ENGINEERING THE DIVERSION

HOW ENGINEERS WILL MEET THE CHALLENGES OF THE $2.75 BILLION FLOOD-CONTROL PROJECT

PREMIER BUSINESS MAGAZINE OF THE NORTHERN PLAINS | FEBRUARY 2019

Evolved.

Perfectly designed to thrive in its environment. Adaptable enough to evolve with the times. Smart solutions, connected communities. It's second nature at KLJ.

5

K LJ E NG .CO M

001822710r1 Nichole Ertman Eastern ND/Western MN 701-739-0955 nertman@prairiebusinessmagazine.com Peter Fetsch Western ND/SD 701-780-1172 pfetsch@prairiebusinessmagazine.com Coming in March 2019.... Who made the list in 2019? The March edition of Prairie Business Magazine will reveal our list of Top 25 Women in Business. We look forward to sharing their accomplishments and celebrating their successes with Prairie Business readers in this special edition. For advertising information, please contact our account managers: 6 TWITTER.COM/PRAIRIEBIZ FACEBOOK.COM/PRAIRIEBUSINESS PRAIRIEBUSINESSMAGAZINE.COM

more at obernel.com MECHANICAL ENGINEERING | ELECTRICAL ENGINEERING | CIVIL ENGINEERING

EVERY DOLLAR SAVED.

Forks,

Learn

FOR

Fargo, Minneapolis, Duluth Bismarck, Grand

Alexandria

Providing the highest quality of building design and coordination to protect every investment made.

BY TOM DENNIS

“IF OUR COMMUNITY BENEFITS, THE BANK BENEFITS,” BANKERS SAY WHEN DESCRIBING THEIR SUPPORT FOR LOCAL CHARITIES. FOR EXAMPLE, CHOICE BANK’S INAUGURAL “HOEDOWN FOR HOSPICE” (SHOWN HERE) RAISED MORE THAN $31,000 FOR CHI HOME HEALTH AND HOSPICE IN DICKINSON, N.D. PAGE 26. IMAGE: CHOICE BANK

22

ARCHITECTURE & ENGINEERING

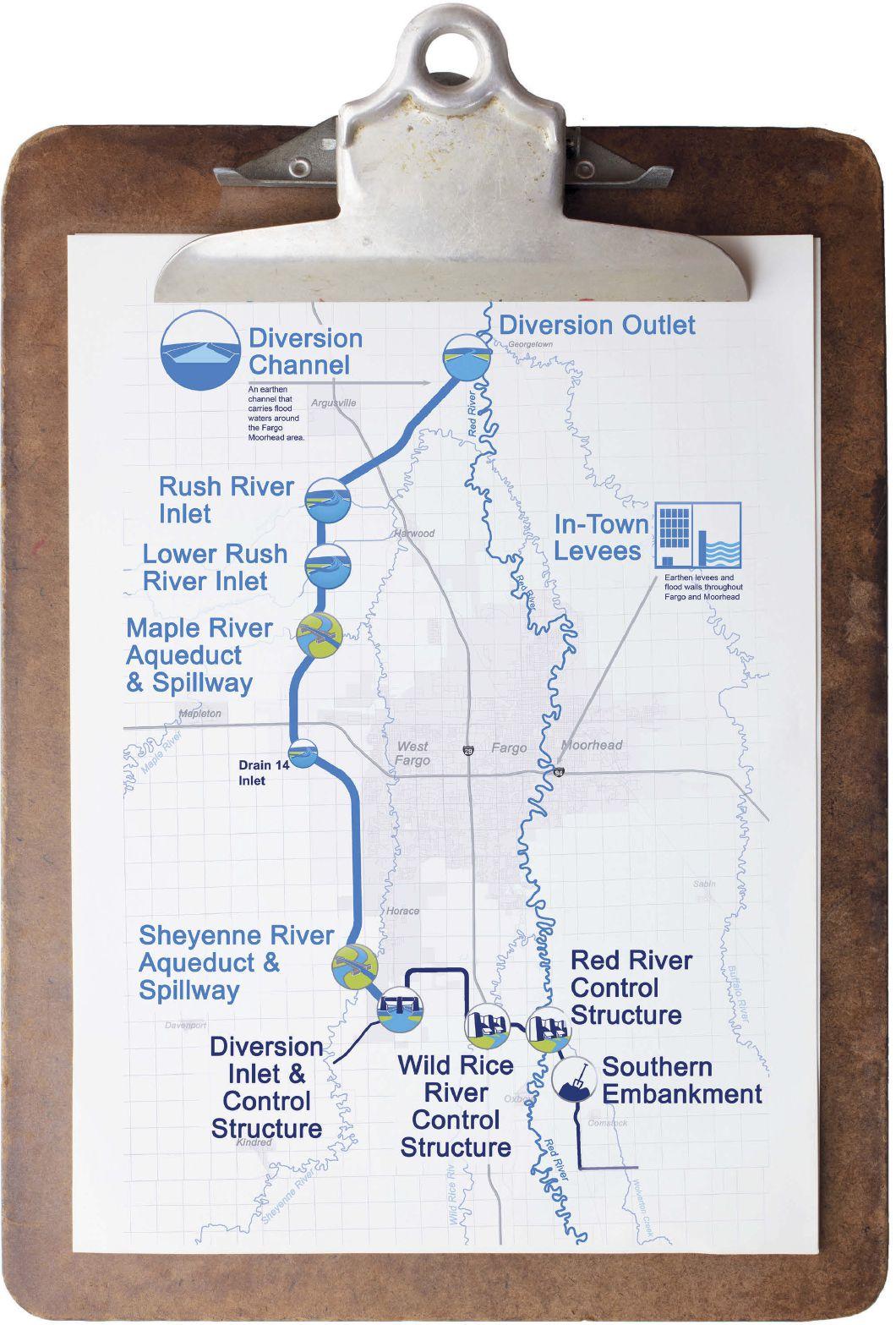

ENGINEERING THE DIVERSION THE FARGO-MOORHEAD FLOOD DIVERSION PROJECT IS PUSHING INNOVATION AMONG FINANCIERS AS WELL AS ENGINEERS

26

BANKING & FINANCE

WELCOME TO BEDFORD FALLS LOCAL BANKS DO GOOD TO HELP THEIR COMMUNITIES DO WELL

31 TAXES

TAXATION WITHOUT PHYSICAL LOCATION AS THE WAYFAIR DECISION TAKES HOLD, BUSINESSES NEED TO PAY ATTENTION

ON THE COVER:

THE $2.75 BILLION FARGO-MOORHEAD FLOOD DIVERSION PROJECT WILL BE THE FIRST PUBLIC-PRIVATE PARTNERSHIP FOR THE U.S. ARMY CORPS OF ENGINEERS. THAT’S BECAUSE WITHOUT PRIVATE PARTNERS, IT WOULD TAKE THE CORPS 20 YEARS OR MORE TO COMPLETE THE PROJECT, CORPS OFFICIALS HAVE SAID. PAGE 22.

16

MANAGEMENT

FOR SKILLED WORKERS, THE GLASS IS NEITHER HALF-EMPTY NOR HALF-FULL. IT’S OVERFLOWING. BY MATTHEW MOHR

18

BUSINESS INSIDER

YES, YOU CAN JOIN A CREDIT UNION, AND YES, YOU CAN GET MOBILE BANKING AND NATIONWIDE SERVICE WHEN YOU DO, SAID JEFF OLSON, CREDIT UNION ASSOCIATION OF THE DAKOTA’S CEO

8 FEBRUARY 2019 VOL 20 ISSUE 2 FEATURES DEPARTMENTS 10 EDITOR’S NOTE

12 CYBERSECURITY CYBERSECURITY CONCERNS CROSS NATIONAL AS WELL AS STATE LINES, WRITES A GHANIAN STUDENT WHO’S STUDYING THE TOPIC AT DAKOTA STATE UNIVERSITY BY FRANCISCA AFUA OPOKU-BOATENG 14 HEALTH CARE AS TECHNOLOGICAL AND LIFESTYLE CHANGES TRANSFORM SOCIETY, NEW MEDICAL SPECIALTIES ARE EMERGING BY DR. ALLISON SUTTLE 36 INSIGHTS & INTUITION 38 BY THE NUMBERS 34 Prairie people TWITTER.COM/PRAIRIEBIZ FACEBOOK.COM/PRAIRIEBUSINESS PRAIRIEBUSINESSMAGAZINE.COM prairie people VISIT WWW.PRAIRIEBUSINESSMAGAZINE.COM TO SEE THESE AND OTHER NEW HIRES, PROMOTIONS AND AWARD WINNERS IN THE REGION. TRISHA PEARSON CAMEON EISENZIMMER HAS BEEN HIRED AS CHIEF OF STAFF OF FORUM COMMUNICATIONS IN FARGO, N.D. SHE HAS WORKED WITH FLINT GROUP, A MARKETING AGENCY IN FARGO, OVER THE PAST 14 YEARS, MOST RECENTLY AS ACCOUNT PLANNER FOR A PORTFOLIO OF ACCOUNTS, INCLUDING BOBCAT CO. EARNED A GRADUATE CERTIFICATE IN HISTORIC PRESERVATION FROM THE UNIVERSITY OF KENTUCKY IN LEXINGTON, KY. EISENZIMMER, AN ARCHAEOLOGIST WITH ACKERMAN-ESTVOLD IN MINOT, N.D., NOW CAN SERVE AS PRINCIPAL INVESTIGATOR IN ARCHAEOLOGY, ARCHITECTURAL HISTORY AND HISTORY.

