Strategic insights to propel continued job growth in Georgia’s top industries

The following industries have experienced the fastest job growth over the last five years in Georgia. This report explores the primary drivers, challenges, and opportunities for growth within each industry.

For an unprecedented 11th consecutive year, Georgia has been named the number one state to do business. The Georgia Chamber’s Executive Insights Survey revealed where only 41% of Georgia executives are optimistic about the U.S. economy, a notable 77% of executives are optimistic or very optimistic about the Georgia economy.1

However, the top issues causing concern for executives, according to the Executive Insights Survey include interest rates, high inflation, supply chain disruptions and an increasing number of regulations, posing challenges for industries to meet or exceed projected growth trends.

Additionally, finding skilled labor remains an issue, and is vital to ensuring Georgia’s sustained economic success. Georgia ranks 30th nationally in terms of educational attainment with only 43.4% of Georgians having an associate’s degree or above.2 Ensuring there is appropriate enrollment in training programs and degree offerings that align with the state’s high-demand occupations is necessary to increase skill and educational attainment.

In 2023, Average earnings for a worker in each of the following industries exceeded $77,000, whereas Georgia’s median income for an individual was $35,753.3 Significant and sustained job growth in these fast-growing industries creates incredible opportunities for Georgians to move into high paying fields with long-term opportunities for career advancement.

The true opportunity lies in ensuring Georgians -- those currently in the workforce and those preparing to enter the workforce -- have a thorough understanding of available job opportunities and how they successfully engage with those industries, especially in high-demand fields. Many job training and degree programs exist, and numerous are at no cost to the student, but increased awareness of those options is needed to ensure individuals enroll and begin their next step in career advancement. Businesses, educational institutions, and non-profits all have a role in collaborating effectively to guide and prepare individuals for potential jobs and more importantly, potential careers.

Georgia’s transportation and warehousing industry has grown significantly in the past five years as the expansion of logistics systems and incoming business projects have increased the need for supply chain and logistics services. The number of jobs in the transportation and warehousing industry in Georgia has grown over 30%, the majority of which offer high-quality career opportunities at a range of skill and education levels, making this industry increasingly important to our state’s economic development strategy.4

Number of Jobs : 305,992 (2023)

Historic Change in Jobs : 70,630

Historic Job Growth : 30%

Average Earnings Per Worker : $77,486

Gross Regional Product : $42.32 billion

Transportation and

Warehousing

85% of the world’s top third-party logistics companies operate in Georgia, driven by the substantial amount of products and materials moving through the state.5 With one of the most extensive rail systems in the Southeast, the fourth busiest container port in the United States, 900 million square feet of warehousing space, more than 96,000 supply chain professionals, and more than 400,000 warehouse professionals, Georgia maintains the logistics network needed to ensure companies can operate smoothly and efficiently. 6

Georgia has a much higher supply of jobs in this industry when compared to other states, indicating a talent hotspot and the presence of robust workforce pipelines. Earnings are slightly above the national average, and the number of jobs is expected to grow another 17% in the next 5 years.7

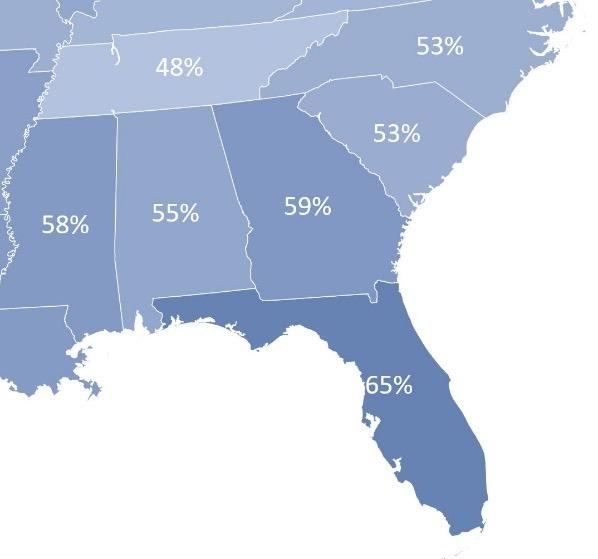

Compared to neighboring Southeastern states, Georgia is expected to have higher job growth in the industry, supports higher wages, and host a great supply of talent. Florida, however, is our state’s biggest regional competitor by number of industry jobs. 8

Continuing to ensure that Georgia maintains talent pipelines by supporting opportunities for attaining skills and certifications such as CDL licenses, logistics and management, as well as maintaining and growing partnerships between education and industry will be critical to realizing the projected future success in this sector.

