Ev er yd ay ,t he thou sand so f ed uc ator sa ndad mini str ator sa tt he We st Fa rg oP ubl ic Sc hools wa ke up re ady to pr epa re learn ers wi th th ek no wle dg ea nd skill stob e co mp as sion at e, co nt ri bu ti ng ci ti ze ns in ar ap id ly- ch an gi ng wo rld .T he co rne rs to ne of th at ci ti ze nr yi s te am wo rk —w hi ch is on di spla ya t th eWes tF ar go Sp orts Ar en a, th e shar ed ho me of th eW es tF ar go Pa ck er ,S he ye nn eM us ta ng ,a nd We st Fa rg oU ni te dh oc ke yt ea ms , as we ll asth eWes tF ar go Ho ck ey As so ci at ion. Th et wo -s he et ar en a ha ss pac ef or both to urname nt co mp et it io na ndpr ac tic ep la y, an dc an “t ra nsfo rm ”i nt ot he ho me ic ef or th ev ar io us te am sw it h little ph ys ic al re qu ir ements .W it h av ari et yofv iewi ng ar ea sa nd se ve nt ee nl oc ke rr oo ms ,t he We st Fa rg oA re naha ss ee nt ho us an ds of pu ck dr op sa nd li gh te dl am ps si nc e ope ni ng in 2 017 an di st he mod el fo r ma ny of th ea re ac ommuni ty ri nks.

ITALLSTARTS WITHYOU. Youworkedhardtoestablish your business,andtransitioningitcanbea dauntingtask. Whether you’re looking tosell,planforsuccessionorotherwise exit yourbusiness,EideBaillycan helpstreamline yourtransitionprocess andempower youwithknowledge and resources,so youcan resteasy knowing yourfinancesareinorder.

What inspires you, inspiresus. 701.239.850 0 | eidebaill y.com/ex itplanning

Theroadsyoudrive,thebridgesyoucross,thewater youdrink,oreventhewirelessconnectionyouuseto stayincontactwithfamilyandfriendsallhaveone thingincommon;theyareelementsofinfrastructure thatwealluseeachandevery day.

Thesethingsaren’tsomethingyouthinkabout–andthat’showitshouldbe. WithEngineers Week rightaroundthecorner(Februar y21-27)thereisno bettertimetoreimagineourtomorrow.Engineers WeekwasfoundedbytheNationalSocietyof ProfessionalEngineers(NSPE)andaimstoenhance awarenessaroundthecivilengineeringindustr y.

AtKLJtheyengineerallkindsofinfrastructureacross avarietyofstates.“Ourengineersandthe professionalswhoworkalongsidethem –the planners,surveyors,CADtechsandmanymoreare reallydoingremarkablethingsinthecommunitiesin whichweliveandwork,”saidCEO,Barr ySchuchard. WhenKLJproposeon,ordesignprojects,theyare alwaysthinkingaboutinnovativeandsafeconcepts andalltheirin-housecapabilities. “Wearecommitted toprovidingthebestpossibleinfrastructure solutions,”saidSchuchard.

Evenwith alargelyremoteworkforce,KLJcontinues toreimaginenotonlytheinfrastructuretheydesign, buttheworkspaceswherethedesigntakesplace. Recentlyannouncing anewofficeinGrandJunction, CO,aswellastherecentjoiningofthefirm’s Fargo

and West Fargo,NDteamsunderoneroofin anew officespace,thecompanyseekstoprovide professionalandinnovativeworkspacewhere creativityandcollaborationcanhappennaturally.

TheGrandJunctionofficewillbelocatedon waterfrontproperty,providing agreatbackdropfor creativeideastoform. “Whileweknowwecanwork fromanywhere,wehavealsoheardfromour employee-ownersandrecruitsthatofficespacestill matters. Withthatsaid,theGrandJunctionlocation willbemove-inreadyduringthespringof2021.It hasbeenver yexcitingtoseethatofficecome together,andwehavestaff hired,readytotransition fromremoteworktoin-officewhenthetimingis right,”saidSchuchard.

The West Fargoofficedesigndoesn’tlackoncreativity either.Theindustrialinspiredofficeincludesnearly 24,000squarefeet,roomforapproximately100 professionals, 3conferencerooms,and alarge trainingroomequippedwith agaragedoorfeature thatopenstothebreakroom.

“W eare re imagining our tomorrow,everyday,whether it be the infrastructurewe design or providing input on our futureoffices,” said Schuchard.

Renderingof KLJ’snew GrandJunction officelocation

MINOT, N.D. • AUSTIN BECKER, PE, HAS RE-JOINED THE ACKERMAN-ESTVOLD MINOT OFFICE AS A FULL-TIME CIVIL ENGINEER.

BECKER EARNED A BACHELOR OF SCIENCE DEGREE FROM NORTH DAKOTA STATE UNIVERSITY IN FARGO, N.D.

WH AT YO U’LL LEAR N

Discoverw hat’scomingdow nthepike under theBidenadminis trationand howthese changes couldaffec tyourbusiness. Plus , review st ateand localt ax (S ALT) topics as they pert ain to signi ficantchangestos tate nexuspolicies, thepandemicimpac tons tate budgets ,and more.

The architecture and engineering services sector countrywide employs more than 1.5 million Americans and supports an additional 3 million indirect jobs, according to a new study by the ACEC Research Institute.

The American Council of Engineering Companies, based in Washington, D.C., recently conducted what it calls a “first-of-its-kind industry profile,” which, among other things, found that the A&E sector drives some $386 billion in annual revenue.

Other key findings of the study include: The architecture and engineering sector pays an average annual salary of $88,000; and industry activity generates nearly $45 billion worth of tax revenue for various local, state and federal government agencies – more per company and employee than most other U.S. sectors.

For those who work in the architecture and engineering industry, it is an exciting time to design and build.

“We have always innately understood that our industry was a critical player on the economic main stage, but now we know – and have numbers to show – what a crucial role we play in the national economy,” ACEC president and CEO Linda Bauer Darr said in a statement announcing the institute’s study.

In the upper Midwest region, the industry plays a significant role and is one that Prairie Business takes a look at frequently throughout the year, highlighting trends in the field.

The February issue of the magazine is one of those times.

Prairie Business highlights trends that some regional architects are noticing as they relate to health care and retail. Some of these trends were pushed by the coronavirus pandemic, but others were the natural result of trying to appeal to a broader customer base.

