elcome to the latest edition of Gazet International Global Magazine. As we navigate the ever-evolving landscape of business, finance, technology, banking and corporate world, we are pleased to present a collection of insightful articles, interviews, and analyses that shed light on the trends, challenges, and opportunities that shape today’s corporate environment. In today’s dynamic landscape, these realms are more interconnected than ever before, and the opportunities are boundless!

In this issue, I have delved deep into topics that are not only timely but also pivotal for business leaders and professionals alike. From exploring the impact of financial discipline among students to understanding the concept of diversified investments, we have curated a wealth of information to keep you informed and inspired.Discover strategies to seize opportunities, navigate volatility, and achieve your investment goals.

The business world is in a constant state of transformation, driven by factors ranging from technological innovation to global economic shifts. As such, adaptability and agility have become the watchwords of success. Our cover story, “Regtech Solutions Saving the Fintech World,” is a case study that examines how regtech is helping fintech navigate its way among the terrains of regulations and compliance requirements. Whether you’re a seasoned pro or just starting your financial journey, GI Global Magazine has got the knowledge to help you thrive.

Furthermore, in the spirit of providing actionable insights, our special article, “Paid Vacations: The Emerging Business Trend Transforming Work-Life Balance,” delves into the ways organizations are restructuring the work benefits and embracing paid vacations to boost productivity and employee satisfaction.

In our “Executive Spotlight” section, we sit down with AsiaPay Malaysia’s Country Head and Associate, Mr. Loo Tak Kheong to get his perspective on the current digital payment landscape and the operational challenges that have shaped the company. His experiences and wisdom provide valuable lessons for those aspiring to excel in their own careers.Get ready to explore the frontiers of innovation and gain a com-

petitive edge in an increasingly digital world.

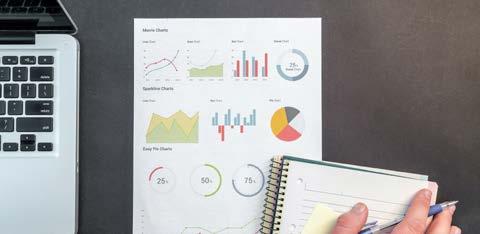

We are also excited to introduce the article, “Data Analytics: An Empowering Tool for Businesses,” which will explore the latest advancements in technology and how they are influencing various industries. I am confident this article will be a gem to businessmen and investors.

As always, we value your feedback and engagement. We encourage you to share your thoughts on our articles and to connect with us on social media and through our website. Your input helps us continue to provide the content that is most relevant and beneficial to you, our discerning readers.

As we embark on this thrilling journey through the realms of commerce, finance, and technology, remember that knowledge is your ultimate asset. The world is changing at an unprecedented pace, and staying ahead of the curve is essential. We remain committed to delivering high-quality content that equips you with the knowledge and strategies needed to thrive in today’s dynamic business landscape. So, open your mind, absorb the insights, and let this issue of Gazet International Global Magazine be your trusted companion on the path to financial success.

The future is yours to shape, and together, we’ll make every page count. Happy reading!

Sincerely,

Suraksha Subba Editor-in-Chief Gazet International Global Magazine

If you are new to the world of investing, you may have heard the term “diversified investments” and wondered what it means.

assets that are not closely correlated, you can reduce the impact of market fluctuations and volatility on your overall returns.

In this article, we will explain the concept of diversification, why it is important, and how you can achieve it in your portfolio.

Diversification is the practice of spreading your money across different types of assets, such as stocks, bonds, real estate, commodities, etc.

The main goal of diversification is to reduce the risk of losing money when one or more of your investments perform poorly. By having a mix of

For example, imagine that you have invested all your money in one company’s stock. If that company goes bankrupt or faces a major scandal, you could lose all your money in a matter of days.

However, if you have invested in a variety of stocks from different industries and sectors, as well as some bonds and real estate, you are less likely to suffer a huge loss from one single event. Even if one of your investments goes down, others may go up or stay stable, balancing out your portfolio.

Diversification also helps you take advantage of

the different characteristics and performance of various asset classes over time. For instance, stocks tend to offer higher returns than bonds in the long run, but they are also more volatile and risky. Bonds tend to offer lower returns than stocks, but they are more stable and provide regular income.

Real estate can offer both capital appreciation and rental income, but it also requires more maintenance and management. Commodities can hedge against inflation and currency fluctuations, but they are also subject to supply and demand shocks.

By diversifying your investments, you can enjoy

the benefits of each asset class while minimizing their drawbacks. You can also align your portfolio with your risk tolerance, time horizon, and financial goals.

For example, if you are young and have a long time until retirement, you may want to invest more in stocks and less in bonds, as you can afford to take more risk for higher returns.

If you are older and nearing retirement, you may want to invest more in bonds and less in stocks, as you need more stability and income.

If you are looking for a way to grow your wealth and achieve your financial goals, you may want to consider investing in a diversified portfolio. A diversified portfolio is a collection of different types of assets, such as stocks, bonds, commodities, real estate, and cash, that can help you reduce your risk and increase your returns over time.

How can you achieve diversification in your portfolio? There are several ways to do so, depending on your level of knowledge, experience, and preference. One way is to use asset allocation funds or target date funds, which are mutual funds or exchange-traded funds (ETFs) that automatically adjust their mix of assets according to a predefined strategy or timeline. For example, an asset allocation fund may start with 80% stocks and 20% bonds when you are young, and gradually shift to 40% stocks and 60% bonds as you approach retirement.

A target date fund may have a specific year in its name, such as 2050 or 2060, indicating when you plan to retire. These funds are designed to simplify the process of diversification for investors who do not want to deal with the hassle of choosing and rebalancing their own assets.

Another way is to build your own diversified portfolio using individual securities or funds. This requires more research and effort on your part, but it also gives you more control and flexibility over your investments. You can choose the asset classes, sectors, regions, styles, and strategies that suit your preferences and goals.

You can also adjust your portfolio as needed based on market conditions and personal circumstances. However, you also need to be careful not to overdiversify or under-diversify your portfolio.

Over-diversification means having too many investments that are similar or redundant, which can lower your returns and increase your costs. Underdiversification means having too few investments that are exposed to high risk or low return, which can jeopardize your financial security.

To avoid these pitfalls, you need to follow some basic principles of diversification:

- Choose a reasonable number of investments that cover different asset classes, sectors, regions, styles, and strategies.

- Choose investments that have low or negative correlation with each other, meaning that they tend to move in different directions or at different magnitudes.

- Choose investments that match your risk tolerance, time horizon, and financial goals.

- Review and rebalance your portfolio periodically to maintain your desired level of diversification.

Diversified investments are an essential part of any successful investing strategy. They can help you reduce risk, enhance returns, and achieve your financial objectives. By following the tips above, you can create a diversified portfolio that works for you..

Diversification is a strategy that aims to reduce the impact of market fluctuations and unexpected events on your portfolio.

By spreading your money across various asset classes, industries, sectors, and regions, you can benefit from the different performance and behavior of each investment.

For example, when one asset class or sector is performing poorly, another may be doing well, offsetting some of the losses and smoothing out your returns.

Diversification also helps you avoid putting all your eggs in one basket.

If you invest all your money in one company, industry, or asset class, you are exposing yourself to a high level of risk. If that investment suffers a major decline or goes bankrupt, you could lose a significant portion or even all of your money. By diversifying your investments, you can reduce the chances of losing everything and protect your portfolio from extreme volatility.

