do I believe this? We have spent years documenting our playbook and it spells out how to accomplish 80 per cent of the

"You just need to write out your playbook, present it to the right players, coach them how to use it and hold them accountable if they don’t."

operations in the business. I suspect you’re thinking, “80 percent? What about the other 20 percent?”

I’m sure you’ve heard of the 80/20 rule. The way I see it, if we have systems and processes that cover 80 percent of the situations encountered on a day-to-day basis, my team can use creative thinking to handle the 20 percent of unusual or uncommon situations. We can’t prepare for every possibility — that’s not realistic — but if each team member knows the mission of the business, what role they play and how to play it, then they can work together to find solutions.

If COVID taught us anything, it was that there are new ways to do business. Our clients have the ability to book an appointment online at any time of day, see what we see when we send them a digital vehicle inspection and pick up their vehicle after hours, once they pay online.

As a shop owner, I can utilize programs that allow me to monitor KPI’s and meet with my managers weekly through online conferencing. I’m only a Facetime call away for a tech that is struggling with a complicated diagnosis or a service advisor who needs advice

on a challenging estimate. They definitely know that I’m not going to do their job for them, but I’m always willing to give advice when they have exhausted all other options.

If you think you need to sell your business to have a less stressful life, to spend more time with your family or to take a vacation without worrying that the shop will burn down without you — that’s not always the case, as long as you plan well.

You just need to write out your playbook, present it to the right players, coach them how to use it and hold them accountable if they don’t. If you aren’t sure what the best plays are, hire a coach and have them teach you how to create systems that ensure you are profitable, efficient and are consistently delivering excellent results to your clients.

Our industry has some amazing coaches who have transformed their businesses and want to help others do the same. Interview a few of them and find one that understands where you are now, and where you want to go.

Keep in mind this isn’t going to happen overnight, you will have some work to do and that may take a couple of years. However, the payoff is that you will employ great people, who will make it a priority to provide excellent service to your clients, while you enjoy a little more freedom.

Erin Vaughan is the owner of Kinetic Auto Service in Regina.

QUALITY WORK BACKED BY CANADA’S BEST NATION-WIDE WARRANTY

FAST & RELIABLE SERVICE

PREFERRED PRICING

TECHNICAL TIPS FROM INDUSTRY LEADING EXPERTS

YOUR SHARPEST TOOL

Waiting for the right time means you’re stuck as a shop owner. Here’s how to start building your self-belief and grow your business

// By Greg Aguilera

Running a shop isn’t just about fixing cars — it’s about building something that lasts. Systems, tools and people are vital, but let’s get real: The real driver behind every breakthrough in your business is you. More specifically? Your self-belief.

This industry is tough. Margins are tight, competition is fierce and the landscape is changing fast. Yet the shop owners who break through, expand and lead the pack all have one thing in common: An unshakable belief that they can do it.

Why it starts with you

You can have the best techs, the sharpest processes and the latest equipment — but if you don’t back yourself, none of it sticks. Self-belief is the foundation that turns plans into action. It’s what pushes you to take the hard decisions: Investing when others pull back, standing firm when the market wobbles and pushing your shop’s standards higher every year.

When you believe in your ability to figure things out, you stop playing small. You stop waiting for the “perfect” moment. You lead.

"Waiting until you feel ready? You’ll be waiting forever. Belief comes before results, not the other way around."

The ripple effect on your team

Here’s the thing: Your mindset sets the ceiling. If you hesitate, your team senses it. If you hold back, they’ll hold back. But when you show up with conviction — especially when things are tough — you send a message that ripples through the entire business: “We’ve got this.”

That belief isn’t just contagious; it’s transformative. Your people start thinking bigger. They get bolder. And that’s when the magic happens: Standards rise, performance improves and the business starts moving forward faster than you thought possible.