Another article highlights how one North Dakota-based commercial A&E firm has branched into the residential market, and the successes it is having on that front.

Other topics in this issue are banking and finance and taxes. Articles look at the importance of businesses to properly manage their cash flow, and how taxes have impacted many companies during the pandemic. What does the new year bring for these businesses? What trends are they noticing?

There also are a couple of guest columns to help business professionals capitalize their finances, and how A&E firms can better use today’s cloud-based technology in their work.

Next month the magazine will profile this year’s Top 25 Women in Business, which is always something to look forward to. For now, we hope you enjoy the February issue of Prairie Business.

Until next time, Andrew Weeks

I look forward to hearing from you at aweeks@prairiebusinessmagazine.com or 701-780-1276.

CIRCULATION MANAGER

LAYOUT DESIGN JAMIE HOYEM

ACCOUNT MANAGER

NICHOLE ERTMAN 800.477.6572 ext. 1162 nertman@prairiebusinessmagazine.com

Prairie Business magazine is published monthly by the Grand Forks Herald and Forum Communications Company with offices at 375 2nd Avenue North, Grand Forks, ND 58203. Subscriptions are available free of charge. Back issue quantities are limited and subject to availability ($2/copy prepaid). The opinions of writers featured in Prairie Business are their own. Unsolicited manuscripts, photographs, artwork are encouraged but will not be returned without a self-addressed, stamped envelope.

SUBSCRIPTIONS

Subscriptions are free www.prairiebusinessmagazine.com

ADDRESS CORRECTIONS

Prairie Business magazine Box 6008 Grand Forks, ND 58206-6008 Beth Bohlman: bbohlman@prairiebusinessmagazine.com

ONLINE www.prairiebusinessmagazine.com

“It sure was a nice birt hdaypresent ,”remember s Bett y Lou My hrum, 82 , of Thief Ri ver Falls, Minnesot a, as she rec alls her TAVR procedure at Es sent ia Heal th in August 2020.

“It sure was a nice birt hdaypresent ,”remember s Bett y Lou My hrum, 82 , of Thief Ri ver Falls, Minnesot a, as she rec alls her TAVR procedure at Es sent ia Heal th in August 2020.

Transc at heter aor tic valvereplacement (TAV R) isa minimall y invasi ve procedure to replacea nar rowed aort ic valve that failsto openproper ly. In the procedure,a doctor inser ts a catheter into your leg orches t and guides it through your blood vessels, using advanced imaging techniques ,to your hear t and into your aort ic valve.

Transc at heter aor tic valvereplacement (TAV R) isa minimall y invasi ve procedure to replacea nar rowed aort ic valve that failsto openproper ly. In the procedure,a doctor inser ts a catheter into your leg orches t and guides it through your blood vessels, using advanced imaging techniques ,to your hear t and into your aort ic valve.

Once your aort ic valveis open , blood flow is restored, and sy mptoms improve, leadingtoa bet ter qualit y ofli fe.

Once your aort ic valveis open , blood flow is restored, and sy mptoms improve, leadingtoa bet ter qualit y ofli fe.

For Bett y Lou, sy mptoms st ar ted severalyear s ago when she noticed she would ex perience weak ness t hat would come and go – as wellas some shor tnes s of breath. She thought it might have to do wi th her Ty pe 2 diabetes . Bu t, during one shor tnes s of breath episode, Bett y Lou knew something more was going on and called anambulance.

For Bett y Lou, sy mptoms st ar ted severalyear s ago when she noticed she would ex perience weak ness t hat would come and go – as wellas some shor tnes s of breath She thought it might have to do wi th her Ty pe 2 diabetes . Bu t, during one shor tnes s of breath episode, Bett y Lou knew something more was going on and called anambulance.

Bet ty Lou was broughtto Es sent ia Heal th -Far go to receive the li fesaving care she needed She saw Dr Alok Saurav,a cardiologis t at the Es sent ia Heal th Hear t and Vascular Center. Af terreview ing her histor y and sy mptoms , Dr Saurav ex plained the bene fi ts of TAVR “A fter talk ing to the doctorfor the firs t time,I had no reservat ions wi th him doing the surger y. He asked me questions and made me feel so comfor table In fact , he ex plained ever ything so well,I didn ’t even have a question to ask,” shares Bett y Lou.

Bet ty Lou was broughtto Es sent ia Heal th -Far go to receive the li fesaving care she needed. She saw Dr. Alok Saurav,a cardiologis t at the Es sent ia Heal th Hear t and Vascular Center. Af terreview ing her histor y and sy mptoms , Dr. Saurav ex plained the bene fi ts of TAVR . “A fter talk ing to the doctorfor the firs t time,I had no reservat ions wi th him doing the surger y. He asked me questions and made me feel so comfor table. In fact , he ex plained ever ything so well,I didn ’t even have a question to ask,” shares Bett y Lou.

Before her TAVR procedure, Bett y Lou shares that she didn ’t have the energ yto really do any thing and she spent most of her time st ar ing at the four walls of her apar tment

Before her TAVR procedure, Bett y Lou shares that she didn ’t have the energ yto really do any thing and she spent most of her time st ar ing at the four walls of her apar tment .

Af ter surger y, she’s able to easil y make the walk to the ot her end of the building to do laundr y, goesgrocer y shopping andis back to gett ing ou t of her apart ment and into the communi ty, which she loves.

Af ter surger y, she’s able to easil y make the walk to the ot her end of the building to do laundr y, goesgrocer y shopping andis back to gett ing ou t of her apart ment and into the communi ty, which she loves.

When theday camefor Bet ty Lou ’s procedure, Dr Sauravlear ned that it was her 82ndbirt hday. “I am honoredto have been able to gi ve her the gi ft of a fi xed hear t,” shares Dr. Saurav.

When theday camefor Bet ty Lou ’s procedure, Dr. Sauravlear ned that it was her 82ndbirt hday. “I am honoredto have been able to gi ve her the gi ft of a fi xed hear t,” shares Dr Saurav

Bet ty Lou said the replaced valve has gi ven her a second chance at li feand she can feelher st reng th and st amina improv ing each day. “I ’ll be back to my old self eventually I am 82 af ter all. It ’s goingto take time,” she says .

