The Next Step

3-D printing companies set their sights on prosthetics, splints

pg. 26

Banking on the Future

pg. 32

3-D printing companies set their sights on prosthetics, splints

pg. 26

Banking on the Future

pg. 32

A new ambulatory care center for the University of Minnesota Physicians and Fairview Health Services brings an ambulatory surgery center, comprehensive cancer center, and a wide variety of clinics under one roof with services like easy check-in and -out and valet parking to make healthcare even healthier.

A new ambulatory care center for the University of Minnesota Physicians and Fairview Health Services brings an ambulatory surgery center, comprehensive cancer center, and a wide variety of clinics under one roof with services like easy check-in and -out and valet parking to make healthcare even healthier.

Banks are rolling out new technologies, evolving with updates to old ones and choosing carefully what to incorporate into their services. See page 32.

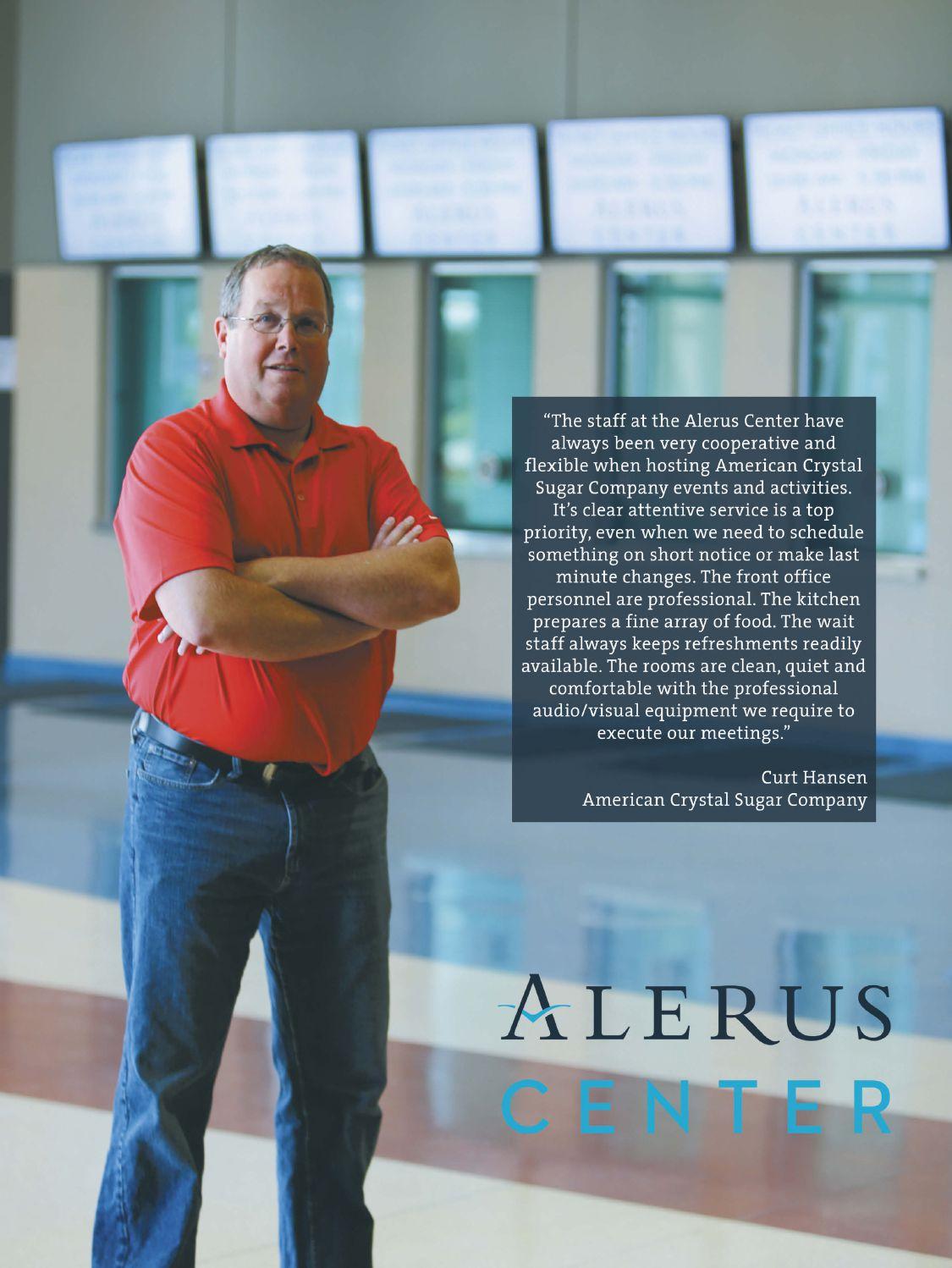

IMAGE: GATE CITY BANK

26 On a 3-D Threshold Regional companies print affordable, personalized orthotics and artificial limbs

Banks introduce responsive mobile apps, EMV chip cards

Erin Rice, an orthotist with Rehabilitation Medical Supply, fits Elijah Gabels with ankle-foot orthotics in Sioux Falls, S.D. Rehabilitation Medical Supply is a division of LifeScape, which soon will provide patients with 3-D printed orthotics, with the help of Sioux Falls-based 3DVHB LLC.

IMAGE: LIFESCAPE

BY LISA GIBSON Technology MATTHEW D. MOHR JAY LIES

701.787.6753

lgibson@prairiebusinessmagazine.com

The scheduled feature topics in this issue of Prairie Business are banking/finance and health care, but the running (and unintentional) theme that emerged is technology. It’s fitting. Some of the most interesting trends in those industries right now center around advancements that make life easier for companies, manufacturers, doctors, patients, clients and customers.

3-D printing has made its way into many industries in the past few years, often impressing and surprising us with its efficiency and seemingly limitless potential. Now, it’s making an entrance into the prosthetic limb and supportive splint sectors. Companies in our readership area are on the cusp of this emerging market that not only carries promise for themselves, but also for people who need those products. Cooper Bierscheid, founder of Protosthetics in Fargo, N.D., and one of the sources for “On a 3-D Threshold,” starting on page 26, cites data showing 11.5 million people worldwide have had limbs amputated and that figure grows by 5 percent each year. In the U.S. alone, 507 amputations occur each day, he says, adding it’s a large industry most people aren't familiar with. Similarly, many people with mobility limitations need supportive devices like braces or splints to help offset a lack of muscle control or maintain muscle control against a progressive disease.

3-D printing of orthotics provides faster and simpler customization, according to a Sioux Falls, S.D.-based company that’s in the early stages of commercializing the concept. The test subject is so pleased with his device that he wants the company to make him a few more.

Meanwhile, technology in the banking industry has us making deposits, checking balances and transferring money between accounts, all through online apps continuously evolving as customer needs change. In the banking feature in this issue, we talk to a few banks in the region about how they decide which technologies to adopt and how they roll out those changes for customers. Enhanced websites and online services, as well as EMV chips on debit and credit cards, are leading the way and simplifying personal and business finances for even those who are not mathematically or technologically inclined. Read more about these new programs, starting on page 32.

In his 25 years in the banking industry, Darrell Lingle, audit partner for Eide Bailly, has seen his share of new technologies and evolutions. In this month’s Business Insider, Lingle discusses the factors that have changed the most, and shares advice for overcoming challenges as new issues arise. See what he has to say on page 24.

Finally, our construction corner highlights South Dakota’s first standalone emergency department, with an optimized interior design for ease of patient and doctor traffic. With varying severities of injuries and patient conditions, the “racetrack” design helps reduce the high-stress environment and avoids staff burnout, developers say. The story starts on page 36.

