THE ROLE OF CENTRAL BANKS IN ECONOMIC RECOVERY

• Corporate Social Responsibility (CSR)

• Rise of Sustainable Finance

• The Role of Social Media in Banking Engagement

30th ITS World Congress, Dubai 16-20 September 2024

The 30th ITS World Congress is set to take place from 16- 20 September ERTICO - ITS Europe, co-organised by the two regional ITS organisations, in Dubai by the Roads and Transport Authority (RTA).

The mission of the ITS Congress is to raise awareness of smart mobility featuring dynamic discussions with specialists across a top-notch an international exhibition and demonstration area.

Do you want to join a community of experts, innovators, researchers, tems and Smart Mobility? Together, we can pave the road for safer, systems for all.

September 2024 at the Dubai World Trade Centre. Organised by organisations, ITS America and ITS Asia-Pacific, the event is hosted mobility solutions among policymakers, experts, and the public, top-notch high-level programme, +200 technical sessions, as well as researchers, and policymakers accelerating Intelligent Transport Syssafer, more accessible, sustainable and seamless transportation

1. Corporate Social Responsibility (CSR)

2. For startups: How to leverage new technologies for rapid growth.

FINANCE AND INVESTING

1. Rise of Sustainable Finance

2. The Role of Artificial Intelligence in Investment Management

1. The Metaverse Unveiled: Navigating the Next Frontier of Digital Interaction

1. Women in Leadership: Breaking Barriers in the Corporate World

LIFESTYLE

1. Slow Living: Embrace the slow living movement, focusing on quality over quantity, and finding balance in a fast-paced world.

ANALYSIS

1. The Role of Central Banks in Economic Recovery

Editor’s Note

Editor’s Note

Welcome to our latest issue, where we explore the vibrant intersections of business, finance, technology, and lifestyle. We have taken a deep dive into a variety of engaging topics, from the evolving landscape of Corporate Social Responsibility (CSR) to the transformative impact of Artificial Intelligence on investment management.

Our Banking segment, crafted by a seasoned banking analyst, explores the pivotal role of social media in enhancing banking engagement and discusses how technology is revolutionizing cross-border payments.

In the Technology section, we uncover the mysteries of the Metaverse, revealing its potential as the next frontier of digital interaction. Meanwhile, our Corporate segment celebrates Women in Leadership, highlighting inspiring individuals who are breaking down barriers in the corporate world.

In the lifestyle realm, we invite you to embrace Slow Living—a mindful approach that prioritizes quality over quantity, offering a serene counterbalance to our fast-paced lives.

Lastly, our insightful Analysis section examines the strategies of central banks worldwide during economic recovery, exploring the impacts of low-interest rates and quantitative easing on inflation and monetary policy.

We hope this issue inspires you, provides valuable insights, and enriches your understanding of these pivotal topics shaping our global community.

Happy reading!

Suraksha Subba Editor-in-Chief

CORPORATE SOCIAL RESPONSIBILITY (CSR)

Examine how businesses are engaging in CSR initiatives, contributing to their communities, and the impact on brand reputation and customer loyalty.

We are in an era where businesses are no longer judged solely based on their profit margins and size. This complex global market has now put a spotlight on Corporate Social Responsibility (CSR). What are businesses doing to give back to the society they are operating in? How are their policies helping make a positive impact on societies and the environment? CSR is not driven by legal obligations, it is driven by ethics and values which motivate companies to enforce policies that foster social and environmental progress.

Corporate Social Responsibility (CSR) is about companies taking a step beyond just making profits and actively working to make a positive impact on society and the environment. It’s a way for businesses to show that they care about the world and the people in it, not just their bottom line.

One of the main aspects of CSR is environmental responsibility. This means companies are doing their part to protect the planet. They might reduce waste, save energy, or use eco-friendly materials. For example, a company might work on lowering its carbon emissions or setting up a recycling program to ensure that they’re not contributing to environmental degradation.

Ethical responsibility is another key part of CSR. This involves running the business in a way that is fair and honest. Companies commit to treating their employees well, being transparent about their operations, and ensuring that their products and materials are sourced responsibly. It’s about respecting human rights and making sure that workers have safe, decent working conditions.

Philanthropic responsibility is where companies give back to their communities. This could be through donations to charities, supporting educational programs, or funding healthcare initiatives. By doing this, companies help improve the lives of people around them, showing that they’re not just about making money, but also about making a difference.

Economic responsibility means that companies are making decisions that benefit more than just their shareholders. They’re thinking about their employees, customers, and the wider community. This might involve sustainable business practices

that ensure long-term growth and stability, creating value not just for the company but for everyone involved.

Legal responsibility is about following the law. Companies make sure they’re compliant with all relevant regulations, whether it’s labor laws, environmental regulations, or corporate governance standards. This shows that they’re committed to operating within the rules and maintaining fair business practices.

CSR brings many benefits to companies. It can enhance their reputation, attract and keep customers, and boost employee morale. When a company is known for its CSR efforts, people see it in a more positive light. Customers are more likely to stay loyal, and employees feel proud to work there. Plus, sustainable practices can lead to cost savings and better risk management, helping the company avoid problems down the line.

To put CSR into action, companies develop strate-

gies that align with their values, engage with stakeholders to understand their needs, and report on their activities transparently. They continuously assess and improve their CSR practices to make sure they’re effective and relevant. In essence, CSR is about companies stepping up and doing their part to make the world a better place, showing that business can be a force for good.

Businesses are waking up to the incredible impact they can have on society through Corporate Social Responsibility (CSR). More than just a buzzword, CSR is about companies stepping up to make a real difference in the world. By embedding CSR into their core strategies, companies aren’t just boosting their brand image—they’re also building trust and goodwill with their stakeholders. These efforts often revolve around environmental sustainability, ethical labor practices, community development, and philanthropy.

Environmental Sustainability: Take Patagonia, for example. This outdoor cloth-

ing company is a trailblazer in environmental conservation. They donate 1% of their sales to environmental causes and have launched initiatives to reduce waste and promote recycling. Their Worn Wear program encourages customers to repair and reuse their clothing, significantly cutting down the environmental impact of textile production. Patagonia shows that businesses can thrive while being kind to the planet.

Ethical Labor Practices:

Then there’s Unilever, a company that has made remarkable progress in ensuring fair labor practices and ethical sourcing. Through its Sustainable Living Plan, Unilever is working to improve the health and well-being of over a billion people, reduce environmental impact, and enhance the livelihoods of millions. They are committed to sourcing 100% of their agricultural raw materials sustainably, ensuring fair wages, safe working conditions, and the empowerment of smallholder farmers, particularly in developing countries. Unilever’s efforts highlight the positive ripple effects that ethical practices can

have on communities around the world.