Bet ty Lou said the replaced valve has gi ven her a second chance at li feand she can feelher st reng th and st amina improv ing each day. “I ’ll be back to my old self eventually. I am 82 af ter all. It ’s goingto take time,” she says

Bet ty Lou had two very specialreasonsto get her hear t fi xed– one of her granddaughters was planning a wedding and anot her was goingto make her a great grandma for the firs t time. Bett y Lou was able to walk down the aisle wi thou t gett ing shor t of breath to watch her granddaughter get married and is delightedto be a grandmaof three anda great grandma of a baby boy.

Bet ty Lou had two very specialreasonsto get her hear t fi xed– one of her granddaughters was planning a wedding and anot her was goingto make her a great grandma for the firs t time. Bett y Lou was able to walk down the aisle wi thou t gett ing shor t of breath to watch her granddaughter get married and is delightedto be a grandmaof three anda great grandma of a baby boy.

“EveryoneI encountered during my time at Es sent ia was just fant as tic,” shares Bett y Lou. “I would come back for anything bec ause it was sucha wonderf ul ex perience!”

“EveryoneI encountered during my time at Es sent ia was just fant as tic,” shares Bett y Lou. “I would come back for anything bec ause it was sucha wonderf ul ex perience!”

HE AR TA ND V AS CU LA RC AR EL IK EN OW HE RE E LSEIf businesses learned anything from 2020, it was to prepare for the unexpected.

According to a few of the region’s financial experts, the best way for any business to prepare financially for unforeseen circumstances – and maximize profit during the best of times – is to use best practices managing its cash flow.

Properly managing cash flow should be practiced all year long, but some businesses over the past several months have had fits and starts because of the challenges caused by the coronavirus pandemic.

The experts say that now, at the beginning of another calendar year, is a good time to revisit those best practices.

Something first must be understood: Managing cash flow is a broad topic, and since every business is different there is no cookie-cutter answer to how a company should go about doing this.

“That’s a big topic,” said Matt Jacobson, lead business advisor at Alerus in Grand Forks, N.D. “No one is going to understand a business’s financials better than the owners or key leaders themselves.”

But, he explained, there are basic strategies that may apply to every business – the best practices of planning, projecting, budgeting and managing.

“It’s tough to meet goals if you’re not setting them,” Jacobson said. The cash flow statement of any business starts with a company’s net income and includes depreciation and amortization, or non-cash

flow expenses, according to an article by U.S. News & World Report. The company then works through adjustments made throughout the year to come to its actual cash flow.

Because of the economic uncertainty over the past year, many businesses have had to reevaluate their expenses. Owners and managers have had to rethink their approach to cash flow – their resources and revenue streams – and how to manage it during difficult times. In many instances, businesses have had to re-learn and re-plan. Some may have decided not to start or complete projects in order to save money, while others may have expanded because the demand for their product and/or service accelerated.

“2020 has forced a lot of businesses to evaluate expenses. We could be talking about employees working from home or scaling back the company’s holiday party, for obvious reasons, but they all come at an expense. I’d say that will likely continue,” Jacobson said. “I think this all ties back to putting together budgets and things of that nature, and then managing them.”

The experts at Gate City Bank echoed the same sentiments.

“2020 has taught us to be flexible and adaptable,” said Chris Lee, Gate City’s chief financial officer in Fargo, N.D. He said a good question to ask is, “What other options do you have for your business? Are there things your business can provide that didn’t exist before? Are there areas of your business, where there is currently no demand, that need to be rethought or restructured? What is this different world going to look like? What kind of changes are people going to continue to stick with and how does your business adapt to those changes? These are all important questions to answer in directing you forward.”

Planning and maintaining a budget also is important to managing cash flow.

“We recommend a strong budgeting practice,” Lee said. “Budget for the next year and develop contingency plans so, if things don’t go the way you anticipate, you know what you are going to do, how you are going to adjust and how you are going to maintain success. Having a strong plan going into the new year, thinking about what your options are, or where there might be demand for your products or services, will allow you to be flexible and adaptable so you can be successful.”

Companies that juggle the supply and demand of inventories should especially focus on a year-long plan. That might be tough in some cases, but it “should be something that is looked at as businesses plan for 2021,” Jacobson said.

Some questions a company might want to ask include: What’s the lead time on my inventory? And, how does that tie to the sales cycle and my cash-flow cycle?

“Knowing the numbers, knowing where revenue is derived and where the expenses are incurred, I think, is important,” Jacobson said. “If you’re going to be able to trim something or look to scale things back to improve cash flow, where do you go? I think it’s critically important, especially as we look to start another year, that people prepare projections.

“Coupled with that is being able to review and understand the expenses that you’re going to incur. It costs money to generate revenue. Marrying those projections with the appropriate inventory level is important. … Many businesses are seeing spikes, they’re seeing drops. Some products are not selling as quickly as others, and understanding where you can maximize not only revenue, but profitability is important.”

Kevin Warner, business lending manager with Gate City Bank, said it is imperative for companies to stay on top of their billing cycles.

“A best practice is to collect receivables as soon as possible,” he said. “Get your billings out in a timely way so you can get those payments in quickly.

When times are good a business might not collect on their receivables as soon as possible, but during more challenging times they look at those things a little more closely and more frequently.

“If you know there is going to be a slow payment coming in, work with the client. Especially for small businesses with a few customers, it’s important to get those payments in,” Warner said. “Consistently managing cash flow and seeing what’s going in and out is important because that allows you to monitor trending and address problems sooner rather than later.

“Continued cash flow management is important, whether it’s weekly or monthly.”

For those businesses that might need a little help, there is plenty of it available. Lee said it is a good idea to reach out to a financial expert early in the planning process and then revisit topics with the advisor from time to time throughout the year.

“It’s a good idea to reach out to your banker early on to see what your options are if there is something you think you’ll want or need,” he said. “Reach out to them at the beginning [of planning] and discuss your ideas with them. Bankers want to help their clients, so leverage that relationship. We encourage our customers to visit with their banker ahead of time so they can be a helper and a trusted advisor.

“We’ve seen a lot of customers rely on their relationships with their banker to help them navigate changes and government stimulus programs. Since we know their business, and work closely with them, it’s a good partnership that allows us to give advice specific for their businesses.”