Our editorial staff learned a great deal while researching and writing to fill this magazine. These new technological enhancements of existing industries are fascinating and I admire the people behind them. PB

KORRIE WENZEL, Publisher

STACI LORD, Ad Director

LISA GIBSON, Editor

KAYLA PRASEK, Staff Writer

BETH BOHLMAN, Circulation Manager

KRIS WOLFF, Layout Design, Ad Design

Account Executive: NICHOLE ERTMAN

800. 477.6572 ext. 1162

nertman@prairiebusinessmagazine.com

Prairie Business magazine is published monthly by the Grand Forks Herald and Forum Communications Company with offices at 375 2nd Avenue North, Grand Forks, ND 58203.

Qualifying subscriptions are available free of charge. Back issue quantities are limited and subject to availability ($2/copy prepaid). The opinions of writers featured in Prairie Business are their own. Unsolicited manuscripts, photographs, artwork are encouraged but will not be returned without a self-addressed, stamped envelope.

Subscriptions Free subscriptions are available online to qualified requestors at www.prairiebusinessmagazine.com

Address corrections

Prairie Business magazine

PO Box 6008

Grand Forks, ND 58206-6008

Beth Bohlman: bbohlman@prairiebusinessmagazine.com

Online www.prairiebusinessmagazine.com

When business is strong and expanding, the cost of doing business in total generally increases in conjunction with revenue. Controlling operating costs over time can be difficult. Once an enterprise reaches a certain size, new costs (generally associated with employees) start to affect the total cost of doing business.

During periods of growth, it is far too easy to let expenses grow out of control. When business slows down, it is often difficult to reduce operating costs. Once a business has the need for a certain employee position, that position likely will be retained, regardless of business conditions. Likewise, once an employer raises wages, it is extremely difficult to reduce wages without creating significant employee issues. Few employees positively embrace a pay cut, but reality dictates a business must keep its costs in line to survive.

An annual financial forecast or budget of expenses is generally helpful in controlling costs, and a penetrating look at all expenses is a valuable exercise.

I once evaluated a small business that had good operating costs in comparison with industry averages. Upon examination, the owner paid for certain expenses incurred by some employees but not all employees. Naturally, it would not be acceptable to take these benefits away from the select few, and by equalizing all employees, which needed to be done, the operating costs would become intolerable.

Controlling costs involves keeping a close eye on expenses, especially during times of declining volume. Many businesses in our region that rely on oil revenue (including our state governments) are facing this dilemma, so we are seeing bankruptcies and bills left unpaid. Operating expenses are a big part of any business and knowing how to manage costs in good times and bad is a big part of success or failure over time. PB

Matthew D. Mohr CEO, Dacotah Paper Co. Fargo, N.D. mmohr@dacotahpaper.comYou collect paycheck after paycheck, but at what expense? A meaningful life isn’t measured by a bank account. Making money doesn’t make memories. At Alerus, we believe that in earning a living, living is half the equation.

Many small business owners wait until the end of the year to assess their businesses and identify ways to improve on their financial performance. Yet, making time for a mid-year check-in — when you have a good idea of your business’ needs — might be one of the best actions to help your business save time and money and operate more efficiently in the long run. From preparing for quarterly taxes to managing cash flow and revising business plans, every business owner can benefit from a financial refresh. Below are three financial tips to help you stay on track the rest of the year.

Every small business should have a formal written business plan to help with decisions and strategic planning. If you don’t have one, or if your plan hasn’t been updated in a long time, now is a great time to consider writing or updating it. The process of putting your goals in writing will help you focus on long-term business objectives and the steps needed to achieve them. Business planning also can help identify current or future obstacles so you can better anticipate and avoid potential risks.

In addition, a business plan might be helpful for obtaining business financing. For example, lenders might require a formal business plan for a Small Business Administration loan, some larger business loans and lines of credit. Wells Fargo offers a free, online Business Plan Center that includes a tool to create or update a written business plan.

As a small business owner, you’re responsible for filing your business taxes on a quarterly basis. If you don’t already, establish a separate bank account and use it to set aside a monthly amount toward estimated taxes.

Also, keeping business checking and credit accounts separate from personal accounts can help

you maintain accurate and complete records of all business-related income and expenses, and can help plan accordingly for when tax payments are due. If you’re unsure about your estimated tax obligations, consult a tax specialist. They can also help you properly track and record your earnings and deductions.

Business owners know there are two essentials to keep a business running: profits and available cash. One best practice is to check your business cash flow every week. Focus on the timing of income and expenses to identify potential gaps and plan ahead to determine how much cash you'll need to cover potential challenges. Nearly every small business will face a time when it needs more cash than it has on hand. You might want to consider a business line of credit to help bridge any gaps your business encounters in cash flow. For instance, when taxes are due, you might want to use a line of credit to help keep cash flow constant and cover ongoing expenses, while paying down tax debts.

Consider making time to meet with your banker for a financial review that includes an assessment of your credit needs. A banker can walk you through the available business financing options and help you choose the proper ones. Remember, the more you talk about your business, needs and goals, the better guidance you’ll receive.

Whether summer is your busiest time of year or your slow season, it’s a good idea to conduct a mid-year financial review. Taking time now can help you stay ahead of the curve and make the most of the remainder of the year. PB

Jay Lies Wells Fargo Business Banking Manager Fargo-Moorhead, Grand Forks 701.293.4327

Icheck my smartphone and shoot a text to a physician candidate who is sailing in the Pacific Ocean. I take a call from an Essentia Health physician who is hiking in the desert and forward an email to my team with the names of potential candidates for follow-up. In between, I watch my seventh-grade daughter play volleyball on a Saturday in a high school gym in south Fargo.

Twenty-four hours a day, seven days a week, 365 days a year — that’s what physician recruitment looks like at Essentia Health, where I serve as vice president of Physician & Professional Services. I lead a 20-member team responsible for recruiting physicians, physician assistants, nurse practitioners and other advanced practitioners to care for patients in Essentia Health’s 68 clinics and 15 hospitals.

My team deploys traditional recruiting routes such as journals, conferences and advertisements. While these are still important avenues, at least 74 percent of our candidates now come through social media and 24 percent are “known to us,” which means they are referred to us by our employees.

To increase the known-to-us referrals, Essentia Health recently embarked on a new candidate-sourcing tactic. We created a grassroots referral campaign that targets communities where Essentia is looking for physicians. Our goal is to find candidates through the network of people and communities that are home to Essentia Health’s clinics and hospitals across North Dakota, Minnesota, Wisconsin and Idaho.

We recruit practicing physicians as well as those who are still in medical school, residencies and fellowships. The same holds true for advanced practitioners. We want to bring folks back home after they’ve gone away for their education, training or job opportunities.

Our latest campaign began with an “ah-ha” moment that came as I listened to a long-time physi-

cian talk about why he had come to Fosston, Minn., and how he loves his work and his community. I realized he should be recruiting. With that picture in my head, I reached out to our marketing team and we talked through the idea. Our advertising agency created a campaign based on the idea of a physician who is well-known in the community saying, “I’m looking for someone to practice medicine with me.”

The initial thought was a series of newspaper ads. But after the advertising agency listened to the physicians’ testimonials and why they came to practice in our rural communities, we expanded the campaign to include radio ads and postcards to distribute in communities and throughout Essentia Health.