Healthcare and social assistance is Georgia’s largest industry as measured by number of jobs, excluding government, and is Georgia’s second fastest growing industry. By some estimates, this industry is projected to add as many as 140,000 jobs by 2032. 9 This industry encompasses not only our healthcare providers, but all necessary support occupations as well. Growing talent pipelines and on-ramps continues to be a challenge but is necessary to ensure all Georgians have access to the health care they need to live, work and play in Georgia.

Number of Industry Jobs: 575,895

Historic Change in Jobs: 65,072 Jobs

Historic Job Growth: 13%

Average Earnings Per Worker: $77,977

Industry Gross Regional Product: $53.78 billion

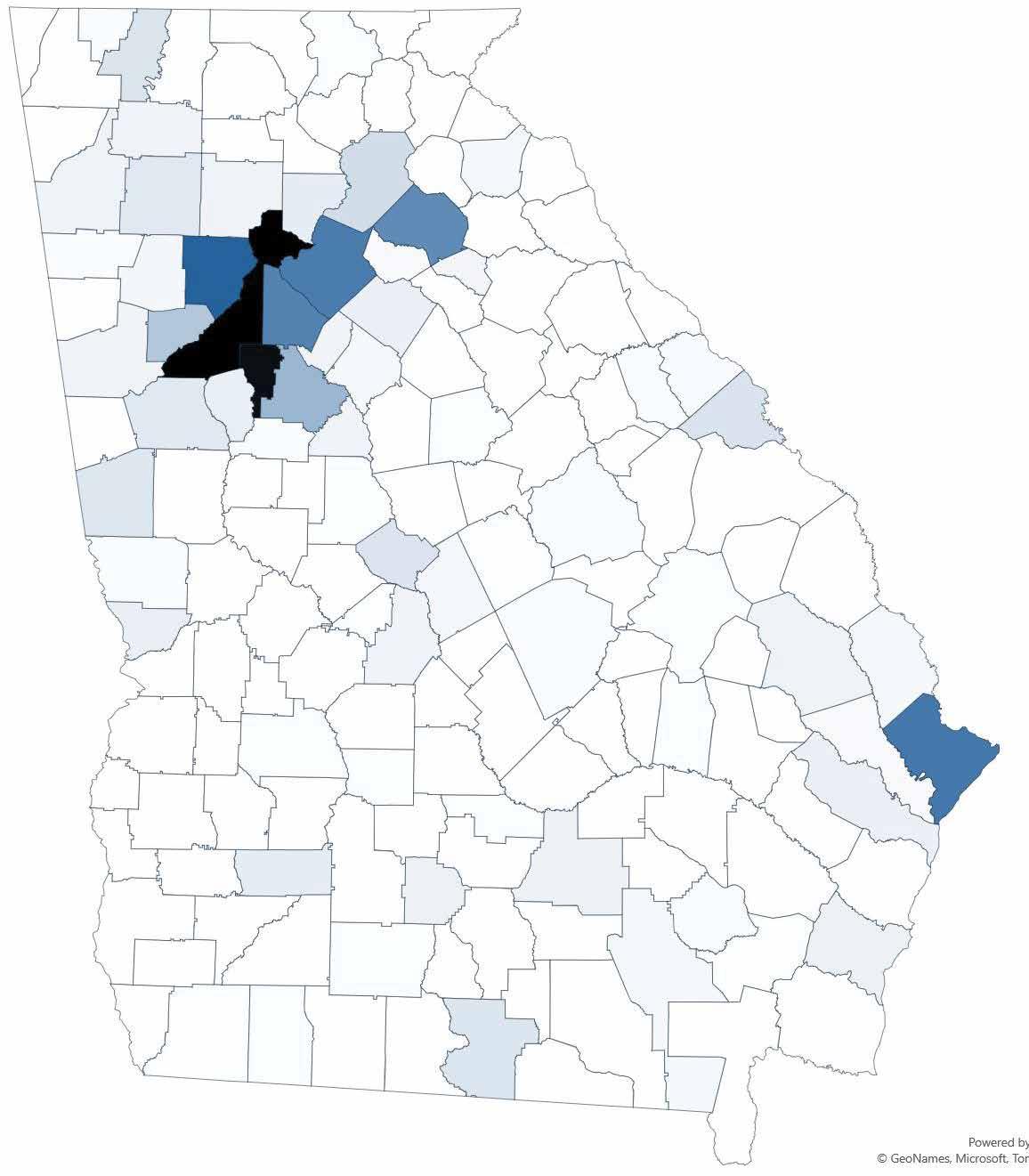

Healthcare

Despite strong historical and future projected growth in Georgia’s healthcare industry, Georgia faces one of the greatest healthcare worker talent gaps in the nation. Georgia has a greater demand for healthcare workers than comparable regions, but also a lower supply. 10 Specifically, the nurse shortage in Georgia is one of the worst in the nation. At only seven nurses per 1,000 people, Georgia falls into the bottom ten of all states.11

This underscores the necessity to expand talent pipelines in this industry. Jobs will continue to grow, especially for practitioner occupations such as registered nurses and nurse practitioners, but support occupations such as physicians’ assistants and medical record keepers will be crucial as well. This is driven by overall population growing needing services in the healthcare sector and the needs in Georgia are more acute since the fastest population group in Georgia is those individuals 65 years and older who often require more healthcare services.

The industry continues to see an exodus of talent, stemming from multiple issues including burnout and fatigue among current workers. A compounding problem is the shortage of faculty and staff at training institutions for high-demand positions, highlighting the need to increase training slots in order to expand the pipeline of incoming talent. In Georgia, this is most acute among nursing professionals. Georgia employs only seven nurses per 1,000 people as of 2022. With most neighboring

states sport higher rates of nursing distribution at nine to ten nurses per 1,000 people. Some states, such as Alabama, are even predicting a nursing excess by 2030. 12