There is no one-size-fits-all formula for building a diversified portfolio. The optimal mix of assets depends on your personal goals, risk tolerance, time horizon, and preferences. However, here are some general steps you can follow to create a diversified portfolio:

1. Determine your risk profile. Your risk profile is a measure of how much risk you are willing and able to take with your investments. It depends on factors such as your age, income, expenses, savings, debt, financial objectives, and personality. Generally speaking, the higher your risk tolerance, the more

aggressive your portfolio can be, meaning you can allocate more of your money to higherrisk and higher-return assets such as stocks. Conversely, the lower your risk tolerance, the more conservative your portfolio should be, meaning you should allocate more of your money to lower-risk and lower-return assets such as bonds.

2. Choose an asset allocation. Asset allocation is the process of dividing your portfolio among different asset classes according to your risk profile and expected returns. The main asset classes are stocks, bonds, commodities, real estate, and cash. Each asset class has its own

characteristics, advantages, and disadvantages. For example:

- Stocks are shares of ownership in a company that can provide capital appreciation and dividends. Stocks are generally considered the most risky but also the most rewarding asset class in the long term.

- Bonds are loans that you make to a government or a corporation that pay interest and principal at maturity. Bonds are generally considered less risky but also less rewarding than stocks in the long term.

- Commodities are physical goods such as gold, oil, wheat, or coffee that can provide protection against inflation and currency fluctuations. Commodities are generally considered volatile and unpredictable but also potentially lucrative in the short term.

- Real estate is property such as land, buildings, or homes that can provide rental income and appreciation. Real estate is generally considered illiquid and expensive but also stable and hedge

against inflation in the long term.

- Cash is money that you keep in a bank account or a money market fund that can provide liquidity and safety. Cash is generally considered the least risky but also the least rewarding asset class in the long term. The proportion of each asset class in your portfolio depends on your risk profile and expected returns. For example, if you have a high risk tolerance and a long time horizon, you may want to allocate more of your portfolio to stocks than bonds. If you have a low risk tolerance and a short time horizon, you may want to allocate more of your portfolio to bonds than stocks.

3. Diversify within each asset class. Once you have decided on your asset allocation, you should further diversify within each asset class by investing in different industries, sectors,etc.

Diversification is one of the most important concepts in investing. It means spreading your money across different types of assets, such as stocks, bonds, cash, and alternative investments, to reduce your overall risk and increase your potential returns. In this blog post, we will explain why diversification matters, and how you can diversify your portfolio in eight simple steps.

Asset classes are different types of investments that have similar characteristics and behaviours in the market. The major asset classes are:

- Equities (stocks): allow investors to have partial ownership in a company

- Fixed-income securities (bonds): securities where investors lend money to a company or a government in exchange for regular interest payments

- Cash: investments or accounts that are liquid and readily accessible (short-term certificates of deposit, money market accounts, checking and savings accounts)

- Alternative investments: investments with a generally lower correlation to the stock market (real estate, commodities, and hedge funds)

The risks and returns associated with each asset class are different. Generally speaking, stocks represent a higher risk and higher returns, while bonds offer lower risk and lower returns. Cash is the safest but also the lowest-returning asset class. Alternative investments can offer higher returns but also higher risks and lower liquidity.

The first step to diversify your portfolio is to allocate your money among different asset classes. This is called asset allocation, and it depends on your age, risk tolerance, time horizon, and financial goals.

A common rule of thumb is to subtract your age from 100 or 110 to determine the percentage of stocks in your portfolio. For example, if you are 30 years old, you could allocate 70% or 80% of your portfolio to stocks, and the rest to bonds and cash.

There are many ways to diversify your portfolio, but here are some basic strategies that you can follow:

As you get older, you should gradually reduce your exposure to stocks and increase your exposure to bonds and cash, to preserve your capital and reduce volatility. However, this rule is not set in stone, and you should adjust it according to your personal situation and preferences. For instance, if you have a high risk tolerance and a long time horizon, you could invest more in stocks than the rule suggests. Conversely, if you have a low risk tolerance and a short time horizon, you could invest less in stocks than the rule suggests.

Diversifying by asset class is not enough. You should also diversify within each asset class by investing in different sectors, industries, companies, regions, and styles.

For example, within the stock asset class, you should invest in companies of different sizes (large-cap, mid-cap, small-cap), types (growth, value), sectors (technology, healthcare, energy), and regions (domestic, international, emerging markets). Similarly, within the bond asset class, you should invest in bonds of different issuers (corporate, government), credit ratings (investment-grade, junk), maturities (short-term, long-term), and regions (domestic, international). By diversifying within each asset class, you can reduce the impact of any specific risk factor on your portfolio performance. For instance, if the technology sector declines, but the healthcare sector rises, your stock portfolio can still generate positive returns. Likewise, if the corporate bond market suffers, but the government bond market thrives, your bond portfolio can still provide income.

One of the easiest and most cost-effective ways to diversify your portfolio is to invest in an index fund. An index fund is a type of mutual fund or exchange-traded fund (ETF) that tracks the performance of a specific market index, such as the S&P 500, the Nasdaq 100, or the Nifty 50.

An index fund allows you to invest in a large number of securities that represent a broad market segment, with a single purchase. This way, you can achieve instant diversification and exposure to a wide range of companies and sectors, without having to research and select individual stocks or bonds.

Another advantage of index funds is that they have low fees and expenses, as they do not require active management or frequent trading. This means that you can keep more of your returns and avoid paying high commissions or taxes.

Fixed-income investments are securities that pay a fixed amount of interest or dividends to investors, such as bonds, preferred stocks, or dividend stocks. Fixed-income investments can provide a steady source of income and stability to your portfolio, especially in times of market volatility or uncertainty.

Fixed-income investments can also help you diversify your portfolio by adding a different type of return than stocks. While stocks offer capital appreciation (the increase in the value of the investment), fixed-income investments offer income generation (the regular payments from the investment).

However, fixed-income investments are not riskfree. They are subject to interest rate risk (the risk that the value of the investment will decline when interest rates rise), credit risk (the risk that the issuer will default on its payments), and inflation risk (the risk that the purchasing power of the investment will erode over time).

Therefore, you should carefully consider the duration, yield, and quality of the fixed-income investments you choose, and diversify them across different issuers, maturities, and regions.

Another way to diversify your portfolio is to follow a buy-hold strategy. This means that you buy quality investments and hold them for the long

term, without trying to time the market or chase short-term trends.

A buy-hold strategy can help you diversify your portfolio by reducing your trading frequency and costs, avoiding emotional decisions and behavioral biases, and benefiting from compounding returns and tax advantages.

By holding your investments for the long term, you can also reduce the impact of market fluctuations and volatility on your portfolio performance, and focus on the fundamentals and growth potential of your investments.

One of the best ways to diversify your portfolio is to keep investing over time, regardless of the market conditions. This is called dollar-cost averaging, and it means that you invest a fixed amount of money at regular intervals, such as monthly or quarterly.

Dollar-cost averaging can help you diversify your portfolio by smoothing out the effects of market movements and price fluctuations on your investments. By investing consistently over time, you can buy more shares when prices are low, and fewer shares when prices are high, resulting in a lower average cost per share.

Dollar-cost averaging can also help you avoid timing the market or making emotional decisions based on fear or greed. Instead, you can stick to your plan and goals, and take advantage of the opportunities that the market offers in the long run.

The final step to diversify your portfolio is to regularly rebalance it. This means that you adjust your portfolio allocation periodically, to bring it

back to your desired mix of asset classes and securities. Rebalancing your portfolio can help you diversify your portfolio by maintaining your risk-return profile and preventing it from drifting away from your original plan. For example, if your portfolio allocation was 70% stocks and 30% bonds at the beginning of the year, but due to market movements it became 80% stocks and 20% bonds by the end of the year, you should rebalance it by selling some stocks and buying some bonds, to restore it to 70% stocks and 30% bonds.