The advertising campaign’s call to action is simple: Call this 1-800 number and tell them the good doctor sent you. My team fields the calls and follows up for details to qualify the lead. Then the lead goes to the appropriate recruiter or our database for future follow-up. Anyone who identifies a lead and provides complete information receives an Essentia Health hooded sweatshirt as a token of our thanks.

The response has been overwhelming. We’re not only finding practicing physicians and advanced practitioners, but we’re also creating a database of future health care professionals with whom we can build relationships over time. We’re also engaging our own employees who are referring friends and relatives to join the Essentia Health team. PB

Kristine A. Olson Vice President of Physician & Professional Services Essentia Health Fargo, N.D.

701.364.8044

kris.olson@essentiahealth.org

Buying a home is an exciting time in life, with important decisions to make and vital paperwork to fill out. Don’t worry — you are not alone. With the assistance of a mortgage loan officer, it should be an efficient, pleasant and ultimately rewarding experience. Many important things should be considered throughout the process, especially if you're a first-time homebuyer. Finding a top mortgage lender with locally approved, financed and serviced home loans will provide you with expert advice and save time. The benefits of a local mortgage is that your mortgage lender can answer servicing questions even after the loan closes. These eight simple steps from Gate City Bank will help keep you on track and successfully open the door to your dream house.

A home purchase might be your largest and most important financial transaction so it’s important to keep an eye on the details. Get the process started by getting pre-approved. Your mortgage loan officer will provide you with the estimated monthly mortgage payment amount for which you have been pre-approved. He or she will explain loan programs and requirements, financing options and details on how your loan will be serviced.

Now, go house hunting.

Found your dream home? Once you’ve made an offer and it’s accepted, share the good news with your local mortgage loan officer. He or she will need a copy of your signed purchase agreement.

Now, let’s get started with the paperwork. Your mortgage loan officer will discuss the following:

• Loan estimate of closing costs. This details the loan amount, charges and fees, annual percentage rate and will also state if your lender will be servicing your loan.

• Locking in interest rate.

• Other forms associated with the specific loan program you have selected.

Now that you’re well on the way to purchasing your home, you’ll need homeowner’s insurance. Your mortgage loan officer will provide you with the information necessary for your agent/agency.

Relax. Your mortgage loan officer will make arrangements for the appraisal, using a third-party company that will inspect the property and compare it to similar properties sold in the area to determine the home’s current appraised value. When it’s done, your mortgage loan officer will provide you with a copy of the appraisal and discuss any items pertaining to the approval process for your loan.

Your mortgage loan officer will obtain a title insurance commitment, which provides the bank with the legal details of the property including any liens against the property.

You’re almost done. During the final loan approval process, a mortgage loan underwriter will review your loan package, appraisal, total debt ratio, credit history, employment history and other required information to make sure it conforms to your chosen loan program.

You will be provided with a closing disclosure, which will contain information about your loan, loan fees and other costs associated with obtaining your loan. Your mortgage loan officer will have the total dollar amount you will need to provide to the title company at closing. The bank will prepare the closing documents for you to sign, and will work with you to ensure you close on your scheduled closing date. Now, sign on the dotted line.

That’s it. Congratulations! You’re a homeowner! This eight-step process to home ownership will create a better way of life. Take your first step today. PB

Roseann Lund Senior Vice President Residential Mortgage Lending and Payment Services Manager Gate City Bank Grand Forks, N.D. roseannlund@gatecitybank.comFor 35 years, Marvin Windows and Doors, headquartered in Warroad, Minn., has awarded annual scholarships to its employees’ children, amounting to about $580,000 for 738 students, says Robert Evans, the company's vice president of human resources.

“The Marvin family of brands believes in living its values,” Evans says. “We highly value caring for our employees, supporting the communities we do business in, and supporting educational efforts. We know that an education can be the key to future success. Broadly, Marvin believes that an educated workforce is a crucial component of a thriving, vibrant economy. Through our scholarship program, we are investing in our employees’ families’ futures, and ultimately, the future of our country.”

This year, Marvin selected 28 recipients to receive scholarships up to $1,500 to attend the two- or four-year college of their choice. Marvin offers this scholarship to employees’ children in all of its locations, including Warroad, Minn., Eagan, Minn., Grafton, N.D., Fargo, N.D., West Fargo, N.D., Baker City, Ore., Ripley, Tenn., and Roanoke, Va.

Recipients in North Dakota and Minnesota are:

→ Madison Dancer, daughter of Timothy and Gail Dancer of Fargo. Dancer attends North Dakota State University, where she plans to major in English education.

→ Reanne Erickson, daughter of Terry and Krista Erickson of Fargo. Erickson attends the University of Minnesota Crookston, where she is studying pre-veterinary medicine.

→ Emilee Gourde, daughter of Jo and Gerard Gourde of Fargo. Gourde will attend North Dakota State University.

→ Alex Sorby, son of Eric and Lori Sorby of Fargo. Sorby attends North Dakota State University, where he is a pharmacy major.

→ Anna Casperson, daughter of Tom and Christina Casperson of Warroad. Casperson attends the University of Minnesota Duluth, where she studies hispanic studies and psychology.

→ Connie Dale, daughter of Craig and Sheila Dale of Warroad. Dale attends the University of St. Thomas, where she studies biochemistry.

→ Robert Davy, son of Rob Davy of Badger, Minn. Davy will attend the University of Minnesota Crookston, where he will major in agronomy/crop production.

→ Bridget Erickson, daughter of Brian and Lynn Erickson of Warroad. Erickson attends the College of St. Benedict, where she studies global business.

→ Matthew Fevold, son of Brad and Teresa Fevold of Warroad. Fevold attends North Dakota State University, where he studies computer science.

→ Deidre Hahn, daughter of Dean and Heather Hahn of Warroad. Hahn attends North Dakota State University, where she is a pharmacy major.

→ Melody Kuehn, daughter of Tim and Kathryn Kuehn of Warroad. Kuehn will attend the College of St. Benedict, where she will major in English.

→ Brianne LaDuke, daughter of Steve and Donna LaDuke of Warroad. LaDuke will attend the University of Minnesota Twin Cities, where she will major in psychology and law.

→ Elissa Rehm, daughter of John and Roxann Rehm of Warroad. Rehm attends Minnesota State Community and Technical College, where she studies business management.

→ Kimberly Schaible, daughter of Brian and Lori Schaible of Warroad. Schaible attends North Dakota State University, where she studies pharmaceutical sciences.

→ Brady Wilmer, son of Kay Wilmer and Owen Hangen of Roosevelt, Minn. Wilmer attends the University of Minnesota: Twin Cities, where he studies mechanical engineering.

→ Lexi Hernandez, daughter of Melissa and Derek Anderson, and Mike Hernandez, all of Grafton. Hernandez will attend the University of North Dakota, where she plans to major in nursing.

→ Michaela Morse, daughter of Merrill and Lisa Morse of Shoreview, Minn. Morse attends the University of Minnesota Twin Cities, where she studies apparel design.

→ Emily Chen, daughter of Jason and Amy Chen of Plymouth, Minn. Chen attends Yale University, where she studies economics.

The scholarship applications are available to employees online or at the facility in which they work, Evans says. Once submitted, completed forms are sent to the administrative non-profit partner, Scholarship America, which determines the scholarship total based on a number of factors, including the applicant’s grade point average, community involvement, extracurricular activities and extenuating circumstances.

The scholarships are available to graduating high school seniors and college students. They are renewable, so are applied each year of college, Evans says. PB

Lisa Gibson Editor, Prairie Business 701.787.6753

RRandy Newman, chairman, president and CEO of Alerus Financial Corp., has been named an Entrepreneur of the Year in the Upper Midwest by Ernst & Young.