TABLEOFcontents

$2.75 BILLION FLOOD-CONTROL PROJECT ENGINEERING THE DIVERSION

EDITOR

Reflections on Duff’s Ditch

In the spring of 1997, after the Red River Floodway had diverted floodwaters around Winnipeg and saved the city an estimated $4 billion in damages, an elderly gentleman walked into a Winnipeg restaurant.

“The entire restaurant clientele rose as if one in a standing ovation,” a Maclean’s magazine columnist wrote.

The honored gent was Duff Roblin, who, as Manitoba’s premier from 1958 to 1967, had championed the floodway project and seen it through to near-completion.

But what a change the applause represented from Roblin’s time in office.

Back then, as a 2001 story from Manitoba History recounted, “Manitobans were strongly divided as to whether the province could afford the capital costs of a mammoth engineering project that would benefit primarily Winnipeg.”

The project was “vehemently denounced by opponents as a monumental, and potentially ruinous, waste of money,” the story continued.

“Indeed, the projected Red River Floodway was derisively referred to as ‘Duff”s Folly’ and ‘Duff’s Ditch’, and decried as ‘approximating the building of the pyramids of Egypt in terms of usefulness.’”

Of course, the floodway quickly proved its worth, as “the decade after 1968 saw a trend toward an increased frequency and severity of flooding,” Manitoba History continued.

Having diverted floodwaters in 1969, 1970, 1974, 1979, 1991, 1994, 1996 and 1997, among other years, the project is credited with preventing more than $40 billion in flood damage in Winnipeg since 1968.

There are no guarantees that the Fargo-Moorhead diversion – the “son of Duff’s Ditch” – will rival its parent in effectiveness. But I wouldn’t be surprised, and if floodwaters start skirting the metro as routinely as happens up north, count on Fargo-Moorhead residents to one day regard their canal as affectionately as Winnipeggers do Duff’s Ditch.

Good reading, Tom Dennis

I welcome your feedback and story ideas. Call me at 701-780-1276 or email me at tdennis@prairiebusinessmagazine.com.

PUBLISHER KORRIE WENZEL

AD DIRECTOR STACI LORD

EDITOR

TOM DENNIS

CIRCULATION MANAGER BETH BOHLMAN

LAYOUT DESIGN ANNA HINSVERK

ACCOUNT MANAGERS

NICHOLE ERTMAN 800.477.6572 ext. 1162 nertman@prairiebusinessmagazine.com

PETER FETSCH 800-477-6572 ext. 1172 pfetsch@prairiebusinessmagazine.com

Prairie Business magazine is published monthly by the Grand Forks Herald and Forum Communications Company with offices at 375 2nd Avenue North, Grand Forks, ND 58203. Subscriptions are available free of charge. Back issue quantities are limited and subject to availability ($2/copy prepaid). The opinions of writers featured in Prairie Business are their own. Unsolicited manuscripts, photographs, artwork are encouraged but will not be returned without a self-addressed, stamped envelope.

SUBSCRIPTIONS

Subscriptions are free www.prairiebusinessmagazine.com

ADDRESS CORRECTIONS

Prairie Business magazine Box 6008 Grand Forks, ND 58206-6008

Beth Bohlman: bbohlman@prairiebusinessmagazine.com

ONLINE www.prairiebusinessmagazine.com

TWITTER.COM/PRAIRIEBIZ FACEBOOK.COM/PRAIRIEBUSINESS PRAIRIEBUSINESSMAGAZINE.COM 10 editor’snote

TOM

DENNIS

tdennis@prairiebusinessmagazine.com 701.780.1276

FEBRUARY 2019 VOL 20 ISSUE 2

001822475r1

MADISON, S.D. – Information is power, and cybersecurity is all about protecting that information to make it as secure as possible. This is important whether you live in the United States or in any country around the world.

Ghana, my home country in West Africa, is not immune to cyber risks and attacks. Electronic payments and commerce fraud, “sakawa” or internet fraud, ransomware, insider threats and identity theft, social media abuse, social engineering, web defacement and ATM fraud are top cybersecurity issues.

Plus, Ghanaian news and media outlets have reported that cybercriminals are getting smarter by the day, sharpening their skills and discovering innovative ways to gain access to networks and data of businesses such as financial institutions. A report released by a Kenyan-based IT firm, Serianu Ltd., revealed how the Ghanaian economy lost a total of U.S. $50 million to cybercrime in 2016.

Ghana is taking baby steps with cybersecurity. For example, in Ghana there was no proven system for monitoring cybersecurity developments, and the International Telecommunication Union of the United Nations observed the absence in the country

Worldwide cooperation needed to improve cybersecurity

By Francisca Afua Opoku-Boateng

of a national governance roadmap for cybersecurity, although Ghana had a drafted national cybersecurity policy. That policy seeks to address the lack of awareness of risks that users and businesses face when doing business in cyberspace.

Leaders have recognized the need to develop a technology framework for combating cyberattacks. So, Ghana’s vice president recently launched the 2018 National Cybersecurity Awareness Program, which calls for the intensification and harmonization of efforts to fight cybercrime and control or limit the increasing danger.

Institutions such as the Bank of Ghana are putting measures in place to fight cybercrime, part of the government’s push to beef up security and protect the country’s business institutions from cyberattacks.

COMBATING CYBER THREATS IN THE U.S.

As Prairie Business readers know, attacks are happening in the United States as well. A recent example is the massive Marriott data breach, which exposed personal information of about 400 million guests.

Schools and hospitals are potential victims

of cyber attacks, and financial institutions run into losses by means of counterfeiting and fraudulent money transfer.

To improve cybersecurity in this country, the U.S. International Strategy for Cyberspace has been officially recognized. National governance roadmaps for cybersecurity are provided by the National Institute of Standards and Technology. The National Checklist Program for IT Products, as spelled out by the NIST Special Publication 800-70, serves as the U.S. government’s repository of publicly available security benchmarks. It offers detailed, low-level guidance on setting the security configuration of operating systems and applications used by various businesses.

PROACTIVE EFFORTS WILL HELP GLOBAL CS

One must be living under a rock not to be struck by a sense of urgency and action in regard to CS, so I believe readiness should be premeditated and not an afterthought. With proactive policies, businesses and organizations can react when they are – not if they are – compromised.

TWITTER.COM/PRAIRIEBIZ FACEBOOK.COM/PRAIRIEBUSINESS PRAIRIEBUSINESSMAGAZINE.COM CYBERSECURITY FEBRUARY 2019 VOL 20 ISSUE 2 12

FRANCISCA AFUA OPOKU-BOATENG, A DOCTORAL STUDENT IN INFORMATION SYSTEMS AT DAKOTA STATE UNIVERSITY IN MADISON, S.D., STANDS IN THE NETWORK SERVER CLASSROOM IN THE BEACOM INSTITUTE OF TECHNOLOGY ON THE DSU CAMPUS. IMAGE: DSU

To quote Kevin Streff, founder of SBS CyberSecurity and professor of information assurance at Dakota State University, when it comes to CS awareness and mitigation, businesses around the world need to stop kicking the can. They need to stop putting off cyber risk mitigation and establish best practices such as compliance to Payment Card Industry Data Security Standard guidelines and requirements.

This is true in the U.S., in Ghana, and in every other country around the world.

Cybersecurity professionals can be proactive on a personal level as well, taking it upon themselves to find out what’s going on outside their own country. They can do this by attending CS conferences to learn about best practices around the world.

As a future cybersecurity professional, I want to be part of the solution, so I am working to gain a comprehensive knowledge and understanding of the latest techniques in specialized information systems and cyber defense.

I can share this with my colleagues here or in Ghana, acting as a bridge of knowledge exchange.

My ultimate goal is to become a digital forensic or security expert/ researcher working in a federal organization so that I may give back to society, helping citizens of all countries use technology to the best of their ability.

Francisca Afua Opoku-Boateng was born and raised in Ghana and completed her bachelor’s degree in information technology at Valley View University there. She also has a master’s degree in computer science and information systems from the University of Michigan.

She is a doctoral student at Dakota State University in Madison, S.D., working toward a degree in information systems with a specialization in cyber defense. She is expected to graduate in 2022.

13

Coming soon to a clinic near you: New medical specialties

By Dr. Allison Suttle

SIOUX FALLS, S.D. – Emerging technologies are changing every industry, and health care is no exception.

But with the advent of more data, more virtual visits and more specialties, some core elements remain: The value of human experience, the art inherent in practicing medicine and the desire to treat the whole patient.

At Sanford Health, we embrace change and how it can help drive better outcomes for our patients, the communities we serve and the regions where we live. I’m excited to share a few of the emerging medical trends and technologies coming to Prairie Business readers’ communities.

CLINICAL INFORMATICS

Imagine all the data available in an electronic medical record: lab results. Patient histories. Visit summaries. Everything from the concrete – a set of vital signs – to the fluid – how a patient seems on a given day, what’s happening in his or her life or work and how those developments are affected by stress.

It’s a mind-boggling amount of information.

But new programs and algorithms are helping providers comb through the data and predict patients who may be at risk of illness.

The algorithms can link seemingly disconnected data points, calling a physician’s attention to a patient who might become sick. This allows physicians to prevent illness and intervene.