At the doctorate level, however, Georgia retains a higher share of medical residents than most Southeastern neighbors and the nation as a whole. 59% of medical residents who complete residency in Georgia remain to practice in-state, slightly over the national rate of 57%. 13 Although Georgia’s nursing distributions are low, this is a crucial indicator that Georgia maintains a climate that offers competitive opportunities for high-skilled healthcare professionals. Georgia’s most immediate healthcare and social assistance talent opportunity will be filling nursing and support staff positions, which are critical to the full operation of our healthcare systems.

Share of Medical Residents Remaining In-State to Practice

Professional, Scientific, and Technical Services is Georgia’s sixth largest industry and third fastest growing industry. Professional, scientific and technical services encompass a range of occupations including legal services, engineering and architecture, scientific research, and computer and information technology related services.14 This industry drives innovation and research in the state and serves as a good indicator of Georgia’s economic dynamism and climate of innovation.

Number

Historic

Industry Gross Regional Product: $59.86 billion

Software Developers | 6.5% of the industry | +37% growth Management Analysis | 5.3% of the industry | +25% growth

General and Operations Managers | 3.5% of the industry | +29% growth

Market Research Analysts and Marketing Specialists | 2.4% of

Jobs in this industry have average annual incomes over $100,000, providing high wage opportunities in a range of occupations. 15 As Atlanta expands as a tech hub, software development occupations are expected to grow significantly, with managerial or strategy occupations following. Although many of these jobs require a bachelor’s degree, this industry is particularly open to career switching, as well as more skills-based hiring models among technology and software development occupations, which opens new opportunities for Georgians looking to enter the field. 16 Investments in cybersecurity and related industries in Augusta and Columbus continue to bring tech industry growth to communities across the state.

Georgia is home to four R1 public and private research institutions, which contribute significantly to an advanced-skill workforce and Research & Development(R&D) across the state. 17 Georgia ranks 14th nationally in projected growth of high-tech employment by 2030 18 , and 11th nationally for the number of STEM doctorates awarded annually 19 , and we are home to 2.1 million STEM professionals 20 Ensuring that Georgia maintains a business climate supportive of innovation will prove important in retaining these graduates and workers, as well as retaining organizations engaging in the R&D critical to propelling continued quality innovation and growth.