The awards program, now in its 30th year, recognizes entrepreneurs who demonstrate excellence and extraordinary success in innovation, financial performance and personal commitment to their businesses and communities. Newman received the Upper Midwest’s top honor in the Financial and Technology Services category.

Finalists for the award were chosen during a nomination process earlier this year. Recipients of the annual award were selected by an independent panel of judges and announced during a black-tie celebration held June 9 at the JW Marriott Minneapolis Mall of America in Bloomington, Minn. Newman and other winners from the Upper Midwest region, which includes Iowa, Minnesota, Nebraska, North Dakota and South Dakota, will be considered for the EY Entrepreneur of the Year national awards, which will be announced Nov. 19 in Palm Springs, Calif.

“I was flattered just to be named a finalist for this award, so to be named one of the top entrepreneurs in the entire Upper Midwest is a true honor,” Newman says in a statement. “Banking isn’t usually the first profession that comes to mind when you think of entrepreneurs, but we encourage all of our employees to approach their work with an entrepreneurial spirit and to take ownership of their roles within the company. That independent thinking and welcoming of new ideas and strategies has allowed us to buck national trends in the financial industry and forge our own path with much success, so I share this award with the entire Alerus team.”

When Newman was named a finalist for the award in May, he said Alerus certainly has demonstrated entrepreneurialism in its expansions, risks, survival and collaborations. When he first got into the banking business in 1981 at what was then called First National Bank North Dakota, 18,000 financial institutions prospered across the country. Today, there are 6,000. “We’ve done more than survived,” he told Prairie Business. “We’ve prospered, through entrepreneurship probably. … Our business is taking risks.” PB

Obermiller Nelson Engineering of Fargo, N.D., has acquired Foster Jacobson and Johnson Engineering of Duluth, Minn. The move strengthens ONE’s regional presence, according to the company, adding engineering staff in Duluth and Minneapolis, as well as an established presence in Sioux Falls, S.D.

Together, the firms now employ 125 in seven cities across North Dakota, South Dakota and Minnesota. “All FJJ engineering employees will become part of ONE,” Jeremiah Christenson, ONE managing partner, tells Prairie Business. “We don’t anticipate any changes other than combining forces to provide better and expanded services to our clients.”

“ONE has a passion for caring for our employees and customers,” Christenson says in a statement. “Our culture is unique and it fosters greatness in our work. Within our culture, we have a desire to make what we do better. FJJ Engineering has a similar culture of innovation and a desire to serve their employees and customers better. By coming together, we are able to combine our resources to have a more efficient, well-rounded company that will continue to serve our employees and customers and push for success.”

FJJ specializes in K-12, but has also done work in health care and higher education, which are ONE’s main areas of expertise, according to Christenson. ONE’s capabilities around commissioning services and civil engineering will complement FJJ Engineering services and expand its offerings to its customer base, he adds.

“The merger of FJJ and ONE strengthens the combined organization with its diversity of talents, expanded markets and complementary services,” says Chip Jacobs, FJJ Engineering partner, in a statement. PB

In an effort to help small to mid-size business owners focus on the reasons they went into business in the first place, Eide Bailly has launched the Possibilities Center. The center is designed to be an outsource center for human resources, information technology, accounting and chief financial officer duties.

While Eide Bailly launched the Possibilities Center in July 2015, the past year has been a slow roll-out, says Jenni Huotari, director of the Possibilities Center and partner at Eide Bailly. “We’re still in the early development stages, but we’re serving clients as we continue to improve on the services we offer.”

Those services include business and strategic planning, outsourced chief financial officer services, education and training for on-staff accounting professionals, bookkeeping services, exit strategy and buy/sell services, outsourced human resources services, tax services and technology. “This is for small to mid-size businesses to have these high-quality services without hiring those people,” Huotari says. “Smaller businesses don’t necessarily have a need for those positions full-time. We’re seeing that businesses do see the value of outsourcing.”

Huotari says the Possibilities Center’s services are “most beneficial for businesses going through a transition or period of high growth. Those times are already high stress, so we can relieve some of the stress. You really can’t outsource your business’s growth, but you can outsource the day-to-day operations, and that’s where we come in.”

Many people who start businesses don’t necessarily have backgrounds in the business side of operations, and the Possibilities Center’s services allow them to focus on the business itself, Huotari says. “Our whole premise is to help clients be successful and help eliminate any barriers that could stop them from being successful. Our ultimate goal is their success.”

While most businesses reach out for accounting and finance help, the Possibilities Center recently added HR services, as it continued to see requests for that knowledge, Huotari says. “Even companies that have HR specialists on staff sometimes have bigger issues to deal with and questions that need to be answered, so we added that partnership as well.”

To learn more about the Possibilities Center’s services, contact Huotari at jhuotari@eidebailly.com. PB

Kayla Prasek Staff Writer, Prairie Business 701.780.1187kprasek@prairiebusinessmagazine.com

BY LISA GIBSON

BY LISA GIBSON

The Energy & Environmental Research Center at the University of North Dakota is one of only two organizations nationally selected to run a second phase of a project to study the benefits of active reservoir management (ARM) in carbon capture and storage (CCS) projects. And the center will get more than $15 million from the U.S. Department of Energy to conduct that research.

EERC, in Grand Forks, N.D., was one of five organizations originally selected from a national pool to conduct phase one of the ARM research. Phase one consisted of feasibility studies and project designs for ARM techniques, says John Hamling, principal engineer at EERC. Phase two funding was awarded to only two organizations of those five, based on their phase one work. “It was competitive,” Hamling says. “We had a great site and a great team.”

ARM is a concept gaining more attention for its potential to improve CCS. Essentially, it produces brine, or saltwater, from a geological horizon into which carbon dioxide is being injected. In theoretical studies using computer modeling and software, ARM has shown it has the potential to better manage formation pressure, help control the footprint of the injected fluids and help improve the injection process, Hamling says.

The ARM concept occurs in every enhanced oil recovery project as it’s being implemented, Hamling says. “However, the difference is for enhanced oil recovery, oil is being produced and subsequently being sold and transported away from the site.” For CCS applications, the produced fluid is not oil, but high-salinity water. Finding ways to treat and move that brine means it could be used in beneficial applications, he says. “You’re able to get rid of that produced fluid and send it to essentially a market for CO2 storage applications.”

The EERC test bed for this research will evaluate next-generation brine treatment, testing low-quality brines to help researchers learn the fundamental knowledge of the process they’ll need to develop a useful technology for widespread implementation. “So it’s looking at these next-generation tech-

nologies that can, ultimately, hopefully, come to market and provide some value in treating low-quality brines,” Hamling says .

Sen. Heidi Heitkamp, D-N.D., says in a statement: “To find a viable path forward for coal, we must continue to develop new and exciting technologies that will produce better uses for carbon dioxide. As a strong supporter of finding new uses for the carbon captured through energy production and generation, we can maintain a true all-of-the-above energy strategy through advances in technology and environmental engineering that will allow the reduction of emissions in an environmentally responsible manner. [The] federal funding will assist the EERC at UND in furthering these technologies and techniques — and demonstrates once again that North Dakota and the EERC are at the forefront of innovation to meet our current and future energy needs while conserving our natural resources.”

Phase two is expected to last about four years, starting with installation of infrastructure such as wells and brine treatment and handling equipment. Active reservoir research and management testing as well as brine treatment technology demonstration will follow, Hamling says. The project has also been given about $4 million in non-DOE funding, for a grand total of almost $20 million, according to EERC.