By Andrew Weeks

By Andrew Weeks

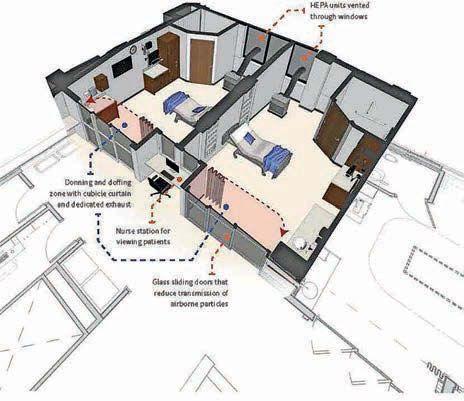

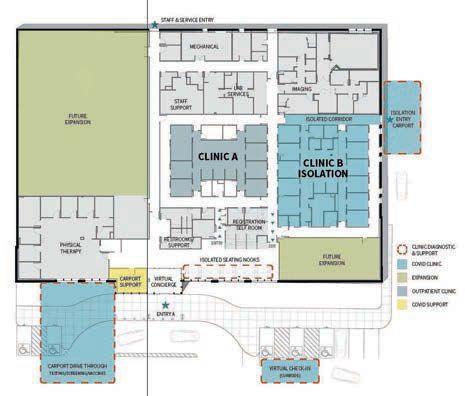

Hospitals and health care clinics learned some valuable lessons in 2020, a year that stretched hospital capacity and brought to the forefront additional needs that are now trending in the industry.

Some of those trends relate to architecture and engineering as designers work to accommodate the needs of the foreseeable future.

It’s no secret that one of the big trends this past year in health care was the increase in telehealth, where more patient-doctor visits were conducted virtually. It’s a trend that will continue and, as such, has created some additional trends on the architecture side: Some firms are helping hospitals and clinics develop designated space with accommodating technology, where providers may meet virtually with their patients. Designs also now include space where patients may self-check in and self-room while they wait for a doctor.

“It has thrown a new twist on things with the telehealth experience,” said Stanley Schimke, director of health practice at EAPC Architects Engineers in Grand Forks, N.D. “There really are no waiting rooms … so it’s to address, in the future, how patients are spending their time, navigating through their patient portal, downloading on their apps. The telehealth care system is looking at how to streamline that and make it a better patient experience. It means looking at creating rooms that are just for telehealth on the clinical or acute care side for staff.”

He said he didn’t do much of those designs until this past year when the pandemic was declared, but almost immediately the collaboration with hospitals and clinics began.

“We did some of that work over the years, maybe as low as 2%,” Schimke said, “but it has now gone as high as 80%.”

Schimke works with clinics and hospitals in the region – Altru, Essentia, Sanford and Trinity among them – but also with health care providers in other states, such as Arizona and Wyoming. These are trends he is seeing not just regionally, but across all of the states in which he works.

Space also is being reviewed in another area of some hospitals: The patient room. With many hospitals stretched to capacity during the COVID-19 crisis, many are rethinking how to maximize their room capacity. Instead of having one-patient private rooms, Schimke said, many hospitals are looking at creating two-bed hospital rooms.

Architects also are developing new entryways for infectious patients, where they can access a designated entry/exit of the building instead of using the main entryway.

David Sogge, project manager at ICON Architects in West Fargo, N.D., has spent much of his career working with the retail and hospitality industry, and over the years has seen a number of different trends

come and go. The biggest trend he is noticing today, and one that will continue post-pandemic, is the blending of entertainment, food and beverage components into retail.

Big box stores want customers to stay in the store longer and be entertained while they are there. Now, many smaller stores are experimenting with these options.

“I think that is a strategy that is working,” Sogge said. “It is becoming pretty prevalent, actually. … You don’t just go there to shop. You grab a coffee, you grab a sandwich.”

One word for it is retail-tainment – “a trend that has started and will continue to go that way,” he said.

Some stores have even blended artwork and other eye-catching displays that keep customers in the store longer.

“It can be a wide variety of different experiences,” he said. “Stores like lululemon, for instance, that have incorporated yoga studios into them; they are experimenting to that level.”

continued on page 30

There’ssomethingtruly wonderfulabout agivingheart.Itinsistsonputtingothers first,itinspires kindnessandgenerosity– itbringsoutsomethingbetterineachofus. Givingheartsareatthe core of whoGateCityBankis, andthisshows everyday.

To date,GateCityBankhas donated$1millionand countless volunteerhourstononprofits thatplaycritical rolesinour communities.TheBankbrings additionalfun to GivingHearts Daybyfacilitatingnomination contests,offeringmatchinggifts andmakingsurpriseboosts. (Boostsarebonusdonations given to charitiesthatare randomlydrawn

randomly drawn from the list of nominations.)

In2020alone,theBankdonated over$250,000 to hund charities.And overthelastthree years, theBankhas re than230,000GivingHeartsDaycharitynominationsan delivered13surprisecharityboosts totaling$138,000.

“Seeingsomuchpassionandsuppor tforour regionalcharitiesisnothingshor tofinspiring. GivingHeartsDayisatrue testament to the goodnessthatlivesinour communities,which iswhyGateCityBankandour teammembers aim to givebackmoreeach year.”

KevinHanson,GateCityBank President &CEO

Butthesearejustnumbers. Andatthe endoftheday, whattrulymatters isservant leadershipthatcreates abetterway oflife forthosearoundus.

dreds of Giving Hear ts Day ceived more nd

“Empowermentistrulythe keytocreating abetterway oflife. We areallcapableofimprovingour communitiesin avarietyofways. At Gate CityBank,empowering teammemberstogiveback to thosearoundthemis acorepar tofourculture.”

Kim Settel,GateCityBankExecutiveVicePresidentof RetailBanking &Lending250,000+ hours

GateCityBankteammembers havevolunteeredat regional charitiessince2003

Morethan

214 charitieshave received GateCityBankdonations onGivingHeartsDay

A $2.8 bill

230,000 GivingHeartsDaycharity donationnominations from communitymembers

$1Million donated to nonprofitson GivingHeartsDay

ionmutualbank foundedin1923,GateCityBankisthe region’s financialinstitution,as wellas the#1mor tgagelenderin Dakota.TheBankemploys morethan735 teammembersat ocationsin22 communitiesacrossNorthDakotaand central nnesota.GateCityBankbelievesincreating abetterway oflife forcustomers, communitiesand teammembers. Additionally,the Bankhasbeennamedoneofthe“50Best Places to Work”seven yearsina rowbyPrairieBusinessmagazine.

GateCityBank teammemberspictured: Kristi Persons,RyanCoye, MeganMeis,NormClark,Dalila Maslesa,BeckyMindeman

We’rehere to take yourbusiness to newheights. Abetter wayoflifeisonthehorizon. Set your financialtrajectoryat GateCity.Bank/Business.