Those interventions vary. For example, patients may be asked if they have a refrigerator for their insulin, or how their nutrition plan is going or if they need a reliable ride to an appointment.

The concept of a clinical informaticist calls for a fellowship-trained expert, and that’s something Sanford Health is considering on the horizon.

LIFESTYLE MEDICINE

We must understand our patients at every stage of their lives if we want to truly take better care of them. That means building a team around physicians to include specialists and social workers and outreach experts who can help tailor advice and treatment to the variety of patients we see.

We will add senior care to our primary care

clinics, screening patients for dementia and other issues.

We will better understand, for example, what exercise means for an 80-year-old patient with congestive heart failure, or a 25-year-old with obesity.

Health care is personal. It is a physician and patient having a conversation, and the physician has a responsibility to understand that patient in the context of who they are and what their goals are – and then offer advice and help.

When people come in, they may be ashamed to say their water has been turned off and they don’t have electricity. But when you go into the home and see those realities, you realize that if you don’t know the whole picture, you don’t know the whole patient.

We will train our providers to be better at this, to look at what this means from a population health perspective – access to transportation, medications, housing and value-based care.

14 TWITTER.COM/PRAIRIEBIZ FACEBOOK.COM/PRAIRIEBUSINESS PRAIRIEBUSINESSMAGAZINE.COM HEALTH CARE FEBRUARY 2019 VOL 20 ISSUE 2

SANFORD PROVIDERS COLLABORATE TO TREAT PATIENTS CLOSE TO HOME WITH TELEMEDICINE. IMAGE: SANFORD HEALTH

VIRTUAL MEDICINE

Virtual medicine has been around for decades. Picture a physician answering your questions over the phone.

But with emerging technology, it’s becoming even more advanced and requiring new skill sets. A medical virtualist – trained to help patients offsite – can help improve access and save time for some patients.

Video calls, cellphones, the ability to send a recording of your heart through the electronic medical record – all these things will make it possible to expand virtual medicine.

The trick will be teaching physicians how to best interpret the data, to know when a patient needs to come in to be seen and to have the right technology to be successful.

Patients will be able to solve things that don’t require an in-person visit. That also means physicians likely will be seeing a sicker patient population in the office, which can be draining. But they may be able to spend more time with each patient and be better able to help them.

What do these developments mean?

For employers in our region, these specialties can help us move the needle on population health, creating a healthier workforce and healthier communities. Maybe an employee can do a virtual visit rather than leave the office for an appointment. Perhaps better options in lifestyle medicine mean employees can better manage their chronic illnesses.

For educators and universities, these specialties create career paths for graduates.

And for Sanford Health, these changes mean we can continue to improve the quality of life for the patients we serve in the communities where they live.

We are able to make a difference. You don’t know a patient until you know his or her story. Our job is to find out that story, and help our patients turn the page.

Dr. Allison Suttle Chief medical officer, Sanford Health Sioux Falls, S.D. 605-333-1000

15

DR. ALLISON SUTTLE

For skilled workers, an exceptionally prosperous era

By Matthew Mohr

FARGO, N.D. – We are living in a unique time in economic history, especially in our region. As businesses try to expand and grow, one of the biggest challenges they face is finding qualified employees at wages that let the business earn a profit.

Smart business owners measure the value of their employees in a variety of ways. Some use wages as a percent of revenue; some use strict cost accounting to determine the labor costs per unit of production.

Sophisticated businesses measure labor as a contribution to profitability, profits per worker or even profit per hour of labor. Some less-informed businesses look at the cost of labor or possibly the percentage of labor cost to total operating costs as a negative statistic, thus making labor an undesirable cost rather than looking at it as a contributor to success.

Certainly, a business owner wants to compare the enterprise’s wage cost as a portion of operating expenses to similar businesses, but the collective attitude of the business management toward human capital costs is a subtle cultural difference. Is management there to watch over and control labor, or is it management’s responsibility to help each employee succeed and develop skills to earn more?

Skilled employment levels are very high by historical standards, and our nation’s general unemployment rate is very low – low enough for some to claim we are at a level economists have referred to as “full employment.” But despite the high demand for laborers and the efforts of most employers to add qualified staff, we have people campaigning for higher minimum wages. Some also are trying to convince the public that we need to force businesses to pay all labor higher wages and, as such, want to mandate what they have called a living wage rate. Meanwhile, few with the most knowledge of national or regional conditions can adequately define what this wage would be. A recent article stated the cost of agricultural laborers in Mexico is $7 to $11 per day. Per day, not per hour! By our standards, this is a terrible wage rate.

When I worked in manufacturing, labor was an input cost, and most managers viewed wages as a cost that was to be pushed as low as possible

on a per-hour basis with the expectation that low per-hour costs would lead to low cost per unit and better profits.

One engineer investigated a new piece of machinery that required a big capital investment and skilled labor. Our cost per labor hour would go up, but the per-unit cost of labor would drop due to the improved throughput of the new machine.

The improvement turned into a winning proposition for the business, as well as for the employees who wanted to learn and improve their lives.

Western North Dakota still is recovering from the employment race caused during the recent oil boom. As employees became scarce, wages accelerated to the point where many smaller businesses couldn’t compete for labor; and as a result, many good locally owned and operated businesses closed.

Then when the price of oil dropped, oil companies cut costs and reduced employment. Many people who’d wanted to stay in our region could not find jobs that paid enough to maintain their higher income lifestyles. Many do not possess the skill levels to earn wages that they were accustomed to receiving from working in the oil fields.

My son is spending a year volunteering at a church-run homeless shelter in The Bronx borough of New York City. Many of the homeless residents at this shelter get welfare and/or Social Security checks, while many have daytime jobs.

According to my son, the ones who chose to work initially don’t earn enough to live on their own, mostly because of the high cost of rent in New York. Those receiving government support either can’t live on their own or often choose to waste the money received.

Over time, the goal of the shelter is to get each person on his or her feet so the person can live a productive independent life. Those who chose to work and grow their skills are the most likely to succeed. Those who do not grow in their ability to earn often are stuck in an endless circle of homelessness.

In this time of economic prosperity, the opportunity for financial and personal success through good work is tremendous.

A person aged 35 to 60 with work experience generally is the most productive and, as such, will provide value for an employer – and assuming the experience is put towards achieving the businesses’ goals, will earn more income.

Income is earned, not dictated by a government mandate or based on what was paid in the past elsewhere. A person who is 60 and broke is probably not a victim of being paid too little, but is more likely a financial failure because of spending more than was earned over time.

Good businesses carefully evaluate the contributions of employees and in the process, take into account skills, competitive wage pressures and labor availability.

Matthew Mohr CEO, Dacotah Paper Co. Fargo, N.D.

16 TWITTER.COM/PRAIRIEBIZ FACEBOOK.COM/PRAIRIEBUSINESS PRAIRIEBUSINESSMAGAZINE.COM MANAGEMENT FEBRUARY 2019 VOL 20 ISSUE 2

mmohr@dacotahpaper.com

MATTHEW MOHR IMAGE: DACOTAH PAPER CO.

17

Open your eyes to a credit union

That’s the slogan of the Credit Union National Association’s upcoming campaign – a campaign that Jeff Olson, president of the Credit Union Association of the Dakotas, is helping to shape

EDITOR’S NOTE:

Jef f Olson is president and CEO of Credit Union Association of the Dakotas, which represents credit unions in both states. In addition, Olson now is serving his second term on the American Association of Credit Union Leagues executive board and sits on the Consumer Consideration Committee of the Credit Union National Association board. In a recent interview, Olson spoke with Prairie Business about credit unions and the challenges they’re facing.

Q.

A. A.

We are a financial cooperative, so we’re just like any other cooperative. We are a not-for-profit, not a nonprofit, and I always have to clarify that.

WHAT’S THE DIFFERENCE?

WHAT IS A CREDIT UNION, AND HOW IS IF DIFFERENT? Q.

The difference is that we’re not a charitable organization. Basically, we are in business to return our profits back to those who own us – so, we are a not-for-profit.

We’re member-owned, and the unique thing about us in comparison to a for-profit bank is that we have no source of secondary investment capital. We make money only on retained earnings – that is, through fees, services and interest on loans.

And so, we’re exempt from federal and state income tax.

That makes us really different, in that we typically can pay higher interest on deposits, and we’re able to provide auto and other consumer loan at better rates than banks can.

But we can only serve people who are in our field of membership. Traditionally, that has meant people who are working in the same industry or for the same company, or living in the same community as other members.

18 TWITTER.COM/PRAIRIEBIZ FACEBOOK.COM/PRAIRIEBUSINESS PRAIRIEBUSINESSMAGAZINE.COM

BUSINESSINSIDER

JEFF OLSON, PRESIDENT AND CEO OF THE CREDIT UNION ASSOCIATION OF THE DAKOTAS, STANDS IN FRONT OF THE CAPITOL IN WASHINGTON IN JANUARY 2016. THE FENCING, FLAGS AND GRANDSTAND WERE IN PREPARATION FOR THE INAUGURATION OF PRESIDENT TRUMP. IMAGE: CUAD

FEBRUARY 2019 VOL 20 ISSUE 2

A. Q.

WOULD MOST PEOPLE BE ELIGIBLE FOR MEMBERSHIP IN A CREDIT UNION?

Yes. In the Dakotas, we have probably a dozen or so selective employee credit unions; so, if you are a postal worker, you can join the Postal Workers Federal Credit Union, or if you’re a VA employee or member of some other groups such as certain VFW posts, you can join the Fargo VA Federal Credit Union.

