Small businesses account for 99.7% of total businesses in Georgia, the vast majority—1.1 million—of which are operated by entrepreneurs with fewer than 20 employees.1

By industry, ‘Professional, Scientific, and Technical Services’ maintains the most small business employers (29,000), employees (162,800), and the largest payroll ($12.7 billion).1 This is consistent with national trends and may be due to lower startup costs compared to other industries.2

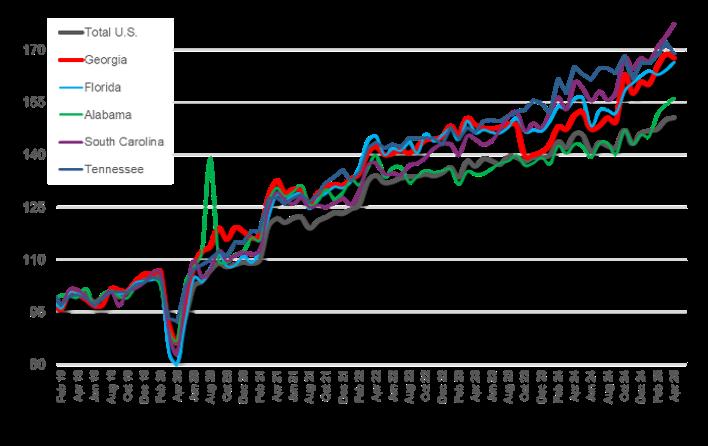

Total business applications spiked both in Georgia and nationwide from 2020 to 2021 as many workers sought alternative and flexible career options. While high-propensity applications have remained elevated nationwide, the number of applications in Georgia has declined.3 In Q1 2025, Georgia averaged about 5,600 high-propensity business applications per month compared to 7,900 in Q1 of 2021.3

T he latest data from the Small Business Credit Survey shows that nationally, expectations for revenue and employment growth remain relatively steady. However, cash flow and higher prices remain challenging, particularly related to operational expenses and hiring talent.4 In their most recent survey, The National Federation of Independent Business reports that 19% of small businesses cite quality of talent as their top challenge for the third consecutive month, and 34% of all small business owners reported job openings they could not fill in April of 2025.5

Tools and Strategies for Small Businesses

• Leverage small business resources in Georgia. Both public and private partners have programs in Georgia to help support emerging small business owners and entrepreneurs.

• Utilize a range of software to streamline processes and connect with additional tools and resources. Visit www.uschamber.com/co/start/strategy/best-small-business-growth-strategies for more information.

• Identify growth opportunities within current contracts and explore opportunities to diversify supply chains and networks.

Engaging with Small Businesses and Entrepreneurs

• The University of Georgia has 18 Small Business Development Centers across the state, which provide a range of services, boosting small business success by 17% compared to those who do not utilize their resources.

• The Russell Innovation Center for Entrepreneurship (RICE) provides resources and convening space for traditionally underserved entrepreneurs.

• SCORE, by the U.S. Small Business Administration, hosts several small business summits, and offers resources, mentors, and low-interest financing options.