“This is an exciting project, as it has the potential to not only help with economically reducing the carbon intensity of fossil fuels, but could also provide produced water treatment options that generate product streams that can be brought to market,” Hamling says. “This project is truly a winwin all around that will help North Dakota energy to stay competitive in an evolving national and global market. Our success is a testament to the expertise, strong partnerships, and work ethic that is part of our culture.” PB

Lisa Gibson Editor, Prairie Business 701.787.6753 lgibson@prairiebusinessmagazine.comCarla Hixson has been named dean of current and emerging technologies, a new role at Bismarck State College in Bismarck, N.D. The role was created to accommodate growth and emerging opportunities in key educational areas. Hixson will oversee BSC’s Transportation & Construction, Computers, Medical Arts & Emergency Services and Career and Technology program areas. She also will be responsible for BSC business outreach activities and career and technical education accreditation. Since 2007, Hixson has been the associate vice president for continuing education, training and innovation (CETI) at BSC. Before that, Hixson led several startup programs for the college, including TrainND and the National Energy Center. Hixson earned a bachelor’s degree from Minnesota State University Moorhead and a master’s degree from the University of Mary in Bismarck.

With Hixson’s move, Sara Vollmer has been promoted to director of CETI. She will be responsible for the college’s innovation initiatives, continuing education, TrainND Southwest, the college’s Occupational Safety and Health Consultation program and humanities programming. Vollmer has been with BSC for 20 years, most recently as training manager in CETI. She holds a bachelor’s degree from North Dakota State University in Fargo and a master’s degree in higher education administration from the University of South Dakota in Vermillion.

Jay Meier has been promoted to associate dean of student affairs, a new position at BSC. In his new role, he will oversee student conduct, developing processes and policies that pertain to student rights, responsibilities and safety. Additionally, he will oversee the student judicial process, serve in a BSC Title IX investigator role and manage the counseling center, accessibility services and student support. Meier has been with BSC since 1999, when he was hired as career services coordinator. He has been the director of the Mystic Advising and Counseling Center since 2005. He has a master’s in education, with emphasis in guidance and counseling, from Northern State University in Aberdeen, S.D., and a bachelor’s degree in psychology from the University of North Dakota in Grand Forks.

Jay Lies has been named business banking manager and market president for Wells Fargo in Fargo, N.D., Moorhead, Minn., and Grand Forks., N.D. In his new role, Lies leads the business banking team and works with business customers to help meet their deposit, cash management and credit needs.

Lies began his Wells Fargo career in 2003 as a credit manager for Wells Fargo Financial in Jamestown, N.D., and was promoted to branch manager in 2004. In 2006, he became a Wells Fargo store manager in Wahpeton, N.D. He joined the business banking team in 2008, working in Bismarck, N.D., and Fargo, most recently as principal business relationship manager.

A Wahpeton native, Lies has a bachelor’s degree from the University of Jamestown.

Wells Fargo names market president for eastern North DakotaJay Lies

Bismarck State College promotes threeCarla Hixson Sara Vollmer Jay Meier

The Chamber of Fargo-Moorhead-West Fargo has hired Katie Ralston as the Young Entrepreneurs Academy (YEA!) program coordinator. Ralston will be responsible for recruiting students and volunteers and overseeing the program.

Ralston has a bachelor’s degree in communication from Minnesota State University Moorhead and recently completed her master’s in communication at North Dakota State University in Fargo. Most recently, she was a graduate teaching assistant in Fundamentals of Public Speaking and Intercultural Communication courses at NDSU.

Summit Brewing Co., headquartered in St. Paul has named Mike Bamonti its new chief sales officer. As a member of Summit's executive team, Bamonti will be responsible for developing strategic sales plans that promote sales growth, territory strength, customer satisfaction, brand loyalty and overall market share.

A 30-year industry veteran, Bamonti has worked at the distributor level in the Chicago, St. Louis and Twin Cities markets. He's spent the past 12 years leading J.J. Taylor Minnesota distributing company as president and general manager. Previously, Bamonti worked for seven years as J.J. Taylor's vice president of sales. He has been a board member and officer for both the Minnesota Beer Wholesalers Association and the National Beer Wholesalers Association. Bamonti also serves on the board for Minnesota Vikings linebacker Chad Greenway's Lead the Way Foundation.

WWhen Darrell Lingle started attending Augustana College, which is now Augustana University, in Sioux Falls, S.D., he planned on majoring in chemistry and eventually becoming an optometrist. Once he realized he didn’t like chemistry and enjoyed his introduction to accounting class, he quickly changed lanes.

Lingle, an audit partner with certified public accounting and business advisory firm Eide Bailly in Bismarck, N.D., graduated from Augustana with a Bachelor of Arts in Business Administration and Accounting. He then worked at an accounting firm in Pierre, S.D., for two years before landing at what was then Eide Helmeke in Bismarck, where he’s been since 1991. Lingle started in tax services before transitioning to audit services, eventually working only with financial institutions. He became a partner in the firm in 2004 and has been audit practice leader for seven years.

“I decided I wanted to focus on public accounting because I liked the diversity and my career naturally led to working with financial institutions,” Lingle says. “It’s a clean industry with people who are good at their jobs so I don’t have to go in and clean up messes. We get satisfaction from helping out our clients and being a trusted adviser and business partner to them.”

Lingle notes several highlights during his 25-year career with Eide Bailly. “As a young accountant, it was passing the CPA. After that, each time you’re able to advance and be promoted is always a milestone. When I was approved to be a partner, it felt like a huge achievement.”

As for challenges in his career, Lingle says “every day there’s something new with regulatory practices, so we’re always working to

Darrell Lingle helps guide financial institutions through business challenges in his role as audit partner with Eide Bailly

help community banks get through their challenges. On top of that, we’re always working on implementing any new standards from the accounting board.”

Lingle has seen the financial industry change over the course of his 25-year career. With that, he says the regulatory burden facing financial institutions is “one of the most significant changes in the past 25 years. It seems that there’s more and more regulations every day.”

Cybersecurity risks also change continuously and have grown significantly during Lingle’s career, thanks to a reliance on information technology. “It seems it changes every day,” Lingle says. “We’re doing whatever we can do to help our clients.”

Both regulatory burdens and cybersecurity continue to be challenges facing the financial industry nationwide, but Lingle is also seeing challenges regionally. Across North Dakota, Lingle predicts banks will face questions of asset quality, with both the agriculture and oil industries suffering heavy setbacks recently. “Our financial institutions have a lot of risk policies in place to protect themselves in these situations, but asset quality will come into question.”

Smaller community banks are facing the struggle of being able to attract talent, especially in key positions, and a succession plan issue, Lingle says.

But, even with the challenges, Lingle says the banks are doing well. “We’ve had a strong economy in the Dakotas and Minnesota, even with the challenges of 2008, ag and oil. Our banks are smart and risk-averse and have come out of all of this well.”