Other credit unions are community-based. That means people who live within a 50-mile radius of Grand Forks, N.D., can join the Area Community Credit Union, for example. Most consumers, especially those in our region’s larger towns and cities, probably can join a credit union.

And some credit unions are open to any potential member who’s willing to pay a small, one-time donation or membership fee.

Q.

WHERE DID CREDIT UNIONS COME FROM?

A.Our roots come actually from Bavaria and elsewhere in Europe. People there would get together, and if they couldn’t get any credit, they’d pool their resources and pay a membership fee to join the group. Then they’d use those fees to invest in their neighbors or community.

In America, credit unions have been around since 1908. The first got started in Manchester, N.H. Back then, mill workers in the town didn’t have credit; they were going to pawn shops and the like to get credit.

There was a French priest who’d come from Canada, where credit unions already were popular. So he introduced the idea in the United States. (Editor’s note: That credit union in Manchester was called La Caisse Populaire, or “The People’s Bank.”)

AND CREDIT UNIONS TRY TO CAPTURE THAT SPIRIT TODAY?

A.Absolutely. In most cases, credit unions are smaller, so they know the individuals who come in. And there have been many, many stories of a credit union helping out an individual, a family or a farmer when that person couldn’t get help anywhere else.

It’s really because it was relationship banking. That was one of the things that helped credit unions grow, and that’s why a lot of people really like their credit union. In customer service surveys, credit unions wind up scoring way better than banks year after year.

A. Q.

WHAT ARE SOME OF THE CHALLENGES THAT CREDIT UNIONS FACE?

Regulations have had a big impact on credit unions, just as they’ve had on community banks. The irony there is when Congress came out with the Financial Regulatory Act in 2010, the purpose was to go after the Wall Street banks, but what they did was harm middle class America with these regulations.

So, we’ve felt that impact here in the Dakotas. When I joined the Credit Union Association 10 years ago, we had 100 credit unions across both states. We’re down to 73.After the financial crisis in 2008 and primarily when the regulations hit in 2010, we’ve had more than 200 new regulations that are basically “one size fits all,” which means the big banks can afford the compliance –they have the personnel – while the smaller institutions were just much harder hit.

Technologies such as mobile banking are another challenge. Fortunately, most credit unions continue to offer very sophisticated services, although some of the much smaller credit unions do struggle to keep up in the technology department. But the biggest challenges probably are the myths that credit unions face.

19 Q.

THIS PROTOTYPE OF AN "OPEN YOUR EYES TO A CREDIT UNION" AD GIVES A SENSE OF THE CREDIT UNION NATIONAL ASSOCIATION'S UPCOMING AWARENESS CAMPAIGN.

A. Q.

WHAT MYTHS ARE THOSE?

That credit unions are too small, that my money’s not safe, that I can’t join and that they probably don’t have the technology that I need.

So the Credit Union National Association is launching a campaign aimed at dispelling all four of those points.

Q.

A.

YOU’RE ON A CREDIT UNION NATIONAL ASSOCIATION COMMITTEE THAT’S HELPING TO DEVELOP THE CAMPAIGN. WHAT’S GOING ON?

At our national association, this has been an issue for years and years – the problem of boosting awareness about credit unions.

So, that’s the origin of our upcoming national campaign. It’s called Open Your Eyes to a Credit Union, and it really debunks those myths about credit unions that I just mentioned.

Moreover, our CEO, Jim Nussle, did this right. He did three years of research involving focus groups, polling and going around the country.

That means the whole campaign is based on research. Specifically, our research found that while most people know what credit unions are, they don’t think they can join. Likewise, they think their local credit unions are too small, can’t provide mobile services and so on.

It’s those myths again. And the fact that the campaign will counter those myths is based on our research, which showed us how widespread the myths are.

Q.

WHAT’S THE STATUS OF CREDIT UNIONS IN THE DAKOTAS?

A.In North Dakota, credit unions have about 10 percent of the deposits. We actually are a state that does well in credit union marketplace, because the national average is 6 percent of people in the country are doing business with a credit union. In South Dakota, it’s even less, because South Dakota is a big banking state. So, credit unions there have about 1 percent of the market share in deposits. Clearly, we’re not taking over the world, but we do think we’re a financial alternative to traditional banking. Moreover, banks and credit unions have co-existed for 100 years in both states. A lot of our members also use a bank, and we may not even be their primary financial institution.

But we do think that we offer a choice, and we think consumers want that choice.

Q.

WHAT’S NEXT FOR THE CAMPAIGN?

A.We are raising $100 million across the country. Credit unions are pledging money on a annual basis for three years.

And it’s being done on a regional basis, so our commitment from the Dakotas is going to be a little over a million dollars. We’re almost to that range right now. Then, the campaign is going to be primarily targeting younger people –millenials. It’s going to be a digital campaign, so little ads are going to be popping up all over the place. We anticipate this to hit our markets in February. And there will be a website where everybody can go to, called YourMoneyFurther. com. It’s still under construction, but before long, people who use it will be able to find a credit union that they’ll be eligible to join.

20 TWITTER.COM/PRAIRIEBIZ FACEBOOK.COM/PRAIRIEBUSINESS PRAIRIEBUSINESSMAGAZINE.COM BUSINESSINSIDER

FEBRUARY 2019 VOL 20 ISSUE 2

JEFF OLSON, PRESIDENT AND CEO OF THE CREDIT UNION ASSOCIATION OF THE DAKOTAS, IS INTERVIEWED BY MIKE LAWSON, FOUNDER OF CU BROADCAST (AN INDUSTRY NEWS SOURCE).

IMAGE: CUAD

21 Elbert Holstad Group joins D.A. Davidson Wealth Management Serving Your Local Community 444 Sheyenne St., Suite 305 | West Fargo, ND | (701) 929-2775 dadavidson.com | D.A. Davidson & Co. member SIPC elbertholstadgroup.com

A diversion

By Tom Dennis

In this Q&A, planners discuss how engineers are meeting key challenges of one of America’s most significant public-works projects: The F-M flood diversion

Editor’s note: In December, the Minnesota Department of Natural Resources granted a conditional permit for the Fargo-Moorhead flood diversion project. Though the project still faces legal challenges from upstream opponents, the permit represents a milestone that significantly boosts the odds of the project being completed.

Engineering firm AE2S is a member of the Project Management Consultant team, which is responsible for the diversion project’s overall direction and management. Eric Dodds, an engineer and AE2S program manager, and Rocky Schneider, an AE2S public affairs strategist, work almost full-time on the project; and in January, they sat down in Fargo with Prairie Business to answer questions about key aspects of the diversion.

A. Q.

TELL US ABOUT THE PUBLIC-PRIVATE PARTNERSHIP, OR P3.

Eric Dodds: The project is being delivered by what we call a split delivery. The embankment or dam on the south end will be delivered by the Army Corps of Engineers. Meanwhile, the channel and all of the bridge crossings will be delivered using this P3 model. So, the P3 developer ultimately will be responsible for finalizing the design, submitting their designs to the Diversion Authority for review, then building the channel and operating it for 30 years.

They also will be responsible for bringing some financing.

Q. THE PRIVATE PARTNER WILL OPERATE, BUT THE DIVERSION AUTHORITY WILL OWN, THE CHANNEL? A.

Dodds: Right. The Diversion Authority basically is hiring this private developer/private partner to finish the design and then to build, operate and maintain the channel for 30 years. The private party will get paid back over those 30 years.

22 TWITTER.COM/PRAIRIEBIZ FACEBOOK.COM/PRAIRIEBUSINESS PRAIRIEBUSINESSMAGAZINE.COM ARCHITECTURE&ENGINEERING FEBRUARY 2019 VOL 20 ISSUE 2

GATES SUCH AS THE ONE SHOWN IN THIS RENDERING WILL CONTROL THE FLOW THROUGH FARGO AND THE FARGO-MOORHEAD DIVERSION CHANNEL. IMAGE: F-M DIVERSION AUTHORITY

THE BANKS OF THE FARGO-MOORHEAD DIVERSION CHANNEL WILL BE DESIGNED TO ACCOMMODATE BIKE TRAILS AND OTHER RECREATIONAL AMENITIES, AS THIS ARTIST'S RENDERING SHOWS. IMAGE: F-M DIVERSION AUTHORITY

immersion

Q.

A.

WHAT ARE THE ADVANTAGES OF A P3?

Dodds: In the traditional process, the channel would be split into about 30 segments, each of which would be built by the lowest bidder.

In this situation, a P3 is well-suited because the project can be completed in full, which means it’ll be functional earlier than it otherwise would be.

Plus, we have long-term sales tax revenue to call upon, which means while we don’t have the money today, we will have it long-term and can tap into it over time.

In other words, we get the facility soon, and we pay it back over a long duration. It’s a multi-generational funding approach.

Rocky Schneider: Another important thing is that the Corps has never done a P3 project. This will be a first for the Corps.

So when you look at a huge project such as this one in a relatively small metro area, you might ask, how did we get moved up to where we got the approvals and the funding commitments that we needed?

One reason is that we have a really good congressional delegation, and another is that we latched onto this P3.

America has a backlog of infrastructure projects, and the Corps has been hearing from Congress that we need new ways of doing these things. So the Corps is committed to the P3, too. It’s their way of showing Congress that they are trying something new.

That has really moved us to the top of the pack in Washington as well.