We’rehere to take yourbusiness to newheights. Abetter wayoflifeisonthehorizon. Set your financialtrajectoryat GateCity.Bank/Business.

701-293-2400•800-423-3344

701-293-2400•800-423-3344

MemberFDIC

MemberFDIC

MINOT, N.D. • A popular commercial architecture and design firm branched into the residential market this past year and is finding success in that segment of the industry.

Ackerman-Estvold kept getting inquiries about residential work but because the company didn’t specialize in that area it had to turn projects away, referring them to other companies.

“We got tired of turning projects away,” said Paul Breiner, senior architect at the firm. He and colleagues Jessica Egge and Kimberly Keller, both project designers, were the brainchildren behind the effort.

So far it has been paying off.

The company has completed a number of residential properties in North Dakota, mostly within a two-hour drive of Minot, but Breiner said the company hopes to branch out farther with residential work as demand grows. If things keep trending the way it did in 2020, that might not be too long of a wait.

Breiner has an idea why the residential market has taken off the way it has during the pandemic, when for many people household budgets were tighter. He believes part of the reason is because more people are now working remotely, and they want their homespace setup for that kind of work. They want the amenities, extra rooms or designated private space, to make the environment more conducive to remote work.

Egge, one of the project designers, said some of the things trending now is that people are asking for more smart technology in their homes, as well as space to meet their obligations, whether that be a home office for remote work or a learning room designated for children who are being home-schooled.

Those trends likely will continue in the new year and into the foreseeable future.

Egge also said people are seeking more contemporary colors and basic designs, not homes that are flashy or pretentious. They want functionality and eye appeal without being pretentious. Black and white are popular colors for homes, she said.

GRAND FORKS, N.D. • TrueNorth Equipment, headquartered in Grand Forks but with a number of offices across North Dakota and Minnesota, had an exceptional year despite challenges caused by the coronavirus pandemic.

It’s a snapshot into the larger agriculture industry, which remains in demand and keeps TrueNorth busy, according to CEO John Oncken, who co-owns the company with Dan Gorder.

“We’ve been fortunate that we haven’t been hit as hard as other businesses with some of the challenges,” he said.

The past year has taught the co-owners to be creative in their business approach, and Oncken said they have “learned a lot of new ways to adapt.”

One notable effort this past year is that TrueNorth, a John Deere dealer that sells and repairs farm equipment, purchased property for a new 66,000 squarefoot impact center.

The new facility, located in the Grand Forks industrial park, will be used to assemble, receive and refurbish farm equipment. The center will open in January and will help take the load off the company’s nine other locations in Minnesota and North Dakota, allowing those offices to focus on providing a more customer-focused approach.

“Basically what we’ve made a decision to do is take some of the stress away from our retail locations, allowing us to store corporate parts and overstock of inventory,” Oncken told Prairie Business in late December. “This is really a first in the industry in our arena of work, to have a facility like this.”

Among its features, the center, formerly owned by Wells Concrete, sits on 18 acres with large bridge cranes to load equipment quickly and safely.

TrueNorth has 211 employees among eight retail locations, a resource center, and now the impact center. Oncken said at some point he would like to have 25 employees at the impact center.

Not bad for a company that traces its roots to 1897 when it sold plows in Grafton, N.D. The company today sells John Deere equipment and machinery across

still in high demand despite challenges of pandemic

the Red River Valley but also offers parts, services, training and producer education.

Joe Breidenbach, director of sales, said there is one thing that surprised his sales team this past year: The industry had projected a slowdown during the pandemic, but just the opposite happened – John Deere products saw record demand. It was a case of demand outpacing supply.

“That was a major shift we didn’t expect,” he said.

Breidenbach said many producers are interested in not only new equipment, but one- to five-year-old equipment. All of it is like-new. They also are interested in having technology on machinery.

“You see those forward-thinking, long-term goal producers wanting and needing, really, because of the slim margins of agriculture, technology to drive productivity and efficiency,” he said. “The solutions around that is not only more efficient hard iron – bigger and faster tractors and sprayers – but technology platforms on board those machines, that’s what’s driving some of these sales. … We are seeing overall demand and the techline is increasing at a rapid pace.”

Amidst the demand, Oncken said the company took advantage of the state’s Economic Resilience Grants to upgrade its facilities with touchless faucets and toilets and installing hand sanitizing stations at its locations to help keep employees and clients safe.

“Not everyone in business took that opportunity,” he said. “But it has played out well for us and we’ve been very fortunate that way.”

Oncken said the future looks bright and he and Gorder plan to eventually open additional locations across the region.

“That is our goal. We’re always looking for the right kind of oppor-

tunities,” he said. “One thing we have to think about is scalability and being able to operate in an ever-changing world. This path that we took – this leap of faith that with the impact center – leads to that as an overall improved cost structure around how we handle machines, how we recondition machines, and it just improves the overall result that, in the end, hopefully helps Joe’s team to sell quickly and deliver a real precise and quality product back to the market.

“We’re really excited about that and we’re excited about the distribution piece of how this fits in with, I will say, how we help revitalize regional locations that otherwise couldn’t have the kind of facilities that we have in Grand Forks.”

For a lot of business owners, it’s hard to imagine a year tougher than 2020. But 2021 is going to give it a shot.

Bill Batchelder, the fourth-generation owner of Bemidji Woolen Mills, knows all about it. The famous Minnesota outlet for flannels, jackets, hats, gloves and the like — nestled among lakeside getaways — would normally be doing big mid-winter business right now.

But things haven’t been normal for a while. In the early days of the pandemic, the Woolen Mills was closed for 71 days straight. In months since, he’s scaled back on his workforce for their safety, but internet shopping demand whittled down his back supply and left him with less product to sell. On top of that, the holiday shopping season has been abysmal — with normally packed, festive downtown streets all but deserted.

“Just the week before Christmas, I got off work. I drove down Third Street — two, three cars,” he said. “It was just heartbreaking and gut wrenching.”

Batchelder has been saved by big batch orders — blankets for a small bank’s Christmas party and a huge swath of hats for Enbridge Energy. He’s also blessed, he said, with about $30,000 in Small Business Administration relief loan money — distributed through the federal “Paycheck Protection Program,” or PPP, that’s boosted so many business’ bottom lines in the past year.