Community Development:

Microsoft is another excellent example of CSR in action. Through its numerous programs aimed at empowering communities with education and technology, Microsoft is bridging the digital divide. Their Global Skills Initiative is helping millions of people gain the digital skills needed for today’s workforce. By providing access to technology and education, Microsoft is opening doors to new opportunities for underrepresented communities.

Philanthropy:

Google’s philanthropic arm, Google.org, exemplifies how companies can manage their charitable activities to address critical global issues. Google. org supports nonprofits that focus on education,

economic opportunity, and inclusion. Through grants, donations, and employee volunteer programs, Google is making a meaningful impact on communities around the globe, proving that technology companies can be powerful agents of positive change.

Employee Engagement:

Employee engagement in CSR is crucial, and Salesforce leads the way with its 1-1-1 model. This model dedicates 1% of the company’s equity, product, and employees’ time to charitable causes. The result? Significant contributions of time, money, and resources to a variety of social and environmental causes, fostering a culture of giving back. Salesforce’s approach shows how businesses can encourage their employees to be active participants in creating positive social impact.

In summary, businesses are increasingly embracing CSR initiatives that make a real difference in their communities and beyond. Companies like Patagonia, Unilever, Microsoft, Google, and Salesforce are leading the charge with innovative and impactful programs. These efforts not only enhance their reputations and build trust with stakeholders but also contribute to a more sustainable and equitable world. Through environmental sustainability, ethical labor practices, community development, and philanthropy, these companies demonstrate that business can be a powerful force for good.

Corporate Social Responsibility (CSR) has a profound impact on brand reputation and customer loyalty, transforming how a company is perceived by the public and its stakeholders. When a company actively engages in CSR initiatives, it shows

a commitment to ethical practices, environmental sustainability, and social good. This commitment can significantly enhance the company’s image, portraying it as responsible and caring—traits that are increasingly important in today’s socially conscious marketplace. Customers, investors, and employees are more likely to support and remain loyal to brands that align with their values. Take Patagonia and Ben & Jerry’s, for example; they have built strong reputations by integrating environmental and social initiatives into their core business strategies, earning widespread admiration and trust.

Moreover, CSR fosters customer loyalty. Today’s consumers are more informed and aware of global issues, preferring to engage with brands that contribute positively to society. When a company prioritizes sustainability, fair labor practices, and

community development, it builds a strong emotional connection with its customers. This connection fosters loyalty, as customers feel good about their purchases, knowing they are supporting a brand that aligns with their values. For instance, TOMS Shoes has cultivated a loyal customer base through its “One for One” initiative, where every purchase leads to a donation of shoes to a child in need. Such impactful CSR initiatives not only attract customers but also keep them coming back, creating a sense of partnership in doing good.

CSR initiatives also enhance customer trust, which is a cornerstone of brand loyalty. Transparency in CSR activities—through regular reporting and open communication about the impact of these initiatives—builds trust. When customers see that a company is genuine in its efforts and transparent about its successes and challenges, they are more likely to develop a long-term relationship with the brand. Trustworthy brands that are perceived as

reliable and ethical enjoy higher levels of customer loyalty. Microsoft, for instance, has maintained strong customer loyalty through its various community empowerment and environmental programs, proving that honesty and integrity in CSR can pay off in customer trust.

Additionally, CSR acts as a differentiator in competitive markets. In industries where products and services are similar, a strong CSR strategy can set a company apart from its competitors. Brands that lead in CSR can attract customers who prioritize ethical consumption. This differentiation not only draws in new customers but also reinforces the loyalty of existing ones. Companies like Unilever, with its Sustainable Living Plan, have successfully distinguished themselves by making CSR a central part of their brand identity, appealing to a broad audience that values sustainability and ethical business practices.

To sum it up, CSR significantly impacts brand reputation and customer loyalty by enhancing the company’s image, building emotional connections, fostering trust, and serving as a market differentiator. As more consumers prioritize ethical and sustainable practices, companies that actively engage in CSR are likely to see enhanced brand loyalty and a stronger reputation, ultimately contributing to their long-term success. By doing good, these companies are not only making a positive impact on the world but also securing their place in the hearts and minds of their customers.

In conclusion, Corporate Social Responsibility (CSR) is more than a corporate trend—it’s a fundamental shift in how businesses operate and engage with the world. By committing to CSR, companies are not only enhancing their brand reputation and fostering customer loyalty but also making significant positive impacts on society and the environment. Through various initiatives focused on environmental sustainability, ethical labor practices,

community development, and philanthropy, businesses like Patagonia, Unilever, Microsoft, Google, and Salesforce demonstrate that profitability and social responsibility can go hand in hand. These efforts build strong emotional connections with consumers, earn their trust, and differentiate companies in competitive markets. As the importance of ethical and sustainable practices continues to grow, embracing CSR will be crucial for companies aiming to thrive in the modern marketplace. Ultimately, CSR is about companies stepping up to be powerful forces for good, creating a more sustainable, equitable, and connected world for everyone.

TECHNOLOGIES

For startups: How to leverage new technologies for rapid growth.

In the dynamic world of startups, the key to success often lies in harnessing the latest technologies to propel growth. But how exactly can startups leverage these cutting-edge tools to accelerate their businesses? What are the most promising technologies available today, and how can startups integrate them into their strategies without overwhelming their teams or budgets?

Which Technologies Should Startups Focus On?

Startups should prioritize technologies that offer scalable solutions, improve efficiency, and enhance customer engagement. Here’s a look at some game-changing options:

1. Artificial Intelligence (AI) and Machine Learning (ML):

AI and ML can automate tasks, glean insights from data, and personalize customer interactions. Think of AI-driven chatbots that provide round-the-clock customer support or ML algorithms that fine-tune marketing strategies based on customer behavior.

2. Cloud Computing:

Cloud services like AWS, Google Cloud, and Microsoft Azure provide flexible infrastructure, enabling startups to handle growth without hefty upfront costs. They also offer robust tools for data management, analysis, and application development.

3. Blockchain:

Beyond cryptocurrencies, blockchain technology

enhances transparency and security in transactions and data management. Startups can use blockchain to streamline operations and build trust with customers, particularly in sectors like supply chain management.

4. Internet of Things (IoT):

IoT devices gather data from physical environments, offering valuable insights into product performance and customer preferences. This technology is invaluable for startups in industries like healthcare, agriculture, and smart home solutions.

5. Virtual and Augmented Reality (VR/AR):

VR and AR technologies revolutionize customer experiences by creating immersive environments. Startups in retail, real estate, and education can use VR/AR to showcase products, enhance learning experiences, and engage customers in innovative ways.