Dodds: And one other really important point is that if you hire a firm only to design and build, you could wind up with poor design and shoddy construction. But this way, the firm also will have to operate and maintain the project for 30 years. Plus, they’ll equity partners who’ll want to get paid back. That means their incentive is to build it correctly, so that it doesn’t fall apart, it’s easier to maintain, and it’s reliable over that 30-year period.

23

Q.

A.

HAS THE P3 PARTNER BEEN SELECTED?

Dodds: Not yet. Assuming legal challenges to the diversion get resolved, the expectation is that the P3 developer – likely, a team consisting of several companies – will be selected in the winter of 2019-20.

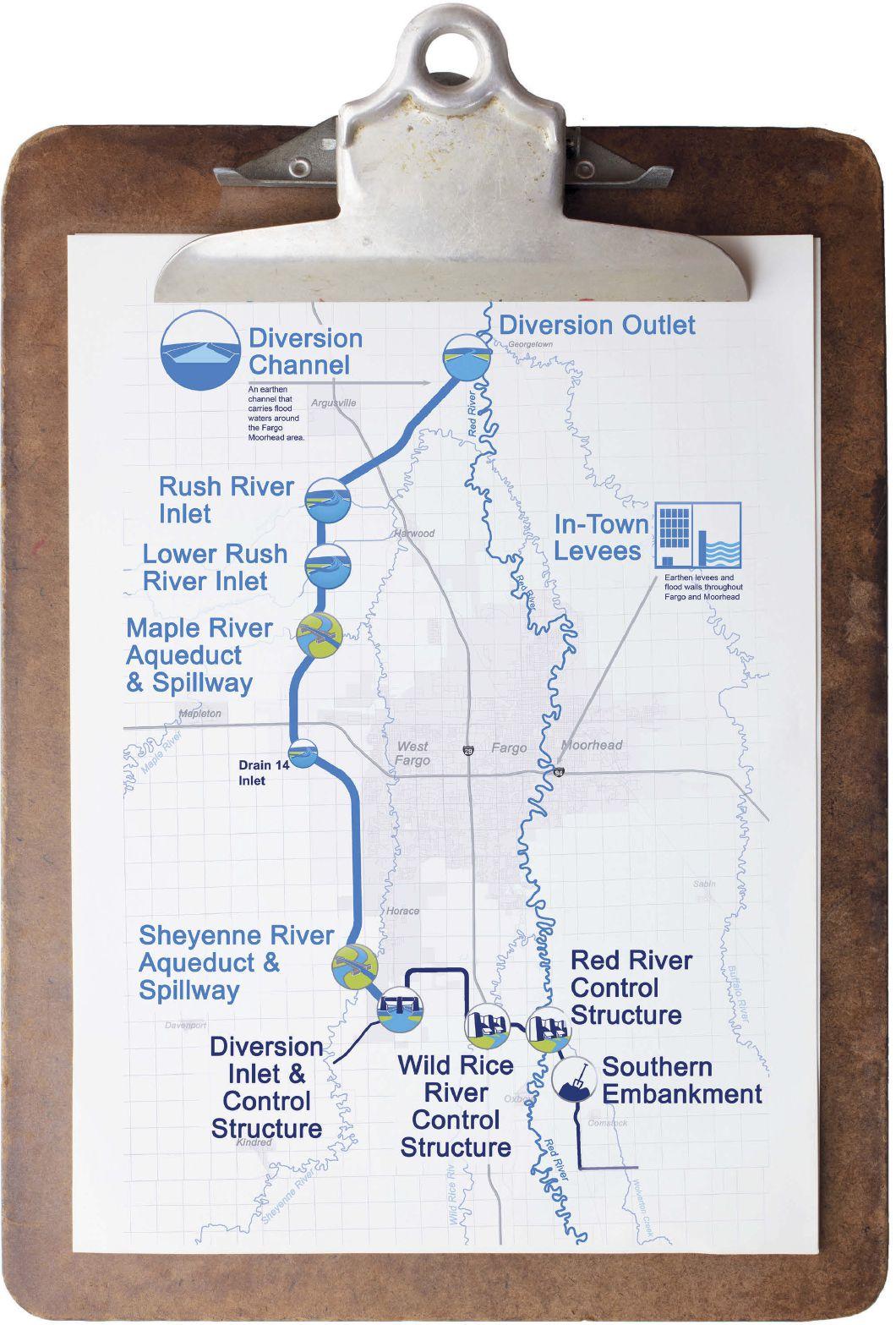

LET’S MOVE ON TO THE DIVERSION. HOW WILL IT WORK?

Dodds: First off, whenever we talk to a new group about the project, we start by talking about the need. We remind people that we have a flood history, which may seem obvious to those of us who have been here for awhile; but frankly, there are new people who move into FargoMoorhead every day, and a lot of them don’t know the history. That’s why I always go back and show pictures from 1997, 2009 and 2011, those big flood events. We’re not sensationalizing, or trying to scare people; we’re just recognizing that hey, there’s a real need here. So we always start with that.

Now, about the operation:

The embankment on the south end includes three different control structures: one at the Red River, one at the Wild Rice River and one at the diversion inlet.

Those three control structures will all have gates that can move up and down.

Normally, the river gates will be open, and the rivers will just flow through underneath them.

But when the flood waters are coming from the south, at some point there will be risk to the community, so the river gates will start to close. The gates will close to control the flow in town to 37 feet. Anything more than that will be slowed down by the gates; that plus the embankment means water will start being stored upstream. Ultimately, that upstream water will start flowing to the west, where the gate will let a controlled flow go into the diversion channel. Then if the water continues to rise, it will continue to flood the ground and spread out over the upstream areas.

SO, THE EMBANKMENT OR DAM HOLDS THE WATER IN PLACE, WHILE THE GATES LET CONTROLLED FLOWS GO DOWNSTREAM?

Schneider: Right. And remember, when most people think of a dam, they think of Hoover Dam or something similar – a concrete structure holding back a big lake.

But in our case, the upstream area will be dry 99.9 percent of the time. In a hundred-year flood, that area is expected to hold water for only about three weeks.

Also, the embankment will be just that: an earthen embankment, probably about the size of a highway-overpass embankment, with grassy sides and maybe some rip-rap rock in places. It’s not a concrete wall.

Q.

TELL US ABOUT THE CHANNEL. WHAT ARE SOME OF ITS KEY ENGINEERING FEATURES?

Dodds: The project will protect against not only the Red River, but also five of its tributaries – including the Wild Rice River, which I’ve mentioned.

The diversion channel will cross the other four tributaries – the Sheyenne, the Maple, the Lower Rush and the Rush.

And the Sheyenne and Maple rivers are going to have aqueduct channels that will carry them across the top of the channel. Those are two of the more interesting structures along the way.

Q.

HOW WILL THEY WORK?

Dodds: It’s much like an interstate highway bridge in which the local street passes over the top. In this situation, the local street is the Sheyenne or the Maple river, and the diversion channel will be underneath.

Under normal conditions, the Sheyenne will meander along its way, and then it’ll get to this open-air aqueduct or “water bridge” that will carry it across the top of the diversion channel. Then it’ll continue to meander on its way after that. Same thing with the Maple River.

Under flood conditions, there will be limits on how much water can flow into the metro or protected area across that water bridge. So as the water gets high, it will overflow into a spillway that will take it into the diversion channel below.

Q.

WHAT ABOUT THE LOWER RUSH AND RUSH CROSSINGS?

Dodds: Currently, those are very straightenedout and channelized rivers. Most people probably wouldn’t even call them rivers.

Right now, they empty into the Sheyenne River up near Harwood, N.D. With this project, they’ll dump directly into the the diversion channel, so all of the flow from the Rush and the Lower Rush will go into the channel.

Q. HOW ABOUT HIGHWAY CROSSINGS?

A. A. A. A.

Dodds: They’ll basically be longer-than-usual bridges, as the distance from edge to edge on the channel is roughly 1,600 feet.

24 TWITTER.COM/PRAIRIEBIZ FACEBOOK.COM/PRAIRIEBUSINESS PRAIRIEBUSINESSMAGAZINE.COM FEBRUARY 2019 VOL 20 ISSUE 2 ARCHITECTURE&ENGINEERING

A.

A. Q.

Q.

Q. GRAND FORKS HAS ITS GREENWAY AS A RESULT OF THE FLOOD-PROTECTION SYSTEM. WILL THE DIVERSION HAVE ANYTHING SIMILAR?

Schneider: That’s an exciting side of the engineering. For example, along the 30 miles of channel, there will be huge piles of the dirt that will have been excavated. These berms won’t really serve a flood protection purpose; they’ll just be piles of dirt. So we can make them into, say, a savannah area with trails meandering through, and we’ll be requiring them to be formatted to accommodate a major trail network, with trailheads and picnic tables and the like.

If you think about it, 30 miles of diversion channel with trails along the whole length – that kind of trail network doesn’t exist anywhere else in North Dakota.

25 001768380r1 subscribe To Our free Digital Edition Visit www.prairiebusinessmagazine.com or text: PBMAG to 72727 Like and follow us Tom

Editor,

Business tdennis@prairiebusinessmagazine.com 701-780-1276 A.

Dennis

Prairie

North Dakota banks: Giving back as economic development

By Tom Regan

BISMARCK, N.D. – Banks are known for supporting the communities they serve. When banks put their own resources behind community projects and donate funds to local charities, they do it for good reason.