But now Batchelder and other business owners are looking warily into 2021.There are so many unknowns — the biggest being the vaccine rollout, which offers a tantalizing possibility of something like normality. But even beyond the virus itself, there’s a big question of the balance between taxes and relief packages ahead.

That makes local, state and federal government some of the biggest mysteries for businesses. As late as Jan. 5, it was still unknown which party would control the U.S. Senate. Now that Democrats have

won those critical Senate races in Georgia, though, it won’t be clear for months exactly how a Biden administration will chart a financial course out of the pandemic. That’s left a lot of business owners anxious about the size of the tax burdens and relief packages and the regulations still to come.

“The path to recovery is not gonna come overnight,” said John Tacke, vice president of sales for the Sioux Falls-based distributor Dakota Beverage. “It’s gonna be years and years now.”

There are reasons for optimism. One is a new tax rule, confirmed in the latest congressional relief bill, that allows businesses to tax-deduct expenses paid for with forgiven PPP loans. Suddenly, businesses who got those loans are looking at significant sums back on their ledgers.

“That weight was a huge weight lifted. It was a boost,” said Brian Johnson, CEO of Choice Financial, which has been closely involved in local distribution on many of those loans. “It doesn’t maybe make anybody more money, but it took a potential burden off the table.”

It’s unclear how big the impact will be in the upper Midwest. But in Minnesota and the Dakotas, the PPP program distributed roughly $14.7 billion through early June in South Dakota, North Dakota and Minnesota.

Another big reason for optimism is that — at least for now — a lot of government leaders are holding off on tax hikes, despite gloomy budget outlooks. Gary Carlson, a lobbyist with the Minnesota League of Cities, said local governments are wella aware of the strains on Main Street. Property taxes for Minnesota’s cities, counties, school districts and the like have increased on a three-year average of 4.8%, he said, but in 2021, that increase will likely be less than 2.5%.

“We don’t have the final numbers yet,” Carlson said in a late December interview. “But the proposed levies that the cities and counties had proposed were significantly lower than the last three or five years.”

But the return to normality is still a long ways away. Many local and state budgets are facing fresh headwinds from a COVID downturn — be that from a gutted oil market or a simple lack of demand. Blake Crosby, the executive director of the North Dakota League of Cities, points to a tale of two economies: gas stations and grocery stores are holding on; bars, restaurants and other sectors of the hospitality industry are not. He added that local governments are fortunate to benefit from a 2018 Supreme Court decision allowing them to collect taxes on internet purchases.

“Everybody saw a downturn,” Crosby said. “Whether you’re a retailer or a wholesaler or a state government or a local government, everybody saw a downturn, but I don’t know if we’ve really seen the net effect of that downturn, because I think everybody’s holding their breath to see if there’s a second downturn.”

And now, all eyes turn to how quickly Americans can get their vaccinations. The good news is that North Dakota and South Dakota rank highly in the percent of vaccine doses shipped to their states that they’ve actually put into patients’ arms — an apparent indication that rollouts are moving efficiently. That’s according to a New York Times database, which puts Minnesota closer to the middle of the pack.

But Crosby warns the full rollout — at least, enough to meaningfully move the economy — might still be a long way off.

“We have to have the vaccines,” he said. “We can’t vaccinate somebody if we don’t have the darn vaccines.”

Despite challenging times, a new tax rule provides some optimism for businesses

Not every business suffers during a disaster or economic upheaval. In general, however, small businesses overwhelmingly face the most risk and bear the brunt of negative impacts. The reason can be boiled down to one critical factor: access to capital.

While public companies have multiple mechanisms to raise capital when revenues are down, small, privately held businesses facing the same scenario have only one choice – borrow more money. To stay solvent during difficult times, small business owners often must obtain additional loans. If that isn’t an option, they may borrow against their home, borrow from friends, or use credit cards to manage the gap. The increased debt places a strain on the business that can be difficult to overcome.

The COVID-19 pandemic and its ongoing impacts have provided our most recent example of the strain lost revenue places on small businesses during economic downturns, but it is not the first. The pandemic has rightly been compared to major events such as the Great Recession and the Great Depression for many reasons, including its economic impacts.

Fortunately, there are a few key differences between the pandemic and those historical events which could lessen the impact to small businesses.

Financial assistance. During the Great Depression, the federal government famously refused to provide financial relief to businesses, resulting in massive closures and crippling unemployment numbers. Seeking to avoid a similar disastrous outcome, the government and Federal Reserve stepped in during the early months of the pandemic to provide assistance through lowered interest rates and the Paycheck Protection Program.

Both tools worked, providing temporary relief to thousands of companies and supporting the employment of 51 million workers. The process wasn’t perfect, of course. The same relief was available to companies whether they were faring well or suffering badly, for example. Regulators also recognized flaws and have attempted to address them. Qualifications for the second round of PPP funding have been tweaked to better identify and target businesses that are truly in need, with the goal of keeping them viable until the pandemic pressures subside.

Lender strength. The banking industry’s performance during past economic downturns has not been stellar. Rampant bank failures during the Great Depression spurred regulatory changes that transformed the industry. In the Great Recession, as it became clear big banks had been a cause of the catastrophe, the word “bank” became a four-letter word and major reform ensued.

Banks are a reflection of their local economies, so small business success or failure during the pandemic will certainly impact lenders, but the industry entered into our current situation much healthier than in past economic downturns, for several reasons.

First, lenders are required to monitor and prepare for anticipated credit losses. As unemployment projections soared in early 2020 and small businesses were forced to shut down, banks built up their reserves to protect against anticipated losses. Second, government-backed financial assistance for businesses and a quick economic recovery in the summer helped banks maintain a position of strength, allowing them to provide ongoing client support.

Lenders were also able to play a key role by providing federal assistance which enabled small businesses to keep workers employed.

The U.S. Small Business Administration utilized lenders as a vehicle to distribute PPP loans — a massive undertaking which simply would not have been possible without bankers working around the clock to help clients apply for and receive support.

To put it in context, throughout 2019 the SBA approved about 42,000 disaster loans for $2.2 billion. Over just a few months in 2020, the PPP program resulted in 4.4 million loans for $510.2 billion. Alerus alone distributed 1,580 loans during that time, obtaining $363 million in funding relief for clients.