Rebalancing your portfolio can also help you lock in some profits and take advantage of market cycles. For instance, if one asset class performs exceptionally well compared to another, you can rebalance your portfolio by selling some of the high-performing assets and buying some of the low-performing assets, thus buying low and selling high.

In conclusion, diversification is a key principle of investing that can help you reduce your risk and increase your returns over time. By following these eight strategies, you can diversify your portfolio across different asset classes, sectors, industries, companies, regions, and styles.

Remember that diversification is not a one-time event, but an ongoing process that requires regular monitoring and adjustment. You should review your portfolio periodically and rebalance it as needed, to ensure that it reflects your goals and preferences.

Financial inclusion is not merely a buzzword but a transformative force that can change lives, communities, and entire economies. It is the idea that everyone, regardless of their economic status, should have access to affordable and reliable financial services. In this article, we’ll delve into the significance of financial inclusion, its impact on individuals and societies, and the steps being taken worldwide to make it a reality.

1. Poverty Alleviation: Access to financial services, such as savings accounts and credit, enables people to manage their finances better, save for the future, and invest in income-generating activities. This, in turn, can help lift individuals and families out of poverty.

2. Economic Growth: When a larger portion of the population has access to financial resources, it can lead to increased economic activity and entrepreneurship. More businesses can access capital to grow, creating jobs and boosting overall economic development.

3. Reducing Inequality : Financial inclusion can help bridge the wealth gap by providing marginalized and vulnerable populations, including women and rural communities, with opportunities for economic advancement.

4. Financial Stability : Widespread access to fi-

nancial services can enhance financial stability at both the individual and national levels. People can better withstand economic shocks, and governments can monitor and regulate financial systems more effectively.

Financial inclusion and the Sustainable Development Goals (SDGs) share a deeply interconnected relationship, as both are aimed at creating a more equitable and prosperous world. The SDGs, adopted by the United Nations in 2015, represent a comprehensive blueprint for global development, addressing issues such as poverty, inequality, health, education, climate change, and sustainable economic growth. Financial inclusion plays a pivotal role in advancing many of these goals. Here’s how:

1. Poverty Alleviation (SDG 1): Financial inclusion is a powerful tool for reducing poverty. When individuals and communities have access to affordable financial services like savings accounts and credit, they can better manage their finances, invest in income-generating activities, and create pathways out of poverty.

2. Hunger and Food Security (SDG 2): Financial inclusion can enable small-scale farmers to access credit for agricultural inputs, improve their farming practices, and build resilience to food security challenges. This contributes to ending hunger and achieving food security.

3. Gender Equality (SDG 5): Financial inclusion can empower women economically, bridging the gender gap in access to financial resources. When women have control over their finances, they can invest in education, health, and businesses, leading to greater gender equality.

4. Decent Work and Economic Growth (SDG 8): Expanding access to financial services promotes economic growth by fostering entrepreneurship and small and medium-sized enterprises (SMEs). These businesses generate jobs, which are essential for achieving SDG 8’s goal of decent work and economic growth.

5. Reduced Inequality (SDG 10): Financial inclusion is a key strategy for reducing economic inequality. It enables marginalized and vulnerable populations, including those in remote areas, to participate in the formal financial system, bridging wealth disparities.

6. Sustainable Cities and Communities (SDG 11): Access to financial services facilitates investment in housing and infrastructure projects, contributing to the development of sustainable, inclusive, and resilient cities and communities.

7. Climate Action (SDG 13): Financial inclusion can support climate action by providing individuals and businesses with access to funds for environmentally sustainable projects and investments in renewable energy, promoting the transition to a low-carbon economy.

8. Partnerships for the Goals (SDG 17): Achieving the SDGs requires collaboration among governments, financial institutions, NGOs, and other stakeholders. Financial inclusion promotes partnerships by bringing together diverse actors to expand access to financial services and drive development.

In essence, financial inclusion is not only a means to an end but a catalyst for achieving multiple SDGs. It empowers individuals, strengthens communities, and promotes economic growth while addressing some of the world’s most pressing challenges. As we work towards the 2030 Agenda for Sustainable Development, recognizing and fostering the symbiotic relationship between financial inclusion and the SDGs is critical to making progress towards a more just and sustainable world.

1. Lack of Access: In many rural and low-income areas, physical bank branches are scarce, making it difficult for people to open accounts or access credit.

2. Financial Literacy : Many individuals lack the knowledge and understanding needed to use financial services effectively.

3. Documentation Requirements: Some people, particularly in developing countries, lack the necessary identification documents to open bank accounts.

4. Costs and Fees: High fees associated with traditional banking services can deter individuals with limited means from participating in the formal financial system.

One of the most promising avenues for expanding financial inclusion is through digital technology. Mobile phones and the internet have revolutionized banking, making financial services accessible to even remote populations. Mobile banking apps, digital wallets, and peer-to-peer lending platforms have democratized finance, allowing people to manage their finances, make payments, and access credit using their smartphones.

Governments worldwide are recognizing the importance of financial inclusion and implementing policies to promote it. Initiatives include:

1. Branch Expansion: Governments are encouraging banks to open branches in underserved areas, reaching rural and remote communities.

2. Financial Literacy Programs: Financial education initiatives are equipping people with the skills and knowledge needed to navigate the financial landscape effectively.

3. Digital Infrastructure: Investments in digital infrastructure, such as expanding mobile networks and improving internet access, are essential for digital financial inclusion.

4. Regulatory Reforms: Governments are revising regulations to encourage competition, innovation, and responsible financial practices, making it easier for new players, including fintech firms, to enter the market.

Financial inclusion and social impact investing are two powerful forces converging to drive positive change in our global economic landscape. Financial inclusion, at its core, is about ensuring that all individuals, regardless of their socioeconomic status, have access to essential financial services. This includes banking, savings, credit, insurance, and payment systems. This access is not only a fundamental human right but also a catalyst for economic empowerment and poverty reduction.

Social impact investing, on the other hand, is a dynamic approach to investment that goes beyond mere financial returns. It seeks to generate measurable, positive social and environmental impacts alongside financial profits. Impact investors deploy their capital into businesses, projects, or organizations that aim to address pressing societal issues, such as education, healthcare, clean energy, and sustainable agriculture.

When these two concepts intersect, remarkable

transformations occur. Social impact investing leverages financial resources to support initiatives focused on financial inclusion. For example, impact investors may fund microfinance institutions that provide small loans to underserved populations, helping them start or expand businesses. These investments not only generate financial returns but also contribute to lifting people out of poverty, creating jobs, and fostering economic stability.

Moreover, social impact investing can foster innovation in financial technology (fintech), which plays a pivotal role in expanding financial inclusion. By supporting fintech startups that develop innovative payment platforms, mobile banking apps, and digital wallets, impact investors help bridge the gap between the unbanked and the formal financial sector. This not only facilitates financial access but also promotes financial literacy and inclusion, ultimately contributing to economic growth and sustainable development.

In essence, the synergy between financial inclusion and social impact investing embodies a visionary approach to addressing some of the world’s most pressing challenges. It offers a path towards a more equitable and prosperous global economy, where finance is a powerful instrument for positive social change. By aligning financial interests with social and environmental goals, we can create a world where investments do more than generate profits; they empower individuals and transform communities.

While progress has been made in the realm of financial inclusion, challenges persist. Privacy concerns, cybersecurity threats, and the risk of over indebtedness are issues that require careful consideration. However, the potential benefits of financial

inclusion are undeniable, making it a goal worth pursuing.