From a marketing standpoint, the actions get the bank’s name out there, shed a positive light on the institution and position it as promoting the general good.

But beyond the public relations considerations, the philosophy of “giving back” seems to be ingrained in the banking profession itself, passed down through generations and corporate culture.

“I was raised to value the importance of giving back to my community,” says Craig Larson, CEO of Starion Bank of Bismarck, whose parents, Frank and JoAndrea Larson, had bought the

bank’s forerunner – First National Bank of Oakes (N.D.) – in 1969.

Fourth-generation banker Christie Obenauer, CEO and president of Union State Bank of Hazen, N.D., echoes Larson’s sentiment. “The importance of generosity and giving back with a humble heart was definitely passed along to me by my family,” she said Prairie Business asked North Dakota bankers to comment on their support of significant community projects, past or present, as well as identify a current, favorite project.

ALERUS

The Alerus Center, a $79 million indoor arena and convention center which opened in 2001, became a reality in Grand Forks after the

devastating flood and fire of 1997. Alerus, the financial institution, lost its own downtown headquarters in the disaster.

The bank bought the naming rights for the center, paying $150,000 a year for 20 years, for a total of $3 million.

“When the opportunity to invest in the Alerus Center became available, we saw it as a chance to double-down on our commitment to the community and the region,” says Chris Wolf, Alerus’ northern valley market president.

Alerus was one of the first major sponsors of the Grand Forks Wild Hog Marathon, which will be celebrating its ninth year in 2019. In addition to supporting the race event financially, Alerus employees traditionally staff the marathon registration table for the entire day.

26 TWITTER.COM/PRAIRIEBIZ FACEBOOK.COM/PRAIRIEBUSINESS

BANKING&FINANCE FEBRUARY 2019 VOL 20 ISSUE 2

PRAIRIEBUSINESSMAGAZINE.COM

“Any community project that affects the greater good is worthy of our consideration and support. If our community benefits, the bank benefits.”

BANK FOUNDED CEO BRANCHESDEPOSITS ASSETS Alerus Randy Newman 1933 18 $1.8B$2.2B Choice Brian L. Johnson 2001 22 $1.86B$2.13B First International Stephen L. Stenehjem 1910 27 $2.5B$2.8B Starion Craig Larson 1969 15 $1.09B$1.3B Union State Christie H. Obenauer 1908 4 $128M$142M MORE ON: Page 28

– Christie Obenauer, CEO and president, Union State Bank, Hazen, N.D.

STARION BANK STARION BANK

CRAIG LARSON, STARION BANK CEO AND BOARD CHAIRMAN, SPEAKS AT THE GROUNDBREAKING FOR THE STARION SPORTS COMPLEX IN MANDAN, N.D., ON APRIL 20, 2016. THE FACILITY - WHICH INCLUDES A TWO-RINK HOCKEY ARENA, GYMNASTICS BUILDING AND NEW TRACK AND FOOTBALL FIELD, AND FOR WHICH STARION BOUGHT THE NAMING RIGHTS - OPENED IN 2017. INSET PHOTO: HERE’S THE ENTRANCE TO THE STARION SPORTS COMPLEX, A $22 MILLION FACILITY IN MANDAN, N.D., THAT OPENED IN 2017. IMAGES: STARION BANK

UNION STATE BANK UNION STATE BANK

CHOICE BANK CHOICE BANK

THE SAKAKAWEA MEDICAL CENTER, A 25-BED, 56,000-SQUARE-FOOT HOSPITAL, OPENED IN HAZEN, N.D., IN 2017 WITH THE HELP OF MULTIPLE DONORS, INCLUDING UNION STATE BANK. IMAGE: UNION STATE BANK

ALERUS ALERUS

THANKS IN PART TO ITS “GO HAWAIIAN FOR HOSPICE” EFFORTS, CHOICE BANK HAS RAISED CLOSE TO $1 MILLION FOR HOSPICE OVER THE PAST SIX YEARS. IMAGE: CHOICE BANK

FIRST INTERNATIONAL BANK & TRUST FIRST INTERNATIONAL BANK & TRUST

A FEATURED ATTRACTION AT THE ALERUS CENTER IN GRAND FORKS, N.D., IS UNIVERSITY OF NORTH DAKOTA FOOTBALL, SHOWN HERE. ALERUS BOUGHT THE NAMING RIGHTS TO THE CENTER, A $79 MILLION INDOOR ARENA AND CONVENTION CENTER THAT OPENED IN 2001. IMAGE: RUSSELL HONS PHOTOGRAPHY AND ALERUS

AT A COST OF ABOUT $10 MILLION, FIRST INTERNATIONAL BANK & TRUST RENOVATED THIS CITY BLOCK IN DOWNTOWN WATFORD CITY, N.D. BESIDES THE BANK’S NEW HEADQUARTERS, THE BLOCK (WHICH WAS COMPLETED IN 2006) ALSO FEATURES A RESTAURANT, A MOVIE THEATER AND AN HISTORICAL GALLERY. IMAGE: FIRST INTERNATIONAL BANK & TRUST

27

CONTINUED FROM: Page 26

CHOICE BANK

In 2010, Choice Bank signed on as a 25-year naming sponsor, with a $2.75 million commitment, for the construction of a 162,000-square-foot health and fitness center in Grand Forks.

The $23.4 million center, operated by the Grand Forks Park District, includes sports courts, fitness machines, an aquatic complex and 3,500 square feet of group exercise studio space.

Since Choice Health and Fitness opened its doors in 2012, fundraising campaigns also have built Sunshine Hospitality Home – a low- or nocost hospitality house for patients and families from around the region – and a new emergency shelter for the Community Violence Intervention Center, among other significant projects. “We knew that, if successful, the fitness center would help inspire future efforts and projects for the

Grand Forks community,” says Choice CEO Brian Johnson.

Choice Bank also supports hospice care centers in Fargo, Grand Forks, Bismarck and Dickinson with “Go Hawaiian for Hospice!” Now in its seventh year, “Go Hawaiian!” invites the general public every summer to a luau-style feast. It has raised nearly $1 million through sponsorships, free-will donations and the enthusiasm of bank employees.

FIRST INTERNATIONAL BANK & TRUST

First International Bank & Trust and its owners, the Stenehjem family, have invested in the Watford City, N.D., community in many ways. A hallmark project, at a cost of approximately $10 million, was the renovation of an entire city block that

included new bank headquarters, a restaurant, a movie theater and an historical gallery.

The bank started planning the project in 1999 and broke ground in 2004. Shortly after completion in 2006, oil started picking up in the Bakken, and Watford City experienced a boom.

“People asked me if I had a crystal ball. Really, I was just building on faith in our community, and being optimistic, maybe overly optimistic,” says Stephen Stenehjem, CEO and chairman.

With an April application deadline, First International will be conducting its fifth annual round of their Live First Community Grants, a program that awards $5,000 to one charity and $1,000 grants to three runners-up. Due to an overwhelming response in 2018, the bank provided additional grants for a total of $10,000.

MORE ON: Page 30

28 TWITTER.COM/PRAIRIEBIZ FACEBOOK.COM/PRAIRIEBUSINESS PRAIRIEBUSINESSMAGAZINE.COM

ISSUE

BANKING&FINANCE FEBRUARY 2019 VOL 20

2

IN 2018, HEAVY METAL BAND METALLICA DREW NEARLY 17,000 FANS TO THE ALERUS CENTER, AN ARENA AND CONVENTION CENTER IN GRAND FORKS, N.D. FINANCIAL INSTITUTION ALERUS BOUGHT THE NAMING RIGHTS TO THE FACILITY, WHICH OPENED IN 2001. IMAGE: ALERUS

29

CONTINUED FROM: Page 28

STARION BANK

“In 2015, Mandan Parks and Recreation approached us about the sports complex,” recalls Craig Larson. “As soon as we heard the plans, we knew it was going to be a game-changer.”

Starion bought the 20-year naming rights for $750,000, and the official name of the 84,000-square-foot facility became the Starion Sports Complex. The $22 million project, which opened in September 2017, includes a two-rink hockey arena, a gymnastics facility, an outdoor track and a football field.

“Since the opening of the complex, we’ve seen great growth in northwest Mandan with businesses and housing,” says Larson.

In honor the bank’s 50th anniversary in 2019, each one of Starion’s 247 employees will be

granted two days of volunteer time off. In addition, each employee will be able to identify a charity or cause to get a $500 donation from the bank.

UNION STATE BANK

Christie Obenauer, CEO and president of Hazen’s Union State Bank, points to the power of collaboration in building a new critical access hospital in Mercer County, N.D. The 25-bed Sakakawea Medical Center opened in 2017.

“Through the collaborative efforts of many partners, including our community banks, the Bank of North Dakota, the U.S. Department of Agriculture and the unwavering support of our local community, we built a new facility that will

take care of our community long into the future,” says Obenauer.

In addition to being at the planning table, the bank donated $250,000 to the project.

When a Hazen community health-needs assessment demonstrated a need for daycare, collaboration was key once again. Eight local businesses joined forces to form an innovative model for daycare: a cooperative.

Union State contributed $35,000 to the Energy Capital Child Care Cooperative, which also opened in 2107.