How Can Startups Integrate These Technologies?

Identify Challenges and Opportunities:

Start by pinpointing areas where technology can solve existing challenges or unlock new possibilities. For example, if customer service is a pain point, consider implementing AI chatbots to handle inquiries efficiently.

Start Small, Scale Gradually:

Begin with pilot projects to test technologies on a smaller scale before expanding. This approach allows startups to gauge effectiveness and refine strategies without committing extensive resources upfront.

Utilize Ready-Made Solutions:

Many technology providers offer ready-to-use platforms and tools. Startups can save time and resources by leveraging these solutions instead of building from scratch. For instance, AI-as-a-Service platforms simplify the implementation of AI capabilities.

Invest in Talent Development:

Building a skilled team is essential for leveraging new technologies effectively. Invest in training or hiring employees with expertise in AI, blockchain, IoT, and

other relevant fields to maximize technology integration.

Real-World Success Stories

Slack:

Slack transformed from an internal communication tool into a global collaboration platform by harnessing cloud computing and seamless integration capabilities. Its user-friendly interface and scalable solutions fueled rapid adoption among businesses.

Airbnb:

Airbnb used machine learning algorithms to personalize user experiences, optimizing search results and pricing recommendations. This data-driven approach enhanced customer satisfaction and contributed to Airbnb’s exponential growth in the travel industry.

Zebra Medical Vision:

Specializing in AI-powered medical diagnostics, Zebra Medical Vision revolutionized healthcare by accelerating the diagnosis of medical imaging. Their innovative use of AI has positioned them as leaders in the digital health sector.

Challenges and Considerations

Avoiding Complexity:

With a multitude of technological options available, startups should focus on technologies aligned with their core objectives and avoid unnecessary complexity.

Prioritizing Data Security:

As startups adopt new technologies, safeguarding data becomes paramount. Robust cybersecurity measures are essential to protect sensitive information and maintain customer trust.

Balancing Innovation with Practicality:

While innovation is crucial, startups must balance technological advancements with practicality and

potential return on investment. Not every new technology may be suitable or beneficial for their business model.

In today’s competitive landscape, startups can gain a significant edge by embracing new technologies strategically. By focusing on scalable solutions like AI, cloud computing, blockchain, IoT, and VR/ AR, startups can streamline operations, enhance customer experiences, and drive rapid growth. Through careful integration, investment in talent, and a clear focus on solving real-world challenges, startups can navigate the technological landscape effectively and emerge as industry leaders. Embracing technology isn’t just about keeping up—it’s about paving the way for innovation and sustainable growth in the digital era.

RISE OF SUSTAINABLE FINANCE

Rise of Sustainable Finance

Sustainable finance isn’t just about making money—it’s about making a difference. It’s a way of investing and managing money that considers how our choices today impact the world tomorrow. Sustainable finance integrates environmental, social, and governance (ESG) factors into financial decision-making. It aims to promote long-term value creation while addressing global challenges such as climate change, social inequality, and resource depletion. By focusing on things like climate action, social fairness, and good governance, it’s about using financial power to build a better future for everyone. It’s like putting your money where your heart is, ensuring that our investments not only grow wealth but also contribute positively to society and the planet we all share.

Sustainable finance has become increasingly vital as we’ve become more aware of how our financial decisions impact the planet and society. In the past, finance often focused solely on immediate profits without considering long-term risks like climate change or social inequality. Now, there’s a growing recognition that sustainable practices aren’t just good for the environment—they’re essential for economic stability and the well-being of communities worldwide.

One way this shift is being reflected is through the rise of green bonds and other innovative financial tools. Green bonds are like loans specifically earmarked for projects that benefit the environment, such as renewable energy initiatives or projects aimed at improving water quality. These bonds ap-

peal to investors who want their money to support positive change while also providing much-needed funding for critical environmental projects.

Beyond green bonds, there are sustainability-linked loans that tie interest rates to a company’s performance on sustainability goals. This encourages businesses to improve their environmental and social practices, showing how financial incentives can drive positive change. Social impact bonds are another example—they fund programs tackling social issues like education or healthcare, with returns for investors tied to the success of these programs in achieving their social goals.

These financial innovations aren’t just about numbers—they’re about making a real impact. They encourage companies to operate more sustaina-

bly and responsibly while also addressing pressing social challenges. They’re part of a broader movement towards transparency and accountability in finance, promoting standards for reporting on environmental, social, and governance (ESG) factors so investors can make informed decisions that align with their values.

Ultimately, sustainable finance is about more than dollars and cents; it’s about creating a world where our financial decisions support a healthier planet and more equitable societies. As individuals, businesses, and governments increasingly prioritize sustainability, the momentum behind sustainable finance is growing, paving the way for a future where prosperity goes hand-in-hand with environmental stewardship and social progress.

THE ROLE OF ARTIFICIAL INTELLIGENCE IN INVESTMENT MANAGEMENT

Investment management is all about professionally handling money and assets for individuals, businesses, and organizations. It’s like having a skilled guide who helps you make smart decisions to grow and protect your money, tailored to your specific financial goals.

Here’s how it works:

1. Finding the Right Mix: Think of it as crafting a customized plan for where to invest your money. Investment managers carefully decide how much to put into different types of investments—like stocks, bonds, or real estate—based on how much risk you’re comfortable with and how long you plan to invest.

2. Building Your Portfolio: They then put together a collection of investments that fit your plan. Each choice is made with your goals in mind and takes into account things like how well a company is doing, what’s happening in the economy, and trends in the markets. By spreading your money across different types of investments, they help lower the chance of losing money while aiming for good returns.

3. Keeping Risk in Check: Managing risk is a big part of their job. They keep an eye on how risky each investment is and how it might affect your overall portfolio. If something could hurt your investments, they use different strategies to help protect your money.

4. Watching Performance: They regularly check how well your investments are doing. They compare your results to other investments like yours to see if things are on track. If changes are needed— like adjusting your investments—they’ll let you know.

5. Doing Their Homework: Investment managers spend a lot of time researching and analyzing the best ways to invest your money. They look at details about companies, what’s happening in the world, and how markets are behaving to find the best opportunities and avoid risks.

6. Staying in Touch: Communication is key. They keep you updated on how your money is doing, what’s going on in the markets, and if any changes

to your plan are needed. They’re there to answer your questions and give you advice based on your financial situation and goals.

7. Following the Rules: They make sure everything they do follows strict rules and laws. This helps make sure your money is handled fairly and responsibly, with your best interests in mind.