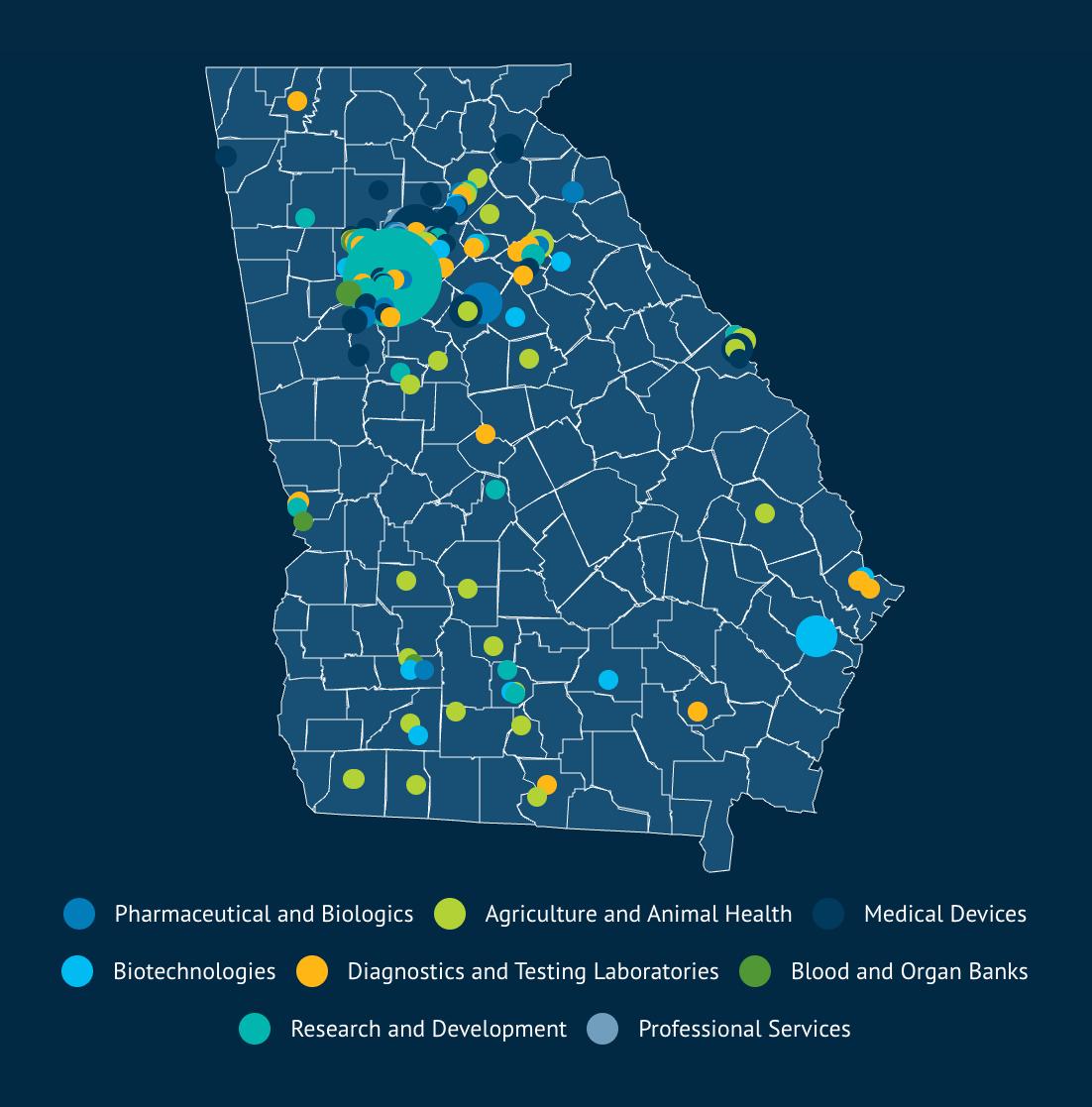

Georgia also counts 1.2 million small businesses in the professional scientific and technical service industry. Many of these businesses contract or serve as suppliers for large organizations. Entrepreneurs in Georgia collectively employ 1.7 million Georgians. 23 Access to capital serves as a significant barrier for entry and expansion for many small businesses, especially in industries with high capital costs. Continuing to expand access to smaller businesses provides significant opportunity to further diversify talent in this space. Life Science Employers, 20+ Employees