In conclusion, financial inclusion is not just about opening bank accounts; it’s about empowering individuals and communities to build better lives. By breaking down barriers, promoting financial literacy, and leveraging technology, we can unlock the potential of billions of people, creating a more prosperous and equitable world for all. Financial inclusion is not just an aspiration; it’s a pathway to a brighter future.

Aug 8th, 2023

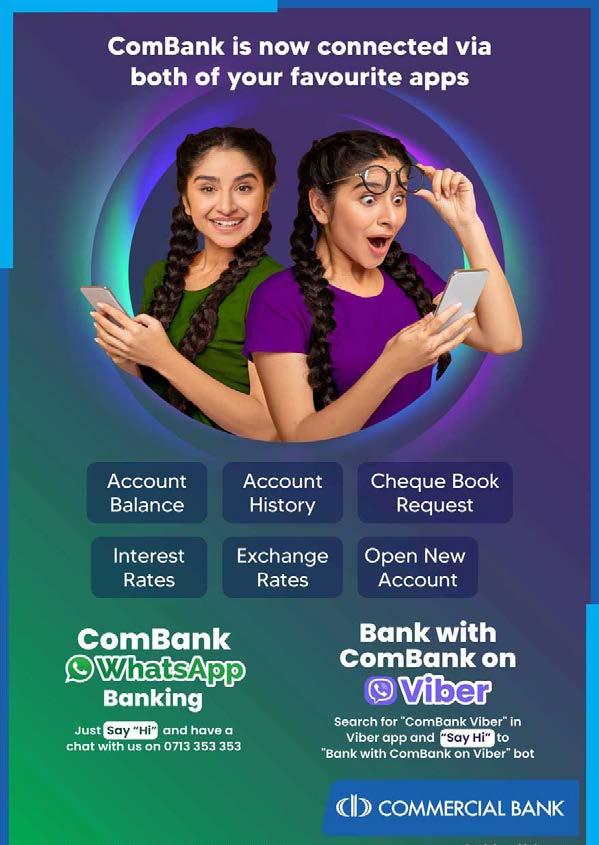

Did you feel the need for a simple way to compare and order banking products, such as credit cards or loans and other types? BankyEgypt is here to help with that!

Banky is the Best Banking Comparison Site in Egypt, that helps users compare credit cards, loans, bank accounts, and savings vessels, regardless of whether you want to apply for a mortgage for that wonderful new home you’ve been looking for, or getting a car loan for that shiny new vehicle, or simply wanting to choose the best bank or product, or looking for the best daily offers in all banks, Banky is the best choice!

On the Banky website, the audiences can search among numerous possibilities that have been specially designed to satisfy their goals with precision and care, and to ensure that they obtain the best desired

results according to their needs, or more precisely, “the best choice” is our slogan. Before 2018, obtaining information about banking products and services was very difficult and required a lot of time and effort, but Banky made it easier. Banky was the only platform in Egypt through which it was possible to know, compare and order all banking products and services.

Banky has collected all the data, information and prices of all banking services and products, in addition to covering all banks indicators and banking sector news 24/7. Therefore, Banky has a competitive advantage, which is a huge database, as well as a large audience base. And, given the importance of social media, particularly Facebook, we launched Banky “Chatbot”, the virtual financial assistant, which was fed with a database, information, and prices for more than 800

programs for about 8 major products in 37 banks operating in the market, making it the largest in the Middle East to serve so far.

It has approximately 100,000 daily users and gets no less than 2 million messages per month, and it is prepared to react to any enquiries regarding all products in all Egyptian banks.

By comparing banking products on the Banky website, you can save money, time, and effort with just a few clicks! Despite this, Banky is absolutely free for users, allowing them to make informed decisions when buying banking products and Banky we strive to provide the audience with reliable, continually updated, and unbiased information to help them make the best choice. Banky is constantly developing its various products and services to serve millions.

If you hold foreign currencies and want to buy or sell it, follow the constantly changing daily rates in all banks operating in the market, especially since the liberalizing, the exchange rate that is linked to the state of supply and demand, making the decision to buy or sell dependent on the best prices. Banky provided the solution by continually updating and calculating the highest and lowest buying or selling price in the market for the most major currencies in all banks.

During the global Covid-19 pandemic, when millions of people around the world turned to technology for help, Banky played an important role in raising awareness and educating about the methods and uses of digital banking services and dealing with them safely and easily, to serve both the audience and banks, and putting forward bank tips to deal with bank branches as well as with cash.

And, because Banky values your time as much as it values your money and your efforts, if you don’t want to read, we developed my Banky newsletter, the first in the Egyptian banking sector, which keeps you up to date on the latest events and changes in the industry.

Banky was created by individuals with substantial expertise in the financial sector. Not only that, but the team includes expert researchers, allowing them to give users with the most up-to-date information.

Banky launched the first banking bulletin using AI (artificial intelligence) technologies to cover the latest and most important news in the banking arena and economic news.

Banky is considered the largest platform that attracts potential customers as it receives thousands of requests from them organically, making it a “Lead Generation” “The largest and first marketing arm of banks”.

“Banky” has the largest gathering hub of customers and bank employees in Egypt, through “Ask Banky,” a group to share all up-to-date banking news and events, for all customers and those interested in the sector, which made it the link between the public, banks and financial institutions.

Banky works to shed light on all banking systems in all parts of the world to convey the latest findings of the banking sector in terms of services, products and technological development through news and analytical coverage abroad and in the same context Banky website provides a special section in English to learn the latest developments in the local, regional and global market.

Indeed, Banky has succeeded in being a platform for achieving financial inclusion and digital transformations, one of the most important goals of the state and its strategic direction to increase dealers with the banking sector, reduces cash circulation and direct the savings of individuals under the umbrella of the banking sector “The largest tool for Banking and financial awareness and education in Egypt.”

A research centre specializing in analysis and economic studies emerged from the “Banky” site, relying on analytical methods and detailed comparisons based on ratios and evaluations to determine the best products and services in the 36 operating banks in the market. Indeed, the largest and the first series of analytical studies in the Egyptian banking sector were launched, aimed at conducting detailed comparisons of all services and products in the Egyptian banking market.

As a result of all this, Banky won about 7 prestigious international awards from major international institutions during the years 2022 and 2023. These awards came to reflect the institution’s appreciation for “Banky” innovation of a successful service model

Traders Union:

Is an informational portal offering unique content and some interesting perks for traders and investors. Established in 2010, the website has amassed a community of over 300,000 registered users. Its mission is to provide quality information, honest reviews, educational re-sources, and tools to enhance trading outcomes. The TU team comprises numerous active traders, analysts, and financial experts from around the globe.

Beginners and experienced traders have an equal need for information about financial mark-ets, including latest data on assets, companies, as well as educational articles on the basics of financial markets, strategies, etc.

TU experts analyze market events, evaluate brokerage companies, publish financial market news, and offer educational materials and trading strategy reviews. Traders Union publishes daily analytics, including re-

views and forecasts from their financial experts, focusing on key assets in Forex, stock, and cryptocurrency markets. The website also features weekly and monthly analytical reviews of financial markets, facilitating traders’ ability to stay informed, adjust their strategies, and make profitable trading decisions.

Traders can reach out to the

support service via live chat, email, or request a call back to obtain clarification or assistance regarding any questions or issues they may have.

Company ratings are another area of TU’s expertise. Traders Union publishes ratings of companies traders and investors can work with to earn money in different financial markets

and manage their equity effectively. Experienced analysts perform comprehensive analyses of numerous companies offering brokerage and payment services, cryptocurrency trading, and banking products. The ratings incorporate user feedback from the website as a mandatory assessment criterion. The website compiles ratings for Forex brokers, stockbrokers, binary brokers, and cryptocurrency exchanges. The ratings consider factors such as:

• License and regulation;

• Trading and non-trading fees;

• Deposit/withdrawal;

• Choice of trading instruments;

• Analytical materials on trading and investing;

• Passive income options, etc.