The health of small businesses, and those that serve them, will continue to be a major concern throughout 2021. Nearly 99% of North Dakota’s businesses (73,142 businesses) are small businesses, employing more than half of North Dakota’s workers. Small businesses are the lifeblood of communities, and widespread small business failure can create a devastating economic domino effect.

Additional federal relief will provide much-needed support. But until the pandemic subsides, hard-hit sectors such as hospitality and commercial real estate will continue to suffer and the negative implications will spread to lenders that are over-leveraged in those sectors, making it difficult for them to support clients. While the consequences may not be as widespread as in the past, it will be important for businesses to seek out financial partners with capacity to service their needs and the ability to provide helpful guidance.

Ou re mp loye es ar ew hatm ake ou rc om pa ny ag re at pl ac eto wo rk.

To geth er,wes ol ve proble ms th at he lp im pr ovet he qu ali ty of life in th ec om munit ie sw here we li ve,work, an dp lay.

Li st ed ev ery ye ar si nc e2 014

We ’r eh ir in g! Ap pl yo nlin e: hou st on eng.co m/ ca reers

No rt hD akot a|M inn es ot a|S ou th Da ko ta

Buildingahouse?Renovatingorremodeling?Ackerman-Estvoldisyour hometownhometeam.Ourarchitectureteamarelicensedprofessionals whocanhelpyouachievethehomeofyourdreams.Ourcustomhouse plansarecreatedwiththehigheststandardsofqualityanddesignto meetyourpersonalneedsandstyle.Wehavecreatedseveraldesign packagestosuityouraestheticand financialneeds.Contactustodayto turnyourdreamintoreality!

system/network provides whatever processing power and memory is needed for users, scaling up and down dynamically.

How is that even possible? As demand grows, additional hardware resources are engaged to meet the demand. As the user base and software needs grow, the hardware is added or upgraded.

Each user has a local profile on this host system and functions as if they were entirely on their computer, yet they access it from any computer remotely – anytime, anywhere.

The way architects and engineers work has changed dramatically in recent years. Driven by an influx of remote and virtual workers in disparate locations, new and innovative graphics-rich applications that AEC professionals require for their projects, and the need for more agile and cost-effective technology solutions, AEC firms continue to forge ahead. In doing so, they are transforming their operations to accommodate how design and build professionals now work, in light of the pandemic, and to continue to be competitive in an already rivalrous environment.

One major part of this transformation that successfully harnesses the new norm of remote and virtual work, project collaboration, and reduced IT costs in one fell swoop is Virtual Desktop Infrastructure (VDI).

VDI is the concept of taking a localized computer system or resources and placing them on a centralized server. This server can be local to a company or cloud-based and hosted around the country or world. You will often hear Virtual Desktop in association with the company that provides it. For example, Windows® Virtual Desktop, or WVD.

Today’s Virtual Desktops have multiple users accessing a shared pool of resources from a host system or network of host systems. Host systems are made up of servers that are interconnected computers dedicated and optimized to perform specific tasks. The host

Virtual Desktops simplify the management of IT infrastructure and alleviate challenges, allow for real-time collaboration providing users access to graphic-intensive applications such as Autodesk® Revit®, Autodesk® Civil 3D®, Lumion®, and Enscape®, and empower employees with work-life balance making it easier for them to work when it’s convenient from anywhere an Internet connection is available.

Ever experience issues with bandwidth or connectivity when working remotely or over a VPN? With Virtual Desktops, work happens on the remote host system, bypassing these bottlenecks. There is no need for files to be transferred over the user’s personal network connection. The files, software, and resources are in the same bubble, with optimized connections to each other.

With office-based IT hardware and equipment costs on the rise, Virtual Desktops are a great alternative as users do not need highend computers.

Thin clients (affordable computers) connect with a Virtual Desktop. They are scalable, so you only pay for what you need when you need it. Baseline costs and usage stay predictable through a monthly subscription cost instead of an upfront capital expense. And keeping everyone updated on the correct version and troubleshooting issues is a breeze with VDI.

IT teams have centralized control over deployment, management, and updates with a lower failure rate. The end-user experience is customizable, but access control is centralized. If something goes wrong, a new profile or host can be deployed to keep the user working, ensuring productivity on projects and less downtime.

With VDI, employees are empowered to complete their projects with the graphics-rich applications they need while collaborating with stakeholders with ease – inside or outside the firm. When it’s time to hire new talent, it no

longer matters where the employee resides as a Virtual Desktop can be provisioned quickly, broadening a firm’s recruiting reach to attract top talent from anywhere.

What to consider on the technical side about VDI Networking. A broadband internet connection is recommended for the best experience. 15/15 Mbps and under 150ms of latency to the Azure region resources are hosted in. Licenses. For Windows Virtual Desktop, every user will require a Windows 10 Enterprise account. Windows Virtual Desktop runs on Windows 10 Enterprise with Windows Server elements that allow multiple concurrent interactive sessions. Every user has their own Windows Profile. Autodesk applications require Single-User Sign-On.

Usage. The number of users and the uptime in the firm is needed. Uptime being the time users need access to the systems. Starting with more than enough resources to meet demands are essential for success, adoption, and getting baseline costs quickly and accurately. Windows Virtual Desktop runs on Azure® (a cloud service provider), making it seamless to transition to a virtual workspace instead of solely relying on in-house/on-premises infrastructure. Local outages are decreased, and an off-site provider manages backups and redundancies – freeing up IT resources’ time to focus on higher priority work. Employees enjoy greater work-life balance, uninterrupted productivity, and project collaboration and delivery are unimpeded. An AEC technology partner, such as U.S. CAD, can provide a turnkey VDI solution with implementation services including setup, configuration, deployment, scaling, application installation, and providing best practices to users.

Brian C. Smith is a cloud solutions specialist at U.S. CAD based in Irvine, Calif. The company has offices located in Minnesota, Missouri, and 11 additional major metropolitan cities.

“AtMDU Resources, ourtag line is Building aS tr on gA me ri ca .T he ND SU C olleg eof Engineeringpreparesgraduatestodojust that –tolead, innovateand do theirpar t to builda strongAmerica .” Davi

dG oo din ,P re si dent, CEO andDirector of MDUResources and prou dN DS UC olle ge of En gin eer ing al um nu s

SPONSORED BY

As a uniquely qualified and involved developer, builder, and manager of real estate, our diligence and thoughtfulness allow us to truly serve our clients and partners from land sourcing through design, planning, building, and real estate management.