Lingle encourages those in the financial industry to “surround yourself with smart people. There are a lot of resources out there. Those organizations are there to provide a network. Take advantage of the network you can build and take advantage of educational opportunities. Allow your staff to build and grow, as they will be valuable as you face challenges. And when you face challenges, someone else in your network has probably already faced it.” PB

Kayla Prasek Staff Prairie Business 701.780.1187kprasek@prairiebusinessmagazine.com

Our North Dakota team is located in Bismarck and our employee-owners understand how the decisions we make in the field will impact your community. We will continue to provide feasible, right-sized, technical solutions for all of your planning and engineering needs including:

Transportation/Traffic/Rail

Civil/Municipal

Water/Wastewater

Flood Control/Stormwater

Industrial Development

Residential/Commercial Development

Solid Waste/Transfer Stations

Environmental

Architecture/Buildings

Community Planning

Economic Development

FundStart™

Surveying Aviation Construction Services

Energy

Just moved to a new location: 4719 Shelburne Street, Suite 6 Bismarck, ND 58503

701.354.7121 • sehinc.com

Writer,

“It’s a clean industry with people who are good at their jobs so I don’t have to go in and clean up messes. We get satisfaction from helping out our clients and being a trusted adviser and business partner to them.”

BY LISA GIBSON

BY LISA GIBSON

Protosthetics in Fargo, N.D., created this myoelectric prosthetic arm with a 3-D printer. It responds to the body’s electrical signals for joint control and can be easily customized for specific patient needs. IMAGE: PROTOSTHETICS

Harlan Temple farms 240 acres of beans, corn and alfalfa south of Sioux Falls, S.D., with the help of a tractor that fits his specific needs. Temple has cerebral palsy and gets around using a wheelchair. For the past two months, he’s also been using a 3-D printed brace that supports his left arm, wrist and hand. He calls himself the guinea pig, being the first patient to have and use a 3-D printed orthotic device produced by 3DVHB LLC, a Sioux Falls company founded in 2002 by Lowell Hyland, a retired Sioux Falls allergy physician, and Duane Burman, a former 3M medical products manufacturing engineer.

Patients with cerebral palsy are perfect candidates for orthotics — braces or splints that support limbs and joints — according to Arlen Klamm, physical and occupational therapy

mobility specialist with LifeScape, a nonprofit health service for patients with disabilities, also based in Sioux Falls. 3DVHB teamed up with LifeScape in 2002, with the goal of helping Klamm ensure his patients receive customized, reasonably priced orthotics that can be easily tweaked and experimented with, Burman says. “We want the orthotics to be prescriptive,” he says. “We want them to fit into a rehabilitation or a restorative pathway that Arlen would define for a given patient.”

For some patients with cerebral palsy, for example, Klamm says one group of muscles in the arm and hand is much stronger than the opposing group of muscles, resulting in a positioning of the limb where all joints are flexed. “And that’s the position they maintain, sometimes all day long and all night long. The splint allows us to support the hand in the

opposite position so they can maintain their range, because keeping the limbs flexed for such a long period of time, eventually the joints lose the motion and they're stuck in that position.”

“It stretches my fingers,” Temple says of his 3-D printed splint. “It really fits perfectly. Previously, they would need to heat up plastic in a frying pan and mold it to my hand. ... My old brace broke, so that’s when they asked me to be the guinea pig. It is lighter and identical to my old brace. Saves so much time. It is more cost efficient.”

Temple is right. The process of 3-D printing an orthotic is much more efficient and simple than producing it the traditional way, Burman says. Klamm says the printing process greatly reduces the amount of craftsmanship and talent required to produce orthotics or prosthetics, allowing therapists without those skills to make them for their patients.

The acrylonitrile butadiene styrene (ABS) plastic material used by 3DVHB to make the devices also stands up to heat better than plastics used in traditional orthotic devices, which protects against melting and harsh wear and tear, Burman and Klamm say. Klamm says most orthotics have about a one-year lifespan, but this technology likely will prolong that, he hopes. Since Temple is the first test subject and he has had his device only a few months, the lifespan is a theory for now. “What I expect is that these will hold up better,” Klamm says. “So you’ll have longer use periods, so over the lifetime of the person, you have fewer orthotics. I also believe these are going to be easier to maintain because of the types of materials they’re printed from.”

Protosthetics in Fargo, N.D., also is working on 3-D prints, focusing more on prosthetics than orthotics. Founder and Chief Futurist Cooper Bierscheid, who graduated from North Dakota State University in December with his degree in manufacturing engineering, also emphasizes the ease of production in 3-D printed devices. In traditional production, molding techniques, injection mold tools and other parts of the process cost money and take time, he says. “If you have people with all different sizes of sockets, you need a new tool for each of those sockets and that gets very costly.” With its software, Protosthetics can digitize a person’s limb and replicate the socket in a printed device within 48 hours, he says. “It gives the chance for people who weren’t able to afford the devices before to own one.”

As part of a senior design project at NDSU, Bierscheid teamed up with fellow students to design the printed artificial limb (PAL), an above-the-elbow prosthetic arm, for a professor’s 4-year-old grandnephew who has no elbows or forearms. The prototype designed for the young boy is myoelectric, meaning it uses the body’s electrical signals to control movement of the joints in the prosthetic. Protosthetics was born from the project, and the company, now led by Bierscheid and partner Josh Teigen, is conducting beta testing on PAL, building its case study around the 4-year-old.

The 3-D printing industry is based on mass customization, with the ability to quickly and efficiently fit unique needs, Bierscheid says. Children will grow out of their prosthetics and orthotics, and 3-D printing — or by its technical name, additive manufacturing — is a great way to continue providing affordable upgrades without remaking motors and electronics. “That’s the great thing about additive manufacturing is we can scale as the child grows. … We simply have to reprint the shell of the arm.

“3-D printing has the chance to change a lot of industries but especially prosthetics and orthotics because of the mass customization,” Bierscheid says.

Protosthetics will sell PAL, once it’s ready for commercialization, for between $6,500 and $8,000, depending on size, colors and add ons, Bierscheid says. The company also unveiled its new product, the Amphibian, in June. The device is a secondary prosthetic leg, Bierscheid explains, adding there’s a large demand on the market for such a product. The leg can be used on the beach,

in water, mud or dirt, where a primary prosthetic normally would not be worn. The Amphibian will be sold for less than $1,000 and can be billed through insurance, significantly helping to achieve Bierscheid’s original goal of making 3-D printed products that will help people.

Michael Filloon, prosthetist and orthotist for Essentia Health in Fargo says 3-D printing holds great promise for orthotics and upper-body extremity prosthetics, mainly because of the ease in production. “I can do it. Therapists can do it. Anyone can do it. Is it a benefit? Yes. A big benefit.”

Filloon has no patients with 3-D printed orthotics currently, but said he would be open to it. “If the technology would allow for the specific stuff that I do in a general day, if it was specific to what I was using and it worked quicker, I would definitely use it in a heartbeat.” He says he’d venture a guess that 3-D printed orthotics will grow in usage.

But 3-D printing of prosthetic legs still hasn’t gained fieldwide acceptance among his colleagues, Filloon says, based on the main limitation of a strong enough material to hold up under high-stress situations. Bierscheid says 3-D printing has gotten a bad reputation for being poorly suited for load-bearing applications, but Protosthetics can print 30 different kinds of plastics, enabling the Amphibian to to be crafted of high-strength nylons, strong polymers and coatings, as well as pylons and rods to provide a stable skeleton.

As the 3-D printing technologies for both orthotics and prosthetics move forward, people who need those devices will see improved access to them. The next step for 3DVHB and LifeScape is to help adult patients successfully enter purposeful work environments where they can create or assemble parts, such as windows or pallets, relying on the support of their orthotics, Burman says.

Klamm adds, “I can envision what we’re doing resulting in improved outcomes for not just the people that I’m seeing, but therapists that are seeing other people wherever they reside, in that it’s going to allow therapists who haven’t been able to provide a high-quality, very customized splint to their patients because the process itself is going to be easier to do that.”