All ratings are updated monthly, allowing potential clients to access the latest information on company pros and cons, assisting them in choosing trustworthy partners.

Given the increasing popularity of digital currencies worldwide, TU provides a rating specifically for cryptocurrency exchanges. The positions in this rating are determined based on trading conditions, liquidity levels, professionalism of the support service, and traders’ reviews. Traders Union analysts utilize their own methodology, described in detail on the website, to evaluate companies. The cryptocurrency rating, like all other ratings on the Traders Union website, is regularly updated to reflect changes in trading conditions, withdrawal methods, and other relevant factors.

Traders Union offers additional benefits, including free legal support, contests for traders on demo accounts with real prize money, and a referral program. The monthly demo account contest allows novice traders to participate for free, using a virtual (demo) account to trade.

The top 10 participants share a $200 prize pool, providing an opportunity to learn and

compete with other traders while having the chance to win real money that can be withdrawn or deposited into a real trading account.

Traders Union is a trusted portal that assists traders in learning, staying informed, and achieving better trading results. The information provided by TU experts is highly regarded for its usefulness, up-to-date nature, and reliability, as confirmed by client reviews. All services on the website are entirely free for traders. To access additional benefits and cash back, traders must register on the TU website and sign up with brokers using TU’s referral links.

This September, Gazet International started their journey with podcasts. The podcast has been named “Industrial Insights Unveiled” which will be hosted by our chief editor and on each episode, we will be joined by guest speakers who are the experts in Business, Finance, Banking, Technology, Investment and related industries. On our first episode, our guest speaker was respected Mr. Loo Tak Kheong, Country Head (Malaysia) and Director of AsiaPay.

AsiaPay is a leading digital payment service provider across the Asia Pacific region. In this interview, we have unveiled insights that revolve around the operations, challenges and opportunities in the digital payment landscape.

1. Can you provide an overview about AsiaPay’s journey and its mission in the digital payment industry?

AsiaPay stands as the leading digital Payment solutions and technology vendor that has been operating across the Asia Pacific since 2000. Its company’s vision primarily relies on e-commerce businesses or rather cashless payments which includes “tap to pay” solutions to the merchants, and to banks that are in need of a trusted payment gateway that also provides alternative payment methods.

AsiaPay offers its variety of award-winning payment solutions that are multi-currency, multi-lingual, multi-card and multi-channel, along with its advanced fraud detection and management solutions. Hence, AsiaPay aims to bring fast, digital, secure and convenient cashless transactions all over the world.

2. Can you tell us about the specific roles you perform as the Country Head, Director at AsiaPay?

- Strategizing and Plan, develop, implement and execute the organization’s business direction as well as operational function to optimize performance.

- Driving profitability.

- Expanding the company.

- Managing company organizational structure, strategy.

- Communicating with partners & stakeholders.

- Mentor and interact with members of staff at all levels to foster growth and encourage development among the senior executive team and all members of staff.

3. Since the birth of AsiaPay, how has the digital payment landscape evolved? What trends do you see that can shape AsiaPay’s future?

AsiaPay believes that digitalization is key to the future of payments. We aim to impart our advanced technology and services to the businesses and promote contactless payments in other parts of Asia. Contactless payment adoption continues to climb especially during COVID to reduce risk of handling card and cash, MasterCard has witnessed a surge of 40% in contactless payments in the first quarter of 2022. In China the highest adoption rate where e-wallet purchases were 23% higher than that of cash purchases. Contactless payment technology continues to evolve to meet consumer demand and address convenience, security concerns. The trends would be:

- More adoption of biometric authentication

-“POS-less”: customer pays directly at APP without going to POS nor being a NFC transaction. Nevertheless the “tap to pay” solution also allows and caters to f2f payments for Merchants that requires it.

- Digital wallet in IOT

- Support and fuel Web 3.0 as contactless payment method as well in near future

- Non-Bank FIs plays an important part to enable / facilitate the adoption of contactless payment

Innovation and Solution

4. Can you highlight some of the innovative payment solutions that AsiaPay offers to businesses and organizations?

On the technology side and being a certified 3D-Secure vendor ACS - access control server/MPI (merchant plug-in), they offer their valued bank and payment platform clients an array of prevailing checkout platform plug-ins, customized ePayment solution platforms especially on payment gateway and anti-fraud, ACS/MPI, tokenization, DCC/MCP, eWallet, Mobile Payment & etc., as well customized integration and development services for valued merchants.

5. How does AsiaPay ensure the security and reliability of its payment processing services, especially in the face of growing cybersecurity threats?

- Reduce Fraud on Payment Transactions - AsiaPay verifies transactions with risk-based analytics to help stop fraud before it happens.

- Enhance Shopping Experience for CustomersEnhance trust and confidence for online shopping

- Increase Business Conversion Rate - Reduce shopping cart abandonment with a more secure and seamless checkout process. We have partnered with strategic partners, ie; Shopify, woocommerce, Magento, Siteminder & etc.

- Merchants Gain Business Insights - Issuers gain greater visibility into cardholder activity to help spot consumer trends. We allow issuers to monitor transactions as well.

6. Could you tell us about the challenges and opportunities that AsiaPay is presented with, as it holds a strong presence in the Asia Pacific region?

Challenges:

- Globalization, big data, mobile internet, new technology trend as the pandemic continues to accelerate global economies towards a cashless future

- From business side: Compliance/ consumer behavior/ product needs/ competition from the West / financial risks/ ROI

- From technical side: Security / regulations/ scalability / integration/ technology risks / access to expertise

- With that, at AsiaPay we have:

1. Positive/ focus/ flexibility/proactivity and organizational skills

2. Agility / vision/ trust / credibility

Opportunity :

- Following China’s lead, digital wallets are growing fast across APAC

- The rest of APAC is catching up to China’s lead in digital wallet adoption

- Emerging economies lead regional e-commerce growth India and Southeast Asia will see APAC’s strongest e-commerce growth through 2026

- Buy now pay later is seeing big gains in e-commerce (BNPL accounted for over $100 billion of APAC’s e-commerce)

- Cash continues to decline rapidly at POS The decline of cash has accelerated due in large part to the proliferation of QR codes

- Real-time payments are driving adoption of A2A in APAC account-to-account (A2A) payments and cross-border commerce is emerging as a global leader in real-time payments

- APAC consumers are a new generation of young, tech-savvy individuals who are inspiring innovative products and services. They enjoy and drive the convenience of shopping online or offline. Conversational/Chat commerce; live streaming commerce

- Cross-border e-commerce / digital n social commerce / payment

- Evolvement of Digital Banking intended to enhance banking experience of Millennial

7. How does AsiaPay personalize its services to meet the diverse needs of businesses across different countries and cultures?

To help our business partners grow their business online by providing innovative, secure and cost-effective solutions that will make them competitive in the e-commerce landscape. We encourage its merchants to bring this secure payment platform to their e-commerce stores and be able to offer premier payment methods to their users. Our other services include:

- VAS

- Anti-fraud and Security (Anti-fraud/ Customized Payment Page/ Member Payment/ Card Tokenization / VTS)

- Processing (AppPay/ PayBooth/ Payment Link/ QR Code/ Recurring Payment/ Batch Payment/ Voucher Payment/ Event Payment/ API/SDK Library)

- On-Us Processing (Instalment Payment/ Card Promotion Discount/ Loyalty Point Redemption)

- Module (Shopping Cart/ Hotel Reservation System/ Event Enrolment System)

- Big Data (Payment Analyser)

- Regional (Multi-Currency Processing /DCC & MCP/ Multi-Lever Report)

Cross Border Transaction:

8. Cross-border transactions have become essential for global businesses. How does AsiaPay facilitate seamless and secure cross-border payments?