As a uniquely qualified and involved developer, builder, and manager of real estate, our diligence and thoughtfulness allow us to truly serve our clients and partners from land sourcing through design, planning, building, and real estate management.

Our clients gain a unique advantage through our team’s involvement from beginning to end; whether we’re managing the building after it’s completed or not, we take immense pride in being able to listen to and advise clients comprehensively to achieve their objectives. The project must achieve the client’s goals and exceed what’s found in the marketplace.

We love challenges and being a valued partner to create inspiring places to live, work, and play.

Creative solutions and proven service are two unique offerings that separate Architecture Incorporated from its competitors. Many firms claim to provide excellent service, but fall short of expectations. For the past 44 years, Architecture Incorporated has consistently been retained by previous clients for subsequent building projects, proving the outstanding quality of our construction documents, talented staff, and exceptional service.It can sometimes be difficult to convey this unrivaled level of service to a prospective client, which is why we are grateful for the plethora of testimonials and referrals we receive from our existing clients. For example, after unforeseen circumstances arose on a recent renovation project, members of our team rushed to develop a temporary, yet innovative, solution which allowed the project to be completed on time. This ensured that the owner was able to maintain their contractual obligations to their customers.

Jason Pittmann Principal Contract Administrator Architecture Incorporated Sioux Falls, S.D.

At ICON, we offer the ability and expertise to incorporate technology systems into a design from the very beginning stages of creation. From digital wayfinding signage to LED messaging displays to security systems, our team brings forth a diverse toolbox of technology applications that allow us to stand out from our competitors.

Throughout the entire design process, our team utilizes technology implementation to enhance the overall experience of the end user. Technology-driven design can build more productive, efficient, and functional living and working spaces. A proper built environment is one that is digitally connected throughout. A “smart” design is pivotal in any industry and one that must not be overlooked. ICON recognizes the value of technology integration and prioritizes including digital concepts in a design that are a direct reflection of the latest trends in the industry, while also staying up to date with new advancements and executing these in upcoming projects. Our team of architects collaborate with our technology specialists to create seamless technology integration for a total solution.

Tom Wesley, AIA Principal Architect

NCI is not your typical full-service IT provider. In addition to traditional technology services and support such as servers, managed IT, and networking or security, NCI also has a full-fledged interactive development team. The department focuses on custom applications and websites as well as integrations between existing applications. This allows NCI to work with customers to develop the right applications for the task at hand that can be seamlessly incorporated into their technology environment, rather than purchasing prebuilt, off-the-shelf solutions that can be difficult and expensive to integrate.

If you already have the right applications but they don’t talk to each other or provide valuable enough insights, NCI’s developers and engineers can explore integrations between applications to help customers stay efficient and informed through automation. These types of solutions help customers get away from redundant and time-consuming tasks and focus on their business. The NCI development team, in addition to the help desk technicians and engineers, allows customers to utilize a single IT company to understand their technology stack top to bottom and can provide valuable insight on maximizing performance of all things IT.

continued From page 14

While some establishments may have had to retool space to accommodate social distancing during the pandemic – and some may have cut back on their blended strategies due to cost savings during these times – Sogge foresees trends reverting back to blending entertainment with retail to enhance the customer experience. He said the store of the future will have even more entertainment components.

Some stores also are experimenting with their online pick-up sections, explaining that some businesses are better at it than others. Those who have positioned their pick-up locations at the back of the store may want to rethink their plan. Having those sites at the front of the store is much more customer friendly.

Ultimately, the store of the future – and the architects who design them – must focus on strong visuals of the brand or product and define variations of a common theme. According to an article by Commercial Design, that means “creating elements” and “concepts and themes” that predominantly relate to the customer “experience and interaction with the space, the social/environmental awareness and, ultimately, the brand’s values.”

In Sogge’s field, all of this means more positive challenges for architects. He said it is exciting to work with retailers who think outside the box and want to experiment with the customer experience. For the architect, it provides new ways to think about designing stores and storefronts.

A lot of online-only stores also are building physical storefronts, and so there’s another opportunity there to make stores that are appealing and new to in-person customers.

“With this whole online trend everyone thinks retail is dead, but it’s not,” he said. “It is reinventing itself.”

ANDREW WEEKS PRAIRIE BUSINESS EDITOR

ANDREW WEEKS PRAIRIE BUSINESS EDITOR

From 2019 to 2020, consumer prices for all items rose 1.4%. Over that period, food prices increased 3.9%, a larger percentage increase than the 12-month increase of 1.8% in 2019. Food at home prices increased 3.9% in 2020, the largest over-theyear increase since 2011. Some notable items include: Prices for all six of the major grocery store food groups increased from 2019 to 2020. Prices for meats, poultry, fish, and eggs rose 4.6% from 2019 to 2020, double the 2.3-%increase of the prior year. Prices for dairy and related products rose 4.4% from 2019 to 2020 after rising 2.4 percent from 2018 to 2019.

Source:

In November 2020, the latest numbers available from the U.S. Bureau of Transportation Statistics, reporting marketing carriers posted an on-time arrival rate of 91.7%, up from 90.9% in October 2020 and from 84.4% in November 2019.

Total nonfarm payroll employment declined by 140,000 in December, and the unemployment rate was unchanged at 6.7%, according to the most recent data by the U.S. Bureau of Labor Statistics. The decline in payroll employment reflects the recent increase in COVID-19 cases and efforts to contain the pandemic. In December, job losses in leisure and hospitality and in private education were partially offset by gains in professional and business services, retail trade, and construction. Source:

ready

Whenyou’vebeendiagnosedwith alife-threateningheartcondition,believethatyoucan findaward-winning cardiaccarerighthere.Fromearlydetectiontotreatment,ourexpertcareteamspartnerwithyou,offeringaccess toadvancedtreatmentsininterventionalcardiology,electrophysiology,andstructuralandvalvedisease.

Becausewebelievethatyoucandothis —andthatyoudon’thavetodoitalone.

Region’s OnlyAccredited

ChestPainCenter with PCI& Resuscitation*

AmericanCollege ofCardiology

Platinum Performancefor HeartAttackCare NCDR

STEMI ReceivingCenter Designation

2020GoldPlusLevel for HeartFailureCare

AmericanHeart Association

Heart &VascularCent er 701-36 4- BE AT EssentiaHealth.org

BlueDistinction DesignationforQuality andCost Effective CardiacCare

BlueCrossBlueShield

Believethatyour bestisyetto come.