In the end, investment management is about having someone skilled and trustworthy to help you navigate the world of money and investments. They’re there to help you make the most of your money while taking care of all the details so you can focus on what matters most to you.

AI and machine learning are changing the game in investment management by bringing advanced capabilities to decision-making and portfolio management. Imagine having a supercharged assistant that can sift through mountains of data—from financial reports to news headlines and social media chatter—much faster and more comprehensively

than any human could. These algorithms don’t just crunch numbers; they uncover patterns and insights that help predict market trends and potential investment opportunities with greater accuracy.

These technologies are particularly powerful in optimizing portfolios. Think of them as adaptive strategists that continuously monitor market conditions and adjust your investments in real-time. They can swiftly respond to economic shifts or changes in investor sentiment, helping to maximize returns while minimizing risks. It’s like having a navigator who adjusts your route based on current traffic conditions to ensure you reach your destination efficiently and safely.

AI also excels in understanding human behavior and emotions in investing. By analyzing how people react to market events and news, these algorithms can pinpoint patterns of behavior that affect investment decisions. This insight is invaluable for anticipating market movements and adjusting strategies accordingly, much like a seasoned coach who understands the psychological dynamics of the game.

For individual investors, AI-powered tools like robo-advisors offer personalized investment advice tailored to your goals and risk tolerance. They’re like having a financial planner at your fingertips, available 24/7 to recommend and manage your investments based on your unique financial situation.

However, while AI brings immense benefits, human expertise remains essential. Investment professionals provide the critical judgment and intuition needed to interpret AI-generated insights, navigate complex economic landscapes, and make strategic decisions that go beyond data analysis. It’s a partnership where technology empowers human judgment, enabling more informed and effective investment management.

In essence, AI and machine learning are transforming investment management into a more data-driven, responsive, and personalized experience. They’re not replacing human professionals but enhancing their capabilities, offering new tools and insights that ultimately aim to deliver better outcomes for investors in a rapidly evolving financial world.

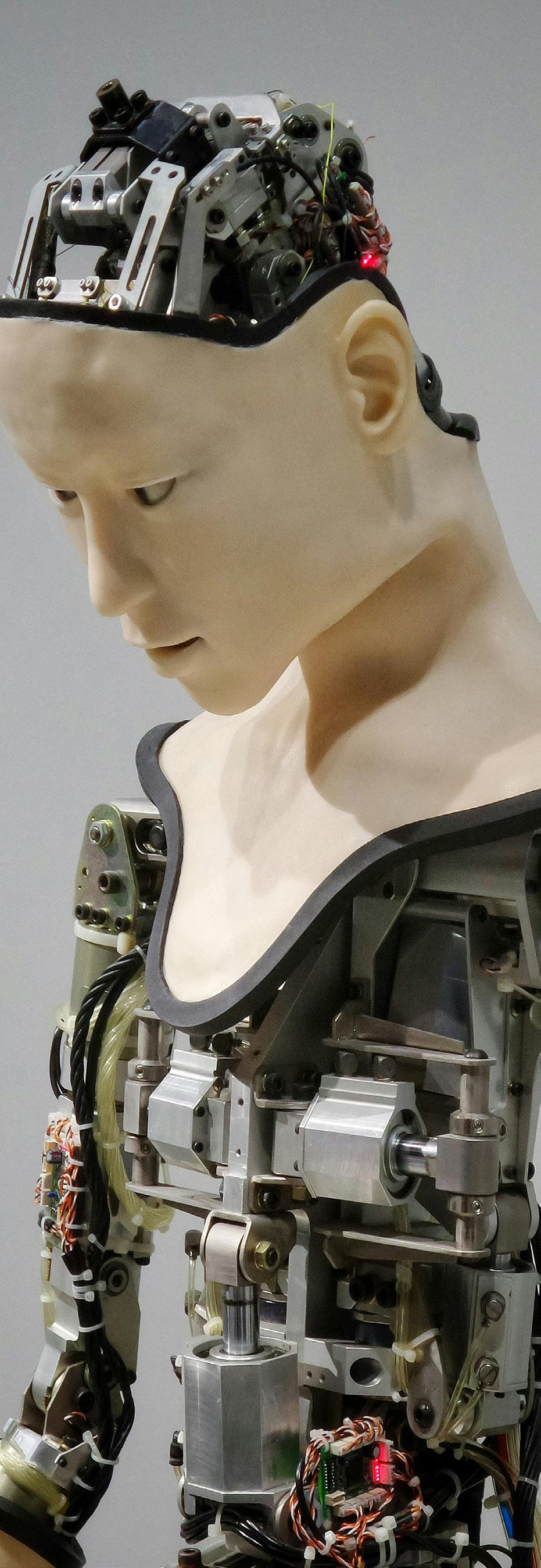

The Metaverse Unveiled: Navigating the Next Frontier of Digital Interaction

Imagine stepping into a vast digital universe where the lines between reality and virtual worlds blur effortlessly—that’s the metaverse. It’s not just about putting on a headset and entering a virtual space; it’s about diving into a dynamic, interconnected realm where you can meet people, explore places, and engage in activities just like in the physical world, but with a twist of innovation and limitless possibilities.

Think of the metaverse as a bustling virtual city that never sleeps, where you can attend concerts, participate in virtual meetings, shop for digital goods, or even build and own virtual properties. It’s a place where creativity knows no bounds and

where everyday tasks—from working and learning to socializing and entertainment—blend seamlessly into a singular, immersive experience.

For professionals across various industries, the metaverse presents exciting opportunities for innovation and transformation. Picture architects designing and walking through virtual buildings before construction begins, doctors practicing surgical techniques in a simulated environment, or educators hosting engaging virtual classes where students from different corners of the globe interact in real time.

Beyond business applications, the metaverse holds promise for enhancing entertainment experiences, revolutionizing remote collaboration, and even reimagining how we approach healthcare and ed-

ucation. It’s about harnessing technology to create more engaging, interactive, and personalized experiences that transcend physical limitations.

Yet, as we embrace the metaverse’s potential, important considerations emerge. How do we safeguard privacy in this digital realm? What measures are needed to ensure cybersecurity and protect against virtual threats? These questions underscore the importance of developing ethical standards, regulatory frameworks, and robust security protocols to foster a safe and inclusive metaverse for all users.

In essence, the metaverse isn’t just a distant concept—it’s a burgeoning digital frontier where imagination meets technology to redefine human interaction and experience. As advancements in virtual reality, augmented reality, and artificial intelligence continue to evolve, the metaverse represents a realm where innovation and creativity converge to shape the future of how we live, work, and connect in a digital-first world.