The top pattern

Let me be clear: Self-belief is the biggest thing I see, time and time again. After working with shop owners across the country, it’s crystal clear that self-belief — or the lack of it — is the single most defining factor between shops that push ahead and those that stay stuck.

It’s also the reason coaching is so crucial. Because no matter how smart or experienced you are, we all hit points where doubt creeps in. Having someone in your corner who challenges your thinking, keeps you accountable, and helps you see what you’re capable of is a game-changer. Coaching isn’t just about tactics — it’s about strengthening that belief muscle until it becomes unshakeable.

Breaking through the stalls

Every owner hits that wall at some point — whether it’s cash flow stress, hiring headaches or feeling like growth has stalled out. Here’s the brutal truth: Most shops stay stuck not because they lack skill or opportunity, but because the owner doubts their next move. Waiting until you feel ready? You’ll be waiting forever. Belief comes before results, not the other way around.

Build it like a muscle

Self-belief isn’t something you’re born with — it’s built. Like anything worth having, it’s a muscle you train. A few ways to sharpen it:

☐ Act fast on small wins: Every time you commit and follow through, you build proof that you can. Stack those wins.

☐ Challenge your comfort zone: The fastest growth comes when you step into discomfort. Hire that next tech. Raise your rates. Push.

☐ Get around big thinkers: Want to level up? Spend time with people who are a few steps ahead. Their belief rubs off on you.

Bottom line

The automotive industry is shifting — fast. Shops that thrive will be led by owners who believe in their vision, their team, and their ability to figure it out, no matter what comes down the road.

If you want to move the game forward, stop looking outward first. Start with your own belief. Because when you back yourself fully, that’s when everything changes.

Aguilera

Would you like to have a con dential conversation about how Mister Transmission might help you MAKE THE SHIFT into retirement? Mark Mossman

Franchise Development 647-467-9673 or email me direct at

BAYWATCH

LINK YOUR LIFTS

The Rotary Flex Max Linker is now available. It allows technicians to connect and control up to 18 Rotary Flex Max mobile column lifts using a single remote control. This innovation facilitates lifting large-scale vehicles like heavyduty trucks, multi-axle buses, coaches, railway wagons and more. Linking the mobile columns together can be done with the pushbutton controls and digital display on the remote. Each linked system can consist of two, four or six columns to adapt to the type and size of vehicle to be lifted.

www.rotarylift.com

END AND WELD YOKES

Dana Incorporated has added additional coverage to its line of Spicer Select RPL yokes with new end yoke and weld yoke part numbers. Newly available Spicer Select RPL yokes include the RPL20 weld yoke (35-20RY607), RPL20 end yoke (35-20WYSC3818), RPL25 weld yoke (35-25RY683), RPL25 end yoke (35-25WYS361), and RPL25 end yoke (35-25WYS442).

www.spicerparts.com

Setting the standard for quality, durability & performance.

Experience Schaeffler’s reliable OEM repair solutions, engineered for quality and efficiency. Maximize uptime, reduce costs, and ensure easy maintenance with our durable components.

www.vls.schaeffler.us

COOLANT, ANTIFREEZE

Aisin introduced six additions to its coolant/antifreeze lineup for North American and European passenger and light-duty vehicles. The products are available in colourcoded formulations: Purple for Stellantis and Chrysler; yellow for Ford; and orange for Chrysler, Ford, GM and any ICE or electric and hybrid vehicles equipped with indirect cooling battery systems. Three European antifreeze/coolants are available in colour-coded formulations: Pink Alfa Romeo, Audi, Ferrari, Fiat, Jaguar, Land Rover, Mini, Porsche, Saab, Volvo and Volkswagen; blue for BMW, Mercedes-Benz, Sprinter; and violet, for newer European vehicles.