Tom Regan Freelance writer Bismarck tregan@bis.midco.net

Tom Regan Freelance writer Bismarck tregan@bis.midco.net

30 TWITTER.COM/PRAIRIEBIZ FACEBOOK.COM/PRAIRIEBUSINESS PRAIRIEBUSINESSMAGAZINE.COM BANKING&FINANCE FEBRUARY 2019 VOL 20 ISSUE 2

The way forward after Wayfair

By Tom Dennis

Thanks to the Supreme Court’s historic ruling, businesses must review their sales-tax practices, accountants say

GRAND FORKS, N.D. – Prairie Business readers who already sweat at the word “Wayfair” can turn the page.

Everyone else should keep reading.

That’s because Wayfair vs. South Dakota, which the U.S. Supreme Court decided last year, dramatically altered the tax environment in a way that requires corporate action.

But because the change came through a court case, it got less notice than it would have if Congress had passed and the president had signed a tax bill.

That’s a shame, because Wayfair deserves all the attention it can get. Here’s the bottom line: Wayfair substantially changed the sales-tax rules of interstate commerce. So, if a company sells online to customers in other states, that

company must start considering Wayfair in its billing practices. And the penalties for failing to do so could be steep.

Companies in Minnesota and the Dakotas are no exception, said accountants consulted by Prairie Business. Some quick background on Wayfair can help explain why.

FROM QUILL TO WAYFAIR

In Quill Corp. vs. North Dakota, the U.S. Supreme Court’s earlier decision in 1992, the court ruled that only those companies with a physical presence in a state could be required to collect sales tax.

As Wikipedia notes, “the decision effectively allowed internet-driven e-commerce to be run tax-free in the United States.”

Thanks to Wayfair, a sheriff now is on scene to police that Wild West environment.

Sensing that a court majority had turned against Quill, South Dakota passed a law meant to challenge the 1992 ruling. The new law required out-of-state companies (such as Wayfair and Overstock.com) with more than 200 transactions in South Dakota or sales in the state of over $100,000 to collect sales tax.

The strategy paid off. In Wayfair vs. South Dakota, the Supreme Court overruled Quill and held that states could, in fact, routinely require out-of-state retailers to collect sales tax.

States now have started to do so. And companies must, by law, comply.

31

Page 32 TAXES PB

MORE ON:

CONTINUED FROM: Page 31

STATE BY STATE

But complying is easier said than done. That’s because in the absence of federal legislation, companies must track the tax laws in all 50 states, especially the 45 states that levy a sales tax.

“There are a number of online businesses such as Amazon that already were collecting sales taxes, so Wayfair didn’t really change things for them,” said Randy Heller, an accountant and partner at Widmer Roel in Fargo, N.D.

“And there are other businesses that don’t have any out-of-state sales, so they’re saying, ‘This doesn’t affect me.’”

But virtually all businesses in between should at least take stock. And their first step should be

determining whether their online sales meet the thresholds such as South Dakota’s, which other states rapidly are establishing, too.

At tinyurl.com/EideBaillyChart, accounting firm Eide Bailly tracks the changes on a chart. “We try to update it as best we can,” said David Casper, a Fargo accountant who is Eide Bailly’s manager in state and local taxation.

“That’s where I would start. You can get all of the beginning information there to say, ‘OK, I need to worry about these states.’”

South Dakota’s thresholds have been adopted by many states – but not all. Pennsylvania, for example, requires out-of-state companies to collect sales tax once their sales reach only

$10,000, while in Massachusetts, the threshold is $500,000.

Note well, though, the other threshold in many states: the number of transactions. Because while a North Dakota jelly-maker won’t hit South Dakota’s $100,000 threshold by selling 300 jars in Sioux Falls, he or she will cross the “more than 200 transactions” threshold – and be required to collect South Dakota sales tax.

Once retailers have determined that they meet a state’s threshold, they’re on track to contact that state, employ software and/or take other steps to start collecting sales tax.

But first, they should do two things.

32 TWITTER.COM/PRAIRIEBIZ FACEBOOK.COM/PRAIRIEBUSINESS PRAIRIEBUSINESSMAGAZINE.COM taxes FEBRUARY 2019 VOL 20 ISSUE 2

THIS SCREENSHOT SHOWS PART OF THE CHART THAT EIDE BAILLY, A FARGO-BASED ACCOUNTING FIRM, HAS PREPARED TO HELP COMPANIES NAVIGATE THEIR NEW SALES-TAX OBLIGATIONS IN THE WAKE OF THE SUPREME COURT'S WAYFAIR DECISION. THE FULL CHART IS AVAILABLE AT TINYURL.COM/EIDEBAILLYCHART.

VOLUNTARY DISCLOSURE

“Before our North Dakota merchant goes to register in another state, they should stop and determine whether they may have created a physical presence there over the years,” Casper said.

In other words, the company should find out whether it owes back taxes under the old Quill rules.

Understand, “physical presence” isn’t limited to buildings. Making sales at a trade show in the state, or storing inventory in a warehouse there, could have qualified as “physical presence” under Quill.

And if those or similar actions are in your company’s past, then you need to contact that state via a tax professional, “and the key words to use are ‘voluntary disclosure program,’” Casper said.

Your disclosure will generate goodwill and may lead to some penalties and interest being forgiven.

But why bother?

Because when you as a company register to

pay sales tax under Wayfair, you’ll be asked by that state about your past actions. “Then if they determine you had physical presence, they’ll be asking you to file some returns,” Casper said.

“And whatever breaks you would have enjoyed through their Voluntary Disclosure Program will not be made available. We have to be really clear about that one, because it’s unfortunate when a company registers and then starts getting notices about taxes due.”

INCOME-TAX IMPLICATIONS

The second order of business is to be mindful of income-tax laws in the new state. Because one of Wayfair’s lesser-known twists is that it might affect some retailers’ income-tax filings, Heller of Widmer Roel said.

“Suppose I’m in North Dakota and selling online into Minnesota,” Heller said.

“North Dakota taxes all of my income, regardless of what state it’s generated in. But if 10 percent of my sales went to Minnesota, then Minnesota may tax me on 10 percent of my income.”

In such a case, North Dakota likely would give a

credit by taxing the individual on only 90 percent of his or her income. But even so, the 10 percent that’s taxed by Minnesota would be meaningful because Minnesota’s rates tend to be higher than North Dakota’s.

“So, besides the administrative burden of paying in two states instead of one, you may wind up paying more,” Heller said.

“The point is, Wayfair has opened up a lot of different avenues and different scenarios for taxation, and it’s something that businesses are going to have to monitor on a continuous basis.” Casper agreed. Business that must collect sales tax in other states can find software solutions, and accounting firms also stand ready to help. But the bottom line is that businesses must pay attention, Casper said, because Wayfair marks a true sea-change in sales-tax law.

Tom Dennis Editor, Prairie Business tdennis@prairiebusinessmagazine.com

701-780-1276

33

PRAIRIEPEOPLE

AE2S names Meyer as CEO

GRAND FORKS, N.D. AE2S has announced its new CEO, the company reports.

Grant Meyer has worked for AE2S for more than 20 years and is credited with strategic initiatives and growth in his time as business development director and chief development officer, as well as bringing the environmental engineering consulting firm into the Twin Cities and Minnesota market by establishing an office in Maple Grove, Minn. Meyer began his career as an intern in the Grand Forks AE2S office while attending the University of North Dakota. While at UND, he earned his bachelor’s degree in civil engineering and a master’s degree in civil engineering with environmental emphasis.

Over the years, he was promoted to operations manager and regional client program leader. He most recently served as the firm’s chief development officer.

Welder joins Credit Union Association of the Dakotas

BISMARCK, N.D. — The Credit Union Association of the Dakotas has hired Lori Welder as the new director of communications in the Bismarck office.

Weider brings more than 20 years of experience in marketing and design to her new position, the association reports. Weider received an associate’s degree in commercial art from Bismarck State College and completed her bachelor’s degree in graphic communications and marketing at Moorhead State University (now Minnesota State University Moorhead). She is a graduate of the Women’s Leadership Program of Bismarck- Mandan, is an active volunteer for Meals on Wheels and United Way and serves on the advisory board for the Bismarck State College Computer and Technology program.

West Plains Engineering announces leadership changes

SIOUX FALLS, S.D. West Plains Engineering recently announced two leadership changes. Marty Christensen has assumed the role of Building Services Division manager, while Mike Fisher has been promoted to office manager in Sioux Falls.

Christensen steps into his new role with 24 years of experience at West Plains. He joined West Plains as a mechanical designer in 1994 and has served in leadership roles as a principal, Sioux Falls office manager and board member.

Fisher joined the Sioux Falls office in 2013 as the Electrical Department head and has nearly 30 years of experience as a consulting engineer. Over the past five years, he has been a leader in project management and business development in Sioux Falls.

34 TWITTER.COM/PRAIRIEBIZ FACEBOOK.COM/PRAIRIEBUSINESS PRAIRIEBUSINESSMAGAZINE.COM FEBRUARY 2019 VOL 20 ISSUE 2 Prairiepeople

Grant Meyer

Marty Christensen

Mike Fisher

Lori Welder

New NFIB North Dakota state director named

BISMARCK, N.D. — The National Federation of Independent Businesses announced that Alison Ritter, senior public relations specialist at Odney, will serve as the new state director for North Dakota.

Founded in 1985, Odney is a public-relations and public-affairs communications agency. Ritter will work directly with the public affairs team of Shane Goettle, Don Larson, and Lacee Bjork-Anderson to provide government relations, media and issue management to represent and advocate on behalf of small businesses.