The potential impact of Metaverse on various industries

Now imagine stepping into a vast digital universe where the boundaries between the virtual and real worlds blur seamlessly—that’s the metaverse. It’s not just about putting on a headset and entering a different reality; it’s about diving into a dynamic, interconnected realm where you can meet people, explore places, and engage in activities much like in the physical world, but with a twist of innovation and limitless possibilities.

For entertainment and gaming enthusiasts, the metaverse opens doors to immersive experiences like virtual concerts where fans from around the globe can attend live shows or interactive gaming adventures where players physically move and interact within digital realms. Games could evolve into more lifelike and dynamic environments,

blending reality with fantasy and introducing new revenue streams through virtual goods and experiences.

In education and training, the metaverse holds the promise of revolutionizing learning. Picture virtual classrooms where students from diverse backgrounds collaborate on projects, embark on virtual field trips, and interact with simulations of historical events or scientific experiments. Industries such as healthcare and aviation could use virtual environments to simulate complex scenarios and train professionals in a safe, controlled setting, enhancing skills and preparedness.

Retailers envision virtual stores within the metaverse, where customers can browse and try on digital versions of products before making purchases. Technologies like virtual reality (VR) and augmented reality (AR) enhance the shopping experience by allowing consumers to visualize how items would look or fit in real life. This immersive approach not only drives engagement but also reduces the need for physical retail spaces, potentially transforming how businesses connect with customers.

In real estate and architecture, the metaverse could redefine property exploration and design. Imagine prospective buyers touring homes and buildings from anywhere in the world through virtual tours and 3D models, gaining a realistic sense of space and layout. Architects could use virtual environments to prototype designs, gather feedback, and optimize plans before breaking ground, potentially streamlining processes and improving design efficiency.

Healthcare professionals foresee the metaverse enhancing telemedicine by creating virtual clinics and hospitals. Patients could receive consultations, therapy sessions, or even surgeries remotely through immersive VR experiences. Medical teams could use simulations to practice procedures, pre-

pare for emergencies, and collaborate globally, ultimately improving access to healthcare and enhancing patient outcomes.

Financial institutions see the metaverse as an opportunity to innovate customer experiences with virtual banking. Imagine managing finances, attending financial workshops, or meeting advisors in a virtual setting. Businesses could use virtual environments for conferences, product launches, and networking events, expanding their reach while reducing costs associated with physical gatherings.

Socially, the metaverse offers a new frontier for global interaction and communication. Imagine attending virtual social events, hosting meetings, or collaborating on projects in simulated environments that mimic real-world settings. This digital realm fosters cross-cultural exchanges, global collaboration, and new forms of digital expression and creativity, bridging distances and connecting people in unprecedented ways.

While the potential benefits of the metaverse are vast, challenges such as privacy concerns, digital

security risks, and equitable access need addressing. As we navigate this new digital frontier, regulatory frameworks must evolve to ensure ethical use of virtual environments and protect users’ rights.

To sum up, the metaverse isn’t just a futuristic concept—it’s a transformative digital landscape poised to redefine how we interact, create, and innovate in the digital age. Its impact across industries promises to reshape business models, consumer experiences, and societal norms, ushering in a new era of innovation and connectivity where imagination meets technology in unprecedented ways.

Current developments, key players and challenges in building the metaverse

Building the metaverse is like constructing a vast digital universe where virtual and real worlds blend seamlessly, offering limitless possibilities for interaction and innovation. Companies like Meta (formerly Facebook), Microsoft, Google, and Apple are at the forefront, pouring resources into developing immersive technologies that bridge the

gap between physical and digital realms. For example, Meta’s Horizon Workrooms and Microsoft’s Mesh platform are paving the way for collaborative virtual spaces where people can meet, collaborate, and attend virtual events as if they were physically together.

In this dynamic landscape, key players range from established tech giants to nimble startups, each contributing to different facets of the metaverse. Companies like Roblox and Epic Games are shaping virtual gaming environments that double as social hubs, attracting millions of users globally. Meanwhile, blockchain-based platforms such as Decentraland and Cryptovoxels are exploring decentralized virtual worlds where users can own virtual land and trade digital assets, creating new economies within digital spaces.

However, creating a cohesive metaverse experience poses significant challenges. One major hurdle is interoperability—the seamless integration of various virtual worlds and applications. Currently, most platforms operate independently, making it

challenging for users to carry over their avatars, identities, and possessions between different environments. Standardizing protocols and enhancing compatibility between technologies will be crucial to realizing a unified metaverse experience.

Privacy and security are also critical concerns. As virtual environments become more immersive and interconnected, protecting user data and ensuring cybersecurity become paramount. Issues like identity theft, data breaches, and unauthorized access to personal information could undermine trust in the metaverse. Implementing robust encryption, secure authentication methods, and stringent data protection measures will be essential to safeguard user privacy.

Moreover, ensuring inclusivity and accessibility in virtual spaces is essential. Designing platforms that accommodate people with disabilities and addressing digital divides in internet access and technology affordability are vital steps. Everyone should have the opportunity to participate fully in the metaverse experience, regardless of their back-

ground or capabilities.

Ethical and regulatory challenges further complicate the development of the metaverse. Questions around intellectual property rights, virtual asset ownership, content moderation, and digital governance require thoughtful consideration and clear guidelines. Establishing fair and transparent rules will be crucial to protect users’ rights and foster a safe environment for creativity and commerce within the metaverse.

In essence, while strides have been made in building the metaverse, addressing challenges like interoperability, privacy/security, inclusivity, and regulatory frameworks is essential for its widespread adoption and success. Collaboration among stakeholders—tech companies, policymakers, and communities—will be key in navigating these complexities and shaping a metaverse that benefits society as a whole. As we continue to innovate and refine virtual experiences, overcoming these challenges will pave the way for a transformative digital future where the boundaries between the physical and

digital worlds blur in unprecedented ways.

How can businesses and individuals leverage the metaverse for innovation and collaboration?

Lastly, imagine a world where businesses break free from physical boundaries and collaboration spans continents effortlessly—that’s the promise of the metaverse. For businesses, this virtual frontier isn’t just about technology; it’s a canvas for innovation and collaboration that defies traditional limits.

Picture global teams coming together in a virtual office, brainstorming ideas in real-time, and refining projects through interactive simulations. In the metaverse, distance becomes irrelevant as architects design virtual prototypes, engineers test cutting-edge technologies, and marketers ideate on campaigns—all without the constraints of physical locations. It’s a playground where creativity thrives, fueled by the seamless interaction that the digital realm offers.