In the e-commerce world, it is already borderless. Whereby if the merchants are able to accept cards from various payment schemes i.e.; Visa / MasterCard / unionpay / discover / diners / JCB… the merchant can accept those Payments cards across the border, globally. Hence, whether by accepting local cards or foreign cards, the same standards of

security should apply to mitigate the risk of fraud. We also have Anti-fraud and Security (Anti-fraud/ Card Tokenization / VTS / Mdes) 3ds OTP authentication – liability shift. On the technology side and being a certified 3D-Secure vendor ACS - access control server/ MPI (merchant plug-in), we offer our valued bank and payment platform clients an array of prevailing checkout platform plug-ins, customized e-Payment solution platforms especially on payment gateway and anti-fraud, ACS/MPI, tokenization, DCC/ MCP, e-Wallet, Mobile Payment & etc., as well customized integration and development services for valued merchants.

E-Commerce and Business Enablement:

9. E-Commerce has grown significantly. What are the methods that AsiaPay implements to contribute to the growth of online

businesses, especially start-ups and small enterprises?

AsiaPay assists and supports merchants in integrating the payment gateways to the acquirers. This is because AsiaPay has already integrated with multiple acquirers, not only in Malaysia but also across Asian regions which will allow the merchants to grow with us, regionally. With regards to that:

- Making a payment is an important part of the overall customer experience and you can use that process as a means to differentiate your business.

- Optimizing online payment experience to increase checkout conversion

- Optimizing local payment methods to a mobile environment

- Improving the mobile-friendliness of our site, with clear and attractive visuals, and smoother navigation. Personalizing their experience at all touchpoints such as with recommendations of solutions or products as per customers’ interests and by sending personalized messages.

- Leveraging customer data appropriately by explicit segmentation of customer profiles and standardization of the data-gathering process across all channels.

- Improving our response times for customer queries when they populate through any of the channels. Engaging and addressing all customer queries through live chat, intelligent chatbots, or interactive discussion forums.

- Providing transparency and reassurance about security

The merchants tech developers will only need to integrate with our API (application programming interface), thereafter, AsiaPay will take it from there connecting to the preferred Acquirer. It is digitally simple. For eCommerce or retail, the future is digital.

11. Could you share some examples of AsiaPay’s successful collaborations with financial institutions (FIs) and businesses, and their impact?

We add value to the FIs or Payment Partners / Schemes by addressing their pain-points, executing the technical part of things i.e., integrating to the merchants, offering multiple payment acceptance methods, dashboard reporting, operation & support & etc..

Enhancing systems for the FIs is very costly and hence, engaging a Tech partner like Asiapay will address these pain-points not only from the cost perspective but also on the technicality perspective as well..

“At Canadia Bank, we continue to leverage technology, invest in digital initiatives, and seek innovative ideas for the customers’ convenience. We are delighted and excited to collaborate with AsiaPay to strengthen the digital payment capabilities of our merchant partners. In return, it will provide more convenience to the individual customers, who are the end users, as they will be able to pay in simple, secure, and convenient manner.” he said.

David Chen, CEO of Atome, said: “Now, more than ever, consumers want flexibility, transparency and a better, more personalized shopping and payment experience. This exciting partnership with AsiaPay will support thousands of businesses across the region in enabling a superior, seamless checkout experience for consumers, both in store and online websites. This in turn will Optimize Customer conversion, increase average orders and repeat usage.”

Bradley Haines, Regional Vice President of Asia Pacific at SiteMinder, says, “Hotels today are chal-

lenged to keep up with the latest consumer demands, behaviours and expectations. Additionally, this year has given rise to booking cancellations and the need for online security like never before. Through our partnership with AsiaPay, our hotel customers can offer greater choice to their guests, so they can increase booking conversions online and save time by not having to manage payments manually onsite. By receiving payments upfront, hotels also have a greater ability to create contactless check-in experiences.”

12. The payment industry is subject to regulations. How does AsiaPay stay compliant with various regulations while operating across different jurisdictions?

We work very closely with the Central Banks i.e.; Bank Negara Malaysia and we are licensed to perform our business as a Payment Gateway provider. Hence, we are consistently being audited by the regulators to ensure that we are comply & certified with the standards of security i.e. PCIDSS (Payment Card Industry Data Security Standard).

So In terms security, We also work very closely with Visa & Mastercard to provide the tokenization services i.e.; VTS (Visa Token Service) & Mdes (Mastercard Digital Enablement Service) to ensure tighter security on the card’s PAN (primary account number) number to prevent fraudulent

13. What can be expected from AsiaPay in terms of future innovations, expansion plans, or new services?

AsiaPay will continue to support partners in growing their online business by providing innovative, secure, and cost-effective solutions to be industry and future-ready with digitalization and technological innovations taking over the economic sector of the world.

We will continually embrace change and innovate capitalizing on the technological trends and strength especially addressing the coming evolution of digital commerce, IOT, mobility, adoption of AI, payment data analytics and blockchain technologies

On top of our existing 16 country operation in Asia, we will continue to expand our footprint in the world to expand our payment solution and service coverage, and further scale out and build stronger business partnerships.

Our Innovation and adjustment strategies are:

• Open API for easy integration process

• Tokenization

• Smart POS – Tap to Pay solution

• Biometric recognition

• KYC – Merchant e-On boarding

• Authentication 3D Secure 2.0

• Crypto/ Blockchain

• Big data

• Artificial intelligence

• Chatbot

14. Can you share any customer success stories that showcase the impact of AsiaPay’s services?

Eastin Hotel Group IT manager: “Previously we were using different gateways, but then we switched to AsiaPay, AsiaPay offers multiple cards and other comprehensive payment methods with multi- lingual and multi-channel payment processing solution, besides, it has an advanced fraud detection and payment management solution. L’occitane Finance manager” Our Company has been using digital payment services since 2014, so it’s already been 9 years, using digital payment will increase our sales, customers can pay us anytime in any way, we are pleased with AsiaPay’s high-quality service, and their support team is very helpful.

15. Could you share some insights from your personal experience about working in the digital payment industry and contributing to AsiaPay’s growth?

In AsiaPay, we have a presence across the region which has enabled many payment methods to support the merchants to grow regionally. We believe in nurturing or supporting the merchants

to grow in the e-commerce space and addressing their pain-points by customizing solutions they need. Likewise, the same objectives and direction for AP to support our partner Banks in providing white-label payment gateways and enabling more e-commerce merchants for the Banks.

16. What advice do you have for businesses, especially start-ups and SMEs, looking to adopt online payment solutions and enhance their digital presence?

1) Transformation and upgrading of digital innovation changes the way we live and do business.

2) Business innovation through Digital Payments is to provide good, safe and secure customer experience.

17. AsiaPay was awarded for being the “Most Advanced Payment Service Provider -Malaysia 2023” in the annual Gazet International Award 2023. How does it feel to be recognized for your achievements in the field of ever growing digital payment landscape? What advice would you give to aspiring professionals who aim to achieve similar recognition and success in their careers or projects?

Having the privilege to receive recognition from the annual Gazet International Award is an overwhelming honour. This banking finance award category is aligned with our vision for market expansion to further deliver cross-border e-commerce convenience, not just in neighbouring regions in Asia. In this technological age, we can testify that striving for globalization, digitization and building a wide range of partnerships can lead to all kinds of business success.