Georgia boasts an international reputation as a global leader for our life science and information technology sectors, which supports non-postsecondary research institutions such as the Centers for Disease Control and Prevention headquarters in Atlanta. Altogether, over 32,000 workers are employed in life science occupations in Georgia. 21 Additionally, Georgia’s IT sector includes more than 14,000 companies and 150,000 employees, and we are well known nationally for our healthcare IT, software development and digital entertainment hubs. 22

Employment in Georgia’s construction industry has grown by 12% in the past five years and the number of construction industry jobs is expected to increase by 6% in the next five years.24 Large business investments in capital expansions and new projects drive much of this commercial growth, but smaller projects and restoration, as well as housing construction projects also notably contribute to economic growth. This industry recovered well from low output in the 2008 Great Recession, producing over $36 billion in Gross Regional Product in 2023.25

Number of Industry Jobs: 287,807

Historic Change in Jobs: 30,735

Historic Job Growth: 12%

Average Earnings Per Worker: $80,121

Industry Gross Regional Product: $35.51 billion

Construction and Extraction | 55% of industry | 7% growth

Management | 12% on industry | 10% growth

Installation, Maintenance and Repair | 9% of industry | 7% growth

Business and Financial Operations | 6% of industry | 6% growth

Transportation and Material Moving | 4% of industry | 8% growth

Both a physical and monetary driver of economic growth, construction comprises 4.5% of Georgia’s gross domestic product. This is above the industry’s national economic gross product share of 4.0%, which demonstrates the notable statewide impact from the construction industry. The majority of non-residential construction spending is through private projects, at $14 billion compared to $8.9 billion in public spending.26

The post-pandemic surge in manufacturing has increased construction jobs across the state, especially those related to clean tech. This, in addition to significant federal investment to expand the clean tech industry, has resulted in additional projects and opportunities for the construction industry. The revitalization of office space, influx of new business projects, and expansion of industrial warehousing space also contribute to the continued growth of this industry in the state. 27 National uncertainty related to interest rates and inflation continues to impact the construction industry. Overall, major career opportunities within the industry exist in targeting emerging markets, especially in healthcare, life sciences and clean tech.

Georgia was ranked as the number one state in the country for the construction industry, because of our overall construction business climate by the Associated Builders and Contractors annual Merit Shop Scorecard. Georgia’s right-to-work status, strong public-private partnership networks, rich workforce development network, career and technical training. and job growth rate all contribute to Georgia’s best-in-the-country ranking.28

Maintaining a strong finance and insurance industry is crucial to ensuring that all businesses, small and large, have the financial resources they need to operate, grow, obtain financing, and secure their assets. Additionally, Georgia’s strong Fintech sector drives technological innovation which continues to attract and retain talent in the state.

Number of Industry Jobs: 221,233

Change in Jobs: 30,635

Percent Job Growth: 16%

Average Earnings Per Worker: $126,950

Industry Gross Regional Product: $63.6 billion

Business and financial operations | 30% of the industry | 20% growth

Office and administrative support | 29% of the industry | 10% growth

Sales and related | 22% of the industry | 33% growth

Management | 10% of the industry | 34% growth

Computer and mathematical | 6% of the industry | 31% growth

Marketing |

Jobs in this industry have grown by 16% in the last five years and are expected to grow by another 12% over the next five years. 29 A significant portion of this growth has been in occupations related to fund and trust management, and current demand is pushed largely by the banking industry. While the highest number of jobs in the financial and insurance industry is within Metro Atlanta, Georgia’s hub communities – midsize metropolitans outside of Metro Atlanta – maintain notable job hubs for their regions.30