Beyond internal collaboration, the metaverse

transforms how businesses engage with customers. Imagine a fashion brand hosting virtual fashion shows where customers can browse collections, try on digital outfits, and make purchases—all from the comfort of their homes. This immersive experience not only enhances customer satisfaction but also revolutionizes personalized marketing and customer service, creating deeper connections between brands and consumers.

Entrepreneurs and startups find fertile ground in the metaverse, tapping into global markets and audiences with innovative ideas. From virtual real estate ventures and digital art galleries to virtual classrooms and telemedicine services in virtual clinics, the metaverse democratizes entrepreneurship. It provides a platform where creativity meets opportunity, empowering individuals to showcase their talents and innovations on a global scale.

In entertainment and gaming, the metaverse blurs the lines between reality and fantasy, offering gamers and enthusiasts alike immersive experiences beyond imagination. Virtual worlds become arenas for socializing, attending live concerts with friends from around the world, and exploring historical epochs through interactive storytelling. It’s not just about playing games; it’s about living experiences that transcend physical limitations.

Yet, navigating the metaverse isn’t without challenges. Ensuring data privacy and cybersecurity in virtual environments is paramount to safeguard sensitive information and build trust among users. Addressing accessibility concerns ensures that everyone, regardless of ability or background, can fully participate in and benefit from the metaverse’s opportunities.

Therefore, the metaverse isn’t merely a technological advancement; it’s a transformative journey for businesses and individuals to innovate, collaborate, and connect in unprecedented ways. By embracing its potential, companies can enhance productiv-

ity, expand their horizons, and create memorable experiences that redefine customer engagement. As we venture into this virtual frontier, balancing innovation with responsibility will be key to unlocking the metaverse’s full potential in shaping the future of business and human interaction.

WOMEN IN LEADERSHIP

Women in Leadership: Breaking Barriers in the Corporate World

In recent years, the corporate world has witnessed a transformative shift as more women break barriers and ascend to leadership positions. This evolution is not just reshaping corporate dynamics but also fostering a more inclusive and diverse workplace environment. As the number of women in leadership roles continues to rise, their impact on the corporate world becomes increasingly evident.

The Rising Population of Women in the Workplace

The increasing presence of women in the workforce is a significant trend. According to a 2020 report by Catalyst, women comprise 39% of the global workforce. In the U.S., the Department of Labor reported that as of 2019, women made up 47% of the labor force. This growing participation is accompanied by a gradual but steady rise in women assuming leadership roles.

A 2021 report by McKinsey & Company revealed that women now hold 28% of senior management roles globally, up from 21% in 2015. Additionally, the number of women in C-suite positions has also increased, with women making up 21% of C-suite executives in North America, compared to 17% in 2015. This positive trend is attributed to various factors, including enhanced educational opportunities, gender diversity initiatives, and changing societal attitudes toward gender roles.

Impact on the Workplace

The rising population of women in leadership is profoundly affecting workplace culture and dynamics. Research shows that gender-diverse leadership teams are more innovative and better at problem-solving. A study by Harvard Business Review found that companies with higher gender diversity in management positions were 21% more likely to experience above-average profitability.

Furthermore, women’s leadership styles often emphasize collaboration, empathy, and mentorship, which can lead to a more supportive and productive work environment. According to a report by Deloitte, companies with inclusive cultures are six times more likely to be innovative and agile.

Trailblazers in the Corporate World

Several women have made significant strides in the corporate world, serving as role models and paving the way for future generations. Here are three wellknown women who are shaping the industry:

1. Mary Barra - CEO of General Motors

Mary Barra became the first female CEO of a major global automaker in 2014. Under her leadership, General Motors (GM) has made substantial progress in electric and autonomous vehicle technology. Barra’s commitment to innovation and sustainability has positioned GM as a leader in the automotive industry’s future. She has also been a vocal advocate for diversity and inclusion within the company, setting ambitious targets for gender parity in leadership roles.

2. Ginni Rometty - Former CEO of IBM

Ginni Rometty served as the CEO of IBM from 2012 to 2020, making her the first woman to head the tech giant. During her tenure, Rometty led IBM’s transformation into a leader in artificial intelligence, cloud computing, and blockchain technology. She championed the company’s transition from hardware to software and services, driving significant growth in these areas. Rometty is also known for her efforts to promote STEM education and career opportunities for women and underrepresented minorities.

3. Indra Nooyi - Former CEO of PepsiCo

Indra Nooyi was the CEO of PepsiCo from 2006 to 2018, where she led the company through a period of remarkable growth and diversification. Nooyi’s strategic vision included focusing on healthier product lines and sustainability initiatives, which have become central to PepsiCo’s business strategy.

Her leadership style, characterized by a focus on long-term goals and social responsibility, has inspired many and demonstrated the importance of ethical leadership in the corporate world.

The rise of women in leadership positions is not just a milestone for gender equality but a critical factor in driving business success and innovation. As more women break barriers and ascend to top roles, they bring diverse perspectives and leadership styles that enrich the corporate world. The examples of Mary Barra, Ginni Rometty, and Indra Nooyi illustrate the transformative impact women leaders can have on their organizations and industries. The continued support for gender diversity in the workplace will undoubtedly lead to a more equitable and prosperous future for all.

SLOW LIVING: EMBRACE THE SLOW LIVING MOVEMENT, FOCUSING ON QUALITY OVER QUANTITY, AND FINDING BALANCE IN A FAST-PACED WORLD.

Slow Living: Embrace the slow living movement, focusing on quality over quantity, and finding balance in a fast-paced world

In a world that seems to spin faster with each passing day, have you ever stopped to ask yourself: “Am I truly living, or am I just surviving?” The slow living movement invites us to ponder this very question, urging us to shift our focus from the relentless pursuit of more to the profound appreciation of less. But what does it mean to truly live slowly? And how can we integrate this philosophy into our hectic lives?

The Philosophy of Slow Living

At its core, slow living is a philosophy that prioritizes quality over quantity. It is about savoring life’s moments, nurturing meaningful relationships, and aligning our daily actions with our deepest values. This movement is a gentle rebellion against the modern ethos of perpetual busyness and consumerism. It encourages us to ask: “What truly brings

me joy and fulfillment?” and to design our lives around the answers.

Inspired by the ancient Greek concept of *eudaimonia*—a term often translated as “human flourishing” or “a life well-lived”—slow living emphasizes intentionality. Aristotle believed that true happiness comes from engaging in activities that align with our virtues and contribute to our growth and well-being. Similarly, slow living invites us to cultivate a life that reflects our personal values and passions, rather than succumbing to societal pressures and superficial goals.