It is my great privilege to receive such a prestigious award. Definitely a strong endorsement for us to recognize our efforts in supporting Malaysia’s businesses particularly in innovation. This will further boost AP’s firm commitment to support the continued demand in Malaysia.

My advice to my fellow awardees is to strive harder in this industry. With the latest acknowledgement added to our businesses’ credentials and expertise, a reliable & credible performance as well as reputation is important for each of our respective companies. As for the start-ups, for now, breaking in the market is what fuels your businesses but offering innovative technology and solutions that can serve both retailers and buyers would be more needed in the long run. In building a business, you may encounter shortcomings but having a goal-driven mindset can lead you to greater success.

So let’s embrace change and digital innovation for the future.

Regtech, a portmanteau of “regulatory technology,” is a specialized sub-sector within the fintech (financial technology) industry. In a landscape marked by an ever-expanding web of regulations and compliance requirements, regtech emerges as a crucial ally for businesses seeking to navigate this complex terrain.

It focuses on the development and deployment of innovative technological solutions to address regulatory and compliance challenges facing financial institutions and businesses.

Regtech leverages advanced technologies such as artificial intelligence (AI), machine learning, data analytics, and automation to streamline and enhance compliance processes, risk management, and reporting obligations. With its ability to pro-

vide real-time insights, automate labor-intensive tasks, and bolster cybersecurity measures, regtech is not just a compliance tool; it’s a strategic asset reshaping the way financial institutions and fintech companies operate, ensuring they not only meet regulatory standards but also thrive in a rapidly evolving industry.

Regtech solutions assist financial institutions in staying compliant with a constantly evolving and complex regulatory landscape. They automate the monitoring of regulatory changes, helping organizations adapt swiftly to new requirements. By automating repetitive and time-consuming compliance tasks, regtech reduces the margin for human error and significantly improves operational efficiency.

This leads to cost savings and enhanced accuracy in compliance efforts. Regtech tools provide advanced risk assessment and management capabilities by analyzing vast datasets in real-time. This allows organizations to identify and mitigate potential risks promptly.

Regtech platforms excel in handling large volumes of data efficiently. They enable businesses to collect, store, and analyze the data necessary for compliance and reporting purposes.

Many regtech solutions offer real-time monitoring of transactions and activities, which is crucial for detecting and preventing fraudulent or illicit activities promptly. Regtech automates the generation of compliance reports and documentation, making it easier for organizations to provide evidence of their adherence to regulatory standards. The automation and efficiency gains achieved through regtech can lead to significant cost reductions for businesses, as they require fewer resources for compliance tasks.

Regtech solutions are designed to be scalable, allowing financial institutions to adapt to changes in their size and scope of operations without major disruptions to their compliance processes. Some regtech applications enhance the customer onboarding experience by simplifying identity verification and due diligence processes, reducing friction for clients.

Regtech systems often maintain detailed audit trails, ensuring transparency and accountability in compliance efforts. In summary, regtech plays a vital role in helping financial institutions navigate the complex regulatory environment efficiently and effectively. By harnessing technology, it not only ensures compliance but also provides opportunities for improved risk management, cost savings, and enhanced customer experiences. As regulations continue to evolve, regtech will remain a critical component of the fintech landscape.

The financial sector is renowned for its intricate and multifaceted regulatory framework, a web of rules and standards designed to ensure the stability, integrity, and fairness of financial markets. These regulations serve as a protective shield for consumers, investors, and the broader economy, helping to prevent crises and fraudulent activities that can have far-reaching consequences. However, the very complexity of these regulations can often present significant challenges for businesses operating in the financial industry.

One of the defining characteristics of the financial regulatory landscape is its sheer volume. Financial institutions, ranging from banks and insurance companies to investment firms and fintech startups, must contend with an ever-expanding library of rules and guidelines issued by various regulatory bodies. These bodies can include government

agencies, central banks, international organizations, and industry-specific authorities, each with its own set of mandates and objectives.

Moreover, financial regulations are not static; they are in a perpetual state of evolution. New regulations are introduced in response to emerging risks and market developments, and existing ones are amended to reflect changing economic conditions and technological advancements. The dynamism of the regulatory environment requires financial institutions to stay vigilant, continuously monitor changes, and adapt their compliance strategies accordingly.

The global nature of finance adds another layer of complexity. Financial institutions often operate across borders, subject to the regulatory oversight of multiple jurisdictions. This means they must grapple with a patchwork of regulations that

can vary significantly from one country to another. Achieving compliance on a global scale while adhering to these diverse sets of rules can be a daunting task.

Furthermore, the interconnectivity of financial markets means that a regulatory change or incident in one part of the world can have cascading effects on a global scale. This interconnectedness underscores the importance of regulatory harmonization and international cooperation in ensuring financial stability.

The world of financial regulations is a labyrinthine landscape where rules are abundant, ever-changing, and often overlapping. Navigating this complex environment demands not only a deep understanding of the regulations but also the strategic deployment of technology and expertise to efficiently and effectively meet compliance obligations. This is precisely where regtech, or regulatory technology, emerges as a critical tool, offering innovative solutions to simplify and streamline compliance efforts in the intricate world of financial regulations.

The fintech industry has witnessed explosive growth in recent years, disrupting traditional financial services and delivering innovative solutions to consumers and businesses alike. However, as fintech companies venture into this dynamic landscape, they encounter a regulatory environment often likened to a “minefield.” The regulatory challenges they face are multifaceted and can pose significant hurdles to their growth and sustainability.

One of the foremost challenges for fintech companies is the diversity of regulatory authorities and frameworks they must contend with. Operating across borders frequently exposes them to a patchwork of regulations, both domestic and international, imposed by government agencies, central banks, and industry-specific oversight bodies. This regulatory fragmentation can result

in compliance complexities, as fintech firms must decipher and adhere to a multitude of often contradictory rules.

Moreover, the pace of technological innovation within fintech often outstrips the ability of regulators to keep up. This lag can lead to regulatory uncertainty and ambiguity, forcing fintech companies to operate in a regulatory gray area. The absence of clear and standardized guidelines can hinder product development, slow down market entry, and deter potential investors.

Additionally, fintech businesses must grapple with stringent know-your-customer (KYC) and anti-money laundering (AML) requirements, designed to prevent financial crimes. These requirements necessitate robust customer identification and due diligence processes, which can be costly

and time-consuming to implement, particularly for start-ups with limited resources.

Furthermore, data protection and privacy regulations, such as the European Union’s General Data Protection Regulation (GDPR), add an additional layer of complexity. Fintech companies must safeguard sensitive customer information while ensuring compliance with these stringent data protection requirements.

Lastly, cybersecurity considerations are paramount. As fintech firms handle sensitive financial data and transactions, they become lucrative targets for cyberattacks. Compliance with cybersecurity regulations, coupled with the proactive management of cybersecurity risks, is vital to protect both the company and its customers.

In short, fintech companies face a formidable challenge when navigating the regulatory landscape, which often resembles a complex and ever-changing minefield. Overcoming these hurdles requires a combination of regulatory expertise, robust compliance strategies, and the strategic deployment of regtech solutions. Successfully navigating the regulatory minefield allows fintech firms to thrive, delivering innovative financial solutions while maintaining the trust and security of their customers.

In the midst of the complex and ever-evolving landscape of financial regulations, a powerful ally has emerged - regtech, short for “regulatory technology.” This innovative field represents the convergence of technology and regulatory compliance, offering solutions that empower financial institutions and businesses to efficiently navigate the intricate regulatory terrain.