Known particularly for our fintech sector, Georgia hosts 6 of the 10 largest payment processing firms’ headquarters and supports more than 30,000 fintech professionals in-state. 70% of all U.S. transactions pass through Georgia companies, and the top 50 Georgia-based fintech companies generate more than $72 billion in annual revenue.31 Georgia’s financial and insurance industry boasted impressive growth, even through the COVID-19 pandemic, when many other industries contracted. Increased demand for online and contactless financial systems drove significant growth and innovation during this time and continues to be supported by innovation hubs that coalesce in metropolitan areas across Georgia.32

Georgia’s banking systems directly employ nearly 17,000 individuals and manages over $155 billion in total assets, and over $109 billion in loans and leases. 33 The health of this sector is critical to ensure that businesses and individuals have access to liquid capital for expansions and investments. Experts agree capital flow is considered one of the biggest benefits to a strong financial service sector.34 While slowing of the housing market has hurt financial institutions as interest rates decrease and businesses and consumers take on more projects and loans, these losses could be regained. This is particularly relevant as Georgia continues to seek solutions to expand housing inventory and access in the state.

Regulatory structures in the financial services and insurance industry can often be extremely complex, making this a challenging industry to operate in. Additionally, companies and consumers continue to seek innovative uses for new AI and generative AI technologies which come with additional layers of complexity.35 However, these same hurdles can be leveraged as opportunities to streamline consumer experiences and optimize information for expanding access to capital and insurance coverage.

Georgia exports more than $37 billion in manufactured goods annually, sending products across the globe. The top five export markets for Georgia manufactured goods are Canada, China, Germany, Mexico, and Singapore. Accounting for over 9% of the state’s total economic output, and 8.6% of the workforce, manufacturing is Georgia’s fourth largest and sixth fastest growing industry36

Number of Industry Jobs: 442,591

Historic Change in Jobs: 26,540

Historic Job Growth: 6%

Average Earnings Per Worker: $84,995

Gross Regional Product: $78.16 billion

Production | 52% of industry | 9% growth

Transportation and Material Moving | 12% of industry | 10% growth

Installations, Maintenance and Repair | 16% of industry | 6% growth

Management | 5% of industry | 16% growth

Architecture and Engineering | 4% of industry | 22% growth

Finance |

Manufacturing jobs have increased by 6% in the last five years and are expected to grow by another 10% over the next five years. 37 Georgia businesses contribute over $64 billion in manufacturing output, and Georgia maintains an above-average supply of manufacturing talent, directly supporting nearly 400,000 workers.38

Georgia’s advanced manufacturing production continues to expand significantly, supporting nearly 290,000 workers and featuring diverse technological growth, making extensive use of automation and computer technology, high precision systems, and information and data science.39As the use of advanced manufacturing techniques grows, so too will opportunities in related sectors.

Almost 70% of jobs in this industry require only technical training or an associate’s-level degree, while there are also many opportunities for a professional with a four-year degree. 40 This enables a variety of entry points for talent coming directly from K-12 or a post-secondary institution, or for individuals working in other industries to move into employment opportunities within the manufacturing industry. Additionally, employees in this industry have substantial career advancement options as individuals grow their skillsets at a company or obtain new certificates and degrees. These factors expand the potential talent pool and strengthen Georgia’s opportunity for growing this industry.

In recent years, global supply chain disruptions and rising costs created uncertainty and challenges for manufacturers in Georgia. While much of this volatility has subsided, talent shortages continue to impact the industry and its growth. Many current workers require upskilling, and attracting and retaining new talent remains a challenge. 41 Partnerships with technical and four-year post-secondary institutions are critical in developing talent, and targeted workforce and training programs provide skill-specific advancement.

By 2050, Georgia is projected to increase its number of jobs by 46%, equating to 3.1 million new career options for Georgians.42 Quality growth will continue to fuel new opportunities for Georgians and Georgia businesses. However, many of Georgia’s industries continue to struggle with skill-specific talent shortages. Aligning K-12 and post-secondary program offerings to high-demand fields, especially those that are local in the community, is essential so individuals are effectively prepared to engage in the workforce. The following programs have employed innovative solutions and partnerships to grow talent pipelines and provide opportunities to upskill or reskill employees.

The newly implemented Georgia Match Program helps Georgia high schoolers better understand what options are available to them following graduation. The Match program connects students with both four-year and technical institutions for which they would be a candidate based on initial eligibility with the goal of broadening students’ knowledge of postsecondary options.