Before working at Odney, Ritter served as the public information officer for the North Dakota Department of Mineral Resources. She also spent nearly a decade working in television news.

Farahmand promoted at BCBSND

FARGO, N.D. — Tracy Farahmand has been promoted to manager of contract and product services at Blue Cross Blue Shield of North Dakota.

Farahmand joined BCBSND in 2013 as a customer service representative. She was promoted to a member advocate role later that year, and in 2015, she was promoted to member advocate specialist. In 2017, she was promoted to team leader of the Call Center before being promoted to her current position.

A native of Riesel, Texas, Farahmand earned a bachelor’s degree in psychology from Tarleton State University in Stephenville, Texas.

Hecht joins SDSU Foundation as report and data analyst

BROOKINGS, S.D. — David Hecht recently joined the South Dakota State University Foundation as the foundation’s report and data analyst.

Hecht earned a bachelor’s degree from Southwest Minnesota State University in business administration and an MBA from the University of South Dakota. His career has focused on data/credit analytics and financial management.

Hecht has worked for banks in Sioux Falls, Brookings, Las Vegas and Mexico City and has also been a small-business owner.

A Brookings native, Hecht and his wife, Jackie, recently returned to Brookings.

Hagen joins Hospice of the Red River Valley

FARGO, N.D. — Hospice of the Red River Valley recently hired Erin Hagen as a development officer. In her role, Hagen will build and maintain relationships with individuals, businesses and organizations that are interested in supporting Hospice of the Red River Valley, the organization reported. Hagen previously was employed by the Alzheimer’s Association Minnesota-North Dakota Chapter as a community engagement manager. She earned a bachelor’s degree from Concordia College in Moorhead, Minn., and lives near Pelican Rapids, Minn.

35

Alison Ritter

David Hecht

Tracy Farahmand

Erin Hagen

Which books on personal finance should be in the library of every Prairie Business reader?

INSIGHTs & INTUITION Q.

The book I’d have to recommend would be “Your Money or Your Life: 9 Steps to Transforming Your Relationship with Money and Achieving Financial Independence” by Vicki Robin and Joe Dominguez.

Many people think that if you save money, you do not get to enjoy life as much. This book talks about how you can still enjoy your life and do the things you want, while saving money.

Given to me by a colleague, “Think and Grow Rich” by Napoleon Hill significantly influenced my definition of financial success both personally and professionally. Based on Hill’s “Law of Success” philosophy, the book identifies money-making secrets from more than 500 affluent people he interviewed.

Included are 13 principles that can help propel you toward success by eliminating your doubt and fear and focusing on your faith and desires. I believe grit and determination start with your mindset, and this book addresses exactly that.

Kayla Kallander Mortgage Loan Originator TCF Home Loans Fargo, ND

36 TWITTER.COM/PRAIRIEBIZ FACEBOOK.COM/PRAIRIEBUSINESS PRAIRIEBUSINESSMAGAZINE.COM INSIGHTs&intuition

Brennen Bergdahl Wealth Advisor Premier Wealth Management Group Grand Forks, N.D.

FEBRUARY 2019 VOL 20 ISSUE 2

“The Total Money Makeover” by Dave Ramsey is a good place to start for your personal finance library. It gives the basics for getting out of debt and building wealth in simple steps.

“The Millionaire Next Door” by Thomas J. Stanley and William D. Danko gives some surprising findings about people who have become millionaires as opposed to people who live like millionaires.

“Rich Dad, Poor Dad” by Robert T. Kiyosaki not only discusses how to manage your own money, but also how to how you can help your kids learn to manage their own money as well.

Rose M. W. Koch

Financial Adviser

Financial Adviser

Sanum Financial Services

Crookston, Minn.

Craig Rottman Financial Advisor

Financial Strategies Group

Fargo, N.D.

Personal finance impacts everyone. Money is often stressful to think about, especially when it seems that you never quite have enough.

I would absolutely recommend reading “All the Money in the World,” by Laura Vanderkam. She does an excellent job challenging you to rethink the relationship between money and happiness.

Not only does the book provide creative ideas on how to get more and spend less, but also it empowers readers to better use what they have. It’s fascinating and thought-provoking!

This is definitely a book to include in your personal library.

I’d recommend “A Woman’s Money: How to Protect and Increase It in the Stock Market” by Catharine Brandt (New York: Parker Publishing Co., 1970).

While written years ago, this book has withstood the test of time. Its principal themes are a regular topic of conversation with clients.

A well-published Christian author, Catharine Brandt found herself widowed at a young age. Faced with a steep learning curve, including decisions about how to protect and increase the capital her husband had left her, she decided to help other women by writing a guide that shows the “modern woman” how to face her financial picture realistically and make the most of it.

Sarah Meusburger

Human Resources Director

Human Resources Director

Banner Associates, Inc.

Brookings, S.D.

37

UnitedVanLines2018NationalMoversStudy

ST. LOUIS, Jan. 2 – Americans are on the move, relocating to western and southern parts of the country. The results of United Van Lines’ 42nd Annual National Movers Study, which tracks customers’ state-to-state migration patterns over the past year, revealed that more residents moved out of New Jersey than any other state in 2018, with 66.8 percent of New Jersey moves being outbound.

+72.6% GROWTH 23 4 MOVES

The study also found that the state with the highest percentage of inbound migration was Vermont (72.6 percent), with 234 total moves.

States in the Mountain West and Pacific West regions, including Oregon, Idaho (62.4 percent), Nevada (61.8 percent), Washington (58.8 percent) and South Dakota (57 percent) continue to increase in popularity for inbound moves.

States ranked from ‘high inbound’ to ‘high outbound,’ 2018:

Total fertility rates by state, 2017:

NOTE: Only Utah and South Dakota have a total fertility rate above replacement (2,100.0).

SOURCE: NCHS, National Vital Statistics System, Natality.

Coincident Economic Activity Indexes for North Dakota, South Dakota and Minnesota

· The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic.

· The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.”

– Federal Reserve Bank of Philadelphia

U.S. RATE IS 1,765.5

· The birthrate in America has been declining, but some places are more fertile than others, according to a new look at federal data that reveals significant variation in fertility rates around the country. Only South Dakota’s and Utah’s fertility rates reached the level needed to sustain the current population. …

· In 2017, the total fertility rate—an estimate of the total number of children a woman will eventually have in her lifetime—was 1,765 births per 1,000 women, well below what is known as the replacement level. …

· States in the Midwest and the Southeast had higher rates of fertility compared with the Northeast or West Coast. A 57 percent difference exists between the highest state rate (South Dakota, 2,227 births) and the lowest (the District of Columbia, 1,421 births).

– The Wall Street Journal, Jan. 10

TWITTER.COM/PRAIRIEBIZ FACEBOOK.COM/PRAIRIEBUSINESS PRAIRIEBUSINESSMAGAZINE.COM BYTHENUMBERs FEBRUARY 2019 VOL 20 ISSUE 2 38

– United Van Lines (UnitedVanLines.com)

62.4% 61.8% 57% 62.4% 58.8% High Inbound Medium Inbound Balanced Medium Outbound High Outbound

Total inbound Total outbound Vermont 72.7 27.4 Oregon 63.8 36.2 Idaho 62.4 37.6 Nevada 61.8 38.2 Arizona 60.2 39.8 South Carolina 59.9 40.1 Washington 58.8 41.2 North Carolina 57 43 South Dakota 57 43 District of Columbia 56.7 43.3 Minnesota 51.4 48.6 North Dakota 48. 7 51.3 Michigan 45 55 Montana 45 55 Iowa 44.5 55.5 Massachusetts 44.3 55.7 Ohio 43.5 56.5 K ansas 41.3 58.7 New York 38.5 61.5 Connecticut 38 62 Illinois 34.1 65.9 New Jersey 33.2 66.8 2,000.0-2,227.5 1,900.0-1,999.9 1,800.0-1,799.9 1,700.0-1,799.9 1,421.0-1,699.9

Coincident Economic Activity Index

Minnesota Coincident Economic Activity Index for North Dakota Coincident Economic Activity Index for South Dakota 140 130 120 110 100 90 80 70 60 50 40 Index 2007 = 100 1980

2010 2015 Shaded areas indicate U.S. recessions

for

19851990199520002005

Source: Federal Reserve Bank of Philadelphia myf.red/g/mEgU

For most commuters near New Town, ND, taking the HWY 23B bypass will save some time, but when Senior Transportation Engineer, Tim Arens, PE, designed this route, he was more concerned with saving lives.

Developed to relieve heavy truck traffic through town, this highway provides a safer route protecting motorists and pedestrians alike.

Tim’s passion is protection; for the residents of New Town and those in every community we serve.

To learn more about the New Town Northeast Truck Reliever Route, visit our website at www.ackerman-estvold.com/projects

39

This is what a good day looks like. ORTHOPEDICS LIKE NOWHERE ELSE Here, our hobbies become our work, and our work becomes our passion. But when joint pain keeps us from doing what we love, it can affect our entire way of life. That’s why we meet these challenges head on — one by one, day after day. So whatever your good day looks like, we’ll find it together. Get started now — call 701-364-HURT or visit EssentiaHealth.org. 32nd Avenue Clinic Orthopedics & Sports Medicine 3000 32nd Avenue S | Fargo Walk-In Clinic Hours: Monday-Friday 8:15-11:30 am and 1:30-4:00 pm

Financial Adviser

Financial Adviser

Human Resources Director

Human Resources Director