The Impact of a Fast-Paced World

Consider this: how often do you find yourself racing against the clock, juggling multiple tasks, and feeling overwhelmed by the never-ending to-do list? Our fast-paced world glorifies hustle and productivity, often at the expense of our mental and physical health. We are bombarded with messages that equate success with busyness, leaving little

room for rest, reflection, and genuine connection.

But at what cost? Chronic stress, burnout, and a sense of disconnection from ourselves and others have become all too common. Studies have shown that this relentless pace can lead to anxiety, depression, and a host of other health issues. Is it any wonder that so many of us yearn for a slower, more meaningful way of living?

Embracing Slow Living

So, how do we embrace the slow living movement in practical terms? Here are a few steps to help you get started:

1. Prioritize What Matters Most

2. Simplify Your Life

Declutter your physical and mental space. Let go of possessions, commitments, and habits that do not serve your well-being. Simplifying your life creates room for the things that truly matter. Reflect on this: “What can I remove from my life to make space for what I love?”

3. Savor the Moment

Practice mindfulness and presence. Engage fully in whatever you are doing, whether it’s enjoying a meal, spending time with loved ones, or working on a project. By slowing down and savoring the moment, you can find joy and contentment in the here and now. Consider: “How can I bring more mindfulness into my daily activities?”

4. Connect with Nature

Begin by identifying what truly matters to you. What activities, relationships, and goals bring you the most joy and fulfillment? Make a conscious effort to prioritize these in your daily life. Ask yourself: “Am I spending my time in a way that aligns with my values?”

Spend time in nature to reconnect with the natural rhythms of life. Nature has a way of grounding us and reminding us of the beauty and simplicity of life. Take a walk in the park, hike in the mountains, or simply sit in your garden. Ask yourself: “When was the last time I truly connected with nature?”

5. Cultivate Gratitude

Focus on what you have rather than what you lack. Cultivating gratitude can shift your perspective and help you appreciate the richness of your life. Keep a gratitude journal, where you regularly jot down things you are thankful for. Reflect on this: “What am I grateful for today?”

The Journey to Slow Living

Embracing slow living is not about abandoning ambition or eschewing modern conveniences. Rather, it is about finding a balance that allows you to live more fully and authentically. It is a journey of self-discovery and transformation, one that re-

quires patience, practice, and perseverance.

As you embark on this journey, remember that slow living is a personal and evolving practice. There is no one-size-fits-all approach. What matters is that you find what works for you and aligns with your values and aspirations.

In a world that is constantly urging us to do more, achieve more, and be more, slow living offers a refreshing and radical alternative. It invites us to slow down, savor the simple pleasures, and cultivate a life of depth and meaning. So, take a deep breath, pause, and ask yourself: “Am I living the life I truly want?” The answer may just lead you to a slower, richer, and more fulfilling way of being.

By embracing the slow living movement, we can reclaim our time, our health, and our happiness. We can find balance in a fast-paced world and rediscover the joy of simply being. So, why not take the first step today? After all, life is not a race to be won, but a journey to be savored.

THE ROLE OF CENTRAL BANKS IN ECONOMIC RECOVERY

Central banks are like the economic architects of nations, tasked with maintaining stability and fostering growth during times of crisis. When economies falter, their strategic moves—such as adjusting interest rates and engaging in unconventional policies like quantitative easing (QE)—become vital in stabilizing financial markets, boosting economic activity, and managing inflation. This article dives into how central banks worldwide have tackled economic challenges, the ripple effects on inflation dynamics, and how their approaches to monetary policy continue to evolve.

1. Strategies Adopted by Central Banks

1. Low-Interest Rates: Stimulating Growth

Imagine interest rates as the throttle of a car engine. Lowering rates makes borrowing cheaper, which encourages businesses and consumers to spend and invest more. For instance, during the 2008 global financial crisis, the U.S. Federal Reserve slashed rates to near-zero. This move was aimed at reviving lending and bolstering the housing market, crucial steps in stabilizing the shaky economy.

Similarly, the European Central Bank (ECB) took decisive action during the Eurozone debt crisis by cutting interest rates to historic lows. This helped inject liquidity into struggling markets and restore faith in the financial system across EU member states. Japan’s Bank of Japan (BoJ) has also long relied on ultra-low rates to combat deflation and spur economic growth amid persistent challenges.

2 Quantitative Easing (QE): Boosting Liquidity

Quantitative easing might sound complex, but it’s essentially about flooding the economy with money. Central banks purchase large quantities of assets, like government bonds, to lower long-term interest rates and stimulate lending. This unconventional approach was a game-changer post-2008, as major banks like the Federal Reserve, ECB, and BoJ pumped trillions into their economies through

asset purchases.

For example, the Federal Reserve’s QE involved buying mortgage-backed securities and Treasury bonds on a massive scale. By doing so, they aimed to lower borrowing costs, spur investment in housing and other sectors, and ensure ample credit flow to businesses and consumers alike.

2. Implications for Inflation and Monetary Policy

2.1 Inflation Dynamics: Walking the Tightrope

Central banks walk a tightrope when it comes to inflation. While their actions—like low rates and QE—can spur inflation by boosting demand, they must ensure it remains stable. Many central banks adopt inflation targeting frameworks, setting clear goals (e.g., maintaining 2% inflation annually) and

adjusting policies accordingly.

For instance, Australia’s Reserve Bank targets a 2-3% inflation range over economic cycles. They use interest rate tweaks and other tools to manage expectations and keep inflation in check, ensuring a healthy balance between growth and stability.

2.2 Monetary Policy Adjustments: Flexibility in Action

Post-2008, central banks expanded their playbook beyond traditional rate cuts. Forward guidance became a key tool, where banks signaled future policy directions to guide market expectations. The ECB, facing diverse economic conditions across Eurozone nations, introduced long-term refinancing operations (LTROs) to provide banks with affordable liquidity during the Eurozone crisis.

These adaptations highlight the flexibility central banks need in responding to unique economic challenges and the importance of clear communication in guiding market reactions.

3. Global Case Studies

3.1 United States: Navigating the Financial Storm

During the 2008 crisis, the Federal Reserve’s bold actions—including QE and near-zero rates—were pivotal. These measures stabilized financial markets, restored lending confidence, and set the stage for gradual economic recovery. The Fed’s proactive stance played a crucial role in averting a deeper recession and laying foundations for sustainable growth.

3.2 European Union: Unity in Diversity

The ECB faced a daunting task during the Eurozone debt crisis, balancing monetary policy across diverse economies with varying fiscal policies. While interest rate cuts and QE helped ease financial strains, structural differences posed challenges. The ECB’s LTROs provided vital liquidity, yet on-

going economic disparities underscored the complexities of unified monetary policy in a diverse economic union.