From the farm, Temple says 3-D printing “absolutely” is a promising technology for him and other people with physical limitations. “I think it’s really exciting. Technology fascinates me. One thing blossoms into another. My mind goes wild.” His next idea is a custom-fitted seat for his tractor. PB

Lisa Gibson Editor, Prairie Business 701.787.6753 lgibson@prairiebusinessmagazine.com

“3-D printing has the chance to change a lot of industries but especially prosthetics and orthotics because of the mass customization”

- Cooper Bierscheid Founder and Chief Futurist Protosthetics, Fargo, N.D.

With ever-changing technology comes the pressure for businesses to continually implement the newest trends. Regional banks are not immune to that pressure, but representatives from Gate City Bank, Bremer Bank, Alerus and Great Western Bank all say they listen to their customers while also taking a wait-and-see approach before committing to anything new.

All four financial institutions have branches throughout the Midwest and have implemented the two biggest trends in financial technology — EMV chip cards and mobile banking.

“Twenty years ago, what we had for channels were ATM, debit cards, checks, wiring money, local branches and credit cards. That was it,” says Maureen Jelinek, executive vice president and director of technology at Gate City Bank, headquartered in Fargo, N.D. “A wide array of things have happened and the technology

landscape has changed so fast in 20 years. There are new products almost daily.”

Jelinek says Gate City’s biggest growth has been in mobile banking. “You don’t need a computer anymore, so our big focus is really on mobile,” she says. “We’re working toward being able to open accounts on our mobile app. You can now register for mobile banking via your mobile device. You can make mobile deposits and receive mobile banking alerts. It’s very convenient for our customers.”

Bremer Bank, headquartered in St. Paul, Minn., also has a mobile app that includes the ability to deposit checks, transfer between accounts and pay bills. The bank also recently launched a new website, which it built from the ground up to be respon-

sive to all devices, from desktop computers to tablets and smartphones, says Tom Grahek, chief information officer for Bremer.

Alerus, headquartered in Grand Forks, N.D., debuted its consumer mobile app in 2013 and added mobile deposit in 2015. Also in 2015, Alerus rolled out mobile business banking, which gives business owners the ability to approve pending wires and financial transactions and look at their financial history, says Kristine Lunde, deposit product specialist lead at Alerus. The bank recently rolled out mobile deposit to its business customers, which allows those customers to make deposits into their business accounts while on the go. “You no longer always have to be in the office to check on your business accounts,” Lunde says.

Great Western Bank, headquartered in Sioux Falls, S.D., recently made a large investment in its online and mobile banking platforms, says Tim Schmidt, senior product manager at Great Western. “The new platforms are integrated and much more usable than what we previously had,” Schmidt says. “They have an updated look and feel.” Great Western rolled out the new

platforms to new customers in April and is currently rolling out the new platforms to existing customers, which the bank expects to have completed by Labor Day. The new platforms include bill pay and mobile deposits, and a series of enhancements will follow in the coming months to introduce Turbo Tax, account integration and retirement plan management.

Great Western Bank also introduced a new commercial banking program in January, which provides more functionality for online banking as well as a mobile channel and a channel to send transaction requests straight to the bank for a more direct process, Schmidt says.

Alerus, Gate City, Great Western and Bremer have all either implemented or are in the process of implementing EMV chip cards. Alerus rolled out chip cards in early 2016 and the process is complete at this point, says Karna Loyland, chief deposit officer at Alerus. “EMV chip cards provide significantly better security and have wider acceptance worldwide for our customers who travel.”

Part of rolling out new technology, such as the EMV chip cards, is educating customers while also continuing to support older technologies, Jelinek says. Gate City is almost done rolling out its chip cards but Jelinek stresses that “the bank needs to continue supporting all the available channels,” which, for example, means continuing to support the magnetic swipe strip while also educating customers on how to use the chip. “As technology changes, our customers rely on us to teach them how to keep up, but at the same time, we’re at the mercy of the merchants to switch to the new technology on their end,” Jelinek says. “We have to explain all the options merchants might have and that they may not always be able to use the chip everywhere they go.”

Bremer Bank has also finished implementing EMV chip cards, while Great Western Bank is planning to have all cards moved over by the end of the year, Schmidt says.

Several of the banks have implemented other technologies as well. At Alerus, business banking customers can

download Trusteer Rapport, a free service the bank recommends to protect against cybercriminals and fraud, Lunde says. The bank also runs behavior analytics on business accounts and alerts those customers as soon as a red flag goes up. Alerus has also “made a concerted effort” to make all documents available electronically and has implemented electronic signatures, Loyland says. “This changes up the business relationship we have with our customers.”

Bremer Bank made Apple Pay available to its customers earlier this year after customers requested it, Grahek says. The bank is also working on implementing Android Pay and Samsung Pay. “As more and more merchants become Apple Pay-enabled, it’ll drive customers to use that option,” Grahek says.

Bremer’s decision to add Apple Pay after customer requests is a common theme among these four banks. As Grahek says, “we want to be a relationship-based bank, so we listen to our customers and monitor the available technology. We always assess where the technology is because we don’t want deployment issues. Sometimes when a product is brand new, there are a lot of issues, so we may wait until the technology is more mainstream.”

At Alerus, “a lot of customers’ expectations for technology are driving changes,” Loyland says. “Our customers have

expectations, and those expectations have pushed the financial industry to keep up with all the technology.” At the same time, the bank is aware that it is possible to have too much change too quickly. “We have to look at ‘how much change are we asking for from our customers?’” Loyland says. “Some of it is intuitive, but some of it takes more time to learn so that can take a longer rollout.”

Schmidt says Great Western prides itself in customer service and sees its online channel as important to customer engagement, which is part of the reason the bank has taken its time migrating customers to its new online and mobile platforms. “It takes a lot of pre-planning and internal and external communication. Our customers need to be aware of what’s coming and how to access and use it.”

Jelinek says Gate City Bank is always watching the latest in financial technology but also knows “we can’t implement everything, so we figure out what’s best for our customers. Security is our highest priority, so as we’re offering more channels, we need to make sure each one is secure. We also have to educate our customers about the importance of security. We work at trying to keep our customers educated about phishing and ransomware. If they fall victim, it could put their information at risk and could compromise their accounts.”

Fighting fraud is a constant for banks, and updating technologies can play a role in that, Grahek says. “Security is very important. We’re consistently investing in the most secure platforms.”

Lunde says it’s “essential we keep pace with technology, but we also have to build the security behind a platform and make sure it keeps everything safe.” Alerus partners with vendors to build its products so the bank must also do its due diligence on those vendors to ensure its customers’ security, she adds.

Thanks to evolving financial technology, Jelinek says there is essentially no reason customers would ever need to close their accounts if they move to a community where there isn’t a branch of their bank. “We can process loans online. We’re working on implementing electronic signatures. You don’t need to come into a branch to do your banking anymore.” PB

Kayla Prasek Staff Writer, Prairie Business 701.780.1187 kprasek@prairiebusinessmagazine.com

“Prairie Business magazine is a great source for a comprehensive regional approach to business news. e magazine o ers a diversity of information. In economic development, it’s important to have a solid overall understanding of the industry sectors regionally. Reading Prairie Business is an excellent source of information in that regard.”

- Jim GartinThis fall, Avera Health will open the first free-standing emergency department in the state of South Dakota. The Avera Emergency & Family Health Center, located west of Interstate 29 in Sioux Falls, also will include a variety of other services, while providing more convenience for residents in that area of the community.