At its core, regtech is about harnessing the transformative potential of advanced technologies to streamline and enhance compliance processes, risk management, and reporting obligations. The rise of regtech can be attributed to several key factors:

1. Explosive Growth of Financial Regulations: As financial regulations multiply in both scope and complexity, businesses face a mounting burden in terms of compliance. Regtech steps in as a force multiplier, automating routine tasks and providing the tools needed to stay ahead of regulatory changes.

2. Data Analytics and Machine Learning: Regtech leverages the power of data analytics and machine learning algorithms to analyze vast datasets in real-time. This capability enables institutions to identify and mitigate risks swiftly, transforming compliance from a static, rule-based process into a dynamic and proactive one.

3. Efficiency and Cost Reduction: Through automation and process optimization, regtech solutions deliver substantial efficiency gains. By automating labor-intensive compliance tasks,

businesses can achieve significant cost savings while improving accuracy and reducing the risk of human error.

4. Enhanced Customer Experience: Some regtech applications enhance the customer experience by simplifying onboarding processes. By expediting identity verification and due diligence procedures, businesses can provide a more frictionless and user-friendly experience for clients.

5. Real-time Monitoring: Regtech tools offer real-time transaction monitoring, allowing businesses to identify and address suspicious activities promptly. This capability is particularly critical in combating financial crimes, such as money laundering and fraud.

6. Digital Transformation: As businesses undergo digital transformations, regtech aligns seamlessly with this trend. It provides the digital infrastructure needed to ensure compliance in an increasingly online and interconnected financial world.

Clearly, the rise of regtech represents a significant shift in the way financial institutions and businesses approach regulatory compliance. It empowers them to not only meet compliance obligations efficiently but also to extract actionable insights from regulatory data. As technology continues to evolve and regulations become more complex, regtech is poised to play an increasingly vital role in safeguarding the integrity and security of the global financial ecosystem.

Regtech’s transformative impact on regulatory compliance and risk management is underpinned by a diverse array of tools and technologies that are reshaping the financial industry’s approach to regulatory challenges. These components are the driving force behind the efficacy and efficiency of regtech solutions:

1. Artificial Intelligence (AI) and Machine Learning (ML): AI and ML algorithms are at the forefront of regtech’s capabilities. They enable the automation of complex tasks such as data analysis, anomaly detection, and predictive modeling. Through continuous learning from data, these technologies enhance the accuracy of risk assessments and compliance monitoring.

2. Big Data Analytics: Regtech leverages big data analytics to process vast volumes of structured and unstructured data, including transaction records, market data, and regulatory texts. By extracting valuable insights from this data, financial institutions gain a deeper understanding of their operations and compliance status.

3. Natural Language Processing (NLP): NLP technology allows regtech solutions to interpret and extract meaning from written and spoken language. It is particularly valuable in automating the analysis of regulatory texts, enabling faster and more comprehensive compliance assessments.

4. Blockchain and Distributed Ledger Technology (DLT): Blockchain and DLT offer transparent and immutable record-keeping, making them valuable tools for transaction verification and auditing. These technologies enhance the security and transparency of financial processes, critical in regulatory compliance.

5. Cloud Computing: The scalability and flexibility of cloud computing are instrumental in regtech solutions. It facilitates the storage and analysis of vast datasets and allows businesses to adapt quickly to changing regulatory requirements.

6. Application Programming Interfaces (APIs): APIs enable seamless integration between various systems and data sources. In the context of regtech, APIs play a pivotal role in connecting data streams, ensuring data accuracy, and facilitating the interoperability of different compliance tools.

7. Robotic Process Automation (RPA): RPA automates repetitive and rule-based tasks, reducing the burden of manual compliance processes. It enhances operational efficiency and accuracy by minimizing human intervention.

8. Regulatory Reporting Software: Specialized software solutions cater to regulatory reporting needs. These tools automate the generation and submission of regulatory reports, ensuring timely compliance with reporting obligations.

9. Biometrics and Authentication Technologies: Biometric verification methods, such as fingerprint and facial recognition, are increasingly used in regtech for identity verification and authentication, bolstering security in customer onboarding processes.

10. Cybersecurity Solutions: Given the criticality of data security in compliance, regtech encompasses a wide range of cybersecurity tools and technologies to protect sensitive financial data from breaches and cyber threats.

The synergy of these key components creates a powerful ecosystem that empowers financial institutions and businesses to navigate the regulatory landscape efficiently and effectively. As technology continues to advance, regtech will evolve further, offering innovative solutions to address emerging regulatory challenges in the ever-changing financial industry.

The rise of regtech (regulatory technology) represents a transformative force within the financial industry, offering innovative solutions that empower businesses to navigate the complex and ever-evolving landscape of regulatory compliance. Here we can explore real-world success stories of regtech adoption, shedding light on how these technologies have reshaped the way financial institutions and businesses approach regulatory challenges. Through a closer examination of key applications, we gain insights into the tangible benefits and impact regtech has had on the global financial ecosystem.

suming. However, with the advent of regtech solutions, financial institutions have experienced a paradigm shift. Companies like ComplyAdvantage have harnessed the power of AI and machine learning to analyze vast datasets in real-time, instantly flagging potential risks and compliance issues. This proactive approach has not only significantly reduced compliance costs but has also improved the accuracy of risk assessments.

One of the most prominent real-world applications of regtech is in automated compliance monitoring. Traditional methods of compliance monitoring were often labor-intensive, error-prone, and time-con-

Regtech’s impact extends to the prevention of financial crimes, such as money laundering and fraud, through real-time transaction monitoring. Companies like Chainalysis have developed sophisticated tools that track cryptocurrency transactions across blockchain networks. These tools provide insights into the origin and destination of digital assets, enabling financial institutions to identify suspicious

activities promptly. By leveraging blockchain analysis and pattern recognition, regtech has bolstered the fight against financial crimes while enhancing transparency in digital transactions.

Efficient Regulatory Reporting: Regulatory reporting is an essential but often arduous task for financial institutions. Regtech solutions such as AQMetrics have streamlined this process, automating data collection, validation, and reporting. By connecting to various data sources and utilizing cloud computing, these tools have reduced the time and effort required for regulatory reporting. This has not only improved accuracy but has also ensured timely compliance with reporting obligations, even in the face of ever-changing regulatory requirements.

In the realm of customer onboarding and identity verification, regtech has significantly enhanced efficiency and security. Companies like Jumio have leveraged biometrics and artificial intelligence to offer seamless and secure customer authentication solutions. Through facial recognition and document verification, they ensure that customers are who they claim to be, combating identity theft and fraud. These solutions have not only expedited onboarding processes but have also enhanced the customer experience by reducing friction and ensuring data security.

Data Privacy and GDPR Compliance: Regtech plays a pivotal role in assisting businesses with data privacy and compliance with regulations like the European Union’s General Data Protection Regulation (GDPR). Tools like OneTrust offer comprehensive platforms for managing data privacy and consent. By automating data inventory, consent management, and compliance assessments, these solutions ensure that organizations adhere to stringent data protection requirements. This is particularly critical in an era of increasing data breaches

and privacy concerns, where non-compliance can lead to severe financial penalties.

The real-world success stories of regtech adoption vividly illustrate the transformative power of these technologies in the financial industry. By automating compliance monitoring, enhancing transaction transparency, streamlining regulatory reporting, improving identity verification, and bolstering data privacy, regtech has become an indispensable asset for businesses navigating the regulatory landscape. These success stories underscore the tangible benefits of regtech adoption, including cost savings, enhanced accuracy, improved customer experiences, and, most importantly, strengthened regulatory compliance. As financial regulations continue to evolve, the innovative applications of regtech will continue to shape the future of the global financial ecosystem, ensuring a secure, efficient, and compliant industry.