4. Conclusion: Steering Towards Stability

Central banks are not just about interest rates and bond purchases; they’re guardians of economic stability, navigating stormy seas with foresight and precision. While their interventions—like low rates and QE—have buoyed economies, they also pose risks, such as asset bubbles and long-term debt concerns. Looking ahead, central banks must innovate, refine policy frameworks, and enhance transparency to meet future economic challenges effectively.

In conclusion, central banks play a pivotal role in shaping economic recovery trajectories, guided by data-driven insights and a commitment to public welfare. Their strategic maneuvers, amidst global uncertainties, underscore their indispensable role in safeguarding economies and fostering sustainable growth.

REFERENCES

- Federal Reserve Economic Data (FRED) - European Central Bank (ECB) publications - Bank of Japan (BoJ) research and statistics - Reserve Bank of Australia (RBA) reports - Academic journals and economic analyses

THE ROLE OF SOCIAL MEDIA IN BANKING ENGAGEMENT

In today’s digital age, social media has transformed the way banks connect with customers, market their services, and cultivate their brand identities. How do financial institutions navigate this dynamic landscape to stay relevant and engaged with their clientele? Platforms like Facebook, Twitter, LinkedIn, and Instagram offer banks unprecedented opportunities for direct interaction. From resolving customer inquiries in real-time to providing round-the-clock support, how does this immediacy build trust and reliability in the banking industry? For instance, banks such as JPMorgan Chase and Wells Fargo maintain dedicated social media teams that ensure customer concerns are addressed promptly. How does this proactive engagement enhance customer satisfaction and bolster the bank’s reputation?

Moreover, social media isn’t just a customer ser-

vice tool—it’s a powerful marketing platform that allows banks to reach broader audiences. How do banks leverage engaging content and targeted advertising to capture and retain customer attention? Can video content on platforms like YouTube and Instagram effectively simplify complex financial products for customers? How does precision marketing on social media help banks tailor their messages to different demographics, from corporate clients on LinkedIn to younger consumers on Instagram?

In the competitive financial sector, establishing a strong brand identity is paramount. How do banks humanize their brands through social media, using storytelling and behind-the-scenes content to foster deeper connections with their audience? Take Citibank, for example, showcasing its CSR efforts. How does highlighting community projects and

sustainability initiatives enhance customer loyalty and attract socially conscious clients?

Furthermore, social media serves as a valuable platform for banks to promote financial literacy and provide educational content. How do informative posts on budgeting, investments, and banking services empower customers to make informed financial decisions? Consider Bank of America’s approach—how does sharing financial tips on social media engage their audience while subtly promoting their services?

During times of crisis, such as the COVID-19 pandemic, social media becomes essential for banks to manage their reputations and communicate effectively. How did banks use social media to provide updates on branch closures, digital services, and financial assistance programs? How did this proac-

tive communication help maintain customer trust and confidence during uncertain times?

As social media continues to evolve, its role in banking engagement will only become more integral. How will banks harness the evolving capabilities of social platforms to enhance customer satisfaction, execute targeted marketing strategies, and shape their brand identities in the future? How might innovation in social media drive the future of customer-bank interactions?

Incorporating social media into banking operations isn’t just about staying current—it’s about leveraging digital tools to create meaningful connections, empower customers, and navigate challenges with transparency and agility.

CROSS-BORDER PAYMENTS AND THE IMPACT OF TECHNOLOGY

The landscape of cross-border payments is undergoing a significant transformation, driven by technological advancements, regulatory changes, and the shifting dynamics of global trade. Historically, international payments have been plagued by high costs, lengthy processing times, and a lack of transparency. However, as businesses expand their operations across borders, the need for efficient, secure, and cost-effective international payment solutions has never been more critical. This need is accentuated by factors such as currency volatility, geopolitical tensions, and diverse regulatory environments, which collectively shape the challenges and opportunities faced by treasurers and financial professionals.

Technological advancements are at the forefront of addressing these challenges and enhancing the efficiency of cross-border payments. Blockchain technology, for example, is revolutionizing the sector by enabling secure and transparent peer-topeer transactions without the need for intermediaries. By using blockchain, financial institutions can reduce processing times from days to minutes and significantly lower transaction costs. Ripple, a blockchain-based payment protocol, exemplifies this transformation by allowing instant cross-border payments with minimal fees. Its network connects banks and payment providers globally, facilitating real-time settlement and transparency.

In addition to blockchain, the development of application programming interfaces (APIs) is streamlining cross-border transactions. APIs enable different financial systems to communicate more effectively, reducing complexity and improving the speed of international payments. For instance, the partnership between Societe Generale and Kyriba leverages API-based connectivity to streamline FX hedging processes, allowing mid-cap corporates in France to execute their hedging strategies with unprecedented ease and efficiency. Similarly, Lloyds Bank’s adoption of the WaveBL electronic trade documentation platform signifies a move towards digitalization, promising enhanced trade efficiencies and sustainability benefits.

Artificial intelligence (AI) and machine learning

are also making significant contributions to the realm of cross-border payments. These technologies detect and prevent fraudulent transactions, ensuring the security and integrity of international payments. AI-powered systems analyze transaction data in real-time, identifying suspicious patterns and flagging potential fraud before it occurs. This not only helps protect consumers and businesses but also reduces the regulatory burden on financial institutions.

Despite these advancements, navigating the international payments landscape still presents numerous challenges and risks. Currency market volatility remains a significant concern, impacting the financial performance of companies engaged in cross-border transactions. Geopolitical tensions

and varying regulatory environments further complicate the process, introducing potential compliance issues. Traditional banking systems, often characterized by inefficiencies and a lack of transparency, can also hinder the speed and cost-effectiveness of transactions. Moreover, the risk of fraud and cyber threats in digital transactions underscores the importance of implementing robust security measures.

Technological innovations, however, are continually emerging to address these challenges and enhance the efficiency of cross-border payments. The focus on sustainability and the adoption of blockchain technology for secure, real-time transactions are reshaping the landscape, offering new opportunities for businesses to optimize their international payment processes. Digital platforms for trade documentation, like WaveBL, reduce the risks and inefficiencies associated with paper-based processes, paving the way for more environmentally friendly and efficient payment workflows.

In conclusion, the incorporation of advanced technologies into cross-border payment systems is transforming the landscape, providing businesses with more efficient, secure, and cost-effective solutions. As these technologies continue to evolve, they promise to mitigate the inherent challenges of international payments and create new opportunities for financial inclusion and global economic growth. The future of cross-border payments is poised to be markedly different from its past, characterized by greater ease, speed, and accessibility, ultimately benefiting businesses and individuals worldwide.