The 72,000-square-foot, $25 million facility broke ground in September 2015 and is expected to open in October. It was designed by Sioux Falls-based architecture firm Perspective, while Sioux Falls Construction is serving as construction manager.

“We chose to build this facility west of I-29 because it’s a very underserved area (in terms of emergency health facilities),” says Mark Vortherms, vice president of primary care for Avera McKennan Hospital and University Health Center in Sioux Falls. “That part of the city doesn’t have a good cross street to get to either hospital, so that was our reasoning for putting an emergency department over there.”

Vortherms says the health care system saw a population it could serve in that location, while the physicians at Avera Medical Group McGreevy, which has a clinic near where the Emergency & Family Health Center is being built, saw an opportunity to grow the market

ABOVE: Construction is expected to be finished on the Avera Emergency & Family Health Center near Sioux Falls, S. D., in October.

ABOVE RIGHT: The center will feature South Dakota's first free-standing emergency department, as shown in this rendering.

IMAGES: AVERA HEALTH

share. “Our goal is to meet all the needs of the community while adding to our growing needs as a health care system,” Vortherms says.

The emergency department, which will be staffed by emergency-trained physicians, will feature a racetrack-style design and have eight rooms. With the design, patients enter from the exterior and an interior corridor provides physicians and nurses access to the rooms, while also keeping everything behind the scenes, which Vortherms says provides a “calming effect” for patients. Richard Molseed, executive vice president of strategy and governance for Avera Health, says the design, which is also featured at Avera McKennan, provides shorter wait times along with higher staff satisfaction and higher security.

Molseed says the emergency department’s layout is strategic. “The emergency department is an interesting place. You get everything from a little cut to someone dying. It’s high stress and very expensive to operate so you need to be as efficient as you can to avoid burnout and continue attracting staff.”

Other services on the first floor of the facility include X-ray, CT scans and laboratory, which will be shared between the clinic and emergency department; an occupational medicine program, which will provide workplace screenings and care for workplace injuries; urgent

care; and optometry services. The second floor will house Avera Medical Group McGreevy family practice physicians and Avera Medical Group Pediatrics. The third floor will house OB-GYN services, including mammography and maternal-fetal ultrasounds. The clinic will feature a design similar to the emergency department to encourage the calming environment.

“The facility provides much closer emergency services, expands our acute care services and brings more services to that part of the city,” Vortherms says. “For the business community, it expands those services and gives the employer one location for all-hours workplace care.”

The decision to include a clinic alongside the emergency department comes from a shift system-wide, Molseed says. Avera has built several Family Health Centers, which combine family practice, obstetrics, pediatrics and internal medicine in one facility. “A single building provides primary care and specialties. Our hope is these become go-to centers, where you’ll get the appropriate level of care. We see these as community centers of health in our largest markets. This project takes it a step further with the emergency department.” PB

Kayla Prasek Staff Writer, Prairie Business 701.780.1187

kprasek@prairiebusinessmagazine.com

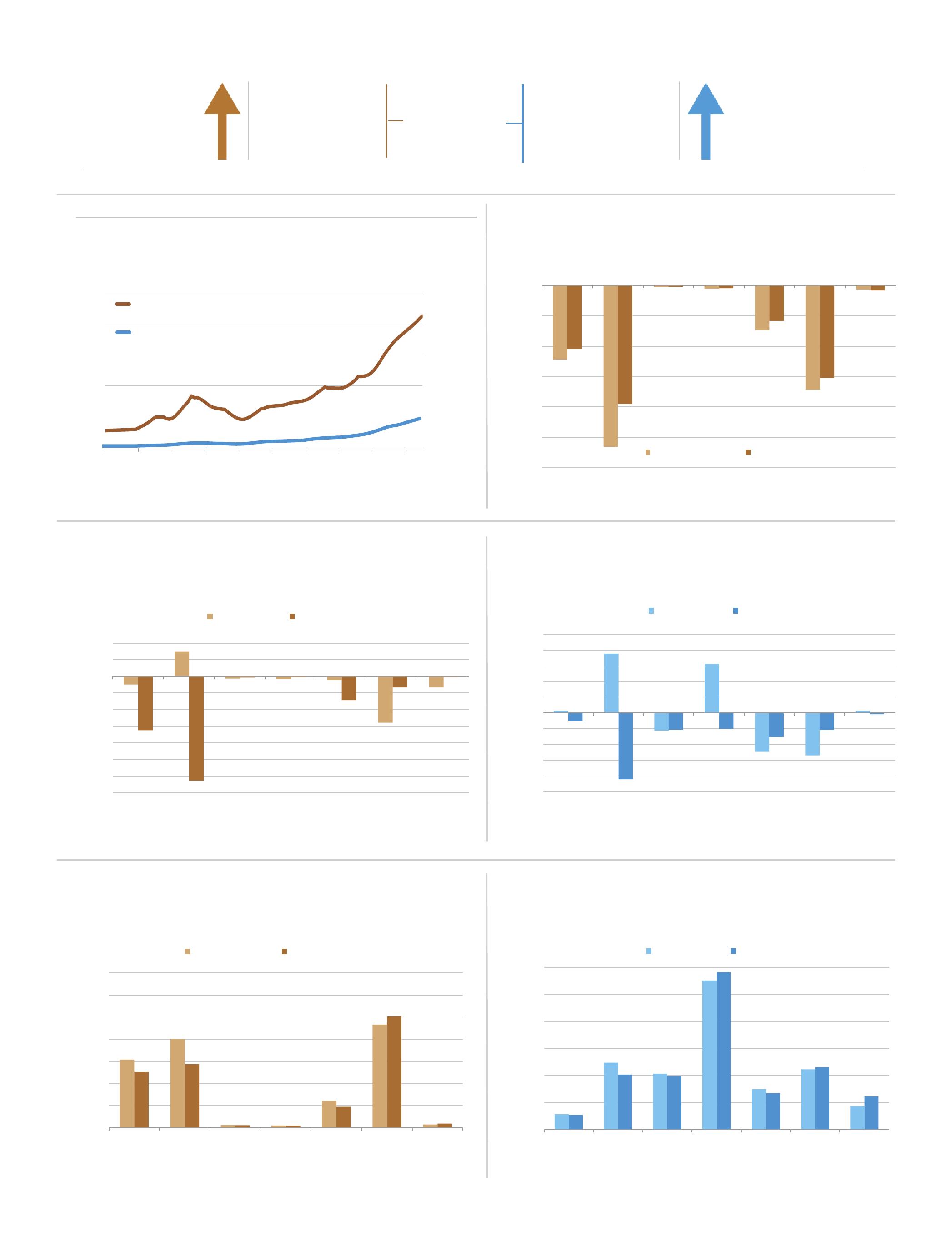

Data provided by David Flynn, chair of the University of North Dakota Department of Economics. Reach him at david.flynn@business.und.edu.

New-well gas production per rig

New-well gas production per rig

July-2015

Indicated monthly change in oil production (Jul vs. Jun)

thousand barrels/day

July-2015 July-2016

BakkenEagle FordHaynesvilleMarcellusNiobraraPermianUtica

June

drilling data through May projected production through July

data through May projected

through July

Indicated monthly change in gas production (Jul vs. Jun)

July-2015

July-2015

July-2015

Indicated monthly change in gas production (Jul vs. Jun)

million cubic feet/day

July-2015 July-2016

FordHaynesvilleMarcellusNiobraraPermian Utica

U. S. Energy Information Administration | Drilling Productivity Report