The Georgia Quick Start program offers customized, company-specific workforce training based on the needs of Georgia businesses in order to reskill and upskill employees at no cost to the business. This program operated through the Technical College System of Georgia and increases access to advanced skill training for all Georgians.

The Be Pro Be Proud initiative began in Cherokee County as a way to engage K-12 students in technical skills for occupations related to many industries including advanced manufacturing, healthcare, agriculture, robotics to name just a few. The organization maintains a mobile lab which travels across the state, offering discovery experiences to students who otherwise would not have access to these innovative learning experiences.

Georgia’s sustained, record-breaking economic success continues to benefit every corner of the state and for the 11th year in a row supports Georgia’s status as the best state in which to do business.

Future prosperity depends upon access to skilled talent for businesses and opportunities for career advancement for Georgians.

Continued targeted efforts to attract, retain and strengthen talent will be increasingly important as our industries grow and evolve. Ensuring access to skill-specific training and encouraging our industry leaders to look ahead to new opportunities will strengthen our business climate and expand economic opportunity across the state.

1 Georgia Chamber of Commerce Foundation, 2024 Executive Insights Survey Results

2 US Census Bureau, 2021 5-Year American Community Survey

3 Lightcast, Regional Overview Report Accessed September 2024

4 Lightcast, Industry Overview Report Accessed September 2024

5 Georgia Department of Economic Development, Transportation Industry Page

6 Georgia Power, Economic Development: Warehousing and Distribution

7 Lightcast, Industry Overview Report Accessed September 2024

8 Lightcast, Regional Comparison Table Report Accessed September 2024

9 Lightcast, Industry Overview Report Accessed September 2024

10 Lightcast, Industry Overview Report Accessed September 2024

11 US Chamber of Commerce, Data Deep Dive: A National Nursing Crisis

12 US Chamber of Commerce, Data Deep Dive: A National Nursing Crisis

13 American Association of Colleges of Nursing, Nursing Faulty Shortage Fact Sheet

14 US Bureau of Labor Statistics, Professional, Scientific and Technical Services

15 Lightcast, Industry Overview Report Accessed September 2024

16 Society for Human Resources Management, Skills-Based Hiring is Gaining Ground

17 Brandeis University, R1 Research Institutions

18 CompTIA, 2023 State of the Tech Workforce Report

19 National Science Foundation, STEM Graduates by State

20 Science is US, State Spotlight: Georgia

21 Georgia Power, Economic Development: Georgia’s Life Science Industry

22 Georgia Department of Economic Development, Center of Innovation: Information Technology

23 US Small Business Association, 2023 Georgia Small Business Profile

24 Lightcast, Industry Overview Report Accessed September 2024

25 Associated General Contractors of Georgia, The Economic Impact of Construction in the United States and Georgia

26 Associated General Contractors of Georgia, The Economic Impact of Construction in the United States and Georgia

27 Georgia Power Economic Development, Construction Trends and Market Outlook in Georgia

28 Associated Builders and Contractors, Inc., Building America: The Merit Shop Scorecard

29 Lightcast, Industry Overview Report Accessed September 2024

30 Lightcast, Staffing Patterns Report Accessed September 2024

31 Georgia Department of Economic Development, Georgia is a World Leader in FinTech

32 Georgia Trend, 2023 Industry Outlook, March 29, 2023

33 Federal Deposit Insurance Corporation (FDIC), Quarterly Banking Profile State Tables

34 Investopedia, Importance and Components of the Financial Services Sector, January 9, 2024

35 Forbes, As Fintech Expand, Opportunities and Challenges Lie Ahead, April 26, 2024

36 National Association of Manufacturers, Georgia Manufacturing Facts

37 Lightcast, Industry Overview Report Accessed September 2024

38 National Association of Manufacturers, Georgia Manufacturing Facts

39 Georgia Department of Economic Development, Georgia Advanced Manufacturing

40 Lightcast, Industry Overview Report Accessed September 2024

41 Middle Georgia CEO, ‘50% of the Top Workforce Challenges...’ September 25, 2024

42 Woods and Poole Economic Consulting