www.aisinaftermarket.com

ELECTRONIC THROTTLE BODY

Standard Motor Products recently released electronic throttle bodies for popular Volvo cars and SUVs through the 2022 model-year, as well as Jeep vehicles like the 2024-22 Grand Cherokee and 2024-18 Wrangler. Additional new coverage includes popular vehicles like the 2024-21 Ford F-150, 2019-15 Hyundai Sonata, and 2022-20 General Motors heavy-duty trucks. New related components include Accelerator Pedal Sensors for the 2023-21 Hyundai Elantra, 2023-22 Hyundai Tucson and 2023 Kia Sportage. www.smpcorp.com

TANK ADDITIVE

Aisin has expanded its product line to include EFI Tank Additive for gasoline engines only. After being added to the fuel tank and while the vehicle is running, the AISIN EFI Tank Additive removes carbon deposits and restores the vehicle’s performance. It helps consumers perform preventive maintenance, and cleans fuel injectors, intake valves and the combustion chamber while the vehicle is being driven.

www.aisinaftermarket.com

RETREAD MASTER KIT

LTI Tools’ 10-Piece Wheel

Hub Master Rethread Kit for Damaged Studs and Bolts allows technicians to quickly repair damaged wheel threading on a variety of vehicles. Auto and Tire Technicians get two rethread kits in one — a precision external stud repair set and an internal bolt tap rethread kit. The set includes four unique split dies for stud repairs covering more than 90 percent of domestic and import vehicles, including light trucks. The kit also contains replacement O-rings for the split dies as well as a 2-pin socket adapter and a handy thread gauge. www.ltitools.com

A special section dedicated to showcasing automotive trade schools

CLASS ACT

CARS will regularly feature automotive schools across Canada. In this issue, we learn more about Centennial College

If you’d like your school featured, reach out to adam@turnkey.media.

Name of school:

City:

Head of program:

Centennial College

Toronto Paulo Santos, acting dean

Tell us about your school. What do you offer? How many students do you have?

Centennial College’s School of Transportation (SOT) offers a wide range of both post-secondary and apprenticeship programs in the transportation sector. At our Downsview Campus, we provide specialized training in Aviation Maintenance. At our Ashtonbee Campus, students can pursue programs in automotive motive power, motorcycle, autobody, heavy equipment, truck and coach, parts technician (apprenticeship), and light rail (apprenticeship).

Additionally, SOT runs a pilot flight program currently based at the Oshawa Airport, with plans to relocate to the Peterborough Airport in the fall of 2026. Across all programs, we typically serve approximately 2,700 students annually

What unique experiences are available to students?

Students at Centennial’s School of Transportation benefit from a hands-on, industry-focused learning environment. Our stateof-the-art labs are outfitted with the latest tools and equipment, providing real-world training opportunities. Classes are led by experienced professors who bring years of industry knowledge and insight into the classroom, ensuring students gain both practical

skills and a deep understanding of the transportation sector.

How are you preparing today’s students to be tomorrow’s automotive service professionals?

We are actively integrating electric vehicle (EV) training into our post-secondary programs to ensure our students are prepared for the rapid technological changes shaping the automotive industry. By staying ahead of industry trends and evolving technologies, our students graduate with the skills employers are looking for — today and in the future.

Why is this an exciting time to be a student in an automotive trade school?

The automotive trades are experiencing strong demand across multiple sectors, making this an ideal time to enter the field. Major automotive groups are increasingly forming partnerships with Centennial’s School of Transportation, creating more opportunities for students. With this demand, students can look forward to competitive wages—not only during their apprenticeships but also as licensed technicians.

Get inside the minds of Canadian vehicle owners and grow your business.

Gain insight on the latest vehicle technology and consumer perceptions with AIA Canada’s latest report, What does this button do? Exploring consumer views on vehicle technology.

Throughout this report, learn about:

• Where ASPs are winning

• Why tech-savvy customers still default to dealerships

• How trust grows with clear communication and visible competence

• What ASPs can do today to boost confidence and build loyalty

Create actionable business strategies and get your copy of the report today — always free to AIA Canada members!

Get the report